© 2022 Deloitte Finance 01

The App Economy in Europe

A review of the mobile app market and its contribution to the

European Economy

August 2022

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

© 2022 Deloitte Finance 02

Disclaimer

This report (hereinafter "the Report") was prepared by Deloitte Finance, an entity of the Deloitte

network, at the request of ACT | The App Association (hereinafter "App Association") according to the

scope and limitations set out below.

The Report was prepared for the sole purpose of presenting an overview of mobile applications’

contribution to the European economy and estimating its economic weight, in terms of value creation

and jobs in 2021. It must not be used for any other purpose or in any other context. Deloitte Finance

accepts no liability in the event of improper use.

The Report is intended to be used exclusively by the App Association. No other party apart from the

App Association has the right to use the Report for any reason whatsoever, and Deloitte Finance

accepts no liability to any party other than the App Association with regard to the Report or its

contents.

The information contained in the Report was provided by the App Association or retrieved from other

sources clearly referenced in the relevant sections of the Report. Although this Report has been

prepared in good faith and with the greatest care, Deloitte Finance does not guarantee, expressly or

implicitly, that the information it contains is accurate or complete. In addition, the findings in the

Report are based on the information available during the writing of the Report (March 2022). The

examples featured in the report are for illustrative purposes only and do not in any way constitute a

recommendation or an endorsement by Deloitte Finance to invest in one of the markets cited or one

of the companies mentioned. Deloitte Finance accepts no liability as a result of the Report and its

contents being used, including any action or decision taken as a result of such use.

Table of

© 2022 Deloitte Finance 3 / 85

Executive Summary

1. The introduction of smartphones has reshaped the way Europeans interact in almost all areas

of personal and professional life. Apps

1

have become an essential part of the way phones, but

also connected televisions, game consoles, virtual reality headsets, or PCs, provide digital

services. Moreover, apps play a central role in the growing Internet of Things (IoT), connecting

users to devices. Focusing on the mobile channel, this report analyzes the benefits of mobile

apps, and quantifies the contribution of the mobile app sector to the European economy

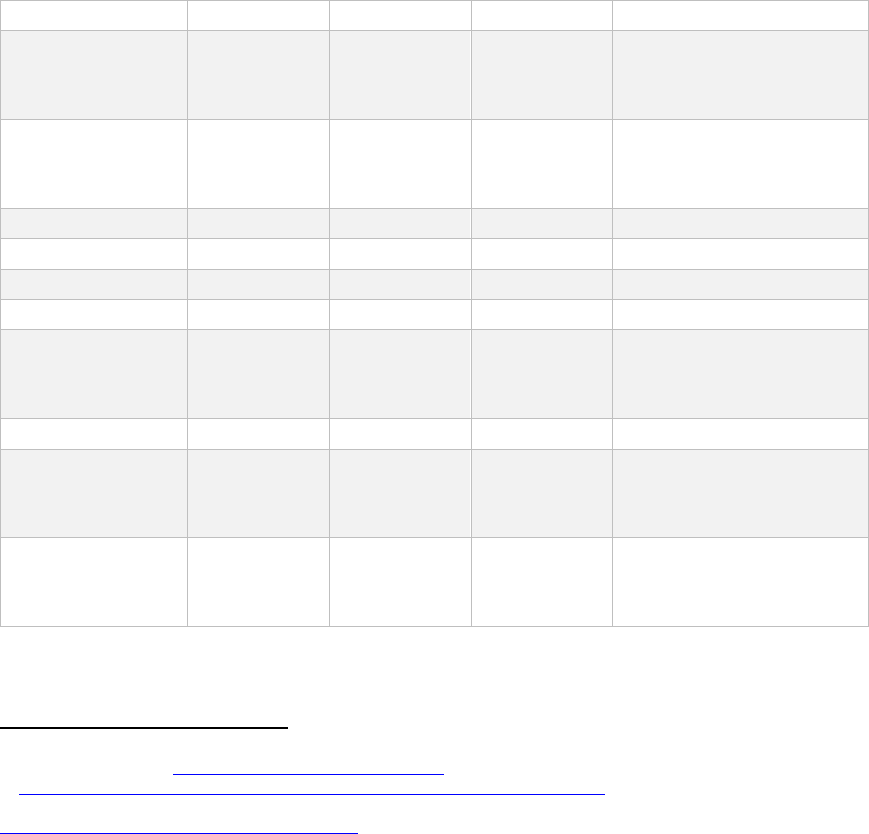

2

. Also

the impact of the Covid-19 crisis on the app economy is studied. The health crisis notably raised

awareness of how mobile apps have become an essential part of life. The report furthermore

discusses the active European landscape of small and medium-sized enterprises (SMEs) in the app

development sector.

2. Our research demonstrates that app stores have a positive impact on the mobile app ecosystem

3

:

- App stores enable disintermediation between buyers and developers which is one way

through which app stores reduce transaction costs for app developers and their users.

- App stores reduce entry barriers for developers and therefore increase the level of

competition.

- App stores increase consumer trust and security by creating a trustworthy platform for users

and developers.

3. The direct revenues of the app economy in the European Union

4

amounted to €95.7 billion in

2021 – these are revenues for mobile app developers. In comparison, box office revenues in the

EU and the UK stood at €3 billion in the same year

5

, and revenues for the provision of sporting

and recreation services were estimated at €168 billion in 2019

6

.

4. Including direct and indirect contributions, the app economy generated €210 billion in revenue

throughout all sectors of the EU’s economy. The breakdown of this sum is as follows:

• Direct contributions are estimated at €95.7 billion with the following categories:

i. Advertising revenue: €19.2 billion

ii. Paid downloads, subscriptions, and in-app purchases: €6.5 billion. Mobile games

represented 63% of this revenue.

iii. Contract work: €66.4 billion

iv. Mobile commerce: €3.6 billion is attributable to the app sector

• Indirect contributions: €114 billion in indirect contributions due to additional business and

household consumption triggered by app development.

1

Apps refer to the software applications that run on smartphones.

2

The contribution of the mobile app sector is quantified for the European Union and the UK separately.

3

App stores refer to all app platforms including Google Play store, Apple App Store, Amazon app store, etc.

4

Throughout this document, figures are cited for EU27.

5

International Union of Cinemas, Cinema-Going in Europe in 2021 - Recovering European Cinemas see 42 percent Box Office Growth in

2021, February 2022.

6

Source: Eurostat, National accounts aggregates by industry (up to NACE A*64). € 168 billion in EU27 and the UK included.

© 2022 Deloitte Finance 4 / 85

The app economy represented 0.7% of the European Union’s GDP in 2021.

5. In the United Kingdom, the direct revenues of the app economy in 2021 amounted to

€38.4 billion.

6. Including direct and indirect contributions, the app economy generated €86.5 billion in revenue

throughout all sectors of the UK’s economy:

• Direct contributions are estimated at €38.4 billion with the following categories:

i. Advertising revenue: €13.8 billion

ii. Paid downloads, subscriptions, and in-app purchases: €2.1 billion. Mobile games

represented 55% of this revenue.

iii. Contract work: €21.3 billion

iv. Mobile commerce: €1.2 billion is attributable to the app sector

v. Indirect contributions: €48 billion in indirect contributions due to additional business

and household consumption triggered by app development.

In terms of value-added, the app economy represented 1.5% of the UK’s GDP in 2021.

7. The total number of jobs generated throughout all sectors of the EU’s economy by the app sector

in 2021 is estimated at 1.4 million, and 400 000 in the UK. Jobs are calculated using our “Input-

Output” framework (total revenue for the sector combined with national accounts data). These

figures include direct jobs (software developers, mobile app specialists), indirect jobs (suppliers

to the app developers), and induced jobs (jobs created by the spending of the directly and

indirectly employed workers).

8. Europe is generally considered to benefit from highly skilled app developers and is home to a

rich ecosystem of SMEs in the app development sector. These include pure players and agencies

that work for the outsourcing market. The UK has the most app development firms in absolute

terms, but smaller countries such as Bulgaria, Poland, Romania, Estonia, Lithuania, and Croatia

show a relative specialization in app development with two to five times more SMEs in the sector

per unit GDP than the UK.

