Voluntary dissolution of not-for-profit

corporations with no assets

Office of the New York State Attorney General

Charities Bureau

28 Liberty Street

New York NY 10005

212-416-8401

WWW.AG.NY.GOV

1

Voluntary dissolution of not-for-profit corporations with no assets

Office of the New York State Attorney General

Charities Bureau

Guidance Document Issue date: 2018

Revised: February 2024

Table of Contents

Getting started: Checklist for petitions ..................................................................................................... 2

Introduction ................................................................................................................................................. 3

Who should use this guidance? ............................................................................................................ 3

Summary of procedures for a no-asset dissolution .................................................................................. 4

Step 1: The board of directors adopts a plan of dissolution (a plan) .................................................... 4

Step 2: The members vote on the plan, if they have voting rights ....................................................... 5

Step 3: The corporation obtains required approval from governing entity that created it ................. 5

Step 4: The corporation fills out a certificate of dissolution ................................................................. 6

Step 5: The corporation petitions the Attorney General for approval of the certificate of dissolution

.............................................................................................................................................................. 6

Step 6: Request a consent to dissolution of a corporation ................................................................... 8

Step 7: The corporation sends documents and payment to Department of State .............................. 8

Step 8: New York state confirms receipt .............................................................................................. 9

Step 9: The corporation sends the receipt to Attorney General ........................................................ 9

Step 10: The corporation checks for Internal Revenue Service (IRS) requirements ............................. 9

Appendix A: Sample form for a plan of dissolution with no assets ...................................................... 10

Appendix B: Sample verified petition to the Attorney General for approval of certificate of

dissolution with no assets .......................................................................................................................... 12

Appendix C: Sample financial report for dissolving entities not otherwise required to file annual

reports ........................................................................................................................................................ 16

Appendix D: Offices of the New York State Attorney General and the counties covered by each ... 17

Appendix E: List of governmental and organizational approvalsc ...................................................... 18

2

Voluntary dissolution of not-for-profit corporations with no assets

Getting started: Checklist for petitions

The following checklist may help you prepare your documents for submission to the Attorney

General or to the supreme court of the county, on notice to the Attorney General.

Checklist of documents for a no-asset dissolution

The necessary forms and documents are:

Plan of dissolution (as an attachment to the petition)

Certificate of dissolution

Petition to the Attorney General for approval of certificate

of dissolution

Attachments to petition for approval of certificate of dissolution

Copy of the certificate of incorporation, together with all

amendments, and the current bylaws

Other than an approval by the Attorney General, all

required governmental body and officer approvals

Plan of dissolution

Resolutions of the board and if appropriate, the membership

Final financial report (and any other required final reports)

Cover letter that includes contact information, including phone number and

email address, for attorney or other individual submitting the petition

3

Introduction

We at the Charities Bureau drafted this document to provide guidance to charitable not-for-

profit corporations that are seeking to dissolve, and the lawyers who represent them. This

document does not contain legal advice. If you do not have legal representation, consult the

lawyer-referral service of the New York State Bar Association at https://nysba.org/new-york-

state-bar-association-lawyer-referral-service/ You may also be able to find an organization

that provides legal services at low or no cost to nonprofit organizations.

To see this guidance and other information for not-for-profit corporations, visit the Attorney

General’s website: https://www.ag.ny.gov/resources.

For corporations located in the following counties, submit petitions via email to

• Albany

• Bronx

• Columbia

• Fulton

• Greene

• Hamilton

• Kings

• Montgomery

• New York

• Queens

• Rensselaer

• Richmond

• Saratoga

• Schenectady

• Schoharie

• Warren

• Washington

For corporations in other counties, submit your petition directly to the regional offices of the

Attorney General that serves your county. Appendix D and the following webpage lists those

offices, their contact information, and the counties they serve:

https://www.ag.ny.gov/regional-office-contact-information

If you have questions, email us at [email protected].

Who should use this guidance?

