Table of Contents

1. Abbreviations ...................................................................................................................... 3

2. P4G Overview ..................................................................................................................... 4

3. P4G Call for Partnerships .................................................................................................... 5

4. What is the Target Business Partner? ................................................................................ 6

5. Concept Note and Eligibility Criteria .................................................................................. 6

1. Partnership commitment and composition .................................................................... 7

2. Key Staff experience and track record ............................................................................ 8

3. Sectors and countries ..................................................................................................... 9

4. Investability ..................................................................................................................... 9

5. Understands and contributes to enabling market environment.................................. 10

6. Additionality and Value Add ......................................................................................... 10

7. Impact results................................................................................................................ 11

8. Activities and budget .................................................................................................... 11

9. Responsible business conduct ...................................................................................... 12

10. Due diligence ............................................................................................................. 12

6. Selection process .............................................................................................................. 13

1. Concept note submission .............................................................................................. 14

2. Eligibility screening ....................................................................................................... 14

3. Short listing ................................................................................................................... 14

4. Proposal preparation .................................................................................................... 14

5. Pitch and full evaluation ............................................................................................... 14

6. Independent Grant Committee (IGC) ........................................................................... 14

7. Evaluation Criteria ............................................................................................................ 15

8. Contact.............................................................................................................................. 16

9. Appendixes ....................................................................................................................... 17

Appendix 1 – Guidelines for Use of P4G Funds .................................................................... 17

Appendix 2 – Requirements for Due diligence .................................................................... 19

Appendix 3. Requirements for Partnerships Selected for Funding ..................................... 19

Appendix 4- P4G´s Exclusion List .......................................................................................... 21

Appendix 5: P4G Theory of Change ..................................................................................... 23

Appendix 6 - Business Plan Template: ................................................................................. 24

3

1. Abbreviations

DD Due Diligence

DFI Development Finance Institutions

ESG Environmental and Social Governance

IGC Independent Grants Committee

IMM Impact Measurement & Management

GHG Greenhouse gases

GIIN Global Impact Investing Network

MDB Multilateral Development Bank

MEL Monitoring, Evaluation and Learning

MOU Memorandum of Understanding

MSE Micro and Small Enterprise

NGO Non-Governmental Organizations

NP National Platforms

NPL National Platform Liaison

ODA Official Development Assistance

OECD Organization for Economic Cooperation and Development

P4G Partnering for Green Growth and the Global Goals 2030

RF Results Framework

SDGs UN Sustainable Development Goals

SoG State of Green

TA Technical Assistance

ToC Theory of Change

WRI World Resources Institute

4

2. P4G Overview

P4G is a multistakeholder initiative hosted by WRI with the aim to contribute to in-country climate

transitions for partner ODA-eligible countries. Its objective is to support early-stage businesses

working in food, water and energy become investment ready while also contributing to improving

overall enabling systems in these countries and sharing learning. It is funded by Denmark, the

Netherlands and the Republic of Korea. P4G has three key activity areas to enable the flow of

climate finance to climate entrepreneurs in our partner countries, as follows:

(1) Investment Readiness: P4G Partnerships comprise early-stage climate private sector businesses

and nongovernmental organizations. The purpose of the partnership is to accelerate a specific climate

business on its journey to become investment ready. P4G partnerships are competitively selected for

grants and technical assistance. The businesses must be working on solutions for climate mitigation,

adaptation and resilience in the areas of food, energy and water. Specifically, applicants must provide

services or products that contribute to poverty alleviation and economic growth while providing social

and environmental benefits in one of the following sub-sectors: climate-smart agriculture, food loss

and waste, water resilience, zero emission mobility and renewable energy.

(2) Enabling Systems Improvements: P4G’s National Platforms (NPs) are co-chaired by senior leaders

of both public and private-sector institutions responsible for in-country transitions, and include

stakeholders from sectoral and finance networks, donor country embassies and WRI country offices.

P4G has NPs in both donor and ODA-eligible partner countries who provide supportive in-country

networks for climate businesses, while also facilitating important learning opportunities related to the

policy and regulatory enabling system. NPs help ensure alignment of P4G’s partnerships with the

country priorities and connect them with the relevant sectoral frameworks and the broader network

supporting them. P4G partner ODA-eligible countries, as of the publication of these guidelines, are

Colombia, Ethiopia, Kenya, South Africa, Indonesia and Vietnam.

(3) Knowledge Mobilization: P4G partnerships represent the vanguard or early-movers in the sector,

where their successes and failures can inform the future growth and enabling systems for businesses

across the entire sector in that country. P4G’s learning is designed to enable the growth of private

sector involvement in and investment into in-country climate solutions. These learning are shared

through global Summits, National Platform Gatherings, knowledge products and other publications

and events.

P4G’s work is aimed at:

• Preparing early-stage climate entrepreneurs for investment readiness.

• Working with National Platforms to improve enabling systems by addressing regulatory and

policy issues pertinent to the business model.

• Disseminating relevant sectoral, partnership or programme related knowledge as examples

for sectoral and business learnings.

• Thereby attracting more private sector climate investment and finance into that sector and

country.

P4G partnership must align with P4G’s Theory of Change which can be seen in Appendix 5.

5

3. P4G Call for Applications

P4G competitively selects partnerships that support early-stage climate entrepreneurs who are either

in their seed or post-seed early growth stage on their way to series A investor readiness. If awarded,

P4G partnerships will be supported through grants and technical assistance. Subject to funding

availability, approximately two to three partnerships will be selected per country per year.

The NGO administrative partner

1

will serve as the WRI grantee, and the business partner may receive

direct financial support as a sub-contractor or sub-grantee of the NGO administrative partner.

P4G partnerships should have a clear stated goal of enabling the investment readiness of the early-

stage climate business during the period of grant implementation. The business partner should ideally

already have relationships in place with its consort of partners and be progressing toward

commercialization prior to its application to P4G.

