2

EMIR and SFTR data

quality report 2021

1 April 2022 ׀ ESMA74-427-607

EMIR and SFTR data quality report 2021 2

EMIR and SFTR data quality report 2021 3

EMIR and SFTR data quality report 2021

1. Table of contents

1. Table of contents............................................................................................................................ 3

2. Executive summary ....................................................................................................................... 4

3. ESMA’s Strategic Priorities on EMIR and SFTR Data Quality ................................................... 7

4. EMIR and SFTR Data Quality Frameworks .................................................................................. 9

4.1 EMIR DQAP ............................................................................................................................. 9

4.2 SFTR DQEF ........................................................................................................................... 10

4.3 Cooperation with data users .................................................................................................. 11

5. Recent developments impacting EMIR and SFTR data quality............................................... 14

5.1 EMIR - TR data ingestion review ........................................................................................... 14

5.2 EMIR regulatory access filtering review................................................................................. 15

5.3 EMIR TAR-TSR review .......................................................................................................... 16

5.4 SFTR – Implementation of new XML schemas ..................................................................... 18

5.5 SFTR – UnaVista wind-down ................................................................................................. 18

6. EMIR reporting trends and selected data quality metrics ....................................................... 20

6.1 Data reporting – Key trends ................................................................................................... 20

6.2 Data completeness, timeliness and availability ..................................................................... 22

6.3 Data integrity – Adherence to format and content rules ........................................................ 26

6.4 Data integrity – Reconciliation ............................................................................................... 27

7. SFTR reporting trends and selected data quality metrics ....................................................... 30

7.1 Data reporting – Key trends ................................................................................................... 30

7.2 Data completeness, timeliness, and availability .................................................................... 32

7.3 Data integrity – Adherence to format and content rules ........................................................ 34

7.4 Data integrity – Reconciliation ............................................................................................... 35

8. Methodological Annex ................................................................................................................. 39

9. List of abbreviations .................................................................................................................... 42

EMIR and SFTR data quality report 2021 4

2. Executive summary

This is the second edition of report on data quality under the European Market Infrastructure Regulation

(EMIR) and under the Securities Financing Transactions Regulation (SFTR). The objective of the report

is to provide a holistic view of state of play of both reporting regimes as regards the quality of the

reported data and the actions that the national competent authorities (NCAs’) and the European

Securities and Markets Authority (ESMA) are taking to improve the quality of the data. EMIR and SFTR

data play a pivotal role in the fulfilment of NCAs’ and ESMA’s supervisory mandates. As such, the data

is used extensively for those purposes

1

. Key highlights of the report are as follows:

ESMA strategic priorities on EMIR and SFTR data quality

As regards ESMA’s supervision of TRs, key areas of focus are:

i. Timely and complete reporting of regulatory information to the users of TR data,

ii. Accuracy and confidentiality of data reported by counterparties to and stored by TRs, and

iii. Accuracy of regulatory reports submitted to the users of TR data.

As regards the reporting by counterparties, the key common areas of priority for NCAs and ESMA are:

i. Completeness and accuracy of the reported information, in particular with regards to the

reporting of valuation and collateral data,

ii. Timely submission of the reports, and

iii. Consistency of reported information reflected in the reconciliation of data submitted by the two

counterparties of the same derivative.

Counterparties are strongly encouraged to use the regulatory data in their own internal risk and

compliance management processes. In doing so, counterparties incentives to report accurate data will

be further aligned.

ESMA, with the cooperation of the NCAs, is and will continue to monitor progress in those areas. ESMA

and the NCAs will take actions with the objective to achieve improvement in areas where insufficient

quality of the data is identified.

Recent developments impacting EMIR and SFTR data quality

Regarding EMIR, ESMA carried out three supervisory projects focusing on i) the ingestion and

processing of data by TRs, ii) application of EMIR access filtering rules for provision of data to NCAs

according to their mandates and iii) the assessment of consistency of two key regulatory reports – the

trade activity and trade state reports. In all three cases, ESMA found that TRs broadly follow regulatory

and supervisory expectations. In certain instances, ESMA found some shortcomings in the quality of

the reports provided to regulators

2

and expects that TRs take appropriate remediation steps. As regards

SFTR, TRs and reporting counterparties implemented first SFTR XML schema update since the start

of reporting in July 2020. The update aimed at removing technical shortcoming that could decrease

quality of the information available to the regulators. ESMA also monitored and coordinated with

NCAs/TRs all relevant aspect of the wind-down of UnaVista repository services under SFTR as well as

the associated porting of SFTR data to other TRs

1

See for example the Trends Risks and Vulnerabilities report (https://www.esma.europa.eu/sites/default/files/library/esma50-

165-1842_trv2-2021.pdf) and the Annual Derivatives Statistical Report (

https://www.esma.europa.eu/sites/default/files/library/esma50-165-2001_emir_asr_derivatives_2021.pdf)

2

Such as under-/over-reporting of data in the case NCA access filtering and report accuracy issues in the case of the trade

activity and trade state reports.

EMIR and SFTR Data Quality Frameworks

Data quality under EMIR and SFTR relies on an efficient supervision of the reporting counterparties by

the NCAs and of the TRs by ESMA. Having in mind these complementary supervisory responsibilities,

NCAs and ESMA have established the following dedicated frameworks to coordinate the joint efforts

on ensuring high data quality: the Data Quality Action Plan (DQAP) under EMIR and the Data Quality

Engagement Framework (DQEF) under SFTR.

Under EMIR DQAP the NCAs analysed and followed up with selected supervised entities on the results

of over 30 tests related to different data quality aspects such as completeness, accuracy, or timeliness.

In a thematic review focused on the reporting of valuations and collateral, misreporting of valuations

was significantly reduced, as compared to the previous year, by around 50% of the targeted entities.

Similarly, in a dedicated exercise on timeliness of reporting, most of the targeted entities improved their

reporting practices and eliminated or significantly reduced late reports.

SFTR DQEF was launched in 2021 and focused on the timeliness of reporting, rejections, and pairing.

While the follow-up on this first iteration of DQEF is still ongoing. Overall, it can be noted that use of the

ISO20022 XML end-to-end reporting has brought important benefits in terms of the quality and

accessibility of the data from the very beginning of the reporting. Furthermore, some positive trends in

key metrics such as rejections and reconciliation can already be observed. Recent developments

impacting EMIR and SFTR data quality

Regarding EMIR, ESMA carried out three supervisory projects focusing on i) the ingestion and

processing of data by TRs, ii) application of EMIR access filtering rules for provision of data to NCAs

according to their mandates and iii) the assessment of consistency of two key regulatory reports – the

trade activity and trade state reports. In all three cases, ESMA found that TRs broadly follow regulatory

and supervisory expectations. In certain instances, ESMA found some shortcomings in the quality of

the reports provided to regulators and expects that TRs take appropriate remediation steps. As regards

SFTR, TRs and reporting counterparties implemented first SFTR XML schema update since the start

of reporting in July 2020. The update aimed at removing technical shortcoming that could decrease

quality of the information available to the regulators. ESMA also monitored and coordinated with

NCAs/TRs all relevant aspect of closely the wind-down of UnaVista repository services under SFTR as

well as the associated porting of SFTR data to other TRs.

