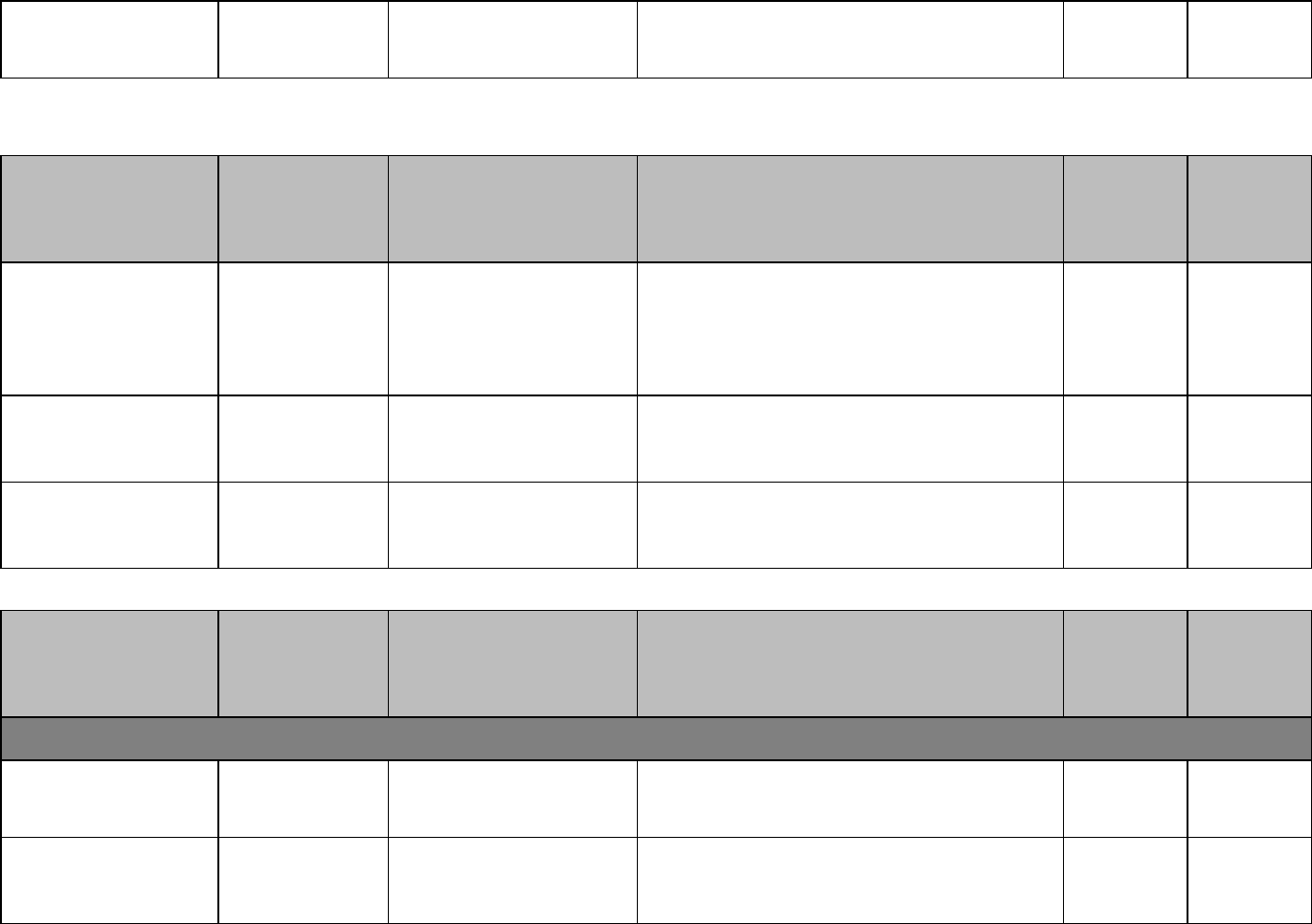

Section Topic Item(s) Required to be Addressed Reference(s)

Applicable to

Business?

Date Last

Reviewed?

General Administration Form Filings Form BD amendments

CAB Rule 014 (“Application of the By-Laws and the Capital Acquisition

Broker Rules”);

1

FINRA By-Laws, Art. IV, Section 1 (“Application for

Membership”).

