We create opportunities for clients,

partners, communities, and the wider

stakeholder fraternity to ‘Rise’ above

limiting circumstances and thrive in

a constantly changing world. Change

that is powered by the intelligent

symphony of technology and humans

designing innovative and sustainable

experiences for the new world order.

At Tech Mahindra, our holistic

solutions simplify digital

transformation and ensure agile

service delivery. We foster a culture

of innovation to deliver appropriate

technology solutions to new and

existing clients that result in better

business outcomes. We synergise

among oerings, leading to superior

business value for clients, supported

by best-in-class technology.

Leveraging a global ecosystem of

partners, we deliver industry-leading

value to our clients; while promoting

a culture of digital responsibility.

Collaborate

We collaborate with clients, academia, eco-system

players and start-ups for business solutions, enabling

our clients to Run their business better, Change faster

and Grow greater by creating new revenue streams.

Co-innovation and co-creation, together, enable us to

quickly deliver disruptive impact for our customers.

Read more on page 22

Change

Our digital go-to market strategy revolves around

solving customers’ business issues. As a global digital

transformation provider, we help businesses adapt to the

fast-changing digital landscape with scalable, replicable

and sustainable outputs and outcomes.

We are happy to contribute to the vibrant digital

revolution, which is constantly enriching and redefining

the way we imagine life on the planet. We see ourselves

playing an even larger transformative role by capitalising

on our dominant position in Technologies of the Future.

Read more on page 26

Connect

Experiences are delivered through the interplay

of process re-imagination, design, innovation and

digital technologies. Connectedness is our core

strength. With automation, we enable clients to

better engage with their customers across the

customer lifecycle and oer the right experience,

integrated with next-gen technology. As part of the

TechMNxt charter, we invest significantly in reskilling

our people to create a future-ready workforce.

Read more on page 24

About Tech Mahindra

Service oerings

Industries we serve

Global presence

02

06

08

10

02

Corporate

Identity

Environment

Social

Governance

28

30

36

28

ESG

P

erformance

Key performance indicators

MD & CEO’s Message

Awards and accolades

Last 3-year performance

12

14

16

17

12

Year in

Review

Corporate Information

Directors’ Report

Corporate Governance Report

Management Discussion and Analysis

Business Responsibility Report

39

40

100

120

136

38

Statutory

Reports

Operating environment

Strategy for growth

Collaborate

Connect

Change

18

20

22

24

26

18

Strategic

Review

Standalone

Consolidated

149

233

148

Financial

Statements

Contents

Delivering

sustainable digital

transformation

About Tech Mahindra

We represent the bold, new, disruptive digital era,

oering innovative and customer-centric services and

solutions to integrate technology with businesses more

meaningfully and innovatively. Our core operation

has been built around the credo ‘Connected World.

Connected Experiences.’

We are a leading global enabler of digital

transformation, consulting and business

re-engineering services and solutions. Part of the

eminent Mahindra Group, we are a

$ . Billion

enterprise with more than ,,

employees

across + countries. We

currently have

active global clients, including

several

Fortune companies. Tech Mahindra featured

as the top non-US Company in the Forbes Global

Digital list for , and featured among

Forbes Fab Companies in Asia in .

We deliver seamless and integrated

experiences across digital, physical,

and convergent dimensions.

Our solutions help clients integrate

their platforms across a wide range

of technologies to deliver tangible

business value to their stakeholders.

We challenge conventional thinking and

innovatively use our resources to drive

positive changes in the lives of our

stakeholders and communities across

the world, to enable them to Rise.

We will continue to RISE to be an

agile, customer-centric and purpose-led

company delivering best-in-class

technology led business solutions

for our stakeholders.

Core purpose Our Vision

Professionalism Good Corporate

Citizenship

Customer

First

Quality

Focus

Dignity of

the Individual

Core values

Rise tenets

Alternative ThinkingAccepting No Limits Driving Positive Change

02

The Mahindra Group is a federation of companies

bound by one purpose - to Rise. Inspired by this spirit

and the group’s legacy and values, it aims to always

positively impact its partners, stakeholders,

communities

and the world at large. Headquartered in Mumbai, the Group

employs over ,,+ people across + countries.

It operates in key industries that propel economic

growth, such as tractors, utility vehicles, information

technology, financial services and vacation ownership.

The Group has a strong presence in agribusiness,

aerospace, components, consulting services, defence,

energy, industrial equipment, logistics, real estate,

retail, steel, commercial vehicles and two-wheelers.

About Mahindra Group

For more information,

visit website:

www.mahindra.com

FY highlights

$. Billion Buyback% %

Growth momentum

for Telecom providers

Among the top

Indian companies

significant

acquisitions

Large deals in

Enterprise

Net new deal wins

($ . Billion in FY)

Completed

first-ever buyback

Digital revenue Free cash flow

conversion to PAT

IT / Network modernisation

spends and telecom providers

lining up for G opportunity

Dow Jones

Sustainability Index

(DJSI) World Ranking

Mad*Pow,

Born Group,

Zen and Cerium

Broad based

growth driven by

BFSI, technology

and healthcare

, Crores

Revenue

,,+

Associates

Active customers

+

Countries where we drive

digital transformation

FY key facts

Annual Report 2019-20 03

Corporate Identity

We oer the right blend of physical and digital

design, powered by technology. We use

digital capabilities to transform client’s internal

businesses and technology operations, and deliver

industry-leading outcomes. Our solutions

help clients accelerate their digital transformation

journey by building intelligent and digital-next

businesses, backed by next-generation technologies.

Transform digitally

Diversified geographic presence

We deliver technology solutions across +

countries in Americas, Europe, Middle-East,

Latin America, Africa and Asia-Pacific. Such

prudent geographic diversification also reduces

market concentration risks to the business.

Key strengths

About Tech Mahindra

Innovation engine

Tech Mahindra’s Makers Lab develops future-ready

solutions by leveraging next generation technologies

like Artificial Intelligence (AI), Machine Learning (ML),

Robotics, Internet of Things (IoT), Augmented Reality

(AR)/ Virtual Reality (VR), G – Network of the future.

With + technology platforms and solutions, we

help customers achieve faster time-to-market and

incremental innovation capabilities.

Industry-specific solutions

Businesses in the new world order are demanding

sophisticated technologies that lower costs, increase

sales, eciency and performance, protect the

environment and enable better management and

control. We support our clients across sectors, with

tailored solutions. Our solutions and services oer a

proven delivery model and in-depth expertise.

04

We believe the ESG parameters have wider impact

on society and business performance. And we have

been at the forefront of driving business results with

ESG. It is aligned with our overarching strategy and

embedded in our execution.

Emphasis on environment, social and governance

Our -- strategy focuses on three mega trends,

four tech bets, and three outcomes for our

customers. TechMNxt is our transformation

approach to deliver it. This strategy is

implemented across industries where we

operate. We are dedicated to enable clients’

success in a digitally disruptive world.

Strategic transformation approach

Strong leadership

Our senior management team comprises

seasoned global leaders in the industry. Equipped

with experience and expertise of diverse

geographies and areas of specialisation, their

leadership has enabled our all-round and consistent

performance, acknowledged by our stakeholders.

We oer an excellent workplace environment so

our people can perform to the best of their abilities.

Our work culture is shaped by self-motivated and

committed professionals, aligned with our business

objectives and working together to deliver top-

notch, tailored solutions to meet our clients’ diverse

expectations, globally. We have been certified as

Great Place to Work (GPTW)™ - which is a testament

to our high-trust, high-performance culture.

High-performance culture

Corporate Identity

Annual Report 2019-20 05

Tailored business

solutions for the

big leap forward

As businesses and industries converge

and sunrise business models emerge,

we think beyond conventions, and

reimagine our strategy, solutions, services

and platforms. Our innovators and thought

leaders interact with industry influencers

to get key insights and help shape

tomorrow’s enterprises worldwide.

Our Integrated Engineering Solutions (IES) delivers

across aerospace and defence, automotive,

industrial, telecom, Hi-tech, healthcare and

transportation sectors.

• Extensive skills in electronics, mechatronics and

mechanical engineering, paired with industry

understanding and product knowledge

• Improved R&D productivity for the global market

to meet continuous method development for

new products, processes and technologies

• Extensive solution portfolio across product

lifecycles — from conception and production to

secondary market services

• Developed savings programmes leading

to cost eectiveness and reduced time to

market by -%

Our wireless network services encompass the

complete lifecycle of networks starting from design,

planning and engineering, rollout, operations and

maintenance, alongside optimisation services.

We

provide managed and professional services model

— to businesses in the wireless networks segment.

Our G network for enterprises provides multiple

services that enable enterprises to establish private

wireless network spanning operative areas and

enabling a plethora of IoT use cases. Tech Mahindra’s

Global Network Operation Centre (NOC) based

in India, provides best practices framework,

right-shoring and automation levers, helping

customers avail a cost-eective yet, progressive setup.

Network services

Engineering services

Service oerings

06

We oer rapidly deployable platform solutions to

drive innovation, bolster performance, and cultivate

an ecosystem of collaborators. We orchestrate,

analyse, automate and artificially intellectualise the

delivery of technology to enterprises. Our vertical

and horizontal solutions standardise and consolidate

business processes, while accommodating changing

needs. Our platforms improve agility, speed and

ability, reduce operational costs, use analytics to

generate insights to manage performance, identify

exceptions and intervene in time, bringing in

automation and enhancing customer experience

as a Service (PaaS) mode.

We provide comprehensive, advanced security

outsourcing services across — Assess, Prevent,

Detect, Respond and Recover stages of

the value chain. We have dedicated security

professionals, with a track record of successful

delivery of + large security outsourcing

projects. We converge technology, people and

processes, with consulting, implementation,

integration, optimisation service, alongside service

management. We have over years’ experience in

information security services, with projects executed

across countries.

Our consulting services is supported by a team

of experts and opinion leaders, who specialise

in business transformation, process consulting,

alongside IT and corporate excellence. We develop

innovative strategies and oer bespoke processes for

our customers according to industries and individual

company requirements. Our global expertise and

seamless cross-platform functionality help create

IT solutions to empower companies to focus on and

enhance their core businesses. Leveraging nearly

three decades of experience, we oer innovative

solutions to integrate technology with business for

several Fortune and companies.

Our technology-focused oerings and powerful

insights enable our clients’ enterprise empowerment.

We leverage latest technologies and platforms to

drive value with the ‘Cultivating Intricate Analytics’

theme. We aord improved connected experiences

across the customer lifecycle with an interplay

of physical and digital strategies across multiple

channels. Following a philosophy of transforming

clients’ business across channels, we are enabling

better processes, lowering risk, increasing revenue

opportunities and enhancing customer experience

for a better society.

