Financing New Nuclear Power Plants: Minimising the Cost of Capital by Optimising Risk Management

Nuclear Technology Development and Economics

2022

N

N

E

E

A

A

Financing New Nuclear Power Plants:

Minimising the Cost of Capital by

Optimising Risk Management

New Perspectives for

Financing Nuclear New Build

Nuclear Technology Development and Economics

New Perspectives for Financing Nuclear New Build

Financing New Nuclear Power Plants:

Minimising the Cost of Capital by Optimising Risk Management

© OECD 2022

NEA No. 7632

NUCLEAR ENERGY AGENCY

ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT

ORGANISATION FOR ECONOMIC CO-OPERATION AND DEVELOPMENT

The OECD is a unique forum where the governments of 38 democracies work together to address the

economic, social and environmental challenges of globalisation. The OECD is also at the forefront of efforts

to understand and to help governments respond to new developments and concerns, such as corporate

governance, the information economy and the challenges of an ageing population. The Organisation provides

a setting where governments can compare policy experiences, seek answers to common problems, identify

good practice and work to co-ordinate domestic and international policies.

The OECD member countries are: Australia, Austria, Belgium, Canada, Chile, Colombia, Costa Rica, the Czech

Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Japan,

Korea, Latvia, Lithuania, Luxembourg, Mexico, the Netherlands, New Zealand, Norway, Poland, Portugal, the

Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Türkiye, the United Kingdom and the United States. The

European Commission takes part in the work of the OECD.

OECD Publishing disseminates widely the results of the Organisation’s statistics gathering and research on

economic, social and environmental issues, as well as the conventions, guidelines and standards agreed by its

members.

This work is published under the responsibility of the Secretary-General of the OECD.

The opinions expressed and arguments employed herein do not necessarily reflect the

official views of the member countries of the OECD or its Nuclear Energy Agency.

NUCLEAR ENERGY AGENCY

The OECD Nuclear Energy Agency (NEA) was established on 1 February 1958. Current NEA membership

consists of 34 countries: Argentina, Australia, Austria, Belgium, Bulgaria, Canada, the Czech Republic,

Denmark, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Japan, Korea, Luxembourg,

Mexico, the Netherlands, Norway, Poland, Portugal, Romania, Russia (suspended), the Slovak Republic,

Slovenia, Spain, Sweden, Switzerland, Türkiye, the United Kingdom and the United States. The European

Commission and the International Atomic Energy Agency also take part in the work of the Agency.

The mission of the NEA is:

• to assist its member countries in maintaining and further developing, through international

co-operation, the scientific, technological and legal bases required for the safe, environmentally

sound and economical use of nuclear energy for peaceful purposes.

• to provide authoritative assessments and to forge common understandings on key issues as input to

government decisions on nuclear energy policy and to broader OECD analyses in areas such as energy

and the sustainable development of low-carbon economies.

Specific areas of NEA competence include the safety and regulation of nuclear activities, radioactive waste

management, radiological protection, nuclear science, economic and technical analyses of the nuclear fuel

cycle, nuclear law and liability, and public information. The NEA Data Bank provides nuclear data and

computer program services for participating countries.

This document, as well as any data and map included herein, are without prejudice to the status of or sovereignty over any territory, to the

delimitation of international frontiers and boundaries and to the name of any territory, city or area.

Corrigenda to OECD publications may be found online at: www.oecd.org/about/publishing/corrigenda.htm.

© OECD 2022

You can copy, download or print OECD content for your own use, and you can include excerpts from OECD publications, databases and multimedia

products in your own documents, presentations, blogs, websites and teaching materials, provided that suitable acknowledgement of the OECD as

source and copyright owner is given. All requests for public or commercial use and translation rights should be submitted to neapub@oecd-nea.org.

Requests for permission to photocopy portions of this material for public or commercial use shall be addressed directly to the Copyright Clearance

Center (CCC) at info@copyright.com or the Centre français d'exploitation du droit de copie (CFC) contact@cfcopies.com.

Cover photos: Unit 3 of Flamanville NPP, France (panoramio, Creative Commons); Financing (KanawatTH, ShutterStock).

FOREWORD

FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022 3

Foreword

Nuclear energy could play a significant role in attaining the net zero targets to which an

increasing number of OECD countries are committed. The IEA’s Net Zero by 2050 assumes an

increase in electricity generated by nuclear power plants from 2 698 TWh in 2020 to 5 497 TWh

in 2050 corresponding to an increase of 415 GW of capacity in 2020 to 812 GW in 2050 (IEA, 2021).

Achieving this near doubling of nuclear capacity in the coming years and decades will require

the ability to leverage considerable amounts of capital at competitive rates. To facilitate this

process, the OECD Nuclear Energy Agency (NEA) and the International Framework for Nuclear

Energy Cooperation (IFNEC), in collaboration with the government of Poland, decided in late

2020 to launch the NEA – IFNEC Initiative on Nuclear Financing. This initiative brought together

experts from academia, industry and energy policymaking to identify key challenges in the

financing of nuclear new build and to identify promising avenues to overcome them.

Informed by their discussions, the NEA is this report exploring a new framework for analysing

financial risk in nuclear new build. Minimising the cost of capital depends on optimising financial

risk management. The framework proposed in this report allows to draw two key conclusions.

First, in a carbon-constrained world, the true capital costs of nuclear energy and other low-carbon

generators are lower than customarily assumed due to their ability to offset systemic financial

risk. Including low-carbon generation investments can thus reduce overall portfolio risks. Second,

there exist effective policies and measures to radically reduce the economic and financial costs of

other risk components such as construction risk, price risk and political risk.

The findings of this report apply equally to private and public investments. There do, however,

remain important roles for governments. First and foremost, governments need to ensure credible

and effective commitments to net zero carbon emissions by 2050. They also need to implement

the measures required to eliminate or reduce the economic costs of construction risk, price risk

and political risk. Finally, governments may become directly involved as project participants, in

cases where they judge that private actors do not realise the full value of a nuclear power project.

Beyond the reduction of financial risks, governments have a role in ensuring efficient project

management structures in large and complex projects such nuclear new build as well as

macroeconomic stability.

If the measures and frameworks indicated in this report are fully implemented to de-risk

nuclear power projects in a context of contributing to the attainment of ambitious net zero

targets, investors private and public will compete for the opportunity to share in the benefits of

dispatchable low-carbon electricity by reducing their required return on capital to significantly

lower rates than is presently the case. The Nuclear Energy Agency (NEA) welcomes comment

and discussion on this and other forthcoming contributions on the financing of nuclear new

build, which is one of the major challenges that need to mastered in order to succeed with

attaining ambitious net zero objectives.

ACKNOWLEDGEMENTS

4 FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022

Acknowledgements

This report was written by Dr Jan Horst Keppler, Nuclear Energy Agency (NEA) Chief Energy

Economist. Diane Cameron, Head of the NEA Division for Nuclear Technology Development and

Economics (NTE), and Dr Michel Berthélemy, NTE Nuclear Energy Analyst, provided valuable

comments throughout the different stages of the report.

The work on this report benefitted greatly from the contributions to the NEA – IFNEC Initiative

on Nuclear Financing launched by the OECD Nuclear Energy Agency (NEA) and the International

Framework for Nuclear Energy Cooperation (IFNEC) in collaboration with the government of

Poland in late 2020. Expert financing workshops on 14-15 January 2021 and 10 March 2022 as well

as webinars on “The Financing of SMRs: Challenges and Opportunities”, 18 May 2021, on

“Taxonomies, Environment, Social, and Governance (ESG) Criteria and the Role of Nuclear Energy”,

19 July 2021, as well as “Contractual Structures and Incentives in Nuclear New Build”,

14 September 2021, identified challenges, formulated questions and provided insights. The high-

level “Warsaw Conference on Nuclear Financing” on 23 November 2021 brought together many of

these contributions, several of which subsequently found their way into this report.

