Theoretical Economics Letters, 2021, 11, 1067-1089

https://www.scirp.org/journal/tel

ISSN Online: 2162-2086

ISSN Print: 2162-2078

DOI:

10.4236/tel.2021.116068 Nov, 12, 2021 1067 Theoretical Economics Letters

The Impact of Gambling Gross Income,

Unemployment Rate, Money Supply and CPI on

Residential Housing Value in Macau: Theory

and Evidence

Ting Lan

Institute of Accounting and Finance, Beijing Institute of Technology, Zhuhai, China

Abstract

This paper uses the classical and easy-to-understand Vector Auto-

regression

Model Method to study the impact of economic and monetary policy va-

riables on the residential property market in Macau. By using sample

monthly

data from Jan. 2005 to May 2021, the empirical results show the dynamic re-

lationship among the residential property value, key economic and monetary

variables. Furthermore, adopting the Granger causality test, generalized im-

pulse response function, variance decomposition and co-integration

test of

the corresponding VAR specification, the tables and graphs clearly explain

the residential housing value has a positive relationship with the gambling gr

oss

income; it has a negative relationship with the unemployment rate; it has

a

positive relationship with the money supply; it has a

negative relationship

with the consumer price index. Finally, this paper gives five policy actions to

help government stabilize the residential property market in Macau and make

it healthy develop.

Keywords

VAR, Granger Causality Test, Generalized Impulse Response Function,

Variance Decomposition and Co-Integration Test

1. Introduction

The full name of Macau Special Administrative Region of the People’s Republic

of China is one of the core cities of the Guangdong-Hong Kong-Macau Greater

Bay Area. On December 20, 1999, Macau returned to the embrace of the mo-

How to cite this paper:

Lan, T. (2021).

The Impact of Gambling Gross Income,

Unemployment Rate,

Money Supply and

CPI on Residential Housing Value in M

a-

cau: Theory

and Evidence.

Theoretical

Economics Letters

, 11,

1067-1089.

https://doi.org/10.4236/tel.2021.116068

Received:

October 9, 2021

Accepted:

November 9, 2021

Published:

November 12, 2021

Copyright © 20

21 by author(s) and

Scientific

Research Publishing Inc.

This work is licensed under the Creative

Commons Attribution International

License (CC BY

4.0).

http://creativecommons.org/licenses/by/4.0/

Open Access

T. Lan

DOI:

10.4236/tel.2021.116068 1068 Theoretical Economics Letters

therland. A thriving service sector and light industry have made it one of the

most developed regions in the world. However, till the year 2020, there are about

683,100 people living on an island of about 33 square kilometers in Macau, and

the population density of 20,000 people per square kilometer is one of the high-

est in the world. The situation of “land is precious” is quite prominent in Macau.

In addition, the per capita GDP is MOP661,000 in the year 2019 and rapid eco-

nomic development is among the top three in the world. These data sources

come from the Statistics and Census Service (DSEC). Many factors work togeth-

er to make the value of land resources in Macau, the value of houses and build-

ings and the value of people’s investment in labor extremely high. These factors

work together to promote the red-hot real estate market in Macau and thus

cause the housing price of Macau to soar to the ground.

In Macau Special Administrative Region, the real estate industry is one of the

four pillar industries, and the analysis of the regional economy is of certain sig-

nificance to the study of Macau real estate market.

Figure 1 displays Macau’s

Annual GDP from the year 2000 to the year 2020. Data source on GDP comes

from the Statistics and Census Service (DSEC) of Macau. As shown in

Figure 1,

After Macau returns to China in 1999, Macau’s economy turned from a high-speed

growth period to stable and sustainable development. Macau’s economic boom

from 2000 to 2014 depended on the liberalization of gambling in 2002. According

to

Figure 1, GDP increased eight times from the year 2000’s 54,369 million Pa-

tacas to the year 2014’s 438,516 million Patacas. As one of the world’s three ma-

jor gambling cities, Macau’s economic development depends largely on tourism

and gambling industries. At the celebration of the 15

th

anniversary of Macau’s

return to China, President Xi Jinping stressed that “we should strengthen and im-

prove supervision over the gaming industry, actively foster new economic

Figure 1. Macau’s Annual GDP (2000-2020). Source: Statistics and Census Service (DSEC)

of Macau.

T. Lan

DOI:

10.4236/tel.2021.116068 1069 Theoretical Economics Letters

growth points, and constantly promote appropriate diversified and sustainable

economic development”. In 2015, Macau’s economy took a turning point. The

gross income of the gambling industry was 231,811 million Patacas, down 34.3%

year on year, and the gross domestic product also decreased to 359,806 million

Patacas. Facing the internal and external difficulties, for the long-term healthy

operation of the economy, the development of the depressed gambling industry

has been deeply adjusted after the year 2015. The economy gradually improved

over the following years. Because of the outbreak of COVID-19 in December

2019, Macau entry passengers plunged, gambling gross income dropped from

January 2020’s 2022.2 billion Patacas to February 2020’s 3.134 billion Patacas,

meanwhile, GDP also decreased dramatically in the year 2020, it was only

194,398 million Patacas. After resuming the visitors’ visa to Macau gradually

in the year 2021, the gross income of the gambling industry rebounded, and

the economy gradually recovered.

After it returned to China in 1999, the government gave Macau a few prefe-

rential policies. In 2002, the 60-year gaming monopoly system was ended, and

the gaming operation rights were opened. Subsequently, the tourism and gam-

bling industries were brilliant, and the economic recovery promoted the devel-

opment of the real estate industry.

