Annual Report and

Financial Statements

2018

Annual Report and Financial Statements 2018

RELX is a global provider of information-based

analytics and decision tools for professional and

business customers.

We help scientists make new discoveries, doctors and

nurses improve the lives of patients and lawyers win

cases. We prevent online fraud and money laundering,

and help insurance companies evaluate and predict risk.

Our events enable customers to learn about markets,

source products and complete transactions.

In short, we enable our customers to make better

decisions, get better results and be more productive.

Forward-looking statements

This Annual Report contains forward-looking statements within the meaning of Section 27A of the US Securities Act of 1933, as amended, and Section 21E of the US

Securities Exchange Act of 1934, as amended. These statements are subject to risks and uncertainties that could cause actual results or outcomes of RELX PLC

(together with its subsidiaries, “RELX”, “we” or “our”) to differ materially from those expressed in any forward-looking statement. The terms “outlook”, “estimate”,

“project”, “plan”, “intend”, “expect”, “should”, “will”, “believe”, “trends” and similar expressions may indicate a forward-looking statement. Important factors that

could cause actual results or outcomes to differ materially from estimates or forecasts contained in the forward-looking statements include, among others, current

and future economic, political and market forces; changes in law and legal interpretations affecting RELX intellectual property rights and internet communications;

regulatory and other changes regarding the collection, transfer or use of third-party content and data; demand for RELX products and services; competitive factors in

the industries in which RELX operates; ability to realise the future anticipated benefits of acquisitions; significant failure or interruption of our systems; compromises

of our data security systems or other unauthorised access to our databases; legislative, fiscal, tax and regulatory developments and political risks; exchange rate

fluctuations; and other risks referenced from time to time in the filings of RELX PLC with the US Securities and Exchange Commission.

Overview Business review Financial review Governance Financial statements and other information

1RELX Annual report and financial statements 2018

Overview

*

2 2018 Financial highlights

3 Chairman’s statement

4 Chief Executive Officer’s report

Business review

*

8 RELX business overview

14 Scientific, Technical & Medical

20 Risk & Business Analytics

28 Legal

34 Exhibitions

41 Corporate Responsibility

Financial review

*

54 Chief Financial Officer’s report

60 Principal risks

Governance

66 Board Directors

68 RELX Business Leaders

70 Chairman’s introduction to corporate governance

72 Corporate governance review

83 Report of the Nominations Committee

85 Directors’ remuneration report

106 Report of the Audit Committee

108 Directors’ report

Financial statements

and other information

113 Independent auditor’s report

121 Consolidated financial statements

169 RELX PLC annual report and financial statements

174 Summary financial information in euros

175 Summary financial information in US dollars

176 Reconciliation of adjusted to GAAP measures

177 Shareholder information

IBC 2019 financial calendar

* Comprises the Strategic Report in accordance with The (UK)

Companies Act 2006 (Strategic Report and Directors’ Report)

Regulations 2013.

Contents

Get more information online

A PDF of the full Annual Report and further

information about our businesses can be

found online at our website: www.relx.com

2 RELX Annual report and financial statements 2018 | Overview

2018 Financial highlights

Underlying revenue growth of 4%

Underlying adjusted operating profit growth of 6%

Reported operating profit £1,964m (£1,905m)

Adjusted EPS growth at constant currency up 7%; in sterling up 6% to 84.7p

Reported EPS 71.9p (81.6p)

Full-year dividend up 7% to 42.1p

Strong financial position and cash flow; cash flow conversion at 96%

RELX PLC and its subsidiaries, joint ventures and associates are together known as “RELX”

† 2017 restated for adoption of new accounting standards IFRS 9, IFRS 15 and IFRS 16. See note 1 on page 126 for further details.

RELX uses adjusted and underlying figures as additional performance measures. Adjusted figures primarily exclude the amortisation of acquired intangible assets and other

items related to acquisitions and disposals, and the associated deferred tax movements. In 2018 and 2017, we also excluded exceptional tax credits, see note 9 on page 138.

Reconciliations between the reported and adjusted figures are set out on page 176. Underlying growth rates are calculated at constant currencies, excluding the results of

acquisitions until twelve months after purchase, and excluding the results of disposals and assets held for sale. Underlying revenue growth rates also exclude exhibition

cycling. Constant currency growth rates are based on 2017 full-year average and hedge exchange rates.

REVENUE ADJUSTED EARNINGS PER SHARE

£m

DIVIDEND PER SHARE ADJUSTED CASH FLOW CONVERSION

Pence

Pence

7,492

7,341

†

96%96%

†

20182017

84.7

80.2

†

20182017

42.1

39.4

20182017

20182017

ADJUSTED OPERATING PROFIT

RETURN ON INVESTED CAPITAL

£m

2,346

2,284

†

13.2%

12.9%

†

20182017

20182017

RELX

Underlying growth +4% Underlying growth +6%

Growth +7%

Constant currency growth +7%

Overview Business review Financial review Governance Financial statements and other information

3RELX Annual report and financial statements 2018

RELX continued its positive

development in 2018. We simplified

our corporate structure into a

single parent company, removing

complexity and increasing

transparency for shareholders.

Shares in the single parent

company have a full weighting

in the FTSE 100 and AEX indices.

RELX continued to execute its strategy aimed at achieving more

predictable revenues, a higher growth profile and improving

returns. As a result, underlying revenue growth was again 4%.

Underlying adjusted operating profits grew 6%, as we continued

to grow revenues ahead of costs. Adjusted earnings per share

in constant currencies grew 7% and in sterling 6% to 84.7p (80.2p).

Reported earnings per share were 71.9p (81.6p).

Dividends

We are proposing a full year dividend increase of 7% to 42.1p.

The long-term dividend policy is unchanged.

Balance sheet

Net debt, including leases as per IFRS 16, was £6.2bn at 31

December 2018, compared with £5.0bn last year. Net debt/ EBITDA

including pensions and leases was 2.4x, compared with 2.2x in

2017. Capital expenditure represented 5% of revenues.

Share buybacks

In 2018, we deployed £700m on share buybacks. In 2019, we intend

to deploy a total of £600m. By 20 February, £100m of this year’s

total had already been completed, leaving a further £500m to be

deployed during the year.

The Board

We continue to refresh the Board. Ben van der Veer will stand

down from the board after nine years’ service. He was replaced

as Chairman of the Audit Committee, a position he had held since

2010, by Adrian Hennah. Adrian is Chief Financial Officer of Reckitt

Benckiser, and was previously Chief Financial Officer of Smith &

Nephew. Andrew Sukawaty will be appointed as a Non-Executive

Director of RELX, subject to shareholder approval, with effect

after the 2019 Annual General Meeting. Andrew has had a 30 year

career in the telecoms industry. He is Chairman of Inmarsat

and was a Non-Executive Director and the Senior Independent

Director of Sky between 2013 and 2018. I would like to thank Ben

for his advice over many years and am delighted that Andrew will

be joining RELX.

Parent company structure

In September 2018, we completed the simplification of the

company’s corporate structure by moving from a dual to a single

parent structure. In June, shareholders of both parent companies,

RELX PLC and RELX NV, voted 99.9% in favour of the measures

which were cost and profit neutral on an ongoing basis and did

not impact the economic interest of any shareholder. RELX NV

shareholders received one new RELX PLC share in exchange for

each RELX NV share, and can continue to trade their new shares

on Euronext Amsterdam, priced in euros. They are also entitled

to receive dividend payments in euros. RELX NV ADRs were

converted one-for-one to RELX PLC ADRs. Shares in the single

parent company are now listed in London, Amsterdam and New

York, and it was confirmed in December that RELX will have a full

weighting in the AEX index in addition to the FTSE 100.

This latest change was a natural step for RELX, removing

complexity and increasing transparency. In 2015, the company

simplified its structure by combining all assets below the two

parent companies into a single new group entity and eliminated

parent company cross-shareholdings. We also increased share

price transparency by moving all share listings to an equalisation

ratio of one to one.

Corporate responsibility

We take our commitment to human rights seriously as evidenced

by our Modern Slavery Act Statement, which outlines how we

work to avoid slavery and trafficking in our direct employment

and in our supply chain. In the year, we held RELX Rule of Law

Cafés in the US, Europe and Asia to bring together the legal

community, corporate peers, government representatives and

non-governmental organisations to share information on going

beyond legal minimums to advance the rule of law.

