The 2019

Ethical Fashion

Report

THE TRUTH BEHIND THE BARCODE

2

Date: April 2019

Project Leads: Libby Sanders, Jasmin Mawson

Lead Researchers: Jessica Tatzenko, Claire Hart, Annie Hollister-Jones

Researcher Support: Meredith Ryland, Luke Medic, Emily Taylor

Behind the Barcode is a project of Baptist World Aid Australia.

New Zealand headquartered companies researched in partnership

with Tearfund New Zealand.

www.behindthebarcode.org.au

THE 2019 ETHICAL FASHION REPORT

THE TRUTH BEHIND THE BARCODE

Report Design: Susanne Geppert

Infographics (pp 10–11): Cadence Media

Front cover photo: © Baptist World Aid Australia

3

CONTENTS

1. Executive Summary .......................................4

2. Methodology

............................................... 12

3. Industry Influences

.......................................17

4. Policies

........................................................25

5. Traceability and Transparency

.....................28

6. Auditing and Supplier Relationships

............33

7. Worker Empowerment

................................ 37

8. Environmental Management

.......................40

9. Brand Index

................................................. 45

1 0. Survey Data

.................................................64

Appendices

Statements from non-responsive brands 90

Letter from auditor 95

Sources 96

About Baptist World Aid Australia 97

Acknowledgements 98

4

1

Executive Summary

This section outlines the research aim

and scope; data collection and findings;

and overall results of all companies.

5

Excitingly, in addition to its traditional focus on

labour rights, this year’s research also incorporates

new environmental management metrics in the

assessment criteria. In 2019, 75% of companies

assessed actively engaged in the research process,

shedding light on the global fashion industry’s

performance in the arenas of labour rights and

environmental management.

For the 43 million workers in the Asia Pacific

1

region, and for millions of others across the world,

Baptist World Aid is pleased to deliver its sixth

consecutive report on labour rights and

environmental management systems in the

fashion industry. The 2019 Ethical Fashion

Report grades 130 companies from A+ to F,

based on the strength of their systems to

mitigate against the risks of forced labour, child

labour, and exploitation in their supply chains.

the global fashion industry remains a significant

employer. It also spurs economic growth,

generates tax revenue, provides valuable skills and

training, and delivers crucial foreign exchange.

Allof these factors can, and often do, contribute

toimproving the lives of workers and their

communities.

At the same time, however, the fashion industry

isa source of exploitation for millions.

EXECUTIVE SUMMARY

INTRODUCTION

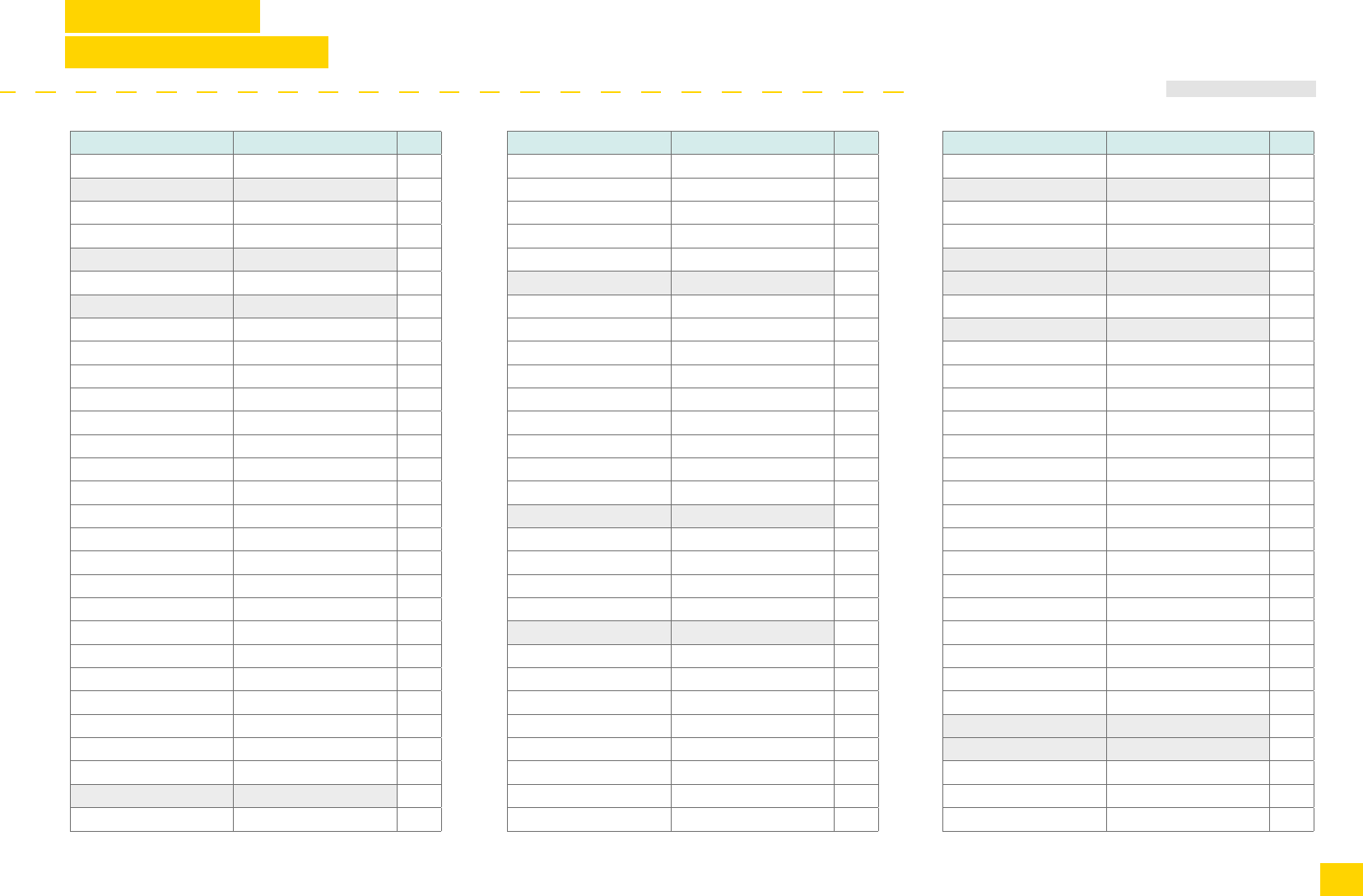

* = non-responsive companies

Overall Grades: A–M

OVERALL GRADE

D–

A

B–

F

C

A–

C+

A–

C

B

F

D+

C+

F

D+

C

D

B–

F

C+

C–

C+

C–

C

C+

F

C+

B+

D+

A–

A–

C–

B

D–

C+

A+

D+

B–

F

D

D–

B

A+

D+

B

D–

B

A–

B

B+

B+

A

F

C

B–

C+

D+

A+

A

A–

B+

C

C+

C–

B

D+

A

B+

A–

A+

B

C–

B

A+

C+

F

A–

B–

B+

C

F

Abercrombie & Fitch*

adidas

ALDI Stores

Ally Fashion*

Anthea Crawford*

APG & Co.

Arcadia Group

AS Colour

ASICS

ASOS

Baby City*

Bardot

Barkers Clothing*

Bec and Bridge*

Ben Sherman Australia

Best & Less

Betts Group

Big W

Bloch*

Blue Illusion

Boardriders

Boden

Boohoo

Brand Collective (Apparel)

Brand Collective (Footwear)

Camilla and Marc*

Canterbury NZ

City Chic Collective

Coles*

Cotton On Group

Country Road Group

Cue

David Jones

Decjuba*

Designworks

Etiko

Ezibuy

Factory X

Farmers*

Fast Future Brands

Forever 21*

Forever New

Freeset T–Shirts

Fruit of the Loom*

Gap Inc.