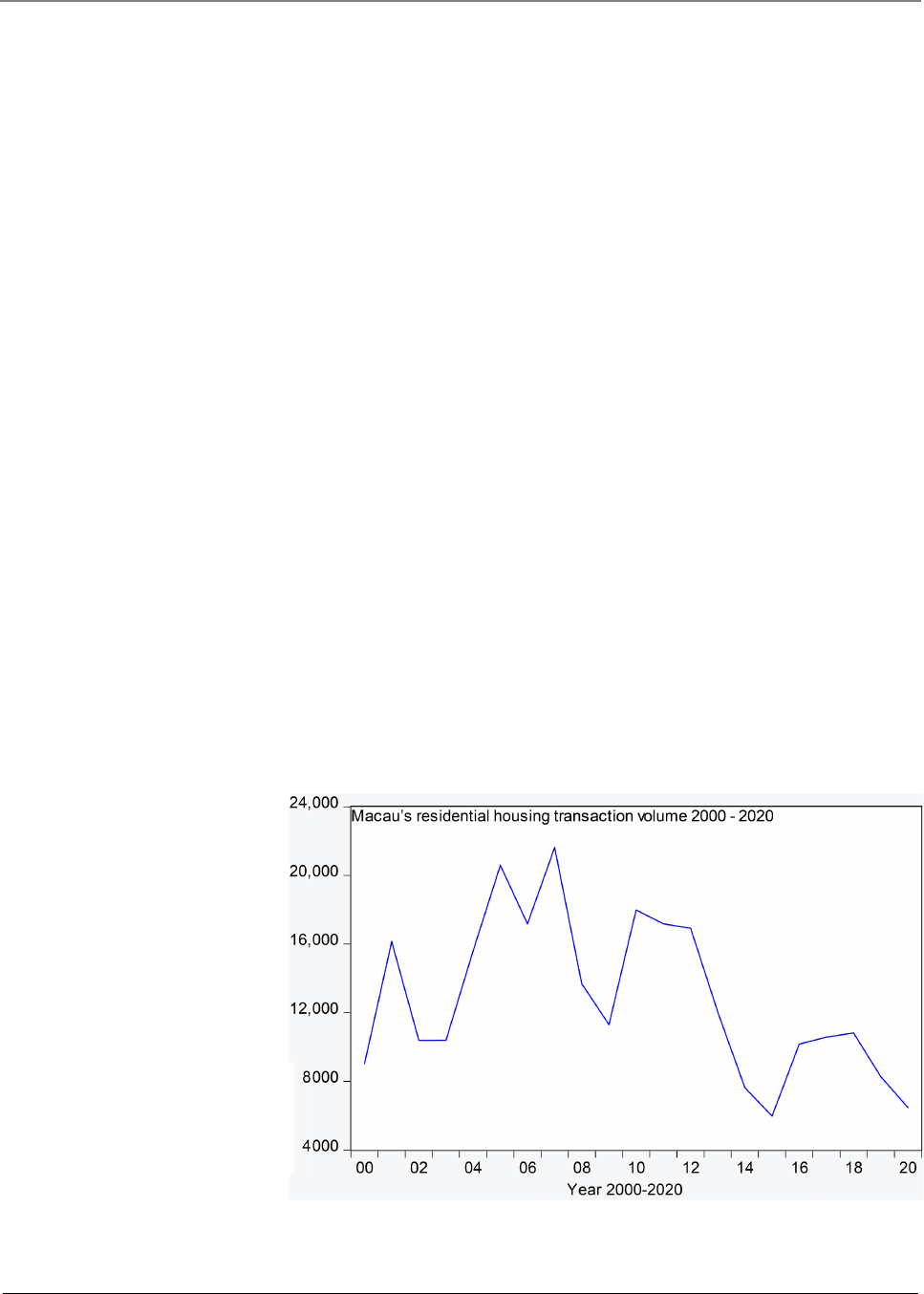

Figure 2 displays Macau’s residential housing

transaction volume from the year 2000 to the year 2020. Data source comes from

the Statistics and Census Service (DSEC) of Macau. In 2008, it was temporarily

affected by the financial crisis, the transaction volume of residential building

units dropped to 13,686, a year-on-year drop of 36.7%. In 2015, it was affected by

the gambling industry, the economy was depressed. In that year, the transaction

volume of residential building units was only 5976, down 21.6% year on year. In

2019, in order to celebrate the 20

th

anniversary of China’s return to China, the

Figure 2. Macau’s residential housing transaction volume (2000-2020). Source: Statistics

and Census Service (DSEC) of Macau.

T. Lan

DOI:

10.4236/tel.2021.116068 1070 Theoretical Economics Letters

government tightened the policy of entry visa issuance, etc., and the transaction

volume of residential buildings and the average property price declined simulta-

neously, showing a slowing trend. Affected by the epidemic, the transaction vo-

lume in February 2020 dropped sharply, down 48.4% year on year. In the first half

of the year 2020, the real estate market was depressed. The transaction volume was

only 6483 in the year 2020. In the first half of the year 2021, the anti-epidemic ef-

fect was achieved, the transaction volume rebounded, and the housing demand

was gradually released.

Tourism also plays a decisive role in Macau’s economy. Many tourists enter

and leave Macau every day, which has led to the rapid development of Macau’s

gambling industry. When tourists spend money and stay in Macau, they also

promote the development of Macau’s tourism and catering industries. In 2020,

the COVID-19 epidemic was prevalent. According to the data disclosed by the

Public Security Police Department of the Macau SAR Government on January

13, 2021, the number of entry-exit persons in Macau in 2020 was 69.55 million,

among which only 5.917 million were incoming passengers, which decreased by

64.2% and 85% respectively. According to the Public Security Police Depart-

ment, under the influence of the COVID-19 epidemic in 2020, the number of

inbound and outbound people in Macau showed a big decline. At the same time,

Macau’s economy also suffered a huge blow; the average residential housing

value also had been affected. According to the Macau Statistics Bureau, under

the condition of COVID-19 gradually improving in the second half of 2020, the

number of inbound and outbound visitors in Macau gradually rose to a histori-

cal peak, and the hotel occupancy rate gradually rose to 53.1% from the lowest

11.8%.

Based on the above regional economic analysis, I found the real estate market

is one of the main industries in Macau, there is a very important relationship

among gambling gross income, GDP, residential housing value and transaction

volume. The objective of this study is to use several popular and available eco-

nomic and monetary policy data in assessing current residential housing value,

which could be applicable to the case of Macau. The fundamental variables such

as gambling gross income, unemployment rate, money supply, and consumer

price index are highlighted as leading impact factors of long-term trends of resi-

dential housing value. This paper draws on the research experience of the past

scholars, combines the historical data of Macau Statistics and Census Service

(DSEC) and the Qianzhan database, it takes the above five factors as the main

research objectives, and then makes an empirical analysis. Under the background

of high residential housing prices in Macau, this study has important theoretical

and practical significance.

The remainder of the paper is structured as follows. Section 2 discusses litera-

ture review; Section 3 describes the data and hypotheses; Section 4 reviews the

VAR model; Section 5 provides empirical test results, and Section 6 provides the

conclusions and policy implications.

T. Lan

DOI:

10.4236/tel.2021.116068 1071 Theoretical Economics Letters

2. Literature Review

In this section, I provide an overview of the literature on the interactions be-

tween house prices and economic variables as well as relationships between

house prices and monetary policy.

2.1. A Large Part of Extant Literatures Examining the Interaction

between House Prices and Economic Variables

Case and Shiller (2003) exam the housing affordability issue that is related to

house prices-to-income ratio, a measure if the house is affordable to the average

buyers. Black et al. (2006) develop an innovative way of computing the funda-

mental value of housing based on a time-varying present value of the real dis-

posable income in the UK as the main factor that can affect the house prices.

Using a dynamic present value model within a VAR framework to get market

fundamental prices, Fraser et al. (2008) use a similar theory and methodology

and confirm the house price in New Zealand is overvalued; Miller et al. (2007,

2009) provide the relationship between house prices and national wealth effect,

and show the result for that there is a positive relationship between them. The

national economy growth has a significant effect on the house prices. Costello et

al. (2011) again use same present value model and find out there is deviation of

actual price from its estimated fundamental prices spillover from cities over

Australia. Typically, the above studies develop and exam the relationship be-

tween the house price prices and income determinants. Li and Chiang (2012)

find that there are long term relationships among real estate price, CPI and GDP

in China.

There are many house price literatures review about deriving the market fun-

damentals from an equilibrium model containing economic variables such as

population, rent, stock of vacant new dwellings and land price etc. And house

prices can be significantly influenced by these factors. Hui and Lui (2002) use

economic variables as the land supply factor that can affect real house prices in

HK. Using demand equals supply equation to construct the log-linear function be-

tween real houses prices and market fundamentals. Introducing the co-integration

test and error correction model which is developed by Engle and Granger (1987)

and widely used in the field of real estate industry; the test is used for examining

the time series of variables to be integrated are of the same order. The empirical

research concludes that there is a big gap between actual house prices and mar-

ket fundamentals in HK. That means HK house market is more volatile than be-

fore. Furthermore, Hui and Shen (2006) measure the relationship between house

prices and market fundamentals in three cities; they are Beijing, Shanghai and

HK. In order to test the economic variables are correspondence with real estate

house prices, the authors use more advanced econometric models to exam the

casual relationship between house prices and market fundamental. They find

there are differences between house prices and market fundamentals in HK and

Shanghai. One important influence house price factor is the supply of land price.

T. Lan

DOI:

10.4236/tel.2021.116068 1072 Theoretical Economics Letters

In urban areas, the supply of land is becoming scarce and the land price is be-

coming expensive. Deng et al. (2009) investigate what are the factors of funda-

mentals affect the house prices in China during the period of 2000-2005. They

report that the house prices are significantly affected by real residential land

prices.

Another house price measure approach is using the price-to-rent ratio, which

is used for evaluating the cost of buying a house versus renting it. OECD (2005)

evaluates price-to-rent ratios with the user cost of housing for the OECD econ-

omies from 1995 to 2005. In countries with high real house price gains during

this period (UK, Ireland, the Netherlands, Spain, Australia and Norway), they

conclude that actual price to rent ratios were above fundamental levels, suggest-

ing there is overvaluation existed and it is cheaper to rent. Smith and Smith

(2006) use a present value model to measure the market fundamentals. Buyers

can decide that if the net present value is positive, the house is worth to buy;

otherwise, renting would be better than owning a house. They also collect data

about the pricing of buying a house or renting in US metropolitan cities. If price

keeps increasing, the price-to-rent ratio should be higher its long-run average.

This approach helps buyers to decide that the prices are too high relative to rent

a house; the buyers will find advantages to rent a house rather than buying it.