We also created Access to Justice Law360, free content to

support the legal community, including legal aid organisations,

in helping citizens gain equal treatment within civil and criminal

justice systems. As a United Nations Global Compact LEAD

company, we joined the action platform, Peace, Justice & Strong

Institutions, ensuring business supports good governance and

legal frameworks.

Another critical priority for RELX is data privacy and security and

in 2018 we expanded security incident response preparedness

through technology, awareness training and simulations.

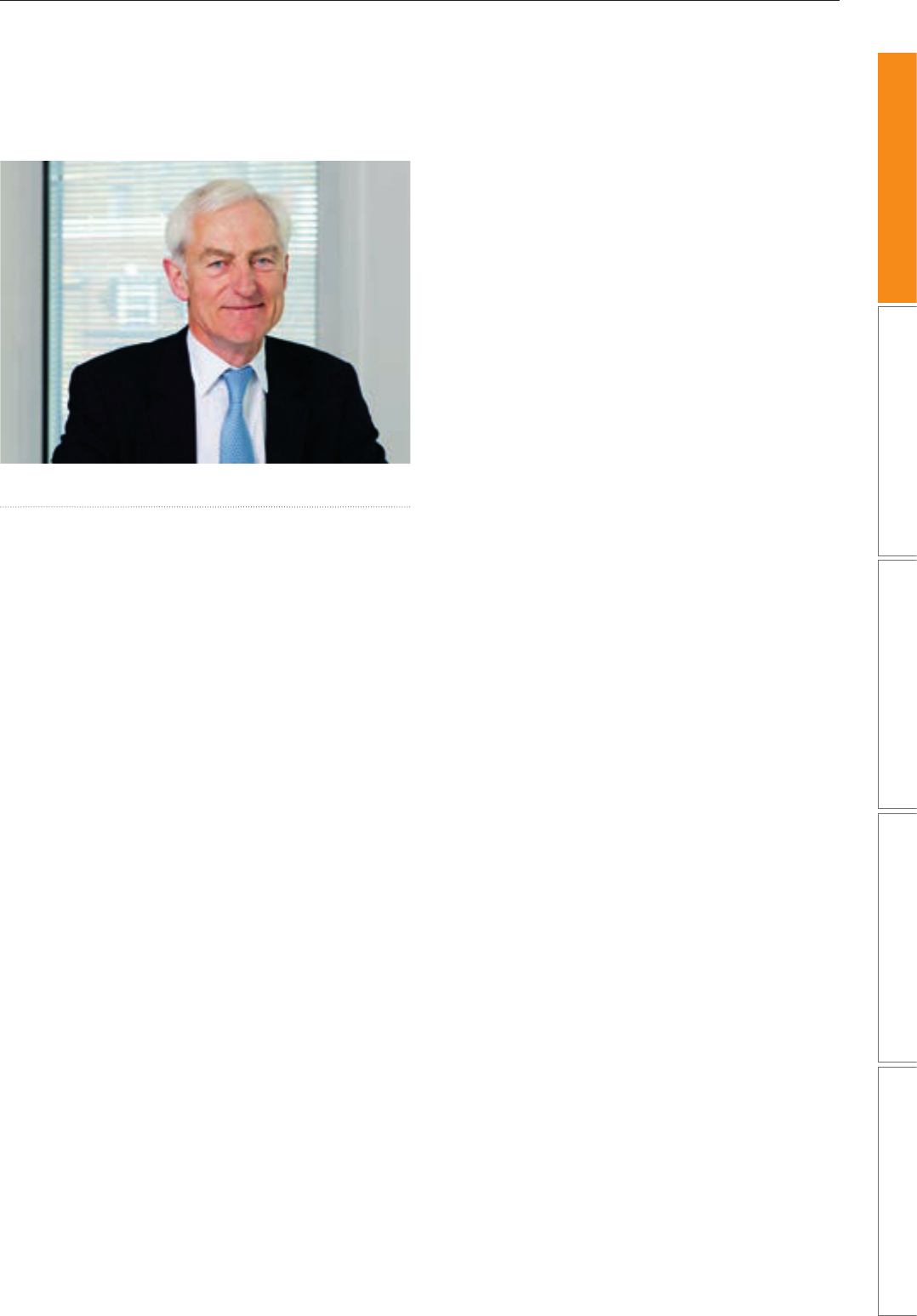

Anthony Habgood

Chairman

Sir Anthony Habgood

Chairman

Chairman’s statement

4 RELX Annual report and financial statements 2018 | Overview

Erik Engstrom

Chief Executive Officer

Chief Executive Officer’s report

Our number one priority

remains the organic development

of increasingly sophisticated

information-based analytics

and decision tools that deliver

enhanced value to our customers.

Strategic direction

Our number one strategic priority is the organic development

of increasingly sophisticated information-based analytics and

decision tools that deliver enhanced value to professional and

business customers across the industries that we serve.

Our goal is to help our customers make better decisions, get better

results and be more productive. We do this by leveraging a deep

understanding of our customers to create innovative solutions

which combine content and data with analytics and technology in

global platforms. These solutions often account for about 1% of

our customers’ total cost base but can have a significant and

positive impact on the economics of the remaining 99%.

We aim to build leading positions in long-term global growth

markets and leverage our skills, assets and resources across

RELX, both to build solutions for our customers and to pursue

cost efficiencies.

We are systematically migrating all of our information solutions

across RELX towards higher value-add decision tools, adding

broader data sets, embedding more sophisticated analytics and

leveraging more powerful technology, primarily through

organic development.

We are transforming our core business, building out new products

and expanding into higher growth adjacencies and geographies.

We are supplementing this organic development with selective

acquisitions of targeted data sets and analytics, and assets in

high-growth markets that support our organic growth strategies,

and are natural additions to our existing businesses.

By focusing on evolving the fundamentals of our business we

believe that, over time, we are improving our business profile

and the quality of our earnings. This has led to more predictable

revenues through a better asset mix and geographic balance; a

higher growth profile as we expand in higher growth segments,

exit from structurally challenged businesses, and gradually

reduce the drag from print format declines; and improved returns

by focusing on organic development with strong cash generation.

UNDERLYING ADJUSTED OPERATING PROFIT GROWTH

20182014 2016 20 172015

+5%+5%

+6% +6%+6%

UNDERLYING REVENUE GROWTH

20182014 2016 20 172015

+3% +3%

+4% +4%

+4%

Overview Business review Financial review Governance Financial statements and other information

5RELX Annual report and financial statements 2018 | Chief Executive Officer’s report

2018 progress

We achieved another year of good underlying revenue growth

in 2018, and continued to generate underlying adjusted operating

profit growth ahead of underlying revenue growth, and adjusted

earnings per share growth at constant currencies ahead of

underlying profit growth. We also had an active year for

acquisitions, focusing on targeted data sets, analytics and assets

that support our organic growth strategies. The underlying

growth rate reflects good growth in electronic and face-to-face

revenues (90% of the total), and the further development of our

analytics and decision tools.

With a strong balance sheet and an inherently cash-generative

business, the strategic priority order for using our cash is

unchanged. First, to invest in the organic development of our

business to drive underlying revenue growth; second to support

our organic growth strategy with targeted acquisitions; third to

grow dividends predictably, broadly in line with EPS growth; fourth

to maintain our leverage in a comfortable range; and finally use

any remaining cash to buy back shares. As part of this we bought

back shares for £700m in 2018, and announced £600m in buybacks

for 2019.

In 2018 we completed nine acquisitions of content, data analytics

and exhibition assets for a total consideration of £978m, and

disposed of eight assets for a total of £45m. This included the

acquisition of ThreatMetrix, a leader in the global risk-based

authentification sector for £580m. Since the year end we have

agreed to acquire Mack Brooks, a leading organiser of over 30

highly complementary events across key geographies and

industrial verticals.

Financial performance

Our positive financial performance continued throughout 2018,

with underlying revenue and adjusted operating profit growth

across all four business areas. Underlying revenue growth was

4%. Underlying operating profit growth was 6%, and adjusted

earnings per share grew 7% at constant currencies.

