Income, Liquidity, and the Consumption Response to the 2020 Economic Stimulus Payments

Scott R. Baker, R. A. Farrokhnia, Steffen Meyer, Michaela Pagel, and Constantine Yannelis

NBER Working Paper No. 27097

May 2020, Revised in September 2020

JEL No. D14,E21,G51

ABSTRACT

The 2020 CARES Act directed large cash payments to households. We analyze house-holds’

spending responses using high-frequency transaction data from a Fintech non-profit, exploring

heterogeneity by income levels, recent income declines, and liquidity as well as linked survey

responses about economic expectations. Households respond rapidly to the re-ceipt of stimulus

payments, with spending increasing by $0.25-$0.40 per dollar of stimulus during the first weeks.

Households with lower incomes, greater income drops, and lower lev-els of liquidity display

stronger responses highlighting the importance of targeting. Liquidity plays the most important

role, with no significant spending response for households with large checking account balances.

Households that expect employment losses and benefit cuts dis-play weaker responses to the

stimulus. Relative to the effects of previous economic stimulus programs in 2001 and 2008, we

see faster effects, smaller increases in durables spending, larger increases in spending on food,

and substantial increases in payments like rents, mortgages, and credit cards reflecting a short-

term debt overhang. We formally show that these differences can make direct payments less

effective in stimulating aggregate consumption.

Scott R. Baker

Kellogg School of Management

Northwestern University

2211 Campus Drive

Evanston, IL 60208

and NBER

R. A. Farrokhnia

Columbia Graduate School of Business

3022 Broadway

New York, NY 10027

Steffen Meyer

University of Southern Denmark

Campusvej 55

5230 Odense M

Denmark

Michaela Pagel

Columbia Business School

3022 Broadway

Uris Hall

New York, NY 10027

and NBER

Constantine Yannelis

Booth School of Business

University of Chicago

5807 S. Woodlawn Avenue

Chicago, IL 60637

and NBER

Income, Liquidity, and the Consumption Response to the 2020

Economic Stimulus Payments

*

Scott R. Baker

†

R.A. Farrokhnia

‡

Steffen Meyer

§

Michaela Pagel

¶

Constantine Yannelis

||

September 15, 2020

Abstract

The 2020 CARES Act directed large cash payments to households. We analyze house-

holds’ spending responses using high-frequency transaction data from a Fintech non-profit,

exploring heterogeneity by income levels, recent income declines, and liquidity as well as

linked survey responses about economic expectations. Households respond rapidly to the re-

ceipt of stimulus payments, with spending increasing by $0.25-$0.40 per dollar of stimulus

during the first weeks. Households with lower incomes, greater income drops, and lower lev-

els of liquidity display stronger responses highlighting the importance of targeting. Liquidity

plays the most important role, with no significant spending response for households with large

checking account balances. Households that expect employment losses and benefit cuts dis-

play weaker responses to the stimulus. Relative to the effects of previous economic stimulus

programs in 2001 and 2008, we see faster effects, smaller increases in durables spending, larger

increases in spending on food, and substantial increases in payments like rents, mortgages, and

credit cards reflecting a short-term debt overhang. We formally show that these differences can

make direct payments less effective in stimulating aggregate consumption.

JEL Classification: D14, E21, G51

Keywords: Household Finance, CARES, Consumption, COVID-19, Stimulus, MPC, Transaction Data

*

The authors wish to thank Sylvain Catherine, Arpit Gupta, Jonathan Parker, and Joe Vavra for helpful discus-

sion and comments as well as seminar participants at the MoFiR Banking Workshop, CEPR New Consumption Data

Conference, Virtual AFFECT seminar, Toulouse School of Economics, Columbia Graduate School of Business, Uni-

versity of Chicago Booth School of Business, and the Federal Reserve Bank of Philadelphia. Constantine Yannelis is

grateful to the Fama Miller Center for generous financial support. R.A. Farrokhnia is grateful to Advanced Projects

and Applied Research in Fintech at Columbia Business School for support. We would like to thank Suwen Ge, Spy-

ros Kypraios, Rebecca Liu, and Sharada Sridhar for excellent research assistance. We are grateful to SaverLife for

providing data access and conducting our user survey.

†

Northwestern University, Kellogg, NBER; [email protected]

‡

Columbia Business School, Columbia Engineering School; farrokhnia@gsb.columbia.edu

§

University of Southern Denmark (SDU) and Danish Finance Institute (DFI); [email protected]

¶

Columbia Business School, NBER, and CEPR; [email protected]

||

University of Chicago Booth School of Business, NBER; [email protected]

1

1 Introduction

In three recent instances, the US government made direct cash payments to households in response

to economic downturns. These payments are generally meant to alleviate the effects of a recession

and stimulate the economy through a multiplier effect, i.e., by increasing households’ consumption

which then translates in to more production and employment. The effectiveness of these payments

relies on households’ marginal propensities to consume, or MPCs, out of these stimulus payments

which, in turn, may depend on household’s expectations (Barro, 1989).

In this paper, we estimate households’ MPC in response to the 2020 CARES Act stimulus pay-

ments using data from a non-profit Fintech firm, SaverLife. We explore how these MPCs vary with

household financial characteristics, such as income, income declines, and cash on hand. We also

describe how household MPCs vary across categories of consumption and how these categorical

responses differ from those seen in previous recessions. Furthermore, this paper links transaction

data to user survey data in order to study how expectations impact household responses to stimulus

payments. Understanding these MPCs is key to targeting policies to households where effects will

be largest, as well as distinguishing between different models of household consumption behavior.

MPCs are important to both policy and economic theory as they determine fiscal multipliers

in a wide class of models. More specifically, heterogeneity in MPCs impacts which households

are most responsive to stimulus payments. In turn, targeting can have large impacts on the effec-

tiveness of stimulus payments on consumption and the aggregate economy. This paper shows that

liquidity is a key determinant of MPC heterogeneity during the 2020 contraction, with highly liq-

uid households showing no response to stimulus payments. Even among households with higher

levels of income, low levels of liquidity are associated with high MPCs.

We explore responses to stimulus payments and individual heterogeneity in MPCs by using

high frequency transaction data from SaverLife, a non-profit financial technology firm. Similar to

many other Fintech firms, idividuals can link their accounts to the service to track their finances.

We have access to de-identified bank account transactions and balances data from August 2016

to August 2020 for these users. The fact that we observe inflows and outflows from individual

accounts as well as balances in this dataset allows us to explore heterogeneity in levels of income,

changes in income, and liquidity. The sample consists primarily of lower- and middle-income

2

households, and we are able to link the bank account transactions data to survey data about eco-

nomic expectations.

We use this detailed data to look at the CARES Act stimulus payments distributed in April and

May 2020. The first stimulus payments were made in mid April via direct deposit from the IRS,

and we can observe the user-specific stimulus amounts as well as spending daily before and after

stimulus payments are made. We see sharp and immediate responses to the stimulus payments;

within ten days, users spend over 20 cents of every dollar received in stimulus payments. The

largest increases in spending are on food, non-durables, and payments like rent, mortgages, and

student loans.

Looking at heterogeneity across financial characteristics, we find that lower income and less

liquidity are associated with larger MPCs while recent drops in income seem to have only small ef-

fects. Individuals with less than $100 in their accounts spend over 40% of their stimulus payments

within the first month, while we observe a statistically insignificant response of only 11 cents for

individuals with more than $4,000 in their accounts.

These heterogeneity results are important in terms of targeting stimulus policies towards groups

most impacted by them. The theory behind stimulus payments links MPCs directly to the ultimate

fiscal multiplier effect, i.e., the effectiveness of the payments in stimulating aggregate consump-

tion. The results of this study suggest that targeting stimulus payments to households with low

levels of liquidity in a type of recession where large sectors of the economy are shut down will

have the largest effects on MPCs, and hence on fiscal multipliers.

