SEPTEMBER 2022 Issue Brief 1

Trends in Prescription Drug Spending, 2016-2021

KEY FINDINGS

• In 2021, the U.S. health care system spent $603 billion on prescription drugs, before accounting for rebates, of

which $421 billion was on retail drugs.

• Spending growth on drugs was largely due to growth in spending per prescription, and to a lesser extent by

increased utilization (i.e., more prescriptions).

• Expenditure growth was larger for non-retail drug expenditures (25%) than for retail expenditures (13%).

• Between 2016 and 2021, the location where people received their drugs changed. Americans increasingly

received their drugs from mail order pharmacies (35% increase), clinics (45% increase), and home health care

(95% increase). During the same time period, there were decreases in drugs received through independent

pharmacies (5% decrease), long term care facilities (17% decrease), and federal facilities (9% decrease).

• Drug spending is heavily driven by a relatively small number of high-cost products. The cost of specialty drugs

has continued to grow, totaling $301 billion in 2021, an increase of 43% since 2016. Specialty drugs

represented 50% of total drug spending in 2021. While the majority (80%) of prescriptions that Americans fill

are for generic drugs, brand name drugs accounted for 80% of prescription drug spending in both retail and

non-retail settings, with little change over time. The top 10% of drugs by price make up fewer than 1% of all

prescriptions, but account for 15% of retail spending and 20%-25% of non-retail spending.

• Prescription drug spending trends have been less affected by the COVID-19 pandemic than health care

services.

• Several provisions in the Inflation Reduction Act address drug pricing, including allowing the Secretary of HHS

to negotiate prices in Medicare Parts B and D for selected medications and introducing Medicare rebates for

drug prices that rise faster than inflation. These provisions may impact future drug spending trends.

Introduction

High prescription drug costs are a leading concern among Americans.

1

Americans pay higher prices for

prescription drugs than any other country in the world, with prescription drug prices in the U.S. more than 2.5

times as high as those in other similar high-income nations.

2

To support the Administration’s efforts to make

drug prices and spending more transparent, the goal of this brief is to present the drivers of total spending on

prescription drugs between 2016 and 2021. The analyses are disaggregated for retail drugs and non-retail drugs.

We also examine spending specifically on brand name drugs, specialty drugs, and the top 10% of drugs by price.

By examining trends over time, we capture changes in prescription drug spending during the COVID-19

pandemic.

1

Bush, L and Sommers, B.D. (2022). Improving Prescription Drug Affordability Through Regulatory Action. JAMA Health Forum 3(8).

2

Mulcahy, A.W., Whaley, C., Tebeka, M.G., Schwam, D., Edenfield, N., and Becerra-Ornelas, A.U. “International Prescription Drug Price

Comparisons: Current Empirical Estimates and Comparisons with Previous Studies,” RAND Research Report RR-2956-ASPEC, 2021.

Available at: https://aspe.hhs.gov/sites/default/files/documents/ca08ebf0d93dbc0faf270f35bbecf28b/international-prescription-drug-

price-comparisons.pdf.

OFFICE OF

SCIENCE & DATA POLICY

ISSUE BRIEF

SEPTEMBER 2022

SEPTEMBER 2022 Issue Brief 2

Methods

Data

The primary data for this analysis were IQVIA National Sales Perspective (NSP) data from 2016 through 2021.

3

IQVIA data are derived from a panel of wholesalers, distributors, and pharmaceutical manufacturers that

represent 90% of the pharmaceutical market and are projected to be nationally representative.

3

We examined two primary outcomes of interest: prescription drug spending and number of prescriptions.

Prescription drug spending was measured in inflation adjusted dollars.

4

The IQVIA dataset reports gross drug

spending, meaning it does not include rebates.

5

The number of prescriptions was calculated as a measure of the

number of units of a drug a manufacturer sold to a wholesaler or pharmacy. The data are at the drug claim level

and include where an individual received drugs (i.e., retail or non-retail dispensers). Retail drugs were defined as

those that are filled in an outpatient setting, including standalone pharmacies and mail order prescriptions. Non-

retail drugs were defined as those administered in an inpatient setting, including hospitals, clinics, physician

offices, long term care facilities, and home health. Non-retail spending on prescription drugs was one of the

fastest drivers of prescription drug spending; thus, capturing these prescriptions was critical to understanding

current prescription drug spending trends.

The drug attributes of interest included brand name and generic drugs, specialty drugs, and the top 10% of

drugs based on price. The top 10% of drugs by price were defined on an annual basis, meaning the drugs change

for each year of the sample.

6

Results

Total Spending Trends

Table 1 shows the number of prescriptions and drug expenditures from 2016 to 2021. Total inflation-adjusted

expenditures on prescription drugs grew from $520 billion in 2016 to $603 billion in 2021, a 16 percent increase.