Our Business Service Group (BSG) oers

customers innovative and optimised business

solutions. With our industry knowledge and

experience in change projects across common

platforms, we conceive holistic solutions

for telecommunications, healthcare and

pharmaceuticals, banking and financial services,

retail and Hi-tech. We work to disrupt customers’

legacy systems by digitalising its end-to-end

product lifecycle through the introduction of

AAC (Automation, Analytics & Consulting)

methodology, with focus on improving and delivering

perpetual positive CX.

Platforms

Security

IT

Digital marketing and

customer experience

Business process

services

Annual Report 2019-20 07

Corporate Identity

A trusted

transformation

partner

Industries we serve

At Tech Mahindra, we understand that

no two businesses are alike. Thus we

adapt our approach to our customers’

digital transformation needs, supported

by a deep understanding of their

industry, the market, customers,

challenges and future strategy.

Retail, Transport and Logistics

Technology, Media and Entertainment (TME)

Healthcare, Life Sciences (HLS), Government and Others

Banking, Financial Services & Insurance (BFSI)

Manufacturing

Communications

Revenue distribution by industry (%)

.

.

.

.

.

.

$

08

Our range of solutions for

communications service providers (CSPs),

telecommunications equipment manufacturers (TEMs)

and independent software manufacturers (ISVs)

make us a preferred partner for leading

telecommunications and cable providers.

We are helping organisations to be future-ready

for the G revolution by helping on network

modernisation. We are enabling G for

enterprises, while driving CX transformation.

With manufacturing-rich DNA and innovative

value-added services, we have extensive

expertise that help us tap into a broad

customer base across diverse industries

such as Aerospace and Defence, Automotive,

Discrete and Process industries. We oer

holistic support across the manufacturing value

chain. Our deep knowledge of mechanical and

electrical engineering, knowhow of sales and

service processes, and hands-on exposure to

the factory shop floor facilitate the bringing of

digital oerings into core business domains.

Communications Manufacturing

Our Hi-tech vertical serves the software

and internet sector, which has disrupted the

way products and services are delivered to

end-users. We also serve the semi-conductor

industry in areas of storage, IDMs, fabless

and equipment manufacturers. With our

Media and Entertainment (M&E) division,

we serve customers from the film, gaming,

sports, publishing and news industries —

from vision to implementation.

Tech Mahindra partners with leading global

companies in the healthcare provider,

pharmaceutical, biotechnology and medical

device sectors. We help to reimagine

businesses processes and deliver remarkable

patient experiences. We have harnessed the

power of digital and information technology

to improve citizens’ lives with solutions that

we provide to public sector companies and

government enterprises.

The BFSI sector is experiencing rapid

reshaping to make the whole spectrum

more customer-centric, personalised,

digitalised and accessible. We bring on the

table over two decades of experience in

oering IT services and innovative solutions

to diverse clients in the BFSI universe, such

as retail banking, lending and leasing, card

management, asset and wealth management,

investment banking, and stock exchanges.

We deliver sustainable customer experiences

to augment customer journeys at every

stage of the retail and consumer packaged

goods (CPG) value chain. Focusing on digital

transformation services, we help on store

re-imagination, digital operations management,

intelligent supply chain, while creating

personalised phygital experiences through

products, devices and services. We are

experienced in working with market leaders in

the transport and logistics industry, conceiving

specific industrial solutions and partnerships

with pioneering players.

Technology, Media and

Entertainment (TME)

Healthcare, Life Sciences (HLS),

Government and Others

Banking, Financial Services

and Insurance (BFSI)

Retail, Consumer Goods,

Transport and Logistics

Annual Report 2019-20 09

Corporate Identity

Our innovation

transcends borders

and time zones

We have taken our expertise and

solutions to the global grandstand,

working with clients across multiple

locations in + countries.

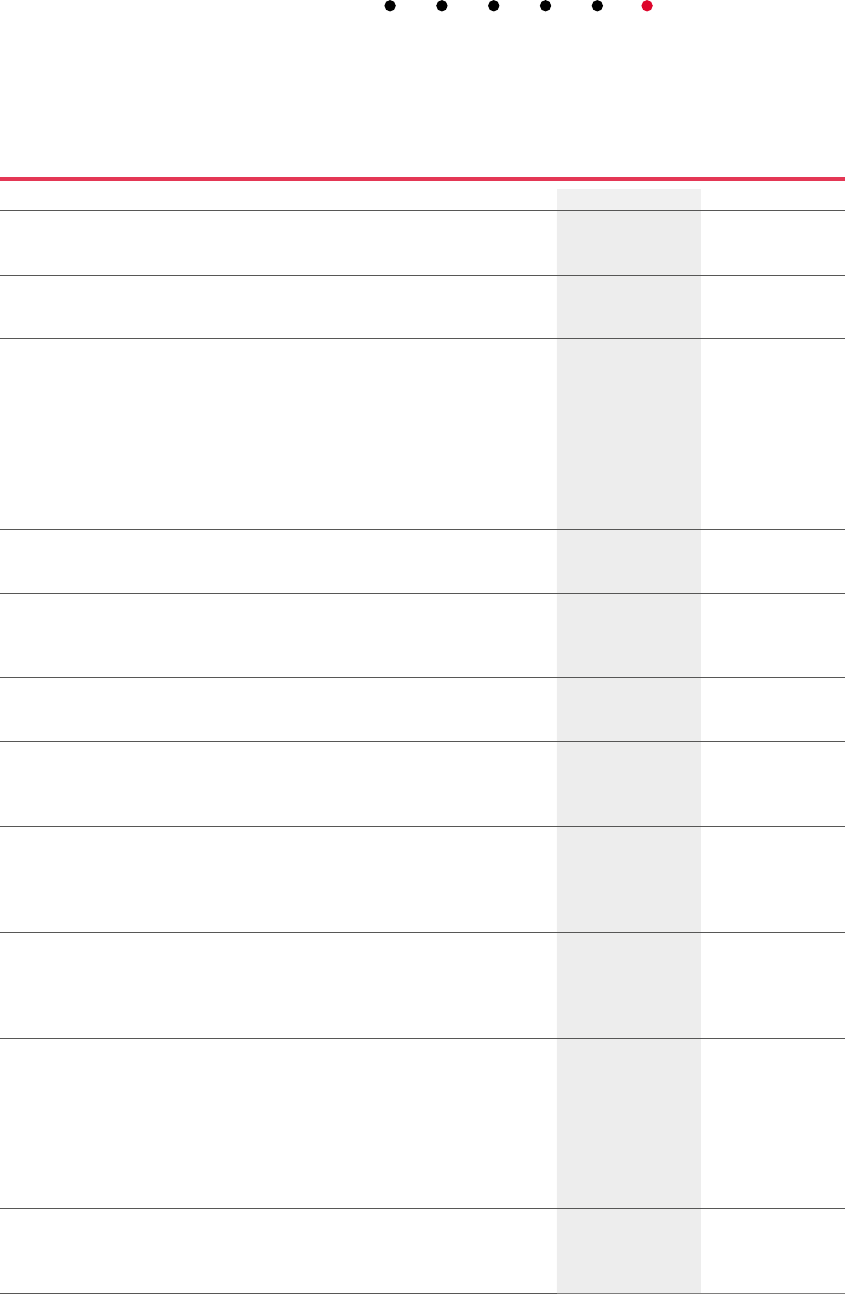

Revenue distribution

by geography (%)

Global presence

oces

development

centres

AMERICAS

Americas

Europe

Rest of the world

.

.

.