We further explore how beliefs about personal and aggregate outcomes impact the response to

stimulus payments, utilizing a survey of our users which we can then link to the transaction data.

Theoretical work has long noted that expectations can play an important role in the efficacy of

stimulus (Barro, 1974, 1989; Seater, 1993; Galí, 2019). In particular, households may respond to

debt-financed spending increases by cutting spending today if they anticipate future tax hikes or

other changes in income (Cochrane, 2009), referred to as Ricardian equivalence.

Discussions about Ricardian equivalence have driven vigorous debates about the efficacy of

fiscal stimulus (Barsky, Mankiw and Zeldes, 1986). In our survey, users are asked about their

expectations regarding unemployment, salary cuts, tax increases, benefit cuts, stock market perfor-

mance, and the duration of the pandemic. We received 1,011 unique responses and find that our

3

users are relatively pessimistic about the length of the pandemic and their own future income and

employment opportunities.

1

While we do not find evidence that anticipated tax increases impact

MPCs, we do find that expectations about employment and government benefit cuts play an im-

portant role in determining MPCs. Households that anticipate unemployment or benefit cuts save

a significantly larger fraction of their stimulus checks.

We then show in a macroeconomic model with multiple sectors that non-targeted fiscal stim-

ulus payments in environments like the 2020 COVID-19 epidemic may be less effective than the

payments in response to the 2001 and 2008 economic downturns. Reflecting the current situation,

we map out a three sector model in which one sector employing lower wage agents is shut down

while a second low-wage essential sector remains operational alongside a higher-wage sector that

can largely work from home.

Due to the shut down of one low wage sector, those poorer and higher MPC agents are largely

excluded from benefiting from additional spending induced by stimulus payments, thereby reduc-

ing the fiscal multiplier effect. We also see that agents in the lower wage sectors tend to accumulate

more debt by borrowing from the higher wage sector. Agents end up using the stimulus payments

to repay debt to high wage individuals who have the lowest MPCs out of income. In short, work-

ers will spend their stimulus payment on mortgages and loan repayments as well as non-durable

essentials which implies that the cash flows immediately to agents with lower MPCs. This tends

to make fiscal stimulus less effective overall. This model thus confirms our empirical results.

There is an extensive literature on households’ responses to tax rebates and previous stim-

ulus payments. Using spending data from the Consumer Expenditure Survey, Johnson, Parker

and Souleles (2006) and Parker, Souleles, Johnson and McClelland (2013) look at the tax rebates

granted in 2001 and the economic stimulus payments in 2008. The authors document positive

effects on spending in both non-durable and durable goods. Broda and Parker (2014) use high-

frequency scanner data and find large positive effects on spending. Besides looking at aggregate

effects, studies have also found heterogeneous effects across agents. Agarwal, Liu and Souleles

1

SaverLife conducted our survey from mid-May to the end of July. This survey also elicited self-reported informa-

tion on the receipt and use of the stimulus checks. In terms of the fiscal stimulus use, our survey results line up nicely

with the empirics. 60% of individuals report that they will not use any portion of the check for durables consumption

and 50% of the users are using at least part of the check amount for food spending. A large majority of users also

reported using at least a portion of the stimulus check for payment of current or past due bills. Finally, 15% of users

are reporting to save most of the check amount and 45% report to save none of the check amount.

4

(2007) work with credit card accounts and find that customers initially saved the tax rebates in

2001, but then increased spending later on. In their setting, customers with low liquidity were

most responsive. Misra and Surico (2014) use a quantile framework to look at the 2001 tax rebates

and the 2008 economic stimulus payments on the distribution of changes in consumption.

In Section 4.1, we discuss some of the differences between our estimates and the previous lit-

erature that analyze past stimulus programs. The existing studies exploit the differences in timing

of the arrival of the payment to infer causal effects. Our results are generally comparable. How-

ever, the three main differences are: 1) during the 2020 stimulus, households spend much of their

stimulus checks in a shorter period of time, 2) they spend more on food and non-durables than

on durable consumption like furniture, electronics, or cars, and 3) they repay credit cards, rent,

mortgages, and other overdue bills. Additionally, our study is the first to empirically explore, by

linking transaction and survey data, how expectations affect MPCs out of stimulus payments, long

a focus of the theory literature.

Kaplan and Violante (2014) focus on the 2001 tax rebates and use a structural model to docu-

ment that responsiveness to rebates is driven by liquid wealth. Households with sizable quantities

of illiquid assets but low liquidity are an important driver of the magnitude of the response. To our

knowledge, our study is the first to look at stimulus payments using high-frequency transaction

data, as such data did not exist in 2008.

2

The use of transaction data allows us to explore very-

short term responses across categories, minimize measurement error, and explore individual daily

heterogeneity in income declines and available cash on hand.

In this paper, we focus on a very different type of contraction relative to those faced dur-

ing previous stimulus programs: one stemming from an infectious disease outbreak that caused

widespread business and government shutdowns. In comparison to the 2001 and 2008 economic

downturns, the downturn due to COVID-19 was inflicted on households at a much faster pace,

causing large job losses much more quickly. In addition, the pandemic has the potential to have

large initial effects on income and liquidity, but potentially comparatively less on future income

and wealth.

2

A number of papers use transaction-level data to look at spending responses to other income, such as Baker

(2018), Kuchler and Pagel (2020), Olafsson and Pagel (2018), Baker and Yannelis (2017), Baugh, Ben-David, Park

and Parker (2018), and Kueng (2018). Broda and Parker (2014) explore some higher frequency weekly responses

using Nielsen Homescan data.

5

While previous studies have pointed out that stimulus payments have positive but heteroge-

neous effects on spending, analyzing the 2020 stimulus program will help us learn more about

effects on spending in different economic circumstances. In particular, this crisis was so fast mov-

ing that households had little ability to increase precautionary savings. Additionally, many sectors

of the economy were shut down due to state and local orders, which can impact the effectiveness of

fiscal stimulus, as discussed above. Some policymakers argued that shutdowns make conventional

fiscal stimulus obsolete.

3

Our results are also important for the ongoing discussion of Representative Agent Neo-Keynesian

(RANK) and Heterogeneous Agent Neo-Keynesian (HANK) models. RANK and HANK models

often offer starkly different predictions, and the observed MPC heterogeneity highlights the im-

portance of the HANK framework. In a recent attempt to study pandemics in a HANK framework,

Kaplan, Moll and Violante (2020a) show that for income declines up to 70%, consumption de-

clines by 10%, and GDP per capita by 6% in a lockdown scenario coupled with economic policy

responses. In another recent working paper, Bayer, Born, Luetticke and Müller (2020) calibrate

a HANK model to study the impact of the quarantine shock on the US economy in the case of a

successful suppression of the pandemic. In their model, the stimulus payment help stabilize con-

sumption and results in an output decline of less than 3.5%. Additionally, Hagedorn, Manovskii

and Mitman (2019) study multipliers in a HANK framework, whose size can depend on market

completeness and the targeting of the stimulus.

This paper also joins a fast-growing literature on the effects of the COVID-19 pandemic on the

economy, and policy responses. Several papers develop macroeconomic frameworks of epidemics,

e.g. Jones, Philippon and Venkateswaran (2020), Barro, Ursua and Weng (2020), Eichenbaum, Re-

belo and Trabandt (2020), and Kaplan, Moll and Violante (2020b). Gormsen and Koijen (2020) use

stock prices and dividend futures to back out growth expectations. Coibion, Gorodnichenko and

Weber (2020) study short-term employment effects and Baker, Bloom, Davis and Terry (2020a)

analyze risk expectations. Granja, Makridis, Yannelis and Zwick (2020) study the targeting and

impact of the Paycheck Protection Program (PPP) on employment. Barrios and Hochberg (2020)

and Allcott, Boxell, Conway, Gentzkow, Thaler and Yang (2020) show that political affiliations im-

3

For example, Joshua Rauh the former chair of the President’s Council of Economic advisers noted that: “A

contraction cannot be addressed via conventional fiscal stimulus since no increase in consumer demand will cause

restaurants closed on government orders to re-open.”