This rate of growth was similar to overall national health care spending growth, with prescription drugs

maintaining approximately an 18 percent share of total health care expenditures throughout this time period.

Overall, retail drug expenditures represented roughly 70% of prescription drug spending and non-retail 30%.

We then examined trends broken out by retail and non-retail drugs. There was a 13 percent increase in retail

prescription drug spending over this five-year period, but only a 5.7 percent increase in the number of retail

prescriptions. On average, there was a 7 percent increase in spending per prescription, which suggests that

changes in utilization (i.e., a greater number of prescriptions being filled) were not the primary driver of

increased retail drug spending. For non-retail drugs, we observed a 25 percent increase in expenditures and a 19

percent increase in the number of prescriptions. On average, there was a 5 percent increase in the spending per

prescription, meaning that the primary driver of increased non-retail prescription drug spending was greater

utilization, rather than higher drug prices. The growth in non-retail prescriptions, 19 percent, was 3.4 times

higher than the increase in prescriptions for retail drugs.

3

Source of the data: IQVIA. U.S. National Data. <https://www.iqvia.com/insights/the-iqvia-institute/available-iqvia-data>.

4

The spending data includes an adjustment for inflation, thereby representing a “real” dollar. The data represent the value of a real

dollar as of quarter 1 of 2022. Source: U.S. Bureau of Economic Analysis, Gross Domestic Product: Implicit Price Deflator [GDPDEF],

retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPDEF, August 19, 2022.

5

Retail drugs can be subject to rebates while non-retail drugs do not have rebates. As a result, retail drug spending may be overestimated

relative to non-retail spending and personal health expenditures (the NHEA estimates are net of rebates for retail drug spending).

6

More details about the variable specifications can be found in the appendix.

SEPTEMBER 2022 Issue Brief 3

Table 1. Prescription Drug Expenditures (in Inflation Adjusted Dollars) and Prescriptions, 2016-2021

Retail

Expenditures

Billions, $

Retail

Prescriptions

Millions

Non-Retail

Expenditures

Billions, $

Non-Retail

Prescriptions

Millions

Total

Expenditures

Billions, $

Total

Prescriptions

Millions

2016

374

4,816

146

3,066

520

7,882

2017

369

4,923

151

3,097

519

8,020

2018

377

5,118

163

3,214

540

8,332

2019

389

5,243

173

3,486

562

8,729

2020

406

4,970

176

3,509

582

8,479

2021

421

5,089

182

3,654

603

8,743

% Change

2016-2021

12.5%

5.7%

25.1%

19.2%

16.0%

10.9%

Source: ASPE analysis of IQVIA National Sales Perspective (NSP) Data. All dollar amounts include an adjustment for inflation so they

represent a “real dollar” as of quarter 1 of 2022.