2.2. Literatures about the Impact between House Prices and

Monetary Policy

As indicated by the above summary of the fundamental house price literatures,

the focus has typically been on various measures of “fundamentals”. The impact

between house prices and monetary policy is another important issue. In west-

ern countries, especially where the real estate market is relatively matured coun-

try, both academic and central bank have broadly pay attention to how the asset

prices are influenced by monetary policy. (Mishkin, 2001, 2007; Iacoviello, 2005;

Taylor, 2007, 2008, 2009) especially study the relationship between housing

prices and monetary policy in USA, and they get the results that monetary policy

can significantly affect house prices. Mishkin (2001) studies the relationship

among monetary transmission mechanism and stock prices, real estate prices

and foreign exchange rates. Except stock market price, the real estate price plays

an important role in the monetary transmission mechanism too. The expansio-

nary of monetary policy reduces interest rate, further reduces the cost of financ-

ing housing and therefore increases the house price. Mishkin (2007) uses the

concept of user cost of capital, when interest rate increases the user cost of capi-

tal, it will cause a decline in housing demand and prices. As a result, the large

run-ups in house price can seriously affect the financial instability, and mone-

tary policy makers should respond to fluctuation of real estate price. There is

empirical evidence on the link from monetary policy to residential prices. Using

the structure VAR methodology, Iacoviello (2005) finds that the impact of mon-

etary policy on real estate prices during 1974Q1 to 2003Q2. The author identifies

T. Lan

DOI:

10.4236/tel.2021.116068 1073 Theoretical Economics Letters

the monetary policy has significant effect on house price through Impulse Re-

sponse Model. Giuliodori (2005) provides some quantitative and qualitative evi-

dence of the house price and monetary transmission mechanism across nine

European countries. The paper presents the response of house prices to interest

rates and the consumption as well. Using several VAR models, the author finds

out the countries with more advantage of mortgage markets and efficient hous-

ing system, the relationship between interest rate and house prices will be

stronger. Ahearne et al. (2005) study houses prices in 18 advanced economies

and get results that confirm the link from monetary policy to housing prices.

Therefore, booming in house prices are often preceded by a period of monetary

policy loosening. Taylor (2007) also provides an early example of a study ascrib-

ing a large role to too loose monetary policy in USA, which means too low in-

terest rate in spurring housing activity after the 2001 recession. Taylor (2008,

2009) increase suggesting that loose monetary policy is a primary cause of the

bubble in house prices and activity. Dokko et al. (2009) review monetary policy

rules from 2003 to 2006 in USA and argue that the loose monetary policy is not

the primary contributing factor to the extraordinary strength in housing market

of USA. The low interest rate is not strong enough to explain the rise in residen-

tial investment or increasing of house prices. In the wide selection of empirical

papers, the majority researchers conclude the loose monetary policy is a primary

cause of the bubble in house prices of western countries. Aizenman et al. (2016)

use the dataset that covers 19 countries and find that the house price apprecia-

tions are positively linked with the expansionary monetary policy.

In recent years, especially after global financial crisis, more Chinese scholars

have started concerning about the housing price in China and its impact factors.

Liang and Cao (2007) study impact of monetary policy on house prices in China

during 1999Q1-2006Q2. According to ARDL framework, the long-run relation-

ship results show if the central government can imply long-term interest rate

and bank credit instruments effectively into the real estate industry, they can

control continue increasing of house prices. Kivu (2010) studies the wealth effect

in China, using the VAR model, the loose monetary policy in China leads to

higher asset prices, especially house prices. Yao et al. (2011) use monthly data

from June 2005 to September 2010 in China to investigate the long-run rela-

tionship between monetary policy and asset prices. Using the VAR model, the

empirical results show that monetary policy has little effect on residential prices,

central bank and government should not only use interest rate to maintain the

financial stability. There are many policies need to be concerned when dealing

with asset bubbles. Xu (2017) examines the relationships among the house pric-

es, interest rates, income and GDP growth rate in China, and find the control

power of the interest rate for the prices is limited. The disposable income in-

creases can increase the demand of houses. And the house price has positive re-

lationship with GDP growth. Zhu et al. (2018) analyze the 35 major cities in

China and find the impact of income on housing prices is positive, the interest

T. Lan

DOI:

10.4236/tel.2021.116068 1074 Theoretical Economics Letters

rate is not significant impact on housing prices, and the population has signifi-

cant impacted on housing prices. Wang et al. (2020) use the wavelet analysis

method and find a positive co-movement between money supply growth and

housing boom in China. Guo et al. (2020) find that expansionary monetary pol-

icy not only promotes total investment but simultaneously also leads to substitu-

tion towards financial assets.

2.3. The Studying Literatures about Macau are Very Limited

Comparing with large amount of research papers about western countries’ and

China’s economic variables impact on house prices, the studying papers about

Macau are very limited. There are only a few Chinese scholars’ study about Ma-

cau real estate market in previous years, and published papers in journals. For

example, Chen (2013a) studies the development process of Macau’s real estate,

analyzes that the reasons why Macau’s housing price was always at a high level

are because of the insufficient regulatory function of Macau’s government and

the imperfect housing security system. Finally, the paper expects that the gov-

ernment can promote the rational allocation of resources and fundamentally re-

verse the space-time situation of the market. Chen (2013b) mainly makes a qua-

litative analysis of the main factors of the real estate market price after Macau’s

return back to China, explains the relevant subsidies and policies in different pe-

riods, analyzes the bubble situation of the real estate in Macau, and then puts

forward suggestions for regulation and control. Tang et al. (2015) use the mul-

ti-factor regression model to confirm various factors impact on the real estate

prices in Macau; they use previous years’ monthly data from January 2005 to

August 2014 and prove that the unemployment rate, non-local employees and

tourist arrivals have statistically significant relationship with the increasing of

housing prices in Macau. Among them, the unemployment rate has a negative

correlation with the housing price, while non-local employees and the number

of tourists have a positive impact on the real estate price. Chen (2016) uses the

VAR method and concludes that the gambling industry and the real estate in-

dustry in Macau are closely related from year 1996 to 2013. Gu et al. (2017) use

2005Q1 to 2015Q3 data to explain that the gaming growth leads to higher in-

come inequality while at the same time both factors are responsible for soaring

housing bubbles in Macau. Gu et al. (2020) also use VAR model to examine ca-

sino tourism expansion plays a fundamental role for both income inequality

heightening and housing price hiking and confirms the income inequality can

cause the housing bubbles in Macau. But they use quarterly data from year 2005

to 2015. The above papers use historical data to examine the real estate market

situation in Macau in previous year.

Since there are still very limited English literatures examining the current real

estate market situation in Macau and the empirical research paper requests to

use the most recent years’ data to do empirical test and show the evidence, in

order to fill in this English literature gap and examine the situation of residential

T. Lan

DOI:

10.4236/tel.2021.116068 1075 Theoretical Economics Letters

housing market of Macau in recent years, in the following research paper, I am

going to use the recent years’ (2005-2021) economics and monetary policy va-

riables’ monthly time-series data in section 3 to examine the residential housing

value in Macau, the classical VAR model will be explained in section 4 and em-

pirical results will be provided in section 5. Also based on these results, I will

provide conclusions and policy implications in section 6 as well.

3. Data and Hypotheses

The monthly data sources come from the Statistics and Census Service (DSEC)

of Macau and QianZhan Database which are used to examine the long-term re-

lationship among residential housing value, economic and monetary policy va-

riables in Macau. The variables that I use in this study and their orders are the

average residential housing value (HV), gambling gross income (Income), un-

employment rate (UE), money supply (M2) and CPI. The sample time periods

are from Jan. 2005 to May 2021.

Economic and monetary policy variables are obtained from QianZhan Data-

base Company. Since the Statistics and Census Service (DSEC) provides num-

bers of residential housing and residential housing value, I use the residential

housing value divided by the numbers of residential housing to calculate the av-

erage residential housing value in Macau.

