Bank of Hawaii

NYSE: BOH

3.8%

3.6%

3.5%

3.6%

3.6%

3.7%

3.7%

3.6%

3.8%

3.2%

3.3%

3.9%

4.2%

4.4%

4.3%

4.1%

3.9%

3.7%

2.8%

2.9%

3.0%

3.0%

2.8%

2.9%

2.8%

1.8%

1.8%

1.7%

2.0%

1.9%

2.0%

2.1%

2.4%

2.1%

1.8%

1.8%

1.9%

1.8%

1.4%

1.3%

1.1%

1.0%

0.9%

0.7%

0.8%

1.2%

1.0%

1.1%

1.1%

1.1%

1.9%

1.8%

1.9%

1.7%

1.7%

1.7%

1.7%

1.2%

1.7%

1.4%

1.5%

2.0%

2.4%

3.0%

3.1%

3.0%

2.9%

2.8%

2.0%

2.2%

1.8%

1.9%

1.7%

1.8%

1.7%

Net Interest Net Non-interest Pre-tax Income

EV/

Earning Assets

EV/

Deposits

EV/

EBT

EV/

Owner Earnings

Frost 0.16 0.17 8.59 5.56

BOK 0.14 0.19 9.15 5.15

Commerce 0.20 0.24 11.36 6.98

UMB Financial 0.15 0.18 14.98 6.68

Central Pacific

Financial

0.15 0.16 9.47 8.17

Minimum 0.14 0.16 8.59 5.15

Maximum 0.20 0.24 14.98 8.17

Median 0.15 0.18 9.47 6.68

Mean 0.16 0.19 10.71 6.51

Standard

Deviation

0.02 0.03 2.60 1.20

Variation 16% 16% 24% 18%

BOH 0.20 0.22 12.04 7.52

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Minimum Maximum Median Mean

Standard

Deviation

Variation

Net Interest Income 383 395 422 429 413 460 494 493 515 414 386 359 366 401 403 393 380 359 306 352 380 386 369 396 405 306 515 395 402 47 12%

Net Non-interest Expense 188 197 201 232 218 249 275 329 288 233 214 172 159 129 118 105 95 89 82 91 151 134 145 147 162 82 329 162 176 67 38%

Pre-tax Income 195 197 221 197 196 211 219 164 226 181 172 186 207 271 285 288 286 271 223 261 229 252 224 249 243 164 288 223 226 37 16%

Short-term Investments 1,358 1,664 1,286 865 730 845 563 579 487 259 870 1,314 390 275 46 21 90 99 697 395 384 267 225 321 487 21 1,664 487 581 446 77%

Securities 2,323 2,695 3,611 3,546 3,171 3,380 3,685 3,672 3,516 3,234 2,768 2,341 2,630 2,904 3,069 3,016 2,969 2,962 4,161 6,008 6,719 6,983 6,909 6,900 6,505 2,323 6,983 3,380 3,987 1,605 40%

Loans 6,484 6,602 6,991 7,394 7,655 8,354 8,930 9,422 9,445 9,544 8,125 5,623 5,640 5,876 6,195 6,458 6,650 6,631 6,246 5,563 5,441 5,775 5,978 6,481 7,481 5,441 9,544 6,602 6,999 1,298 19%

Total Earning Assets 10,165 10,961 11,889 11,805 11,556 12,578 13,177 13,673 13,447 13,038 11,763 9,277 8,660 9,055 9,310 9,495 9,708 9,692 11,105 11,966 12,545 13,025 13,113 13,702 14,473 8,660 14,473 11,805 11,567 1,726 15%

Non-interest bearing

1,135 1,232 1,325 1,386 1,403 1,566 1,781 2,098 2,088 2,011 1,886 1,556 1,754 1,929 1,973 1,950 1,892 1,742 1,994 2,240 2,596 3,024 3,389 3,688 4,040 1,135 4,040 1,929 2,067 748 36%

Interest-bearing Deposits 7,496 7,186 6,208 5,909 5,633 6,617 7,467 7,452 7,228 6,994 6,181 5,044 5,292 5,493 5,793 5,781 5,996 6,110 7,115 7,270 7,356 7,911 8,008 8,434 8,885 5,044 8,885 6,994 6,754 1,024 15%

Total Deposits 8,631 8,418 7,532 7,295 7,037 8,182 9,248 9,550 9,315 9,005 8,067 6,600 7,046 7,422 7,767 7,731 7,888 7,851 9,108 9,509 9,952 10,935 11,397 12,122 12,925 6,600 12,925 8,418 8,821 1,635 19%

Equity 683 785 893 971 1,026 1,071 1,109 1,161 1,210 1,235 1,344 1,184 900 761 731 696 730 783 877 1,013 1,020 1,023 1,018 1,052 1,084 683 1,344 1,018 974 184 19%

Return on Earning Assets

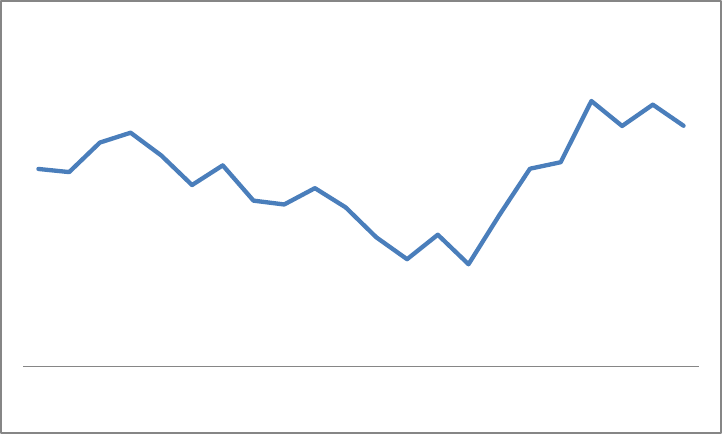

Net Interest Income 3.76% 3.60% 3.55% 3.64% 3.58% 3.66% 3.75% 3.61% 3.83% 3.18% 3.28% 3.87% 4.23% 4.43% 4.33% 4.13% 3.92% 3.71% 2.75% 2.94% 3.03% 2.96% 2.81% 2.89% 2.80% 2.75% 4.43% 3.61% 3.53% 0.50% 0.14

Net Non-interest Expense 1.85% 1.80% 1.69% 1.97% 1.88% 1.98% 2.09% 2.41% 2.14% 1.79% 1.82% 1.86% 1.84% 1.43% 1.27% 1.10% 0.98% 0.92% 0.74% 0.76% 1.20% 1.03% 1.10% 1.07% 1.12% 0.74% 2.41% 1.69% 1.51% 0.48% 0.32

Pre-tax Income 1.92% 1.80% 1.86% 1.67% 1.69% 1.68% 1.66% 1.20% 1.68% 1.39% 1.46% 2.01% 2.39% 3.00% 3.06% 3.03% 2.94% 2.79% 2.01% 2.18% 1.83% 1.93% 1.71% 1.82% 1.68% 1.20% 3.06% 1.83% 2.02% 0.54% 0.27

Leverage

Earning Assets/Equity 14.89 13.97 13.31 12.16 11.26 11.75 11.88 11.78 11.11 10.56 8.75 7.84 9.62 11.90 12.73 13.64 13.29 12.38 12.66 11.82 12.30 12.73 12.88 13.02 13.35 7.84 14.89 12.30 12.06 1.59 13%

RETURNS

Return on Equity 29% 25% 25% 20% 19% 20% 20% 14% 19% 15% 13% 16% 23% 36% 39% 41% 39% 35% 25% 26% 22% 25% 22% 24% 22% 13% 41% 23% 24% 8% 0.32

GROWTH

Net Interest Income 3% 7% 2% -4% 11% 7% 0% 4% -19% -7% -7% 2% 9% 1% -3% -3% -6% -15% 15% 8% 2% -4% 7% 2% -19% 15% 2% 1% 8% 14.43

Net Non-interest Expense 5% 2% 16% -6% 15% 10% 20% -12% -19% -8% -19% -8% -19% -8% -11% -9% -7% -7% 11% 66% -11% 8% 1% 10% -19% 66% -6% 1% 18% 25.76

Pre-tax Income 1% 12% -11% -1% 8% 4% -25% 38% -20% -5% 9% 11% 31% 5% 1% -1% -5% -17% 17% -12% 10% -11% 11% -2% -25% 38% 1% 2% 15% 7.64

Federal Funds and Other

Deposits

23% -23% -33% -16% 16% -33% 3% -16% -47% 235% 51% -70% -29% -83% -56% 335% 10% 606% -43% -3% -30% -16% 42% 52% -83% 606% -16% 36% 153% 4.18

Securities 16% 34% -2% -11% 7% 9% 0% -4% -8% -14% -15% 12% 10% 6% -2% -2% 0% 40% 44% 12% 4% -1% 0% -6% -15% 44% 0% 5% 16% 2.89

Loans 2% 6% 6% 4% 9% 7% 6% 0% 1% -15% -31% 0% 4% 5% 4% 3% 0% -6% -11% -2% 6% 4% 8% 15% -31% 15% 4% 1% 9% 8.70

