EXECUTIVE DIRECTOR’S REPORT

TO THE

PORT OF PORTLAND COMMISSION

FOR MARCH 2016

SAFETY REPORT

Port of Portland safety performance for February 2016 showed continued signs of improvement

in both frequency and severity, compared to Calendar Year 2015 for the same period.

Monthly Report of Injury Incidents

Aviation

There were two incidents reported, one recordable, one non-recordable:

• An employee was cutting zip ties with a razor knife. The knife slipped, cutting the

employee on the inner calf of the left leg.

• An employee was attempting to take a combative suspect into custody when the suspect

suddenly pulled away. The employee lost their grip and fell to the floor, resulting in a

strain to the chest.

Navigation

There was one non-recordable incident:

• An employee was attempting to open a storage container. The door was stuck, due to a

mechanical issue. In the process of opening the door, the employee suffered a strain to

the low back.

2

AVIATION REPORT

Expanded service at PDX that was announced in the past month:

Start Date Airline Destination Frequency Notes

Late June

2016

Icelandair Reykjavik

Increased to

4/week

Extending the season at 2/week from

mid-Sept. through Jan. 2016

3

Month/Month % change FYTD % change

February July-February

Passengers

12.2% 8.8%

Concessions Revenue

13.8% 10.8%

Rental Car Revenue

22.4% 4.3%

Parking Revenue

7.3% 7.9%

Passengers

Since 2016 is a leap year, the extra day in February equates to about 3.5 percent growth.

For February, passengers grew at a rate of 12.2 percent on an increase in seat capacity of 17.8

percent. The load factor dropped 4.1 points to 80.4.

Concessions Revenue

Combined terminal concessions operations reported a 13.8 percent, or $115,000, rent increase

on the month, against a 12.2 percent passenger increase. Net plus rent performances from

new and transitioning operators of $106,000 were the primary factors that impacted this

performance.

Rental Car Revenue

Rental car operations reported a 22.4 percent, or $265,000, rent increase on the month

compared to last year, against a passenger increase of 12.2 percent.

Parking Revenue by Lot

Parking revenue continues to experience strong growth. The lower growth rate in the long-term

garage is due to changes in how garage parking is managed. Long-term customers who arrive

mid-week when long-term is full are parking in the short-term garage or economy lot.

Parking transactions are up 10.6 percent in February 2016 over February 2015, and up 9.1

percent year-to-date.

Product Revenue Variance YTD Variance

Short-Term $1,322,828 17% 14%

Long-Term $1,610,812 -5% 1%

Economy $1,603,444 13% 10%

Valet $107,260 26% 28%

Total $4,654,943 7% 8%

4

Environmental

The Port hosted a meeting to explore the logistics, costs and funding associated with delivery of

Sustainable Aviation Fuels (SAF) – renewable biofuels – to airlines at Portland International

Airport (PDX), in an effort to lower our carbon footprint. Alaska Airlines joined the conversation

with the SAF suppliers, which is a partnership between SkyNRG (Amsterdam) and The Carbon

War Room (TCWR), founded by Richard Branson of Virgin Airlines. Alaska Air Group has a

goal of using SAF at one of its airports by 2020, and has asked the Port to partner with them to

explore the possibilities at PDX. SkyNRG and TCWR have a joint goal of accelerating the use

of SAF worldwide and are seeking an airport partner in North America. The initial planning goal

would be to replace one to three percent of aviation fuel with SAF per year, within two years.

No commitments have been made at this time.

CAPITAL GRANTS

Portland International Airport (PDX)

Staff submitted a reimbursement request to the Transportation Security Administration for the Law

Enforcement Officer program in the amount of $12,400 (Agreement No. HSTS0213HSLR118).

Staff submitted a reimbursement request to the Federal Bureau of Investigation for the Joint

Terrorism Task Force program in the amount of $3,956 (Agreement No. 03-026).

Hillsboro Airport (HIO)

Staff submitted a reimbursement request to the Federal Aviation Administration for the Airport

Improvement Program – HIO 12L/30R project in the amount of $1,000 (Agreement No. 03-41-

0025-023).