10

oces

countries

APAC

oces

development

centres

AUSTRA LIA

oces

countries

AFR ICA

oces

development centers

+ countries

EUROPE

oces

+ states

INDIA

Annual Report 2019-20 11

Corporate Identity

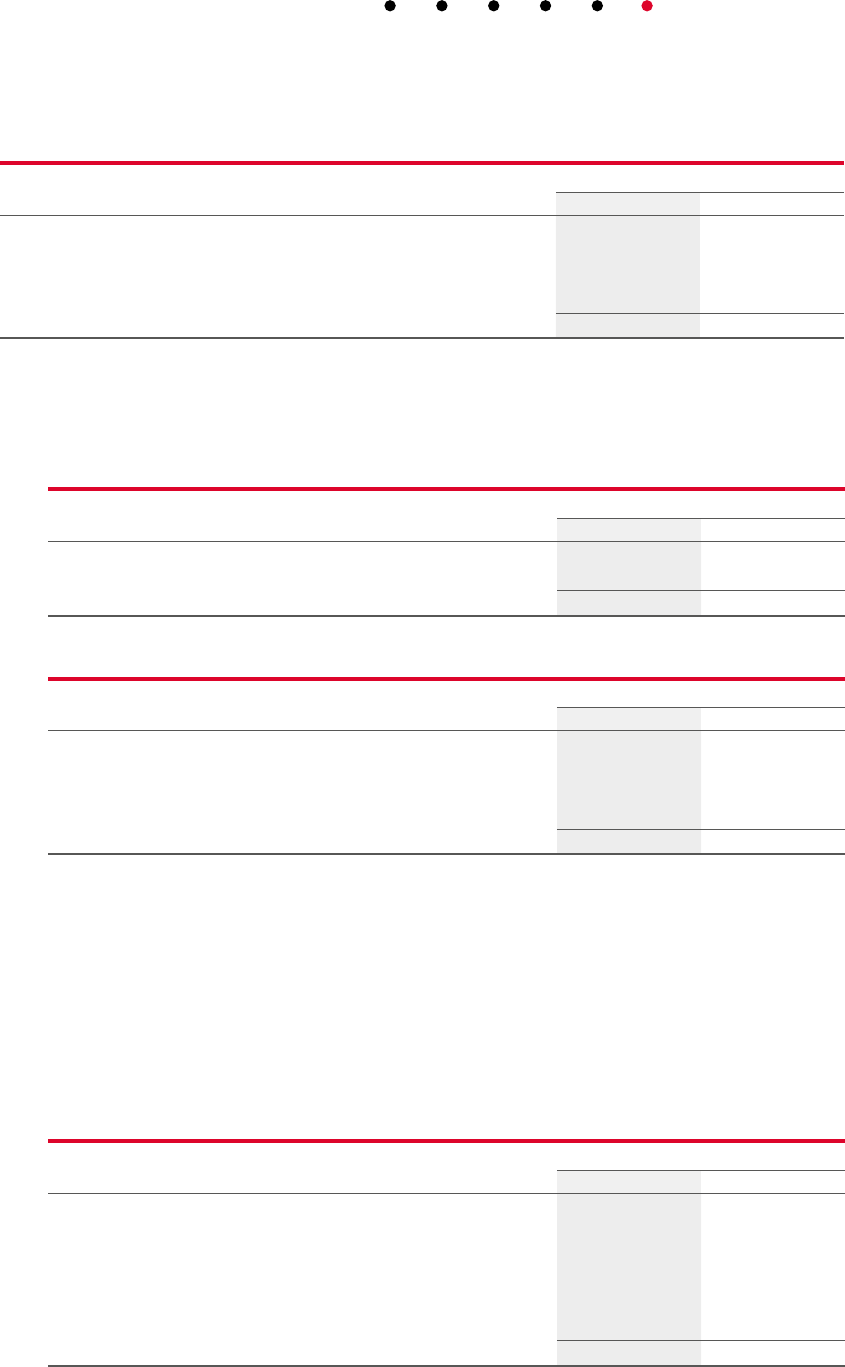

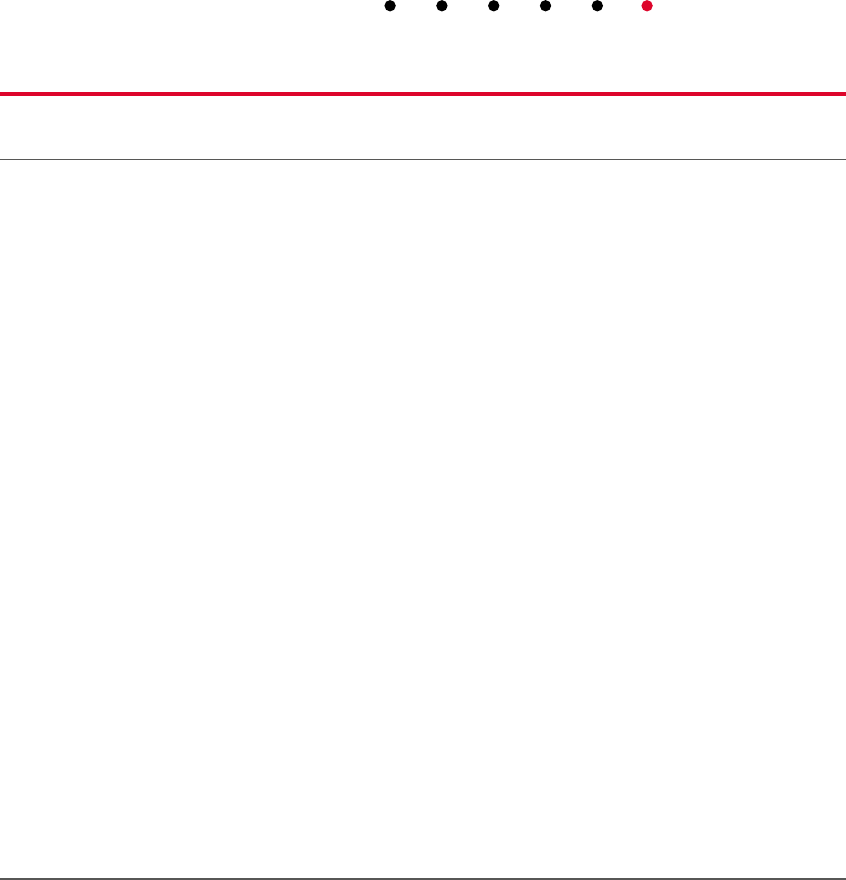

Measuring

our progress

Key performance indicators

CAGR .%

Market Capitalisation ` Billion

FY

FY

FY

FY

FY

.

.

.

.

.

CAGR .%

Net Worth ` Million

FY

FY

FY

FY

FY

,,

,,

,,

,,

,,

CAGR .%

EPS (Diluted) `

FY

FY

FY

FY

FY

.

.

.

.

.

CAGR .%

Net Profit ` Million

FY

FY

FY

FY

FY

,

,

,

,

,

CAGR .%

EBITDA ` Million

FY

FY

FY

FY

FY

,

,

,

,

,

Revenue from Operations ` Million

FY

FY

FY

FY

FY

,,

,,

,,

,,

,,

CAGR .%

12

Cash and Cash Equivalent ` Million

FY

FY

FY

FY

FY

,

,

,

,

,

Total Headcount No.

FY

FY

FY

FY

FY

,,

,,

,,

,,

,,

Active Clients No.

FY

FY

FY

FY

FY

Dividend Per Share `

FY

FY

FY

FY

FY

.

.

.

.

.

Free Cash Flow / PAT %

FY

FY

FY

FY

FY

.

.

.

.

.

Return on Capital Employed %

FY

FY

FY

FY

FY

.

.

.

.

.

CSR and Donations ` Million

FY

FY

FY

FY

FY

,

IT Utilisation (including Trainees) %

FY

FY

FY

FY

FY

Annual Report 2019-20 13

Year in Review

Dear Shareholders,

It’s a new day. A new world. A new normal. The world

has changed in the last six months and what we have

witnessed, weathered and traversed in the last

six months has transformed our perspective, and how!

As I write this letter, we have only started to recover

from the immediate impact of COVID-. In a short

time, the pandemic has had a far-reaching impact

globally, impacting the economy, our society and

human life in all aspects. And yet, amidst all

of this, we have seen some magnificent examples

of human resilience, solidarity and innovation

.

When the pandemic broke out, we had two key

priorities - the safety and wellbeing of our people and

business continuity of our customers. We facilitated

work-from-home for over % of our associates while

safeguarding those attending oce. We surpassed

customer expectations with our continuous connect,

seamless delivery and data security measures.

We

adopted a new #DistantButConnected logo to

convey

our solidarity in the global war

against

COVID-,

as

well as our commitment to #WellnessFirst. Leadership

teams and support functions worked round the clock

to ensure associates remained safe, connected,

informed and motivated. I thank every TechMighty for

staying together as one family always, but especially

during this crisis.

The year that was

In retrospect, our focus on becoming an increasingly

agile, resilient and future-ready company has helped

us overcome changing business challenges in the

globally disruptive environment. We were able to

leverage our digital prowess to create sustainable

solutions, catalyse societal growth and contribute

positively to climate action.

Looking at some of the key performance highlights for

the year, Communications Vertical has grown by .%

in constant currency terms, driven by modernisation

spend and pre-G

work. We announced a strategic

collaboration with AT&T, t

o accelerate its network

application, shared systems modernisation and

movement to cloud. The Enterprise business, although

impacted by weaker macro trends in select verticals,

grew by .% constant currency terms. We signed

the largest Enterprise deal in history in Insurance and

Annuities space. We announced net new deal wins of

$. Billion, significantly higher than $. Billion in

FY. Our digital oerings were strengthened with the

acquisition of Born Group, Mad*Pow, Zen and Cerium.

Our focus on cash collections helped us generate $

Million of free cashflow, while we returned capital

to our shareholders through the completion of our

maiden buyback. We also announced a higher dividend

of ` for FY. Overall, it was a satisfactory year, with

revenues at $ ,. Million and profit after tax at

$ . Million.

Our ESG focus: co-creating a better world

We focused on environment, social and

governance in all aspects of our work and tried to

innovatively solve problems by connecting ESG with

business results.

We are at par with global practices in technology

disruption, climate change and water scarcity,

Mr. C P Gurnani

Crafting

new

pathways

Managing Director and CEO’s Message

14

among others. We reviewed our operating strategy

and business model to align with the UN Sustainable

Development Goals (SDGs) and re-emerged as a

sustainability leader, becoming one among three

Indian companies to feature in the DJSI (Dow Jones

Sustainability Indices) World Index and one of the

Indian companies who are part of the Emerging

Markets category.

I am happy with the initiatives we took to reduce

our ecological impact. We adopted sustainable,

environment-friendly practices in our daily lives

through our -- initiative (Every associate to plant

trees a month, take carpool rides and volunteer

hours a month). Our focus on encouraging individual

social contribution included institutionalising an

award (ISR award) that allowed associates to take

time o work to donate to social causes.

We earned the Great Place To Work (GPTW)

certification this year: a recognition of our focus

on diversity, inclusion and sustainability even as

we continued to create great experiences for

our associates.

Technology for good

The after COVID- world will see human experiences

becoming more contactless, yet even more

connected. This is exactly where our competitive

advantage will come to the fore: new age tech will

determine who survives and thrives, as much as

tech for good (technology that changes people’s

everyday lives for the better) will distinguish who

makes a dierence.

Our Run-Change-Grow strategy is even more

relevant in the current environment as we help

customers ‘run’ their existing businesses in dicult

times, enable them to ‘change’ by making their

portfolio oerings post-covid ready and ‘grow’ their

businesses by constructing new revenue streams.

As part of our TechMNxt charter, we are leveraging

next-gen technology such as remote computing,

cloud transformation, G, AI, blockchain and

cybersecurity to deliver enhanced experiences for

our customers globally.

At Makers Lab, we are working in collaboration with

customers to deliver innovative solutions. Some of

them like the in-house developed chatbot, Entellio,

have helped government institutions and customers

stay safe during the crisis.

For our people

Our talented workforce is our most valuable asset

and reflects our strength, resilience and future

readiness. The focus last year was on onboarding

the right talent, building capability, nurturing

an innovation-centric work environment and

creating an inclusive, empowering and balanced

work environment.

Continuing on Innovation journey, Tech Mahindra

launched K, its first HR Humanoid, which took

over our HR transactions and created an enhanced

employee experience. We also implemented an AI-

based facial recognition system to register attendance

and monitor the emotional quotient of our employees.

Rising for good

We are building a sustainable future where everyone

can access the benefits and opportunities created

by technology. As part of our corporate social

responsibility (CSR) programmes, Tech Mahindra

Foundation is working to benefit the overall

socioeconomic development in communities

that we operate in.

Our teams were swift in coming forward during the

COVID- crisis and our associates across locations

volunteered in food drives and donated leaves,

salaries, award money and cash.

The Tech Mahindra Foundation reached out to the

most vulnerable of population - healthcare workers,

security personnel, migrant workers and households

from the bottom-most of the pyramid to support them

with foodgrains, PPEs and medicines.

Everything we do is inspired by a deep sense of

purpose. Our values hold us in good stead and

are helping us become more ethical, reliable and

transparent than ever. I am proud of the way we

prepare to deal with the current operating scenario

and would like to thank our associates, customers and

stakeholders for their perseverance and support. We

will continue to innovate and drive success throughout

our ecosystem, today, tomorrow and beyond.

C P Gurnani

Managing Director and

Chief Executive Ocer

Annual Report 2019-20 15

Year in Review

Awards and accolades

Celebrating our

Rise moments

Company Sustainability

• Winner of the ‘COMPANY OF THE YEAR – IT’

at the second edition of CNBC-AWAAZ CEO

Awards for Year

• Ranked # in India’s Best Companies to Work

For by the Great Place to Work® Institute.

