UNITED STATES OF AMERICA

FEDERAL ENERGY REGULATORY COMMISSION

2014 REPORT ON ENFORCEMENT

Docket No. AD07-13-008

Prepared by Staff of the

Office of Enforcement

Federal Energy Regulatory Commission

Washington, D.C.

NOVEMBER 20, 2014

The matters presented in this staff report do not necessarily represent the views

of the Federal Energy Regulatory Commission, its Chairman, or individual

Commissioners, and are not binding on the Commission.

2014 Staff Report on Enforcement i

TABLE OF CONTENTS

Table of Contents ............................................................................................................................. i

Introduction ......................................................................................................................................1

Office of Enforcement Priorities ......................................................................................................2

DIVISION OF INVESTIGATIONS................................................................................................4

A. Overview ....................................................................................................................................4

B. Significant Matters .....................................................................................................................5

Barclays Bank, PLC, Daniel Brin, Scott Connelly, Karen Levine, and Ryan Smith (Barclays

1.

and Traders) ................................................................................................................................. 5

ISO-NE Day-Ahead Load Response Program (DALRP) ............................................................ 5 2.

BP America, Inc. and Affiliates (BP) .......................................................................................... 6 3.

C. Settlements .................................................................................................................................6

D. Self-Reports .............................................................................................................................12

1. Illustrative Self-Reports Closed with No Action ..................................................................15

E. Investigations ..........................................................................................................................21

1. Statistics on Investigations ........................................................................................................ 21

Illustrative Investigations Closed with No Action ..................................................................... 26 2.

F. Enforcement Hotline ................................................................................................................28

G. Other Matters ...........................................................................................................................28

DIVISION OF AUDITS AND ACCOUNTING ...........................................................................30

A. Overview ..................................................................................................................................30

B. Compliance Reviews and Alerts ..............................................................................................31

1. Compliance Reviews ........................................................................................................31

2. Compliance Alerts ............................................................................................................32

C. Audit Matters ...........................................................................................................................34

Formula Rates ............................................................................................................................ 34 1.

Transmission Incentives ............................................................................................................ 35 2.

Mergers & Acquisitions............................................................................................................. 36 3.

Accounting and Reporting ......................................................................................................... 37 4.

Open Access Transmission Tariff ............................................................................................. 37 5.

Market-Based Rates and Electric Quarterly Reports ................................................................. 38 6.

Capacity Markets and Demand Response ................................................................................. 38 7.

Oversight of ERO Audited-Related Activities to Ensure Reliability of the Bulk-Electric 8.

System ....................................................................................................................................... 38

No Audit Findings ..................................................................................................................... 39 9.

2014 Staff Report on Enforcement ii

D. Accounting Matters ..................................................................................................................39

Requests for Approval of the Chief Accountant ........................................................................ 40 1.

Certificate Proceedings .............................................................................................................. 40 2.

Merger and Acquisition Proceedings ........................................................................................ 41 3.

Debt and Security Issuance Proceedings ................................................................................... 41 4.

Rate Proceedings ....................................................................................................................... 41 5.

Accounting Inquiries ................................................................................................................. 42 6.

International Financial Reporting Standards ............................................................................. 42 7.

Energy Storage Assets ............................................................................................................... 43 8.

Accounting Filing Statistics....................................................................................................... 43 9.

DIVISION OF ENERGY MARKET OVERSIGHT .....................................................................44

A. Overview ..................................................................................................................................44

B. Market Monitoring ...................................................................................................................44

2013 State of the Markets Report .............................................................................................. 44 1.

Seasonal Market Assessments ................................................................................................... 45 2.

C. Outreach and Communication .................................................................................................45

Website ...................................................................................................................................... 45 1.

Snapshot Calls ........................................................................................................................... 46 2.

Domestic and Foreign Delegation Briefings ............................................................................. 46 3.

D. Forms Administration and Filing Compliance ........................................................................46

Electric Quarterly Reports ......................................................................................................... 46 1.

E. Agenda Items and Rulemakings ..............................................................................................47

Winter 2013-2014 Operations and Market Performance in RTOs and ISOs ............................ 47 1.

Gas-Electric Coordination ......................................................................................................... 48 2.