EMIR reporting trends and selected data quality metrics

Brexit has had an important impact on the EU supervisory data reporting landscape as volumes of

reported derivatives fell by approximately 50%. In terms of data reporting volumes, equities and futures

contracts continue to be the most prominent asset class and contract type respectively. While less than

10% of reported derivatives tend to be reported late by the counterparties, more than 20% do not receive

updated valuation on a daily basis as required by EMIR. Non-reporting dropped sharply due to Brexit

and is now less than 5%. The sharp drop has been driven by the end of the reporting obligation of UK

counterparties and the more limited dual-side reporting which does not allow to detect potential non-

reporting issues. TR rejections continue to be low at around 2%. Furthermore, only 1% of records in TR

regulatory reports seem to not comply with the applicable validation rules. Volumes of duplicated

reporting

3

are negligible. As regards reconciliation, pairing rate continues to be relatively low at 60%

while there is on average 5% difference between the number of open derivatives reported between a

pair of counterparties. Lastly, in some instances, TRs disagree on the number of derivatives they

reconcile against each other. This may be an indication of further enhancements required for the inter-

TR reconciliation process. While much attention has already been put to timely reporting, reporting of

3

Reported derivatives are considered duplicated where two or more records have been reported with the same combination of

reporting counterparty ID, ID of the other counterparty and trade ID fields. In contrast, double-sided reporting under EMIR is not

duplicative since two records on the same derivative should be reported always from the perspective of the respective reporting

counterparty.

EMIR and SFTR data quality report 2021 6

valuations and reconciliation, clearly much more improvements are needed and those area s will

continue to be point of focus of ESMA and NCAs going forward.

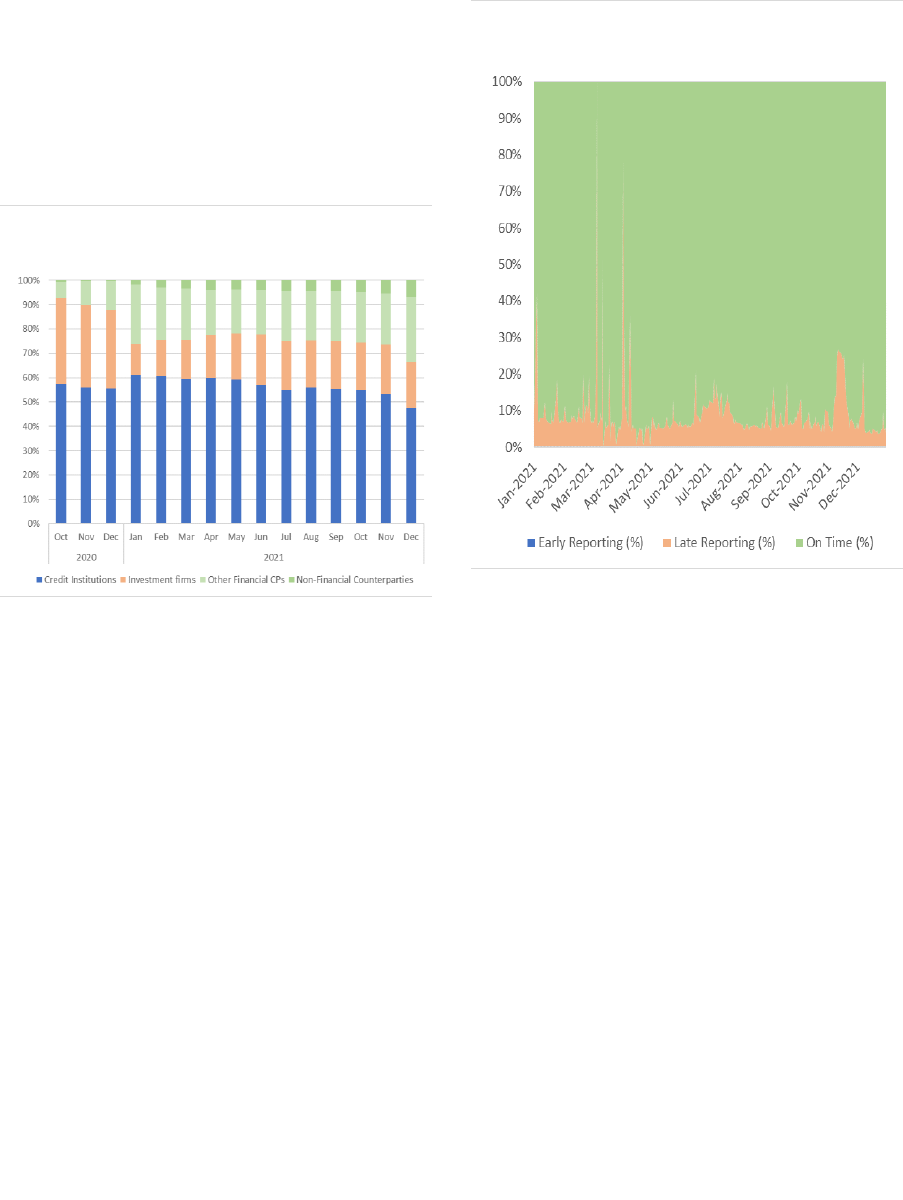

SFTR reporting trends and selected data quality metrics

Similar to EMIR, data reporting volumes dropped approximately by 50% following Brexit. In terms of

number of open transactions, securities lending and borrowing is the largest SFT type reported with

around 70% share at the end of 2021. Credit institutions report most open SFTs (around 50%) while

credit institutions share has been increasing (to around 30% at the end of 2021). After merely 1.5 years

of reporting, SFTR exhibits comparable results to EMIR across all data quality metrics. Around 10% of

SFTs are reported late (after T+1). On the contrary, rejections have been low (around 2%) and

duplicated reporting does not pose major issues. As regards reconciliation, pairing rate has been only

around 60%. Reconciliation rate of loan and collateral data has been low but increasing to around 40%

and 30% respectively. Similar to EMIR, TRs do not agree on the number of records they reconcile

against each other, which may be an indication of issues in the inter-TR reconciliation process.

Timeliness of reporting, adherence to format and content rules (via rejections) and reconciliation

(pairing) has been the point of focus of ESMA and NCAs during 2021. While progress has been made,

some areas (particularly reconciliation) need to remain areas of focus also in the future.

3. ESMA’s Strategic Priorities

on EMIR and SFTR Data

Quality

Summary: As regards ESMA’s supervision of TRs, key areas of focus are: i) timely and complete

reporting of regulatory information to the users of TR data, ii) accuracy and confidentiality of data

reported by counterparties to and stored by TRs, and iii) accuracy of regulatory reports submitted to the

users of TR data.

As regards the reporting by counterparties, the key common areas of priority for NCAs and ESMA are:

i) Completeness and accuracy of the reported information, in particular with regards to the reporting of

valuation and collateral data, ii) timely submission of the reports, and iii) consistency of reported

information reflected in the reconciliation of data submitted by the two counterparties of the same

derivative. Counterparties are strongly encouraged to use the regulatory data in their own internal risk

and compliance management processes. In doing so, counterparties incentives to report accurate data

will be further aligned.

ESMA, with the cooperation of the NCAs, is and will continue to monitor progress in those areas. ESMA

and the NCAs will take actions with the objective to achieve improvement in areas where insufficient

quality of the data is identified.

TR supervisory objectives: ESMA is the direct

supervisor of TRs under EMIR and SFTR. ESMA

sets its supervisory priorities on an annual basis

and publishes them in ESMA’s annual work

programme.

ESMA is a data-driven and risk-based supervisor.

Thus, it sets its priorities based on risks it

observes which may negatively impact quality of

the reported data. The most prominent risks are

then included in the list of its annual priorities in

the form of a specific project or a supervisory

review. Besides one-off projects, ESMA also

performs a variety of monitoring activities

4

on an

ongoing basis.

Even though ESMA’s priorities may evolve from

one year to another, there are common themes

that remain present over time.

Those themes are:

1. Timely and complete reporting of

regulatory reports to the users of TR data;

4

For example: monitoring timeliness and completeness of TR

daily regulatory report submissions.

5

See Subsection 5.1. on EMIR TR data ingestion review

carried out through 2020 and 2021.

2. accuracy and confidentiality of data

reported by counterparties to and stored

by TRs

5

; and

3. accuracy of regulatory reports submitted

to the users of TR data

6

.

ESMA expects that the TRs pay utmost attention

to the above-mentioned aspects and that they

have processes, systems and controls in place to

monitor and timely identify any issues.