6

pact the social distancing response to the pandemic, and Coven and Gupta (2020) study disparities

in COVID-19 infections and responses.

Our related paper, Baker, Farrokhnia, Meyer, Pagel and Yannelis (2020b), studies household

consumption during the onset of the pandemic in the United States using a smaller sample drawn

from the same data source. Carvalho, Garcia, Hansen, Ortiz, Rodrigo, Mora and Ruiz (2020),

Andersen, Hansen, Johannesen and Sheridan (2020), Bounie, Camara and Galbraith (2020), Chen,

Qian and Wen (2020) perform similar analyses as the one in this paper using transaction-level data

from the Spain, Denmark, France, and China. Dunn, Hood and Driessen (2020) uses transaction-

level data from the US provided by merchants rather than individual-level data and find similar

results to Baker, Farrokhnia, Meyer, Pagel and Yannelis (2020b). We join this emerging and

rapidly-growing literature by providing early evidence on how households responded to the cri-

sis and on the details of the impacts of federal stimulus policy. The results suggesting that MPCs

are much higher for low liquidity households are important in designing future rounds of stimulus,

as the effects of the epidemic will persist over the next months.

We also join a literature on how expectations affect household’s economic behavior. Macroe-

conomic models since the 1980s have noted that government budget deficits may in the short-

term affect household’s expectations about future taxes, and implicitly transfers (Barro, 1989). A

newer and growing body of recent work also shows that expectations about individual and aggre-

gate outcomes impact behavior, studying households (Giglio, Maggiori, Stroebel and Utkus, 2019;

Kuchler and Zafar, 2019; Armona, Fuster and Zafar, 2019; D’Acunto, Hoang and Weber, 2020;

Manski, 2004) and firms (Landier and Thesmar, 2020; Landier, Ma and Thesmar, 2017; Bouchaud,

Krueger, Landier and Thesmar, 2019; Gennaioli, Ma and Shleifer, 2016). During the debate about

the efficacy of the 2008 stimulus, the role that expectations would play in the program’s efficacy

and stimulating consumption was discussed at length, however, there is little empirical work ex-

ploring how expectations affect the MPCs out of stimulus payments.

The remainder of this paper is organized as follows. Section 2 provides background informa-

tion regarding the 2020 stimulus and our empirical strategy. Section 3 describes the main transac-

tion data used in the paper as well as the linked survey data. Section 4 presents the main results and

Section 5 discusses heterogeneity by income, income drops, and liquidity. Section 6 explores how

expectations interact with stimulus payments to affect consumption responses. Section 7 presents

7

a simple model to explain how fiscal multiplier effects may differ from prior stimulus programs.

Section 8 concludes and suggests directions for future research.

2 Institutional Background and Empirical Strategy

2.1 2020 Household Stimulus

COVID-19, a novel coronavirus, was first identified in Wuhan, China and subsequently spread

worldwide in early 2020. By some estimates, the new virus had a mortality rate which is ten

times higher than the seasonal flu and has at least twice the rate of infection. The first case in the

United States was identified in late January in Washington state and spread within the country in

February. By mid-March, the virus was spreading rapidly, with significant clusters in New York,

San Francisco, and Seattle. Federal, state, and local governments responded to the COVID-19

pandemic in a number of ways: by issuing travel restrictions, shelter-in-place orders, and closures

of many non-essential businesses.

The federal government soon passed legislation aimed at ameliorating economic damage stem-

ming from the spreading virus and shelter-in-place policies. The CARES Act was passed on March

25, 2020 as a response to the economic damage of the new virus. The Act deployed nearly $2 tril-

lion across a range of programs for households and businesses. This study focuses on the portion

of the Act that directed cash transfers to the vast majority of American households. These one-time

payments consist of $1,200 per adult and an additional $500 per child under the age of 17. For

an overview of amounts by household, see Appendix Figure A.1. These amounts are substantially

larger than the 2001 and 2008 stimulus programs. In 2020, a married couple with two children

would be sent $3,400, a significant amount, particularly for liquidity-constrained households.

Most American households qualified for these payments. All independent adults who have a

social security number, filed their tax returns, and earn below certain income thresholds qualified

for the direct payments. Payments begin phasing out at $75,000 per individual, $112,500 for heads

of households (single parents with children), and $150,000 for married couples. No payments were

made to individuals earning more than $99,000 or married couples earning more than $198,000.

4

4

Due to data limitations, in identifying stimulus payments, we are unable to identify these partial payments from

these higher-income households. However, these individuals are a very small fraction of total households, both overall

8

Payments are made by direct deposit whenever available, or by paper check when direct deposit

information was unavailable. Funds are disbursed by the IRS, and the first payments by direct

deposit were made on April 9th. The IRS expected that direct deposits would largely be completed

by April 15th. In practice, the timing varied across banks and financial institutions, with some

making payments available earlier than others, and direct deposits being spread out across more

than one week. Amounts and accounts for direct deposits were determined using 2019 tax returns,

or 2018 tax returns if the former were unavailable.

For individuals without direct deposit information, paper checks were scheduled to be mailed

starting on April 24th. Approximately 70-80% of taxpayers use direct deposit to receive their tax

refunds, though given changes in banking information or addresses, many individuals were unable

to receive their payments through direct deposit even when they had received prior tax refunds via

direct deposit. In the case of paper checks, the order of payments across households is not random.

The IRS directed to send individuals with the lowest adjusted gross income checks first in late

April, and additional paper checks were sent throughout May. Appendix A provides further details

regarding the timing of payments and the stimulus.

2.2 Empirical Strategy

Our empirical strategy exploits our high-frequency data and the timing of stimulus payments to

capture spending responses. We first show estimates of β

k

from the following specification:

c

it

= α

i

+ α

t

+

23

X

k=−7

β

k

[t = k]

it

+ ε

it

(1)

c

it

denotes spending by individual i aggregated to the daily level t. α

i

are individual fixed

effects, while α

t

are date fixed effects. Individual fixed effects α

i

absorb time invariant user-

specific factors, such as some individuals having greater average income or wealth. The date fixed

effects α

t

absorb time-varying shocks that affect all users, such as the overall state of the economy

and economic sentiment. [t = k]

it

is an indicator of the time period k days after receipt of the

stimulus payment for individual i at time t.

In some specifications, we interact individual fixed effects with day of the week or day of the

and particularly among our sample which is skewed towards lower income households.

9

month fixed effects to capture individual-level time-varying spending patterns over the week and

month. For example, some individuals may spend more on weekends, or on their paydays. We

run regressions at an individual-day level to examine more precisely the high frequency changes

in behavior brought about by the receipts of the stimulus payments. Standard errors are clustered

at the individual level. The coefficient β

k

captures the excess spending on a given day before and

after stimulus payments are made. In our graphs, the solid lines show point estimates of β

k

, while

the dashed lines show 95% confidence intervals.

We identify daily MPCs using the following specification:

c

it

= α

i

+ α

t

+

23

X

k=−7

γ

k

P

i

× [t = k]

it

+ ε

it

(2)

where P

i

are stimulus payments for individual i. To identify cumulative MPCs since the pay-

ment, we scale indicators of a time period being after a stimulus payment by the amount of the

payment over the number of days since the payment. That is, our estimate of a cumulative MPC ζ

comes from the following specification:

c

it

= α

i

+ α

t

+ ζ

P ost

it

× P

i

D

it

+ ε

it

(3)

where P

i

is the stimulus payment an individual i is paid, D

it

is the total number of days over

which we estimate the MPC, and P ost

it

is an indicator of the time period t being after individual

i receives a stimulus payment. The coefficient ζ thus captures the aggregate effect of the stimulus

in the time period in question, by scaling the average effect per day by the number of days since

receipt. The resulting coefficients can be interpreted as the fraction of stimulus money spent during

that period: a coefficient of 0.05 corresponds to the user spending 5% of their stimulus check

during their observed post-stimulus period.