Total Earning Assets 8% 8% -1% -2% 9% 5% 4% -2% -3% -10% -21% -7% 5% 3% 2% 2% 0% 15% 8% 5% 4% 1% 4% 6% -21% 15% 3% 2% 7% 4.11

Non-interest bearing

Deposits

9% 8% 5% 1% 12% 14% 18% 0% -4% -6% -17% 13% 10% 2% -1% -3% -8% 14% 12% 16% 16% 12% 9% 10% -17% 18% 9% 6% 9% 1.55

Interest-bearing Deposits -4% -14% -5% -5% 17% 13% 0% -3% -3% -12% -18% 5% 4% 5% 0% 4% 2% 16% 2% 1% 8% 1% 5% 5% -18% 17% 2% 1% 9% 8.01

Total Deposits -2% -11% -3% -4% 16% 13% 3% -2% -3% -10% -18% 7% 5% 5% 0% 2% 0% 16% 4% 5% 10% 4% 6% 7% -18% 16% 4% 2% 8% 4.05

Equity 15% 14% 9% 6% 4% 4% 5% 4% 2% 9% -12% -24% -15% -4% -5% 5% 7% 12% 15% 1% 0% 0% 3% 3% -24% 15% 4% 2% 9% 3.92

TABLE OF CONTENTS

DURABILITY 3

MOAT 5

QUALITY 7

CAPITAL ALLOCATION 8

VALUE 10

GROWTH 12

MISJUDGMENT 13

FUTURE 15

APPRAISAL 17

NOTES 19

SINGULAR DILIGENCE

Geoff Gannon, Writer Quan Hoang, Analyst

Tobias Carlisle, Publisher

OVERVIEW

Bank of Hawaii is the second largest

bank in the island state of Hawaii. From

1994 through 2015, Bank of Hawaii’s

deposit share in that state ranged from

about 27% (on the eve of the 2008

nancial crisis) to 32% today. Generally,

Bank of Hawaii has had a deposit share

of about 30%. In most U.S. states, no

bank has anywhere near 30% of all

deposits. Hawaii’s banking industry is

much more consolidated than the

banking industry in other U.S. states.

Bank of Hawaii was founded in 1893. It

opened its rst branch in Kauai in 1903.

Over the next 90 years, Bank of Hawaii

acquired many other Hawaiian banks.

For example, it bought First Bank of

Hilo – a four branch Hawaiian bank – in

1922. It bought Amalgamated Bank of

Maui in 1930. By 1995, the company

was called Hawaii Bancorporaon. It

had 31% deposit share in Hawaii. The

bank as it exists today is very similar to

what it looked like 20 to 25 years ago.

The big dierence is that Bank of

Hawaii sold o its non-Hawaiian assets.

During the 1980s and 1990s, Hawaiian

Bancorporaon grew outside the state

of Hawaii. At the peak of its expansion,

the bank had branches in the U.S.

mainland states of California, Arizona,

and New York. It also had foreign (that

is, non-U.S.) branches in 8 dierent

South Pacic naons. It even had 6

locaons in Asia. Hawaii has the closest

es to Asia of any U.S. state. Much of

Hawaii’s populaon are descendants of

Chinese immigrants. Hawaii is also a

popular desnaon for Japanese tourists. During the 1990s, Bank of Hawaii couldn’t

grow its revenue the way mainland banks could. It already had 30% of the Hawaiian

market. And Hawaii was no longer an especially fast growing economy. So, Bank of

Hawaii started buying loans outside of Hawaii. The company’s 1997 name change

from Hawaiian Bancorporaon to Pacic Century Financial is indicave of

management’s focus on external growth.

That focus came back to bite BOH. The late 1990s were a boom me for U.S. banks.

And especially for U.S. bank stocks. But not for Bank of Hawaii – or Pacic Century

Financial as it was then named. Net charge-os to loans were 0.34% in the year Bank

of Hawaii made the name change to Pacic Century. They rose from there. In 1998,

net charge-os were 0.70%. They rose to 0.78% in 1999. Then 0.94% in 2000. And

then 1.57% in 2001. The period 1997-2000 was hardly a trying me for the U.S.

economy. So, that was a lousy loan loss trend. Bank of Hawaii’s stock performed

badly. In 2000, it was the only big U.S. bank stock trading below book value. The

Chairman of the company resigned. And Michael O’Neil – the former Vice Chairman

and CFO of Bank of America – was made both Chairman and CEO. He was given the

task of turning the company around.

Michael O’Neil re-focused Bank of Hawaii on its core business. In 2002, Pacic

Century Financial changed its name to Bank of Hawaii. It sold o non-Hawaiian

Bank of Hawaii (NYSE: BOH) s One of the Biggest

Players in the Best Banking Market in the U.S.

SINGULAR DILIGENCE 1

Over the last 22 years, Bank of Hawaii has consistently held a 27% to

33% share of all deposits in Hawaii.

assets and closed branches. The bank

actually shrank itself by choice. In 2000,

Bank of Hawaii had $14 billion in total

assets. In 2004, it had just $9.7 billion

in total assets. So, the bank shrank at a

rate of about 10% a year for four

straight years. That really is a

disciplined approach to focus. Bank of

Hawaii’s best deposits had always been

in Hawaii. It had a relavely small

number of branches with a relavely

high amount of very low cost deposits

per branch. This was the bank’s real

franchise. So, cung away all of the

non-Hawaiian business really helped

the bank’s expense situaon. A bank’s

eciency can best be measured not as

analysts like to focus on in terms of

expense as a percent of revenue – but

instead in terms of expenses relave to

deposits. Banks don’t control their

revenues. Most banks make a lot of

money o interest. Well, the Fed sets

interest rates – banks don’t set interest

rates. So banks don’t have control over

revenue in the form of interest. What

banks do have complete control over is

their net operang expense. This is non

-interest expense less non-interest

income. In the long-run, this is the

number that maers. Bank of Hawaii

had net operang expenses of 1.79% of

earning assets in 2000. In 2007, net

operang expense at a percent of

earning assets was just 0.98%. That

made Bank of Hawaii one of the best

banks in America.

Bank of Hawaii is sll one of the best

banks in America. Not in terms of

growth potenal. And not in terms of

loan losses. But in terms of deposits.

Bank of Hawaii has one of the very best

deposit bases you’ll nd anywhere in

the world. Right now, Bank of Hawaii is

funded 91% by deposits. And 91% of

these deposits are what are called

“core deposits”. So, about 83% of Bank

of Hawaii’s balance sheet is supported

by core deposits. Core deposits are

scky. Customer retenon is 90% or

higher at many banks. They also tend

to be cheap. For example, 31% of Bank

of Hawaii’s deposits (which is 28% of

the bank’s balance sheet) is interest

free. Customers receive no interest on

these accounts. Since we know Bank of Hawaii’s net operang expense is less than

1% of deposits – an account that doesn’t pay interest, costs Bank of Hawaii less

than 1% in total. The U.S. government can’t borrow long-term – remember,

customers tend to leave their money with the same bank for 5 to 10 years – at less

than 1%. You don’t have to be a very good lender to make money if your funding is

cheap and scky.

Hawaii is the best banking industry in the country. Hawaiian banks tend to have the

highest liquidity – they have high customer deposits relave to their total balance

sheet – and the lowest cost of deposits of banks in any U.S. state. Bank of Hawaii

has the lowest cost of funding among Hawaiian banks. In fact, it has one of the

lowest costs of funding of any bank in the country. There are some banks with

lower costs of funding. Warren Bue owns Wells Fargo. Wells has a very low cost

of deposits. And we wrote about Frost – it’s sll our favorite bank – in a past issue

of Singular Diligence. So, yes, there are a few banks with a lower cost of funding

than Bank of Hawaii. But there are literally a few thousand banks with a higher cost

of funding. Every other Hawaiian bank has a higher cost of funding than BOH. As a

rule, Bank of Hawaii obtains its deposits at two-thirds the cost of the average

Hawaiian bank and half the cost of the average mainland bank. BOH’s net operang

expense divided by total earning assets is usually less than 1%. Other U.S. regional

banks – which are about the same size as BOH – have net operang expenses in the

1.5% to 3% range.

This obviously means BOH has higher returns on equity. Let’s use the boom period

of 2004 to 2007 as an illustraon. We can’t use the 2008-2016 period, because

interest rates were so low as to be meaningless. When analyzing banks, we have to

use some sort of “normal” interest rate level. Here, we’ll treat 2004 to 2007 as

normal. From 2004 through 2007, Bank of Hawaii generated a pre-tax return on

earning assets of 3%. It had 14 mes leverage. By this we mean earnings assets

were 14 mes shareholder’s equity. So, the pre-tax return on shareholder’s equity

was 14 mes 3% which is 42%. This translates into an aer-tax return on equity of

27%. Lately, the bank’s return on equity has been nowhere near this level. For

example, in 2015, BOH’s pre-tax return on earning assets was 1.7% instead of the

3% it earned in 2004 to 2007. This is because BOH is hurt by lower interest rates.

