AIRLINE

PASSENGER

PROTECTIONS

Observationson

FlightDelaysand

Cancellations,and

DOT’sEffortsto

AddressThem

Accessible Version

ReporttoCongressionalRequesters

April 2023

GAO-23-105524

United States Government Accountability Office

United States Government Accountability Office

GAOHighlights

Highlights of GAO-23-105524, a report to

congressional requesters

April 2023

AIRLINE PASSENGER PROTECTIONS

Observations on Flight Delays and Cancellations, and

DOT’s Efforts to Address Them

What GAO Found

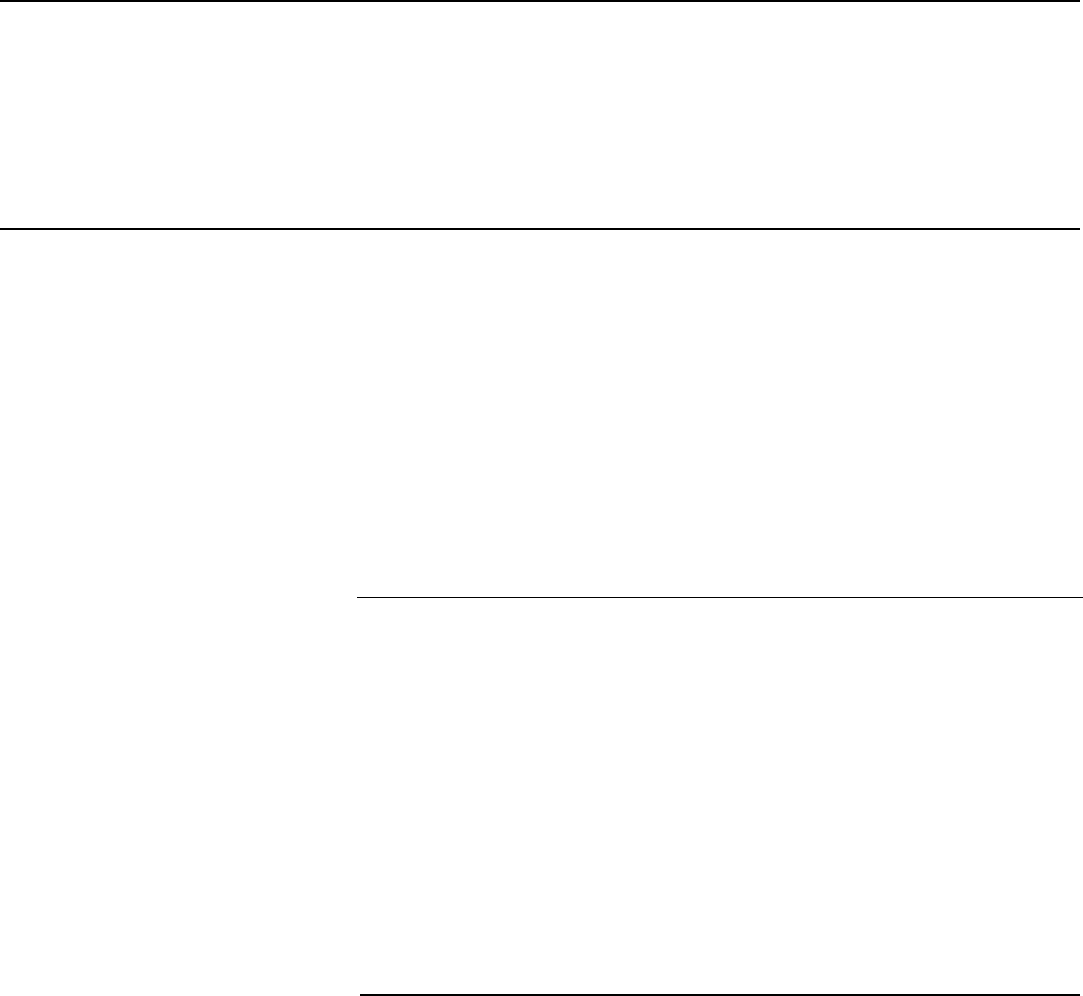

Flight cancellation rates in the last 6 months of 2021 outpaced 2018 and 2019

rates despite 14 percent fewer scheduled flights, according to GAO’s analysis of

data from the Department of Transportation (DOT). Increased cancellation rates

continued through April 2022, the most recent data at the time of GAO’s analysis.

In contrast, flight delays in the last 6 months of 2021 remained at similar rates

compared to 2018 and 2019. According to DOT data, factors within the airlines’

control (e.g., aircraft maintenance or lack of crew) were the leading cause of

cancellations from October through December 2021 as well as in April 2022 and

airline-caused delays increased for nearly all airlines in the last half of 2021.

Percentage of Airline-Caused Cancelled Flights, January 2018 through April 2022

Stakeholders said that operational challenges, including a need for additional

pilots and crew, have made it harder for airlines to manage flight disruptions. In

response, airlines added new staff, opened new training facilities, and reduced

the number of scheduled flights, among other things. Airline representatives GAO

interviewed said they attempt to accommodate affected passengers, offering

meal and hotel vouchers. However, consumer advocate representatives were

generally not satisfied with airlines’ responses, noting the significant

inconvenience passengers experienced, such as missing important events.

DOT and the Federal Aviation Administration (FAA) are taking several actions to

address flight disruptions. For example, DOT and FAA met with airlines to

discuss disruptions and airlines’ customer service obligations. In early September

2022, DOT released its Airline Customer Service Dashboard, which shows the

services and amenities U.S. airlines provide if the airline causes a delayed or

cancelled flight. Additionally, DOT monitors chronically delayed flights—a long

standing practice. Over the course of GAO’s review, DOT enhanced its oversight

of airline-scheduling practices. Specifically, DOT began analyzing system-wide

cancellation and on-time performance data and routinely meeting with airlines to

review their scheduling and operational performance. DOT plans to continue

these actions.

View GAO-23-105524. For more information,

contact Heather Krause at (202) 512-2834 or

Why GAO Did This Study

As air travel in the U.S. began to

recover from the pandemic in mid-

2021, U.S. passenger airlines

experienced frequent flight disruptions.

These flight disruptions, including

delays and cancellations, continued

into 2022 and affected millions of

passengers. Industry observers raised

questions about airline-scheduling

practices, as well as the role of DOT in

enforcing consumer protections.

GAO was asked to determine key

changes in the U.S. passenger airline

industry resulting from the pandemic.

This report examines (1) trends in and

causes of flight disruptions before and

after the pandemic; (2) challenges

airlines faced managing and

responding to flight disruptions; and (3)

FAA and DOT actions to help address

them.

GAO analyzed DOT data on U.S.

airline operations from January 2018

through April 2022. GAO reviewed

relevant federal statutes and

regulations. GAO interviewed DOT and

FAA officials, as well as

representatives from U.S. passenger

airlines, unions, and consumer

organizations selected based on

background research and prior GAO

work, among other things.

GAO’s draft report recommended that

DOT use network-level (i.e., system-

wide) data to identify instances of

potential unrealistic scheduling. In

response, DOT provided additional

information about its recent analysis of

airlines’ scheduling practices. As a

result, GAO removed the

recommendation and modified the

report accordingly.

