Avis Budget Group - Water Security 2023

W0. Introduction

W0.1

(W0.1) Give a general description of and introduction to your organization.

Avis Budget Group is leading global provider of mobility solutions through our three most recognized brands, Avis, Budget and Zipcar, as well as several other brands, well

recognized in their respective markets. Our brands offer a range of options, from car and truck rental to car sharing. We license the use of the Avis, Budget, Zipcar and other

brands’ trademarks to licensees in areas in which we do not operate directly. We and our licensees operate our brands in approximately 180 countries throughout the world.

We generally maintain a leading share of airport car rental revenues in North America, Europe and Australasia, and we operate a leading car sharing network, and one of the

leading commercial truck rental businesses in the United States.

On average, our global rental fleet totaled approximately 655,000 vehicles in 2022. We completed more than 36 million vehicle rental transactions worldwide and generated

total revenues of approximately $12 billion during 2022. Our brands and mobility solutions have an extended global reach with nearly 10,250 rental locations throughout the

world, including approximately 3,900 locations operated by our licensees.

FORWARD LOOKING STATEMENTS: Certain statements contained in this CDP 2023 Water Security disclosure may be considered “forward-looking statements” as that

term is defined in the Private Securities Litigation Reform Act of 1995. The forward-looking statements contained herein are subject to known and unknown risks,

uncertainties, assumptions and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by

any such forward-looking statements. Forward-looking statements include information concerning our future financial performance, business strategy, projected plans and

objectives. These statements may be identified by the fact that they do not relate to historical or current facts and may use words such as “believes,” “expects,” “anticipates,”

“will,” “should,” “could,” “may,” “would,” “intends,” “projects,” “estimates,” “plans,” and similar words, expressions or phrases. The following important factors and assumptions

could affect our future results and could cause actual results to differ materially from those expressed in such forward-looking statements.

W0.2

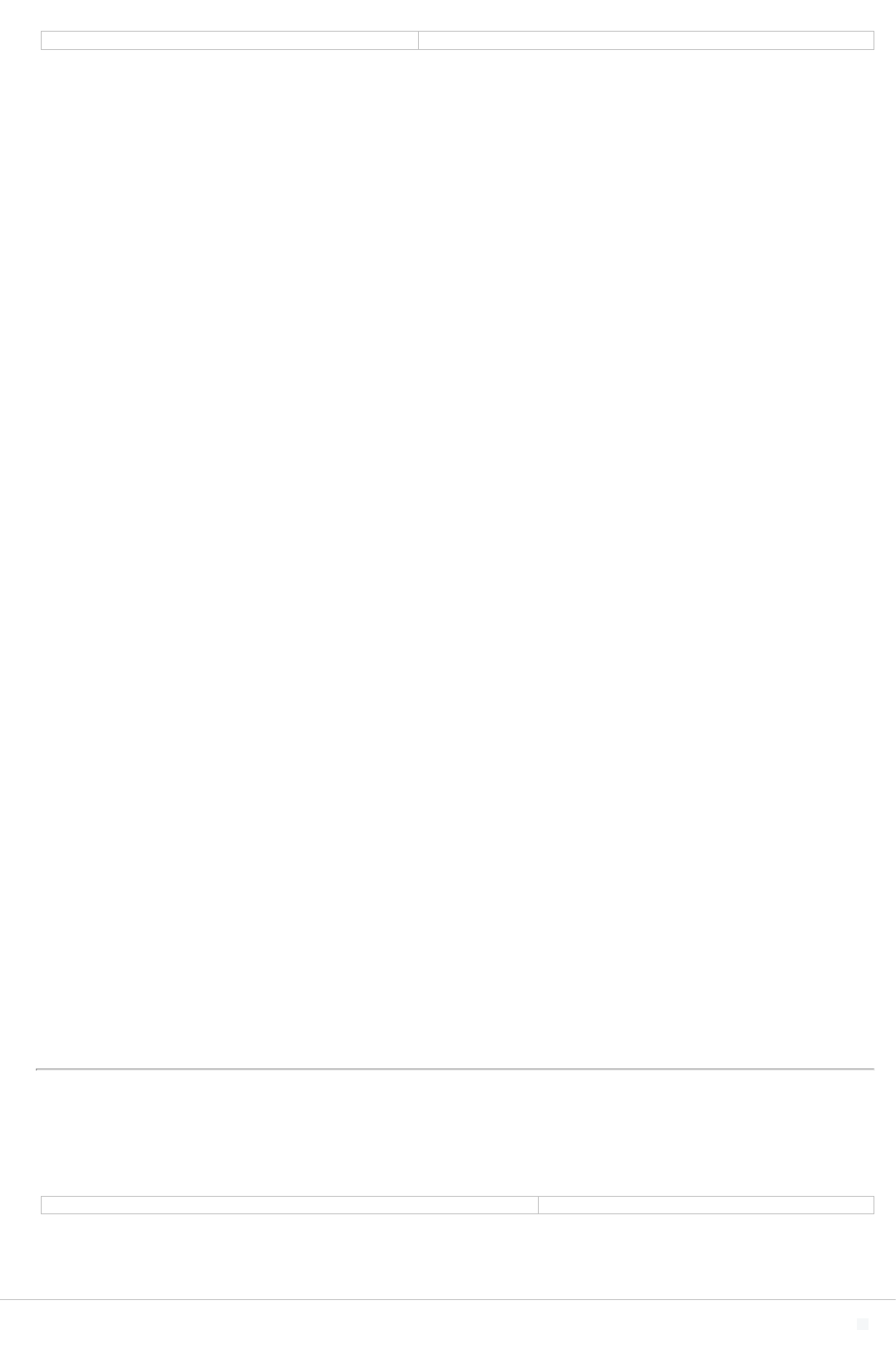

(W0.2) State the start and end date of the year for which you are reporting data.

Start date End date

Reporting year January 1 2022 December 31 2022

W0.3

(W0.3) Select the countries/areas in which you operate.

United States of America

W0.4

(W0.4) Select the currency used for all financial information disclosed throughout your response.

USD

W0.5

(W0.5) Select the option that best describes the reporting boundary for companies, entities, or groups for which water impacts on your business are being

reported.

Companies, entities or groups over which operational control is exercised

W0.6

(W0.6) Within this boundary, are there any geographies, facilities, water aspects, or other exclusions from your disclosure?

Yes

CDP Page of 251

W0.6a

(W0.6a) Please report the exclusions.

Exclusion Please explain

Company-operated locations outside of

the United States

Due to limited data availability, Avis Budget Group does not report on water withdrawals for international locations outside of the United States. We plan to report water

withdrawals for international locations within the next two years.

W0.7

(W0.7) Does your organization have an ISIN code or another unique identifier (e.g., Ticker, CUSIP, etc.)?

Indicate whether you are able to provide a unique identifier for your organization. Provide your unique identifier

Yes, a Ticker symbol CAR

W1. Current state

W1.1

(W1.1) Rate the importance (current and future) of water quality and water quantity to the success of your business.

Direct use

importance

rating

Indirect

use

importance

rating

Please explain

Sufficient amounts of good

quality freshwater available for

use

Neutral Vital Avis Budget Group is a leading global provider of mobility solutions, and as such, the availability of water is important to our business and stakeholders,

including local communities. Although our operations do depend on freshwater to be available to clean our rental vehicles and also for our employees,

the availability of recycled water is significantly more vital to our business.

For example, at our major facilities, we continue to maintain and install water saving car wash systems that recycle and reuse up to 80% of their

wastewater. Our suppliers and their workers also require access to quality freshwater for production, sanitation and health purposes.

We do not expect the future water dependency of sufficient amounts of good quality freshwater available for use to differ for either direct or indirect use,

as we do not expect our business requirements to change.

Sufficient amounts of recycled,

brackish and/or produced water

available for use

Vital Important Sufficient amounts of recycled, brackish and/or produced water available for use is vital for our business. For example, across our major facilities, we

continue to maintain and install water saving car

wash systems, that recycle and reuse up to 80% of their wastewater.

Sufficient amounts of recycled, brackish and/or produced water is also important to our indirect operations and value chain, as our suppliers may need

recycled, brackish and/or produced water to produce items within our supplier chain.

Sufficient amounts of recycled, brackish and/or produced water may become even more vital for our business in the future as we aim to increase the use

of recycled water in the car wash systems. Sufficient amount of recycled, brackish and/or produced water may become more important as areas of water

stress increase, reducing the amount of freshwater available.