Remember, BOH doesn’t pay interest on 30% of its deposits – but it receives

interest on all of its assets. So, low interest rates benet borrowers at the expense

of a lender like BOH. In the medium-term, BOH will have very strong earnings

growth. This growth will be a one-me event caused by the Fed raising interest

rates. BOH’s return on earning assets can increase from about 1.7% to 3%. But, this

will only happen once. Aer that, BOH will grow no faster than the nominal GDP of

Hawaii. Hawaii can’t have high populaon growth in the future. It doesn’t have

enough available land. It’s simply too crowded to grow as fast as a sparsely

populated state like Texas. So, BOH will never be able to grow faster than 3% to 4%

a year. This is why Quan and I much prefer Frost over BOH. Both have great deposit

bases. Frost can grow its base quickly for a long me. BOH can’t. However, BOH can

use 80% to 90% of its earnings to buy back stock and pay dividends while sll

growing 3% to 4% a year. That doesn’t sound amazing. For example, BOH trades for

18 mes earnings right now. That’s an earnings yield of 5.6% (1/18 = 5.6%). Let’s

take 80% of that. That’s 4.5%. That’s all BOH can pay out in dividends and use for

buy backs right now. And then it can grow 3% to 4% a year. Let’s say 3%. That’s only

a 7.5% return in the stock. Is that beer than what the S&P 500 will do? Maybe. But

not a lot beer. However, there are two points to consider. One, BOH is under

earning its true potenal. Interest rates aren’t normal right now. It doesn’t maer

what BOH earns when the Fed Funds Rate is between 0% and 1%. What maers is

what BOH will earn when the Fed Funds Rate is between 3% and 4%. So, while it

looks like BOH is trading at a P/E of 18 – and it is, if interest rates stay where they

SINGULAR DILIGENCE 2

are forever – Quan and I actually think

BOH is trading at a “normalized” P/E of

just 11. So, imagine you have a stock

with a P/E of 11 paying out 80% of its

earnings in dividends and share

buybacks and growing 3% a year. That’s

not a bad stock. You’re talking about

something yielding more like 7% of

your purchase price in a combinaon of

dividends and buybacks plus growing

that yield by 3% each year. You’ve

found yourself a stock that can return

10% a year for the long-run. That’s

what BOH should look like in a normal

interest rate environment. On top of

that, BOH has an incredibly wide moat.

Banking is a predictable business.

Customers rarely ever switch banks.

And market share doesn’t change much

at all. In Hawaii, market share shis are

very small. It’s an incredibly

concentrated market. From 1994

through 2015, the same four banks –

First Hawaiian Bank, Bank of Hawaii,

American Savings Bank, and Central

Pacic Financial – have always

controlled between 90% and 92% of

the state’s deposits. As a group, their

deposit share almost never varies. In

fact, the acons of all other banks in

Hawaii really don’t maer. What

maers are just two pairs of banks. The

big two are: First Hawaiian Bank (36%

deposit share) and Bank of Hawaii

(32%). The medium two are: American

Savings Bank (12%) and Central Pacic

Financial (11%). Bank of Hawaii is very

insulated from competor acons. It is

in the banking industry which already

has sky high customer retenon – this

minimizes rivalry among rms. And

then the banking industry in Hawaii –

unlike most other states – is an

oligopoly. So, you have an oligopoly

where each of the oligopolists has a

very, very loyal customer base. Hawaii’s

populaon growth is low. So, new

branches are rarely opened in the

state. In fact, Bank of Hawaii has shrunk

its number of branches even while

increasing its amount of deposits. So,

it’s a wide moat stock. If interest rates

never rise, it’s a wide moat stock that

would be on a trajectory to return 7% a

year. If interest rates increase, it’ll then

be a wide moat stock on a trajectory to return 10% a year. And if you buy the stock

today and then hold the stock while the Fed raises interest rates – you’ll get a one-

me boost in reported earnings. Bank of Hawaii will be an acceptable but not

especially protable investment if the Fed never raises interest rates. Once the Fed

does raise rates, it’ll be a good long-term investment from that point on. And in the

medium-term – say from 2016 through 2021 – Bank of Hawaii is an excellent

speculaon on higher interest rates. The stock should provide excellent annual

returns during the 5-year period where interest rates increase at the fastest pace.

That me may be now. That part is speculave. But it adds to the stock’s appeal.

DURABILITY

Bank of Hawaii has a Perfectly Durable Compeve Posion and Low Cost of

Funding – However, its Leverage Rao and Loan Losses are Only Good, Not

Great

There are four big banks in Hawaii: First Hawaiian Bank (37% market share), Bank of

Hawaii (32%), American Savings Bank (13%), and Central Pacic Financial (11%).

The toughest test of their survival came in the 2007-2008 nancial crisis. First

Hawaiian, BOH, and American Savings Bank all did ne. Central Pacic was

essenally wiped out. Shareholders lost about 95% of their money during the crisis.

So, when tesng the durability of a Hawaiian bank we will be looking at the recent

nancial crisis. There was an earlier crisis in Hawaii – it was ed to the crash in

Japanese asset values (both land and stocks) in the late 1980s. And BOH itself had a

harder me in the late 1990s and early 2000s than it did in the nancial crisis of

2007-2008. But that was due to self-inicted wounds. BOH “di-worsied” into loans

and securies outside of Hawaii. Central Pacic’s collapse in the nancial crisis had

a similar di-worsicaon aspect to it. So, let’s start with that collapse now.

In 2007, CPF had $1.2 billion in construcon loans. That was 30% of its loan

porolio. This is a very, very high poron of a bank’s overall porolio to put in

construcon loans. Many banks make almost no construcon loans. CPF had made

the addional mistake of lending a lot of money in California instead of Hawaii. In

2007, CPF had 25% of its total loan porolio in California. Most of the loans in

California were construcon loans. In fact, a full 15% of CPF’s total loan porolio

was made up just of Californian construcon loans. Concentrang that much in

construcon is unusual. Concentrang that much in a single state is unusual. And –

probably the worst part – concentrang that much of your lending in a state where

you are not headquartered is especially unusual. In 2008 and 2009, CPF charged o

more than $600 million from a total loan porolio of only about $4 billion. Banks

are built to lose well over 10% of their total loan porolio. Bank of Hawaii is a fairly

conservave bank. It has very low cost funding. So, it is generang decent pre-loss

provision earnings right now. In a normal interest rate environment, BOH would be

earning really excellent pre-loss provision earnings. But, even BOH would start

reporng net losses if it wrote o around 4.5% of its total loans or more in a single

year. CPF charged o more like 15% of its loan porolio in just 3 years. Now, that

was one of the worst nancial crises in history. So, it is a good test of what the

worst case for a Hawaiian bank can look like. Even then, CPF’s losses were largely

the result of lending in California and lending in construcon. BOH is unlikely to do

this. Let’s take a moment to explain why.

This is what BOH’s then CEO said in 2008: “Our credit philosophy is to stay within

our market. I think to understand a lile bit about what’s important to Bank of

Hawaii and why we might approach this a lile bit dierently (it) would be good to

return just briey in history (to) 2000…the Bank of Hawaii was suering from some

prey poor nancial performance…What happened to us is when we grew beyond

our natural markets, we inevitably lost money. When we purchased loans outside

SINGULAR DILIGENCE 3

of our marketplace, we had a hard me

guring out how to make any prot for

our shareholders on that business…So

making sure we stay with proven

products, making sure we have

appropriate underwring standards

and monitoring processes are an

important part of our credit culture and

avoiding what we call mistakes of the

past.”

Bank of Hawaii is not the most

conservave bank in Hawaii. It had

higher loan loss charge-os than some

competors. However, BOH’s

residenal real estate lending – which

is a big part of the business – has fairly

conservave lending standards

compared to mainland banks. More

importantly, BOH is locally focused. The

bank’s loan porolio is 91% Hawaii, 5%

Guam, and just 3% U.S. mainland.

There is more compeon among

lenders – and more lending done by

banks with lax standards – on the

mainland than there is in Hawaii. The

Hawaiian bank oligopoly where two

banks have almost 70% of the market

and 4 banks have 90% of the market

puts less pressure on local banks to

make bad loans. This can be seen in

BOH’s mortgage lending. If we look at

the second quarter of 2007 – this is

close to the point where lending would

have been laxest during the crisis –

BOH’s residenal mortgage porolio

had a 60% loan to value rao. The

average FICO score was around 750.

BOH had solid loan to value and FICO

score standards in both its mortgage

lending and its home equity loans.