Page i GAO-23-105524 Airline Passenger Protections

Contents

GAO Highlights ii

Why GAO Did This Study ii

What GAO Found ii

Letter 1

Background 3

Flight Cancellations Rose Substantially in Late 2021, with Airline-

Caused Cancellations and Delays Outpacing Pre-Pandemic

Levels 10

Airlines Attempted to Respond to Operational Challenges and

Persistent Flight Disruptions with a Range of Actions 18

DOT and FAA Are Taking Actions to Address Flight Disruptions,

Including Analyzing Airlines’ Scheduling Practices 23

Agency Comments and Our Evaluation 33

Appendix I: Objectives, Scope, and Methodology 36

Appendix II: Selected Flight Disruption Snapshots 42

Appendix III: GAO Contact and Staff Acknowledgments 60

Tables

Table 1: Annual Refund and Flight Problem Complaints Submitted

to the Department of Transportation, 2018 to 2022 24

Table 2: 95th Percentile Thresholds for GAO’s Analyses of

Sustained Cancellation Events 37

Table 3: List of Entities and Individuals Interviewed 40

Figures

Figure 1: Percentage Change from March 2020 to October 2022

in Full-Time Employees at Major U.S. Passenger Airlines,

Compared to February 2020 7

Figure 2: Transportation Security Administration (TSA)-Screened

Passengers and Centers for Disease Control and

Prevention (CDC)-Reported COVID-19 Cases, January

2020 through August 2022 8

Figure 3: Percentage of Total Flights Cancelled from July through

December, 2018, 2019, and 2021 11

Page ii GAO-23-105524 Airline Passenger Protections

Figure 4: Percentage of Total Flights Cancelled from January

through April, 2018, 2019, and 2022 12

Figure 5: Percentage of Flights Delayed from January 2018

through April 2022 14

Figure 6: Percentage of Cancelled Flights Caused by Airlines,

January 2018 through April 2022 15

Figure 7: Percentage of Total Cancelled Flights Attributed to

Airlines, July through December 2019, 2021 16

Figure 8: Percentage of Delay-Minutes Attributed to Airlines, July

through December 2019, 2021 17

Figure 9 Cancelled and Delayed Flights, October 8, 2021 through

October 11, 2021 43

Figure 10 Reported Causes of Flight Cancellations, October 8,

2021 through October 11, 2021 43

Figure 11 Cancelled Flight Locations in the Contiguous United

States (Origin City), October 8, 2021 through October 11,

2021 43

Accessible Data for Figure 9 Cancelled and Delayed Flights,

October 8, 2021 through October 11, 2021 44

Accessible Data for Figure 10 Reported Causes of Flight

Cancellations, October 8, 2021 through October 11, 2021 44

Accessible Data for Figure 11 Cancelled Flight Locations in the

Contiguous United States (Origin City), October 8, 2021

through October 11, 2021 44

Figure 12 Cancelled and Delayed Flights, October 28, 2021

through November 1, 2021 48

Figure 13 Reported Causes of Flight Cancellations, October 28,

2021 through November 1, 2021 48

Figure 14 Cancelled Flight Locations in the Contiguous United

States (Origin City), October 28, 2021 through November

1, 2021 48

Accessible Data for Figure 12 Cancelled and Delayed Flights,

October 28, 2021 through November 1, 2021 49

Accessible Data for Figure 13 Reported Causes of Flight

Cancellations, October 28, 2021 through November 1,

2021 49

Accessible Data for Figure 14 Cancelled Flight Locations in the

Contiguous United States (Origin City), October 28, 2021

through November 1, 2021 49

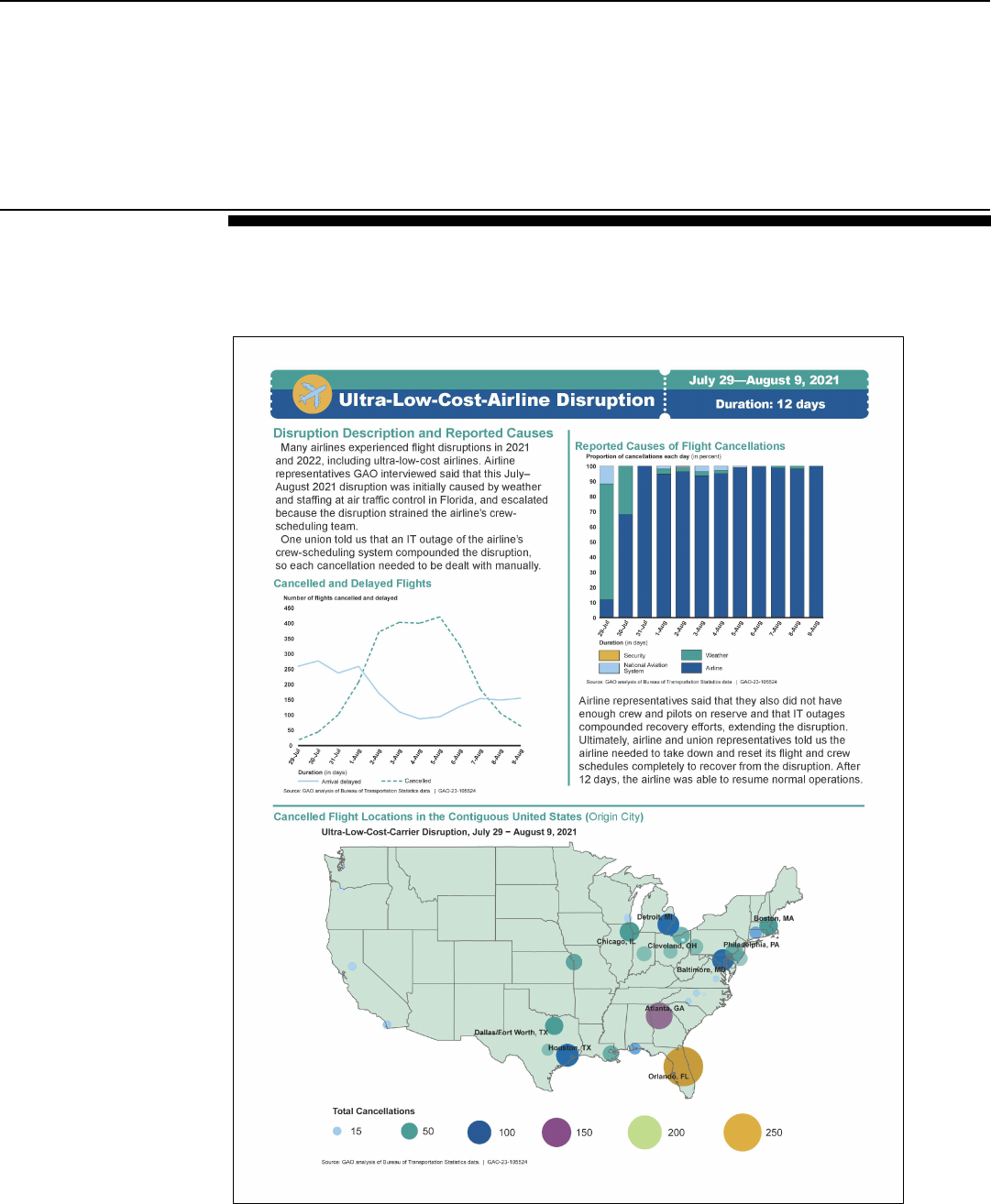

Figure 15 Cancelled and Delayed Flights, July 29, 2021 through

August 9, 2021 56

Page iii GAO-23-105524 Airline Passenger Protections

Figure 16 Reported Causes of Flight Cancellations, July 29, 2021

through August 9, 2021 56

Figure 17 Cancelled Flight Locations in the Contiguous United

States (Origin City), July 29, 2021 through August 9,

2021 56

Accessible Data for Figure 15 Cancelled and Delayed Flights, July

29, 2021 through August 9, 2021 57

Accessible Data for Figure 16 Reported Causes of Flight

Cancellations, July 29, 2021 through August 9, 2021 57

Accessible Data for Figure 17 Cancelled Flight Locations in the

Contiguous United States (Origin City), July 29, 2021

through August 9, 2021 58

Abbreviations

ASQP Airline Service Quality Performance System

BTS Bureau of Transportation Statistics

CDC Centers for Disease Control and Prevention

DOT Department of Transportation

FAA Federal Aviation Administration

NPRM notice of proposed rulemaking

PSP Payroll Support Program

TSA Transportation Security Administration

This is a work of the U.S. government and is not subject to copyright protection in the

United States. The published product may be reproduced and distributed in its entirety

without further permission from GAO. However, because this work may contain

copyrighted images or other material, permission from the copyright holder may be

necessary if you wish to reproduce this material separately.

Page 1 GAO-23-105524 Airline Passenger Protections

441 G St. N.W.

Washington, DC 20548

Letter

April 13, 2023

The Honorable Sam Graves

Chairman

Committee on Transportation and Infrastructure

House of Representatives

The Honorable Garret Graves

Chairman

Subcommittee on Aviation

Committee on Transportation and Infrastructure

House of Representatives

The COVID-19 pandemic had a severe and profound effect on the U.S.

aviation industry. Domestic passenger airlines experienced an

unprecedented drop in passenger traffic in 2020, and since then their

recovery has been uneven. Congress provided about $54 billion to

passenger airlines through the Payroll Support Program (PSP).

1

Despite

this support, which barred recipient airlines from conducting involuntarily

furloughs or terminations during certain time periods, many airlines

reduced their workforce, including pilots and flight attendants, through

early retirements or other incentives to help manage costs.