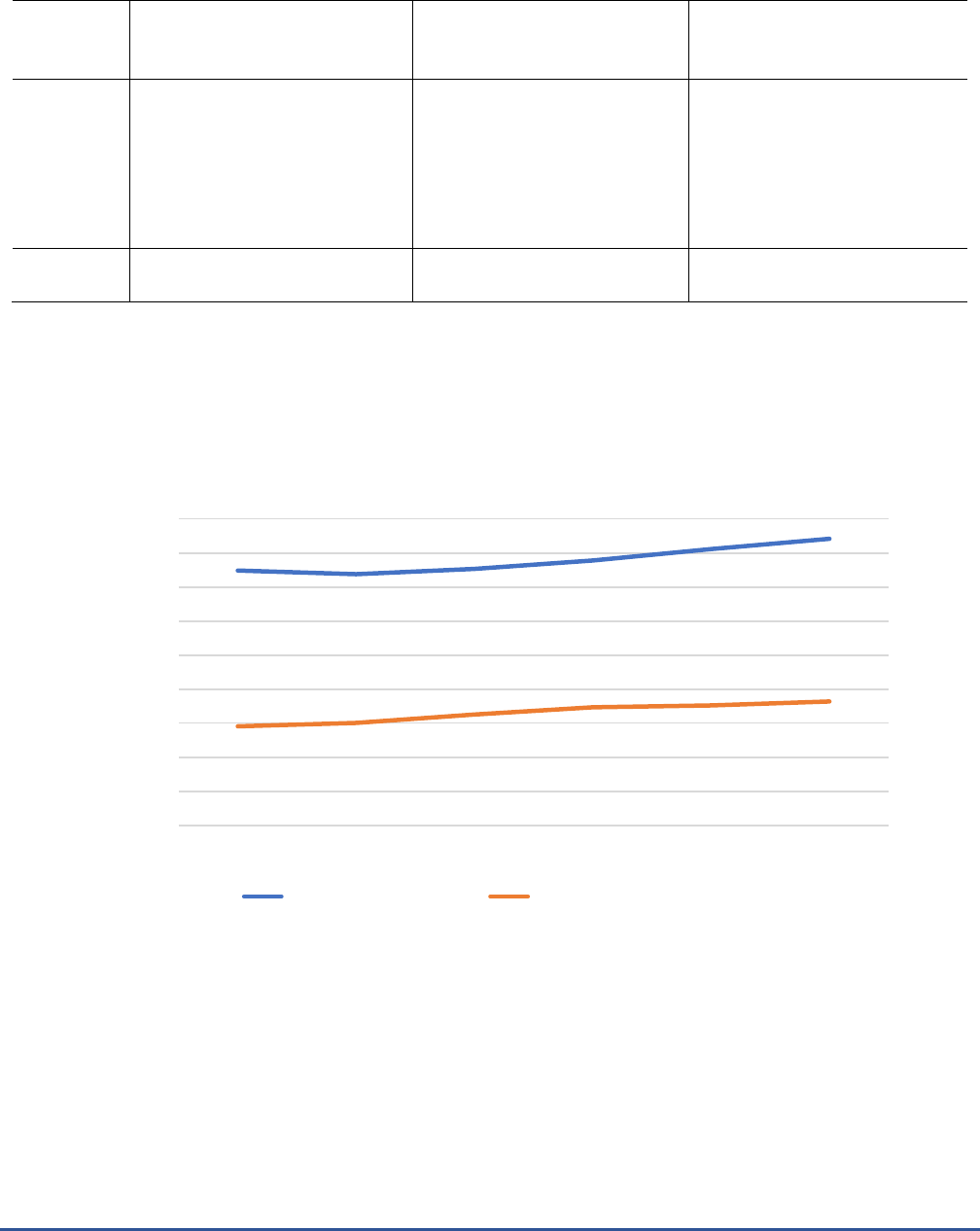

Figure 1 shows the change in retail and non-retail expenditures between 2016 and 2021. Similar to Table 1, we

observe growth in both retail and non-retail drug expenditures, with a slightly faster rate of growth for non-

retail drug spending.

Figure 1. Spending (in Inflation Adjusted Dollars) on Retail and Non-Retail Drugs, 2016-2021

Source: ASPE analysis of IQVIA National Sales Perspective Data. All dollar amounts include an adjustment for inflation so they represent a

“real dollar” as of quarter 1 of 2022.

Location of Sale

Table 2 shows the breakdown of spending over time by location of sale. There were four locations of sale for

retail drug expenditures – chain store pharmacy, mail order pharmacy, independent pharmacy, and food store

pharmacy. Three of the four locations experienced an increase in sales between 2016 and 2021. Expenditures

increased by 4 percent in chain store pharmacies, 35 percent for mail order pharmacies, and 1 percent for food

store pharmacies, but decreased 5 percent for independent pharmacies.

0

50

100

150

200

250

300

350

400

450

2016 2017 2018 2019 2020 2021

Billions of Inflation Adjusted Dollars

Retail Expenditures Non-Retail Expenditures

SEPTEMBER 2022 Issue Brief 4

For non-retail drug spending, there were more potential locations of sale, but the majority of these locations

dispensed small volumes of drugs. Over the full five-year period, the most common location of sale for non-

retail drug expenditures were clinics. Spending in clinics increased from $76 billion in 2016 to $110 billion in

2021, a 45 percent increase. The other location with substantial sales of non-retail drugs were non-federal

hospitals. Non-federal hospitals spent $39 billion on non-retail drugs in 2016 which increased by 4 percent to

$41 billion in 2021. The location with the largest increase in use was home health care, where there was a 95

percent increase from 2016 through 2021. Five locations of sale experienced declines in non-retail drug

expenditures over the time span. These was a 31 percent drop in non-retail drug spending in universities, a 17

percent drop in non-retail expenditures in long term care facilities, a 15 percent drop in “other” non-retail

settings, a 10 percent drop in prison non-retail drug expenditures, and a 9 percent drop in federal facilities.