Counterparty reporting supervisory objectives:

NCAs are responsible for the supervision of the

reporting by the counterparties while ESMA

coordinates some key common initiatives in the

context of its supervisory convergence mandate

7

.

While common priorities are also set annually,

there are key areas of permanent focus by NCAs

and ESMA:

1. Completeness and accuracy of the

reported information, in particular with

6

See Subsection 5.2. on EMIR regulatory access filtering

review and Subsection 5.3. EMIR TAR-TSR consistency both

carried out in 2021.

7

See Section 0.

EMIR and SFTR data quality report 2021 8

regards to the reporting of valuation and

collateral data;

2. timeliness of the reports; and

3. consistency of reporting reflected in the

reconciliation of data reported by the two

counterparties of the same derivative.

Reporting counterparties are expected to have

processes, systems and controls in place to

ensure completeness, accuracy and timeliness of

the reported information. Furthermore, they are

expected to actively engage in detecting and

resolving any identified report rejections,

reconciliation breaks and other data quality

issues in the already reported data.

Counterparties are strongly encouraged to use

the regulatory data in their own internal risk and

compliance management processes. In doing so,

counterparties will have the appropriate

incentives to report accurate data and will be in

apposition to better exploit the benefits of

consistent data reporting.

What we aim to achieve: ESMA, with the

cooperation of the NCAs, is and will continue to

monitor progress in those areas. ESMA and the

NCAs will take actions with the objective to

achieve improvement in areas where insufficient

quality of the data is identified.

4. EMIR and SFTR Data

Quality Frameworks

Summary: Data quality under EMIR and SFTR relies on an efficient supervision of the reporting

counterparties by the NCAs and of the TRs by ESMA. Having in mind these complementary supervisory

responsibilities, NCAs and ESMA have established the following dedicated frameworks to coordinate

the joint efforts on ensuring high data quality: the Data Quality Action Plan (DQAP) under EMIR and the

Data Quality Engagement Framework (DQEF) under SFTR.

Under EMIR DQAP the NCAs analysed and followed up with selected supervised entities on the results

of over 30 tests related to different data quality aspects such as completeness, accuracy or timeliness.

In a thematic review focused on the reporting of valuations and collateral, misreporting of valuations

was significantly reduced, as compared to the previous year, by around 50% of the targeted entities.

Similarly, in a dedicated exercise on timeliness of reporting, most of the targeted entities improved their

reporting practices and eliminated or significantly reduced late reports.

SFTR DQEF was launched in 2021 and focused on the timeliness of reporting, rejections and pairing.

While the follow-up on this first iteration of DQEF is still ongoing, overall, it can be noted that use of the

ISO20022 XML end-to-end reporting has brought important benefits in terms of the quality and

accessibility of the data from the very beginning of the reporting. Furthermore, some positive trends in

key metrics such as rejections and reconciliation can already be observed.

4.1 EMIR DQAP

EMIR Data Quality Action Plan (DQAP) the

DQAP is a major project that NCAs and ESMA

jointly launched in September 2014. It aims at

improving the quality and usability of data that is

reported by counterparties and made available by

the TRs.

The DQAP encompasses activities related to the

policy work, NCAs’ supervision of the reporting

counterparties and ESMA’s supervision of the

TRs, to address the potential issues in all areas

that are key for the quality of the final data,

notably: (i) the comprehensive, detailed, and

precise specification of the reporting

requirements; (ii) the complete and correct

reporting by the counterparties to the TRs; and

(iii) the provision of complete and accurate data

by the TRs to the authorities.

Data Quality Review (DQR): The DQR is

currently the main common exercise performed in

the context of the DQAP with regards to the

supervision of the reporting by the counterparties.

Under the DQR, each NCA, applying a commonly

agreed methodology, performs a quantitative

assessment of the quality of data reported by

selected counterparties in their Member State

and follow up with the relevant entities on the

identified issues.

NCAs provide subsequently to ESMA information

on the results of the DQR and on the follow-up

supervisory actions. Based on this feedback

ESMA prepares a summary report that is

subsequently shared with the NCAs. High-level

outcomes are also provided to the Board of

Supervisors as part of the annual update on the

execution of the DQAP.

DQR 2021: Similarly to the previous year, the

2021 DQR contained a series of over 30 data

quality tests grouped into three broad areas: (i)

analysis of pairing and matching of the reports,

(ii) analysis of completeness, accuracy,

timeliness, and rejections of reports made by

significant reporting entities, and (iii) thematic

review: analysis of reporting of valuation and

collateral data.

EMIR and SFTR data quality report 2021 10

In 2021, 19 NCAs participated in the DQR. Given

that the DQR analysis is based on limited

samples of counterparties

8

and that each

counterparty may face different reporting issues,

the results of the data quality checks are not

representative for the full EMIR dataset and vary

across the different tests and between the

participating Member States. However, based on

the samples considered in the DQR, overall, a

slight improvement has been noted in some of the

analysed areas as compared with the 2020 DQR,

notably the pairing and matching rates as well as

the consistency of number of reported derivatives

with the entities’ internal records.

Thematic review: Furthermore, it is worth

mentioning the outcomes of the thematic review,

focused on the reporting of valuations and

margins, which is a key information for the

monitoring of systemic risks. In addition to

analysing the aggregate results for the samples

from each Member State, ESMA has looked also

into the evolution of one basic measure, notably

the number of trades with empty/zero valuations,

at entity level for all the entities that were selected

for the thematic review based on this measure in

the 2020 DQR. The comparison of the statistics

computed for the purpose of 2020 DQR and 2021

DQR, revealed that approximately 50% of the

entities have significantly reduced the

misreporting of valuations

9

and further 20%

recorded some reduction in the number of trades

impacted by this data quality issue.

These outcomes confirm the conclusions from

the previous year that adequate supervisory

pressure and close monitoring of the

implementation of remedial actions are needed to

ensure a material long-term impact on the

improvement of the quality of data by all relevant

entities. They also show that targeted actions

directed at the main misreporting entities having

the highest impact on a given data quality aspect

constitute an efficient approach to resolve the

data quality problems.

Framework for provision of information on data

quality issues to NCAs and the follow-up with

supervised entities: In line with these findings

NCAs and ESMA have also established a

common framework, applicable whenever a

significant problem impacting the data quality of

the EMIR data at EU level is identified. The

framework sets up a procedure for an efficient

8

Each Member State selects 5 entities per each of the three

areas of analyses

resolution of such most significant data quality

issues, specifying, among others:

• the responsibilities of NCAs and ESMA,

• the timelines for the exchange of

information between NCAs and ESMA,

• the format and minimum content of the

statistics to be shared by ESMA,

• the criteria to decide which reporting

should be addressed,

• the feedback information to be provided

by the NCAs to ESMA,

• the steps to ensure that the data quality

problem has been mitigated (incl.

reassessment of the data).

The important feature of the framework is that

the follow-up is focused on a limited subset of

entities with the highest share of incorrect

reports in the total number of impacted reports at

EU level, thus ensuring the most efficient use of

the NCAs resources. The framework was first

launched in practice in 2021 for the follow-up on

the timeliness of reporting and resulted in a

material improvement in the reporting practices

of the targeted entities. (see Subsection 4.3 for

more details).

What have we achieved: EMIR DQAP is a

comprehensive data quality framework based on

the harmonised data assessment methodology.

Implementation of EMIR DQAP by the NCAs

allowed them to detect and follow up on several

data quality issues with their supervised entities.

Furthermore, ESMA shared with relevant NCAs

information on entities with highest numbers of

late reports at EU level. The targeted follow-up

with those entities resulted in an improvement of

their reporting practices.

4.2 SFTR DQEF

SFTR Data Quality Engagement Framework

(DQEF) The reporting under SFTR started in July

2020, following a three-month delay due to the

Covid-19 pandemic. SFTR, as a new transaction-

level reporting regime, has required dedicated

efforts for its supervision and data quality over the

year 2021.