5

5

As an example to illustrate this, imagine that a $1 transfer leads to $1 dollar of additional spending in the day

immediately after receipt. Thus if we estimated the effect over one day, we would scale by 1 and ζ = 1. If we estimate

the effect over 10 days, the average effect each day is 0.1, which would be the coefficient on a regression of P ost

it

×P

i

and we scale by 10 so again ζ = 1. If we estimate the effect over 100 days, the average effect per day is 0.01, again

we would scale by 100 and so on.

10

3 Data

3.1 Transaction Data

In this paper, we utilize de-identified transaction-level data from SaverLife, a non-profit fin-tech

helping working families meet financial goals. As with a number of other personal financial apps,

SaverLife allows users to link their main bank accounts to their service. Users can link their check-

ing, savings, as well as their credit card accounts. The sample is skewed towards lower income

individuals, given that the non-profit fin-tech targets assisting households that have difficulty sav-

ing and meeting budgetary commitments. SaverLife offers users the ability to aggregate financial

data and observe trends and statistics about their own spending.

Figure 1 shows two screenshots of the online interface in the app. The first is a screenshot

of the linked main account while the second is a screenshot of the savings and financial advice

resources that the website provides. This data is described in more detail in Baker, Farrokhnia,

Meyer, Pagel and Yannelis (2020b).

Overall, we have been granted access to de-identified bank account transactions and balances

data from August 2016 to August 2020. We observe 90,844 users in total who live across the

United States. In addition, for a large number of users, we are able to link financial transactions to

self-reported demographic and spatial information such as age, education, ZIP code, family size,

and the number of children they have.

We also observe a category that classifies each transaction. Spending transactions are cate-

gorized into a large number of categories and subcategories. For the purposes of this paper, we

mostly analyze and report spending responses into the following aggregated categories: food,

household goods and personal care, durables like auto-related spending, furniture, and electronics,

non-durables and services, and payments including check spending, loans, mortgages, and rent.

Across all specifications, we exclude transactions that represent transfers between accounts like

transfers to savings or investment accounts.

Looking only at the sample of users who have updated their accounts reliably up until May

2020, we have complete data for 38,379 users to analyze in this paper. We require these users to

have at least 2 transactions in December 2019, at least 5 transactions per month in each month of

2020, and more than 20 transactions adding up to at least $1,000 in total per user. We require 5

11

transactions in account usage as a completeness-of-record check for bank-account data following

(Ganong and Noel, 2019).

In Table 1, we report descriptive statistics for users’ spending in a number of selected categories

as well as their incomes at the monthly level. We note that income is relatively low for many

SaverLife users, with an average level of observed income being approximately $36,000 per year.

Note that this observed income is what arrives in a user’s bank account and is therefore post-tax

and post-withholding. In addition, we show the distribution of balances across users’ accounts

during the week before most stimulus checks arrived (the first week of April). Consistent with the

low levels of income, we see that most users maintain a fairly low balance in their linked financial

account, with the median balance being only $98.

We identify stimulus payments using payment amounts stipulated by the CARES Act, identi-

fying all payments at the specific amounts (eg. $1,200, $1,700, $2,400) paid after April 9th in the

categories ’Refund’, ‘Deposit’, ‘Government Income’, and ‘Credit.’ Figure 2 shows the identified

number of payments of this type, relaxing the time restrictions in 2020. While there are a small

number of payments in these categories at the exact stimulus amounts prior to the beginning of

payments, there is a clear massive increase in frequency after April 9th. This suggests that there

are relatively few false positives, and that the observed payments are due to the stimulus program

and not other payments of the same amount.

As of August, approximately 60% of users have received a stimulus payment into their linked

account. The remainder of the sample may have not linked the account that they received the

stimulus check in, be still waiting for a stimulus check, or may be ineligible for one.

6

Some banks

and credit unions had issues processing stimulus deposits and these deposits were still pending for

a number of Americans. In addition, users may not have had direct deposit information on file with

the IRS and would then need to wait for a check to be mailed. Finally, users may be ineligible for

stimulus checks due to their status as a dependent, because they did not file their taxes in previous

years, or because they made more than the eligible income thresholds for receipt. Of those who

6

We note that the completeness-of-record checks we employ following (Ganong and Noel, 2019) are relatively

weak. However, keeping a fraction of inactive users in the sample does not affect our results as we can restrict

our analysis to users for which we observe the stimulus payments obtaining the same results. When we look at the

spending behavior of non-stimulus-check recipients around the time when they likely would have received a check,

we do not see a spending response (see Figure A.5) suggesting that these users did not link either their main tax or

spending accounts.

12

receive payments, two-thirds received them by April 15, with 40% of all payments occurring on

April 15. 92% of those who received payments in our sample did so in April.

While most American households were due to receive a stimulus check, the amount varied

according to the number of tax filers and numbers of children. Figure A.1 gives an accounting

of amounts due to a range of household types. While we cannot observe the exact household

composition for each user, we are able to observe a self-reported measure of household size. Our

measure matches up reasonably well with the received stimulus payments.

Appendix A provides further details regarding payments in our sample. Payments line up

closely with self-reported household size. Because of our strategy for picking out stimulus checks,

being within the ‘phase-out’ region of income would mean that we would falsely classify an in-

dividual as having not received a stimulus check, since his or her check would be for a non-even

number. This would likely attenuate our empirical estimates slightly. We conduct a placebo exer-

cise in the appendix, and look at spending around April for households that do not receive a check

(see Figure A.5). We do not see any sharp breaks in spending beyond day of the week effects,

suggesting that the impact of mis-categorization is small.

3.2 Survey Data

SaverLife conducted a survey between mid-May to the end of July to elicit self-reported informa-

tion on the receipt and use of the stimulus checks, expectations about personal financial situations,

and the duration of the pandemic. Participants were sent emails and text messages by SaverLife,

and offered $3 to $10 for participation. If individuals did not respond initially, they were sendt

email and text reminders. Users could take the survey on a computer or mobile device, and they

were allowed to skip questions. The survey was sent to 6,060 individuals, who were longer-term

active users of the platform and identified as being potentially responsive to surveys in the past. We

received 1,011 unique responses, indicating a response rate of around 16.7%. The survey questions

are loosely based off of the Federal Reserve Bank of New York Survey of Consumer Expectations.

The survey focused on the following areas:

• Expectations regarding income, the economy and benefits.

• Expectations regarding the length of the pandemic.

13

• Self-reported difficulties in paying bills and anxiety.

• Credit.

• Stimulus check spending.

• Political affiliation.