General Administration Form Filings Form U4/Form U5

CAB Rule 014 (“Application of the By-Laws and the Capital Acquisition

Broker Rules”); CAB Rule 453 (“Reporting Requirements”), which

incorporates FINRA Rule 4530; FINRA By Laws, Art. V, Sections 2

(“Application for Registration”) and 3 (“Notification of Termination;

Amendments to Notification”).

2

General Administration Form Filings Fingerprint cards

CAB Rule 101 (“Electronic Filing Requirements for Universal Forms”),

which incorporates FINRA Rule 1010(d); Securities Exchange Act of 1934

(“SEA”) Rule 17f-2 (“Fingerprinting of securities industry personnel”).

Capital Acquisition Brokers

Written Supervisory Procedures Checklist

Overview -- The Capital Acquisition Broker (“CAB”) Written Supervisory Procedures Checklist (“WSP Checklist”) is an outline of selected key topics representative of the business activities typically engaged in by CAB members and

permissible under FINRA’s CAB Rules. A complete copy of the CAB Rules can be found here: https://www.finra.org/rules-guidance/rulebooks/capital-acquisition- broker-rules

https://www.finra.org/rules-guidance/rulebooks/capital-acquisition-broker-rules

FINRA Compliance Tools Disclaimer -- This optional tool is provided to assist member firms in fulfilling their regulatory obligations. This tool is provided as a starting point and you must tailor this tool to reflect the size and needs of

your firm. Using this tool does not guarantee compliance with or create any safe harbor with respect to FINRA rules, the federal securities laws or state laws, or other applicable federal or state regulatory requirements. This tool

does not create any new legal or regulatory obligations for firms or otherentities.

Updates – This tool was last reviewed, and updated as needed, on February 22, 2024. This tool does not reflect any regulatory changes since that date. FINRA periodically reviews and update these tools. FINRA reminds member

firms to stay apprised of new or amended laws, rules and regulations, and update their WSPs and compliance programs on an ongoing basis.

Member firms seeking additional guidance on certain regulatory obligations should review the relevant FINRA Topic Pages.

Staff Contact(s) – FINRA's Office of General Counsel (OGC) staff provides broker-dealers, attorneys, registered representatives, investors and other interested parties with interpretative guidance relating to FINRA’s rules. Please see

Interpreting the Rules for more information.

OGC staff contacts:

Joe Savage FINRA, OGC

1700 K Street, NW Washington, DC 20006

(202) 728-8000

I. GENERAL ADMINISTRATION

1

General Administration Form Filings

Designation of principal responsible for

supervision of Form filings

CAB Rule 101 (“Electronic Filing Requirements for Universal Forms”),

which incorporates FINRA Rule 1010(b).

