2019 ANNUAL REPORT

Purpose, Progress, Possibilities

WORKING TOGETHER

WITH YOU

CONTENTS

Chairman’s Message

inside front cover

2019 Financial Summary

pg 3

Year in Review

pg 4

Our Community

pg 9

Our Employees

pg 12

Client Profiles

pg 14

2019 Financial Report

pg 22

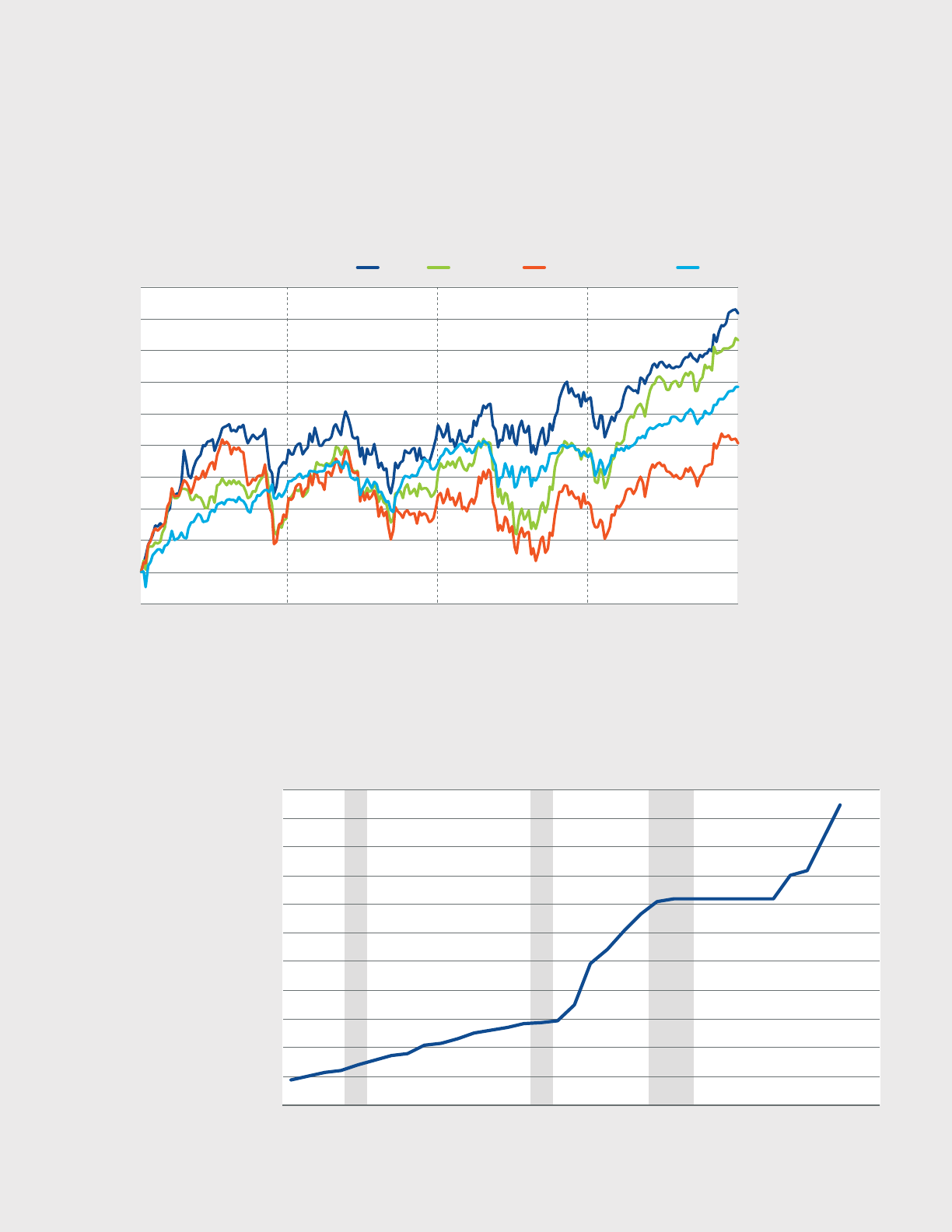

Relative Stock Prices

pg 24

BOH Locations

& Economic Information

pg 25

Managing Committee

pg 26

Board of Directors

pg 28

Shareholder Information

pg 29

Purpose, Progress, Possibilities

Working Together With You

Bank of Hawaii understands there is no one-size-

fits-all solution to banking. Our employees work

together to oer products and services that give our

customers choice. We are proud of our 122-year

legacy of supporting our customers, while constantly

progressing and improving so we may continue to

provide the optimum banking experience.

View Bank of Hawaii’s 2019 digital Summary Annual Report,

featuring videos of our Chairman, clients, community and

employees at www.boh.com.

© 2019, Bank of Hawaii Corporation. Bank of Hawaii®,

Bank of Hawaii The Private Bank, Bankoh® and the Bank of Hawaii

logo are registered trademarks of Bank of Hawaii. SimpliFi Mortgage

and SmartMoney Seminar are service marks of Bank of Hawaii

Corporation. Bankoh Investment Services, Inc. is a non-banking

subsidiary of Bank of Hawaii, member FINRA and SIPC. Cardless

Cash is a trademark of FIS. All other trademarks and service marks

appearing in this report, in print or online, are the property of their

respective owners and no claim of ownership is made by their use.

The individuals and/or owners of any other trademarks, logos,

brands or other designations or origin mentioned herein did not

sponsor, approve or endorse this publication.

American Express is a federally registered service mark of

American Express, used pursuant to a license.

Visa and Visa Signature are registered trademarks of

Visa International Service Association and are used by pursuant

to a license from Visa U.S.A., Inc.

The Hawaiian Airlines® Bank of Hawaii World Elite Mastercard®

is issued by Barclays Bank Delaware pursuant to a license by

Mastercard International Incorporated. Mastercard and World Elite

Mastercard are registered trademarks, and the circles design is a

trademark of Mastercard International Incorporated.

As we conclude the second

decade of the 21st century,

Bank of Hawaii remains

consistent in its operating

results, and well-positioned

strategically for the next

decade.

Hawaii’s Economy

Hawaii’s economy remained steady in 2019. Employment, visitor activity

and housing dynamics each exhibited strong fundamentals.

Our seasonally adjusted unemployment rate remained low at 2.6% in

December 2019, compared with 3.5% nationally.

Our visitor industry achieved record arrivals for the seventh consecutive

year while spending increased slightly. Hawaii’s visitor arrivals rose to

10.5 million in 2019, compared to 9.9 million visitors in 2018. Spending

increased 0.9% percent in 2019 to $17.8 billion. These numbers come

subsequent to several consecutive preceding years of strong visitor

counts and spending.

Average median single family home prices on Oahu, our primary market,

fell slightly by 0.1% to $789,000. Average median condominium prices

increased 1.2% in 2019 to $425,000. Months of inventory on the market

of single-family homes and condominiums on Oahu were 2.5 months and

3.4 months respectively, reflecting continued tight housing dynamics.

DEAR FELLOW

SHAREHOLDERS

Diluted earnings per share were a record $5.56, up 6.3% from

last year. Loans grew 5.2% to $11.0 billion, with balanced

growth in both our commercial and consumer businesses.

Deposits grew 5.0% to $15.8 billion. Return on average equity

for 2019 was an industry attractive 17.7%. Our eciency ratio

improved to 55.7% versus 56.7% in 2018. Credit conditions

were benign throughout the year due, in part, to our hallmark

culture of conservatism and to solid economic underpinnings

in our core Hawaii market. Additionally, our board approved

two dividend increases in 2019, bringing quarterly dividends

to $0.67 per share.

Risk management remains a key priority for Bank of Hawaii.

In 2019, Moody’s armed our Bank Deposit Long-Term Rating

at Aa2, placing us among the top 15 financial institutions in the

U.S. in that category. Additionally, we were recognized once

again by Forbes magazine as one of America’s Best Banks, as

well as an industry leader by D.A. Davidson for ESG practices,

and Barron’s magazine for environmental practices.

BANK OF HAWAII 2019 ANNUAL REPORT 1

Our Strategy

Our longstanding strategy remains

unchanged. We are committed to building

our business in the Hawaii and West

Pacific markets, where we have both

scale and market knowledge advantages.