W1.2

CDP Page of 252

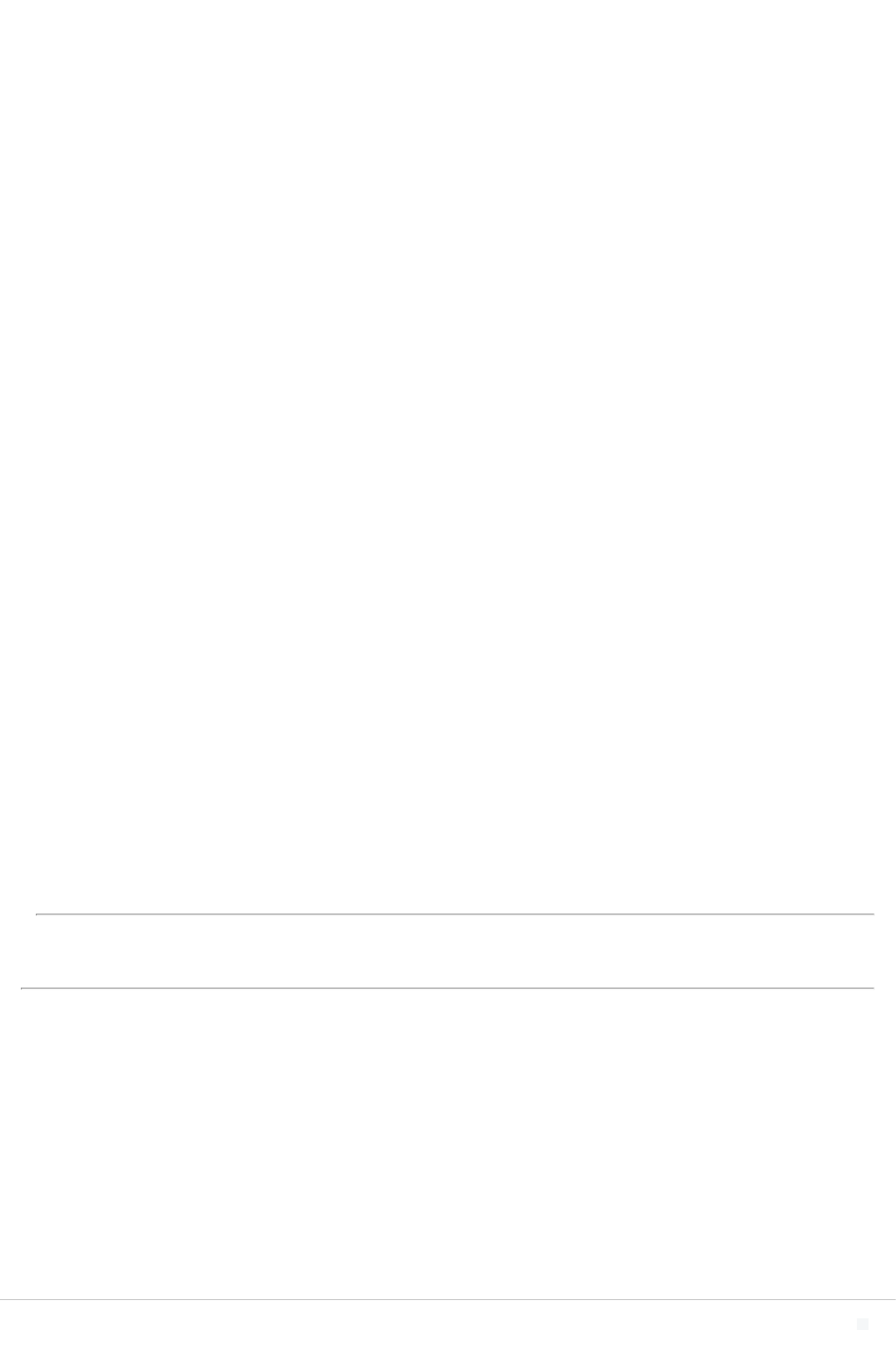

(W1.2) Across all your operations, what proportion of the following water aspects are regularly measured and monitored?

% of

sites/facilities/operations

Frequency of

measurement

Method of measurement Please explain

Water withdrawals – total

volumes

76-99 Monthly We monitor water withdrawals – total volume

monthly through our utility invoice systems.

Please note, we utilize two different invoice

systems (one system for leased sites and

one system where the utility invoices is paid

by ABG).

In 2022, our data boundary included all of our company-operated U.S. operating

locations. This data is monitored on a monthly basis through our utility invoice

monitoring system and reported annually in our ESG Report.

Water withdrawals – volumes

by source

76-99 Monthly We monitor water withdrawals – volumes by

source monthly through our utility invoice

systems. Please note, we utilize two different

invoice systems (one system for leased sites

and one system where the utility invoices is

paid by ABG).

In 2022, our primary withdrawal source was municipal water, and our data boundary

included all of our company-operated U.S. operating locations. This data is monitored

on a monthly basis through our utility invoice monitoring system and reported annually

in our ESG Report. Please note, other sources of water withdrawals such as

groundwater such are either not used or estimated to not be a significant source of

overall water withdrawals.

Entrained water associated with

your metals & mining and/or

coal sector activities - total

volumes [only metals and

mining and coal sectors]

<Not Applicable> <Not

Applicable>

<Not Applicable> <Not Applicable>

Produced water associated with

your oil & gas sector activities -

total volumes [only oil and gas

sector]

<Not Applicable> <Not

Applicable>

<Not Applicable> <Not Applicable>

Water withdrawals quality Not relevant <Not

Applicable>

<Not Applicable> Water withdrawals quality, is not relevant for our business because most of our water

withdrawals are attributed to car washing at our operating locations.

Water discharges – total

volumes

76-99 Monthly We monitor water discharges – total volume

monthly through our utility invoice systems.

Please note, we utilize two different invoice

systems (one system for leased sites and

one system where the utility invoices is paid

by ABG).

Avis Budget Group monitors water discharges on a monthly basis through our utility

invoice monitoring system. Water discharges are also monitored per our municipal, state

and/or federal compliance requirements.

Water discharges – volumes by

destination

Not monitored <Not

Applicable>

<Not Applicable> Water discharges are believed to be the returned to the source, namely sewers for our

withdrawals of municipal water; therefore water discharges – volumes by destination

are not monitored.

Water discharges – volumes by

treatment method

Not relevant <Not

Applicable>

<Not Applicable> Water discharges by treatment method are applicable to local municipalities (and not

our business) once our water withdrawals are returned to the source, namely sewers for

our withdrawals of municipal water.

Water discharge quality – by

standard effluent parameters

Not relevant <Not

Applicable>

<Not Applicable> Water discharge quality by standard effluent parameters are typically addressed by local

municipalities once our water withdrawals are returned to the source, namely sewers for

our withdrawals of municipal water; and are therefore not relevant to our business.

Water discharge quality –

emissions to water (nitrates,

phosphates, pesticides, and/or

other priority substances)

Not relevant <Not

Applicable>

<Not Applicable> Discharge quality, including discharge quality is typically addressed by local

municipalities once our water withdrawals are returned to the source, namely sewers for

our withdrawals of municipal water; and is therefore not relevant to our business.

Water discharge quality –

temperature

Not relevant <Not

Applicable>

<Not Applicable> Discharge quality, including temperatures, is typically addressed by local municipalities

once our water withdrawals are returned to the source, namely sewers for our

withdrawals of municipal water; and is therefore not relevant to our business.

Water consumption – total

volume

76-99 Monthly We monitor water consumption – total volume

monthly through our utility invoice systems.

Please note, we utilize two different invoice

systems (one system for leased sites and

one system where the utility invoices is paid

by ABG).

We currently assume that our water withdrawn is consumed. In 2022, our data

boundary included all of our company-operated U.S. operating locations. This data is

monitored on a monthly basis through our utility invoice monitoring system and reported

annually in our ESG Report.

Water recycled/reused 26-50 Monthly At main locations with car washing, we

monitor water recycled / reused monthly

through onsite systems

We monitor water recycled / reused at certain locations to ensure the car washing

systems are running efficiently.

The provision of fully-

functioning, safely managed

WASH services to all workers

100% Monthly At all locations we track and provide safe,

clean, and potable drinking water for all

workers and available at all times from

sources compliant with municipal, state and

federal requirements.

Avis Budget Group aims to ensure the provision of fully-functioning, safely managed

WASH services to all workers as relevant and in compliance with any application

regulations.