2

Due to these workforce reductions, airlines faced challenges resuming

operations when travel demand began to rapidly recover in the spring and

summer of 2021. Several severe, high-profile flight disruptions—involving

flight cancellations and delays—affected thousands of passengers in the

summer and fall of 2021. For example, Spirit Airlines cancelled more than

2,000 flights in late July and August 2021, according to media outlets and

the airline’s financial filings. As flight disruptions have persisted

1

Pub. L. No. 116-136, § 4112, 134 Stat. 281, 498 (2020) (codified at 15 U.S.C. § 9072);

Pub. L. No. 116-260, div. N, tit. IV, § 402, 134 Stat. 1182, 2053 (2020) (codified at 15

U.S.C. § 9092); Pub. L. No. 117-2, § 7301, 135 Stat. 4, 104-107. Including these funds,

COVID-19 relief laws have provided more than $100 billion in assistance for aviation

businesses and airports since March 2020, in response to the public health and economic

crises.

2

For information about the effects of the pandemic on the aviation industry, among other

things, see GAO, COVID-19 Pandemic: Observations on the Ongoing Recovery of the

Aviation Industry, GAO-22-104429 (Washington, D.C.: Oct. 21, 2021).

Letter

Page 2 GAO-23-105524 Airline Passenger Protections

throughout 2022, affecting millions of passengers, industry observers

have raised questions about the extent to which the pandemic has

permanently affected the passenger airline industry—and whether the

Department of Transportation (DOT) is fulfilling its mission to protect

passengers, especially those who have been affected by the ongoing

flight disruptions.

3

You asked us to review key changes in the U.S. passenger airline

industry resulting from the COVID-19 pandemic. This report addresses

three objectives:

1. how flight disruptions in 2021 and 2022 and their underlying causes

compare to the 2 years preceding the COVID-19 pandemic;

2. the operational challenges airlines faced in managing flight

disruptions, and actions airlines have taken to address them; and

3. the actions taken by DOT and the Federal Aviation Administration

(FAA) in 2021 and 2022 to help address flight disruptions.

To address these objectives, we analyzed data collected by DOT’s

Bureau of Transportation Statistics (BTS) from January 2018 through

April 2022, the most recently available data at the time of our analysis, on

U.S. domestic flight delays and cancellations and airline operations.

4

Because there is a several month lag before BTS publishes each month’s

airline performance data, our data analysis is limited to the first 4 months

of 2022. We determined the data were sufficiently reliable for our

purposes by reviewing documentation and electronic testing of data.

Further, we conducted semi-structured interviews with representatives

from a non-generalizable sample of 15 stakeholders, including four

airlines; three unions representing pilots and flight attendants; three

industry associations; two consumer organizations; one trade association;

and two academics. We also interviewed DOT and FAA officials. For

additional information on our scope and methodology, see appendix I.

We conducted this performance audit from November 2021 to April 2023

in accordance with generally accepted government auditing standards.

Those standards require that we plan and perform the audit to obtain

3

More recently, during the 2022-2023 holiday season, Southwest Airlines delayed and

cancelled thousands of flights over multiple days.

4

For the purposes of our analysis, we excluded 2020 data in certain instances. Given the

effects of the pandemic on the industry, 2020 airline operational data are not comparable

to other years.

Letter

Page 3 GAO-23-105524 Airline Passenger Protections

sufficient, appropriate evidence to provide a reasonable basis for our

findings and conclusions based on our audit objectives. We believe that

the evidence obtained provides a reasonable basis for our findings and

conclusions based on our audit objectives.

Background

AirlineOperationsandFlightDisruptions

The U.S. passenger airline industry, composed primarily of network,

regional, and low-cost airlines, is a vital contributor to the domestic

economy. In 2019, the U.S. aviation industry supported $852.3 billion in

direct economic activity, and contributed 2 percent of U.S. gross domestic

product, according to a report issued by FAA.

5

The aviation industry also

plays a critical role in supporting tourism and other travel-related

industries. Network airlines operate complex hub-and-spoke operations

with thousands of employees and hundreds of aircraft. Regional airlines

operate smaller aircraft, typically under contract to network airlines, and

generally provide service to smaller communities. Low-cost airlines tend

to operate more affordable point-to-point service mostly within the U.S.

Airline operations are complex, and many factors may affect airlines’

operational and on-time performance. Tens of thousands of flights on

average operate in the National Airspace System each day. As part of

these operations, airlines have always experienced some amount of flight

disruptions, which can include prolonged flight cancellations and delays.

6

Some of the factors that cause flight disruptions, such as mechanical

5

FAA, The Economic Impact of U.S. Civil Aviation: 2020. These values represent the

direct aviation sector, which includes airline and airport operations, and aircraft

manufacturing, among other things. This report also includes information about the

economic impact of civil aviation in 2020.

6

For the purposes of reporting airline performance data to DOT, a cancellation is a flight

operation that was not operated, but that was listed in a carrier’s computer reservation

system within 7 calendar days of the scheduled departure. 14 C.F.R. § 234.2. Delays can

range in severity. For the purposes of reporting an arrival delayed flight to BTS, airlines

must report a flight as delayed if it arrives at the gate 15 minutes or more after its

published arrival time. “Diversions,” defined as a flight that is operated from the origin to a

point other than the scheduled destination point, are another type of flight disruption. We

excluded diversions for the purposes of this report. Although in law, U.S. airlines are

generally referred to as “air carriers” we will refer to them as “airlines” for the purpose of

this report.

Letter

Page 4 GAO-23-105524 Airline Passenger Protections

issues or crew staffing, are within the airline’s control, while other factors,

such as weather, are not.

Federal regulations require that U.S. passenger airlines report monthly

data to BTS on airline operations and on-time performance, including

data on cancellations, delays, and their causal factors.

7

BTS requires that

airlines report the primary cause of cancellations in one of the following

categories:

8

· Air carrier (Airline): This category includes factors that are within the

airline’s control, such as aircraft maintenance or a lack of crew.

· Extreme weather: This category includes actual or forecasted

weather conditions that prevent the operation of the flight or

subsequent flights due to the aircraft being out of position because of

weather conditions.

· National Aviation System: This category includes factors that are

within the National Aviation System, including, for example, non-

extreme weather, heavy traffic volume, and air traffic control issues.

· Security: This category includes factors resulting from the

malfunctioning screening or security equipment, or certain breaches

of security.

9

These same four categories apply when airlines report arrival delays. For

arrival delays, however, airlines can attribute a delay to a fifth category:

late arriving aircraft, which are delays that are the result of a late incoming

aircraft from a previous flight. Unlike for cancellations, airlines must report

each cause of delay that contributes 5 minutes or more to the delay.

7

Airlines whose domestic scheduled-service passenger revenues exceeds 0.5 percent are

required to report on-time performance to DOT. 14 C.F.R. § 234.2. Reporting airlines

include network airlines, regional airlines, low-cost airlines, and ultra-low cost airlines. In

2022, 17 airlines were required to report data to BTS. These airlines represent

approximately 96 percent of passenger traffic in the U.S., according to DOT officials.

8

Although airlines typically track specific reasons for flight delays and cancellations

internally, they only report a single cause for a cancelled flight to BTS.

9

Pursuant to DOT guidance, this category also includes compliance with federal directives

and notices to mitigate the spread of COVID-19, closure of National Aviation System

facilities to protect people from the spread of COVID-19, and airline management of

system capacity because of actions to mitigate the spread of COVID-19. See Reporting

the Causes of Flight Delays and Cancellations Given the Unprecedented Impact of the

COVID-19 Public Health Emergency on Air Travel, United States Department of

Transportation Office of the Secretary (April 17, 2020).

Letter

Page 5 GAO-23-105524 Airline Passenger Protections

Airlines must also report the total minutes the cause contributed to the

delay. Therefore, airlines may report multiple causes to BTS for a single

flight delay.

When airline operations are disrupted, airlines attempt to minimize the

effects of disruptions on their network and passengers. As we have

previously reported, flight delays and cancellations that occur in one

location of an airline’s network can cause subsequent disruptions

elsewhere in the airline’s network.

10

This ripple effect often occurs

because key resources, such as aircraft and airline’s staff, do not get to

their next destination in time to operate the subsequent flight. As a result,

flight disruptions can persist for days after the event that triggered the

disruption if the airline does not have sufficient capacity to clear the

backlog.

PassengerAirlinesandthePandemic

During the COVID-19 pandemic, which triggered an unprecedented

reduction in demand for air travel in 2020, Congress established multiple

federal relief programs for the aviation industry totaling more than $100

billion.

11

One of these programs, PSP, provided up to $54 billion in

financial assistance for passenger airlines to use exclusively for employee

wages, salaries, and benefits. This assistance contained provisions to

keep employees on airlines’ payroll.

12

According to an aviation industry

association, maintaining a stable workforce helped airlines be better

positioned to restart operations when demand for air travel recovered.