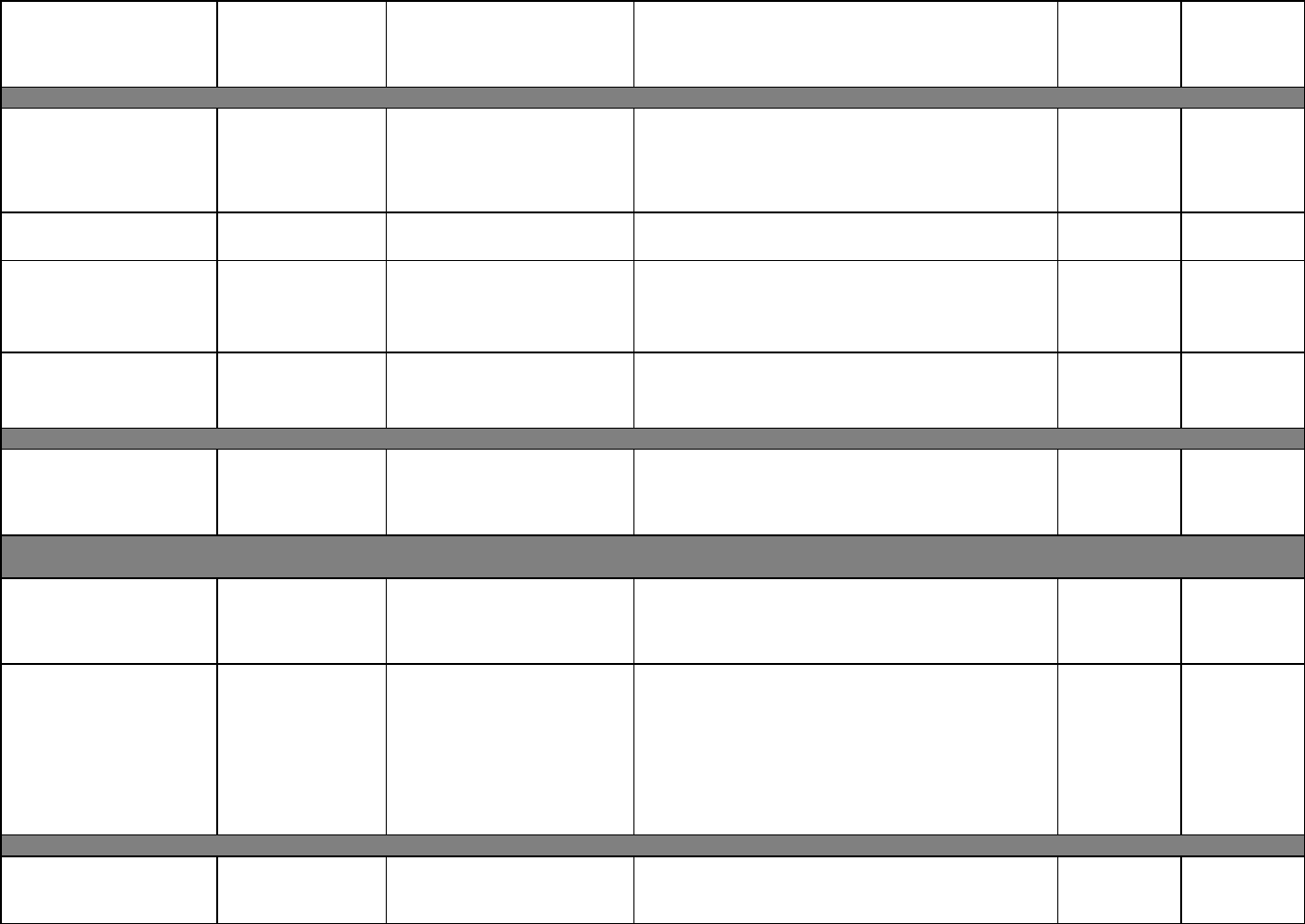

Section Topic Item(s) Required to be Addressed Reference(s)

Applicable to

Business?

Date Last

Reviewed?

Firm Supervision and Oversight Designation of Supervisors Designation of executive representative

CAB Rule 014 (“Application of the By-Laws and the Capital Acquisition

Broker Rules”);

3

CAB Rule 454 (“Member Filing and Contact Information

Requirements”), which incorporates FINRA Rule 4517; FINRA By-Laws, Art.

IV, Section 3 (“Executive Representative”).

Firm Supervision and Oversight

Designation of Supervisors

Updates to FINRA contact system

CAB Rule 454 (“Member Filing and Contact Information Requirements”),

which incorporates FINRA Rule 4517.

General Administration

Regulatory

Fees

FINRA fees and assessments

CAB Rule 014 (“Application of the By-Laws and the Capital Acquisition

Broker Rules”);

4

FINRA By-Laws, Schedule A.

Section Topic Item(s) Required to be Addressed Reference(s)

Applicable to

Business?

Date Last

Reviewed?

Personnel Hiring Practices

Investigation of background and

qualifications

CAB Rule 311(a) (“Capital Acquisition Broker Compliance and

Supervision”), which incorporates FINRA Rule 3110(a)(6) and FINRA Rule

3110(e).

Personnel Hiring Practices

Screening for statutorily disqualified

persons hired inclerical or ministerial

positions

CAB Rule 014 (“Application of the By-Laws and the Capital Acquisition

Broker Rules”);

5

FINRA By-Laws, Art. III (“Qualifications of Members and

Associated Person”).

1

Per CAB Rule 014, "All persons that have been approved for membership in FINRA as a capital acquisition broker and persons associated with capital

acquisition brokers shall be subject to the FINRA By-Laws (including the schedules thereto), unless the context requires otherwise, and the Capital Acquisition Broker Rules. Persons associated with a capital acquisition broker shall

have the same duties and obligations as a capital acquisition broker under the Capital Acquisition Broker Rules. "

II. PERSONNEL

A. Hiring Practices, Registration and Qualifications

2

Id.

3

Id.

4

Id.

2

Personnel

Qualification and

Registration

Determine qualifications of supervisory

personnel

CAB Rule 311(a) (“Capital Acquisition Broker Compliance and

Supervision”), which incorporates FINRA Rule 3110(a)(6) and FINRA Rule

3110(e). See also Notice to Members 99-45.

