New horizons

Annual Report

2023

B PolyNovo Limited Annual Report 2023

CONTENTS

Our Vision 1

Our Values 1

Our Performance 2

Chairman and CEO Report 4

A Year in Review: Swami Raote 6

Global Strategy 8

Multiple Options For Global Growth 9

Expanding Global Reach 10

NovoSorb® MTX 12

Clinical Trials 13

Directors’ Report 14

ESG Statement and Corporate Governance 25

Remuneration Report – Audited 28

Auditor’s Independence Declaration 38

Consolidated Statement of Comprehensive Income 39

Consolidated Statement of Financial Position 40

Consolidated Statement of Changes in Equity 41

Consolidated Statement of Cash Flows 42

Notes to the Consolidated Financial Statements 43

Directors’ Declaration 74

Independent Auditor’s Report 75

Shareholder Information 79

Corporate Directory 81

NovoSorb MTX

Received FDA 510(k) clearance

on 19 September 2022. NovoSorb

MTX represents a major product

innovation for so tissue

regeneration.

Read more on Page 12

1PolyNovo Limited Annual Report 2023

OUR VISION

Healing.

Redefined.

Our mission is to innovate and bring disruptive

technologies to market by partnering with the

best minds to improve patient outcomes and

reimagine the standard of care.

We refreshed the company Vision, Mission, and Values in FY23 which

will serve as guiding principles as the company continues to grow.

A collaborative eort engaging sta, clinicians and leaders, our Vision, Mission

and Values speak to our shared purpose to redefine healing to the benefit of

patients across the world.

We see an exciting future of continued expansion and innovation, fuelled by

our people, a network of surgeon advocates and continued investment in the

drivers of growth.

We put

patients

first.

We earn

trust.

We

innovate

boldly.

We believe

in each

other.

We respect

and nurture

diversity.

OUR VALUES

2 PolyNovo Limited Annual Report 2023

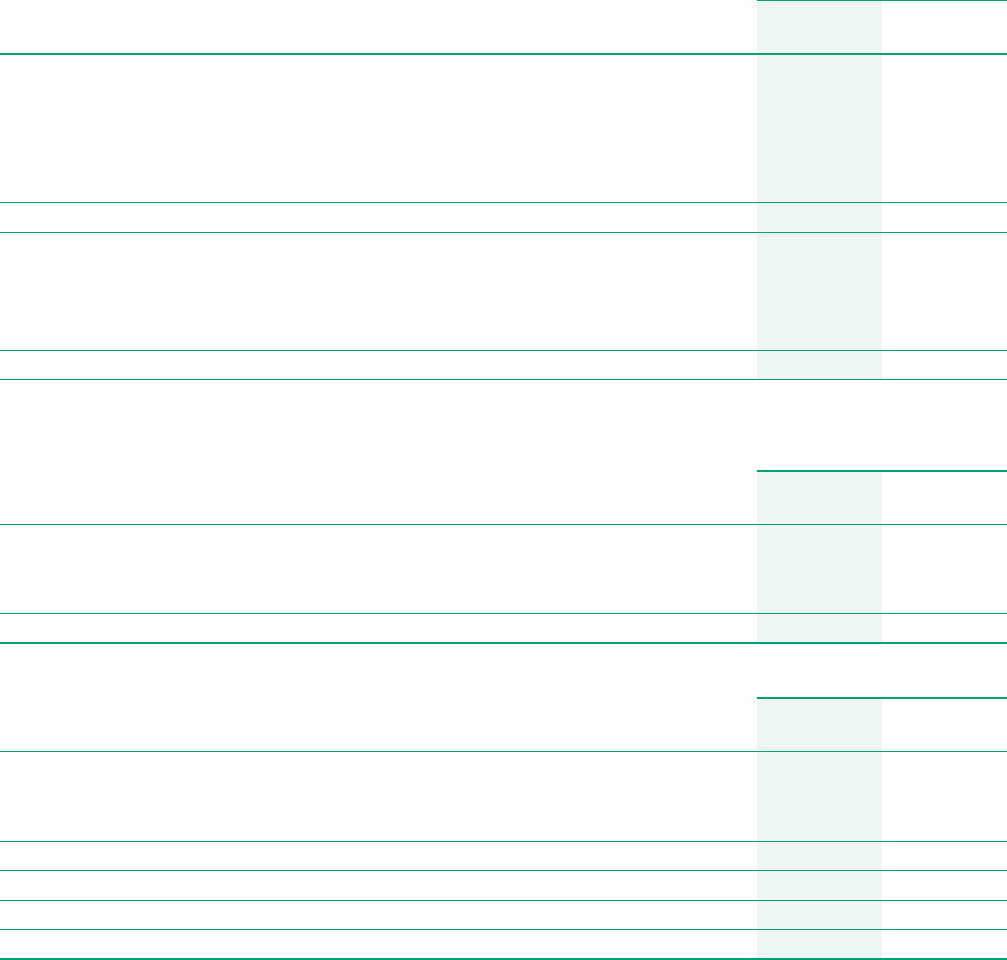

In FY23 sales growth in our direct

markets accelerated, particularly

in 2H23 where in May, monthly

sales exceeded $7 million and

total revenue exceeded $8 million

for the first time. Annual growth in

NovoSorb sales of 58.3% reflects

the strength of our commercial

teams, surgeon-led innovation,

and increasing demand for our

products globally.

OUR PERFORMANCE

58.3%

FY23 $59.6m | FY22 $37.6m

NOVOSORB GROUP SALES

58.8%

FY23 $66.5m | FY22 $41.9m

TOTAL GROUP REVENUE

FY23FY22FY21FY20FY19FY18

$66.5m

$41.9m

$29.3m

$22.2m

$14.4m

$6.8m

58.8%

42.8%

32.0%

54.6%

110.5%

TOTAL REVENUE

GROWTH

3

29.3%

FY23 $7.4m | FY22 $5.7m

R&D EXPENDITURE

667.7%

FY23 $46.8m | FY22 $6.1m

CASH ON HAND

43.4%

FY23 218 | FY22 152

TOTAL EMPLOYEES

53.9%

FY23 $38.3m | FY22 $24.9m

EMPLOYEE RELATED

EXPENDITURE

(EXCL. SHARE BASED PAYMENTS)

44.6%

FY23 $46.1m | FY22 $31.9m

NOVOSORB U.S. SALES

133.9%

FY23 $13.5m | FY22 $5.8m

NOVOSORB ROW SALES

49.2%

FY23 $5.7m | FY22 $3.8m

BARDA REVENUE

16.0%

FY23 $2.3m | FY22 $2.0m

NET LOSS AFTER TAX

(EXCL. NON-CASH ITEMS)

312.9%

FY23 $4.9m | FY22 $1.2m

NET LOSS AFTER TAX

PolyNovo Limited Annual Report 2023

210.7%

FY23 $1.5m | FY22 $0.5m

CAPITAL EXPENDITURE

4 PolyNovo Limited Annual Report 2023

Sales growth in our direct markets continued to accelerate throughout the

year, particularly in 2H23 where in May, monthly sales exceeded $7 million

and total revenue exceeded $8 million for the first time.

Growth in sales has been driven by organic growth across established

accounts and new account acquisition, facilitated by the continued expansion

of our sales teams across direct markets, especially in the U.S., Australia and

UK. We have entered new markets India, Hong Kong and Canada and launched

a new product NovoSorb MTX, all of which will drive further sales growth.

Dear Shareholders,

Sales growth and geographical market

penetration reflect an acknowledgement that

NovoSorb BTM and NovoSorb MTX are being

accepted by surgeons as the next generation

dermal substitute. Consequently, and more

significantly the technology is changing the

way in which many indications are treated

by clinicians.

The PolyNovo team is proud to receive surgeon

acceptance and recognition that NovoSorb

BTM is a robust, versatile medical device,

delivering superior outcomes with lower

operational complexity and cost. Unprompted,

more surgeons are writing about the product

in journals and presenting their experiences at

conferences. Many of these clinicians have

identified other patient needs that would

benefit from NovoSorb BTM or NovoSorb MTX.

Underneath this surgeon engagement is the

knowledge that patient lives are being changed

for good.

In FY23 sales growth in our direct markets

accelerated through the year and across all

geographies. We had a stand-out result in

May 2023, when our monthly sales exceeded

A$7 million and total revenue exceeded

A$8 million. Monthly sales will always be

lumpy, but the sales graphs show exceptional

growth over the medium term.

Group Performance

Global NovoSorb BTM sales of $59.6m were

up 58.3% on the prior year. The U.S. market

was up 44.6% in AUD and the Rest of World

(ROW) was up 133.9% vs. prior year. Australia

increased sales by 84.3%, UKI 168.8% and

distributors in the EU particularly Germany

grew by 192.8% vs. prior year. These results

demonstrate the eorts of our commercial

teams but also the ingenuity of clinicians who

are driving innovation, new applications, and

the education of their colleagues.

Total revenue of $66.5m was up 58.8% on

the prior year which includes revenue from

the BARDA pivotal trial. With 64 enrolled

patients, we have crossed an important

mid-point in the trial.

Net loss aer tax excluding non-cash items

was $2.3m, up 16.0% on the prior year

$2.0m loss.

Executing on Strategic Plan

NovoSorb BTM has the ability to temporise and

heal deep dermal burns and various other

types of tissue loss comprehensively. PolyNovo

is well known in burn procedures and has the

proven ability to leverage that reputation into

acute care. However, over time clinicians and

their ingenuity has taken us to many new

places – plastic and reconstruction surgeries

associated with trauma, vascular, diabetic foot

and pressure ulcers, oncological and other

complex wound reconstructions. Our

NovoSorb MTX product received 510(k) FDA

approval during the year and already has good

support from surgeons.

