MACAU AND HONG KONG REPORT

20

ASIAN LEGAL BUSINESS

AUGUST 2013

MINING TITANS, MOVIE MOGULS: MACAU’S JUNKET OPERATORS ARE NOW

BRANCHING OUT, FINDS FARAH MASTER OF REUTERS

ADDITIONAL REPORTING BY RANAJIT DAM

W

hen junket operator Suncity

opened its first high roller bac-

carat table at Steve Wynn’s

Macau casino in 2007 to lure

China’s wealthiest punters, the firm had fewer

than 30 employees and no computers or

equipment other than pen and paper.

Five years later, Suncity has emerged as

the dominant junket in the Chinese territory.

It is planning to open its own resort, indepen-

dent of casino stalwarts such as Las Vegas

Sands, and is expanding into everything from

mining to films.

Macau’s booming revenues that totalled

$38 billion last year - six times that of the Las

Vegas strip - are indebted to its unique VIP

junket system, where licensed middlemen

act on behalf of the casinos to attract “big

whale” spenders by arranging their travel and

accommodation and handle their gambling

credit. Now the transformation of the former

Portuguese colony from a hotbed of crime

into a playground for China’s nouveau riche

has spawned a new breed of junkets, eager to

shed the industry’s shady image and establish

themselves as multinational conglomerates.

“Suncity is a young and very energetic

corporate. There is a need to be diversified,”

says YM Choong, a senior executive at the

company. “For future investments, we would

look to expand in different areas, particularly

property, finance and media. We would look

to list other parts of the business.”

According to Julia Brockman, partner at

DSL Lawyers in Macau, since junket operators

became subject to licensing by the govern-

ment in 2002, she has observed three major

trends – concentration, closer cooperation

with the gaming operators, and institution-

alisation. “Traditionally, there were many

different operators running their business

as junkets in Macau and nowadays, that has

evolved to a number of them having been ac-

quired or having come under the same own-

ership or under the same group,” she says.

Secondly, she sees much closer coopera-

tion with the casino operators, the conces-

sionaires that have been granted a gaming

concession by the government to run casinos

in Macau. “Although junkets have always

been decisive to the operation of the gaming

industry in Macau, for many years, they were

only working closely with SJM from the empire

of Stanley Ho,” says Brockman. “Only more

recently, when the new gaming operators

started their businesses and reached a certain

level of growth, they became increasingly

aware of the importance of these junkets,

resulting in a much closer operation between

those casino operators and the junkets.” She

adds that this has led to a cap determined

by the government on the commissions that

can be paid to the junket operator, precisely

to tackle a commission dispute that started a

few years ago between Melco and the other

operators in Macau.

Finally, Brockman notes that junket opera-

tors today are more institutionalised and are

now being run as proper corporations. “A few

have been listed on the stock exchange - usu-

ally through black listings because it is quite

difficult to get a proper licence to the direct

listing of the junket operations,” she says.

“Even for those that have not yet been listed,

A limousine featuring the company logo of Suncity Group is parked outside Macau Galaxy resort in Macau June 23, 2013. Suncity has

emerged as the most dominant junket in the Chinese controlled territory. It is planning to open its own resort, independent of casino

stalwarts such as Las Vegas Sands, and is expanding into everything from mining to films. REUTERS/Paul Yeung