Also recognised as Best in Mega Employer and

in Best Companies for Career Management list

• CEO & MD, C P Gurnani won the Business Today’s

Best CEO award in IT & ITES, for the third

consecutive year

Social

• Tech Mahindra’s CSR arm, Tech Mahindra

Foundation (TMF) received ASSOCHAM Skilling

India Awards for Best Higher Vocational

Institute for Skill Development

• TMF won Gold in ‘Excellence in CSR’

for the category ‘Best Corporate-Nonprofit

Partnership’ at the th ACEF

Asian Leaders Forum

• TMF was recognised at The Economic

Times-Rotary CSR Awards,

Technology & Solutions

• Recognised amongst ‘Most Valuable Digital

Transformation Companies in ’ by a global

business magazine, CIOLook

• Winner of ‘Technology Excellence for Blockchain’

and close contender for Technology Excellence

in Emerging Technology (IoT) in the NASSCOM

Technology Award and Conclave

• Won the ET Innovation Award in the ‘People

Innovation’ category from The Economic Times

• Recognised as a global leader on climate change

for four years in a row. Tech Mahindra is one

of the only four Indian companies to secure a

position in the Carbon Disclosure Project (CDP)

Global Supplier A List in for engaging with

its suppliers on climate change

• We are part of FTSE Good Index Series ,

demonstrating leadership position in ESG

parameters of sustainability

Human Resource

• Winner of ‘The Golden Peacock HR Excellence

Award’ for the year in the IT sector

• Emerged winners in the categories of ‘Diversity

& Inclusion’ and ‘HR Technology’ in both

BusinessWorld HR Excellence Awards and

th Asia’s Best Employer Brand Awards

• Tech Mahindra is amongst the only three Indian

companies to be included in the Bloomberg

Gender-Equality Index (GEI)