The core NovoSorb technology can support

other clinical needs and we are open to

partners to help co-develop, commercialise

or distribute new products. Building successful

partnerships will help PolyNovo reach many

more patients sooner than we could do alone.

During the year, we launched our products in

Hong Kong, Canada, India, Spain, and France.

We are excited about each of these

jurisdictions for dierent reasons. Hong Kong

as a precursor to a China entry, India to prove

we can satisfy the economics of developing

markets and to contribute to the BARDA trial,

etc. We have experienced early and impressive

sales in new markets. Other markets like China

and Japan are on our radar.

CHAIRMAN AND CEO REPORT

Swami Raote

Chief Executive Ocer

David Williams

Chairman

Employees increased from 152 to 218. We

have continued to increase the sales teams in

established markets particularly the U.S. whilst

onboarding sales professionals in the newly

entered markets of Hong Kong and India. We

have invested in building our clinical capabilities

and R&D teams to gain insights, evidence and

build new solutions for clinicians and patients.

Our second manufacturing facility, adjacent

to the current facility was commissioned and

operational in May 2023. The capital raising

of $53 million in November 2022 allows us

to take this further, with a new co-located

manufacturing facility currently being designed

and estimated to be operational in Q1 FY26.

The new facility will service an additional

A$500 million in revenue, approximately

5 times current production volumes.

Outlook

We ended the year 30 June 2023 with

$46.8 million cash, putting us in a strong

position to fuel global expansion.

In FY24 we expect to see strong revenue

growth in direct markets particularly the U.S.,

UKI and ANZ, India, and Hong Kong. We also

expect our key distributor markets of Germany

and Canada will continue to perform well, and

that of our recently appointed distributors in

Spain and France will experience early sales.

Further applications for FDA 510(k) clearances

are expected in FY24 allowing expansion of our

NovoSorb MTX and BTM product portfolio.

Clinical trials are progressing well, and the

BARDA pivotal burns trial recently passed the

mid-way point of 60 patients. 64 patients

have been enrolled and we expect recruitment

to be completed in FY24. A chronic wound

study comparing the use of NovoSorb BTM

combined with negative pressure wound

therapy to clinical standard of care has enrolled

35 out of 64 patients and recruitment is

expected to be completed in late CY 2023.

The NovoSorb SynPath randomised control trial

of 138 patients is being reviewed to make sure

the Mode of Action of SynPath is not

compromised by the study design and the

device is working eectively. 25 patients

have been enrolled so far.

Closing

We would like to thank our shareholders for

their continued support and confidence.

We would also like to thank the clinicians for

their input and support. Lastly, we would like

to thank our team around the world for their

hard work and enthusiasm.

David Williams

Chairman

Swami Raote

Chief Executive Ocer

5PolyNovo Limited Annual Report 2023

We are excited about the

year ahead but below we

catalogue some of our

achievements in FY23:

• Annual NovoSorb BTM revenue

growth of 58.3%

• Annual U.S. revenue growth

in $AUD of 44.6%

• Annual ROW revenue growth

in $AUD of 133.9%

• First $7 million sales month in

May 2023 (May 2022: $3.3 million)

• Completion of $53,000,000

capital raising

• Received for 510(k) clearance

from the FDA for NovoSorb MTX

• Successfully entered Hong Kong,

India, and Canadian markets

• Grew the U.S. team from 54 to 93

and increased the U.S. customer

accounts from 189 to 299 hospitals

• In our direct markets including the

U.S., we increased our customer

accounts from 470 to 638 hospitals

• Increased sta from 152 to 218

• Enrolled 64 patients into the U.S.

BARDA pivotal burns study (53%)

• Enrolled 25 patients into the U.S.

DFU Chronic Wound study for health

insurance reimbursement (18%)

• Enrolled 35 patients into the

chronic wound study with Flinders

University South Australia (55%)

• Leased an adjacent property in

Port Melbourne to significantly

increase manufacturing capacity

• Awarded Victorian Government

grant for manufacturing Diabetic

Foot Ulcer product (NovoSorb

SynPath)

6 PolyNovo Limited Annual Report 2023

A YEAR IN REVIEW: SWAMI RAOTE

What are the highlights

of the past 12 months?

My highlights are:

a) our acceptance by clinicians as being

the next generation standard of care

for burn care,

b) outpacing the global dermal implant

category by a factor of ten and winning

market share in all geographies we are in,

c) shareholders and new investors providing

funding for accelerating our global growth,

d) launching in India and ensuring that our

simple, transformative, and cost-eective

technology was available to patients who

needed it but were constrained due to cost

and lack of availability.

Can you provide an

update on global growth?

We have expanded our presence in the U.S.

and entered Canada, Hong Kong, India and

very recently, Spain and France. We are

investing to ensure the growth of NovoSorb

BTM in so tissue reconstruction due to

trauma, oncological resection, hand surgery,

limb salvage, vascular diseases, and many

other disease etiologies. Surgeons are excited

by the NovoSorb technology, and we are

following them to provide solutions to their

clinical needs.

In terms of products, we are strengthening

eorts behind NovoSorb MTX, working with

clinicians to understand and support them.

Our product portfolio continues to expand

and evolve in response to their insights. We are

exploring external alliances to partner and build

on our procedural strength in burns, while

leveraging other businesses and academia

for their expertise. Our plans for capacity

expansion are on track for a significant

increase in production to satisfy demand.

What is the biggest

opportunity for PolyNovo

in FY24?

We are focused on expanding the use of

NovoSorb BTM and NovoSorb MTX in the

so tissue reconstruction space, while

maintaining our excellence in burn care.

While we have an amazing technology,

smart partnerships will help us amplify and

accelerate our global reach and impact, in

many types of tissue loss and reconstruction.

We served over 13,000 patients in 2023,

but have the technology and capacity to

serve many times that number.

We are focused on expanding the

possibilities for NovoSorb BTM

and NovoSorb MTX in the soft

tissue reconstruction space, while

maintaining excellence in burns

and developing smart partnerships

to accelerate our growth.

7PolyNovo Limited Annual Report 2023

8 PolyNovo Limited Annual Report 2023

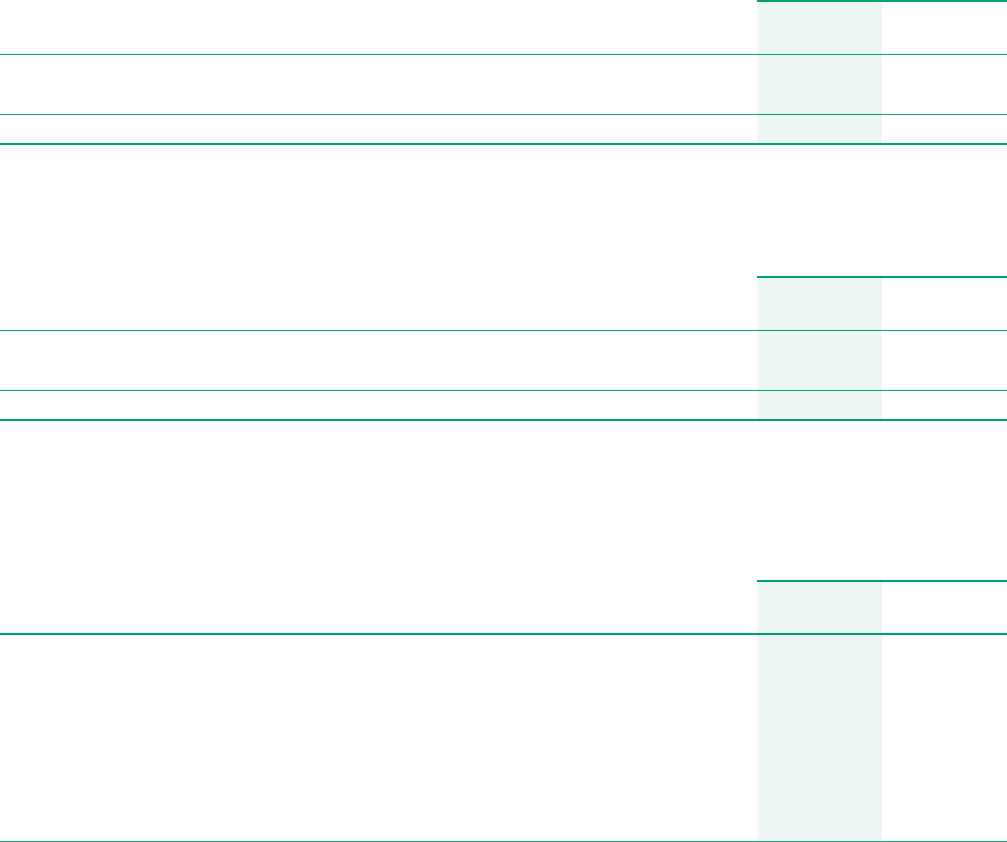

GLOBAL STRATEGY: GRAFTABLE AND IMPLANTABLE

Lead Grow Develop Seed

BTM BTM / MTX SynPath SynTrel

Deep Dermal Burns

Intensive Care

Burn Surgeons

USA / ANZ

Trauma, Necrotizing

Fasciitis, Hidradenitis,

Paediatric

Acute Care

Plastic &

Reconstruction,

Trauma, Paediatric

UK, Germany, Hong

Kong, India, Canada

Vascular, Pressure,

Diabetic foot Ulcers

Acute Care, Outpatient

Plastic & Reconstruction,

General, Trauma,

Surgical Podiatry

Japan, China

Breast Reconstruction

& Augmentation,

Abdominal Wall, Pelvic

Reconstruction, Hernia

Acute Care,

Ambulatory Care,

Physicians Oce

Aesthetic Surgeons

South Korea, Thailand,

Italy, Spain, Brazil

PolyNovo Focus Alliance Potential

Transformational

M&A possibilities

Burns & Trauma

US, entering

Japan, China

Plastic and

Reconstructive Surgery

oriented businesses

Hernia, Abdominal

Wall Reconstruction

Breast Reconstruction,

Augmentation, Aesthetics

Orthobiologics

Continuing to explore

the enormous potential

of our proprietary

NovoSorb resorbable

polymer platform.

