Application to Purchase

1011 Bemis Street SE

Are you interested in 1011 Bemis Street SE, a CHLT home? Here is the basic process for applying to

the program! You can review this home’s information here.

We highly recommend you read our full CHLT Homebuyer + Homeowner Guide BEFORE

applying for a CHLT home. The Guide can be found here and on our website.

Submit a Complete CHLT Application

01

Interested buyers will need to submit all required documents to

be considered. Applications can be accepted online using this link,

through links available on our website (iccf.org), OR hardcopies

can be picked up/dropped off at our office.

Meet with a Housing Counselor

02

Once a complete application is received, buyers who appear to

meet income guidelines will be scheduled for a final income

verification meeting with a HUD Certified Housing Counselor in

the order they were received.

Take a HUD Certified Homebuyer Education Course

03

Before you are able to officially purchase the home, buyers will

need to complete a HUD Certified Introduction to

Homeownership course and submit a completion certificate. ICCF

offers a variety of class options and counselors can make

recommendations of other programs as well.

CHLT Application

Please note, not all lenders work with CLT's and to form a new partnership with a lender not on the

list could take more than 12 months. Buyers wishing to work with a lender who is NOT on the

partner list should send their lender the included Lender Guide Document.

** - Interested buyers must be able to qualify for a 30-year conventional mortgage with a CLT-

compatible mortgage partner. The CHLT is currently unable to work with FHA or VA financing.

Required Documents

Below are the required items you will need to apply to purchase a CHLT home. If any of the items

are not included, your application may be denied.

*CHLT and ICCF staff reserve the right to request additional information to determine the final approval of your application.

ICCF Home Specific Application

Income Documentation

2 months of most recent bank statements

2 months of most recent utility bills

3 months of most recent proof of income

Examples – paystubs, award letters, child support, social security, disability,

unemployment, financial aid, gift letter

Tax Returns from previous 2 years

W-2’s from all jobs held in the last year

Pre-Approval Letter**

Completion Certificate for Intro to Homeownership Class

Due before the final closing - if available, can be submitted with the application

If you need assistance, please contact [email protected]

Be aware that the online submission page will ONLY accept PDFs. The application form can be

completely filled out online, downloaded, and then uploaded to the submission page. Scans of

the document can also be uploaded. If you need assistance, please contact [email protected].

You will also be unable to submit the application once you have uploaded ALL the required

documents. If you do not have the items, it will not let you move forward or submit the application.

Submitting Application +

Required Documents

Applications are home-specific and can be accessed in the

following ways:

Once you have completed the application form and gathered all

other required documents, you can submit them in the following

ways:

Downloaded directly from our website

Applications will be listed under the individual homes and on all Home Specific

Flyers

Downloaded through the Application Submission Page

select the home you want to apply for and links to the application will be listed

Hardcopies + the Required Document Checklists can be picked at the ICCF

Offices - 415 MLK Jr. St SE, Suite 100, Grand Rapids, MI

Through the Application Submission Page

Dropped off at the ICCF Offices - 415 MLK Jr. St SE, Suite 100, Grand

Rapids, MI

CHLT Application

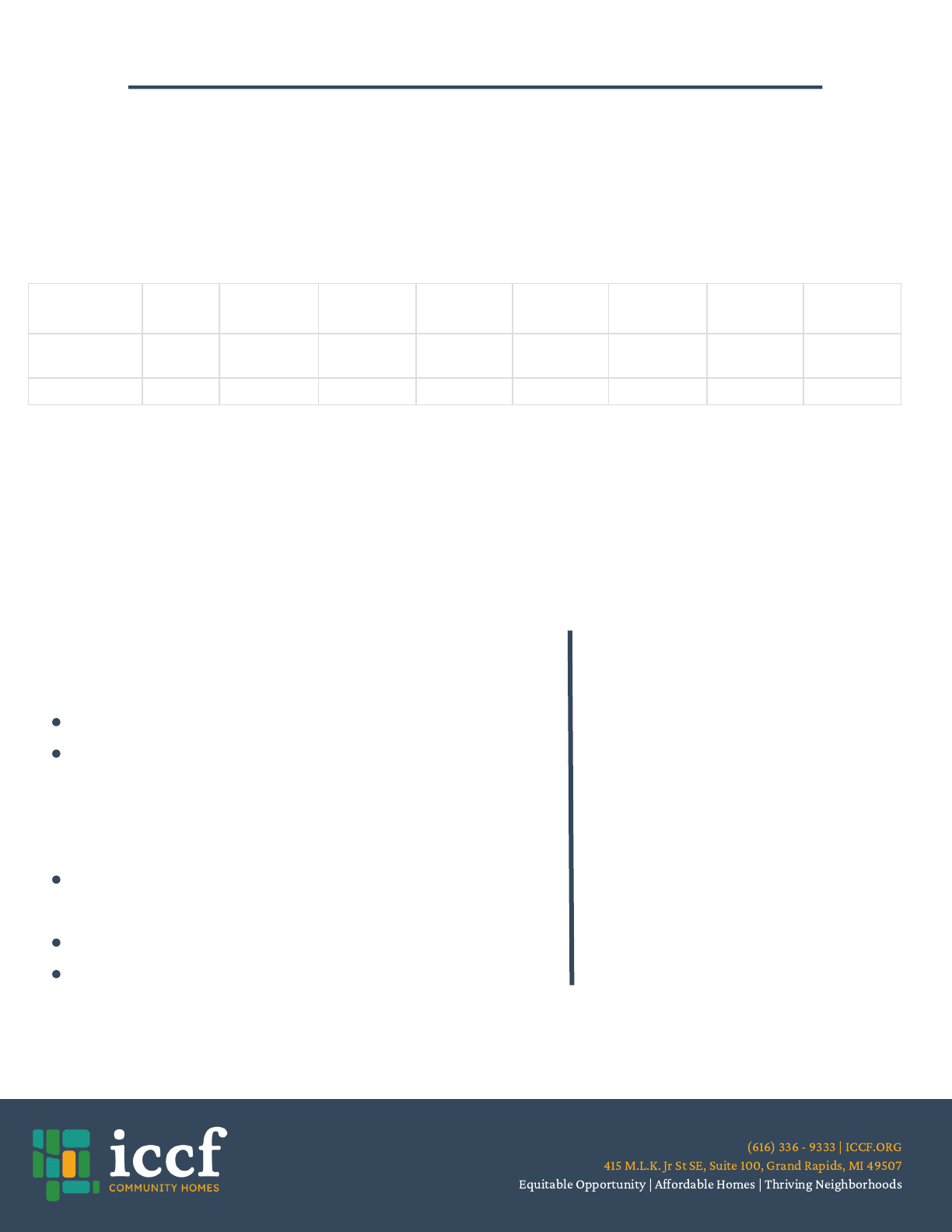

Household Income Guidelines for Buyers

The home you are interested in purchasing will be sold to an income-qualifying household with a combined annual

household income under 80% AMI. If your combined household income exceeds the amount listed in the table below

(for your household’s size), you DO NOT qualify for this home.