16

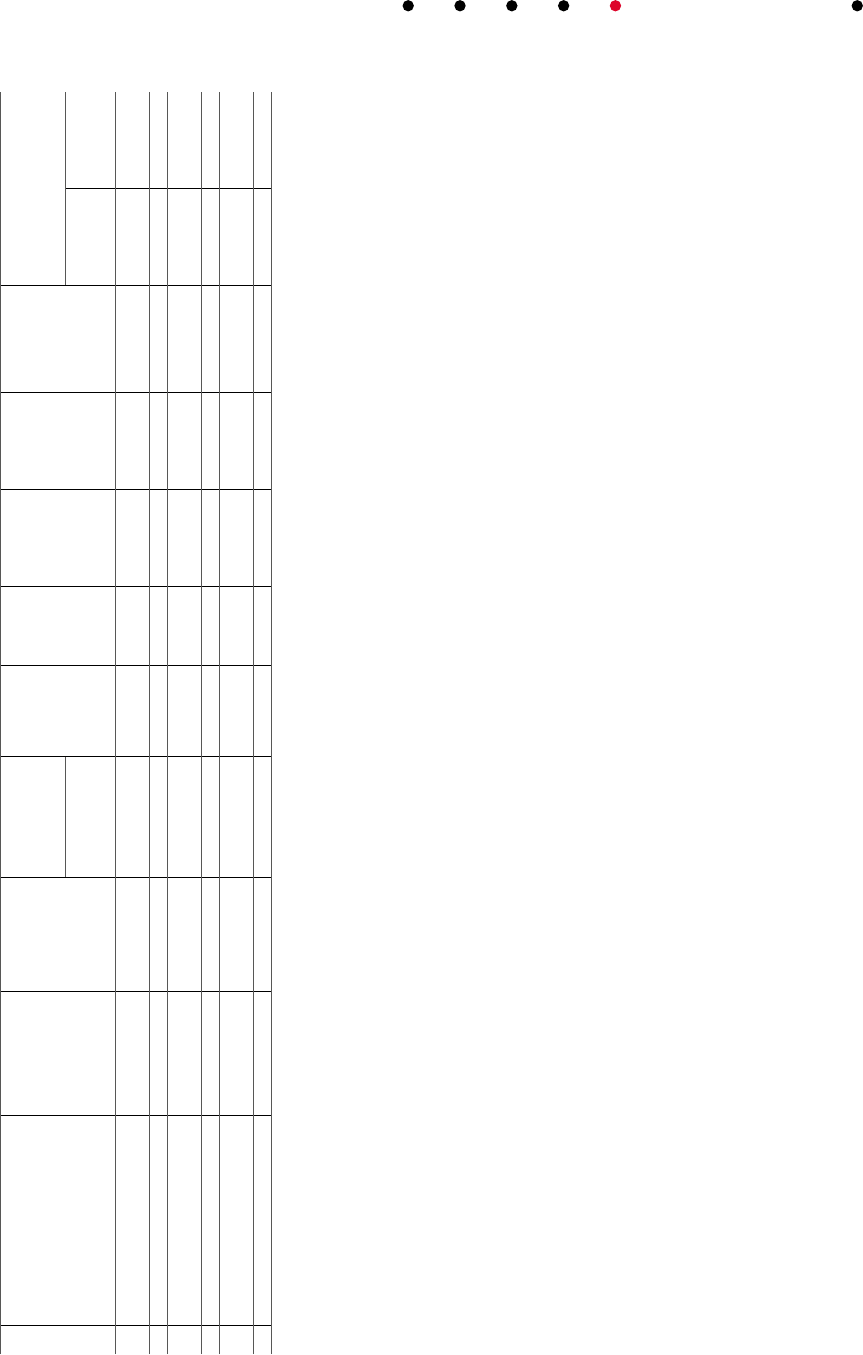

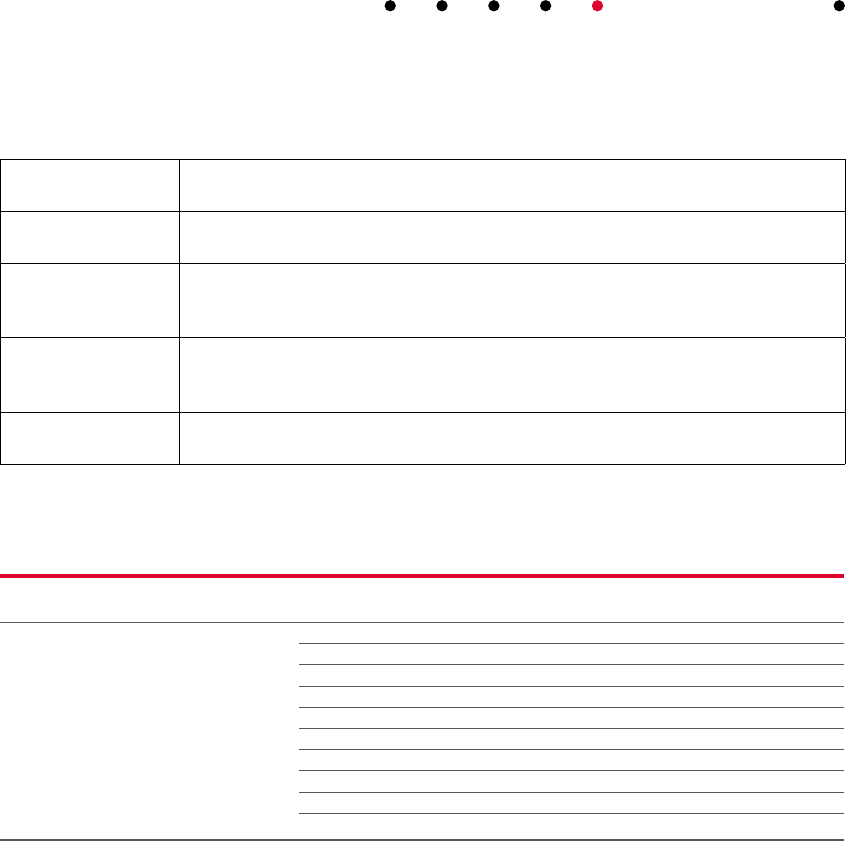

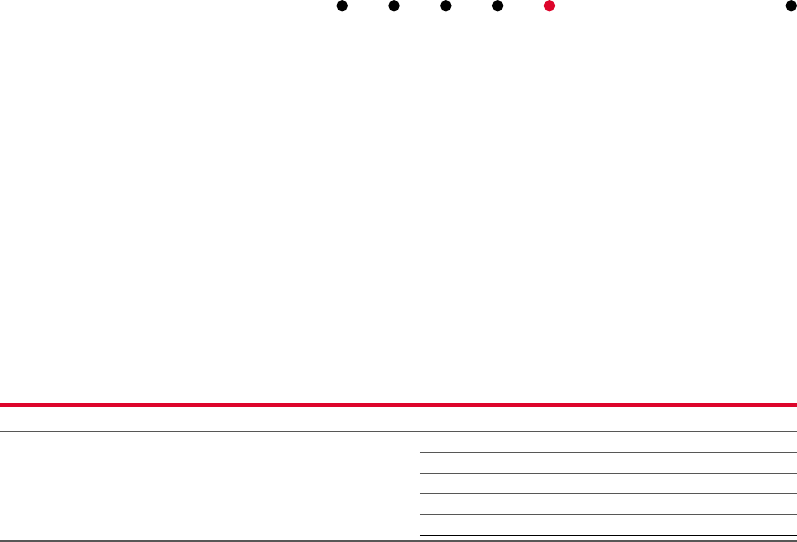

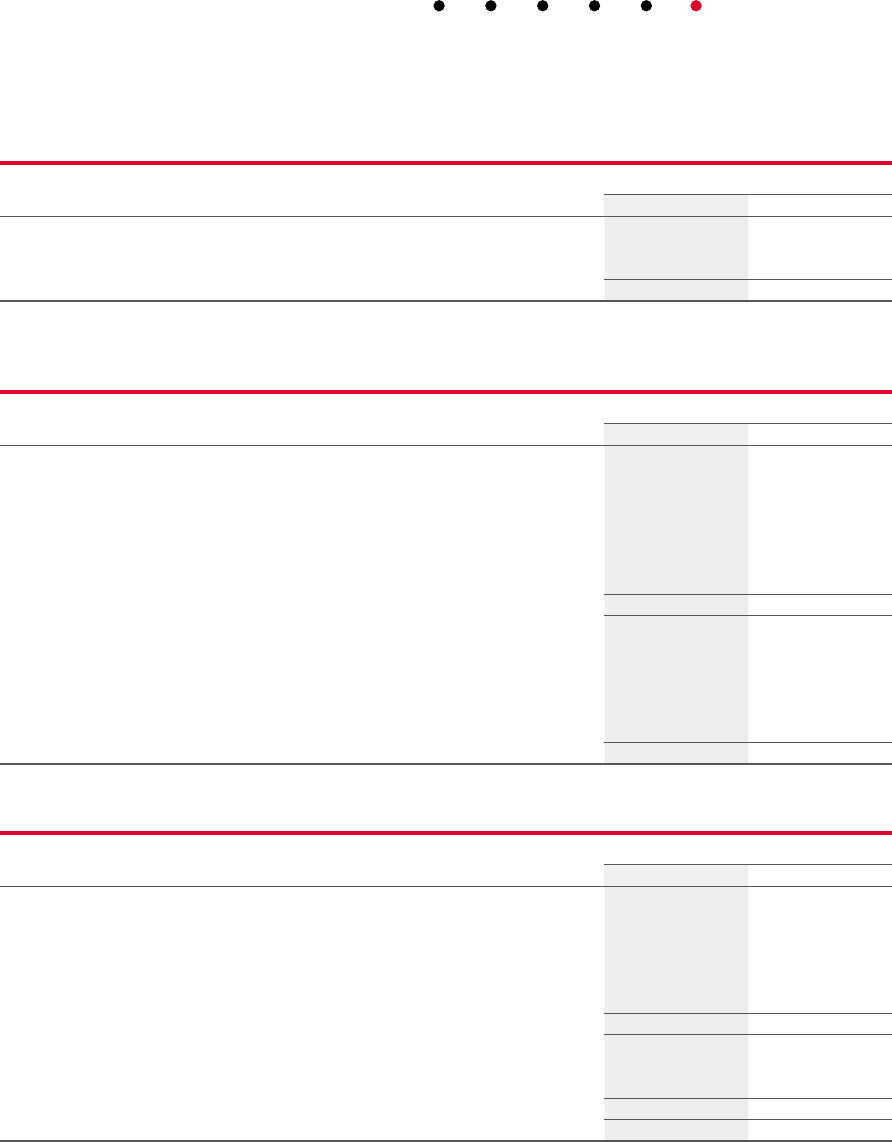

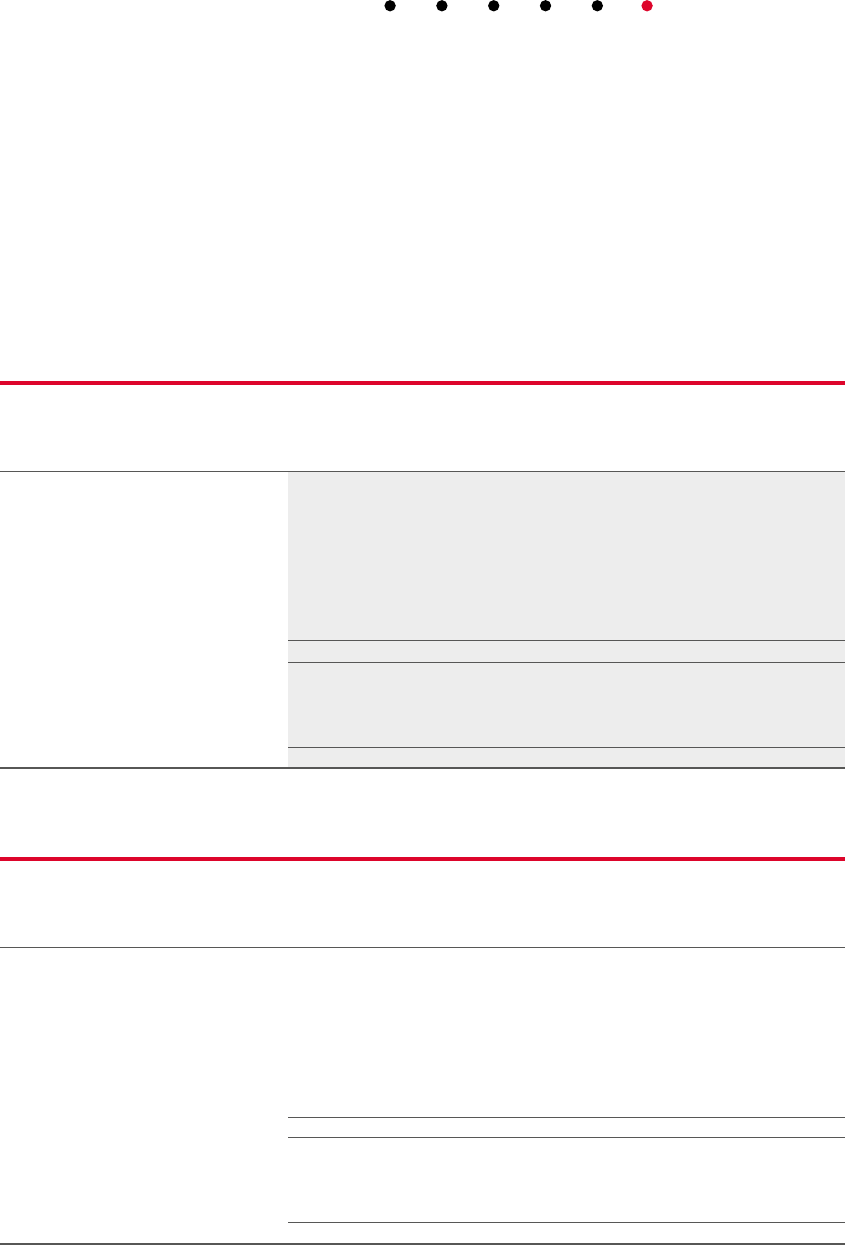

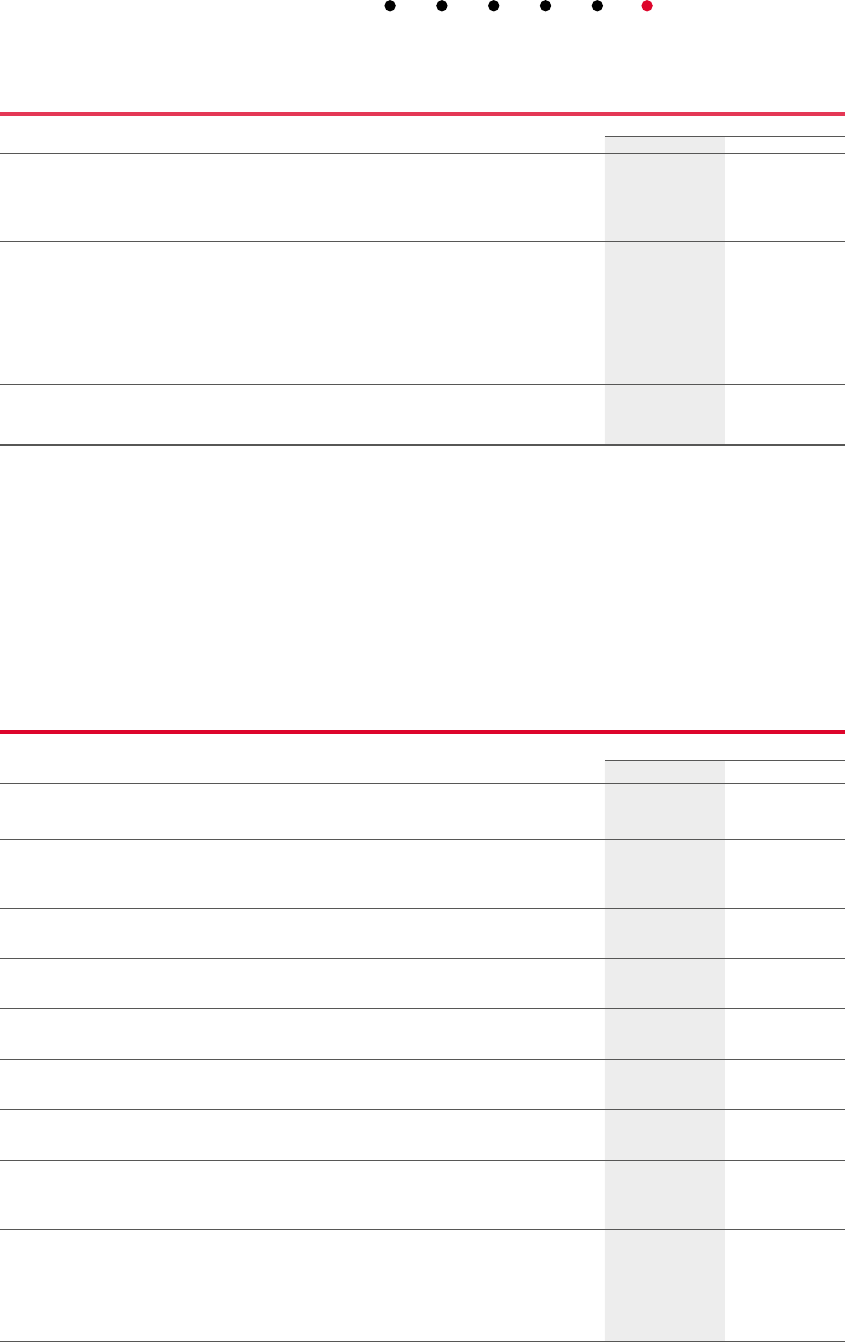

Last -year performance

Particulars

FY18 FY19 FY20

` Mn US$ Mn ` Mn US$ Mn ` Mn US$ Mn

FINANCIAL RESULTS

Revenue from Operations

3,07,729 4,770.8 3,47,421 4,970.5 3,68,677 5,181.9

Cost of services 2,15,300 3,338.9 2,33,590 3,343.4 2,59,743 3,653.4

Contribution

92,429 1,431.8 1,13,831 1,627.2 1,08,934 1,528.5

Contribution %

30.0% 30.0% 32.8% 32.8% 29.5% 29.5%

Selling, General & Administration Expenses 45,333 702.9 50,462 721.3 51,673 725.1

EBIDTA

47,096 728.9 63,369 905.9 57,261 803.4

EBIDTA %

15.3% 15.3% 18.2% 18.2% 15.5% 15.5%

Depreciation & Amortisation 10,850 168.2 11,292 161.4 14,458 203.3

EBIT

36,246 560.7 52,077 744.5 42,803 600.1

EBIT %

11.8% 11.8% 15.0% 15.0% 11.6% 11.6%

Other Income

14,165 219.5 5,342 76.2 11,924 167.4

Profit Before Tax (PBT)

48,788 755.1 55,432 792.4 50,578 711.1

Profit After Tax (PAT)^

37,998 588.1 42,976 614.6 40,330 566.8

PAT %

12.3% 12.3% 12.4% 12.4% 10.9% 10.9%

Particulars

FY18 FY19 FY20

` Mn US$ Mn ` Mn US$ Mn ` Mn US$ Mn

FINANCIAL POSITION

Net Worth

1,88,428 2,891.3 2,02,844 2,933.2 2,18,131 2,884.6

Non-Current Liabilities

19,382 297.4 11,232 162.4 29,910 395.5

Current Liabilities

79,167 1,214.8 1,03,312 1,493.9 1,09,257 1,444.8

Total Liabilities & Equity*

3,04,372 4,670.4 3,34,469 4,836.5 3,73,535 4,939.6

Non-Current Assets

1,23,302 1,892.0 1,18,811 1,718.0 1,41,812 1,875.3

Current Assets

1,81,070 2,778.4 2,15,658 3,118.5 2,31,723 3,064.3

Total Assets 3,04,372 4,670.4 3,34,469 4,836.5 3,73,535 4,939.6

Notes:

^

Owners Share of Profit

*Includes Non Controlling interest

Previous period figures have been regrouped/rearranged wherever necessary.