Finally, the report also gained from the oversight and comments of the NEA Committee on

Nuclear Development and the Fuel Cycle (NDC) under its Chair Patrick Lederman and the NEA

Working Party on Nuclear Energy Economics (WPNE) under its Chair William D’haeseleer and

co-chair Brent Dixon.

TABLE OF CONTENTS

FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022 5

Table of contents

Executive summary ................................................................................................................................ 9

The cost of capital is a key driver for the competitiveness of nuclear new build ...... 10

Successful risk management can reduce the costs of capital of nuclear new build.. 11

Risk management in nuclear new build in practice and the role of governments .... 13

Chapter 1. Context and introduction .................................................................................................. 15

1.1. The NEA – IFNEC Financing Initiative in collaboration with the

government of Poland ................................................................................................ 15

1.2. The role of nuclear energy in mitigating climate change ..................................... 19

1.3. The importance of financing costs for nuclear new build .................................... 22

Chapter 2. Minimising the economic costs of risk and optimising the cost of capital in

financing the construction of new nuclear power plants ........................................... 25

2.1. Introduction ................................................................................................................. 25

2.2. The conceptual framework: the capital asset pricing model (CAPM) .................. 27

2.3. The risk-free rate and the correlation of nuclear new build projects with

systemic risk ................................................................................................................ 29

2.4. The three idiosyncratic risks of investing in a nuclear power plant ................... 34

2.5. Synthesis ...................................................................................................................... 48

Chapter 3. Remarks on overnight costs, incentive compatibility and project structure ........... 51

3.1. Overnight costs ........................................................................................................... 51

3.2. The challenge of incentive compatibility ................................................................ 52

3.3. Project structure: How to best leverage the relative strengths of the public

and private sectors ..................................................................................................... 53

Chapter 4. Experiences to date with the financing of nuclear new build and policy

conclusions .......................................................................................................................... 57

References .............................................................................................................................................. 61

List of boxes

2.1. Does it make a difference whether the private or the public sector assumes risks? ...... 35

2.2. The impact of price volatility on the cost of capital ............................................................ 40

List of figures

ES.1. Potential contribution of nuclear new build and long-term operation (LTO) to

carbon emission reductions by 2050 ........................................................................................ 9

ES.2. Competitiveness of baseload power generation technologies as a function of

the cost of capital...................................................................................................................... 10

ES.3. Including low-carbon projects improves the risk-reward ratio of financial

portfolios .................................................................................................................................... 12

TABLE OF CONTENTS

6 FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022

1.1a. LCOE ranges for different power generation technologies at a cost of capital of 7% ...... 19

1.1b. LCOE ranges for different power generation technologies at a cost of capital of 0% ...... 20

1.2. The full potential of nuclear energy to contribute to net zero ........................................... 21

1.3. Carbon emissions avoided by nuclear power and non-power applications ..................... 21

1.4. The competitiveness of baseload power generation technologies as a function of

the cost of capital (discount rate) ........................................................................................... 22

2.1. General investment risk vs. the risk of low-carbon investments in a net zero

context ....................................................................................................................................... 33

2.2. The inclusion of low carbon projects improves the risk-reward ratio of financial

portfolios .................................................................................................................................... 33

2.3. Hourly demand in a low-carbon electricity system (50 gCO

2

/kWh) with 75% wind

and solar PV ............................................................................................................................... 38

2.4. Full cost recovery of combined cycle gas plants in France and Germany

(percent, 2008-2019) .................................................................................................................. 39

2.5. Costs of capital and correlation with systemic risk (beta) with residual carbon

emissions ................................................................................................................................... 41

2.6. Costs of capital and correlation with systemic risk (beta) in a net zero system .............. 41

2.7. Reducing the economic cost of risk when sharing it between two agents ....................... 44

3.1. Options to reduce overnight costs in nuclear new build..................................................... 51

List of tables

1.1. Investment costs per kW at different costs of capital (overnight costs correspond

to zero interest rate) .............................................................................................................. 23

1.2. The LCOE of nuclear power plants at different costs of capital (investment costs

include decommissioning costs) .......................................................................................... 23

LIST OF ABBREVIATIONS AND ACRONYMS

FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022 7

List of abbreviations and acronyms

CAPM Capital asset pricing model

CCGT Combined cycle gas turbines

CFD Contracts for difference

CWP Construction work in progress

ESG Taxonomies, Environment, Social, and Governance

FIT Feed-in tariffs

FOAK First-of-a-kind

IFNEC International Framework for Nuclear Energy Cooperation

LTO Long-term operation

NEA Nuclear Energy Agency

NOAK Nth-of-a-kind

O&M Operations and maintenance

OECD Organisation for Economic Cooperation and Development

RAB Regulated asset base

SMR Small modular reactors

VRE Variable renewable energy

WACC Weighted average cost of capital

EXECUTIVE SUMMARY

FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022 9

Executive summary

Attaining net zero carbon emissions by 2050 will require financing and developing significant

capacity of new nuclear power generation in the coming years and decades. The IEA’s Net Zero

by 2050 assumes an increase in electricity generated by nuclear power plants from 2 698 TWh

in 2020 to 5 497 TWh in 2050 corresponding to an increase of 415 GW of capacity in 2020 to

812 GW in 2050 (IEA, 2021). Those data are modelled for the Net‐Zero Emissions (NZE) Scenario.

This corresponds to 7.8% of the global electricity production in 2050 (IEA, 2021). Achieving this

near doubling of nuclear capacity in the coming years and decades will require the ability to

leverage considerable amounts of capital at competitive rates. The OECD Nuclear Energy Agency

(NEA) and the International Framework for Nuclear Energy Cooperation (IFNEC), in collaboration

with the government of Poland, have thus decided in late 2020 to launch the NEA – IFNEC

Initiative on Nuclear Financing. This initiative brought together experts from academia,

industry and energy policymaking to identify key challenges in the financing of nuclear new

build and to identify promising avenues to overcome them.

Figure ES.1

Potential contribution of nuclear new build and long-term operation (LTO)

to carbon emission reductions by 2050

Source: NEA (2021).

Informed by their discussions, the NEA has written this report exploring a new framework

based on the capital asset pricing model (CAPM) for analysing financial risk in nuclear new build.

In doing so it is possible to indicate possible avenues to minimise the cost of capital – and hence

the overall costs of investment when constructing new nuclear power plants. This framework

led to two key conclusions. First, in a carbon-constrained world, the true capital costs of nuclear

EXECUTIVE SUMMARY

10 FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022

energy and other low-carbon generators are lower than customarily assumed due to their ability

to offset systemic financial risk. Second, there exist effective policies and measures to radically

reduce the economic and financial costs of other risk components such as construction risk,

price risk and political risk. The findings of this report apply equally to private and public

investments. They include the possibility that governments may become directly involved as

project participants in cases where they judge that private actors do not realise the full value of

a nuclear power project.

As a dispatchable generating technology predictably producing large amounts of low carbon

electricity that can be scaled at will, nuclear energy could play a significant role in attaining the

net zero targets to which an increasing number of OECD governments are explicitly or implicitly

committed

1

. Recent NEA work has shown that nuclear energy could avoid 87 million tonnes of

CO

2

globally by 2050 given its competitiveness, in particular when considering the electricity

system in its entirety.These emission savings would likely be achieved by a mix of LTO of

existing plants and the construction of nuclear capacity in the form of both Generation III

reactors and small modular reactors (SMRs).