Gazal*

General Pants Group

Gildan Activewear

Gorman

H&M

Hallenstein Glasson Holdings

Hanesbrands

Hot Springs*

House of Quirky

Huer

Hugo Boss Group

Hunting & Fishing NZ

Icebreaker

Inditex

Industrie

Jeanswest

JETS

Just Group

K&K

Karen Walker*

Kate Sylvester*

Kathmandu

Kmart Australia

Kookai

Kowtow

L Brands

Lacoste

Levi Strauss & Co.*

Liminal Apparel

Lorna Jane

Lowes*

Lululemon Athletica

Macpac

Marks & Spencer

Max*

Merric Apparel NZ*

Policies

B–

A+

A+

F

A+

A+

A+

A+

A

A+

F

A–

A+

F

A–

A+

A–

A+

F

A+

A–

A+

A–

A+

A+

F

A+

A+

A–

A+

A+

A

A+

B+

A+

A+

A

A+

B

A–

C

A+

A+

A

A+

A+

A+

A+

A+

A+

A+

A+

F

A+

A+

A+

A–

A+

A+

A+

A+

A+

A+

A+

A+

A+

A+

A+

A+

A+

A+

A+

A+

A+

A+

B–

A+

A+

A+

A+

F

Trancparency and

Traceability

D–

A+

A–

F

D+

A+

B

A+

B

A–

F

C–

B+

F

C–

C+

D+

B+

F

C+

C–

B+

C–

C+

B

F

A–

A

C+

A+

A

D

B+

F

C+

A

D+

A–

F

D

F

A–

A+

C

A

F

B+

A

A–

A–

A–

A

F

B–

A

B+

C

A+

A

B+

A–

C+

C+

C

B–

C–

A+

A

A–

A+

B+

C–

A–

A+

B–

F

A

B

A+

B

F

Auditing and

supplier

relationships

D–

B+

B–

F

C–

A

C–

A–

C

B

F

D–

D+

F

C–

C

D

C

F

C+

C

C+

C

D+

C

F

C

A–

D

A–

A

C–

B

F

C+

A–

D

C–

F

D

F

C+

A+

D

C+

F

B

A

C

B–

B

A+

F

C+

C–

C–

D

A+

A

B

B+

D+

B–

D+

B

D–

A–

B+

A–

A

B+

D+

B–

B+

B–

F

A+

B–

C

C

F

Worker

empowerment

F

B–

D–

F

C–

B–

D–

B–

D–

C–

F

F

D

F

D–

D–

F

D+

F

D

D

D+

D–

D

C–

F

D

C+

F

B

B

D+

C–

F

D

A+

F

C–

F

F

F

C–

A+

D–

D+

F

D+

C+

C–

C–

C+

B+

F

D–

D

D

F

A–

B+

B+

C

F

D+

D–

C–

F

B+

C–

B–

A–

D+

F

D–

A+

C–

F

B–

D+

D+

D

F

Environmental

management

D

A

A–

F

F

B

C

A–

B

B

F

F

C+

F

F

C+

F

C–

F

B+

C–

D

C

D

D

F

D+

D

F

B+

B+

F

B–

F

C–

A+

F

C+

F

D

D

B+

A+

D–

A–

F

B+

A–

B+

A+

B+

A+

F

D–

D+

B

C–

A+

A+

A+

A

C

D+

F

B–

D

B+

C–

B+

A+

A–

D+

A+

A+

F

F

A–

C+

A+

F

F

6

For the majority of workers in the fashion industry,

wages are so low that it leaves them, and their

families, trapped in the cycle of poverty. Beyond

this, fashion production throughout the Asia

Pacific is marred by the prevalence of slavery and

child labour. In addition, whilst safety standards

have improved, fire safety, structural defects within

factories, and unsafe working conditions remain

reasons for continued concern.

EXECUTIVE SUMMARY

INTRODUCTION

For six years, this research has assessed

companies across the globe on the strength of

their labour rights management systems. In the

2018 Ethical Fashion Report, we acknowledged

that a “truly ethical” company not only ensures

that its supply chain empowers workers and pays

them a living wage, it also understands its impact

on the environment and manages its footprint to

keep waterways, the earth, and the atmosphere

These 130 companies represent

480 brands. To check brand

grades, go to the brand index

on page 45 or online at

www.behindthebarcode.org.au

healthy. Correspondingly, it is the workers in the

fashion supply chain that most acutely feel the

detrimental eects of poor environmental

management. This is the first year that the Ethical

Fashion Report will assess companies on their

environmental management systems, alongside

their labour rights management systems, in

consideration of their final grade.

OVERALL GRADE

A+

D

B–

A–

B

B–

B–

A–

D

B+

C+

A+

D

C–

A

F

C

B

C+

B–

C–

C+

B+

A–

A

C

B

C–

F

D+

B

C+

F

F

B

F

C+

C–

B–

D–

C

F

B+

B

F

F

C

D–

B–

Mighty Good Group

Munro Footwear Group

Myer

Nature Baby

New Balance

Next

Nike

Nobody Denim

Noni B Group

Nudie Jeans Co.

Oroton Group

Outland Denim

Oxford

Pagani

Patagonia

Pavement United Brands*

Postie+

Puma

PVH Corp.*

R.M. Williams

Ralph Lauren*

Retail Apparel Group

Rip Curl

Rodd & Gunn

RREPP

Ruby Apparel

Seafolly

Seed Heritage

Showpo*

Simon de Winter Group

Sussan Group

Swanndri NZ

3 Wise Men Ltd.*

T&T Fashions*

Target Australia

The Baby Factory*

The Iconic*

The PAS Group

The Warehouse Group

Tigerlily*

Tree of Life

Trelise Cooper*

UNIQLO

VF Corp.

Voyager Distributing Co.*

Wish Designs*

Workwear Group

WORLD*

Zimmermann

Policies

A+

A–

A+

A+

A+

A+

A+

A+

A–

A+

A+

A+

A

A+

A+

F

A+

A+

A+

A+

A+

A

A+

A+

A+

A+

A+

A+

F

A

A+

A+

F

F

A+

F

A+

A+

A+

C–

A

B+

A+

A+

F

F

A

A

A

Trancparency and

Traceability

A+

D

C+

A–

A–

B+

A–

A+

D+

A

C+

A+

D

B–

A+

D–

C

A–

B+

A–

B–

B

A

A

A+

C

B

C–

F

D+

B

B

F

F

A–

F

B

C

A–

D

C

F

A

A–

F

F

B–

F

C+

Auditing and

supplier

relationships

B+

D–

B

A–

C+

B–

C

B+

D

B–

B

A+

D

C–

A

F

D+

B

C

B

D+

B

B

B–

B+

C–

B+

C–

F

D+

B+

D+

F

F

B

F

C–

C–

B–

F

C

F

B+

C+

F

F

C+

F

B

Worker

empowerment

A+

F

D+

B–

D

D–

D–

B+

F

B–

D+

A+

F

D–

B

F

C–

D+

D–

D–

F

D–

D+

B–

B+

D+

D

D–

F

F

C+

D+

F

F

C–

F

D–

F

D+

F

D+

F

D

D+

F

F

D

F

C+

Environmental

management

A+

F

D+

A+

B+

B–

A+

A

F

B+

F

A+

D

F

A+

F

C

A

B–

D

D+

D+

B

A–

A+

C–

A

D

F

F

C+

B

F

F

C–

F

C+

D

C–

D–

D

F

A+

A+

F

F

D

F

D+

Overall Grades: M–Z

* = non-responsive companies

7

The annual nature of this research enables us to track the

progress in ethical sourcing, made by the fashion industry.

Since last year, improvements have been made across the

industry in 79% of the areas assessed. Most noteworthy

areas of improvement in 2019 are:

Gender inequality 61% of companies (an increase of

22%) have created policies addressing gender inequality

intheir supply chain, including the introduction of

strategies addressing discrimination faced by women.

Responsible purchasing practices 45% of companies

(an increase of 18%) have introduced policies addressing

responsible purchasing practices, with an aim to improve

working conditions.