Marine

Staff submitted a reimbursement request to the Oregon Department of Transportation (ODOT)

for the ConnectOregon III – Terminal 6 (T-6) Crane Upgrades project in the amount of $7,068

(Agreement No. 26915).

Staff submitted a reimbursement request to ODOT for the ConnectOregon IV – T-6 Wharf

Optimization project in the amount of $18,828 (Agreement No. 28695).

Staff submitted a reimbursement request to ODOT for the ConnectOregon V – T-6 Crane Drive

Electronics project in the amount of $7,764 (Agreement No. 30128).

5

MARINE & INDUSTRIAL DEVELOPMENT REPORT

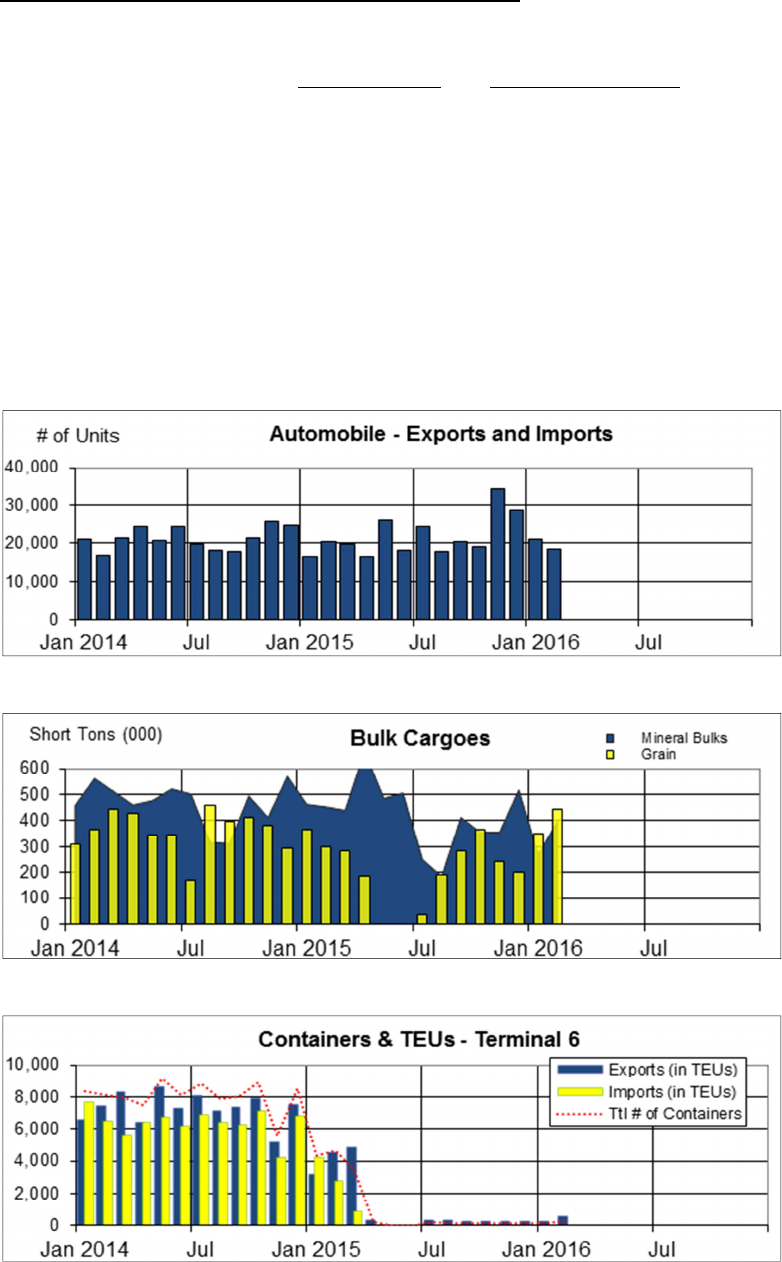

The figures in the table below show change relative to the prior year.