MACAU AND HONG KONG REPORT

21

WWW.LEGALBUSINESSONLINE.COM

: @ALB_Magazine : Connect with Asian Legal Business

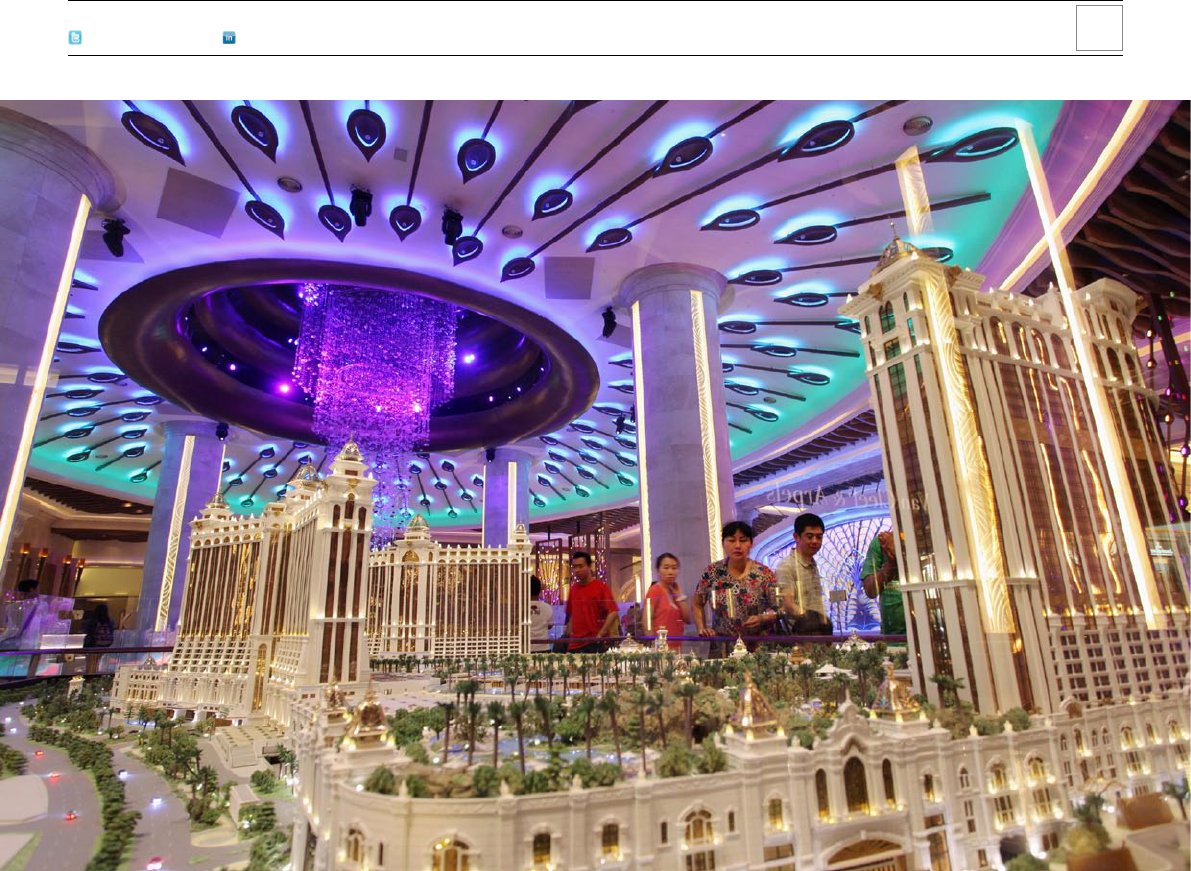

Visitors look at a model of Galaxy Macau resort inside Galaxy Macau in Macau June 13, 2013. Francis Lui, Deputy Chairman of the Galaxy Entertainment Group, who formally took over

last year from his father, has helped build Galaxy into Macau’s No. 2 casino operator by stock market value. He has drawn on both his China and overseas experience to expand in the

booming Chinese gambling hub and compete with rivals. REUTERS/Paul Yeung

it is obvious in the way they are structuring

the business that they have plans to list it in

the future.”

The evolution of the junkets is welcomed

by the authorities, who are eager to reposition

Macau as an all-round international travel

destination, but could shake up the dynamics

of the world’s largest gambling market.

The junkets have traditionally worked for

the casinos, which rely on them for more than

two-thirds of their revenue. Now, leverag-

ing their extensive customer databases and

sophisticated resources, they could one day

start competing with them.