DIVISION OF ANALYTICS AND SURVEILLANCE ...............................................................49

A. Overview ..................................................................................................................................49

B. Natural Gas Surveillance .........................................................................................................50

C. Electric Surveillance ................................................................................................................50

D. Analytics ..................................................................................................................................51

Conclusion .....................................................................................................................................52

APPENDIX A: Office of Enforcement Organization Chart .........................................................53

APPENDIX B: FY2014 Civil Penalty Enforcement Actions .......................................................54

APPENDIX C: FY2014 Notices of Alleged Violations ...............................................................56

2014 Staff Report on Enforcement 1

INTRODUCTION

The staff of the Office of Enforcement (Enforcement) of the Federal Energy Regulatory

Commission (Commission) is issuing this report as directed by the Commission in its Revised

Policy Statement on Enforcement.

1

This report informs the public and the regulated community

of Enforcement’s activities during Fiscal Year 2014 (FY2014),

2

including an overview of, and

statistics reflecting, the activities of the four divisions within Enforcement: Division of

Investigations (DOI), Division of Audits and Accounting (DAA), Division of Energy Market

Oversight (Market Oversight), and Division of Analytics and Surveillance (DAS).

Enforcement recognizes the importance of informing the public of the activities of

Enforcement staff and prepares this report with that objective in mind. Because much of the

investigative work of Enforcement is non-public, most of the information the public receives

about investigations comes from public Commission orders approving settlements, orders to

show cause, publicly released staff reports, and notices of alleged violations. However, not all of

Enforcement’s activities result in public actions by the Commission. As in previous years, the

FY2014 report provides the public with more information regarding the nature of non-public

Enforcement activities, such as self-reported violations and investigations that are closed without

public enforcement action. This report also highlights Enforcement’s work auditing

jurisdictional companies, compiling and monitoring data from forms and reports submitted to the

Commission by market participants, and performing surveillance and analysis of conduct in

wholesale natural gas and electric markets.

1

Enforcement of Statutes, Regulations and Orders

, 123 FERC ¶ 61,156, at P 12 (2008) (Revised Policy Statement).

A current Enforcement organizational chart is attached as Appendix A to this report.

2

The Commission’s fiscal year begins October 1 and ends September 30 of the following year. FY2014, the subject

of this report, began on October 1, 2013 and ended on September 30, 2014.

2014 Staff Report on Enforcement 2

OFFICE OF ENFORCEMENT PRIORITIES

The Commission’s Strategic Plan announced its mission of assisting consumers in obtaining

reliable, efficient, and sustainable energy services at a reasonable cost through appropriate

regulatory and market means.

3

The Strategic Plan identifies three primary goals to fulfill this

mission: (1) ensuring that rates, terms, and conditions of jurisdictional services are just,

reasonable, and not unduly discriminatory or preferential; (2) promoting the development of a

safe, reliable, and efficient energy infrastructure that serves the public interest; and (3)

facilitating organizational excellence through increased transparency, communication, and

managing Commission resources and employees. To further those goals and assist the

Commission in its obligation to oversee regulated markets, Enforcement’s four divisions gather

information about market behavior, market participants, and market rules. The divisions

continue to work to bring entities into compliance with applicable statutes, Commission rules,

orders, regulations, and tariff provisions.

Enforcement selected priorities for its four divisions. In FY2014, Enforcement continued to

focus on matters involving:

• Fraud and market manipulation;

• Serious violations of the Reliability Standards;

• Anticompetitive conduct; and

• Conduct that threatens the transparency of regulated markets.

Enforcement does not intend to change these priorities in FY2015. Conduct involving fraud

and market manipulation poses a significant threat to the markets the Commission oversees.

Such intentional misconduct undermines the Commission’s goal of ensuring provision of

efficient energy services at a reasonable cost because the losses imposed by fraud and

manipulation are ultimately passed on to consumers. Similarly, anticompetitive conduct and

conduct that threatens market transparency undermine confidence in the energy markets and

harm consumers and competitors. Such conduct might also involve the violation of rules

designed to limit market power or to ensure the efficient operation of regulated markets.