The cost of capital is a key driver for the competitiveness of nuclear new build

Nuclear power can thus contribute significantly to reducing carbon emissions. This will depend,

however, on the ability of governments, project managers and reactor vendors to work together

to deliver sufficient numbers of nuclear reactors at an attractive cost. Like other low-carbon

technologies such as hydroelectricity, wind or solar PV, nuclear energy is highly capital-intensive.

This high capital intensity distinguishes these low-carbon generation technologies from

technologies based on fossil fuels such as coal and gas, for which fuel costs and the costs of carbon

emissions are the key cost components (see IEA/NEA, 2020 and NEA, 2019, in particular Table B3.2,

p. 125, for details). High capital intensity furthermore implies that the cost of capital, that is the

rate of return paid to investors, is together with overnight costs and effective project management

one of the three key determinants of the overall costs of nuclear new build and of the

competitiveness of nuclear energy compared to other baseload technologies such as gas and coal.

Figure ES.2

Competitiveness of baseload power generation technologies

as a function of the cost of capital

Source: IEA/NEA (2020), p. 84.

1. As with other generation technologies, the dispatchability of nuclear power is subject to ramping

constraints such as limits to the gradient of power changes, minimum up- and downtimes as well

minimal power requirements (see NEA, 2019, p. 96, for details).

EXECUTIVE SUMMARY

FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022 11

At low costs of capital (see Figure ES.2), nuclear energy is highly competitive even against gas-

fired power generation, with fuel costs for Europe of USD 8 per MMBTU (USD 27.2 per MWh) and

carbon costs of USD 30 per tonne of CO

2

. This cost advantage disappears rapidly at higher costs of

capital. Recent events have driven the costs of both gas and carbon emissions considerably higher

and thus improved the competitiveness of nuclear energy. And yet, attaining net zero carbon

emissions in 2050 and investing in power generation capacity are long-term endeavours and the

assumptions of the 2020 edition of Projected Costs of Generating Electricity (IEA/NEA, 2020) remain

relevant for energy decision-making.

Successful risk management can reduce the costs of capital of nuclear new build

The cost of capital in nuclear new build, as elsewhere, is a function of risk management and risk

allocation. One important principle in this context is that risks should always be allocated to the

party that is best equipped to minimise the economic costs of those risks. The ability to minimise

the cost of risk is usually tied to either a particular technical competence (utilities managing

nuclear power plants should bear operational risk, for example) or to a particular ability to share,

diversify and hedge risks. This report introduces an additional consideration: in policy

frameworks that aim to reduce carbon emissions in order to achieve net zero by 2050, low-carbon

generators such as nuclear power can play an important role in offsetting financial portfolio risk.

The cost of capital in investment is determined by the costs of risk. The higher the costs of the

different types of risk for investors, the higher will be the rates of return that they will seek from

the proponents of a project. This principle of financial economics is universal and affects

investments in any economic sector. It assumes, however, a particular relevance when investing

in capital-intensive low-carbon power generation projects such as nuclear new build. The capital

asset pricing model (CAPM), the most widely applied model in financial economics to determine

the cost of capital, offers a systematic approach to the analysis of risk. It allows, in particular, to

analyse the different dimensions of financial risk in nuclear new build one by one and thus offers

both a more complete view of the overall risk as well as the ability to better design measures to

manage, reduce and allocate the economic costs of risk in a coherent and transparent manner.

For any given investment project, the CAPM distinguishes the following components of risk:

(1) the risk-free rate at which countries with high credit ratings can borrow, (2) the systemic risk

of the market and the project’s correlation with the systemic risk and (3) different forms of project-

specific or “idiosyncratic” risk. In a nuclear new build project, the idiosyncratic risks would

typically include construction risk, price risk and political risk. The premise of this report is that

the costs of these risks are either lower than habitually assumed or that there exist effective

measures to reduce them further. The arguments for each risk category are the following:

1. In real terms, that is net of inflation, the risk-free rate at which countries with high

credit ratings can borrow for the long term remains at historic lows despite recent

increases in short-term rates.

2. In the case of systemic market risk, the key parameter is a project’s correlation. If the

latter is lower than average, zero or even negative, investors can lower their overall risk

by adding such a project to their portfolios as it offsets the systemic risk of other

investments. In a net zero world, this applies to low-carbon generators. As climate

change and efforts to combat it intensify, implicit and explicit carbon prices rise. This

decreases profitability throughout the economy but increases the profitability of low-

carbon investments. In this case, including low-carbon investments will reduce the risk

and improve the risk-reward ratio, also called the Sharpe ratio, of financial portfolios

(see Figure ES.3). Consequently, investors will accept very low or even zero returns on

such investments as their value lies primarily in their hedging function rather than their

individual payoff.