The flexibility of configuration (foams, filaments, films, non-woven and woven structures,

thermoplastics), proven biocompatibility, and predictable and tailored resorption profile

provides the opportunity to address unmet clinical needs in dermal repair, so tissue

replacement, and regeneration of missing or damaged structures in both so and hard tissues.

Our current focus has been development of graable applications, best exemplified in our

flagship product NovoSorb BTM that has broad application in burns, acute and chronic wounds,

limb salvage, necrotising fasciitis, and other applications on the surface of the body.

We recently launched NovoSorb MTX which further expands our reach into dermal repair and

regeneration where temporising a wound with the removable sealing membrane is

not required, such as in smaller acute wounds as well as deeper chronic wounds.

Our NovoSorb platform technology also has unique attributes to address implantable

applications, including development of surgical mesh products for hernia (both simple and

ventral), abdominal wall reconstruction, post-mastectomy breast reconstruction, so-tissue

fillers, tendon repair (rotator cu, achilles), and bone regeneration, among others.

Our current focus on implantable applications is for hernia repair utilising both foam and

monofilament forms of the NovoSorb polymer, and plastic and reconstructive applications

following breast reconstruction.

Potential of NovoSorb technology

MULTIPLE OPTIONS FOR GLOBAL GROWTH

Geographic

expansion

• Entered Canada, Hong Kong and

India markets

• Strengthened the U.S. team from 54 to 93

(June 2023) people and increased the U.S.

customer accounts by 110

• Core markets (Australia, U.S.) provide

expertise, evidence, and business model

to support international expansion.

• Increased customer accounts globally

from 470 to 638

• Exploring entry into China and Japan —

the global #2 and #3 medical

device markets

New

indications

for NovoSorb

• Surgeon led insights and innovation are

driving new indications and applications

• NovoSorb BTM is already a leader in third

degree burns in Australia and New Zealand

and is on a steep growth curve in US

• Sales growth for indications other than

burns is accelerating

• Opportunity to increase TAM through

access to new markets with existing

products, e.g.

- Complex Trauma reconstruction,

including paediatric indications

- Diabetic Foot Ulcers

New

products

• Investing in R&D to support new product

and faster commercialisation

• Alliances with global category leaders

and academia for Clinical & Health

economics evidence

• Up-stream application and marketing,

insight generation, biologic sciences,

expand pre-clinical, process and product

engineering, and package engineering

• Opportunity to enter breast reconstruction,

so tissue reinforcement, orthobiologics,

delivery of therapeutics.

Capacity

expansion

to satisfy

growth

• Delivery of new oce space to support

additional investment in enabling functions

e.g., HR, IT and Legal.

• Commenced design of new

manufacturing facility

• New co-located facility with production,

R&D and oce facilities, designed for

scale with focus on flexibility, modularity

and automation

• Will service an additional A$500m in

revenue (~5x current production volumes)

Growth PlansProgress in FY23

9PolyNovo Limited Annual Report 2023

10 PolyNovo Limited Annual Report 2023

EXPANDING GLOBAL REACH

Europe & UK

In the UK, sales have grown significantly from

facilitating NovoSorb BTM usage across a wide

range of plastic specialities. This has instilled

surgeon confidence and secured NovoSorb

BTM use in all the major trauma and burn

centres across the UK.

The team has continued to focus on a wide

range of wounds including, partial and full

thickness wounds, pressure ulcers, venous

and diabetic ulcers, surgical wounds, trauma

wounds, cancer, and scar reconstruction.

Importantly, as the year progressed and

confidence grew, we have also achieved market

leadership in the burns segment. This success

has resulted in sales increasing by 160.3%

over the prior year and the number of hospitals

purchasing NovoSorb BTM has grown from

42 last year to 74.

As experience has grown in the UK, we have

seen the generation of high-quality clinical

data published by UK surgeons and they have

presented regularly at conferences across

Europe, detailing their successful outcomes.

In Europe, our sales eort is supported by

exceptional distribution partners in defined

geographies. Sales in Europe have increased

this year by 182.4%, with the final quarter of

this year being a record. Of particular success,

was our DACH partner who increased sales by

192.8% this year. They also have hospitals

across the country purchasing BTM and are

present in 98% of the burn centres in Germany.

We continue to seek complimentary partners

throughout Europe and have recently filled

stocking orders with distributors in France and

Spain, which will significantly enhance our sales

footprint and enable us to touch more patients.

In addition, we also received first orders from

the UAE. Finally, our 3PL, Movianto Belgium,

provides a European warehouse, which went

live in September 2021, an ecient logistics

solution for the EU.

North America

Our U.S. business is profitable. Sales revenue

and customer growth is strong and defined

by our ability to acquire new accounts and

expand the business within current accounts.

Our focus remains on outstanding patient

outcomes through clinical education.

Growth in the business is fuelled by excellent

clinical outcomes. Our product range is

expanding with NovoSorb MTX 510(k)

clearance and our Limited Market Release

to capture necessary clinical data. NovoSorb

SynPath will be launched in the U.S. aer

completion of a 138-patient Diabetic Foot

Ulcer (DFU) trial which commenced in July

2022. The data from the study will be used

to submit for insurance reimbursement in

the USD $400 million outpatient market.

Our BARDA funded pivotal trial is in progress

with 64 patients enrolled out of a target 120

with recruitment occurring through 21 U.S.

burn centres and one site in Canada. We are

currently enrolling an additional 5 U.S. sites,

4 Canadian and 3 Indian based burns centres.

In early October 2022, PolyNovo received

regulatory approval to enter Canada with our

full indications, including full thickness burns.

We launched at the Canadian Burn Association

meeting which included a symposium hosted

by PolyNovo and our guest speaker Dr. Marcus

Wagsta. Over 200 healthcare professionals

were in attendance. In January 2023 we

added an experienced sales agent and team,

onboarding burn centres and hospitals in

several provinces. We plan to add additional

sales agents in the first half of FY24.

PolyNovo Limited Annual Report 2023

+58.3%

Global FY23 NovoSorb

sales growth

+44.6%

U.S. FY23 sales

growth in AUD

+744.0%

Canada FY23 sales

growth in AUD

11PolyNovo Limited Annual Report 2023

Australia and NZ

Australia grew strongly, and all 14 burns units in

Australia have used BTM. Revenue outside of burns

continues to grow with our shi to trauma, plastic

reconstruction, and other indications. The total

number of patients touched has increased rapidly,

growing by approximately 70%. The team also

acquired an additional 26 hospital accounts. We

have 7 dedicated professionals, with plans to hire

one more.

Our New Zealand business continues its success,

and in FY23, our dedicated market resource

onboarded in FY22 gained early traction with the

newest product in our portfolio, NovoSorb MTX.

The clinical data from use of NovoSorb MTX in New

Zealand will be leveraged to support regulatory

approvals across the globe. NovoSorb BTM

continues to be widely used in burns, but plastic

surgeons are using the product for numerous

non-burn indications.

To educate surgeons about the life-saving

benefits of NovoSorb BTM, a creative program

called “VOW” (Victory Over Wounds) has been

implemented, raising awareness of the potential

impact of NovoSorb BTM.

Recognising the immense potential in India, the

inclusion of the country in the BARDA-run clinical

trial is significant. Three trial sites have been

identified and approved, with the trials scheduled

to commence in September 2023.

Singapore grew strongly in FY23, with sales

increasing by 151.2%.

Our success in Taiwan continues as our current

distributor engagement enters its third year.

An initial focus on small traumas has been

leveraged to move into other indications, including

larger burns. Revenue from this market has seen

significant growth, more than doubling.

Asia

Hong Kong, India, Singapore, Taiwan

PolyNovo ocially entered Hong Kong in October

2022, appointing a highly experienced Business

Development Manager in May 2023 to build on

the initial success in the territory when it was

managed remotely. PolyNovo will quickly accelerate

our footprint in the market by implementing the

model developed in Australia, leveraging leadership

in the burns category to extend into trauma, plastic

reconstruction, and other indications. To date,

5 hospitals have trialled NovoSorb BTM and

2 have purchased product.

India experiences 7 million burn incidents and

has over 100 million diabetes patients with 20%

suering from chronic ulcers. This underscores

the urgent need for NovoSorb BTM.

To address this significant opportunity, a strategic

entry was made into the Indian market through a

Mumbai-based subsidiary, PolyNovo Biomaterials

India Private Limited, supported by a dedicated

team of 16 direct sales professionals. Since the

commencement of commercial operations in

April 2023 over 50 patients have been treated.

+182.4%

Europe FY23 sales

growth in AUD

+84.3%

Australia FY23

sales growth

India

Go Live

April 2023

Hong Kong

Go Live

October 2022

+160.3%

UK FY23 sales

growth in AUD

12 PolyNovo Limited Annual Report 2023

NOVOSORB

®

MTX

Surgeon-led insights

provide avenues for

indication expansion.

NovoSorb MTX leverages the technology

platform underpinning the clinical success of

NovoSorb BTM, without a sealing membrane.