Compared to EMIR, SFTR is ISO20022 XML

end-to-end reporting regime and this has brought

important benefits in terms of the quality and

9

Reduction of the number of trades with empty/missing

valuation by halve or more was considered as a significant

reduction

EMIR and SFTR data quality report 2021 11

accessibility of the data from the very beginning

of the reporting.

To ensure a consistent and efficient approach to

data quality assurance and supervision, ESMA is

systematically developing and implementing

various convergence tools across all relevant

reporting regimens and data systems including

the SFTR DQEF.

The SFTR DQEF was agreed in 2021 and

leverages on the EMIR DQAP setting out the

SFTs data quality work to be undertaken jointly

by NCAs and ESMA. It defines the necessary

coordinated procedures to verify, communicate

and prioritise the data quality findings detected in

the SFT data submitted by the reporting

counterparties and to subsequently apply the

relevant corrective measures leveraging on the

agreed best practices to foster the SFTs data

quality and to enforce the supervisory actions.

DQEF 2021: 2021 has been the first year of data

quality assessments performed by NCAs and

ESMA on SFTR data. Some national authorities

indicated that due to the novelty of the SFTR

reporting regime and to the complexity of the

activities to be implemented, they were not able

to contribute to the first data quality exercises. To

allow NCAs to focus on building their systems as

well as to facilitate the deployment of adequate

resources for their supervisory activities and

engagement with entities, ESMA has centrally

performed, on behalf of the NCAs, a targeted set

of checks and reported the detected data quality

issues to the NCAs. In turn, during the first year

of activities, the NCAs focused mostly on the

remedial actions and follow-ups with the

counterparties and entities responsible for

reporting under their direct supervision.

The implementation and performance of the data

quality checks is based on an incremental

approach. The 2021 data quality exercise was

performed in two separate rounds of tests on

weekly datasets (June and November) and had a

very targeted nature focusing on the aspects,

which under other reporting regimes have proven

to be the cornerstones of data quality, namely: (i)

timeliness of reporting, (ii) rejected reports due to

incorrectness or inaccuracy of SFT records

according to the validation rules (iii) unsuccessful

paired status of the reported records.

Considering the importance of the SFTR regime

on the one hand and its relative complexity on the

other, it is crucial to perform regular data quality

assessments and expand in the near future the

existing data quality activities with a view to

ensure the usability of the data for monitoring of

financial stability risks.

What have we achieved: The activities related to

the data issues of November 2021 cycle are not

yet completely terminated as the participating

NCAs are finalising the outputs of their

interactions with the supervised entities and

communicate them to ESMA. Therefore, it is

premature to draw conclusions on the overall

outcome of their remedial actions in this report. It

is important to highlight that the trends of the data

quality findings of the two cycles are also

reflected in the relevant outcomes of the SFTR

data quality analyses that are covered in Section

7. In some areas such as rejections and

reconciliation rates, these indicators already

begin to show positive trend.

4.3 Cooperation with data users

EMIR Timeliness Analysis: ESMA performed an

analysis of the timeliness of reports under EMIR

based on a time series constructed for several

dates across 5 months and using both Trade

State Reports (TSR) and Trade Activity Reports

(TAR). Thanks to the interactions with the NCAs,

the analysis was further enhanced to eliminate

certain false positives or legacy trades.

In line with the criteria specified in the framework

for provision of data by ESMA to NCAs (incorrect

reports by a given entity exceeding the 1% of all

incorrect reports in the EU), ESMA has identified

for the follow-up 15 counterparties from 7

jurisdictions. Furthermore, as envisaged in the

framework, all relevant NCAs have provided

ESMA with the feedback on the follow-up with the

entities explaining the reasons for late reporting

and indicating whether the issue has been

resolved.

In order to assess the actual impact of the

exercise, ESMA staff have rerun the timeliness

analysis for other dates in July, i.e., after the

NCAs finalised the follow-up with the entities.

No improvement was observed in the TSR, which

was an expected outcome given the particularity

of late reporting, i.e., once a given derivative is

reported late, it is not possible to ‘correct’ the time

of its initial submission. Therefore, such

derivative until further life-cycle event is reported,

will continue to appear as reported late in the

TSR. However, the approached entities have

enhanced their reporting practices with regards to

EMIR and SFTR data quality report 2021 12

timeliness, as an improvement has been

observed in the TAR submitted after the follow-

up. In particular, among the 10 entities which

were identified for the follow-up based on the

number of late reports in the TAR data, 4 entities

had no more late reports in the TAR of July and a

reduction in the number of late reports has been

observed also for the remaining 6 entities.

This example showed that targeted ad-hoc

exercises directed at the most relevant entities

are very efficient to reduce the most significant

data quality issues. ESMA plans to continue

engaging with NCAs in this way on a broader

number of issues.

Abnormal values: In August 2020 ESMA

implemented a new data quality process to

identify abnormal values on the numerical fields

reported by the counterparties under EMIR

regime. The data were then shared with the

NCAs to support them in their supervisory

activities. Notably, once the data are shared,

NCAs can verify if the detected outliers are due

to data quality issues in the reporting of the

counterparties under their supervision and follow

up accordingly, if needed.

The data quality analysis identifies irregular

numerical values (e.g., too high or too low)

reported for EMIR fields such as value of the

contract, margins, notional, fixed-rate legs of the

contract, price rate and quantity

10

. The focus on

these values is driven by the impossibility to

automatically detect and reject outliers through

the validation rules and the need for specific soft

checks.

The abnormal value analyses were shared with

the NCA monthly from August 2020 to August

2021. This section summarises the main findings.

Firstly, the abnormal values that ESMA identified

represent a small proportion of the outstanding

open derivatives. However, given the high impact

on data quality of the derivatives with abnormal

values, it is important to perform such data quality

checks on an ongoing basis to swiftly detect any

abnormal values and to inform the NCAs

responsible for the supervision of the

counterparties reporting such values. For

instance, a recurrent example concerns the

reported value of the contract above 100 billion

EUR, which may impact significantly results of

analyses based on EMIR data.

10

ESMA uses various internal methodologies to identify and

treat abnormal values. For example, for the purposes of

economic analysis, ESMA is using a statistical approach

(identifying outliers in notional values) elaborated in detail

here:

From August 2020 to August 2021, ESMA

notified NCAs on 84 occasions, reporting 3493

potential outliers to fifteen jurisdictions. ESMA

then received 19 responses from NCAs clarifying

the reasons for the outlier or committing to

contact the counterparty responsible for the

misreporting. Chart 1 provides an overview of the

notified potential abnormal values detected from

August 2020 to August 2021 per jurisdiction.

Chart 2 shows the EMIR fields with most outliers

identified in the same period.

Chart 1

Cooperation with data users

Number of abnormal values, per country

Source: ESMA data & calculations

Chart 2

Cooperation with data users

Number of abnormal values by EMIR field

Source: ESMA data & calculations

EMIR and SFTR log of data quality issues: Since

2016, ESMA has established a structured

framework for the users of data to be able to

https://www.esma.europa.eu/system/files_force/library/esma

50-165-639_esma-rae_asr-

derivatives_2018.pdf?download=1

EMIR and SFTR data quality report 2021 13

report any encountered issues and, in turn, to

receive feedback. ESMA receives issues

pertaining to TRs (for example, incorrect

generation of regulatory reports) as well as

counterparties (for example, implausible

notional/collateral values). When a counterparty

reporting issue is identified, the issue is

channelled to the responsible NCA. TR issues

are addressed by ESMA.

Chart 3 shows the breakdown of all reported

issues since the inception of the log by their

status, i.e., TR issues closed and open, and

counterparty reporting issues. In 2021, ESMA

processed around 30 issues overall. Most TR

issues are also being closed during the same

year. However, ESMA prioritizes its follow-ups

based on urgency and impact, thus not all the

issues may be addressed during the same year.

