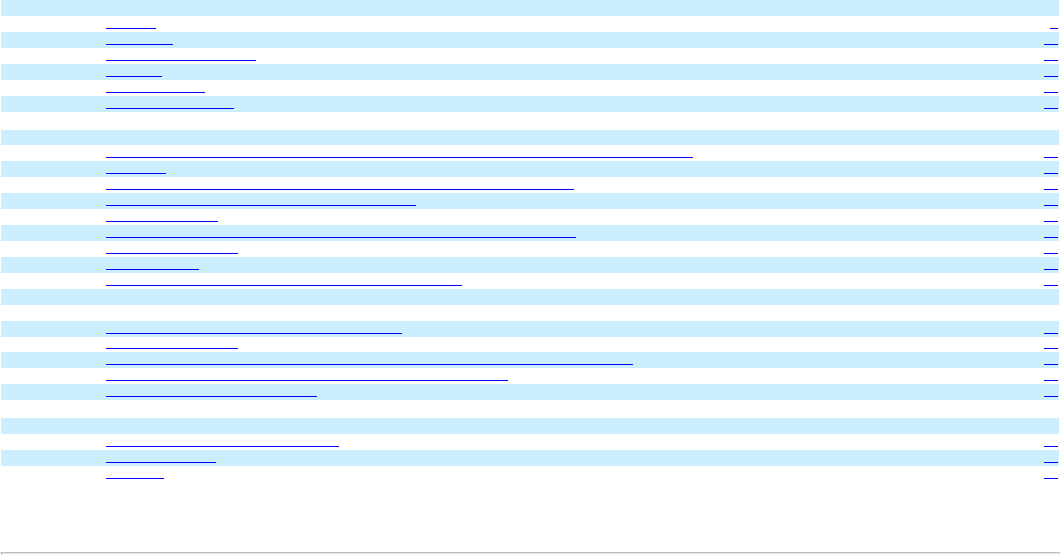

Allegiant Travel (ALGT) Historical Annual Reports 2009-2024

Year Report Size

2024

Allegiant Travel (ALGT) 10-K Annual Report - Mar 8th, 2024

235kb

2024

Allegiant Travel (ALGT) 10-K Annual Report - Feb 29th, 2024

5.8mb

2022

Allegiant Travel (ALGT) 10-K Annual Report - Mar 1st, 2022

620kb

2021

Allegiant Travel (ALGT) 10-K Annual Report - Mar 1st, 2021

584kb

2020

Allegiant Travel (ALGT) 10-K Annual Report - Feb 27th, 2020

1.1mb

2019

Allegiant Travel (ALGT) 10-K Annual Report - Feb 28th, 2019

1.3mb

2018

Allegiant Travel (ALGT) 10-K Annual Report - Apr 30th, 2018

403kb

2018

Allegiant Travel (ALGT) 10-K Annual Report - Mar 1st, 2018

805kb

2017

Allegiant Travel (ALGT) 10-K Annual Report - Feb 24th, 2017

791kb

2016

Allegiant Travel (ALGT) 10-K Annual Report - Apr 29th, 2016

334kb

2016

Allegiant Travel (ALGT) 10-K Annual Report - Feb 22nd, 2016

637kb

2015

Allegiant Travel (ALGT) 10-K Annual Report - Feb 26th, 2015

734kb

2014

Allegiant Travel (ALGT) 10-K Annual Report - May 2nd, 2014

259kb

2014

Allegiant Travel (ALGT) 10-K Annual Report - Apr 30th, 2014

296kb

2014

Allegiant Travel (ALGT) 10-K Annual Report - Feb 28th, 2014

716kb

2013

Allegiant Travel (ALGT) 10-K Annual Report - Feb 26th, 2013

521kb

2012

Allegiant Travel (ALGT) 10-K Annual Report - Feb 27th, 2012

511kb

2011

Allegiant Travel (ALGT) 10-K Annual Report - Mar 17th, 2011

286kb

2011

Allegiant Travel (ALGT) 10-K Annual Report - Mar 11th, 2011

543kb

2010

Allegiant Travel (ALGT) 10-K Annual Report - Apr 30th, 2010

219kb

2010

Allegiant Travel (ALGT) 10-K Annual Report - Mar 9th, 2010

564kb

2009

Allegiant Travel (ALGT) 10-K Annual Report - Apr 27th, 2009

201kb

2009

Allegiant Travel (ALGT) 10-K Annual Report - Mar 3rd, 2009

556kb

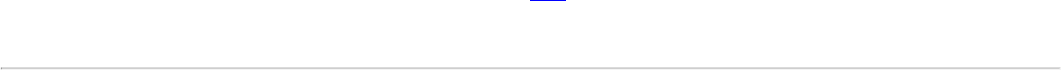

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedDecember 31, 2022

Or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission File Number 001-33166

Allegiant Travel Company

(Exact Name of Registrant as Specified in Its Charter)

Nevada 20-4745737

(State or Other Jurisdiction of Incorporation or Organization) (IRS Employer Identification No.)

1201 North Town Center Drive

Las Vegas, Nevada 89144

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (702) 851-7300

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

Trading

Symbol Name of each exchange on which registered

Common Stock, $0.001 Par Value ALGT Nasdaq Global Select Market

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to

Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,”

“accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ☒ Accelerated filer ☐

Non-accelerated filer ☐ Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section

404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to

previously issued financial statements. □Yes ☐ No ☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers

during the relevant recovery period pursuant to §240.10D-1(b). Yes ☐ No ☒

The aggregate market value of common equity held by non-affiliates of the registrant was approximately $1.7 billion computed by reference to the closing sale price of the common stock on the Nasdaq

Global Select Market on June 30, 2022, the last trading day of the registrant’s most recently completed second fiscal quarter.

The number of shares of the registrant’s common stock outstanding as of the close of business on February 1, 2023 was 18,121,668.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement to be used in connection with the solicitation of proxies to be voted at the registrant’s annual meeting to be held on June 21, 2023, and to be filed with the Commission

subsequent to the date hereof, are incorporated by reference into Part III of this Report on Form 10-K.

EXHIBIT INDEX IS LOCATED ON PAGE 89.

Allegiant Travel Company

Form 10-K

For the Year Ended December 31, 2022

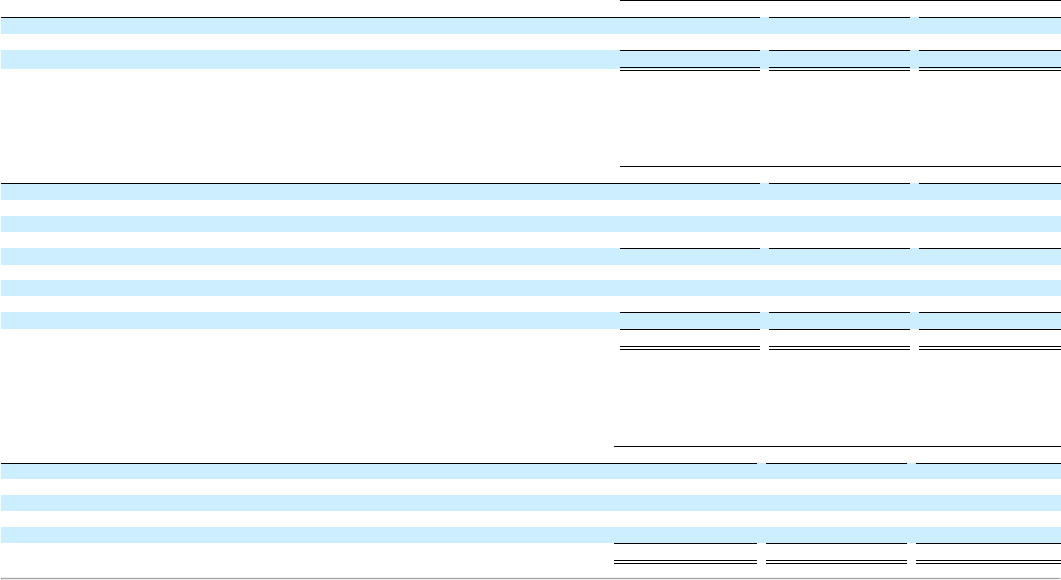

Table of Contents

PART I

ITEM 1. Business 4

ITEM 1A. Risk Factors 18

ITEM 1B. Unresolved Staff Comments 28

ITEM 2. Properties 29

ITEM 3. Legal Proceedings 31

ITEM 4. Mine Safety Disclosures 31

PART II

ITEM 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities 32

ITEM 6. (Reserved) 34

ITEM 7. Management's Discussion and Analysis of Financial Condition and Results of Operations 35