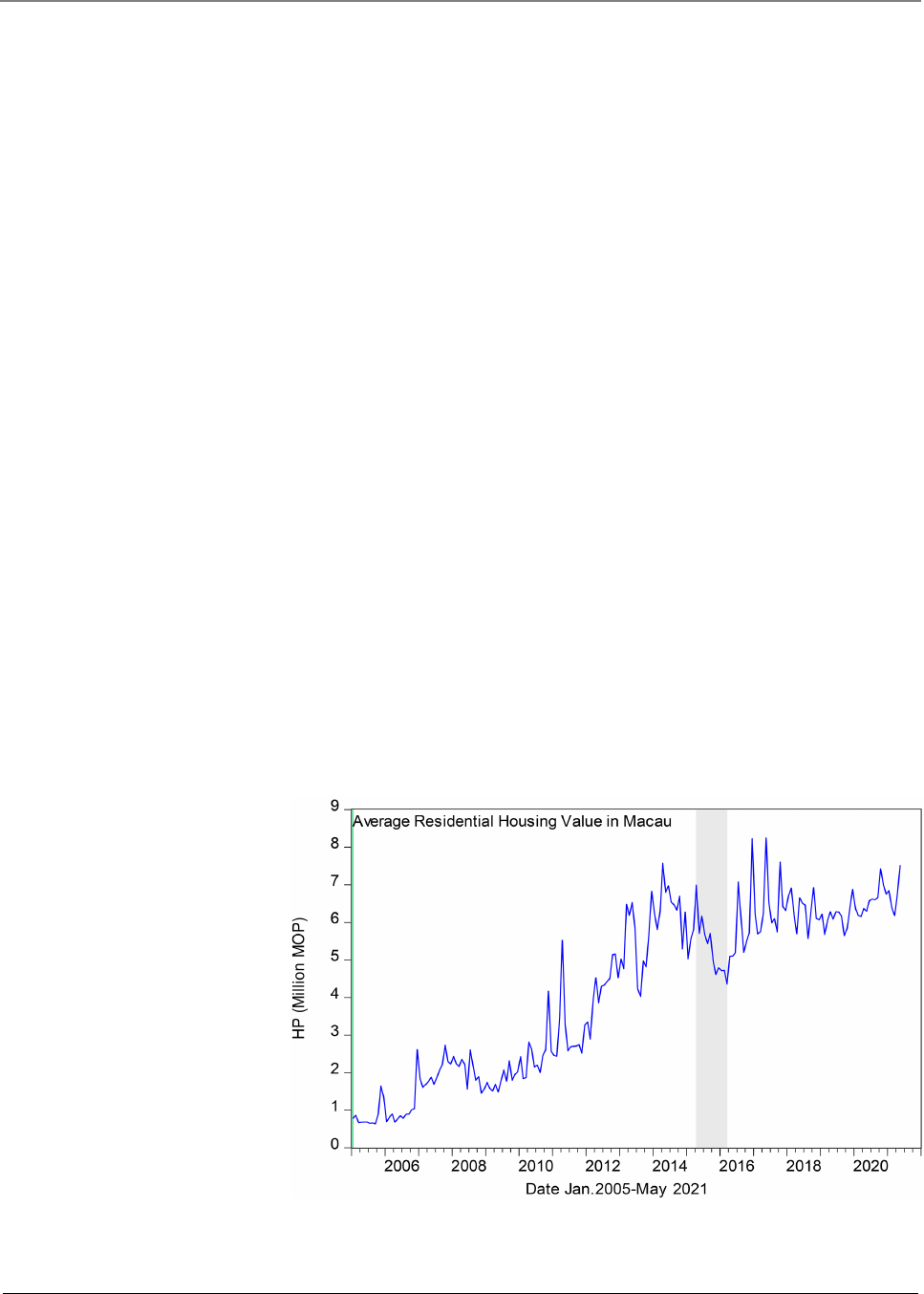

Figure 3 displays the monthly data of

the average residential housing value in Macau from Jan. 2005 to May 2021.

From

Figure 3, I can find that from Jan. 2005 to May 2015, the average resi-

dential housing value shows an increasing trend, which is correspondence with

the previous content mentioned the booming GDP, increasing of gambling gross

income, and visitors arrivals. But from May 2015 to March 2016, the housing price

dropped down a lot since the central government of China changed the government

Figure 3. Macau’s average residential housing value (Jan. 2005-May 2021). Source: Statis-

tics and Census Service (DSEC) of Macau.

T. Lan

DOI:

10.4236/tel.2021.116068 1076 Theoretical Economics Letters

policy to Macau. The GDP also decreased during that period (Figure 2). From

year 2017 to 2021, the average residential housing value shows a stable trend.

Table 1 shows the summary statistics of these variables at monthly data fre-

quency. The table provides the mean, standard deviation, maximum, minimum,

and the measure of skewness and kurtosis. The negative skewness of residential

housing value in Macau is around −0.72, the kurtosis is around 3.49. It shows a

non-normal distribution. The table also includes the summary statistics of other

variables. In Jan. 2005, Macau has a historically high unemployment rate at

4.2%, and after that the rapid economic growth makes the unemployment rate

drops down to the lowest 1.7 in year 2014. But under the influence of the

COVID-19 epidemic in 2020, the unemployment rose from 2% to 3% between

year 2020 to the first half of year 2021. The table shows the maximum unem-

ployment rate is 4.2% and the minimum is 1.7%. During the global financial cri-

sis period, Macau has a very high inflation rate, the maximum rate reached to

8.7%, but during the epidemic period, the inflation rate dropped down and

turned to deflation rate at the lowest −1.18% in Jan. 2021.

Table 2 reports the correlations among these variables. From the table result,

it can be seen that 1) the residential housing value has positive relationship with

Table 1. Descriptive Statistics

Macau

N

Mean

Max

Min

SD

Skewness

Kurtosis

LnHV

197

8.05

9.86

5.7

0.70

−0.72

3.49

LnIncome

197

9.50

10.55

6.64

0.78

−1.14

3.98

UE

197

2.54

4.2

1.7

0.79

0.65

2.12

LnM2

197

12.73

13.48

11.72

1.56

−0.25

1.62

CPI

197

3.86

8.7

−1.18

2.21

−0.16

2.44

Note: the table reports the summary statistics of the variables in this reseach paper. The

data are obtained from the Statistics and Census Service (DSEC) and QianShan Database.

The time-series data period starts from Jan. 2005 to May 2021. “N” is the number of data

points. “Min” and “Max” are respectively the minimum and maximum data values. “S.D”

is the standard deviation.

Table 2. Correlations among variables.

LnHV

LnIncome

UE

LnM2

CPI

LnHV

1

0.471

−0.598

0.509

−0.279

LnIncome

0.471

1

−0.739

0.451

0.142

UE

−0.598

−0.739

1

−0.839

0.043

LnM2

0.509

0.451

−0.839

1

−0.407

CPI

−0.279

0.142

0.043

−0.407

1

Note: Source the Statistics and Census Service (DSEC) and QianShan Database. The

time-series data period starts from Jan. 2005 to May 2021.

T. Lan

DOI:

10.4236/tel.2021.116068 1077 Theoretical Economics Letters

the gambling gross income, 2) it has negative relationship with the unemploy-

ment rate; 3) it has positive relationship with the money supply; and 4) it has

negative relationship with the consumer price index. The results are consisted

with the common sense but should be examined by the empirical model such as

classical VAR system.

The residential housing value in Macau can be affected by many economic

factors. Based on the availability of data from database and the correlation

among variables from

Table 2, this research paper provides the following four

hypotheses.

H1: The gambling gross income has positive relationship with the residential

housing value.

The contribution of gambling industry to Macau’s economy is more than 70%

of the total GDP, and it has significant impact to Macau’s economy. The city

with the gambling industry as the main source of economic resources are short

of natural resources and land resources, the main customers are not local resi-

dents, but a large number of non-local tourists. While the gambling industry in

Macau is developing, it is also paying attention to improving the quality of ca-

tering, hotel and other service industries, which will also drive up the develop-

ment of real estate industry. Through the empirical analysis of the impact of

Macau’s gambling industry on the real estate industry, it is known that the im-

pact of Macau’s gambling industry on the real estate industry is extremely high

and has a positive role in driving the real estate industry, but the impact of real

estate industry on Macau’s gambling industry is very small. After returning to

China and the legalization of the gambling industry, various kinds of foreign

capital kept pouring in and luxury casinos are started built up, which greatly

boosted the economic development of Macau. The housing price in Macau also

kept soaring, and the residential housing value rose accordingly. The gambling

industry has greatly developed Macau’s economy, which led to the improvement

of the living standard of Macau residents, and the demand for housing also in-

crease.

H2: Unemployment rate has negative relationship with the residential housing

value.