9. Nearshoring contributes to the success of app development SMEs in Europe. Notably, app

development firms in above-mentioned relatively specialized countries often work for clients in

for example Northern and Western Europe, leveraging their high-skilled, cost-competitive

developers. Cost difference between these countries and developers in Northern or Western

Europe can reach a factor of two to three. In addition, nearshoring benefits from low risk due to

proximity (language, culture, time-zone). Indeed, the remote delivery model works very well in

the app development sector, resulting in intra-European trade, benefits for both clients and

developer firms, and more opportunities for SMEs and startups throughout Europe.

© 2022 Deloitte Finance 5 / 85

10. Apps have permeated business models in several ways. Many firms integrated apps into the

way they provide services to their clients. For example, European airline and railways companies

facilitate the booking and travel process with mobile apps. Moreover, specific features of mobile

phones (geo-localization, accelerometer, camera, touch screen) have enabled the development

of new services.

11. Furthermore, pure players, companies that have built their activities only on apps, have

confirmed their importance in the ecosystem. Well-known examples are ride-hailing apps, which

use geo-localization, and mobile games. Europe counts innovative mobile game developers and

specialized firms such as Citymapper or Greenly, which are transforming consumer behavior.

12. Citymapper calculates, in real-time, the routes of urban transport for users, by combining several

modes of transport, suggesting alternative transport means to users

7

. Greenly is another app that

changes user behavior. The app informs users on the greenhouse gas emissions generated by

their mode of consumption, obtained through their banking transactions.

13. In interviews conducted for this study, several app developers stated that future innovation in

apps will not come from hardware developments but from the software side.

14. The mobile app sector has been resilient during the Covid-19 pandemic. Growth of the app

sector decoupled from the evolution of GDP in the EU and the UK. While real GDP in the EU

decreased in 2020 by 7.8%, and by 11.5% in the UK, the mobile app sector has seen an

acceleration in its growth trajectory in 2020: In the EU, real growth of consumer spending on apps

was 30% in 2020, and in Great Britain 29%. Comparison of pre-Covid-19 market estimates and

2021 growth of app store revenue suggests that the long-term growth trajectory is unaffected.

15. This resilience is related to the fact that the use of apps such as mobile games was not impaired

by physical distancing requirements. Furthermore, mobile apps have provided innovative

solutions to deal with the crisis. They contributed to the continuity of public services, social and

business activities during lockdown periods. Teleworking apps allowed desk-type jobs in mainly

the service sector mainly to pursue activities. In the health sector, Covid-19 tracking-, vaccination-

and testing-apps became the most downloaded medical apps in Europe in 2021. Apps for

teleconsultation facilitated the provision of health services. Finally, the use of food delivery apps,

such as Uber Eats or Deliveroo, increased dramatically during periods with strong physical

distancing requirements, allowing restaurants to continue to operate.

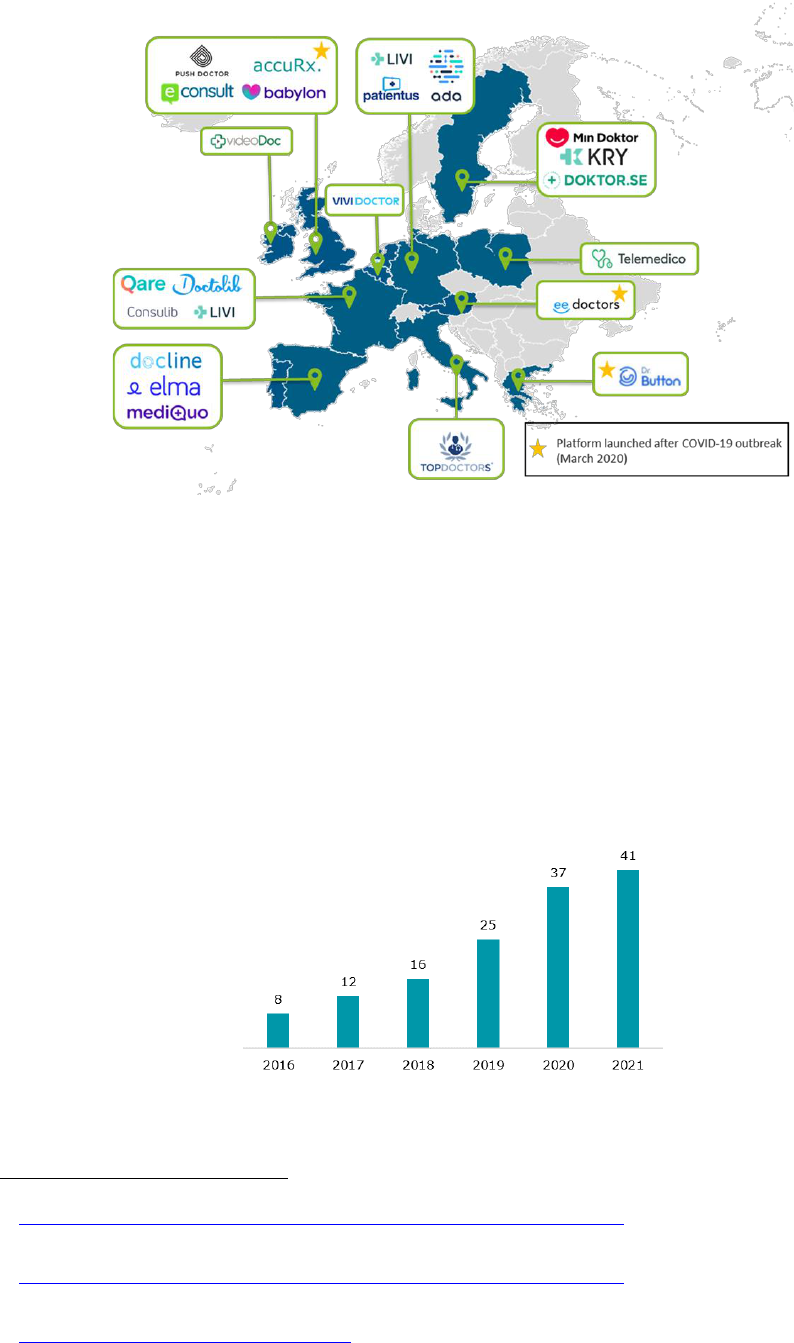

16. The pandemic has accelerated the digital transition in many sectors. Trends initiated during the

Covid-19 pandemic are set to become permanent, as the crisis has shaped new ways of life. For

example, the increased use of telemedicine changed the publics’ view on this practice: for

example, in France between 2019 and 2020, the proportion of patients that had a positive opinion

on telemedicine grew from 60% to 73%, and that of health professionals from 70% to 84%

8

. Along

the same lines, teleworking was first used to adapt to the crisis, but its massive adoption during

lockdowns has changed Europeans’ perception on work and workplace organization.

17. App developers shared how they think their solutions will continue to permeate more areas of

our lives. Areas where the use of mobile apps will further increase in Europe are hybrid events,

education, and healthcare (online health records, connected medical devices, etc.). In addition,

5G networks now enable higher connection density which allows the use of many connected

7

These include public transport networks, taxi and self-service rental networks (scooters and bikes).

8

Odoxa pour l’Agence du Numérique en Santé, Baromètre Vague 1 et 3

© 2022 Deloitte Finance 6 / 85

devices in the Internet of Things (IoT). The higher speed and lower latency of 5G will allow

developers to create richer user experiences, further increasing apps usage. The value created

by mobile apps in the European economy is expected to grow significantly in the years to come.

Accelerated by the Covid-19 crisis, the digital way and the use of mobile apps have become

more and more widespread. Apps will continue to introduce major innovations that will shape

the future of European consumers and firms.