We believe steady quality growth guided

by a commitment to ever higher risk

adjusted capital return is the foundation

of financial success. We continue to value

conservative underwriting and operating

practices.

We further recognize that the path to our

continued success lies in maintaining and

building the client relationships fostered

throughout our 122-year history in the

islands while continuing to deliver and

improve a customer experience relevant

and appropriate to the changing needs

and demands of 21st century financial

services customers.

To do this, we are focused on consistently

improving the customer experience,

enabling the digital experience more fully,

and improving operational eciency.

Of course, to achieve these aspirational

goals, we know we have to ever empower,

engage and equip our team of over

2,100 employees.

Facilities Modernization Eorts

Since 2016, we have launched eight new

Branches of Tomorrow. These branch

formats combine fresh contemporary

design while accommodating the

changing transacting habits of our

customers. They are ecient in design

and are built to provide an omni-channel

experience unrivaled in our marketplace.

Our branch format is also designed to

optimize person-to-person consultation

on everything from basic budgeting to

complex trust and estate planning.

In 2020, we plan to launch four more

Branches of Tomorrow.

The renovation of our corporate

headquarters in downtown Honolulu is

also nearing completion. By the end of

first quarter 2020, our employees will

enjoy a fully modernized space that

oers technical, collaborative and

mobile conveniences all delivered in

a contemporary attractive workspace.

We believe this investment will enable

us to attract and retain the best talent in

our market and encourage the requisite

collaboration and teamwork necessary

to thrive in the 21st-century workplace.

In addition to enhancing our brand and

providing our employees and customers

with fresh and attractive physical

environments in which to operate, our

facilities activities have also generated

substantial financial eciencies. The step

up in capital depreciation created by the

projects has been oset by lower facilities

expenses and reduced physical square

footage needs.

Digital Enhancements

Customers expect digital conveniences

to be quicker than ever, as well as simple

and seamless. It’s no surprise that nearly

75% of Americans most often access

their bank accounts via online and mobile

channels, according to an American

Bankers Association survey. In 2019,

we continued to enhance our online and

mobile oerings.

Our online mortgage application,

SimpliFi Mortgage by Bank of Hawaii,

has helped us retain our market position

as Hawaii’s No. 1 residential lender for

the seventh year in a row. This direct-to-

consumer channel grew meaningfully in

2019. We also enhanced the online

direct-to-consumer experience for our

deposit products, our home equity

products, as well as our installment loan

products. Further enhancements are

forthcoming in 2020.

We were the first in the state of Hawaii

to integrate Zelle, the popular person-to-

person payment feature, into our mobile

banking app. Launched in the fourth

quarter of 2019, we’ve been pleasantly

surprised by the rate of adoption of this

payment vehicle.

In 2019, we also launched Debit Card

Controls, within our mobile app, to allow

our debit card consumers to exercise

more control and have greater security in

their accounts. These controls allow our

customers to control debit payments by

size, type and location.

Our Employees

Attracting, retaining and engaging the

best talent in our markets is critical to our

current and future success. We were the

first local financial institution to increase

our minimum wage level to $15.00 per

hour in 2018. In 2019, we continued to

develop ways to enhance our employees’

well-being. During the year, we

announced three employee financial

programs designed to support the full

financial range of our employees.

We’ve created a new employee savings

product known as the GROW Account.

This program encourages the habit of

building an emergency savings nest egg

by our employees. Through these

special accounts, we offer a $50 bonus

to our employees when they reach

$500 in savings in their GROW Account.

We offer an additional $100 bonus to

those employees who then save an

additional $500. As you may know, an

alarming level of Americans do not have

money saved and available to meet

typical unforeseen expenses. We hope

this new program helps our team build

healthy and important savings habits

for the long term.

We also created a new Student Loan

Assistance Program. Student loan debt

is a significant impediment to a key

demographic sector of our national

community. This new program provides

$100 per month, up to a lifetime

maximum of $10,000, for an individual

employee’s student loan debt. As of the

end of 2019, we had over 100 employees

signed up for this generous program.

Finally, we created a new Employee

Mortgage Program. This program provides

our employees with a discount of up to

1% o of prevailing market rates for their

primary residences. This is an attractive

retention tool for Bank of Hawaii given the

high cost of housing in our islands.

Our College Assistance Program,

launched in 2016 with Chaminade

University of Honolulu, continues to be

popular with employees seeking their first

college degree. With 55 participants as

of October 2019, we look forward to our

first bachelor degree graduates in 2020.

To enhance the program, we began a

new partnership with the University of

Hawai‘i’s Community Colleges, where

employees can earn an associate’s of arts

degree in under three years, with the

same tuition reimbursement benefit.

We continued to support the education

of employees’ children and grandchildren

through our Bank of Hawaii Foundation

Scholarship. In 2019, we awarded

22 scholarships, and since 2014, have

funded 171 scholarships totaling

$602,500.

Chairman’s Message

Our Community

Our community support comes in many

forms—monetary donations, hands-on

activities, grants and board involvement.

In 2019, our “Bankoh Blue Crew”

volunteered more than 15,000 hours

of their time in 154 community-based

events to help nonprofits fulfill their

missions.

Employees also generously donated a

record-breaking $860,000 to nonprofits

through our Live Kōkua Giving Campaign.

2019 marked our 10th anniversary of this

annual giving eort, which is a very

personal endeavor for our employees.

They not only vote online for their

preferred nonprofits, but take the lead in

organizing creative fundraisers over the

span of several weeks.

Together, Bank of Hawaii, our foundation,

employees and retirees donated more

than $2.9 million to over 400

organizations in 2019. This consistent

support addresses a wide array of causes

within the health and medical industry,

social services, conservation/

environmental, performing arts,

and child and senior services.

Our commitment to diversity and

inclusion is woven into our core values of

excellence, integrity, respect, innovation,

commitment and teamwork. For the third

year in a row, we supported the Honolulu

Pride Parade & Festival. In 2019, we

increased our sponsorship to the

visionary level, and were proud to make a

statement with 300-plus BOH marchers.

Progressing Toward

Environmental Sustainability

Reducing energy consumption remains

one of our top priorities. We have set

ambitious short-term goals to meet the

challenge of operating in a more

sustainable fashion.

Within the next couple of years, our goal

is to meet 100% of our electrical needs

from renewable sources, including

investment matches. Through

conservation and energy-eciency

eorts, such as building management

systems and infrastructure

modernization, we have already cut our

energy use by half since 2012.

Modernization of our branch and

company headquarters also includes solar

installations. Currently, 14 facilities have

solar, and we are looking at additional

ways to increase our use of solar power,

including the addition of energy storage

systems. In the past few years, roof-

mounted PV solar panels have reduced

our utility-provided energy consumption

while additional solar system installations

are designed to double the reduction (or

more) of each building’s electrical load.

Our plan to reduce paper usage in half by

2022 is supported by utilizing new digital

resources, reducing the amount of paper

required for transactions, and imaging

records to reduce storage costs. Other

conservation eorts include increased

subsidies for employee bus passes to

encourage use of public transport,

subsidies for employees who bike to work,

plus the installation of water stations to

reduce single-use plastic bottles.

Our sustainability goals help to support

Hawaii’s Clean Energy Initiative to

produce 100% of the state’s electricity

through renewable sources by 2045.

We look forward to finding additional

opportunities to continue operating in

a sustainable manner.

Aloha and Mahalo to

Mary Bitterman and Bob Huret

I want to wish a fond aloha to two

of our directors—Mary Bitterman and

Robert Huret—who will retire from our

Board at our 2020 annual shareholders

meeting. No two individuals have served

our organization more exceptionally than

Mary and Bob. Their combined counsel

to numerous Bank of Hawaii CEOs over

the years cannot be dimensioned.

Mary Bitterman, president of The Bernard

Osher Foundation, has served on our

board since 1984, and has served

distinctively as our Lead Independent

Director since 1999. In addition to serving

as Chair of the Nominating & Corporate

Governance Committee, she served on

our Audit & Risk Committee and the

Human Resources & Compensation

Committee. Mary has a deep

understanding of our organization and

community, and I will miss her keen

insight, valuable leadership and guidance

she has provided over the years.