“Macau’s junket operators are fully aware

that their network and database of high net

worth VIPs is valuable,” says Edmund Lee, a

partner at PwC in Hong Kong who focuses on

the gaming sector.

Suncity, headed by 39-year-old Alvin Chau,

is one of more than 200 junket operators

licensed in Macau on China’s southern coast,

the only place in the country where locals are

allowed to gamble in casinos.

The biggest operators, which include

Neptune, Golden Group, Jimei and Dore, ac-

count for more than half the monthly junket

turnover of $75 billion.

Despite robust mass market demand,

a crackdown on corruption and pervasive

graft has seen the supply of millionaire VIP

players to Macau decline over the past year,

prompting junkets to seek to diversify their

income streams.

“Because of the growth that junket opera-

tors have been able to induce in their busi-

nesses in the last few years, they are now

diversifying their activities and investing in

businesses that are parallel or accessory to

their main activity,” says Carlos Simoes, also

a partner at DSL Lawyers. “That includes res-

taurants, bars, travel agencies and car rent-

als. But above all is real estate investment.”

Suncity, which makes around HK$135 bil-

lion ($17 billion) in monthly gaming turnover,

according to Choong, has expanded into

mining with iron ore operations in Indonesia.

It has also branched out into financial

services in Hong Kong with 24-hour securi-

ties, forex and commodities trading, real

estate in China, food and beverage, film and

media. The company has two listed arms, Sun

International Resources Ltd and Sun Century

Group Ltd.

Golden Resorts Group, headed by Hong

Kong billionaire Pollyanna Chu, has been

invested in financial services through listed

arm Kingston Financial Group since 2011.

But the trend for larger junkets, flush with

cash from the gambling boom over the past

decade, to diversify as a hedge against the

volatile VIP gaming sector has accelerated

over the last year.

MACAU AND HONG KONG REPORT

22

ASIAN LEGAL BUSINESS

AUGUST 2013

Macau’s enacted its Pre-Sale Law on

May 27, and since then transactions in

the property market, particularly in the

residential property sector, have seen

a significant slowdown. Ranajit Dam

speaks to Carlos Duque Simoes, manag-

ing partner at DSL Lawyers, on the impact

of this new law.

What are the most important aspects

of the new Pre-Sale Law?

The first notable aspect is that the pre-

sale of properties now requires prior au-

thorisation from the Macau government.

Secondly, such authorisation can only be

obtained when the construction process

has achieved a certain stage, namely the

completion of the foundations. Thirdly,

besides requiring an authorisation for

pre-sale, the contracts to be signed at the

pre-sale stage (for buildings under this

authorisation) must comply with several

requirements from which the developers

were exempted until now. Now there

are rules for the terms and payment of

price, timing of installments, nature of

disclosures required from the developer,

details and obligations that are required

to be inserted in these agreements, and

inclusively the commitments of the devel-

oper in the longer term.

Thus overall, the contents of the

agreements for pre-sale units are now

very well regulated by the law, with a

substantial degree of detail that did not

exist before. Because of this, there have

been extreme efforts made by the local

developers in order to comply with these

new requirements - although it is only

possible to achieve them if construction

has already reached the stage of comple-

tion of foundations. Therefore, developers

now substantially depend on the licences

to be obtained from the Public Works

Department in relation to the construc-

tion process for the pre-sale of properties.

Most importantly, all the developers that

have not obtained such licences are now

virtually cut off from the market and they

will not be able to put the properties for

sale until works are licensed, construc-

tion partially completed, and pre-sale

authorised.

How do you think it will impact the local

real estate industry?

There has been a very substantial reduc-

tion in the number of transactions and

we are seeing now a consolidation of

the industry, because given the require-

ments under this new law, not all the

developers will be able to compete on

the same footing Therefore, there will

be a clear segmentation of the property

market between first, second and third

tier developers. Naturally, it is also unclear

what will be the long-term effects of this

new law, which is clearly aimed at cooling

down the property market and bringing

more transparency and clarity to market

practices. So far, however, this law seems

to be achieving those objectives.