Enforcement focuses its efforts on preventing and remedying misconduct involving the greatest

harm to the public, where there may be significant gain to the violator or loss to the victims.

The Reliability Standards established by the Electric Reliability Organization (ERO) and

approved by the Commission protect the public interest by requiring a reliable and secure bulk

power system. This office enforces these standards and focuses primarily on violations resulting

in actual harm, through the loss of load or other means. Enforcement also focuses on cases

involving repeat violations of the Reliability Standards or violations that present a substantial

risk to the bulk power system. In addition, the office enforces safety and environmental

standards established by the Commission in order to promote the development of a safe, reliable,

and efficient energy infrastructure with an emphasis on cases involving actual harm or a high

risk of harm.

3

The Federal Energy Regulatory Commission, Strategic Plan FY 2014-2018 (Mar. 2014)),

available at

http://www.ferc.gov/about/strat-docs/FY-2014-FY-2018-strat-plan.pdf.

2014 Staff Report on Enforcement 3

Enforcement continued its commitment to these priorities in FY2014. DOI staff opened 17

new investigations while bringing 15 pending investigations to closure with no action or

settlement. During FY2014, staff obtained a total of almost $25 million in civil penalties and

disgorgement of approximately $4 million in unjust profits. In addition, all of these settlements

included provisions requiring the subject to enhance its compliance programs, and periodically

report back to Enforcement regarding the results of those compliance enhancements.

Staff from DAA reviewed the conduct of regulated entities through 19 financial and

operational audits of public utilities and natural gas pipelines. DAA’s audits resulted in 162

recommendations for corrective action and directed refunds and recoveries totaling over

$11.7 million.

Market Oversight continued its analysis of market fundamentals, including significant trends

and developments, market structure and operations to identify market anomalies, flawed market

rules, and potentially improper behavior by market participants. As in prior years, Market

Oversight presented its annual State of the Markets report assessing significant events of the

previous year, as well as its Winter Energy Market Assessment and Summer Energy Market and

Reliability Assessment. Additionally, Market Oversight continued ensuring compliance with the

Commission’s filing requirements for Electric Quarterly Reports (EQR) and various Commission

financial forms.

Finally, in FY2014, DAS reviewed numerous instances of potential misconduct and referred

matters to DOI for investigation. The Commission also continued to enhance its ability to

conduct surveillance of the natural gas and electric markets and to analyze individual market

participant behavior by gaining access to the Commodity Futures Trading Commission’s (CFTC)

Large Trader Report (LTR) data. In addition, DAS led an extensive review of the Polar Vortex

events that occurred in January and February of 2014 to determine whether potentially

manipulative trading behavior contributed to the high natural gas prices and elevated electricity

costs.

2014 Staff Report on Enforcement 4

DIVISION OF INVESTIGATIONS

A. Overview

The Division of Investigations (DOI) conducts public and non-public investigations of

possible violations of the statutes, regulations, rules, orders, and tariffs administered by the

Commission. Investigations may begin from self-reports, tips, calls to the Enforcement Hotline,

referrals from organized markets or their monitoring units, other agencies, other divisions in

Enforcement, other offices within the Commission, or as a result of other investigations. In its

investigations, DOI staff coordinates with other divisions in Enforcement and subject matter

experts in other Commission offices as appropriate. Where staff finds violations of sufficient

seriousness, staff reports its findings to the Commission and attempts to settle investigations for

appropriate sanctions and future compliance improvements before recommending that the

Commission initiate a public show cause proceeding.

4

The Commission continues to increase the transparency of Enforcement activities and

promote consistency in Enforcement actions. In FY2014, the Director of Enforcement directed

the Secretary to issue 9 notices of alleged violations involving conduct of 21 separate corporate

entities and 6 individuals. The notices involved alleged violations of the Commission’s

prohibition of market manipulation, tariffs, regulations, and Reliability Standards. The notices

identified investigation subjects and alleged violations with a concise description of the alleged

wrongful conduct.

5

In FY2014, DOI continued to focus on the enforcement of the Reliability Standards.

Through Enforcement’s investigations, with the assistance of technical expertise from the Office

of Electric Reliability (OER) and in conjunction with the investigative efforts of the North

American Electric Reliability Corporation (NERC), the Commission addressed and resolved

findings of numerous Reliability Standards violations.