In Macau, a region lacking natural resources and land resources, the demand

for real estate resources exceeds the supply and the price is relatively high.

Moreover, residents’ income level also determines residents’ quality of life to

some extent, and the increase of residents’ quality of life will also increase

people’s demand for real estate, thus leading to the rise of the housing price.

Under the influence of the global epidemic, the number of visitor arrivals in

Macau has dropped sharply, the development of various industries in Macau has

slowed or even stagnated, and the unemployment rate has also been rising. The

unemployment rate has a negative impact on real estate industry, that is, the

higher the unemployment rate is, and the lower the real estate value will be.

People have no time to protect their own lives, and affect the confidence of in-

T. Lan

DOI:

10.4236/tel.2021.116068 1078 Theoretical Economics Letters

vestment into the property, housing value will be fluctuated.

H3: The money supply has positive relationship with the residential housing

value.

The monetary policy of Macau is to ensure that Macau has full currency con-

vertibility and to expand the scope of exchange of Macau currency. The money

supply mainly causes price changes by affecting the money market and the

amount of money in circulation in the capital market. The cost of various mate-

rials and labor will also be changed. Finally, the real estate price will inevitably

change accordingly. For the real estate industry, if investors find the real estate

industry profitable, and the profit is considerable, it will attract many invest-

ments, and then cause the housing price to continue to rise. From the perspec-

tive of money supply, if there is excess money entering the market, the excess

money will go to the industry with very considerable return rate, such as the real

estate industry, which will lead to the rise of housing prices.

H4: CPI has negative relationship with the residential housing value.

The consumer price index mainly reflects the price level and is usually used

as a measure of inflation. Macau Consumer Price Index (CPI) is usually used

to measure various price indexes in Macau, China. When the CPI increases too

much, it indicates that inflation has become a destabilizing factor in the

economy. Nowadays, with the development of economy and urbanization in

Macau, houses have become a necessity for people. The rising house price

leads to the decrease of people’s consumption of other goods. A long period of

rising house prices may be one reason for the CPI rise. However, after the im-

pact of the epidemic in 2020, Macau’s Inflation shows negative. This is the first

time in nearly a decade that the inflation in Macau has turned from positive to

negative which means the social price level has declined and shows a deflatio-

nary trend. it has also affected the residential housing value and caused some

fluctuations.

4. Research Method

In order to know whether the time series of residential housing value and vari-

ous proxies of economy and monetary policy variables are interacted and causal-

ity effect with each other. This paper uses the vector auto regression technique

model that is suggested by (Sims, 1980) to predict the interconnected time series

system and analyze the dynamic influence of random disturbance on variable

system. The methodology has been widely used in many econometrics models in

the field of real estate industry. For example, Chen and Patel (1998) use the VAR

to investigate the house prices in Taiwan, Hui and Shen (2006) conduct statio-

nary and Granger causality tests on three metropolitans house prices and eco-

nomic variables in China.

The VAR model can be introduced in the following Equation (1):

11 2 2

, 1, 2, ,

t t t ptp

Y AY AY A Y t n

ε

−− −

= + + + = ⋅⋅⋅

. (1)

T. Lan

DOI:

10.4236/tel.2021.116068 1079 Theoretical Economics Letters

In this Equation (1),

t

Y

is a vector of the non-stationary variables and

p

A

is

the coefficient matrix which contains information about the relationships among

these variables. The VAR model contains five variables: the residential housing

value (LnHV), gambling gross income (LnIncome), unemployment rate (UE),

money supply (LnM2) and CPI. The lag period of the model is determined ac-

cording to the three information criteria (Akaike, Schwarz, and Hannan-Quinn).

Except the unemployment rate and CPI, all the other variables are expressed in

natural logarithms in order to dispel heteroskedasticity.

5. Empirical Test Results

5.1. Unit Root Test Results

I need to test the order of integration of the time series data. After many tests, I

find the three information criteria are the smallest when the lag period is 4.

Ta-

ble 3 shows the results from the Phillips-Perron unit root tests, the number of

lags (4) included in the tests was defined by the information criteria.

The results of PP test in

Table 3 indicate that these variables are not stationary

in level, which means have a unit root; but are stationary after first differencing.

The test results show that all the time series variables are I (1).

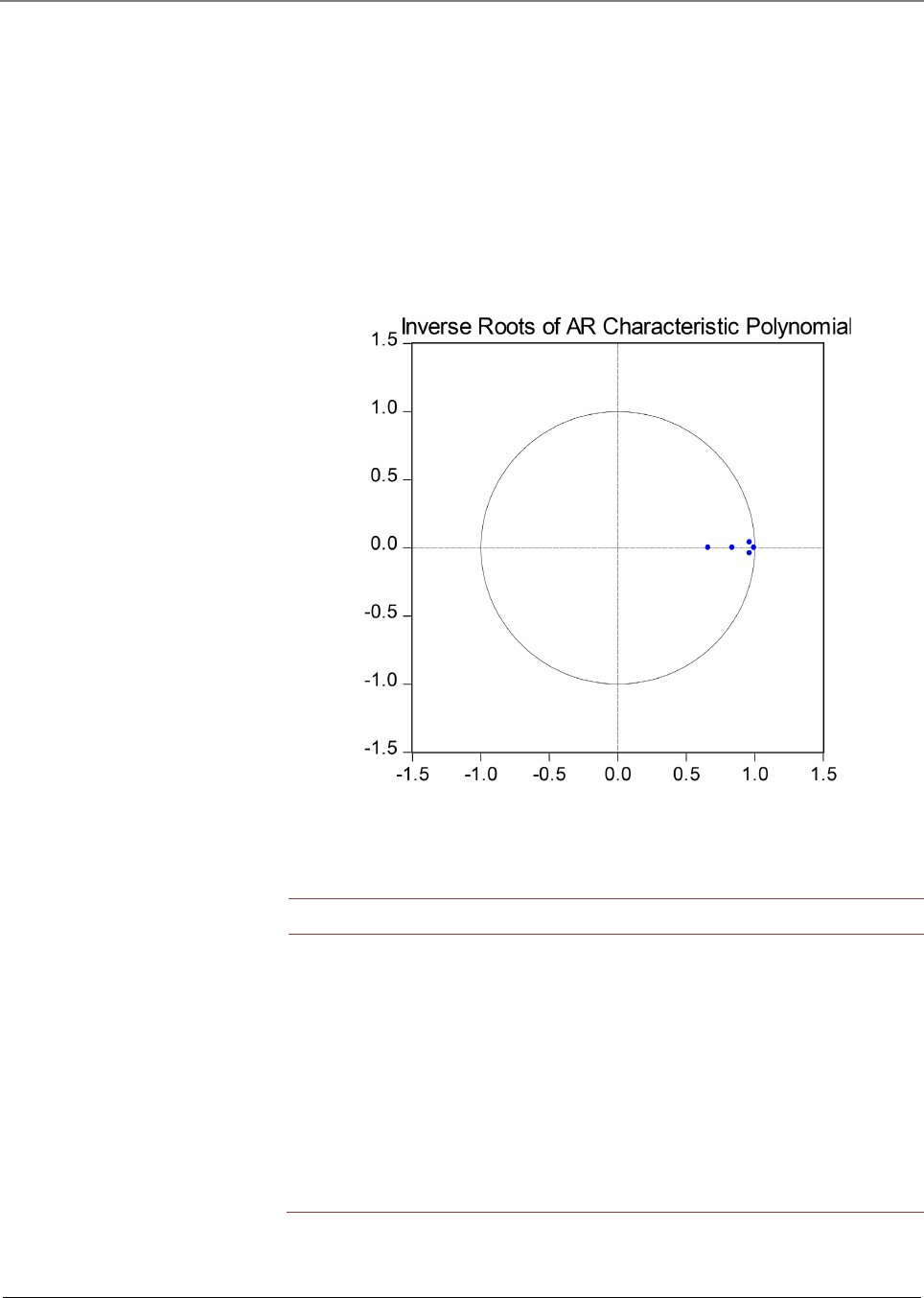

Since the VAR model requires that the variable sequence are stable, I use the

inverse roots of AR characteristic polynomial to test the stability again, it can be

seen from the test in

Figure 4 that the five unit roots are all in the circle, which

shows the VAR system is stable.