EXECUTIVE SUMMARY

12 FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022

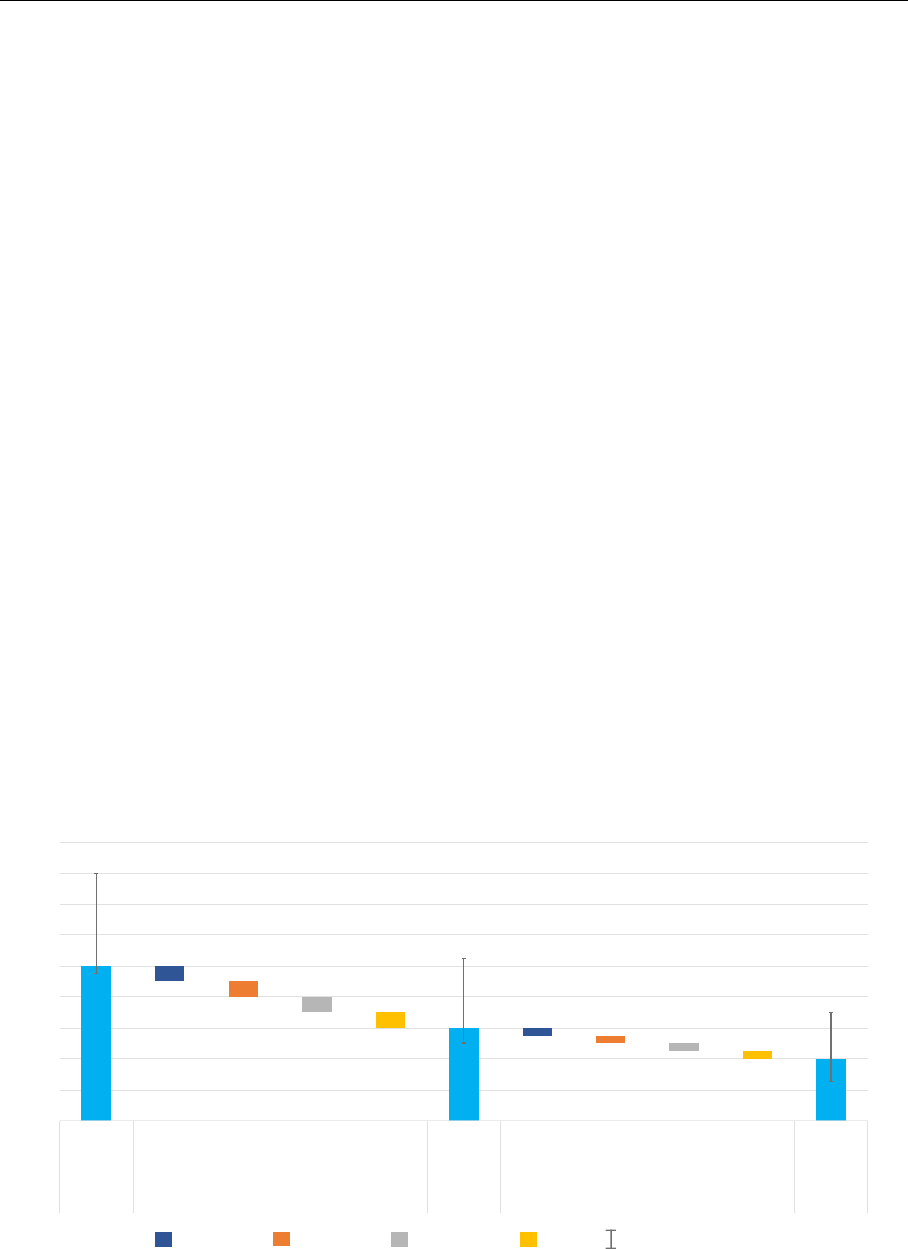

Figure ES.3

Including low-carbon projects improves the risk-reward

ratio of financial portfolios

3. As far as the project-specific risks of a nuclear new build project are concerned, the aim

is less to interpret differently the true cost of capital as to implement effective measures

to reduce the economic costs of the underlying risks. For the different idiosyncratic

risks, it thus holds that:

a) For the large, complex projects that constitute nuclear new build, construction risk is

perhaps the most important project-specific risk. If an individual company shoulders

that risk, its survival may be at stake. Consequently, investors would demand a hefty

bankruptcy premium when exposed to construction risk. As an alternative, measures

such as regulated asset base (RAB) in the United Kingdom or construction work in

progress (CWP) in the United States have been put forward. Such measures transfer

the cost of building the plant to the electricity bills of ratepayers from the moment

construction starts rather than from the moment electricity generation starts.

Economic theory shows that this implies not just a transfer of risk but, as long as a

number of reasonable assumptions hold, a reduction in the economic costs of risk as

the amounts in play are a very small portion of each ratepayer’s budget.

b) Price risk in the deregulated electricity markets that dominate the electricity sectors

of OECD countries has long been recognised as a driver of the cost of capital (see, for

instance, NEA, 2015). This is why regulators have proposed in certain instances, price

guarantees in the form of feed-in tariffs (FIT) or contracts for difference (CFD). This is,

however, only the beginning. In future low-carbon systems, prices will increasingly be

set by the zero or very low short-term marginal costs of nuclear and renewables. The

budget constraints of generators will require these low prices to be offset by scarcity

hours where prices may reach hundreds or thousands of USD. Increasingly, a

consensus is forming that in a net zero context, all low-carbon providers will need to

benefit from generalised long-term contracts with guaranteed prices at the level of

average costs over the complete lifetime of the project.

c) In the case of political risk, the logic that requires allocating risk to the party most

apt to minimise and internalise it is, by and large, already respected. Contractual

indemnification clauses insure project operators and their investors against changes

in energy policy that would limit the use of nuclear power and attributes that risk to

national governments.

Capital market lines (CML) with and

without low-carbon projects

Set of portfolios with

low-carbon projects

Set of portfolios without

low-carbon projects

0

Risk-free

rate

Expected

return

Expected portfolio risk

EXECUTIVE SUMMARY

FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022 13

In summary, this report shows that the cost of capital for nuclear new build projects is either

lower than is usually assumed or can be radically reduced through appropriate measures. In the

first case, the long-term real risk-free rate is still very low while the correlation with system

market risk can be prudently assumed to be zero, as long as net zero targets are pursued with

vigour and consistency. In the second case, governments and electricity market regulators have

at their disposal effective measures to reduce not only the effective risk for investors but also

the overall economic cost of construction risk, electricity price risk and political risk.

The same insight can be formulated in another manner: if nuclear new build projects are

thoroughly de-risked in the manner outlined above, this will provide in particular private

investors with the stable framework that will enable them to offer capital at lower rates of return

to acquire a share in predictably generated low-carbon electricity.

Risk management in nuclear new build in practice and the role of governments

Given the significant sums involved and the number of successfully concluded projects, it is

obvious that financial risk management has always been part of nuclear new build. Historically,

arrangements were often quite straightforward. In the vast majority of successful nuclear new

build projects, utilities were public, which means construction risk was spread in another way,

over a large number of taxpayers, and tariffs were regulated. The advent of electricity market

deregulation in the 1990s changed all this. Financial risk management needed to become more

sophisticated to remain market compatible. The forthcoming NEA report on lessons learnt from

the financing of recent nuclear power plant projects will provide a comprehensive overview of

such efforts (NEA, forthcoming).

The picture that emerges is that financial risk management in nuclear new build projects in

a context of deregulated electricity markets is frequently applied in a partial and sometimes

haphazard manner that owes more to national precedent and prevailing political considerations

than to systematic analysis. The objective of this report is precisely to provide decision makers

with a comprehensive view of financial risk management to allow a more consistent and

transparent management and allocation of the different risks to different stakeholders.

This is a task that will ultimately need to be performed by governments. The report’s

conclusion that the costs of capital for nuclear new build projects can be significantly lower

than usually assumed applies equally to public and private investors. Nevertheless, there

remain important roles for government in this context.

The first task of governments is to ensure a credible and effective commitment to carbon

emission reductions. The decorrelation of low-carbon projects from systemic market risk will

not be realised where strong emission reduction commitments are not followed up by actions

that have real traction in the economy. Second, governments need to implement the strategies

that are discussed above to eliminate or reduce the economic costs of three project-specific

idiosyncratic risks: construction risk through risk spreading over ratepayers, price risk through

long-term contracts or regulated tariffs and political risk through appropriate indemnification

clauses with government. Third, governments may become directly involved as project

participants in cases where they judge that private actors do not realise the full value of a

nuclear power projects. This does not require an argument based on the public good or strategic

objectives such as security of energy supply, technological development, regional cohesion or

employment – however valuable they may be. The only relevant market failures would concern

the incorrect appreciation of the true costs and benefits of dispatchable low-carbon electricity

generated by new nuclear power projects. Fourth, governments have a role in ensuring efficient

project management structures in nuclear new build. The interaction of financing structures,

project management, incentives and electricity market design in nuclear new build is an issue

that will be developed in a future NEA report. At this point, it suffices to say that governments

need to ensure that all stakeholders contribute to an eventually shared objective of completing

nuclear new build projects on time and to budget. Fifth, governments would need to ensure

macroeconomic stability to keep country risk premiums at a minimum. Nuclear generation

projects are capital-intensive and large. An increase of one or two percent above the risk-free

rate quickly makes a difference in the real costs of these projects.

EXECUTIVE SUMMARY

14 FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022

Governments therefore need to stay involved to create the framework conditions and to

implement the measures reducing the economic costs of financial risk. First and foremost,

commitments to net zero carbon emissions by 2050 need to be translated into effective action. If

these conditions are ensured, there will be a tendency for the costs of capital for nuclear new build

projects to approach the risk-free rate plus any required country risk premium. This is not only a

conceptual proposition. If nuclear new build projects are thoroughly de-risked as indicated, this

will provide in particular private investors with the stable framework that will enable them to

offer capital to acquire shares in predictably generated low-carbon electricity at considerably

lower rates than is presently the case.

