1

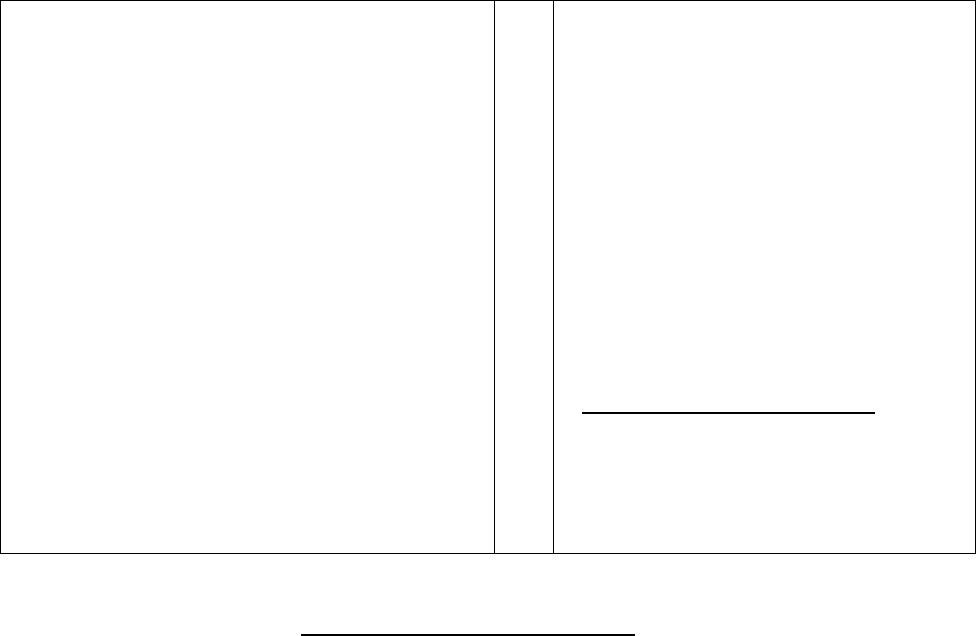

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF MASSACHUSETTS

SUYAPA ALLEN on behalf of herself and

all others similarly situated,

Plaintiff,

vs.

DECISION ONE MORTGAGE

COMPANY, LLC, HSBC FINANCE

CORPORATION, and ZEUS FUNDING,

LLC,

Defendants.

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

)

C.A. NO. 07-11669

JURY TRIAL DEMANDED

CLASS ACTION COMPLAINT

Plaintiff, Suyapa Allen ("Plaintiff"), on behalf of herself and all others similarly situated,

by her undersigned attorneys, alleges as follows:

1. This is a class action brought by Plaintiff, on behalf of herself and other similarly

situated black homeowners, against Decision One Mortgage Company, LLC ("Decision One"),

and HSBC Finance Corporation ("HSBC Finance") (collectively "HSBC" or "Defendants"),

under the Equal Credit Opportunity Act, 15 U.S.C. § 1691, et seq. (“ECOA”) and the Fair

Housing Act, 42 U.S.C. § 3601, et seq. Plaintiff seeks remedies for herself and the Class (defined

in ¶ 18, below) for the discriminatory effects of HSBC's home financing policies and practices.

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 1 of 18

2

2. As described below, HSBC has established a specific, identifiable and uniform

credit pricing system, a component of which, referred to herein as the Discretionary Pricing

Policy, authorizes unchecked, subjective surcharge of additional points and fees to an otherwise

objective risk-based financing rate. In other words, after a finance rate acceptable to HSBC is

determined by objective criteria (e.g., the individual’s credit history, credit score, debt-to-income

ratio and loan-to-value ratios), HSBC's credit pricing policy authorizes additional discretionary

financing charges and interest mark-ups. These subjective, additional finance charges have a

widespread discriminatory impact on black applicants for home mortgage loans, in violation of

ECOA and the FHA.

3. HSBC has established policies for retail and wholesale access to its loan products

that subject black financing applicants to a significantly higher likelihood of exposure to

discretionary points, fees and interest mark-ups. These costs drive up the average cost of a

mortgage loan made by Decision One to black applicants.

4. Plaintiff seeks declaratory and injunctive relief, disgorgement and restitution of

monies disparately obtained from black borrowers.

JURISDICTION AND VENUE

5. Plaintiffs invoke the jurisdiction of this Court pursuant to 28 U.S.C. § 1331,

which confers original jurisdiction upon this Court in a civil action arising under federal law.