This guidance is for dissolving charitable not-for-profit corporations that have no assets

or liabilities at the time of dissolution. We have prepared it to assist these corporations

4

fulfill the requirements for dissolution pursuant to Article 10 of the Not-for-Profit

Corporation Law (N-PCL).

If your corporation has assets to distribute or liabilities at the time of dissolution, use

“Voluntary dissolution of not-for-profit corporations with assets,” which is available on the

Attorney General’s website at https://ag.ny.gov/sites/default/files/regulatory-

documents/dissolution-with-assets.pdf.

If your corporation is insolvent, or if its assets are insufficient to pay its debts and liabilities

in full, bring a judicial dissolution proceeding in the supreme court of your corporation’s

county pursuant to N-PCL Article 11. The statute requires notice to creditors and the

Attorney General (see N-PCL §§ 1102(a)(1)(A), 1103(b), and 1104(c)).

This guidance is for nonjudicial dissolution under Article 10 of N-PCL.

Notes:

Dissolving corporations that are required to be registered with the Charities Bureau must

update their registration and annual filings prior to dissolution.

1

Corporations that have never been funded and have not conducted any activities are not

required to register.

Non-charitable not-for-profit corporations do not require court or Attorney General approval

unless they hold charitable assets at the time of dissolution (N-PCL § 1002(d)(1)).

Summary of procedures for a no-asset dissolution

Step 1: The board of directors adopts a plan of dissolution (a plan)

See Appendix B for a sample plan.

A quorum must be present and at least a majority of the directors present must vote for

dissolution. As the alternative, if not prohibited by the certificate of incorporation or the bylaws,

the board can adopt the plan by unanimous written consent. If the board has fewer than three

directors, the affirmative vote of all remaining directors is required to adopt the plan. If only one

director remains, identify that person as the "sole remaining director."

1

The officers and directors of charitable organizations are obligated to administer the organizations’ assets

responsibly, and comply with the duties of care, loyalty, and obedience. If the assets are not being used for

their intended purposes, they must be distributed to another charitable organization with similar purposes (N-

PCL §§ 720(a)(1)(A); 1001(d)(3)).

5

Quick statutory reference guide

Board of directors’ adoption and authorization of plan

of dissolution

N-PCL §§ 1001(a), 1002(a), & 1002(b)

Quorum and required vote for board approval of plan

N-PCL §§ 1002(a)(1)(i), 707, 708, and 709

Requirement for unanimous vote if there are fewer than

the number of directors required for a quorum

N-PCL § 1002(a)(1)(ii)

Step 2: The members vote on the plan, if they have voting rights

If the corporation has members entitled to vote, after the board of directors has authorized the

plan, the plan is submitted to the membership for approval. Approval constitutes a vote of at

least two-thirds of the members with a quorum present at a meeting. If the corporation’s

documents permit, the plan can be approved without a meeting by unanimous written consent

of all the members entitled to vote.

Note: A corporation has members entitled to vote on the plan if the corporation’s certificate

of incorporation or bylaws include membership rights, such as the right to elect the board of

directors.

If the organization has no members, the plan is deemed authorized upon adoption by the

board.

Quick statutory reference guide

Membership rights

N-PCL § 103(a)(9)

Submission of plan to members for approval

N-PCL § 1002(a)(2)

Quorum and required vote for membership approval

N-PCL §§ 1002(a)(2), 612, 613(c), and 614

Authorization requirements if there are no members

N-PCL § 1002(b)

Step 3: The corporation obtains required approval from governing entity that created it

If the approval of any governmental body or officer was required for the formation of the

corporation, the corporation must get written approval of the dissolution from the same

governmental entity. To determine whether any approvals are necessary, see N-PCL §§

404(b)-(v) and 1002(c) and the corporation’s certificate of incorporation. Please refer to

Appendix E for list of required government approvals.

Note: Attach a copy of the required approvals to the certificate of dissolution.