Development of NovoSorb MTX was informed

by clinical experience with NovoSorb BTM, where

early removal of the sealing membrane is followed

by rapid formation of granulation tissue and

wound closure. The product was developed to

satisfy clinician demand for a product for use

in indications where the sealing membrane is

not required.

With NovoSorb MTX, a wound can be closed

with a skin gra or allowed to heal by contraction

and formation of an epithelial layer. This can

simplify wound management and presents wider

applications for common wound healing problems.

NovoSorb MTX is indicated for use in partial and

full thickness wounds, pressure ulcers, venous

ulcers, chronic and vascular ulcers, diabetic ulcers,

and surgical and trauma wounds, oering

clinicians greater versatility in wound

management. NovoSorb BTM and NovoSorb

MTX are complementary, and it is expected

clinicians will use both products.

The NovoSorb MTX product portfolio expands

PolyNovo’s addressable market in the U.S.

by an estimated $AU500M.

FDA 510(k) clearance for NovoSorb MTX

received 19 September 2022

Major product innovation for so tissue

regeneration for the management of

complex wounds

The NovoSorb MTX product portfolio

expands PolyNovo’s addressable market

in the U.S. by an estimated $AU500M

13PolyNovo Limited Annual Report 2023

CLINICAL TRIALS

Description

Randomised controlled pivotal

sponsored clinical trial to assess

the safety and eectiveness

of NovoSorb BTM in subjects

with severe burn skin injuries.

A comparison will be made to the

outcomes resulting from the use

of NovoSorb BTM to FDA-cleared

standard of care, (Integra and

cadaveric Allogra).

Indications

Obtaining additional clinical evidence

to support the use of NovoSorb

BTM as a class III medical device

for the management of deep

dermal/ full thickness burn injury

wounds in the U.S.

Progress

The first patient was enrolled

into the trial in September 2021.

A minimum of 120 subjects will

be recruited in a 2:1 ratio of BTM

to standard of care. To date,

64 subjects have been recruited.

Expected completion

Recruitment is expected to be

completed in Q2 2024.

Description

Randomised controlled sponsored

clinical trial comparing the use of

NovoSorb SynPath to clinical

standard of care in subjects with

non-responsive, chronic diabetic

foot ulcers.

Indications

Obtaining additional clinical evidence

to support a reimbursement code

for the use of NovoSorb SynPath for

the management of chronic wounds

in the U.S.

Progress

Trial commenced in July 2022.

A total of 138 subjects will be

recruited, with equal numbers

in each trial group. To date,

25 patients have been enrolled

into the study.

Expected completion

We are looking closely at the

study design to make sure the

Mode of Action of SynPath is not

compromised in any way and the

device is working eectively in the

patient population.

Description

Randomised controlled investigator-

initiated clinical study comparing

the use of NovoSorb BTM combined

with negative pressure wound

therapy (NPWT) to clinical standard

of care (NPWT alone) in subjects

with neuroischemic diabetic

foot wounds.

Indications

Obtaining additional clinical evidence

to support the use of NovoSorb

BTM for the management of chronic

wounds, namely diabetic foot

wounds complicated by vascular

insuciency, in global markets.

Progress

Study commenced in April 2022.

A total of 64 subjects will be

recruited, with equal numbers

in each study group. To date,

35 subjects have been recruited.

Expected completion

Recruitment is expected to be

completed in late 2023.

U.S. Burns Pivotal

Trial (BARDA)

SynPath

DFU Chronic

Wound Trial

Chronic Wound

Study

DIRECTORS’ REPORT

14 PolyNovo Limited Annual Report 2023

Mr David Williams

B.Ec (Hons), M.Ec, FAICD

Non-executive Chairman

Mr Williams was appointed as a Non-Executive

Director on 28 February 2014 and Chairman

on 13 March 2014. Mr Williams is an

experienced Director and investment banker

with a track record in business development

as well as in mergers and acquisitions and

capital raising. He has experience advising

ASX-listed companies in the food, medical

device, and pharmaceutical sectors. Mr

Williams is currently Chairman of RMA Global

Ltd (ASX: RMY) and is Managing Director of

corporate advisory firm Kidder Williams.

Mr Williams is the Chair of the PolyNovo

Remuneration Committee.

Dr Robyn Elliott

BSc (Hons) Chemistry, PhD Inorganic Chemistry

Non-executive Director

Dr Elliott was appointed a Director of PolyNovo

on 28 October 2019. Dr Elliott is currently

Global Head, Strategic Portfolio Management

at CSL Behring, a role that is responsible for

governance oversight and business value

delivery from a multi-billion-dollar capital

expansion portfolio. Dr Elliott previously held

Strategic Expansion and Quality Senior

Director roles within CSL, was the Managing

Director at IDT Australia and commenced her

career at DBL Faulding. Dr Elliott has a proven

track record in product development, clinical

trials, regulatory aairs, audits, quality

management, project management and

operational strategy. Her worldwide

experience in new facility delivery, production

scale up, strategy, regulatory aairs and audit

will be invaluable to PolyNovo as the company

scales its operations globally. Dr Elliott is a

member of the Audit and Risk Committee.

The Directors of PolyNovo Limited

(PolyNovo) present the Directors’ Report,

together with the Financial Report, of the

Company and its controlled entities (the

Group) for the year ended 30 June 2023

and the related Auditor’s Report.

Board of Directors and

Senior Management

The details of Directors and Senior

Management during the year and until

the date of this report are set out below.

Directors were in oce for the entire

period unless otherwise stated.

15PolyNovo Limited Annual Report 2023

Ms Christine Emmanuel-Donnelly

BSc (Hons) Chemistry, MSc Enterprise,

FIPTA, MAICD

Non-executive Director

Ms Emmanuel-Donnelly was appointed a

Director of PolyNovo on 13 May 2020.

Ms Emmanuel is an accomplished IP and

business development professional with

more than 30 years’ local and international

experience. Ms Emmanuel has a Bachelor of

Science with a major in Economics (Hons:

Chem) from Monash University, Certificate

in Intellectual Property Law from Queen Mary

College, University of London, Masters of

Enterprise from Melbourne University. She is

a member of the Chartered Institute of Patent

Attorneys UK and has been on the Board of

the Institute of Patent and Trade Mark

Attorneys of Australia for over a decade.

Ms Emmanuel is currently on the Board of

Medical Developments International Ltd and

was previously Executive Manager of Business

Development and Commercial at the CSIRO,

having founded and grown the central IP

management team and led the management

of CSIRO’s IP portfolio for over 10 years and

managed the growth of the CSIRO equity

portfolio for 5 years. Previously she was

in-house IP Counsel for Unilever in the UK and

practised as a patent and trademark attorney

for Wilson Gunn (UK) and Davies Collison Cave

and Grith Hack in Melbourne. Ms Emmanuel-

Donnelly is a member of the PolyNovo

Remuneration Committee.

Mr Leon Hoare

GradDipBus, AssocDipAppSc (Orth), GAICD

Non-executive Director

Mr Hoare was appointed a Director of

PolyNovo on 27 January 2016. He is currently

the Managing Director of Lohmann &

Rauscher, Australia & New Zealand (ANZ),

a private EU based medical device company.

Previously he was Managing Director of Smith

& Nephew ANZ (all divisions) until 2015, one

of Smith & Nephew’s largest global subsidiaries

outside the USA. He served as President of

Smith & Nephew’s Asia-Pacific Advanced

Wound Management (AWM) businesses

for 5 years and was a member of the Global

Executive Management for the AWM Division

(as one of three Regional Presidents). In his

24 years with Smith & Nephew, he also held

roles in marketing, divisional and general

management. His career has also included a

senior role at Bristol-Myers Squibb (medical

devices), and as Vice Chair of the Board of

Australia’s peak medical device industry body,

Medical Technology Association of Australia.

He is currently a Non-Executive Director of

Medical Developments International Ltd

(ASX: MVP). Mr Hoare is a member of the

PolyNovo Remuneration Committee.

Mr Andrew Lumsden

MA (Hons) in Accountancy & Finance,

CA, AGIA ACG, MAICD

Non-executive Director

Mr Lumsden was appointed a Director

of PolyNovo on 4 June 2021. He is an

accomplished Chartered Accountant and

finance executive with more than 20 years’

experience locally and internationally. He holds

a Master of Arts in Accountancy and Finance

(First Class Hons), is an Associate of The

Chartered Governance Institute and a member

of the Australian Institute of Company

Directors. Mr Lumsden is currently Chief

Executive Ocer of Wellcom Worldwide

Australasia having previously held the roles

of Group Chief Financial Ocer and Group

Chief Operating Ocer. Prior to joining

Wellcom, Mr Lumsden was a Senior Manager

within the Audit and Assurance practice of

PricewaterhouseCoopers. Mr Lumsden is

the Chair of the Audit and Risk Committee.

16 PolyNovo Limited Annual Report 2023

DIRECTORS’ REPORT CONTINUED

Mr Bruce Rathie

B. Comm, LLB, MBA, FIML, FAICD, FGIA

Non-executive Director

Mr Rathie was appointed a Director of

PolyNovo on 18 February 2010. He is an

experienced Company Director with a finance

and legal background. He practised as a

partner in a large legal firm and acted as Senior

Corporate Counsel to Bell Resources Limited

in its early years. He then studied for his MBA

in Geneva and embarked on his 15-year

investment banking career. When Head of the

Industrial Franchise Group at Salomon Smith

Barney he led Salomon’s roles in the Federal

Government’s privatisation of Qantas,

Commonwealth Bank (CBA3) and Telstra (T1).

He now has over 20 years’ experience as a

full-time professional Non-executive Director.