Child and forced labour 35% of companies (an increase

of 17%) have robust remediation plans to redress child or

forced labour if it is found in their supply chain.

Manufacturing Restrictive Substance List (MRSL)

35% of companies (an increase of 14%) have a

comprehensive MRSL that they test against to ensure

workers are not exposed to hazardous chemicals with

direenvironmental impacts.

An important part of the annual reporting process is

to give companies the opportunity to report on the

improvements they have made, which encourages

continual improvement across the industry. Of the

companies that were assessed by both the 2018 and

2019 Ethical Fashion Reports, 38% improved their overall

grade. The area showing the highest improvement in

2019 is Auditing and Supplier Relationships, followed

by Environmental Management (which was assessed

in 2018, but not included in the grading until 2019).

EXECUTIVE SUMMARY

INDUSTRY PROGRESS

Workers with Bangladesh Independent Garment Workers Union.

© Solidarity Center via https://flic.kr/p/Lcxknw

8

Despite the significant progress we’ve

seen across the industry in the last six

years, serious concerns remain that

need addressing.

Traceability

A company’s investment in traceability and its

knowledge of suppliers remains a key pillar of

a strong labour rights management system.

If companies don’t know (or don’t care) who

their suppliers are, then there’s virtually no way

of ensuring that the workers who make their

products aren’t being exploited. It is encouraging

then, that this continues to be one of the most

significant areas of improvement for the industry

— since Baptist World Aid began publishing this

research in 2013, there has been a 32% increase in

companies who are tracing their inputs suppliers

and a 31% increase in companies who are tracing

their raw materials supplier.

Notwithstanding these improvements, traceability

remains a significant challenge across the industry.

While 69% of companies could demonstrate

tracing all final stage suppliers, only 18% have

traced all inputs suppliers, and just 8% have traced

all raw material suppliers. Although the majority of

companies have begun tracing suppliers at these

deeper stages of their supply chain, it is evident

that many still have no knowledge of where their

inputs and raw materials are being sourced. With

less visibility, comes greater risk. The prominence

of forced and child labour is well documented at

these earlier stages of production.

2

Transparency

Investment in transparency demonstrates a

company’s willingness to be accountable to

consumers, civil society, and workers; and makes

it easier for these groups to collaborate to ensure

that the rights of workers are upheld. There are

many examples of corporate transparency around

supply chain practices, but one of the most

significant examples would be the publication

of a list of suppliers, that includes supplier

business names and addresses. The 2019 Ethical

Fashion Report has found that 37% of companies

have published a complete list of all final stage

suppliers, increasing to 50% when including

companies that have published information about

at least some suppliers.

Despite the percentage of companies publishing

full supplier lists having more than doubled since

we began this research in 2013, transparency

remains an ongoing challenge in the industry. Low

transparency is one of the biggest determinants

for the receipt of a low grade, because companies

are graded based on a combination of publicly

available information and any information they are

willing to disclose to our researchers.

As mentioned previously, 75% of companies chose

to engage with the research process this year, with

most companies seeing value in the process of

being benchmarked and gaining feedback.

Several companies with no publicly available

information regarding their ethical sourcing

practices have chosen not to engage with the

research process, and so receive F grades in the

2019 Ethical Fashion Report. Without making

information known, it becomes impossible for

the public to know if these companies are doing

anything to combat exploitation in their supply

chains. A number of companies in this Report were

non-responsive, but still scored reasonable grades,

as high as a B, due to the amount of publicly

available information they published. For more

information about the research process and non-

responsive companies, refer to the methodology

(page 12). Non-responsive companies were also

given the opportunity to provide a statement

about why they chose not to engage with this

research. These statements are included on

page90.

But transparency is no longer an expectation only

driven by consumers, this expectation has also

been legislated in a number of countries. The USA,

France, the UK, and, now, Australia (through the

introduction of a Commonwealth Modern Slavery

Act) all require companies to publish details of the

systems they have in place to ensure that workers

aren’t being enslaved. You can read more about

the introduction of modern slavery legislation in

Australia on page 18.

EXECUTIVE SUMMARY

INDUSTRY CHALLENGES

9

EXECUTIVE SUMMARY

INDUSTRY CHALLENGES

Living wage

A living wage is a wage that is sucient for

workers to be able to aord the basics (food, water,

healthcare, clothing, electricity, and education)

for themselves and their dependants. Yet most

garment sector workers receive wages well below

this figure. It comes as no surprise, then, that low

wages are among the chief concerns for workers.

3

The benefits of a living wage are substantial. In fact,

payment of a living wage could transform the lives

of millions by allowing people to lift themselves out

of poverty and, at the same time, drive economic

growth within communities and nations. However,

it remains one of the most poorly assessed areas

ofour research.

Questions around living wage make up a significant

portion of the Worker Empowerment section of

this research. Worker Empowerment is 2019 Ethical

Fashion Report’s lowest scoring section, with a

median grade of D. Just 5% of companies could

demonstrate that they were paying a living wage

toall workers at their final stage of production.

While the industry still has a great deal of work

to do to in the area of living wage, small steps are

being taken. In 2019, 48% of companies assessed

reported that they had started to develop a living

wage methodology and 24% of companies had

published a commitment to pay a living wage.

For more information on the fashion industry’s

approach to tackling the continuing issue of living

wage, see page 19.

Environmental management

The environmental impact of the fashion industry

is significant with the apparel industry accounting

for 10% of global emissions.

4

Up to 20,000 litres

of water is needed to produce 1 kg of cotton —

with it taking up to 2,700 litres to produce the

cotton needed to make a single T-shirt.

5

Globally,

humans are consuming 800 billion new pieces of

clothing per year, 400% more than we consumed

two decades ago. Australia is the second largest

consumer of new textiles after the US, averaging

27 kg of new textiles per year.

6

Even more

concerningly, Australians are currently disposing

of 6,000 kg of fashion and textile waste every ten

minutes, with the majority of this going to landfill.

7

It is the poor and vulnerable who feel the impact

of this environmental damage most acutely, with

the eects of landfill, water pollution and poor

chemical management impacting on the health

and wellbeing of workers throughout the apparel

supply chain.

This year, for the first time, the Ethical Fashion

Report assesses the eort of companies to

mitigate their environmental impact. 11 questions

were asked in order to measure a company’s

impacts on climate, chemical management

practices, water usage, use of sustainable fibres,

provision of take-back and repair programs, and,

finally, whether had completed an environmental

impact assessment.

Of these areas of concern, water use is one of the

most substantial issues. Up to 20,000 litres of

water is needed to produce 1kg of cotton — with

it taking up to 2,700 litres of water to produce a

single cotton T-shirt. We found that just 12% of

companies were collecting and benchmarking

water use data from all of their water intensive

facilities. When it comes to wastewater, again, just

12% of companies are monitoring the wastewater

from all wet-processing facilities to ensure it is not

environmentally hazardous.

Positively, an increased number of companies

are investing in more sustainable fibres. Just

over a third of companies have assessed the

environmental impact of the fibres they use and

are investing in more sustainable fibres in their

product design and production as a result.

More information about the fashion industry’s

environmental impact can be found on page 22.