6

Quick statutory reference guide

Government approvals of plan of dissolution

N-PCL §§ 404(b)-(v) and 1002(c)

Step 4: The corporation fills out a certificate of dissolution

Prepare a certificate of dissolution. You can download a blank form for the certificate of

dissolution at the Department of State website:

https://dos.ny.gov/system/files/documents/2018/12/1561-f.pdf

Tips for filling out the certificate of dissolution

Name of corporation

Use exact name, including punctuation

Date of incorporation

https://apps.dos.ny.gov/publicInquiry/

Paragraph Eighth

Choose #3 (Plan filed with Attorney General)

Filer

Person filing the certificate of dissolution

The certificate of dissolution confirms that, at the time of dissolution, your corporation had

no assets and no liabilities. The certificate of dissolution must be signed by an officer,

director, attorney-in-fact, or other duly authorized person and must identify the name of that

person and the capacity in which the person signs. Attach all required approvals to the

certificate of dissolution (N-PCL §§ 1003(b)(1) and 404(b)-(v)).

Quick statutory reference guide

Preparation of certificate of dissolution

N-PCL §§ 104(d) and 1003(a)

Attachment of approvals to certificate of dissolution

N-PCL §§ 1003(b)(1) and 404(b)-(v)

Step 5: The corporation petitions the Attorney General for approval of the certificate of

dissolution

Prepare a petition to the Attorney General for approval of the certificate of dissolution (see

Appendix B). File the petition with the appropriate office of the Attorney General (see

Appendix D for Attorney General offices).

Quick statutory reference guide

Preparation of petition for approval of the certificate of

dissolution

N-PCL § 1003(c)

7

Checklist of what to submit to the Attorney General

The petition with all required attachments:

a copy of the certificate of incorporation, together with any amendments, and

the current bylaws

the plan of dissolution

copies of any required government approvals (attached to the

certificate of dissolution)

either the unanimous written consent of the board, or

certified copies of resolutions adopted at a meeting and, if

applicable, the same for the corporation’s membership

All required financial reports, including a final report (see Appendix C and

the sample verified petition for a list of final reports)

Registration requirements and final reports

Here are some important considerations.

• A not-for-profit corporation seeking to dissolve must be in compliance

with the registration and reporting requirements of section 8-1.4 of the

Estates, Powers and Trusts Law or Article 7-A of the Executive Law.

Read the full text of both statutes as well as a summary of the

registration and reporting requirements on the Attorney General’s

website at: https://ag.ny.gov/resources/organizations/charities-

nonprofits-fundraisers/regulations-statutes

• If the corporation is subject to the registration and reporting

requirements of section 8-1.4 of the Estates, Powers and Trusts Law

or Article 7-A of the Executive Law, but has failed to comply, it

must register, file annual financial reports (e.g., Attorney General’s

Form CHAR500 with federal form 990) for the last three years. It

must also pay all required filing fees.

• If the corporation is subject to the registration and reporting

requirements of section 8-1.4 of the Estates, Powers and Trusts Law

or Article 7-A of the Executive Law, but has been exempt from

filing annual financial reports, it must submit a summary annual

report

for the last six years. No filing fees are required to accompany

such reports.

•

If the corporation is not subject to the registration and reporting

requirements of section 8-1.4 of the Estates, Powers and Trusts Law or

Article 7-A of the Executive Law, it must submit a summary annual

report

for the last six years. No filing fees are required to accompany

8

such reports.

If your petition is acceptable, the Attorney General will provide an endorsement of the

certificate of dissolution and return it to your corporation or its attorney, if submitted by an

attorney, who must then file it with the Department of State.

Quick statutory reference guide

Verified petition to the Attorney General

N-PCL § 1003(c)

Step 6: Request a consent to dissolution of a corporation

The organization must request a “consent to dissolution of a corporation” from the New

York State Department of Taxation and Finance (tax department). The process and the

documentation you will need depend on whether your organization has been granted tax-

exempt status (not all charitable organizations have tax-exempt status in New York).

Instructions and forms for securing the tax department’s consent are at:

https://www.tax.ny.gov/bus/doingbus/vol_dissolution.htm. To avoid processing delays, you

can make this request at the time you submit the petition to the Attorney General.