Table 2. Expenditures (in Inflation Adjusted Dollars) on Drugs Based on Location of Sale, 2016-2021

Location of Sale

2016

2017

2018

2019

2020

2021

% Change

2016-2021

Billions, $

Retail

Chain Store Pharmacy

161

154

156

158

164

167

4

Mail Order Pharmacy

123

128

136

146

158

166

35

Independent Pharmacy

58

57

56

55

54

55

-5

Food Store Pharmacy

32

30

29

30

31

33

1

Non-Retail

Clinics

76

82

91

101

106

110

45

Non-Federal Hospital

39

39

40

41

39

41

4

Long-Term Care

19

19

19

17

16

16

-17

Home Health Care

4.4

4.8

6.3

7.5

8.2

8.6

95

Federal Facilities

3.0

3.1

3.1

3.2

2.9

2.8

-9

HMO

1.8

2.0

2.1

2.4

2.5

2.1

21

Other

0.6

0.7

0.5

0.6

0.6

0.5

-15

Prisons

0.6

0.6

0.6

0.6

0.5

0.5

-10

Universities

0.32

0.33

0.33

0.32

0.23

0.22

-31

Source: ASPE analysis of IQVIA National Sales Perspective (NSP) Data. All dollar amounts include an adjustment for inflation so they

represent a “real dollar” as of quarter 1 of 2022.

HMO = Health Maintenance Organization

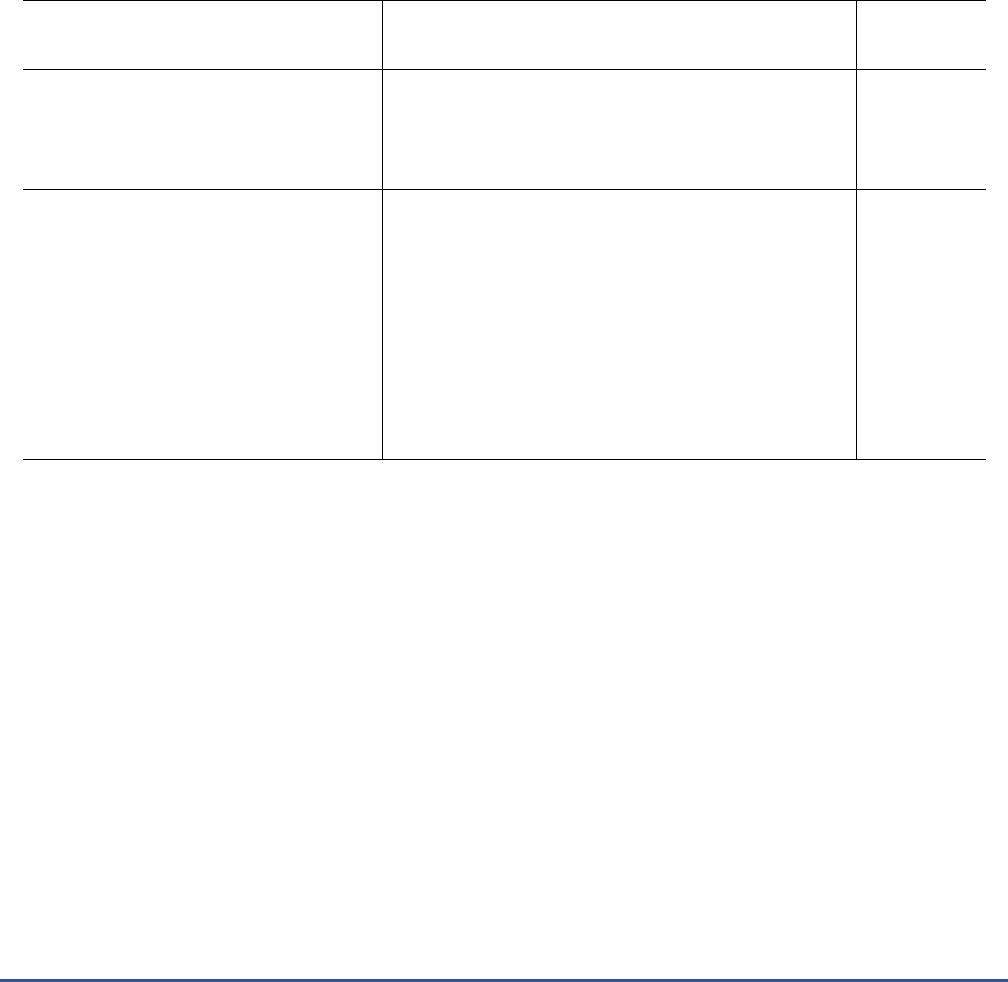

Figure 2 shows the change in the total share of prescriptions filled by location of sale between 2016 and 2021. In

2016, the plurality of retail prescriptions, 43 percent, were purchased at a chain store pharmacy, but by 2021,

there were equal shares of retail drug expenditures at chain store pharmacies and mail order pharmacies (40

percent each). In the non-retail setting, clinics were the most common location of sale in 2016 and they

increased their share of non-retail drug expenditures by 8 percent in 2021. The increase was the result of a 4

percent decrease each in the share of non-retail drug expenditures in non-federal hospitals and long-term care

facilities.