Partnerships will use their grants for a specific set of activities that will contribute to investment

readiness, improving enabling systems and promoting solutions and lessons learned to influence in-

country transitions, which are further described as follows:

• Grants: Partnerships will receive non-returnable grants of USD 350,000 on average (grants will

range from USD 100,000 to USD 500,000) to implement in a period between 18-24 months.

2

These non-returnable grants will be made to NGOs as the prime grantee with a sub-contract to

the early-stage business partner.

• Technical Assistance includes:

o Investment due diligence and gap analysis of partnership business models;

o political engagement for contributing to enabling systems;

o business matchmaking sessions;

o knowledge mobilization and communication; and

o introductions to intermediary investment facilities by DFIs and other similar actors

providing a finance bridge to scale partnership operations.

• Knowledge Sharing is an important objective of P4G’s work. All partnerships should be prepared

to participate in the following activities:

o knowledge sharing of partnerships’ lessons learned and successes to relevant public and

private-sector stakeholders and through P4G’s communications channels;

o focused engagements with NP networks in-country; and

o sharing lessons learned at global events such as the P4G Summit, United Nations General

Assembly (UNGA) and Conference of Parties (COP) to influence in-country transitions in P4G

countries and beyond.

1

The NGO Admin Partner may also have sub-grants or sub-contracts to other NGOs and/or consultants hired to help the climate business

become investment ready.

2

Partnerships may be eligible for a second round of grants and/or extensions in their funding period for a maximum of 12 additional months,

subject to available funding and progress made. An abbreviated application process will be followed for partnerships getting refunded but

will still require evaluation and approval by the Independent Grants Committee (IGC).

6

4. What is the Target Business Partner?

Early-stage climate businesses are the focus of P4G partnerships. These businesses must provide

solutions in the area of climate mitigation, adaptation or resilience that are focused on services or

products in food, water and energy that contribute to poverty reduction. They are in either the seed

or post-seed stage of their commercial growth. This means that they have a proven technology and

are beyond the concept stage and are well on their journey to raise capital. They are typically post-

revenue and pre-series A.

P4G climate businesses must also be:

• Innovative enterprises

3

with products, services or processes which are new or substantially

improved compared to the state of the art in its industry and in the relevant country of operation.

• Micro-Small Enterprises P4G’s climate entrepreneurs must be micro and small enterprises

(MSEs). A small enterprise employs fewer than 50 persons, while a micro enterprise employs

fewer than 10 persons.

5. Concept Note and Eligibility Criteria

Prospective partnerships must submit a complete Concept Note that fulfills all 10 of the below

eligibility criteria. These criteria are designed to select partnerships with an early-stage climate

business that has the potential to become fully investment ready. If any one of the below 10 criteria

do not apply to the applicant, then they will be rejected and informed of which criteria they did not

meet. If a partnership fails to provide any of the requested materials their application will be rejected.

The P4G Concept Note is an online form that needs to include information on the following sections,

each of which is designed to filter and screen partnerships for eligibility:

1. Partnership commitment – P4G commitment letter and a draft partnership charter (or

equivalent document) and any government documents.

2. Experience and track record – organizational and key staff qualifications.

3. Sectors and countries – in which the partnership activities will take place.

4. Investability –submission of the business plan, pro forma and pitch deck as attachments.

5. Enabling system– understanding of and contributions to enabling market systems, including

anticipated collaboration with the NPs and relevant national and international forums.

6. Additionality – showing how the model is innovative and aligned with P4G’s Theory of

Change.

7. Impact results – during the grant period, during business operations and ESG planning.

8. Activities and budget – Theory of change summary, with planned activities for each TOC

output, aligned draft budget line items for each activity, and a workplan with cost share and

eligible expenses.

9. Responsible business conduct – self-assessment.

10. Due diligence – self-assessment and annual financials for previous year for the administrative

NGO partner and business partner. The financials of the administrative partner should be

audited.

3

An Innovative enterprise can demonstrate, by means of an evaluation carried out by an external expert that it will in the foreseeable future

develop products, services or processes which are new or substantially improved compared to the state of the art in its industry, and which

carry a risk of technological or industrial failure, or the research and development costs of which represent at least 10 % of its total operating

costs in at least one of the three years preceding the granting of the aid or, in the case of a start-up enterprise without any financial history,

in the audit of its current fiscal period, as certified by an external auditor.

7

1. Partnership commitment and composition

Partnerships must comprise at least one early-stage climate business partner and a lead civil society

NGO administrative partner. Additional partners can be included as needed to help realize the

business proposition. All the partners should have a shared objective of realizing the investment

readiness of the business.

Commitment letter: Each partnership must submit a cover letter for its Concept Note submission. This

letter should be from the formal partnership members to P4G indicating that all information included

is complete and accurate. This must be signed by at least the authorized representative of the lead

NGO administrative partner and the lead early-stage climate business partner.

Partnership charter: All members of the partnership must show their commitment to the climate

entrepreneur in a charter, letter of commitment, compact, memorandum of understanding, or other

agreement, which must remain in effect for the duration of the P4G funding period. This document

should be ideally signed or presented as a draft and does not need to be a legally binding commitment.

It does not need to include the governmental partner if doing so would significantly delay the process.

This document will be considered a statement of serious intent – agreed to voluntarily by equal

partners – of the commitment, resources and other considerations that each of the parties will bring.

Where the partnership already has an agreement in place, they may submit that agreement,

otherwise they may use the Charter Template provided as additional material in the P4G website as a

guide (note that this is not a prescriptive document).