W1.2b

CDP Page of 253

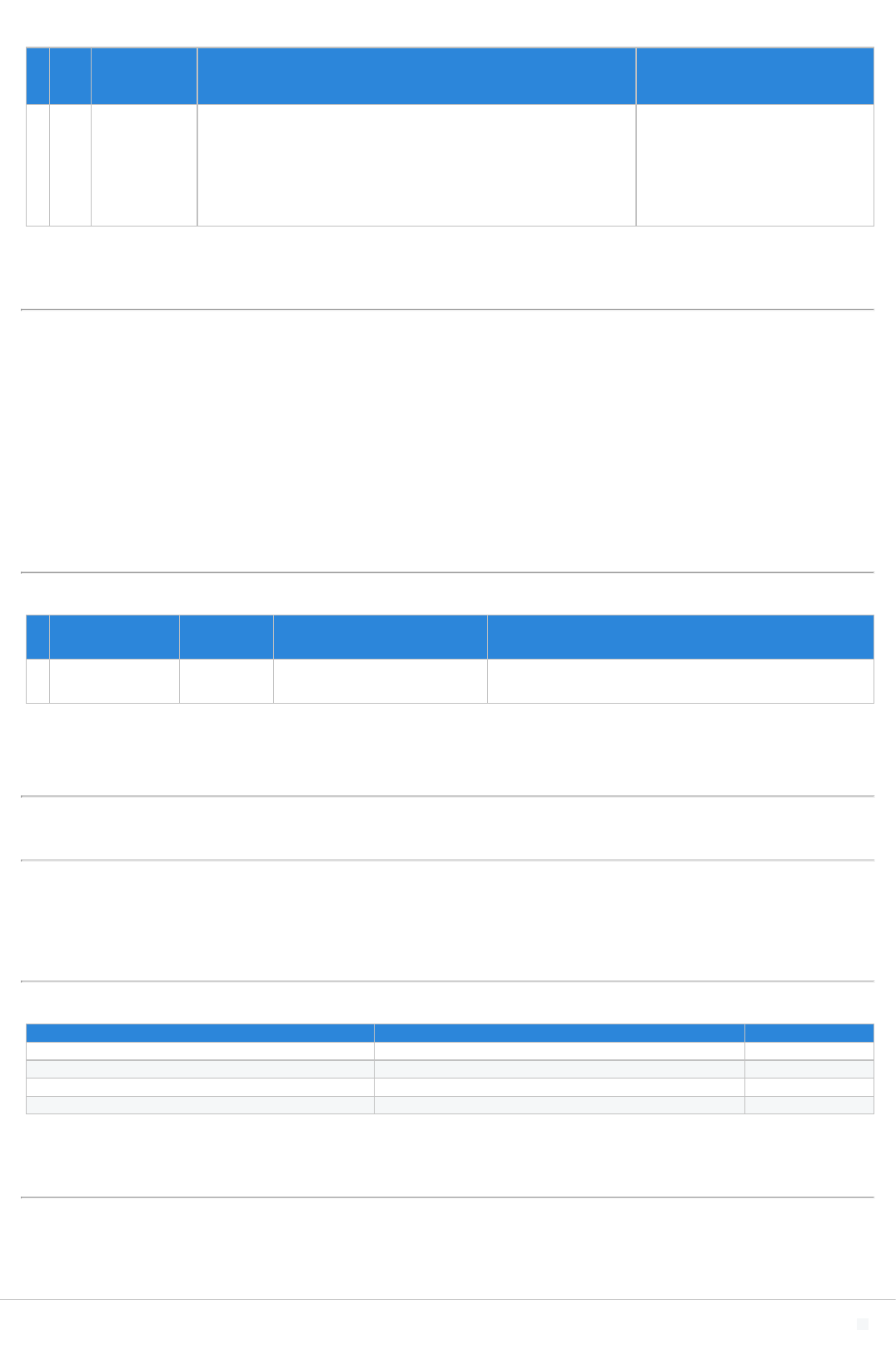

(W1.2b) What are the total volumes of water withdrawn, discharged, and consumed across all your operations, how do they compare to the previous reporting

year, and how are they forecasted to change?

Volume

(megaliters/year)

Comparison

with

previous

reporting

year

Primary reason

for comparison

with previous

reporting year

Five-

year

forecast

Primary reason

for forecast

Please explain

Total

withdrawals

1275.84 Lower Increase/decrease

in efficiency

Lower Increase/decrease

in efficiency

In 2022, Avis Budget Group’s total water withdrawals decreased by approximately 2.6%, due to increases in water

efficiency. For example, In 2022, we installed 10 water-saving car wash systems across our major facilities in the

U.S. A total of 45 water-saving car wash systems since 2021. These systems recycle and reuse up to 80% of their

wastewater, which not only saves water, but is also more cost-effective compared to tradition carwash systems.

Another example is ABG’s location in Copenhagen, Denmark, that piloted the installation of a closed loop

carwash.Through this system, 100% of the location’s water is recirculated and purified in a closed loop.This

system saves approximately 265,000 gallons (1 million liters) of water annually.

Additionally, begining in 2019, Spain piloted a Wash and Clean Quick Turn Around process to save water.

Returned vehicles under a short-term rental were visually inspected and when considered not dirty enough to go

through a cleaning circuit, their interiors are simply dry-cleaned with chemical products for a waterless process. In

2021, this program was deployed across Europe and Asia Pacific and it is planned to be piloted in desginated

locations in the U.S. in 2024.

As we continue to increase efficiencies, we expect total water withdrawals will continue to decrease.

Total

discharges

1275.84 Lower Increase/decrease

in efficiency

Lower Increase/decrease

in efficiency

In 2022, Avis Budget Group’s total water withdrawals decreased by approximately 2.6%, due to increases in water

efficiency. For example, In 2022, we installed 10 water-saving car wash systems across our major facilities in the

U.S. A total of 45 water-saving car wash systems since 2021. These systems recycle and reuse up to 80% of their

wastewater, which not only saves water, but is also more cost-effective compared to tradition carwash systems.

Another example is ABG’s location in Copenhagen, Denmark, that piloted the installation of a closed loop

carwash.Through this system, 100% of the location’s water is recirculated and purified in a closed loop.This

system saves approximately 265,000 gallons (1 million liters) of water annually.

Additionally, begining in 2019, Spain piloted a Wash and Clean Quick Turn Around process to save water.

Returned vehicles under a short-term rental were visually inspected and when considered not dirty enough to go

through a cleaning circuit, their interiors are simply dry-cleaned with chemical products for a waterless process. In

2021, this program was deployed across Europe and Asia Pacific and it is planned to be piloted in desginated

locations in the U.S. in 2024.

As we continue to increase efficiencies, we expect total water withdrawals will continue to decrease.

Total

consumption

1275.84 Lower Increase/decrease

in efficiency

Lower Increase/decrease

in efficiency

In 2022, Avis Budget Group’s total water withdrawals decreased by approximately 2.6%, due to increases in water

efficiency. For example, In 2022, we installed 10 water-saving car wash systems across our major facilities in the

U.S. A total of 45 water-saving car wash systems since 2021. These systems recycle and reuse up to 80% of their

wastewater, which not only saves water, but is also more cost-effective compared to tradition carwash systems.

Another example is ABG’s location in Copenhagen, Denmark, that piloted the installation of a closed loop

carwash.Through this system, 100% of the location’s water is recirculated and purified in a closed loop.This

system saves approximately 265,000 gallons (1 million liters) of water annually.

Additionally, begining in 2019, Spain piloted a Wash and Clean Quick Turn Around process to save water.

Returned vehicles under a short-term rental were visually inspected and when considered not dirty enough to go

through a cleaning circuit, their interiors are simply dry-cleaned with chemical products for a waterless process. In

2021, this program was deployed across Europe and Asia Pacific and it is planned to be piloted in desginated

locations in the U.S. in 2024.

As we continue to increase efficiencies, we expect total water withdrawals will continue to decrease.

W1.2d

(W1.2d) Indicate whether water is withdrawn from areas with water stress, provide the proportion, how it compares with the previous reporting year, and how it is

forecasted to change.

Withdrawals

are from

areas with

water stress

%

withdrawn

from

areas with

water

stress

Comparison

with

previous

reporting

year

Primary reason

for comparison

with previous

reporting year

Five-

year

forecast

Primary reason

for forecast

Identification

tool

Please explain

Row

1

Yes 26-50 Lower Increase/decrease

in efficiency

Lower Increase/decrease

in efficiency

WRI

Aqueduct

In 2022, we conducted our annual water assessment of Avis Budget Group’s U.S. operating

locations. The methodology for assessing our company’s exposure to water risks included mapping

properties using the World Resources Institute (WRI) Aqueduct tool to identify locations with

baseline water stress, riverine and coastal flood, drought and future water stress risks.

Approximately 30% of water withdrawn from U.S. operating locations located in areas of “high” or

“extremely high” stress using the WRI Aqueduct tool.

W1.2h

CDP Page of 254

(W1.2h) Provide total water withdrawal data by source.