SEPTEMBER 2022 Issue Brief 5

Figure 2. Percent of Spending on each Location of Sale, 2016-2021

Note: Four categories (Health Maintenance Organizations, Other, Prisons, and Universities) were not included because they represented

fewer than 2% of prescriptions in 2016 and 2021)

Source: ASPE analysis of IQVIA National Sales Perspective Data

Brand vs. Generic Drug Changes

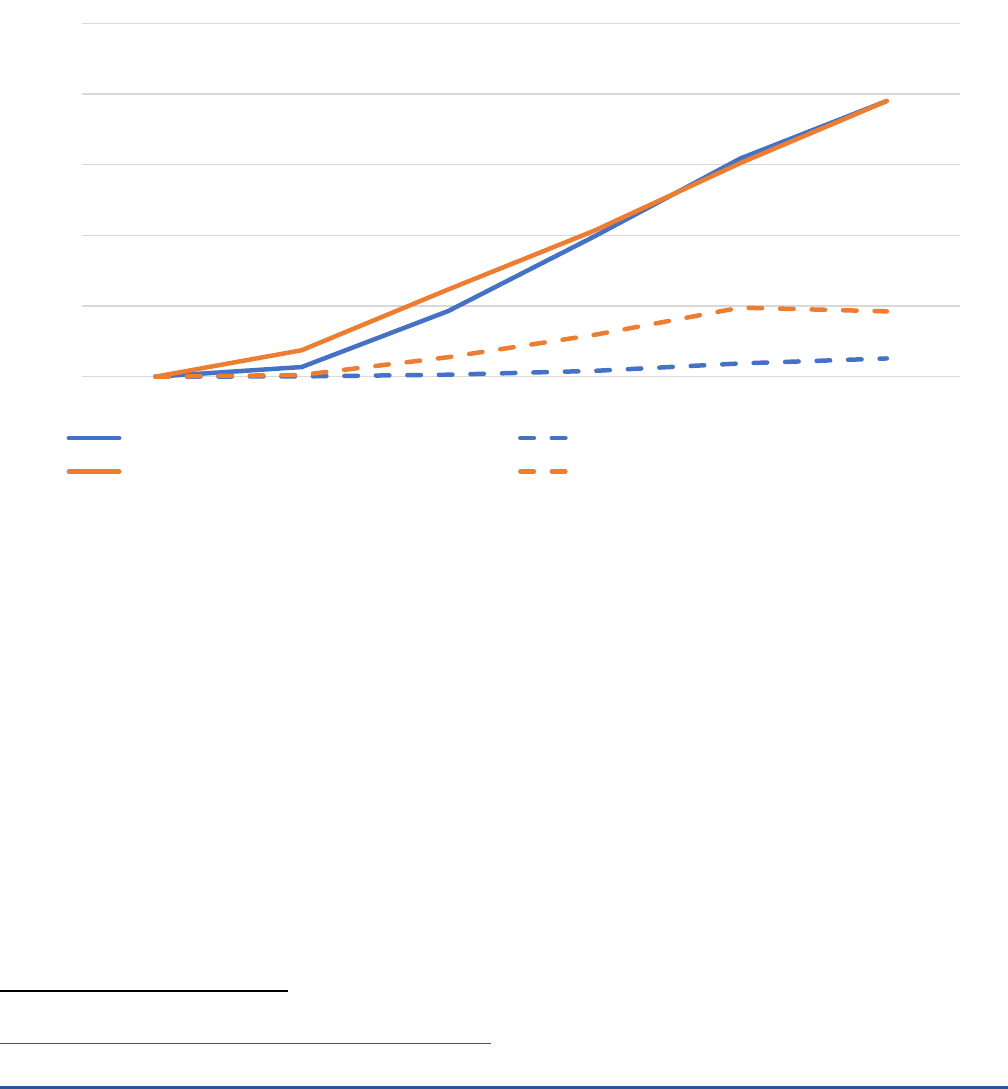

Figure 3 breaks down changes in prescription drug spending and number of prescriptions by brand name versus

generic drugs. Among brand name drugs, there was growth in both retail and non-retail drug expenditures

across the five-year time span, including during 2020. The trend for brand name drug expenditures was

consistent with the trend seen for overall prescription drug spending in Figure 1.

7

The trends in expenditures

and prescriptions for generic drugs were different than for brand name drugs. For generic drugs, from 2016 to

2021, there was a steady decline in retail generic drug expenditures and a steady increase in non-retail generic

drug expenditures.

However, the number of brand name prescriptions varied by year for both brand name and generic drugs.