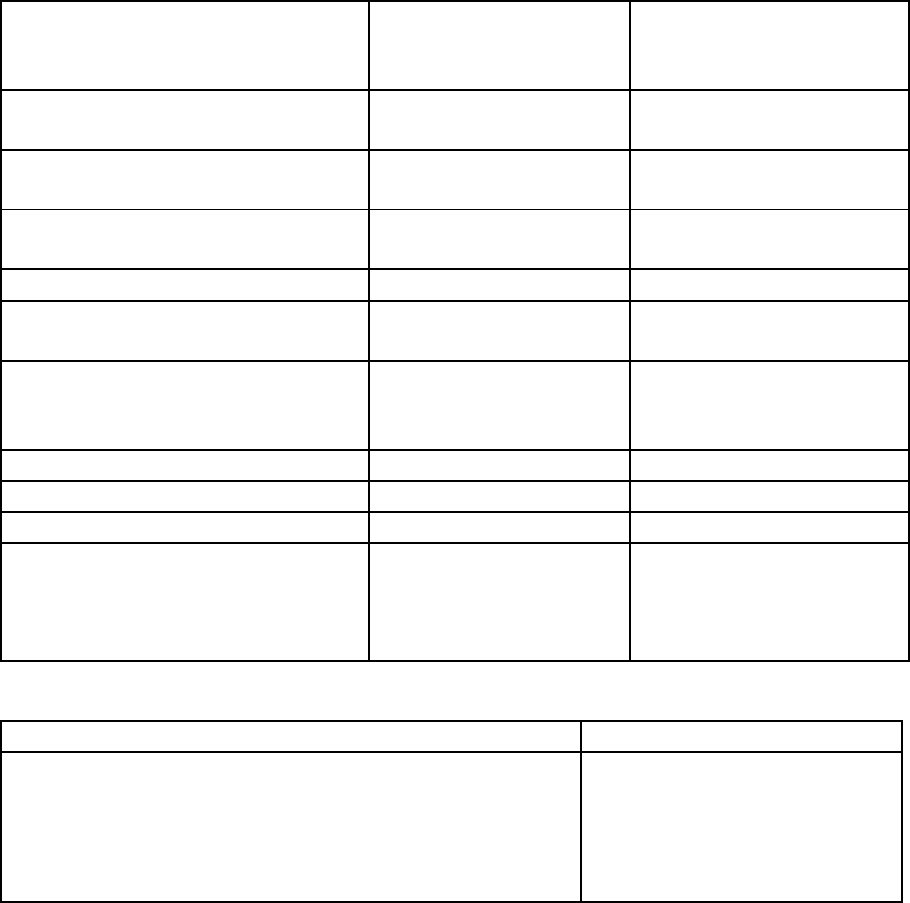

Composition: The partnership may consist of multiple partners as described in the tables below. Table

1 clarifies the mandatory minimum role of the two core partners, while Table 2 shows optional

additional partners who may contribute needed expertise and service gaps. The partnership team

should be carefully designed to include the partners necessary for the climate business to realize

commercial readiness and fulfill the requirements in the “Expertise and Track Record” criteria below.

Table 1. Mandatory lead partners’ characteristics and roles

Partner(s)

Characteristics

Role

Lead

Business

Partner

(required)

• Early-stage climate businesses.

4

• Intends to register, or preferably is

already registered, in the P4G

partner country of implementation.

• Has a clear business plan, a financial

pro forma and an executive team

with relevant expertise.

• Implementor of the climate business

model.

• Seeks to attract commercial investors for

its business.

Lead Civil

Society/

NGO

5

(required)

• Civil Society, NGO, business member

organizations, industry associations,

trade unions.

• Registered in-country

6

and/or

partnered with an NGO who is

registered in country.

• Capacity building of early-stage business

to assist the business partner in

becoming investment ready.

• Enabling systems support for the

business partner investment-readiness

work, particularly as related to needed

4

See Section 3 above on the characteristics of the target business partner.

5

For additional information on the types of nongovernmental organizations that are eligible as partners see Table 1 in Appendix 1.

6

Including subsidiary offices.

8

• Primary recipient of grant funding

and administrative partner.

7

• Stated goal to assist the business

partner in becoming investment

ready.

• Strong network in-country with

government and/or private sector.

shifts in the relevant

policy/regulatory/permitting schemes.

• Monitoring, evaluation and learning

(MEL) including the responsibility to

measure impact.

• In-country relationships.

• Knowledge product to capture and share

learning related to the partnership and

the sector.

Table 2. Other partner characteristics and roles

Partner(s)

Characteristics

Potential Role(s)

Other NGOs

(optional)

• Add complementary value or

expertise to the partnership in

areas where the Lead NGO or

other partners may not.

• Localized expertise and relationships in

the target community, academia,

accelerators/incubators, etc.

• Specialized policy/regulatory expertise.

Other

commercial

or corporate

partners

(optional)

• Commercial 3rd party such as

sub-consultants to provide due

diligence (required), or financial

advice or services related to

operationalization and investor

readiness.

• Typically includes key members

of the climate businesses value

chain such as offtakers, buyers,

suppliers, etc.

• Provide legal, financial, IT, operational or

other activities needed to start or scale

the new green commercial venture.

• Tech transfer, training, capacity building

• Increase the sustainability of their supply

chain or of their own operations. E.g.

Multinational companies.

Government

(optional –

see below

requirements)

• Line ministry or relevant

government entity at the

national, regional/provincial,

municipal levels, association or

other partner or the P4G National

Platform.

• Facilitate a stable, enabling system for

investment in green venture.

• Support and/or guide development of

the market and policy links.

• Advance supporting policies.

• Typically needed for the proof of concept

market testing phase.

Where government permissions are required for i.e., registration, land, permits, operations or other

otherwise, the partnership must submit documentation that these have either been provided or have

been requested.

8

2. Key Staff experience and track record

Partnerships must have a demonstrated track record across the team members within each partner

organization on the following areas of expertise:

• Knowledge within the relevant sectors and country of implementation for the relevant

technical area(s) and the policy and regulatory environment. Each area of expertise should be

clearly defined by the partnership and aligned with the partnership’s workplan and outputs.

7

The administrative partner will be the primary contractual recipient of P4G funds and must be a legally registered non-commercial entity,

all other budgeted partners must be sub-grantees or sub-contracts. The World Resources Institute will be the grantor.