During the period he was Chairman of

Capricorn Mutual Limited, Chairman of ASX

listed CleanSpace Holdings Limited (ASX:CSX)

and a Non-executive Director of ASX listed

Cettire Limited (ASX:CTT) and Capricorn

Society Limited. In the medical device space,

he is currently Chairman of ASX listed

4DMedical Limited (ASX: 4DX) and was

previously Chairman of ASX listed Anteo

Diagnostics Limited and a Director of

Compumedics Limited and USCOM Limited.

Mr Rathie is a member of the Audit and

Risk Committee.

Mr Swami Raote

B. Pharmacy, MBA

Chief Executive Ocer

Mr Raote was appointed Chief Executive

Ocer of PolyNovo Limited on 29 July 2022.

Mr Raote held the position of Worldwide

President, Vision Care from 2017 to 2021, a

division of Johnson & Johnson the world’s

largest medical, pharmaceutical and consumer

healthcare company, where Mr Raote had a

30-year career. From 2014 to 2016 Mr Raote

served a dual role as the Area Vice President,

Medical Devices for North Asia and Vice

President for Ethicon, Asia Pacific. From 2009

to 2014 Mr Raote served in a variety of roles

across India for Johnson & Johnson including

Managing Director for Janssen India and Area

Managing Director ASEAN and India. Mr Raote

was also President Director in Indonesia from

2004 to 2008. Mr Raote’s early career

included leadership roles across Johnson &

Johnson Asia Pacific in sales, marketing, supply

chain, finance, and IT. Mr Raote is currently a

Non-executive Director of EOS Vision in China

and holds several advisory roles to private and

government institutions.

Mr Jan Gielen

CA, Bachelor Bus (Acc)

Chief Financial Ocer and Company Secretary

Mr Gielen joined PolyNovo Limited on

12 December 2018. Mr Gielen holds a

Bachelor of Business (Accounting) degree

from Monash University, is a member of the

Institute of Chartered Accountants and

commenced his career with Pitcher Partners.

Since then, Mr Gielen has held senior finance

roles for various businesses across a range of

industries such as retail, ICT, logistics (3PL)

& medical, locally and internationally. Mr Gielen

has extensive experience in CFO and Finance

Director roles for fast growing PE and VC

backed businesses and played an important

part in expanding these businesses globally,

both from a financial and operational

perspective. Mr Gielen had a long involvement

from inception with ICIX, a leading SaaS

platform supporting global retailers and

manufacturers where he served as Finance

Director in Silicon Valley. Mr Gielen’s most

recent role was CFO of CardioScan for

6 years, Australia’s largest cardiac reporting

provider, which during his tenure expanded

to HK, Singapore & North America.

17PolyNovo Limited Annual Report 2023

Mr Philip Scorgie

Master, Bus Inf Tech

Chief Information Ocer

Mr Scorgie joined PolyNovo Limited as Chief

Information Ocer on the 22 May 2023.

Mr Scorgie holds a Master’s degree in Business

Information Technology from Swinburne

University and is a Non-executive Director

of Wallara, a disability service provider that

focusses on empowering individuals with

dierent abilities. Mr Scorgie held the position

of Global Chief Information Ocer in Chicago

at the top 20 global law firm, Mayer Brown

from 2012 – 2016. Before working for

PolyNovo Limited Mr Scorgie was an

independent consultant involved in strategic

technology consulting, providing valuable

guidance to diverse businesses ranging from

local manufacturing companies to international

banking and commercial law firms. Mr Scorgie

has extensive experience in a wide range of

technology industries across the globe

including Germany, South Africa and Hong

Kong. Mr Scorgie was the Regional Chief

Information Ocer at Deacons in Hong Kong

from 1997 to 2005.

Dr David McQuillan

BSc (Hons) Biochemistry, PhD Biochemisty

Chief Technical and Scientific Ocer

Dr McQuillan was appointed a Director of

PolyNovo on 6 August 2012. He resigned as

Non-Executive Director and was appointed as

Chief Technical and Scientific Ocer on 1

September 2022. He has extensive technical,

medical, scientific, and regulatory knowledge.

Previously he was a Fellow at the NIH

(Bethesda, MD), an NH&MRC Fellow at the

University of Melbourne, and Associate

Professor at Texas A&M University (Houston,

TX) where he studied Tissue Engineering,

Regenerative Medicine, and Biochemistry of

the Extracellular Matrix. Dr McQuillan was with

LifeCell Inc/Kinetic Concepts Inc (KCI) for 12

years, holding a number of senior roles,

including Vice President for Research and

Development at LifeCell and Senior Vice

President of Advanced Research and

Technology at KCI. He was Chief Science

Ocer for TELA Bio, a VC-funded

development-stage biotechnology company

from 2013 to 2015.

18 PolyNovo Limited Annual Report 2023

DIRECTORS’ REPORT CONTINUED

Review of Operations

Corporate and Organisational

Structure

PolyNovo Limited, the ultimate parent entity

of the PolyNovo Group, is a public company

listed on the Australian Securities Exchange.

As of 30 June 2023, PolyNovo Limited had

ten wholly owned subsidiaries: PolyNovo

Biomaterials Pty Limited, NovoSkin Pty Ltd,

NovoWound Pty Ltd, PolyNovo NZ Ltd,

PolyNovo UK Ltd, PolyNovo North America LLC

(PNA LLC) PolyNovo Singapore Private Ltd,

PolyNovo Ireland Ltd, PolyNovo Biomaterials

India Private Ltd, and PolyNovo Hong Kong Ltd.

The first three subsidiary companies listed

above are Australian proprietary companies

whilst the other entities are the trading and

employment entities for those countries.

Principal Activities and Operations

PolyNovo’s principal activity is the

development of innovative medical devices

for medical applications, utilising the patented

bioabsorbable polymer technology NovoSorb.

NovoSorb is a family of proprietary medical

grade polymers that can be utilised to

manufacture novel medical devices designed

to support tissue repair and which then bio

absorb in a defined fashion in-situ to harmless

by-products. NovoSorb has significant

advantages over competitor bioabsorbable

polymers in terms of its design flexibility and

biocompatibility.

PolyNovo can manufacture NovoSorb polymer

devices with the ability to elute drugs,

antimicrobials as well as be expressed in a

variety of physical formats including:

• Films

• Foam

• Coatings/sprays

• Fibres

• Plastic structures

• Biologic carrier

NovoSorb is currently covered by numerous

patents all fully owned by PolyNovo. PolyNovo

has no royalty or licence obligations to any

other parties. Below is a summary of

PolyNovo’s lead projects.

NovoSorb BTM

NovoSorb Biodegradable Temporising Matrix

(BTM) is used in a fully debrided clean surgical

wound to physiologically ‘close the wound’.

With the BTM scaold in place, the dermal

layer is regenerated within the scaold. Once

fully integrated, the outer layer of BTM is

delaminated and the wound closes through

secondary intention (smaller wounds) or with

the application of a split skin gra.

NovoSorb BTM is sold directly by PolyNovo

salesforce Australia, Hong Kong, India, Ireland,

New Zealand, Singapore, United Kingdom,

and the United States. PolyNovo utilises

distributors for sales in Canada, the EU,

Taiwan, and South Africa. The Company is

working on obtaining regulatory approvals

in other markets to quickly expand our

geographical footprint.

Key attributes of the NovoSorb technology

include an unparalleled range of mechanical

properties and bioabsorption times, excellent

biocompatibility and safety profile and

harmless degradants.

NovoSorb BTM continues to feature in major

clinical conference presentations around the

world. Many new clinical papers have been

published in peer review journals and the

surgeon-to-surgeon referral of the benefits

of NovoSorb BTM continues to accelerate.