Year in Review

Annual Report 2019-20 17

Adapting to

change is

evolution

We operate in a rapidly evolving

industry where the explosion

of connected devices, power

of emerging technologies

and exponentiality of content

consumption are redefining our

operating landscape at a faster

rate than we can imagine.

The result is that disruption is

the new normal that businesses

have to learn to live with.

Operating environment

AI and ML

Artificial Intelligence (AI) and Machine Learning (ML)

are now the preferred technologies for businesses to

boost productivity, increase customer engagement

and drive digital transformation. It is established that

AI can do these tasks faster and more accurately

than humans. According to Gartner’s AI and ML

Development Strategies survey, % of respondents

said they have deployed AI. These companies are

running four AI or ML projects, on an average.

Business by design

The futuristic products need to be adapted for

a convergent world through enhanced design

capabilities. In a world where customer experience

determines the future of business, integrated

customer interface driven by convergence of digital

and physical world will be required. Customer

experience and design will drive growth for

enterprises by aligning with the new-age consumer.

Cyber security

As the digital world continues to advance, so do

threats that lurk online. Today, enterprises are at a

greater risk of cyber-attacks and none are safe from

the target of cyber criminals. This risk is resulting

in increased investment around cyber security and

proper measures among businesses and individuals

alike. The cyber security drift will aect everyone

in the future. The primary motive is that businesses

that operate online must eectively protect both

themselves and their customers.

G

G promises a more deeply connected ecosystem

with vast improvements over the current G network.

It

will allow fast data speed and can aord latency of

a mere one millisecond. It will have capabilities to

embrace up to times more connected devices per

unit area. G will usher in the next-generation era of

wireless connectivity among enterprises. A number of

industry verticals that include manufacturing, automotive,

airlines, healthcare, mining and retail are poised for

disruption with G in combination with IoT, AI/ML and new

technologies like AR/VR.

From AI and Blockchain to Industry . and

quantum computing, disruptive technologies

are unveiling new pathways for us to help our

clients steer through an increasingly complex

landscape. With today’s trends becoming

tomorrow’s mainstream, organisations need

to consider eects of these trends on their

businesses and prioritise accordingly.

Force Multipliers

18

We are looking at a future where beyond mobiles,

computers and tablets being linked to the internet,

an assortment of everyday objects - grocery

products, city assets, among others can be

integrated. This presents opportunities for the

emergence of organisations providing services and

applications to manage complex IoT ecosystems and

convert data into smart insights. Thus, everything we

do as technology enablers are built around these key

force multipliers.

Q FY saw unprecedented events with an advent

of the COVID- pandemic. The world momentarily

came to a standstill as governments enforced

lockdowns and other measures for public health

an safety. During this period of global crisis, our

priority was to ensure the safety and wellbeing of

our employees while helping our customers maintain

seamless business service continuity. We scaled up

fast to adopt social distancing norms, adopting new

policies and restricting travel while enabling remote

working for our associates.

However, during this period we remained committed

to safeguarding the interests of our customers and

ensuring the continuity of their operations. We

activated Business Continuity Plans (BCP) enabling

remote working and monitoring of our deliverables.

An obvious result of the crisis is that companies

need to accelerate and evolve their digitisation

journey and enhance business flexibility. Social

distancing and work from home will continue as

operating models for many global enterprises.

The

acceleration of remote

working

and the need

for a secure work environment will, in turn, accelerate

digital

transformation spends and services like

AI for IT operations (AIOps).

The need for cyber security

and remote computing has increased multi-fold

in the current environment. Industries such as

manufacturing will see significant opportunities for

reorganising supply chains, while healthcare will see

rise of remote health monitoring, facial recognition

and thermal imaging.

Our approach

COVID -:

How we responded to the situation

COVID- pandemic to

accelerate technology adoption

As these trends progress and potentially merge,

we are ideating on novel ways to run a fully

automated business, while serving customers more

engagingly. With our extraordinary depth across

the digital value chain, we combine digital customer

experience capabilities with digital operational

excellence to shape new, innovative business models

and partnerships.

We enabled multilevel communication with

clients, backed by a technology engagement plan

covering detailed steps across various aspects of

each program. We helped clients with their BCP,

anticipating challenges in their business while

addressing them with technological solutions.

Customers have appreciated the swiftness of our

response, quality control, data protection and the level

of support to ensure business continuity.

In parallel, we prioritised the wellness of our

associates. Awareness sessions were conducted by

doctors across all global locations, while our internal

microsites were updated to provide latest information

and guidelines. We are equipped to support the

communities we serve and the ones our people

inhabit. It is our commitment to help citizens live and

work sustainably and confidently in an ever-changing

digital landscape.

Consumer-facing industries such as travel, transport

and banking will see the emergence of contact-less

solutions such as drone-based delivery, autonomous

vehicles, contactless payments. The IT infrastructure

will transform with more virtual call centres, cloud

migrations or data centres in the cloud. The need

for ever-faster access to data and automation

will enhance the focus on network equipment

and communications and speed up G network

deployments. Tech Mahindra is working with clients

with solutions tuned to such needs.

Annual Report 2019-20 19

Strategic Review

Innovating to

address client

aspirations

Strategy for growth

Our clients expect us to have in-depth

understanding of their businesses,

almost as much as they do themselves.

So that we can serve them better

consistently and with measurable

outcomes. Our -- strategy is

targeted towards achieving that

purpose with speed and precision.

Our -- strategy works with disruptive

trends and transformative technologies to

help customers succeed in their markets

worldwide. We are enabled by a strong

ecosystem of partnerships (alliances,

start-ups, niche collaborations) to help us

build winning solutions and services.

It means addressing mega trends across

markets, bets that we would take to

address those mega trends, those which fit

in to the areas of a Company’s priorities.

Run BetterExperience.NXt

Business.NXt Change Faster

Explosion of

intelligent devices

Power of new

technologies

Mega trends

ObjectivesBig bets

Exponentiality of

content consumption

Platforms.NXt

Infra.NXt

Grow Greater

20

As we look at the four bets, we are confident that they resonate with the

market. We secured validations on the bets and are working towards

making them more robust and relevant to the operating landscape.

We are also co-creating solutions with the customer, taking them to the

market and executing them with zeal.

We believe that the following mega trends

will provide immense opportunities:

Tech bets defining our future strategy

Our key customer objectives

Boom of connected devices Data explosionThe power of new network

technologies like

connected IoT

devices by

of data would be

consumed by video

will enable an always-

connected experience

We identified a strategy that

enables and manifests these

transformations across four

key business and technology

related areas to change the

way we work and live:

We aspire to pioneer a digital

journey for our customers,

while ensuring their existing

businesses run better

We intend to enable faster

customer transformation as

their chosen technology partner

We want to facilitate our customers’

growth through risk sharing and

technology as a service and

multiple business models

Experience.NXt

Orchestrate the interplay of design, digital and convergent

technologies to deliver connected customer experiences.

Platforms.NXt

Creating scalable non-linear technology propositions to

help customers grow their business faster and eciently.

Business.NXt

Proven technology transformative solutions that help

customers adopt to business and operative changes.

Infra.NXt

To drive transformation of next-generation infrastructure

and connectivity in a connected world.

Run Better Change Faster Grow Greater

~ Billion ~%G

Strategic Review

Annual Report 2019-20 21

Collaborate

Creating

collaborative

disruption

Technology spurs demand,

and demand drives the

development of more novel

technologies across multiple

platforms. We live in a world

where customer requirements

are getting more specialised,

more complex and collaboration

is the key to surviving and

thriving in this new landscape.

locations

globally

locations

in India

As the trusted partner of our customers’ digital

journey, Tech Mahindra not only designs, integrates

and operates customer solutions specific to

partners’ technology, but also develops high-end

technologies, products and indigenous IPs that bring

unique additional value in performance and security.

Our objective is to co-innovate with customers to

enhance processes and experiences across the

board. The Makers Lab is a Research & Development

hub for co-innovation of solutions of the future with

customers, partner companies, research institutions,

universities, and start-ups. Open collaboration is the

critical enabler for innovation within the R&D hub.

Entellio – Supervised, self-learning NLP/AI/ML-

based enterprise chatbot

X-Retail – Next generation retail

transformation platform

Storicool – A story or content creator, which

creates animation stories using natural

language conversation

Vetturino – Indigenous smart On-Board Diagnostics

(OBD) controller by an all-women team

Darpan – Application made for farmers by Makers

Lab in their bet for Agritech within the country to

enable farmers to keep a record of their expenses

Makers Lab is

now present across

Our IPs

22

Road ahead

For the past five years, Makers Lab

has been focusing on six dierent

radical technologies

We help synergise businesses and

simplify their complex operations, helping

them stay ahead of the curve. Going ahead, we

look to innovate and build solutions in areas of

ML and AI

Build smart and revolutionary machines to combine

Emotional Quotient (EQ) with Intelligent Quotient (IQ)

~ EQ+ IQ = EI (Extended Intelligence)

Delivered several use-cases globally

• Video encryption using quantum key

generation developed by UK Makers Lab

• Driving AR and VR with a Tier

telecommunication company through

Bangalore Makers Lab

• New Zealand (NZ) Makers Lab assisted

in writing software for robotics based

enhanced assistant for a Tier customer

• Pune Lab researching with top institutes

around the world on neuroscience inspired AI

Focusing on co-creation

with customers

Space

Agritech

Autonomous

Vehicle

Quantum

Computing

Ethical

AI Switch

Education

+ Access

• Tele-medicine platform – Remote medical

assistance via remote consultations

• SEIR modelling – What if analysis – tool

for prediction of spread of pandemic with

various levels of lockdowns

• SOS Seva – Citizen help – managing

emergencies – helping all citizens to stay

safe and ensure they get quick help

• ePASS – Emergency solution - managing

emergencies – controlling movement of

people during pandemic

Innovation to win the war

against the pandemic

Extended Reality

Perceive, visualise, and extend

reality via enterprise gamification

IoT and Robotics

Interpret and analyse the world around us

Blockchain

Secure reality via distributed ledgers

Design Thinking

Consider the ‘why’, before the ‘what’ and

the ‘how’ to deconstruct the complex

Quantum Computing

Extend through research the physical to the

quantum world, where we try and solve the

unsolved. We are the first SI to implement a

quantum encryption use case

Annual Report 2019-20 23

Strategic Review

Total number of

associates certified

across various

streams of Automation

and AI technologies

The emergence of digital disruption prompted us

to move fast, build intelligent automation services.