Table 3. PP tests of the Variables in Macau, Jan. 2005-May 2021.

Variables

Test

statistics

1% C.V.

5% C.V

10% C.V.

Stationary

LnHV

0.408

−2.577 −1.942 −1.616

No

DLnHV

−24.385

YES

LnIncome

0.092

−2.577 −1.942 −1.616

No

DLnIncome

−20.166

YES

UE

−1.281

−2.577 −1.942 −1.616

No

DUE

−11.643

YES

LnM2

6.879

−2.577 −1.942 −1.616

No

DLnM2

−13.924

Yes

CPI

−

1.098

−2.577 −1.942 −1.616

No

DCPI

−14.496

Yes

Note: Four variables are used as the proxies for economic and monetary policy variables:

gambling gross income, unemployment rate, money supply and consumer price index.

The corresponding critical values for a model without trend and intercept for PP unit

root tests are −2.577, −1.942, and −1.616 at the 1, 5, and 10 percent significance level, re-

spectively.

T. Lan

DOI:

10.4236/tel.2021.116068 1080 Theoretical Economics Letters

5.2. Granger Causality Test Results

Under the VAR system, Table 4 concludes that all variables have predictive

power for housing prices in Macau. Each variable is the Granger cause of resi-

dential housing value when its lag behinds the first order. For the null hypothesis

that gambling gross income does not Granger cause residential housing value,

the null hypothesis is rejected with the P value at 0.034. It can be explained that

the residential housing value is due to the gambling gross income; while the res-

idential housing value is not the cause of the gambling gross income. There is a

one-way causality from gambling gross income to residential housing value in

Figure 4. Inverse roots of AR characteristic polynomial. Source: Statistics and Census

Service (DSEC) of Macau and QianZhan Database.

Table 4. Pair-wise granger causality test results.

Cause → Effect

F-Statistics

P Value

Results Cause → Effect

Lnincome → LnHV

2.263

0.034

YES

LnHV → Lnincome

2.776

0.097

No

UE → LnHV

6.625

0.011

YES

LnHV → UE

9.841

0.002

YES

LnM2 → LnHV

5.943

0.016

YES

LnHV → LnM2

1.193

0.276

No

CPI → LnHV

3.231

0.074

YES

LnHV → CPI

1.193

0.276

No

Note: Source the Statistics and Census Service (DSEC) and QianShan Database. The

time-series data period starts from Jan. 2005 to May 2021.

T. Lan

DOI:

10.4236/tel.2021.116068 1081 Theoretical Economics Letters

Macau. This empirical result is the same as the research paper of Chen (2016).

Also, there is one-way causality from money supply to residential housing value

and one-way causality from consumer price index to residential housing value as

well. Based on the tests results, there is only a two-way causality from unem-

ployment rate to residential housing value in Macau.

5.3. Impulse Response Function Results

I want to know the interconnected relationship among these variables, and the

level of impact, one of the methods is to analyze the case when a disturbance

term is changed or when the model is hit by some sorts of shock, what the dy-

namic effects of the system will be, and this method is called the impulse re-

sponse function method. It explains the positive and negative directions of the

response, the adjustment of the time delay and the stability process generated by

the impact of the system. The impulse response functions results are shown in

Figures 5-8.

As shown in

Figure 5, there is evidence that the gambling gross income has

positive impact on residential housing value. Positive impacts on gambling gross

income are described to increase the residential housing value for up to more

than 12 periods. This graph result confirms the hypothesis 1.

As shown in

Figure 6, it indicates clearly that the unemployment rate has

negative impact on residential housing value. Negative impacts on unemploy-

ment rate are described to decrease the residential housing value for up to more

than 12 periods. This graph result confirms the hypothesis 2.

As shown in

Figure 7, the graph indicates in the longer trend, after 10 pe-

riods, the money supply has positive impact on residential housing value. Since

money supply is a very important monetary policy instrument as mentioned be-

fore in this research paper, it takes time to invest in the real estate industry,

Figure 5. Response of LnHV to lnIncome innovation.

T. Lan

DOI:

10.4236/tel.2021.116068 1082 Theoretical Economics Letters

Figure 6. Response of LnHV to UE innovation.

Figure 7. Response of LnHV to LnM2 innovation.

therefore, it shows a lagged impact. But for a long time period, the graph result

shows it has positive impact on residential housing value. The graph result con-

firms the hypothesis 3.

As shown in

Figure 8, it indicates clearly that the consumer price index has

negative impact on residential housing value. Negative impacts on consumer

price index are described to decrease the residential housing value for up to

more than 12 periods. This graph result confirms the hypothesis 4.

5.4. Forecast Error Variance Decomposition Results

The forecast error variance decomposition method is to evaluate the importance

of different structural shocks by analyzing the contribution of each structural

T. Lan

DOI:

10.4236/tel.2021.116068 1083 Theoretical Economics Letters

Figure 8. Response of LnHV to CPI innovation.

Table 5. Results of variance decomposition test.

Forecast

Horizon

Variance Decomposition of Residential Housing Value

LnHV

LnIncome

UE

LnM2

CPI

Total

2

99.377

0.239

0.049

0.061

0.273

100

5

73.819

2.441

2.734

14.917

1.778

100

10

58.990

2.850

4.672

25.938

7.550

100

12

55.364

2.678

5.664

28.502

7.792

100

Note: The table reports the variance decomposition after 2, 5, 10 and 12 lags for residen-

tial housing value and other variables under shock to residential housing value.

shock to the change of variables. Variance decomposition results are shown in

Table 5. It can be observed that the contribution of residential housing value in

the 2

nd

period is affected its own shock for 99.377%. As the period increases to

12

th

period, the variance in shock to residential housing value is affected by its

own shock decreases to 55.364%, money supply accounts for 28.502% of the

residential housing value variance, showing that money supply is powerful in af-

fecting housing value. CPI and unemployment rate also shows increasing shocks

to residential housing value. These results are consistent completely with the

findings from Granger causality test result and impulse response function test

results.

5.5. Co-Integration Test Result

From the previous analysis results, all the variables are integrated in order 1,

they satisfy the condition of co-integration test, I use Johansen and Juselius

(1990) co-integration test to examine the relationship among these variables.

The null hypothesis of the maximum eigenvalue test is that there are at most r

T. Lan

DOI:

10.4236/tel.2021.116068 1084 Theoretical Economics Letters

co-integrating vectors. The null hypothesis of the trace test is that the number of

co-integrating vectors is less than or equal to r.

When applying the co-integrating test, all the variables in the VAR model

should be non-stationary.

Table 3 reports that all the variables have unit roots at

their levels.

Table 6 shows the results for the rank tests results by using

co-integration method. The tests are based on 1 lag for the entire period. The

results show that there are at least two cointegration equations among these va-

riables. Both trace statistics test and maximum eigenvalue test reject the null

hypothesis of r less than 1 at the 5% significance level, therefore, the null hypo-

thesis of no integration is rejected by both the trace and max-eigenvalue statis-

tics at the 5% significance value. The results show the residential housing value

and the economic and monetary variables are co-integrated over the entire pe-

riod. This implies that there is a long-run relationship between residential hous-

ing value in Macau and its determinants.

To sum up, based on the VAR model and its test methods, I use the time se-

ries data from Jan. 2005 to May 2021, and obtain the following results.

The gambling gross income has significant positive relationship with the resi-

dential housing value. Currently, the gambling industry in Macau continues to

decline, in this background, the future development of the real estate industry

will be greatly affected too. This result is consistent with the research papers of

Gu et al. (2017, 2020). Unemployment rate has significant negative relationship

with the residential housing value. Based on the data source from QianZhan

Database, the average unemployment rate from March to June 2021 is 2.9%. The

local citizen unemployment rate in June 2021 increased to 3.9%. By industry,

gambling agencies and hotels are the main source of unemployment in Macau.

As can be seen from the data, there is a lag in the real estate market. Under the

influence of the rising unemployment rate, the housing value in Macau has gen-

erally decreased. Among them, the high residential housing value in May was

Table 6. Johansen and Juselius tests for co-integration relation, Jan. 2005-May 2021.

Time

Series

Lags

Trace

Statistics

Rank

5% C.V.

Max

Statistics

Rank

5% C.V.