What have we achieved: Data quality issues can

be of structural nature, but significant issues can

also appear from one day to another. Thus, it is

important for ESMA and NCAs to maintain agility

to be able to react to issues that were not planned

to be addressed through structural projects such

as the EMIR DQAP and SFTR DQEF.

Through ad-hoc sharing of DQ issues (such

timeliness reporting, abnormal values, and any

other data quality issues) and their immediate

prioritisation, identified problems are being

address in an agile fashion.

Chart 3

Cooperation with data users

Data quality issues reported by NCAs\CBs

Note: Number of issues reported data quality issues since

inception and broken down by status.

Source: ESMA data & calculations

5. Recent developments

impacting EMIR and SFTR

data quality

Summary: Regarding EMIR, ESMA carried out three supervisory projects focusing on i) the ingestion

and processing of data by TRs, ii) application of EMIR access filtering rules for provision of data to

NCAs according to their mandates and iii) the assessment of consistency of two key regulatory reports

– the trade activity and trade state reports. In all three cases, ESMA found that TRs broadly follow

regulatory and supervisory expectations. In certain instances, ESMA found some shortcomings in the

quality of the reports provided to regulators

11

and expects that TRs take appropriate remediation steps.

As regards SFTR, TRs and reporting counterparties implemented first SFTR XML schema update since

the start of reporting in July 2020. The update aimed at removing technical shortcoming that could

decrease quality of the information available to the regulators. ESMA also monitored and coordinated

with NCAs/TRs all relevant aspect of the wind-down of UnaVista repository services under SFTR as

well as the associated porting of SFTR data to other TRs

5.1 EMIR - TR data ingestion review

In 2020, ESMA identified a need to verify whether

and to what extent EMIR data quality issues arise

during the data ingestion processes

12

of TRs. A

thematic review was initiated to assess the data

ingestion processes of three out of four registered

TRs using a data-driven supervisory approach.

The sample consisted of trade activity reports for

two consecutive dates (25-26 November 2020)

from eleven major financial counterparties.

ESMA engaged with the French (AMF), Dutch

(AFM) and German (BaFin) authorities to obtain

proprietary trade activity data from the selected

counterparties. Without the collaboration of these

NCAs and the effort made by the counterparties

to extract, prepare, and submit the data to ESMA,

it would have not been possible to fully assess

the data ingestion processes of TRs.

A methodology and algorithms were developed to

assess and identify concrete data integrity issues

stemming from TRs’ data ingestion processes. In

broad terms, it consisted of comparing data

reported by counterparties with data stored by

11

Such as under-/over-reporting of data in the case NCA access filtering and report accuracy issues in the case of the trade

activity and trade state reports.

12

Data ingestion refers to the part of TR data processing after it the data is received from the reporting participants and before it

is loaded to TR databases. TRs typically queue, validate and perform other pre-processing tasks on the incoming data before it

is loaded TR databases.

TRs in their internal databases before any

subsequent data transformation, aggregation,

filtering, or report generation processes were

performed. The end-to-end process was also

verified by comparing data reported by

counterparties with data received through

TRACE.

Over 20 million records were processed and

analysed both from a data completeness (paring)

and accuracy (matching) perspective. While in

some cases the ingestion process remains

inherently complex and issues were detected, our

analysis showed a robust EMIR data ingestion

process and a good level of data integrity for all

the three TRs included in our sample. This

implies that the information stored in the TRs’

internal database matches the information

reported by the counterparties.

Chart 4 summarises the results from the data

completeness analysis. Perfect or nearly perfect

pairing rates (>99%) were obtained for eight out

of eleven TR-counterparty sets. This implies that

EMIR and SFTR data quality report 2021 15

all or almost all records in the counterparty

dataset were successfully identified in the TR

dataset for these cases.

Chart 4

EMIR – TR Data Ingestion Review

EMIR – TR Data Ingestion Review

Comparative analysis of CP and TR data

Note: Trade repositories and counterparties in the sample

are anonymized.

Source: Trade Repositories & ESMA calculations

On the contrary, lower completeness rates were

observed for three out of eleven TR-counterparty

sets. The main reason for these discrepancies is

not directly attributed to deficiencies with the TR’s

data ingestion process but rather to the

submission of out-of-scope data by these

counterparties for this review (i.e., records with

reporting timestamp not being part of the subset

defined in the request for information).

What have we achieved: In terms of data

accuracy, ESMA discovered a range of

discrepancies between the information submitted

by counterparties and how it had been stored in

the TRs’ internal databases. Most were of non-

critical nature and could be explained by the way

the TRs’ have implemented their internal IT

systems. For example, rounding errors of decimal

values, date/time formats and other

misalignments which did not have a critical

13

ESMA receives all derivatives data reported under EMIR.

impact on data quality when TRs generate

outbound reports for regulatory authorities.

However, a few critical issues caused by

inappropriate modification of counterparty data

were detected. ESMA is liaising with the affected

TRs to rectify these issues which can have an

adverse impact on data quality.

The outcome of this review will mainly be used as

input to ESMA’s data quality risk assessment, by

eliminating risks that could arise from the data

ingestion process and focusing the supervisory

efforts on other EMIR data reporting process.

It is also worth mentioning that this analysis was

carried out under the current reporting

framework. The entry into force of EMIR Refit

could bring significant changes that could

adversely impact the TR’s data ingestion

processes. Going forward, ESMA will continue to

monitor incidents and complaints that are linked

to TR’s data ingestion processes to ensure that

those processes are adequate and resilient to

regulatory changes.

5.2 EMIR regulatory access filtering

review

When providing data to the authorities, TRs need

to apply filtering rules to make the data available

to the authorities based on their respective

mandates. This is important to avoid that an

authority receives data which it is not entitled to

and to ensure that each authority receives all the

data that is necessary to fulfil its mandates.

Mandates of authorities are set out in the Article

81(3) of EMIR and further developed in technical

standards. In order to verify that TRs are

providing data according to the regulatory

requirements, ESMA has cooperated with four

NCAs: CBoI (IE), CNB (CZ), CSSF (LU) and

MFSA (MT). These authorities shared with ESMA

the regulatory reports submitted to them by the

TRs. In parallel, ESMA applied the expected

filtering rules applicable to each authority to its

own reports received from the TRs

13

. Then

ESMA compared its filtered report with those that

were actually received by the NCAs.

Through this assessment, ESMA confirmed that

TRs seem to broadly follow the regulatory

EMIR and SFTR data quality report 2021 16

requirements with regards to provision of data to

the authorities.

ESMA also identified some shortcomings at TRs

which led to either underreporting or

overreporting of EMIR data to NCAs. Such issues

may affect the data completeness and thus the

ability of the NCAs to effectively supervise all

entities under their mandates.

The project identified the following key findings:

• On average, 4.5% of expected derivative

reports are not provided by TRs

(underreporting). This may prevent NCAs

from fulfilling their supervisory mandate

due to the missing information

14

.

• On average, 1.7% more derivative reports

than expected are provided by TRs

(overreporting). This poses a

confidentiality issue as the NCAs receiving

these additional derivative reports are not

entitled to have access to them.

Chart 5

EMIR ESMA regulatory access filtering review

Derivatives overreported to NCAs

Note: The tables show number of open derivatives for one

reference date that were present in the NCA report but

shouldn’t. The first table shows the total number of

overreported records. The second table shows the number

of overreported records as a percentage of the total

number of records that should have been included in each

NCA report (this number is not shown in the table). The

total number of records that should have been included in

each NCA report also serves as a weight to calculate

weighted averages by NCAs and TRs.

TR2 confirmed to ESMA that the problem is related to a

one-off issue with the generation of the regulatory report in

question. The issue has been now remediated.