Note: If your organization has done business in New York City and has incurred tax or other

liabilities under the New York City Administrative Code, it will also need the consent of the

Commissioner of Finance of New York City. Download a “request for consent to

dissolution” form at:

http://www1.nyc.gov/assets/finance//downloads/pdf/collections/request_dissolution.pdf

Quick statutory reference guide

Consent of the NYS Department of Taxation

N-PCL § 1004(a)

Consent of New York City Commissioner of Finance

N-PCL § 1004(b)

For corporations filing outside New York City: Check the requirements of your local

commissioner of finance.

Step 7: The corporation sends documents and payment to Department of State

The corporation (or its attorney) sends copies of the certificate of dissolution, with clearance

from the tax department and the required governmental body or officer consents, along with

a check for the required filing fee

2

payable to the NYS Department of State to:

NYS Department of State Division of Corporations

One Commerce Plaza

99 Washington Avenue

2

Check N-PCL § 104-A(l) to determine the amount of the required filing fee.

9

Albany NY 12231

Step 8: New York state confirms receipt

The Department of State sends the filer a receipt indicating that the certificate of dissolution

has been filed.

Step 9: The corporation sends the receipt to Attorney General

Your corporation sends a copy of the Department of State’s receipt to the Attorney General.

Once the corporation files its final annual financial report with the Charities Bureau (as

requested by the petition to the Attorney General), your corporation will no longer be

required to file with the Charities Bureau. Its registration will be closed.

Note: If your corporation’s final filing year ends after the certificate of dissolution is signed,

file your final annual financial report electronically via the Attorney General’s website (see

instructions at https://ag.ny.gov/resources/organizations/charities-nonprofits-

fundraisers/charities-annual-filing-char500). If your organization is not required to register

with the Charities Bureau, send your final report to the assigned Assistant Attorney General.

Step 10: The corporation checks for Internal Revenue Service (IRS) requirements

Determine whether your corporation is required to file certain documents with the IRS. If so,

upon dissolution, submit those documents to the IRS (see “Termination of an exempt

organization” posted by the IRS at https://www.irs.gov/charities-non-profits/termination-of-

an-exempt-organization).

10

Appendix A: Sample form for a plan of dissolution with no assets

Plan of Dissolution of

_______________

The Board of Directors of [name of corporation] has considered the advisability of

voluntarily dissolving the corporation and has determined that dissolution is in the best

interest of the corporation.

1.

The Corporation has no assets or liabilities.

Or

The corporation has no assets to distribute, other than a reserve not to

exceed twenty-five thousand dollars for the purpose of paying ordinary

and necessary expenses of winding up its affairs including attorney and

accountant fees, and liabilities not in excess of ten thousand dollars at

the time of adoption of the plan of dissolution N-PCL 1001(c).

2.

If applicable: Since the date of its incorporation on (date), (name of

corporation) has never been funded and has never had any assets. (NOTE:

This statement applies only to corporations that have never received any

funds or other assets from any source.)

3.

(A.) In addition to Attorney General approval, the following

governmental approvals of the Plan are required, and copies of the

approvals will be attached to the Verified Petition submitted to the

Attorney General.

[list governmental approvals]

or

(B.) Other than the approval of the Attorney General, no approval of

11

the dissolution of the corporation by any governmental body or

officer is required.

A Certificate of Dissolution shall be signed by an authorized director or officer and all

required approvals shall be attached thereto.

(Name of Officer and Title)

(Date)

12

Appendix B: Sample verified petition to the Attorney General for approval of certificate of

dissolution with no assets

X

In the Matter of the Application of

(Name of Corporation) : VERIFIED PETITION

For Approval of Certificate of

Dissolution pursuant to :

Section 1002 of the Not-for -

Profit Corporation Law. :

X

TO: THE ATTORNEY GENERAL OF THE STATE OF NEW YORK

OFFICE OF THE ATTORNEY GENERAL

(Street Address)

(City/Town), New York (Zip Code)

Petitioner, (Name of Corporation) by (Name and Title of Signatory) of the

corporation, for its Verified Petition alleges:

1.