10

GAO, National Airspace System: DOT and FAA Actions Will Likely Have a Limited Effect

on Reducing Delays during Summer 2008 Travel Season, GAO-08-934T (Washington,

D.C.: July 15, 2008).

11

For a summary of these programs, see GAO-22-104429.

12

In total, PSP provided up to $63 billion for passenger airlines, cargo airlines, and

aviation contractors. According to data available in March 2022, passenger airlines

received about $53.4 billion in payments, aviation contractors received about $4.6 billion,

and cargo airlines received about $827.4 million. Most of the remaining funds were

appropriated but not awarded to cargo airlines, because total demand by cargo airlines

was far below available funds. For more information about the program, see GAO,

COVID-19: Current and Future Federal Preparedness Requires Fixes to Improve Health

Data and Address Improper Payments, GAO-22-105397 (Washington, D.C.: April 27,

2022).

Letter

Page 6 GAO-23-105524 Airline Passenger Protections

PSP was implemented through three COVID-19 relief laws.

13

Each of the

three rounds of PSP prohibited airlines from conducting involuntary

furloughs and terminations and required airlines to maintain minimum

service obligations, among other things. These requirements generally

only applied during timeframes specified in each COVID-19 relief law. For

the most recent round of PSP, prohibitions on involuntary furloughs and

terminations expired the later of September 30, 2021, or when the

recipient had expended all of its payroll support.

While recipients receiving payments from PSP were prohibited from

conducting involuntary terminations and furloughs during specified time

periods, they could—and did—offer voluntary incentives to reduce their

workforce. Those incentives included voluntary unpaid leave or

separation or early retirement. For example, at one airline about 18,000

employees participated in early retirement and voluntary separation

programs in 2020, according to the airline’s financial filings. Airlines also

halted non-essential hiring.

These actions resulted in significant reductions in the airlines’ workforces

in 2020, as shown in figure 1. For example, the number of full-time

employees for major U.S. passenger airlines decreased by about 9.5

percent between February 2020 and May 2020.

14

As passenger demand

for air travel returned in the spring of 2021, airlines began hiring new

employees, including pilots. In October 2022, the number of full-time

employees at major U.S. passenger airlines was 2.8 percent above pre-

pandemic levels (February 2020).

13

These laws were the CARES Act (Pub. L. No. 116-136, § 4112, 134 Stat. 281, 498

(2020) (codified at 15 U.S.C. § 9072), the Consolidated Appropriations Act, 2021 (Pub. L.

No. 116-260, div. N, tit. IV, § 402, 134 Stat. 1182, 2053 (2020) (codified at 15 U.S.C. §

9092), and the American Rescue Plan Act of 2021 (Pub. L. No. 117-2, § 7301, 135 Stat. 4,

104-107)(codified at 15 U.S.C. § 9141).

14

We analyzed data on full-time employees for the major airlines, defined by BTS as

airlines with over $1 billion annual operating revenue. We only analyzed data for

passenger airlines, and we excluded five cargo airlines that are considered major airlines.

Letter

Page 7 GAO-23-105524 Airline Passenger Protections

Figure 1: Percentage Change from March 2020 to October 2022 in Full-Time Employees at Major U.S. Passenger Airlines,

Compared to February 2020

Note: We analyzed data on full-time employees for the major airlines, defined by BTS as airlines with

over $1 billion annual operating revenue. We only analyzed data for passenger airlines, and we

excluded five cargo airlines that are considered major airlines.

According to an aviation industry association, by summer 2021, after

COVID-19 vaccines became more widely available to the public,

passenger demand for domestic leisure air travel was returning to near

pre-pandemic levels. For example, the number of passengers on

scheduled passenger domestic flights in the second half of 2021 was

about 13.6 percent below the number during the same period in 2019.

15

TSA screening data, a proxy for passenger demand, shows that demand

for air travel continued to increase in 2022.

16

For example, from January

through June 2022 screening levels were about 3.5 percent higher than

the previous 6 months. See figure 2 for key trends during the COVID-19

pandemic.

15

Our scope was limited to data from 10 airlines that sell passengers’ tickets that report

monthly data to BTS. The airlines we included in this calculation were Alaska Airlines,

Allegiant Air, American Airlines, Delta Air Lines, Frontier Airlines, Hawaiian Airlines,

JetBlue Airways, Southwest Airlines, Spirit Airlines, and United Airlines.

16

TSA screened passenger data include TSA, airport, and airline employees transiting

checkpoints and therefore represents slightly more than actual passenger traffic.

Letter

Page 8 GAO-23-105524 Airline Passenger Protections

Figure 2: Transportation Security Administration (TSA)-Screened Passengers and Centers for Disease Control and Prevention

(CDC)-Reported COVID-19 Cases, January 2020 through August 2022

a

TSA screened passenger data include TSA, airport, and airline employees transiting checkpoints

and therefore represents slightly more than actual passenger traffic. The 7-day moving averages

were calculated as the (current day + 6 preceding days)/7, where data were reported. The TSA data

were accessed on August 16 and August 18, 2022. TSA data are subject to change.

b

Reported COVID-19 cases include confirmed and probable cases. The 7-day moving averages were

calculated as the (current day + 6 preceding days)/7, where data were reported. The CDC data were

accessed on August 17, 2022.

c

The TSA screened passenger data on February 29, 2020 were not reported and therefore not

included in the 7-day moving average.

DOT’sRegulatoryEfforts

While U.S. airlines’ business practices are largely deregulated, a number

of consumer protections are in place at the federal level.

17

DOT, which is

17

The Airline Deregulation Act of 1978 largely deregulated U.S. airlines’ business

practices, including removing federal control over airline pricing and routes, and state and

local governments are generally preempted by federal law from regulating airlines’ prices,

routes, or service. See 49 U.S.C. § 41713(b)(1). As such, state governments and

individuals are prevented from bringing lawsuits against airlines on prices, services, and

routes. However, airline passengers may still bring lawsuits against airlines concerning

contractual obligations undertaken by an airline, including for an airline’s failure to honor

its contract of carriage, a legal document that includes rights, liabilities, and duties of the

airline and passenger.

Letter

Page 9 GAO-23-105524 Airline Passenger Protections

responsible for ensuring airlines comply with federal consumer protection

laws and regulations, has authority to investigate and order airlines to

stop engaging in unfair or deceptive practices, and may promulgate

consumer protection regulations under this authority.

18

DOT’s Office of

Aviation Consumer Protection is responsible for investigating potentially

unfair and deceptive airline practices, such as unrealistic scheduling of

flights. The office also provides compliance assistance to airlines. If DOT

finds that an airline has violated consumer protection requirements, it has

the authority to take enforcement action, including assessing civil

penalties. DOT also provides information to educate passengers about

their rights and services provided by airlines.

In addition, DOT requires airlines to provide cash refunds to passengers

whose flights are cancelled or significantly changed, and DOT issued a

proposed rule in August 2022 to define these terms.

19

Beyond DOT’s

requirement for airlines to provide cash refunds to passengers for

cancelled or significantly changed flights, airline compensation to

passengers is generally limited. Airlines are not required to provide

accommodations for flight disruptions unless specified in an airline’s

contract of carriage or customer service plan, although airlines may

provide additional accommodations in certain circumstances. As we have

previously reported, airline assistance to affected passengers can vary

significantly.

20

Flight disruptions, particularly if they are long lasting, can

significantly inconvenience passengers.

18

See 49 U.S.C. § 41712, 49 U.S.C. § 40101(a)(4),(9).

19

Current regulations do not define cancelled or significantly changed flights in the context

of an airline’s legal obligation to provide refunds. However, DOT’s August 2022 Notice of

Proposed Rulemaking, Airline Ticket Refunds and Consumer Protections, proposes to

define a significant change of flight itinerary. 87 Fed. Reg. 51550 (Aug. 22, 2022). The

proposed definition would include, among other things, changes to a flight itinerary for a

domestic flight when a passenger departs from the origination airport 3 or more hours

earlier than the scheduled departure, or arrives at the destination airport 3 hours or more

later than the scheduled arrival time. DOT also proposes to define a cancelled flight as a

flight that was published in the airline’s Computer Reservation System at the time the

ticket was sold, but was not operated. This rulemaking closed for public comment on

December 16, 2022.

20

GAO, Commercial Aviation: Information on Airline IT Outages, GAO-19-514

(Washington, D.C.: June 12, 2019).