CONTEXT AND INTRODUCTION

FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022 15

Chapter 1. Context and introduction

1.1. The NEA-IFNEC Financing Initiative in collaboration with the government of

Poland

In an effort to help develop the nuclear power generation needed to meet net zero targets by

mid-century, the OECD Nuclear Energy Agency (NEA) as part of the 2021-22 Programme of Work

of the NEA Committee for Technical and Economic Studies on Nuclear Energy Development and

Fuel Cycle (NDC) and the International Framework for Nuclear Energy Cooperation (IFNEC), in

collaboration with the government of Poland, launched in late 2020 the NEA-IFNEC Initiative on

Nuclear Financing. The Initiative started with the “NEA-IFNEC Kick-off Workshop on Conceptual

Issues in the Financing of Nuclear New Build” on 14-15 January 2021, bringing together experts

from academia, industry and energy policymaking to identify key challenges in the financing of

nuclear new build and promising avenues to overcome them.

Over the course of 2021, a series of NEA-IFNEC webinars helped sharpen both the

understanding of the barriers to financing nuclear new build as well as the means to surmount

them. Subsequent webinars dealt with “The Financing of SMRs: Challenges and Opportunities”

on 18 May 2021, “Taxonomies, Environment, Social, and Governance (ESG) Criteria and the Role

of Nuclear Energy” on 19 July 2021, as well as with “Contractual Structures and Incentives in

Nuclear New Build” on 14 September 2021.

In parallel, the NEA has been working on a report combining insights from conceptual

analysis and empirical experience on nuclear financing, with this background paper providing

the first results. The “Warsaw Conference on Nuclear Financing” on 23 November 2021

constituted a first high-point of the NEA-IFNEC Initiative on Nuclear Financing in collaboration

with the government of Poland. The Warsaw conference discussed preliminary insights from

this work at the policy level in order to make them relevant in the national contexts of the

nuclear new build programmes of the participating countries.

Today’s efforts to build new nuclear power plants are part of climate change mitigation

plans and the ambition of many OECD countries, including Poland and the countries of the

European Union, to achieve net zero greenhouse gas emissions by 2050. Recent events have also

highlighted the role that nuclear energy, alongside other low-carbon technologies, can play in

improving the security of electricity supply as it reduces the need for imported fossil fuels for

electricity generation. Nuclear as a reliable provider of dispatchable low-carbon electricity is an

indispensable complement to variable renewables such as wind and solar PV. Work by the NEA

and others has shown that significant shares of nuclear power generation contribute to

reducing the overall costs of attaining ambitious net zero targets.

Due to their high capital intensity, all low-carbon technologies face special investment

challenges and would benefit from market design with a stable long-term outlook of electricity

prices. Beyond this, each low-carbon technology faces different challenges. Wind and solar PV are

variable and hydropower is constrained by the availability of suitable sites. In the case of nuclear

generation, the large size of projects and their regulatory and institutional infrastructures would

require a concerted effort to launch nuclear new build programmes. Once built, nuclear power

plants contribute substantially to carbon emission reductions, air quality and the security of

energy supply.

The success of these efforts will depend crucially on the financing conditions for nuclear new

build projects. This regards not only the availability of large amounts of capital from private and

public sources. As long-term trends indicate a structural overhang of savings over investments,

properly structured projects will find interested investors. Like other low-carbon generation

technologies such as hydro or variable renewables, nuclear energy has comparatively high capital

CONTEXT AND INTRODUCTION

16 FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022

costs and low variable costs (see IEA/NEA, 2020 and NEA, 2019, p. 125). The key parameter for the

successful financing of new nuclear power plants is thus the cost of capital, i.e. the level of

remuneration that public and private investors will require. This level of remuneration is directly

related to the risk that investors are exposed to in different dimensions. The efficient allocation

among private and public stakeholders of risks relating to the construction, pricing arrangements

and policy frameworks of new nuclear power plants has indeed emerged as a key theme. Is there

a risk that construction takes longer than planned? May electricity prices be lower than expected?

What about changes in the political frameworks? The answers to each of these questions will

influence the level of risk, the rate of return that investors demand and the costs of nuclear new

build projects.

These questions and their answers have not substantially changed in 2022 when electricity

prices, driven mainly by gas prices, reached previously unimaginable levels. In Europe, the price

for one-year forward delivery of electricity baseload in 2023 was about EUR 200/MWh, far above

the estimated levelised cost of electricity (LCOE) of nuclear power plants, even at considerable

capital costs. Such a price certainly provides a welcome addition to the revenues of existing

plants, nuclear or other, and may even affect the economics of long-term operation (LTO) or

lifetime extensions. However, they will have little if any impact on decisions to invest in the

construction of new nuclear power plants. The time frames are just too long and the

uncertainties, be they driven by geopolitics, domestic concerns, climate change concerns or new

technology developments, are just too high.

Through the NEA-IFNEC Financing Initiative and as presented at the Warsaw conference, the

NEA has approached these questions in two ways. First, the NEA developed a conceptual

framework in which to discuss the question, “What is today the optimal cost of capital for a new

nuclear power generation project from a societal point of view?”. Combining insights from

finance, public economics and energy economics, the NEA is putting forward the new and striking

proposal that the socially optimal rate for the cost of capital for a nuclear new build project should

be close to the cost of capital of public funds, i.e. the rate at which national governments can

borrow in financial markets. Such a result, however, depends on the systematic de-risking of new

nuclear projects and thus on a number of assumptions that require careful discussion. For

example, eventual nuclear new build projects would need to be a part of a coherent national

strategy to protect the economy against the risks of climate change. In addition, construction,

price and political risks would need to be handled in a manner that minimises their private and

social costs. While fulfilment of these conditions is possible, it will not be achieved without a

comprehensive and robust policy effort.

Second, the NEA has empirically studied the financing structures of successful new build

projects in the recent past. This work shows that the success of nuclear new build projects

historically depended substantially on the de-risking of projects in several dimensions. For

example, successful projects have with only few exceptions benefitted from long-term

guarantees concerning the level of remuneration in terms of electricity process. Also, projects

tend to benefit from close co-operation between relevant stakeholders, not only from the start

of the project but many years before “first concrete” is poured. Finally, the articulation between

the financial model, procurement choices and ownership structure is key to align stakeholders’

interests and thus ensure project success.

The NEA work on nuclear finance is based on the idea that the costs of financing nuclear

new build correspond to the sum of the risks of building new nuclear power plants. In this

context, this report explores three key hypotheses:

1) The financing costs of nuclear new build can be substantially lowered if price risk,

construction risk and political risk are each optimally managed and allocated through

different measures to be implemented by governments or public actors.

2) Independent of the fact that risk optimisation will be primarily driven by governments,

both public and private investors would benefit from such measures. This may extend

to including nuclear power generation in investment portfolios to the extent that they

can provide a form of financial hedge against the economic impacts of climate change.

3) Private sector participation in nuclear new build is desirable and often required for various

reasons, including to find staff with the appropriate technical, project management or

CONTEXT AND INTRODUCTION

FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022 17

operational skills. Specific provisions for project management, incentive structures and

ownership can help optimise the benefits of public-private co-operation.

This report pursues primarily a normative approach. It thus poses the question, “What

should be the cost of capital for building new nuclear power plants under an optimal

management and allocation of risks and in the absence of market failures, transaction costs,

non-aligned incentives or asymmetric information?” The answer should not depend on whether

investors are from the public or private sector. If indeed new nuclear construction projects are

systematically de-risked, private actors should be compelled to invest at the same rates of

return as public entities.