Income limits are based on the gross income of all adults who will be living in the household at the time of purchase,

regardless of whether or not they will be on the mortgage.

All income is counted, including regular employment wages, plus child support, alimony, social security, and

disability benefits.

Buyers only have to income qualify at the time of original purchase. Their income is never monitored again, and

there is no limit on how much they can earn in the future.

Household Size

1

2

3

4

5

6

7

8

80% AMI

Max Annual Income

$53,040

$60,640

$68,240

$75,760

$81,840

$87,920

$94,000

$100,080

Max Monthly Income

$4,420

$5,053

$5,686

$6,313

$6,820

7,326

$7,833

$8,340

HOUSEHOLDS MUST ALSO:

* NOTES ABOUT DEBT

RATIOS:

Be a first-time homebuyer

Monthly housing costs - mortgage

payments, taxes, insurance, and ground lease

fees -cannot exceed 35% of the

household’s monthly income*

Total housing costs + existing debt cannot

exceed 43%*

Have under $35,000 cash assets

Have verified funds to close

These ratios or percentages of

monthly income limits may

change if the buyer is using a city

or state-funded down payment

assistance program or if they

qualify for a specific mortgage

through their lender. The CHLT

and ICCF staff always assist

households in navigating these

requirements.

If your monthly housing costs EXCEED 35% of your monthly income or if your housing costs plus

your current debt EXCEEDS 43% of your monthly income, you DO NOT qualify for this home.

CHLT Application - HOME assisted property

Opportunities to Consider -

Grand Rapids Homebuyer Assistance Fund

*At least 18 years old and has not owned a home within the last 3 years

*Agrees to occupy the home as a primary residence for at least 5 years

*Household does not exceed Annual Income Limits shown below

The household has $10,000 or less in assets

*Pre-approved for a mortgage from a participating lender (not all HAF lenders have approved the CHLT program)

*Completes an approved homebuyer education course

The Homebuyer Assistance Fund (HAF) program offers up to $7,500 for income-qualifying homebuyers to use on

down payment, closing costs, and prepaid expenses. These funds are awarded as a zero-interest, second mortgage

loan with no monthly payments to first-time homebuyers. The loan is forgiven over the course of 5-years.

For this home, additional funds could be made available based on the household’s income and availability of

funds. If you are interested in these additional funds, you must apply for the HAF program through your lender!

Homebuyer Requirements:

*-indicate that the requirement is also a

r

equirement of the CHLT program

Household Size

1

2

3

4

5

6

7

8

80% AMI

Max Annual Income

$53,040

$60,640

$68,240

$75,760

$81,840

$87,920

$94,000

$100,080

Max Monthly Income

$4,420

$5,053

$5,686

$6,313

$6,820

7,326

$7,833

$8,340

Note - this program has different Debt-to-income requirements.

CHLT Application - HOME assisted property

Updated 11/7/2022

Education and Housing Counseling Participant Profile

First Name

Middle Name

Last Name

Address

City

State

Zip Code

County

Email Address

Phone Number

1. Date of Birth: (month/date/year)

2. Gender (check one): Male Female Transgender Male Transgender Female

Choose not to respond Other:

3. Personal Pronouns: She/Her/Hers He/Him/His They/Them/Theirs Choose not to respond

4. What is your preferred language? (check one): English Spanish Other:

5. Describe your English proficiency: Proficient (not limited) Limited English Choose not to respond

6. Do you live in a rural area? (check one): Yes No

7. Household Type (check one):

Single Adult

Female-Headed Single Parent

Male-Headed Single Parent

Married Without Children

Married With Children

Two or More Unrelated Adults

Other

8. Are you a veteran? (check one): Yes No

9. Do you have a disability? (check one): Yes No

10. Do you receive disability benefits? (check one): Yes No

11. How did you hear about us? (check any and all that apply)

Habitat for Humanity

GR Housing Commission

Wyoming Housing Commission

MSHDA

Kent Community Action Agency

Walk-In

ICCF Event

LINC

New Development

Project GREEN

Online/Website

Family/Friend

Other:

12. Race (check all that apply)

American Indian/Alaskan Native

Asian

Black/African American

Native Hawaiian/Pacific Islander

White

Other:

Choose not to respond

Updated 11/7/2022

13. Ethnicity (check one): Hispanic or Latino Not Hispanic or Latino Choose not to respond

14. Have you experienced housing discrimination within the last 180 days? (check one): Yes No

15. Are you a Colonias Resident? (Are you a permanent resident of Texas, New Mexico, Arizona, or California?)

(check one): Yes No

16. Have you purchased a home within the last three years? (check one): Yes No

17. Total number of people in your household:

18. Total number of dependents:

19. Total Gross Monthly Income (includes wages, worker’s comp, veteran benefits, unemployment, SSI, Social Security

benefits, retirement, public assistance, military, child support, alimony)

20. Total Monthly Debt (includes MONTHLY payments of credit cards, automobile loan, mortgage, student loans, child

support, alimony)

21. When was the last time you got a copy of your credit report and/or score? Date:

22. Credit Scores:

Transunion

Equifax

Experian

I don’t know

23. Do you currently use any third-party businesses to track your score? Check all that apply.

AnnualCreditReport.com

Credit Karma

Credit Sesame

Quizzle

Other

24. Do you plan to purchase a home in the next… (check anticipated time frame)

30 Days

3 Months

6 Months

1 Year

Longer than 1 year

25. Do you currently follow a written or electronic budget? (check one): Yes No

26. Do you have money set aside in the event of an emergency? (check one): Yes No

If yes, how much?

27. Do you have a checking account? (check one): Yes No

28. Do you have a savings account? (check one): Yes No

29. Would you like help with any of the following: (check all that apply)

Establish a plan to maintain or improve

your credit score

Establish a plan to increase your

emergency funds

Begin a savings plan

Reduce debt

Review your credit score

Become mortgage eligible

30. Are you a current ICCF Community Homes tenant? (check one): Yes No

31. Are you a Community Homes Initiative tenant (previously managed by Blue Bay Properties)?

(check one): Yes No

Printed Name Signature Date

Updated 11/7/2022

Education and Housing Counseling Participant Profile

This Second Profile is for the Co-Signer (if applicable)

First Name

Middle Name

Last Name

Address

City

State

Zip Code

County

Email Address

Phone Number

1. Date of Birth: (month/date/year)

2. Gender (check one): Male Female Transgender Male Transgender Female

Choose not to respond Other:

3. Personal Pronouns: She/Her/Hers He/Him/His They/Them/Theirs Choose not to respond

4. What is your preferred language? (check one): English Spanish Other:

5. Describe your English proficiency: Proficient (not limited) Limited English Choose not to respond

6. Do you live in a rural area? (check one): Yes No

7. Household Type (check one):

Single Adult

Female-Headed Single Parent

Male-Headed Single Parent

Married Without Children

Married With Children

Two or More Unrelated Adults

Other

8. Are you a veteran? (check one): Yes No

9. Do you have a disability? (check one): Yes No

10. Do you receive disability benefits? (check one): Yes No

11. How did you hear about us? (check any and all that apply)

Habitat for Humanity

GR Housing Commission

Wyoming Housing Commission

MSHDA

Kent Community Action Agency

Walk-In

ICCF Event

LINC

New Development

Project GREEN

Online/Website

Family/Friend

Other:

12. Race (check all that apply)

American Indian/Alaskan Native

Asian

Black/African American

Native Hawaiian/Pacific Islander

White

Other:

Choose not to respond

Updated 11/7/2022

13. Ethnicity (check one): Hispanic or Latino Not Hispanic or Latino Choose not to respond

14. Have you experienced housing discrimination within the last 180 days? (check one): Yes No

15. Are you a Colonias Resident? (Are you a permanent resident of Texas, New Mexico, Arizona, or California?)

(check one): Yes No

16. Have you purchased a home within the last three years? (check one): Yes No

17. Total number of people in your household:

18. Total number of dependents:

19. Total Gross Monthly Income (includes wages, worker’s comp, veteran benefits, unemployment, SSI, Social Security

benefits, retirement, public assistance, military, child support, alimony)

20. Total Monthly Debt (includes MONTHLY payments of credit cards, automobile loan, mortgage, student loans, child

support, alimony)

21. When was the last time you got a copy of your credit report and/or score? Date:

22. Credit Scores:

Transunion

Equifax

Experian

I don’t know

23. Do you currently use any third-party businesses to track your score? Check all that apply.

AnnualCreditReport.com

Credit Karma

Credit Sesame

Quizzle

Other

24. Do you plan to purchase a home in the next… (check anticipated time frame)

30 Days

3 Months

6 Months

1 Year

Longer than 1 year

25. Do you currently follow a written or electronic budget? (check one): Yes No

26. Do you have money set aside in the event of an emergency? (check one): Yes No

If yes, how much?

27. Do you have a checking account? (check one): Yes No

28. Do you have a savings account? (check one): Yes No

29. Would you like help with any of the following: (check all that apply)

Establish a plan to maintain or improve

your credit score

Establish a plan to increase your

emergency funds

Begin a savings plan

Reduce debt

Review your credit score

Become mortgage eligible

30. Are you a current ICCF Community Homes tenant? (check one): Yes No

31. Are you a Community Homes Initiative tenant (previously managed by Blue Bay Properties)?

(check one): Yes No

Printed Name (Co-Borrower Signature (Co-Borrower) Date

Updated 5/12/22

Housing Education Program Agreement

and Release of Information

In signing this agreement and release, I/We agree to actively participate in the Housing Education Services being

offered by this agency. I/We understand:

1. A referral to other services of the organization or another agency (as appropriate) may be made to assist

with particular concerns that have been identified. I understand that I am not obligated to use any of

the services offered to me.

2. That this agency receives funds through MSHDA and HUD and as such, is required to share some of my

personal information with program administrators or their agents for purposes of program monitoring,

compliance and evaluation.

3. That a counselor may answer questions and provide information but cannot give legal advice. If I want

legal advice, I will be referred to an attorney for appropriate assistance.

4. That this agency may provide information on numerous housing programs and loan products and I

further understand that the housing services received from this agency in no way obligates me/us to

choose any of their particular housing programs or loan products.

For Pre-Purchase Education Services only:

By initialing I/We acknowledge the agency has provided me/us with (1) For Your

Protection Get a Home Inspection (HUD-92564), (2) Ten Important Questions to Ask a Home Inspector, and

(3) Disclosure of Lead-Based Paint Hazards in Housing (EPA-747-F-96-002)

For Post-Purchase Education Services only:

I/We hereby allow this Agency its agents, employees, or affiliates to request and obtain income and

asset information, mortgage, credit bureau and personal information pertinent to the housing

counseling received. I/We allow contact to be made on my/our behalf with representatives from

mortgage, attorney, collection and credit bureau companies.

CONSENT: Failure to sign this consent form may result in denial of program assistance or termination of

counseling program benefits.

Client’s Printed Name:

Client’s Signature:

Date

Signed:

Client #2 Printed Name:

Client #2 Signature:

Date

Signed:

Client’s Current Address:

City:

Zip Code:

To be completed by Counselor:

Agency Name:

ICCF Community Homes

Agency Phone Number:

616-336-9333

Counselor Name:

Counselor Signature:

Date Signed:

Updated 6/10/2022

Data Release Form & Third Party Authorization

If you have an impairment, disability, language barrier, or otherwise require an alternative means of

completing this form or accessing information about housing counseling, please talk to your housing

counselor about arranging alternative accommodations.

You hereby authorize and instruct ICCF Community Homes and/or its assigned agents to:

• Obtain and review your credit report, and

• Request verifications of your income, assets, and any other information deemed necessary for improving your

housing situation.

Your credit report will be obtained from a credit reporting agency chosen by ICCF Community Homes. You understand and

agree that ICCF Community Homes intends to use the credit report for the purpose of evaluating your financial readiness to

purchase or rent a home and/or to engage in post-purchase counseling activities. You hereby authorize ICCF Community

Homes, when necessary, to share your credit report and any information that you provided (including any computations and

assessments produced) with the entities listed below in order to help ICCF Community Homes determine your viable

financial options.

Lenders Debt Collectors Property Management Companies

Banks Landlords Social Service Agencies

Mortgage Servicers Public Housing Authorities Counseling Agencies

Entities such as mortgage lenders and/or counseling agencies may contact your ICCF Community Homes counselor to

evaluate the options for which you may be eligible. In connection with such evaluation, you authorize the credit reporting

and/or financial agencies to release information and cooperate with your ICCF Community Homes counselor. No information

will be discussed about you with entities not directly involved in your efforts to improve your housing situation. Only

information pertinent to the inquiry at hand will be shared.

You hereby authorize the release of your information to program monitoring organizations of ICCF Community Homes,

including but not limited to, Federal, State, and nonprofit partners for program review, monitoring, auditing, research,

and/or oversight purposes. You also agree to keep ICCF Community Homes informed of any changes in address, telephone

number, job status, marital status, or other conditions which may affect your eligibility for a program you have applied for or

a counseling service that you are seeking.

Finally, you understand that you may revoke consent to these disclosures by notifying ICCF Community

Homes in writing.

Name 1 (Printed) SSN# Date of Birth Signature Today’s Date

Name 2 (Printed) SSN# Date of Birth Signature Today’s Date

Current Address:

Previous Address:

(Required if you reside at current address less than 2 years)

Verified Client Identification and SSN:

Counselor Signature Date

Updated 6/10/2022

Program Disclosure

If you have an impairment, disability, language barrier, or otherwise require an alternative means of

completing this form or accessing information about housing counseling, please talk to your housing

counselor about arranging accommodations.