Section Topic Item(s) Required to be Addressed Reference(s)

Applicable to

Business?

Date Last

Reviewed?

Personnel

Qualification and

Registration

All Associated Persons are properly

registered

CAB Rule 014 (“Application of the By-Laws and the Capital Acquisition

Broker Rules”);

7

CAB Rule 121 (“Registration Requirements”), which

incorporates FINRA Rule 1210; CAB Rule 122 (“Registration Categories”),

which incorporates FINRA Rule 1220; CAB Rule 123 (“Associated Persons

Exempt from Registration”), which incorporates FINRA Rule 1230; FINRA

By- Laws, Art. III, Sec. 2.

Recordkeeping

Associated Persons Records

Records for all Associated Persons

CAB Rule 451(a) (“Books and Records”), which incorporates FINRA Rule

4511; SEA Rule 17a-3(a)(12) (“Records to be Maintained by Certain

Exchange Members, Brokers and Dealers”). See also Notice to Members

01-80.

Personnel Continuing Education

CE contact person; Person responsible for

Firm's continuing education program

CAB Rule 124 (“Continuing Education Requirements”), which incorporates

FINRA Rule 1240; CAB Rule 454 (“Member Filing and Contact Information

Requirements”), which incorporates FINRA Rule 4517.

Personnel Continuing Education

Monitor compliance with the Regulatory

Element of continuing education

CAB Rule 124 (“Continuing Education Requirements”), which incorporates

FINRA Rule 1240.

Section Topic Item(s) Required to be Addressed Reference(s)

Applicable to

Business?

Date Last

Reviewed?

Personnel Continuing Education Firm Element of continuing education

CAB Rule 124 (“Continuing Education Requirements”), which incorporates

FINRA Rule 1240.

Firm Supervision and Oversight

Designation of Supervisors

Designation of supervisors and supervisory

duties

CAB Rule 311(a) (“Capital Acquisition Broker Compliance and

Supervision”), which incorporates FINRA Rules 3110(a)(2) and (a)(3). See

also Notice to Members 99-45.

Firm Supervision and Oversight

General Supervisory

Obligations

Assign each registered rep to a supervisor

and create a record of all reps supervised

by a supervisor

CAB Rule 311(a) (“Capital Acquisition Broker Compliance and

Supervision”), which incorporates FINRA Rule 3110(a)(5).

B. Continuing Education

5

Id.

6

Id.

III. Firm Supervision and Oversight

A. Supervisory System

7

Id.

3

Firm Supervision and Oversight

Designation of Supervisors Designation of branch supervisor

CAB Rule 311(a) (“Capital Acquisition Broker Compliance and

Supervision”), which incorporates FINRA Rule 3110(a)(4).

Firm Supervision and Oversight

General Supervisory

Obligations

Distribution of procedures and

amendments

CAB Rule 311(a) (“Capital Acquisition Broker Compliance and

Supervision”), which incorporates FINRA Rule 3110(b)(7).

Firm Supervision and Oversight

General Supervisory

Obligations

Payments to unregistered persons

CAB Rule 204 ("Payments to Unregistered Persons"), which incorporates

FINRA Rule 2040.

Firm Supervision and Oversight

General Supervisory

Obligations

Review of firm activities

CAB Rule 240 (“Engaging in Impermissible Activities”), which references

CAB Rule 016(c).

Firm Supervision and Oversight Employee Supervision Gifts and gratuities

CAB Rule 322 (“Influencing or Rewarding Employees of Others”), which

incorporates FINRA Rule 3220.

Firm Supervision and Oversight Employee Supervision

Borrowing and lending between associated

persons and customers

CAB Rule 324 (“Borrowing or Lending to Customers”), which incorporates

FINRA Rule 3240; CAB Rule 311 (“Capital Acquisition Broker Compliance

and Supervision”).

Firm Supervision and Oversight Employee Supervision Outside business activities

CAB Rule 327 (“Outside Business Activities of Registered Persons”), which

incorporates FINRA Rule 3270.

Firm Supervision and Oversight Employee Supervision Private securities transactions

CAB Rule 328 (“Private Securities Transactions of an Associated Person”),

which prohibits associated persons of CABs from participating in any

manner in private securities transactions as defined in FINRA Rule 3280(e).

Firm Supervision and Oversight

General Supervisory

Obligations

Supervision of outsourcing arrangements

CAB Rule 311 (“Capital Acquisition Broker Compliance and Supervision”).