Notably, during this fiscal year the Commission approved settlement of an investigation of a

self-reported violation of the Commission’s Anti-Manipulation Rule, 18 C.F.R. § 1c.1 (2014),

the first self-report of this kind to result in a Commission-approved settlement. Launched by a

self-report by Direct Energy Services, LLC (Direct Energy), DOI and DAS investigated whether

Direct Energy manipulated natural gas prices at three hubs in 2011 and 2012. Staff ultimately

concluded that Direct Energy engaged in manipulation in May 2012 at Algonquin and Transco

Zone 6 to benefit its related financial positions. Direct Energy stipulated to the facts (without

admitting that it committed a violation), and agreed to pay a civil penalty of $20,000, to disgorge

$31,935, and to continue implementing its existing compliance measures, which include periodic

review of its employees’ trading conduct. Importantly, Direct Energy received a relatively small

civil penalty and disgorgement payments due to its self-reporting, strong compliance program,

quick action, and full cooperation with Enforcement’s investigation.

The Commission also approved settlements of reliability investigations of Arizona Public

Service Company (APS) and Imperial Irrigation District (IID), respectively. The investigations

arose out of a joint inquiry between the Commission and NERC into the September 2011 outage

4

For a discussion of the processes by which Enforcement staff conducts and concludes investigations,

see

Revised

Policy Statement,

supra

note 1.

5

See

Appendix C to this report for a complete listing of the notices of alleged violations that Enforcement issued in

FY2014.

2014 Staff Report on Enforcement 5

in Arizona, Southern California and Baja California, Mexico, that resulted in over 30,000 MWh

of lost firm load and left approximately 2.7 million customers (5 million or more individuals)

without power for up to 12 hours. APS and IID stipulated to the facts (without admitting

violations of the Reliability Standards) and agreed to mitigation and compliance monitoring.

APS agreed to a civil penalty of $3.25 million, $1.25 million to be invested in reliability

enhancement measures beyond Reliability Standards requirements. IID agreed to a civil penalty

of $12 million, $9 million to be invested in reliability enhancement measures. The Commission

has also issued a Notice of Alleged Violations against the Western Electricity Coordinating

Counsel, the California ISO, Southern California Edison Company

6

and Western Area Power

Authority-Desert Southwest Region in connection with the same outage.

Additionally, DOI work in FY2014 included obtaining multiple settlements resolving

investigations concerning manipulative conduct, submission to the Commission of inaccurate

and misleading information, violations of the Standards of Conduct for transmission providers,

violations of the Reliability Standards, violations of Open Access Transmission Tariff (OATT)

provisions, and violations of hydropower safety regulations. In addition to investigation-related

work, DOI continued its rigorous analysis of self-reports, Enforcement Hotline calls, referrals,

and other matters within the Commission. DOI staff continues to provide guidance and

assistance as requested by other program offices on advisory matters.

B. Significant Matters

Barclays Bank, PLC, Daniel Brin, Scott Connelly, Karen Levine, and Ryan Smith 1.

(Barclays and Traders)

On October 9, 2013, the Commission filed a petition in the United States District Court for

the Eastern District of California (the court) to affirm the Commission’s assessment of civil

penalties of $435 million against Barclays and of $18 million against the named Traders and to

order disgorgement by Barclays of $34.9 million plus interest in unjust profits. Previously, on

July 16, 2013, the Commission determined that Barclays and the Traders violated the

Commission’s Anti-Manipulation Rule, 18 C.F.R. § 1c.2, by engaging in loss-generating trading

of next-day, fixed-price physical electricity on the Intercontinental Exchange (ICE) with the

intent to benefit financial swap positions at primary electricity trading points in the western

United States. On December 16, 2013, Barclays and the Traders filed a motion to dismiss the

Commission’s petition or alternatively to transfer it to the United States District Court for the

Southern District of New York. The Commission filed an opposition to Barclays and the

Traders’ motion on February 14, 2014, and Barclays and the Traders filed a reply brief on March

21, 2014. The motion is pending before the court as of November 17, 2014.