8

Evidence that the relevant governmental permissions have been requested can be provided in the form of the official government

acknowledgement of receipt – and need not be a signed document.

9

• Entrepreneurial development including business, finance and international investment skills

ideally in a related field.

9

• Social, environmental and development expertise including the ability to create and execute

a clear Theory of Change / Results Framework and MEL framework that show how the

partnership’s work will enable the business partner to reach investment readiness. They

should also start to demonstrate social and environmental impacts through their market

testing and operations and tracking the results.

• Grant management: The NGO must have the relevant expertise and systems to manage the

WRI grant. This is further addressed in the Due Diligence section of this document.

Ideally the partners will already be working together and have an existing relationship, but newly

formulated partnerships are also eligible as long as there are strongly demonstrated synergies and

expertise in the above areas.

3. Sectors and countries

All partnership activities funded by P4G must take place within P4G partner ODA-eligible countries,

which, as of the publication of these guidelines, includes Colombia, Ethiopia, Indonesia, Kenya, South

Africa and Vietnam. The partnership may also implement solutions in other ODA-eligible countries,

but these activities cannot be funded by P4G.

The partnership’s climate business must be working in one of the areas of climate mitigation,

adaptation and resilience by providing services or products in the areas of climate smart agriculture,

food loss and waste, water resilience, zero emissions mobility and renewable energy.

4. Investability

The early-stage climate business partner must demonstrate that it is in either a seed or a post-seed

financing stage, meaning it has already developed a product or service, established a customer base,

and is on the path to commercialize or raise capital. This must be demonstrated in a robust business

plan and financial model with early market proof points, a defined path to commercialization, and the

intent to attract commercial investors. The early-stage business should demonstrate that it has

already developed these materials, at least in a preliminary format, as part of its pre-seed activities.

Partnerships must submit the following three items

10

:

- Their full business plans

- Their 5-year financial model and pro forma

11

- Pitch deck

These documents must be uploaded with the application materials, and can be submitted as multiple

attachments in PDF, Word, PowerPoint or Excel formats.

9

Note that this knowledge area can be supplemented by a sub-contractor specialist company, with plans for the resulting tools, templates

and knowledge to be transferred to the early-stage climate business.

10

Ensure contains minimum information indicated on Concept Note template.

11

Financial model and proforma must cover five year of projections including cash flow and balance sheet, break-even analysis, rate of

return, EBIDTA, revenue margin, deadstock and inventory management (if applicable).

10

To every degree possible P4G wishes to avoid technology risk and only deploy solutions with proven

commercial technologies.

12

This means that the innovation and additionality we are seeking is

primarily on the business or financial structure side, often enabled by soft tech customer integration

through IOT and API, rather than through technology hardware innovations. Therefore most

applicants will be using technologies that are widely available and broadly affordable, with software

applications or financial innovations that enable the model. However, Tech Transfer can be an

important factor in the development and acceleration of new climate enterprises in ODA-eligible

countries. As such and if relevant a P4G partnership may include expenditures related to technology

transfer and the associated work of adopting that technology to a new country where local conditions

may affect the operability of that technology as a part of the business and testing the business case

at a seed level stage of enterprise development. Therefore, in the case of partnerships involving tech

transfer the technology in question must be at a Technical Readiness Level (TRL) of 6 or higher –

meaning that they are commercially available in another country or sector, but upon being transferred

to a new country, it will be an innovative approach and a new environment for testing technical

readiness.

5. Understands and contributes to enabling market environment.

Partnerships must show a clear understanding of the policy and market in the country of

implementation. This should include discussion of the full suite of legal and regulatory requirements

for the business and sector in which the partnership is operating. Additionally, the anticipated legal

and regulatory challenges which may still need to be overcome should be included and discussed,

along with proposed activities to address them.

The objective of this element of the work is three-fold:

- Improve the investability of the climate business by addressing these risks as part of the

planned and budgeted activities and outputs.

- Improve the ability of the P4G NP members to work collaboratively to improve the enabling

system.

- Improve the understanding of the enabling system within the relevant sector and country for

other climate entrepreneurs and interested investors.

Therefore, applicants need to have clear proposed outputs and activities to improve the existing

enabling legal and regulatory systems that will support the business partner's ability to become

investment ready. These activities must be directly aligned with and clearly linked to improving the

partner’s business case.

6. Additionality and Value Add

Partnerships must demonstrate that their climate business solution is innovative in that it is

substantially improved when compared to the state of the art in that industry and in the relevant

country of operation. Partnership must show how they are aligned with P4G’s theory of change, and

the value add that can be unlocked for the business growth and sectoral transformations.

12

A proven commercial technology means one that has realized commercial sales of greater than 50 units and must include a feasibility

study that includes analysis of the global supply chain and availability of skilled labor.

11

7. Impact results

Partnerships will need to show the linkages between their activities and results in the following three

areas, each of which is an essential component of responsible impact investing:

P4G Grant: Partnership must provide a Theory of Change and Results Framework that aligns with

P4G’s and shows a clear linkage between the targeted objectives, outcomes, outputs and indicators.

Business Operations: Applicants must demonstrate that their business will demonstrate a beneficial

impact on climate adaptation and/or mitigation, the relevant food/energy/water/transport sector, as

well as inclusive economic growth, poverty reduction and gender equity as key objectives integrated

into the partnership. All P4G partnerships are required to meet the requirements for the 2x Global

Challenge for financing for women.

ESG Plan: The climate business should develop an ESG plan that describes to prospective investors the

manner in which it will address business risks related to environmental, social and governance factors.

If the business does not already have an ESG plan, one can be included in the requested P4G scope of

work.

8. Activities and budget

Partnerships are required to submit a budget and workplan that shows clear alignment with the

partnership Theory of Change. With the key goals as outputs, including the specific activities and

dates. As part of the concept note it is required to submit a summary of key information. Meanwhile

as part of the full proposal the partnership must submit a full workplan and budget. In both cases,

partnerships must use the P4G template provided on the P4G Website.