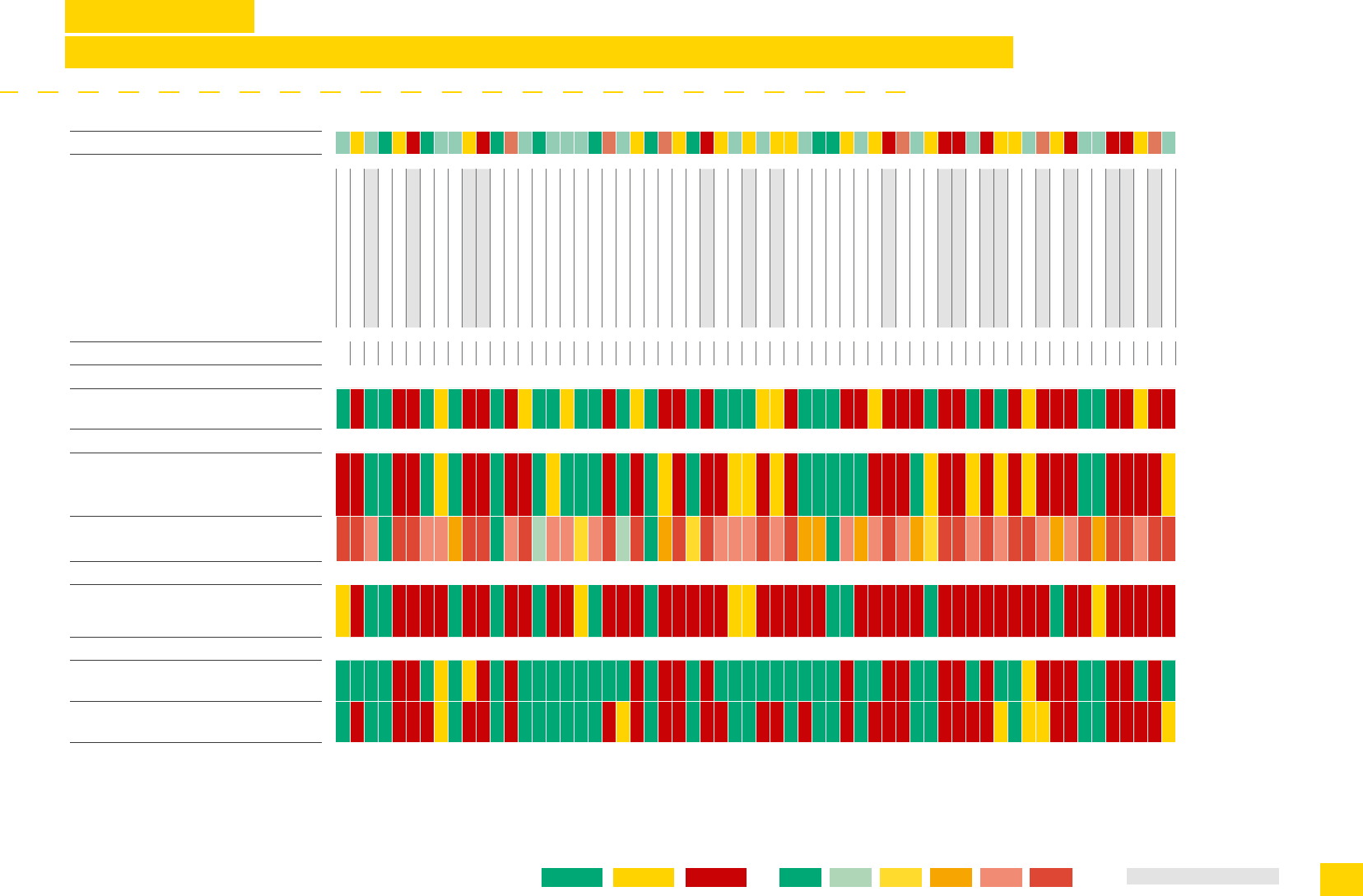

1010

more

Companies

are investing

in Responsible

Purchasing

Practices

more

companies

are investing

in Gender

Equality within

the supply

chain

17

Companies

received F

7

Companies

received A+

Companies

assessed

Median

grade

130

C+

A+

Policies

B

Traceability &

Transparency

C

Auditing &

Supplier relationships

C-

Environmental

Management

D

Worker

Empowerment

38%

of Companies saw an

improvement in their Grade

from the 2018 Report

2019 at

a glance

15%

17%

22%

more

Companies

are ready to

address and

Remediate

Child and

Forced Labour

some of the biggest gains

5%

of Companies can

demonstrate paying a living

wage to all workers at Final

Stage facilities

2013 2019

Companies working

to trace where their

fabrics come from

49% 81%

2013 2019

Companies working to

trace where their raw

materials come from

17%

48%

61%

Changes in the

industry through

the years

There have been many

improvement in 2019,

such as...

of Companies are investing

in using sustainable bres

...but despite the progress,

signicant issues remain:

From 2013 to 2019 the percentage of

companies publishing full direct

supplier lists has increased

18%

37%

12

2

This section outlines the aims and scope of our

research, the process of data collection and

evaluation, and our company grading system.

Methodology

research considers five broad themes of social

responsibility and environmental impact: policies,

traceability and transparency, auditing and

supplier relationships, worker empowerment, and

environmental management (outlined on page 15).

This year marks the first year that environmental

management metrics have been included in the

assessment criteria, expanding this research

from its purely labour rights focus. It is widely

understood that the fashion industry has a

considerable, and often negative, impact on the

13

The 2019 Ethical Fashion Report provides

a picture of ethical sourcing practices in the

fashion industry as a resource for consumers,

corporations, investors, and policymakers.

This research seeks to empower consumers

to make more informed and ethical choices in

purchasing fashion and footwear and provides

insight into supply chain governance for

investors. It also aims to assist companies with

benchmarking and learnings, as well as identify

issues for policymakers to address. By presenting

the performance of companies (relative to one

another) in an A+ to F grading system which is

updated on an annual basis, individual companies,

and the wider industry, are encouraged to engage

in continuous improvement with respect to their

ethical sourcing practices.

We recognise the fashion industry’s potential for

positive impact around the world. The ultimate

goal of this project is to work collaboratively

alongside companies in the fashion industry

to contribute to ending worker exploitation,

alleviating poverty, and building environmental

sustainability throughout the fashion industry.

Scope of the research

The 2019 Ethical Fashion Report Grading Tool

classifies the fashion manufacturing supply chain

into three stages of production: final stage, inputs

stage, and raw materials (outlined on page 15).

Across these three stages of production, this

METHODOLOGY

Statement on Non-Responsive Companies

Companies that are non-responsive, along

with those that do not provide any substantive

information, are indicated in the Report

and Guide with an asterisk (*) next to their

name. These companies are also given the

opportunity to provide a short statement as

to why they chose not to respond, found on

page90 of this report.

We acknowledge that many of the non-

responsive brands may be doing more to

improve their ethical sourcing that we have

been able to assess them on. However, if

brands do not disclose, or are unwilling to

disclose, what they are doing to ensure that

workers are not exploited in their supply

chains, then it becomes almost impossible for

consumers and the public to know if these

brands are investing suciently to mitigate

these risks.

Companies may prefer to disclose their supply

chain management practices publicly, instead

of responding to our survey (e.g. they might

be surveyed by multiple research projects or

they might prefer a single public disclosure,

rather than disclosing through the survey).

By assessing non-responsive companies on

publicly available information we can give

due credit to these eorts. In the history of

our research, non-responsive companies

have received a wide range of grades based

on their publicly available information. In the

2019 Ethical Fashion Report non-responsive

companies received grades ranging from a B

to an F.

environment. In order to ensure that the research

remains the fashion industry benchmark when

it comes to ethical and sustainable sourcing

environmental metrics were developed in 2018.

These metrics were initially weighted at 0%, to

ensure participating companies had adequate

lead time ahead of a new focus area being added

to the performance assessment process. From

this report onwards, the environmental metrics

will inform each company’s grade, contributing

to10%of the final grade.

14

It is worth emphasising that Baptist World Aid

does not conduct site inspections of factories.

Therefore, company grades are not an assessment

of actual conditions in factories and farms, but

rather an analysis of the strength of a company’s

labour rights and environmental management

systems. This research relies on data that is publicly

available, alongside evidence of systems and

practices provided by the companies themselves.

Data collection and evaluation

As a proxy for the entire fashion supply chain,

the 2019 Ethical Fashion Report assesses a large

selection of companies on 44 specific criteria

across the five key themes, at three critical stages

of the supply chain.