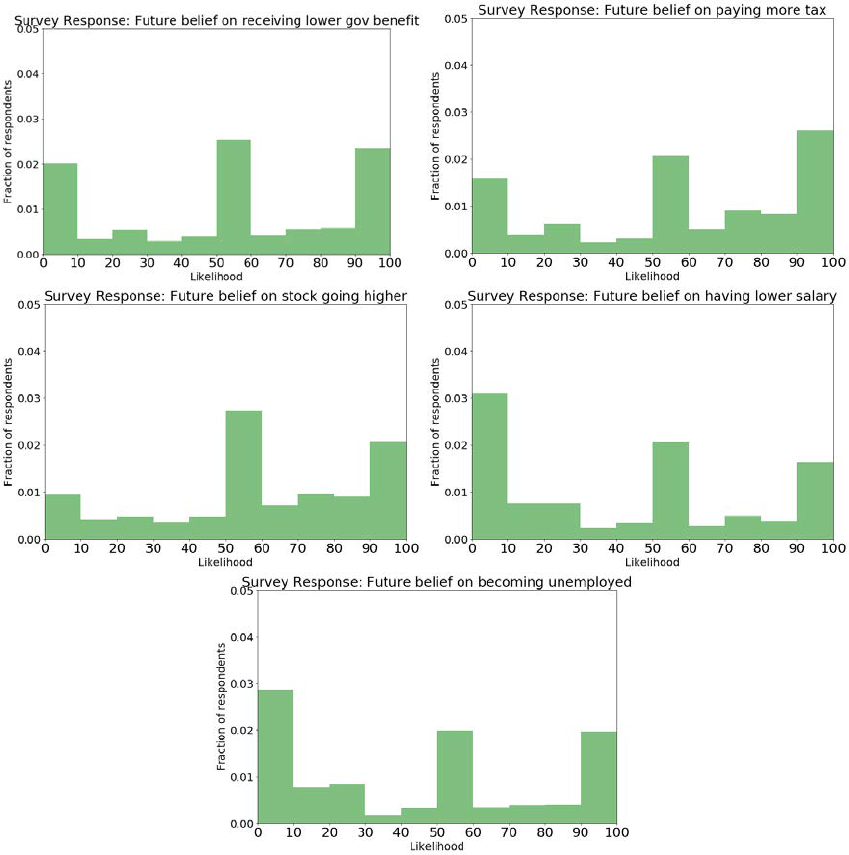

In the online appendix, we report raw survey responses and questions. Figure B.1 shows the

survey instrument on a smartphone, and lists all questions in the survey and Figures B.2 to B.4

show the raw averages of the survey responses. In Figure B.2, we can see that at the time 70% of

the users replied that they received a stimulus check while 15% of the users were still waiting. This

lines up closely with the 66% of users we identify as receiving checks in the data. Additionally,

our user population was subject to a number of financial hardships and subject to difficulties in

payment bills, rents, and mortgages. 30% of users reported they had difficulty obtaining credit and

70% received new credit primarily through a new credit card. Our users are relatively pessimistic

about the lasting effects of the pandemic.

In Figure B.3, we can see that our empirical results in terms of the fiscal stimulus use line up

with the survey data. 60% of individuals report to not use the check amount for durables consump-

tion and 50% of the users are using part of the check amount for food spending. Additionally, only

15% of users said they will not use the check to pay past bills or will use it for future bills. Finally,

15% of users report saving most of the check amount and 45% report to save none of the check

amount.

In Figure B.4, we can see our survey results for expectations other than the duration of the

crisis. Individuals have mixed expectations about the prospects of future stimulus payments and

taxes as well as the stock market. A substantial fraction of users believes they will have lower

salaries in the future or become unemployed.

7

7

Appendix figure B.5 further shows correlations between survey responses as a validation exercise. Households

more pessimistic about stock market performance are more likely to believe that they will become unemployed or see

salary cuts. Households that anticipate tax increases also anticipate benefit cuts, consistent with beliefs about greater

fiscal pressures. Beliefs about unemployment and salary cuts are also highly correlated.

14

4 Effects of Stimulus Payments

Looking at the raw levels of spending for users receiving stimulus payments, Figure 3 shows mean

daily spending before and after the receipt of a stimulus payment without any other controls or

comparison group. In this figure, we only show spending data for users who receive a stimulus

check in our sample period. Prior to receiving a check, the typical individual in the sample who

receives a stimulus check is spending around $90 per day.

8

Mean daily spending rises to about

$250 for the week days after the receipt of the stimulus payment.

To identify the direct impacts of the stimulus check payments, we effectively compare users

receiving stimulus payments to themselves before and after the event as well as to those that did

not receive one on that day. Figure 4 shows estimates of β

k

from the equation: c

it

= α

i

+ α

t

+

P

23

k=−7

β

k

[t = k]

it

+ ε

it

. ‘Time to Payment’ is equal to zero for a user on the day of receiving the

stimulus check. Here, we see that users who receive stimulus checks tend to not behave differently

than those that do not in the days before they receive the checks. Upon receiving the stimulus

check, users dramatically increase spending relative to users who do not receive the checks.

There is a sharp and immediate increase in spending following the receipt of a stimulus deposit;

users show large increases in spending in the first days following the stimulus check receipt and

keep spending significantly more than those who have not received checks for the entirety of the

post-check period that we observe. The relative difference in spending declines during weekends,

mostly driven by the fact that observed levels of spending tend to be depressed during these days

for reasons described above.

In Figure 5, we break down users’ spending responses by categories of spending. We map our

categories to roughly correspond to those reported in the Consumer Expenditure Survey: food,

household goods and personal care, durables like auto-related spending, furniture, and electronics,

non-durables and services, and payments including check spending, loans, mortgages, and rent.

Across all categories, we find statistically significant increases in spending following the re-

ceipt of a stimulus check. These responses are widely distributed across categories, with cumula-

tive spending on food, household, non-durables, and payments each increasing by approximately

8

There are substantial intra-week patterns in spending, with Mondays typically seeing the highest levels of posted

transactions and spending as transactions that occurred during the weekend sometimes process only on the Monday

that follows.

15

$75-$150 in the week following receipt of a check. Durables spending sees a significant increase,

but it is much smaller in economic terms with only a $20 relative increase in spending during the

first three days.

Table 2 presents similar information, presenting coefficients from the regression c

it

= α

i

+

α

t

+

P

23

k=−7

β

k

[t = k]

it

× P

i

+ ε

it

. That is, we examine the excess spending among users who

received stimulus payments on each day following the receipt of their stimulus checks, scaled by

the size of their payment. A value of 0.03 can be interpreted as the user spending, on day t, 3% of

their stimulus check (eg. $36 out of a $1,200 stimulus check) more than a user who did not receive

a check. In our sample, the average stimulus check size was $2,166 (median of $1,700).

Columns 1-3 test how total user spending responds with three different sets of fixed effects.

Column 1 presents results using individual and day of the month fixed effects. Column 2 also

includes individual-by-day-of-month fixed effects, and Column 3 includes individual, calendar

date, and individual-by-day-of-week fixed effects. We find similar effects across all specifications,

with spending among those who received a stimulus check tending to increase substantially in the

first week after stimulus receipt.

Spending on days during this period is economically and statistically significantly higher for

those receiving stimulus checks and there are no days with significant reversals – days with stim-

ulus check recipients having lower spending than those who did not. Overall, for each dollar of

stimulus received, households in our sample spent approximately $0.35 more in the month follow-

ing the stimulus.

The remainder of the columns in Table 2 decompose the effect that we see in overall spend-

ing according to the category of spending. We find significant increases in spending in all of

these categories, with the largest increases coming from non-durables and payments. We find

muted effects of the stimulus payments on durables spending. In previous recessions, spending

on durables (mainly auto-related spending) was a large component of the household response to

stimulus checks. At least in the short-term, we find significantly different results, with durables

spending contributing negligibly to the overall household response. We discuss some of these

differences relative to past stimulus programs in Section 4.1.

Because our sample is not representative of the nation as a whole, we also perform a similar

analysis while re-weighting our sample on several dimensions using Current Population Survey

16

(CPS) weights. We show results of this approach in Table 3, we compare our estimates from

our unweighted regressions to those using user weights defined on age, sex, state, and income

bins. Column (4) thus runs our primary MPC calculation using these user weights, finding an

MPC of approximately 0.266 rather than 0.369 in column (3). In general, when weighting our

sample to match the national distribution of households more closely, we see qualitatively similar

results approximately 30% lower in magnitudes when weighting along these dimensions. Given

our sample being younger and having lower incomes and assets than the nation as a whole, it is

unsurprising that down-weighting these types of users produces a somewhat lower MPC.

4.1 Comparison to Previous Economic Stimulus Programs

Johnson, Parker and Souleles (2006) and Parker, Souleles, Johnson and McClelland (2013) exam-

ine the response of households to economic stimulus programs during the previous two recessions

(2001 and 2008). These programs were similar in nature to the stimulus program in 2020 but were

smaller in magnitude ($300-600 rather than $1,200 checks).