Theory of Change and aligned activities: Partnerships must outline their Theory of Change for the

partnership during the P4G period of performance, this should include an overall objective statement,

outcomes and outputs (see P4G ToC in annexes) with aligned activities that are budgeted line items

in the high-level budget.

Budget: The partnership budget should outline activities and line items that will enhance the

investment readiness of the business model, improve the financial case, and facilitate smooth

business operations. A summary excel template is included in the online materials for applicants to

submit during the concept note stage.

13

As part of the proposal submission certain budget elements

are mandatory, while the remainder of the budget should be for the specific activities required to

accomplish the targeted outputs.

Mandatory activities: All partnerships must include the following mandatory activities, with tied

outputs and budget line items for the following:

• Enabling system work including necessary policy and regulatory work with relevant

governmental, private sector and NGO bodies working on addressing the needs of early-stage

climate businesses to reduce the barriers to entry and improve related market efficiencies in

13

A full workplan and budget template will be provided to shortlisted partnerships if they are invited to submit a full

proposal.

12

the relevant country. This should include engagement activities such as meetings and

workshops with the NPs.

• A knowledge product: (case study, short paper or similar) This should reflect the partnership’s

lessons learned and successes around investability, the legal/regulatory enabling

environment and impact. The knowledge product should be aimed at relevant public and

private-sector stakeholders, the due diligence process and learnings. See the list of knowledge

sharing activities in section 2 above.

• ESG: If required, a set amount of budget to develop a partnership ESG strategy or improve

one during the implementation of the project.

• Due Diligence and Gap Assessment: This will be conducted at the beginning of the

implementation of the partnership. P4G will contract with a third-party provider to conduct

the investment DD. Therefore, partnerships should include in their budget only the activities

that they will need to conduct to: (1) support the due diligence gap analysis and (2) activities

to resolve identified gaps and finalize investor readiness. The initial investor due diligence gap

analysis may generate changes in the proposed items to resolve the gaps and finalize

materials. Therefore, the specific activities and budget for item number 2 (above) should

include a proposed small amount of funding set aside to cover any additional DD gap

remediation identified during this process.

• Audit: All partnerships will be required to have an audit that shall be conducted upon

completion of the project. P4G will contract with a third-party to provide the audit, therefore

partnerships should only include their associated internal costs to support the audit.

Cost share and eligible expenses: Applicants must include a cost share of at least 30% of the total

project budget in the form of either grants, operating capital or another monetary match that is not

in-kind.

14

Therefore, P4G grant funding will be 70% as a maximum. Furthermore, partnerships must

review the eligible expenses and ensure that their P4G budget items comply. Table 2 Appendix 1

indicates the eligible and non-eligible cost share and budget requirements.

9. Responsible business conduct

Partnerships must not have activities that are in P4G’s exclusion list. P4G´s exclusion list defines the

types of activities that P4G does not support (See Appendix 4 for detailed list).

In addition, it is encouraged that partnerships either demonstrate their ESG plan or include a plan to

develop one included in the requested P4G scope of work. The development of this ESG strategy

would be subject to the result of the investor due diligence assessment.

The ESG strategy aims, at minimum, to ensure that the project complies with national legislation and

regulation in the host country and integrates human rights, decent work, environmental impact, and

anti-corruption concerns into its operations and core strategies.

10. Due diligence

The two lead institutions (the NGO and the business partner) must have the ability to meet due

diligence requirements as conducted through document and information requests, interviews and in-

person visits. See Appendix 2 for the full list of documents to be requested.

14

Cost share that is monetary is more fungible when partnerships need to pivot in direction and is an indicator of the partnership’s financial

viability.

13

As part of the application, all partnerships must complete a provided self-assessment to indicate that,

if advanced to the finalist stage, they can provide documentation that shows:

• All partners are registered legal entities.

• The commercial partners are legally and financially independent from the non-commercial

partners.

• All documentation stipulated in Appendix 2 can be provided by the NGO administrative

partner upon request.

In addition, as part of its application, partnerships must submit annual reports for the most recent

financial year of the administrative partner as well as the business partner. Those of the administrative

partner should be audited. The application needs to be dated and signed by all partners in the

consortium.

For applicants that advance to the full proposal evaluation stage there will be additional due diligence

analysis including documentation requests, calls and on-site visits.

6. Selection process

P4G will conduct a continuously open application and selection process with specific evaluation and

decision periods twice per year. The process begins with the submission of the application materials,

after which P4G will shortlist a subset of finalists who will submit a full proposal. P4G typically receives

and screens over 100 applications, then shortlists and evaluates final proposals for the top scoring

about 15-25 partnerships and awards final funding and support to between 15-20 partnerships.

Prospective applicants are encouraged to reach out to the appropriate P4G National Platform Liaison

team member and/or to a member of the National Platform about their climate business concept and

its alignment to the sectoral priorities of each country. National Platforms will provide feedback about

partnership alignment with national priorities as part of the full evaluation process.

Figure 2 shows the progression from each stage to the next throughout the Selection process, which

is further detailed in the following text.

Figure 2. P4G Partnerships application and selection process

14

1. Concept note submission

Applicants must submit their concept notes and associated materials through P4G’s website by the

deadlines listed on the webpage. An application portal on P4G’s website will include instructions for

each field and document upload requirements.

Applications must be submitted by the NGO lead organization administrative partner through P4G’s

web portal. All applications must be submitted online in English and all word and page limits must be

strictly followed. Any applications submitted in another language or exceeding any of the word or

page limits will not be considered.

2. Eligibility screening

P4G will screen applicants for eligibility based on the criteria as outline in Section 4 above. Proposals

that do not meet all 10 criteria will be considered ineligible and will receive emailed feedback about

which criteria were not met.