The survey and the weightings applied through

the Grading Tool has been developed with input

from supply chain specialists, non-government

organisations, and company experts (see

‘acknowledgements’ on page 97). The criteria

contained within the Grading Tool draws upon

international standards, including those articulated

by the International Labour Organization, the

Sustainable Development Goals, and the United

Nation’s Guiding Principles for Business and

Human Rights. The Grading Tool will continue to

evolve over time to incorporate new learnings and

reflect changing industry best practice.

In conducting a company evaluation, our

researchers assess a company’s own publications,

alongside any relevant independent reports and

METHODOLOGY

© ILO via https://flic.kr/p/V9uWtJ

Garment factory in Hung Yên,

data. Our researchers then send the findings

(marked against the assessment criteria) to the

company for comment and further input. This

input is then further reviewed. Baptist World Aid

seeks to engage with companies, collect evidence,

and understand their processes and systems;

however, we do not conduct site inspections as

part of the grading process.

Beyond engaging brands, our researchers also

work with relevant certifiers to get a better

understanding of what systems are covered by

their certification. Where companies use these

certifications, information from the certification

body is considered in the process of the

company’s assessment. Certification bodies that

have been engaged with include Better Cotton

Initiative, the Global Organic Textile Standard,

Fairtrade and Ethical Clothing Australia.

Our researchers actively seek to engage

companies (and pursue contact with non-

responsive companies) using at least three

dierent mediums: phone calls, emails, and

letters. All non-responsive companies receive their

findings twice by post. Letters are also mailed to

the company’s Board Chair and CEO. This process

seeks to ensure that, in almost every instance

where a brand has not responded, it is because it

has intentionally chosen not to do so.

In 2019, 75% of brands engaged directly with this

research process.

15

METHODOLOGY

Policies Transparency

and Traceability

Auditing and Supplier

Relationships

Worker

Empowerment

(and living wage)

Environmental

Management

Why it matters:

Policies form the

standards that

brands want their

production to

adhere to. They

are the baseline

by which a brand

can measure the

effectiveness of

its overall efforts

to uphold worker

rights.

What we assess:

Provisions to

prohibit forced

labour and child

labour, allow

for freedom of

association and

protect worker

health and safety;

whether a brand

intends its policies

to cover the entire

production process;

whether the brand

is undertaking

important measures

towards improving

working conditions

in facilities.

Why it matters:

In order to ensure

that worker rights

are being upheld,

brands need to

know which facilities

are responsible for

the production of

their product.

What we assess:

How much of

the supply chain

a company has

traced; what it

does to monitor

and address

subcontracting;

what efforts it is

undertaking to

trace the remainder

of its supply

chain; a brand’s

transparency

and how willing

they are to be

held accountable

through the

information it shares

about it’s supply

chain.

Why it matters: Monitoring

facilities and building

relationships are critical to

ensuring policies are adhered

to and improvements in

working conditions are

being delivered. While

no monitoring process

is perfect, high quality

monitoring helps to provide

a better understanding of

the conditions of workers.

A focus on strengthening

relationships allows trust

building, and increases a

brand’s capacity to drive

change.

What we assess: What

percentage of production

facilities are audited;

whether unannounced and

offsite worker interviews

and anonymous worker

surveys are used; whether

checks are done on high risk

activities like labour brokers

and recruitment fees;

whether the brand is willing

to be transparent about its

results and remedial actions;

whether brands are actively

involved in building supplier

relationships through

consolidation, collaboration,

supplier training and long

term relationship building.

Why it matters: For a

labour rights system

to improve working

conditions, workers must

be empowered, allowed

a voice, and have their

most critical concerns

addressed. It is workers

themselves who have the

best visibility of working

conditions.

What we assess:

Whether workers are

able to unite through

democratic trade unions;

whether collective

bargaining agreements

have been established;

whether effective

grievance mechanisms

are in place; whether

workers are receiving a

living wage so they can

support their families; a

brand’s efforts in moving

towards paying a living

wage.

Why it matters: The

fashion supply chain

can cause significant

environmental

degradation, which

affects the wellbeing

of workers, the

communities they live

in, and their natural

environment. By

assessing the materials

and facilities they use

to make their products,

brands can take

informed steps to reduce

their environmental

impact from the farm to

the final item of clothing.

What we assess:

Whether the company

has done its own

assessment of the

environmental impact

throughout its supply

chain; the percentage

of sustainable materials

used; if the company has

collected data on water

use and chemical use in

its facilities; monitoring

systems to improve

chemical and water

management; whether

take-back and repair

programs have been

offered to customers.

What the research covers

The research collects and evaluates data

from fashion companies using the following

classification of the supply chain and across

the following themes of social responsibility.

RAW MATERIALS

• Cotton (farming)

• Wool, etc (husbandry,

shearing etc)

• Crude Oil for synthetic

fibres, plastics, etc

(extraction, refining)

INPUTS PRODUCTION

• Textiles production

(ginning, spinning, knitting,

dying, embroidery)

• Leather (tanning)

• Plastic (processing,

moulding)

FINAL STAGE PRODUCTION

• Cut-Make-Trim (CMT)

manufacturing (cutting,

sewing, printing)

16

because it allows the benchmark of an ethically

managed supply change to shift as the industry

standard improves. Using an adjusted bell curve

rather than a fixed standard, means that it is

industry practice (and not Baptist World Aid)

that sets the standard of ethical supply chain

management. Companies are incentivised to

continue improvements in order to align with the

progression of the industry.

Some company structures own several brands

with diering supply chain management systems

in place. In these cases, the 2019 Ethical Fashion

Report grades brands separately. Individual brands

corresponding to a single company are listed,

alongside their grade, in the Brand Index of this

Report (see page 45).

Grading

The grades awarded in the Report are a measure

of the eorts undertaken by each company to

mitigate the risks of forced labour, child labour,

worker exploitation, and environmental harm

throughout their supply chains. Higher grades

correspond to companies with labour rights

and environmental management systems that,

if implemented well, should reduce the risk and

extent of worker exploitation and environmental

harm in the production of that company’s

products. Low graded companies are those that

are not taking these initiatives, or those choosing

not to disclose if they are taking such initiatives.

It is important to note that a high grade does not

mean that a company has a supply chain which

is free from exploitation or environmental harm.

Rather, it is an indicator of the eorts the company

is undertaking and the strength of its systems to

reduce risk. Furthermore, the 2019 Ethical Fashion

Report’s grading methodology is designed

to spread companies out along an A+ to F

continuum, based on the relative strength of their

eorts and awarding grades on an adjusted bell

curve (i.e. the best performers receive A+ grades,

the worst receive F grades, with many others in

the middle).

The adjusted bell curve is a key element to support

this project’s advocacy purpose. It encourages

companies to continue working on improving

their supply chain management, as the bell curve

grades a company comparatively against industry

peers. This is preferable to a fixed standard

Data verification

To verify the data provided by companies,

company responses are reviewed and clarification

and supporting documentation are sought where

necessary. In some instances, the audit data

provided by companies is relied upon to verify

conditions and benefits that workers receive.

Wherever possible, our researchers and company

representatives work through the survey questions

together, allowing both parties to be satisfied that

the data presented is an accurate representation

of the company’s policies and processes.

To ensure consistency in the assessment of

companies after completing the survey, company

responses are cross-checked by another member

of our research team.

Survey support document

2018 saw the introduction of the Survey Support

Document (previously referenced as the

“Assessment Support Document”). This document

was reviewed and updated after the release of

the 2018 Ethical Fashion Report. It was once

again provided to companies as part of this year’s

research process.

The Survey Support Document acts as a helpful

guide for companies. It includes a rationale for

each survey question, and examples of what

constitutes a strong labour rights system. The

Survey Support Document also details the

validation requirements that need to be adhered

to, in order to demonstrate that a system or policy

is in place.

METHODOLOGY

Baptist World Aid’s methodology

and grading process has been audited,

for detail please see page95 of the

Appendices.

17

3

This section looks are three areas that are currently having

a significant influence on the fashion industry; The Modern

Slavery Act, Living Wages and Environmental concerns.