6. Venue is proper in this Court pursuant to 28 U.S.C. 1391(b) inasmuch as the

unlawful discriminatory practice is alleged to have been committed in this District, Defendants

regularly conduct business in this District, and the named Plaintiff resides in this District.

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 2 of 18

3

PARTIES

7. Plaintiff, Suyapa Allen, is a black homeowner who resides at 78 Blackstone

Street, Unit 78, Stoughton, MA 02072.

8. Defendant, Decision One Mortgage Company, LLC ("Decision One"), is a

mortgage lender with a principal place of business at 3023 HSBC Way, Fort Mill, South

Carolina 29707. Decision One operates through more than 15 branches in cities nationwide, as

well as through relationships with loan brokers and correspondents. Decision One Mortgage is

owned by British bank HSBC Holdings through that company's US-based HSBC Finance

subsidiary. Decision One was purchased by Household International in 1999.

9. Defendant, HSBC Finance (formerly Household International) is the consumer

lending arm of HSBC Holdings. HSBC Finance has a place of business at 2700 Sanders Road,

Prospect Heights, Illinois 60070.

10. Defendant, Zeus Funding, LLC is a mortgage broker with a principal place of

business at 850 SW Lighthouse Drive, Palm City, Florida 34990.

CLASS ALLEGATIONS

11. Plaintiff repeats and re-alleges every allegation above as if set forth herein in full.

12. This class action is brought pursuant to ECOA and the FHA by the individual

named Plaintiff on behalf of herself and all black consumers (the “Class”) who obtained a

Decision One home mortgage loan in the United States between January 1, 2001 and the date of

judgment in this action (the “Class Period”) and who were subject to HSBC's Discretionary

Pricing Policy pursuant to which they paid discretionary points, fees or interest mark-ups in

connection with their loan.

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 3 of 18

4

13. Plaintiff sues on her own behalf and on behalf of a class of persons under Rules

23(a) and (b)(2) and (b)(3) of the Federal Rules of Civil Procedure.

14. "Discretionary Pricing Policy" means HSBC's policy of authorizing its loan

officers, brokers and correspondent lenders to impose subjective, discretionary charges and

interest mark-ups, that are included in the finance charge loans they originate.

15. Plaintiff does not know the exact size or identities of the proposed Class, since

such information is in the exclusive control of HSBC. Plaintiff believes that the Class

encompasses many thousands or tens of thousands of individuals who are geographically

dispersed throughout the United States. Therefore, the proposed class is so numerous that

joinder of all members is impracticable.

16. All members of the Class have been subject to and affected by the same

Discretionary Pricing Policy. There are questions of law and fact that are common to the Class,

and predominate over any questions affecting only individual members of the Class. These

questions include, but are not limited to the following:

a. the nature, scope and operations of HSBC's Discretionary Pricing Policy;

b. whether HSBC Finance and Decision One are creditors under the ECOA because,

for example, in the ordinary course of their business they participate in the

decision of whether or not to extend credit to consumers;

c. whether HSBC's Discretionary Pricing Policy is a facially neutral credit pricing

system that has effected racial discrimination in violation of ECOA;

d. whether there are statistically significant disparities between the amount of the

discretionary charges imposed on black persons and the amount of the

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 4 of 18

5

discretionary charges imposed on white persons that are unrelated to

creditworthiness;

e. whether any legitimate business reason for the Discretionary Pricing Policy can

be achieved by a credit pricing system less discriminatory in its impact;

f. whether the Court can enter declaratory and injunctive relief; and

g. the proper measure of disgorgement or damages.

17. The claims of the individual named Plaintiff are typical of the claims of the Class

and do not conflict with the interests of any other members of the Class in that both the Plaintiff

and the other members of the Class were subject to the same Discretionary Pricing Policy that

has disproportionately affected black homeowners.

18. The individual named Plaintiff will fairly and adequately represent the interests of

the Class. She is committed to the vigorous prosecution of the Class’ claims and has retained

attorneys who are qualified to pursue this litigation and have experience in class actions – in

particular, consumer protection and discrimination actions.

19. A class action is superior to other methods for the fast and efficient adjudication

of this controversy. A class action regarding the issues in this case does not create any problems

of manageability.

20. In the alternative, HSBC has acted or refused to act on grounds generally

applicable to the class, thereby making appropriate final injunctive relief or corresponding

declaratory relief with respect to the class as a whole.