© 2022 Deloitte Finance 7 / 85

Table of Contents

The App Economy in Europe .................................................................................. 1

Executive Summary ................................................................................................. 3

1 Mobile app platforms and the “economy of platforms” ............................. 8

1.1 Mobile app markets are typified by a specific market structure ............................ 8

1.2 The positive effects of app stores ......................................................................... 13

1.3 App stores have an impact beyond the platforms' direct users ........................... 19

2 The economic weight of the mobile app market in the EU and in the UK 22

2.1 Presentation of the mobile app market in the European Union and the UK ........ 22

2.2 The app-ecosystem stimulates growth and increases consumer well-being ....... 25

2.3 The value created by the app economy in Europe ................................................ 30

2.4 The app economy and job creation in Europe ...................................................... 37

2.5 SMEs in the app economy ..................................................................................... 40

2.6 Impact of the Covid-19 pandemic on the app economy ....................................... 46

3 Mobile apps will shape the economy of tomorrow ................................... 48

3.1 Success stories of firms that integrated apps into their business model ............. 48

3.2 Pure Players ........................................................................................................... 54

3.3 Seizing mobile apps’ potential: technologies and companies of tomorrow ......... 60

3.4 What the Covid-19 crisis reveals about the mobile app sector ............................ 65

Conclusion ............................................................................................................. 76

4 Appendices ................................................................................................. 79

4.1 Methodology to determine the size of the smartphone-only population ............ 79

4.2 M-commerce revenue ........................................................................................... 80

4.3 The Covid-19 Stringency Index .............................................................................. 81

5 Bibliography................................................................................................ 82

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

© 2022 Deloitte Finance 08

1 Mobile app platforms and the “economy of

platforms”

1.1 Mobile app markets are typified by a specific market structure

1.1.1 A presentation of app platforms

18. Mobile apps and app stores were originally introduced by Apple with the launch of the first iPhone

in 2007. Since then, the phenomenal growth observed in this market has been fueled by the entry

of several innovative competitors in mobile devices and app store markets. Competitors in the

mobile device market include HTC, Huawei, LG and Samsung. The main competitor of Apple’s app

store is Google Play

9

.

19. Moreover, the range of app platform actors is wider than Apple Store and Google Play.

Different types of platforms co-exist. Native app stores belong to the major mobile OS

developers, most notably iOS, Android and Windows. Third-party app stores involve

manufacturer-specific app stores, including Samsung, LG, Motorola and Lenovo, but also carrier-

specific app stores, such as Vodafone, T-mobile and TIM store.

20. Depending on the service provided by the app, apps not only run on smartphones, but may also

run on other types of devices, such as connected televisions, game consoles, virtual reality

headsets, or PCs. This report focuses on the mobile channel.

21. Developments in mobile devices and app store markets significantly increase the capabilities of

mobile devices and the utility they provide to users.

“From a battle of devices to a war of ecosystems”

10

S. Elop, former Executive Vice President of Microsoft’s Devices and Services

22. Hence, in the mobile communication industry, the role of apps and app platforms is key.

According to the former CEO of Nokia, this market is turning from “a battle of devices to a war of

ecosystems”. Indeed, based on the theory of network externalities

11

, the development of app

ecosystems and apps has been crucial to the business strategy of leading mobile operating system

providers. Network externalities imply that attracting developers in an app ecosystem will lead

to a large number of available apps, which will attract a large number of users and underpin

device sales

12

.

9

Néstor Duch-Brown (2017).

10

Stephen Elop, former Executive Vice President of Microsoft’s Devices and Services and former CEO of Nokia Corporation, speech at D9,

June 1, 2011.

11

Hyrynsalmi, Suominen and Mäntymäki (2016), Katz, Shapiro (1985).

12

Holzer, Ondrus (2011).

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

9 / 85

© Deloitte Finance

23. As of Q1 2021, about 3 482 452 apps were available on Google Play, and 2 226 823 on the Apple

App Store (Figure 1). App stores host a large number of apps, and the number of apps

downloaded from app stores is increasing significantly (Figure 2).

Figure 1. Number of apps available in leading app stores as of 1

st

quarter 2021, worldwide

Source: Statista, Number of apps available in leading app stores as of 1st quarter 2021. Windows Store figure is for March 2016, which is the latest

available figure

Figure 2. Number of mobile app downloads worldwide from 2016 to 2021 (billions)

App Annie Intelligence (January 2022). Note: iOS App Store, Google Play and third-party Android stores combined. Downloads are first time

downloads only

24. The use of smartphones is also linked to the interest of consumers in apps and the utility they

derive from this market. The number of smartphone users worldwide has increased from 2.5 to

3.6 billion between 2016-2020 and is expected to reach 4.6 billion in 2024 (Figure 3). This

represents a Compound Annual Growth Rate (CAGR) of 6.1 % over the period 2019-2024

13

.

13

Global Mobile Market Report (Free version, 2021), Newzoo.

3 482 452

2 226 823

669 000

460 619

Windows Store*Google Play Amazon AppstoreApple App Store

141

192

204

218

230

20212016 2018 2019 2020

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

10 / 85

© Deloitte Finance

Figure 3. Number of smartphone users worldwide from 2016 to 2024 (billions)

Global Mobile Market Report (Free version, 2021), Newzoo . * are forecasts

25. This increase in smartphone usage has been accompanied by an increase in consumer spending

on mobile apps from USD 57.7 billion in 2016 to USD 170 billion in 2021 (Figure 4). This represents

a CAGR of 24.1%. Moreover, worldwide mobile app consumer spending is expected to grow on

Apple App Store (from USD 72 billion in 2020 to USD 185 billion in 2025) and on Google Play Store

(from USD 39 billion to USD 85 billion) (Figure 5).

Figure 4. Worldwide consumer expenditure on mobile apps from 2016 to 2021 (billion U.S.

dollars)

App Annie Intelligence (January 2022)

2018 2023*2016 2022*2017 2019 2020 2021* 2024*

2.5

2.7

2.9

3.4

3.6

3.8

4.1

4.3

4.6

6.1%

20202016

82.1

143.0

2017 20192018 2021

57.7

101.0

120.0

170.0

24.1%

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

11 / 85

© Deloitte Finance

Figure 5. Mobile app consumer spending worldwide from 2020 to 2025, by store (billion U.S.

dollars)

Sensor Tower (February 2021)* are forecasts

1.1.2 App stores are “multi-sided markets”

26. In the information and communication technology (ICT) sector, app stores have a central position

in the provision of digital services by connecting app buyers and sellers. Economic literature uses

the concept of "multi-sided market" to define this type of market. Two-sided markets are

characterized by the presence of (cross-side) network effects: the utility which users on one side

of the market derive from their participation in the platform depends on the number of

participants on the other side of the market.

27. The mobile app market is a “multi-sided market”, bringing together app developers on one side

of the market and mobile phone (smartphone) users on the other side

14

. This specific market

structure benefits both users and developers:

• For mobile app developers: app stores represent an efficient distribution channel. More

generally speaking, the rise of the internet has reduced distribution costs and has made it

easier to serve niche markets, also coined as reaching the “long tail” of the market. App stores

further reduce these costs by making it easier for developers to access a wide potential market

with limited marketing and advertising expenditure.

• For mobile app users: thanks to platforms, end users have a one-stop-shop with access to a

host of apps. A multitude of websites would make searching and choosing apps more time-

consuming for users. The cost-reduction in reaching end-users yields greater competition and

reduced prices.

14

Hyrynsalmi, Suominen & Mäntymäki (2016), Rochet, Tirole (2003), Armstrong (2006).

72

92

112

134

159

185

39

50

58

67

76

85

2024*2020 2023*2021* 2022* 2025*

App Store

Google Play

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

12 / 85

© Deloitte Finance

Figure 6. Illustration of the mobile app market

Deloitte Economic Advisory

Smartphone manufacturers

(innovation and sales)

Mobile app

developers

Consumers

App Stores

Demand of mobile applications

Supply of mobile applications

New distribution channel

Access to mobile applications

Access to market

Indirect

network

effects

Indirect

network

effects

Cross-side

network effects

Provision of mobile applications

Recommendations and payments

Important brands

(notoriety)

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

13 / 85

© Deloitte Finance

1.2 The positive effects of app stores

28. Economists studied specificities of the mobile app market

15

and analyzed benefits introduced

both on the supply side and the demand side. The positive effects of app stores for developers

and users are presented in the following sections.