See also Notice to Members 05-48.

Firm Supervision and Oversight Employee Supervision

Heightened supervision

(including registered persons from a

disciplined firm)

CAB Rule 311 (“Capital Acquisition Broker Compliance and Supervision”).

See also Notice to Members 97-19.

Firm Supervision and Oversight Employee Supervision

Supervision of statutorily disqualified

individuals

CAB Rule 014 (“Application of the By-Laws and the Capital Acquisition

Broker Rules”);

8

CAB Rule 311 (“Capital Acquisition Broker Compliance and

Supervision”); CAB Rule 453 (“Reporting Requirements”), which

incorporates FINRA Rule 4530; FINRA By-Laws, Art. III, Sec. 3 and 4; Form

MC-400.

Firm Supervision and Oversight Correspondence Review

Correspondence: incoming, outgoing,

including facsimiles and electronic

messages (email, instant messages, etc.)

CAB Rule 311(a) (“Capital Acquisition Broker Compliance and

Supervision”), which incorporates FINRA Rule 3110(b)(4).

B. General Supervisory Obligations

C. Review of Accounts and Correspondence

4

Firm Supervision and Oversight

General Supervisory

Obligations

Transactions involving FINRA employees

CAB Rule 207 (“Transactions Involving FINRA Employees”), which

incorporates FINRA Rule 2070.

Firm Supervision and Oversight

Branch Supervision and

Inspections

Designation of Offices of Supervisory

Jurisdiction (OSJ)

CAB Rule 311(a) (“Capital Acquisition Broker Compliance and

Supervision”), which incorporates FINRA Rule 3110(a)(3) and (f)(1).

Firm Supervision and Oversight

Monitoring for Insider

Trading

Periodically reviewing employee trading

CAB Rule 201 (“Standards of Commercial Honor and Principles of Trade”),

which incorporates FINRA Rule 2010; CAB Rule 202 (“Use of Manipulative,

Deceptive, or Other Fraudulent Devices”), which incorporates FINRA Rule

2020; SEA Rule 10b-5 (“Employment of Manipulative and Deceptive

Devices”).

Firm Supervision and Oversight

Monitoring for Insider

Trading

Criteria for investigating suspect trades

SEA Section 15(g) (“Prevention of Misuse of Material, Nonpublic

Information”). See also Notice to Members 91-45.

Firm Supervision and Oversight

Monitoring for Insider

Trading

Require employees to sign attestation

SEA Section 15(g) (“Prevention of Misuse of Material, Nonpublic

Information”). See also Notice to Members 91-45.

Firm Supervision and Oversight

Monitoring for Insider

Trading

Update employees on new or

revised insider trading rules and

regulations

SEA Section 15(g) (“Prevention of Misuse of Material, Nonpublic

Information”).

Firm Supervision and Oversight

Monitoring for Insider

Trading

Definition of material, non- public

information, insiders, and other relevant

terms and prohibitions

CAB Rule 201 (“Standards of Commercial Honor and Principles of Trade”),

which incorporates FINRA Rule 2010; CAB Rule 202 (“Use of Manipulative,

Deceptive, or Other Fraudulent Devices”), which incorporates FINRA Rule

2020; SEA Rule 10b-5 (“Employment of Manipulative and Deceptive

Devices”). See also Notice to Members 89-05.

Firm Supervision and Oversight

Monitoring for Insider

Trading

Policies and procedures on access to

utilization of material, non-public

information

CAB Rule 311(a) (“Capital Acquisition Broker Compliance and

Supervision”); SEA Section 15(g) (“Prevention of Misuse of Material,

Nonpublic Information”).

Firm Supervision and Oversight

Monitoring for Insider

Trading

Tools and methods for inhibiting or

monitoring

transactions in restricted securities

CAB Rule 311 (“Capital Acquisition Broker Compliance and Supervision”);

SEA Rule 144 (“Selling Restricted and Control Securities”). See also Notice

to Members 09-05.