Letter

Page 10 GAO-23-105524 Airline Passenger Protections

FlightCancellationsRoseSubstantiallyinLate

2021,withAirlineCausedCancellationsand

DelaysOutpacingPrePandemicLevels

Our analysis found that flight cancellations increased in the second half of

2021 and the first 4 months of 2022, outpacing cancellation rates in both

2018 and 2019 despite fewer flights overall. In addition, BTS data show

that factors within the airlines’ control were the leading causes of flight

cancellations and delays in the last 3 months of 2021, as well as in April

2022.

FlightCancellationsIncreasedintheSecondHalfof

2021,OutpacingPrePandemicRates,butDelayRates

WereRoughlytheSame

Based on our analysis, flight cancellation rates increased from July

through December 2021, despite around 14 percent fewer scheduled

flights during that time period.

21

In early 2021, air traffic remained low. As

travel demand rose in the second half of the year, cancellation rates

increased in several months compared to the same time period in 2018

and 2019 (see fig. 3). Specifically, flight cancellations in the last 6 months

of 2021—when passenger demand was approaching near pre-pandemic

levels—were up approximately 16 percent compared to the last half of

2019. The majority of U.S airlines reporting data to BTS (7 of 10)

cancelled a larger percentage of their flights in the last half of 2021

compared to both 2018 and 2019.

21

Cancellation rates are calculated by dividing the total number of cancelled flights by the

number of scheduled flights.

Letter

Page 11 GAO-23-105524 Airline Passenger Protections

Figure 3: Percentage of Total Flights Cancelled from July through December, 2018, 2019, and 2021

Note: For the purposes of this analysis, we excluded 2020 data. Given the effects of the pandemic on

the industry, 2020 airline operational data are not comparable to other years.

Flight cancellations increased in early 2022. Compared to 2018 and 2019,

airlines continued to cancel flights at higher rates through February 2022,

with substantial improvement in March and April (see fig. 4). Many of

these winter cancellations were primarily caused by weather events. We

found that the total number of flight cancellations in the first 4 months of

2022 (81,593) exceeded the flights cancelled during the same time period

in 2018 (56,356) and 2019 (67,190).

Letter

Page 12 GAO-23-105524 Airline Passenger Protections

Figure 4: Percentage of Total Flights Cancelled from January through April, 2018,

2019, and 2022

Note: For the purposes of this analysis, we excluded 2020 data. Given the effects of the pandemic on

the industry, 2020 airline operational data are not comparable to other years.

Airlines continued to experience flight cancellations throughout 2022,

beyond the timeframe of our analysis.

22

According to data separately

reported by BTS, cancellations over Memorial Day weekend (Friday May

27, 2022, through Monday May 30, 2022) increased to 3.1 percent of

flights compared to 1.1 percent during the 2019 Memorial Day holiday.

23

Flight cancellations continued over the July Fourth 2022 holiday

weekend. More broadly, BTS data indicate that the cancellation rate in

2022 was the highest in the past decade, with the exception of 2020. Air

travel demand continued to rise despite the disruptions. From January

through June 2022, passenger throughput was about 3.5 percent higher

than the previous 6 months, according to TSA data.

24

Additionally, in

December 2022 Southwest cancelled 16,700 flights during the holiday

travel period, according to the airline’s financial filings. Media reports at

22

Due to lags in reporting BTS airline performance data, we were only able to analyze

flight disruptions between July 2021 and April 2022.

23

BTS reports data about delays and cancellations during holiday travel seasons by

reporting airline for 10 major airlines from 1987 to present.

24

TSA-screened passenger data include TSA, airport, and airline employees’ transiting

checkpoints, and therefore represents slightly more than actual passenger traffic.

Letter

Page 13 GAO-23-105524 Airline Passenger Protections

the time of the event estimated that these cancellations represented over

70 percent of the airline’s scheduled flights on certain days. The

disruption resulted in DOT initiating an investigation into Southwest to

determine whether the airline set an unrealistic schedule and provided

timely refunds and reimbursements to passengers.

Sustained cancellation events, or a series of days where an airline

cancelled a large percentage of daily flights, lasted longer and became

more common as travel demand increased. Specifically, while some flight

cancellations are inevitable due to weather and other events, BTS data

indicate that both in the second half of 2021 and in early 2022 airlines

experienced longer, more frequent sustained cancellation events as

compared to the 2 years before the pandemic.

25

Our analysis showed:

· From July to December 2021, on average, it took 1.9 days for an

airline to recover from a sustained cancellation event. In comparison,

in both the second halves of 2018 and 2019, it took airlines around

1.5 days on average to recover. In the first 4 months of 2022, it took

airlines even longer to recover from these events, averaging nearly 3

days per event compared to 1.6 days and 1.3 days in the first 4

months of 2019 and 2018, respectively.

· In the last half of 2021, there were 6.3 percent more sustained

cancellation events than during the same time period in 2018, and

12.2 percent more than in 2019, despite 14 percent fewer scheduled

flights compared to 2019.

26

In the first 4 months of 2022, the number

of sustained cancellation events increased even more substantially,

with 56.9 percent more events in this time period compared to the

same 4-month time period in 2018, and 42.9 percent more than in the

first 4 months of 2019.

27

There were 12.6 percent fewer scheduled

flights during the relevant 2022 time period as compared to the same

time period in 2019.

25

We defined sustained cancellation events as an ongoing series of days where an airline

cancelled flights at a higher rate than 95 percent of the days in 2018 and 2019. When an

airline’s daily cancellation rate dropped below this threshold, we considered it “recovered”

from the event. To account for seasonal trends in airline operations, we adjusted the daily

cancellation threshold each quarter.

26

From July through December of each year, we identified 95 sustained cancellation

events in 2018, 90 in 2019, and 101 in 2021.

27

From January through April of each year, we identified 51 sustained cancellation events

in 2018, 56 in 2019, and 80 in 2022.

Letter

Page 14 GAO-23-105524 Airline Passenger Protections

Although flight delays have steadily increased with the return of air travel

demand in the summer of 2021, they remained similar to pre-pandemic

levels through April 2022 (see fig. 5). In the second half of 2021,

approximately 19 percent of domestic flights were delayed at least 15

minutes compared to 18 percent of flights in 2019 and 19 percent of

flights in 2018. Flight delays were also similar to pre-pandemic levels for

both shorter delays under 45 minutes, and longer delays over 75 minutes.

While there may be other contributing factors, fewer flights in the last half

of 2021 compared to 2018 and 2019 may have helped mitigate the

number of flight delays and congestion in the national airspace.

Figure 5: Percentage of Flights Delayed from January 2018 through April 2022

Note: Flights are considered delayed by BTS if they arrive at least 15 minutes late.

AirlineCausedCancellationsandDelaysHaveIncreased

SincethePandemicBegan,withaSubstantialIncreasein

CancellationsinLate2021

Unlike in 2018 and 2019, our analysis of BTS data showed that factors

within the airlines’ control were the leading causes of flight cancellations

Letter

Page 15 GAO-23-105524 Airline Passenger Protections

in the last 3 months of 2021.

28

In 2018 and 2019, weather was the leading

cause of flight cancellations. However, the proportion of airline-caused

cancellations began to increase after February 2021 (see fig. 6). From

October through December 2021, airlines caused 60 percent or more of

flight cancellations each month, exceeding any point reached in 2018 and

2019.

29

Airlines were again the leading cause of flight cancellations in

April 2022.

Figure 6: Percentage of Cancelled Flights Caused by Airlines, January 2018 through April 2022

Note: Airlines attribute cancellations in BTS data to one of four causes: Extreme weather events; Air

Carrier (the airline or factors within an airline’s control); the National Aviation System, such as Federal

28

According to BTS, air carrier delays and cancellations can represent issues like staffing,

mechanical issues with a plane, or IT outages; however, these specific causes are not

captured in BTS’ data. Airlines are required to report data about delays, cancellations, and

causal factors to DOT, and airlines certify the accuracy of the data. DOT officials said that

DOT does not take any steps to verify the attributed cause of cancellations or delays.

However, DOT does perform some checks to validate the data, including cross checking

the data with another database. DOT officials said that the data in the two databases

generally correspond.

29

Aligning with our data analysis, we found that factors within an airline’s control extended

three selected flight disruptions that occurred in late 2021. In each case, airline

representatives told us that airline staffing and other operational challenges contributed to

each incident, and extended the amount of time it took the airlines to recover from an

initial disruptive event, such as severe weather. Appendix 2 provides additional details

about each of the flight disruptions we examined and their reported causes, and we

discuss airlines’ operational challenges more broadly later in the report.

Letter

Page 16 GAO-23-105524 Airline Passenger Protections

Aviation Administration ground delays and airspace congestion; or security, such as airport security

breaches.