Industry Influences

18

For six years now, Baptist World Aid has called

on fashion companies to disclose their efforts

to address the risk of slavery in their supply

chains, reporting on these efforts through the

Ethical Fashion Report.

Through this research, we have become

increasingly aware of the critical role that

governments have to play in ending child labour

and exploitation in corporate supply chains. For this

reason, we have been resolute in our calls for supply

chain regulation in Australia and our organisation

has been invited to participate in the various

conversations and inquiries to achieve this end.

1

2018 saw the introduction of two important pieces

of anti-slavery legislation in Australia.

New South Wales Modern Slavery Act

2

In June 2018, New South Wales became the first

Australian jurisdiction to introduce modern slavery

legislation.

The NSW Modern Slavery Act requires commercial

entities with an annual turnover of at least $50

million, and at least one employee in New South

Wales, to annually report on the structure of

their supply chain; key risk areas and mitigation

strategies; policies and due diligence processes

relating to modern slavery; and training practices

relating to modern slavery.

The NSW Modern Slavery Act also provides for

penalties of up to $1.1 million for non-compliance

or providing false or misleading information. It also

instates a state-level, independent Anti-Slavery

Commissioner — tasked with educating the public

on the issues of modern slavery and promoting

action to end it.

Commonwealth Modern Slavery Act

3

After years of advocacy from civil society groups,

including Baptist World Aid and our Coalition

partner, STOP THE TRAFFIK, Australia now has

a federal Modern Slavery Act. This is a welcome

first step in addressing transparency and modern

slavery in corporate supply chains.

The Modern Slavery Act, which became eective

on 1 January 2019, requires entities that are

either based, or operating, in Australia, that have

an annual consolidated revenue of more than

$100million, to report annually on the risks of

modern slavery in their operations and supply

chains. This annual report, known as a ‘Modern

Slavery Statement’, must list the actions a

company has taken to assess and address those

risks, as well as gauge the quality of the company’s

response. This statement must be approved by the

company’s Board of Directors, or an equivalent,

and signed by a Company Director. Once

submitted, this statement will be made publicly

available on a central repository known as the

‘Modern Slavery Statements Register’

4

.

It is estimated that these requirements will aect

approximately 3,000 businesses.

5

While Baptist World Aid welcomes the

introduction of the Commonwealth Modern

Slavery Act, we acknowledge that more work

needs to be done to ensure it is as robust as

possible. We will continue to call for penalties for

companies that fail to comply with the reporting

requirement, and an Independent Commissioner

to ensure that the legislation is eectively

implemented.

Impact

There is no doubt that this new legislation will be

a catalyst for change in the business community.

We look forward to seeing how the fashion

industry responds, not only to these new legal

requirements placed upon it, but also to public

pressure, as consumers are presented with more

detailed information about how their favourite

brands produce their clothes.

We also anticipate that other groups within civil

society, like investors and boutique fund managers,

will now have a more direct avenue to both

engage with, and measure, a company’s appetite

for corporate social responsibility as it relates

to the issue of modern slavery. In turn, we are

hopeful that this will further drive improvements in

corporate practice.

Finally, this legislation adds significant weight to

the eorts of Baptist World Aid in this space, as

it addresses several areas that we have — and

will continue to — assess companies on. There

are many brands in the fashion industry that

have worked collaboratively with Baptist World

Aid to reduce the risk of modern slavery in their

supply chains. These companies will now be well

positioned to report on their achievements to date.

INDUSTRY INFLUENCES

THE MODERN SLAVERY ACT

19

INDUSTRY INFLUENCES

LIVING WAGES

Not being paid a living wage is one of the most

significant issues faced by fashion supply chain

workers

4

, as the benefits of receiving a living

wage would be nothing short of life-changing.

The reality is, the payment of a living wage could

transform the lives of millions by allowing people

This results in minimum wages that are far below

what would regularly be considered a living wage.

In Bangladesh for example, living wage estimates

are 2.8 times its current minimum wage and, in

Vietnam, the current minimum wage is half of the

estimated living wage

3

.

Low wages and excessive working hours are

endemic and persistent issues in global supply

chains, which, all too often, leave full-time

workers, and their families, trapped in a cycle

of poverty. Baptist World Aid, through this

assessment of companies and their brands,

promotes the adoption of a living wage

that will meet a workers’ basic needs and

allow them to maintain a safe and decent

standard of living.

State of the industry

Fashion is a lucrative industry. The Australian

Fashion Industry alone, was worth close to

$23.5billion in 2018

1

. Its value is projected to

continue growing, with fast fashion, in particular,

expected to grow at 6.2% over the next five

years

2

.These profits extend beyond Australia,

underpinning the economies of developing

countries such as Bangladesh, Cambodia, and

Vietnam, where garments are amongst the largest

exports.

But in the majority of circumstances, these

profits do not reach the workers who make these

garments. This is because garment-producing

countries, in an eort to retain the investment of

foreign companies, frequently set minimum wages

too low. Fearing that higher prices, might drive

interested companies to competitor countries.

Cotton picker in Shayampet,

© World Wide Fund via https://flic.kr/p/81oLDu

20

INDUSTRY INFLUENCES

LIVING WAGES

One of the most important first steps a company

can take when seeking to pay its workers a living

wage, is deciding on a robust methodology to

help determine a figure for each region it sources

from. 48% of companies assessed by this report

received credit for taking this step. The majority

cited using the Anker Methodology.

ACT

ACT (Action, Collaboration, Transformation) is an

agreement between international brands, retailers,

manufacturers, and trade unions, to address the

issue of living wage in the textile and garment

supply chain. ACT aims to improve wages in

the fashion industry by establishing collective

bargaining in key garment and textile sourcing

countries, at an industry level, supported by world-

class manufacturing standards and responsible

purchasing practices.

ACT is a collaboration of global brands and the

Industrial Global Union, representing garment,

textile, and footwear workers from around the

globe. Of the 21 brands that are members of ACT,

ten are represented in the 2019 Ethical Fashion

Report:

civil society, consumers factory management, and

workers.

There are many initiatives currently working

to progress the payment of living wages, two

worth mentioning are the Anker Methodology, In

partnership with the Global Living Wage Coalition

(GLWC), and ACT.

Anker Methodology

The Anker Methodology defines a living wage as,

“Remuneration received for a standard work week

by a worker in a particular place sucient to

aord a decent standard of living for the worker

and her or his family. Elements of a decent

standard of living include food, water, housing,

education, health care, transport, clothing, and

other essential needs, including provision for

unexpected events

5

.”

Developed by academic researchers and

economists Martha and Richard Anker in

partnership with GLWC, the methodology has two

main components

6

:

1. Estimating the cost of a basic decent lifestyle

for workers and his/her family in a particular

geographical location; and

2. Determining whether the estimated living wage

is being paid to workers.

The Ankers have conducted robust research

to develop living wage calculations for a number

of regions across the Asia Pacific and continue

to include more regions in its analysis, annually.

to lift themselves — and their families — out of

poverty and, at the same time, drive economic

growth within communities and nations.

However, the reality of paying living wages is

complex and dicult to implement. It is well

recognised that attaining a living wage is not

something that can be achieved by retailers alone.

It requires a multi-stakeholder approach, that

includes companies and their brands, government,

• Arcadia

• ASOS

• Canterbury

• Cotton on Group

• H&M

• Inditex

• Kmart Australia

• Next

• PVH

• Target

© ILO via https://flic.kr/p/eiJ64a

Garment factory in HCM City, Vietnam.

21

However, when looking at tangible benefits

to workers, only 20% of companies could

demonstrate that they were paying a living wage

to some portion of their supply chain, with a

mere 5% of these companies paying a living wage

to all workers in their final stage of production.

INDUSTRY INFLUENCES

LIVING WAGES

Members of ACT agree to the following

principles

7

:

•

A joint approach is needed where all participants

in global supply chains assume their respective

responsibilities in achieving freedom of

association, collective bargaining and living

wages.