ISO-NE Day-Ahead Load Response Program (DALRP) 2.

Based on an Enforcement investigation of Lincoln Paper and Tissue LLC (Lincoln),

Competitive Energy Services, LLC (CES), and Richard Silkman (the CES managing partner), on

August 29, 2013, the Commission issued Orders Assessing Civil Penalties to Lincoln, CES, and

Silkman,

7

finding that the subjects fraudulently inflated load baselines and repeatedly offered

6

After the fiscal year ended, on October 21, the Commission approved a settlement in which SCE agreed to a civil

penalty of $650,000, with $250,000 to be paid in equal shares to the Treasury and NERC, and $400,000 to be

invested in reliability enhancement measures.

7

Lincoln Paper and Tissue, LLC

, 144 FERC ¶ 61,162 (2013) (order assessing civil penalty);

Competitive Energy

Services, LLC

, 144 FERC ¶ 61,163 (2013) (order assessing civil penalty);

Richard Silkman

, 144 FERC ¶ 61,164

(2013) (order assessing civil penalty).

2014 Staff Report on Enforcement 6

load reductions at the minimum offer price in order to maintain the inflated baseline.

Enforcement found that the scheme involved uneconomic energy purchases that served no

legitimate purpose and were designed to increase Day Ahead Load Response Program (DALRP)

payments that would not have otherwise been obtained. The Commission determined that this

scheme misled ISO-NE, inducing payments to these entities based on the inflated baselines for

load reductions that never occurred. The Commission ordered all three respondents to pay civil

penalties, and also ordered Lincoln and CES to pay disgorgement. None of the respondents paid

the amounts assessed by the Commission. Staff filed two petitions in the United States District

Court for the District of Massachusetts on December 2, 2013 seeking affirmance of the

Commission’s orders. Currently pending in federal court are multiple motions to dismiss and a

motion for judgment on the pleadings. All Respondents seek transfer to Maine if the cases are

not dismissed. On July 18, 2014, staff participated in a motions hearing before Judge Douglas P.

Woodlock in Springfield, Massachusetts. The hearing addressed motions to dismiss and for

judgment on the pleadings filed by the Respondents in both cases and a motion to transfer filed

by Silkman and CES. The motions are pending before the court as of November 17, 2014.

BP America, Inc. and Affiliates (BP) 3.

On May 15, 2014, the Commission issued an order establishing a hearing before an

Administrative Law Judge (ALJ) to determine whether certain trading by BP of next-day, fixed-

price natural gas at the Houston Ship Channel violated the Commission’s anti-manipulation rule,

18 C.F.R. § 1c.1. Enforcement alleges that such trading was uneconomic and part of a

manipulative scheme to increase the value of BP’s financial position based on Houston Ship

Channel natural gas prices. The order addressed BP’s answer to the Commission’s August 5,

2013 order to show cause in this matter, denied BP’s motion to dismiss the proceeding, and

found that there are issues of fact requiring a hearing before an ALJ. The order directed the ALJ

to make findings with respect to subject matter jurisdiction, the allegations of manipulation, and

factors relevant to a possible civil penalty. Staff filed its direct testimony on September 22, 2014

and BP will file its reply testimony on January 6, 2015. The hearing before the ALJ is scheduled

to commence on March 30, 2015, and the ALJ’s Initial Decision is scheduled for issuance on or

before August 14.

C. Settlements

In FY2014, the Commission approved 8 settlement agreements between Enforcement and 9

separate subjects to resolve pending investigations. The settlements assessed a total of almost

$25 million in civil penalties, disgorgement of approximately $4 million plus interest, and $1.7

million in public safety enhancements by Erie Boulevard Hydropower, L.P. and Brookfield

Power US Assets Management, LLC.

8

In five of the eight cases, subject compliance efforts

warranted credit to reduce penalties. Since 2007, the total civil penalties assessed (excluding

overturned and pending proceedings) amount to over $602 million and the total disgorgements

amount to almost $300 million.

9

8

A table of FY2014 Civil Penalty Enforcement Actions, both those resolved through settlement and those resolved

through agency proceedings, is attached to this report as Appendix B.