From July through December 2021, the percentage of airline-caused

cancellations increased for every airline reporting BTS data compared to

2019 (see fig. 7).

Figure 7: Percentage of Total Cancelled Flights Attributed to Airlines, July through December 2019, 2021

Note: Cancelled flights attributed to airlines represents the percentage of airline-caused cancelled

flights out of the total number of flight cancellations during that time period.

Although flights were delayed at similar rates in 2021 overall compared to

2018 and 2019, the reported causes of flight delays changed during the

pandemic. In 2018 and 2019, late-arriving aircraft were generally the

leading cause of flight delays, shifting to airline-caused delays when the

pandemic began in March 2020.

30

Airlines continued to be the leading

cause of delays throughout 2021, as air traffic returned to near pre-

pandemic levels. For all but one airline reporting BTS data, the

percentage of airline-caused delays they reported increased in the last

half of 2021 compared to the same time period in 2019 (see fig. 8). These

30

Late arriving aircraft can cause a delayed flight, but that previous flight is delayed for

another cause. Flights flying connected routes are not linked in the BTS dataset, and

therefore, the initial cause of the delay is unknown.

Letter

Page 17 GAO-23-105524 Airline Passenger Protections

patterns generally continued through April 2022. Because airlines can

report multiple causes for a flight’s delay and BTS data on delays are

reported in minutes, a single flight may have delay-minutes attributed to

more than one cause.

Figure 8: Percentage of Delay-Minutes Attributed to Airlines, July through December 2019, 2021

While BTS data on flight disruptions (including flight cancellations and/or

delays) do not include the number of passengers on each scheduled

flight, the 2021 and 2022 flight disruptions affected large numbers of

travelers during the pandemic. Our own estimate suggests that flight

cancellations from July 2021 through April 2022 potentially affected over

15 million passengers, and flight delays during that time period potentially

affected over 116 million passengers.

31

31

Our estimate is based on an average of 102 passengers per flight from DOT onboarding

data from July 2021 through April 2022. We multiplied this number by the number of

cancelled and delayed flights during that same time period, to estimate the number of

passengers who were affected by flight disruptions.

Letter

Page 18 GAO-23-105524 Airline Passenger Protections

AirlinesAttemptedtoRespondtoOperational

ChallengesandPersistentFlightDisruptions

withaRangeofActions

StakeholdersSaidStaffingandSchedulingChallenges

MadeItHarderforAirlinestoManageFlightDisruptions

While BTS data do not provide additional detail on cancellations and

delays beyond the broad causal categories, airline and union

representatives told us that operational challenges made managing

disruptive events more difficult when air travel began to rebound in 2021.

For example, representatives from all four airlines and three unions we

spoke with said it was more difficult than before the pandemic for airlines

to ensure they had enough crew to staff aircraft and to set reliable airline

schedules.

The airline and union representatives we spoke with cited a number of

different staffing challenges that affected their operations, including:

· A need for additional pilots and crew. Representatives from three

of the four airlines we spoke with said they faced challenges hiring

pilots to operate flights due to increased competition for workers. For

example, representatives from one airline told us that because all

airlines were trying to hire pilots at the same time, each pilot was

receiving multiple job offers to pick from. Representatives from one

union said that low staffing levels affected a member airline’s

operations and contributed to a flight disruption in June 2021.

Specifically, the airline did not have enough employees available to

operate the number of flights needed to match travel demand.

· Training capacity. Representatives from three of the four airlines we

talked to reported challenges operating training facilities and

onboarding new employees as flight operations rapidly increased in

2021. Representatives from one airline told us that they had stopped

conducting training during the first year of the pandemic.

32

Consequently, the airline had to handle a large number of staff

certifications when operations increased. In addition, one union’s

representatives said that an airline’s choice to retire certain aircraft

32

Due to the pandemic, FAA issued regulatory exemptions providing airlines grace periods

for certain personnel to complete some training requirements.

Letter

Page 19 GAO-23-105524 Airline Passenger Protections

added to the backlog, as pilots needed to then be retrained on other

aircraft types.

· Performance of pre-pandemic staffing models. Representatives

from all three unions we interviewed and one industry association

acknowledged that some airlines relied on scheduling practices, such

as pre-pandemic staffing models, that proved to be too optimistic in

light of staffing levels. Representatives from one union said some

airlines made poor business decisions by overscheduling flights.

These decisions, along with a backlog in training and staff availability

issues, complicated airlines’ ability to meet their schedules.

Representatives from all four airlines also described changes in

staffing models, including employees’ reluctance to pick up shifts, as a

challenge for their operations in 2021. According to representatives

from one union, airlines will not be able to plan for as high a sign-up

rate for extra shifts as before the pandemic, despite their hiring efforts.

Representatives from one airline told us that a reluctance to pick up

shifts in 2021 had contributed to flight disruptions.

33

Representatives

from two unions told us that pilots and flight crews were more

reluctant to pick up shifts for a number of reasons, including disruptive

and unruly passengers and increased scheduling uncertainty.

AirlinesHaveOngoingEffortstoAddressStaffingand

OtherOperationalChallenges

To reduce flight disruptions, airline representatives we interviewed in

spring 2022 said they were taking a variety of actions to rebuild their

workforces following the pandemic and improve the resilience of their

airline networks. Based on these interviews, as well as our review of

airlines’ publicly available financial documents and press releases, these

actions remained a work in progress throughout the summer of 2022.

Many of the actions airline representatives pointed to focused on staffing

and training issues:

· Hiring new employees and increasing incentives. Since 2021,

airlines have worked to hire employees in a range of positions,

including pilots, flight attendants, training staff, and staff that are

33

Representatives from one airline said COVID-19 infections among employees were a

major contributor to flight disruptions throughout late 2021, but representatives from two

airlines said that Omicron-variant infections among their employees contributed

specifically to flight disruptions during the 2021 end-of-year holiday period.

Letter

Page 20 GAO-23-105524 Airline Passenger Protections

responsible for developing crew schedules (i.e., crew schedulers).

One airline eventually exceeded the number of employees it had

before the pandemic, according to a July 2022 press release.

34

Another airline told us it had 75 percent more crew-schedulers in April

2022 than it did during its summer 2021 flight disruption.

Representatives from all four airlines we interviewed said that they

offered increased pay and other incentives to attract and retain

employees. According to three union representatives and two industry

associations, airlines were also offering increased pay and other

incentives. One industry association representative stated that airlines

were offering pilots 200 or 300 percent more pay to fly on certain

days.

35

· Increasing training capacity. To increase training capacity, airlines

focused on recruiting new training staff and in some cases, opening

new training facilities. Representatives from one airline said that they

needed to hire twice the number of training staff to support their hiring

efforts. In another instance, airline representatives told us they

focused on increasing workforce flexibilities for training staff after

experiencing a shortage of flight instructors. Specifically, the airline

improved recruitment by allowing flight instructors to work part-time.

36

Representatives from another airline said that in response to the

employee attrition it experienced, it opened another training facility for

flight attendants.

· Improving staffing models. Representatives from two airlines told us

they had refined their approach to staffing, with the aim of minimizing

the number of employees who need to be rescheduled during a flight

disruption. For example, representatives from one airline said that

they began pairing pilots with flight attendants so that they travel as a

group to a hub and then on to the next flight. If a flight is cancelled,

34

The airline measured employment levels in terms of full-time equivalent employees,

according to the airline’s press release.

35

For regional airlines, incentives were not always successful at attracting and retaining

employees. For instance, a representative from a regional airline we interviewed said that

offering increased pay, such as signing and retention bonuses ranging from $20,000 to

$40,000, was not enough to compete with higher-paying cargo and network airlines. Other

regional airlines have signed new contracts that include additional financial incentives, but

it is not clear yet how these will affect retention. For example, in September 2022, pilots at

Horizon Airlines ratified an amendment to their contract that included pay rate increases of

74 percent for captains and 85 percent for first officers.

36

We have previously reported on challenges regarding flight instructor hiring and

retention. See GAO, Collegiate Aviation Schools: Stakeholders’ Views on Challenges for

Initial Pilot Training Programs, GAO-18-403 (Washington, D.C.: May 15, 2018).

Letter

Page 21 GAO-23-105524 Airline Passenger Protections

the airline keeps the pilot and flight attendants together, and

reschedules them on another flight. Before adopting this approach,

the airline had to reschedule each employee separately.