Bob Huret has served as a director since

2000, as vice chairman of our Audit & Risk

Committee and a member of our

Nominating & Corporate Governance

Committee. Bob has brought exceptional

knowledge and wisdom to our company

through his experience as a banker, as

Founding Partner of FTV Capital, a

private equity firm, and as chairman of

Huret Rothenberg & Co., a private

investment firm.

Also, Director Clinton Churchill retired

from our Board in April 2019 after

26 years. He served on our Audit & Risk

Committee from 2001 to 2017, and

chaired it for 15 of those years. Clint had

a distinguished military and business

career, and served on many nonprofit

boards to make Hawaii a better place.

In 2019, we welcomed three new

members to our board, John Erickson

and Josh Feldman in January, and

Michelle Hulst in July. John Erickson

joined us with 31 years of diverse banking

experience with Union Bank of California,

where he retired in 2014 as vice chairman.

During his tenure at Union Bank, John

served as both chief risk ocer and chief

corporate banking ocer. Josh Feldman is

president and CEO of Tori Richard Ltd., a

leading Hawaii apparel retailer recognized

globally for its creative design. Josh brings

excellent local knowledge of the Hawaii

business community as well as a strong

retail background. Michelle Hulst is a

group vice president with Oracle Data

Cloud, and brings with her great expertise

in technology, data management and

digital marketing.

In Closing

As we embark on a new decade,

we look forward to the possibilities that

lie ahead for our shareholders, employees,

customers and community.

Mahalo nui loa,

Peter S. Ho

Chairman, President and CEO

FOR THE YEAR ENDED DECEMBER 31 2019 2018

Earnings Highlights and Performance Ratios

Net Income $ 225,913 $ 219,602

Basic Earnings Per Share 5.59 5.26

Diluted Earnings Per Share 5.56 5.23

Dividends Declared Per Share 2.59 2.34

Net Income to Average Total Assets (ROA) 1.29 % 1.29 %

Net Income to Average Shareholders’ Equity (ROE) 17.65 % 17.63 %

Net Interest Margin

1

3.03 % 3.05 %

Eciency Ratio

2

55.68 % 56.71 %

Market Price Per Share of Common Stock:

Closing $ 95.16 $ 67.32

High 95.68 89.09

Low 66.54 63.64

AS OF DECEMBER 31

Statements of Condition Highlights and Performance Ratios

Loans and Leases $ 10,990,892 $ 10,448,774

Total Assets 18,095,496 17,143,974

Total Deposits 15,784,482 15,027,242

Other Debt 85,565 135,643

Total Shareholders’ Equity 1,286,832 1,268,200

Book Value Per Common Share $ 32.14 $ 30.56

Allowance to Loans and Leases Outstanding 1.00 % 1.02 %

Full-Time Equivalent Employees 2,124 2,122

Branches and Oces 68 69

FOR THE QUARTER ENDED DECEMBER 31

Earnings Highlights and Performance Ratios

Net Income $ 58,143 $ 53,911

Basic Earnings Per Share 1.46 1.30

Diluted Earnings Per Share 1.45 1.30

Net Income to Average Total Assets (ROA) 1.29 % 1.26 %

Net Income to Average Shareholders’ Equity (ROE) 17.84 % 17.05 %

Net Interest Margin

1

2.95 % 3.10 %

Eciency Ratio

2

54.26 % 57.75 %

1

Net interest margin is defined as net interest income, on a taxable-equivalent basis, as a percentage of average earning assets.

2

Eciency ratio is defined as noninterest expense divided by total revenue (net interest income and total noninterest income).

BANK OF HAWAII 2019 ANNUAL REPORT 3

2019 FINANCIAL SUMMARY

Bank of Hawaii Corporation and Subsidiaries (dollars in thousands, except per share amounts)

Year in Review

At Bank of Hawaii, we have a clear understanding of our purpose.

As a trusted partner in the success of all our stakeholders—

shareholders, customers, employees and community—we rely

on the timeless guidance of our vision and values to serve all

of them. Constantly evaluating our performance, we take a

proactive approach to adapting our service to meet our

customers’ changing needs, and to providing the best workplace

we can for our employees, while also bringing consistent value

to our shareholders and to our community.

OFFERING DIGITAL

CONVENIENCES AND

EXCEPTIONAL PERSONAL

CONNECTIONS

We know that our success depends on

our ability to build strong relationships

with our customers in ways that will

serve them over generations. We’ve

made significant investments in

keeping our services convenient.

Whether in person in our branches,

within our mobile banking app, online,

by phone or ATM, it’s a privilege to

provide our customers with the options

that work best for them.

Branch Banking

Our Branch of Tomorrow network is

growing. In July 2019, we celebrated

the opening of our first in-store

Branch of Tomorrow at the new

Safeway store in Kahului, Maui. On

Oahu, our new Iwilei Branch on

Dillingham Boulevard is scheduled to

open in early 2020. In October, we

opened a four-teller Kahala Mall

Kiosk, located between Longs Drugs

and Macy’s, with extended hours

seven days a week, while our new

Waialae-Kahala Branch is under

renovation.

On Hawaii Island, plans are underway

to build a new Hilo Branch, and by

mid-2020, groundbreaking will kick

o construction for our new West

Pacific Regional headquarters and

branch in Tamuning, Guam.

Our Branch of Tomorrow

modernizations include energy-

ecient features and provide

upgraded technology, easy-deposit

ATMs (with Cardless Cash) and Wi-Fi.

In August, six-and-a-half years after

announcing our plans to leave

American Samoa, we closed our

remaining operations in the territory.

To help with the transition, we donated

our fixed assets, including our Tafuna

Branch building and local residence, to

One measure of our success is the recognition we continue to receive.

Here’s a snapshot of our 2019 accolades:

• D.A. Davidson ranked Bank of Hawaii No. 1 for ESG (Environmental,

Social, Governance) among all financial institutions in the U.S.

• Barron’s magazine ranked BOH No. 4 among U.S. financial institutions

and No. 40 overall in its “100 Most Sustainable Companies” list.

• WomenInc. magazine named BOH’s five women board members

to its 2019 “Most Influential Corporate Board Directors” list.

• Moody’s Investors Service:

– armed our Aa2 “Bank Deposit Long-Term Rating,” placing

BOH among the top 15 financial institutions in the U.S., and the

highest in Hawaii; and

– rated BOH with an A1 “Baseline Credit Assessment,” placing us

among the top six institutions in the U.S.

• Forbes magazine:

– ranked us one of “America’s Best Banks” for the eleventh consecutive

year; making BOH the only local bank to be recognized in all 11 years

the list has been compiled; and

– ranked us No. 28 out of 60 nationally in its “World’s Best Banks” list.

• Pacific Business News selected BOH as Company Honoree and

employee as Individual Honoree in its Business of Pride awards for

diversity and inclusion.

• The readers of Honolulu Star-Advertiser, Hawaii Tribune-Herald and

The Garden Island selected BOH as Hawaii’s “Best Bank.”

WITH YOU,

FOR YOU

BANK OF HAWAII 2019 ANNUAL REPORT 5

the American Samoa government for

the purpose of starting its own bank.

Territorial Bank of American Samoa

opened its doors in 2016.

Modernizing Our Corporate

Headquarters

The transformation of our locations

also extends to our downtown

Honolulu corporate headquarters,

which is scheduled to be complete

by the end of the first quarter of 2020.

One of the most dramatic changes

is to the topmost 22nd floor, which

has been completely renovated.

Appropriately named Ka Nu‘u Ho‘oulu

I Ka Ho‘olōkahi Mau, “the summit of

growth and inspiration, aligned in

enduring unity,” the space features

sweeping views from the mountains

to Honolulu Harbor, state-of-the-art

technology, numerous collaborative

work areas, and a welcoming space

for ocial celebrations and gatherings.

Digital Banking Solutions

for Consumers

We continue to invest in ways to

provide digital banking options for

our customers. In September, we

embedded Zelle directly into our BOH

mobile app, allowing customers to

safely send and receive money within

minutes to almost anyone they know

with a bank account in the U.S.