February 2016 Fiscal Year-to-Date

Total Tonnage

1.3% -32.3%

Containers (TEU)

-92.6% -97.3%

Import Full Containers

-100.0% -100.0%

Export Full Containers

-84.8% -92.8%

Breakbulk

–––– -60.1%

Autos

-9.4% 11.8%

Mineral Bulk

-11.9% -22.0%

Grain

47.7% -23.8%

6

PROJECT COMPLETION REPORT

The following construction contracts, previously awarded by the Commission, have been

completed:

Automated Vehicle Identification System – PDX

Approved by Port Commission

May 14, 2014

Contract Award Amount

$3,360,308.00

Authorized Contract Amendments

$548,524.92

Final Contract Amount*

$3,908,832.92

*The original Automated Vehicle Identification (AVI) System contract was exceeded by 10

percent due primarily to scope changes associated with revising the AVI system architecture,

including dividing the ground transportation and parking functions into separate software

packages, increasing the number of system credentials and miscellaneous field changes. This

contract was a design/build contract with the contractor Transcore and most of the changes

were not exposed until the contractor was able to perform the detailed design.

Concourses C & D Skylight Rehabilitation – PDX

Approved by Port Commission

June 11, 2014

Contract Award Amount

$555,551.00

Authorized Contract Amendments

$27,724.28

Final Contract Amount

$583,275.28

Concourse C Skylight Rehabilitation – PDX

Approved by Port Commission

May 13, 2015

Contract Award Amount

$548,000.00

Authorized Contract Amendments

$58,455.95

Final Contract Amount*

$606,455.95

*The original Concourse C Skylight Rehabilitation contract was exceeded by 10 percent due

primarily to scope changes from unknown deficiencies from a prior installation that were

uncovered when roofing was removed as part of this project. In addition, for efficiency reasons,

some scope from contract “Concourses C & D Skylight Rehabilitation” was transferred over into

this contract.

7

REAL ESTATE TRANSACTIONS EXECUTED PURSUANT TO DELEGATED AUTHORITY

Host International, Inc. dba Starbucks – Food & Beverage Concession Lease

Location: PDX

Term: January 13, 2016 to June 30, 2026

Use: Ten-year lease for a specialty coffee concession.

PacifiCorp – Utility Easement

Location: PDX

Term: Effective February 12, 2016

Use: PacifiCorp is granted an easement over, under, upon and across a portion of Port

property for the purpose of installing electrical distribution lines and transformers.

American Cruise Lines Inc. – Dockage Agreement

Location: Terminal 4

Term: February 26, 2016 to March 26, 2016

Use: Berth space at Terminal 4 for passenger vessel for one month.

EAN Holdings, LLC dba Enterprise Rent-A-Car – Permit for Parking

Location: PDX

Term: January 6, 2016 to January 19, 2016

Use: This permit gives access to Port property for the purpose of vehicle overflow

parking.

Skanska USA Building, Inc. – Permit & Right of Entry

Location: PDX

Term: January 4, 2016 to June 1, 2018

Use: This permit allows access to Port property in order to facilitate a construction

project.

USA-DOC-NOAA – Permit and Right of Entry

Location: Government Island

Term: February 1, 2016 to June 30, 2016

Use: This permit grants access to Port property for the purpose of conducting a radio

telemetry study to collect data on the movement and survival of salmon and the

predatory activities of sea lions in the Columbia River.

The Years Project, LLC – Permit and Right of Entry for Photography and Filming

Location: PDX

Term: February 12, 2016

Use: Permit for filming on February 12, 2016 from 3:00 p.m. to 4:00 p.m. in various

areas of the airport.

8

Level 3 Communications, LLC – Permit and Right of Entry

Location: PDX

Term: February 16, 2016 to March 31, 2016

Use: Allows access to Port property for the purpose of bringing telecommunications

services to Port property on NE Airport Way and Frontage Road.

EAN Holdings, LLC dba Enterprise Rent-A-Car – Permit & Right of Entry

Location: PDX

Term: Effective February 18, 2016

Use: This permit allows Enterprise to have access to a parking area for temporary

overflow parking of rental cars.