ALLEGATIONS OF CLASS-WIDE DISCRIMINATION

21. HSBC publicly promotes its home financing expertise by means of nationwide

advertising campaigns. In its advertisements, HSBC solicits persons to apply for financing with

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 5 of 18

6

HSBC either in one of its offices or through one of the mortgage brokers whom HSBC has

authorized to accept applications on its behalf.

22. HSBC makes home-mortgage loans directly to consumers through its branches in

several markets.

23. HSBC also makes home-mortgage loans that are arranged by its network of

mortgage brokers. Those loans are made in reliance on HSBC’s credit-granting policies and

with the participation of Decision One.

24. Due to HSBC's policies as to where to place its offices and how to market its

products, black borrowers are more likely than white borrowers to apply for credit from HSBC

through Decision One, by an application made to an authorized broker.

25. Because of the Discretionary Pricing Policy, loans obtained from HSBC through

Decision One or HSBC's network of brokers are more expensive to black homeowners, on

average, than loans obtained directly from HSBC.

26. A high-APR loan is a loan whose APR is at least three percentage points higher

than the interest rate on U.S. Treasury securities of the same maturity, at the time the loan was

made.

27. Based on the latest available Home Mortgage Disclosure Act (“HMDA”) data,

available from the Department of Housing and Urban Development, whites who borrow from

Decision One are over one and a half times more likely than blacks to have received a loan other

than a high-APR loan to purchase or refinance their home.

28. While credit differences may explain some part of the disparities in rate and

terms, HSBC's Discretionary Pricing Policy accounts for a significant portion of the disparity.

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 6 of 18

7

29. HSBC's Discretionary Pricing Policy is unrelated to a borrower’s objective credit

characteristics such as credit history, credit score, debt-to-income ratio and loan-to-value ratios

and results in purely subjective charges that affect the rate otherwise available to borrowers.

30. HSBC provides authorized mortgage brokers with substantial information about

its loan programs, rates and credit criteria, as well as its policies for compensating mortgage

brokers and correspondent lenders who arrange business for it.

31. HSBC authorizes mortgage brokers who have signed a contract with it to accept

applications on its behalf, quote financing rates and terms on it (within the limitations set by

Decision One), inform credit applicants of HSBC's financing options and to originate finance

transactions using HSBC’s forms, in accordance with its policies.

32. In all of the home-mortgage-finance-transactions at issue, HSBC advances the

funds to make the loans and bears some or all of the risk of default. HSBC provides its loan

officers, brokers and correspondent lenders with credit applications, loan contracts and other

required financing forms, as well as instructions on filling out such documents necessary to

complete home mortgage transactions.

33. After a customer provides credit information to one of HSBC's loan officers or

brokers, HSBC computes a financing rate through an objective credit analysis that, in general,

discerns the creditworthiness of the customer.

34. These credit analyses consider numerous risk-related variables of

creditworthiness, including credit bureau histories, payment amounts, debt ratio, bankruptcies,

automobile repossessions, charge-offs, prior foreclosures, payment histories, credit score, debt-

to-income ratios, loan-to-value ratios and other risk-related attributes or variables. On

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 7 of 18

8

information and belief, HSBC uses these variables to determine a “mortgage score” for each

credit applicant.

35. Based on these objective risk-related variables and the resulting mortgage score,

HSBC derives a risk-based financing rate at which it would provide a home mortgage, often

called the “Par Rate.” Alternatively, experienced HSBC loan officers, brokers and

correspondent lenders can estimate the risk-related Par Rate by referring to the applicant’s credit

bureau determined credit score.

36. Although HSBC's initial analysis applies objective criteria to calculate this risk-

related Par Rate, HSBC then authorizes a subjective component in its credit pricing system —the

Discretionary Pricing Policy — to impose additional non-risk charges. On information and

belief, the applicable Par Rates and authorized discretionary charges are communicated by

HSBC to its loan officers and brokers via regularly published “rate sheets.” Such rate sheets are

published by HSBC via intranet and internet.

37. The discretionary charges are paid by the customer as a component of the total

finance charge (the “Contract APR”), without the homeowner knowing that a portion of their

Contract APR was a non-risk-related charge.

38. Loan officers and brokers have discretion, within the limits set by HSBC, to

impose discretionary mark-ups as additional points in interest – “a rate mark-up”. When there is

a rate mark-up, HSBC shares the additional income, even if the loan is originated by a broker.