In these previous stimulus programs, households also tended to respond strongly to the receipt

of their checks. For instance, in 2008, Parker, Souleles, Johnson and McClelland (2013) estimated

that households spent approximately 12-30% of their stimulus payments on non-durables and ser-

vices and a total of 50-90% of their checks on total additional spending (including durables) in the

six months following receipt. In 2001, approximately 20-40% of stimulus checks were spent on

non-durables and services in the six months following receipt.

In one paper examining the high-frequency responses (Broda and Parker, 2014), the authors are

able to use Nielsen Homescan data to examine weekly spending responses to the 2008 stimulus

payments. They find that a household’s spending on covered goods increased by approximately ten

percent in the week that it received a payment. While these authors were not able to examine the

timing of all types of spending due to data limitations, we demonstrate that households respond

extremely quickly to receiving stimulus checks across multiple categories of spending. Rather

than taking weeks or months to spend appreciable portions of their stimulus checks, we show that

households react extremely rapidly, with household spending increasing by approximately one

third of the stimulus check within the first 10 days.

Another notable difference from the stimulus programs is that we find substantially smaller

17

impacts on durables spending and confirm this in our survey of users. Previous research has found

strong responses of durables spending to large tax rebates and stimulus programs, especially on

automobiles (about 90% of the estimated impact on durables spending in the 2008 stimulus pro-

gram was driven by auto spending). In contrast, despite a sizable response in non-durables and

service spending, we see little immediate impact on durables. In part, this discrepancy with past

recessions may be driven by the fact that automobile use and spending is highly depressed, with

many cities and states being under shelter-in-place orders and car use being restricted. Similarly,

as these orders hinder home purchases, professional appliance installment and spending on home

furnishings may be lower as well.

Finally, across both 2001 and 2008, Parker, Souleles, Johnson and McClelland (2013) note that

lower income households tend to respond more, and that households with either larger declines in

net worth or households with lower levels of assets also tend to respond more strongly to stimulus

checks. These results are largely consistent with the patterns we observe in 2020. We find that

households with low levels of income and lower levels of wealth tend to respond much more

strongly. In addition, our measure of available liquidity from actual account balances arguably

suffers from much less measurement error than the measures used in previous research on stimulus

checks, giving additional confidence in our estimates.

5 Income, Liquidity, and Drops in Income

The 2020 CARES Act stimulus payments were sent to taxpayers with minimal regard for current

income, wealth, and employment status. While there was an income threshold above which no

stimulus would be received, this threshold was fairly high relative to average individual income

and most Americans were eligible for payments. During debates about the size and scope of the

stimulus, a common question was whether Americans with higher incomes, unaffected jobs, and

higher levels of wealth needed additional financial support. With data on both the income and bank

balances of SaverLife users, we are able to test whether the consumption and spending responses

differed markedly between users who belonged to these different groups.

In Figures 6-8, we show the cumulative estimated MPCs from regressions of spending on an

indicator of a time period being after a stimulus payment is received. Each figure contains the

18

results of multiple regressions, with users broken down into subsamples according to a number

of financial characteristics that we can observe. That is, the graphs represent the sum of daily

coefficients seen in a regression as in Table 2, by group. In these figures, we divide the samples of

users by their level of income, the drop in income we observed over the course of 2020, and their

levels of liquidity prior to the receipt of stimulus payments.

Figure 6 splits users by their average income in January and February 2020 (prior to the major

impacts of the pandemic). We see clear evidence that users with lower levels of income tended to

respond much more strongly to the receipt of a stimulus payment than those with higher levels of

income. Users who had earned under $1,000 per month saw an MPC about twice as large as users

who earned $5,000 a month or more.

We also split our sample of users according to their accounts’ balances at the beginning of

April, before any stimulus payments were made. We separate users into multiple groups according

to account balances, from under $10 to over $4,000. Figure 7 displays dramatic differences across

these groups of users. Users with the highest balances in their bank accounts tend not to have

MPCs on the order of 0.1 while those who had under $100 have MPCs of 0.4 or above.

In Figure 8, we examine whether a similar pattern can be seen among users who have had

declines in income following the COVID outbreak. For each user, we measure the change in

income received in March 2020 relative to how much was received, on average, in January and

February 2020. We split users into those who had a decline in monthly income and those who

saw no decline in income (or had an increase). Here we see a significant difference in MPCs,

but of lower magnitude than the previous splits. Households that saw income declines had an

MPC of just over 0.4 while those with no decline in income registered MPCs of about 0.33. This

smaller difference may be driven by the fact that the federal government had also made generous

unemployment insurance available to nearly all workers, mitigating the potential loss of income

from job loss for many lower income households.

Tables 4 - 6 display some of these results in regression form. In general, we find that users

with lower incomes, larger drops in income, and lower pre-stimulus balances tend to respond

more strongly than other users. Again, across all subsamples of our users based on financial

characteristics, we see that low liquidity tends to be the strongest predictor of a high MPC and

high liquidity tends to be the strongest predictor of low MPCs.

19

6 Expectations and Stimulus Responses

In this section, we explore how household beliefs impact the response to stimulus payments.

Household beliefs may impact MPCs in a number of ways. First, if households anticipate income

declines in the future, they may save more to smooth consumption. Second, if households be-

lieve that taxes or government benefits may change as a result of current fiscal policy or economic

conditions, they will also change consumption decisions. For example, households anticipating

benefit cuts may increase current savings levels. Finally, beliefs about future macroeconomic con-

ditions may also impact household decision-making. On the one hand, if individuals believe that

macroeconomic conditions will improve, they may believe that their own incomes or benefits may

increase, and increase consumption today. On the other hand, individuals may also expect higher

asset returns and invest more out of current resources.

We surveyed over 1,000 users in our sample and asked them about their beliefs regarding

personal unemployment, income, government benefits and taxes, as well as expectations about

the stock market and the duration of the pandemic. We discuss the survey, which was conducted

via mobile device or email, in more detail in section 3.2. We interact these surveyed beliefs with

stimulus receipt and explore how beliefs impact MPCs.

Figure 9 shows MPCs for subgroups, based on user beliefs regarding personal unemployment,

salary cuts, tax increases, government benefit cuts, stock market increases and the duration of the

pandemic. The figure shows cumulative MPCs estimated from coefficients from regressions of

spending on an indicator of a time period being after a stimulus payment, scaled by the amount

of the payment over the number of days since the payment (ζ from c

it

= α

i

+ α

t

+ ζ

P ost

it

×P

i

D

it

+

ε

it

). Each bars show individuals above and below the median of the sample in terms of their

expectations.

The top row shows splits by employment outcomes. The left panel splits the sample by in-

dividual beliefs about whether they will become unemployed over the next year. The right panel

splits the sample by individual beliefs regarding whether they will face a salary cut over the next

year. Individuals who believe that they will be more likely to face unemployment or salary cuts see

slightly smaller MPCs, consistent with higher savings in this group. The effect is much larger for

individuals more likely to believe that they will be unemployed, relative to individuals who believe

20

that they will face salary cuts.

The middle panel shows splits by outcomes related to government spending– taxes and benefits,

which relates to the classic theory of Ricardian equivalence. The left panel splits the sample by

individual beliefs about tax increases, while the right panel splits the sample by individual beliefs

about government benefit cuts. We see smaller MPCs for individuals who expect tax increases or

government benefit cuts, but the effect sizes are much larger for government benefit cuts. This may

be consistent with the fact that our sample disproportionately includes lower-income individuals

who pay little in taxes, and receive significant government transfers.

The bottom panel splits the sample by expectations regarding whether the stock market will rise

in the next year and whether the duration of the pandemic will last more than two years. Perhaps

surprisingly, we find much smaller MPCs for individuals who expect the stock market to rise. One

potential mechanism is that individuals who believe that the stock market will rise choose to invest

rather than spend. We see little difference for individuals who think that the crisis will be over

within two years, relative to those who think that it will last longer.