However, the home equity loan

porolio had much higher charge-os

than the mortgage porolio. We don’t

have a perfect explanaon for why this

would be. However, Hawaiian real

estate is expensive compared to the

rest of the country and also compared

to the income and spending levels of

homeowners in Hawaii. In other words,

the equity in a Hawaiian home is a

bigger potenal piggy bank for its

owner than say a similar home in

Missouri. In 2006, the market value of

the median single family home in Oahu

(which is BOH’s biggest market) was

$644,000. By the end of 2008, BOH’s average home equity loan would have been

backed by a FICO score of about 770 (which is quite good) and a loan to value rao

of about 70% (which is adequate though not excellent). The potenal for Hawaiians

to comfortably borrow anywhere from half to two-thirds of the value of a home

that is worth more than $600,000 means that Hawaiians would oen be tempted

to tap into something like $300,000 to $400,000 of purchasing power. During the

housing boom, prices were rising prey quick in most parts of the country. A 10%

increase in the value of a Hawaiian home could provide an addional borrowing

opportunity of more than $30,000 quite easily. This is what makes home equity

loans a lot more tempng when you live in a $650,000 home than when you live in

a $250,000 home. The higher the value of your home relave to the amount of

your annual income – the higher the addional borrowing potenal in a rising

housing market will be versus what you are accustomed to spending each year. This

is probably the explanaon for BOH’s problems in home equity during the crisis.

They weren’t unusual. Everyone had problems in this area.

BOH’s loan losses for the crisis were 0.24% in 2007, 0.43% in 2008, 1.43% in 2009,

0.94% in 2010, and then 0.40% in 2011. Commercial and industrial had a bad 2009-

2010. Losses in that area were 2.74% in 2009 and 2.49% in 2010. These basically

coincide – with the typical lag in loan losses to actual adverse events – with the

recession itself. BOH’s losses were exacerbated by airline loans. It also had some

construcon loan charge-os in 2009 that looked real bad – but most of those

charge-os were actually reversed in 2010 and BOH had no net losses in this area in

2011. So, the actual period 2009-2011 turned out – in retrospect – to not have

been that bad in BOH’s construcon lending. This wasn’t obvious to the bank’s

management in 2009 though. BOH charged o nearly 7% of its construcon loan

porolio in that one year. BOH’s construcon loans were never more than 4% of

the bank’s porolio. So loan losses – no maer how large – in construcon could

never threaten the bank’s overall health. The two key lending areas for BOH are

residenal mortgage and commercial and industrial lending in Hawaii. Most other

categories are too small to be relevant. And no other state is remotely relevant to

BOH’s performance.

I’ve spent almost all of this secon discussing the possibility of loan losses because

there are no other risks to BOH’s durability. The company’s securies porolio is

high quality and liquid. And the bank’s funding sources are scky, low-cost – and

frankly, among the best deposit bases in the country. BOH funds 83% of its earning

SINGULAR DILIGENCE 4

The same four banks have held more than 90% of all deposits in Hawaii

in each of the last 22 years.

assets (that’s loans plus securies) with

core deposits. The vast majority of

BOH’s $13.5 billion in total deposits

come from scky customer deposits

like savings accounts ($5.2 billion), non-

interest bearing checking ($4.3 billion),

and interest-bearing checking ($2.8

billion). Basically, checking accounts

provide $7.1 billion and savings

accounts provide $5.2 billion. That’s

$12.3 billion in what are really bank

customer (either household or

business) funds. These are scky. They

aren’t like me deposits (CDs) or

borrowings from other nancial

instuons. Total earning assets are

$14.8 billion. So, only $2.5 billion of

that is in the form of any kind of money

– CDs and other borrowings – that

could disappear during a nancial crisis.

Bank customers aren’t going to

abandon their bank even in a 2007-

2008 type situaon. BOH’s security

porolio is also liquid. About 67% of

securies mature within ve years and

97% of the porolio matures within 10

years. The annual cash ow coming o

this porolio is $1.4 billion. BOH

doesn’t need to access the market to

get more than $100 million a month

turning to cash from this porolio. The

bank is very liquid. Its deposit base is

excellent. So, the only potenal

problem is bad lending in the form of

self-inicted wounds. BOH’s own

history is a good example of what can

go wrong. The bank got itself into

trouble by 2000, despite having a

deposit base and compeve posion

in Hawaii that was very similar to what

it is today. All BOH changed from 2000

to today is its lending pracces and its

diversicaon outside of Hawaii.

Improving lending standards and

focusing completely on Hawaii is really

all it took to change a bank that was

perceived to be low quality in 2000 to

one that is perceived to be especially

high quality today.

MOAT

Except When They Make Bad Loans, All Hawaiian Banks Generate Above

Average Returns

Bank of Hawaii has a wide moat. An oligopoly of four banks – First Hawaiian, Bank

of Hawaii, American Savings Bank, and Central Pacic – control 90% of the

Hawaiian market for banking deposits. These same four banks have held between

90% and 92% of total deposits in every year for the last 22 years. So, this is a stable

monopoly. Bank of Hawaii is the second largest bank in Hawaii. However, it has the

strongest compeve posion by several measures. As menoned earlier, bank of

Hawaii funds about 83% of its earning assets with customer deposits. Most of these

deposits are scky transacon accounts. They are relaonship based accounts that

aren’t sensive to interest. About 50% of deposits are from households, 40% are

from businesses, and 10% are from governments and other instuons. More than

50% of Hawaiian households have an account with Bank of Hawaii. And almost 65%

of Hawaiian household use some sort of Bank of Hawaii product – deposit,

investment, or borrowing of some sort. Meanwhile, Bank of Hawaii’s penetraon

rate among Hawaiian businesses is even higher. More than 70% of Hawaii’s large

businesses have a banking relaonship with Bank of Hawaii. These relaonships

tend to be scky. Banks generally have retenon rates in the 80% to 90% range for

deposits. In other words, if a bank wins 100 new household depositors in 2016, it

will sll have about y of those accounts with the bank in 2021 at even a bank

that is only so-so in terms of customer retenon. At banks that are excellent at

customer retenon – like Frost in Texas – winning 100 new household depositors in

2016 will result in the bank sll having more than 50 of these accounts in 2026. It’s

not unusual for a depositor to stay with the same bank for between 5 and 10 years.

These are long-term relaonships. And compeon in Hawaii is lower than it is on

the mainland. Bank of Hawaii faces only 3 real competors. No mainland bank

competes in Hawaii anymore. Bank of America made an acquision to enter the

Hawaiian market several years ago. However, BofA failed to successfully integrate

the acquision and it closed the business down enrely within 5 years of making

the acquision. There are 3 banks – First Hawaiian, American Savings, and Central

Pacic – headquartered in Hawaii that compete with Bank of Hawaii. There are also

many credit unions. However, all 100 or so credit unions taken together have less

than 8% market share. So, they aren’t relevant to the compeve situaon.

Despite being the second largest bank in Hawaii – Bank of Hawaii has the best

compeve posion in the Hawaiian retail banking market. Bank of Hawaii has the

lowest cost of deposits of any Hawaiian bank. This is because the bank has more

basic checking and savings accounts that are used for working capital purposes for

households and businesses. These types of accounts tend to be scky. And the

customer is not usually focused on how much interest the account pays. In fact,

Bank of Hawaii tries to focus on service rather than interest rates. In general, BOH

pays the lowest rate of interest on each type of account versus its compeon.

However, BOH is the most convenient bank. BOH has the most branches and ATMs

in Hawaii. It is the ATM leader by far. BOH has 70 branches and 456 ATMs. The next

two biggest banks in Hawaii – First Hawaiian (the biggest by assets) and American

Savings have 300 ATMs and 130 ATMs respecvely. So, Bank of Hawaii has more

ATMs than its two largest competors combined. Bank of Hawaii has more ATMs

because it has exclusive relaonships with McDonalds, Costco, Safeway, and CVS

on Hawaii. Bank of Hawaii is the number one or number two bank almost

everywhere in the state. For example, there are 45 zip codes in the state of Hawaii.

In 82% of those zip codes, BOH is either the number one or number two in terms of

deposit share. Bank of Hawaii is also the largest bank in the state in terms of core

deposits. Quan and I consider the cost of core deposits – and especially household

SINGULAR DILIGENCE 5

and business checking and savings

accounts – to be the key determinant

of a bank’s funding advantage and

therefore its earning power relave to

the industry. BOH has 12% more core

deposits than First Hawaiian. It has 50%

more core deposits than the #3

(American Savings) and #4 (Central

Pacic) Hawaiian Banks combined. For

the years 2002 through 2015, we have

direct funding cost comparisons for

Bank of Hawaii, American Savings Bank,

and Central Pacic. Bank of Hawaii has

a forty basis point (0.40%) funding

advantage over Central Pacic and a

thirty-four basis point (0.34%) funding

advantage over American Savings Bank.

Even more remarkable, Bank of Hawaii

had a 0.21% lower cost of funding than

Wells Fargo from 2002 through 2015.

Wells Fargo is one of the lowest cost of

funding banks in all the United States.

These may sound like small advantages,

but if Bank of Hawaii has a 0.5%

funding cost advantage over the

average bank with more than $10

billion in assets and it leverages its

deposits 10 to 1 relave to

shareholder’s equity (as many banks

do) that is a 5% dierence in pre-tax

return on equity. Even aer taxes, that

is the dierence between a bank that

returns say 10% a year and a bank that

returns 13% a year. It’s a big dierence

caused by nothing other than a funding

cost dierence. And the numbers I just

gave you could vastly understate BOH’s

advantage in normal mes. The period

2002-2015 included many years (2008-

2015) with near zero rates. In 2007,

BOH’s funding cost advantage was

0.34% over American Savings, 0.65%

over Central Pacic, 1.06% over Wells

Fargo, and 1.39% over all banks with

more than $10 billion in assets.