Portland Timbers – Second Amendment to Corporate Parking Agreement

Location: PDX

Term: January 1, 2016 to December 31, 2016

Use: This amendment extends the term of the agreement, clarifies the permitted uses

and fees and modifies the address for payment of fees.

Beaches PDX, Inc. – Vehicle Display Information for Permit and Right-of-Entry

Location: PDX

Term: Effective May 14, 2010

Use: As required by a Permit and Right of Entry between Beaches, PDX and the Port,

Beaches is submitting for Port signature a vehicle display information form for

display of motor vehicles within Beaches Restaurant at the Airport.

Avis Budget Car Rental, LLC – Second Amendment to Ground Lease for Excess Parking

Location: PDX

Term: Effective March 1, 2016

Use: This amendment deletes the area from the lease referred to as the Term

Premises.

Avis Budget Car Rental, LLC – First Amendment to Facility Lease

Location: PDX

Term: Effective February 3, 2016

Use: This amendment extends the term and deletes the language regarding options to

extend.

Budget Rent A Car System, Inc. – Third Amendment to Rental Car Limited Service Kiosk Lease

Location: PDX

Term: Effective February 3, 2016

Use: This amendment extends the term and deletes the language regarding options to

extend.

9

Avis Budget Car Rental, LLC – Second Amendment to Rental Car Concession Lease and

Operating Agreement

Location: PDX

Term: Effective February 3, 2016

Use: This amendment extends the term and clarifies environmental responsibilities of

Concessionaire.

Larry T. Yip & Oi Sim Yip – Permanent Waiver and Release of First Opportunity to Purchase

Real Property and Repurchase Right Relating to Construction Obligations and of Owner

Notification Requirement to Dahlin Fernandez, et al

Location: Mocks Landing

Term: Effective February 18, 2016

Use: Permanent waiver Re: 6421 N. Cutter Circle.

Triangle Aviation RDD, LLC – Third Amendment to Ground Lease and Development Agreement

Location: PDX

Term: Effective February 9, 2016

Use: This amendment provides for reimbursement of eligible water line construction

expenses to the Port.

Wilma TV – Permit and Right of Entry for Photography and Filming

Location: PDX

Term: Effective February 24, 2016

Use: Permit for filming on February 24, 2016 at Portland International Airport.

Todd Investment Company dba Dollar Rent-A-Car – Permit and Right of Entry

Location: PDX

Term: Effective March 1, 2016

Use: This permit allows Dollar to have access to a parking area for temporary overflow

parking of rental cars.

Fulwell 73 Limited – Permit and Right of Entry for Photography and Filming

Location: PDX

Term: Effective February 22, 2016

Use: Permit for filming on February 22, 2016 at Portland International Airport.

Foot Traffic LLC – Permit and Right of Entry

Location: PDX

Term: Effective March 25, 2016

Use: Allows access to Port property for the purpose of parking for an event.

10

Bangkok Xpress LLC dba Bangkok Xpress II LLC – First Amendment to Food Cart Permit

Location: PDX

Term: Effective March 1, 2016

Use: This amendment reduces percentage rent and eliminates payment for storage.

Abundance Unlimited LLC dba PBJ’s Grilled – First Amendment to Food Cart Permit

Location: PDX

Term: Effective February 17, 2016

Use: This amendment changes the expiration date to February 15, 2016.

Mark and Teresa Lawwill – Aircraft Noise Easement and Noise Disclosure Statement

Location: PDX

Term: Effective February 10, 2016

Use: These documents need Port acknowledgment as required by the Airport Noise

Impact Zone, X-Overlay program.

Capers Café & Catering Co. – Lessor’s Agreement

Location: PDX

Term: Effective February 22, 2016

Use: The Port is required to sign this lessor’s agreement in order for Capers to receive

a loan from its bank.

Contracts Over $50,000 Pursuant to Delegated Authority

Monthly Report for March 2016 (February Activity)

Title

Requestor

Department

Vendor

Name

P.O. Amount

Obtain design services for the

Dredge Oregon Spud Keeper and

Pile project.