D. Insider Trading

8

Supra at Note 1. Per CAB Rule 014, "All persons that have been approved for membership in FINRA as a capital acquisition broker and persons associated with

capital acquisition brokers shall be subject to the FINRA By-Laws (including the schedules thereto), unless the context requires otherwise, and the Capital

Acquisition Broker Rules. Persons associated with a capital acquisition broker shall have the same duties and obligations as a capital acquisition broker under the Capital Acquisition Broker Rules. "

5

Firm Supervision and Oversight

Monitoring for Insider

Trading

Information barrier procedures including:

1) method for determining whether firm

trading should be restricted; 2)

determining and identifying activities that

are restricted while security is on list; 3)

monitoring associated persons' trading of

restricted securities; 4) time period

covered and frequency of review; 5)

recording details of associated persons'

trade in restricted security; and 6) creation

and maintenance of documentation to

evidence supervisory reviews

CAB Rule 311 (“Capital Acquisition Broker Compliance and Supervision”);

SEA Rule 144 (“Selling Restricted and Control Securities”). See also

Regulatory Notice 09-05 and Notice to Members 91-45.

Firm Supervision and Oversight

Monitoring for Insider

Trading

Procedures to detect transactions in

restricted/control securities, e.g. ,

compliance, gray, or watch lists, etc.

CAB Rule 311 (“Capital Acquisition Broker Compliance and Supervision”);

SEA Rule 144 (“Selling Restricted and Control Securities”). See also Notice

to Members 09-05 and Notice to Members 91-45.

Firm Supervision and Oversight

Monitoring for Insider

Trading

Securities transactions for personal and

family-related accounts

CAB Rule 201 (“Standards of Commercial Honor and Principles of Trade”),

which incorporates FINRA Rule 2010.

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Designate AML contact person

CAB Rule 331(d) (“Anti-Money Laundering Compliance Program”).

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Written Anti-Money

Laundering compliance program

approved in writing by senior management

CAB Rule 331 (“Anti-Money Laundering Compliance Program”).

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Establish and implement policies and

procedures to detect and cause the

reporting of suspicious transactions

CAB Rule 331(a) (“Anti-Money Laundering Compliance Program”).

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Bank Secrecy Act policies and procedures

CAB Rule 331(b) (“Anti-Money Laundering Compliance Program”); Bank

Secrecy Act (31 U.S.C. §5311 et seq .).

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Independent testing of AML compliance

program

CAB Rule 331(c) (“Anti-Money Laundering Compliance Program”).

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

On-going training of firm personnel

CAB Rule 331(e) (“Anti-Money Laundering Compliance Program”).

E. Anti-Money Laundering Compliance Program

6

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Customer Identification Program and

verification of customers' identity

CAB Rule 209 (“Know Your Customer”); CAB Rule 331(f) (“Anti- Money

Laundering Compliance Program”); USA Patriot Act, Section 326; SEA Rule

17a- 8 (“Financial Recordkeeping and Reporting of Currency and Foreign

Transactions”). See also Notice to Members 03-34.

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Determine whether customer appears on

any list of known terrorists or terrorist

organizations, such as those

listed on the Treasury's OFAC web site, as

well as those on the list of embargoed

countries/regions on the OFAC List

CAB Rule 331(f) (“Anti-Money Laundering Compliance Program”); USA

Patriot Act, Section 314; Bank Secrecy Act (31 U.S.C. §5311 et seq .).

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Responding to information requests from

FinCEN concerning money laundering or

terrorist financing, including how the firm

will protect the security and confidentiality

of the information requests

CAB Rule 331 (“Anti-Money Laundering Compliance Program”); US Patriot

Act, Section 314; Bank Secrecy Act (31 U.S.C. §5311 et seq. ).

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Sharing information with other financial

institutions, if applicable (including

requirement to provide annual sharing

agreement to FinCEN)

CAB Rule 331 (“Anti-Money Laundering Compliance Program”); USA

Patriot Act, Section 314; Bank Secrecy Act (31 U.S.C. §5311 et seq. ).

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Determine the identity of the nominal and

beneficial account holders and the source

of funds deposited into “private banking

accounts,” and to conduct enhanced

scrutiny of accounts of a senior foreign

political figure

CAB Rule 331 (“Anti-Money Laundering Compliance Program”); USA

Patriot Act, Section 314; Bank Secrecy Act (31 U.S.C. §5311 et seq. ).

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Prohibit transactions with persons who are

suspected of terrorist activities pursuant to

Executive Order #13224 that was issued

through OFAC

CAB Rule 331 (“Anti-Money Laundering Compliance Program”); USA

Patriot Act, Section 314; Bank Secrecy Act (31 U.S.C. §5311 et seq. ). See

also Notice to Members 01-67.

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

If the firm prohibits the receipt of

currency, procedures and internal controls

to detect its receipt

CAB Rule 331(b) (“Anti-Money Laundering Compliance Program”).