Transactions via Zelle can be easily

sent using an email address or a

U.S. mobile phone number.

In April, we launched Debit Card

Controls to allow customers the

flexibility to temporarily turn their

debit cards on or o, control their

cards by location, merchant and

transaction types, and set spending

limits and customizable alerts.

These controls are designed to give

our customers more security for their

accounts and help prevent fraud.

A New boh.com

We’ve also been proactive in

improving ways for our customers

to bank online. In November, we

introduced a completely redesigned

boh.com. The new, mobile-friendly

website works seamlessly on a

smartphone, tablet or desktop,

making it easier for customers to

access the information they need

on any device.

The redesigned site has been

streamlined to be more intuitive.

Some of the new features include

an enhanced Branch & ATM map,

a side-by-side comparison product

tool, and a product finder, which

provides customers personalized

recommendations after answering

a few short questions. Additionally,

we added the ability for customers

to now open CDs and Bankohana

accounts online.

Above: BOH's 22nd floor renovation was completed in March 2019. Appropriately named Ka Nu‘u

Ho‘oulu I Ka Ho‘olōkahi Mau—“the summit of growth and inspiration, aligned in enduring unity,”

the space features sweeping views from the mountains to Honolulu Harbor, and state-of-the-art

technology, modern design elements and numerous collaborative work areas.

Top: BOH’s Kahala Mall Kiosk is the first of its

kind and opened in October 2019 to conveniently

serve the Kahala community.

Bottom: Debit Card Controls can help consumers

prevent fraud by allowing them to set specific

preferences within the BOH mobile app.

Year in Review

Credit Cards

In 2019, MyBankoh credit card holders

were switched to Mastercard from

Visa and American Express, as

Barclays took ownership of the

accounts. The three cards that were

converted were the Bank of Hawaii

American Express Card with

MyBankoh Rewards, the Bank of

Hawaii Visa Signature Credit Card with

MyBankoh Rewards, and the Bank of

Hawaii Elite American Express Card

with MyBankoh Rewards. The change

did not aect our debit cards nor our

Hawaiian Airlines Bank of Hawaii

World Elite Mastercard.

Call Center Upgrades

Phase 1 of cloud-based technology

upgrades were made to our Call

Center in 2019 to provide greater

flexibility, convenience and security

in communicating with customers.

The enhancements route calls more

eciently and provide callers with

faster access to basic topics, such as

password resets and balance inquiries.

Call Center agents now respond to

chat inquiries via select pages on

boh.com through a new, live web

chat feature. Additional security to

Call Center communications was

implemented via one-time passcodes,

which callers may receive via text or

email, so that our agents can

authenticate them as rightful account

holders. Phase 2 of the upgrades will

continue to be implemented in 2020.

Mortgage, Consumer and Dealer

Indirect Lending

We understand that for many people,

buying or building a home is the

fulfillment of a dream, and one of the

biggest financial decisions they may

make. The process of applying for a

mortgage became much more

convenient for buyers or those

homeowners looking to refinance an

existing mortgage through our fully

integrated online application, SimpliFi

Mortgage by Bank of Hawaii. The online

application gives customers the best of

both worlds—personal connection to

our local loan ocers and the ability to

use technology to apply, seamlessly

upload documents, e-sign, review

disclosures and more online.

We continue to take a leadership role

in streamlining VA home loans and

loans for Department of Hawaiian

Home Lands (DHHL) lessees due to

our depth of understanding of the

complexities involved. We remain the

only Hawaii-based lender providing

DHHL loans.

Bank of Hawaii continues to be an

overall leader both in home equity and

residential lending. We were honored

to again be named the No. 1 residential

lender in Hawaii and Guam, both for

the number of residential loans

recorded and total dollars loaned in

2019. Local processing, underwriting

and servicing of home equity,

construction and mortgage loans

ensure that our customers get the

products and flexibility of service that

best fit their needs.

We have expanded our auto lending in

the West Pacific, and continue to be

No. 1 in that marketplace. We continue

to be the No. 2 auto lender in the state

of Hawaii, and our combined auto loan

and leasing portfolios grew to $825.2

million, as of December 2019. Our

flexible, ecient auto loan servicing,

which is handled locally, helped us to

grow our dealer partnerships in 2019.

Commercial Real Estate Lending

When it comes to housing prices,

Honolulu is one of the most expensive

cities in the U.S. There is a limited

supply of aordable housing due to the

high costs of land and construction.

Bank of Hawaii has always been

committed to aordable housing

solutions, and our support for Aloha

United Way’s ALICE (Asset Limited

Income Constrained, Employed)

Report is helping us to sharpen our

focus to find more ways to work with

developers in an eort to help create

more aordable and workforce

housing across Hawaii and the

Western Pacific.

In 2019, the Honolulu City Council

passed Bill 7, a five-year pilot program

to attract developers by allowing small

lot developments to be built on lots

of 20,000 sq. ft. or less, with higher

density and smaller setbacks than

were previously permitted. We

partnered with a developer to fund

the first project under Bill 7, Puuhue

Apartments, which is a planned

four-story building in Honolulu

that will bring 25 aordable rentals

to market.

Queen Emma Tower, once a neglected

building in the heart of Honolulu, will

be fully renovated by Āhē Group and

create 71 aordable rental units. In

addition to Queen Emma Tower, the

bank helped finance 22 units of

aordable housing for Maui seniors at

Hale Mahaolu Ewalu II, developed by

Hale Mahaolu. The bank also financed

35 units of aordable family housing

rentals on Kauai at Waimea Huakai,

which are currently under construction

by Āhē Group.

More than 320 aordable housing

units started or completed

construction in 2019, thanks in part to

Bank of Hawaii, and almost 610 more

are in the pipeline. Bank of Hawaii

plans to continue developing other

partnerships to meet the financing

needs for aordable and workplace

housing in our community.

BANK OF HAWAII 2019 ANNUAL REPORT 7

THE PRIVATE BANK

Bank of Hawaii The Private Bank takes a holistic approach to providing

personalized wealth management services through every stage of life. In addition

to basic banking, The Private Bank offers a comprehensive array of services,

including customized lending; investments; insurance; financial, estate and tax

planning; charitable giving; and trust services. The Private Bank team is a trusted

ally in anticipating and meeting the complex and unique needs of high-value

clients. We have taken a leadership role in utilizing new technology to make these

specialized services as convenient as possible, and we take a team approach to

developing integrated strategies to deliver exceptional results over time.

In October, we completed renovations of the third floor of our downtown Honolulu

bank building. The entire floor is designed for serving customers of The Private

Bank and Trust Services Group, and includes upgraded technology and multiple

meeting rooms.

As part of our International Client Banking Division, we are working toward

opening a representative oce in Tokyo. Our new representative will act as

a liaison to network among banks, CPAs, tax advisors and other financial

professionals on behalf of Bank of Hawaii.

Trust, Estate and Financial Planning

The Private Bank team members create a personalized plan to help each client

meet his or her immediate and long-term financial goals, offering guidance in

analyzing assets and tax implications, and investment opportunities to

optimize returns.

One of our specialties is creating multi-generational wealth strategies. Our

dedicated relationship managers guide clients through succession planning,

and business transitions or sales to help create a lasting legacy that reflects

the values and priorities of one generation while engaging younger generations

to carry on successfully.

One of our wealth management

services includes assistance with

establishing and administering

nonprofit foundations and charitable

trusts. Responsible for approximately

120 grant-making foundations, our

Charitable Foundation Services team

has been helping individuals and

corporations devise the best, most

eective ways to direct and manage

their giving through private charitable

trusts and foundations. Many of these

nonprofits distribute grants, and our

Charitable Foundation Services team

is responsible for overseeing grant

requests, review and distributions.

As the largest administrator of

irrevocable trusts in the state with

more than $3 billion in assets under

management, Bank of Hawaii has the

depth of expertise necessary to

handle every aspect of trust accounts

for our clients.

Investment and Insurance Services

Bank of Hawaii continues to be the

premiere provider of fiduciary and

investment services in Hawaii and the

Pacific. We remain the biggest

municipal bond manager in the state

of Hawaii, and manage three tax-free

bonds. Our trusted team of certified

financial planners (CFP) and certified

financial analysts (CFA) manages

almost $7 billion in assets through a

wide array of advisory and brokerage

services.