1.2.1 App platforms generate benefits for app developers

App platforms benefit developers by being the main intermediary between apps and users

29. App platforms are accessible to all users. Users mainly install apps via an app platform. Even

though users have the possibility to download an app directly from the developers’ website or by

jailbreaking their phone, it requires technical knowledge and might be risky.

16

App stores create trust capital for developers

30. App stores create a relationship of trust between users and developers, stimulating the demand

for app development. Indeed, the success of developers depends on creating and maintaining

trust of users, and app stores are a cornerstone in establishing trust between users and

developers. App stores draw up contracts with each developer and verify all new app updates

before they are released. This is beneficial to users due to the approval process behind the

submission of each app. Consumer recognition for Apple or Google reflects the trust they place

in their respective app stores

17

.

App stores reduce transaction costs for developers

31. The economic literature suggests that app stores reduce transaction costs

18

for developers. App

stores provide a variety of ready-to-use services for developers such as:

▪ ubiquity in user interface/user experience features,

▪ a secure platform to promote their products,

▪ storage systems for hosting apps and managing downloads,

▪ a billing service,

▪ a payment management system (micropayments) which makes it easy for

mobile app developers to recover sales revenue.

32. Each developer avoids having to create and manage these services when using a centralized

platform. Marketing and operational costs are therefore lower.

33. App stores provide their services to app developers through a standardized contract. The

harmonized legal framework effectively reduces information asymmetry between the different

developers. This has the effect of reducing transaction costs by reducing negotiation costs (i.e.,

15

Heitkoetter et al. (2012), Holzer et al. (2011), Parker and Van Alsyne (2000), Rochet and Tirole (2006).

16

Kramer, J and Zierke, O (2019).

17

Cuadrado et al. (2012), Hyrynsalmi et al. (2014), Yun et al. (2017), Lee et al. (2014), Roma et al. (2012).

18

Transaction costs were defined by the economist Ronald Coase "When one wants to carry out a market transaction, it is necessary to

discover who it is that one wishes to deal with, to give them certain necessary information and set the conditions of the contract, to conduct

negotiations that result in a bargain, to draw up the contract, to put in place control structures to make sure that the terms of the contract

are being observed by both parties, etc.".

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

14 / 85

© Deloitte Finance

this framework prevents a proliferation of contracts)

19

. In addition, standardized contracts also

assure that larger developers do not negotiate better terms than smaller developers.

34. App stores provide ready to use interfaces for integrating advertisements into apps, thereby

reducing research and transaction costs for developers

20

. Advertising departments of app stores

are used by developers who wish to display advertisements on their app. This service combines

several tasks – such as technology management and payments – together into one interface,

reduces marketing effort and transaction costs for app developers. Without this service,

developers would be forced to find an agency themselves, contract with them and manage

payments.

35. A whole range of tasks required to market a mobile app is thus managed by app stores. All these

services contribute to reducing time to market for developers

21

.

App stores facilitate entrance to markets

36. App stores facilitate developers’ – and especially small business developers’ – entrance into

markets

22

. The platforms effectively enable fast and inexpensive access to smartphone users

around the world. Low barriers to entry mean that even the smallest businesses have access to

3.5 billion smartphone users globally

23

. Facilitating market entrance of small innovative

companies increases the sustainability of this dynamic ecosystem.

App stores reduce apps’ production costs

37. Mobile platforms benefit from economies of scale and efficiency gains. App stores can spread

costs across a large customer base, thereby lowering costs for all listed developers

24

.

38. Moreover, app platform’s developer membership, in addition to giving developers the possibility

to distribute their apps worldwide, provides access to high-quality programming tools

25

such as

tools to realize in-app purchases and subscriptions and, in the case of Apple’s app store, ARKit

and Core ML which provide augmented reality and machine learning services. This reduces the

need for developers to invest in software programming tools and, therefore, brings down the

cost of developing mobile apps.

App stores enable developers to choose their payment modalities

39. App stores offer developers freedom in their business models. Developers are free to choose

how their apps are remunerated. Today there are seven leading business models: distribution

channel, paid download, in-app purchase, subscription, in-app advertising, freemium and

paidmium

26

. They are explained in Table 1

27

.

40. Apps do not necessarily have a single business model: they have the possibility to generate

revenues via several channels, offering options to the user. These business models are called

19

Amit and Zott (2001).

20

ITU (2016).

21

Cuadrado et al. (2012).

22

Roma et al. (2012), Pon (2015), OECD (2013), Ershov (2018).

23

https://www.statista.com/statistics/330695/number-of-smartphone-users-worldwide/

24

Rob Frieden (2017).

25

Cuadrado et al. (2012).

26

A Freeemium app is downloaded for free on app stores, but users do not have access to all the features: they are encouraged to pay or

subscribe for advanced features. Paidmium apps are apps for which users pay the downloads and can also make purchases in the app.

27

Tang (2016).

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

15 / 85

© Deloitte Finance

hybrid monetization. The number of apps using hybrid monetization has increased by more than

50% between 2017 and 2018

28

.

41. The paidmium model is an example of a hybrid business model, in which users have access to

differentiated services depending on the app-features they choose. Users first pay to access

common features and are offered the possibility to pay for additional features.

42. Other forms of hybrid monetization exist beyond the paidmium model. A growing number of

developers

20

are finding that ads can co-exist with other sources of revenue, such as in-app

purchases or subscriptions. Some apps, for example, offer a free version on which they display

advertisements. The consumer can choose to pay for a free-of-ads premium version. The revenue

stream is determined by the user’s willingness to pay.

43. Hybrid monetization is frequent in mobile games. Most players are not willing to pay for games,

so advertising has become the most popular way of monetizing these apps. However, to capture

revenues from users that are willing to pay, many games also include in-app purchase items.

Another possibility for developers is to display in-app purchase announcements: this is a way to

convert some players into paying users

29

.

44. Reader-apps allow users to read various digital content within apps: videos, music, documents,

books, including digital content purchased outside the app. For instance, Youtube, Netflix, Spotify,

Kindle, and Audible are reader-apps. Reader-apps often use hybrid monetization: users have the

choice between a free version, with ads and/or limited features, and a paid version. For example,

Spotify is either free with ads after every 6 songs, or users can subscribe and pay for a premium

version without ads on which they also benefit from exclusive features

30

.

Multi-homing is an available option for all app developers

45. The presence of several coexisting app stores allows multi-homing for developers. When Multi-

homing a developer publishes its product on several platforms. Even though multi-homing is not

used by all developers, exclusive contracts between an app and an app store are very rare

31

.

Multi-homing is an option available to all developers and give them access to each user.

46. Multi-homing is very common for the most attractive apps

32

. The largest app developers and

companies – such as banks or airline companies – that wish to interact with their clients usually

contract with several app stores to publish their apps. Moreover, when an app initially published

on one app store meets great success, it is often developed for the other app stores

33

.

28

https://admob.google.com/home/resources/monetize-mobile-game-with-ads/

29

https://static.googleusercontent.com/media/www.google.com/en//admob/pdf/admob-mobirix.pdf

30

Including offline listening, higher quality audio streams, unlimited playlists

31

Sami Hyrynsalmi, Arho Suominen & Matti Mäntymäki (2016)

32

Bresnahan, Timothy F. et al. (2014)

33

Lévêque, François (2016)

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

16 / 85

© Deloitte Finance

Table 1. Different business models available to mobile app developers

Business model

How it works

Examples of mobile apps

Single business models

Distribution channel

(Sale of goods and services)

Goods purchased in the mobile app are

sent directly to users. Apps make the

shopping experience frictionless and

enable provision of new services.

Amazon

eBay

Uber/Lyft

grubHub

Paid downloads

(Paid)

Payment is made at the moment the

app is downloaded (with access to all

the app features).