How do you think it will impact foreign

investment?

As this new Pre-Sale Law is tied to a

number of changes to the Stamp Duty

Law, which makes the acquisition of

properties in Macau by foreign companies

much more onerous, we are going to see

a period where Macau may become less

attractive to foreign investors who are

going to be concerned with the difficulties

in entering the market and completing

developments. On the other hand, once

there is a perception of how these rules

work and how they are applied by the

government, it is possible that some of

those investors will come back, because

the new law will also make returns more

stable and assure that there is not much

competition for developers that have been

able to comply with the law, and to bring

properties to the market.

NEW IMAGE?

Large junkets such as Jimei, which operates

casinos in the Philippines and hosts golf

tournaments, have moved into wealth man-

agement and securities which complement

their VIP clientele base.

Neptune, which also uses the name

Guangdong Group, sponsored a high-profile

poker tournament last month, while Dore

Holdings announced it was buying a majority

stake in a Chinese pawn loan business.

Macau’s junket system was created in the

1970s with the rise of Stanley Ho, an influen-

tial local businessman who opened the gaudy

egg shaped Casino Lisboa.

Ho gave the junkets control of the casinos’

VIP rooms, sparking a turf war in the late

1990s as rival gangs fought to dominate.

Since the liberalisation of Macau’s casino

market in 2002, which marked the entry of

foreign players such as Las Vegas moguls

Steve Wynn and Sheldon Adelson, the junket

industry has been a subject of scrutiny from

U.S. regulators, who allege the operators

have ties to organised crime and facilitate

illicit money flows.

To combat this image, Emilie Tran, a

professor at the University of Saint Joseph

Macau, says junkets are trying to associate

with more wholesome activities such as or-

ganising community and youth events.

“Working for a junket is now seen as re-

spectable and a job like any other,” says Tran.

The shift to sophisticated corporate en-

tities with sizable business development,

accounting and marketing teams is clearly

visible. Shabby junket storefronts at the Hong

Kong-Macau ferry terminal have been re-

placed with marble offices in prime business

districts, while customised Hummer limou-

“TRADITIONALLY, THERE

WERE MANY DIFFERENT

OPERATORS RUNNING

THEIR BUSINESS AS

JUNKETS IN MACAU AND

NOWADAYS, THAT HAS

EVOLVED TO A NUMBER

OF THEM HAVING BEEN

ACQUIRED OR HAVING

COME UNDER THE SAME

OWNERSHIP OR UNDER

THE SAME GROUP.”

JULIA BROCKMAN, DSL Lawyers

Q&A:

Macau’snewPre-SaleLaw

anditspossibleimpact

MACAU AND HONG KONG REPORT

23

WWW.LEGALBUSINESSONLINE.COM

: @ALB_Magazine : Connect with Asian Legal Business

Corporate M&A

Property

Banking & Finance

Litigation & Arbitration

Intellectual Property (IP)

Employment

Tax

Construction & Infrastructure

Telecommunications & Media

China Investment Desk

Portuguese Speaking Countries Desk

Practice Areas:

DSL Lawyers provides an extensive range of legal services to local and international

corporations with interests t

hroughout Macau. Our team of experienced professionals

has international qualifications, language capabilities and long

time knowledge of the

region and industries.

Our lawyers are committed to their Clients’ needs and problems, making available the

time and resources required for the completion of any deal or for the right decision to

be made in a timely manner.

We know our Clients and we know their needs. Our lawyers have acquired a long time

experience at DSL and previously with other firms, with deep legal insight of the main

Macau industries and its international players. Such experience makes the difference

and is recognized by our Clients.

The involvement of partners at different levels of practice, as main contact points to

Clients, and the supervision and monitoring of other lawyers’ and staff work allows high

quality service and reliability of results. The structure of the practice in teams led by

partners also promotes a healthy growth, supported by solid procedures.