3. Short listing

All eligible applicants will then be scored using the Scoring Criteria listed later in this guide. This pre-

evaluation includes a due diligence call with the highest scoring partnerships. Successful partnerships

considered shortlisted and invited to the next stage are those that reached a minimum overall grade

of 7 from a scale of 0-10. Applicants that do not advance will be informed via email of the criteria in

which they received a low score, and will be encouraged to re-apply when they are ready.

4. Proposal preparation

Shortlisted partnerships will be invited to submit a detailed final proposal. Each partnership will have

four weeks to submit the requested documents. During this period, partnerships should be prepared

for discussions and in-person visits from P4G team members as part of the due diligence process.

The full proposal materials to be requested will include, but not be limited to, the following:

• An updated application with finalized information, including any updated attachments as

necessary/applicable (i.e., updated pro-forma).

• Detailed workplan and budget.

• Monitoring, Evaluation and Learning plan providing and elaborating on the Theory of Change

(ToC) and Results Framework including indicators for impact, baseline and target values.

• Due Diligence documents and information requested by P4G.

5. Pitch and full evaluation

Shortlisted partnerships that successfully submit detailed documents will be invited to a virtual pitch

presentation. P4G will conduct an evaluation of each proposal and share results and

recommendations with the IGC for its final decision.

6. Independent Grant Committee (IGC)

The IGC is composed of an independent group of external experts who will review and evaluate all

finalist applications and select the final partnerships for funding. The IGC will meet twice a year to

make partnerships funding decisions as per the schedule published below. Applicants rejected during

the finalist evaluation stage will be provided with an opportunity to debrief through a virtual meeting

during which detailed feedback will be provided.

15

Table 4. Dates of the decision rounds 2023-2025

Selection

Process

Dates

1st decision

2023

1st decision

2024

2

nd

decision

2024

1st decision

2025

2

nd

decision

2025

Proposal

Submission

September 8

March 8

September 9

March 10

September 8

IGC decision

Dec

Jun

Dec

Jun

Dec

7. Evaluation Criteria

In the short-listing stage, partnerships will be scored against the criteria below, then weighted and

totaled. Only partnerships with an overall grade of 7 or higher will advance to the shortlist for full

proposal submission and evaluation.

Table 5. P4G Scoring Criteria

Criteria

%

Description

1. Potential

to be

financially

investable

25%

The business model shows a clear and compelling strategy to grow a

sustainable and commercially viable business and potential to attract

commercial investment, with all required policy or regulatory needs and

barriers clearly identified. Business plan considers the amount and

sources of finance and related risk mitigation mechanisms required to

meet specific business targets.

2. Ability to

deliver

25%

Partnership organizations and key staff have a track record

15

of relevant

work, are experienced in the target sectors defined by the partnership,

and have a clear commitment to delivering the planned results of the

partnership

3. Legal &

Regulatory

20%

Clear understanding of and case for policy or regulatory requirements of

the business, as well as the shifts that could further enable the business

model or improve the financial case and the ease of doing business. Clear

proposed activities to support improvements to enabling systems that

specifically benefit the business case.

4. Impact

plan & scale

30%

The Business Plan shows clear rationale between positive quantifiable and

significant scalable impact with clear actions to address climate challenges

and improve the well-being of people and natural ecosystems. Specific

metrics toward carbon reduction, climate adaptation or resilience, job

creation and poverty reduction as aligned with P4G’s TOC and IMM are

required. Partnerships will comply with the gender 2x criteria. Includes a

capstone learning or knowledge product.

15

See above eligibility section on track record.

16

Table 6. P4G Scoring Scale

Score

Description

10

The response fulfils all requirements of the criteria and there is a high degree of confidence

to deliver with a high quality.

7

The response fulfils most of the requirements of the criteria but could be further

strengthened. The response is feasible, and it demonstrates a good level of confidence to

deliver.

5

The response fulfils some components of the criteria, however there are some

misunderstandings of the issues related to the key delivery of the proposed idea and its

sustainability.

0

Submitted information is insufficient or inconclusive.

8. Contact

Any questions may be addressed to the below National Platform Liaison (NPL) for your country.

17

9. Appendices

Appendix 1 – Guidelines for Use of P4G Funds

The expenditure of P4G funding must comply with EU State Aid Rules. All funding will flow from WRI

to the NGO administrative partner through a negotiated grant mechanism.

Table 1. Organizations Allowed to Act as Administrative Partner and to Receive P4G Funds from

Administrative Partner

Type of Organization

Allowed to manage P4G

funds as administrative

partner?

Allowed to receive P4G

funds from administrative

partner?

Non-profit Organization, Including

Business Associations

Yes

Yes

Non-profit Organization Located in

Non-ODA-eligible Country

Yes

Yes

P4G Board Members: Country and

Corporate Partners

No

No

P4G Managing Partner: WRI

No

No

P4G National Platforms

No

Yes, by exception on a case-

by-case basis

For-profit Organization (Including B-

corporations), Not on P4G Board

No

Yes, for the early-stage

business partner and sub-

contractors

Multilateral Organizations

No

No

Non-legally Registered Entity

No

No

Academic Institutions

No

Yes

Public Institutions, including any

partial- or quasi-governmental entities

and municipally- or publicly-owned

utilities

No

Yes

Table 2. Eligible and Non-eligible Cost Share

Eligible as Cost Share

Non-eligible as Cost Share

• Salary expenses of the early-stage climate business and

the NGO admin partner (not already funded by P4G)

• Travel and other non-salary expenses of commercial

partners

• Equipment and products

• Land, buildings and large

infrastructure Activities in

non P4G countries.

18

Table 3. Eligible and Non-eligible Expenses

Eligible Expenses

Non-eligible Expenses

• All project-related activities carried out by

any NGO, non-commercial members, or

early-stage business lead of the project.

This includes, but is not limited to:

reasonable staff salaries, travel cost, report

preparation, monitoring and management

of the project.