Key business trends in Scientific, Technical & Medical

remained positive, with underlying revenue growth in line with

the prior year and underlying profit growth matching underlying

revenue growth.

At Risk & Business Analytics, underlying revenue growth

remained strong, in line with the prior year. Underlying profit

growth matched underlying revenue growth.

In Legal, underlying revenue growth was in line with the prior

year, with continued efficiency gains driving strong underlying

operating profit growth.

Exhibitions achieved strong underlying revenue growth, with

underlying operating profit growth reflecting cycling-in effects.

Corporate responsibility

Business action is crucial to achieving the United Nations

Sustainable Development Goals (SDGs), 17 goals for the world

by 2030. Among the ways RELX is contributing is through the free

SDG Resource Centre, which aggregates essential content from

across the Group to advance the SDGs. In 2018, we produced

original research, available on the Resource Centre, on the state

ADJUSTED EARNINGS PER SHARE GROWTH

Constant currency

20182014 2016 20 172015

+1 0%

+8% +8%

+7%

+7%

ADJUSTED CASH FLOW CONVERSION

20182014 2016 20172015

96%

94%

96%

†

96%

†

96%

RETURN ON INVESTED CAPITAL

20182014 2016 20172015

12.8%

12.7%

13.0%

13.2%

12.9%

†

DIVIDEND PER SHARE

Pence

42.1

39.4

35.95

29.7

26.0

20182017201620152014

† 2017 and 2016 restated for the adoption of new accounting standards IFRS 9, IFRS 15 and IFRS 16.

6 RELX Annual report and financial statements 2018 | Overview

of science underpinning SDG 3, good health and well-being,

and also launched the SDG Perspectives Project on the site

showcasing how the SDGs are influencing scholarly debates.

In the year, we used our convening power to bring a wide range

of stakeholders together to inspire collaboration on the SDGs

including one on partnerships in Amsterdam and one on disruptive

technology to advance the goals in Silicon Valley. In 2019, we

will hold an SDG Inspiration Day on sustainable cities in Delhi.

We conducted our triennial Employee Opinion Survey to

understand the views of our people. There was a 90% response

rate, up three percentage points from 2015, with a three

percentage point increase in engagement and a five percentage

point increase in satisfaction; 85% of employees said we were a

company that supports community involvement. All managers

have received their team’s scores and I will be reviewing progress

on responding to employee feedback. In 2018, we updated our

diversity and inclusion strategy, held our first-ever Diversity

& Inclusion Awareness Month, and advanced our Women in

Technology mentor programme.

Outlook

Key business trends in the early part of 2019 are consistent with

2018, and we are confident that, by continuing to execute on our

strategy, we will deliver another year of underlying growth in

revenue and in adjusted operating profit, together with growth in

adjusted earnings per share on a constant currency basis.

Erik Engstrom

Chief Executive Officer

PrintFace-to-faceElectronic

REVENUE BY FORMAT

20012000 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 20182017

22%22%

28%

30%

32%

35%

37%

48%

50%

59%

61%

63%

64%

66%66%

70%

74% 74%

14%14%

12%

12%

12%

13%

12%

15%

17%

14%

14%

15%

15%

15%

16%

15%

15%

64%64%

60%

58%

56%

52%

51%

37%

33%

27%

25%

22%

21%

19%

18%

15%

11%

16%

10%

72%

15%

13%

REVENUE BY FORMAT REVENUE BY GEOGRAPHICAL MARKET REVENUE BY TYPE

£7,492m

Electronic

Face-to-face

Print

10%

16%

74%

£7,492m

North America

Europe

Rest of world

21%

24%

55%

£7,492m

Subscriptions

Transactional

Advertising

1%

47%

52%

RELX Annual report and financial statements 2018

In this section

8 RELX business overview

14 Scientific, Technical & Medical

20 Risk & Business Analytics

28 Legal

34 Exhibitions

41 Corporate Responsibility

Business

review

7

Overview Business review Financial review Governance Financial statements and other information

RELX business overview

RELX is a global provider of information-based analytics and decision

tools for professional and business customers.

The Group serves customers in more than 180 countries and has offices in about 40 countries. It employs over 30,000 people, of whom

almost half are in North America.

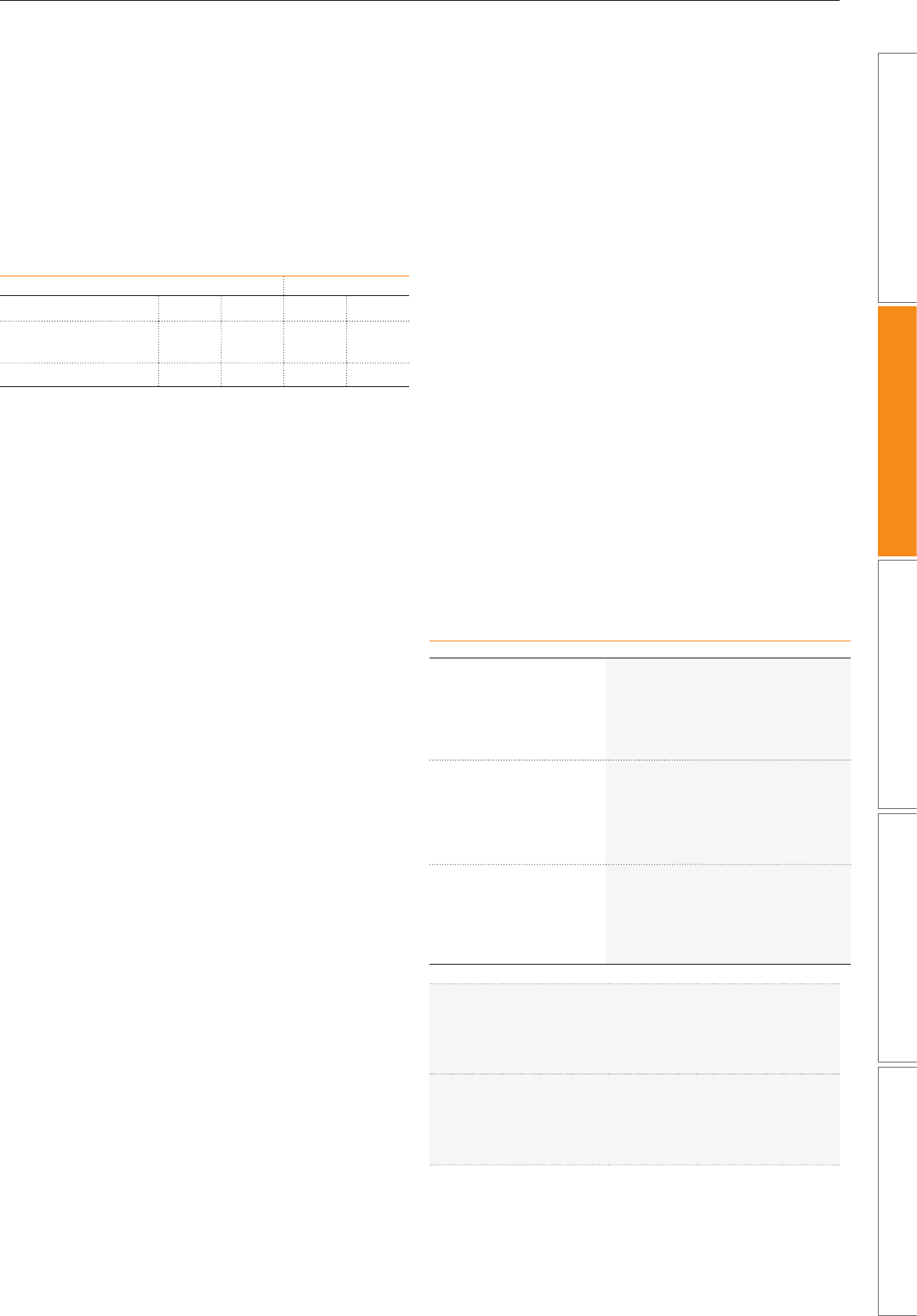

RELX financial summary

REPORTED FIGURES

2018

£m

2017

†

£m Change

Change at

constant

currencies

Change

underlyingFor the year ended 31 December

Revenue 7,492 7,341 +2% +4% +4%

Operating profit 1,964 1,905 +3%

Profit before tax 1,720 1,721 0%

Net profit attributable to RELX PLC shareholders 1,422 1,648 -14%

Net margin 19.0% 22.4%

Net borrowings 6,177 5,042

Reported earnings per share 71.9p 81.6p -12%

Ordinary dividend per RELX PLC share 42.1p 39.4p +7%

ADJUSTED FIGURES

2018

£m

2017

†

£m Change

Change at

constant

currencies

Change

underlyingFor the year ended 31 December

Operating profit 2,346 2,284 +3% +4% +6%

Operating margin 31.3% 31.1%

Profit before tax 2,145 2,101 +2% +3%

Net profit attributable to RELX PLC shareholders 1,674 1,620 +3% +5%

Net margin 22.3% 22.1%

Cash flow 2,243 2,197 +2%

Cash flow conversion 96% 96%

Return on invested capital 13.2% 12.9%

Adjusted earnings per share 84.7p 80.2p +6% +7%

†

2017 numbers have been restated to reflect the adoption of new accounting standards. See note 1 on page 126 for further details.