LnHV

1

117.51

0*

69.82

58.21

0*

33.88

LnIncome

(AIC,

59.30

1*

47.86

38.47

1*

27.58

UE

HQ,

20.83

2

29.79

11.34

2

21.13

LnM2

SBIC)

9.49

3

15.49

8.01

3

14.26

CPI

1.48

4

3.84

1.48

4

3.84

Note: 1 lag is used in all the co-integration vectors based on three information criteria.

The null hypothesis in which there exists at more r co-integration vectors in the system.

The co-integration tests are done under the assumption of a trend in data and an inter-

cept and trend in the co-integration eq. C.V. (5%) is the critical value of the trace statis-

tics and maximium eigenvalue statistics for cointegration tests.*indicates significant at the

5% level.

T. Lan

DOI:

10.4236/tel.2021.116068 1085 Theoretical Economics Letters

due to the recovery of the epidemic, the market rebound, and the accumulation

of months of housing demand concentrated burst. The money supply has signif-

icant positive relationship with the residential housing value. In recent years,

major cities in the Guangdong-Hong Kong-Macau Greater Bay Area have been

closely linked and restrictions on household registration have been relaxed,

which has continuously stimulated market vitality. The good and harmonious

social atmosphere has accelerated the introduction of foreign investment in Ma-

cau, and investors have invested and bought property in Macau. Macau’s econ-

omy has a good momentum of development, the related industries have been

reasonably developed, and the active housing transactions have led to the rise of

housing values. CPI has significant negative relationship with the residential

housing value. Due to the impact of the epidemic, the Composite price index of

Macau has dropped for twelve consecutive months from January’s 2.98% to De-

cember’s −0.87% in year 2020, and it has been continuing showing a deflation

trend in the first half year of 2021. Since the CPI shows a deflationary trend. The

cost of raw materials for housing construction has decreased, leading to the

fluctuation of housing values. It is not hard to be seen from the QianZhan data-

base that the consumer price index has a bigger negative impact on housing val-

ue. Deflation will make enterprises hard to withdraw funds and increase the risk

of bad debts; Household incomes are falling, and dampening consumer demand.

A long period of deflation may lead to the instability of the economy, the gov-

ernment is actively taking measures to avoid this situation, CPI may go back up

soon, the real estate industry will keep heating up.

6. Conclusion and Policy Implications

Based on the above summary, in order to promote the healthy development of

the real estate industry in Macau, I put forward the following five suggestions.

First, appropriately guide the development of the real estate industry in Macau

since the return of Macau and the opening of gambling rights, a large number of

foreign capital poured into Macau, which led to the continuous rise of housing

prices in Macau, leading to the rise of prices and the increase of people’s living

costs. As one of the four basic industries in Macau, real estate plays an unshaka-

ble role in Macau’s economic development. The government of the Macau spe-

cial administrative region should continue to encourage and support the devel-

opment of the real estate industry, perfect the relevant management system of

the industry, guide the real estate industry diversification development, foster

the development of new industrial chain, reduce the risk of real estate enterprise

capital chain break up and promote the sustainable and healthy development of

the real estate industry in Macau.

Second, to strengthen Macau’s cooperation with the mainland, the construc-

tion of the greater Bay Area urban agglomeration has given investors confidence

to invest in it. At present, Macau, Zhuhai and even the Pearl River Delta region

are integrated into industries and rely on each other economically. A better

T. Lan

DOI:

10.4236/tel.2021.116068 1086 Theoretical Economics Letters

mainland economy will accelerate the pace of Macau’s economic progress. To

strengthen in-depth cooperation with the mainland is an inevitable trend of de-

velopment, it is the common aspiration of the people in Macau and the main-

land and a necessary requirement for promoting economic diversification in

Macau. Because of the COVID-19 spread and Macau’s economy has been facing

decreasing, the CPI shows a deflation trend. In order to rebound the real estate

industry and improve the quality of life of the residents, the Macau government

can allow cross-border real estate investment for Macau citizens. And allow

them to use the house mortgage loan in Macau to invest real estate market in

Zhuhai, China.

Third, it is rectifying the financial market and standardizing bank credit ser-

vices. At present, the residential housing price in Macau is still a heavy burden

for ordinary families. As shown in

Figure 3, the average residential housing val-

ue is 7 million Patacas in Macau and equals more than 5 million RMB. Most of

the families buy a property through mortgage loans. The Macau monetary au-

thority report shows that the average housing mortgage loan is between 4 mil-

lion Patacas to 6 million Patacas in the first quarter of the year 2021, which oc-

cupies 39.1% of all the mortgage loans. Therefore, the Macau government should

enhance the management of the financial market, strengthen the supervision of

commercial banks and improve the risk prevention and control mechanism. At

the same time, commercial banks should strengthen their awareness of risk pre-

vention, strictly examine the credit of loan officers, and regulate real estate credit

services.

Fourth, it is to control regional economy and justify monetary policy. With

the continuous development of China’s real estate economy and the continuous

completion of the Guangdong-Hong Kong-Macau Greater Bay Area urban ag-

glomeration, the housing price transmission mechanism between cities will be-

come stronger and stronger. The central government of China should continue

improving the economic system of the real estate market in the Greater Bay Area,

focusing on economic regulation, strengthening economic linkage among dif-

ferent regions and avoiding direct intervention in local economic development.

In addition, the central government can adopt monetary policies corresponding

to the economy according to the different market conditions. Especially in 2020,

when the epidemic is rampant, all industries are affected by varying degrees.

Appropriate expansionary monetary policy can reduce the impact of the epi-

demic, improve the job market and increase the employment rate; at the mean-

time, it can lower the savings interest rate, stimulate residents’ consumption, and

make people shift their investment focus to the real estate industry and improve

people’s living standard.

Finally, it is to vigorously develop tourism and the gambling industries. The

year 2020 is difficult. Not only Macau, but all human beings across the country

have suffered a great recession. The recovery of the national economy has be-

come a major focus of current development. Therefore, while ensuring the pre-

T. Lan

DOI:

10.4236/tel.2021.116068 1087 Theoretical Economics Letters

vention and control of the epidemic, the tourism industry should be reasonably

developed to attract tourists to Macau, the development of the gambling indus-

try should be restored, and the employment rate of Macau’s population should

be correspondingly increased. For example, the recent decreases in the tourist

price index and hotel room prices in Macau have to some extent stimulated the

consumption of tourists in Macau. And Grand Lisboa Palace Resort is opened

on July 31

st

, 2021, which attracts more visitors’ attention. If the epidemic is fully

under control and disappears, Macau’s economy will surely be recovered, and

the real estate industry will also achieve good development as well.

Acknowledgements

This research paper was presented in front of my Supervisor and committee

members at University of Macau before; they gave me some comments and sug-

gestions. Therefore, I would like to thank Professor Jacky SO, Professor Rose

Lai, Professor Zhang Yang, Professor Maggie Fu, and Professor Yuan Jia. They

gave me helpful comments and suggestions on the earlier version of the manu-

script. I also need to thank anonymous reviewer and editor who provide detailed

suggestions to my manuscript and let me improve it in order to meet the journal

publishing requirement. The author is grateful for financial support from Beijing

Institute of Technology, Zhuhai.

Conflicts of Interest

The author declares no conflicts of interest regarding the publication of this pa-

per.

References

Ahearne, A. G., Ammer, J., Doyle, B. D., Kole, L. S., & Martin, R. F. H. (2005).

House

Prices and Monetary Policy: A Cross-Country Study

.

International Finance Discussion

Papers. No. 841, Board of Governors of the Federal Reserve System

.

https://doi.org/10.17016/IFDP.2005.841

Aizenman, J., Jinjarak, Y., & Zheng, H. (2016).

House Valuations and Economic Growth:

Some International Evidence

. Working Paper No. 22699, National Bureau of Economic

Research. https://doi.org/10.3386/w22699

Black, A., Fraser, P., & Hoesli, M. (2006). House Prices, Fundamentals and Bubbles.

Journal of Business, Finance & Accounting, 33,

1535-1555.

https://doi.org/10.1111/j.1468-5957.2006.00638.x

Case, K. E., & Shiller R. J. (2003). Is there a Bubble in the Housing Market?