AQT (Automation-Quality-Time) is our change

framework to continuously increase business

eciency through Robotic Process Automation

(RPA) and AI technologies.

Automation and AI solutions continued

to make strides during the year. We further

strengthened our competencies with in-house

platforms, partnerships with top providers and

start-ups to enhance our portfolio, helping address

intelligent process automation, conversational AI,

text analytics and Natural Language Processing (NLP),

alongside computer vision and advanced analytics

solution areas. We developed + use cases

and solutions across key domains to solve

business concerns.

As a premier member of the Linux Foundation

AI project, we continued our investments in

Acumos AI platform, and launched the enterprise

version of Acumos called GAIA to accelerate the

industrialisation and democratisation of AI.

GAIA provides EE life-cycle management for

Automation framework

,+

Connect

Faster, replicable

outcomes are critical

for a disrupted

operating environment

In a digital economy and

society, businesses must build

nimble operating models

that help deliver integrated

technology solutions.

AI and serves as a marketplace for monetisation and

re-use of industry solutions and use cases. Adoption

of AQT, our automation framework, for ongoing

engagements crossed + customers and continues

on the fast track. We have ,+ certified associates

in automation and AI technologies to strengthen our

upskilling agenda using AQT proficiency framework.

Our cognitive operations automation platform, TACTiX

won the Express IT Awards under the Digital Solution

of the Year category.

24

The #NewAgeDELIVERY engine aims at bringing in

eciencies and productivity in the entire software

development lifecycle (SDLC) phases of IT service

delivery. It allows dynamic identification of new

skills demand through deep data analytics and

AI, encouraging associates to reskill by choosing

courses online and getting industry-recognised

certification. The process helps the project team’s

ecacy and increases the knowledge quotient of the

individual significantly. The engine focuses on:

With our skilling vision ‘Creating future-ready

workforce today, while fulfilling associates’ career

aspirations’, our aim is to develop well-rounded

professionals who are aligned with the Company’s

core values, the Mahindra brand philosophy

and possess the right technical skills with an

entrepreneurial and solution-oriented mindset.

The Upskilling-as-a-service platform of

#NewAgeDELIVERY is enabling our teams to

stay relevant and develop a culture of continuous

learning. The AI based platform provides interactive,

on-demand, contextual and personalised #upskilling

to associates in self-service mode. ,+ skill

knowledge units using world class content and

assessments empower the associates to become

full stack ready.

As part of our TechMNxt charter, we introduced the

initiative — #FitFuture, that creates a future-ready

workforce through upskilling and right-skilling.

The programme is designed by pre-empting

customers’ evolving and dynamic needs. We focus

on technology innovation within AI, Blockchain,

cyber security and AI-infused IoT solutions.

#NewAgeDELIVERY (NAD) Right-skilling talent

Enables teams to increase productivity and

time to market using ready-to-use, pre-tested,

industry-grade digital assets

Focuses on AI-powered continuous learning,

recommended by the engine to consume

bite-sized micro-learnings and create full stack

SCRUM commandos

Facilitates teams to test the outcome before

the first line of code leveraging massive reuse,

collaboration and automated delivery to arrest

design debt at every step

Works with the best multi-skilled talents globally,

ensuring the customer is part of the team

Uses gamification to rank and rate assets,

portfolio, team members and partners

to create a competitive environment and

substantially enhance productivity

Significant reuse

Upskilling

Design thinking

Collaboration

Gamification

Associates

undergoing upskilling

in technology, domain

and leadership skills

Career paths, through

RIDE programme

under #FitFuture

Associates

are proactively

becoming

ready for future

,+

,+

Annual Report 2019-20 25

Strategic Review

Change

Tech Mahindra helps clients define their digital strategy

based on their business strategy and trends in their

industry. We help them design new business and

organisational models. We use Design Thinking

workshops to work collaboratively with client

stakeholders and create prioritised execution

roadmaps, business and technology architecture,

and people capability development plans. We

help clients define and manage outcomes: from

creating the right business cases to implementing

and managing change across people, process,

technology and partners.

Tech Mahindra uses its consulting models and

frameworks to assess Digital Maturity, Supply Chain

Risk, Industry . Maturity, etc. Among others, we have

worked with a North American logistics major to create

their digital strategy for x growth, and have created

a full blueprint to achieve Industry . for a global

automotive manufacturer. Both these clients are using

Tech Mahindra services to implement the strategy.

We help our clients engage better across the

customer lifecycle, crafting the right experience at

each stage. With our investments in Pininfarina, the

BIO agency, Dynacommerce, Mad*Pow, and BORN,

we bring the best design minds from across the globe

to create a compelling blend of physical and digital

experience. These organisations work with

Tech Mahindra’s

technology teams to use the power of technology

and platforms to implement their design concepts.

Whether it is creative, content, campaigns or

commerce, Tech Mahindra has the skills and IP to

design and execute. Last year, we enabled a leading

bank in North America to provide a completely

reimagined, easy-to-use, fully online, mortgage

experience to their customers, enabling them to

borrow upto $ Million in minutes.

Digital heralds an

all-encompassing

transformation

Strategy & Design Digital Customer

Digital Insights Digital Foundation

Tech Mahindra has evolved

organically and inorganically

in digital. As a part of a

transformation journey which

begun in , the Company

invested in a strategic initiative

called ‘DigitALL’ that transformed

internal processes as well as

market-facing capabilities.

Aligned with TechMNxt philosophy, we constantly

invest in next-generation capabilities which we align

to clients’ businesses through our Digital Themes,

which are explained below.

Strategy

& Design

Digital

Customer

Future

Enterprise

Intelligent

Operations

26

In this theme, we help clients to experiment with

new technologies and determine how to use them

to create their future enterprise. Our network of

innovation labs (termed Makers Labs) allows clients

to quickly create proofs-of-concept for various

business needs, and then decide where to make their

investments for the future. They are able to leverage

our investments in what we call RADIQAL (Mixed

Reality, Artificial Intelligence, Distributed Ledger, IoT,

Quantum Computing, All powered by G), along with

an ecosystem of + startups, industry partners,

and academic institutions, to get a curated set of skills

and IP in one place.

Some of our recent engagements have been

preventing unsolicited communication across

Million

subscribers using blockchain for a leading

Indian Telco, and creating the world’s first cloud-native

lab for G roll out for a Japanese conglomerate.

In this theme, we improve the eciency of clients’

business and technology functions. For business

functions, we assess and automate processes, and

use AI to significantly improve productivity. In the

factory, we use Industry . principles with robotics

and IoT to improve quality and throughput.

Tech Mahindra uses its proven strengths in business

process consulting, engineering, automation

and IP in vertical platforms such as WarrantEaze

(managing the warranty process for manufacturing

clients), Connect Sense (Patient engagement

suite), FEEDS (Farm to Fork supply chain

management). Our intelligent operation solutions

have helped a large telco in the US achieve

savings of over $ Million in inventory costs and

a leading bank to realise a return of $ . for every

$ invested in automation.

All the above themes use Tech Mahindra’s digital insight

capabilities extensively, by harnessing the potential

of data, analytics, and cognitive technologies to

derive actionable and impactful insights. We help

clients define and streamline their data strategy.

We leverage multiple platforms and frameworks,

such as PRISM (predictive analytics), GAIA (platform

for hosting AI models), iDecisions (industry-focused,

highly-customisable packaged analytics solutions) to

drive the right insights for their business.

A leading bank in India has used these services to

improve cross-sell revenue by %. We have helped

a telco market leader in ANZ to reduce operational

cost by preventing truck rolls for customer service,

using AI and ML.

Delivering experiences with

We help clients create a robust, secure, and

future-proof digital foundation by adopting the right

platforms, frameworks and methodology. We help

clients move to a product-based agile organisation,

automate IT using DevSecOps, implement

microservices, cloud and low-code/no-code app

tools, all using our investment in platforms and IP.

Using Tech Mahindra’s New Age Delivery platform,

a European Telco achieved % increase in

productivity and % decrease in defects.

Future EnterpriseIntelligent Operations

Digital Insights Digital Foundation

Strategic Review

Annual Report 2019-20 27

Strategic Review

Environment

Reimagining

sustainability

Tech Mahindra believes that

agility, simplicity and resilience

will help businesses become more

sustainable. We are moving towards

a zero-carbon resilient economy

by adopting sustainable practices

and next-gen technologies.

These imperatives will shape the

future of how we live, work, and

use technology to ensure we

are sustainable and profitable

in the long term.

• Implemented Carbon Price- $/tonne CO

• Renewable energy mix increased to .%

from .% in FY

• Scope + absolute emissions reduced by

.% (from FY)

• Recycled ~ Million litres of water through

sewage treatment plants

• Paper consumption reduced by % (from FY)

• Single-use plastics banned across campuses

• Planted ,+ trees

Our sustainability framework is geared towards

building an enduring business by rejuvenating

the environment and enabling stakeholders

to Rise. We ensure that we are a great place to

work, foster inclusive development and ensure

making sustainability personal.

We help enrich the environment by aiming

to be carbon neutral, become water positive,

ensure no waste to landfill and promote

biodiversity. Growing our green revenue,

mitigating climate risks, embracing technology

and innovation and enhancing brand equity,

while also making our value chain sustainable

are our means of building an enduring business.

Sustainability Framework

Environmental Highlights:

The Tech Mahindra Board has an oversight to all aspects

of sustainability & climate change and considers Task

Force on Climate-related Financial Disclosures (TCFD)

recommendations for climate change risks. The next

level has the CSR committee of the Board responsible

for all aspects of Sustainability and sets the course for

promoting the Sustainability agenda within the company.

Our CEO & MD is the chairman of the committee and has

the ultimate responsibility of sustainability and climate

change at Tech Mahindra. He is ably supported by the

Chief Sustainability Ocer and other CXOs who are

members of the Sustainability Council. They strategise,

review and monitor all climate change and sustainability

issues, including climate-related risks and opportunities.

Sustainability Governance

28

Tech Mahindra aligns itself to the Paris agreement

on climate change and supports eorts to hold

global temperature rise to within .°C above

pre-industrial levels by implementing the following

sustainable practices:

1. Adopt low emission technology

Replace existing equipment with more ecient

and environment-friendly alternatives viz.

LED, motion sensors, ecient equipment etc.

Increase use of renewable energy through onsite

installations and PPAs.