Source: Trade Repositories & ESMA calculations

14

As shown in Chart 5, TR2, exhibiting the worst results,

confirmed that the problem is related to a one-off issue with

Chart 6

EMIR ESMA regulatory access filtering review

Derivatives underreported to NCAs

Note: The tables show number of open derivatives for one

reference date that weren’t present in the NCA report, but

should have been. The first table shows the total number

of underreported records. The second table shows the

number of underreported records as a percentage of total

number of records that should have been included in each

NCA report (this number is not shown in the table). The

total number of records that should have been included in

each NCA report also serves as a weight to calculate

weighted averages by NCAs and TRs.

Source: Trade Repositories & ESMA calculations

What have we achieved: With this project, ESMA

has verified that NCAs are broadly receiving data

in accordance with their mandates as specified in

EMIR.

As outlined above, ESMA identified several

shortcomings in the provision of data to

authorities. ESMA will follow up on those issues

with TRs and ensure that they are appropriately

remediated.

5.3 EMIR TAR-TSR review

The incorrect incorporation of the information

contained in the Trade Activity Reports (TAR) into

the Trade State Reports (TSR) is one of the key

TR data quality issues identified by the NCAs

during the execution of the EMIR DQR. ESMA

has been conducting in 2021 a dedicated project

for the comparison of the TAR and TSR data, in

particular, for the assessment of the

completeness and accuracy of the TSR as an

aggregation of individual TARs.

the generation of the regulatory report in question. The issue

has been now remediated.

TR/NCA NCA1 NCA2 NCA3 NCA4 TR total

TR1

240,952 285 80 - 241,317

TR2 3,303 100,668 1,001 296,466 401,438

TR3 12,766 308,597 35,938 47 357,348

TR4 27,577 35,640 23,044 N/A 86,261

NCA total 284,598 445,190 60,063 296,513 1,086,364

TR/NCA NCA1 NCA2 NCA3 NCA4

TR weighted

average

TR1

7.1% 0.0% 0.0% 0.0% 2.5%

TR2 35.3% 96.0% 30.3% 10.2% 13.3%

TR3 1.1% 8.0% 4.4% 0.0% 5.4%

TR4 1.7% 2.2% 1.3% N/A 1.7%

NCA weighted

average

4.6% 6.2% 1.2% 4.9% 4.5%

TR/NCA NCA1 NCA2 NCA3 NCA4 TR total

TR1

9,936 9,545 9,996 10,252 39,725

TR2 4 2 1 562 569

TR3 34,003 34,785 1,145 41,340 111,277

TR4 22,199 189,195 25,831 237,226

NCA total 66,142 233,527 36,973 52,154 388,797

TR/NCA NCA1 NCA2 NCA3 NCA4

TR weighted

average

TR1

0.3% 0.6% 0.4% 0.4% 0.4%

TR2 0.1% 0.0% 0.0% 0.0% 0.0%

TR3 2.9% 1.0% 0.4% 4.7% 2.0%

TR4 1.3% 10.7% 1.5% N/A 4.6%

NCA weighted

average

1.1% 3.4% 0.9% 0.9% 1.7%

EMIR and SFTR data quality report 2021 17

The project methodology is based on the

comparison of two consecutive EMIR TSRs. The

information collected in the first TSR is

dynamically updated with the successive TARs

received in the period between them. This results

in a calculated TSR which is compared with the

second TSR submitted by the TR. By comparing

the two files, it is possible to detect quality

problems related to the incorrect incorporation of

the information into the TSR.

The analysis was carried out during 4

consecutive weeks in November 2021, the

information presented in this report represents

the average of the individual results obtained in

each of these weeks. Considering all TRs, more

than 300 million TAR and 80 million of TSR

records were processed for each week of

analysis.

The metrics obtained allow the identification of

two types of data quality issues: first,

completeness issues related to the incorrect

presence or absence of records in the TSR;

second, accuracy issues related to the incorrect

update of a selected group of TSR fields. ESMA

is currently checking and following up with the

TRs on the results presented below.

Completeness of the TSR: Chart 7 shows the

percentage of missing records in the TSR over

the total volume of records (i.e., derivatives

present in the internally calculated TSR and not

found in the TSR received from the TRs). These

are records that were erroneously deleted or not

included in the TSR by the TRs. Although in

general terms the results can be considered

positive, there are certain divergences in the

figures obtained for each TR as one of the TRs

presents results close to 2%. These, together

with the high volumes of operations that

constitute TSR makes a further analysis of the

root causes of this issue necessary. It is equally

relevant to note that some TRs show very positive

results, with error levels close to 0%.

Analogously, as shown in Chart 8, data on

redundant records have also been obtained (i.e.

derivatives present in the TSR received from the

TRs but not in the internally calculated TSR).

These are records that were erroneously

included or not removed from the TSR by the

TRs. The results again diverge when comparing

the different TRs, although it is important to

highlight that one of the entities presents very

positive results with virtually no errors in this

metric. As in the previous test, the results require

further analysis to understand the possible

explanations for these findings.

Chart 7

Completeness of the TSR

Missing records in the TSR

Note: Trade Repositories are anonymized and presented

as TR1, TR2, TR3 & TR4. The repositories included in this

chart are DDRIE, KDPW, UNAVISTA B.V. & REGIS, the

anonymized aliases do not correspond to the order of the

TRs named.

Source: Trade Repositories & ESMA calculations

Chart 8

Completeness of the TSR

Redundant records in the TSR

Note: Trade Repositories are anonymized and presented

as TR1, TR2, TR3 & TR4. The repositories included in this

chart are DDRIE, KDPW, UNAVISTA B.V. & REGIS, the

anonymized aliases do not correspond to the order of the

TRs named.

Source: Trade Repositories & ESMA calculations

Accuracy of the TSR: The second part of the

project consisted in comparing a number of key

fields (36 different fields were selected) of the

TSR to verify whether the information contained

in them has been correctly updated or not. For

this purpose, the records of the internally

calculated TSR and the TSR provided by the TRs

were compared. The results are shown in Chart

9.

EMIR and SFTR data quality report 2021 18

In general terms, it can be observed that all TRs

are close to 100%, which implies that a vast

majority of the fields in the report are correctly

updated. However, in this first cycle of analysis a

selection of 36 fields of the TSR has been used,

so the results may vary if the number of fields

analysed is extended in future iterations.

Chart 9

Completeness of the TSR

Equality of the fields analysed

Note: Trade Repositories are anonymized and presented

as TR1, TR2, TR3 & TR4. The repositories included in this

chart are DDRIE, KDPW, UNAVISTA B.V. & REGIS, the

anonymized aliases do not correspond to the order of the

TRs named.

Source: Trade Repositories & ESMA calculations

Consideration will be given to broadening the

scope of fields included in the accuracy test to

verify whether the problems identified can be

extrapolated to the rest of the fields in the TSR.

Overall, for the two types of analyses included in

the test (completeness and accuracy), the

observed values differ between the different TRs

and the metrics obtained do not show significant

issues in terms of the correct generation of the

two key regulatory reports.

What have we achieved: It has been found that,

in general terms, there is a correct configuration

of the TSR as a result of the messages reported

in TAR. This further enhances the usefulness of

both reports for subsequent analysis by the

NCAs. On the other hand, the project has allowed

the implementation of a verification framework for

this process that can be replicated and increased

in the future. Finally, the project has allowed the

detection of certain data quality issues that, once

solved, will increase the overall quality of the

EMIR reporting framework.

15

See esma74-362-

1941_consultation_paper_guidelines_on_portability_emir_sft

r.pdf (europa.eu)

5.4 SFTR – Implementation of new

XML schemas

Leveraging on the experience with the

implementation of EMIR, SFTR reporting regime

relied since the beginning on the end-to-end

reporting in a standardised ISO 20022 XML

schema. Such design of the reporting framework

allowed to mitigate many data quality issues and

improve the usability of the data from the start.