• Funding of external consultants and service

providers to carry out discrete portions or

deliverables of the project where necessary.

• Minor office supplies and equipment.

• Certain technology transfer costs [see note]

• Communication costs (such as knowledge

sharing, information dissemination, etc.)

• General and Administrative (G&A) costs

paid to the Administrative Partner

organization to cover core institutional

services for the organization as a whole.

Please note that any G&A costs should be

applied to all funding sources at the same

percentage. G&A percentage charges over

7% are subject to WRI approval pending

justification from the partnership.

16

• Funding may be used for compliance with

any directly relevant local administration

costs such as, but not limited to, local

inspections, licenses, approval by local

authorities and establishing a field office.

• Expenses associated with purchasing land,

buildings, or infrastructure.

• Non-commercial partner equipment or

infrastructure expenses that contribute to

commercial business equity.

• Purchase any large-scale equipment or

property such as vehicles, property,

construction equipment, etc.

• Product development in the private

domain

• Salary and travel expenses for large

commercial partners (but they can be

presented as in-kind contribution)

• Direct subsidy of a financial mechanism

(i.e. de-risking) or fund, unless given a

waiver due to overwhelming public good

• Consulting fees above the at-cost rate

16

The G&A includes other institutional costs that are relevant but cannot be directly attributable to the project, such as salary for the overall

support staff.

19

Appendix 2 – Requirements for Due diligence

The information in this section serves as a reference only and is subject to change. Final details will be

provided to applicants as part of due diligence process. P4G will request additional information from

business and NGO partnerships when requested as part of the selection process. This is likely to

include:

1. Documentation that confirms the administrative partner (the contractual recipient of P4G funds)

is a legally registered non-for-profit entity.

2. Documentation of the partnership (partnership agreement or letter of commitment signed by

partners, memorandum of understanding, or similar) that, at minimum:

a. Outlines the goal/purpose of the partnership.

b. Outlines the responsibilities of each partner organization, including the financial and/or

time commitment.

c. Is formally agreed to by a representative of each partnering organization.

d. Remains in effect for the duration of the P4G funding period.

2. Evidence of relevant government acknowledgement and endorsement of the partnership’s

activities, if government is not a member of the partnership. May be documented via email, letter,

or other form of legal or non-binding agreement (such as the Governance Charter above), from

the focal ministry of the relevant P4G National Platform or any level of government (national to

local) that is pertinent to the operating parameters of the partnership.

3. Administrative partner’s financial statements and information about the organization’s

governance policies and financial controls.

4. Pre-approval of legal language in the funding agreement template.

5. W8 form for non US based entities.

6. US tax form W9 for US based entities.

7. Organization chart.

8. Ethics policy (conflict of interest and/or anti-bribery/corruption).

9. Timekeeping Policy.

10. Indirect Cost Policy.

11. Policy and Templates for Onward Granting of Funds.

12. Procurement Policy.

13. Most recent organizational audit and management letter.

14. Balance Sheet, income statement, and cash flow statements for prior 2 years.

Appendix 3. Requirements for Partnerships Selected for Funding

Funding Agreement: To receive funding, the administrative partner will sign the funding agreement

on behalf of the partnership. The funding agreement language will be provided to finalists in advance

for review.

Audit: A final audit of partnership funding will be required for all partnerships (details will be included

in the funding agreement). This should be reflected in the budget.

Budget Allocation: Include mandatory activities described in the budget section of the eligibility

criteria. Ten percent of funding will be held until final reports are accepted by P4G.

Financial Reporting: Funded P4G partnerships will be required to report on partnership expenses

against the approved budget (typically on a quarterly basis, though this may vary depending on the

20

complexity of the partnership and the financial risk profile of its administrative partner). Applicants

will need to include cost share in their budget submission and will be required to report cost share

contribution with their regular financial reporting. Partnerships that do not demonstrate cost share

for each reporting period will not receive additional funding.

Activity, Impact and Progress Reporting: Funded P4G partnerships will be required to report at least

twice a year on their activities and progress in line with the stated workplan and milestones. Progress

reporting aligns with the financial reporting described above. Reports will also include indicators for

impact, documenting progress towards the partnership’s stated goals, P4G’s collective impact, and

relevant SDG targets

17

or GIIN standards.

P4G Acceleration Meetings: P4G will have regular check-in calls with awarded partnerships on a

frequency between fortnightly and quarterly, depending on the opportunity for acceleration.

P4G Events: Partnerships should plan on and budget for attending and presenting at P4G’s biennial

summit during the term of the funding agreement.

Promotion: P4G partnerships agree to participate in P4G promotional activities, which may include

featuring the partnership in news releases and webinar presentations, and on the P4G website and

social media. P4G will request the partnership provide images that represent the work of the

partnership that can be used in promotional activities. Funded partnerships agree to acknowledge

P4G’s support and include P4G co-branding in their promotional materials, events, knowledge

products and on their website(s) about the partnership and to invite P4G to events when possible.

P4G Impact Network: Following the funding period, P4G expects partnerships to continue providing

impact updates on an annual basis. These updates may be in the form of an email to P4G highlighting

the partnership’s progress or response to a survey. “Graduated” partnerships will also remain part of

the “P4G Family” and will be invited to relevant events.

Disbursement of P4G Funding: The initial installment of funding will be paid to the administrative

partner after the administrative partner returns the countersigned funding agreement and other

required documentation. The amount of the initial installment will be confirmed in the funding

agreement. Subsequent disbursement amounts will be informed by the workplan and budget

submitted. Disbursement is typically in quarterly installments (following each financial report),

depending on the assessment of the administrative partner’s capacity and financial controls. Ten

percent of the funding amount will be held until final reports and the promotional plan to share the

results of the partnership have been submitted and accepted by the P4G Global Hub.

Bank account: The grantee must open a project specific bank account and provide P4G with the name

and address of the bank, account number, and account name, which must be the official name of the

organization. The project bank account must be for the sole use of the P4G/WRI grant.