Relevance Volume

(megaliters/year)

Comparison

with

previous

reporting

year

Primary reason

for comparison

with previous

reporting year

Please explain

Fresh surface

water, including

rainwater, water

from wetlands,

rivers, and lakes

Not

relevant

<Not Applicable> <Not

Applicable>

<Not Applicable> In 2022, the use of fresh surface water, including rainwater, water from wetlands, rivers and lakes was not material within our

data boundary

Brackish surface

water/Seawater

Not

relevant

<Not Applicable> <Not

Applicable>

<Not Applicable> There are no known instances where Avis Budget Group currently uses brackish surface water or seawater at our operating

locations in the United States.

Groundwater –

renewable

Not

relevant

<Not Applicable> <Not

Applicable>

<Not Applicable> There are no known instances where Avis Budget Group currently uses groundwater at our operating locations in the United

States.

Groundwater –

non-renewable

Not

relevant

<Not Applicable> <Not

Applicable>

<Not Applicable> There are no known instances where Avis Budget Group currently uses groundwater at our operating locations in the United

States.

Produced/Entrained

water

Not

relevant

<Not Applicable> <Not

Applicable>

<Not Applicable> There are no known instances where Avis Budget Group currently uses produced or entrained water at our operating

locations in the United States.

Third party sources Relevant 1275.84 Lower Increase/decrease

in efficiency

In 2022, Avis Budget Group’s total water withdrawals decreased by approximately 2.6%, due to increases in water efficiency.

For example, In 2022, we installed 10 water-saving car wash systems across our major facilities in the U.S. A total of 45

water-saving car wash systems since 2021. These systems recycle and reuse up to 80% of their wastewater, which not only

saves water, but is also more cost-effective compared to tradition carwash systems. Another example is ABG’s location in

Copenhagen, Denmark, that piloted the installation of a closed loop carwash.Through this system, 100% of the location’s

water is recirculated and purified in a closed loop.This system saves approximately 265,000 gallons (1 million liters) of water

annually. Additionally, begining in 2019, Spain piloted a Wash and Clean Quick Turn Around process to dry-clean vehicles

with chemical products for a waterless process. In 2024, this program is planned to be piloted in the U.S.

W1.3

(W1.3) Provide a figure for your organization’s total water withdrawal efficiency.

Revenue Total water

withdrawal volume

(megaliters)

Total water

withdrawal

efficiency

Anticipated forward trend

Row

1

1199400

0000

1275.84 In 2022, Avis Budget Group’s total water withdrawals decreased by approximately 2.6%, due to increases in water efficiency. For example, In 2022, we

installed 10 water-saving car wash systems across our major facilities in the U.S. A total of 45 water-saving car wash systems since 2021.

W1.4

(W1.4) Do any of your products contain substances classified as hazardous by a regulatory authority?

Products contain hazardous substances Comment

Row 1 No We do not sell products that contain substances classified as hazardous by a regulatory authority.

W1.5

(W1.5) Do you engage with your value chain on water-related issues?

Engagement Primary reason for no engagement Please explain

Suppliers Yes <Not Applicable> <Not Applicable>

Other value chain partners (e.g., customers) Yes <Not Applicable> <Not Applicable>

W1.5a

CDP Page of 255

(W1.5a) Do you assess your suppliers according to their impact on water security?

Row 1

Assessment of supplier impact

No, we do not currently assess the impact of our suppliers, but we plan to do so within the next two years

Considered in assessment

<Not Applicable>

Number of suppliers identified as having a substantive impact

<Not Applicable>

% of total suppliers identified as having a substantive impact

<Not Applicable>

Please explain

Although Avis Budget Group does not currently request that our suppliers report on their water use. We aim to conduct appropriate diligence including research and

analysis of a company or organization in the selection process to reduce risk and comply with the applicable laws. Our approach is to conduct a risk-based screening of our

business partners to ensure the ability to comply with our Third-Party Standards of Conduct.

W1.5b

(W1.5b) Do your suppliers have to meet water-related requirements as part of your organization’s purchasing process?

Suppliers have to meet specific water-related requirements Comment

Row 1 Yes, water-related requirements are included in our supplier contracts <Not Applicable>

W1.5c

(W1.5c) Provide details of the water-related requirements that suppliers have to meet as part of your organization’s purchasing process, and the compliance

measures in place.

Water-related requirement

Complying with going beyond water-related regulatory requirements

% of suppliers with a substantive impact required to comply with this water-related requirement

<Not Applicable>

% of suppliers with a substantive impact in compliance with this water-related requirement

<Not Applicable>

Mechanisms for monitoring compliance with this water-related requirement

Supplier self-assessment

Response to supplier non-compliance with this water-related requirement

Retain and engage

Comment

Avis Budget Group’s Third Party Standards of Conduct represents our company’s commitment to foster sustainable relationships with our business partners, agents,

consultants, suppliers and other third parties and ensure that they uphold ethical standards and adhere to social and environmental responsibilities for the good of the

communities that we serve. Avis Budget Group expects that Third Parties, in all their activities, will comply with all applicable laws, rules and regulations of the countries

and localities in which they operate, whether or not specifically referenced in the Third Party Standards of Conduct.

W1.5d

CDP Page of 256

(W1.5d) Provide details of any other water-related supplier engagement activity.

Type of engagement

Information collection

Details of engagement

Collect water management information at least annually from suppliers

% of suppliers by number

1-25

% of suppliers with a substantive impact

<Not Applicable>

Rationale for your engagement

Avis Budget Group engages with suppliers through actively communicating our ESG strategy.

Impact of the engagement and measures of success

Not yet evaluated

Comment

We partenered with SynESGy to assess the Environemental, Social and Governance strategy, oversight, and metrics from a selected group of suppliers in Europe. The

ESG assessment was launched in 2023 and data requested to suppliers covers information on water impacts and metrics. Our supplier's ESG assessment is planed to be

expanded to all major suppliers within the next two years.

W1.5e

(W1.5e) Provide details of any water-related engagement activity with customers or other value chain partners.

Type of stakeholder

Customers

Type of engagement

Education / information sharing

Details of engagement

Run an engagement campaign to educate stakeholders about your water-related performance and strategy

Rationale for your engagement

Avis Budget Group engages with customers through actively communicating our ESG strategy.

Impact of the engagement and measures of success

We get requests from customers to provide information on water impacts including related data. Customers not just requesting information, but they want to see results and

this has supproted our busniess case to continue retrofiting our car washes with water-efficient systems.

W2. Business impacts

W2.1

(W2.1) Has your organization experienced any detrimental water-related impacts?

No

W2.2

(W2.2) In the reporting year, was your organization subject to any fines, enforcement orders, and/or other penalties for water-related regulatory violations?

Water-related regulatory violations Fines, enforcement orders, and/or other penalties Comment

Row 1 No <Not Applicable>

W3. Procedures

W3.1

CDP Page of 257

(W3.1) Does your organization identify and classify potential water pollutants associated with its activities that could have a detrimental impact on water

ecosystems or human health?

Identification and classification of potential water

pollutants

How potential water pollutants are identified and

classified

Please explain

Row

1

No, we do not identify and classify our potential water

pollutants

<Not Applicable> We do not identify and classify our potential water pollutants as this is more relevant to

manufacturing industries.

W3.3

(W3.3) Does your organization undertake a water-related risk assessment?

Yes, water-related risks are assessed

W3.3a

(W3.3a) Select the options that best describe your procedures for identifying and assessing water-related risks.

Value chain stage

Direct operations

Coverage

Full

Risk assessment procedure

Water risks are assessed in an environmental risk assessment

Frequency of assessment

Annually

How far into the future are risks considered?

More than 6 years

Type of tools and methods used

Tools on the market

Enterprise risk management

Tools and methods used

WRI Aqueduct

Contextual issues considered

Water availability at a basin/catchment level

Water quality at a basin/catchment level

Stakeholders considered

Customers

Employees

Investors

Local communities

NGOs

Regulators

Suppliers

Water utilities at a local level

Comment

Avis Budget Group completed our first water risk assessment that covered our U.S. operating locations. The methodology for assessing our company’s exposure to water

risks included mapping properties using the World Resources Institute (WRI) Aqueduct tool to identify locations with baseline water stress, riverine and coastal flood,

drought and future water stress risks.

We assessed both current and future risks across numerous dimensions, including: (1) current water stress, (2) number of vehicle rentals at each location, (3) flood risk and

(4) drought risk.

Value chain stage

Supply chain

Coverage

Partial

Risk assessment procedure

Water risks are assessed as part of an established enterprise risk management framework

Frequency of assessment

More than once a year

How far into the future are risks considered?