We are fluent in Portuguese, English, Mandarin, Cantonese and German languages.

Av. da Praia Grande 409, China Law Building 16/F, Macau | T: +853 2822 3355 | F: +853 2872 5588 | @: m[email protected] | Web: www.dsl-lawyers.com

sines owned by the operators are frequently

seen parked outside Macau’s newest casinos.

BIG AMBITIONS

Politics is the next phase of the junkets’

makeover, says Tran, who cites the example

of Suncity’s Chau, who joined the Guangdong

provincial committee of the Chinese People’s

Political Consultative Conference (CPPCC),

China’s parliamentary advisory body, this

year.

Chau, with his dapper appearance, is

often likened to a famous Hong Kong movie

star. An avid tennis player and gym goer, he

is frequently pictured in the local tabloids

at parties.

Pollyanna Chu of Golden Resorts Group,

ranked by Forbes as the 35

th

richest billionaire

in Hong Kong, sits on the CPPCC national

committee, while Hoffman Ma, deputy chair-

man of the Success Universe Group, sits on

the Chongqing Committee of the CPPCC.

Manuel Neves, head of Macau’s gaming

body the DICJ, says junkets diversifying into

other industries fitted into the government’s

attempts to wean the territory, home to

600,000 people, off the gambling industry

that accounted for more than 80 percent of

government revenues last year.

“For the government, when people talk

about Macau, we want them to not talk

about gaming. We are doing a very big effort

to push the diversification. It’s not an easy

task,” says Neves.

Despite the move to diversify, the role of

the junket is likely to remain critical to Macau’s

gaming sector over the coming years, as

gambling debts are not legally enforceable

in China. Junkets bring in gamblers from the

mainland, and then find their own ways to

collect debts.

Suncity is massively expanding its gam-

ing division, having doubled its workforce to

1,200 over the past year, but it is still short

staffed.

DSL Lawyers’ Simoes believes that the

increasing prominence of these junket op-

erators will have two basic results: They will

compete more and become intertwined with

the casino operators and, with time, they will

be as important to the gaming industry as the

casino operators themselves. “The listings

that they have been able to obtain are a sign

of that,” he says.

“Secondly, they will have to grow into

proper corporations and will be more care-

fully structured due to their greater role in the

economy. That will also raise the thresholds

to be met in terms of reporting, governance

and transparency,” he adds.

As major junkets move from operating one

or two VIP rooms in Macau’s flashy casinos

to owning their own properties, Macau’s li-

censed concessionaires Sands, Wynn, MGM,

Melco Crown and Galaxy may have to find

new ways to lure customers.

Meanwhile, Simoes believes that the

future of junket operators remains bright, es-

pecially for those that have achieved a certain

scale. “There will be no more casino operators

in the near future as the government is not

going to change gaming law. But there will

be no limit to the number of junket promoters

that could be in operation in Macau,” he says.

“However, even with that increased compe-

tition, they will still be able to grow their busi-

ness and remain as the primary factor of growth

for the VIP segment of the market,” he adds.

MACAU AND HONG KONG REPORT

24

ASIAN LEGAL BUSINESS

AUGUST 2013

I

n February this year, Hong Kong Financial

Secretary John Tsang Chun-wah an-

nounced that the government would

propose changes in the city’s investment

laws to allow private equity funds to enjoy the

same tax exemption as offshore funds. He

added that he planned to allow Hong Kong

funds a more flexible structure by amend-

ing the current law that requires investment

funds established in Hong Kong only to take

the form of trusts.

The announcements have been whole-

heartedly welcomed by hedge funds and

PE firms who see them as a way for Hong

Kong, which currently has more than HK$9

trillion ($1.16 trillion) of fund assets under

management, the second in Asia, to so-

lidify Hong Kong’s potential to become a

regional private equity centre. According to

PricewaterhouseCoopers, Hong Kong is home

to less than 1 percent of funds globally, but

industry watchers say that the new policy

along with the ongoing internationalisation of

the yuan is expected to catapult Hong Kong

into second place by 2020.