ABOUT ICCF COMMUNITY HOMES AND PROGRAM PURPOSE

ICCF Community Homes is a non-profit housing counseling agency and a housing developer. Our goal in working

with you is to help you make the best decision about your finances and housing counseling needs. ICCF

Community Homes provides the full spectrum of housing counseling services including, pre-purchase, foreclosure

prevention, non-delinquency post-purchase, rental and homeless counseling. We serve all clients regardless of

income, race, color, religion/creed, sex, national origin, age, family status, disability, or sexual orientation/gender

identity. We administer our programs in conformity with local, state, and federal anti-discrimination laws,

including the federal Fair Housing Act (42 USC 3600, et seq).

AGENCY CONDUCT

No ICCF Community Homes employee, officer, director, contractor, volunteer, or agent shall undertake any action

that might result in, or create the appearance of, administering counseling operations for personal or private gain,

provide preferential treatment for any person or organization, or engage in conduct that will compromise our

agency’s compliance with federal regulations and our commitment to serving the best interests of our clients.

As a housing counseling client you are not obligated to receive, purchase or utilize any other service offered by this

organization or its partners. You have the right to work with any mortgage company, to apply for any housing

program or to use any mortgage product that you choose. We encourage you to shop around for the best program

or production that fits your circumstances. Our Individual Development Accounts are held at Mercantile Bank, this

does not require you to use Mercantile Bank for your mortgage company or personal banking.

You also have the right to seek HUD approved counseling services at other agencies. Other agencies in the Grand

Rapids area include and are not limited to:

Home Repair Services

1100 S. Division Ave

616-241-2601

Grand Rapids Urban League

745 Eastern Ave

616-245-2207

MSU Extension

775 Ball Ave NE

616-632-7865

Your signature below indicates you have read and understand these statements.

Printed Name Signature Date Signed

Co-Borrower Printed Name Co-Borrower Signature Date Signed

PLEASE SEE PAGE TWO OF THIS DOCUMENT →

Updated 6/10/2022

ICCF COMMUNITY HOMES PARTNERSHIPS

ICCF Community Homes has partnerships with various organizations; you have the right to be informed of these

partnerships.

This listing is intended to be representative and does not include all possible entities with which ICCF Community

Homes may have a relationship either now or in the future. This document will be updated as a practicable. An

inquiry about ICCF Community Homes’ various partnerships and affiliations is available by contacting ICCF

Community Homes’ main offices located at 415 Martin Luther King Jr. St. SE, Grand Rapids, MI.

The following chart is representative of various subsidiaries and affiliates of ICCF Community Homes:

ICCF COMMUNITY

HOMES-NPH

The ICCF Community Homes Nonprofit Housing Corporation (ICCF Community

Homes-NPH) is a subsidiary of the parent corporation, ICCF Community Homes.

Most real estate development activities are conducted through ICCF Community

Homes-NPH including the development of affordable rental and ownership units.

ICCF Community Homes-NPH owns a variety of entities through which it engages in

the development of affordable housing. These include Stockbridge Apartments, 415

Martin Luther King Jr. St, 435 La Grave at Tapestry Square, 501 Eastern Apartments,

and Pleasant Prospect Homes Phase III. A full listing of these entities is available at

ICCF Community Homes’ main offices located at 415 Martin Luther King Jr. St. SE,

Grand Rapids, MI.

ICCF COMMUNITY

HOMES RENTAL

PROPERTIES

ICCF Community Homes is a MSHDA certified property management entity and owns

several affordable rental properties. A full listing of these entities is available at ICCF’s

main offices located at 415 Martin Luther King Jr. St. SE, Grand Rapids, MI.

CARMODY

APARTMENTS

Carmody (also known previously as Madison Apartments) is a multi-unit rental

development consisting of nineteen (19) 1, 2, and 3 bedroom units. ICCF Community

Homes has owned and operated Carmody since 1990. Applications for these

apartments are available through ICCF’s Real Estate Development and Management

division.

ICCF COMMUNITY

HOMES

HOMEOWNERSHIP

PROGRAMS

ICCF Community Homes is a licensed residential builder and either reconstructs or

newly constructs single family homes for sale to income qualified buyers. ICCF’s

homes are sold to qualified buyers using mortgage financing available through

numerous local lenders.

ICCF Community Homes has financial affiliations with numerous entities including the following: Michigan State

Housing Development Authority, Michigan Department of Health and Human Services (MDHHS), Kent County,

City of Grand Rapids, Salvation Army, National Community Reinvestment Coalition, Department of Housing and

Urban Development (Federal), Oakland/Livingston Human Service Agency, Habitat for Humanity of Kent County,

West Michigan United Way, Kent ISD, Office of the Administration for Children and Families (Federal)

Updated 6/10/2022

Counselor and Client Agreement

ICCF Community Homes and its counselor(s) agree to provide professional housing counseling services to

(you).

WHAT TO EXPECT

The counselor will help you:

• Understand the relevant housing processes so that you know what to expect and what to do next;

• Explore options available to you in regards to your own housing goals.

• Counselors are not able to guarantee certain outcomes, but are committed to working with you so you can make the

best decisions possible to meet your housing goals.

The counselor will work with you to understand:

• Your current credit information by reviewing your credit report;

• Your income and expenses by developing a spending plan;

• Possible solutions and adjustments to your spending plan, as needed;

• Current mortgage products and options available to you;

• Referral options as needed.

Together with the counselor you will develop an action plan with steps for both you and the counselor.

COUNSELOR COMMITMENT

The counselor agrees to:

• Provide you with factual information;

• Complete action plan steps in a timely manner;

• Make referrals to needed resources;

• Provide services confidentially, honestly and respectfully;

• Communicate with involved parties (ex. Housing commissions or Mortgage Company).

CLIENT COMMITMENT

You understand that in order for the counselor to provide you with the best service possible, you agree to:

• Provide honest and complete information;

• Provide all necessary documentation and complete action plan steps within the timeframe requested;

• Notify the counselor immediately, preferably 6 hours before a scheduled appointment, if you will be unable to attend

an appointment;

• Arrive on time for appointments. You understand that if you are late for an appointment, the appointment will still

end at the scheduled time and the counselor may need to reschedule;

• Contact the counselor about any changes in your situation immediately;

• Complete required classes, counseling, and workshops needed to succeed.

Client Printed Name Client Signature Date Signed

Co-Borrower Printed Name (If applicable) Co-Borrower Signature Date Signed

Counselor Printed Name Counselor Signature Date Signed

PLEASE SEE PAGE TWO OF THIS DOCUMENT

Updated 6/10/2022

PRIVACY POLICY

ICCF Community Homes follows HUD and MSHDA guidelines in regards to protecting your privacy and protecting

your Personally Identifiable Information (PII). We are committed to protecting the privacy of your information

whether it is stored electronically, in client management software or in paper form. Our Counselors follow federal

privacy related guidance and best practices, including, but not limited to:

Limiting Collection of PII

Your Counselor will not collect or maintain your PII without proper authorization and only collect that which is

needed for the purpose of Housing Counseling and Education Services.