Engineering Project

Development

Glosten $81,642

Obtain wastewater operator services

for HQ Living Machine.

Administrative

Services

Puttman

Infrastructure,

Inc.

$84,000

Obtain consulting services to assist

with consolidation of employee

policies into a new guidebook.

Human Resources Shorett

Communications

LLC

$99,000

Purchase console furniture for the

PDX Communication Center

Remodel Project.

Engineering Project

Development

Watson Furniture

Group, Inc.

$110,944

Purchase replacement computer

hardware.

Information

Technology

Dell Marketing LP $129,100

Obtain permits for PDX Grease

Separation Project.

Engineering Project

Development

City of Portland $162,813

New Purchases

APPROVAL LIMITS (Administrative Policy 7.2.3)

All expenditures require management approval:

BUDGET Approval by Directors Up to $ 50,000

APPROVAL Approval by Chief Officers Up to $250,000

Approval by Executive Director & Deputy Executive Director Unlimited

Contracting authority is limited to the following:

CONTRACTING Chief Officers Up to $ 10,000

APPROVAL Buyers Up to $ 50,000

Manager of Contracts & Procurement Up to $ 250,000*

Executive Director & Deputy Executive Director Up to $ 500,000

*And any amount approved by Commission

Obtain permits for PDX Quick

Turnaround (QTA) Car Wash and

Fueling Facility Project.

Engineering Project

Development

City of Portland $331,599

Obtain construction services for the

PDX Central Utility Plant (CUP)

Chilled Water Capacity

Replacement Project.

Engineering Project

Development

Fox Engineering

Company

$468,412

Purchase six shuttle buses for use

at PDX.

Engineering Design

Services

Eldorado National

(California), Inc.

$2,606,352

Obtain Construction Manager

General Contractor services for the

PDX QTA Facility Project.

Engineering Project

Development

Hoffman

Construction

Company of

Oregon

$52,406,784

Title

Requestor

Department

Vendor

Name

Original

Amount

Previous

Changes to

Contract

Current Change

to Contract

New Contract

Total

Change orders Nos. 26-31 to obtain

additional construction services for

the PDX Taxiway E North

Rehabilitation Project.

Engineering Project

Development

K&E Excavating,

Inc.

$12,038,872 $91,109 $12,129,981

Amendment No. 3 to obtain

additional engineering services

related to the PDX CUP Emergency

Generator Programmable Logic

Controller Upgrade Project.

Engineering Project

Development

Mike Brendle LLC $15,000 $274,260 $93,405 $382,665

Administrative action to add funding

for 2016 usage of the City's

Computer Aided Dispatch System.

Information

Technology

City of Portland $96,248 $295,857 $98,975 $491,080

Administrative action to add funding

for continued customs inspections

services at Hillsboro Airport.

Airport Operations U.S. Customs

and Border

Protection

$140,874 $1,125,912 $123,438 $1,390,224

Change orders Nos. 1-31 for

construction services for the PDX

Grease Separation Project.

Engineering Project

Development

Payne

Construction, Inc.

$3,753,251 $372,570 $4,125,821

Change Orders and Amendments to Project-Specific Contracts

Contracts in this category are initially awarded with a specific work scope and an identified not-to-exceed project total.

Amendment No. 5 for services for

the PDX Terminal Balancing

Concourse E Ext. Project.

Engineering Project

Development

Hennebery Eddy

Architects, Inc.

$499,970 $7,365,400 $5,800,000 $13,665,370

Title

Requestor

Department

Vendor

Name

Original Task

Order Amount

Previous

Changes to Task

Order

Current Change

to Task Order

New Task

Order Total

Total Contract

Activity -

All Task Orders

Task order against contract No. 742

to obtain construction management

services.

Engineering Project

Development

Hatch Mott

Macdonald

Holdings, Inc.

$62,900 $62,900 $2,179,330

Task order against contract No. 706

for construction compliance

monitoring services at the Troutdale

Reynolds Industrial Park.

Engineering Project

Development

Hart Crowser,

Inc.

$67,558 $67,558 $1,357,290

Task order against contract No. 901

for vegetation management services

on Government Island.

