Page 1 of 4

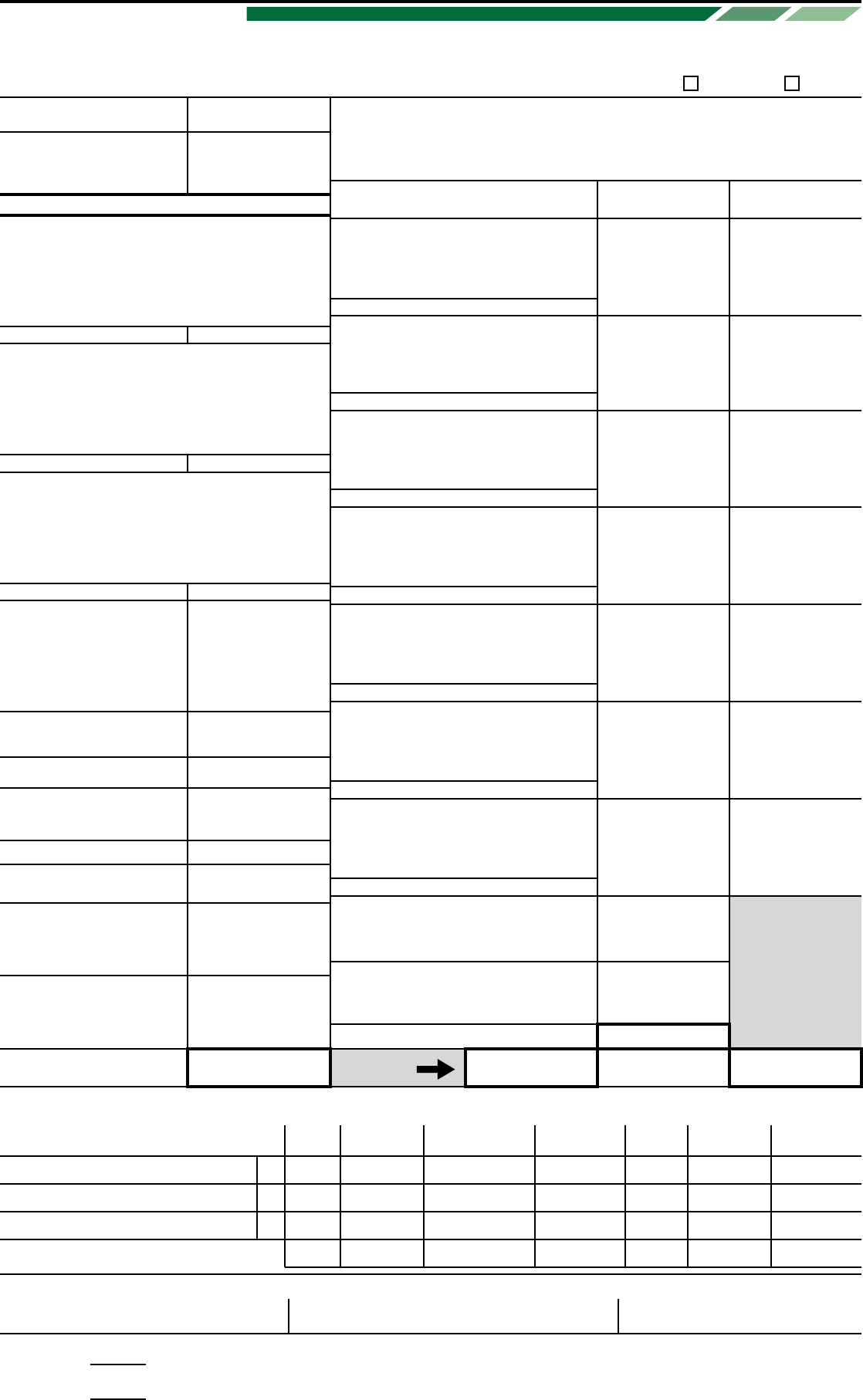

PERSONAL INCOME SOURCES

MONTHLY ANNUALLY

Borrower and Co-Borrower Gross Salary

Schedule B (Recruiting Interest and Dividends)

Schedule C (Net Profit of Proprietorships)

Schedule D (Recurring Capital Gains Less Losses)

Schedule E (Recurring Rental Income Exluding Subject Property)

Other (List)

TOTAL PERSONAL INCOME

PERSONAL CASH REQUIREMENTS

MONTHLY ANNUALLY

Residence Mortgage Payment / Rent Payment

Federal, State & Real Estate Taxes

Installment Loan Payments

Credit Card Payments

Rental Mortgage P&I Payments and Expenses (Exlude Subject Property)

Alimony/Child Support

Other (List)

TOTAL PERSONAL EXPENSES

Commercial Loan Application

PERSONAL INFORMATION

RESUME

DECLARATIONS

Borrower

Borrower’s Name DOB (mm/dd/yyyy)

Social Security Number

Borrower

Co-Borrower

E-Mail Address E-Mail Address

Present Address (street, city, state, zip)

Name and Address of Employer

Name and Address of Employer

Title/Position Type of Business

Years on this job Yrs in ProfessionBusiness Phone (incl. area code)

Title/Position Type of Business

Dates (from-to)Business Phone (incl. area code)

Name and Address of Employer

Name and Address of Employer

Title/Position Type of Business

Years on this job Yrs in ProfessionBusiness Phone (incl. area code)

Title/Position Type of Business

Dates (from-to)Business Phone (incl. area code)

Former Address (street, city, state, zip)

If residing at present address for less than seven (7) years, complete the following:

If employed in current position for less than two (2) years, complete the following:

Married Separated Unmarried (include single, divorced, widowed)

Rent $ Per Mo. No. Yrs.