Grand Theft Auto – San Andreas

FaceTune

Terraria

In-app purchase

Apps are offered free of charge. Users

can pay for additional services or add-

ons in the app (this business model is

found mainly on gaming applications.)

CandyCrush

Clash of Clans

Brawl Stars

Subscription

The user must pay a monthly

subscription to be able to use the app.

Netflix

Coyotte

In-app Advertising

Installing and using the app is free. It

displays advertising banners or video

clips when it is used.

Rolly Vortex

Helix Jump

Waze

Freemium

(derivative of in-app purchase)

The app is downloaded for free on app

stores, but users do not have access to

all the features. They are encouraged

to pay or subscribe for advanced

features.

Monster Strike

TomTom

Shazam

Hybrid business models

Paidmium

(derivative of in-app purchase)

Users must pay to download the app.

They can also make purchases in the

app (add-ons, etc.).

Minecraft - Pocket Edition

Minecraft - Story Mode

Ghost Blows Out the Light 3D

Other hybrid business models

Revenues are generated via a mix of

business models, depending on the

users’ choice. Reader apps and games

often use hybrid business models.

Spotify and Youtube: combination of

in-app advertising and subscription

34

Duolinguo: combination of in-app

advertising, in-app purchase and

subscriptions

35

Candy Crush: combination of in-app

advertising and in-app purchase

36

Deloitte analysis

34

Users either have access to a free version with ads or they can subscribe for an ad-free version with more features

35

Users have access to a free version with ads, on which they can buy additional services. Users can also subscribe to an ad-free version

with unlimited services.

36

Users can play for free, with ads being displayed. Players can also make some in-app purchase.

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

17 / 85

© Deloitte Finance

1.2.2 Economic theory highlights various benefits introduced by app platforms for consumers

App stores reduce transaction and research costs

47. Platforms reduce the cost and time spent by users to search for an application

37

. The possibility

for users to quickly discover new services and apps is a significant advantage offered by platforms.

Using an app store is straightforward as users do not need any technical knowledge to install and

use available apps.

48. App stores offer users a single platform where they can download any app compatible with

their smartphone’s operating system. This phenomenon of "one-stop shopping" reduces

research and transaction costs. App stores offer users a single and secure interface for all their

purchases on the platform.

49. To facilitate the discovery of new apps, app platforms offer an editor-curated section to

promote new high-quality apps. The spotlight helps increase sales for the featured products. In

addition, these editor’s picks have spillover effects and stimulate sales of apps from the same

developer and of the same app on other platforms

38

. In addition, there is a weak spillover effect

for the same type of apps (similar functionality but different developer).

App stores promote a variety of innovative, high quality mobile apps

50. App stores produce strong network effects conducive to the development of a rich and dynamic

ecosystem of developers and apps

39

. The distinguishing feature of cross-side network effects

relies on the fact that the utility of an agent on one side of the market depends on the number of

participants on the other side of the market.

51. The large number of apps available on app stores pushes developers to constantly innovate to

attract new users

40

. As the pace of innovation and new developments is high, developers must

be able to offer apps that meet new user expectations

41

.

52. Platforms have made innovative services available to users. Without platforms, several services

would not exist. Uber, Tinder, TooGoodToGo and other apps that use geolocation would not exist

without the development of mobile app platforms. These services require a geolocation system

to operate and need to instantly reach a critical mass of users. App stores, with 3 billion users,

offer developers means to create these new services.

53. The fact that app stores enable app ratings has a positive impact on consumers. The economic

literature about the reputation effect demonstrates that there is a correlation between the

viability of apps and their scores on app stores

42

. This system has the advantage of rewarding

apps that better meet the expectations of end users and intensifies competition among

developers. An app rated as "excellent" by its users is more likely to survive on the market than

an app with a low rating.

37

Ershov (2018), Cachon et al. (2008).

38

Zhan et al. (2017).

39

Cuadrado et al. (2012).

40

Cuadrado et al. (2012).

41

McIlroy et al. (2016).

42

Lee et al. (2014).

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

18 / 85

© Deloitte Finance

App stores also have a positive impact through the way apps are ranked

54. Promoting high-quality apps is in the interest of app stores. Major app stores include quality and

performance metrics in their ranking algorithm. Experience has shown that people use high-

quality apps more and uninstall them less

43

. Promoting apps based on their quality and value to

users is in the interest of app platforms. In fact, app stores are partially remunerated by sharing

the revenue generated by app developers through their platform.

55. Kramer and Zierke (2019) analyzed the impact of app stores’ ranking mechanism using a game-

theoretic model

44

. In their model, app stores can rank apps according to their quality (a quality-

based ranking) or according to their financial contribution (sponsored ranking). The study reveals

that quality-based ranking has a high impact on app quality and consumer surplus if app stores

accurately assess app quality

45

. Indeed, under a quality-based ranking, app developers will be

more likely to invest in app quality to appear higher in the search results. This result is conditioned

by the ability of app stores to accurately assess the quality of apps. The result underlines the

importance of the review process of apps, the search algorithm, and the editorial choice.

App stores benefit users in terms of security

56. The consistent approval process behind the submission of each app benefits users. The apps

downloaded by users thus present higher functionalities and present less risks to their device.

The brand recognition the public has for the Apple or Google app stores reflects the trust that

users place in their respective app stores

46

. For example, the Apple store’s review process

included since the early days a manual review of apps and put emphasis on protecting the total

user experience, such as making sure users do not accidently perform in-app purchases and are

informed about the use of data. The two major app platforms conduct today an approval process

that consists of an automatic, algorithmic part and possibly a manual part

47

. A manual review is

conducted for certain types of apps, such as in the case of apps for children

48

.

57. Moreover, app stores also moderate reviews and inappropriate content. This is an important

role as consumers are confident that negative reviews will not be deleted by the app developer,

while preventing inappropriate content from being published.

43

Ahn, A. (2017).

44

Kramer, J and Zierke, O (2019).

45

The conclusions are based on certain hypothesis on the behaviors of the consumer, developer and app platform: in the model, the app

store and the developer maximize profit and the consumer prefers to use high-quality apps.

46

Cuadrado et al. (2012), Hyrynsalmi et al. (2014), Yun et al. (2017), Lee et al. (2014), Roma et al. (2012).

47

Up till 2015, the Google Play review process of apps was entirely automatic.

48

https://www.cnbc.com/2019/06/21/how-apples-app-review-process-for-the-app-store-works.html

https://yalantis.com/blog/apple-app-store-and-google-play-store/ https://www.androidpolice.com/2020/03/16/google-play-store-app-

reviews-will-take-7-days-or-longer/.

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

19 / 85

© Deloitte Finance

1.3 App stores have an impact beyond the platforms' direct users

1.3.1 App stores generate indirect network effects

58. App stores have a positive impact on smartphone manufacturers. By increasing the number and

the quality of apps available to users, the utility of the smartphone increases for users. This higher

utility, in turn, increases smartphone sales

49

.

59. Mobile app performance increases rapidly with the addition of new features

50

. Smartphone

manufacturers, therefore, follow this trend by investing in research and development to offer

their customers more efficient smartphones. Mobile apps thus encourage smartphone

manufacturers to innovate

51

.

60. Indeed, as highlighted in Figure 7, platform developers, content providers, third-party app

developers and software developers provide content and services directly linked to the mobile

devices market. Innovations of smartphone manufacturers − triggered by mobile app

performance − require electronic manufacturing services, original equipment manufacturers

and original design manufacturers, as well as suppliers of raw materials and components such

as metals, plastics and chips.

61. The strong relationship between the mobile industry, app stores and apps, has been a

cornerstone of the business strategy of leading mobile operating system providers when

developing their own ecosystems. This strategy is based on the theory of network externalities

52

.

The multitude of quality apps will attract users, which will drive device sales, and leads to a

virtuous circle

53

.