(Name of Corporation), whose principal address is located in the county of (Name of

County), was incorporated pursuant to New York’s Not-for-Profit Corporation Law on

(Date of Incorporation). A copy of the Certificate of Incorporation (and all amendments)

and the complete and current By-laws are attached as Exhibit .

3

2.

The names, addresses and titles of the corporation’s directors and officers are as follows:

Name Title Address

3.

The purposes for which the corporation was organized are set forth in its Certificate of

Incorporation [or relevant amendment] at paragraph thereof and are as

follows:

[insert a description of the purposes of the corporation]

4.

The corporation is a charitable corporation.

5.

The corporation plans to dissolve in accordance with the Plan of Dissolution attached

hereto as Exhibit (the “Plan”).

6.

The corporation is dissolving because [add a brief explanation of reasons for

dissolution.] [Please also note here if the corporation is aware of any ongoing or

3

Please check the Department of State website to confirm that the name of your organization and the stated date of

incorporation is consistent with their records.

13

completed audit or inquiry by the Internal Revenue Service (“IRS”) in the past three

years or if the corporation paid any excise taxes or disclosed an excess benefit transaction

or diversion of assets on its information returns to the IRS.]

7.

(A.) The Board of Directors met at a duly called meeting on proper notice on [date] at

which a quorum of directors out of total directors, each of whom in was

present in person or electronically in accordance with the requirements of the Not-for-

Profit Corporation Law, and [unanimously approved] [approved by votes

in favor votes against] resolutions adopting the Plan and

authorizing the filing of a Certificate of Dissolution. Such resolution, certified by the

Secretary or other duly authorized officer is attached hereto as Exhibit .

or

(B.) [The Board of Directors by unanimous written consent] [The sole remaining director

by written consent] dated approved resolutions adopting the Plan and

authorizing the filing of a Certificate of Dissolution. Such written consent is attached

hereto as Exhibit .

8.

(A)(i). [Include one of these paragraphs only if the corporation has members with voting

rights.] After the Board of Directors approved the Plan, the members received and

reviewed the Plan and adopted a resolution approving the Plan at a duly called meeting on

proper notice on [state date] at which a quorum of members was present [by at least a

two-thirds majority consisting of members out of a total of ____votes, in

favor or unanimous vote.] Such resolution, certified by the Secretary or other duly

authorized officer, is attached hereto as Exhibit .

or

(ii). After the Board of Directors approved the Plan, the members received and reviewed

it and by unanimous written consent voted in favor of adoption of the Plan. Such

unanimous written consent is attached hereto as Exhibit .

or

(B.) The corporation does not have any members.

9.

The corporation has no assets or liabilities as of the date hereof.

or

The corporation has no assets to distribute, other than a reserve not to exceed twenty-five

thousand dollars for the purpose of paying ordinary and necessary expenses of winding

up its affairs including attorney and accountant fees, and liabilities not in excess of ten

thousand dollars at the time of adoption of the plan of dissolution, N-PCL 1001(c).

14

10.

The corporation has filed a final financial report with form CHAR500, with all required

attachments, with the Charities Bureau showing no assets or liabilities and attaching the

appropriate registration fee, if required, a copy of which is attached hereto as Exhibit

____.

or

The corporation acknowledges its obligation to file electronically a final financial report

with form CHAR500, with all required attachments, with the Charities Bureau showing

no assets or liabilities and is submitting such draft herewith as Exhibit . The

corporation gives its assurance that (i) the final financial report shall be the same in all

material respects to that which is attached hereto and, (ii) if registered with the Charities

Bureau, the corporation shall duly file timely its final CHAR500 report with all required

attachments with the Charities Bureau, pursuant to the Estates, Powers & Trusts Law

and/or Article 7-A of the Executive Law.

or

Because the organization is exempt from registration with the Charities Bureau, the

corporation is submitting a summary annual report for the last six years in accordance

with Appendix C.

11.