ITEM 7A. Quantitative and Qualitative Disclosures about Market Risk 52

ITEM 8. Financial Statements 53

ITEM 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure 86

ITEM 9A. Controls and Procedures 86

ITEM 9B. Other Information 86

ITEM 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections 86

PART III

ITEM 10. Directors, Executive Officers and Corporate Governance 88

ITEM 11. Executive Compensation 88

ITEM 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters 88

ITEM 13. Certain Relationships and Related Transactions, and Director Independence 88

ITEM 14. Principal Accountant Fees and Services 88

PART IV

ITEM 15. Exhibits and Financial Statement Schedules 89

ITEM 16. Form 10-K Summary 94

Signatures 95

2

PART I

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

We have made forward-looking statements in this annual report on Form 10-K, and in the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” that

are based on our management’s beliefs and assumptions, and on information currently available to our management. Forward-looking statements include our statements regarding future expenses,

revenues, earnings, ASM growth, fuel cost and consumption, expected capital expenditures, number of contracted aircraft to be placed in service in the future, our ability to consummate announced

aircraft transactions, timing of aircraft deliveries and retirements, number of possible future markets that may be served, the implementation of a joint alliance with VivaAerobus, the development of our

Sunseeker Resort, as well as other information concerning future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities,

the effects of future regulation and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking

terminology such as the words "believe," "expect," "anticipate," "intend," "plan," "estimate," “project,” “hope” or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in the forward-looking statements. Important risk factors that could

cause our results to differ materially from those expressed in the forward-looking statements generally may be found in our periodic reports and registration statements filed with the Securities and

Exchange Commission at www.sec.gov. These risk factors include, without limitation, the impact and duration of the COVID-19 pandemic on airline travel and the economy, an accident involving, or

problems with, our aircraft, public perception of our safety, our reliance on our automated systems, our reliance on third parties to deliver aircraft under contract to us on a timely basis, risk of breach of

security of personal data, volatility of fuel costs, labor issues and costs, the ability to obtain regulatory approvals as needed, the effect of economic conditions on leisure travel, debt covenants and

balances, the impact of governmental regulations on the airline industry, the ability to finance aircraft under contract, the ability to obtain necessary U.S. and Mexican government approvals to

implement the announced alliance with VivaAerobus and to otherwise prepare to offer international service, terrorist attacks, risks inherent to airlines, our competitive environment, our reliance on third

parties who provide facilities or services to us, the impact of management changes and possible loss of key personnel, economic and other conditions in markets in which we operate, the ability to

successfully develop a resort in Southwest Florida, governmental regulation, increases in maintenance costs, cyclical and seasonal fluctuations in our operating results, and the perceived acceptability

of our environmental, social and governance efforts.

Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events,

new information or otherwise.

3

Item 1. Business

Overview

We are a leisure travel company focused on providing travel and leisure services and products to residents of under-served cities in the United States. We were founded in 1997 and, in conjunction with

our initial public offering in 2006, we incorporated in the state of Nevada. Our unique business model provides diversified revenue streams from various travel services and product offerings which

distinguish us from other travel companies. We operate a low-cost, low utilization passenger airline marketed primarily to leisure travelers in under-served cities, allowing us to sell air transportation both

on a stand-alone basis and bundled with the sale of air-related and third party services and products. In addition, we provide air transportation under fixed fee flight arrangements. Our developed

nation-wide route network, pricing philosophy, direct distribution, advertising, and product offerings built around relationships with premier leisure companies, are all intended to appeal to leisure

travelers and make it attractive for them to purchase air travel and related services and products from us.

In connection with our leisure travel focus, we are completing the construction of our Sunseeker Resort in Southwest Florida, which we expect to open in late 2023.

Below is a brief description of the travel services and products we provide to our customers:

Scheduled service air transportation. We provide scheduled air transportation on limited-frequency, nonstop flights predominantly between under-served cities and popular leisure destinations. As of

February 1, 2023, our operating fleet consisted of 122 Airbus A320 series aircraft. As of that date, we were selling travel on 573 routes to 125 cities. In this document, references to "Airbus A320 series

aircraft" are intended to describe both Airbus A319 and A320 aircraft.

Ancillary air-related products and services. We provide unbundled air-related services and products in conjunction with air transportation for an additional cost to customers. These optional air-related

services and products include baggage fees, advance seat assignments, our own travel protection product, change fees, use of our call center for purchases, priority boarding, a customer convenience

fee, food and beverage purchases on board, and other air-related services. The revenue for ancillary air-related products and services is reflected in the passenger revenue income statement line item,

along with scheduled service air transportation revenue and travel point redemptions from our co-branded Allegiant credit card and our non-card loyalty program.

Third party products and services. We offer third party travel products such as hotel rooms and ground transportation (rental cars and hotel shuttle products) for sale to our passengers. The marketing

component of revenue related to our co-branded credit card is also included in this category.

Fixed fee contract air transportation. We provide air transportation through fixed fee agreements and charter service on a year-round and ad-hoc basis.

Allegiant 2.0

We continue to sharpen our focus on offerings to meet more of the travel and leisure needs of our customers. We have coined this next stage of our Company strategy as "Allegiant 2.0" which includes

the following Company goals:

– maintaining our foundation of providing affordably accessible air travel while refining and strengthening our air travel product;

– expanding our already broad domestic network as we have identified more than 1,400 incremental routes of which approximately 80 percent currently have no nonstop service;

– seeking to offer (subject to government approval) transborder international scheduled service into Mexico through our partnership with VivaAerobus;

– utilizing our customer data to capture accretive, asset-light direct-to-consumer revenue opportunities;

– transforming our eCommerce strategy to create a frictionless experience for our customers and drive increased air ancillary and third party revenue generation;

– expanding our co-branded credit card program and our non-card loyalty program;

– expanding our travel company focus and offerings with the construction of Sunseeker Resort at Charlotte Harbor (the "Resort" or "Sunseeker Resort") (expected to open in late 2023).

– refining our marketing investment dollars by entering into dynamic agreements, such as the naming rights agreement with the Raiders of the National Football League for Allegiant Stadium in

Las Vegas

Our principal executive offices are located at 1201 N. Town Center Drive, Las Vegas, Nevada 89144. Our telephone number is (702) 851-7300. Our website address is http://www.allegiant.com. We

have not incorporated by reference into this annual report the information on our website and investors should not consider it to be a part of this document. Our website address is included in this

document for reference only. Our annual report, quarterly reports, current reports and amendments to those reports are made available free of charge through the investor relations section on our

website as soon as reasonably practicable after electronically filed with or furnished to the Securities and Exchange Commission (“SEC”).