The shares of RELX PLC are traded on the London, Amsterdam and New York stock exchanges. RELX PLC and its subsidiaries, joint ventures and associates are together

known as ‘RELX’.

8 RELX Annual report and financial statements 2018 | Business review

RELX Annual report and financial statements 2018 | RELX business overview

Market segments*

Segment position

Scientific, Technical & Medical provides information and analytics that help institutions and

professionals progress science, advance healthcare and improve performance

Global #1

Risk & Business Analytics provides customers with information-based analytics and decision

tools that combine public and industry-specific content with advanced technology and algorithms

to assist them in evaluating and predicting risk and enhancing operational efficiency

Key verticals #1

Legal provides legal, regulatory and business information and analytics that helps customers

increase their productivity, improve decision-making and achieve better outcomes

US #2

Outside US #1 or 2

Exhibitions is a leading global events business. It combines face-to-face with data and digital tools

to help customers learn about markets, source products and complete transactions at over 500

events in almost 30 countries, attracting more than 7m participants

Global #2

* For additional information regarding revenue from our business activities and geographical markets, see market segments section starting on page 13.

Financial summary by market segment

Revenue Adjusted operating profit

2018

£m

Change

underlying

2018

£m

Change

underlying

Scientific, Technical & Medical 2,538 +2% 942 +2%

Risk & Business Analytics 2,117 +8% 776 +8%

Legal 1,618 +2% 320 +10%

Exhibitions 1,219 +6% 313 +10%

Unallocated items (5)

7,492 +4% 2,346 +6%

RELX uses adjusted and underlying figures as additional performance measures. Adjusted figures primarily exclude the amortisation of acquired intangible assets and

other items related to acquisitions and disposals, and the associated deferred tax movements. In 2018 and 2017, we also excluded exceptional tax credits, see note 9 on page 138.

Reconciliations between the reported and adjusted figures are set out on page 176. Underlying growth rates are calculated at constant currencies, excluding the results of

acquisitions until twelve months after purchase, and excluding the results of disposals and assets held for sale. Underlying revenue growth rates also exclude exhibition cycling.

Constant currency growth rates are based on 2017 full-year average and hedge exchange rates.

REVENUE

£7,492m

Scientific,

Technical

& Medical

Risk &

Business

Analytics

Legal

Exhibitions

16%

22%

28%

34%

ADJUSTED OPERATING PROFIT

£2,346m

Scientific,

Technical

& Medical

Risk &

Business

Analytics

Legal

Exhibitions

13%

14%

33%

40%

9

Overview Business review Financial review Governance Financial statements and other information

Harnessing technology

across RELX

Around 8,000 technologists, half

of whom are software engineers,

work at RELX. Annually, the

company spends $1.4bn on

technology. The combination of

our rich data assets, technology

infrastructure and knowledge

of how to use next generation

technologies, such as machine

learning and natural language

processing, allows us to create

effective solutions for our customers.

Helping research chemists with

Elsevier’s Reaxys

Reaxys enables the shortest path to chemistry

research answers, supporting the early stages of

drug development in the pharmaceutical industry,

exploratory chemistry research in academia,

and product development in industries such

as chemicals and oil & gas.

The amount of chemical information published

each year is increasing exponentially, making it

more and more challenging for research chemists

to quickly find targeted and actionable information

to help support their research.

To help researchers stay on top of their field,

Elsevier developed a new chemistry text mining

engine, using state-of-the-art natural language

processing that identified 4.9m key substances in

5.2m documents from more than 15,000 journal

titles in 2018.

This significantly increased the content coverage

and substance information searchable on Reaxys,

addressing a key pain point in customer efforts

to find the data they need for drug discovery.

4.9m

key chemical

substances identified

using Elsevier’s

natural language

processing technology

Providing comprehensive and

relevant information as fast as

possible is a critical challenge

for our customers in a highly

competitive environment. Elsevier’s

sophisticated automatic processing

methods have helped make

Reaxys, where this information

is contained, an indispensable tool

for chemical research.

Dr Juergen Swienty-Busch

Director of Product Management,

Chemistry Solutions, Elsevier

10 RELX Annual report and financial statements 2018 | Business review

Lexis Answers is one of several

features within Lexis Advance

that brings the power of artificial

intelligence and machine learning

to our customers – ultimately

improving their research efficiency,

enhancing their legal workflow

and transforming legal research.

Jeff Pfeifer

Vice President of Product Management,

LexisNexis

Making legal research faster and more

intuitive with Lexis Answers

Every year, an immense volume of legal data is

generated, adding to the existing collection of

more than 16m case law legal decisions and 91m

statutes, regulations, constitutions and legislative

documents in the US alone. As the amount of

electronic data increases, legal research, analysis

and discovery has become increasingly challenging

and time-consuming.

Traditional legal database searches require legal

researchers to make their query using precise key

words or phrases. This can often produce multiple

responses which may not give the specific

answer needed.

As part of the Lexis Advance online legal research

tool, LexisNexis developed the Lexis Answers

service which allows users to enter their query in

the form of a natural language question. Using

machine learning, cognitive computing and

advanced natural language processing

technologies, Lexis Answers anticipates a

user’s research path, curating and delivering

relevant answers based on their question type.

The result is faster answers in fewer searches.

44%

time saved per

research query using

Lexis Answers

RELX data centre

11

Overview Business review Financial review Governance Financial statements and other information

RELX Annual report and financial statements 2018 | RELX business overview

12 RELX Annual report and financial statements 2018 | Business review

Market

segments

In this section

14 Scientific, Technical & Medical

20 Risk & Business Analytics

28 Legal

34 Exhibitions

RELX Annual report and financial statements 2018 13

Overview Business review Financial review Governance Financial statements and other information

Business overview

Scientific, Technical & Medical provides information and analytics

that help institutions and professionals progress science, advance

healthcare and improve performance.

Elsevier is headquartered in Amsterdam, with further principal

operations in Boston, New York, Philadelphia, St. Louis and

Berkeley in North America, London, Oxford, Frankfurt, Munich,

Madrid and Paris in Europe, Beijing, Chennai, Delhi, Singapore and

Tokyo in Asia Pacific and Rio de Janeiro in South America. It has

7,900 employees and serves customers in around 180 countries.

Revenues for the year ended 31 December 2018 were £2,538m,

compared with £2,473m

†

in 2017 and £2,318m

†

in 2016. In 2018,

44% of revenue came from North America, 24% from Europe

and the remaining 32% from the rest of the world. Subscription

sales generated 74% of revenue, transactional sales 24% and

advertising 2%.

Elsevier serves the needs of scientific, technical and medical

markets by organising the review, editing and dissemination of

primary research, reference and professional education content.

Building on its heritage of high-quality publishing, Elsevier today

applies technology to authoritative information, providing tools

that enable faster and more efficient ways of working, freeing up

users to focus on their goals.

Elsevier’s customers are scientists, academic institutions,

research leaders and administrators, medical researchers,

doctors, nurses, allied health professionals and students,

as well as hospitals, research institutions, health insurers,

managed healthcare organisations, research-intensive

corporations and governments.

Elsevier services fall into four market categories: Primary

Research, Databases & Tools, Reference and Pharma Promotion.