Environmental Green Banks LLC $84,470 $84,470 $118,470

Task order against contract No. 867

to obtain support for various capital

projects.

Planning &

Development

DBC

Architecture, Inc.

$114,300 $114,300 $699,604

Task order against contract No. 835

to obtain testing services for the

Terminal Balancing and Concourse

E Extension Project.

Engineering Project

Development

Mayes Testing

Engineers, Inc.

$124,738 $124,738 $464,503

Task order against contract No. 742

to obtain inspection support for

various projects.

Engineering Project

Development

Hatch Mott

Macdonald

Holdings, Inc.

$157,200 $157,200 $2,179,330

Task order against contract No. 744

for construction management

services for various projects.

Engineering Project

Development

URS Corporation $175,542 $175,542 $1,542,730

Task order against contract No. 913

to obtain consulting services for the

PDX Maintenance Campus Master

Plan Update.

PDX Maintenance Mackenzie $176,057 $176,057 $214,317

New Task Orders and Changes to Task Orders Against Non-Project Specific Contracts

Items in this category are issued against contracts that were initially awarded with no specific work scope or product quantity identified (e.g., "requirements" or "on-call"

contracts). These contracts establish pricing or rates for products or work that may be needed over a stated term. Estimated quantities may be identified, but no

guarantee of actual contract compensation or work is made. Contract durations may be short-term or for multiple years with optional renewal/extension terms.

Task order against contract No. 745

to purchase 24 Common Use Self

Service kiosks for the PDX lobby.

Information

Technology

ARINC

Incorporated

$295,749 $295,749 $1,808,191

Amendment No. 9 to task order

against contract No. 300 for

janitorial services for PDX Food

Court areas in 2016.

Airport Properties Portland

Habilitation

Center, Inc.

$524,218 $4,171,547 $761,080 $5,456,845 $7,169,326

Port of Portland Operating & Financial Results

FY 2015-16 through February 29, 2016

General Fund

Marine

Annual

Adopted

Budget

Actual

Amounts

Variance

Adopted

Budget

VOLUMES

Autos (Units)

173,817 184,468 6.1% 267,000

Breakbulk (Short Tons)

60,517 124,891 106.4% 110,232

Containers (TEUs)

64,014 2,580 (96.0%) 94,000

Grain Bulk (Short Tons)

3,020,334 2,122,447 (29.7%) 4,409,247

Mineral Bulk (Short Tons)

3,423,555 2,780,811 (18.8%) 5,389,200

Industrial Development

Navigation

General Aviation

Current Year-to-Date

The General Fund includes Marine, Industrial Development, Navigation, General Aviation, Environmental, Financial &

Administrative Services, Executive, Public Affairs, Human Resources, Legal, and Project & Technical Services (IT, Engineering,

and the Project Portfolio Office).

Comments:

Operating revenues (including land sales) are tracking well against the budget for the month, but lag on a fiscal year-to-date

(YTD) basis primarily due to timing of land sales. The sale of TRIP lot 1 is expected to occur in the second half of the fiscal

year; lots 11 and 12 are now forecast to close in FY 16-17.

YTD operating expenses excluding depreciation are $22.7M under budget due to the delays in TRIP land sales and the

corresponding cost of property sold. Operating expenses excluding land sales are $8.9 million less than budget due to the

following:

• Container carrier incentive payments ($2.0M under budget);

• Position vacancies (personnel $2.2M under budget); and

• Timing of contracts, professional & consulting services expenses ($3.8M under budget).

$(20)

$(10)

$0

$10

$20

$30

$40

$50

$60

$70

Op Revenue Op Exp Excl

Deprec

OIBD Deprec Op Inc / (Loss)

Millions

Curr Mo Budget Curr Mo Actual YTD Budget YTD Actual

$(10)

$(5)

$0

$5

$10

$15

$20

$25

Op Revenue Op Exp Excl

Deprec

OIBD Deprec Op Inc / (Loss)

Millions

Curr Mo Budget Curr Mo Actual YTD Budget YTD Actual

Marine Volumes:

Autos – YTD auto volumes are 6% higher than forecast and 12% higher than last year due to Toyota imports and Ford

exports.