62. Although a significant percentage of mobile apps do not generate revenue directly, they provide

an additional distribution channel and can give existing services a broader customer base. For

example, when the mobile eBay app was launched in 2009, more than $600 million in sales were

made through the mobile application

54

. More recently, start-ups have created business models

based on consumer-to-consumer sales via mobile apps. OfferUp, which was founded in 2011, is

now the largest peer-to-peer commerce marketplace

55

. The mobile market has expanded to allow

new innovative business models that are mainly based on sales and activity via apps.

49

Holzer et al. (2011).

50

According to a study by SensorTower, the size of mobile apps has continued to increase in recent years. Over the period 2013-2017, the

size of the 10 most used applications on iPhones (Facebook, Uber, Gmail, Snapchat, Spotify, Messenger, Google Maps, YouTube, Instagram

and Netflix) increased by 1,000% https://sensortower.com/blog/ios-app-size-growth.

51

Cuadrado et al. (2012).

52

Sami Hyrynsalmi, Arho Suominen and Matti Mäntymäki (2016), Katz, M.L., Shapiro, C., (1985).

53

Holzer, A., Ondrus, J., (2011).

54

eBay Inc. Annual Report 2009. http://files.shareholder.com/downloads/ebay/923940436x0x361552/b45137ee-aa41-4c2c-94ca-

d72d5b0844be/eBay_77655_BANNERLESS.pdf.

55

Friedmann, Z., Meet Two Young Entrepreneurs Who Raised $221 Million To Disrupt Craigslist, Forbes, 2017.

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

20 / 85

© Deloitte Finance

Figure 7. Main suppliers of mobile phone groups

Xerfi Global, 2019

1.3.2 The platforms have been proactive in addressing several challenges such as personal

information or payment

63. Mobile platforms manage users' and developers’ personal information. They also manage

financial transactions like payment for apps, in-app purchases, or payment of revenue to

developers. The fact that sensitive information is increasingly digitized and stored on the cloud

naturally raises concerns about inappropriate use or exposure to unauthorized entities. To

prevent this risk, app stores invest heavily in cyber security

56

.

64. Moreover, the centralization of personal data on online platforms could pose a problem for the

pricing of applications. Since platforms have access to the complete purchase history or users,

they could have a precise idea about users’ willingness to pay and therefore offer services at the

highest possible price. This fear is unfounded to the extent that app stores do not set the prices

of apps, this decision being the sole prerogative of developers

57

. Since developers do not have

access to other consumer app purchases, they cannot leverage that information for pricing

decisions.

56

“Cybersecurity has been a part of Apple’s DNA for a long time, and embedded into all of its products” Steve Morgan, Founder and Editor-

in-Chief of Cybersecurity Ventures (Cybersecurity Q1 2018: Trends and takeaways https://investingnews.com/daily/tech-

investing/cybersecurity-investing/cybersecurity-update-q1-2018-review/.

57

OECD (2013).

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

21 / 85

© Deloitte Finance

Figure 8. Benefits generated by app stores

Source: Deloitte analysis

➢ New perspective

➢ New services

➢ Dynamic ecosystem

➢ Variety and innovation

➢ Create trust

➢ Reduce research costs and transaction costs

➢ Simplicity

➢ Compatibility

➢ Promote brand recognition

➢ New communication channel

➢ Gain customer loyalty

➢ Foster innovation among smartphone manufacturers

➢ Increase sales of smartphones

➢ Quality signaling

➢ Profit increase

➢ Encourage market entry

➢ Freedom in terms of business models

➢ Reduce costs of:

➢ transaction,

➢ marketing,

➢ development, research, and negotiation

➢ Create trust

Indirect

Beneficiaries

(e.g. smartphone

manufacturers,

etc.)

Developers

Users

App

stores

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

22 / 85

© Deloitte Finance

2 The economic weight of the mobile app

market in the European Union and in the UK

65. This section quantifies the mobile app market in the EU and in the UK. We start with user statistics

that characterize the increasingly important role of the app-ecosystem in daily life (section 2.1).

Section 2.2 discusses how the app-ecosystem enhances consumer well-being and contributes to

growth. Figures on revenue and jobs generated by the app economy are presented in the

following two sections (2.3 and 2.4), and section 0 discusses the rich landscape of SMEs in the

sector throughout Europe. Finally, we discuss the impact of the Covid-19 crisis on the app sector

(0).

2.1 Presentation of the mobile app market in the European Union and the UK

2.1.1 Increasing adoption of the app-ecosystem the European Union and in the UK

66. In 2020, the European Union counted around 542 million mobile-cellular telephone

subscriptions

58

, corresponding to a mobile penetration rate of 121%

59

. The same year, the UK

counted 79 million mobile-cellular telephone subscriptions corresponding to a mobile

penetration rate of 118%

60

. In Europe, smartphone adoption increased by 2.6% in 2020, reaching

78% of mobile phone connections

61

. This figure is expected by the GSMA (GSM Association) to

reach 83% by 2025

62

.

67. With increasing smartphone adoption, a new category of internet users emerged across Europe:

the mobile-only population. This category is characterized by people having only a mobile

subscription and no fixed broadband subscription. Mobile-only users represent 21% of the EU’s

population and 14% of the UK’s population in 2020

63

.

68. On average in 2018, Europeans spent 185 minutes per day on their mobile phone, and 46% of

them spent more than 3 hours per day

64

. 88% of the time spent on a mobile is dedicated to the

use of mobile apps

65

.

58

International Telecommunication Union (ITU) Statistics (accessed:01/18/2022). Indicator definition from ICT: “Mobile-cellular telephone

subscriptions refers to the number of subscriptions to a public mobile-telephone service that provide access to the PSTN using cellular

technology. The indicator includes (and is split into) the number of postpaid subscriptions and the number of active prepaid accounts (i.e.

that have been used during the last three months). The indicator applies to all mobile-cellular subscriptions that offer voice

communications. It excludes subscriptions via data cards or USB modems, subscriptions to public mobile data services, private trunked

mobile radio, telepoint, radio paging and telemetry services.”

59

EU27 population was 447.8 million in 2020 (source: World Bank, accessed :01/18/2022).

60

UK population was 67.2 million in 2020 (source: World Bank, accessed :01/18/2022).

61

GSMA Intelligence (2021), The Mobile Economy 2021.

62

Ibid.

63

Estimate based on ITU data. Cf. Appendix 4.1.

64

Interactive Advertising Bureau, 2017.

65

Comscore, 2018.

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

23 / 85

© Deloitte Finance

2.1.2 Business models of the app economy

69. App development takes place at a diverse selection of companies

66

. Some, such as mobile game

companies, develop and maintain their own apps and distribute them via the app platforms. Their

revenues are obtained directly from consumer payments for the app and/or sale of ad-space. A

closely related business model is used by mixed companies that propose services that run both

on desktop and on mobile (for example Deezer and Spotify).

70. Large companies that use mobile apps to support their business or which provide mobile services

to their customers, might have in-house developers. This is for example the case for Danske

Bank

67

. The more common arrangement however is to outsource app development and

maintenance. Many software companies in Europe thrive on this business model, developing

apps for enterprises. An important category are apps that serve as distribution channels for

consumer goods (M-commerce).

“(Our product studio) works with innovation and business teams that want to open new lines of mobile

products and digitalize their products to create an IoT layer.”

68

G. Dombri, CEO of mobile product studio Tapptitude

71. Six different sources of revenue are generated via apps. The analysis of the app economy’s weight

in the European economy quantifies each of them:

a. Developers can generate revenue by charging for the download of their app.

b. Developers can opt for in-app purchases. In this case, developers provide their app for free to

increase the user base.

c. Developers can also be compensated by offering a subscription for the use of their application.

This is the case with several newspaper or periodical apps, such as the Economist (UK), Gazeta

Wyborcza in Poland, and Sme.sk in Slovenia, for which consumers pay a subscription fee to

access articles.

d. Developers can be paid by displaying advertisements in their app. This payment method is

possible for both free and paid apps.

e. Developers can be paid as subcontractors for the development of apps that support the clients’

business. Examples are apps that provide mobile banking services and apps that are a

distribution channel for consumer goods (M-commerce).

f. Many retailers use a mobile app to open a new distribution channel for consumer goods. For

example, the Amazon app allows orders to be placed directly without using a PC. To access a

large clientele, retailers provide their app for free in app stores. Revenues generated through

this channel are grouped under the name of mobile commerce or M-commerce.