Primary Research, accounts for around half of revenues. Elsevier

serves the global scientific research community, publishing over

470,000 articles in 2018, 60% more than a decade ago. 2018 saw

continued strong growth both in article submissions and usage,

with 1.8m articles submitted and 1bn articles downloaded by

researchers. In 2018, Elsevier published over 34,000 gold open

access articles, a double-digit growth on the previous year,

making it one of the largest open access publishers in the world.

Elsevier’s portfolio of 2,500 journals is managed by more than

20,000 editors and many are the foremost publications in their

field. They include flagship titles such as Cell and The Lancet

family of journals. In 2018, Elsevier’s article output accounted

for 18% of global research output while garnering a 25% share

of citations, demonstrating Elsevier’s commitment to delivering

research quality significantly ahead of the industry average.

In 2018, Elsevier launched 9 new subscription and 45 full open

access journals, including iScience and One Earth from Cell Press

and the Lancet’s Eclinical Medicine.

Research content is distributed and accessed via ScienceDirect,

the world’s largest database dedicated to peer-reviewed primary

scientific and medical research, hosting over 16m pieces of

content as well as 39,000 e-books.

In 2018, Elsevier acquired Aries Systems, a best-in-class

publication solutions provider, used for manuscript submission,

peer review, production tracking and e-commerce of journals,

books and other publications.

Scientific, Technical & Medical

We help researchers make new discoveries,

collaborate with their colleagues and give them

the knowledge they need to findfunding. We help

governments and universities evaluate and

improve their research strategies. We help

doctors and nurses improve the lives of patients,

providing insight to find the right clinical

answers.

We enhance the quality of scientific research

output by organising the review, editing and

dissemination of 18% of the world’s

scientific articles

ScienceDirect, the world’s largest database

dedicated to peer-reviewed primary scientific

and medical research, has 16m monthly

unique visitors

Scopus is a leading abstract and citation

database of research literature, with over 73m

records across 24,000 journals, sourced from

more than 5,000 publishers

SciVal offers insights into the research

performance of over 10,000 research

institutions

ClinicalKey, the flagship clinical reference

platform, is accessed in over 90 countries and

territories, and by over 1,900 institutions in

North America alone

Elsevier journals have at some point featured

articles by 183 of 184 science and economics

Nobel prize winners since 2000

† 2016 and 2017 restated for adoption of new accounting standards

IFRS 9, IFRS 15 and IFRS 16.

14 RELX Annual report and financial statements 2018 | Business review

Premier life sciences journal with the

highest impact factor in biochemistry

and molecular biology

An innovative research management

and social collaboration platform

The world’s largest database dedicated to

peer-reviewed primary scientific and

medical research

Combines leading reference and evidence based

medical content into its fully integrated clinical

insight engine specialised for doctors, nurses,

or pharmacists

CiteScore™ metrics are a set of

comprehensive, transparent, current and

free metrics to help measure the citation

impact of journals

This chemical compound and reaction

synthesis database enables the shortest path

to chemistry research answers, supporting

drug discovery, chemical R&D and education

Ready-to-use tools to analyse the world of

research, and establish, execute and evaluate

the best strategies for research organisations

A leader in scientific publication workflow

solutions used by journals, books and other

publications for manuscript submission, peer

review, production tracking and e-commerce

A leading abstract and citation database of

peer-reviewed literature featuring smart

tools to track, analyse and visualise research

One of the world’s leading medical journals

since 1823

Designed to help improve patient outcomes,

Via Oncology provides clinical pathways

delivering personalised, evidence-based

guidance at the point of care

ClinicalKey is growing well and is accessed in over 90

countries and territories, and by over 1,900 institutions in

North America alone.

In medical education, Elsevier serves students of medicine,

nursing and allied health professions in multiple formats

including electronic books and electronic solutions. For example

Sherpath, an adaptive teaching and learning solution for nursing

and health education, now provides highly focused, personalised

and adaptive learning paths at over 400 institutions, supporting

more than 37,000 enrolments.

For healthcare professionals, Elsevier’s clinical solutions include

Interactive Patient Education and Care Planning. Arezzo, an active

clinical decision support engine integrated with clinical care

systems, matches evidence-based guidelines with patient and

disease information and dynamically evaluates best-practice

treatment options.

In 2018, Elsevier acquired Via Oncology, which provides decision

support and best practices in cancer care management, bringing

additional technology and innovation to Elsevier’s strength in

clinical pathways.

In commercial healthcare, consumer, provider and medical claims

data is used to deliver leading identity, fraud, compliance and

health risk analytics solutions for payers, providers, pharmacies

and life sciences organisations.

In Reference, Elsevier is a global leader in providing authoritative

and current professional reference content to scientific, technical

and medical reference markets. Flagship titles include Gray’s

Anatomy, Nelson’s Pediatrics and Netter’s Atlas of Human

Anatomy. Reference content is delivered in both electronic and

print formats, with print reference now accounting for less than

10% of Elsevier revenues.

In Databases & Tools, Elsevier offers a suite of products for

academic and corporate researchers. Significant products

include Scopus, Reaxys and Knovel. Scopus is the largest abstract

and citation database of peer reviewed literature curated by

independent external academic advisers, with over 73m records

across 24,000 journals, sourced from more than 5,000 publishers.

It allows researchers to track, analyse and visualise the world’s

research output with features such as CiteScore, providing

comprehensive, transparent and current insights into journal

impact. Reaxys enables the shortest path to chemistry research

answers, supporting the early stages of drug development in the

pharmaceutical industry, exploratory chemistry research in

academia, and product development in industries such as

chemicals and oil & gas. Knovel is a decision support tool for

engineers that helps them to select the right materials, a

mission-critical use case in product development across

chemicals, oil & gas and other engineering-focused industries.

Elsevier serves academic and government research

administrators through its Research Intelligence suite of

products. Leveraging bibliometric data from Scopus and other

data types such as patent citations and usage data, SciVal is a

decision tool that helps institutions to establish, execute and

evaluate research strategies. Pure is an enterprise research

management solution that aggregates an organisation’s research

information from numerous sources into a single platform,

enabling research networking and expertise discovery while

reducing the administrative burden for faculty and staff.

Elsevier’s flagship clinical reference platform, ClinicalKey,

provides physicians, nurses and pharmacists with access to

leading Elsevier and third-party reference and evidence-based

medical content, including over 490 clinical overviews that provide

quick clinical answers and summaries; over 4m images and

51,000 medical and surgical videos in a single, fully integrated site.

RELX Annual report and financial statements 2018 | Scientific, Technical & Medical 15

Overview Business review Financial review Governance Financial statements and other information

In reference markets, Elsevier’s priorities are to expand content

coverage and ensure consistent and seamless linking of content

assets across products.

In every market, Elsevier is applying advanced machine learning

(ML) and natural language processing (NLP) techniques to help

researchers, engineers and clinicians perform their work better.

For example, in research, ML and NLP techniques classify scientific

content and organise it thematically, enabling users to get faster

access to relevant results and related scientific topics. In parallel,

advanced information extraction and NLP techniques are applied

to extract the most important information for scientific concepts in

concise summaries. Elsevier also applies advanced ML techniques

that detect trending topics per domain, helping researchers make

more informed decisions about their research. Coupled with the

automated profiling and extraction of funding body information

from scientific articles, this process supports the whole

researcher journey; from planning, to execution and funding.

Similarly, in health, Elsevier is developing clinical decision

support applications utilising cognitive technologies to map

patient and claims data sets, and large image and text content

repositories. These applications embedded in technology

platforms will enhance the delivery of the right content, in the right

care setting, to the right care providers. This will help health

professionals perform their work better, make more accurate

diagnoses, ensure appropriate care delivery, and save more

human lives.

Business model, distribution channels and competition

In Primary Research, science and medical research is principally

disseminated on a paid subscription basis to the research facilities

of academic institutions, governments and corporations and,

in the case of medical and healthcare journals, to individual

practitioners and medical society members.

While researchers may continue to prefer paid subscription as the

primary distribution model, alternative payment models for the

dissemination of research have evolved over the past twenty

years. Elsevier has long invested in all business models to serve

researchers and research institutions. Author pays open access

is one example, with over 1,900 of Elsevier’s journals now offering

the option of funding publication and distribution via a sponsored

article fee. In addition, Elsevier now publishes around 250 gold

open access titles.