Breakbulk – YTD is 106% higher than forecast due to the timing of ship calls and an unexpected shipment of lead ingots.

However, compared to last year YTD breakbulk volume is only 1% higher.

Containers – TEUs are down almost 100% from the forecast and last year now that Westwood is the only carrier calling

Portland amid the labor issues at T-6.

Grain Bulk – YTD grain volumes are 30% less than forecast and 24% lower than last year. Demand is currently very low. In

addition, a strong dollar means buyers can purchase grain elsewhere at a lower relative price.

Mineral Bulk – Overall, volumes are down 19% from the forecast and 21% from last year due primarily to lower than

expected potash volumes. Portland Bulk was offline for the first two months of the fiscal year while their new shiploader was

installed.

YTD operating revenues excluding land sales are in line with the Adopted Budget. Land sale revenues are $15.2M under

budget due to timing of the sales of TRIP Lots 1, 11 and 12, which were all originally assumed to close before November

2015. The sale of TRIP lot 1 is now expected to occur in the second half of the fiscal year; lots 11 and 12 are not expected to

close until FY 16-17. YTD operating expenses excluding land sales are $1.7M under budget, with the largest variances listed

below:

• Contracts, professional & consulting services are $834K under budget due to the timing of Gresham Vista traffic study and

mitigation expenses ($250K), Hayden Island environmental expenses ($182K), expenses related to TRIP land sales ($100K),

and Government Island management fees ($50K).

• Personnel services are $255K under budget due to position vacancies.

• Interdepartmental charges are $434K under budget due to lower than anticipated services received from Marine and

Engineering.

$(5)

$0

$5

$10

$15

$20

$25

$30

Op Revenue Op Exp Excl

Deprec

OIBD Deprec Op Inc / (Loss)

Millions

Curr Mo Budget Curr Mo Actual YTD Budget YTD Actual

YTD operating revenues are $219K higher than budgeted due to Dredge repower loan reimbursements from the Corps of

Engineers that were not assumed in the budget. YTD operating expenses before depreciation are $93K under budget. There

were some signficant materials and supplies purchases in the first quarter ($368K over budget YTD), but the timing of

various outside services expenses and lower fuel prices ($872K under budget YTD) help to partially offset these higher

expenses.

$(2)

$0

$2

$4

$6

$8

$10

$12

Op Revenue Op Exp Excl

Deprec

OIBD Deprec Op Inc / (Loss)

Millions

Curr Mo Budget Curr Mo Actual YTD Budget YTD Actual

YTD operating revenues are in line with the Proposed Budget.

YTD operating expenses are over budget by $500K, primarily due to a $460K write-off for Troutdale's Runway 7-25 non-

capitalized costs as well as higher than budgeted water and sewer costs (over $80K).

$(4.0)

$(3.0)

$(2.0)

$(1.0)

$0.0

$1.0

$2.0

$3.0

$4.0

Op Revenue Op Exp Excl

Deprec

OIBD Deprec Op Inc / (Loss)

Millions

Curr Mo Budget Curr Mo Actual YTD Budget YTD Actual

Marine Operating Results:

YTD operating revenues are $2.2M less than the Adopted Budget due to lower ICTSI maintenance services reimbursement

revenues; lower than anticipated potash tonnage at T-5; and lower than anticipated grain volumes. YTD operating expenses

are $5.8M under budget, with the largest variances listed below.

• Other expense is $2.0M under budget due to only $46K in actuals for the T-6 carrier incentive program (budget = $2M).

• Contracts, professional & consulting services are $1.3M under budget due to Berth 501 & 503 grading projects not

moving forward based on hydrographic survey results ($200K), T-2 and Berth 401 dredging project savings ($73K), lower

outside services expenses related to terminal development and marketing ($135K), and timing of master planning and

environmental expenses ($586K).

• Longshore labor expenses are $1.1M under budget due to lower than anticipated crane maintenance activity at T-6.