Unique Business Model

We have developed a unique business model that primarily focuses on leisure travelers in under-served cities. The business model has evolved as our experienced management team has looked

differently at the traditional way business has been conducted in the airline and travel industries. Our focus on the leisure customer allows us to eliminate the significant costs associated with serving a

wide variety of customers and to concentrate our product appeal on a customer base which is under-served by traditional airlines. We have consciously developed a business model which distinguishes

us from the traditional airline approach:

Traditional Airline Approach Allegiant Approach

Customer Base: Business and leisure Leisure

Network: Primarily large and mid-sized markets Primarily small/medium-sized under-served markets

Flight Connections: Nonstop or connect through hubs All nonstop

Competition: High Low

Schedule: Uniform throughout the week Low frequency/variable capacity

Distribution: Sell through various intermediaries Sell only directly to travelers

Fare Strategy: High base fares/low ancillary revenue Low base fares/high ancillary revenue

By separating base airfare from our air-related services and products such as baggage fees, advance seat assignments, travel protection, change fees, priority boarding, and food and beverage

purchases, we are able to lower our airfares and target leisure travelers who are more concerned with price and the ability to customize their experience with us by only purchasing the additional

conveniences they value. This strategy allows us to generate additional passenger revenues from our customers' decisions to purchase these ancillary products.

We have established a broad route network with a national footprint, providing service on 571 routes between 93 origination cities and 32 leisure destinations, and serving 42 states as of February 1,

2023. As of this same date, we were selling 573 routes. In most of these cities, we provide service to more than one of our leisure destinations which are offered either on a year-round or seasonal

basis. Our vast network footprint, coupled with our low frequency scheduling, provides us with a diversified, resilient network. We operate to more cities than any non-legacy U.S. carrier, protecting us

against overexposure to any one geographic location. Our 24 bases spread throughout the country provide us the flexibility to redeploy capacity to best match demand trends around the country.

The geographic diversity of our route network protects us from regional variations in the economy and helps insulate us from competitive actions, as it would be difficult for a competitor to materially

impact our business by targeting one city or region. Our widespread route network also contributes to the continued growth of our customer base. The below map illustrates our route network as of

February 1, 2023, including service announcements as of that date. The orange dots represent leisure destinations and the blue dots represent origination cities.

We have identified more than 1,400 additional domestic routes which we could target in the future to further expand our network.

In developing a unique business model, our ancillary offerings (ancillary air-related items included in passenger revenue as well as the sale of third party products and services) have been a significant

source of our revenue growth. We have increased revenue related to these ancillary items from $5.87 per passenger in 2004 to $67.74 per passenger in 2022. We own and manage our own

eCommerce platform, which gives us the ability to modify our system to enhance third party product offerings

based on specific needs. We believe the control of our automation systems has allowed us to be innovators in the industry by providing our customers with a variety of different travel services and

products, and allowing us to seek to increase revenues through testing of alternative revenue management approaches.

We believe the following strengths from our unique business model allow us to maintain a competitive advantage in the markets we serve:

Focus on leisure traffic from under-served cities

We believe small and medium-sized cities represent a large, under-served market, especially for leisure travel. Prior to the initiation of our service, leisure travelers from these markets had limited

desirable options to reach leisure destinations because existing carriers are generally focused on connecting business customers through their hub-and-spoke networks.

We believe our low fare, nonstop service, along with our leisure company relationships, make it attractive for leisure travelers to purchase airfare and travel-related products from us. The size of the

markets we serve, and our focus on the leisure customer, allow us to adequately serve these markets with less frequency, and to vary our air transportation capacity to match seasonal and day-of-the-

week demand patterns.

By focusing primarily on under-served cities and routes, we believe we avoid the intense competition in high traffic domestic air corridors. In most of our markets, travelers previously faced high airfares

and cumbersome connections, or long drives, to major airports in order to reach our leisure destinations. Based on published data from the U.S. Department of Transportation (“DOT”), we believe the

initiation of our service stimulates demand, as we have typically seen a substantial increase in traffic subsequent to new service beginning. Our market strategy is neither hostile to legacy carriers,

whose historical focus has been connecting small cities to business markets with regional jets, nor to traditional low cost or ultra-low cost carriers generally focused on larger markets. Additionally, major

carriers have reduced service to medium-sized cities which we believe they no longer consider to be core hubs.

Capacity management

We actively manage our seat capacity to match leisure demand patterns. This is enabled by our highly variable cost structure which allows us to increase capacity in high demand periods. This has

resulted in our being able to generate as much as 60 percent of our operating income in the peak periods of March, summer (June and July) and the holiday seasons.

Our core business model manages seat capacity by increased utilization of our aircraft during periods of high leisure demand and decreased utilization in low leisure demand periods. By way of

illustration, in 2022, during our peak demand period in July, we averaged 8.2 system block hours per aircraft per day while in September, our lowest month for demand, we averaged only 4.7 system

block hours per aircraft per day.

Our management of seat capacity also includes changes in weekly frequency of certain markets based on identified peak and off-peak travel demand throughout the year. Unlike other carriers which

provide a fairly consistent number of flights every day of the week, we manage our capacity with a goal of being profitable on each route. We do this by flying only on days with sufficient market

demand. In 2022, we were able to profitably fly a disproportionately low 12 percent of our scheduled ASMs on off-peak days (Tuesdays and Wednesdays).

To effectively hedge against fuel cost increases during periods of high fuel cost, we will often pull back capacity, particularly in off peak periods, and focus our flying in peak periods which drives higher

fares to offset the fuel cost increases. Conversely, during periods of lower fuel costs, we will increase flying in off peak periods as marginally profitable flights will become more profitable with lower fuel

costs.

Our strong revenue production from ancillary items, coupled with our ability to rapidly adjust capacity, has allowed us to consistently operate profitably and in many cases, produce industry leading

margins in challenging macro environments, including periods of high fuel prices, economic recession and a pandemic.

Low cost structure

We believe a low cost structure is essential to competitive success in the airline industry, particularly as a solely leisure focused carrier. In evaluating our cost performance, our management team

typically compares to the following other publicly held domestic airlines: Delta Air Lines, American Airlines, United Airlines, Southwest Airlines, JetBlue Airways, Alaska Airlines, Hawaiian Airlines, Spirit

Airlines, Frontier Airlines and Sun Country Airlines (which we refer to as the "Industry"). Our airline operating CASM, excluding fuel (that is, excluding Sunseeker) was 7.33 ¢ in 2022, which was 25.0

percent lower than the Industry average of 9.77 ¢ for 2022.

We continue to focus on maintaining low operating costs through the following tactics and strategies:

Low aircraft ownership costs. We achieve low aircraft ownership costs by opportunistically acquiring aircraft and by primarily owning our aircraft. As of February 1, 2023, we own or finance lease all but

17 of the aircraft in our operating fleet. In addition, we believe that we properly balance lower aircraft acquisition costs and operating costs to minimize our total costs.

Throughout our history, we have primarily purchased used aircraft with meaningful remaining useful lives, at reduced prices. As of February 1, 2023, our operating fleet consists of 122 Airbus A320

series aircraft, of which 109 were acquired used.

In December 2021, we opportunistically negotiated an agreement with The Boeing Company to purchase 50 newly manufactured 737MAX aircraft scheduled to be delivered in 2023 to 2025 with

options to purchase an additional 50 737MAX aircraft. We believe this new aircraft purchase is complimentary with our low cost strategy. Our intent to retain ownership of the aircraft, coupled with the

longer useful life for depreciation purposes should result in similar ownership expense when compared with a used aircraft in our fleet. In addition, the expected fuel savings, improved operational

reliability, and other savings expected from the use of these new aircraft should aid in improving our overall low cost structure.

We expect to continue to acquire used aircraft as necessary to support planned growth and aircraft retirements.