Pharma Promotion offers customised commercial marketing

services to pharmaceutical and medical device companies,

building on Elsevier’s trusted global content brands to connect

and engage with doctors, nurses and other healthcare

professionals who are influential decision makers.

Market opportunities

Scientific, technical and medical information markets have good

long-term growth characteristics. The importance of research

and development to economic performance and competitive

positioning is well understood by governments, academic

institutions and corporations. This is reflected in the long-term

growth in research and development spending and in the number

of researchers worldwide. Growth in health markets is driven

by ageing populations in developed markets, rising prosperity

in developing markets and the increasing focus on improving

medical outcomes and efficiency. Given that a significant

proportion of scientific research and healthcare is funded

directly or indirectly by governments, spending is influenced by

governmental budgetary considerations. The commitment to

research and health provision does, however, remain high,

even in more difficult budgetary environments.

Strategic priorities

Elsevier’s strategic priorities are to: continue to increase

content volume and quality; expand content coverage, building

out integrated solutions and decision tools combining Elsevier,

third-party and customer data; increase content utility, using

‘Smart Content’ to enable new e-solutions; combine content

with analytics and technology, focused on measurably improved

productivity and outcomes for customers; and continue to drive

operational efficiency and effectiveness.

In the primary research market, Elsevier aims to deliver journal

and article quality above the industry average at below average

cost, leveraging the scale of its platform. We work directly with our

customers to understand their objectives and help them reach

their research goals in a way that is satisfactory from a content,

service and economic perspective. Elsevier looks to enhance

quality by building on our premium brands and grow article

volume through new journal launches, the expansion of open

access journals and growth from emerging markets; and add

value to core platforms by implementing new capabilities such

as advanced recommendations on ScienceDirect and social

collaboration through reference manager and collaboration

tool Mendeley.

Electronic

83%

Print 17%

£2,538m

REVENUE BY FORMAT

Rest of

world

32%

Europe 24%

North

America

44

%

£2,538m

REVENUE BY GEOGRAPHICAL MARKET

Advertising

2%

Transactional

24%

Subscription

74%

£2,538m

REVENUE BY TYPE

16 RELX Annual report and financial statements 2018 | Business review

For well over a decade, content has been provided free or at very

low cost in more than 100 countries and territories in the developing

world through Research4Life, a United Nations partnership

initiative. For some journals, advertising and promotional income

represents a small proportion of revenues, predominantly from

pharmaceutical companies in healthcare titles.

Next to journals, Elsevier has also invested in other solutions

to serve the needs of the research community. SSRN is an open

access online preprint community where researchers post

early-stage research, prior to publication in academic journals.

Mendeley data enables researchers to make their research data

publicly available by providing an open research data repository,

while bepress helps academic libraries showcase and share

their institutions’ research via institutional repositories for

greatest impact.

Electronic products, such as ScienceDirect, Scopus and ClinicalKey,

are generally sold direct to customers through a dedicated sales

force that has offices around the world. Subscription agents

sometimes facilitate the sales and administrative process for

remaining print sales. Reference and educational content is sold

directly to institutions and individuals and accessed on Elsevier

platforms. Sometimes it is still sold in printed book form through

retailers, wholesalers or directly to end users.

Competition within science and medical reference content is

generally on a title-by-title and product-by-product basis and

is typically with learned societies and professional information

providers, such as Springer Nature, Clarivate Analytics and

Wolters Kluwer. Decision tools face similar competition, as well

as from software companies and internal solutions developed

by customers.

Key business trends remained positive in 2018, with underlying

revenue growth in line with the prior year, and underlying

profit growth matching revenue growth.

Underlying revenue growth was +2%. The difference between

the constant currency and underlying growth rates reflects the

impact of portfolio changes and the transfer of a small number of

healthcare products from Risk & Business Analytics.

Underlying adjusted operating profit growth was +2% with

underlying cost growth marginally below underlying revenue

growth. The reported margin increased by 0.1 percentage points,

with currency impacts largely offset by portfolio effects.

Electronic revenues saw continued good growth. In primary

research we continued to enhance customer value by providing

broader content sets across our research offering, increasing

the sophistication of our analytics, and evolving our technology

platforms. Databases & tools continued to drive growth

across market segments through enhanced functionality

and content development.

Print book sales, which represent around 10% of divisional

revenues, reverted to historical levels of decline for the main

selling season, with return rates also at historical levels. Print

pharma promotion revenues, which represent less than 5%

of the divisional total, saw a slightly steeper decline than in

recent years.

In 2018 we made three small acquisitions in support of our

organic growth strategy, Via Oncology, Aries Systems and

Science-Metrix, and disposed of a minor pharma business

in Japan.

2019 outlook

Our customer environment remains largely unchanged, and

we expect another year of modest underlying revenue growth,

with underlying operating profit growth exceeding underlying

revenue growth.

2018 financial performance

2018

£m

2017

†

£m

Underlying

growth

Portfolio

changes

Currency

effects

Total

growth

Revenue 2,538 2,473 +2% +2% -1% +3%

Adjusted operating profit 942 914 +2% 0% +1% +3%

† 2017 restated for adoption of new accounting standards IFRS 9, IFRS 15 and IFRS 16.

REVENUE

2018

2,538

2,473

†

Underlying growth +2%

2017

£m

ADJUSTED OPERATING PROFIT

2018

942

914

†

Underlying growth +2%

2017

£m

RELX Annual report and financial statements 2018 | Scientific, Technical & Medical 17

Overview Business review Financial review Governance Financial statements and other information

Via Oncology

helping The Center for

Cancer and Blood Disorders

improve patient treatment

The Center for Cancer and Blood Disorders

in Fort Worth, Texas, treats more than 6,000

new cancer patients annually. That equates

to more than 300,000 patient visits every

year. It has over 25 specialist oncologists and

150 healthcare professionals across nine

locations throughout North Texas.

25%

clinical trials

participation rate for

lung cancer patients

as a result of using

Via Pathways, more

than five times

higher than the

national average

Elsevier’s Via Oncology partnered with The Center

over ten years ago after oncologists at the clinic

identified a need to ensure that patients experience

consistent, standardised treatment across their

many locations and oncologists.

Via Oncology’s sophisticated online clinical pathway

system, Via Pathways, is an advanced clinical

decision support system that provides points of

care recommendations for diagnostics and

treatment. By using Via Pathways, oncologists

can follow evidence-based care maps based upon

the most current medical evidence and reduce

unwarranted care variability.

Oncologists also are presented with all locally

available clinical trials prior to starting a

treatment pathway for new patients, ensuring

they are presented with all options for treatment.

Since implementing Via Pathways, The Center’s

oncologists can review more data on their

patients’ outcomes, demonstrating that the care

they deliver is consistent across their network.

For example, The Center’s capture rate, which

measures how consistently doctors use Via

Pathways and tracks all patient visits, has

reached 89% across 34 disease pathways

representing over 95% of cancer types.

The Center considers Via Oncology to be at the

crux of its value-based care initiatives, enabling

participation in studies of new care models.

18 RELX Annual report and financial statements 2018 | Business review

Via Pathways is a great tool that we

can use to standardize our therapies.

We can show that physicians are being

congruent with standards of care and

are taking into account the effectiveness,

toxicity and cost, and making appropriate

treatment choices. That means we’re

providing the highest standard of care

to our patients.

Dr Ray Page, DO, PhD

President of The Center for Cancer

and Blood Disorders, Texas

About Via Oncology

Part of Elsevier, Via Oncology is a

Pittsburgh, Pennsylvania-based

business that provides decision

support and best practices in cancer

care management.

It helps cancer centres demonstrate the

value of their care to patients, doctors and

payers by developing and implementing

clinical pathways in collaboration with its

network of more than 1,500 US cancer care

providers. Via Oncology’s evidence-based

proprietary content, Via Pathways, is

developed by leading oncologists and

forms the basis of clinical algorithms

covering 95% of cancer types treated

in the US. This content is deployed to

doctors and their staff at the point of care

through the Via Portal, a patient-specific

decision support tool that is integrated

with electronic medical records and

provides seamless measurements of

adherence to treatment.