What have we achieved: Since the beginning of

reporting under SFTR in July 2020, ESMA has

identified or has been made aware of some

limitations and inconsistencies in the XML

schemas used in SFTR. ESMA collected and

thoroughly analysed all the identified issues and,

basing on this assessment, prepared an updated

version of the schemas. The amendments to the

schemas are aimed to ensure that there are no

technical limitations to the accuracy of the reports

submitted by the counterparties to the TRs or the

reports provided by the TRs to the authorities.

The go-live of the updated schemas took place

on 31 January 2022.

5.5 SFTR – UnaVista wind-down

In August 2021, UnaVista initiated the wind-down

process of its SFTR TR as a result of a decision

to not continue to provide these services.

Although the Guidelines on data transfer between

trade repositories under SFTR were still under

consultation at the time

15

, the four SFTR TRs

began the implementation of the porting

infrastructure for SFTs. Leveraging on the

already existing portability framework and

infrastructure under EMIR and based on the

guidance provided by ESMA, TRs were able to

quickly adapt the existing porting infrastructure

and implement the necessary functionalities to

enable porting of SFT data.

UnaVista started the porting out process of

outstanding SFTs in November 2021. By late

January 2022, all outstanding SFTs were ported

out to the new TRs. The data transfer process of

the remaining SFT data is to be finalised by

March 2022.

EMIR and SFTR data quality report 2021 19

What have we achieved: Through continuous

monitoring, consequent follow-ups with the

involved TRs, and quick resolution of the

encountered issues, ESMA ensured that the

wind-down activities did not lead to any

interruptions in the continuity of the provision of

regulatory reports to all data users.

6. EMIR reporting trends and

selected data quality

metrics

Summary: Brexit has had an important impact on the EU supervisory data reporting landscape as

volumes of reported derivatives fell by approximately 50%. In terms of data reporting volumes, equities

and futures contracts continue to be the most prominent asset class and contract type respectively.

While less than 10% of reported derivatives tend to be reported late by the counterparties, more than

20% do not receive updated valuation on a daily basis as required by EMIR. Non-reporting dropped

sharply due to Brexit and is now less than 5%. The sharp drop has been driven by the end of the

reporting obligation of UK counterparties and the more limited dual-side reporting which does not allow

to detect potential non-reporting issues. TR rejections continue to be low at around 2%. Furthermore,

only 1% of records in TR regulatory reports seem to not comply with the applicable validation rules.

Volumes of duplicated reporting

16

are negligible. As regards reconciliation, pairing rate continues to be

relatively low at 60% while there is on average 5% difference between the number of open derivatives

reported between a pair of counterparties. Lastly, in some instances, TRs disagree on the number of

derivatives they reconcile against each other. This may be an indication of further enhancements

required for the inter-TR reconciliation process. While much attention has already been put to timely

reporting , reporting of valuations and reconciliation, clearly much more improvements are needed and

those area s will continue to be point of focus of ESMA and NCAs going forward.

6.1 Data reporting – Key trends

EMIR reporting trends can be viewed through

various dimensions of the data, such as the

number of life-cycle events, contract types, or by

asset class.

Submissions are the life-cycle event reports

received by the TRs representing the conclusion,

modification, and termination of a derivative (as

specified in the EMIR action type field)

throughout its life. When market volatility is high,

it may affect reporting counterparties’ trading

behaviour, leading to an increase in traded

volumes, which in turn will result in an increase in

the number of reported submissions.

Key trends: Most notable in Chart 10 is the

decrease in reported volumes post-Brexit, as UK

counterparties ceased to report under EMIR.

There has been a significant uptick in the

volumes reported by REGIS under EMIR since

16

Reported derivatives are considered duplicated where two or more records have been reported with the same combination of

reporting counterparty ID, ID of the other counterparty and trade ID fields. In contrast, double-sided reporting under EMIR is not

duplicative since two records on the same derivative should be reported always from the perspective of the respective reporting

counterparty.

the dissolution of CME and ICE Trade

Repositories.

Chart 10

EMIR reporting key trends

Monthly submissions per TR

Note: Total number of submissions per month and TR.

DDRIE is former DDRL and UNAVISTA B.V. is former

UNAVISTA LTD.

Source: Trade Repositories & ESMA calculations

EMIR and SFTR data quality report 2021 21

Chart 11 includes a breakdown of the total

number of submitted EMIR reports by action type.

The action type refers to the type of derivative life-

cycle event reported in the submission by the

reporting counterparty. In order of reported

frequency, the most common submissions are

valuation updates, position components, new

derivatives, modifications, compressions, early

terminations, corrections and errors. Valuation

updates remain the most frequent action type

submitted by the counterparties.

Chart 11

EMIR reporting key trends

Valuations are the most common submitted

action type

Note: Total number of submissions per month and action

type.

Source: Trade Repositories & ESMA calculations

Chart 12 shows that the share of each asset

class has remained relatively stable during the

year 2021. Notably there was a shift post Brexit

with equites representing a higher portion

amongst other asset classes, while commodity

and emission allowances as well as credit occupy

a lesser portion than previously.

Chart 13 provides a breakdown of EMIR

reporting by contract type: despite a relative

reduction after the end of 2020, futures remained

in 2021 the most reported EMIR contract type (on

average 40% of total reporting), followed by

financial contracts for difference (30%), options

(25%) and other types (5%).

Chart 12

EMIR reporting key trends

Equities are the most common EMIR asset

class

Note: Total number of daily submissions per month and

asset class. As a percentage of total.

Source: Trade Repositories & ESMA calculations

Chart 13

EMIR reporting key trends

Futures are the most common EMIR contract

type

Note: Total number of daily submissions per month and

contact type. As a percentage of total.

Source: Trade Repositories & ESMA calculations

EMIR and SFTR data quality report 2021 22

6.2 Data completeness, timeliness and

availability

EMIR Timeliness Analysis: Counterparties are

required to report newly concluded derivative

contracts by the end of the following working day

to a TR of their choice. To assess the timeliness

of reporting by the counterparties, ESMA

considers the difference between the “Execution

timestamp”, reflecting the date and time of a

derivative contract’s conclusion, and the

“Reporting timestamp”, reflecting the date and

time of reporting to the TR.

A derivative is considered “reported on time”, if it

is reported by the working day following the day

on which the contract was concluded, at the

latest. A derivative is considered “late reported”,

if it is reported later than the working day following

the day on which the contract was executed. A

derivative is considered “early reported”, if it is

reported earlier than the date specified in the

“Execution timestamp” field.

A derivative concluded on a Friday or Saturday

and reported on the consecutive Monday is

subject to a “weekend effect” which is accounted

for in the calculation and correctly classified as

“on time”.

On the contrary, public-, national- and bank

holidays (i.e. “calendar effect”) are not accounted

for in the calculation, nor is the conversion of

Coordinated Universal Time (UTC) to local time

made. These approximations simplify and speed

up the calculation but could give rise to some

degree of inaccuracy (i.e., records wrongly

classified as “Late Reporting” due to UTC vs local

time differences, or due to calendar effect)

impacting the overall results. Despite these

methodology limitations, the analysis depicts a

fair representation of reporting behaviour by the

reporting entities.

Chart 14 shows the results obtained from the

analysis of daily Trade Activity Reports (TAR) for

2021. The proportion of late reporting remained

on average below 10% while early reporting is

negligible or non-existent.

17

For example, Maltese MFSA has engaged with two most

problematic counterparties in their jurisdiction and is seeking

remediation of the issue.

Chart 14

EMIR data completeness, timeliness and availability

EMIR TAR - Timeliness Analysis (daily)

Note: A derivative executed at time T and reported at T+1

at latest, is considered “On Time”. A derivative executed at

time T and reported after T+1 is considered “Late

Reporting”. A derivative executed at time T and reported

before T is considered “Early Reporting”. A derivative

subject to “weekend effect” is classified as “On time”.

Source: Trade Repositories, and ESMA calculations using

daily trade activity reports for 2021.