Among retail brand name prescriptions, there was a growing number of prescriptions from 2016 to 2018 and

then a plateau between 2018 and 2021, with a slight dip in 2020. Despite this variation in the number of

prescriptions, there was a continual increase in total expenditures on brand name drugs throughout this five-

year period, which is likely the result of growth in spending per prescription. For non-retail brand name

prescriptions and retail generic drugs, there was year to year variation, as seen in Figure 3. For non-retail generic

prescriptions, there was some year-to-year fluctuation between 2018 and 2021, but, across the full time period,

there was no change. Examining these trends collectively, utilization increases played a role in increased

expenditures among retail brand name drugs but played no role in expenditure growth for non-retail drugs.

7

For brand name prescription expenditures, the data presented does not include rebates. Rebates for generic drugs and non-retail drugs

are minimal.

43%

33%

16%

9%

52%

27%

13%

3%

40%

40%

13%

8%

60%

23%

9%

5%

0%

10%

20%

30%

40%

50%

60%

70%

Chain Store Pharmacy

Mail Order Pharmacy

Independent Pharmacy

Food Store Pharmacy

Clinics

Non-Federal Hospital

Long-Term Care

Home Health Care

Retail Non-Retail

Series1 Series2

2016 2021

SEPTEMBER 2022 Issue Brief 6

Figure 3. Change in Expenditures (in Inflation Adjusted Dollars) and Prescriptions for Brand Name and Generic

Drugs, 2016-2021

Brand Name Drugs

Generic Drugs

8

Source: ASPE analysis of IQVIA National Sales Perspective Data. All dollar amounts include an adjustment for inflation so

they represent a “real dollar” as of quarter 1 of 2022.

Figure 4 shows the share of all prescriptions and expenditures for brand name drugs from 2016 to 2021. There

was almost no change over this period for either measure. Brand name drugs accounted for 80 percent of

prescription drug expenditures in both retail and non-retail settings, despite accounting for only 20 percent of

retail and non-retail prescriptions, with little change over time. However, there was a noticeable dip in non-

retail prescriptions in 2020 that was likely related to a drop in office visits during the early stages of the COVID-

19 pandemic. However, there was no corresponding dip in spending on non-retail drugs.

8

“Generic drugs” includes both true generics and branded generics

70

80

90

100

110

120

130

140

2016 2017 2018 2019 2020 2021

% As a Share of 2016 Levels

70

80

90

100

110

120

130

140

2016 2017 2018 2019 2020 2021

% as a Share of 2016 Level

Retail Expenditures Retail Prescriptions

Non-Retail Expenditures Non-Retail Prescriptions

SEPTEMBER 2022 Issue Brief 7

Figure 4. Brand Name Drugs as a Share of All Prescription Drug Spending and Prescriptions

9

Source: ASPE analysis of IQVIA National Sales Perspective Data

Specialty Drugs

Table 3 shows trends in specialty drug spending between 2016 and 2021 (see Appendix for definition of

specialty drugs). The overall changes resemble what was evident for all drugs, spending growth was largely due

to higher prices per prescription, not increases in utilization. By 2021, specialty drugs were more than 40

percent of retail drug spending and nearly 70 percent of non-retail drug spending.

10

Specialty drug spending between 2016 and 2021 increased by 43 percent for a total of $301 billion in 2021,

despite there being only a 0.5 percent increase in the number of specialty prescriptions. Disaggregating the data

for the retail and non-retail settings, the percent of retail drug spending on specialty drugs increased 22 percent

between 2016 and 2021. The number of retail prescriptions for specialty drugs increased from 2016 through

2019, but there was a drop in 2020 and 2021. When examining the five-year trend, there was a net 18 percent

drop in the specialty share of retail prescriptions. In contrast, when examining non-retail specialty drugs, the

percent of spending on specialty drugs increased 20 percent over the five-year time horizon and the number of

prescriptions for specialty drugs increased by 40 percent, despite decreases in prescriptions in 2019, 2020, and

2021.

9

The rate of generic drugs as a share of all prescription drug spending and prescriptions is the inverse of the brand name spending and

prescriptions.

10

Rebates for specialty drugs with competition can be substantial, were is not accounted for in this analysis.

10%

20%

30%

40%

50%

60%

70%

80%

90%

2016 2017 2018 2019 2020 2021

Share of Retail Spending Share of Retail Prescriptions

Share of Non-Retail Spending Share of Non-Retail Prescriptions

SEPTEMBER 2022 Issue Brief 8

Table 3. Specialty Drug Expenditures (in Inflation Adjusted Dollars), 2016-2021

Total

Specialty

Spending

Billions, $

Number of

Specialty

Prescriptions

Millions

Retail Spending Non-Retail Spending

% Retail

Spending on

Specialty

% Retail

Prescriptions

on Specialty

% Non-Retail

Spending on

Specialty

% Non-Retail

Prescriptions

on Specialty

2016

211

1,107

34.3

18.9

57.2

6.4

2017

225

1,160

36.5

19.3

60.0

6.8

2018

245

1,443

37.6

21.3

63.6

11.0

2019

268

1,413

39.7

20.4

65.8

9.8

2020

287

1,161

41.3

16.9

67.8

9.1

2021

301

1,113

41.8

15.4

68.8

8.9

% Change

2016-2021

42.5%

0.5%

21.9%

-18.3%

20.3%

40.0%

Source: ASPE analysis of IQVIA data. All dollar amounts include an adjustment for inflation so they represent a “real dollar” as of quarter

1 of 2022.