Low distribution costs. Our nontraditional marketing approach reduces distribution costs. We do not sell our product through outside sales channels, thus avoiding the fees charged by travel websites

(Expedia, Orbitz or Travelocity) and traditional global distribution systems (“GDS”) (Sabre or Worldspan). Our customers can only purchase travel at our airport ticket counters or, for a fee, on our

website or through our telephone reservation center. The purchase of travel through our website is the least expensive form of distribution for us and accounted for 96.0 percent of our scheduled service

revenue during 2022.

Data driven. We are a data driven organization. We are continuing to focus on capturing data to identify trends and patterns in an effort to gain efficiencies and decrease costs. For example, we utilize

predictive maintenance to identify necessary aircraft maintenance before a problem arises, thereby avoiding unscheduled maintenance events which are costly and disruptive to our schedule. In

addition, our direct to consumer distribution method results in enhanced data which helps us deepen our relationship with our customers and increase sales.

Highly productive workforce. Our high level of employee productivity is due to our cost-driven scheduling, fewer unproductive labor work rules, and the effective use of automation and part-time

employees. In an effort to control costs, we outsource major maintenance, stations and other functions to reliable third party service providers.

Simple product. We believe offering a simple product is critical to achieving low operating costs. As such, we sell only nonstop flights; we do not currently code-share or interline with other carriers; we

have a single class cabin; we do not provide any free catered items - everything on board is for sale; we do not provide cargo or mail services; and we do not offer other perks such as airport lounges.

Under-served market airports. Our business model focuses on residents of under-served cities in the United States. Typically, the airports in these cities have lower operating costs than airports in

larger cities. These lower costs are driven by less expensive passenger facilities, landing, and ground service charges. In addition to inexpensive airport costs, many of our airports provide marketing

support.

Cost-driven schedule. We aim to build our scheduled service so that substantially all of our crews and aircraft return to base each night. This allows us to maximize crew efficiency, and more cost-

effectively manage maintenance, spare aircraft and spare parts. Additionally, this structure allows us to add or subtract markets served by a base without incremental costs. We believe leisure travelers

are generally less concerned about departure and arrival times than business travelers, so we are able to schedule flights at times that enable us to reduce costs while remaining desirable to our leisure

customers.

Ancillary product offerings

We believe many leisure travelers are concerned primarily with purchasing air travel at the least expensive price. As such, we offer the unbundling of the air transportation product by charging fees for

services many U.S. airlines have historically only bundled in their base fare. This pricing structure allows us to target travelers who are most concerned with low fare travel while also allowing travelers

to customize their experience with us by purchasing only the additional conveniences they value. For example, we do not offer complimentary advance seat assignments; however, customers who

value this product can purchase advance seat assignments for a small incremental cost. In addition, snacks and beverages are sold individually on the aircraft, allowing passengers to purchase only

items they value. Our direct to consumer distribution method enables a variety of added revenue opportunities with direct “one-stop” shopping solutions and managed product offerings.

We offer various bundled ancillary products whereby customers can elect to purchase multiple ancillary products at a discount.

Revenue from ancillary items will continue to be a key component in our total average fare as we believe leisure travelers are less sensitive to ancillary fees than the base fare.

Our third party product offerings give our customers the opportunity to purchase hotel rooms, rental cars and airport shuttle service. Our third party offerings are available to customers based on our

agreements with various travel and leisure companies. For example, we have partnered exclusively with Enterprise Holdings Inc. for the sale of rental cars packaged with air travel. The pricing of each

product and our margin can be adjusted based on customer demand because our customers purchase travel directly through our booking engine.

Financial position

As of December 31, 2022, we had $1.02 billion of unrestricted cash, cash equivalents and investment securities, and total debt and finance lease obligations (net of related costs) of $2.10 billion. We

had net debt (total debt and finance lease obligations less cash, cash equivalents and investment securities) of $1.08 billion as of December 31, 2022. As of February 1, 2023, we have $275.0 million of

undrawn capacity under revolving credit facilities plus another $169.7 million of undrawn capacity under our pre-delivery payment (PDP) financing facility.

Our financial position and discipline regarding use of capital allow us to have greater financial flexibility to grow our business and to efficiently and effectively adapt to changing economic conditions.

Routes and schedules

Our current scheduled air service (including seasonal service) predominantly consists of limited frequency, nonstop flights into leisure destinations from under-served cities across the continental United

States. The scheduled service routes we are selling as of February 1, 2023 are summarized below (includes 571 routes we are currently serving, and two new announced routes on which will begin

service in 2023):

Routes to Orlando 67

Routes to Las Vegas 61

Routes to Tampa/St. Petersburg 57

Routes to Punta Gorda 51

Routes to Phoenix 50

Routes to Destin 32

Routes to Sarasota 29

Other routes 226

Total routes 573

The number of routes served varies from time to time as some routes are offered seasonally or on a temporary basis.

Marketing and Distribution

Core to Allegiant’s business model is our direct-to-customer distribution. In lieu of the GDS distribution points used by most airlines, allegiant.com is our primary distribution method. This low-cost

strategy results in significant cost savings by avoiding fees associated with GDS. It also enables a variety of added revenue opportunities with direct “one-stop” shopping solutions and managed

product offerings.

Automation is key to this strategy as we continue to enhance our capabilities. Our website and mobile app streamline the booking process and strengthen our ability to sell air ancillary and third-party

products. Additionally, we expect other automation enhancements will create additional revenue opportunities by allowing us to capitalize on customer loyalty with additional product offerings.

Our direct-to-customer distribution method also enables us to gather valuable customer data. In addition to helping us better understand our customers, we utilize data such as customer email to market

our products and services in a cost-effective way. Database marketing opportunities span the full customer journey including the time of travel purchase, between purchase and travel, and after travel is

complete. To this end, we are working to strengthen customer engagement, while affording a more elastic, reliable information technology infrastructure with significant development advantages for

marketing as well as for other business units across the company.

Beyond allegiant.com, we market our products and services through a combination of traditional advertising, including radio, television as well as digital advertising. Enhanced data and analytics are

being streamlined into our digital advertising system to build more targeted campaigns driving efficiency in our digital media spend. We can more surgically match our digital advertising dollars and the

impressions they drive with the web users who are most likely to book their travel for the routes, to better optimize load and yield.

Whether introducing new service to a community or promoting existing routes, our advertising is often supported by airport authorities and destination marketing organizations. We continue to see

benefit from these cooperative marketing campaigns, as well as from high-profile sponsorships like Allegiant Stadium. Underpinning our advertising efforts, high-profile sponsorships add credibility to

our brand, drive new customer acquisition and enhance our national profile.

Our co-branded credit card incentivizes customers who fly more often to maximize their benefits with members-only promotions and travel perks like complimentary priority boarding. Cardholders are

among our most engaged customers and book air ancillary and third-party products at a higher rate than other customers. Our non-card loyalty program, Allways Rewards®, launched in August 2021,

allows us to develop and maintain direct, long-term relationships with our customers. Similar to our cardholder program, we provide greater value to our Allways members through personalized

promotions and targeted communications which we expect will result in customer loyalty and increased revenues over time.

Competition

The airline industry is highly competitive. Passenger demand and fare levels have historically been influenced by, among other things, the general state of the economy, international events, fuel prices,

industry capacity, and pricing actions taken by other airlines. The principal competitive factors in the airline industry are price, nonstop flights, schedule, customer service, routes served, types of

aircraft, safety record and reputation, code-sharing relationships, and frequent flyer or loyalty programs.

Our competitors include legacy airlines, low cost carriers ("LCCs"), ultra-low cost carriers ("ULCC"), regional airlines, new entrant airlines, and other forms of transportation to a much lesser extent. The

legacy airlines are larger, have significantly greater financial resources, are better known, and have more established reputations than us. In a limited number of cases, following our

entry into a market, competitors have chosen to add service, reduce their fares, or both. Competitors may also choose to enter after we have developed a market.