More than 6 years

Type of tools and methods used

Tools on the market

Enterprise risk management

Tools and methods used

CDP Page of 258

COSO Enterprise Risk Management Framework

Contextual issues considered

Water availability at a basin/catchment level

Water quality at a basin/catchment level

Stakeholders considered

Customers

Employees

Investors

Local communities

Regulators

Suppliers

Comment

Supply chain risks, including those associated with extreme weather events and other water-related risks that may impact our company’s overall risk factors, are regularly

reviewed as part of our multi-disciplinary, company-wide risk management process.

Value chain stage

Other stages of the value chain

Coverage

Partial

Risk assessment procedure

Water risks are assessed as part of an established enterprise risk management framework

Frequency of assessment

More than once a year

How far into the future are risks considered?

More than 6 years

Type of tools and methods used

Enterprise risk management

Tools and methods used

COSO Enterprise Risk Management Framework

Contextual issues considered

Water availability at a basin/catchment level

Water quality at a basin/catchment level

Stakeholders considered

Customers

Employees

Investors

Local communities

Regulators

Suppliers

Comment

Value chain risks, including those associated with safety and other water-related risks may impact our company’s overall risk factors, are regularly reviewed as part of our

multi-disciplinary, company-wide risk management process.

W3.3b

CDP Page of 259

(W3.3b) Describe your organization’s process for identifying, assessing, and responding to water-related risks within your direct operations and other stages of

your value chain.

Rationale for approach to risk

assessment

Explanation of contextual

issues considered

Explanation of stakeholders considered Decision-making process for risk response

Row

1

Our processes at the company level,

our ESG team maintains daily

strategic oversight to identify and

manage risks related to water that

may impact our Company’s

reputation, profitability and access to

capital. Key methods include (1)

engagement with subject matter

experts within our organization, (2)

engagement with consultants and

industry experts, and (3) reviewing

sustainability-related questionnaires

and assessment criteria from the

investor community and our corporate

purchasers.

Our processes at the asset level are

location-based. We identify and

assess water-related risks and

opportunities by actively tracking

environmental performance and

water-related risks. Additionally, our

business continuity processes enable

us to identify and assess physical

water risks (including flooding and

drought risks).

In 2022, we updated our water risk

assessment which includes all of our

U.S. operating locations. We

assessed both current risks across

these locations, including: (1) current

baseline water stress, (2) number of

vehicle rentals at each location, (3)

flood risk, (4) drought risk and (5)

water usage. Avis Budget Group

assesses water availability at the

basin level and water quality at the

basin level, considering baseline

water stress using the WRI Aqueduct

tool. We also consider risks related to

the status of ecosystems and

habitats to be relevant to our

business model, particularly in the

context of our dependency on a

thriving travel and tourism industry.

We consider all markets

where our brands (including

affiliate-managed

operations) have a

presence We also consider

global environmental and

socioeconomic trends,

which may impact the value

of our assets in addition to

revenue and costs in our

key markets, including

those in the Americas

(North America, South

America, Central America,

and the Caribbean). Our

company considers ESG

risks and opportunities,

including those related to

water security, within a 10-

year time horizon.

Additional contextual issues

considered are included in

the WRI aqueduct tool.

these include overall water

risk, which includes

indicators from the physical

quantity, quality and

regulatory & reputational

risk categories.

All our customers are considered in our company’s water-related risk assessment.

Increasingly, sustainability is becoming an important factor that drives brand reputation.

Our corporate customers are also increasingly interested in reducing their environmental

impact. Employees are also considered in our company’s water-related risk

assessments. Our employees depend on access to water to clean our rental vehicles.

Investors are considered in our company’s water-related risk assessments. Through our

annual ESG reporting, we aim to increase our public disclosures to better demonstrate

to shareholders our strategy and actions taken to better mitigate risks and drive more

sustainable, responsible growth. Local communities where operating facilities are

located are considered in our company’s water-related risk assessments, as we aim to

strengthen community resilience. These communities may be affected by water-related

risks, including baseline water stress, droughts and flooding. We consider NGOs in our

company’s water-related risk assessments. This includes partnering with organizations

to support community resilience. We consider regulators in our company’s water-related

risk assessments, specifically in the markets where we operate. We consider suppliers in

our company’s water-related risk assessments. We actively partner with suppliers to

manage risks and create shared value. We consider water utilities at a local level in our

company’s water-related risk assessments.

If the results of the water risk assessment

indicate the potential for a substantial financial

and/or strategic impact, we utilize qualitative and

quantitative measures to determine next steps.

Qualitative measures consider correlations to our

business model, mission and value chain. The

criteria used to determine our priorities with

regards to water risks and opportunities is based

on the degree of potential market, physical,

regulatory and/or business model impacts. We

also consider our value chain impacts, industry

trends and level of stakeholder interest among

our employees, investors, customers, and

affiliates. Examples related to water-related

issues have influenced our business strategy and

planning process includes the establishment of

our 2030 water reduction target and initiatives to

improve water efficiency at our operating

locations.

Within the decision-making process, the following

internal stakeholders are engaged to collaborate

and determine the next steps necessary in order

to mitigate the water-related risks. At times, it

may also be necessary to engage external

stakeholders, including consultants to advise on

the best path of action. For example, if it is found

that an ABG location is at significant risk for

extremely high water stress-related impacts, the

company may work with an engineering team to

evaluate water efficiency measures that can be

implemented at a car wash.

W4. Risks and opportunities

W4.1

(W4.1) Have you identified any inherent water-related risks with the potential to have a substantive financial or strategic impact on your business?

Yes, only within our direct operations

W4.1a

(W4.1a) How does your organization define substantive financial or strategic impact on your business?

DEFINITION OF SUBSTANTIVE IMPACT: We define risk as having a substantial financial and strategic impact using both qualitative and quantitative measures.

Qualitative measures consider correlations to our business model, mission, and value chain. Quantitatively, we generally consider a risk to be substantive based

on a scenario where at least 0.5% of our operating costs could be impacted. In our CDP 2023 Water Security response, this threshold was approximately $24

million.

FACTORS CONSIDERED: To determine whether to risk is substantive, the risk probability and frequency over a 5-year time horizon are the most significant

factors. We also consider the potential magnitude of water-related risks.

METRICS USED: Operating costs is used as the primary metric to contextualize risk thresholds. To track our progress toward managing water-related risks,

current metrics used include (1) water consumption, (2) water intensity, and (3) progress towards our 2030 water reduction target. Our current target is to reduce

our water footprint by 30%, prioritizing water stressed locations.

W4.1b

CDP Page of 2510

(W4.1b) What is the total number of facilities exposed to water risks with the potential to have a substantive financial or strategic impact on your business, and

what proportion of your company-wide facilities does this represent?

Total number of

facilities exposed to

water risk

% company-wide

facilities this

represents

Comment

Row

1

2 Less than 1% We have prioritized two operating locations within our data boundary with notable water risk at based on the following factors: (2) located in “extremely high”

water stress areas, based on the WRI Aqueduct tool. One of these facilities is located in Arizona; and one of these facilities is located in Colorado.

W4.1c

(W4.1c) By river basin, what is the number and proportion of facilities exposed to water risks that could have a substantive financial or strategic impact on your

business, and what is the potential business impact associated with those facilities?

Country/Area & River basin

United States of America Colorado River (Pacific Ocean)

Number of facilities exposed to water risk

2

% company-wide facilities this represents

Less than 1%

Production value for the metals & mining activities associated with these facilities

<Not Applicable>

% company’s annual electricity generation that could be affected by these facilities

<Not Applicable>

% company’s global oil & gas production volume that could be affected by these facilities

<Not Applicable>

% company’s total global revenue that could be affected

Less than 1%

Comment

We have prioritized two operating locations within our data boundary with notable water risk at based on the following factors: Both located in “extremely high” water stress

areas, based on the WRI Aqueduct tool. One

of these facilities is located in Arizona; and one of these facilities is located in Colorado.

W4.2

CDP Page of 2511

(W4.2) Provide details of identified risks in your direct operations with the potential to have a substantive financial or strategic impact on your business, and your

response to those risks.