Own

Yes No

Rent $ Per Mo. No. Yrs.

If you answer “yes” to any questions 1 through 6, use Continuation Sheet for explanations.

1. Are there any outstanding judgements against you?

2. Have you been declared bankrupt in the last 10 years?

3. Have you had property forclosed upon or given title or deed in lieu?

4. Are you a party to a lawsuit?

5. Are you obligated to pay alimony, child support, or separate maintenance?

6. Are any of your assets held in a trust?

7. Are you a U.S. citizen?

8. Are you a permanent resident alien? If yes please provide a copy of resident alien ID card.

Home Phone (incl. area code)

Cell Phone (incl. area code)

Co-Borrower’s Name

Co-Borrower

Yes No

Married Separated Unmarried (include single, divorced, widowed)

DOB (mm/dd/yyyy)

Social Security Number

Present Address (street, city, state, zip)

Former Address (street, city, state, zip)

OwnOwn Rent $ Per Mo. No. Yrs.

Own Rent $ Per Mo. No. Yrs.

Home Phone (incl. area code)

Cell Phone (incl. area code)

Page 2 of 4

ASSETS AND LIABILITIES

Cash deposit toward

purchase held by:

Name and address of Bank, S&L, or Credit Union

Acct. no. $

Name and address of Bank, S&L, or Credit Union

Acct. no. $

Name and address of Bank, S&L, or Credit Union

Acct. no. $

$

$

$

$

$

$

$

$

$

Stocks & Bonds (Company

name/number description)

Life insurance net cash value

Real Estate owned (enter market

value from schedule of real

estate owned)

Vested interest in retirement fund

Net worth of business(es) owned

(attach financial statement)

Automobiles owned (make & yr.)

Schedule of Real Estate Owned (if additional properties are owned, use continuation sheet)

List any additional names under which credit has previously been received and indicate appropriate creditor name(s) and account number(s):

Other Assets (itemize)

Property Address (enter S if sold, PS if pending

sale or R if rental being held for income)

Creditor Name Account NumberAlternate Name

Total Assets a.

Face amount: $

Subtotal Liquid Assets

Name and address of Company

Acct. no.

$ Payments/Months $

Name and address of Company

Acct. no.

$ Payments/Months $

Name and address of Company

Acct. no.

$ Payments/Months $

Name and address of Company

Acct. no.

$ Payments/Months $

Name and address of Company

Acct. no.

$ Payments/Months $

Name and address of Company

Alimony/Child Support/Separate

Maintenance Payments Owed to:

Job-related Expense (child care, union

dues, etc.)

Net Worth

(a minus b)

Total Monthly Payments

Total Liabilities b.

Acct. no.

Acct. no.

$ Payments/Months $

Name and address of Company

Type of

Property

Totals

Present

Market Value

Amount of

Mortgages & Liens

Gross

Rental Income

Mortgage

Payments

Net

Rental Income

Insurance,

Maintenance,

Taxes & Misc.

$ Payments/Months $

$

$

$

$

$ $ $ $ $

$ $ $ $ $

$ $ $ $ $

$ $ $ $

$

$

$

$ $

$

$

ASSETS

LIABILITIES Unpaid Balance

Monthly Payment &

Months Left to Pay

List checking and savings accounts below

Cash or

Market Value

Commercial Loan Application

Description

Borrower

Co-Borrower

Jointly Not JointlyCompleted

This Statement and any applicable supporting schedules may be completed jointly by both married and unmarried Co-Borrowers if their assets and liabilities

are sufficiently joined so that the Statement can be meaningfully and fairly presented on a combined basis; otherwise, separate Statements and Schedules

are required. If the Co-Borrower section was completed about a non-applicant spouce or other person, this Statement and supporting schedules must be

completed by that spouce or other person also.

Liabilities and Pleged Assets. List the creditor’s name, address and account number for all

outstanding debts, including automobile loans, revolving charge accounts, real estate loans,

alimony, child support, stock pledges, etc. Use continuation sheet, if necessary. Indicate by (*)

those liabilities which will be satisfied upon sale of real estate owned or upon refinancing of the

subject property.

Page 3 of 4

INFORMATION ABOUT PROPERTY TO BE FINANCED

Property Address

Construction Type (CTU, frame, block, etc.)

Purchase Money Loan

Purchase Price

Refinance Loan

Have all payments been made on time for the last 12 months?

Year Aquired

Existing Liens - Lender

Cash Out Request

Amount Requested

(If no, please explain on a separate page)

Cash out use:

Date Made Original Amount Current Balance Term Rate SBA?