Managing Access to Sensitive PII

• Your Counselor will only share or discuss your sensitive PII with those who have a need to know for

counseling services purposes.

• Your Counselor will not distribute or release your sensitive PII to others without an authorized release.

• Before discussing your sensitive PII over the telephone, your counselor will confirm that they are speaking

to the right person. They will not leave voicemails that contain your sensitive PII.

• Your Counselor will avoid discussing your sensitive PII if there are unauthorized persons in public spaces,

and will hold meetings in private spaces when your individual information may be discussed.

• Your Counselor will treat notes from meetings discussing your data as confidential and insure they are

stored securely.

Securing Sensitive PII

• Your file will remain in a locked filing cabinet when the Housing and Family Services department is not

staffed.

• The Housing and Family Services office space will remain secure when staff is not present.

• Only program staff and their supervisors will have keys to filing cabinets containing your PII. When your

file is in use, staff will take all reasonable measures to secure your information.

• Your file will be stored for a period consistent with grant and contact terms.

• Any of your documents containing personal information that is no longer needed will be destroyed via

professional shredding services.

• Any of your electronic data will be stored only in a secured area on the network or in the appropriate client

management databases.

• All databases will be secured with individual passwords for program staff and their supervisors, and Staff

will password-protect their computers when they step away from their workspaces.

-

CAUTION—Your Action is Required Soon

U.S. Department of Housing

OMB Approval No: 2502-0538

and Urban Development

(exp. 06/30/2021)

Federal Housing Administration (FHA)

For Your Protection:

Get a Home Inspection

You must make a choice on getting a Home Inspection. It is not done automatically.

You have the right to examine carefully your potential new home with a professional home inspector. But a home inspection is

not required by law, and will occur only if you ask for one and make the arrangements. You may schedule the inspection for

before or after signing your contract. You may be able to negotiate with the seller to make the contract contingent on the results

of the inspection. For this reason, it is usually in your best interest to conduct your home inspection as soon as possible i f you

want one. In a home inspection, a professional home inspector takes an in-depth, unbiased look at your potential new home to:

Evaluate the physical condition: structure, construction, and mechanical systems;

Identify items that need to be repaired and

Estimate the remaining useful life of the major systems, equipment, structure, and finishes.

The Appraisal is NOT a Home Inspection and does not replace an inspection.

An appraisal estimates the market value of the home to protect the lender. An appraisal does not examine or evaluate the

condition of the home to protect the homebuyer. An appraisal only makes sure that that the home meets FHA and/or your lender’s

minimum property standards. A home inspection provides much more detail.

FHA and Lenders may not Guarantee the Condition of your Potential New Home

If you find problems with your new home after closing, neither FHA nor your lender may give or lend you money for repairs.

Additionally, neither FHA nor your lender may buy the home back from you. Ask a qualified home inspector to inspect your

potential new home and give you the information you need to make a wise decision.

Your Home Inspector may test for Radon, Health/Safety, and Energy Efficiency

EPA, HUD and DOE recommend that houses be tested and inspected for radon, health and safety, and energy efficiency,

respectively. Specific tests are available to you. You may ask about tests with your home inspector, in addition to the structural

and mechanical systems inspection. For more information: Radon -- call 1-800-SOS-Radon; Health and Safety – see the HUD

Healthy Homes Program at

www.HUD.gov

; Energy Efficiency -- see the DOE EnergyStar Program at www.energystar.gov.

Selecting a Trained Professional Home Inspector

Seek referrals from friends, neighbors, other buyers, realtors, as well as local listings from licensing authorities and local

advertisements. In addition, consult the American Society of Home Inspectors (ASHI) on the web at: www.ashi.org or by

telephone at: 1-800-743-2744.

I / We (circle one) have read this document and understand that if I/we wish to get a home inspection, it is best do so as soon as

possible. The appraisal is not a home inspection. I/we will make a voluntary choice whether to get a home inspection. A home

inspection will be done only if I/we ask for one and schedule it. Your lender may not perform a home inspection and neither FHA nor

your lender may guarantee the condition of the home. Health and safety tests can be included in the home inspection if I/we choose.

________________________________/__/___

_______________________________/__/____

(Signed) Homebuyer

Date

(Signed) Homebuyer

Date

Public reporting burden for this collection is estimated at an average of 30 minutes to review the instructions, find the information, and complete this form. This agency cannot conduct or sponsor a collection of

information unless a valid OMB number is displayed. You are not required to respond to a collection of information if this number is not displayed. Valid OMB numbers can be located on the OMB Internet page at

http://www.whitehouse.gov/library/omb/OMBINVC.html - HUD If desired you can call 1-800-827-1000 to get information on where to send comments or suggestions about this form.

HUD-92564-CN (expiration)

Updated 11/7/2022

Ten Important Questions to Ask Your Home Inspector

1. What does your inspection cover? The inspector should ensure that their inspection and

inspection report will meet all applicable requirements in your state if applicable and will

comply with a well-recognized standard of practice and code of ethics. You should be able

to request and see a copy of these items ahead of time and ask any questions you may have.

If there are any areas you want to make sure are inspected, be sure to identify them upfront.

2. How long have you been practicing in the home inspection profession and how many

inspections have you completed? The inspector should be able to provide his or her history

in the profession and perhaps even a few names as referrals. Newer inspectors can be very

qualified, and many work with a partner or have access to more experienced inspectors to

assist them in the inspection.

3. Are you specifically experienced in residential inspection? Related experience in

construction or engineering is helpful but is no substitute for training and experience in the

unique discipline of home inspection. If the inspection is for a commercial property, then

this should be asked about as well.

4. Do you offer to do repairs or improvements based on the inspection? Some inspector

associations and state regulations allow the inspector to perform repair work on problems

uncovered in the inspection. Other associations and regulations strictly forbid this as a

conflict of interest.

5. How long will the inspection take? The average on-site inspection time for a single

inspector is two to three hours for a typical single-family house; anything significantly less

may not be enough time to perform a thorough inspection. Additional inspectors may be

brought in for very large properties and buildings.

6. How much will it cost? Costs vary dramatically, depending on the region, size and age of the

house, scope of services and other factors. A typical range might be $300-$500 but consider

the value of the home inspection in terms of the investment being made. Cost does not

necessarily reflect quality. HUD does not regulate home inspection fees.

7. What type of inspection report do you provide and how long will it take to receive the

report? Ask to see samples and determine whether or not you can understand the

inspector's reporting style and if the time parameters fulfill your needs. Most inspectors

provide their full report within 24 hours of the inspection.