Oncology doctor and nurse

at The Center for Cancer

and Blood Disorders

19

Overview Business review Financial review Governance Financial statements and other information

RELX Annual report and financial statements 2018 | Scientific, Technical & Medical

Business overview

Risk & Business Analytics provides customers with information-

based analytics and decision tools that combine public and

industry-specific content with advanced technology and

algorithms to assist them in evaluating and predicting risk and

enhancing operational efficiency.

Risk & Business Analytics, headquartered in Alpharetta, Georgia,

has principal operations in California, Florida, Illinois and Ohio

in North America as well as London in Europe and Beijing in Asia

Pacific. It has about 8,700 employees and serves customers in

more than 170 countries.

Revenues for the year ended 31 December 2018 were £2,117m,

compared with £2,073m

†

in 2017 and £1,905m

†

in 2016. In 2018, 79%

of revenue came from North America, 15% from Europe and the

remaining 6% from the rest of the world. Subscription sales

generated 36% of revenues, transactional sales 63% and

advertising 1%.

Risk & Business Analytics comprises the following market-facing

industry/sector groups: Insurance Solutions, Business Services,

Data Services (including banking, energy and chemicals, aviation,

agriculture and human resources) and Government Solutions.

Insurance Solutions, the largest segment, provides

comprehensive data, analytics and decision tools for personal,

commercial and life insurance carriers in the US to improve

critical aspects of their business. Information solutions, including

the most comprehensive US personal loss history database,

C.L.U.E., help insurers assess risks and provide important inputs

to pricing and underwriting insurance policies. Additional key

products include LexisNexis Data Prefill, which provides

information on customers directly into the insurance work stream

and LexisNexis Current Carrier, which identifies insurance

coverage details and any lapses in coverage.

The focus is on delivering innovative decision tools through

a single point of access within an insurer’s infrastructure.

LexisNexis Active Insights, our solution for active risk

management, connects proprietary linking algorithms with vast

amounts of data to proactively inform insurers of key events

impacting their policyholders. Insurance Solutions is advancing

its strategy to drive more consistency and efficiency in claims

through its solution suite, Claims Compass, with Claims Datafill

providing data and decisions at first notice of loss and throughout

the claim life cycle. Risk Classifier solution, which uses public and

motor vehicle records and predictive modelling, is used by around

a quarter of the top 50 life insurers to better understand risk and

improve underwriting efficiency.

Insurance Solutions continues to make progress outside the US.

In the UK, contributory solutions including No Claims Discount

module, which automates verification of claims history and Policy

Insights, a predictor of motor claims loss, are delivered through the

LexisNexis Informed Quotes platform to provide real-time data in

the quoting process. In China, Genilex is delivering key vehicle data

to auto insurers and is looking to add more analytics solutions. In

India, our Intelligence Exchange contributory platform and Risk

Insights solution are used by life insurers to predict, better assess

and manage risk within the underwriting and claims management

processes. In Brazil, Insurance Solutions is delivering telematics

solutions, data and analytics to help motor insurers in underwriting

and working with health insurers to reduce claims costs and make

faster, more focused decisions.

Risk & Business Analytics

We combine data and analytics with deep

industry expertise to help customers make

better decisions and manage risk. We deliver

insight to insurance companies and help detect

and prevent online fraud and money laundering.

We provide digital tools that help airlines and

farmers improve their operations.

More than 80% of new US auto insurance

policies issued to consumers in 2017 benefited

from our products

LexisNexis Risk Solutions performs over 100m

identity verification checks and over 100bn

customer and transaction screening requests

annually, supporting industries such as

banking, fintech and e-commerce

LexisNexis Risk Solutions works with more

than 75% of Fortune 500 companies, seven out

of ten of the world’s top banks and 95 out of the

top 100 personal lines insurance companies

With insight into over 900m ThreatMetrix ID

anonymised user identities, ThreatMetrix

delivers the intelligence behind over 30bn

annual authentication and trust decisions to

differentiate legitimate customers from

fraudsters in real time

Accuity has information on over 22,000 banks,

and hosts over 600,000 financial counterparty

due diligence documents. Over 95 of the world’s

largest 100 banks use its data

Cirium tracks 100,000 commercial flights every

day and more than 70m passenger itineraries a

year, while analysing 2.5bn travel segments per

annum worth about $300bn. Cirium holds data

on more than 100,000 commercial aircraft

† 2016 and 2017 restated for adoption of new accounting standards

IFRS 9, IFRS 15 and IFRS 16.

20 RELX Annual report and financial statements 2018 | Business review

RELX Annual report and financial statements 2018 | Risk & Business Analytics

VerifyHCP World Compliance

The VerifyHCP solution provides a proven

approach to help payers keep their provider

directories current and improve compliance

with US state and federal regulations

Our leading-edge curated content related

to economic sanctions, financial crime

enforcement actions, politically exposed

persons (PEPs), and adverse media enables

customers to comprehensively and efficiently

protect their enterprises from reputational,

regulatory, legal and enforcement risks

LexisNexis Active Insights Risk Defense Platform

An active risk management solution that

provides timely alerts of recent changes

occurring in the household to help insurers

enhance customer relationships with

better service

Innovative solutions for payments and compliance

professionals, from comprehensive data and

software to manage risk and compliance, to

flexible tools that optimise payments pathways

An innovative fraud prevention and identity

management platform that seamlessly

delivers the broadest of solutions including the

latest in machine learning that adapts to ever-

changing fraud schemes, simplifying efforts

to detect and prevent risks associated with the

merging of digital and physical identities

Claims Compass Accurint

®

Virtual Crime Center ThreatMetrix

®

Digital Identity Network

®

Data analytics suite with LexisNexis Claims

Datafill and LexisNexis Police Records that

improves the claims process from first notice

of loss, triage, investigation and resolution

through recovery

Policing platform used for analytics, crime

analysis and investigations linking public

records to national law enforcement data

for a complete picture across jurisdictions

A network that provides insight into true

digital identity, by analysing global shared

intelligence across more than 30bn annual

transactions to distinguish legitimate

consumers versus fraudsters

Data and analytics for the global commercial

aviation and travel industry

Global provider of news, price benchmarks,

data and research to the energy, chemical

and fertiliser industries

Business Services works with customers to solve key issues,

such as financial exclusion and financial transparency. Business

Services leverages technology, data, advanced linking and

analytics to help banks, telecommunications and e-commerce

companies, retailers and other organisations to prevent fraud,

manage identity risk, comply with financial crime regulations,

assess credit risk and collect debt.

Customers rely on Business Services for identify verification,

watch-list screening, due diligence, credit scoring and skip

tracing. It leverages machine learning (ML) and artificial

intelligence (AI) algorithms in its products to provide customers

with clarity, enabling faster decisions with a greater degree

of confidence.

In 2018, Business Services added digital identity data to its physical

identity dataset through the acquisition of ThreatMetrix. As a result

of the transaction, customers gained access to solutions that

provide a 360-degree view into an identity. This perspective helps

customers make decisions that thwart bad actors while enabling

legitimate consumers to transact frequently in a frictionless

environment. The ThreatMetrix integration continues to hit its

acquisition milestones, including: the creation of a combined

go-to-market organisation that consists of global sales and

marketing teams; the initiation of work to combine our physical

and digital identity solutions into a holistic fraud prevention

and identity management solution; and the undertaking of

development efforts to expand the Digital Identity Network into

financial crime compliance and credit risk assessment for

developing economies.

Business Services continued to make progress in international

markets outside the US, building scale in key geographies

including the UK and Brazil.

Data Services provides indispensable business information, data

and analytics solutions to professionals in many of the world’s

biggest industries, including: Accuity, a provider of services and

solutions to the banking and corporate sectors focused on

payment efficiency, Know Your Customer (KYC), anti-money

laundering (AML) and compliance; ICIS, an information and data

service in chemicals, energy and fertilisers; Cirium, a leading

provider of data and analytics for the global commercial aviation

and travel industry; Proagrica, a provider of software, connectivity

solutions, data, analytics and media streams for the global

agriculture sector; XpertHR, an online service providing

regulatory guidance, best practices and tools for human resource

professionals; EG, which delivers a mix of high-quality data,

decision tools and high-value news and information to the UK’s

commercial real estate market; and Nextens, a provider of tools

and services for tax professionals.