66

Thelle M.H. et al (2017).

67

Keenan C., “No gimmicks for Danske Bank’s agile app team. Danske Bank’s journey to becoming a truly digital business now includes its

own in-house app development team.”, Sync NI, 2018.

68

Interview with Deloitte, February 2022.

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

24 / 85

© Deloitte Finance

Table 2. Revenue sources via apps

Revenue for developers

Revenue for

retailers

Revenue generated on app stores

Sale of ad-space

Contract work

Online sales

platforms

Paid

download

In-app purchases

Subscriptions

Mobile ads

App development

for clients

Distribution

channel

a

Revenue

generated by the

sale of apps on

app stores

b

In-app purchases

(including

Freemium and

Paidmium)

c

Revenue

generated by

subscriptions

d

Revenue

generated by

mobile advertising

e

Revenue

generated through

contract work

f

Mobile

commerce

69

Deloitte analysis

72. The revenue generated through sources a-to-e, − i.e., on app stores, through the sale of in-app

ad-space and through subcontracting − is revenue for developers. M-commerce revenue is

different in nature. Indeed, developers are remunerated for the development of the app;

however, the sales-revenue accrues to retailers. M-commerce apps facilitate the sale of goods

and services that are generally also available via alternative distribution channels.

73. The first four revenue sources (a-d) can also be combined (hybrid monetization). For example,

games can be monetized through a combination of in-app ads and in-app purchases. In the EU,

63% of the App market revenue was generated on the “Games” segment in 2021

70

. In the UK,

this ratio was a little smaller (55%)

71

. In 2021, three European mobile game companies generated

more than €1 billion in revenues, app store revenues and advertising combined (Table 3).

Table 3. Top European mobile game developers

Company

Number of games available

on app platforms

Total downloads

(million)

Revenue in 2021

(million Euros)

King

52

2 800

2275

72

Supercell

13

1 800

1 890

73

Playrix

6

995

1 730

74

Statista, Venture Beat, 2021

69

Mobile-commerce includes all commercial transactions carried out on mobile devices, both via web apps and via native apps. The

transactions are possibly carried out on the move, but also at home.

70

SensorTower Enterprise, accessed: 01/25/2022).

71

SensorTower Enterprise, accessed: 01/25/2022).

72

King annual revenue 2021 | Statista.

73

Supercell makes $852M on $2.24 billion in 2021 revenue | VentureBeat.

74

Playrix annual IAP revenue 2021, Statista.

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

25 / 85

© Deloitte Finance

2.2 The app-ecosystem stimulates growth and increases consumer well-

being

74. The new products and services offered by apps increase consumer choice and consequently, their

well-being. Indeed, the rapid adoption of smartphones and apps demonstrates the preference of

many consumers for apps over alternative channels. In addition, growth is stimulated by the

creation of new products which offer new ways to generate revenue. Finally, growth is stimulated

by the increase in efficiency due to the use of mobile apps. Each of these aspects is detailed below.

2.2.1 The app-ecosystem increases efficiency in firms

75. Apps provide a fluid device-user interaction and offer personalized services. These characteristics

offered by the app ecosystem have the potential to improve efficiency of many types of

professional tasks like e-mails, expense reports, conference calls, etc. The economic role and

impact of mobile internet use and apps can be regarded as distinct from fixed internet

connection

75

. The influence on firms of mobile and apps has been little studied. However, a few

studies indicate a positive relationship between the smart mobile office and firm productivity.

76. Mobile devices and applications coupled with workplace flexibility have been shown to enhance

labor productivity. The use of mobile communication technologies in firms is associated with a

significant increase in labor productivity with an increasing penetration rate of mobile devices

amongst employees

76

. Moreover, a causal relationship is revealed, meaning the data studied

support the idea that mobile use causes the increase in labor productivity

77

. Also, increased

productivity due to the use of mobile devices would be higher when employees are granted

autonomy in the context of trust-based workplace arrangements

78

.

2.2.2 The app-ecosystem has a positive impact on consumer well-being

Consumer preference for apps

77. Smartphone- and app-use displayed impressive growth in recent years. In the EU, consumers

spent 21% more on apps in 2021 than in 2020, and in the UK 23% more. Growth of app-spending

thus decelerated compared to 2020 (33% increase in both the EU and the UK), but was in line

with average pre-Covid-19 growth rates over the period 2017-2019 (26% in the EU and 24% in

the UK)

79

.

78. The total number of downloads of apps decreased in 2021 by 6% in the EU, and by 8% in the UK

(Figure 9). This can be interpreted as a normalization of the particularly high consumption of apps

in 2020. Indeed, in 2020, app downloads increased by 17% in the EU and by 16% in the UK,

compared to 5% average growth over the period 2017-2019 in the EU and 7% in the UK

80

.

75

Draca et al (2018).

76

Viete S. and Erdsiek D. (2020), Bertschek, I. and Niebel, T. (2016).

77

Bertschek, I. and Niebel, T. (2016).

78

Viete S. and Erdsiek D. (2020).

79

SensorTower. Average growth rates are compound average growth rates (CAGR).

80

SensorTower.

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

26 / 85

© Deloitte Finance

79. In 2019, European smartphone owners downloaded on average 31 new apps

81

. 76% of people

spend more than an hour per day on their mobile phone and 88% of time spent on a phone is

spent in apps

82

.

Figure 9. Number of apps downloaded in the EU and in the UK, 2017-2021 (billions)

Source: SensorTower

Mobile-only population

80. Another development showing an increase of consumer well-being due to the app-ecosystem is

linked to the growth of the “mobile-only” population. This choice has become attractive thanks

to the generalization of high-speed and very high-speed mobile data networks and affordability

of smartphones. Access to information and services via mobile sites and apps are important for

this category of population.

81. Based on ITU databases, 21% of the EU population is mobile-only, representing a total of about

78.4 million people (cf. appendix 4.1 for the methodology). In the UK, the mobile-only population

represents 14% or 7.6 million people).

82. Choosing to only access the internet via a mobile device is possible because of the high-quality

user experience offered by mobile websites and apps. The growth in size of the mobile only

population shows that when having the possibility, many users opt for mobile-only. This choice

allows them to save costs on a fixed internet subscription, optimize their budget and increase

consumer welfare.

2.2.3 The app ecosystem creates new services

83. A mobile device has many functionalities which make interaction intuitive and fast: geo-

localization, a camera, a microphone, a tactile screen, and movement detection. In addition, a

smartphone is a device that can be taken anywhere: 91% of smartphone owners report they

never leave home without their phone

83

. With mobile devices, new user experiences have

emerged: augmented reality used in games or services, games based on the movement of the

smartphone itself, ride-hailing services, dating apps that use geo-localization, online

marketplaces for used items, health apps, etc.

81

These are unique installations. Source: GSMA.

82

Comscore, 2018.

83

Ward, A., (2016).

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

27 / 85

© Deloitte Finance

84. In the future, apps are likely to offer more and more new types of services as they will adopt

technologies such as virtual reality (VR), connection of smart objects (internet of things IoT), and

the analysis by artificial intelligence algorithms of user data collected through apps combined

with other data sources. Below, we discuss several categories of apps that use the specific

features of mobile devices.

Games

85. Many games, such as casual and hyper-casual games

84

, only exist on smartphones. In 2021, it was

estimated that there were 100.8 million game app users in the EU

85

(23% of the population), and

25.8 million in the UK (38% of the population)

86

. Games account for 10% of user time spent in

apps

87

.

86. Mobile games offer new experiences to users. The players’ experience is often built around the

tactile screen. For instance, the Swedish game Candy Crush Saga is based on tactile screen

specificity: the game is played by swiping candies in any direction.

