3/7/2011

1

RPM Workshop 1:

BASIC RATEMAKING

Development of an Overall Indication

1

Development

of

an

Overall

Indication

Jennifer Jabben, FCAS, MAAA

Assistant Actuary

Allstate Insurance Company

Jennifer.Jabben@Allstate.com

March 20, 2011

New Orleans, LA

ANTITRUST NOTICE

• The Casualty Actuarial Society is committed to adhering strictly to the

letter and spirit of the antitrust laws. Seminars conducted under the

auspices of the CAS are designed solely to provide a forum for the

expression of various points of view on topics described in the programs or

agendas for such meetings.

• Under no circumstances shall CAS seminars be used as a means for

competing companies or firms to reach any understanding

–

expressed or

2

competing

companies

or

firms

to

reach

any

understanding

–

expressed

or

implied – that restricts competition or in any way impairs the ability of

members to exercise independent business judgment regarding matters

affecting competition.

• It is the responsibility of all seminar participants to be aware of antitrust

regulations, to prevent any written or verbal discussions that appear to

violate these laws, and to adhere in every respect to the CAS antitrust

compliance policy.

AGENDA

• BASIC RATEMAKING EQUATION

• UNDERLYING DATA MANIPULATION

• PROFIT AND CONTINGENCY PROVISIONS

•

EXAMPLE

3

•

EXAMPLE

3/7/2011

2

BASIC EQUATION

REQUIRED

PREMIUM

4

FUTURE LOSSES FUTURE EXPENSES

UW PROFIT &

CONTINGECNY

PROVISION

BASIC METHODS

LOSS RATIO

• Produces Indicated Rate Change

• Based on Premium

• Requires Existing Rates

PURE PREMIUM

• Produces Indicated Rates

• Based on Exposures

• Does Not Require Existing Rates

5

Note: The two methods produce identical results when identical data

and assumptions are used.

BASIC FORMULA:

REQUIRED

PREMIUM

(R)

UW PROFIT &

6

FUTURE LOSSES

(Includes Loss Adjustment Expense)

(L)

FUTURE EXPENSES

UW

PROFIT

&

CONTINGECNY

PROVISION

(Q)

VARIABLE

EXPENSES

(V)

FIXED

EXPENSES

(E

f

)

3/7/2011

3

BASIC FORMULA

R = L + V*R + E

F

+ Q*R

Solve for R:

R – V*R – Q*R = L + E

F

R*(1 – V – Q) = L + E

F

7

R = L + E

F

(1-V-Q)

Variable Permissible Loss Ratio = 1 – V – Q

– The percentage of each premium dollar that is intended to pay for the

projected loss and fixed expense components.

BASIC FORMULA:

Loss Ratio

Indicated Change = Loss Ratio + Fixed Expense Ratio

Variable Permissible Loss Ratio

8

(R

1

-R

0

) /R

0

= (L/R

0

+ E

F

/R

0

)

(1 –V –Q)

BASIC FORMULA:

Pure Premium

Indicated Rate = Pure Premium + Fixed Expense

Variable Permissible Loss Ratio

9

R

1

/X= (L/X + E

F

/X)

(1 –V –Q)

3/7/2011

4

DATA CATEGORIZATION

• CALENDAR YEAR

• POLICY YEAR

• ACCIDENT YEAR

10

CALENDAR YEAR

Premium and Loss transactions that occur during the

year.

– Advantages:

Dt i ilbl ikl

11

•

D

a

t

a

i

s ava

il

a

bl

e qu

i

c

kl

y

• FIXED AT YEAR END

– Consistent with Financial Statements

– Disadvantage:

• Premium and Loss Transactions DO NOT match.

– Loss data includes payments and changes to reserves for policies

whose premiums were earned in prior periods.

POLICY YEAR

Premium and Loss transactions on policies with effective dates

(new or renewal) during the year.

– Advantages

:

• Premium and Loss transactions DO

match.

Transactions from policies effective in prior years do not distort the

12

–

Transactions

from

policies

effective

in

prior

years

do

not

distort

the

data for ratemaking.

– Disadvantage:

• Data is not available until one term after the end of the policy year.

• Losses are NOT fixed at year end.

3/7/2011

5

ACCIDENT YEAR

Loss transactions for accidents occurring during the year, and

Premium transactions during the same 12 months.

– Advantages

:

• Represents a better match of premium and losses than Calendar

Year aggregation

13

Year

aggregation

.

– Transactions from accidents occurring in prior years do not distort the

data for ratemaking.

– Disadvantage:

• Data with slight time lag.

• Losses are NOT fixed at year end.

UNDERLYING

DATA MANIPULATION

HISTORICAL

DATA

LOSS EXPENSE PREMIUM

14

CAT/Large Loss

ADJUSTMENTS

LOSS

DEVELOPMENT

TREND

FIXED

VARIABLE

TREND

CURRENT

RATE LEVEL

TREND

TREND

Historical loss, premium and exposure data is

trended to reflect the level predicted to exist

during the pricing period.

to account for expected difference between the

15

–

to

account

for

expected

difference

between

the

historical period and the future period.