In 2019, we introduced our investment

and insurance services in Guam,

helping customers to navigate through

these important aspects of their

financial journey. We continue to

enhance our investment and insurance

capabilities with the goal of providing

our clients access to comprehensive

wealth management solutions to

address their accumulation, protection

and wealth transfer needs.

At left: The Private Bank's renovated third

floor includes state-of-the-art technology

in conference rooms, paired with modern

design elements and traditional artwork.

Year in Review

BANKING FOR BUSINESS

As the marketplace changes and develops at an increasingly rapid pace,

Bank of Hawaii is positioned to assist customers meet the unique challenges

of doing business in Hawaii. We provide leading-edge banking technology

and sound financial advice for every size and type of business—entrepreneurs,

nonprofits, family-owned businesses and global corporations, local healthcare

practitioners and international businesses. Whether it’s helping a medical

practice upgrade equipment, finding the best merchant services, or helping a

customer apply for a Small Business Administration (SBA) loan or finance energy

sustainability measures, Bank of Hawaii has innovative solutions to help small

businesses grow and succeed.

Digital Banking Solutions for Businesses

In 2019, we began an upgrade to our digital resources for our business clients.

We invested more than $1.5 million in our platforms to prepare them for continued

enhancements and emerging technologies. This investment in upgrades for online

Business Banking, ACH platform, Lockbox Services, Wire Monitoring and

Processing and Client Access will continue into 2020. These advancements

underscore our commitment to enhanced security and delivery of complex

processing or reporting needs. We pride ourselves on ensuring robust finance

management functions that help our business customers improve eciencies and

deliver better service to their own customers.

As digital payment options for businesses continue to rapidly evolve, we continue

to scope and construct solutions to meet the needs of our customers. We

launched new Merchant Service solutions that work for large and small businesses

by collaborating with Clover and OptBlue. The Clover point-of-sale system not

only accepts swipe-card, chip-card, and contactless payments, such as Apple Pay,

but also issues refunds, manages tips, applies discounts, performs closeout

reporting and more. The OptBlue program allows business customers to accept

American Express card payments at a more competitive rate, and oers

consolidated billing and reporting via Bank of Hawaii.

We also developed new software to make it easier for our business customers to

stay compliant with the evolving technical and operational payment card industry

(PCI) standards they need to follow to ensure that cardholders’ credit card data

remains protected.

Commercial/Corporate Banking

Our commercial and corporate bankers take the time to understand our customers’

businesses—from their operations to their long-term goals. Their deep

understanding of the Hawaii marketplace combined with our comprehensive

products and services allow them to come up with competitive and versatile

solutions for our clients. The team is highly experienced in working with many

dierent industries and works closely with other financial services experts across

the bank to help provide tailored strategies and recommendations for a broad range

of needs, including real estate and construction loans, liquidity management and

equipment financing.

In 2019, we continued to be the largest commercial mortgage lender in the state of

Hawaii. Our team finds customized financial solutions for owners, developers and

investors with multi-family, retail, industrial, oce and mixed-use properties.

Captive Insurance

Bank of Hawaii’s solid captive

insurance industry service and

leadership continue to grow this

business segment. With over 95

diverse captive clients, our Captive

Insurance Services team continues to

support the Hawaii domicile as we

have done since the industry’s

inception in 1986. Bank of Hawaii

currently oversees more than $1.5

billion in investment assets and

deposits for Hawaii-based captive

insurance businesses.

Many local, national and

international businesses turn to Bank

of Hawaii for advice and tailored

services to meet their captive’s

banking and investment needs and

objectives. We help in evaluating

current risk and financing structures,

as well as in developing portfolio

solutions to build reserve assets.

As reserve funds grow over time

through premiums paid and healthy

claims experiences, clients can allow

for increased insurance coverage

options and improved cash flow and

insurance expense management.

While many large corporations have

long been utilizing captives, we see

good future growth potential for

developing businesses and established

middle market companies from a

range of industries. In particular,

we are seeing increased interest from

Japanese companies that have been

aware of the captive industry for

a number of years, but were more

gradual in deploying captive

strategies.

To address the very real issues that we face today in our island

home, Bank of Hawaii collaborates with organizations that are

focused on bringing about long-term improvements.

Sustaining healthy, thriving communities happens when we invest

in the nonprofits supporting and transforming families and

individuals. That’s why we continue to partner with nonprofits—

to help them bring about necessary changes and find new ways

to make a difference.

Our community support in 2019 reflects the wide range of

interests of our employees and the needs of our community.

Here are a few examples.

Above: Nearly 300 BOH employees, family

and friends worked together on a variety of

‘aina-based service projects at Papahana

Kuaola for Community Service Day.

Bank of Hawaii, its

Foundation and employees

contributed approximately

$2.9 million in 2019 to

400 organizations.

Working Together to Support

OUR COMMUNITY

BANK OF HAWAII 2019 ANNUAL REPORT 9

BANK OF HAWAII

FOUNDATION

Supporting the vision and

dedication of local nonprofits

via Bank of Hawaii Foundation

grants is one of the ways we

work to improve lives in the

communities we serve. We

invest in a wide range of

important community needs,

such as education, housing,

community development,

environmental sustainability,

literacy and the arts. In 2019,

Bank of Hawaii Foundation

supported 61 nonprofits with

70 grants totaling $1.2 million.

Catholic Charities

Hawai‘i Laulima House

Catholic Charities Hawai‘i received a

donation of $100,000 over four years

from Bank of Hawaii Foundation in

support of its Laulima House

campaign to expand child and family

services. Located on Oahu, Laulima

House provides a private home-like

setting for family-strengthening visits

between keiki and their biological

parents, or children being considered

for foster care.

Hawaiian Community Assets

Hawaiian Community Assets (HCA)

provides housing and financial

counseling services to low- and

moderate-income communities, with

a focus on helping Native Hawaiians

achieve economic self-sufficiency.

Bank of Hawaii Foundation donated

a $25,000 grant to HCA’s Next

Generation Homeownership

Initiative. Using its nationally

recognized Kahua Waiwai: Building

a Foundation of Wealth curriculum,

HCA delivers intergenerational

financial and homebuyer education

to increase the financial capacity of

500 Native Hawaiian families so

they may own homes on or near

Hawaiian Home Lands.

Helping Low-Income Families Receive Their Income Tax Refunds

During tax season, 22 BOH volunteers on Oahu and Hawaii Island partnered with

Goodwill Hawaii and Honolulu Community Action Program to provide free tax

preparation services for eligible taxpayers as part of the Volunteer Income Tax

Assistance (VITA) program. Our volunteers donated approximately 311 hours to

prepare 219 tax returns that returned $362,000 back to the community. This

includes $110,865 in federal earned income tax credits that working families and

individuals would not have received if they hadn’t filed. VITA oers free tax help

to people in our communities who can benefit the most from tax refunds,

including people with disabilities, the elderly, those with limited understanding

of English, and those who make approximately $54,000 or less.

Our Community

LIVE KŌKUA

Total Employee Giving

More than

$8.2 million since

2007 to more than 400 local

nonprofits

311

HOURS TO

PREPARE 2019

TAX RETURNS

$362,000

BACK TO THE COMMUNITY

GIVING CAMPAIGN

$860,000

A record-breaking amount

donated to 25 nonprofits in 2019,

including neighbor islands and

Guam

VOLUNTEERISM

15,459 Hours / 154 Events

2019 FINANCIAL EDUCATION/COMMUNITY

REINVESTMENT ACT (CRA)

At left: Catholic Charities

Laulima House on Oahu.

BANK OF HAWAII 2019 ANNUAL REPORT 11

Our Bankoh Blue Crew

Out in Full Force

Hands-on outreach in our community

has always been part of our DNA. As

our communities grow and evolve, our

employee-led Live Kōkua Volunteer

Program looks for more ways to give

back to the communities we serve.