Country/Area & River basin

United States of America Other, please specify (Gulf of Mexico and North Atlantic Coast)

Type of risk & Primary risk driver

Acute physical Cyclone, hurricane, typhoon

Primary potential impact

Increased operating costs

Company-specific description

Increases in the frequency and severity of extreme weather events, such as hurricanes, floods, and wildfires, could impact travel demand in specific markets, lead to supply

chain interruptions and may cause damage to physical assets required for business continuity. For example, we rely heavily on the satisfactory performance and availability

of our information systems, including our reservation systems, websites and network infrastructure to attract and retain customers, accept reservations, process rental and

sales transactions, manage our fleet of vehicles, account for our activities and otherwise conduct our business. A failure or interruption that results in the unavailability of

any of our information systems, or a major disruption of communications between a system and the locations it serves, could cause a loss of reservations, interfere with our

fleet management, slow rental and sales processes, create negative publicity that damages our reputation or otherwise adversely impacts our ability to manage our

business effectively. For example, following Hurricanes Harvey, Irma and Maria, we experienced an impact of approximately $15 million in quarterly adjusted EBITDA

associated with lost revenue; lower utilization due to airport closures; incremental shuttling costs that we incurred to move vehicles to the impacted area; and property

damage. On an annual basis, we typically incur 5-20 extreme weather events that require us to execute upon our business continuity plans. Over the past decade, extreme

weather events have increased in both their severity and their reach. Historically, hurricanes were typically localized events, however, these extreme weather events are

becoming more regional.

Timeframe

More than 6 years

Magnitude of potential impact

Medium-low

Likelihood

More likely than not

Are you able to provide a potential financial impact figure?

Yes, a single figure estimate

Potential financial impact figure (currency)

48000000

Potential financial impact figure - minimum (currency)

<Not Applicable>

Potential financial impact figure - maximum (currency)

<Not Applicable>

Explanation of financial impact

Estimated financial impact assumes the potential for an approximate 1% increase in 2022 operating expenses (approximately $48 million) associated with variability in fuel

and/or energy costs.

Primary response to risk

Amend the Business Continuity Plan

Description of response

Over the past 75 years, we have developed strong competencies in how we are able to respond when extreme weather events, including those also associated with water

related risks, including flooding. Avis Budget Group’s business continuity processes are central to how we execute. Our number #1 focus is on protecting our people,

property and infrastructure; and we utilize an “all hands-on deck” approach to ensure that we can respond as rapidly and effectively as possible. For example, we are able

to quickly respond through our crisis management team to mitigate risks and impacts that may disrupt our operations. We have also developed longstanding partnerships

with leading national disaster agencies, which strengthen our ability to provide support to affected customers, employees and communities. Consistent with our “all hands

on deck” approach, our teams across the globe provide vehicles and volunteer time to help communities recover from hurricanes, floods and other disasters throughout the

year. We also manage risks to our fleet by self-insuring vehicles against property damage. The insurance policies supplement those that our customers also have in place

for rented vehicles. To also manage risks related to extreme weather events, Avis Budget Group conducted a water risks assessment, which highlighted our company’s

flood risks for our U.S. operating locations. We will use the results from this assessment to evaluate opportunities to implement additional mitigation measures at high-risk

locations.

Each year, we also conduct a water risk assessment. Through this assessment, approximately 30% of our locations face high- or extremely-high water related risks. This

assessment helps us to prioritize areas with high risk and implement additional mitigation measures.

Cost of response

10000000

Explanation of cost of response

Annually, we typically incur expenditures in excess of $10 million associated with our insurance programs, business continuity processes and disaster response and relief

efforts.

W4.2c

CDP Page of 2512

(W4.2c) Why does your organization not consider itself exposed to water risks in its value chain (beyond direct operations) with the potential to have a

substantive financial or strategic impact?

Primary reason Please explain

Row

1

Risks exist, but

no substantive

impact

anticipated

Avis Budget Group has not identified any substantial impacts from water-related risks in our value chain. Quantitatively, we generally consider a risk to be substantive based on a scenario

where at least 1% of our revenue can be impacted. Potential risks within our value chain include potential (1) supply chain disruptions as a result of extreme weather events, such as

hurricanes and floods; (2) increased costs in good that we procure; and (3) local community health risks associated with declining water quality.

W4.3

(W4.3) Have you identified any water-related opportunities with the potential to have a substantive financial or strategic impact on your business?

Yes, we have identified opportunities, and some/all are being realized

W4.3a

(W4.3a) Provide details of opportunities currently being realized that could have a substantive financial or strategic impact on your business.

Type of opportunity

Efficiency

Primary water-related opportunity

Improved water efficiency in operations

Company-specific description & strategy to realize opportunity

Water is a vital resource for the world, and for Avis Budget Group. Limited or irregular water supply can have an impact on our operations, specifically where our locations

include car washes. Therefore, we are focused on being responsible, efficient stewards of local water resources. To minimize ABG’s water footprint, the company focuses

on the areas with the greatest opportunities. These include water consumption and wastewater associated with cleaning and maintaining its fleet. The company also

prioritizes reductions and efficiency measures at operating locations which experience the highest level of water stress. These measures include implementation of closed

loop and waterless car washing.

OUR STRATEGY: Avis Budget group has set a water reduction target to reduce our water footprint by 30% by 2030, prioritizing water stressed locations. Each year, we

conduct a water risk assessment to also evaluate water-related risks. Based on this assessment, approximately 30% our water consumption is withdrawn from locations

with at least “high” baseline water stress.

We are also committed to evaluating opportunities to increase water efficiency measures, including installing water savings car wash systems. We are also committed to

finding alternative waterless cleaning processes. For example, in 2022 we installed 10 car wash systems across our major facilities in the U.S. that recycle and reuse up to

80% of their wastewater. We have installed 45 of this car wash sytems since 2021. Also, in ABG’s location in Copenhagen, Denmark, piloted the installation of a closed

loop carwash, which not only saves water, but is also more cost-effective compared to tradition carwash systems. Through this system, 100% of the location’s water is

recirculated and purified in a closed loop. This system saves pproximately 265,000 gallons (1 million liters) of water annually.

Estimated timeframe for realization

4 to 6 years

Magnitude of potential financial impact

Low-medium

Are you able to provide a potential financial impact figure?

Yes, a single figure estimate

Potential financial impact figure (currency)

150000

Potential financial impact figure – minimum (currency)

<Not Applicable>

Potential financial impact figure – maximum (currency)

<Not Applicable>

Explanation of financial impact

Estimated financial impact assumes the cost of one water efficient car wash system potential of approximately $150,000, In 2022, we spent $1,500,000 to purchase 10 of

this car wash systems.

W5. Facility-level water accounting

W5.1

(W5.1) For each facility referenced in W4.1c, provide coordinates, water accounting data, and a comparison with the previous reporting year.

Facility reference number

Facility 1

Facility name (optional)

Phoenix, Az

CDP Page of 2513

Country/Area & River basin

United States of America Colorado River (Pacific Ocean)

Latitude

33.435867

Longitude

-112.049313

Located in area with water stress

Yes

Primary power generation source for your electricity generation at this facility

<Not Applicable>

Oil & gas sector business division

<Not Applicable>

Total water withdrawals at this facility (megaliters/year)

81.98

Comparison of total withdrawals with previous reporting year

Higher

Withdrawals from fresh surface water, including rainwater, water from wetlands, rivers and lakes

0

Withdrawals from brackish surface water/seawater

0

Withdrawals from groundwater - renewable

0

Withdrawals from groundwater - non-renewable

0

Withdrawals from produced/entrained water

0

Withdrawals from third party sources

81.98

Total water discharges at this facility (megaliters/year)

81.98

Comparison of total discharges with previous reporting year

Higher

Discharges to fresh surface water

0

Discharges to brackish surface water/seawater

0

Discharges to groundwater

0

Discharges to third party destinations

81.98

Total water consumption at this facility (megaliters/year)

81.98

Comparison of total consumption with previous reporting year

Higher

Please explain

Our total water consumption at our airport location in Phoenix, AZ location increased 25% compared to 2021. This increase was primarily due to strong demand for vehicle

rental as a result of COVID-19 travel restrictions being lifted and an increase in global travel demand compared to pre-pandemic levels.

This location is currently identified as having “extremely high” water stress using the WRI Aqueduct Tool. This site has been prioritized for water risk based on total water

withdrawals compared to other U.S. operating locations. At this location, we operate a water saving carwash system that recycle and reuse up to 80% of their wastewater.

Facility reference number

Facility 2

Facility name (optional)

Denver, Co

Country/Area & River basin

United States of America Mississippi River

Latitude

39.836151

CDP Page of 2514

Longitude

-104.692819

Located in area with water stress

Yes

Primary power generation source for your electricity generation at this facility

<Not Applicable>

Oil & gas sector business division

<Not Applicable>

Total water withdrawals at this facility (megaliters/year)

74.51

Comparison of total withdrawals with previous reporting year

Lower

Withdrawals from fresh surface water, including rainwater, water from wetlands, rivers and lakes

0

Withdrawals from brackish surface water/seawater

0

Withdrawals from groundwater - renewable

0

Withdrawals from groundwater - non-renewable

0

Withdrawals from produced/entrained water

0

Withdrawals from third party sources

74.51

Total water discharges at this facility (megaliters/year)

74.51

Comparison of total discharges with previous reporting year

Lower

Discharges to fresh surface water

0

Discharges to brackish surface water/seawater

0

Discharges to groundwater

0

Discharges to third party destinations

74.51

Total water consumption at this facility (megaliters/year)

74.51

Comparison of total consumption with previous reporting year

Lower

Please explain

Our airport location in Denver, CO is currently identified as having “extremely high” water stress using the WRI Aqueduct Tool. This site has been prioritized for water risk

based on total water withdrawals compared to other U.S. operating locations. At this location, we operate a water saving carwash system that recycle and reuse up to 80%

of their wastewater. Total water consumption at this facility decreased 18.5% in 2022 compared to 2021.