Figure 5 shows trends over time in the share of retail and non-retail drug spending and prescriptions for

specialty drugs. Between 2016 and 2021, there was a slight increase, up to 10 percent, in the share of both retail

and non-retail spending for specialty drugs. But there was very little change over time in the number of

prescriptions for specialty drugs; the share of retail prescriptions on specialty drugs rarely exceeded 20 percent

and the share of non-retail prescriptions on specialty drugs rarely exceeded 10 percent.

Figure 5. Specialty Drugs as a Share of All Retail Prescription Drug Spending and Prescriptions

Source: ASPE analysis of IQVIA National Sales Perspective Data

0%

10%

20%

30%

40%

50%

60%

70%

80%

2016 2017 2018 2019 2020 2021

Share of Retail Spending Share of Non-Retail Spending

Share of Retail Prescriptions Share of Non-Retail Prescriptions

SEPTEMBER 2022 Issue Brief 9

Over the past decade, there has been a trend towards a larger share of new drug approvals for specialty drugs.

11

Figure 6 shows the annual share of specialty drug spending on new drugs, defined as those drugs introduced

after 2016. By 2021, the share of specialty drug spending on new drugs, in both the retail and non-retail settings,

was 20 percent. Among all specialty drug prescriptions, fewer than 5 percent of prescriptions were for new

drugs, in both the retail and non-retail settings. This means that in the retail setting, 1 percent of prescriptions

for new specialty drugs accounted for 20 percent of spending ($25 billion).

Figure 6. Share of New Drugs (Introduced Since 2016) as a Share of Specialty Drug Spending, 2016-2021

Source: ASPE analysis of IQVIA National Sales Perspective Data

Most Expensive Drugs

Figure 7 shows the share of spending and prescriptions for the top ten percent of drugs by price

12

. The top 10

percent of drugs by price made up 15 percent of retail spending between 2016 and 2021, with little change over

time. The top 10 percent of drugs by price made up 20 to 25 percent of non-retail spending, depending on the

year. For both retail and non-retail prescriptions, the top 10 percent of drugs by price made up less than 1

percent of total prescriptions.

11

Congressional Budget Office. (2021). A Comparison of Brand-Name Drug Prices Among Selected Federal Programs.

https://www.cbo.gov/system/files/2021-02/56978-Drug-Prices.pdf

12

Price was defined as the reported drug price (i.e., gross drug cost before rebates) in the IQVIA data.

0

5

10

15

20

25

2016 2017 2018 2019 2020 2021

Share of Retail Specialty Spending Share of Retail Specialty Prescriptions

Share of Non-Retail Specialty Spending Share of Non-Retail Specialty Prescriptions

SEPTEMBER 2022 Issue Brief 10

Figure 7. Top 10% of Drugs by Price as a Fraction of All Drug Expenditures (in Inflation Adjusted Dollars) on

Prescription Drugs

Source: ASPE analysis of IQVIA National Sales Perspective Data

Conclusion

This brief shows trends in prescription drug spending between 2016 and 2021, disaggregated by retail and non-

retail settings, generic vs. brand drugs, and specialty and high-cost drugs. We found a steady increase in

prescription drug spending from $520 billion in 2016 to $603 billion in 2021. This increase was driven by

increases in spending per prescription, and less so by increases in the number of prescriptions. The largest rate

of growth occurred among non-retail drugs, which increased by 40 percent. There was also a continued increase

in the share of spending on specialty drugs. These trends are a continuation of the findings from an ASPE Issue

Brief that examined prescription drug spending between 2009 and 2015, despite rapid change in the

prescription drug market during this period, including the increase in specialty drugs use and the use of rebates

for high-cost drugs with competition.

13

Despite our time period coinciding with the COVID-19 pandemic, we saw little impact of the pandemic on

prescription drug spending. Among the measures of drug spending we examined, only one measure – brand

name prescriptions – experienced a noticeable change in 2020 and 2021 that was different than the trend

established between 2016 and 2019. This suggests that spending on prescription drugs was not impacted as

significantly by the pandemic as other health care services.