9

This civil penalty number does not include the $30,000,000 assessed in Hunter and overturned on jurisdictional

grounds by the U.S. Court of Appeals for the District of Columbia Circuit. It also does not include penalties

proposed or assessed in the following currently pending matters: $28,000,000 in BP America Inc.,

et al

.;

$453,000,000 in Barclays Bank PLC,

et al

.; $5,000,000 assessed in Lincoln Paper and Tissue, LLC; $7,500,000

assessed in Competitive Energy Services, LLC; or $1,250,000 assessed in Richard Silkman. The disgorgement

2014 Staff Report on Enforcement 7

Since the 2010 issuance of the Revised Penalty Guidelines,

10

almost every Commission-

approved settlement guided by the Penalty Guidelines has fallen within the established range.

An organization’s civil penalty can vary significantly depending on the amount of market harm

caused by the violation, the amount of unjust profits, an organization’s efforts to remedy the

violation, and other culpability factors, such as senior-level involvement, prior history of

violations, compliance programs, self-reporting of the violation, and cooperation with

Enforcement’s investigation. For example, under the Penalty Guidelines, an organization’s

culpability score can be reduced via favorable culpability factors to zero, lowering the base

penalty by as much as 95 percent.

11

Because a number of factors can influence the civil penalty

in each case, the amount of disgorgement of unjust profits (if any) often does not directly relate

to the amount of the civil penalty.

In FY2014, the Commission approved settlement agreements (some involving multiple

categories of violations) that resolved OATT violations by two entities, violations of Reliability

Standards by two entities, violations of hydropower safety regulations by one entity, violations

of Commission regulations regarding filings and facility merger/consolidation authorization by

four affiliated entities, violations of prohibitions on submission of inaccurate information by one

entity, and violations of the Commission’s regulations prohibiting manipulation in natural gas

and electric markets by two entities.

number does not include amounts ordered in the same pending matters: $34,900,000 ordered in Barclays; $379.016

ordered in Lincoln Paper; or $166,841 ordered in Competitive Energy Services.

10

Revised Policy Statement on Penalty Guidelines

, 132 FERC ¶ 61,216 (2010) (Revised Penalty Guidelines).

11

Revised Penalty Guidelines, 132 FERC ¶ 61,216 at P109.