87. Innovation is also important for app games. A more recent development in the game industry is

the introduction of augmented reality (AR) technology. Apps using AR create an interactive user

experience, overlaying digital objects with the real-world environment, thus creating composite

views that augment the real world. The most common use of AR is a digital image being viewed

through the smartphone’s camera. Artificial environments are created, and users can interact

with them by moving the phone, swiping, and clicking. AR apps do this by accessing the

smartphone’s camera, motion sensor and geo-localization.

88. For example, the ARrrrgh app, developed by Warping Media AB (Sweden), uses the tactile screen,

geo-tracking system, and camera to offer players an AR experience in a classic hide and seek game

that transforms players into modern-day pirates. Players look for digital-generated treasures

hidden in the real world through their phone’s camera.

Ride-haling services

89. Ride-Hailing applications offer a new type of service thanks to the geo-location of the user. Ride-

hailing apps connect clients and drivers through an app, and the geo-tracking system finds a car

close to the client. Both the client’s waiting time and the distance the driver must drive to pick up

clients are reduced, increasing efficiency for both passengers and drivers.

90. Ride-Hailing apps have been present in the EU for about 10 years, with the introduction of Uber

in Paris in 2011. Uber remains the most used app in the EU, but many similar companies were

successfully created all around Europe, offering ride-hailing services to millions of users.

84

Casual games are games targeted at a wide audience. Hyper-casual games are very easy-to-learn games that usually monetize with in-

app ads.

85

Estimates from Statista, Digital Market Outlook, Mobile Games, EU-27 (most recent update: Nov 2021).

86

Estimates from Statista, Digital Market Outlook, Mobile Games, UK (most recent update: Nov 2021).

87

AppAnnie, Worldwide Data, 2019.

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

28 / 85

© Deloitte Finance

Dating apps

91. Dating apps offer customers new types of dating services. For dating applications, geolocation is

a crucial feature as the app matches users geographically close to each other. Happn relies on this

feature: the app allows users to see all other users they cross paths with while on the move.

Whenever registered users walk by each other, the app shows them their respective profiles and

a map of where they crossed.

92. Tinder is another example of new experience introduced by apps. It relies on the tactile screen:

users slide other user’s picture to the right or left on the screen if they like or dislike the profile.

Other types of apps that offer new services

93. Apple’s ARKit and Google’s ARCore developer tool were released in 2016, allowing AR experiences

to be included in more apps and allowing AR to go beyond game apps. AR features are now

implemented in many app categories: lifestyle, shopping, learning, culture. This new technology

is widely adopted by European developers (cf. Figure 10).

94. Health apps also offer a new type of service and are widely adopted. Health information, such as

duration of sleep or total number of steps can be recorded using motion and location sensors,

sometimes in conjunction with a connected device. The possibility to connect smartphones with

other (medical) devices allows the phone to record extensive data on users’ health.

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

29 / 85

© Deloitte Finance

Figure 10. Presentation of 4 European non-gaming apps using AR

AR apps transform shopping experience

Amikasa

Amikasa 3D Room Designer allows users to build,

restyle, and redesign their rooms with furniture

from several brands, flooring and wall colors.

Users can choose their room shape and

dimensions, then decorate and furnish with

different color and shape combinations.

Education is a great use for augmented reality

BBC Civilizations AR

The BBC developed the Civilizations AR app

(2018), giving users the ability to admire diverse

historical artifacts. Users can visualize ancient

treasures in lifelike 3D, see inside it with an X-

Ray function, and hear about its history at the

same time.

Blippar

Using the camera from the smartphone or

tablet, the Blippar app recognizes any object,

from famous faces, flowers, cars, landmarks,

product packaging and more, and displays

information about scanned objects. It can also

place relevant AR content in front of users.

GeoGebra

GeoGebra is an education app allowing users to

place math figures on any surface, walk around

them and photograph them from different

angles. The app helps students develop their

skills in geometry and mathematics via 2D and

3D modeling or function transformations in 3D.

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

30 / 85

© Deloitte Finance

2.3 The value created by the app economy in Europe

2.3.1 The app economy creates value in Europe via several channels

95. The study of the economic value of the app economy in the European Union is divided into three

parts:

- Direct economic impact: this includes the total direct revenue earned by companies in the

sector. This direct impact is calculated by evaluating the revenues generated through

downloads, in-app purchases, subscriptions, in-app advertisement, and contract work. Most

of these revenues are generated via the app platforms.

- Impact due to spillover effects: an important spillover effect of the app ecosystem is the rise

of M-commerce. The revenues generated by sales through mobile sites go to retailers,

wholesalers, and producers

88

. In addition to the choice of consumers to purchase standard

products like clothing and even tickets via mobile apps, M-commerce also brought new types

of services. The revenues associated with the new types of services are considered as

economic activity created by the app-sector.

- Indirect impact: because the different sectors of the economy are interdependent, the app

economy generates wealth beyond the companies in the app industry. These indirect impacts

include both impacts on other productive sectors and impacts on households. These indirect

impacts are quantified according to the methodology presented in section 2.3.4.

2.3.2 Direct economic impact of the mobile app market in Europe

Revenue generated directly on app platforms

96. In 2021, app platforms generated a total revenue of €6.5 billion in the European Union, of which

63% stems from mobile games

89

.The same year, app platforms generated a total revenue of

around €2.1 billion in Great Britain, of which 55% came from mobile games

90

. These revenues are

generated by paid downloads, in-app purchases, and subscriptions. In 2021, the EU accounted for

8.4% of global app platform revenue, while Great Britain accounted for 2.7%

91

. App platform

revenues from EU users increased by 17% and from Great Britain users by 19% in 2021

92

. If growth

continues at the same rate in 2022, revenue generated via app stores could reach €10.1 billion in

the EU and Great Britain in 2022.

88

The developers are remunerated for the development and maintenance of the app.

89

Source: SensorTower,accessed January2021. EU Appstore revenue is $ 7729 billion. Average 2021 exchange rate: € 0.8458 = 1 $,

https://www.exchangerates.org.uk/USD-EUR-spot-exchange-rates-history-2021.html.

90

SensorTower, accessed January 2021.

91

SensorTower, accessed January 2021. In 2021, global app platform revenue was USD 92 billion (EUR 78 billion).

92

The growth rate is calculated in euros. Average 2020 exchange rate: 1$ = 0,8755 $, World Bank, LCU per US$, period average.

The App Economy in Europe – A review of the mobile app market and its contribution to the European Economy

31 / 85

© Deloitte Finance

Revenue generated by in-app advertising

97. Many apps are free to download and use. In this case, developers generally gain revenues from

selling in-app ad-space. In 2021, mobile ad revenues represented roughly €19.2 billion

93

in the

EU, and 13.8 billion in the UK

94

.

Revenue generated through contract work

98. Many apps are developed by software companies for third party clients to meet specific needs.

These can be B2B or B2C apps

95

. B2C apps provide value for the client by delivering mobile

services to the final consumers, thereby for example increasing their competitiveness. Common

examples are banks that provide apps for mobile banking or retail apps. B2B apps, by enabling

mobility, can stimulate productivity, enhance well-being at the workplace and increase efficiency

in B2B relations and transactions. Apps are used for business tasks such as e-mail, online

collaboration, inventory management, automation of the purchase process and many more.

These practices are already widely adopted: in 2019, the share of revenue from web sales in the

EU was mainly realized via enterprises' own websites or apps

96

.

99. Companies are increasingly interested in having their custom apps: the share of developers’

revenue coming from the development of custom apps for businesses increased from 23% in 2014

to 32% in 2016

97

. We can expect an increase in the demand for mobile apps, since young business

owners are the ones developing most mobile apps: 55% of small business owned by millennials

have a mobile app, while only 13% of small business owned by baby-boomers have one.

100. The development of these apps is sometimes done in-house in the case of large firms but is

generally subcontracted to specialized app-development firms.

101. These apps do not generate revenue via the app store. Developers are directly remunerated for

the development of the app by their client. The value for the client is in the services these custom