19PolyNovo Limited Annual Report 2023

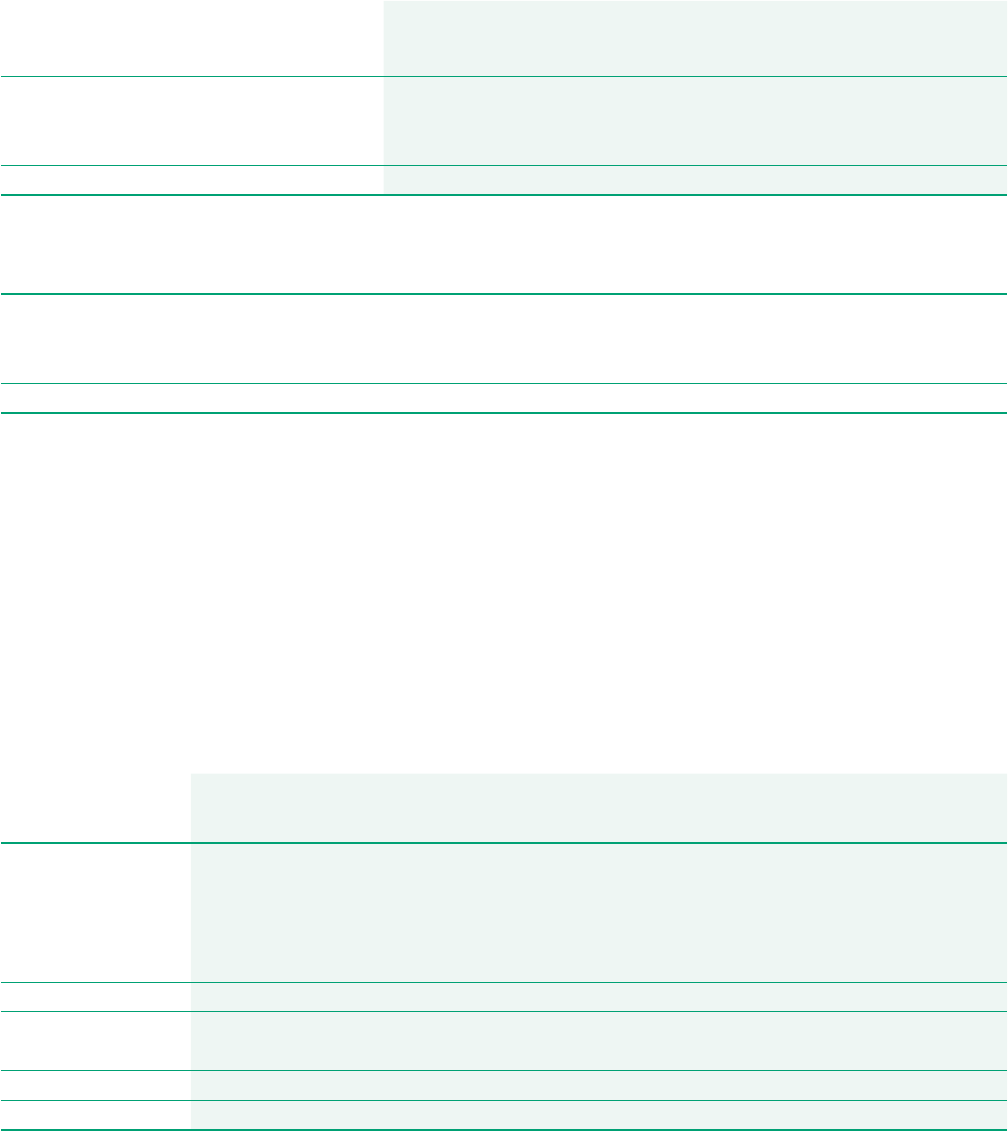

Chart 1: NovoSorb BTM Publication Growth

Publications and videos relating to NovoSorb

BTM applications can be found on our website:

www.polynovo.com.

The company is currently working on

expanding the BTM product range of products.

An additional 510(k) submission to further

support the BTM range will be submitted to

the FDA later in 2023. Additional 510(k)

submissions are planned for 2024.

NovoSorb BTM indication

for full thickness burns

NovoSorb BTM is indicated for full thickness/

third degree burns in markets outside of the

U.S. Full thickness burns treatment for a U.S.

FDA regulatory ‘indication’ requires additional

clinical evidence (trials). A pivotal trial is in

progress and funded by BARDA. Successful

completion of this trial will enable PolyNovo

to file a PMA application for full thickness

burn use and may lead to BARDA stockpiling

NovoSorb BTM for disaster management.

USA Burns Pivotal Trial – BARDA

PolyNovo’s Biomedical Advanced Research

and Development Authority (BARDA) contract

funded by the U.S. Department of Health and

Human Services (Oce of the Assistant

Secretary for Preparedness and Response)

commenced on 28 September 2015. The

feasibility trial concluded in March 2020 and

the Company announced the result for this

trial on 21 April 2020.

PolyNovo completed a swine toxicology

study mapping the full degradation pathway

of NovoSorb BTM during FY20. The data

generated in this study will support our

Premarket Approval (PMA) application and

add to the body of evidence demonstrating

the mode of action of NovoSorb BTM.

The pivotal trial is funded by BARDA to USD

$15 million aer extending the contract in

FY21. The contract is a cost-plus monthly

reimbursement arrangement. PolyNovo will

also contribute to the trial through provision

of product, employee resources and

infrastructure support. The first patient was

enrolled into the trial in September 2021,

and we are currently recruiting patients

through 21 U.S. burn centres and 1 site in

Canada. We are in the process of enrolling

an additional 5 U.S. sites, 4 Canadian sites

and 3 Indian sites to participate in the trial.

Currently, 64 patients have been enrolled into

the study out of a target 120, and we expect

the recruitment to be completed in FY24.

Successful completion of the pivotal trial will

lead to a PMA application with the U.S. FDA

and the use of the BTM scaold in full

thickness acute burns.

Dr Marcus Wagsta is PolyNovo Medical

Director overseeing the clinical conduct of

PolyNovo trials and providing valuable clinical

support for our global medical teams. Dr Tina

Palmieri, UC Davis Sacramento, and Dr. Sigrid

Blome Eberwein, Lehigh Valley, are the

co-principal investigators for the pivotal

trial study.

NovoSorb BTM already has the CE Mark,

a requirement for the EU market, which

includes an indication for use in full thickness

burns as well as other surgical wounds and

reconstructive procedures.

Regulatory update for

NovoSorb BTM

Registrations & Certifications

NovoSorb BTM Medical Device Licence was

issued in October 2022 by Health Canada

in Canada.

NovoSorb MTX 510(k) clearance issued

September 2022 by FDA in U.S.

EU MDR and UK K-CA submissions for

NovoSorb BTM are currently under full

technical review.

Registrations are under review for Bolivia and

Ecuador for NovoSorb BTM and we are in the

initial stages of exploring registration in UAE,

China and Japan.

NovoSorb SynPath

Our NovoSorb SynPath product is being

used in a randomised control trial (RCT)

of 138 patients compared to the Standard of

Care in the treatment of non-healing diabetic

foot ulcers (DFU). The trial commenced on

21 June 2022 and 25 patients have been

enrolled. We are looking closely at the study

design to make sure the Mode of Action of

SynPath is not compromised in any way and

the device is working eectively in the patient

population. The RCT follows the successful

pilot study on 10 patients who presented with

a Wagner Grade 1 or 2 DFU.

The purpose of the study and RCT is to

assess the safety and clinical ecacy of

NovoSorb SynPath to promote wound closure

in non-healing DFU. The data from this study

will be used to submit for insurance

reimbursement coverage for chronic wound

applications in the U.S. outpatient setting.

The market segment has a total addressable

market of USD $400 million.

Chronic Wound Study

This is a randomised controlled study

comparing the use of NovoSorb BTM combined

with negative pressure wound therapy (NPWT)

to the usual standard of care in neuroischemic

diabetic foot wounds. The study will assess

rates and time to complete wound healing and

rates of post-surgical infection, perioperative

complications, and proximal lower limb

amputations. In addition, the impact of

NovoSorb BTM will be explored on a range

of factors including cellular proliferation and

neo-angiogenesis that are known to aect

wound healing, as well as quality of life and

health economics.

The focus of this study is patients with

moderate to high risk of amputation. 35 out

of a total 64 patients have been recruited and

recruitment is expected to be complete late

2023. Data from the trial will provide

additional clinical evidence for its broader

use in patients with diabetic foot wounds

complicated by vascular insuciency.

NovoSorb MTX

MTX has broad applicability for single stage

graing in burns, chronic, surgical, and deep

tunnelling wounds to provide increased

treatment options and better outcomes.

MTX and BTM are complementary, and it

is expected clinicians will use both products

for the treatment of so tissue defects.

MTX comprises BTM foam only without the

temporising film. It is supplied in various sizes.

PolyNovo announced on 19 September 2022

it had received FDA 510(k) clearance for

NovoSorb® MTX with a 2mm thickness and

a U.S. limited market release commenced in

April 2023. The total addressable U.S. market

comprising in and out-patient settings is

estimated at AUD $500 million. An additional

510(k) submission to further support the

MTX range will be submitted to the FDA later

in 2023 with further product extensions

scheduled in 2024.

0

50

100

150

200

250

2018 2019 2020 2021 2022 YTD

2023

26

42

64

108

172

214

20 PolyNovo Limited Annual Report 2023

DIRECTORS’ REPORT CONTINUED

Hernia Repair

PolyNovo has focused its approach to hernia

repair and is developing a targeted solution

for ventral hernia and complex abdominal

wall reconstruction. This comprises a novel

NovoSorb-based textile that will expand

the clinical application of the NovoSorb

polymer technology.

Plastics and Reconstructive

Device Products

PolyNovo previously announced that it has

taken the breast development program

in-house. We envisage this program will

leverage the experience and processes

developed for the hernia devices. The hernia

product development models serve as

eective building blocks for other tissue

reinforcement products in breast,

orthopaedics, and other applications.

We anticipate that manufacturing processes,

technology and equipment will be shared

across a range of new products.

NovoSorb Dermal Beta-Cell

Implant

PolyNovo is supplying NovoSorb BTM in

modified sizes to Beta-Cell Technologies,

a third-party R&D group. Beta-Cell is

collaborating with a global supplier of stem

cell-derived Islet cells for use in this program.

PolyNovo will be supplying NovoSorb BTM in

unique shapes and sizes for the trial and

Beta-Cell will explore the potential of

integrated NovoSorb BTM to host pancreatic

Islet cells in the skin. This treatment holds

significant promise for treating Type 1 diabetes

with reduced reliance on a donor pancreas.

Capital Investment

PolyNovo’s capital expenditure in FY23 was

higher than FY22 due to investing in enhancing

manufacturing capabilities and oce expansion.

This included cleanroom upgrades and new

manufacturing and process equipment.

This capital investment was partly funded

by the Victorian State Governments Medtech

Manufacturing Capability Program in the

amount of $500k.

PolyNovo leased a property in September 2022

located next door to the current facilities which

will more than double the current oce and

manufacturing footprint. The design process

has commenced for the new manufacturing

facility which will service an additional

A$500m in annual sales.

Status of Markets

1H23 demonstrated the unshackling of

Covid-19 impacts with sales up 67.5% on the

prior period and strong customer account

growth. Access to hospitals, surgeons and

logistics capacity is comparable to pre-Covid

era albeit with some remnants remaining.

PolyNovo achieved 58.3% in sales growth for

FY23 including a $7.2m sales month in May

2023 and accelerated customer account

growth with now over 600 accounts in

direct markets.