We believe our under-served city strategy and less than daily service has reduced the intensity of competition we might otherwise face. As of February 1, 2023, we are the only mainline domestic

scheduled carrier operating out of the Orlando Sanford International Airport and at 11 other airports in our network. We and Sun Country Airlines are the only mainline domestic scheduled carriers

serving Phoenix Mesa Gateway Airport, Punta Gorda Airport, and St. Petersburg-Clearwater Airport. Although no other mainline domestic scheduled carriers operate in these airports, most U.S.

airlines serve the major airport for Orlando, Phoenix, Fort Myers, and Tampa. In addition, many U.S. airlines serve our other leisure destinations. As a result, there is potential for increased competition

on our routes.

As of February 1, 2023, we face mainline competition on approximately 22 percent of our operating and announced routes. We overlap with Southwest Airlines on 73 routes, Frontier Airlines on 38

routes, Spirit Airlines on 32 routes, American Airlines on 19 routes, Delta Airlines on 13 routes, Breeze Airways on 14 routes, United Airlines on nine routes, JetBlue Airlines on six routes, Sun Country

Airlines on five routes and Alaska Airlines on three routes. In many cases, we face competition from more than one other airline on the same route, resulting in a total of 124 competitive routes as of

that date. These 124 routes represent 22 percent of the total number of routes we are serving as of February 1, 2023. We may also experience additional competition based on recent route

announcements of other airlines.

Indirectly, we compete with various carriers that provide nonstop service to our leisure destinations from airports near our cities. We also face indirect competition from legacy carriers offering hub-and-

spoke connecting flights to our markets, although these fares tend to be substantially higher, with much longer elapsed travel times. Several airlines also offer competitive one-stop service from the

cities we serve.

In our fixed fee operations, we compete with other scheduled airlines in addition to independent passenger charter airlines. We also compete with aircraft owned or controlled by large tour companies.

The basis of competition in the fixed fee market is cost, equipment capabilities, service, reputation, and schedule flexibility.

Environmental, Social and Governance (ESG)

We recognize our responsibility to reduce environmental impact from our operations. As an integrated travel company with an expanding airline business, we believe that solidifying our commitment to

ESG efforts is a natural integration into our long-term corporate strategy and will enable us to better serve our stakeholders. In 2022, we entered a 3-year partnership with Schneider Electric to develop

a comprehensive ESG program including:

– Identify and prioritize relevant ESG topics through a materiality assessment. These topics were addressed in our inaugural ESG report.

– Develop inaugural ESG report referencing the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB) frameworks, which was issued in December 2022.

– Provide ongoing carbon emissions reporting of Scope 1, 2 and 3 greenhouse gas (GHG) emissions using Schneider Electric’s EcoStruxureTM Resource Advisor, the initial reporting having

been included in our inaugural ESG report.

– Establish ESG targets and environmental target achievement plans.

We issued our inaugural sustainability report during 2022. This comprehensive report outlines our disclosures pertaining to material topics identified by key stakeholders.

To determine material topics, a materiality assessment was conducted. This assessment benchmarked material ESG topics across our industry, global reporting frameworks and third-party rating and

ranking methodologies. We then engaged with more than 400 stakeholders including customers, employees, suppliers, shareholders and community partners. Based on survey and interview results,

we identified the following topics as material to Allegiant:

– Environmental: Emissions, Energy, Waste and Hazardous Materials

– Social: Product Quality and Safety, Accident and Safety Management, Human Rights, Benefits and Work-Life Balance, Non-Discrimination, Employee Health and Safety, Employment,

Diversity, Equity and Inclusion, Employee Training and Development, Labor Management, Local Job Creation, Response to COVID

– Governance: Business Ethics and Integrity, Anti-Corruption, Competitive Behavior, Data Security, Customer Privacy

These material topics will guide the development of our ESG targets and annual ESG reports, including the inaugural ESG report published in December 2022.

In addition, we made recent investments in several ESG areas that will enable us to build a more resilient business, drive greater efficiencies and give back to our communities. These include the

following:

Environmental: Agreed to purchase 50 Boeing 737MAX aircraft, which are expected to burn up to 20 percent less fuel on a per passenger basis compared to certain of the older Airbus A320

Series aircraft in our fleet, with the option to purchase an additional 50 Boeing 737MAX aircraft.

Social: Provided in-kind travel for Make-A-Wish kids and their families, and continued offering free office space in our Las Vegas headquarters to the nonprofit’s Southern Nevada Chapter.

Gifted hundreds of flight vouchers to local

elementary and high school teachers in partnership with The Smith Center for the Performing Arts’ The Heart of Education Awards program. Opened three new aircraft bases, creating

approximately 350 new jobs.

Governance: Separated the roles of the board and chief executive officer to uphold board independence. Established the chief experience officer role to further foster a positive experience for

customers and team members. Implemented a new talent management system to improve tracking of diversity, equity, and inclusion recruitment efforts.

Environment

The aviation industry accounts for roughly two percent of global greenhouse gas emissions, almost all of which is attributable to aircraft fuel. In 2013, we began the process of transitioning our fleet from

a mixture of MD-80 aircraft and Boeing 757 aircraft to an all-Airbus fleet with the transition concluding in November 2018. Throughout this transition period and continuing through 2022, we saw

significant improvement in fuel efficiency. During 2022, we consumed 219 million gallons of fuel averaging 84.3 available seat miles (ASMs) per gallon of fuel, a 34 percent improvement when

compared to 2012. Our agreement with Boeing and CFM International to purchase 50 Boeing 737MAX aircraft powered by LEAP 1-B engines, with deliveries beginning before the end of 2023, will

provide us with new aircraft and more environmentally friendly engines. This aircraft is expected to burn up to 20 percent less fuel on a per passenger basis as compared to certain of the older Airbus

A320 aircraft in our fleet.

As of December 31, 2022, the composition of our fleet included a mix of A319 and A320 aircraft with seat configurations ranging from 156 to 186 seats, some of which are fitted with fuel-efficient

Sharklets. As we grow the fleet over the next several years, the preference will be to continue adding 180-seat Sharklet-equipped Airbus aircraft in addition to our Boeing 737MAX order. We expect to

continue to see modest improvements in fuel efficiency due to further upgauging and greater use of Sharklet wingtips where possible.

Despite the significant fuel efficiencies gained over the past decade, we recognize we have a responsibility to do more. We have an internal Fuel Steering Committee that meets monthly to discuss

various alternatives to conserve fuel. In conjunction with the focused efforts and contributions of our pilots, dispatchers, and stations personnel, we have implemented several fuel conservation

practices, which include the following:

• Single engine taxi in and out, as time permits

• Constant descent angle approach, as permitted by air traffic

• Flaps 3 for landing, an Airbus green procedure creating less drag during the landing process, conditions permitting

• Idle thrust reverse for landing, conditions permitting

• Auxiliary power unit fuel optimization

• Route optimization

• Data collection by aircraft to identify performance deterioration and rectify where necessary

• Trial of several electric ground handling equipment

• Optimization of the amount of contingency and dispatch fuel

• Deployment of process to find optimal winds aloft while inflight

In addition to the above initiatives, the Fuel Steering Committee is currently researching sustainable aviation fuel to see if this could be a viable option on some of our routes.