Brookings

Papers on Economic Activity, 2003,

299-342. https://doi.org/10.1353/eca.2004.0004

Chen, M. C., & Patel, K. (1998). House Price Dynamics and Granger Causality: An Anal-

ysis of Taipei New Dwelling Market.

Journal of the Asian Real Estate Society, 1,

101-126.

Chen, R. P. (2013a).

Macao Real Estate Market Analysis and Regulation Voice

. South

China University of Technology.

Chen, W. B. (2013b). Analysis on the Trend of Macao Real Estate Market.

Foreign In-

T. Lan

DOI:

10.4236/tel.2021.116068 1088 Theoretical Economics Letters

vestment in China, 24,

92-93.

Chen, Z. X. (2016). An Empirical Analysis of the Impact of Macau Gambling Industry on

Real Estate Industry.

Hong Kong and Macao Research

, 3, 84-92.

Costello, G., Fraser, P., & Groenewold, N. (2011). House Prices, Non-Fundamental

Components and Interstate Spillovers: The Australian Experience.

Journal of Banking

& Finance, 35,

653-669. https://doi.org/10.1016/j.jbankfin.2010.07.035

Deng, C. R., Ma, Y. K., & Chiang, Y. M. (2009). The Dynamic Behavior of Chinese Hous-

ing Prices.

International Real Estate Review, 12,

121-134.

https://doi.org/10.53383/100108

Dokko, J., Doyle, B., Kiley, M. T., Kim, J., Sherlund, S., Sim, J., & Heuvel, S. V. D. (2009).

Monetary Policy and the Housing Bubble

.

Board of Governors of the Federal Reserve

System. https://doi.org/10.17016/FEDS.2009.49

Engle, R. F., & Granger, C. W. J. (1987). Cointegration and Error Correctionn: Represen-

tationn, Estimation and Testing.

Econometrica, 55,

251-276.

https://doi.org/10.2307/1913236

Fraser, P., Hoesli, M., & McAlevey, L. (2008). House Prices and Bubbles in New Zealand.

The Journal of Real Estate Finance and Economics, 37,

71-91.

https://doi.org/10.1007/s11146-007-9060-8

Giuliodori, M. (2005). The Role of House Prices in the Monetary Transmission Mechan-

ism across European Countries.

Scottish Journal of Political Economy, 52,

519-543.

https://doi.org/10.1111/j.1467-9485.2005.00354.x

Gu, X. H., Li, G. Q., Chang, X., & Guo, H. Z. (2017). Casino Tourism, Economic Inequa-

lity, and Housing Bubbles.

Tourism Management, 62,

253-263.

https://doi.org/10.1016/j.tourman.2017.04.006

Gu, X. H., Li, G. Q., Lei, C. K., Li, S., & Zhao, Q. B. (2020). The Inequality-Housing Price

Nexus in Tourist Resorts: Theory and Evidence.

Asia-Pacific Journal of Accounting

and Economics, 27,

132-150. https://doi.org/10.1080/16081625.2020.1686842

Guo, Y., Huang, X., & Peng, P. (2020). How Does House Price Influence Monetary Policy

Transmission?

International Review of Financial Analysis, 72,

Article ID: 101595.

https://doi.org/10.1016/j.irfa.2020.101595

Hui, E. C. M., & Shen, Y. (2006). Housing Price Bubbles in Hong Kong, Beijing and

Shanghai: A Comparative Study.

Journal of Real Estate Finance and Economics, 33,

299-327. https://doi.org/10.1007/s11146-006-0335-2

Hui, E., & Lui, T. Y. (2002). Rational Expectations and Market Fundamentals: Evidence

from Hong Kong’s Boom and Bust Cycles.

Journal of Property Investment & Finance,

20,

9-22. https://doi.org/10.1108/14635780210416237

Iacoviello, M. (2005) House Prices, Borrowing Constraints, and Monetary Policy in the

Business Cycle.

American Economic Review, 95,

739-764.

https://doi.org/10.1257/0002828054201477

Johansen, S., & Juselius, K. (1990). Maximum Likelihood Estimation and Inference on

Cointegration—With Application to the Demand for Money.

Oxford Bulletin of Eco-

nomics and Statistics, 52,

169-210.

https://doi.org/10.1111/j.1468-0084.1990.mp52002003.x

Kivu, T. (2010).

Monetary Policy, Asset Prices and Consumption in China

. Working Pa-

per Series No. 1240, European Central Bank. https://doi.org/10.2139/ssrn.1703371

Li, J., & Chiang, Y. H. (2012). What Pushes Up China’s Real Estate Price?

International

Journal of Housing Markets and Analysis, 5,

161-176.

T. Lan

DOI:

10.4236/tel.2021.116068 1089 Theoretical Economics Letters

https://doi.org/10.1108/17538271211225913

Liang, Q., & Cao, H. (2007). Property Prices and Bank Lending in China.

Journal of Asian

Economics, 18,

63-75. https://doi.org/10.1016/j.asieco.2006.12.013

Miller, N., & Liang, P. (2007).

House Prices and Economic Growth

. Working Paper, Uni-

versity of Colorado.

Miller, N., Liang, P., & Sklarz, M. (2009). House Prices and Economic Growth.

Journal of

Real Estate Finance and Economics, 42,

522-541.

https://doi.org/10.1007/s11146-009-9197-8

Mishkin, F. S. (2001).

The Transmission Mechanism and the Role of Asset Prices in

Monetary Policy

. Working Paper Series No. 8617, National Bureau of Economic Re-

search. https://doi.org/10.3386/w8617

Mishkin, F. S. (2007).

Housing and the Monetary Transmission Mechanism

. NBER

Working Paper Series No.13518, National Bureau of Economic Research.

https://doi.org/10.3386/w13518

OECD (Organisation for Economic Co-Operation and Development) (2005). Recent

House Price Development: The Role of Fundamentals. Economic Survey of Eighteen

Countries.

OECD Economic Outlook, 2002,

123-154.

https://doi.org/10.1787/eco_outlook-v2005-2-38-en

Sims, C. A. (1980). Macroeconomics and Reality.

Econometrica, 48,

1-48.

https://doi.org/10.2307/1912017

Smith, M. H., & Smith, G. (2006). Bubble, Bubble, Where’s the Housing Bubble?

Brook-

ings Papers on Economic Activity, 1,

1-67. https://doi.org/10.1353/eca.2006.0019

Tang, X. H., Zhang, Y., & Chen, J. B. (2015). Determinants of Real Estate Prices in Macao.

Real Estate Guide, No. 13,

31, 35.

Taylor, J. B. (2007).

Housing and Monetary Policy

. Working Paper Series No. 13682, Na-

tional Bureau of Economic Research. https://doi.org/10.3386/w13682

https://www.nber.org/papers/w13682.pdf

Taylor, J. B. (2008).

The Financial Crisis and the Policy Responses: An Empirical Analysis

of What Went Wrong

. Speech delivered at a Festschrift in Honor of David Dodge’s

Contributions on Canadian Public Policy at the Bank of Canada.

Taylor, J. B. (2009).

The Financial Crisis and the Policy Responses: An Empirical Analysis

of What Went Wrong

. NBER Working Paper Series No. 14631, National Bureau of

Economic Research. https://doi.org/10.3386/w14631

https://www.nber.org/papers/w14631

Wang, X. Q., Hao, L. N., Tao, R., & Su, C. W

.

(2020). Does Money Supply Growth Drive

Housing Boom in China? A Wavelet-Based Analysis.

Journal of Housing and the Built

Environment, 35,

125-141. https://doi.org/10.1007/s10901-019-09668-w

Xu, T. (2017). The Relationship between Interest Rates, Income, GDP Growth and House

Prices.

Research in Economics and Management, 2,

30-37.

https://doi.org/10.22158/rem.v2n1p30

Yao, S. J., Luo, D., & Loh, L. X. (2011).

On China’s Monetary Policy and Asset Prices

.

Discussion Paper No. 71. The University of Nottingham, China Policy Institute.

https://doi.org/10.2139/ssrn.1788064

Zhu, H. M., Li, Z., & Guo, P. (2018). The Impact of Income, Economic Openness and In-

terest Rates on Housing Prices in China: Evidence from Dynamic Panel Quantile Re-

gression.

Applied Economics, 50,

4086-4098.

https://doi.org/10.1080/00036846.2018.1441512