In 2018, Data Services completed the acquisitions of Safe Banking

Systems, a specialist provider of AML and KYC compliance

solutions with a particular focus on account screening and SST

Solutions, a leading provider of precision agriculture technologies

and tools in the US. Data Services also continued to reshape its

portfolio, exiting areas not core to its strategy, divesting Boerderij,

a Netherlands-based agriculture title, during the course of

the year.

21

Overview Business review Financial review Governance Financial statements and other information

Government Solutions provides a variety of identity management,

fraud detection and prevention, collections and investigation

solutions to US federal, state and local law enforcement and

government agencies. These solutions help verify beneficiaries

for government programmes, solve criminal cases, support

national security initiatives and identify fraud, waste and abuse

in government benefit programmes, as well as identity theft

solutions for tax agencies to help ensure legitimate taxpayers

receive refunds and business intelligence solutions allowing

government agencies to find additional fraud and property tax.

Market opportunities

We operate in markets with strong long-term growth in demand

for high-quality advanced analytics based on industry information

and insight, including: insurance underwriting transactions;

insurance acquisition, retention and claims handling; healthcare,

tax and public benefits fraud; financial crime compliance; business

risk; fraud and identity solutions; due diligence requirements

surrounding customer enrolment; security and privacy

considerations; and data and advanced analytics for the banking,

energy and chemicals, aviation and human resources sectors.

In the insurance segment, growth is supported by increasing

transactional activity in the auto, commercial and life insurance

markets and the increasing adoption by insurance carriers of

more sophisticated data and analytics in the prospecting,

underwriting and claims evaluation processes, to assess risk,

increase competitiveness and improve operating cost efficiency.

Transactional activity is driven by growth in insurance quoting and

policy switching, as consumers seek better policy terms.

This activity is stimulated by competition among insurance

companies, high levels of carrier advertising and rising levels of

internet quoting and policy binding. We continue to expand our

services to make it easier for the consumer to transact with an

insurer throughout the insurance process. We are developing

solutions that bridge insurers and automakers, utilising

connectivity as a means to leverage and monetise the data from

Advanced Driver Assistance Systems (ADAS) and connected cars,

and engage consumers with driving behaviour information,

collision detection and other insurance-related services.

Mounting fraud losses, continuing AML fines, high-profile

anti-bribery and corruption cases, growth through consumer and

business credit expansion, and heightened regulatory scrutiny

create growth opportunities. The rise of fintech, alternative lending

and digital economy companies is also creating opportunities.

A number of factors support growth for compliance solutions in

banking and financial services markets, including cross-border

payments and trade finance levels. In collections, demand is driven

mainly by the ongoing escalation of consumer debt and the prospect

of recovering that debt.

The increasing demand for our contributory solutions to combat

criminal activity, fraud and tax evasion is driving growth in

government markets. The level and timing of demand in this market

is influenced by government funding and revenue considerations.

Growth in the global energy and chemicals markets is led by

increasing trade and demand for more sophisticated information

solutions. Aviation information markets are being driven by increases

in air traffic and in the number of aircraft transactions. Growth in

agriculture markets is being driven by adoption of technology and

data solutions plus increasing supply chain connectivity.

Strategic priorities

Our strategic goal is to help businesses and governments achieve

better outcomes with information and decision support in their

individual markets through better understanding of the risks and

opportunities associated with individuals, other businesses,

transactions and regulations. By providing high quality industry

data and decision tools, we assist customers in understanding their

markets and managing risks efficiently and cost effectively. To

achieve this, we are focused on: delivering innovative new products;

expanding the range of risk management solutions across adjacent

markets; addressing international opportunities in selected

markets to meet local needs; further growing our data services

businesses; and continuing to strengthen our content, technology

and analytical capabilities.

Risk & Business Analytics has been developing AI and ML

techniques for a number of years to generate the actionable insights

that help our customers to make accurate, better informed and

more timely decisions. The successful deployment of AI and ML

techniques starts with a deep understanding of customer needs,

leverages the breadth and depth of our data sets, coupled with the

expertise and domain knowledge to discern which AI/ML algorithm

to use, in what context, to solve our customers’ business problems

effectively.

Print

2%

Face-to-

face 2%

Electronic

96%

£2,117m

REVENUE BY FORMAT

Rest of world

6%

Europe

15%

North

America

79%

£2,117m

REVENUE BY GEOGRAPHICAL MARKET

Advertising

1%

Transactional

63%

Subscription

36%

£2,117m

REVENUE BY TYPE

22 RELX Annual report and financial statements 2018 | Business review

Business model, distribution channels and competition

Our products are mainly sold directly, typically on a subscription

or transactional basis. Pricing is predominantly on a transactional

basis for insurance carriers and corporations, and primarily on

a subscription basis for government entities.

In the insurance sector, our competitor Verisk sells data and

analytics solutions to insurance carriers but largely addresses

different activities to ours. Principal competitors in the Business

Services and Government Solutions segments include the major

credit bureaus, which in many cases address different activities in

these segments as well.

Data Services competes with a number of information providers

on a service and title-by-title basis including S&P Global Platts,

Thomson Reuters and IHS Markit as well as number of niche and

privately owned competitors.

Underlying revenue growth was strong in 2018, in line with the

prior year. Underlying profit growth matched underlying

revenue growth.

Underlying revenue growth was +8%. The difference between

the constant currency and underlying growth rates reflects

portfolio changes and the transfer of a small number of

healthcare products to Scientific Technical & Medical.

Underlying adjusted operating profit growth matched underlying

revenue growth as we continued to pursue our strategy, with a

primary focus on organic development.

Insurance grew strongly. We continued to drive growth through

the roll-out of enhanced analytics, the extension of data sets, and

by further expansion in adjacent verticals, in US market

conditions that, over the year as a whole, were neutral to mildly

positive. International initiatives continued to progress well.

In Business Services, further development of analytics that help

our customers to detect and prevent fraud and to manage risk

across the financial and corporate sectors continued to drive

growth, in a robust US and international market environment.

In Data Services, organic development of innovative new

products and expansion of the range of risk management

solutions drove growth across market verticals. In Government,

which accounts for around 5% of divisional revenues, we

continued to drive customer value through the introduction of

sophisticated analytics.

Risk & Business Analytics acquired three data and analytics

businesses that support our organic growth strategy in 2018,

ThreatMetrix, SST and Safe Banking Systems, and disposed of a

number of minor print and other assets.

2019 outlook

The fundamental growth drivers of Risk & Business Analytics

remain strong, and we expect underlying operating profit growth

to continue to broadly match underlying revenue growth.

2018 financial performance

2018

£m

2017

†

£m

Underlying

growth

Portfolio

changes

Currency

effects

Total

growth

Revenue 2,117 2,073 +8% -3% -3% +2%

Adjusted operating profit 776 760 +8% -2% -4% +2%

REVENUE

2018

2,117

2,073

†

Underlying growth +8%

2017

£m

ADJUSTED OPERATING PROFIT

2018

776

760

†

Underlying growth +8%

2017

£m

† 2017 restated for adoption of new accounting standards IFRS 9, IFRS 15 and IFRS 16.

RELX Annual report and financial statements 2018 | Risk & Business Analytics 23

Overview Business review Financial review Governance Financial statements and other information

Cirium

managing the cost

of disrupted flights

reduction in time

spent resolving a

traveller’s disrupted

flight using Cirium’s

services

Labour strikes, natural disasters and extreme

weather all cause flight disruption, which has a

significant impact on traveller experience and

travel industry costs. In 2017, 3.6m flights were

cancelled or delayed by over 30 minutes. Every year,

airlines lose approximately $35bn because of these

irregular operations. This cost jumps to more than

$60bn when considering the impact to travellers

and the broader ecosystem.

When disruption happens, most airlines publish

waivers to allow travellers to change their flight

plans ahead of the disruption with no change fee.

Most waivers are handled manually on a reactive

basis. There isn’t a standardised format and

travellers often aren’t alerted effectively or

quickly enough.

Cirium’s Travel Waiver Services automate the

process of matching trips to waivers, making it

easier and quicker for agents to find waiver details

and understand if a traveller’s flight qualifies.

These services allow agents to reallocate travellers