•

Agreement on a living wage should be

reached through collective bargaining between

employers and workers and their representatives,

at industry level.

•

Workers must be free and able to exercise their

right to organise and bargain collectively in

accordance with ILO Conventions.

Collective bargaining is at the heart of ACT’s

work. ACT believes that eective freedom of

association will empower workers to negotiate

tailor-made solutions which allow both flexibility

and security.

Corporate response

Baptist World Aid has observed an increasing

number of companies that are taking meaningful

action to work towards paying a living wage

to workers in their supply chains. 48% of

companies have started to develop a living

wage methodology for the regions they source

from. 24% of companies have published a level

of commitment to pay their workers a living

wage, demonstrating their willingness to be

held accountable and their recognition of the

importance of paying a living wage.

So,whilst the fashion industry’s progress towards

understanding the importance of a living wage is

promising, much more work needs to be done in

order to ensure workers receive the living wage

they deserve.

Workers in wool manufacturing plant in Bangladesh.

© Asia Development Bank via https://flic.kr/p/dQCiZw

22

INDUSTRY INFLUENCES

ENVIRONMENTAL CONCERNS

Across the last six years, the Ethical Fashion

Report has assessed the labour rights

management systems of fashion companies

across the globe. In the 2018 Ethical Fashion

Report, we acknowledged that a “truly ethical”

company not only ensures their supply chain

empowers workers and pays them a living

wage, it also understands its impact on the

environment and manages its footprint to

keep waterways, the earth, and the

atmosphere healthy. Correspondingly, it is the

workers in the fashion supply chain that most

acutely feel the detrimental effects of poor

environmental management.

The significant environmental impact of the

fashion industry — starting from the raw materials

stage and continuing across all stages, through

to the end-of-life of a garment — has been well

documented. The breadth of environmental issues

that the industry touches on is also wide, from

carbon emissions to water consumption, and

waste concerns

1

. Across time, the rapid growth

of production and consumption in the fashion

industry has seen the environmental impact of

the industry grow

2

. The depth, breadth, and rapid

scaling-up of the fashion industry’s environmental

impact, highlights that there is a need to

understand and address the issue.

Environmental and social ethics matter

deeply to consumers too. 86% of the general

population think companies should be addressing

social and environmental issues

3

. When looking

at GenZ — the generation that will account

for 40% of consumers by 2020 — this statistic

jumps to 94%

4

. The purchasing decisions of

consumers are already guided by their values

5

,

and this trend only looks set to grow. For the

fashion industry, increasing consumer concern

and the continued significant environmental

impact of production signal a strong impetus

for change.

Environmental impact concerns

in the fashion industry

Like many other industries, the fashion industry’s

impact on the environment is diverse. Research

has documented direct impact on climate change

through high CO

2

emissions; significant freshwater

withdrawal to grow fibres and for the dyeing and

finishing process of fabrics; impacted ecosystem

quality through a range of forms of pollution; harm

to human health; and resource depletion

6

.

It is important to note that most of the

environmental impact caused by the fashion

industry occurs within its supply chains, most

notably at the raw materials and input stages

7

.

Therefore, companies which have put significant

eort into tracing facilities deep in their supply

chain are at an advantage to understand and

improve environmental management practices.

The type and severity of impact that an item of

clothing will have depends significantly on the

material that it is made from. Cotton, polyester,

neoprene, and recycled fibres are made and

processed in very dierent ways and require

dierent solutions to mitigate their eect on the

environment. The fashion industry is a significant

consumer of fresh water, using approximately

79 billion cubic metres per year

8

. Conversely,

synthetic fibres made from plastic and chemically

processed plant materials use less water and land

to process, however they create other eects, such

as a significantly higher greenhouse gas emission

footprint than cotton

9

. Companies therefore need

to take tailored approaches to reducing their

impact, however there are some common themes

of environmental impact across fashion supply

chains. Chemical use, water use, and the treatment

of wastewater are vital considerations when

managing inputs facilities, such as dyeing and

finishing facilities.

The impact of the fashion industry on the

environment varies significantly depending on

which stage of production is being observed, what

raw material is used, and where the production is

taking place. In order to capture this complexity

and advocate for better practice in environmental

management, we asked fashion companies to

address aspects of environmental management

which were at the intersection of the impact and

the fashion industry’s ability to act.

23

Companies can (and should) also actively seek to

use fibres that are available from more sustainable

sources, including those cultivated from less

water-intensive or chemical-intensive raw materials

and recycled fibres.

Emissions

This year, we also asked, “Has the company

publicly announced a net-zero carbon emissions

reduction target by 2050 for its supply chain? Or

is it lobbying for this target in the countries that it

is operating in?”

Carbon emissions are a consequence of all stages

of the supply chain. The Paris Agreement is a

worldwide framework to address greenhouse

“What percentage of the company’s final product

is made from sustainable fibres?”

We recognise that fibres have dierent impacts

depending on their type, source, and how they are

processed. Our first question regarding materials

seeks to grow understanding of the top three

fibres used by volume in a company’s supply

chain, then encourage implementation of that

understanding into the product design stage.

Environmental impact can thereby be prevented,

rather than treated after-the-fact. The percentage

of companies that have assessed the impact of

their top three fibres and used these assessments

to inform changes in their design and production

increased by 7% in 2019.

Benchmarking environmental

management in the fashion industry

These are the metrics used to assess companies,

including the questions asked and a rationale

as to the significance of each question. Of the

44questions asked overall in our Grading

Tool, 11were dedicated to environmental

management, contributing to 10% of a company’s

overall grade.

Governance

This year we asked, “Has the company undertaken

an assessment of its environmental impact and

risks throughout its supply chain?”

A clear starting point in managing the risks of

harmful environmental impact within the fashion

industry, is for companies to understand the

risks at play in their own supply chain. Company

decision-makers will be best situated to develop

a strategic approach to managing environmental

matters, when they are aware of the current

environmental impact of their company and the

possible environmental risks throughout its

supply chain.

Materials

We asked companies two questions related to the

materials used in their supply chain. These were:

“Has the company assessed the environmental

impact of its top three fibres and materials used

in its apparel products and implemented learnings

from this assessment into product design and

production?” and;

INDUSTRY INFLUENCES

ENVIRONMENTAL CONCERNS

Better Work Factory in Vietnam.

© ILO via https://flic.kr/p/BUtnpt

24

INDUSTRY INFLUENCES

ENVIRONMENTAL CONCERNS

including testing, were being used to ensure that

final products complied with the RSL.

Secondly, and deeper into the supply chain, a

manufacturing restricted substance list (MRSL)

defines banned and restricted hazardous

substances to prevent their use and discharge into

the environment during manufacturing. Again, it

was important for us to see that quality assurance

systems were in place, such as monitoring of

chemical management systems and water quality.

Since our preliminary analysis of companies in

2018, we have seen a 14% increase in companies

checking compliance with their MRSL.

Water use

This year we asked, “For what percentage of water

intensive facilities has the company collected and

benchmarked water use data?” and;

“Has the company used the above data to

implement a water use plan?”

Garment production is water-intensive. Our first

question aims to increase company understanding

of actual and ideal water usage in water-intensive

facilities throughout their supply chain, while the

following question aims to encourage companies

to implement these learnings.

Wastewater

Similar to the above questions, we also sought

to explore wastewater management through the

following questions:

gases emissions, including carbon emissions.

The net-zero carbon emissions reduction target

aligns with the Paris Agreement. We believe that

company commitment to this target does two

things: firstly, it indicates to governments that

the private sector endorses and seeks to align its

practices with the Paris Agreement; and secondly,

it sets a target for companies to bring their supply

chain energy usage into line with. To acknowledge

that companies may be taking a range of diered

actions to this end, we noted in our assessment

that companies may alternatively, or additionally,

engage on this issue with the government in the

countries where they operate through various

forms of lobbying. There has been a 10% increase

this year in the number of companies receiving full

credit through publicly committing to a target or

lobbying governments.