(A.) Other than the approval of the Attorney General, no approval of the dissolution of

the corporation is required by any governmental body or officer.

or

(B.) Copies of any governmental approvals to the Plan are set forth in the Plan and

attached to the Certificate of Dissolution.

12.

With this Petition, the Certificate of Dissolution is being submitted to the Attorney

General for approval pursuant to Not-for-Profit Corporation Law Section 1003.

WHEREFORE, petitioner requests that the Attorney General approve the Certificate of

Dissolution of (Name of Corporation), a not-for-profit corporation, pursuant to Not-for-Profit

Corporation Law Section 1003.

IN WITNESS WHEREOF, the corporation has caused this Petition to be executed

This day of , 20 , by

Signature

(Name of Signatory and Title)

Note: The signature must be verified (see next page).

15

Verification and Certification

STATE OF NEW YORK )

:SS.:

COUNTY OF __________)

(Name) , being duly sworn, deposes and says:

I am the (Title) of (Name of Corporation) , the corporation

named in the above Petition, and make this verification and certification at the

direction of its Board of Directors. I have read the foregoing Petition and (i) I

know the contents thereof to be true of my own knowledge, except those matters

that are stated on information and belief, and as to those matters, I believe them to

be true and (ii) I hereby certify under penalties of perjury that the Plan was duly

authorized and adopted by the Board of Directors [and by the corporation’s

members.]

Signature

Sworn to before me this

day of , 20 .