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Filing reports of international

transportation of currency or monetary

instruments

CAB Rule 331 (“Anti-Money Laundering Compliance Program”).

7

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Filing reports of foreign bank and financial

accounts

CAB Rule 331(a) and(b) (“Anti-Money Laundering Compliance Program”);

SEA Rule 17a-8 (“Financial Recordkeeping and Reporting of Currency and

Foreign Transactions”); Bank Secrecy Act (31 U.S.C. §5311 et seq. ).

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Procedures to detect and report suspicious

transactions by filing Suspicious Activity

Reports (SAR-SF)

CAB Rule 331 (“Anti-Money Laundering Compliance Program”); SEA Rule

17a-8 (“Financial Recordkeeping and Reporting of Currency and Foreign

Transactions”); Bank Secrecy Act (31

U.S.C. §5311 et seq. ). See also Notice to Members 02-47.

Firm Supervision and Oversight

Anti-Money Laundering

Policies and Procedures

Record keeping requirements (currently a

5-year requirement)

CAB Rule 331 (“Anti-Money Laundering Compliance Program”); SEA Rule

17a-8 (“Financial Recordkeeping and Reporting of Currency and Foreign

Transactions”); Bank Secrecy Act (31

U.S.C. §5311 et seq. ).

Sales Practices

Communications with the

Public

Advertising and sales literature (including

email and web sites)

CAB Rule 221 (“Communications with the Public”).

Sales Practices

Communications with the

Public

Speaking engagements; scripts; outlines;

media participation; chat

rooms

CAB Rule 221 (“Communications with the Public”).

Sales Practices

Communications with the

Public

Sales literature review

CAB Rule 221 (“Communications with the Public”);

CAB Rule 311 (“Capital Acquisition Broker Compliance and Supervision”).

Sales Practices

Customer Information and

Disclosures

Material event and customer complaint

reporting

CAB Rule 453 (“Reporting Requirements”), which incorporates FINRA Rule

4530.

Sales Practices

Customer Information and

Disclosures

Regulation S-P requirement to provide

initial, annual, and revised privacy policy

notice; description of how and when

distributed to customers; administrative,

technical, and physical safeguard of

information; testing of firewalls

Regulation S-P (“Privacy of Consumer Financial Information”).

Sales Practices

Customer Information and

Disclosures

Disclosures

SEA Rule 10b-9 (“Prohibited Representations in Connection with Certain

Offerings”).

Firm Supervision and Oversight

General Supervisory

Obligations

Conduct and fair dealing; fraud

CAB Rule 202 (“Use of Manipulative, Deceptive or Other Fraudulent

Devices”), which incorporates FINRA Rule 2020.

IV. SALES PRACTICES

A. Communications with the Public

B. Disclosures to Customers

C. Customer Information Controls

8

Sales Practices

Customer Information

Controls

Customer records

CAB Rule 211 (“Suitability”); CAB Rule 451 (“Books and Records”); SEA

Rule 17a-3 (“Records to be maintained by exchange members, brokers and

dealers”).

Sales Practices Suitability

Suitability of recommendations to persons

other than retail customers as defined in

Reg BI

CAB Rule 201 (“Standards of Commercial Honor and Principles of Trade”),

which incorporates FINRA Rule 2010; CAB Rule 211 (“Suitability”); CAB

Rule 451 (“Books and Records”), which incorporates FINRA Rule 4511.

Sales Practices Suitability and Reg BI Review of subscription agreements CAB Rule 211 (“Suitability”); SEA Rule 15l-1 (Reg BI).

Sales Practices Reg BI

Recommendations of securities

transactions or investment strategies

involving securities to retail customers as

defined in Reg

BI

SEA Rule 15l-1 (Reg BI).

Sales Practices

Reasonable Investigations

Reasonable Investigations of prospective

offerings

SEA Rule 10b-5 (“Employment of manipulative and deceptive devices”);

SEA Rule 15l-1 (Reg BI). Refer to FINRA Notice 10-22 ("Obligation of Broker-

Dealers to Conduct Reasonable

Investigations in Regulation D Offerings").

Sales Practices

Reviewing Transactions and

Handling Customer

Complaints

Customer complaints

CAB Rule 453 (“Reporting Requirements”), which incorporates FINRA Rule

4530; CAB Rule 451(c)

(“Records of Written Customer Complaints”), which incorporates FINRA

Rule 4513.