Chemical use

Regarding chemical use, we asked two key

questions of companies this year. These were:

“Does the company have a restricted substances

list against which it tests compliance?” and;

“Does the company have a manufacturing

restricted substances list against which it tests

compliance?”

Firstly, a restricted substance list (RSL) defines the

permitted levels of chemical content and chemical

exposure for final products being produced by

a company. It was important for us to see that

not only was this RSL being communicated to

suppliers, but that quality assurance systems,

“For what percentage of wet-processing facilities

has the company collected wastewater quality

data?” and;

“Of these, do all have wastewater improvement

strategies?”

Wet-processing facilities include those that

undertake viscose-manufacturing, weaving,

dyeing, printing, and finishing processes. These

facilities are more likely to have euent that is

environmentally hazardous, if not treated prior to

release into the environment.

Wastewater management can be achieved

through wastewater treatment systems, inputs

management, wastewater quality testing,

standards development and implementation, and a

combination of the above.

The number of companies using wastewater

improvement strategies has grown this year. For

companies which are collecting wastewater quality

data on their facilities, only 15% do not have

improvement strategies implemented in any facility.

Material/product waste

The 2018 assessment also recognises that

textile waste is a major and growing problem.

We therefore asked a final question to this end,

namely, “Does the company make available to

customers a take-back and/or repair program?”.

Take-back programs have the potential to lead

to textile recycling into new textiles, insulation,

and other products. Repair programs allow for

longevity of garment use.

25

4

Policies

This section evaluates the policies that fashion companies have in place to

address the risk of worker exploitation in supplier and subcontracted factories.

Most companies have now adopted policies which set the minimum working

conditions they expect of their suppliers and factories. Policies are the first step

to creating a robust supply chain management system.

26

Regular and excessive overtime is

a significant and ongoing issue for

worker welfare in the global fashion

industry. Long hours reduce worker

safety, as most workplace accidents

happen when workers are tired. Long

hours also place undue stress on a

large number of workers. Excessive

overtime is often driven by low and

insucient wages and pressure from

managers to extend working hours

or meet deadlines. The majority of

companies assessed have codes that

include standards addressing limits

on overtime.

Women represent about 80% of

global garment workers. Despite

this, gender-based discrimination in

recruitment, and sexual harassment,

are widespread in the workplace. Of

note, is that all countries in the Asia-

Pacific record a gender pay gap. It is

therefore important that companies

proactively implement policies

and clear strategies to address the

vulnerability and discrimination faced

by female workers in their supply

chain.

We found that roughly a third of

companies surveyed do have such

systems in place. While a healthy

start, this is an area that requires

further industry attention.

A Code of Conduct includes the

basic worker rights which supplier

factories are expected to observe.

At a minimum, a good code of

conduct will include the ILO’s Four

Fundamental Principles and Rights

at Work. This prohibits child labour;

forced labour; discrimination;

and guarantees worker rights to

freedom of association and collective

bargaining.

Among the companies assessed,

87% have Codes of Conduct

that include at least these basic

principles.

By stating that their code applies to

multiple levels of their supply chain,

companies are accepting that their

sphere of responsibility is not limited

to their final stage manufacturers.

The deeper, more removed levels of

the supply chain are at greatest risk

of worker exploitation, which makes

eorts to ensure that these suppliers

operate in line with Code standards

critical.

33% of companies reported

applying their Code of Conduct

to multiple levels of their supply

chain, including to the level of raw

material production, while a further

43% reported making eorts to

insist standards within their Code

of Conduct are adhered to as far as

their fabric production suppliers.

Does the company have a code

that addresses the ILO Four

Fundamental Principles and

Rights at Work?

Does the code apply to multiple

levels of the supply chain, including

the raw materials level? (Partial =

applies to inputs production)

Does the code prohibit the use of

regular and excessive overtime?

Does the company have a policy

addressing gender inequality in the

supply chain, including a strategy

to address discrimination faced by

women in the apparel industry?

POLICIES

INDUSTRY OVERVIEW

Key:

YES PARTIAL NO

YES 87% YES 33% YES 69% YES 32%

27

AS Colour – Purchasing Practises

AS Colour is committed to ensuring ethical

purchasing practises. Through regular factory visits

and engaging in open dialogue with its suppliers,

AS Colour hopes to encourage more discussions

about supplier challenges as well as its own.

In line with industry-wide experience, the

overriding feedback to come out of this open

dialogue has been that the fast fashion buying

cycle remains the biggest challenge. This is one

reason that AS Colour chooses to operate outside

of this sphere, developing its buying calendar

in collaboration with suppliers, so as to ensure

enough buer time and stock to accommodate

the setbacks which can occur in complex and

people intensive supply chains. Additionally, AS

Colour continues to invest its time and resource

inunderstanding actual production lead-times.

Adherence to these processes is governed by the

founder of AS Colour, who, having established

these principles himself, continues to have a

hands on approach signing o any new suppliers,

overseeing order placement and timelines, and

promoting a culture of continuous improvement

from both within the company’s operation as well

as from its suppliers.

Finally, this year, AS Colour has invested in joining

Amfori (a business association which promotes

open and sustainable trade). It has also employed

an ethical sourcing specialist, whose dual role is

to work with the AS Colour buying team, as well

as raising awareness with its retail team, who are

increasingly being approached by customers who

are interested in AS Colour’s ethical stance and

organic products.

“Whilst many supplier challenges at times seem

daunting (or outside the scope of influence) for

a relatively small business such as ours, the fact

remains that their problems ultimately impact on

our workers and our production. For these reasons,

we have always believed it important to invest the

time to ensure we are aware of the bigger picture,

to evolve our business and purchasing practises to

oer support and solutions where we can, and, as

a responsible industry practitioner, work to build

our influence.”

AS Colour

New Balance – Gender Strategy

Across the world, women comprise the majority

of the footwear and garment manufacturing

workforce. In an eort to improve health, literacy,

and healthcare access for women factory

workers in Vietnam, New Balance has partnered

with one of its key suppliers, Business for Social

Responsibility, to implement their HERHealth

program.

Through HERHealth, 2,000 women workers

received training and participated in peer

education programs on nutrition, reproductive

health, pre and post-natal care, and early detection

of breast cancer. Participants reported enjoying

the training on nutrition — an area impacting

workers beyond the factory with their eating

decisions impacting on the health of their families.

One supplier reported that the worker knowledge

on health issues had increased and that they’d also

experienced a decrease in worker turnover.

New Balance plans to take the learnings from

this project to further develop and inform their

strategy on women’s empowerment and gender

in their supply chain. At the time of writing this

report, a final impact assessment of the program

was underway.

POLICIES

BEST PRACTICE HIGHLIGHTS

28

5

Transparency and Traceability

This section measures the degree to which a company has traced

its suppliers at three key stages of production: final stage, inputs

and raw materials. It also looks at how transparent the company

is with respect to the location and nature of its suppliers.

29

TRANSPARENCY AND TRACEABILITY

INDUSTRY OVERVIEW

While most companies trace and audit their

suppliers to ensure that basic working conditions

are adhered to, it takes a particularly mature

approach to transparency and social responsibility

to admit that suppliers do not always meet

standards set for them. Consequently, only 29% of

companies shared data about their broad auditing

results with the general public. We believe that

admissions of noncompliance do not represent

failures in social compliance; but rather, an

important step towards greater transparency and

accountability that will drive improved working

conditions. It is the companies that are unable to

identify or admit to concerns in their supply chain

that are most hampered from improving.

Tracing the location of suppliers is an important

way in which a company can begin to take

responsibility for working conditions in its supply

chain. It’s almost impossible for companies to know

that suppliers are adhering to Code standards if

they do not know who their suppliers are.

70% of companies have traced all of their final

stage facilities, but the level of traceability tapers

for the more removed parts of the supply chain,

particularly inputs and raw materials suppliers. It