Notary Public

Name of Attorney or Other Filer

Mailing Address

Telephone Number

Email Address

16

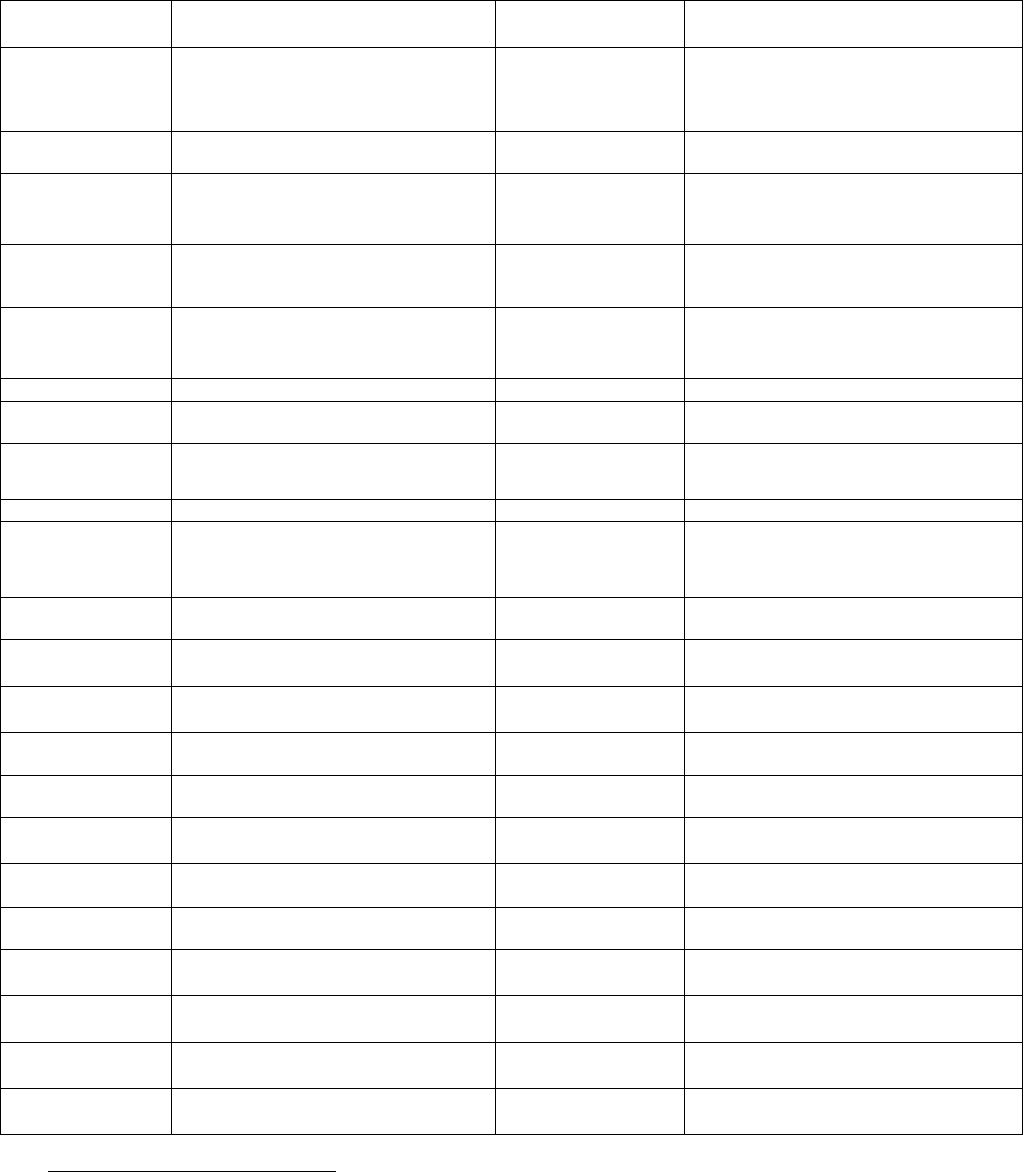

Appendix C: Sample financial report for dissolving entities not otherwise required to file

annual reports

Note: This schedule is for informational purposes only and illustrates the type of information

the Office of the Attorney General reviews regarding dissolving entities otherwise exempt

from filing annual financial reports. Such entities may also submit financial reports

maintained in the ordinary course of their operations that contain similar information.

Year ended

/ /

/ /

/ /

/ /

/ /

/ /

Statement of revenues and expenses

1

Beginning cash balance

2

Contributions received

3

Investment income (interest, dividends)

4

Rental income

5

Gains/(losses) from sale of securities

6

Net proceeds from sale of assets

7

Other income (itemize)

8

Total income (add lines 1-7)

9

Salaries

10

Legal fees

11

Accounting fees

12

Other expenses of dissolution

13

Occupancy/Rent

14

Contributions paid (itemize)

15

Other expenses: (itemize)

16

Total expenses (add lines 9-15)

17

Ending cash balance (Line 1 + Line 8 -

Line 16)

Balance sheets

18

Cash, savings, investments

19

Other assets (itemize)

20

Total assets (Line 18 + Line 19)

21

Total liabilities (itemize)

22

Net assets or fund balances (Line 20 -

21)

Appendix D: Offices of the New York State Attorney General and the counties covered by

each

Albany

Charities Bureau

The Capitol

Albany NY 12224-0341

518-776-2160

Counties: Albany, Columbia, Fulton, Greene,

Hamilton, Montgomery, Rensselaer, Saratoga,

Schenectady, Schoharie, Warren, and Washington

(Note: Sullivan and Ulster for trusts and estates

matters only)

Binghamton regional office

44 Hawley Street, 17th Floor

Binghamton NY 13901-4433

607-251-2770

Counties: Broome, Chemung, Chenango,

Delaware, Otsego, Schuyler, Tioga, and Tompkins

Buffalo regional office

Main Place Tower, Suite 300A

Buffalo NY 14202

716-853-8400

Counties: Allegheny, Cattaraugus, Chautauqua,

Erie, Genesee, Niagara, Orleans, and Wyoming

Nassau regional office

200 Old Country Road, Suite 240

Mineola NY 11501-4241

516-248-3302

Counties: Nassau (Note: Trusts and estates matters

are handled by NYC)

New York City

Charities Bureau Transactions Section

28 Liberty Street

New York NY 10005

212-416-8401

Counties: Bronx, Kings, New York, Queens, and

Richmond (Note: NYC also handles Dutchess,

Nassau, Orange, Putnam, Rockland, Suffolk, and

Westchester – trusts and estates matters only)