Firm Supervision and Oversight

FinOp Responsibilities

FinOp's duties and responsibilities

(including FinOps registered with multiple

firms)

CAB Rule 122 (“Registration Categories”), which

incorporates FINRA Rule 1220. See also Regulatory Notice 06- 23.

Financial and Operational

Filing of FOCUS and Related

Forms

Financial reporting/backup - Net Capital

computation, FOCUS filings

CAB Rule 014 (“Application of the By-Laws and the Capital Acquisition

Broker Rules”);

9

CAB Rule 451(a) (“Books and Records – General

Requirements”), which incorporates FINRA Rule 4511; CAB Rule 452(b)

(“Supplemental FOCUS Information”), which incorporates FINRA Rule

4524; CAB Rule 411 (“Capital Compliance”); FINRA By-Laws, Schedule A;

SEA Rule 17a-5 (“Reports to be made by certain brokers and dealers”); SEA

Rule 17a-11 (“Notification provisions for brokers and dealers”).

Financial and Operational Net Capital Requirements Net Capital Rule

SEA Rule 15c3-1 (“Net capital requirements for brokers or dealers”); SEA

Rule 17a-11 (“Notification provisions for brokers and dealers”).

D. Suitability/Regulation Best Interest (Reg BI)

E. Transaction Review and Handling of Customer Complaints

X0A5T

V. FINANCIAL AND OPERATIONAL ISSUES

A. Financial Reporting

B. Financial and Operational Responsibilities

9

Financial and Operational

Capital & Credit Regulation

Disclosure of firm balance sheets upon

customer request

SEA Rule 17a-5 (“Reports to be made by certain brokers and dealers”).

Recordkeeping

Maintenance of Books and

Records

Maintenance of books and records (main

office; other offices; and update customer

account information)

CAB Rule 451(a) (“Books and Records – General Requirements”), which

incorporates FINRA Rule 4511.

Recordkeeping Electronic Communications Instant messaging

CAB Rule 311 (“Capital Acquisition Broker Compliance and Supervision”),

which incorporates FINRA Rule 3110(b)(1)(4) and.06 (“Supervision”); CAB

Rule 451(a) (“Books and Records – General Requirements”), which

incorporates FINRA Rule 4511. See also Regulatory Notice 11-39,

Regulatory Notice 07-59 and Notice to Members 03-33.

Recordkeeping Electronic Communications Conditions and notification requirements

SEA Rule 17a-4(f) ("Records to be preserved by certain exchange

members, broker and dealers").

Internal Controls

Systems and Operations

Controls

Information security measures

(e.g. , securing equipment, controls on

system entitlements, limits on password

sharing, administrative procedures to

change passwords,

audit trail for tracking changes in

entitlements, etc.)

Regulation S-P, 17 CFR 248.30 (“Procedures to safeguard customer records

and information; disposal of consumer report information”).

Municipal Securities Municipal Securities

Solicitation of municipal securities

business

CAB Rule 203 (“Engaging in Distribution and Solicitation Activities with

Government Entities“), which incorporates FINRA Rule 2030. CAB Rule 458

("Books and Records Requirements for Government Distribution and

Solicitation Activities").

Private Placements Advising on Offerings Exemptions from registration

CAB Rule 512 (“Private Placements of Securities Issued by Members”),

which incorporates FINRA Rule 5122; See also Securities Act Regulation A

(“Conditional Small Issues Exemption”); Securities Act Regulation D

(“Rules Governing the Limited Offer and Sale of Securities Without

Registration Under the Securities Act of 1933”).

9

Supra at Note 1. All CABs and their associated persons shall be subject to the FINRA By-Laws (including the schedules thereto) unless the context requires

otherwise.

C. Capital and Credit Regulation

VI. RECORDKEEPING

VII. INTERNAL CONTROLS

VIII. FIXED INCOME SECURITIES

IX. PRIVATE PLACEMENTS

10

Private Placements

Advising on Securities

Registration

Public offerings (securities registration)

Securities Act of 1933, Section 5 (“Prohibitions Relating to Interstate

Commerce and the Mails”).

Private Placements

Advising on Securities

Registration

Misrepresentations as to registration

SEA Rule 15c1-3 (“Misrepresentation by brokers, dealers, and municipal

securities dealers as to registration”).

Private Placements Advising on Offerings Regulation M - Rules 101 - 105

Securities Act Regulation M (“Anti-Manipulation Rules Concerning

Securities Offerings”).

11