BOH’s operang cost advantage is even

beer. This isn’t surprising. BOH is in

the best market – Hawaii – for

generang high amounts of deposits

per branch. And then BOH has the best

deposit base among the 4 banks that

make up Hawaii’s banking oligopoly. As

a result, BOH’s average deposits per

branch are $185 million. This is among

the highest total for any bank

anywhere in the U.S. It is probably more than 3 mes the amount a normal bank in

a normal part of the country would have. First Hawaiian has a terric operang cost

posion. In fact, First Hawaiian’s non-interest expenses relave to deposits are

oen lower than BOH’s. But American Savings and Central Pacic each have about

double the level of expenses per deposit that bank of Hawaii does. Overall, BOH

has averaged a 1% rao of net non-interest expenses to earning assets from 2005-

2015. During this same me period, most regional banks in the country had

operang expense levels in the 1.6% to 3.3% range. So, BOH has a sixty basis point

(0.6%) operang cost advantage over even some of the best run regional banks on

the mainland. Again, consider what leverage does. A rao of 10 deposit dollars for

1 equity dollar turns a 0.6% operang cost advantage into a 6% pre-tax return on

equity advantage. This would lead to more than a 4% advantage in aer-tax return

on equity. Coupled with BOH’s funding cost advantage, we are talking about a bank

that can easily earn a 17% return on equity in a year during which the average very

well run mainland regional bank earns just a 10% return on equity. BOH’s moat is

near perfect. There are no major mainland competors for Hawaiian deposits. The

last real incursion was Bank of America’s acquision of HonFed in the early 1990s.

Five years later, BofA exited the Hawaiian market. There is essenally no growth in

the Hawaiian banking industry. In fact, not only have there been no new

competors. There have also been no net new branches added by exisng

competors. Hawaii had 305 bank branches in 2000, in 2005 it was down to 285

branches, in 2010 the total was 284 branches, and today the state has just 279

branches. So, there is no threat of entry by new companies and no threat of

branches being added by exisng banks. Bank of Hawaii has perhaps the widest

moat of any U.S. bank. That is the good news. The bad news is that BOH’s

penetraon rate in the state of Hawaii is so high that it is now almost impossible for

BOH to add new customers. No Hawaiian bank has taken much market share from

its competors over the last 20-25 years. So, BOH’s moat is nearly perfect while its

opportunity for customer growth is nearly zero.

SINGULAR DILIGENCE 6

The four big Hawaiian banks often generate pre-tax returns on assets of

2% to 4% a year.

QUALITY

When Interest Rates are Normal,

Bank of Hawaii Can Generate

Returns of Equity Between 15% and

30%

Bank of Hawaii is a high-quality bank.

However, it is interest rate sensive.

With the Fed Funds Rate near zero,

Bank of Hawaii is now earning less than

it would earn in normal mes. For

example, Bank of Hawaii’s pre-tax

return on earning assets fell from 3.1%

in 2005 to just 1.7% last year. From

2004 through 2008, BOH’s pre-tax

return on assets ranged from 2.8% to

3.1%. In the 7 years since the Fed

slashed rates (2009-2015), BOH’s pre-

tax return on assets ranged from 1.7%

to 2.2%. Which is the beer gauge of

BOH’s normal earning power? Is it the

2004-2008 period where BOH

generated pre-tax return on assets of

about 3%? Or is it the 2009-2015

period during which BOH generated a

pre-tax returns on assets of about 2%

or less? Quan and I think that while the

truth may be something in between –

the 2004 to 2008 period is a much

beer approximaon of “normal” than

the 2009 to 2015 period. Why?

Let’s look at the net interest margin.

Net interest margin is the yield on a

bank’s earning assets – loans and

securies – less the interest cost of

funding those assets. So, if a bank pays

you 1% to get $100,000 of deposits

from you and then it turns around and

lends those $100,000 of deposits to a

local business at a rate of 4% a year –

the net interest margin would be 3%.

Historically, banks have made money

because they have a lower relave cost

of funding than any other

organizaons. Banks don’t need to

make loans at higher rates than other

rms do. Nor do they have to get beer

returns on their bonds than pension

funds, insurance companies, etc. make

on those investments. All banks have to

do is have a lower cost of funding than

the holders of the same assets – loans

and bonds – that they choose to own. If

we look at the U.S. banking industry

overall – it has had a net interest

margin of about 3.6% from 1996 through 2014. This is the interest margin only. It’s

not the economic margin. This is an important disncon. Because net interest

margin tends to be incredibly stable – but operang cost isn’t so stable. This means

that a bank with really low operang costs – non-interest expense less non-interest

income as a percent of total earning assets – will be squeezed during a period of

low interest rates. In fact, the best banks in the country might be at their relave

worst during a period of near zero interest costs. Bank of Hawaii is one of the best

banks in the country. But that is less obvious today – when interest rates are near

zero – than it was in the 2004-2008 period and then it will be again a few years

aer the Fed raises rates.

BOH’s net yield is mediocre. Net yield is the interest a loan pays less the charge-os

associated with those loans. So, one bank can have a higher net yield than another

bank if it has some combinaon of charging more on its loans or taking lower losses

on those loans. BOH doesn’t charge a lot for its loans. From 2002 through 2015,

BOH had a 0.53% lower gross yield than Central Pacic (the Hawaiian bank that

went under during the crisis) and 0.28% lower gross yield than American Savings

Bank. However, BOH’s net yield was somewhere between American Savings Bank

and Central Pacic. Overall, BOH has been a beer lender than Central Pacic –

which was a terrible lender that caused its own demise – and a worse lender than

American Savings Bank. American Savings Bank is quite a good lender. BOH has no

advantages as a lender over American Savings Bank. All of BOH’s advantages come

from its deposit gathering rather than from its lending.

Bank of Hawaii’s interest bearing demand deposits – so, basically household and

business checking accounts that pay interest – are very low cost sources of funding.

From 2003-2008 the rates BOH paid ranged from 0.21% to 1.01%. In general, BOH

paid rates that were 0.2 mes the Fed Funds Rate. In other words, when the Fed

Funds Rate was 1%, BOH tended to pay these depositors 0.2%. And then when the

Fed Funds Rate was 5%, BOH tended to pay these depositors 1%. Obviously, these

checking customers cared very lile about the amount of interest BOH was paying.

Other banks in the country paid more than BOH for deposits. Customers could have

moved to other banks or put their money in CDs if their goal was simply to get the

most interest on their money. This isn’t the main objecve for most BOH

customers. The customers are obviously more concerned about things like

convenient access to their money in Hawaii. Savings rates at BOH pay a higher rate

relave to the Fed Fund Rates. BOH pays about 0.5 mes the Fed Funds rate on its

savings account. This is in line with U.S. Bancorp (0.4 mes Fed Funds) and Wells

Fargo (0.54 mes Fed Funds). Finally, BOH has some me deposits (CDs) and other

SINGULAR DILIGENCE 7

Over the last 11 years, Bank of Hawaii’s pre-tax return on earning assets

has ranged from 1.7% to 3.1%.

borrowings. These generally cost a

bank about 110% of the Fed Funds

Rate. They are a very bad form of

funding. No bank can be high quality

while funding itself using a lot of me

deposits and other borrowings. BOH

uses relavely lile funding from such

sources. Overall, BOH’s weighted cost

of funding is about 0.4 mes the Fed

Funds Rate. In other words, when the

Fed Funds Rate is at 1%, BOH is paying

0.4% for its funding. When the Fed

Funds Rate is 2%, BOH is paying 0.8%.

At 3% Fed Funds, BOH would be paying

1.2%. At 4% Fed Funds, BOH would be

paying 1.6% for its funds. And at a 5%

Fed Funds, BOH would be paying 2%.

Quan and I probably consider a

“normal” Fed Funds Rate to be about

3% plus or minus 2%. In other words, a

“normal” interest rate cycle might have

a 1% Fed Funds Rate at the boom of

the bust and a 5% rate at the top of the

boom. Obviously, the Fed Funds Rate

has been lower than 1% at mes and

much, much higher than 5% at other

mes. But, when you’re looking at a

bank it makes sense to think about the

Fed Funds being maybe 2%, 3%, or 4%.

Not 0% or 6%. Not normally. We are

talking in absolute terms here. We can

switch to relave terms if that’s easier

to imagine. So, instead of saying the

Fed Funds would normally be 3% and

BOH’s cost of funding would normally

be 1.2% – we can simply ask how big

BOH’s funding cost advantage is over

other banks. That’s easy to answer.