8. Will I be able to attend the inspection? This is a valuable educational opportunity, and an

inspector's refusal to allow this should raise a red flag. Never pass up this opportunity to see

your prospective home through the eyes of an expert.

9. Do you maintain membership in a professional home inspector association? There are

many state and national associations for home inspectors. Request to see their membership

ID and perform whatever due diligence you deem appropriate.

10. Do you participate in continuing education programs to keep your expertise up to date?

One can never know it all, and the inspector's commitment to continuing education is a

good measure of his or her professionalism and service to the consumer. This is especially

important in cases where the home is much older or includes unique elements requiring

additional or updated training.

HUD

United States Prevention, Pesticides, EPA-747-F-96-002

Environmental Protection and Toxic Substances March 1996

Agency (7404) (Revised 12/96)

FACT SHEET

EPA and HUD Move to Protect Children from Lead-Based Paint

Poisoning; Disclosure of Lead-Based Paint Hazards in Housing

SUMMARY

The Environmental Protection Agency (EPA) and the

Department of Housing and Urban Development

(HUD) are announcing efforts to ensure that the public

receives the information necessary to prevent lead

poisoning in homes that may contain lead-based paint

hazards. Beginning this fall, most home buyers and

renters will receive known information on lead-based

paint and lead-based paint hazards during sales and

rentals of housing built before 1978. Buyers and

renters will receive specific information on lead-based

paint in the housing as well as a Federal pamphlet with

practical, low-cost tips on identifying and controlling

lead-based paint hazards. Sellers, landlords, and their

agents will be responsible for providing this

information to the buyer or renter before sale or lease.

LEAD-BASED PAINT IN HOUSING

Approximately three-quarters of the nation’s housing

stock built before 1978 (approximately 64 million

dwellings) contains some lead-based paint. When

properly maintained and managed, this paint poses

little risk. However, 1.7 million children have blood-

lead levels above safe limits, mostly due to exposure to

lead-based paint hazards.

EFFECTS OF LEAD POISONING

Lead poisoning can cause permanent damage to the

brain and many other organs and causes reduced

intelligence and behavioral problems. Lead can also

cause abnormal fetal development in pregnant women.

BACKGROUND

To protect families from exposure to lead from paint,

dust, and soil, Congress passed the Residential Lead-

Based Paint Hazard Reduction Act of 1992, also

known as Title X. Section 1018 of this law directed

HUD and EPA to require the disclosure of known

information on lead-based paint and lead-based paint

hazards before the sale or lease of most housing built

before 1978.

WHAT IS REQUIRED

Before ratification of a contract for housing sale or

lease:

! Sellers and landlords must disclose known lead-

based paint and lead-based paint hazards and

provide available reports to buyers or renters.

! Sellers and landlords

must give buyers and

renters the pamphlet,

developed by EPA,

HUD, and the

Consumer Product

Safety Commission

(CPSC), titled Protect

Your Family from

Lead in Your Home.

! Home buyers will get

a 10-day period to

conduct a lead-based paint inspection or risk

assessment at their own expense. The rule gives the

two parties flexibility to negotiate key terms of the

evaluation.

! Sales contracts and leasing agreements must include

certain notification and disclosure language.

! Sellers, lessors, and real estate agents share

responsibility for ensuring compliance.

FOR MORE INFORMATION

! For a copy of Protect Your Family from Lead in Your Home (in English or Spanish) , the sample disclosure

forms, or the rule, call the National Lead Information Clearinghouse (NLIC) at (800) 424–LEAD, or TDD

(800) 526–5456 for the hearing impaired. You may also send your request by fax to (202) 659–1192 or by

Internet E-mail to [email protected]. Visit the NLIC on the Internet at http://www.nsc.org/nsc/ehc/ehc.html.

! Bulk copies of the pamphlet are available from the Government Printing Office (GPO) at (202) 512–1800.

Refer to the complete title or GPO stock number 055–000–00507–9. The price is $26.00 for a pack of 50

copies. Alternatively, persons may reproduce the pamphlet, for use or distribution, if the text and graphics are

reproduced in full. Camera-ready copies of the pamphlet are available from the National Lead Information

Clearinghouse.

! For specific questions about lead-based paint and lead-based paint hazards, call the National Lead Information

Clearinghouse at (800) 424–LEAD, or TDD (800) 526–5456 for the hearing impaired.

! The EPA pamphlet and rule are available electronically and may be accessed through the Internet.

Electronic Access:

Gopher: gopher.epa.gov:70/11/Offices/PestPreventToxic/Toxic/lead_pm

WWW: http://www.epa.gov/opptintr/lead/index.html

http://www.hud.gov

Dial up: (919) 558–0335

FTP: ftp.epa.gov (To login, type “anonymous.” Your password is your Internet E-mail address.)

WHAT IS NOT REQUIRED

! This rule does not require any testing or removal of

lead-based paint by sellers or landlords.

! This rule does not invalidate leasing and sales

contracts.

TYPE OF HOUSING COVERED

Most private housing, public housing, Federally owned

housing, and housing receiving Federal assistance are

affected by this rule.

TYPE OF HOUSING NOT COVERED

! Housing built after 1977 (Congress chose not to

cover post-1977 housing because the CPSC banned

the use of lead-based paint for residential use in

1978).

! Zero-bedroom units, such as efficiencies, lofts, and

dormitories.

! Leases for less than 100 days, such as vacation

houses or short-term rentals.

! Housing for the elderly (unless children live there).

! Housing for the handicapped (unless children live

there).

! Rental housing that has been inspected by a certified

inspector and found to be free of lead-based paint.

! Foreclosure sales.

EFFECTIVE DATES

! For owners of more than 4 dwelling units, the

effective date is September 6, 1996.

! For owners of 4 or fewer dwelling units, the

effective date is December 6, 1996.

THOSE AFFECTED

The rule will help inform about 9 million renters

and 3 million home buyers each year. The estimated

cost associated with learning about the requirements,

obtaining the pamphlet and other materials, and

conducting disclosure activities is about $6 per

transaction.

EFFECT ON STATES AND LOCAL

GOVERNMENTS

This rule should not impose additional burdens on

states since it is a Federally administered and enforced

requirement. Some state laws and regulations require

the disclosure of lead hazards in housing. The Federal

regulations will act as a complement to existing state

requirements.

Did you know...?

■ Radon is the second leading cause of lung cancer, after

smoking.

1

■ Approximately 20,000 cancer deaths each year are caused by

radon.

2

■ Radon is the leading cause of cancer among nonsmokers.

3

What is it?

Radon is a radioactive gas that cannot be seen or smelled and is

found naturally around the country. When you breathe air contain-

ing radon, cells in your airway may be damaged, increasing your

risk of getting lung cancer.

Radon is found in the dirt and rocks beneath houses, in well

water, and in some building materials. It can enter your house

through soil, dirt floors in crawlspaces, and cracks in foundations,

floors, and walls.