Table 7 quantifies this graphical evidence, interacting expectations with stimulus receipt. More

precisely, the table shows MPC estimates and interactions (ζ and ζ

0

) from the specification:

c

it

= α

i

+ α

t

+ ζ

P ost

it

× P

i

D

it

+ ζ

0

P ost

it

× P

i

× Belief

i

D

it

+ ω

P ost

it

× Belief

i

D

it

+ ε

it

(4)

where as before P

i

is the stimulus payment an individual i is paid, and D

it

is the total number

of days over which we estimate the MPC and P ost

it

is an indicator of the time period t being after

individual i receives a stimulus payment. Belief

i

is the probability that an individual believes that

an event will occur. The coefficient ζ can be interpreted as the aggregate effect of the stimulus in

the time period in question for individuals who do not believe that the mentioned event will occur.

The sum of the coefficients ζ and ζ

0

can be interpreted as the aggregate effect of the stimulus in

the time period in question for individuals who believe that the mentioned event will occur.

Table 7 indicates that beliefs that individuals will be unemployed, government benefits will

be cut, the pandemic will last longer and stock markets will rise are significantly associated with

smaller MPCs. Beliefs about salary cuts or tax increases do not see a statistically significant

21

association with MPCs, but the coefficients are negative and this relationship may reflect a lack

of power or the fact that the individuals in our sample pay little in taxes. Overall, our estimates

indicate that beliefs and expectations about personal and aggregate events play an important role

in shaping household responses to stimulus payments.

7 Modeling the Effectiveness of Fiscal Stimulus Payments

In Figure 10, we note the impact of the stimulus check on financial payments. In particular, we

examine the impact on total financial payments as well as payments on several subsets of payments

such as credit card payments as well as rent and mortgage payments. Rent payments are not always

able to be accurately identified due to the number of users who utilize checks or online transfer

tools like Chase QuickPay, Zelle, or Venmo to pay their rent. Such payments will still be accurately

captured by the ‘Total Financial Payments’ category.

We find that financial payments surge substantially upon receipt of the 2020 stimulus payments.

Marginal spending on total financial payments totals about one third of total MPC out of the stimu-

lus payments. We argue that our empirical findings imply that the fiscal stimulus payments may be

less effective in stimulating aggregate consumption in the 2020 environment relative to previous

downturns.

We now present a simple model that outlines two reasons, consistent with our empirical find-

ings, that the fiscal stimulus in 2020 may be less effective in actually stimulating the economy than

the 2001 or 2008 payments. The basic reason for this lack of effectiveness is that sectors of the

economy employing workers with the lowest levels of liquidity are shut down, leading to lower

fiscal multipliers.

Suppose that we have three types of sectors and workers employed by those sectors. First, we

have a sector that we call groceries and necessities. Here, we refer to large firms that sell groceries

and basic household supplies that are both essential and non-durable (moderate depreciation). For

instance, large supermarkets or stores such as Target, Walmart, and CVS. At the same time, the

grocery and necessity sector is moderately labor intensive. This sector is not shut down in response

to an epidemic.

In turn, we have a second sector, called restaurants and hospitality, that produces non-durable

22

consumption which depreciates immediately and is more labor intensive than the first sector. Being

less essential to households, the second sector is shut down in response to the crisis.

Finally, we have a third sector of the economy. This sector is broader, and encompasses

durables production as well as many white-collar services like banking and tech. This sector

can avoid being locked down through employing safety measures in production or by working re-

motely. This sector pays higher wages than in sectors 1 and 2. Consequently, the corporations in

sectors 1 and 2 are owned by the workers in sector 3. We assume that workers in sector 1 and 2

borrow (for example, rent, mortgages, or financial lending) from workers in sector 3.

The effectiveness of fiscal stimulus rests on the idea that stimulus checks induce extra spending

by recipients. For example, workers in sector 3 spend in sector 2 and generate income for workers

in that sector that is then spent again. Thus, if the MPC out of a stimulus payment is 0.8, then out

of a $100 payment, $80 is consumed, generating $80 of income for another worker. That worker

then again consumes $64 which generates income for another worker, and so on. In the classic

Keynesian framework the equation for the fiscal multiplier is given by 1/(1 − MP C). The more

cash arrives with agents that have high MPCs, the higher the fiscal multiplier.

In our framework, there are two reasons why fiscal stimulus is less effective in this environment

relative to the 2001 and 2008 recessions. First, in a lockdown induced by an epidemic, neither

group of workers can spend in sector 2. At the same time, workers in sector 2 are the poorest

and have the highest MPCs. Second, workers in sectors 1 and 2 (who are poorer) use the stimulus

payment to pay down debt held by sector 3 workers. Therefore, the excess spending from the

stimulus flows to workers that have a lower MPC.

More formally, we have a three-period model inspired by Guerrieri, Lorenzoni, Straub and

Werning (2020) and consider an economy with three sectors. All sector s agents’ preferences are

represented by the utility function:

3

X

t=0

β

t

U(c

s

t

) (5)

where c

s

t

is consumption and U(c) = c

1−σ

/(1 − σ) is a standard power utility function. Each

agent is endowed with ¯n

s

t

> 0 units of labor which are supplied inelastically but they can only

work in their own sector. Competitive firms in each sector s produce the final good from labor

23

using the linear technology:

Y

s

t

= ¯n

s

t

. (6)

Each agent maximizes utility subject to:

c

s

t

+ a

s

t

≤ w

s

t

¯n

s

t

+ (1 + r

t−1

)a

s

t−1

. (7)

As the initial condition, we assume that agents in sectors 1 and 2 borrow from agents in sector

3, such that a

1

1

< 0, a

2

1

< 0, and a

1

1

+ a

2

1

= −a

3

1

. Given the economy is frictionless, agents choose

their consumption to satisfy their Euler equation:

U

0

(c

s

t

) = β(1 + r

t

)U

0

(c

s

t+1

). (8)

Because preferences are homothetic, we can think of all agents in each sector as just be-

ing represented by one agent. In turn, each agent can consume consumption goods from any

sector, denoted by c

ss

t

. The consumption composite, c

s

t

, over the three sectors’ consumption

goods equals f

c

(c

s1

t

, c

s2

t

, c

s3

t

) and relative goods prices meeting the composite constraint p

t

c

s

t

=

p

1

t

c

s1

t

+ p

2

t

c

s2

t

+ p

3

t

c

s3

t

adjust to ensure full employment in each sector. Additionally, we assume

that

∂f

c

c

s1

t

|

c

s1

t

→0

= ∞ whereas

∂f

c

c

s2

t

|

c

s2

t

→0

and

∂f

c

c

s3

t

|

c

s3

t

→0

approach finite numbers, which implies that

consumption purchased in sector 1 is necessary, whereas it is not necessary when it comes from

sectors 2 and 3. Finally, the goods market clearing condition has to hold in each period:

c

1s

t

+ c

2s

t

+ c

3s

t

= ¯n

s

t

. (9)

Suppose the central bank implements a fixed rate 1 + r

0

= 1/β and the economy starts from a

state in which each agent consumes his or her labor income in composite consumption c

s

1

= w

s

1

¯n

s

1

and does not accumulate or decumlate their debt or savings. In turn, in period 2, an unexpected

shock hits that restricts agents working in sector 2 in periods 2 and 3, i.e., w

2

2

= w

2

3

= 0, and

the government promises a stimulus payment S in period 3. Then agents in sector 2 allocate

consumption in periods 2 and all the following periods according to their Euler equation and budget

constraints.