Community Service Day

In September, Bankoh Blue Crew

volunteers turned out for our

14th annual Community Service Day

on Windward Oahu. Partnering with

Papahana Kuaola in He‘eia, BOH

employees, family members and friends

helped plant more than 800 native

trees, rehabilitate one mile of trail, clean

two lo‘i, and propagate more than

3,000 native plants. Leaders from

Papahana Kuaola integrated Hawaiian

knowledge into the volunteers’

environmental restoration and

economic sustainability activities.

Honolulu Pride Parade & Festival

In October, BOH volunteers

participated in Hawaii’s largest and

most colorful LGBTQ event, the 2019

Honolulu Pride Parade & Festival in

Waikiki. Attendees danced along with

our 300 volunteers, who marched in

the parade in support of the LGBTQ

community. We are proud that one of

our employees, Andy Downes, was

recognized with one of Pacific Business

News’ 2019 Business of Pride Awards

for his part in developing our Diversity

and Inclusion program. Bank of

Hawaii is also honored to be one of

the companies that received the

corporate award for making Hawaii’s

workplace more inclusive.

Live Kōkua Giving Campaign

For the 10th anniversary of the annual

employee giving campaign, BOH

employees across the Pacific

exceeded our $775,000 goal and

raised a record-breaking amount of

$860,000 for 25 local nonprofits,

ranging from health and educational

programs to food and housing

services. Employees fundraised

through bake sales, silent auctions

and other activities for organizations

they care deeply about.

Left: For the second year in a row, Bank of

Hawaii returned to Waikiki to participate in

Hawaii’s largest and most colorful LGBTQ

event—the 2019 Honolulu Pride Parade &

Festival!

Above: Bank of Hawaii employees and

retirees raised a record $860,000 for 25 local

nonprofits in 2019.

We are incredibly proud that

Honolulu magazine honored long-

time Bankoh Blue Crew volunteer

Priscilla “Cilla” Arelliano, and her

husband Kevin, as 2019 Ola Pono

Awardees for their outstanding

volunteerism in donating their time

and talents to make our islands a

better place. From 2016 to 2019,

Cilla volunteered at 202 events

totaling 679 hours through our

Live Kōkua Volunteer Program.

Cilla gives back whenever she can

and encourages fellow teammates

to do the same. As a show of

appreciation, the bank surprised

the Arellianos with a three-night stay

at the Aulani, a Disney Resort and

Spa and a $1,000 donation, in

Cilla’s honor, to the organization(s)

of her choice.

Above: Cilla and Kevin Arelliano

LIVE KŌKUA VOLUNTEER PROGRAM

EMPLOYEE

SPOTLIGHT

Priscilla “Cilla” Arelliano —

2019 Ola Pono Awardee

At Bank of Hawaii, much of

our focus on innovation and

growth centers on our people.

That’s because we have

always recognized that

investing in their success is

the key to the continuing

success of our business, our

customers and our

community. As banking

becomes more digitized to

meet customers’ changing

expectations, our employees

need the broad range of

specialized skills to adapt and

thrive while delivering the

exceptional service our

customers deserve.

Professional Development

Each of our employees brings

diverse experience and a unique

learning style to our workplace, and

we want to retain them while also

helping them find opportunities

across the bank to grow in their

careers.

One of the bank’s biggest

continuing investments is in the

personal and professional

development of our employees to

give them more opportunities to

learn and grow toward leadership

positions, or to equip them to

explore potential new career paths

via our leadership, skills and

management training. In 2019, more

than 32,000 hours of training was

provided by Bank of Hawaii.

In 2019, we enhanced our Tuition

Assistance Program (TAP) by oering

new discounts for undergraduate and

graduate-level courses at Hawaii

Pacific University, whether online or

in person, as well as graduate-level

courses at Chaminade University of

Honolulu. TAP brings new choices

to our employees in ways to obtain

specialized knowledge in their

professional field through single

courses, or by pursuing an associate’s

degree, a bachelor’s degree, or an

advanced degree.

A new enhancement to Bank of

Hawaii’s College Assistance Program

(CAP) was introduced in 2019 to

include a new partner. Employees can

now pursue an associate of arts

degree with online courses through

the University of Hawaii’s Community

Colleges (UHCC). The UHCC degree

is an accelerated program that allows

participants to earn an associate’s

degree in approximately 2.5 years.

The UHCC program joins the CAP

degree program oered in partnership

with Chaminade University of

Honolulu. Started in August 2016 to

provide employees without a

bachelor’s degree a way to make a

college education a reality, 55 BOH

employees were enrolled in CAP for

the fall 2019 term.

Diversity and Inclusion

The bank has always promoted a

culture of diversity and inclusion, and

we continued to promote inclusiveness

in the workplace through our Fostering

Workplace Excellence training series.

Two new training modules were added

to the curriculum in 2019: Bystander

Intervention training (the choice to

intervene as a positive influence in

potentially harmful situations to help

prevent harassment) and Unconscious

Bias training (the unconscious feelings,

attitudes and beliefs that we all have

about people and/or situations).

Bank of Hawaii was also named a

company honoree for Pacific Business

News’ Business of Pride Awards. As a

longtime supporter of the LGBTQ

community, Bank of Hawaii has

sponsored many events and programs,

including the Honolulu Rainbow Film

Festival and the 2019 Honolulu Pride

Parade & Festival. Bank of Hawaii’s

Diversity and Inclusion program

includes workplace culture and

environment; learning and

development; and attracting and

retaining diverse talent and

community engagement by oering

connection, support, information and

networking and leadership

opportunities.

Our Employees

ALWAYS

MOVING

FORWARD

Above: Juliemay Peralta, Cynthia Esparza and Arliza Borja Losano take a victory lap around

the Neal S. Blaisdell Center Arena in honor of earning their associate degrees from Chaminade

University in May 2019.

BANK OF HAWAII 2019 ANNUAL REPORT 13

New Financial Benefits

As part of our commitment to making Bank of Hawaii a great

place to work, we oer employees a diverse range of competitive

benefits and services to meet their dierent needs and evolving

lifestyle changes. In an eort to help them save more and

strengthen their financial foundation, three new financial wellness

benefits launched in January 2020.

• Student Loan Assistance Program: Employees will receive

$100 per month (up to a maximum of $10,000), toward their

student loan repayment;

• EASE by Bank of Hawaii Grow Account: The bank will help

employees save toward their rainy day funds by providing

a one-time $50 bonus once employees save $500, and an

additional one-time bonus of $100 once $1,000 is saved.

• Mortgage Discount: Employees are eligible for up to a 1%

reduction in the Employee Note Rate for new mortgage loans

when either purchasing or refinancing a home to be used as their

primary residence.

Bottom left: BOH’s 2019 Pathways to Professional Excellence cohort kicked o

their six-month learning journey in July. From left: front row: Emily Araki,

Kristin Yama, Tiany Mitani and Arleen Torrijos. Second row: George Cochard,

Taj’a Wong, Ester Sisson, Jessica Pacpaco, Cilla Arelliano and Charmaine

Depaynos-Mayo. Third row: Darren Bullock, Lena Zheng, Matt Shishido,

Kasi Young and Carol-Lynn Lester. Fourth row: Jose Lopez, Megan Nguyen

and Serena Thomas. Back row: Je Dailly, Hayley Musashi, Manatu Tokelau,

Kevin Sun and Demi Willis.

Bottom right: Our six-month Bank

Associates (BA) program includes a

community service project. BOH’s 11 BAs

organized an event in November to help

Oahu nonprofit Kahumana Organic Farm

and Café Community, whose mission

is to co-create a healthy, inclusive and

productive farm-based community with

homeless families, people with disabilities

and youth. Nearly 70 bank employees

came out to volunteer, including 2019 BA

Preston Young.

BY THE NUMBERS (2019)

This eight-week program is

designed to attract and develop

emerging talent.

29

TOTAL

COLLEGE INTERNS

2,553

HOURS OF TRAINING

This six-month program is aimed

at developing recent college

graduates for banking careers.

11

TOTAL

BANK ASSOCIATES

1,877

HOURS OF TRAINING

This six-month program is

aimed at employees identified

with leadership potential.