BOH tends to have a 0.9% lower cost of

funding than other banks. When you

leverage this up at 10 mes deposits

per dollar of shareholder’s equity – you

get a 9% higher return on equity at

BOH than at other banks. This is from

funding costs alone. It does not

consider dierence in lending or in

operang costs. BOH is a mediocre

lender. It is an extraordinarily good

operator. BOH gets a full 1% relave

cost advantage over other banks in the

form of non-interest costs. Over the

last 10 years, BOH has had a 1% net

non-interest expense rao. First

Hawaiian has had a 0.91% non-interest

cost. Actually, if you look at BOH and

First Hawaiian as top er competors in Hawaii and American Savings and Central

Pacic as boom er competors – you see a paern. Together, BOH and FHB have

68% market share and 0.9% to 1% operang costs. American Savings and Central

Pacic combine for 24% market share and have 2% to 2.25% operang costs. The

biggest banks in Hawaii benet from economies of scale. Economies of scale – at

both the branch level and the corporate level – are very important in having a low

operang cost. BOH’s economies of scale at the branch level are among the very,

very best in the country. Bank of Hawaii has $185 million in deposits per branch.

The average bank on the U.S. mainland is happy to have even $60 million in

deposits per branch. In other words, BOH has 3 mes more deposits per branch

than most banks do. Most of BOH’s tremendous earning potenal comes from this

simple fact.

BOH’s actual return on equity depends on how much deposits it has relave to

equity. Deposits are relavely xed – customers decide how much to leave with

BOH. What BOH can change is the amount of equity it allows to build up without

paying out dividends to shareholders or buying back stock. BOH is not especially

conservave in this regard. Generally, BOH has used a 7% tangible equity rao. This

is equivalent to having 14 dollars in deposits – that is, $14 of customer money – for

every 1 dollar of owner money. As a result, BOH has tended to earn between 23%

and 42% in pre-tax return on equity. This translates into about a 14% to 28% aer-

tax return on equity. I think that’s a reasonable ROE to expect in the future. So, you

can assume BOH will earn about a 20% aer-tax ROE. It can do this even when the

average bank in the U.S. earns much closer to a 10% return on equity. BOH is the

best bank in Hawaii. Hawaii is the best banking market in the U.S. And the U.S. is

probably the best – or very, very close to the best – banking market in the world.

So, BOH is among the very best banks in the world. This is only in terms of

protability. BOH can easily earn a 20% ROE year aer year. It can’t easily grow.

CAPITAL ALLOCATION

Bank of Hawaii Buys Back its Own Stock and Pays a Dividend

Bank of Hawaii has a very high return on equity combined with very lile potenal

for growth. As a result, the bank chooses to pay out almost all of its earnings in

stock buybacks and dividends. From 2006 through 2015, BOH paid out 88 cents of

each dollar it earned in either share buybacks or dividends. BOH does have some

share diluon that these buybacks need to overcome. Gross diluon is about 1.1%

a year. However, net diluon – which includes the eect of share buybacks funded

through the use of proceeds from the exercise of stock opons – is more like 0.5% a

year. So, BOH’s buybacks start from a posion of needing to oset 0.5% in diluon

each year. The bank does this easily. So, it has been buying back more than 0.5% of

its shares each year for a long me. The result is a constantly declining share count.

As a result, EPS grows faster than net income. BOH has an execuve compensaon

plan that is mostly based on three metrics: 1) Return on equity, 2) Stock price-to-

book rao, and 3) The bank’s Tier 1 Capital Rao. Tier 1 Capital is basically a

leverage rao. It isn’t much dierent from using tangible shareholder’s equity as a

percent of total assets. If you think about what drives return on equity, the stock’s

price to book rao, and the er 1 capital rao – it’s really all return on assets.

Return on equity is simple to understand. Price to book for a stock tends to be

higher the higher that stock’s return on equity is. This is because the P/E rao is

oen more stable than the P/B rao. Highly leveraged and troubled stocks may

have lower P/B raos than stocks with lile leverage. And then nally you have the

er 1 capital rao. That is a measure where the higher equity is relave to assets –

the beer the measure will be. Taken together, the one driver that really improves

all 3 of these measures is having the highest possible ROA. So, I’m not sure how

dierent BOH’s compensaon plan would be if it simply used a pure ROA target.

SINGULAR DILIGENCE 8

Now, in reality, BOH’s management

may not run the bank purely to target

the highest possible compensaon for

themselves. They may not be that

raonal about their own interests. They

may rely more on rules. For example,

BOH tends to always have a rao of

about 7 cents of tangible equity for

every 1 dollar of total assets. This

seems like following a rule. And it

makes sense to do that because the

compensaon plan is somewhat

contradictory in this regard. It includes

higher Tier 1 capital as a good thing but

then it includes – at twice the weight –

a return on equity measure. ROE

benets from higher leverage. Tier 1

benets from lower leverage. But, the

compensaon plan weights ROE more

highly than Tier 1 capital. As a result,

the plan encourages rather than

discourages leverage. Yet, BOH keeps a

fairly normal rao of 7% tangible equity

to assets. In fact, I’d say 7% is the

normal rao for a regional bank like

BOH. Let’s take a second to compare

BOH’s capital levels to that of other

banks. BOH keeps its tangible equity

levels extraordinarily stable. That is

why I say that it seems the

management is just following a rule by

rote here. From 2005 to 2015, tangible

equity ranged from just 6.46% to 7.48%

of assets. The coecient of variaon

was 0.04. That’s unbelievable low

variaon in a variable you aren’t

targeng for complete stability. You

should accidentally have more wobble

in your capital levels than that. So, I

think BOH just asks itself how much

cash it has beyond the amount needed

to keep a 7% tangible equity rao at

the end of the year and then it just

earmarks the rest for dividends and

buybacks. What kind of levels do other

banks keep? Frost had a tangible equity

rao of roughly 7% from 2002-2007.

That was pre-crisis. Frost and BOH are

very, very similar in terms of funding.

They both have incredibly high deposits

per branch, very low interest costs, and

very stable pools of customer deposits.

In theory, these banks could have some

of the lowest tangible equity raos and

sll be safe as long as they used those

deposits to buy safe, short-term

securies. The liability side of their balance sheet is perfect. The risk is just on the

asset side. Prosperity – another bank in Texas – is more aggressive. It targets a

tangible equity rao between 4.5% and 7%. This is because Prosperity acquires

other banks. A 7% tangible equity rao will oen result in a Tier 1 Capital Level of

between 10% and 15%. This isn’t guaranteed. But, as a general rule, if you’re

comparing Tier 1 Capital Levels (which banks somemes menon) to the measure

Quan and I use instead (tangible equity to total assets) a 7% tangible equity rao is

like a 10% to 15% Tier 1 Capital Rao.

BOH has no capital allocaon risk related to acquisions – because it just doesn’t

make any acquisions. There aren’t any acquision targets in Hawaii. Mainland

acquisions would be a mistake. There are really only 3 other banks BOH could

acquire in a synergisc way. And there would be regulatory concerns with any of

the big 4 Hawaiian banks – which control 90% or more of the state’s banking

industry – from merging with each other.

Before the 2007 nancial crisis, BOH returned essenally 100% of earnings. Its rule

was a 40% dividend payout rao and then it would dedicate about 50% of earnings

to share buybacks. BOH really doesn’t need more than 10% of its earnings from the

year to support what lile incremental growth in deposits it experiences each year.

There is some evidence that BOH’s capital allocaon in recent years is a response to

the crisis. In other words, when Quan and I say that BOH returns like 85% or more

of its earnings each year – we’re perhaps underesmang the future situaon. BOH

used to always return 90% to a lile over 100% of earnings each year. Most banks

de-leveraged since the crisis.

One huge dierence between BOH and other banks is how much of its own stock it

buys back each year. From 2000 through 2015, BOH bought back 46% of its shares

outstanding. This is a 4% annual decline in share count. The bank can connue this

indenitely. It doesn’t me share buybacks. So, what is happening here is just that

half of all earnings are being used to buy back stock. So, assume BOH has a 40%

dividend payout rate and a 90% to 100% earnings payout rao. That means the

bank will tend to use 50% to 60% of its earnings to buy back stock each year. There

is that 0.5% drag in employee stock opons I menoned at the start of this secon.

So, the only other queson is what BOH’s P/E rao is. Let’s say the P/E rao is 15.

That’s about a 6.67% earnings yield. Let’s say half of EPS is used to buy back stock.

That’s 6.67% less drag of 0.5% equals 6.17%. Half of that translates into a 3.08% net

share reducon per year. Mathemacally, the impact on EPS growth is always

slightly greater than the rate of reducon in the shares. For example, a 1% share

reducon causes a 1.1% EPS boost (1/0.99 = 1.011 not 1.01). So, let’s just pretend a

P/E of 15 is normal for BOH and that a constant share reducon rate of around 3%

a year will cause about a 3% a year growth in EPS beyond net income. This is a bit

SINGULAR DILIGENCE 9

Over the last 16 years, Bank of Hawaii bought back 46% of its shares

outstanding.

conservave. But, it’s a reasonable

approximaon. Your return in the stock

will then be Net Income Growth +

Dividend Yield + 3%. As I write this, the

dividend yield on the stock is 2.7%. A

3% annual EPS boost from stock

buybacks from now ll forever is

reasonable. So, 2.7% + 3% equals a

5.7% return from dividends and

buybacks. So, to decide whether or not

you should buy BOH stock you would

just take your own personal hurdle rate

– what you want to get from a buy and

hold forever stock – and then subtract

5.7% and ask yourself whether BOH can

grow net income by that amount.