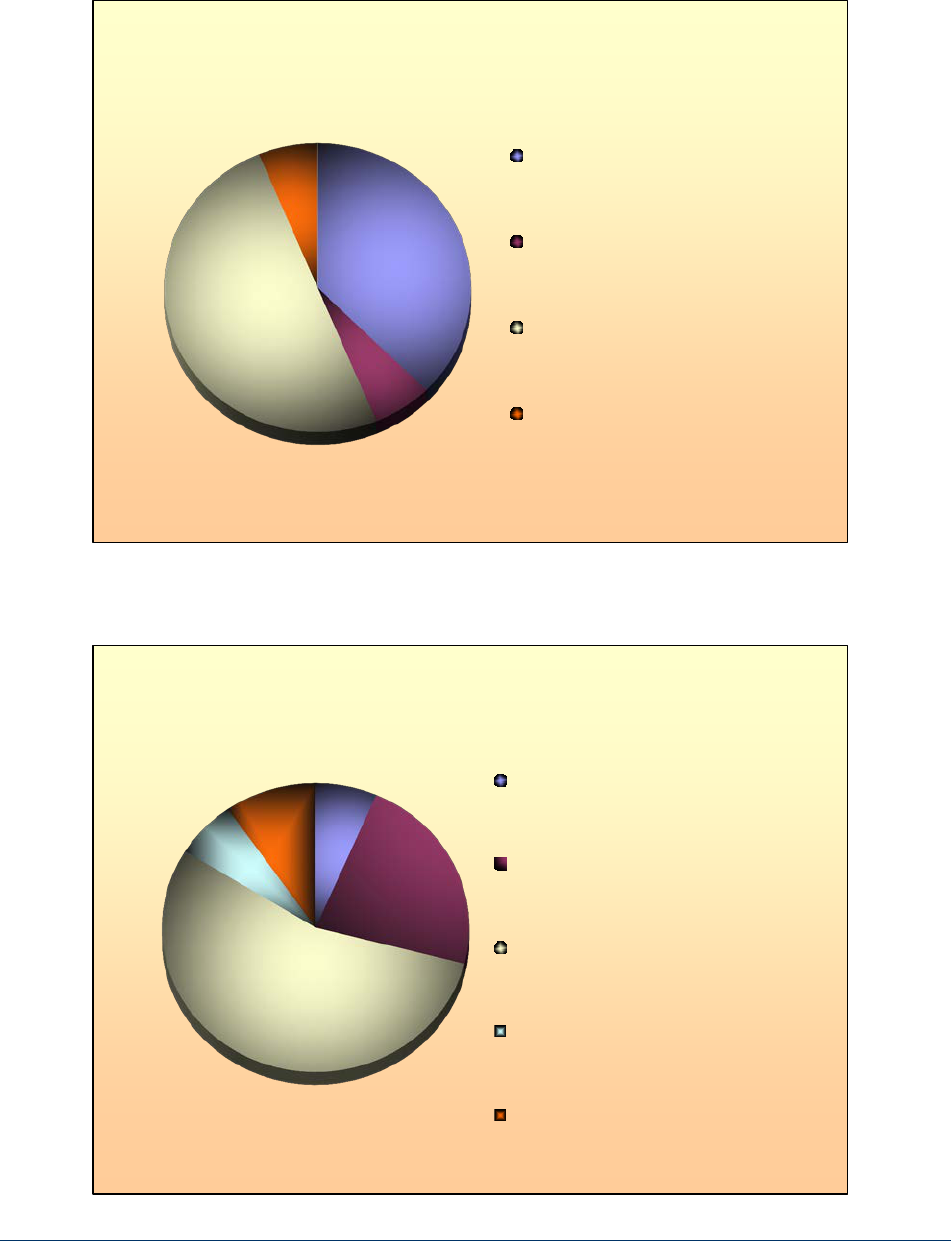

Types of Violations Settled, FY2014

Merger/Consolidation

Authorization

Hydro

OATT/Tariff

Market Manipulation and/or

False Statements

Reliability

2014 Staff Report on Enforcement 8

Types of Violations Settled, FY2012

Natural Gas Transportation

OATT/Tariff

Reliability Standards

Market Manipulation and/or

False and Misleading

Statements

Types of Violations Settled, FY2013

Natural Gas Transportation

OATT/Tariff

Reliability Standards

Market Manipulation and/or False and

Misleading Statements

Market Based Rate Violation

Hydro Licensing

2014 Staff Report on Enforcement 9

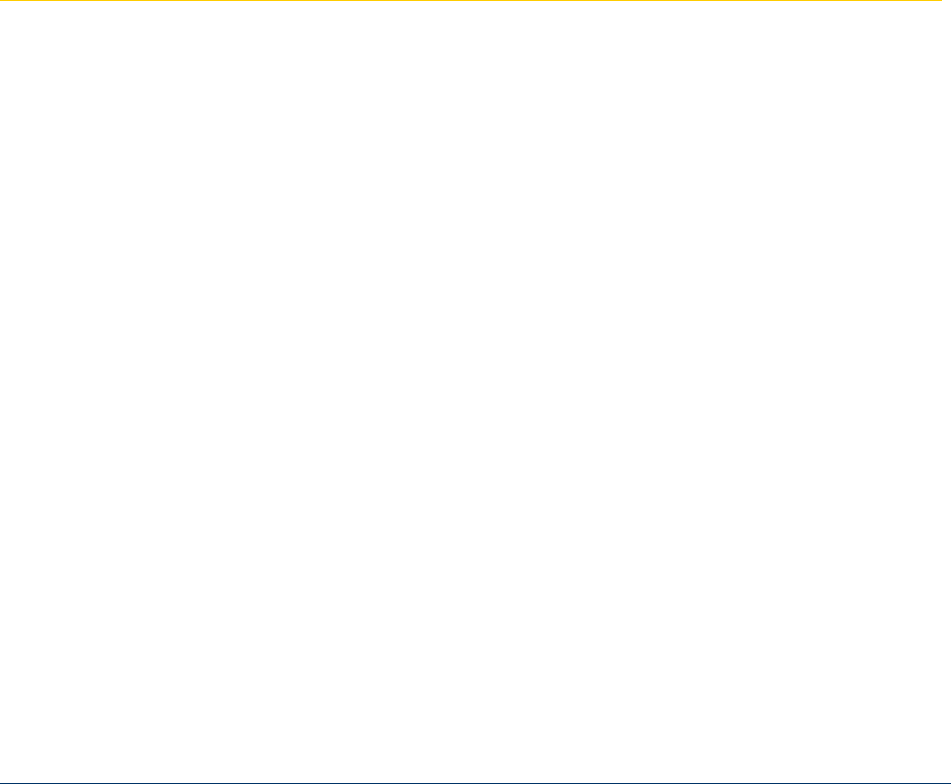

Types of Violations Settled, FY2011

Natural Gas Transportation

OATT/Tariff

Reliability Standards

Market Manipulation and/or False

Statements

Market Based Rate Violation

Violation of Commission Order

Types of Violations Settled, FY2010

Natural Gas

Transportation

OATT/Tariff

Reliability Standards

2014 Staff Report on Enforcement 10

A number of FY2014 settlement agreements are summarized below:

Constellation Energy Commodities Group, Docket No. IN13-17-000. On October 18, 2013, the

Commission approved a settlement between Enforcement and Constellation Energy

Commodities Group (CECG), resolving a pending investigation of CECG’s wheeling-through

transactions in the California Independent System Operator (CAISO) market. CAISO’s market

monitor referred the trades, believing they were improperly designated as wheel-through

transactions because they did not include a generation resource or load outside of the CAISO.

CECG and Exelon Corporation (then recently merged) stipulated to the facts and admitted that

the trade designations violated the requirement in 18 C.F.R. § 35.41(b) of truth and accuracy to

the Commission and its ISOs. CECG and Exelon also admitted to violations of a similar CAISO

tariff provision and agreed to pay a $500,000 civil penalty, disgorge $145,928 of unjust profits,

and submit to compliance monitoring. The Commission’s order noted the importance of candor

and accuracy during investigations based on two CECG misrepresentations to staff that CAISO

would be willing to see the investigation close without imposing a penalty. These