“This is great news since this would, for

sure, encourage more private equity funds

to come to Hong Kong,” says Terence Chiu,

partner at Li & Partners. “We know for a fact

that fund managers in Asia are all based in

onshore financial centres like Shanghai, Hong

Kong, Singapore and so on. Where funds are

resident largely depends on tax. This move

will put Hong Kong in a very strong position to

become ‘Asia’s asset-management centre.’”

While Hong Kong has been an ideal dis-

tribution centre for fund managers looking

to sell their fund products to Asian inves-

tors, insiders expect more hedge funds and

private equity firms to set up in the SAR. Of

the roughly 1,700 funds in Hong Kong, only

about 300 are domiciled there, with many of

the rest domiciled in Luxemburg and Dublin

because of favourable tax regimes.

In 2006, Hong Kong granted a tax exemp-

tion to offshore funds investing in stocks and

futures, and the region is now looking to ex-

pand the tax exemption to offshore PE funds

that invest directly in companies. Tsang also

wants funds domiciled in Hong Kong to be

established as companies, instead of trusts,

which is how they are currently required to

be set up as.

THE CHINA FACTOR

As an added benefit, the tax incentives are

also expected to lure over large numbers

of investment houses from the mainland to

THE HONG KONG GOVERNMENT’S PROPOSED INCENTIVES LOOK

TO SERIOUSLY BOLSTER THE CITY’S POTENTIAL TO BECOME A

REGIONAL PRIVATE EQUITY CENTRE, FINDS RANAJIT DAM

HONG KONG & MACAU COUNTRY REPORT

24

ASIAN LEGAL BUSINESS

AUGUST 2013

Photos of yuan (top) and U.S. dollar banknotes are displayed at a money exchange in Hong Kong. REUTERS/Bobby Yip

MACAU AND HONG KONG REPORT

25

WWW.LEGALBUSINESSONLINE.COM

: @ALB_Magazine : Connect with Asian Legal Business

22nd Floor, World-Wide House,

Central, Hong Kong

Telephone: (852) 2501 0088

Fax: (852) 2501 0028

Website: www.li-partners.com

E-mail: info@li-partners.com

Banking & Finance

LP’s banking and finance team represents borrowers and lenders on a wide range of

finance transactions. LP lawyers have extensive experience in banking law and regulations,

cross-border lending, syndicated loans, acquisition financing, shipping and aviation finance,

equipment leasing, trade and property finance and other forms of financing for listed

securities transactions.

Construction

LP’s construction team deals with both contentious and non-contentious matters: providing

legal and contractual advice to developers, construction professionals and contractors,

drafting construction and consultancy contracts in South East Asia, Africa, HK & China as

well as representing parties in resolving construction related disputes through litigation,

CIETAC, ICC & other arbitration and ADR methods. Certain lawyers in our offices hold multiple

professional qualifications with charter status in quantity surveying and / or civil engineering

as well.

Litigation and Arbitration

LP’s litigation team has substantial experience in dispute resolution and enforcement/recovery

actions in particular with regard to shareholder disputes, joint ventures, insolvency-related

matters, secured lending recovery, mortgagee actions, enforcement of third party security, trade

finance, employment, corporate fraud, listing/regulatory regime matters, licensing agreements

and matrimonial proceedings.

Intellectual Property

LP’s IP team advises on both contentious and non-contentious IP matters, including brand

building and protection strategy, acquisition of IP related assets, IP due diligence, technology

transfer, and entertainment related matters.

THE FIRM

Li & Partners (“LP”) was the first leading Hong Kong law firm established by a PRC lawyer

who is also a Hong Kong qualified lawyer. The office consists of Hong Kong, PRC, UK, USA and

Japan qualified lawyers. The firm is committed to become the best Chinese international law

firm in various common law jurisdictions.