Original Cost Year Improved Improvement Cost Present Value

Is there a prepayment penalty?

Seller Credits

$

Source of Down Payment

Property Type (industrial, retail, office, mixed use, etc.)

Yes No

Zoning % Occupied Now

County

# Units Building Size Lot Size Year Built

Yes No

Commercial Loan Application

VESTING OF REAL ESTATE TITLE

Loan Amount Requested

Print Exact Names of Individuals, Form of Title, or Entity

Borrower

Co-Borrower

Purpose

Purchase Refinance Refi-Cash Out

Type of Entity (select one) C-Corp S-Corp Partnership Proprietorship Other:

Business Type (select one) Retail Service Wholesale Manufacturing Construction

OWNERSHIP/OFFICERS/DIRECTORS

Name: Title: % Owned:

Name: Title: % Owned:

Name: Title: % Owned:

Name: Title: % Owned:

Name: Title: % Owned:

Name: Title: % Owned:

BUSINESS INFORMATION

Business Name

DBA:

Primary Business Address

Primary Contact Name:

Phone #:

Fax #:

Mo. Rent paid at this location: $ Sq.Ft.?

Mo/Mo?Lease Expires:

Business Tax ID #:

E-Mail Address:

Number of Employees:

Date Business Established:

Web Site:

Executive / Mailing Address, if other Sq.Ft. Mo. Rent $ Lease Expires

List Additional Business Locations Sq.Ft. Mo. Rent $ Lease Expires

Page 4 of 4

Commercial Loan Application

HISTORY

Nature of Business

Types of Products / Services as percentage of total revenue

Business revenue (Sales) trends in the last 3 years are

Explain what factors have affected your trends:

Increasing Decreasing Stable

Business profitability (Net Income) trends in the last 3 years are

Explain what factors have affected your trends:

Increasing Decreasing Stable

BUSINESS DECLARATIONS

Yes No N/A

If you answer “Yes” to any questions, use Continuation Sheet for explanations.

1. Is the business a party to a lawsuit?

2. Has the business been involved in bankruptcy proceedings in the last 10 years?

3. Does the business have deliquent federal, state, payroll, sales or other tax liability?

4. Has the business had property foreclosed upon or given title or deed in lieu?

5. If renting, have you paid rent on time for each of the last 12 months?

6. Does the business, its owners or majority stockholders have any other loans?

(If “Yes”, please provide information)

DOCUMENTS ADDITIONALY NEEDED

In order to be considered for a commercial loan approval, the following documents are required.

Fully executed purchase contract; if applicable

Tri-merge credit report.

DSCR worksheet - signed and dated.

Environmental Disclosure - signed and dated.

Structural Disclosure - signed and dated.

Rental or mortgage history. 12 months cancelled checks or bank statements evidencing payment history.

Evidence of being in business for 2 years and business license.

Photos of subject property.

ACKNOWLEDGEMENT AND AGREEMENT

Borrower’s Signature

BORROWER

Ethnicity:

I do not wish to furnish this information

Hispanic or Latino

Female Male

Not Hispanic or Latino

Race:

Sex:

To be Completed by Interviewer

American Indian or

Alaska Native

Native Hawaiian or

Other Pacific Islander

Asian

White

Black or

African American

CO-BORROWER

Ethnicity:

I do not wish to furnish this information

Hispanic or Latino

Female Male

Not Hispanic or Latino

Race:

Sex:

American Indian or

Alaska Native

Native Hawaiian or

Other Pacific Islander

Asian

White

Black or

African American

This application was taken by:

Name and Address of Interviewer’s EmployerInterviewer’s Name (print or type)

Interviewer’s Signature Date

Interviewer’s Phone Number (incl. area code)

Face-to-face interview

Mail

Telephone

Internet

Date

X X

DateCo-Borrower’s Signature

I/We authorize ________________________________________________ and/or assigns to make inquiries as necessary to verify the accuracy of the

statements made in this application and to determine my/our creditworthiness. I/We authorize and instruct any person or consumer reporting agency to

compile and furnish any information it may have or obtain in response to such credit inquiries. I/We certify the above and the statements contained in the

attachments are true and accurate as of the stated date. These statements are made for the purposes of obtaining a loan. I/We understand FALSE

statements may result in possible prosecution by the U.S. Attorney General (Reference 18 U.S.C. 1001). I/We authorize the release of this information

whether the signature below is an original or copy.

The following information is requested by the Federal Government for certain types of loans related to a dwelling in order to monitor the lender’s compliance with equal credit

opportunity, fair housing and home mortgage diclosure laws. You are not required to furnish this information, but are encouraged to do so. The law provides that a lender may not

discriminate either on the basis of this information, or on whether you choose to furnish it. If you furnish the information, please provide both ethnicity and race. For race, you may

check more than one designation. If you do not furnish ethnicity, race, or sex, under Federal regulations, this lender is required to note the information on the basis of visual

observation and surname if you have made this application in person. If you do not wish to furnish the information, please check the box below. (Lender must review the above

material to assure that the disclosures satisfy all requirements to whcih the lender is subject under applicable state law for the particular type of loan applied for.)