24

U

0

(c

2

2

) = U

0

(c

2

3

), c

2

2

+ a

2

2

≤ 1/βa

2

1

, and c

2

3

= S + 1/βa

2

2

. (10)

In turn, we obtain:

c

2

2

= c

2

3

=

S + 1/β

2

a

2

1

1 + 1/β

and a

2

2

= 1/βa

2

1

−

S + 1/β

2

a

2

1

1 + 1/β

. (11)

Agents in sector 1 allocate consumption in periods 2 and 3 according to their Euler equation and

budget constraints in the same manner and we obtain:

c

1

2

= c

1

3

=

S + w

1

3

¯n

1

3

+ 1/β(w

1

2

¯n

1

2

+ 1/βa

1

1

)

1 + 1/β

and (12)

a

1

2

= w

1

2

¯n

1

2

+ 1/βa

1

1

−

S + w

1

3

¯n

1

3

+ 1/β(w

1

2

¯n

1

2

+ 1/βa

1

1

)

1 + 1/β

. (13)

Consumption for agents in sector 3 follows the above straightforwardly.

Proposition 1. The MPC out of income (or fiscal stimulus payments) is larger for agents in sector

2 than for agents in sectors 1 or 3.

Proof. Compare MPCs, i.e., how much out of income (or fiscal stimulus payments) are consumed:

∂c

2

2

∂S

=

∂c

2

3

∂S

=

∂(

S+1/β

2

a

2

1

(1+1/β)

)

∂S

=

1

1 + 1/β

>

∂c

1

2

∂(S + w

1

2

¯n

1

2

+ w

1

3

¯n

1

3

)

as

∂(

S+w

1

2

¯n

1

2

+w

1

3

¯n

1

3

+(1/β−1)w

1

2

¯n

1

2

+1/β

2

a

1

1

1+1/β

)

∂(S + w

1

2

¯n

1

2

+ w

1

3

¯n

1

3

)

=

1

1 + 1/β

+

∂(

(1/β−1)

1+1/β

w

1

2

¯n

1

2

)

∂(S + w

1

2

¯n

1

2

+ w

1

3

¯n

1

3

)

| {z }

<0

and

(1/β − 1)

1 + 1/β

< 0.

This argument extends straightforwardly to the comparison of agents in sectors 2 and 3.

Proposition 2. The marginal propensity to repay debt out of income (or fiscal stimulus payments)

is larger for agents in sector 2 than for agents in sector 1.

Proof. Compare the propensity to repay mortgages, i.e., how much out of income (or fiscal stim-

ulus payments) are used to repay debt:

∂(−a

2

2

)

∂S

=

∂(−1/βa

2

1

+

S+1/β

2

a

2

1

(1+1/β)

)

∂S

=

1

1 + 1/β

>

∂(−a

1

2

)

∂(S + w

1

2

¯n

1

2

+ w

1

3

¯n

1

3

)

25

as

∂(−w

1

2

¯n

1

2

− 1/βa

1

1

+

S+w

1

2

¯n

1

2

+w

1

3

¯n

1

3

+(1/β−1)w

1

2

¯n

1

2

1+1/β

)

∂(S + w

1

2

¯n

1

2

+ w

1

3

¯n

1

3

)

=

1

1 + 1/β

+

∂(−w

1

2

¯n

1

2

+

(1/β−1)

1+1/β

w

1

2

¯n

1

2

)

∂(S + w

1

2

¯n

1

2

+ w

1

3

¯n

1

3

)

| {z }

<0

.

If we now compare this economy to one in which sector 2 would not shut down, there are three

differences that each diminish the amount of consumption induced by the stimulus payment S.

First, agents in all sectors cannot consume in sector 2, thereby foregoing increases in employment

and income in that sector. Secondly, sector 2 agents are the poorest agents with the highest MPC

out of their income, so declines in their income disproportionately decrease the fiscal multiplier.

Finally, agents in sector 2 choose to accumulate more debt in period 2 planning to repay it with

their stimulus payment. In turn, the stimulus payment goes to agents in sector 3 that have lower

MPCs out of the stimulus payment.

In summary, in this economy, workers in sectors 1 and 2 will spend their stimulus payment

on mortgages and loan repayments as well as non-durable necessary consumption (sector 1). As

shown above, this means that the fiscal stimulus payments flow to households with less high MPCs

and directly decreases the fiscal multiplier, i.e., 1/(1 − MP C), making fiscal stimulus less effec-

tive.

8 Conclusion

This paper studies the impact of the 2020 CARES Act stimulus payments on household spending

using detailed high-frequency transaction data. We utilize this dataset to explore heterogeneity of

MPCs in response to the stimulus payments, an important parameter both in determining multi-

pliers and in testing between representative and heterogeneous agent models. We hope that our

results inform the ongoing debate about appropriate policy measures and next steps in the face of

the COVID-19 pandemic.

We find large consumption responses to fiscal stimulus payments and significant heterogeneity

across individuals. Income levels and liquidity play important roles in determining MPCs, with

liquidity being the strongest predictor of MPC heterogeneity. We find substantial responses for

households with low levels of liquidity and no response to stimulus payments for households with

26

high levels of account balances or cash on hand. The results will potentially be important for

policy-makers in terms of designing future rounds of stimulus if the 2020 crisis persists. Our

results suggest that the effects of stimulus are much larger when targeted to households with low

levels of liquidity.

More work should be done to study how targeting can be designed to have large impacts on

consumption without generating significant behavioral effects. Just as unemployment benefits may

increase unemployment durations (Meyer, 1990), policies targeting stimulus payments towards

households with low levels of liquidity could discourage liquid savings.

27

References

Agarwal, Sumit, Chunlin Liu, and Nicholas S Souleles, “The Reaction of Consumer Spending

and Debt to Tax Rebates-Evidence from Consumer Credit Data,” Journal of Political Economy,

dec 2007, 115 (6), 986–1019.

Allcott, Hunt, Levi Boxell, Jacob Conway, Matthew Gentzkow, Michael Thaler, and David Y

Yang, “Polarization and Public Health: Partisan Differences in Social Distancing During the

Coronavirus Pandemic,” NBER Working Paper, 2020.

Andersen, Asger Lau, Emil Toft Hansen, Niels Johannesen, and Adam Sheridan, “Consumer

Reponses to the COVID-19 Crisis: Evidence from Bank Account Transaction Data,” Technical

Report, Working Paper 2020.

Armona, Luis, Andreas Fuster, and Basit Zafar, “Home Price Expectations and Behaviour:

Evidence from a Randomized Information Experiment,” The Review of Economic Studies, 2019,

86 (4), 1371–1410.

Baker, Scott R, “Debt and the Response to Household Income Shocks: Validation and Application

of Linked Financial Account Data,” Journal of Political Economy, 2018, 126 (4), 1504–1557.

Baker, Scott R. and Constantine Yannelis, “Income Changes and Consumption: Evidence from

the 2013 Federal Government Shutdown,” Review of Economic Dynamics, 2017, 23, 99–124.

Baker, Scott R, Nicholas Bloom, Steven J Davis, and Stephen J Terry, “Covid-Induced Eco-

nomic Uncertainty,” National Bureau of Economic Research Working Paper, 2020.

, RA Farrokhnia, Steffen Meyer, Michaela Pagel, and Constantine Yannelis, “How Does

Household Spending Respond to an Epidemic? Consumption During the 2020 COVID-19 Pan-

demic,” National Bureau of Economic Research Working Paper, 2020.

Barrios, John and Yael Hochberg, “Risk Perception Through the Lens Of Politics in the Time of

the COVID-19 Pandemic,” Working Paper, 2020.

Barro, Robert J, “Are Government Bonds Net Wealth?,” Journal of Political Economy, 1974, 82

(6), 1095–1117.

, “The Ricardian Approach to Budget Deficits,” Journal of Economic Perspectives, 1989, 3 (2),

37–54.

28

, José F Ursua, and Joanna Weng, “The Coronavirus and the Great Influenza Epidemic,”

Working Paper, 2020.