Unlike many air carriers focused on business travel, our strategy is to provide access to affordable travel for leisure travelers who highly value their vacations and are likely to take vacations in any

economic environment. We are a low utilization air carrier focusing on leisure travel. We seek to closely match our available capacity with demand trends in providing only nonstop service from under-

served cities to leisure destinations. For example, in 2022 during our peak demand period in July, we averaged 8.2 system block hours per aircraft per day while in September, we averaged only 4.7

system block hours per aircraft per day when leisure demand is seasonally lower. This practice of significantly reduced flying during the off-peak periods leads to consistently high load factors, and

further enhances fuel efficiency. During 2022, we consumed roughly 14.0 gallons of fuel per thousand revenue passenger miles compared with an Industry average of 16.0 gallons per thousand

revenue passenger miles, or 12.8 percent more efficient on a revenue passenger mile basis. We offer all nonstop flights, directly from 125 cities as of February 1, 2023, providing service in many

markets abandoned or under-served by larger carriers. If not for Allegiant, many of the customers we serve would not have access to direct flights by virtue of either geography or price point. Prior to

our initiation of service on these routes, many of these passengers either traveled by car, which is significantly less fuel efficient than air travel, or traveled by car to larger airports to fly, where higher

cost connecting flights were the only option. As fuel consumption is greatest during take-off, the ability to travel to the destination with a single take-off, as opposed to at least two take-offs on connecting

flights, is more fuel efficient.

Aircraft Fuel

The cost of fuel is volatile, as it is subject to many economic and geopolitical factors we can neither control nor predict. Significant increases in fuel costs could materially affect our operating results and

profitability. We have not used financial derivative products to hedge our exposure to fuel price volatility in over 15 years, nor do we have any plans to do so in the future. Our largely variable cost

structure allows us to adjust capacity accordingly based on the fuel environment.

Data Security

We continue to invest heavily in cybersecurity, cyber risk, vendor risk, and privacy initiatives. We employ experienced staff dedicated to cybersecurity and cyber risk analysis, process, and technology.

We continue to evaluate and proactively implement

new preventive and detective processes and technologies including forward looking threat intelligence and data centric security measures.

One of our current and ongoing data security initiatives is the migration of critical business applications into the cloud infrastructure, which will allow us to take advantage of analytics and automation

functionality. These improvements also provide further opportunities to increase business intelligence and flexibility, improve business continuity, and mitigate disaster scenarios. Protecting business

data and our customers’ privacy is critical to our continued operations and we intend to continue investing resources in cyber security accordingly.

Employees

As of December 31, 2022, we employed 5,315 full-time equivalent employees. Full-time equivalent employees consisted of approximately 1,100 pilots, 1,750 flight attendants, 500 airport operations

personnel, 550 maintenance personnel, 200 reservation agents, 50 flight dispatchers, and 1,150 management and other personnel.

Four groups of our employees – pilots, flight attendants, dispatchers, and maintenance technicians – are represented by labor organizations pursuant to the Railway Labor Act (“RLA”). Those unions

have negotiated separate collective bargaining agreements (“CBAs”) with us covering the rates of pay, rules, and working conditions that apply to those employees.

The CBAs covering our dispatchers and maintenance technicians both have five-year terms and do not become amendable until 2024 and 2026, respectively. The CBAs covering our pilots and flight

attendants became amendable in 2021 and 2022, respectively, and we are currently engaged in collective bargaining with the respective representatives of those employees for successor agreements.

Under the RLA, if direct negotiations do not result in an agreement, either party may request the National Mediation Board ("NMB") to appoint a federal mediator to assist the parties with their

negotiations. If no agreement is reached in these mediated discussions, the NMB must proffer binding arbitration to the parties. If either party rejects binding arbitration, the RLA imposes a “cooling off”

period and allows for the President of the United States to create an emergency board to investigate the dispute and issue recommendations for reaching a settlement. Only after this process has been

exhausted may either party resort to self-help, such as a work stoppage by the union and its members.

In January 2023, we and the union that represents our pilots jointly requested the appointment of a mediator through the NMB. The NMB has appointed a mediator and the parties are participating in

mediated negotiations.

To date, we have not experienced any work interruptions or stoppages from our non-unionized or unionized employee groups.

System Implementations

Beginning in 2021, we have made significant investments to replace certain core proprietary systems with more advanced and integrated third party software solutions. We have selected SAP as our

accounting system, Trax as our Maintenance, Repair, and Overhaul (MRO) system, Navitaire as our passenger service system, and Navblue as our operations control and crew management systems.

We are transitioning to new systems in other areas as well.

SAP's accounting system is expected to simplify our financial operations, enabling real-time data access and improved financial reporting. Trax's MRO system is expected to provide enhanced

maintenance, repair, and overhaul operations, streamlining aircraft maintenance schedules and reducing associated costs. Navitaire’ s passenger service system is expected to improve the way the

airline manages customer interactions, reservations, and allows for dynamically priced ancillary products. Navitaire is also expected to facilitate the initiation and operation of our joint alliance with

VivaAerobus. Navblue’s operations control and crew management system are expected to provide an integrated platform for managing flight schedules and crew assignments, enhancing our

operational efficiency.

We expect that we will have spent more than $50.0 million in total to complete all of these system implementations. We currently expect to switch over to SAP, Trax and Navitaire in 2023 with the

Navblue cutover projected in 2024.

Human Capital

As part of our human capital resource objectives, we seek to recruit, retain, and develop our existing and future workforce. We strive to build and maintain a diverse environment that people want to join,

and where team members want to stay to build their careers. Our total rewards philosophies support these objectives. Above all else, safety is our number one core value, along with achievement,

flexibility, innovation, bias for action, teamwork, transparency and accountability, and outcome-based values that define our human capital mission.

We have long supported Diversity, Equity and Inclusion and operate a Diversity & Inclusivity Council made up of company leadership, and facilitate more than ten company-wide network groups to

inspire a more inclusive culture while giving a dedicated focus to our recruiting processes to continue driving diverse hiring.

Our total rewards philosophy is based around building a culture of high performance. We utilize competitive base salaries, discretionary performance-based bonuses, spot rewards, profit sharing, and

equity as attraction and retention tools for our team members.

As of December 31, 2022, we had approximately 5,315 team members (including both full-time and part-time employees), of whom approximately 65 percent are in front line positions such as flight

crew, mechanics or airport personnel.

The safety and well-being of our team members is a top priority, and we believe each and every team member plays an essential role in creating a safe and healthy workplace. Our health and safety

policies and practices are intended to protect not only our team members, but also our customers in all things we do.

Our human capital focus has been externally recognized through Allegiant’s placement on Newsweek's America's Greatest Workplaces for Diversity 2023, Forbes top 500 Midsize Employers in 2023. In

addition, we received recognition in 2022 from Military Friendly as a "Top 10 Military Spouse Employer" and a "Silver Level Military Friendly Employer". We were also recognized as a "Certified Most

Loved Workplace" by Best Practice Institute, a Partner of Newsweek Magazine.

Community Involvement

Allegiant has worked with the Make-A-Wish® Foundation since 2012 by flying "wish kids" and their families to their desired destinations, at no cost, and donating a portion of proceeds from our in-flight

Wingz Kids Snack Pack to the organization. To kick off 2023, we celebrated a special milestone welcoming our 2000th wish kid on board an Allegiant flight. This in-kind flight program provides Make-A-

Wish with a valuable service at no cost to the organization or the wish families. Additionally, we donate the use of 7,500 square feet of office space at our headquarters campus to the Southern Nevada

chapter of Make-A-Wish, providing a home for the nonprofit organization's administrative office at no cost. The site also serves as the host location for volunteer training, meetings and a place of support

for families of children receiving wishes. Allegiant is considered a Wish Champion by Make-A-Wish America, recognizing more than $1 million in annual contributions.

We have also been a national partner with The Arc, a nonprofit organization dedicated to advocacy on behalf of people with intellectual and developmental disabilities. Allegiant partners with the

organization to offer “Wings for All” educational programs in communities we serve, helping make travel accessible for individuals with autism and other developmental disabilities.