PolyNovo recorded strong NovoSorb BTM

sales growth in all markets notably in the U.S.

up 34.0% in local USD currency and ROW was

up 133.9%. The ROW increase includes strong

performances in Australia up 84.3%, UK/Ireland

up 168.8%, Germany up 192.8% and also

strong sales in Canada and Hong Kong and

first sales in India. Following the completion

of the $53m capital raising in November 2022

a recruitment drive for the U.S. sales and

marketing teams commenced and 28 hires

were completed by Q4 2023. The ecient

onboarding and training of the new employees

has had a positive impact on sales and account

growth but importantly sets up the business

for further growth in FY24. Inflation and rising

interest rates have increased some costs in

all markets including wages and salaries.

PolyNovo debt level remains low with an

equipment finance facility owing $2,802,941

as at 30 June 2023. PolyNovo maximises

interest earned on cash deposits via high

interest term deposits. To manage the impact

of higher inflation and interest costs we update

our cash flow forecasts to include the impact

of changes in costs. The Group has a level of

discretion in managing cash outflows in response

to changes in the impact of rising costs.

Significant Changes in

the State of Aairs

Other than the above and except as otherwise

set out in this report, the Directors are unaware

of any significant changes in the principal

activities of PolyNovo during the year ended

30 June 2023.

Strategic Overview and

Likely Developments

PolyNovo’s focus over the next 12 months

will be to:

• Continue to accelerate revenue from

NovoSorb BTM in existing markets and

recently entered markets India, Canada

and Hong Kong

• Expand product range of NovoSorb BTM

and NovoSorb MTX

• Identify potential partners in China and Japan

• Identify potential partners for indication

expansion such as hernia and breast

• Finalise device design options for hernia

and breast

• Complete recruitment of 120 patients in

FY24 for the U.S. BARDA pivotal trial for

full thickness burns

• Near completion of the 138-patient

randomised control trial for diabetic foot

ulcers using NovoSorb SynPath

• Sign additional GPO/IDN agreements in

the U.S. to further accelerate sales

• Support BetaCell with the supply of

NovoSorb BTM for use as a dermal deposit

for Type 1 diabetes

• Finalise design and appoint construction

contractor for new manufacturing facility

at 326 Lorimer Street Port Melbourne

Significant Events Aer

the Balance Date

The Directors are not aware of any other

matters or circumstances since the end of the

financial year other than those described above,

nor otherwise dealt with in this report, which

have significantly aected, or may significantly

aect, the operations of the Group, the results

of those operations or the state of aairs of

the Group in subsequent financial years.

Announcements released by the Company

aer 30 June 2023 include:

• 11 August 2023 - Webcast Details

FY23 Results

Financial Results

PolyNovo Limited reported revenue for the

year ended 30 June 2023 of $66,535,017 an

increase of $24,644,414 from the prior year’s

$41,890,603. The net loss aer tax (NLAT)

of $4,924,539 for FY23 was an increase of

$3,732,007 from the prior year’s net loss

of $1,192,532.

Excluding non-cash items of share-based

payments $1,113,207, unrealised forex gain

$787,301 and depreciation & amortisation

$2,282,553, the underlying net loss aer tax

is $2,316,080 (2022: net loss $1,996,442).

Several factors contributed to the result

as follows:

• Revenue from the sale of commercial

products for FY23 increased by

58.3% to $59,578,531 from the prior

year’s $37,643,160.

21PolyNovo Limited Annual Report 2023

• Revenue from BARDA for FY23 increased

by 49.2% to $5,662,938 from the prior

year’s $3,796,679. This increase is reflective

of the patient enrolment in the pivotal trial

which is currently at 64 patients out of a

target 120 patients.

• Other Income includes $408,000 from

Victorian State Government supporting

our manufacturing development and

commercialisation of new products.

• Employee related expenses increased by

84.1% to $39,438,210 but aer excluding

the reversal of share options and share

awards forfeited by the previous CEO and

COO on their resignations in the prior year of

$4,708,151, the increase for FY23 is 50.9%.

This increase is due to headcount increase

to drive and support growth primarily within

sales, marketing, production, research and

development, and quality.

• Research and development expenses

increased by 29.3% to $7,428,821 due

to increased activity in research and

commercialisation of new products.

• Depreciation and amortisation increased

by $448,446 attributable to property,

plant and equipment acquired for the

manufacturing facility and research

and development.

• Corporate, administrative, and overhead

expenses increased by 67.6% to

$17,415,763 reflecting the increased

growth and activity in the business.

R&D Tax Incentives

During the 2023 financial year, the Company

received a 38.5% non-refundable tax oset

of $887,721 (non-cash) in relation to the

FY22 R&D tax incentive scheme.

As the Company has exceeded the

$20.0 million R&D cash tax threshold being

the maximum revenue allowable for the

claiming of a cash refund, a deduction is

recognised against taxable income.

Closing Share Price

Date $

30 June 2018 $0.54

30 June 2019 $1.54

30 June 2020 $2.54

30 June 2021 $2.82

30 June 2022 $1.35

30 June 2023 $1.55

A high of $4.01 was reached on

29 December 2020.

Loss Per Share

In Australian dollars $

Cents Basic loss per

share – cents (0.72)

Diluted loss per share (0.72)

As the Group made a loss for the year ended

30 June 2023, potential ordinary shares, being

options or performance rights to acquire

ordinary shares, are considered non-dilutive

and therefore not included in the diluted

earnings per share calculation.

As at 30 June 2023, there are 8,450,000

unvested share options issued and nil

performance rights.

Dividends

No amounts have been recommended by the

Directors to be paid by way of dividend during

the current financial year. No cash dividends

have been paid or declared by PolyNovo since

the beginning of the financial year.

Indemnification and Insurance

of Directors and Ocers

During the year ended 30 June 2023, the

Company indemnified its Directors, Company

Secretary and Executive Ocers in respect

of any acts or omissions giving rise to a liability

to another person (other than the Company

or a related party) unless the liability arose

out of conduct involving a lack of good faith.

In addition, the Company indemnified the

Directors and the Company Secretary against

any liability incurred by them in their capacity

as Directors or Company Secretary in

successfully defending civil or criminal

proceedings in relation to the Company.

No monetary restriction was placed on

this indemnity.

The Company has insured its Directors,

Company Secretary and Executive Ocers

for the period under review. Under the

Company’s Directors’ and Ocers’ Liability

Insurance Policy, the Company shall not release

to any third party or otherwise publish details

of the nature of the liabilities insured by the

policy or the amount of the premium.

Accordingly, the Company relies on section

300(9) of the Corporations Act 2001 to

exempt it from the requirement to disclose the

nature of the liability insured against and the

premium amount of the relevant policy.

Indemnification of Auditors

To the extent permitted by law, the Company

has agreed to indemnify its auditors, Ernst &

Young Australia, as part of the terms of its

engagement agreement against claims by

third parties arising from the audit (for an

unspecified amount). No payment has been

made to indemnify Ernst & Young Australia

during or since the financial year.

Inherent Risks of Investment in

Biotechnology Companies

There are many inherent risks associated

with the development of pharmaceutical and

medical products to a marketable stage. The

clinical trial process is designed to assess the

safety and ecacy of a drug or medical device

prior to commercialisation and a significant

proportion of drugs and medical devices fail

one or both of these criteria.