Plattsburgh regional office

43 Durkee Street, Suite 700

Plattsburgh NY 12901-2958

518-562-3288

Counties: Clinton, Essex, and Franklin

Poughkeepsie regional office

One Civic Center Plaza, Suite 401

Poughkeepsie NY 12601-3157

845-485-3900

Counties: Dutchess, Orange, Sullivan, and Ulster

(Note: Dutchess and Orange County trusts and

estates matters are handled by NYC; Sullivan and

Ulster County trusts and estates matters are handled

by Albany)

Rochester regional office

144 Exchange Boulevard

Rochester NY 14614-2176

716-546-7430

Counties: Livingston, Monroe, Ontario, Seneca,

Steuben, Wayne, and Yates

Suffolk regional office

300 Motor Parkway

Hauppauge NY 11788-5127

631-231-2424

Counties: Suffolk (Note: Trusts and estates matters

are handled by NYC)

Syracuse regional office

615 Erie Blvd. West, Suite 102

Syracuse NY 13204

315-448-4800

Counties: Cayuga, Cortland, Madison, Onondaga,

and Oswego

Utica regional office

207 Genesee Street, Room 508

Utica NY 13501-2812

315-864-2000

Counties: Herkimer and Oneida

Watertown regional office

Dulles State Office Building

317 Washington Street

Watertown NY 13601-3744

315-523-6080

Counties: Jefferson, Lewis, and St. Lawrence

Westchester regional office

44 South Broadway

White Plains NY 10601

914-422-8755

Counties: Putnam, Rockland, and Westchester

(Note: Trusts and estates matters are handled by

NYC)

18

Appendix E: List of governmental and organizational approvals

4

N-PCL 404(d) has two parts as noted: actual educational organization such as school, library, museum, or college

that require “pre-filing consent, and all others require post-filing consent. All post-filing consent is done within 30

days.

Section of N-PCL

Organizational purpose

When is consent

required?

Which state agency is involved?

404(b)(1)

Destitute children, adult care

facility, residential program for

youth, unmarried mothers

Before filing

NYS Department of Health (DOH)

404(b)(2)

Child day care center

After filing

Office of Children and Family Services

404(c)

Hospital Service, health service of

medical or dental expense indemnity

plan

Before filing

NYS DOH

404(d)

4

Operation of a school, college or

university, museum, or library

Before filing

NYS Education Department

404(d)

Any other corporation whose

purposes might be chartered by the

Regents

After filing

NYS Education Department

404I

Cemetery Corporation

Before filing

NYS Cemetery Board

404(f)

Fire Corporations

Before filing

Village, Town or City Board

404(g)

Prevention of cruelty to animals

Before filing unless

dispensed with

American Society for the Prevention of

Cruelty to Animals

404(h)

YMCAs

Before filing

National YMCA

404(i)

Support of armed forces in

US or foreign country

Before filing

Adjutant General and the Department of

State Post lists of

approved organizations

404(j)

Labor Unions

Before filing

Industrial Board of Appeals

404(k)

Savings bank or life insurance

Before filing

NYS Department of Financial Services

(DFS), superintendent of banks

404(l)

Licensed insurance agents

or brokers or underwriters

Before filing

NYS DFS, superintendent of

Financial services

404(m)

Political parties

Before filing

County committee of appropriate party

404(n)

American Legions

Before filing

American Legion Department of NY

404(o)

Hospital corporations

Before filing

Public Health and Health

Planning Council

404(p)

Medical corporation

Before filing

NYS DOH and Public Health and

Health Planning Council

404(q)

Mental health facility

Before filing

Commissioner of Mental Health

404(r)

Health maintenance

organization

Before filing

NYS DOH

404(t)

Facility providing health-related

services

Before filing

Public Health and Health

Planning Council

404(u)

Substance-abuse programs

Before filing

U.S. Office of Alcoholism and

Substance Abuse Services

404(v)

Non-profit

Property or casualty insurance

Before filing

DFS, superintendent of

insurance

19