The passage of the Inflation Reduction Act (IRA) of 2022 will introduce several new provisions intended to affect

drug spending trends in the future.

14

The HHS Secretary will have the authority to negotiate drug prices for

13

Observations on Trends in Prescription Drug Spending. Washington, DC: Office of the Assistant Secretary for Planning and Evaluation,

U.S. Department of Health and Human Services. March 2016.

https://aspe.hhs.gov/sites/default/files/migrated_legacy_files//142181/Drugspending.pdf

14

U.S. Congress. (2022). H.R.5376 - Inflation Reduction Act of 2022. https://www.congress.gov/bill/117th-congress/house-bill/5376

0%

5%

10%

15%

20%

25%

30%

2016 2017 2018 2019 2020 2021

Share of Retail Spending Share of Retail Prescriptions

Share of Non-Retail Spending Share of Non-Retail Prescriptions

SEPTEMBER 2022 Issue Brief 11

selected products in Medicare; the first group of drugs for negotiation will be identified in 2023, with negotiated

prices effective starting in 2026.

15

Drugs qualify as negotiation-eligible based on absence of generic or biosimilar

competitors; total spending in Medicare Part B and Medicare Part D; and time elapsed since FDA approval. By

targeting the highest spending drugs without competition, this provision of the IRA aims to slow the rate of

increase in drug spending over time. The IRA also requires manufacturers who raise Medicare Part B and

Medicare Part D drug prices faster than inflation to pay rebates to Medicare. The goal of this policy is to lower

year-over-year increases in the price of prescription drugs, particularly brand name drugs, which make up 80

percent of all prescription drug spending. Since the primary driver of increased prescription drug spending has

been increases in spending per prescription, not greater utilization, discouraging price increases above inflation

for drugs already on the market may help reduce future growth in prescription drug spending. Other IRA

provisions include eliminating Medicare Part D cost-sharing for recommended vaccines and capping Medicare

Part B and Part D insulin cost-sharing at $35 per insulin product per month beginning in 2023; eliminating cost

sharing for beneficiaries in the catastrophic phase of the Part D benefit, expanding the low-income subsidy

program, and ensuring premium stabilization beginning in 2024; and capping beneficiary out-of-pocket

Medicare Part D costs at $2,000 and implementing a new manufacturer discount program beginning in 2025.

These provisions may also impact future drug spending trends.

15

Congressional Research Service. (2022). Selected Health Provisions of the Inflation Reduction Act.

https://crsreports.congress.gov/product/pdf/IF/IF12203

.

SEPTEMBER 2022 Issue Brief 12

Appendix

The variable used to measure the number of prescriptions throughout this brief is the “eaches” variable in IQVIA

data, which is defined as “the number of single items (such as vials, syringes, bottles, or packet of pills)

contained in a unit or shipping package and purchased by pharmacies in a specific time period. An each is not a

single pill or dosage of medicine (unless one package consists of a single dose). An each may be the same as a

unit if the unit does not subdivide into packages.”

Specialty drugs are defined by IQVIA as products used to treat chronic, rare or complex diseases and that meet 4

or more of the following criteria

3

:

• Initiated and maintained by a specialist

• Generally injectable and/or not self-administered

• Products that require an additional level of care in their chain of custody (i.e., refrigerated, frozen,

chemo, biohazard, etc.)

• Expensive (USD $6K annual cost of therapy)

• Unique distribution (e.g., specialty MO, REMS)

• Requires extensive or in-depth monitoring/patient counseling

• Requires reimbursement assistance

• Products that clearly meet the above criteria are defined as Specialty. Products that are borderline (e.g.

meet three, rather than four criteria) will be brought before the Specialty Governance Board for review

and final decision.

SEPTEMBER 2022 Issue Brief 13

U.S. DEPARTMENT OF HEALTH AND HUMAN SERVICES

Office of the Assistant Secretary for Planning and Evaluation

200 Independence Avenue SW, Mailstop 434E

Washington, D.C. 20201

For more ASPE briefs and other publications, visit: aspe.hhs.gov/reports

ABOUT THE AUTHORS

Sonal Parasrampuria is a Social Science Analyst and FDA portfolio lead in the Office of Science and Data Policy in ASPE.

Stephen Murphy is an Economist in the Office of Science and Data Policy in ASPE.

SUGGESTED CITATION

Parasrampuria, S. and Murphy, S. Trends in Prescription Drug Spending, 2016-2021. Washington, DC: Office of the Assistant

Secretary for Planning and Evaluation, U.S. Department of Health and Human Services. September 2022.

COPYRIGHT INFORMATION

All material appearing in this report is in the public domain and may be reproduced or copied without permission; citation

as to source, however, is appreciated.

___________________________________

For general questions or general information about ASPE: aspe.hhs.gov/about