22 PolyNovo Limited Annual Report 2023

DIRECTORS’ REPORT CONTINUED

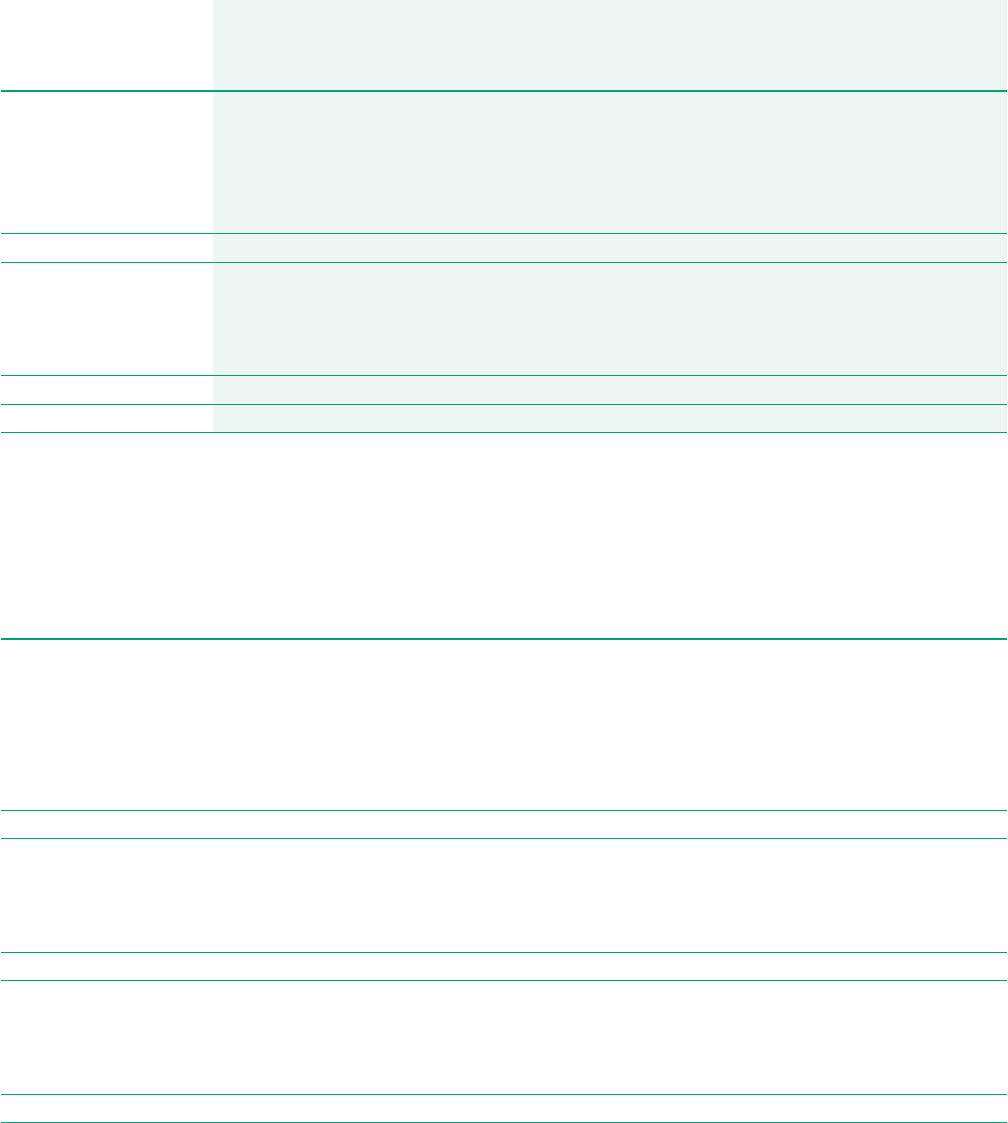

Board and Committee

Meetings

Details of the number of meetings of the

Board of Directors and Board committees,

and Directors’ attendance at those meetings,

during the year under review are set out in

the table below.

Other risks include uncertainty of patent

protection and proprietary rights, whether

patent applications and issued patents will

oer adequate protection to enable product

development, the obtaining of necessary

regulatory authority approvals and diculties

caused by the rapid advancements

in technology.

Companies such as PolyNovo are dependent

on the success of their research projects and

their ability to attract funding to support

these activities. Investment in research and

development projects cannot be assessed

on the same fundamentals as other trading

enterprises and access to capital and funding

for the Group and its projects going forward

cannot be guaranteed. Investment in

companies specialising in research projects,

such as PolyNovo, should be regarded as highly

speculative. PolyNovo strongly recommends

that professional investment advice be sought

prior to individuals making such investments.

The Company recognises it has an impact on the

environment, directly through its operations,

and indirectly through its value chain. PolyNovo

is committed to minimising the environmental

impact of its operations and its products.

Forward-looking Statements

Certain statements in this Annual Report

contain forward-looking statements regarding

the Company’s business and the therapeutic

and commercial potential of its technologies

and products in development. Any statement

describing the Company’s goals, expectations,

intentions, or beliefs is a forward-looking

statement and should be considered an at-risk

statement. Such statements are subject to

certain risks and uncertainties, particularly

those risks or uncertainties inherent in the

process of discovering, developing and

commercialising drugs and medical devices

that can be proven to be safe and eective for

use in humans, and in the endeavour of building

a business around such products and services.

PolyNovo undertakes no obligation to publicly

update any forward-looking statement,

whether as a result of new information, future

events, or otherwise. Actual results could

dier materially from those discussed in this

Annual Report. As a result, readers of this

report are cautioned not to rely on forward-

looking statements.

Directors’ Shareholdings

and Declared Interests

As at 30 June 2023, the Directors of

PolyNovo collectively hold 26,315,183

shares in the Company.

As at the date of this report the interests of

the Directors in the Company’s shares are:

Name

Directors

Shares held

directly

Shares held

indirectly

Mr David

Williams – 21,421,385

Mr Bruce

Rathie – 3,250,000

Mr Leon

Hoare – 1,180,220

Dr Robyn

Elliott 42,789 –

Ms Christine

Emmanuel-

Donnelly – 270,789

Mr Andrew

Lumsden – 150,000

Total 42,789 26,272,394

As at 30 June 2023 and as at the date of

this report, no Director has an interest in any

contract or proposed contract with PolyNovo

other than disclosed below or in the Group’s

2023 Annual Report. Further details of the

equity interests of Directors can be found in

the Remuneration Report.

Full Board Audit and Risk Committee Remuneration Committee

Directors Role

Meetings

Attended

Meetings

eligible to

attend

Meetings

Attended

Meetings

eligible to

attend

Meetings

Attended

Meetings

eligible to

attend

Total number of

meetings held

12 3 5

Mr David Williams* Non-Executive Director 12 12 – – 5 5

Dr Robyn Elliott Non-Executive Director 12 12 3 3 – –

Ms Christine Emmanuel-Donnelly Non-Executive Director 12 12 – – 5 5

Dr David McQuillan*** Non-Executive Director 1 2 – – – –

Mr Leon Hoare Non-Executive Director 12 12 – – 5 5

Mr Bruce Rathie Non-Executive Director 12 12 3 3 – –

Mr Andrew Lumsden** Non-Executive Director 11 12 3 3 – –

* Mr David Williams is Chair of the Remuneration Committee.

** Mr Andrew Lumsden is Chair of the Audit and Risk Committee.

*** Dr David McQuillan resigned as a director on 1 September 2022.

23PolyNovo Limited Annual Report 2023 23PolyNovo Limited Annual Report 2023

Auditor

Ernst & Young (EY) continues in oce in

accordance with section 327b (2) of the

Corporations Act 2001.

Non-audit Services

During the year ended 30 June 2023, the

amount received, or due and receivable for

non-audit services provided by PolyNovo’s

auditor Ernst & Young were as shown below.

The directors are satisfied that the provision

of non-audit services is compatible with the

general standard of independence for auditors

imposed by the Corporations Act 2001.

The nature and scope of each type of

non-audit service provided means that

auditor independence was not compromised.

Non-audit services $

Tax compliance and corporate

secretarial services 149,933

The auditor has provided a written declaration

that no professional engagement for the Group

has been carried out during the financial

year that would impair Ernst & Young’s

independence as auditor. The declaration

is set out on Page 38.

24 PolyNovo Limited Annual Report 2023

25PolyNovo Limited Annual Report 2023

ESG STATEMENT AND CORPORATE GOVERNANCE

Apart from saving lives, to our knowledge,

no NovoSorb BTM treated area of our patients

have had to undergo scar revision surgery.

This reduces the social, economic, physiological,

and emotional demands of our patients allowing

them to recover to live their best possible lives.

We strive to improve on all aspects of our

business year on year in line with our

commercial development.

Our Approach to ESG

PolyNovo acknowledges the importance of

an integrated and consistent approach to

Environmental, Social and Governance (ESG)

risk factors. We have added additional

resources dedicated to delivering a holistic and

integrated, robust ESG framework and package.

Environment

PolyNovo acknowledges we have an important

role in protecting the environment and

recognises the contribution we can make

towards transitioning to a low carbon economy.

Our manufacturing process is already low

emitting, with approximately 560 grams of

carbon emitted per batch of NovoSorb BTM.

PolyNovo is carbon neutral certified for its

business operations for the reporting period

FY2021-22 (projected); the FY2021-22

true-up report is submitted and is currently

under assessment by Climate Active.

PolyNovo only uses environmentally

certified commercial waste disposal providers,

with minimal waste produced in our

manufacturing process. To further improve our

waste management processes, we engaged a

specialised third-party consultancy to develop

a waste management and reduction plan.

We are committed to reducing our operational

waste and water use. Our recycling programs

will be further enhanced by the ongoing

migration to paperless documentation systems

in our business support functions.

PolyNovo’s Environment Policy can be found on

its website: https://polynovo.com/about-us/

Social

Our People

Every employee plays a role in our success

and by working together, we develop new

opportunities for patients, customers,

our community, and shareholders.

The company has a strong focus on learning

and development, and all employees have

access to an online learning platform.

Employees also have an appraisal and

development program to ensure we continue

to develop our skill base, improve productivity,

and give employees and managers the

opportunity for personal and professional

growth. Training is achieved through targeted

educational programs and mentorship.

PolyNovo’s Gender Diversity Profile

PolyNovo aims to provide an inclusive

workplace where everyone is valued and

treated with respect, without discrimination

or bias. We have developed a company-wide

Diversity Profile, which is monitored to ensure

we are a leading example of a diverse

organisation in our industry. We celebrate

religious and cultural events with our teams

with learnings from these informing our

international operations. Embracing diversity

makes PolyNovo an interesting, exciting, and

dynamic workplace where alternative thinking

provides us with an innovative edge.

PolyNovo brings disruptive, innovative, and

regenerative medical devices to market that

improve clinical, functional and cosmetic

outcomes for patients. Our products oer

significant health economic benefits to patients,

surgeons, and health systems.

26 PolyNovo Limited Annual Report 2023

Managers/

Supervisors

Board of

Directors

ESG STATEMENT AND CORPORATE GOVERNANCE CONTINUED

Health & Safety

Safety is central to the responsible operation

of our business, and the health and safety

of our employees and contractors is a top

priority. We maintain a strong focus on

preventing injuries and continuously

improving our practices.

Our Health & Safety Policy arms our

aspiration to avoid harm, empower our people

to perform their tasks safely and responsibly,

and continuously improve our performance.

In FY21, we started measuring our safety

performance monthly to track progress and

enable comparison with published industry

data. Over FY23, there was zero (0) lost time

injury and zero (0) medical treatment injuries

to our employee and contractor workforce.

The company Total Recordable Injury

Frequency Rate (TRIFR) is zero for the year,

unchanged from FY22.

PolyNovo’s Health & Safety Policy can be

found on its website: https://polynovo.com/

about-us/.