Many of the observations made in this report on the financing of new nuclear power plants

are transferable to the financing of other low-carbon generation technologies such as

hydroelectricity or renewable energy sources. The report can thus be read as a general guide to

financing new generation capacity in the electricity sector of OECD countries in the context of

their ambition to reach net zero carbon emissions by 2050. In particular, low-carbon

investments would, in principle, all benefit from a progressive increase in carbon constraints

while other investments would tend to be negatively affected. This decorrelation with systemic

financial risk would, in principle, favour decreased costs of capital for low-carbon generators in

general. While the implications of such new constellations still need to be worked out in detail

and, with time, subjected to empirical verification, it is already clear that binding net zero

commitments will lead to a new finance and macroeconomics of the energy transition with

wide-reaching ramifications. The question of how to approach the financing of new nuclear

power plants is at the heart of this transformation.

Of course, this does not mean that all low-carbon technologies face exactly the same

financing challenges. Variable sources such as wind and solar PV have to deal with financial

risks linked to their autocorrelation, i.e. the fact that all installations of a given technology

produce together during a limited number of hours, which generates lower than average value

both for the system and themselves. Nuclear power plants have to face the risks of their long

and complex construction, which is dealt with carefully in this report. While large hydropower

installations or certain offshore wind installations might be comparable in size and complexity

as construction projects, beyond some similarities among low-carbon technologies there

remain a number of technology-specific challenges even in a general net zero context.

However, even in a world without market failures and transaction costs, governments have a

fundamental role. It is governments that decide on the societal allocation of risks and set the

framework conditions. Whether price risk is borne by producers or consumers is a question of

market design. Whether construction risk is borne by individual parties or socialised depends on

the financing models decided upon by governments and regulators. Political risk is by definition

a function of the political processes that both determine and are determined by governments.

There are also other situations in which governments may have an important role to play. In

the real world, markets are not always complete, transaction costs are high and the incentives of

different actors are not aligned, among other things. In particular, the private sector might

struggle to adequately price the ability of low-carbon electricity generation to offset systemic

economic risk. Such market failures are a textbook example of when government intervention is

needed through regulation, fiscal measures or public investment. Needless to say, projects as

complex as building nuclear power plants provide myriad possibilities for co-ordination failures

that markets cannot adequately address. This is an important issue and has, for instance, been

addressed in NEA (2015), Nuclear New Build: Insights into Financing and Project Management.

The two aspects of government intervention, optimising risk allocation and remediation of

market failures, are discussed in Chapter 2 of this report, which examines at length the issue of

reducing the economic costs of construction risk through risk sharing. Transferring construction

risk partially or entirely to ratepayers and electricity consumers can be accomplished by way of

mechanisms such as regulated asset base (RAB) or construction work in progress (CWP). Clearly

there is an element of simply transferring risk from one party to another; however, there is also

an element of reducing the economic costs of risk that could not be accomplished by markets

alone.

CONTEXT AND INTRODUCTION

18 FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022

The need for governments to intervene in the construction of new nuclear power plants or

other low-carbon generation assets to remediate for market failures over and above the optimal

allocation of risk is discussed in a more synthetic manner in Chapter 3. Here the report provides

a number of guiding principles for governments to carefully set the framework conditions for the

division of labour between the public and private sectors in nuclear new build projects. Future

NEA work, building on this report, will provide a more systematic treatment of the role of

governments in addressing incomplete markets, transaction costs and asymmetric information.

Under all circumstances, history, culture and national industrial structure will be important.

Different countries will thus choose different arrangements. Overall, the public sector has

historically been deeply involved in the financing and, to a lesser extent, the project management

of nuclear new build in many countries. It is now the time to combine new conceptual insights

and empirical experience to develop financing models that can be successfully adapted by

member countries.

While reducing the costs of financing is crucial for successful nuclear new build, it is not the

only factor necessary to build new nuclear power plants at attractive costs. Proven, or at least

fully completed, designs that allow for reasonable overnight costs, i.e. capital costs net of

financing costs, are fundamental. The contractual structures of project management and

appropriate incentive mechanisms that align the interests of different stakeholders can also be

decisive. On overnight costs, Unlocking Reductions in the Construction Costs of Nuclear (NEA, 2020)

has already provided a number of new perspectives. The second part of this report will comment

on contractual structures and incentive mechanisms.

However, there is also a consideration that goes beyond the financing and construction of

nuclear energy sources and concerns all low-carbon electricity generation technologies as well

as the effort to attain net zero emissions by 2050: it will not be possible to attain this ambitious

objective within the current designs for electricity markets. Deregulated markets for low-carbon

electricity with marginal cost pricing will display pricing patterns with unsustainable levels of

volatility where prices alternate between zero and the level of voluntary or involuntary demand

response. This is due to two independent but mutually reinforcing characteristics: first, as

indicated above, the high capital costs and low variable costs of all low-carbon technologies and,

second, the compression of the generation from wind and solar PV during a limited number of

hours. When the wind is blowing and the sun is shining, prices will tend towards zero and if

neither is, the case prices will tend towards the level of demand response.

Optimising the cost of capital would thus be a necessary but not a sufficient condition to allow

for significant amounts of nuclear new build in order to contribute to net zero targets. Energy

market reform and long-term pricing arrangements such as regulated tariffs, contracts for

difference (CFD) or widespread power purchasing agreements would thus be a necessary

complement to efforts to reduce the cost of financing per se. Yet, the converse also holds true:

energy market reform will not be sufficient to ensure the amounts of nuclear new build that net

zero requires. Other than price risk and, depending on the context, policy risk, nuclear power

plants are subject to significant levels of construction risk. Of course, CFDs could tempt investors

to undertake nuclear construction projects even in the absence of specific measures to handle

construction risk. However, the levels of such CFDs would need to be so high as to become difficult

to sustain at the level of political debate and the workings of the electricity market.

Last but not least, geopolitical upheaval in 2022 has raised questions about markets, prices,

and the functions of government in the energy field including ensuring the safety and security of

vulnerable energy infrastructures. However, as far as the financing of new nuclear power plants

is concerned, these disruptions have re-enforced rather than limited the conclusions of the

present report. Alongside the imperative of reducing carbon emissions to reach net zero by 2050,

the security of energy supplies is a second non-negotiable priority. Nuclear energy can, of course,

play a role in both areas. Current events have also highlighted the fact that in the energy field,

despite 30 years of liberalisation, many risks cannot be expressed in the form of the well-defined

probability functions that markets rely on to function properly. Governments thus remain the

ultimate decision-makers both on the supply and the demand side. For financing of new nuclear

power plants, this means that governments have an even stronger mandate to set clear

framework conditions in order to allocate risks, which may include geopolitical risks.

CONTEXT AND INTRODUCTION

FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022 19

1.2. The role of nuclear energy in mitigating climate change

Depending in particular on its cost of finance, nuclear energy can be a competitive form of low-

carbon electricity generation. The widely read reference publication Projected Costs of Generating

Electricity: 2020 Edition by the International Energy Agency and NEA, for instance, states that

nuclear is the dispatchable low-carbon technology with the lowest costs.

2

Only large hydro

reservoirs, where available, can provide a similar system contribution at comparable costs.

Electricity produced from nuclear LTO is even more competitive and is the least cost option not

only for low-carbon generation but for all power generation.