Allegiant supports Science, Technology, Engineering and Mathematics ("STEM") education programs that provide access to careers in aeronautical sciences in under-served communities. We have

partnered with local high schools and with Embry-Riddle Aeronautical University to offer Allegiant Careers in Aviation Scholarships, assisting students pursuing careers in the aviation industry.

We also partner with the American Red Cross, supporting disaster preparedness, relief and recovery efforts in communities we serve. In this effort, we have provided no-cost supply flights and volunteer

transport to support Red Cross hurricane recovery efforts in Florida and Puerto Rico. In the wake of Hurricane Ian in 2022, Allegiant made a $100,000 donation to the organization to help restore critical

resources in the community. In addition, we sponsored a month-long nationwide blood drive to further support relief efforts.

During the COVID-19 pandemic and periodically, we provide additional support in our home community of Las Vegas, donating surplus in-flight food and beverage items such as juices, sodas and

snacks to a local community food bank for distribution to families in need. We also provide $40,000 worth of flight vouchers on an annual basis to hundreds of local elementary and high school teachers

as part of The Smith Center for the Performing Arts’ Heart of Education Awards program.

Aircraft Maintenance

We have a Federal Aviation Administration ("FAA") approved maintenance program, which is administered by our maintenance department headquartered in Las Vegas. Technicians employed by us

have appropriate experience and hold required licenses issued by the FAA. We provide them with comprehensive training and maintain our aircraft in accordance with FAA regulations. The

maintenance performed on our aircraft can be divided into three general categories: line maintenance, major maintenance, and component and engine overhaul and repair. Line maintenance is

generally performed by our personnel in certain cities of our network and by contractors elsewhere. We contract with FAA-approved outside organizations to provide major maintenance and component

and engine overhaul and repair. We have chosen not to invest in facilities or equipment to perform our own major maintenance, engine overhaul or component work. Our management supervises all

maintenance functions performed by our personnel and contractors employed by us, and by outside organizations. In addition to the maintenance contractors we presently utilize, we believe there are

sufficient qualified alternative providers of maintenance services that we can use to satisfy our ongoing maintenance needs.

VivaAerobus Alliance

In December 2021, we announced plans for a fully-integrated commercial alliance agreement with VivaAerobus, designed to expand options for nonstop leisure air travel between our markets in the

United States and Mexico. We and VivaAerobus have submitted a joint application to the DOT requesting approval of and antitrust immunity for the alliance. We believe this alliance is consistent with the

DOT's goal of providing maximum benefits to the public, as the alliance is expected to increase competition, reduce transborder fares and provide increased nonstop service for our consumers traveling

between the US and Mexico.

The alliance is anticipated to add new transborder routes and nonstop competition where currently only connecting service is available. More than 250 new potential nonstop route opportunities have

been identified as part of the DOT application, though specific routes targeted for service wilI be announced at a later date, following the application's approval.

We and VivaAerobus currently expect to offer flights under the alliance beginning in the first half of 2023, pending governmental approval of the applications.

In addition, we have made an investment of $50.0 million in VivaAerobus, and our Executive Chairman and Chairman of the Board Maurice J. Gallagher, Jr. is expected to join the VivaAerobus board of

directors.

Non-Airline Initiatives

Sunseeker Resort

We are developing Sunseeker Resort in Southwest Florida. When completed, the Resort will feature approximately 500 hotel rooms, more than 180 suites, 55,000 square feet of meeting and

conference space, 20 restaurants and bars, a rooftop pool and a ground level pool, a fitness center and spa and retail outlets along a harbor walk. We also own a golf course, Aileron (formerly known

as Kingsway Golf Course), which is a short drive from the Resort site and is considered to be an additional Resort amenity.

Construction on the Resort began in the first quarter of 2019 and was suspended in March 2020 so that we could conserve liquidity during the pandemic. The golf course closed for renovation just

before the pandemic and the renovation was suspended to conserve liquidity during the pandemic. We recommenced construction on the Resort in August 2021 and commenced the golf course

renovation in November 2021. Although the Resort suffered damage from Hurricane Ian and construction was delayed as a result, we expect to open the Resort in late 2023. We expect that the

renovated golf course will open simultaneously with the Resort.

Other travel and leisure initiatives

Consistent with our travel and leisure company focus, we may pursue other travel and leisure initiatives from time to time in the future.

Insurance

We maintain insurance policies we believe are of types customary in the airline industry and as required by the DOT, and are in amounts we believe to be adequate to protect us against material loss.

The policies principally provide coverage for public liability, war-risk, passenger liability, baggage and cargo liability, property damage, including coverages for loss or damage to our flight equipment

and directors and officers, workers’ compensation. We also maintain what we believe to be customary insurance on Sunseeker Resort and as required by the terms of our construction loan. We expect

the Sunseeker insurance to cover all damage incurred from Hurricane Ian. There is no assurance, however, that the amount of insurance we carry will be sufficient to protect us from material loss in all

cases. Available commercial insurance in the future could be more expensive, could have material differences in coverage than is currently provided, and may not be adequate to protect us from risk of

loss.

Government Regulation

We are subject to federal, state and local laws affecting the airline industry and to extensive regulation by the DOT, the FAA, and other governmental agencies.

DOT. The DOT primarily regulates economic issues affecting air transportation such as certification and fitness of carriers, consumer protection, competitive practices, insurance requirements, and

statistical reporting. The DOT also regulates requirements for accommodation of passengers with disabilities, including those using service animals. The DOT monitors the continuing fitness of carriers

and has the authority to promulgate regulations and to investigate (including by on-site inspections) and institute proceedings to enforce its regulations and related federal statutes, and may assess civil

penalties, suspend or revoke operating authority, and seek criminal sanctions. The DOT also has authority to restrict or prohibit a carrier’s cessation of service to certain communities if such cessation

would leave the community without scheduled airline service.

In addition, the DOT has authority to approve alliance or partnership agreements under which two or more air carriers collaborate and to grant immunity from U.S. antitrust laws for the provision of such

collaboration. In December 2021, we (i.e., our airline subsidiary) and Aeroenlaces Nacionales, S.A. de C.V. doing business as VivaAerobus (“Viva”), a Mexican airline, submitted to DOT a joint

application requesting approval of and antitrust immunity for a comprehensive alliance agreement applicable to all routes we and/or Viva may operate between points in the United States and points in

Mexico. The joint application explains how the proposed Allegiant-Viva alliance is expected to benefit the traveling public (as well as Allegiant, Viva, and their respective employees) by bringing

significant new competition and service options, including lower fares, additional capacity on existing routes, and increased overall transborder capacity in the form of nonstop flights on routes now

served only via connecting service. Although the DOT process has progressed substantially and is continuing, there is no assurance when or whether DOT will ultimately approve the agreement and

grant antitrust immunity.

We hold DOT certificates of public convenience and necessity authorizing us to engage in scheduled air transportation of passengers, property and mail within the United States, its territories and

possessions, and between the United States and all countries that maintain a liberal aviation trade relationship with the United States (known as “open skies” countries). We also hold DOT authority to

engage in scheduled air transportation of passengers, property and mail between the United States and Mexico. We hold DOT authority to engage in charter air transportation of passengers, property,

and mail on a domestic and international basis.