Airlines also took actions to improve operational performance system-

wide and during flight disruptions:

· Reducing flights and airline schedules. Airlines attempted to

increase the reliability and resilience of their networks—including their

ability to manage and recover from flight disruptions—by reducing

flight schedules. In 2021, airlines reduced the number of scheduled

flights to respond to flight disruptions, and made additional reductions

in 2022. Representatives from three airlines said that after their flight

disruptions in 2021, they reduced capacity by decreasing the number

of scheduled flights.

37

Some of these airlines continued capacity

reductions into 2022. For example, in 2022, American Airlines

reported in its second quarter public financial report that its domestic

capacity during that time period was down 6.6 percent compared to

the second quarter of 2019.

· Developing technology improvements. Representatives from two

airlines we interviewed described technology improvements their

airline developed to address flight disruptions more quickly and

decrease reliance on manual processes. For example, one airline

compiled information about flight disruptions so it could apply lessons

learned from past flight disruptions to improve the outcomes of future

flight disruptions. To help improve outcomes during a major

disruption, the airline also rolled out new technology that it had been

working on for several years that identifies flights to delay, rather than

cancel, and reschedules those flights. This tool, according to the

airline representative, helps achieve better outcomes during a flight

disruption because it forces the scheduling system to build the

delayed flights later into the schedule, so that the airline can ultimately

complete the flight.

· Providing some accommodations for affected passengers. During

a flight disruption, airlines told us they try to provide compensation for

affected passengers. An airline representative said that the airline

managed its October 2021 flight disruption by accommodating many

37

The fourth airline we interviewed, a regional airline, notified DOT in early 2022 that it did

not have staff available to continue providing “Essential Air Service” to 31 small

communities and plans to exit these markets. DOT’s Essential Air Service program helps

ensure that eligible small communities will be served by a certain minimum level of

scheduled air service.

Effect of Capacity Cuts on Small

Communities Access to the National

Airspace System

According to the Transportation Research

Board, airlines may reduce flights on routes

that they view as least profitable or

uneconomical to serve, such as smaller

communities. According to a 2020 DOT

Inspector General report, from 2005 through

2017, small communities lost about one-third

of their departures. This report found that

when communities that received subsidies

through the Essential Air Service Program

were excluded, small communities lost about

40 percent of departures on average. As we

have previously reported, the pandemic may

also exacerbate the loss of service to small

communities.

Sources: GAO-22-104429; DOT Office of the Inspector

General, Changes in Airline Service Differ Significantly

for Smaller Communities, but Limited Data on Ancillary

Fees Hinders Further Analysis, EC 2020036

(May 2020). | GAO-23-105524

Letter

Page 22 GAO-23-105524 Airline Passenger Protections

passengers on different flights the same day; automatically emailing

hotel, meal and transportation vouchers to some passengers;

reimbursing hotel, meal, and transportation costs for other

passengers; and providing compensation to all passengers affected

by delays that were within the airline’s control and all cancellations.

While airline representatives said they generally attempt to accommodate

passengers who are disrupted by a delay or cancellation, passengers

sometimes still experience extensive delays in reaching their final

destination. According to a consumer representative, last minute

cancellations are especially disruptive to passengers because their other

reservations, such as for hotels or cruises, can also be affected.

Passengers stranded during trips can also miss important events like

weddings or business meetings. Some academic researchers have

estimated that the delay a passenger actually experiences can be

significantly greater than the amount of time an individual flight or set of

flights is delayed.

38

Their research suggests that passengers experience

significant delays when flights are cancelled, or when a flight delay

causes them to miss a connecting flight. If flights that are still operating

during a disruption have few empty seats, there will be fewer

opportunities to rebook passengers whose flights were cancelled earlier

that day, or who missed a connection due to a delay.

38

Lance Sherry, “A Model for Estimating Airline Passenger Trip Reliability Metrics from

System-wide Flight Simulation,” Journal of Transport Literature (April 2013); Cynthia

Barnhart, Douglas Fearing, and Vikrant Vaze, Modeling Passenger Travel and Delays in

the National Air Transportation System (2014), Operations Research 62 (3): 580-601.

Consumer Advocate and Trade

Association Perspective on Airline

Accommodations

Two consumer representatives and one trade

association we interviewed were generally

not satisfied with airlines’ responses to flight

disruptions and said that more could be done

to help passengers. They also characterized

airlines’ customer service as inadequate. For

example, representatives from one consumer

advocate and one trade association

consumer said that airlines should be held to

higher standards, including reducing wait

times for passengers who need to be

rescheduled on another flight, and providing

more advanced notice when flights are

disrupted.

The same two consumer representatives and

one trade association also identified ticket

refunds as a significant issue. Early in the

pandemic, airlines offered passengers time-

limited travel vouchers for significant delays

and cancellations instead of refunds to which

consumers were entitled. Two consumer

representatives said that strengthening DOT

rules around refunds, and increased

enforcement action if airlines do not provide

timely refunds to passengers would help

protect passengers during air travel. We

discuss DOT actions relating to refunds later

in the report.

Source: GAO analysis of interviews. | GAO-23-105524

Letter

Page 23 GAO-23-105524 Airline Passenger Protections

DOTandFAAAreTakingActionstoAddress

FlightDisruptions,IncludingAnalyzingAirlines’

SchedulingPractices

DOTandFAAAreTakingSeveralActionstoAddress

FlightDisruptions

DOT’s Office of Aviation Consumer Protection applies its existing

enforcement approach to promote regulatory compliance with consumer

protections.

39

According to DOT officials, this approach reflects DOT’s

preference to use all available tools, including working with industry to

ensure they understand their obligations and taking enforcement action

for violations of consumer protection regulations, to achieve compliance.

DOT used a range of methods in response to flight disruptions during the

pandemic. These methods included processing passenger complaints,

issuing guidance, including guidance about airlines’ obligations to provide

refunds for cancelled or significantly delayed flights, conducting

investigations, and conducting outreach to airlines. In addition, DOT also

took enforcement actions related to airlines’ failure to provide refunds for

cancelled or significantly delayed flights.

However, given the deregulated nature of the airline industry, DOT has

limited authority to regulate airline delays and cancellations. Under its

authority to prohibit unfair and deceptive practices, DOT requires that

airlines provide refunds for flights that are cancelled or significantly

changed. Beyond these requirements, an airline is not required to provide

compensation to passengers for scheduling changes unless the airline

voluntarily promises to provide compensation such as in its contract of

carriage or customer service plan.

In 2020, at the start of the pandemic, DOT received an unprecedented

number of complaints about airline practices. In total, DOT received

39

In January 2023, DOT issued a notice of its sanction and enforcement practices, titled

Notice Regarding Investigatory and Enforcement Policies and Procedures. The notice,

issued in response to a prior recommendation we made, describes, among other things,

methods that DOT uses to ensure compliance and DOT’s intention to take enforcement

action when it sees a pattern or practice of violations. Specifically, in October 2020, we

recommended that DOT provide additional information on the process it uses to

investigate potential consumer protection violations, assess risk, and pursue enforcement

action. See GAO-21-109 for additional information.

Letter

Page 24 GAO-23-105524 Airline Passenger Protections

102,560 complaints in 2020, and although complaints decreased in 2021

(49,958), they are expected to be higher in 2022, significantly above pre-

pandemic levels.

40

In 2020, most complaints submitted to DOT were

about ticket refunds (e.g., delays in refunding the cost of a cancelled flight

or a passenger being offered a travel credit rather than a cash refund),

and refund complaints continued to be the highest ranking complaint

category into 2022. Complaints about flight problems, which include

delays and cancellations, were the highest-ranking category pre-

pandemic, and were ranked fourth in 2020 (see table 1).

Table 1: Annual Refund and Flight Problem Complaints Submitted to the Department of Transportation, 2018 to 2022

Year

Number of

Complaints

about

Refunds

a

Refund

Complaints

as a Percentage

of Total Complaints

Ranking

b

Number of

Complaints about

Flight Problems

c

Flight Problems

Complaints as a

Percentage of Total

Complaints

Ranking

2018

1,329

8.5

6

4,517

29.1

1

2019

1,574

10.3

5

4,757

31

1

2020

89,511

87.3

1

1,498

1.5

4

2021

29,507

59.1

1

6,311

12.6

2

January through

September

2022

14,239

29.2

1

12,607

25.9

2

Source: GAO analysis of Department of Transportation data. | GAO-23-105524.

a

These numbers include complaints against U.S. airlines, foreign airlines, travel agents, tour

operators, and miscellaneous entities.

b

DOT has multiple complaint categories, of which refunds and flight problems are two of the

categories.

c

The flight problems complaint category includes complaints about cancellations, delays, or other

deviations from the schedule, whether planned or unplanned. These numbers include complaints

against U.S. airlines, foreign airlines, travel agents, tour operators, and miscellaneous entities.