3/7/2011

6

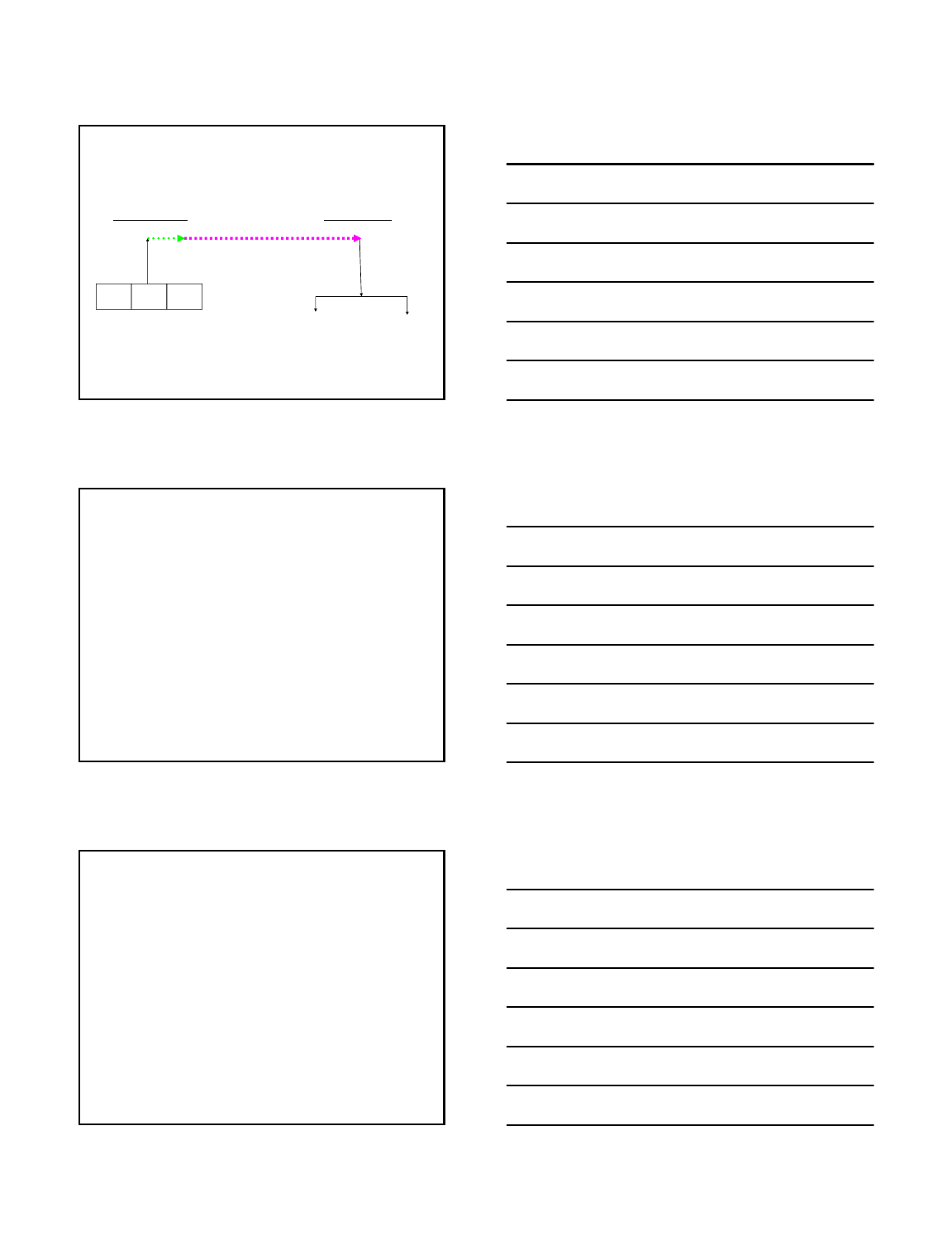

TREND PERIOD

Experience Period

Exposure Period

16

Eff. Date

Eff. Date + 1 +

Policy term

Latest Year

of Data

Latest Year

-1

Latest Year

-2

Trend to Date =

Eff. Date + ½ +

½ Policy Term

CATASTROPHE/Large Loss

• Catastrophe losses are very volatile from year to year,

and should be removed from the underlying data

because of their large size and infrequency of

occurrence.

Recognition of exposure is appropriate and can be

17

–

Recognition

of

exposure

is

appropriate

and

can

be

incorporated using various methods.

• Long-Term Average, Catastrophe Simulation Modeling.

• Appropriate to give consideration to the impact of

other non-catastrophe large losses on underlying data

and analysis.

LOSS DEVELOPMENT

Adjustment made to underlying accident year

loss data to reflect an expected ultimate value.