39. HSBC's Discretionary Pricing Policy, by design, causes persons with identical or

similar credit scores to pay different amounts for the cost of credit. As a result of using a

subjective pricing component that is designed to charge persons with the same credit profiles

different amounts of finance charge, the objective qualities of the initial credit analysis used to

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 8 of 18

9

calculate the Par Rate are undermined and the potential for race bias becomes inherent in the

transaction.

40. The Discretionary Pricing Policy, although facially neutral (insofar as HSBC uses

the same or effectively the same policy for all credit applicants), has a disproportionately adverse

effect on blacks compared to similarly situated whites in that blacks pay disparately more

discretionary charges (both in frequency and amount) than similarly situated whites. Statistical

analysis of discretionary charges imposed on black and white customers of other mortgage

companies that use credit pricing systems structured like that of HSBC has revealed that blacks,

after controlling for credit risk, are substantially more likely than similarly situated whites to pay

such charges.

41. Loan officers and brokers are agents of HSBC for the purpose of setting credit

price, which is always set based on HSBC's policy.

42. The disparate impact suffered by blacks is a direct result of HSBC's Discretionary

Pricing Policy in that HSBC designed, disseminated, controlled, implemented and profited from

the Discretionary Pricing Policy creating the disparate impact.

43. HSBC has a non-delegable duty to ensure that its mortgage financing structure

and policies do not have a disparate impact on legally protected classes, such as blacks. Despite

having such a non-delegable duty, HSBC has chosen to use, and on information and belief,

continues to use, a commission-driven, subjective pricing policy that it knows or should have

known has a significant and pervasive adverse impact on black homeowners.

44. The disparities between the terms of HSBC's transactions involving black

homeowners and the terms involving whites homeowners cannot be a product of chance and

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 9 of 18

10

cannot be explained by factors unrelated to race, but, instead, are the direct causal result of the

use of the discriminatory Discretionary Pricing Policy.

45. There are no legitimate business reasons justifying HSBC's discriminatory

Discretionary Pricing Policy that could not be achieved by a policy that has no discriminatory

impact or a greatly reduced discriminatory impact.

ALLEGATIONS OF NON-DISCLOSURE –

FRAUDULENT CONCEALMENT

(TOLLING)

46. Commission-driven, discretionary pricing systems – such as those in the real

estate mortgage industry that are structurally similar to the system utilized by HSBC – have been

found to produce significant discriminatory effects. Knowledge concerning the significant and

pervasive discriminatory impact of such commission-driven, discretionary credit pricing systems

has been widely circulated throughout the financing industry for several years, particularly since

1994, as a result of numerous high profile actions by the United States Department of Justice and

federal regulatory agencies. HSBC has known or should have known that its credit pricing

system causes blacks to pay the Defendant more for mortgage financing than the amounts paid

by white customers with identical or effectively identical credit scores. The following various

regulatory settlements involved discriminatory pricing policies structurally similar to HSBC's

pricing policy and were widely reported through the financing industry:

United States v. Blackpipe State Bank, Civ. Act. No. 93-5115 (D. S.D. filed

November 16, 1993)(charging American Indians higher interest rates)

United States v. First National Bank of Vicksburg, No. 5:94 CV 6(B)(N) (S.D.

Miss. filed Jan. 21, 1994) (charging African-Americans higher interest rates)

United States v. Huntington Mortgage Co., No. 1; 95 CV 2211 (N.D. Ohio filed

October 18, 1995)(charging African-Americans higher fees)

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 10 of 18

11

United States v. Security State Bank of Pecos, No. SA 95 CA 0996 (W.D.Tex.

filed October 15, 1995)(charging Hispanics higher interest rates)

United States v. First National Bank of Gordon, No. CIV-96-5035 (W.D.S.D.

filed April 15, 1996)(charging American Indians higher interest rates)

United States v. Fleet Mortgage Corp., No. 96-2279 (E.D.N.Y. filed May 7,

1996)(charging African-Americans and Hispanics higher interest rates)

United States v. Long Beach Mortgage Co., No. CV-96-6159 (C.D. Cal. filed

Sept. 5, 1996)(charging African-Americans, Latinos, women and persons over

age 55 higher interest rates)

47. Despite the fact that HSBC has known or should have known of the

discriminatory effect of its credit pricing policy, none of the loan documents inform the customer

that its finance rates are subjective and not based solely on risk-related characteristics.