Figures 1.1a and 1.1b below provides an overview of the range of levelised costs of electricity

(LCOE) for different power generation technologies on the basis of the data received from

participating countries in the Projected Costs study. These results are reported below first for a

relatively high cost of capital of 7% and then for a capital cost of 0%. The NEA work on the

socially optimal cost of capital for low-carbon technologies presented in Chapter 2 of this

background document argues that far lower costs of capital should be used in the context of

national and regional efforts to achieve net zero emission targets by 2050. Applying such socially

optimal costs of capital would not primarily affect the relative competitiveness of different low-

carbon technologies such as nuclear, hydro or variable renewables – since all of them are highly

capital-intensive – but the competitiveness between low-carbon technologies and fossil fuel-

based technologies, primarily coal and gas. The latter’s overall costs are primarily determined

by the costs for fuel and carbon, so a reduction in capital costs is of lesser importance for them.

Figure 1.1a

LCOE ranges for different power generation technologies at a cost of capital of 7%

Note: Box plots indicate maximum, median and minimum values. The boxes indicate the central 50% of values, i.e. the second

and the third quartile.

2. As with other generation technologies, the dispatchability of nuclear power is subject to ramping

constraints such as limits to the gradient of power changes, minimum up- and downtimes as well

minimal power requirements (see NEA, 2019, p. 96, for details).

CONTEXT AND INTRODUCTION

20 FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022

The impact of the costs of capital on the competitiveness of different power generation

technologies and, in particular, the competitiveness of capital-intensive low-carbon technologies

such as nuclear, hydroelectricity, wind and solar PV against gas and coal-fired power generators

is shown in the graph below. It computes the same LCOE at a capital cost of 0%, which is close to

the rate at which countries with high credit ratings currently borrow in long-term capital markets.

The costs of all low-carbon technologies, both nuclear and variable renewables, are significantly

reduced, while those of gas and coal-fired power generation change very little. Clearly, the cost of

capital is one of the principal drivers for a successful realisation of the clean carbon transition (for

nuclear specifically, see also Tables 1.1 and 1.2 below).

Figure 1.1b

LCOE ranges for different power generation technologies at a cost of capital of 0%

Note: Box plots indicate maximum, median and minimum values. The boxes indicate the central 50% of values, i.e. the second and the

third quartile.

Nuclear energy can play a significant role in the reduction of global carbon emissions.

Recent work by the NEA has provided an overview of how large such a contribution could be

both with conservative and with more ambitious assumptions (see Figure 1.2 below; the left-

hand axis shows total installed capacity and the right hand axis cumulatively avoided CO

2

emissions). Under ambitious assumptions, nuclear energy would avoid globally 87.1 million

tonnes of CO

2

(GtCO

2

).

In order to put the contribution of nuclear energy into perspective, global energy-related

carbon emissions amounted to 31.5 GtCO

2

per year. In other words, realising the full cumulative

contribution of nuclear power until 2050 would correspond to roughly three years’ worth of

energy-related carbon emissions. However, this would require the nuclear sector to realise

ambitious targets in all three of its main segments, the LTO of reactors that are already

operating today, the construction of new Generation III plants and the deployment of nearly

200 GW of small modular reactors (SMRs).

0

50

100

150

200

250

Lignite

Coal

Gas (CCGT)

Nuclear

Nuclear (LTO)

Wind onshore (>= 1 MW)

Wind offshore

Solar PV (utility scale)

Solar PV (commercial)

Solar PV (residential)

Solar thermal (CSP-

Hydro (reservoir. >= 5 MW)

Hydro (run of river. >= 5 MW)

Geothermal

Biomass

Lignite (CCS)

Coal (CCS)

Gas (CCGT, CCS)

Fossil fuel Low carbon technologies

LCOE [USD/MWh]

CONTEXT AND INTRODUCTION

FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022 21

Figure 1.2

The full potential of nuclear energy to contribute to net zero

Source: NEA (2021), p.7.

The potential contribution of nuclear power can also be analysed in terms of power and

non-power applications. While low-carbon electricity produced by nuclear power will provide

the bulk of emissions savings with over 50 GtCO

2

avoided, nuclear heat as well as nuclear

hydrogen are expected to play increasingly important roles in the low-carbon electricity and

energy systems of the future. The key notion here is “sector coupling”, as the electricity sector

progressively integrates with transport, industrial uses and residential heating.

Figure 1.3

Carbon emissions avoided by nuclear power and non-power applications

Source: Ibid, p. 34.

CONTEXT AND INTRODUCTION

22 FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022

1.3. The importance of financing costs for nuclear new build

Nuclear power can contribute significantly to reducing carbon emissions. In competitive

electricity sectors, realising this contribution will depend, however, on the ability of

governments, project managers and reactor vendors to work together to deliver a significant

number of nuclear reactors at attractive costs. Like other low-carbon technologies such as

hydroelectricity, wind or solar PV, nuclear energy is highly capital-intensive. This high capital-

intensity distinguishes low-carbon generation technologies from carbon-intensive generation

based on fossil fuels such as coal and gas, for which fuel costs are the key cost component.

Figure 1.4

The competitiveness of baseload power generation technologies

as a function of the cost of capital (discount rate)

Source: IEA/NEA (2020), p. 84.

For low-carbon technologies the key cost component is the cost of capital. Figure 1.4

indicates the competitiveness of the principal technologies for dispatchable baseload power

generation from nuclear reactors, coal-fired power plants and combined cycle gas turbines

(CCGT) in terms of the levelised costs of electricity (LCOE) in function of the real cost of capital

(net of inflation) or the private discount rate (in LCOE accounting, these two items are identical

and coincide also with the real interest rate).

It is easy to see that at low and very low-interest rates nuclear power is the most competitive

technology by a considerable margin. At a cost of capital of zero, a level that corresponds to the

risk-free rate for public borrowing in major industrialised countries and is considered in the

remainder of the paper the relevant level also for investments in nuclear energy, nuclear power

is highly competitive, producing electricity at a cost that is less than half that produced either

by a coal-fired power plant or a CCGT. However, this cost advantage quickly dissipates at higher

interest rates. At a cost of capital of 5% CCGTs become the least-cost baseload generator and at

10% even coal has a lower cost than nuclear despite the 30 USD/tCO

2

carbon cost that is included

in the LCOE of coal-fired power generation.

Keeping the costs of capital low is thus key both for the competitiveness of nuclear energy

against alternative baseload generators as well as for limiting the overall costs of the transition

to net zero energy systems by 2050. Tables 1.1 and 1.2 quantitatively demonstrate this link.

However, it should be emphasised that the cost of capital is not the only parameter determining

the successful completion of nuclear new build projects where issues such as electricity market

design, project management and incentive structures play important complementary roles.

CONTEXT AND INTRODUCTION

FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022 23

Table 1.1

Investment costs per kW at different costs of capital

(overnight costs correspond to zero interest rate)

Country Technology

Net capacity

(MWe)

Overnight costs

(USD/kWe)

Investment costs (USD/kWe)

3% 7% 10%

France

EPR

1 650

4 013

4 459

5 132

5 705

Japan ALWR 1 152 3 963 4 402 5 068 5 633

Korea

ALWR

1 377

2 157

2 396

2 759

3 066

Russia

VVER

1 122

2 271

2 523

2 904

3 228

Slovak Republic Other nuclear 1 004 6 920 7 688 8 850 9 837

United States LWR 1 100 4 250 4 721 5 435 6 041

Non-OECD countries

China LWR 950 2 500 2 777 3 197 3 554

India

LWR

950

2 778

3 086

3 552

3 949

Source: Ibid, p. 49.

Overall capital costs, i.e. the amount of financing that needs to be mobilised by investors,

increase considerably when moving from a real cost of capital of zero to 3%, 7% or even 10%. It

should be recalled that these funds need to be disbursed before the first MWh is produced and

thus do include construction risk as well as other risks. Managing, transferring or sharing this

risk will be crucial to keeping financing costs manageable.