Guidelines on unutilized funds at the end of project implementation: Any approved P4G grants that

remain unutilized following completion of project activities and/or interest accrued as a result of

unspent funds will be withdrawn by WRI.

17

For more information about these SDGs go to https://www.un.org/sustainabledevelopment/sustainable-development-goals/.

21

Appendix 4- P4G´s Exclusion List

P4G´s exclusion list defines the types of projects that P4G does not finance, provide any grant or

technical support. This list consolidates IFU and IFC

18

Exclusion Lists.

1. Harmful or exploitative forms of forced labor

19

/harmful child labor.

20

2. Activities or material deemed illegal under host country laws or regulations or international

conventions and agreements, or subject to international phase-outs or bans, such as

a. Ozone depleting substances, PCB's (Polychlorinated Biphenyls) and other specific,

hazardous pharmaceuticals, pesticides/herbicides or chemicals;

b. Wildlife or products regulated under the Convention on International Trade in

Endangered Species or Wild Fauna and Flora (CITES); or

c. Unsustainable fishing methods (e.g. blast fishing and drift net fishing in the marine

environment using nets in excess of 2.5 km in length).

2. Cross-border trade in waste and waste products, unless compliant with the Basel Convention and

the underlying regulations.

3. Destruction

21

of High Conservation Value areas.

22

4. Radioactive materials

23

and unbounded asbestos fibers.

5. Production or trade in wood or other forestry products other than from sustainably managed

forests.

6. Commercial logging operations for use in primary tropical moist forest.

7. Production or activities that impinge on the lands owned, or claimed under adjudication, by

Indigenous Peoples, without full documented consent of such peoples.

8. In the event that any of the following products form a substantial part of a project’s primary

financed business activities:

24

(a) Alcoholic beverages (excluding beer and wine); (b) Tobacco, (c)

Weapons and munitions, (d) Gambling, casinos and equivalent enterprises.

9. Production, trade, storage, or transport of significant volumes of hazardous chemicals, or

commercial scale usage of hazardous chemicals. Hazardous chemicals include gasoline, kerosene,

and other petroleum products.

10. Standalone fossil fueled power plants.

11. Drilling, exploration, extraction, refining and sale of crude oil, natural gas and thermal coal.

12. Storage, supporting infrastructure (pipelines etc.), transportation and logistics, and services

primarily related to fossil fuels.

13. Any business using captive coal for power and/or heat generation.

14. Electricity generation from peat and activities leading to deforestation.

18

For more information go to https://www.ifu.dk/wp-content/uploads/2022/06/Exclusion-list-2022.pdf and

https://www.ifc.org/wps/wcm/connect/topics_ext_content/ifc_external_corporate_site/sustainability-at-ifc/company-

resources/ifcexclusionlist

19

Forced labour means all work or service, not voluntarily performed, that is extracted from an individual under threat of force or penalty

as defined by ILO conventions.

20

Persons may only be employed if they are at least 14 years old, as defined in the ILO Fundamental Human Rights Conventions (Minimum

Age Convention C138, Art. 2), unless local legislation specifies compulsory school attendance or the minimum age for working. In such cases

the higher age shall apply.

21

Destruction means the (1) elimination or severe diminution of the integrity of an area caused by a major, long-term change in land or

water use or (2) modification of a habitat in such a way that the area’s ability to maintain its role is lost.

22

High Conservation Value (HCV) areas are defined as natural habitats where these values are considered to be of outstanding significance

or critical importance (See http://www.hcvnetwork.org).

23

This does not apply to the purchase of medical equipment, quality control (measurement) equipment or any other equipment where the

radioactive source is understood to be trivial and/or adequately shielded.

24

For companies, “substantial” means more than 10% of their consolidated balance sheets or earnings. For financial institutions and

investment funds, “substantial” means more than 10% of their underlying portfolio volumes.

22

15. Investments and/or other projects that aim to produce or make use of agricultural or forestry

products associated with unsustainable expansion of agricultural activity into land that had the

status of high carbon stock and high biodiversity areas.

16. Biomaterials and biofuel production that make use of feedstock that could otherwise meaningfully

serve as food or compromise food security.

17. Export-oriented agribusiness models that focus on long-haul air cargo

25

for commercialization.

18. Meat and dairy industries based on production systems that involve unsustainable animal rearing

and/or lead to increased GHG emissions as compared to best industry, low-carbon

standards/benchmarks.

26

25

Following Eurocontrol’s definition, long-haul is taken to be longer than 4 000 kilometres (The EIB Group Climate Bank Roadmap 2021-

2025).

26

For agrifood value chain projects in countries with vulnerable food supply systems, benchmarking of GHG emissions of agro-industry

projects on local instead of international best standards is possible on a case-by-case basis. This would apply in particular to smallholder and

agriculture microfinance schemes or agrifood industries that target local demand and may involve derogation of general carbon footprint

thresholds related to power and heat generation established in this bioeconomy section and under the industry and energy tables above

(The EIB Group Climate Bank Roadmap 2021-2025).

23

Appendix 5: P4G Theory of Change

24

Appendix 6 - Business Plan Template:

The Full Business Plan should at least include:

27

• Executive summary and business overview

• Company information and description

• Problems to be addressed

• The business and technology solution

• Market description, including market size and demand, customers, partners,

competitors, marketing strategy, SWOT analysis, regulatory and legal barriers and

requirements.

• Detailed description of the financial model and pro forma including 5-year financial

projections including cash flow and balance sheet, break-even analysis, rate of return,

EBIDTA, revenue margin, deadstock and inventory management (if applicable).

Attachments to the business plan should include:

• Financial model as excel, sheets or other commonly available software

• Pitch deck that presents an overview

27

The following link of a business plan is provided as a reference only and is not a prescriptive document

http://viewer.zmags.com/publication/9022bdee#/9022bdee/20