48. Although, pursuant to HSBC's Discretionary Pricing Policy, the final credit rate

that a customer pays for credit is subjective, HSBC's advertisements, marketing materials and

financing documents universally create and foster the image that HSBC offers non-negotiable,

competitive finance rates that are objectively set by HSBC based on credit-risk factors.

49. Despite spending millions of dollars annually on advertising, marketing materials,

and the creation and distribution of HSBC financing documents that falsely create and foster the

image that HSBC offers competitive rates that are objectively set, HSBC never discloses the

truth to its credit applicants concerning the fact that: (a) its credit rates are subjective and can

vary significantly among persons with identical credit profiles, and (b) that it has authorized and

provided a financial incentive to its loan officers, authorized brokers and correspondent lenders

to subjectively increase the credit rate above the rate otherwise available to homeowners.

50. HSBC's black customers, due to the inherent nature of the HSBC's undisclosed

pricing system and due to HSBC's deception and concealment, have no way of knowing or

suspecting (a) the existence of HSBC's subjective credit pricing policy; (b) that they were

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 11 of 18

12

charged additional subjective credit charges; and (c) that they were charged a disproportionately

greater amount for their cost of credit than similarly situated white persons.

FACTUAL ALLEGATIONS

Facts Relating To Plaintiff Suyapa Allen

51. Suyapa Allen resides at 78 Blackstone Street, Unit 78, Stoughton, MA 02072.

52. After attending a first-time homebuyer's class and finding a home she wanted to

buy, Ms. Allen's realtor, Prudential Scott Haynes Realtor, in Dorchester, Massachusetts, referred

her to Zeus Funding to seek financing.

53. On September 8, 2006, Ms. Allen entered into a mortgage transaction with

Decision One as lender and Zeus Funding as broker. The transaction was divided into two loans.

54. The larger loan (Loan No. 2090060823014) is a 30-year, adjustable rate loan with

a balloon feature and a disclosed APR of 11.2141%. The loan amount was $243,200.00.

55. According to the HUD-One Settlement Statement, Decision One paid Zeus

Funding a yield spread premium of an undisclosed amount in connection with the loan.

56. The smaller loan (Loan No. 2090060823015), which had a loan amount of

$60,800, is a 15-year fixed rate loan with a balloon feature, providing for a final payment of

$53,390.01. The APR of the smaller loan is 12.7483%.

57. A true and correct copy of the Truth-in-Lending disclosure provided in

connection with Loan No. 2090060823014 is attached hereto and labeled Exhibit 1.

58. True and correct copies of Truth-in-Lending disclosure and HUD-One Settlement

Statement provided in connection with Loan No. 2090060823015are attached hereto and labeled

Exhibit 2 and Exhibit 3, respectively.

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 12 of 18

13

59. At the time of the transaction, Ms. Allen had a credit score that would have

qualified with many lenders for a mortgage in the prime-market. Instead, Ms. Allen received

mortgages at sub-prime rates and on sub-prime terms.

60. On information and belief, unbeknownst to Ms. Allen, the contract APR on the

mortgage loans was actually a combination of an objective, risk-based calculation and a totally

subjective, discretionary component added pursuant to the HSBC's Discretionary Pricing Policy.

61. On information and belief, Ms. Allen was subject to HSBC's Discretionary

Pricing Policy.

62. On information and belief, Ms. Allen was charged a disproportionately greater

amount in non-risk-related credit charges than similarly situated white persons.

COUNT I

(DISCRIMINATION IN VIOLATION OF THE EQUAL CREDIT OPPORTUNITY ACT

AGAINST HSBC BY PLAINTIFF ON BEHALF OF THE CLASS)

63. Plaintiff repeats and re-alleges every allegation above as if set forth herein in full.

64. Decision One and HSBC Finance are creditors as defined in the ECOA, and in the

ordinary course of its business, each participated in the decision of whether or not to extend

credit to the Plaintiff, the proposed Class representative herein, and all prospective Class

members.

65. HSBC designed, disseminated, controlled, implemented and profited from the

discriminatory policy and practice alleged herein — the Discretionary Pricing Policy —which

has had a disparate economic impact on blacks compared to similarly situated whites.

66. All actions taken by the HSBC loan officers and HSBC’s brokers were in

accordance with the specific authority granted to them by HSBC and were in furtherance of

HSBC's policies and practices.