23

TOTAL

PARTICIPANTS

3,468

HOURS OF TRAINING

Summer Intern

Program

Bank Associate

Program

Pathways to

Professional

Excellence Program

Top left: 2019 BOH summer interns

Tari-Lynn Manin (left) and Ford Nakagawa

brainstorm during BOH's annual College

Career Connections event, a networking and

skill-building program designed to generate

interest and create opportunities for

potential interns and new hires.

Free tuition toward an

associate’s or bachelor’s degree.

55

EMPLOYEES

CURRENTLY ENROLLED

IN OCTOBER TERM

9,460

CLASSROOM HOURS

College

Assistance

Program

REALTOR® is a registered trademark of the National Association of REALTORS®

Wong Family

Rita Wong: William and I came to

Hawaii in 1977 to finish up military

service in the Air Force. A year after

we arrived, we were able to buy an

oce space at the Aiea Medical

Building for Bill’s dermatology practice.

When we bought the space, it was

only a shell. After having our loan

application for renovations rejected at

another bank, we decided to go across

the street to Bank of Hawaii.

Dr. William Wong, Sr.: At that time,

BOH had a branch in Aiea, and the

branch manager oered us a second

mortgage of $50,000 to improve our

oce. As the practice gradually grew

over the years, we grew in our banking

relationship.

Now we have one realty company

and two private medical practices

(dermatology and ophthalmology)

in our family, and we have found

Bank of Hawaii very convenient and

supportive of both business and

personal banking.

Dr. William Wong, Jr.: My first

experience was with my BOH checking

account as a teenager. When we

moved back to Hawaii, my story is

somewhat similar to my parents, with

the bank providing funding to open the

Vision Clinic based on the good

relationship built up over the years.

Starting a small business is always

risky, and BOH helps us keep it

running. Whenever we need

equipment upgrades, BOH is always

there to provide the next business

loan. Especially when cash flow is tight

or the economy isn’t doing so well,

they will set up terms that will work for

our business. It’s a good relationship.

They have always been there when we

needed assistance.

Five years ago we faced a critical

decision whether to expand by

opening a second practice location in

town. Knowing BOH was willing to

make funds available prompted us to

move ahead with the purchase,

remodel, and furnishing of our new

Kakaako oce at Nauru Tower.

While expanding the practice, we

were also in the process of building

our new forever home; it was quite a

stressful time. BOH’s construction

department guided us through the

process, and was flexible enough to

extend the construction loan to help

us cope with the inevitable delays and

obstacles that arise with big projects

in Hawaii. We now have a farm where

the kids have space to explore nature,

and learn the joys of caring for

animals and plants.

Kerri Wong: We have three kids, and

we opened bank accounts for them

very early on so they would

understand the value of money.

Whenever they would receive

monetary gifts over the years, I’ve had

them divide it up: a part for spending, a

part for donating (either to the church

or a charity of their choice), and a part

for putting away. And so they’ve been

able to watch their accounts grow over

the years and begin to learn about

long-term savings and investments.

Rita: We are always learning about

new services and opportunities via

financial planning meetings hosted by

BOH. Our current private bank advisor,

Cori Weston, has been a great source

of knowledge, advice and financial

resources.

Through the bank, I, as an active

Realtor® and real estate investor, was

able to acquire multiple Waikiki

properties, including two apartment

buildings. Years ago we used the bank

to help us fund Punahou education for

our kids through an equipment leasing

program. Recently, we wanted to do

the same for our grandchildren, and

Cori helped us set up the 529 Plan

with all the necessary vehicles and

administrations. It’s very nice that at

one bank we’re able to take care of all

three generations.

William Wong, Jr.: BOH is solid. They

were around when I was a kid and will

be around for generations to come.

William Wong, Sr.: It’s the relationship

factor based on mutual trust, working

together over the years, achieving new

goals. They know our needs, and have

facilitated helping us. Bank of Hawaii is

a real ‘ohana bank.

Profile: The Private Bank Clients

“BOH is solid. They were

around when I was a kid

and will be around for

generations to come.”

Dr. William Wong, Sr., owner of Hawaii

Dermatology & Surgery, Inc. and his wife,

REALTOR® Rita Wong, owner of Rita Wong

Realty, Inc., Dr. William Wong, Jr., owner

of Hawaii Vision Clinic, 2017 past president

of Hawaii County Medical Association, and

2018 past president of Hawaii Medical

Association, with his wife, Kerri Wong,

proud mom of their three loving kids.

—Dr. William Wong, Jr.

BANK OF HAWAII 2019 ANNUAL REPORT 15

Lyndsey Haraguchi-Nakayama

Lyndsey Haraguchi-Nakayama:

Our farm is a six-generation working

family farm that’s over 100 years old.

We have been mainly growing taro for

several generations, but we grow

diversified crops.

Hanalei Taro & Juice Co. are our food

trucks. They serve the value-added

food portion of our family farm where

we specialize in fresh taro dishes. We

serve our Hanalei taro veggie burger,

taro hummus, and kūlolo (a traditional

Hawaiian dessert). Our menu provides

a variety of items, including vegan and

gluten- and dairy-free dishes, all the

way to traditional Hawaiian food, like

laulau and kalua pork.

We also care for the Ho‘opulapula

Haraguchi Rice Mill, a 501 c(3)

nonprofit agrarian museum that was

started by my parents in the early

1980s. I am the educational

administrator, and my parents, Rodney

and Karol Haraguchi, oversee it along

with the help of a community-led

board of directors.

From our family’s viewpoint, we don’t

think our life as farmers is interesting.

However, my mother is a teacher and

she realized that nowhere else in the

state could children come and see

agricultural artifacts that have been

preserved from the 1800s and early

1900s. She also saw the museum as

an opportunity to preserve local oral

history while informing visitors about

current challenges. We educate

about the local ecosystem, about

endangered and invasive species,

and instill the importance of farming

because that’s needed for future

generations to survive.

In April 2018, the North Shore

community, Koloa, and other areas

of Kauai and Oahu were aected by

historic flooding, and everybody is still

rebuilding.

On our farm not only did we need to

salvage artifacts that were washed out

of the museum, but five foundational

pillars from the farmhouse and oce

were knocked out by the flood, so the

floors are collapsing. Toward the end

of 2019, we received permission to

begin demolishing and start rebuilding.

The museum is still closed to the

public as we continue with taro field

flood recovery and eco-farm education

tours. It’s taking a lot longer than we’d

like, and we continue to work daily on

the farm and at the food trucks, but it’s

probably going to take us at least two

to three years to complete rebuilding.

I look for trustworthiness,

dependability and understanding in a

banking relationship. After the floods,

BOH was very empathetic; they

listened to our situation, and they

wanted to know how they could help.

Brandon Sassone, the Princeville

Branch manager, came to a Hanalei

Business Co-Operative meeting where

I told him that I would like to make

more deposits using the mobile app.

Brandon helped to extend the limit so

I could deposit many work checks at

one time online. That really helped.

It was heartwarming to see how the

community pulled together after the

flooding, and some reached out by

donating online at HaraguchiRiceMill.org.

Thanks to BOH SVP and Kauai Market

Manager Sonia Topenio, a special

account was set up to accept

donations and acknowledge them

with receipts for tax deductions.

Even when we face disasters, we have

to be able to move forward. Working

from my farm truck was the quickest

way that I could get things back up and

running on a day-to-day basis. Mobile

banking is what I utilize the most, and

I also use online banking for bill paying

and payroll transfers. I have a wooden

desk that fits over the steering wheel in

my truck to hold my laptop, and I can

pay invoices or make deposits within a

few minutes.

We also worked to quickly reopen our

Hanalei food truck because we wanted

the community to have a place to get

food, and we wanted our sta to have

jobs. All of our electrical equipment in

the food truck got washed in the flood.

Chris Kashiwagi, our senior relationship

banker at BOH, has always been very

helpful with anything we need. She

spearheaded my getting two new credit

cards to purchase replacement

equipment so we could reopen the food

truck and our sta could stay employed.

BOH is definitely a bank with Hawaii

people in mind. Whether it’s personal,

or business or nonprofit, they stand for

the local community. They understand

the challenges. That makes all the

dierence.

“Bank of Hawaii is definitely

a bank with Hawaii people in

mind. Whether it’s personal,

or business or nonprofit,

they stand for the local

community. They understand

the challenges. That makes

all the difference.”