– 2 reasons for Accident Year losses to develop

•

New Losses emerge after year

-

end (IBNR)

18

•

New

Losses

emerge

after

year

-

end

(IBNR)

• Development on known claims

3/7/2011

7

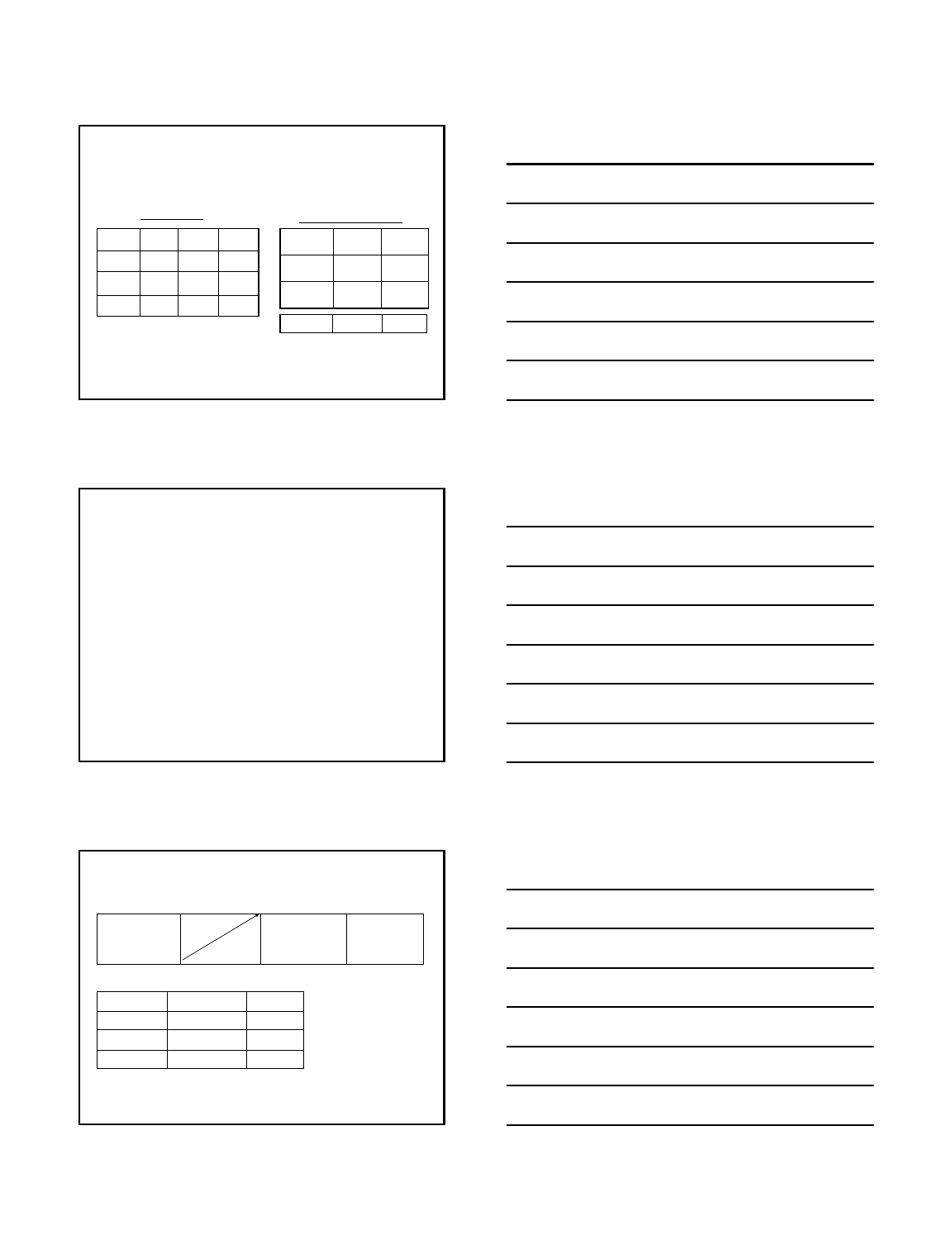

LOSS DEVELOPMENT FACTOR

(LDF) METHOD

ACCIDENT

YEAR

@ 12mo @ 24mo @ 36mo

2008 $1,000 $2,000 $2,500

ACCIDENT

YEAR

12-24 24-36

2008

200

125

Incurred Losses

Loss Development Factors

19

2009 $2,000 $3,000

2010 $2,500 X?

2008

2

.

00

1

.

25

2009 1.50

LDF 1.75 1.25

Estimated Ultimate 2010 AY Loss = $2,500 x 1.75 x 1.25 = $5,469

CURRENT RATE LEVEL

• Adjustment to reflect rate changes that are not

already included in the historical recorded

premium.

Common Techniques:

20

–

Common

Techniques:

• Extension of Exposures

• Parallelogram Method

PARALLELOGRAM METHOD

2009

2010 2011 2012

A

B

0%

Earned

100%

Earned

Rate Change = 10% on 1/1/2010

1.00 1.10

21

Area Percent of 2010 Rate Index

A .50 1.00

B .50 1.10

2010 1.00 1.05

2010 FCRL = (1.10/1.05) = 1.048

3/7/2011

8

PROFIT & CONTINGENCY

• UNDERWRITING PROFIT PROVISION

– Basic Selection = 5%

– More Complex Calculation

• Consideration of Investment Income

22

• CONTINGENCY

– Provision for expected differences, if any, between the

estimated costs and the average actual costs, that cannot be

eliminated by changes in the other components of the

ratemaking process.

? QUESTIONS ?

23