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 13 of 18

14

67. As a result of HSBC's Discretionary Pricing Policy, HSBC has collected more in

finance charges from blacks than from similarly situated white persons, for reasons totally

unrelated to credit risk.

68. HSBC's Discretionary Pricing Policy violates the Equal Credit Opportunity Act.

69. Plaintiff and prospective class members are aggrieved persons as defined in

ECOA by virtue of having been subject to the discriminatory, Discretionary Pricing Policy.

COUNT II

(DISCRIMINATION IN VIOLATION OF THE

FAIR HOUSING ACT AGAINST HSBC BY PLAINTIFF

ON BEHALF OF THE CLASS)

70. Plaintiff repeats and re-alleges every allegation above as if set forth herein in full.

71. HSBC engaged in residential real estate-related transactions with respect to the

Plaintiff, the proposed Class representative herein, and all prospective Class members.

72. HSBC's Discretionary Pricing Policy has resulted in discrimination with respect

to the Plaintiff, the proposed Class representative herein, and all prospective members of the

Class.

73. As a result of HSBC's Discretionary Pricing Policy, HSBC has collected more in

finance charges from blacks than from similarly situated white persons, for reasons totally

unrelated to credit risk.

74. HSBC's Discretionary Pricing Policy violates the Fair Housing Act and

constitutes actionable discrimination on the basis of race.

75. Plaintiff and the Class are aggrieved persons as defined in FHA by virtue of

having been subject to the discriminatory, HSBC's Discretionary Pricing Policy.

COUNT III

(DISCRIMINATION IN VIOLATION OF THE

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 14 of 18

15

EQUAL CREDIT OPPORTUNITY ACT AGAINST ZEUS FUNDING BY PLAINTIFF

ON BEHALF OF HERSELF, INDIVIDUALLY)

76. Plaintiff repeats and re-alleges every allegation above as if set forth herein in full.

77. Zeus Funding is a creditor as defined in ECOA, and in the ordinary course of its

business, participated in the decision of whether or not to extend credit to the Plaintiff.

78. The Plaintiff, Ms. Allen, is a member of a protected class.

79. Following her credit application, Zeus Funding extended credit to Ms. Allen on

sub-prime rather than prime terms because of her race.

80. During the same period, Zeus Funding extended credit to similarly situated white

borrowers on prime terms.

81. Zeus Funding's conduct violates the Equal Credit Opportunity Act.

82. Ms. Allen is an aggrieved person as defined in ECOA by virtue of having been

subject to this disparate treatment.

COUNT IV

(DISCRIMINATION IN VIOLATION OF THE

FAIR HOUSING ACT AGAINST ZEUS FUNDING BY PLAINTIFF ON BEHALF OF

HERSELF, INDIVIDUALLY)

83. Plaintiff repeats and re-alleges every allegation above as if set forth herein in full.

84. Zeus Funding engaged in residential real estate-related transactions with respect

to Ms. Allen.

85. The Plaintiff, Ms. Allen, is a member of a protected class.

86. Following her credit application, Zeus Funding extended credit to Ms. Allen on

sub-prime rather than prime terms because of her race.

87. During the same period, Zeus Funding extended credit to similarly situated white

borrowers on prime terms.

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 15 of 18

16

88. Zeus Funding's conduct violates the FHA.

89. Ms. Allen is an aggrieved person as defined in FHA by virtue of having been

subject to this disparate treatment.

PRAYER FOR RELIEF

WHEREFORE, the Plaintiffs respectfully request the following relief:

On behalf of the Class:

a. Certify this case as a class action and certify the named Plaintiff herein to be

adequate class representative and her counsel to be class counsel;

b. Enter a judgment, pursuant to 15 U.S.C. 1691e(c) and/or 42 U.S.C. § 3613,

declaring the acts and practices of HSBC complained of herein to be in violation of ECOA and

the FHA;

c. Grant a permanent or final injunction, pursuant to 15 U.S.C. 1691e(c) and/or 42