AREAS OF PRACTICE

China Practice

LP is widely recognized as one of the top-tier cross-border law firms advising state-owned

institutional clients and corporate clients on cross-border investment, stock exchange listings

and capital market transactions. Lawyers in our Hong Kong office work closely with lawyers

in our PRC offices to represent Asian, US and European clients in structuring, negotiating and

documenting investment projects with their PRC counterparts.

Capital Markets / Corporate Finance

LP lawyers have substantial experience and expertise in capital markets and corporate finance

matters. LP advises institutional and corporate clients on IPOs, takeovers, privatizations,

convertible note/bond issues, rights issues as well as mergers and acquisitions.

Corporate & Commercial / M&A

LP regularly advises corporate clients on high-end corporate matters, such as post-IPO

compliance matters and interpretation of listing rules and securities-related legislation, sale

and purchase of private/public companies, takeovers and private equity investment. LP also

advises on outbound investments and cross-border M&As for institutional and corporate

clients from the PRC.

Contact:

Terence CHIU - Partner

terencechiu@li-partners.com

Other offices:

Beijing; *Shenzhen;

*Shanghai *

Associate office

Languages: Cantonese,

English, Mandarin

Legal Solutions Between East and West

raise their first offshore PE funds in the city,

a reversal of what happened a few years ago,

when PE firms were heading to the mainland

to raise yuan funds, attracted by reform prom-

ises by Beijing.

This is expected to greatly benefit both

mainland PE firms as well as Hong Kong.

Mainland firms will find it easier to raise

money for their Hong Kong-based private

equity funds from their China connections,

and this will help Hong Kong’s long-term de-

velopment and its position as a major global

asset management centre.

The HK government is also in talks with

mainland authorities on a possible mutual

recognition agreement that would mainly

pave the way for cross-border selling of fund

products between the two sides. “It would be

advantageous for HK-based funds to partici-

pate in cross-border transactions which will

no doubt enhance their competitiveness and

performance,” says Lin Lei, partner at Chinese

firm Zhong Lun W&D.

The internationalisation of the yuan also

adds to the allure for PE firms. “The ongoing

financial liberalisation by mainland authori-

ties will attract more overseas private equity

capital into the mainland, and mainland en-

terprises will also use Hong Kong private

equity fund managers to seek more private

equity opportunities overseas,” says Chiu.

“The law and regulations shall strike for the

balance of interests between the fund houses

and the investors.”

According to Lin, the “offer of more flex-

ibility and diversification in fund industry

operations is likely to bring more investment

into Hong Kong, including schemes and prod-

ucts denominated in RMB.” However, he says

that it will also bring with it “problems such

as insufficient investment products and a lack

of experienced fund managers.”

HONG KONG POTENTIAL

Lawyers generally rate Hong Kong’s potential

to become a regional private equity centre

highly. “Hong Kong is currently among top-

tier destinations attracting worldwide funds

due to its legal system, geographical advan-

tage and talent pool,” says Lin. “It is likely to

become the biggest and most competitive

private equity centre in the coming years,

ahead of other regional competitors.”

Chiu agrees. “I rate Hong Kong highly on

its potential to become a regional private

equity centre,” he says. “Hong Kong has so

many positive factors: its physical proximity

to China, being the gateway to [the] mainland

China market and the largest offshore RMB

bond market, having [a] well-established

system of rule of law, a low and simple tax

regime, a stable currency with no foreign ex-

change control, being a free economy, world-

class infrastructure, the strong and highly

liquid Hong Kong IPO market, and so on.”

And reforms like the ones proposed by

Tsang are cementing Hong Kong’s place. “The

recent change in regulatory and banking law

in enhancing investor protection and the pro-

posed changes to the Companies Ordinance

for better corporate governance further put

Hong Kong ahead of other places to become

Asia’s asset-management centre,” says Chiu.

Lin foresees “the demand for suitable and

sustainable regulations in connection with

the private equity fund industry in order to

keep up with the pace of the development of

funds in Hong Kong.”