So, assume your hurdle rate is 8% a

year. You take 8% minus 5.7% and you

get 2.3%. Can BOH grow companywide

net income by at least 2.3% a year

forever? Yes. What if your hurdle rate

is 10% a year? You take 10% minus

5.7% and you get 4.3%. Can BOH grow

companywide net income by 4.3% a

year? This queson is easy to model.

BOH is part of a stable oligopoly.

Financial services doesn’t really shrink

as a percent of GDP. So, the queson is

whether Hawaii will have nominal GDP

growth – that’s producvity growth

plus populaon growth plus inaon –

of 4.3% a year? That sounds

reasonable. Growth of less than 3% a

year is unreasonable. Growth of more

than 6% a year is also probably

unreasonable. Growth in the 4% to 5%

a year range seems achievable even if

BOH doesn’t benet from any

economies of scale that cause net

income to grow faster than earnings.

So, if you have a hurdle rate in the 10%

to 11% a year range for a buy and hold

investment – BOH is right on that

hurdle rate. This does not address the

issue of the Fed Funds Rate. This is the

investment poron of the decision

only. There’s also a speculave

component. You might have a big one-

me gain if the Fed Funds Rate goes

from less than 1% to something more

like 3%. BOH is interest rate sensive.

We’ll discuss this more in the value

secon of the issue. But, for now – just

know that even without the benet of

a higher Fed Funds Rate, it is

reasonable to buy BOH if you want a roughly 10% a year return out of a buy and

hold forever investment. That’s about what BOH is priced to return.

VALUE

Bank of Hawaii is Fairly Priced Based on Current Earnings and Cheap Based

on Normal Earnings

Bank of Hawaii is trading at between 7 and 8 mes our esmate of normal pre-tax

earnings. However, it is trading at about 12 mes last year’s pre-tax earnings. Why

is the dierence so big? Because of the Fed Funds Rate. For example, last year –

BOH had a yield of 4% on its loans. But at a 3% Fed Funds Rate, the yield on the

loan porolio would be about 6%. Likewise, the yield on BOH’s securies porolio

would be about 4% in normal mes. It was 2.2% last year. So, it is the yield side of

the earnings picture that changes depending on the Fed Funds Rate.

There is another way to think about normal earnings. We can pick a dierent

period in me and ask how much Bank of Hawaii actually earned in those years. For

example, we know that BOH earned a 3% pre-tax return on assets (so 2% aer-tax)

during the boom years of 2004 through 2007. This 3% return was prey stable. It

was 3% exactly in 2004, 3.06% in 2005, 3.03% in 2006, and then 2.94% in 2007.

Those were the boom years though. Quan and I have assumed BOH will earn just a

2.6% pre-tax return on its earning assets in normal mes. That is a lile under $400

million in pre-tax prots. At today’s price, that works out to a stock price of about

12 mes today’s pre-tax earnings but only about 7 mes our esmate of normal

pre-tax earnings.

How is BOH priced versus peers? It is more expensive than Frost – one of the two

biggest banks in Texas. BOH also has worse growth prospects than Frost – mainly

because Hawaii has worse growth prospects than Texas. So, if you have to choose

between buying BOH or buying Frost – buy Frost. Frost is priced at about 10 mes

last year’s pre-tax prot but less than 7 mes our esmate of normal pre-tax

earnings. It’s a lile cheaper than BOH. And Frost has much, much beer growth

prospects. BOK Financial is another stock Quan and I wrote about. It is the leading

bank in Oklahoma. It also has a big presence in Texas. BOK has much beer growth

prospects than Bank of Hawaii – because unlike Bank of Hawaii, BOK is a big

acquirer. It likes to start new businesses and to enter new states. It has oen been

successful doing this. The culture at BOK Is very dierent from the culture at BOH.

And, as a result, BOK has grown deposits by 11% a year over the last 22 years, 10%

a year over the last 15 years, and 8% a year over the last 10 years. This makes BOK

a growth stock even though it is mostly in the rather slow growing – compared to

Texas – state of Oklahoma. BOK is a big energy lender. It has 19% of its loans in the

energy category. And energy loans account for 11% of total earning assets.

Obviously, there was an oil price crash recently. So, this is a concern for some

investors. Quan and I aren’t very concerned. Even if BOK wrote o half of its energy

loans – and over the previous 20 years, it wrote o something ny like 0.2% a year

or less of all loans in this category – it would only destroy about 5% of total earning

assets. That would destroy the bank’s earnings for a me. But it wouldn’t cause the

bank to fail. BOK is prey cheap. It trades for about 5 mes normal pre-tax earnings

and about 9 mes last year’s pre-tax earnings. So, BOK is a smidge cheaper than

either BOH or Frost. However, BOK is riskier. It makes more energy loans. And its

growth potenal comes from entering new product lines and making acquisions.

Commerce is a Missouri based bank. Missouri is a slow growing state. It is

comparable to Hawaii in that way. This makes Commerce a good peer for BOH and

a bad peer for Frost. Commerce’s deposit growth was just 5% a year over the last

23 years. The bank is high quality. It’s also cheap. Commerce shares are priced at

SINGULAR DILIGENCE 10

about 11 mes last year’s pre-tax prot

and only about 7 mes normal pre-tax

prot. These are all good, cheap banks

we are talking about. I think Commerce

is probably the best direct comparison

to BOH. Quan probably likes Commerce

a lile more than BOH. I probably like

BOH a bit beer than Commerce. They

are priced similarly. And they have

similar growth prospects.

UMB is another Missouri based bank. It

gets most of its deposits from Kansas

City. Kansas City is also a really big

market for Commerce. UMB grew

deposits by 6% a year over the last 25

years. Again, this is prey slow growth

for a bank. It means UMB grows at only

about the rate of nominal GDP growth.

To be fair, Missouri’s nominal GDP

might have lagged U.S. GDP by a lile

bit – so UMB certainly kept pace with

the economy of Missouri. It didn’t

shrink relave to the market it operates

in. But, UMB is not a growth stock.

Central Pacic is the most obvious peer

for BOH. Central Pacic is a publicly

traded bank stock under the cker

“CPF”. It’s the fourth largest bank in

Hawaii with 11% deposit share (so BOH

is almost 3 mes the size of CPF). Like I

said, CPF is an obvious peer. But it’s not

actually a good peer. CPF went belly up

during the nancial crisis. It

parcipated in TARP. That parcipaon

required it to grant the government 10-

year warrants to purchase a ton of

shares at less than $13 a share despite

CPF stock starng that same year

(2007) at around $40 a share. CPF

raised even more funds in a 2011

private placement. The simple way of

looking at what Quan and I classify as

CPF’s ‘going belly up’ despite the bank

never being seized by the FDIC is that

its share price declined by more than

95% from the start of 2007. Losing 95%

of your shareholder’s wealth is basically

the same thing as failing. So, CPF prey

much failed during the crisis. The stock

is quite cheap on a price to earning

assets value. That’s an important

number. And Quan and I use it a lot

when comparing one bank to itself. It’s

a lile trickier when comparing BOH to

CPF – because BOH can always earn a

lot more on each dollar of deposits than CPF can. For example, Quan and I use 1.8%

as the normal pre-tax return on earning assets for CPF and 2.6% a year for the

normal pre-tax return on assets for BOH. This means that CPF is actually priced

higher than BOH in terms of normal earnings. So, CPF is more expensive than BOH

despite being a lower quality business. CPF has an inferior compeve posion.

Frost is a beer bank than BOH. It has a lower funding cost and a slightly higher

(1.4% versus 1.1%) operang cost than BOH. But, Frost has much greater growth.

Historically, deposit growth at Frost has been in the 9% to 10% range while deposit

growth at BOH was in the 3% to 4% range. This is a huge dierence. It’s an

especially huge dierence in valuaon for these two banks because of how high

their ROE is. Growth is very, very valuable for shareholders at both BOH and Frost

because it requires so lile retenon of earnings. BOK is a good bank. But it has

risks BOH doesn’t. So, we’ll set it aside as a possible higher risk. Frost is clearly

superior to BOH. CPF is an inferior peer. Yes, CPF is another Hawaiian bank. But, it’s

a much worse bank. That leaves the two Missouri banks – UMB and Commerce – as

the best peers for BOH. Commerce and BOH have similar growth prospects and

similar returns on earning assets. Quan thinks Commerce deserves a slightly higher

valuaon than BOH. I think BOH deserves a slightly higher valuaon than

Commerce. Let’s split the dierence and say BOH and Commerce should be priced

exactly the same.