HO‘OPULAPULA HARAGUCHI RICE MILL MUSEUM & TARO FARM

HANALEI TARO & JUICE CO. LUNCH WAGONS

Profile: Branch Banking and Commercial Banking Client

BANK OF HAWAII 2019 ANNUAL REPORT 17

Co-owner and fifth-generation

farmer Lyndsey Haraguchi-Nakayama

at her family’s 55-acre taro farm and

historic rice mill in Hanalei, Kauai.

Jason and Juliana Sung

Jason Sung: We opened our

Dillingham location in 2010. It looks

brand new because we completed a

renovation in November 2018 that

added almost 1,000 sq. ft. We

opened our Waimalu Plaza restaurant

in 2014 with an SBA loan.

Juliana Sung: Our landlord at the

City Square Shopping Center first

introduced us to Bank of Hawaii. BOH

helped us apply for the SBA loan for

our Waimalu Plaza location, and they

also wrote up our winning nomination

for SBA’s Young Entrepreneur of the

Year in Honolulu County. By that time,

Reid Hinaga was our banker, and he

attended the SBA awards luncheon

with us along with our parents. My

mom remembered Reid from when

he was an assistant manager at the

Hawaii Kai Safeway Branch years ago.

Jason: We had always been open

until 2 p.m., but when we opened in

Waimalu, we decided to extend the

hours to 9 p.m. It was a hit; everyone

loved it. People wanted to come for

dinner, and they loved that we were

using real plates and real utensils.

We had a vision after the second

location was a hit. And because we

had two dierent locations that

operated dierently, we wanted to

make it look like an actual chain.

That’s why we chose to renovate this

location, expand the kitchen, put in a

dishwasher, and extend the hours. Ever

since, our business here has grown.

Juli: Everyone appreciates that it’s

really clean, bright and modern, and

where people can feel comfortable

bringing the whole family. We also

wanted to expand the kitchen so that

we could take advantage of more

catering opportunities. In the end, it

worked out well for our customers

and for our business.

Jason: BOH gave us a commercial

loan for the renovation. We do all

of our banking with BOH including

our personal banking, commercial

lending, credit card processing, and

our home equity line. It’s easy—I can

just text Reid and give him the details.

Everything can be done over the

phone or via email.

Reid and I are from the same

generation; we’re both around the

same age; we both have kids, so

there’s a lot we can relate to. He’s my

friend. He knows our needs, and I feel

comfortable talking with him.

Juli: We look for convenience in a

banking relationship, and someone

we can trust. Because we know BOH

does their due diligence, that gives

us another level of confidence in our

abilities. They have faith in us, and

we have faith in them.

Jason: We now have an ongoing

relationship with the bank through

Reid, who knows the challenges that

we face as a local, family-owned

business. He can relate to us;

we can relate to him.

Juli: We have some employees

who have been with us for a long

time, and we appreciate them. They

are a huge part of the company’s

success. Each time we expanded with

help from BOH, we increased our

number of employees. It’s about

creating jobs in the community as

well as serving our customers.

Jason: I don’t want to expand too fast;

slow growth is the best growth. But

eventually I do want a third location.

People say that having two is really

hard, but that the third and fourth

may come easier because you already

have the blueprint of what you are

doing. You just need to find the right

location and people.

I can’t wait to do more business with

BOH! Thanks for having faith and

confidence in our business, and with

me and Juli. This is just the beginning;

we are still young and plan to keep

going. We hope they keep going with

us and help us grow even more.

“This is just the beginning; we are still young and plan

to keep going. We hope Bank of Hawaii will keep going

with us and help us grow even more.”

Profile: Branch Banking and Commercial Banking Clients

PANCAKES & WAFFLES B.L.D.

Co-owners Juliana and Jason Sung in their recently renovated

Dillingham restaurant location.

—Jason Sung

BANK OF HAWAII 2019 ANNUAL REPORT 19

Mark Fukunaga

Mark Fukunaga: Servco has been

defined by the idea of service from the

start, and that idea has allowed us to

reach 100 years in business. Putting

customers first is still at the heart of

how we operate today, even when it

might be disruptive to our business.

We do things because it’s the right

thing to do.

Any business that’s been around for

100 years has reinvented itself five or

six times over that period, and

certainly that has been the case with

us. Implicit in every reinvention is the

ability to take risks, embrace new ideas

and new ways of doing business, and

to walk away from some more

traditional ways of doing things. You

ultimately have to follow where the

customer wants to go.

That’s always been a part of Servco,

but perhaps what’s changed is the

pace. We’re dealing with many

disruptive digital forces that are

changing the way we engage and

serve our customers. At the same

time, we’re also planning for how we

adapt to new ownership models, like

car sharing and ride sharing, and new

technologies like autonomous vehicles

and electric drivetrains that use

batteries, fuel cells and plug-in hybrid

systems.

Our first foray into this disruption was

through the launch of our new car

share service called Hui. Hui Car Share

is a collaboration between Toyota

Connected and Servco, and is Toyota’s

first global car sharing initiative. We

launched it in 2018, and we now have

100 vehicles in our Hui fleet at 45

stations across Oahu. We’re delighted

that BOH is a mobility partner with Hui

and has a station at its corporate

oces in Honolulu.

What I think is innovative about BOH

is they are thinking about using Hui for

their employees who want to work

downtown without bringing their car.

This is a way for them to commute via

mass transit options (like bus and

eventually rail transit), car pool, or

bike. Then, once in the city, if they

need to use a car to run errands or

meet a client they have easy access

with Hui.

Servco has been a BOH client at least

since 1972. They have been a key

partner for us over the years,

supporting our borrowing needs for

general corporate and real estate

projects. BOH has also been very

helpful in enabling our customers to

buy and lease vehicles. They provide

funding for all of our Lexus inventory in

Hawaii. And BOH is the only local bank

that we use for leasing our cars, which

is an important part of our business.

To me, a partner is someone who

takes the time to understand our

business and therefore understands

what we need. BOH has been terrific

over the years at understanding

Servco’s business, and anticipating

what we’re going to need because they

know us well.

I also think a partner is there when

times get tough. Servco has been lucky

to avoid having financial diculties,

but when everyone faced challenges in

2008, Bankoh was fully there standing

beside everyone. We know they’ll be

there if we hit a bump in the road.

In the last five years or so, I’ve also

appreciated the opportunity to do

some exchange of thoughts as we both

look forward into the future as both

automotive and banking industries are

facing significant changes in our

business models.

We have common challenges and

we think about the future similarly. We

both try to serve customers who range

in ages from their teens to their 70s,

and across that age gap there are all

kinds of dierences in how customers

want to be treated. We have some

very interesting conversations with

Bankoh leadership, including Peter Ho,

around those ideas, and I enjoy having

meaningful discussions with

a trusted business partner like BOH.

Bank of Hawaii is a long-term

partner who is supportive, who

we can rely on. And, like us, values

innovation through new initiatives that

are good for our business and, most

importantly, our community

as a whole.

SERVCO PACIFIC INC.

Profile: Commercial Banking Client

“Bank of Hawaii is a

long-term partner who is

supportive, who we can

rely on. And, like us,

values innovation

through new initiatives

that are good for our

business and, most

importantly, our

community as a whole.”

Mark Fukunaga, Chairman & CEO

of Servco Pacific Inc.

BANK OF HAWAII 2019 ANNUAL REPORT 21

FOR THE YEAR ENDED DECEMBER 31 2019 2018

Interest Income

Interest and Fees on Loans and Leases $ 439,012 $ 410,597

Income on Investment Securities

Available-for-Sale 62,174 50,152

Held-to-Maturity 81,616 84,310

Deposits 41 34

Funds Sold 3,553 3,723

Other 1,001 1,357

Total Interest Income 587,397 550,173

Interest Expense

Deposits 68,374 41,143

Securities Sold Under Agreements to Repurchase 17,522 18,519

Funds Purchased 840 609

Short-Term Borrowings 38 145

Other Debt 2,908 3,405

Total Interest Expense 89,682 63,821

Net Interest Income 497,715 486,352

Provision for Credit Losses 16,000 13,425

Net Interest Income After Provision for Credit Losses 481,715 472,927