All houses have some radon, but houses next to each other can

have very different radon levels, so the only way to determine your

particular risk is to test your home. Radon is measured in “picoCuries

per liter of air,” abbreviated “pCi/L.” This unit of measure describes

the number of radon gas particles in one liter of air. The amount of

radon outdoors is usually around 0.4 pCi/L, and indoors is around 1.3

pCi/L. Even though all radon exposure is unhealthy, radon at levels

below 4 pCi/L are considered acceptable.

There is no known “safe” level of radon exposure. If your home

has a radon level of 4 pCi/L or more, you should take action to

lower this level.

continued on back

www.hud.gov/healthyhomes

“You can't see radon. But it may

be a problem in your home”

U.S. Environmental Protection Agency

R ADON

U.S. Department of Housing and Urban Development • Office of Healthy Homes and Lead Hazard Control

www.hud.gov/healthyhomes

RADON

U.S. Department of Housing and

Urban Development

Office of Healthy Homes and Lead

Hazard Control

For more information . . .

Visit HUD’s website at www.hud.gov/healthyhomes for more

information about addressing health hazards in homes or to learn

if HUD has a Healthy Homes program in your community.

Download a copy of “Help Yourself to A Healthy Home” for more

practical steps you can take to make your home a healthy home.

More Federal Resources

US Environmental Protection Agency (EPA)

www.epa.gov/radon

Other Resources

State Radon Contacts

www.epa.gov/iag

National Radon Hotline to order radon test kits

1-800/SOS-RADON (1-800-767-7236)

National Safety Council and EPA Radon Hotline with an operator

to answer questions about radon

1-800-55RADON (1-800-557-2366)

Radon Fix-it Hotline

1-800-644-6999

American Lung Association

www.lungusa.org

What can you do?

Test your Home!

About 1 out of every 15 homes has a radon problem. The only

way to know for sure is to test your home. You can buy a radon test

at a hardware store or order it by mail. There are two types of tests:

short-term tests take 2 to 90 days, while long-term tests take more

than 90 days but provide a better estimate of your annual average

radon level.

In real estate transactions, short-term tests are more common

because of the time limitations. (Consult EPA's Home Buyer's and

Seller's Guide for more on radon testing in real estate transactions.

Follow all the instructions that come with your test kit.

If possible during the test, keep your windows closed to keep air from

escaping. Place your test kit in a room on the lowest level of your

home that you use regularly, probably on the first floor or in the

basement. When the test is done, send it to a lab to process your

results.

You can also hire a professional tester to do the test for you.

Contact your state's radon office for a list of qualified testers. (www.

epa.gov/iaq/whereyoulive.html)

Other helpful steps:

1. Stop smoking and discourage smoking in your home. Smoking

significantly increases the risk of lung cancer from radon.

2. Increase air flow in your house by opening windows and using

fans and vents to circulate air. Natural ventilation in any type of

house is only a temporary strategy to reduce radon.

3. Seal cracks in floors and walls with plaster, caulk, or other mate-

rials designed for this purpose. Contact your state radon office for

a list of qualified contractors in your area and for information on

how to fix radon problems yourself. Always test again after fin-

ishing to make sure you’ve fixed your radon problem.

4. Ask about radon resistant construction techniques if you are buy-

ing a new home. It is almost always cheaper and easier to build

these features into new homes than to add them later.

Radon test kits are available at hardware stores

or by mail

1

U.S. Environmental Protection Agency “Indoor Air- Radon” www.epa.gov/radon August

25, 2004

2

U.S. Environmental Protection Agency “Assessment of Risks from Radon in Homes”

www.epa.gov/radon/risk_assessment.html August 25, 2004

3U.S. Environmental Protection Agency "Indoor Air-Radon"www.epa.gov/iaq/radon/

index.html August 4, 2008

FACT SHEET: YOUR FAIR HOUSING RIGHTS

What is fair housing?

Fair housing is the right to choose housing free from unlawful discrimination.

Federal, state and local fair housing laws protect people from discrimination in

housing transactions such as rentals, sales, lending, appraisals, and insurance.

Specifically, the federal Fair Housing Act and Michigan’s Elliott-Larsen Civil Rights Act

protect against housing discrimination based on the following protected classes:

• Race

• Color

• Religion

• Sex, including Gender Identity,

Sexual Orientation

• National origin

• Familial status

• Disability

• Marital status

• Age

20 Hall Street SE

Grand Rapids, MI 49507

616-451-2980 phone

616-451-2657 fax

866-389-FAIR

fhcwm.org

Some communities in west Michigan also protect people from discrimination in housing based on their

source of income or other protected classes. Visit www.fhcwm.org/laws to learn more.

Housing discrimination sometimes happens blatantly, but is more often difficult to recognize or fully

identify. If you feel like you had a housing experience where you were possibly treated differently than

someone else because of a protected class, it may be housing discrimination. If you are a homeseeker

looking for information on your fair housing rights, the Fair Housing Center of West Michigan (FHCWM) can

help!

What We Do

Our advocacy and enforcement programs serve to assist individuals in reporting housing discrimination;

investigate, mediate and resolve allegations of housing discrimination; remove systemic barriers to housing

choice; and ensure the protection of fair housing choice. We also assist with reasonable accommodation

(accessible assigned parking) and modification (ramps, grab bars) requests for persons with disabilities.

About the Fair Housing Center

The FHCWM is a private, non-profit fair housing organization that provides comprehensive fair housing

services, including education, outreach, research, advocacy and enforcement. The FHCWM is the front

door to housing choice, ensuring that everyone in our community has equal opportunity to choose housing

that’s right for them. Through education, research and advocacy, we prevent housing discrimination,

remove barriers that allow it to persist, and restore housing choice when discrimination happens.

Our Service Area

We currently serve 12 counties in western Michigan: Allegan, Grand Traverse, Ionia, Isabella, Kent,

Mecosta, Montcalm, Muskegon, Newaygo, Oceana, Osceola and Ottawa.

SIGNS OF POSSIBLE DISCRIMINATION, IF BASED ON A PROTECTED CLASS

• Refusing to rent or sell an apartment or a home to you or your family

• The housing is advertised for preferred groups of people only (i.e. “perfect for empty nesters”)

• Being restricted to a certain neighborhood or specific floor of an apartment complex

• A refusal to work with you because you request a sign language interpreter or need some other

reasonable accommodation, such as meeting in a wheelchair-accessible location

• Being told the housing is not available, even though it is listed or has a sign

• Being told you won’t be safe, neighbors won’t want you there, or the neighborhood is not ‘right’ for you

• Terms, conditions, or availability change between phone contact and an in-person visit

• A refusal to provide information about the housing or make a loan to a qualified applicant

Updated 6/10/2022

Monthly Budget

Applicant Name(s): ____________________________________________________________________

Instructions: Fill out the “Current” column with your average monthly earnings/spending. This helps the Housing Counselor get a sense

of where your income and spending are currently at. To calculate the final numbers, move the Total Monthly Expenses (A) to space (F).