A few spikes in late reporting observed around

New Year, Easter and other public holidays

should be considered as merely a calendar effect

impacting the accuracy of the results.

Chart 15 shows the aggregated results split by

the jurisdiction of reporting counterparties. While

in most jurisdictions the occurrence of late

reporting remains limited and low, there are a few

jurisdictions like Lithuania, Malta, Latvia, Greece,

Austria, amongst others, where reporting entities

tend to systematically report late.

It is often one or a few reporting entities that

drives the build-up of late reporting which is why

it is relevant for NCAs to intervene appropriately

as targeted effort from their side can often rectify

the problem quickly and bring down a significant

portion of late reporting within its jurisdiction

17

.

EMIR and SFTR data quality report 2021 23

Chart 15

EMIR data completeness, timeliness and availability

EMIR TAR - Timeliness Analysis by

jurisdiction

Note: A derivative executed at time T and reported at T+1

at latest, is considered “On Time”. A derivative executed at

time T and reported after T+1 is considered “Late

Reporting”. A derivative executed at time T and reported

before T is considered “Early Reporting”. A derivative

subject to “weekend effect” is classified as “On time”.

Source: Trade Repositories, GLEIF and ESMA

calculations using daily trade activity reports for 2021.

To complement and expand the previous

analysis, ESMA applied the same calculation

using a different dataset, namely the Trade State

Report (TSR), which contains the latest state of

all outstanding derivative contracts.

Chart 16 shows the results obtained from the

analysis of the weekly TSR data for 2021. The

proportion of late reporting is significantly higher

compared to the results obtained using TAR data.

This was somewhat expected as TSR data

reflects the cumulative effect of daily reporting

events.

Once a given derivative contract is executed and

reported late, it is not possible to ‘correct’ the time

of its initial submission. Therefore, such

derivative contract will continue to appear as

reported late in the TSR (at least until another

lifecycle event is reported for the same contract).

Moreover, the share of late reports in the TSR

may also be partially caused by batches of back-

dated reporting of previously non-reported

trades.

However, monitoring of the evolution of

timeliness reporting using TSR data can help to

identify persistent patterns caused by the

frequent as well as the sporadic misreporting

events that would otherwise be difficult to identify.

Chart 16

EMIR data completeness, timeliness and availability

EMIR TSR - Timeliness Analysis (weekly)

Note: A derivative executed at time T and reported at T+1

at latest, is considered “On Time”. A derivative executed at

time T and reported after T+1 is considered “Late

Reporting”. A derivative executed at time T and reported

before T is considered “Early Reporting”. A derivative

subject to “weekend effect” is classified as “On time –

weekend effect”.

Source: Trade Repositories, and ESMA calculations using

weekly trade state reports for 2021.

Chart 17 shows the aggregated results split by

the jurisdiction of reporting counterparties. Also,

here the effect of late reporting is more

pronounced compared to the results obtained

using TAR data (see Chart 15). Thirteen out of

thirty jurisdictions have a late reporting rate

above 20% and a few are even above 40%.

Although the late reporting is perceived as a

marginal issue when looking at TAR data, it

becomes more relevant when analysing the

cumulative effect of such misreporting behaviour

in the TSR data.

Identifying reporting entities who consistently

report late newly executed derivatives and

rectifying such behaviour remains important for

EMIR and SFTR data quality report 2021 24

achieving an accurate picture of the derivatives’

market at all times and thus for the efficient

surveillance of the systemic risk.

Timeliness of reporting by counterparties has

been the focus of NCAs during 2021 (see

Subsection 4.3 Cooperation with data users).

Chart 17

EMIR data completeness, timeliness, and availability

EMIR TSR - Timeliness Analysis by

jurisdiction

Note: A derivative executed at time T and reported at T+1

at latest, is considered “On Time”. A derivative executed at

time T and reported after T+1 is considered “Late

Reporting”. A derivative executed at time T and reported

before T is considered “Early Reporting”. A derivative

subject to “weekend effect” is classified as “On time –

weekend effect”.

Source: Trade Repositories, GLEIF and ESMA

calculations using the trade state report of 2021/21/31.

:

Non-reporting of valuations by counterparties:

EMIR requires that financial and non-financial

counterparties above the clearing threshold

report daily the valuation and collateral data

relating to their open derivatives.

To assess the timeliness of reporting of the

valuation updates, ESMA computes the

difference in number of days between the

reference date of a Trade State Report (TSR) and

the “Valuation timestamp” of a record, which

reflects the date and time of a valuation update.

While a stricter reading of EMIR would mean that

valuations that are older than one working day

are outdated, for the purposes of this analysis it

is considered that valuation updates older than

15 calendar days are outdated and should have

been subject to new valuation updates. Four

distinct buckets are used to group each record

that is in scope for this analysis and measure how

frequent valuation updates occur.

Chart 18 shows that around 80% of open

derivatives have received valuation updates that

are not older than 15 days. It also shows that

around 20% of open derivatives subject to daily

valuation have not received updates for several

days, months and even years.

Chart 18

EMIR data completeness, timeliness, and availability

EMIR TSR - Valuation updates

Note: The analysis uses all open derivatives from Trade

State Reports (TSR) with action type = “N” (new) or “V”

(valuation) and clearing threshold = “Y”. The difference in

number of days is computed between the reference date

of the TSR and the valuation timestamp of a record. Each

record is grouped into one of the four buckets to measure

the magnitude of number of outstanding trades that have

or have not received a valuation update between a certain

number of days.

Source: Trade Repositories and ESMA calculations

A significant number of open derivatives with

outdated valuation timestamps could indicate

misreporting practices by counterparties and/or

open derivatives that have not been properly

terminated (i.e., “dead” trades).

Chart 19 shows the aggregated results split by

the jurisdiction of reporting counterparties. While

in most jurisdictions the stock of open derivatives

is frequently receiving valuation updates, in a few

other jurisdictions there is a significant portion of

open derivatives that are not being updated. The

problem appears to be mostly prominent in

Bulgaria, Estonia, Latvia and Malta based on the

EMIR and SFTR data quality report 2021 25

results obtained from the trade state report of 31

December 2021

18

.

Considering the importance of the valuation data

for economic and financial risk analysis, NCAs

and ESMA will continue focusing on the

completeness and timeliness of valuation

reporting going forward.

Timeliness of valuations reporting by

counterparties has been the focus of NCAs

during 2021 during the EMIR DQR (see

Subsection 4.1 EMIR DQAP).

Chart 19

EMIR data completeness, timeliness, and availability

EMIR TSR - Valuation updates by

jurisdiction

Note: The analysis uses all open derivatives from Trade

State Reports (TSR) with action type = “N” (new) or “V”

(valuation) and clearing threshold = “Y”. The difference in

number of days is computed between the reference date

of the TSR and the valuation timestamp of a record. Each

record is grouped into one of the four buckets to measure

the magnitude of number of outstanding trades that have

or have not received a valuation update between a certain

number of days.

Source: Trade Repositories, GLEIF and ESMA

calculations using the trade state report from 2021/12/31.

18

For example Maltese MFSA confirmed that it engaged with

the most problematic counterparties in their jurisdiction and

they are now actively working on the remediation of the issue.

Non-reporting of derivatives: Chart 20 shows the

scale of potential non-reporting. It is not possible

to estimate the non-reporting fully, however, due

to the double-sided reporting obligation ESMA

has estimated the potential scale of the problem

by identifying derivatives where only a report in

one direction was submitted and a report from the

other direction is expected, i.e., the other

counterparty is in the EEA, and it has a reporting

obligation. Prior to Brexit, the number of

potentially non-reported derivatives stood at

around 3.5 million (approximately 5% of open

reconcilable derivatives at the end of 2020). After

Brexit, with the end of reporting obligation of UK

counterparties the number has sharply dropped

to around 0.5 million open derivatives (around 1%

of open reconcilable derivatives).