2. Leverage green soluons

Key initiatives include micro grid as a service,

smart city solutions, smart grid, smart data

hubs, smart street light, smart bin, smart energy

management, smart metering and analytics, IEVCS

(Intelligent Electric Vehicle Charging System),

CAPE (Community Action Platform for Energy) and

Blockchain PP (peer to peer) trading.

3. Technology disrupon

Co-create innovative solution with technologies

like IoT, Automation, Blockchain and AI in

sustainability that will help enable a pathway

to reduce emissions and other impacts of

climate change. GAiA powered by Acumos is our

open source AI platform, reshaping work, life,

communities and the planet.

Carbon Neutrality

The rise in the Earth’s temperature has resulted in

increased severity of extreme events, changes in

precipitation patterns, extreme variability in weather

patterns and rising sea levels, all posing serious

impacts on the way we operate our business.

Tech Mahindra has business continuity and disaster

recovery plans to handle climate-related impacts

and a rapid incident response team for all cyber and

security incidents. We are investing in low carbon

technologies, implementing an internal carbon

price, developing green solutions and using cloud

computing and virtualisation to reduce the impact

of climate related risks and drive energy eciency

initiatives in line with GHG regulations.

Emerging Climate Risks

We believe in inculcating the spirit of personal

sustainability and have a team of passionate

associates, the Green Marshals, driving our

‘Making Sustainability Personal’ programme.

They spearhead the cause of environment and

sustainability across the Company, initiate activities

and encourage advocacy campaigns to increase

awareness towards sustainable way of life.

Tech Mahindra’s commitment to corporate governance,

ethical business conduct, environmental stewardship

and sustainability also extends to our sustainability.

We assess and conduct site audits and conduct

workshops for our key suppliers on ESG parameters.

Comprehensive risk analysis done on our supply chain

helps the business continuity management system

to view, plan, coordinate and execute strategies

accordingly to mitigate the risk.

The United Nations SDGs have become a

platform for stakeholders to work together to

develop solutions on a global stage. We have

embarked on a journey to embed the SDGs into

our business planning and activities, with a focus

on those SDGs that most closely align to the areas

where we have the greatest influence and impact.

Our contribution towards SDGs forms a blueprint

to achieve a better and more sustainable future.

Enable Sustainable Workplace

Supplier Responsibility

Sustainable Development

Goals (SDGs)

Annual Report 2019-20 29

ESG Performance

Social

TechMighties

propel our

progress

Our associates fuel our technology and

services leadership. We bring together people

with myriad views, skills and backgrounds and

ensure we create a diverse and inclusive work

environment where people have the freedom

to explore. We make our TechMighties

‘Fit for the Future’ and give them meaningful

human experiences.

Our culture defines what we stand for as an

organisation. It dierentiates and unites all

TechMighties. A positive work culture is never

accidental — it is created by design. And our

culture is articulated and reflected in three

tenets: Driving positive change, celebrating

each moment and empowering all to Rise.

Through these three elements, we change

stakeholders’ lives for the better, celebrate

every moment and help others become more

empowered versions of themselves. By living

our culture, both as individuals and as a team,

we establish and advance our presence

as a global, innovative and caring brand.

Our culture is what drives us to become

a Company with a Purpose.

Each one of our associates have played a major

role in our journey and are responsible for

living our culture and making a dierence.

To celebrate the ‘good’ within the Company and

cheer for ‘what could be better’, we introduced

the #lovetobeTechM initiative. The word ‘love’

was chosen as it is one of the most powerful

emotions a human being experiences. Love

is also one of the strongest bonds between

the Company and its associates. Through

this initiative, TechMighties shared their

appreciation and pride for Tech Mahindra. The

stream of stories, testimonials and anecdotes

from our associates have demonstrated that

the spirit of the organisation and sentiment of

shared purpose is very strong.

Our culture drives us to create

‘a Company with a Purpose’

#lovetobeTechM is a celebration

of human experiences

‘We create the best human

experiences for our associates

with a healthy and inclusive

environment; ensuring our

associates are future-ready;

fostering innovation with

meaningful work; driving

performance orientation for

individual and organisational

growth, while celebrating

each moment.’

People policy

Total no. of associates

including subsidiaries

,,

FEB 2020–JAN 2021

INDIA

Certified

30

We are a certified ‘Great Place to Work’ (GPTW). It is

an important validation of the pillars of our culture

and the initiatives taken to ensure associate delight:

• We successfully ran the largest transformation

programme of reskilling our associates for

a brighter future with UaaS (Upskilling as a

Service) platform

• Maintained the mantra of ‘Wellness>Business’

and continued to promote the wellbeing

of associates

• Robust rewards and recognition practices giving

us industry leading numbers for associates

being recognised and for budget utilisation

• Associate experiences are at the centre

of every process/initiative, be it UVO

chat-bot, facial recognition or K, our first

humanoid associate

• Introduced progressive policies like insurance

coverage for same sex partners, support for

gender reassignment surgery, extension of

adoption leave for same sex partner and

single parents (male) among others

• Strengthened our commitment to society and

climate change through smart centres and

cities and by pledging to create a Company

with a Purpose through sustainable practices

Tech Mahindra is a

Great Place to Work

ESG Performance

Annual Report 2019-20 31

Making talent future-ready

Our people philosophy manifests itself in mantras like

FitFuture where we train associates to pursue growth,

focus on leadership development and create self-driven

career plans. By developing ‘Future-Ready Talent’ we

stay ahead of the curve by ‘sensing and anticipating’ the

future of work and the kind of skills needed to support

organisational revenue growth. We also develop ‘Future

Focused Leadership’ to achieve both financial and social

goals in a continuous disruptive world. The aggregate

performance and skills of our people, which are a sum

of the individual abilities and performance of each of

our TechMighties, has a direct impact on the Company’s

key metrics like revenue, growth and profitability.

Our approach to learning

Our customers expect the best and the brightest to help

them transform their businesses. Hence, we encourage

our associates to stay apprised of developments in the

industry and learn anytime and anywhere. We oer

blended learning modules, inclusive of crowdsourcing,

discussion forums, and video sharing through a skill

marketplace — UaaS (Upskilling as a Service). This AI-

based system as part of our ‘#NAD (New Age DELIVERY)’

platform identifies relevant future technologies and

provides contextual and real-time upskilling to associates.

Diverse by nature

A diverse and inclusive workforce is the underlying

basis to nurture innovation, creativity, and for talent

to thrive in an increasingly global and competitive

market. Our operations span over countries and

we recognise the value diverse people bring to the

workplace. We believe in being ‘intentionally diverse’,

which essentially means that we encourage inclusive

practices across all aspects of gender, sexuality,

generation, socio-economic strata, stakeholders,

cultures, belief, abilities and technology.

Social

Community

wellbeing is

our priority

At Tech Mahindra, our objective is to

empower communities by extending

our radius of responsibility beyond

immediate benefit to lasting good.

Our commitment and sincerity to

helping change lives for the better

is as intense as to cutting-edge

technology and innovative solutions

to our customers.

Tech Mahindra Foundation (TMF)

Tech Mahindra Foundation—the Corporate Social

Responsibility division of Tech Mahindra was

established in , as a Section Company

(referred to as a Section Company in the

Companies Act, ). TMF works for children,

youth and teachers from urban, disadvantaged

communities in India, with a focus on women

and persons with disabilities. TMF operates from

Chennai, Bhubaneswar, Chandigarh, Delhi-NCR,

Hyderabad, Kolkata, Mumbai, Nagpur, Pune,

Visakhapatnam and Bengaluru.

High-impact projects

Partners

Total no. of children, teachers

and youth impacted in FY

,

Tech Mahindra Foundation and Mahindra École

Centrale, our Corporate Social Responsibility arms

ensure continuous engagement with stakeholders

to create maximum impact on beneficiaries.

Our CSR vision:

Empowerment

through Education

32

Education

Shikshaantar

Mobile Science Lab

Breakthroughs come about when organisations look

for solutions, the nature of problem notwithstanding.

TMF actions the government agenda of Sarva

Shiksha Abhiyaan by ensuring quality education

across all its partner schools through its primary

school improvement programmes. The objective

is to look at four connected dimensions in overall

development of schools and the learnings provided

therein. They are as follows:

Shikshaantar works to build greater capacities among

government school teachers through workshops,

learning festivals and experiential activities.

Through its partnered and directly implemented

projects such as the In-Service Teacher Education

Institutes of North Delhi and East Delhi, TMF has

augmented its education portfolio.

To increase TMF’s influence in education and maximise

reach, it launched a unique initiative during the year:

the Mobile Science Lab. A Mahindra bus was remodelled

into a science laboratory on wheels. It goes from school

to school in East Delhi to cover Science, Technology,

Engineering and Mathematics (STEM) learnings.

During the year, the initiative received massive response

from over , children, with a potential to expand

manifold in the future.

Under this flagship Education initiative,

TMF partners with local government

schools and credible NGOs for long-term

school improvement programmes.

All Round Improvement in

School Education (ARISE)

• Academic dimension—to warrant children’s

acquisition of grade-appropriate learnings

• Social dimension—to ensure that students’

families are equal stakeholders in their holistic

learning and development journeys

• Infrastructural dimension—to create

happier classrooms

• Organisational dimension—to ascertain that

schools are equipped with latest curriculum

and trained teachers for the organic

growth of children

Students covered

under the programme

Teachers

trained in FY

Government schools

turned into model

schools of excellence

,

,

Annual Report 2019-20 33

ESG Performance

Disability

The third major area of intervention, inclusive of

employability and education initiatives, is for the cause

of uplifting people with disabilities. Our Board mandates

the need for % of beneficiaries to be PWDs. The

two major programmes under Disability are ARISE (All

Round Improvement in School Education) and SMART+

(Skills for Market Training for Persons with Disabilities).

In FY, TMF expanded its scope of work for children

with disabilities. ARISE, an education programme,

provides children with chronic therapy and special

education to help them lead more fulfilling lives.

Through projects, the programme enabled ,

children with disabilities to become more independent

in managing themselves and become better learners.

To ensure that youth with

disabilities are a part of the

mainstream skilled workforce

cadre, TMF’s SMART+

programme trains them in

market-related skills for dignified

jobs in hospitality, BPO, retail,

and IT-enabled industries.

SMART Centres

SMART Academies

Employability

Skills-for-Market Training (SMART) is TMF’s flagship

programme in employability. It is built on the vision of an

educated, enabled and empowered India, and the belief

that educated and skilled youth are the country’s true

strength. These include SMART and SMART+ centres

(training for people with disabilities), alongside SMART-T

centres (training in technical trades).

TMF launched the Tech Mahindra SMART Academies,

which provide the highest quality of skill training to

youngsters in healthcare and digital technologies.

During FY, , students were enrolled in the