W5.1a

(W5.1a) For the facilities referenced in W5.1, what proportion of water accounting data has been third party verified?

Water withdrawals – total volumes

% verified

Not verified

Verification standard used

<Not Applicable>

Please explain

We do not currently have data associated with water withdrawals third-party assured.

CDP Page of 2515

Water withdrawals – volume by source

% verified

Not verified

Verification standard used

<Not Applicable>

Please explain

We do not currently have data associated with water withdrawals third-party assured.

Water withdrawals – quality by standard water quality parameters

% verified

Not verified

Verification standard used

<Not Applicable>

Please explain

We do not currently have data associated with water withdrawals third-party assured.

Water discharges – total volumes

% verified

Not verified

Verification standard used

<Not Applicable>

Please explain

We do not currently have data associated with water discharges third-party assured.

Water discharges – volume by destination

% verified

Not verified

Verification standard used

<Not Applicable>

Please explain

We do not currently have data associated with water discharges third-party assured.

Water discharges – volume by final treatment level

% verified

Not verified

Verification standard used

<Not Applicable>

Please explain

We do not currently have data associated with water discharges third-party assured.

Water discharges – quality by standard water quality parameters

% verified

Not verified

Verification standard used

<Not Applicable>

Please explain

We do not currently have data associated with water discharges third-party assured.

Water consumption – total volume

% verified

Not verified

Verification standard used

<Not Applicable>

Please explain

We do not currently have data associated with water consumption third-party assured.

W6. Governance

W6.1

(W6.1) Does your organization have a water policy?

Yes, we have a documented water policy that is publicly available

CDP Page of 2516

W6.1a

(W6.1a) Select the options that best describe the scope and content of your water policy.

Scope Content Please explain

Row

1

Company-

wide

Description of the scope

(including value chain stages)

covered by the policy

Description of business

dependency on water

Description of business impact

on water

Commitment to reduce water

withdrawal and/or consumption

volumes in supply chain

Commitments beyond regulatory

compliance

Reference to company water-

related targets

Acknowledgement of the human

right to water and sanitation

Avis Budget Group’s Environmental Policy describes our company-wide commitment to water stewardship. This policy is publicly available at:

https://avisbudgetgroup.com/wpcontent/uploads/2019/06/ABG-Environmental-Policy-2019.pdf.

We believe that access to clean, potable water is a fundamental right for all. We are focused on being responsible, efficient stewards of local water resources.

Water is a precious resource for the world, and for Avis Budget Group. Limited or irregular water supply can have an impact on our operations. Therefore, we are

focused on being responsible, efficient stewards of local water resources.

To minimize our water footprint, we are targeting our greatest impacts, which includes consumption and wastewater associated with cleaning and maintaining our

vehicles. We are also prioritizing reductions and efficiency measures at our operating locations with the highest level of water stress and scarcity risks. We have

set a goal to reduce our water footprint by 30%, prioritizing water stressed locations.

W6.2

(W6.2) Is there board level oversight of water-related issues within your organization?

Yes

W6.2a

(W6.2a) Identify the position(s) (do not include any names) of the individual(s) on the board with responsibility for water-related issues.

Position

of

individual

or

committee

Responsibilities for water-related issues

Board-level

committee

The highest level of responsibility within Avis Budget Group Corporation for the management of water-related issues is held by the Corporate Governance Committee of our Board of Directors. The

Corporate Governance Committee’s responsibilities include (1) reviewing and discussing emerging best practices, trends and key issues related to ESG matters and (2) overseeing the Company’s

strategy and governance of ESG matters and to advise the Board on such matters. The Corporate Governance Committee also oversees the Company’s risks and disclosure related to ESG and

annual ESG reporting, which includes water-related risks. In addition, the Corporate Governance Committee conducts periodic reviews of the Company’s programs, policies and procedures in the area

of ESG. This includes, among other things, directing senior management to report to the Corporate Governance Committee, on a periodic basis, assessments and progress against both longer- and

shorter-term key objectives, metrics and program enhancements set by senior management and reviewed by the Committee. An example of a water-related decision that the Board-level reviewed over

the past two years was the setting of the company’s water reduction target. Further oversight on water-related issues is provided by our Audit Committee, which is tasked with oversight for (1) and (2)

the steps management has undertaken to control these risks.

W6.2b

(W6.2b) Provide further details on the board’s oversight of water-related issues.

Frequency that

water-related

issues are a

scheduled

agenda item

Governance

mechanisms into

which water-

related issues

are integrated

Please explain

Row

1

Scheduled -

some meetings

Monitoring

implementation

and performance

Monitoring

progress towards

corporate targets

Reviewing and

guiding annual

budgets

Reviewing and

guiding corporate

responsibility

strategy

Reviewing and

guiding major

plans of action

Reviewing and

guiding risk

management

policies

Reviewing and

guiding strategy

Other, please

specify

(monitoring

policies and

procedures )

The Corporate Governance Committee of our Board of Directors is tasked with oversight of specific ESG-related risks including water-related risks. Our Corporate Social

Responsibility team provides updates to our entire Board on our progress against annual milestones and key objectives.

The Corporate Governance Committee conducts periodic reviews of the Company’s programs, policies and procedures in the area of ESG. This includes, among other

things, directing senior management to report to the Corporate Governance Committee, on a periodic basis, assessments and progress against both longer- and shorter-

term key objectives, metrics and program enhancements set by senior management and reviewed by the Committee.

Additionally, the Audit Committee oversees risks related to application laws and regulations. Our full Board of Directors receives reports from our committees (including

our Audit and Corporate Governance Committees) at every regular Board meeting and receives regular reports from members of senior management that include

discussion of the risks and exposures involved in their respective areas of responsibility. Such reports are provided in connection with and discussed at Board meetings.

For example, topics covered in these reports may include business continuity and strategic initiatives (including sustainable mobility and related ESG strategies).

CDP Page of 2517

W6.2d

(W6.2d) Does your organization have at least one board member with competence on water-related issues?

Board member(s) have

competence on water-

related issues

Criteria used to assess competence of

board member(s) on water-related

issues

Primary reason for no board-level

competence on water-related

issues

Explain why your organization does not have at least one board member with

competence on water-related issues and any plans to address board-level competence

in the future

Row

1

No, but we plan to address this

within the next two years

<Not Applicable> Important but not an immediate

priority

Avis Budget Group will continue to evaluate Board qualifications, attributes, skills and

experience including building competence on water-related issues.

W6.3

CDP Page of 2518

(W6.3) Provide the highest management-level position(s) or committee(s) with responsibility for water-related issues (do not include the names of individuals).

Name of the position(s) and/or committee(s)

Other C-Suite Officer, please specify (Chief Human Resources Officer (CHRO))

Water-related responsibilities of this position

Assessing water-related risks and opportunities

Managing water-related risks and opportunities

Setting water-related corporate targets

Monitoring progress against water-related corporate targets

Managing value chain engagement on water-related issues

Integrating water-related issues into business strategy

Frequency of reporting to the board on water-related issues

Quarterly

Please explain

RESPONSIBILITIES: Our Chief Human Resources Officer is responsible for (1) engaging our Board of Directors, leadership team and relevant departments to advance our

environmental initiatives and the management of substantive water-related risks and opportunities; (2) overseeing the execution of our global, company-wide Environmental

Policy and (3) assessing the sustainability-related needs and expectations of our investors, corporate customers, retail customers, employees, and communities.

MONITORING OF WATER-RELATED ISSUES: Examples of current processes whereby our Chief Human Resources Officer monitors water-related issues include the

following: (1) reviewing emerging topics of greatest interest to our stakeholders (as evidenced by investor ratings and corporate customer requests for information) and (2)

measuring and tracking our global operational environmental footprint and progress against our water reduction target.