FAA. The FAA primarily regulates flight operations and safety, including matters such as airworthiness and maintenance requirements for aircraft, pilot, mechanic, dispatcher and flight attendant training

and certification, flight and duty time limitations, and air traffic control. The FAA requires each commercial airline to obtain and hold an FAA air carrier certificate. This certificate, in combination with

operation specifications issued to the airline by the FAA, authorizes the airline to operate at specific airports using aircraft certificated by the FAA. We have and maintain in effect FAA certificates of

airworthiness for all our aircraft, and we hold the necessary FAA authority to fly to all the cities we currently serve. Like all U.S. certificated carriers, our provision of scheduled service to certain

destinations may require specific governmental authorization. The FAA has the authority to investigate all matters within its purview, to modify, suspend or revoke our authority to provide air

transportation, to approve or disapprove the addition of aircraft to our operation specifications, and to modify, suspend or revoke FAA licenses issued to individual personnel, for failure to comply with

FAA regulations. The FAA can assess civil penalties for such failures and institute proceedings for the collection of monetary fines after notice and hearing. The FAA also has authority to seek criminal

sanctions. The FAA can suspend or revoke our authority to provide air transportation on an emergency basis, without notice and hearing, if, in the FAA’s judgment, safety requires such action. A legal

right to an independent, expedited review of such FAA action exists. Emergency suspensions or revocations have been upheld with few exceptions. The FAA monitors our compliance with

maintenance, flight operations and safety regulations on an ongoing basis, maintains a continuous working relationship with our operations and maintenance management personnel, and performs pre-

scheduled inspections as well as frequent spot inspections of our aircraft, employees and records.

The FAA also has the authority to promulgate rules and regulations and issue maintenance directives and other mandatory orders relating to, among other things, inspection, repair and modification of

aircraft and engines, safety management systems, aircraft equipment requirements, noise abatement, mandatory removal and replacement of aircraft parts and components, mandatory retirement of

aircraft, operational requirements and procedures, and employee drug and alcohol testing. Such rules, regulations and directives are normally issued after an opportunity for public comment; however,

they may be issued without advance notice or opportunity for comment if, in the FAA’s judgment, safety requires such action. We believe we are operating in compliance with applicable DOT and FAA

regulations, interpretations and policies and we hold all necessary operating and airworthiness authorizations, certificates and licenses.

The FAA periodically conducts extensive or targeted audits of our operations. We have satisfactorily responded to all findings on all Certificate Holder Evaluation Process and other inspections

conducted.

Security. Within the United States, civil aviation security functions, including review and approval of the content and implementation of air carriers’ security programs, passenger and baggage screening,

cargo security measures, airport security, assessment and distribution of intelligence, threat response, and security research and development are the responsibility of the Transportation Security

Administration (“TSA”) of the Department of Homeland Security. The TSA has enforcement powers similar to the DOT’s and FAA’s described above. It also has the authority to issue regulations,

including in cases of emergency, the authority to do so without advance notice, including issuance of a grounding order as occurred on September 11, 2001. In addition, the TSA has authority over face

mask requirements applicable to individuals across all U.S. public transportation networks, including at airports and onboard commercial aircraft which were applicable during the pandemic.

Aviation Taxes and Fees. The authority of the federal government to collect most types of aviation taxes, which are used, in part, to finance the nation’s airport and air traffic control systems, and the

authority of the FAA to expend those funds must be periodically reauthorized by the U.S. Congress. On October 5, 2018, the FAA Reauthorization Act of 2018 was signed into law extending certain

commercial aviation taxes (known generally as Federal Excise Taxes or "FET") through September 30, 2023. All carriers are required to collect these taxes from passengers and pass them through to

the federal government. In addition to FET, there are federal fees related to services provided by the TSA, and, in the case of international flights, U.S. Customs and Border Protection ("CBP"), U.S.

Citizenship and Immigration Services (“CIS”), and the U.S. Department of Agriculture's Animal and Plant Health Inspection Service ("APHIS"). There are also FAA-approved Passenger Facility Charges

("PFCs") imposed by most of the airports we serve. Like FET, air carriers are required to collect these fees from passengers and pass them through to the respective federal agency or airport authority.

These fees do not need to be reauthorized, although their amounts may be revised periodically.

Particularly since FAA reauthorization expires September 30, 2023, during the current year Congress may consider legislation that could increase the amount of FET and/or one or more of the other

federally imposed or approved fees identified above. Increasing the overall price charged to passengers could lessen demand for air travel. Additionally, federal funding to airports and/or airport bond

financing could be affected through legislation, which could result in higher fees, rates, and charges at many of the airports we serve.

Environmental. We are subject to various federal, state and local laws and regulations relating to the protection of the environment and affecting matters such as aircraft engine emissions, aircraft noise

emissions, and the discharge or disposal of materials and chemicals, which laws and regulations are administered by numerous state and federal agencies. These agencies have enforcement powers

similar to the DOT’s and FAA’s described above. In addition, we may be required to conduct an environmental review of the effects projected from the addition of our service at airports.

In 2016 the U.S. Environmental Protection Agency (“EPA”) formally concluded that current and projected concentrations of greenhouse gases ("GHG") emitted by various aircraft, including all the

aircraft we and other air carriers operate, threaten public health and welfare. This finding may be a precursor to increased EPA regulation of commercial aircraft emissions in the United States, as has

taken effect for operations within the European Union under EU legislation. Binding international measures adopted under the auspices of the International Civil Aviation Organization (“ICAO”), a

specialized agency of the United Nations, are scheduled to become effective over the next several years, with the pilot phase having begun in 2021. In January 2021 the EPA adopted regulations

setting emissions standards equivalent to ICAO’s for newly-designed aircraft, with immediate effect, and for in-production aircraft, effective 2028. Similarly, in December 2022, the EPA adopted

particulate matter emission standards and test procedures for newly-designed aircraft, with immediate effect, and for in-production aircraft, effective 2028.

These new standards and procedures harmonize with ICAO requirements. At present, the aircraft we operate are not affected by these standards.

We anticipate that in 2023 and thereafter, legislative and regulatory concern with the environmental impacts of the air transportation industry will increase, and that the longer-term effects on our fleet

and operating costs may be substantial.

According to a September 2021 White House announcement, civil aviation accounts for 11 percent of emissions by the U.S. transportation sector as a whole. The FAA has announced a U.S. aviation

sector goal of net-zero GHG emissions by 2050, consistent with the broader federal objective of achieving net-zero GHG emissions economy-wide by 2050. We cannot predict whether these or similar

initiatives will lead to legislation that will pass the Congress or, if enacted into law, how it ultimately would apply to our operations or the airline industry.

Federal law recognizes the right of airport operators with special noise problems to implement local noise abatement procedures so long as those procedures do not interfere unreasonably with

interstate and foreign commerce and the national air transportation system. These restrictions can include limiting nighttime operations, directing specific aircraft operational procedures during takeoff

and initial climb, and limiting the overall number of flights at an airport. None of the airports we serve currently impose such restrictions on the number of flights or hours of operation that have a

meaningful impact on our operations. It is possible one or more such airports may impose additional future restrictions with or without advance notice, which may impact our operations.

Foreign Ownership. To maintain our DOT and FAA certificates, our airline operating subsidiary and we (as the airline’s holding company) must qualify continuously as citizens of the United States within

the meaning of U.S. aeronautical laws and regulations. This means we must be under the actual control of U.S. citizens and we must satisfy certain other requirements, including that our president/chief

executive officer and at least two-thirds of our board of directors and other managing officers are U.S. citizens, and that not more than 25 percent of our voting stock is owned or controlled by non-U.S.

citizens. The amount of non-voting stock that may be owned or controlled by non-U.S. citizens is strictly limited as well. We believe we are in compliance with these ownership and control criteria.

Other Regulations. Air carriers are subject to certain provisions of federal laws and regulations governing communications because of their extensive use of radio and other communication facilities, and

are required to obtain an aeronautical radio license from the Federal Communications Commission (“FCC”). To the extent we are subject to FCC requirements, we intend to continue to comply with

those requirements.