The effect of the cost of capital is even more striking when considering its impact on the

LCOE. This is due to the fact that intertemporal consistency demands that the cost of capital is

equal to the discount rate. At higher discount rates, the revenues for electricity sold many years

after the date of commissioning are discounted more heavily. Since the LCOE methodology also

requires an identical price for each MWh at each point in time, the two effects combine to yield

an algebraic result that is equivalent to discounting future physical output.

Table 1.2

The LCOE of nuclear power plants at different costs of capital

(investment costs include decommissioning costs)

Country Technology

Net capacity

(MWe)

Investment (USD/MWh)

Fuel

(USD/MWh)

O&M

(USD/MWh)

LCOE (USD/MWh)

3% 7% 10% 3% 7% 10%

France

EPR

1 650

22.05

47.56

73.31

9.33

14.26

45.27

71.10

96.89

Japan

ALWR

1 152

21.77

46.96

72.39

13.92

25.84

61.16

86.67

112.13

Korea ALWR 1 377 11.85 25.56 39.40 9.33 18.44 39.42 53.30 67.16

Russia

VVER

1 122

12.48

26.91

41.48

4.99

10.15

27.41

42.02

56.61

Slovak Republic

Other nuclear

1 004

40.37

83.76

127.66

9.33

9.72

57.61

101.84

146.06

United States LWR 1 100 23.35 50.37 77.63 9.33 11.60 43.90 71.25 98.56

Non-OECD countries

China LWR 950 13.73 29.63 45.67 10.00 26.42 49.92 66.01 82.08

India LWR 950 15.25 32.92 50.74 9.33 23.84 48.17 66.06 83.91

Source: Ibid (adapted), p. 58-59.

At such higher discount rates, it thus seems as if total costs were divided by a lower number

of MWh. In reality, the number of physical MWh remains the same year after year but MWh

generated in far-away future years count increasingly less towards cost recovery than MWh

generated in years closer to the date of commissioning. LCOE thus increase doubly with the cost

of capital, first due to the increase in the cost of capital during construction until the date of

commissioning and, second, due to the decreasing value of future production after

commissioning. Whatever the mechanics behind LCOE accounting: keeping the cost of capital

low is crucial for the competitiveness of nuclear energy as well as for delivering the energy

transition in a cost-effective manner.

MINIMISING THE ECONOMIC COSTS OF RISK AND OPTIMISING THE COST OF CAPITAL IN FINANCING THE CONSTRUCTION OF NEW NPPs

FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022 25

Chapter 2. Minimising the economic costs of risk and

optimising the cost of capital in financing the construction

of new nuclear power plants

2.1. Introduction

Establishing frameworks that allow for cost-efficient financing is crucial for the construction of

new nuclear power plants. Without efficient financing, the large number of new plants required

to reach the net zero targets of NEA member countries will not be realised, as it will be

impossible to mobilise the large amount of capital required. In a world with a structural savings

overhang and trillion-dollar stimulus programmes, this is not primarily a question of the

availability of capital but of its required rate of return, the cost of capital.

The availability of capital, in principle, does not mean that all desirable projects will

automatically be financed. In particular, projects whose social benefits exceed the private

benefits, which typically include low-carbon power generation projects such as nuclear energy,

will not be financed at socially desirable levels if their cost of capital is higher than socially

optimal. Reasons for these high costs can include market failures, such as short-termism or the

inability to price in positive externalities, but also market design issues creating high volatility

and risks for investors. The principal purpose of this report is precisely to develop proposals for

bridging the gap between a general financial environment, in which capital is plentiful and its

cost are low, and the specific conditions for investments in low-carbon electricity generation

and nuclear energy, where the costs of capital can be considerable.

The cost of capital for a new nuclear power plant thus depends partly on the global savings

and investment balance, partly on the view society takes of the nature and role of low-carbon

electricity generation and partly on the specifics of nuclear power projects. It may also matter

who finances construction, in particular whether investors are public or private entities and

what their views are. In all circumstances, the cost of capital is ultimately a function of the risk

that investors have to bear or perceive to have to bear. The lower the real or perceived investor

risk, the lower the cost of capital.

3

If private investors have a different view from public sector

actors concerning the risks of a specific project, their costs of capital will be higher.

In this context, it is necessary to underline the normative nature of this report. It indeed tries

to establish a framework in order to determine what the cost of capital in financing a new

nuclear power plant should be once all different risk dimensions have been optimised. It comes

to the conclusion that the cost of capital of a de-risked, low-carbon generation project should

be close to the risk-free rate plus the risk premium for the country or the enterprise undertaking

the project. This conclusion is independent of whether investors are private or public. It results

from an economic approach interested in overall welfare maximisation. This conclusion would

thus be the view of the policymaker to the extent that he or she is convinced by the economic

argument. However, what happens if private investors do not share this view and demand

higher rates of return than those implied by the present framework? This would constitute a

typical case of market failure, i.e. markets have a selective view of a broader economic reality

for various reasons, including policy myopia, transaction costs, the negligence of externalities,

herd behaviour around long-entrenched perceptions.

3. Hereafter the terms “cost of capital”, “rate of return” and “discount rate” are used interchangeably. The

note also does not distinguish between observed and expected rates and is exclusively concerned with

real rather than nominal rates. The different terms are, of course, identical only in a system in long-

term equilibrium and may not be identical in the here and now of concrete projects.

MINIMISING THE ECONOMIC COSTS OF RISK AND OPTIMISING THE COST OF CAPITAL IN FINANCING THE CONSTRUCTION OF NEW NPPs

26 FINANCING NEW NUCLEAR POWER PLANTS: MINIMISING THE COST OF CAPITAL BY OPTIMISING RISK MANAGEMENT, NEA No. 7632, © OECD 2022

In such cases, there are two options. Either governments or public actors undertake the

investments themselves or they introduce support measures that bridge the gap between private

and public perceptions of risk and the cost of capital. The latter does not necessarily involve

financial transfers. Typically, this has taken the form of guaranteeing different risks around a new

nuclear new build project, in particular political risk, price risk and construction risk. However,

electricity market reforms, carbon pricing or better information and improved transparency can

also be used to bring reality in line with the normatively established optimal rate of capital in

nuclear new build in the context of attaining net zero carbon emissions by 2050.

One high-profile area in which attempts to bridge the gap between private and public

perceptions of projects with good environmental performance have already materialised is so-

called ESG investing, which integrates environmental, social and governance considerations to

steer private capital into publicly desired sectors or projects. The means to do so is the promise

of higher rates of return, either through “halo effects” attracting certain investor groups or by

signalling long-term policy risks, including possible differentiated rates for capital gains taxes

on ESG and other financial products. One of the most prominent ESG frameworks is currently

the EU Taxonomy. In December 2021, the European Council approved the climate-related

Delegated Act (DA), confirming into EU law the adoption of Technical Screening Criteria (TSC)

for activities that contribute substantially to climate change mitigation and adaptation

objectives. A draft version of the Taxonomy proposed by the EU Commission in December 2021

for acceptance by the European Council in summer of 2022 includes both nuclear energy and

natural gas as transitional solutions for a limited time. The EU Taxonomy is far from being the

only instrument for screening investments for their environmental, social and governance

impacts. In June 2021, the United States House of Representatives voted the ESG Disclosure

Simplification Act which aims to broaden communication on the impact of climate change and

ESG performance. It is currently awaiting Senate confirmation.