Then Add B+C+D+E together and put that total in (G). Then subtract (F)-(G), to give you the difference, which will be either the extra

money you have at the end of the month, or the amount of money you spent that you didn’t have.

Note: The “Revised” Column will be completed later with a Housing Counselor.

Monthly Income

Current

Revised

Applicant Income

Co-Applicant Income

Social Security/SSI/Disability

Child Support

Food Stamps/FIA Income

Other

Total Monthly Income (A)

Fixed Expenses

Current

Revised

Housing – Rent/Mortgage

Car Loan #1

Car Loan #2

Car Insurance & Registration

Student Loan

Loan (Other)

Child Support

Child Care

Savings

Other

Total Fixed Expenses (B)

Flexible Expenses

Current

Revised

Food – Groceries

In Between Grocery Expenses

Toiletries/Cosmetics

Natural Gas/Propane

Electric

Trash Removal

Water Bill

Telephone

Cell Phone

Automobile Gas, Oil, Antifreeze

Automobile Repair, Maintenance

Internet

Cable/Movies/Movie Rental/Streaming Services

Laundry/Dry Cleaning

Activities/Going Out

Dinners Out

Lunches Out

Kids School Lunches

Dues/Subscriptions/Phone App costs

Medical Insurance (Not Taken Out of Paycheck)

Continue to next page

$ 0.00

$ 0.00

Updated 6/10/2022

Flexible Expenses Continued

Current

Revised

Gym Membership

Money Orders or Cashier’s Checks

Fees: Bank, Checking, ATM, Check Cashing, Overdraft, etc.

Rent to Own (furniture, appliances, etc.)

Hair Care: products, styling, salon/barber, cuts, etc.

Nail Care: salon visits, at home materials, etc.

Clothing

Gambling/Casinos/Lotto

Recreational Substance Use

(ie. Cigarettes/Vape/Cigars/Marijuana/Edibles/Alcohol/etc.)

Charity/Tithing

Education/Tuition

Storage Unit

Pets

Allowance/Children’s Activities

Other

Total Flexible Expenses (C)

Occasional Expenses

Current

Revised

Renters Insurance

Medical/Dental/Vision (copays, coinsurance, RX, glasses)

Birthdays

Christmas/Holidays

Vacation

Other

Total Occasional Expenses (D)

Debt Reducing Expenses

Current

Revised

Credit Card #1

Credit Card #2

Credit Card #3

Credit Card #4

Credit Card #5

Credit Card #6

Credit Card #7

Credit Card #8

Credit Card #9

Credit Card #10

Other

Total Debt Reducing Expenses

(E)

Final Calculations

Current

Revised

Total Monthly Income

(Amount from “A”)

(F)

Total Monthly Expenses

(Add B+C+D+E)

(G)

Difference - either a gain or a loss.

(Subtract F from G)

Printed Name

Signature

Date

Printed Name

Signature

Date

***Please Note: If you think you struggle with gambling or substance use and would like support, let us know. We can provide you with

resources to help.

$ 0.00

$ 0.00

$ 0.00

$ 0.00

$ 0.00

6

(last 4 digits)

1

HOME

Investment Partnerships Program

City of Grand Rapids Household Eligibility for Purchase

The house you are interested in purchasing was built or rehabbed with funding from the HOME Investment Partnerships

Program. A Buyer’s gross household income must be under 80% of the area median income (AMI) to purchase the

house. The purchase is contingent on household income verification and approval by the City of Grand Rapids

Community Development Department.

Household.

Complete the Household Composition chart below. Include the head of household, all persons 18 years of age and

older, and all children who reside in the household. Include children who are subject to shared custody agreements and

reside within the household at least 50% of the time. DO NOT INCLUDE: foster children, live-in aides and children of live-

in aides, unborn children, and children being pursued for legal custody or adoption who do not currently live within the

household. Additional household members can be included on a separate sheet of paper if there is insufficient room.

Name

Relationship to Head of

Household

Sex

M/F

Birth Date

Mo/Day/Yr

Student

Yes No

Has income?

Yes No

self

Marital Status. Head of Household is (check one): Married Single Widowed Divorced Separated

Ethnicity. Head of Household is (check one): Hispanic or Latino Not Hispanic or Latino

Race. Head of Household is (check one):

Alaskan Native or American Indian Alaskan Native or American Indian and White

Asian Alaskan Native or American Indian and Black

Black or African American Asian and White

Native Hawaiian or Pacific Islander Black or African American and White

White Other multi-racial _____________________________________

Homebuyer Counseling.

In order to purchase this house, you are required to complete an approved homebuyer counseling course. Please check

the appropriate box below:

I have completed a HUD approved homebuyer education course and am including a copy of my completion

certificate.

I have not yet completed a HUD approved course but plan to do so on ___________________ (insert date of course).

Authorization to Release Information Form & Income Checklist.

Complete the accompanying Authorization to Release Information Form and Income Checklist. Note that a separate

Income Checklist must be completed by each household member age 18 and older.

2

City of Grand Rapids

Authorization to Release Information

Your signature on this Eligibility Release Form and

the signatures of each member of your household

who is 18 years of age or older authorize the City

of Grand Rapids to obtain information from a third

party relative to your eligibility to purchase a

house built or rehabbed with funding from the

HOME Investment Partnerships Program.

Authorization: I authorize the City of Grand Rapids to

obtain information about me and my household that is

pertinent to eligibility for home purchase. Specifically,

I authorize the City to obtain any and all income and

employment information and documentation that is

needed. In the event that I purchase the home, I

authorize the City to communicate with my home

insurance company to ensure the City is listed as

second mortgagee as applicable. I acknowledge that:

1) A photocopy of this form is as valid as the original.

2) I have the right to review information obtained

using this form (accompanied by a person of my

choosing).

3) I have the right to a copy of information obtained

using this form and to request correction of

information I believe inaccurate.

4) To be eligible, all household members age 18 and

older must sign this form and cooperate with the City

and other parties in this process.

This authorization to release information expires 15

months after the date this form is signed.

Privacy Act Notice Statement: The Department of

Housing and Urban Development is requiring the

collection of information to determine an

applicant's eligibility in a federally assisted

program and the amount of assistance necessary

using federal funds. This information will be used

to establish level of benefit on the federal

program; to protect the Government's financial

interest; and to verify the accuracy of the

information furnished. It may be released to

appropriate federal, state, and local agencies when

relevant, to civil, criminal, or regulatory

investigators, and to prosecutors. Failure to

provide any information may result in a delay or

rejection of your eligibility approval.

________________________________________________________________________________________________

Name of Head of Household (print) Signature Date

________________________________________________________________________________________________

Other Adult Household Member (print) Signature Date

________________________________________________________________________________________________

Other Adult Household Member (print) Signature Date

________________________________________________________________________________________________

Other Adult Household Member (print) Signature Date