U.S.C. § 3613(c), enjoining HSBC, and HSBC's agents and employees, affiliates and

subsidiaries, from continuing to discriminate against plaintiffs and the members of the Class

because of their race through further use of the Discretionary Pricing Policy or any non-risk-

related Discretionary pricing policy employed by HSBC;

d. Order HSBC, pursuant to 15 U.S.C. § 1691e(c) and/or 42 U.S.C. § 3613(c), to

adopt and enforce a policy that requires appropriate training of HSBC's employees and its

brokers to prevent discrimination;

e. Order HSBC, pursuant to 15 U.S.C. § 1691e(c) and/or 42 U.S.C. § 3613(c), to

monitor and/or audit the racial pattern of its financings to ensure the cessation of discriminatory

effects in its home mortgage transactions;

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 16 of 18

17

f. Order disgorgement, pursuant to 15 U.S.C. § 1691e (c), of all disproportionate

non-risk charges imposed on blacks by HSBC's Discretionary Pricing Policy; and order the

equitable distribution of such charges, as restitutionary relief, to all appropriate class members;

g. Order actual and punitive damages to the Plaintiff and the class pursuant to 42

U.S.C. § 3613(c);

h. Award Plaintiff the costs of this action, including the fees and costs of experts,

together with reasonable attorneys’ fees, pursuant to 15 U.S.C. § 1691e(d) and/or 42 U.S.C. §

3613(c); and

i. Grant Plaintiff and the Class such other and further relief as this Court finds

necessary and proper.

On behalf of Ms. Allen:

j. Order actual and punitive damages to the Plaintiff pursuant to 42 U.S.C. §

3613(c);

k. Award Ms. Allen the costs of this action, including the fees and costs of experts,

together with reasonable attorneys’ fees, pursuant to 15 U.S.C. § 1691e(d) and/or 42 U.S.C. §

3613(c); and

l. Grant Ms. Allen such other and further relief as this Court finds necessary and

proper.

JURY TRIAL DEMANDED

Plaintiff demands a trial by jury on all issues so triable.

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 17 of 18

18

Respectfully submitted,

On Behalf of the Plaintiff,

/s/ Gary Klein

Gary Klein

Gary Klein (BBO # 560769)

Shennan Kavanagh (BBO # 655174)

Gillian Feiner (BBO # 664152)

RODDY KLEIN & RYAN

727 Atlantic Avenue

Boston, MA 02111-2810

Telephone: (617) 357-5500 ext. 15

Facsimile: (617) 357-5030

Marvin A. Miller

Matthew E. VanTine

Lori A. Fanning

MILLER LAW LLC

115 South LaSalle Street, Suite 2910

Chicago, IL 60603

Telephone: (312) 332-3400

DATE: September 6, 2007

Thomas M. Sobol (BBO # 471770)

Gregory Matthews (BBO # 653316)

HAGENS BERMAN SOBOL SHAPIRO LLP

One Main Street, 4th Floor

Boston, MA 02142

Telephone: (617) 475-1950

Facsimile: (617) 482-3003

Case 1:07-cv-11669-GAO Document 1 Filed 09/06/07 Page 18 of 18

Case 1:07-cv-11669-GAO Document 1-2 Filed 09/06/07 Page 1 of 7

Case 1:07-cv-11669-GAO Document 1-2 Filed 09/06/07 Page 2 of 7

Case 1:07-cv-11669-GAO Document 1-2 Filed 09/06/07 Page 3 of 7

Case 1:07-cv-11669-GAO Document 1-2 Filed 09/06/07 Page 4 of 7

Case 1:07-cv-11669-GAO Document 1-2 Filed 09/06/07 Page 5 of 7

Case 1:07-cv-11669-GAO Document 1-2 Filed 09/06/07 Page 6 of 7

Case 1:07-cv-11669-GAO Document 1-2 Filed 09/06/07 Page 7 of 7

C.A. No. 07-11669

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 1 of 3

C.A. No. 07-11669

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 2 of 3

C.A. No. 07-11669

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 3 of 3

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 1 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 2 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 3 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 4 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 5 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 6 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 7 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 8 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 9 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 10 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 11 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 12 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 13 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 14 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 15 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 16 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 17 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 18 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 19 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 20 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 21 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 22 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 23 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 24 of 25

Case 1:07-cv-11669-GAO Document 1-3 Filed 09/06/07 Page 25 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 1 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 2 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 3 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 4 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 5 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 6 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 7 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 8 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 9 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 10 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 11 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 12 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 13 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 14 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 15 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 16 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 17 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 18 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 19 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 20 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 21 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 22 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 23 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 24 of 25

Case 1:07-cv-11669-GAO Document 1-4 Filed 09/06/07 Page 25 of 25