DOT officials stated that they review submitted complaints to determine

whether a violation of airline consumer protection laws has occurred.

Given the increased volume of complaints received during the pandemic,

beginning in 2020 and continuing into 2022, the Office of Aviation

Consumer Protection increased the number of staff processing consumer

complaints. Specifically, DOT hired 6 temporary employees to help its

40

These numbers include complaints against U.S. airlines, foreign airlines, travel agents,

tour operators, and miscellaneous entities. In 2020, DOT received 35,914 complaints

against U.S. airlines, and in 2021, DOT received 20,350 complaints against U.S. airlines.

Complaints to airlines are generally much higher than to DOT. DOT estimates that for

every complaint the agency receives, airlines receive 50 such complaints. See

GAO-19-76. Full year 2022 was not available at the time of our analysis.

Letter

Page 25 GAO-23-105524 Airline Passenger Protections

existing 15 full-time employees, increasing its staffing level by 40 percent.

For fiscal year 2023, DOT received $1 million above its request to

increase efforts to protect consumers from deceptive practices.

41

The

fiscal year 2024 budget request includes a request for funding for an

aviation consumer complaint system and an approximately $2 million

request to bolster aviation consumer protection activities, including hiring

eight additional staff, which will build on staff increases expected to start

in 2023.

42

In 2020, DOT issued guidance that addresses, among other things,

airlines’ obligations to provide refunds for cancelled or significantly

delayed flights. We have previously reported on these guidance

documents, specifically:

43

· In April 2020, DOT issued guidance that addresses airlines’ legal

obligations to provide refunds; that guidance stated that given the

challenges facing the industry, DOT would provide airlines an

opportunity to become compliant before taking enforcement action

against airlines that provided travel vouchers to passengers instead of

refunds they were entitled to. Airlines would have to take certain

corrective actions to avoid enforcement action.

44

· In May 2020, DOT issued additional guidance about refunds, which

answers common questions to help ensure that passengers

understand when they are entitled to a refund, and that airlines are

complying with aviation consumer protection requirements. The

guidance also stated that airlines could not retroactively apply

changed refund policies to passengers and clarified that passengers

with non-refundable tickets who changed or cancelled their

reservation are generally not entitled to a refund or voucher, even if

41

Joint Explanatory Statement, December 20, 2022.

42

DOT, Office of the Secretary of Transportation, Budget Estimates, Fiscal Year 2024.

43

GAO-21-109.

44

DOT, Enforcement Notice Regarding Refunds by Carriers Given the Unprecedented

Impact of the COVID-19 Public Health Emergency on Air Travel (Apr. 3, 2020). These

actions included contacting passengers who received a voucher when they were entitled

to a refund to notify them of the option for a refund and ensuring that airlines personnel

understand the circumstances under which refunds are made.

Letter

Page 26 GAO-23-105524 Airline Passenger Protections

the changes were because of health or safety concerns related to

COVID-19.

45

DOT has applied this guidance during investigations it conducts. For

example:

· In November 2021, DOT settled its investigation with Air Canada for

$4.5 million for its failure to provide timely refunds to passengers

during the pandemic for flights it cancelled or significantly changed.

· In January 2021, DOT found that United Airlines had changed its

refund policy to restrict the circumstances under which passengers

whose flights were changed would be eligible for a refund, and

applied the policy retroactively to passengers. DOT advised United

Airlines that it considered this action a violation of DOT’s prohibition

on unfair and deceptive practices. In response to DOT’s investigation,

in June 2020, United changed its policy and agreed to take other

corrective actions. Consistent with its April 2020 and May 2020

guidance, DOT later dismissed complaints related to this issue in

January 2021.

In November 2022, DOT took enforcement action against six airlines and

assessed more than $7.25 million in fines for the airlines’ extreme delays

in providing refunds to passengers whose flights were cancelled or

significantly changed by the airline.

46

While most of these airlines are

foreign airlines, DOT fined one domestic airline, Frontier Airlines, due to

changes the airline made to its refund policy in March 2020.

47

Specifically,

until March 25, 2020, Frontier defined a significant change that would

entitle passengers to a refund as a “schedule change of more than 3

hours.” On March 25, 2020, Frontier changed its definition to a schedule

change that could not be accommodated on the same calendar day or a

misconnection. Frontier applied this policy retroactively and provided

credits instead of refunds to tens of thousands of customers who

purchased tickets under the earlier more generous policy. The airline also

instructed passengers to redeem travel credits through an online system

that did not function for 15 days. Due to these actions, DOT fined Frontier

45

DOT, Frequently Asked Questions Regarding Airline Ticket Refunds Given the

Unprecedented Impact of the COVID-19 Public Health Emergency on Air Travel (May 12,

2020).

46

According to DOT officials, these enforcement actions contributed to airlines refunding

more than $600 million to passengers whose flights were cancelled or significantly

changed.

47

Other domestic airlines received more passenger complaints about refunds in 2020 than

Frontier Airlines.

Letter

Page 27 GAO-23-105524 Airline Passenger Protections

$2.2 million. In late October 2020, Frontier changed its definition of a

significant change back to its original definition.

In addition to the investigations and enforcement actions that DOT

conducts, officials from the Office of Aviation Consumer Protection

monitor airlines that have experienced flight disruptions to discuss the

flight disruption and its causes. As part of this monitoring, DOT officials

remind airlines of their obligation to comply with their customer service

commitments, inquire about the timeliness of refunds provided to affected

passengers, and warn airlines about their obligation to set realistic

schedules, among other things. For example, after disruptions in Spirit

Airline’s flights in July-August 2021, DOT officials told us they contacted

the airline to discuss the flight disruption, the underlying cause, and to

obtain assurance from the airline that it was providing timely refunds to

passengers.

DOT also requires that airlines develop and adhere to a customer service

plan, which describes the accommodations the airline provides to

passengers for flight cancellations or misconnections, as well as airlines’

commitments to providing refunds to passengers. According to DOT

officials, DOT enforces airlines’ adherence to airlines’ customer service

plans because it would be an unfair and deceptive practice for an airline

to promise a service and not provide it. As mentioned previously, DOT

requires airlines to provide requested refunds for flights that the airline

significantly delays or cancels. However, DOT regulations do not currently

define what constitutes a significant delay or cancellation. Airlines instead

may set their own threshold for a significant delay, resulting in

inconsistent policies across airlines regarding when a passenger is

entitled to a refund.

DOT issued a notice of proposed rulemaking (NPRM) that proposes to

define some of the terms, such as cancellations and significant changes,

which are included in airlines’ customer service plans.

48

Specifically, in

August 2022, in part due to the significant increase in passenger

complaints about refunds, DOT issued an NPRM entitled, Airline Ticket

Refunds and Consumer Protections.

49

In this NPRM, DOT proposes to

codify its interpretation that an airline’s failure to provide a refund for

48

Airline Ticket Refunds and Consumer Protections, 87 Fed. Reg. 51550, 51550 (Aug. 22,

2022).

49

87 Fed. Reg. at 51557.

Letter

Page 28 GAO-23-105524 Airline Passenger Protections

cancelled or significantly changed flights is an unfair practice. Among

other things, the NPRM also proposed to define for the first time the terms

“significant change” and “cancellations” for the purposes of consumer

refunds.

50

The comment period on this rulemaking closed on December

16, 2022. A public hearing was scheduled for March 21, 2023.

In August 2022, the Secretary of Transportation sent a letter to airlines

urging them to provide essential services to passengers, and in early

September, DOT released the Airline Customer Service Dashboard on its

aviation consumer protection webpage. The dashboard helped to

increase transparency about the services each airline provides if a flight is

delayed or cancelled for reasons within the airlines’ control.

51

The

information in the dashboard is based on information in customer service

plans for each of the 10 largest U.S. airlines that sell tickets. According to

DOT officials, all 10 airlines included in the dashboard made changes to

their customer service plans as a result of the Secretary of

Transportation’s August 2022 letter. For example, DOT officials said that

prior to the release of the dashboard, none of the airlines guaranteed

meals and hotels for passengers affected by flight disruptions. After the

dashboard’s release, 9 out of 10 airlines included on the dashboard

guaranteed providing hotels when passengers have to wait overnight and

10 airlines guaranteed meals or vouchers for meals for passengers on

flights that are delayed 3 hours or more. According to DOT officials, the

dashboard has benefitted passengers by helping them understand their

rights when flights are delayed and cancelled, and providing transparency