Name of the position(s) and/or committee(s)

Other, please specify (Senior Vice President, General Counsel & Corporate Secretary (SVP))

Water-related responsibilities of this position

Assessing water-related risks and opportunities

Managing water-related risks and opportunities

Setting water-related corporate targets

Monitoring progress against water-related corporate targets

Managing value chain engagement on water-related issues

Integrating water-related issues into business strategy

Frequency of reporting to the board on water-related issues

Quarterly

Please explain

RESPONSIBILITIES: Avis Budget Group’s SVP, General Counsel, Chief Compliance Officer & Corporate Secretary (General Counsel) is responsible for (1) engaging our

Board of Directors, leadership team and relevant departments within our Company to advance our environmental initiatives and the management of substantive water

related risks and opportunities; (2) overseeing the execution of our global, company-wide Environmental Policy and (3) assessing the sustainability-related needs and

expectations of our investors, corporate customers, retail customers, employees, and communities. MONITORING OF WATER-RELATED ISSUES: Examples of current

processes whereby our General Counsel monitors water-related issues include: (1) reviewing emerging topics of greatest interest to our stakeholders (as evidenced by

investor ratings and corporate customer requests for information) and (2) measuring and tracking our global operational environmental footprint and progress against our

water reduction target.

Name of the position(s) and/or committee(s)

Sustainability committee

Water-related responsibilities of this position

Assessing water-related risks and opportunities

Managing water-related risks and opportunities

Conducting water-related scenario analysis

Setting water-related corporate targets

Monitoring progress against water-related corporate targets

Managing value chain engagement on water-related issues

Integrating water-related issues into business strategy

Managing annual budgets relating to water security

Managing major capital and/or operational expenditures related to low water impact products or services (including R&D)

Frequency of reporting to the board on water-related issues

Quarterly

Please explain

RESPONSIBILITIES: Avis Budget Group’s ESG Steering Committee, includes a Water & Waste Steering Committee. This Committee is responsible for monitoring water-

related impacts and performance. This includes Avis Budget Group’s water consumption metrics, and progress against our goals and targets.

MONITORING OF WATER-RELATED ISSUES: Examples of processes whereby our Water & Waste Steering Committee monitors water-related issues include the

following: (1) reviewing emerging topics of greatest interest to our stakeholders (as evidenced by investor ratings and corporate customer requests for information), (2)

measuring and tracking our water footprint; and (3) continuing to enhance our water strategy, including efficiency measures.

W6.4

CDP Page of 2519

(W6.4) Do you provide incentives to C-suite employees or board members for the management of water-related issues?

Provide incentives

for management of

water-related issues

Comment

Row

1

Yes Progress toward Avis Budget Group’s corporate ESG strategy is directly linked to compensation for our Chief Human Resources Officer and Senior Vice President, General Counsel,

Chief Compliance Officer & Corporate Secretary. Progress toward Avis Budget Group’s ESG strategy – notably our focus on advancing the future of sustainable mobility solutions – is

indirectly linked and highly correlated to compensation for our company’s named executive officers, including our Chief Executive Officer.

W6.4a

(W6.4a) What incentives are provided to C-suite employees or board members for the management of water-related issues (do not include the names of

individuals)?

Role(s)

entitled

to

incentive

Performance

indicator

Contribution of incentives to the achievement of your organization’s water commitments Please explain

Monetary

reward

Chief

Executive

Officer

(CEO)

Reduction of

water

withdrawals –

direct

operations

Progress toward Avis Budget Group’s ESG strategy (i.e., the reduction of water withdrawals) – notably our focus on advancing the future

of sustainable mobility solutions – is indirectly linked and highly correlated to compensation for our company’s named executive officers,

including our Chief Executive Officer. A redesigned annual incentive program containing a more heavily weighted individual performance

component, to be based on key metrics and measurable targets utilizing a “scorecard” approach, subject to the Company’s attainment

of financial performance goals. Part of the annual objectives for our Chief Human Resources Officer and Senior Vice President, General

Counsel, Chief Compliance Officer & Corporate Secretary is to oversee and advance our strategy and communication of ABG’s

environmental initiatives and overarching corporate ESG platform. This also includes progress towards our water and climate-related

strategies.

Progress toward Avis Budget Group’s

ESG strategy – notably our focus on

advancing the future of sustainable

mobility solutions – is indirectly linked

and highly correlated to compensation

for our company’s named executive

officers, including our Chief Executive

Officer.

Non-

monetary

reward

General

Counsel

Reduction of

water

withdrawals –

direct

operations

Progress toward Avis Budget Group’s ESG strategy (i.e., the reduction of water withdrawals) – notably our focus on advancing the future

of sustainable mobility solutions – is indirectly linked and highly correlated to compensation for our company’s named executive officers,

including our Chief Executive Officer. A redesigned annual incentive program containing a more heavily weighted individual performance

component, to be based on key metrics and measurable targets utilizing a “scorecard” approach, subject to the Company’s attainment

of financial performance goals. Part of the annual objectives for our Chief Human Resources Officer and Senior Vice President, General

Counsel, Chief Compliance Officer & Corporate Secretary is to oversee and advance our strategy and communication of ABG’s

environmental initiatives and overarching corporate ESG platform. This also includes progress towards our water and climate-related

strategies.

Progress toward Avis Budget Group’s

corporate ESG strategy is directly

linked to compensation for our Senior

Vice President, General Counsel,

Chief Compliance Officer & Corporate

Secretary.

W6.5

(W6.5) Do you engage in activities that could either directly or indirectly influence public policy on water through any of the following?

Yes, trade associations

W6.5a

(W6.5a) What processes do you have in place to ensure that all of your direct and indirect activities seeking to influence policy are consistent with your water

policy/water commitments?

Our processes to ensure that indirect activities are consistent with our overall water change strategy are as follows: (1) Prior to entering into new affiliations or

expanding the scope of current affiliations, an organization’s policy positions are among the several factors that we would consider. (2) Through membership

and participation, we would be able to monitor whether their activities are consistent with our climate and water strategy. (3) Additionally, we utilize our annual

disclosures to the CDP Water Security program as an opportunity to further review and assess whether the public policy positions of trade associations for

which Avis Budget Group has an affiliation are consistent with our own ESG strategy. If any inconsistencies are found, Avis Budget Group will further investigate

these indirect activities.

W6.6

(W6.6) Did your organization include information about its response to water-related risks in its most recent mainstream financial report?

Yes (you may attach the report - this is optional)

Avis Budget Group 2022 10-K.pdf

W7. Business strategy

W7.1

CDP Page of 2520

(W7.1) Are water-related issues integrated into any aspects of your long-term strategic business plan, and if so how?

Are water-

related

issues

integrated?

Long-

term

time

horizon

(years)

Please explain

Long-

term

business

objectives

Yes, water-

related

issues are

integrated

11-15 ISSUES INTEGRATED: Avis Budget Group considers the management of water-related risks and opportunities, including access water to support our operations, throughout our

long-term strategic planning of at least 11-15 years. INFLUENCE ON PLANNING: The decision-making process with regards to strategy and financial planning considers the

following materiality-based factors: (1) greatest business impacts; (2) our degree of control and/or influence; and (3) the needs, concerns, and key business drivers of our

stakeholders. Water-related issues have directly influenced our business strategy in the following ways: (1) as part of strategy, it is important to deliver long-term sustainable value

for our stakeholders and (2) implementing sustainability practices will also help strengthen our brand reputation. As such, we actively report on our water-related performance and

evaluate opportunities to communicate our ESG strategy to our stakeholders. This includes reporting water metrics and risks and opportunities. Examples of actions taken to

integrate the water-related issues identified include our investments into waterless and closed loop car washing. In 2022, we installed 10 water-saving car wash systems across

our major facilities in the U.S. A total of 45 water-saving car wash systems since 2021. These systems recycle and reuse up to 80% of their wastewater, which not only saves

water, but is also more cost-effective compared to tradition carwash systems.

Strategy

for

achieving

long-term

objectives

Yes, water-

related

issues are

integrated

11-15 ISSUES INTEGRATED: We aim to deliver sustainable, responsible growth to our shareholders, demonstrating our commitment to best-in-class environmental, social and

governance (ESG) practices. As such, Avis Budget Group considers water-related issues, extreme weather events and associated impacts (including flooding) and other physical

risks (including droughts) throughout our long-term strategic planning of at least 11-15 years. INFLUENCE ON PLANNING: We remain committed to increasing water efficiency

measures at our operating locations. This includes evaluating opportunities for waterless cleaning processes at our car wash locations. Additionally, we set a water reduction

target, which aims to reduce our water footprint by 30% by 2030, prioritizing water stressed locations. Examples of actions taken to integrate the water-related issues identified

include our investments into waterless and closed loop car washing. In 2022, we installed 10 water-saving car wash systems across our major facilities in the U.S. A total of 45

water-saving car wash systems since 2021. These systems recycle and reuse up to 80% of their wastewater, which not only saves water, but is also more cost-effective compared