• Personnel services are $722K under budget primarily due to vacant positions and lower than budgeted maintenance

overtime as a result of lower than anticipated maintenance services.

• Materials & supplies expenses are $492K under budget primarily due to lower than anticipated materials for T-6 cranes.

• Travel and management expenses are $213K under budget due to timing.

Port of Portland Operating & Financial Results

FY 2015-16 through February 29, 2016

Support Services

Portland International Airport

Total Passengers

PDX Airline Cost Center (ACC)

PDX Port Cost Center (PCC)

Support Services is comprised of Financial & Administrative Services, Executive, Public Affairs, Human Resources, Legal, and

Project & Technical Services. Costs for these areas are allocated to the operating areas.

YTD operating expenses excluding depreciation are almost $1.2M under budget, with the largest variances listed below:

• Personnel services are $1.2M under budget due to vacant positions.

• Contracts, professional & consulting services are $665K under budget, mosty due to timing of IT outside services

expenses.

• Travel and management expenses are $192K under budget due to timing.

• Other expenses are $177K under budget due to the timing of software expenses.

• Partially offsetting these lower expenses, interdepartmental transfers are $1.3M over budget due to lower than

anticipated services provided by Engineering and capitalized labor for both IT and Engineering.

YTD airline revenues are $2.7M higher than budget due to higher than expected landing activity (over $1.0M), common use

rentals (over $800K), and leased terminal space (over $200K). Retail, food and beverage revenues are $200K higher than

budget as a result of higher than expected passenger activity. Other non-airline revenues are $410K higher than budget as a

result of higher utility reimbursements (over $210K), as well as higher PDX GA landing activity (over $160K), and other

miscellaneous and concessions revenues (over $110K).

YTD ACC expenses are $1.9M below budget. Personnel services expense is $750K under budget due to police, maintenance,

and admin position vacancies. Materials and services are $1.0M under budget, primarily due to timing of outside services

related to the terminal (down $400K), custodial services (down $230K), deicing environmental costs (down $190K),

other

aviation environmental expenses (down $180K).

YTD parking revenues are $2.4M higher than budget due to higher passenger volume and higher than expected parking

activity. Rental car revenues are in line with the Adopted Budget. Other PCC revenues are $1.0M higher than budget as a

result of higher than expected in-flight meal concessions (over $220K), transportation network companies (e.g. Uber, Lyft;

over $200K), hotel revenues (over $170K), PIC revenues (over $130K), as well as other PDX GA and cargo revenues.

PCC expenses are $1.0M lower than budget. Personnel services expense is $360K under budget due to police, maintenance,

and admin position vacancies. Materials and services are $600K under budget, primarily due to timing of outside consulting

services related to facility studies and timing of environmental expenses related to undeveloped properties.

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

Revenues Expenses (excl

Deprec)

Debt Service &

Coverage

Surplus / (Deficit)

Millions

YTD Budget YTD Actuals

$0

$5

$10

$15

$20

$25

$30

$35

$40

$45

Parking

Revenues

Rental Cars

& Other

Rev

Expenses

(excl

Deprec)

Debt

Service &

Coverage

Revenue

Sharing

Income

Millions

YTD Budget YTD Actual

Passengers traveling through PDX are a key driver of revenues and expenses for the Airport. YTD, nearly 11.6 million total

passengers have utilized PDX, exceeding the prior year by 8.8% (and the budget by 4.0%). Current forecasts are for PDX to

reach a new record of 17.2 million passengers for the fiscal year. The higher passenger levels are a result of the continued

growing economy and new flights added by nearly all carriers serving PDX. As a result of the increased seat capacity and

strong demand for air travel, PDX passenger levels are increasing as carriers are adding flights.

1.0

1.2

1.4

1.6

1.8

Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun

Millions

FY 14/15 Actual FY 15/16 Actual FY 15/16 Budget

$(30)

$(20)

$(10)

$0

$10

$20

$30

Op Revenue Op Exp Excl

Deprec

OIBD Deprec Op Inc / (Loss)

Millions

Curr Mo Budget Curr Mo Actual YTD Budget YTD Actual