What’s the right price? Banks are higher return businesses than rms in other

industries. There’s really no reason for a bank with the kind of ROE that BOH has to

be priced below an average stock. Historically, an average stock in the U.S. was

priced at 15 mes aer-tax earnings. BOH can grow between 3% and 4% a year. It

can return at least 80% of its earnings in dividends. At a normal type P/E of around

15, BOH would have a dividend yield plus stock buyback rate of at least 5% a year.

It would also grow at least 3% a year organically. So, that’s a return of at least 8% a

year. This gure could rise to closer to 10% a year depending on the exact

esmates you make. But, 8% a year is an adequate return for a fairly valued stock.

So, 15 mes normal earnings is a good appraisal level to pick for BOH. Quan and I

think the bank’s earning power is around $400 million in normal mes. Fieen

mes aer-tax earnings is the same thing as ten mes pre-tax earnings. So, a pre-

tax earning power of about $400 million a year deserves an enterprise value of

about $4 billion for the company. Right now, the company’s market cap is around

$3 billion. So, BOH is trading at about 75% of what it should be worth in a normal

interest rate environment.

SINGULAR DILIGENCE 11

Bank of Hawaii trades for 18 times today’s after-tax profits and 10-12

times normal after-tax profits.

could be some slight economies of scale at Bank of Hawaii. So, net income growth

could be a bit higher than deposit growth. In fact, that has almost always been the

very long-term trend for big banks in the U.S. This is mainly due to increased fee

income and economies of scale at the branch level. The greater the amount of

deposits per branch, the lower the bank’s operang cost per deposit. In fact, Hawaii

has fewer branches today than it did in the past. And Bank of Hawaii has said its

branches are too big. The average branch is 4,200 square feet. Management

believes branches of just 3,000 square feet are ideal. Having more ATMs and higher

use of ATMs, mobile banking, etc. by customers can help reduce the need for

square footage and employees at the branch level. These are the two big expenses

for a bank. How many deposits do you have per square foot? How many deposits

do you have per branch employee? The more the beer. I think there are some

long-term economies of scale in this area for Bank of Hawaii specically and for the

banking industry generally. So, I don’t think net income will grow any slower than

deposits – and I think it might grow faster. For that reason, I don’t think it makes

sense to assume net income growth of any less than 4% a year at Bank of Hawaii.

Let’s look at what that means for the value of this stock. Bank of Hawaii can make a

25% aer-tax ROE in a normal year. It can even make a 15% ROE in a bad year.

Quan and I think the bank can pay out somewhere between 80% and 85% of all

earnings through a combinaon of dividends and share buybacks. Employee

compensaon in the form of stock opons creates a 0.5% a year drag on the stock.

Actual stock opons are higher than this. However, proceeds from the exercise of

opons can – and are – put back into buying the stock. So, only the net impact

maers. The net result is a 0.5% annual drag on the stock. So, what will your total

return in BOH stock be? We start from a 0.5% a year annual hole. That is what

would happen if the bank neither increased earnings nor paid stock opons or

dividends. It would shrink 0.5% a year in per share value. But I think net income will

grow 4% a year. So, we go from a 0.5% a year hole to an immediate 3.5% a year

total return. Now, the rest of your total return in Bank of Hawaii depends enrely

on the price mulple you buy the stock at. We can put this in the form of an

equaon if you want. Total return is 3.5% plus 0.8 mes earnings yield. So, 3.5% is

the constant growth rate of the company’s net income growth less stock opons as

a diluve expense. And 0.8 is the constant rate at which BOH uses earnings to pay

dividends and buyback stock. So, what maers is how much you pay per dollar of

normal earnings. Let’s say you buy BOH stock at 15 mes normal aer-tax earnings.

Can we restate that as an earnings yield? Yes. One divided by 15 equals 6.67%. And

then BOH will retain up to 20 cents of each dollar of earnings. So, you only get the

other 80 cents per dollar of EPS paid out in dividends and buybacks. That means

GROWTH

Hawaii is a Slow Growing Economy

Over the last 13 years, Bank of Hawaii

grew its deposits by 5.8% a year. This is

a decent growth rate for a bank.

However, Hawaii is not a fast growth

state. Hawaii’s GDP has grown in line

with U.S. GDP from 1997 through

today. Populaon growth has also been

close to the U.S. naonal average. The

state’s populaon is forecast to grow a

lile over 0.7% a year over the next 25

years. So, assume real GDP growth per

capita of say 0.8% to 1.2% or so –

basically, 1% a year plus or minus a bit

– and inaon of say 2% to 4% a year.

You can have a range of nominal GDP

growth rates for Hawaii starng at

about 3.5% a year (0.7% populaon

growth plus 0.8% real GDP per capita

growth plus 2% inaon). The top end

of the range would be something like

6.9% using these numbers (4% inaon

plus 1.2% real GDP per capita growth

plus 0.7% populaon growth). In other

words, nominal GDP growth is unlikely

to be less than 3% a year or more than

7% a year. Deposit growth can be a

lile higher or a lile lower than

nominal GDP growth depending on

whether nancial services is growing as

a percent of total GDP. This can depend

on things like asset values. If houses

and stocks and bonds are all expensive

– then borrowing capacity can be high

relave to income and the actual

physical output of a place. In other

words, very low interest rates can

mean very high asset prices which can

mean very high indebtedness which

can mean bigger bank balance sheets.

Bank of Hawaii’s compound annual

growth rate in deposits was 4% a year

from 1994 through 2015. I think this is

the best esmate of future growth for

the bank. A conservave esmate

would be 3% a year. It’s very unlikely

deposits will grow less than 3% a year.

BOH has not gained or lost much

market share. It has had market share

of between 31% and 33% of all deposits

in Hawaii in each year of the last 20

years. So, if Hawaii grows deposits by

4% a year – Bank of Hawaii will also

grow deposits by 4% a year. There

SINGULAR DILIGENCE 12

In the past, Bank of Hawaii grew its companywide deposits by 5% to 6%

a year.

6.67% mes 0.8 equals 5.33%. Let’s

round that o to 5.3%. And then add

that to the net income growth less

opons diluon of 3.5% a year. We get

8.8% a year in total return if you buy

BOH at 15 mes normal earnings.

That’s not the stock’s price though.

Fieen mes normal aer-tax earnings

is 10 mes pre-tax earnings. Right now,

BOH is trading at about 7 mes

“normal” pre-tax earnings. Seven mes

pre-tax earnings is about 11 mes aer

-tax earnings. And 11 mes aer-tax

earnings works out to an earnings yield

of 9.09%. So, the equaon now would

look more like 3.5% plus 0.8(9.09%). If

we mulply 9.09% by 0.8 we get 7.27%.

So, add 3.5% to 7.3%, and you get

10.8% a year. That’s a good esmate of

your total return in BOH. But only if the

Fed Funds Rate was already 3% at this

moment. It’s not. So, BOH can’t return

anything like 10.8% a year ll the Fed

Funds Rate is raised to a “normal”

level. Let’s imagine it never is. Instead

BOH stock trades for a P/E of like 18.

One divided by 18 is 5.55%. And 5.55%

mes 0.8 equals 4.44%. So, our

equaon would now be 3.5% plus 4.4%

equals 7.9%. If the Fed never raises

interest rates – you’ll make between

7% and 8% a year in BOH stock. If the

Fed starts raising interest rates

immediately – and/or if you hold BOH

stock virtually forever – then you will

make more like 10% to 11% a year. It’s

hard to imagine a long-term buy and

hold return here of less than 7% a year

no maer how low interest rates are

for how long. And it’s hard to imagine a

long-term buy and hold return of more

than 11% a year no maer how quickly

the Fed raises rates. I think you could –

speculavely, as a trade – make a lot

more than 11% a year on BOH if you

buy it today and hold it through a series

of Fed Funds increases over several

years and then sell at a higher point in

the interest rate cycle. But this is a buy

and hold newsleer. If you buy BOH

stock today, I feel prey sure you’ll

make more than 7% a year and less

than 11% a year if you hold it forever.

Returns in the 8% to 10% a year range

seem most likely. This is a wide moat

stock. It’s in an oligopoly. It is ed to

interest rates in the opposite way of most of the stocks in your porolio (unless you

own a lot of banks and insurers). So, BOH is an excellent diversier. I think it’ll

return 8% to 10% a year. And I think the S&P 500 will denitely not return as much

as 8% to 10% a year if you buy it at today’s price. So, BOH can benet your porolio

by adding higher returns and more diversicaon. If you don’t own Frost – I’d buy

that stock rst. But, I would suggest BOH as a good buy and hold forever stock for

just about any porolio.

MISJUDGMENT

Bank of Hawaii is Not an Especially Conservave Lender

Bank of Hawaii is not the most conservave lender in Hawaii. During the nancial

crisis, there were four major banks in Hawaii. Central Pacic Financial essenally

failed. It lost 95% of its market value as a stock. And it had to take TARP funds from

the government. The other three Hawaiian banks – American Savings, First

Hawaiian, and Bank of Hawaii – all survived without needing bailout money. Of

those three banks, Bank of Hawaii had the highest loan losses during the crisis.