misrepresentations cost CECG and Exelon credit for cooperation in their penalty calculation.

Erie Boulevard Hydropower, L.P., Docket No. IN13-12-000. On January 15, 2014, the

Commission issued an order approving settlement between Enforcement and Erie Boulevard

Hydropower, L.P. (Erie), resolving an investigation into deaths of two fisherman on September

28, 2010 at Erie’s Varick development in Oswego, New York. Staff determined after a referral

by the Commission’s Dam Safety Office that Erie violated numerous provisions of the

Commission’s Part 12 regulations regarding safety of water power projects and project works.

Erie failed to timely repair or replace a safety camera at Varick’s powerhouse and staggered-

height flashboards, and also to file required information on these safety issues. Erie also failed,

among other things, to provide adequate training to the remote system operator (on duty the day

of the deaths) on Varick’s fishermen Alert System or public safety. Erie and Brookfield Power

US Assets Management, LLC stipulated to the facts, neither admitted nor denied they constituted

violations of Part 12, and agreed to a civil penalty of $4,000,000 and to budget $1,700,000 for

public safety enhancements at their U.S. hydroelectric projects, as well as other compliance

measures.

Arizona-Southern California Outage (Arizona Public Service Company), Docket No.

IN14-6-000. On July 7, 2014, the Commission issued an order approving the settlement of a

reliability investigation of Arizona Public Service Company (APS). The investigation arose out

of a joint FERC/NERC inquiry into the September 8, 2011 outage in Arizona, Southern

California and Baja California, Mexico that caused over 30,000 MWh of lost firm load. In the

settlement, APS stipulated to the facts, neither admitted nor denied violations of four

Requirements of two Reliability Standards, and agreed to a civil penalty of $3,250,000, with

$2,000,000 to be paid in equal shares to the Treasury and NERC, and a $1,250,000 investment in

reliability enhancement measures beyond Reliability Standards requirements (including the

installation of additional transmission system monitoring equipment). APS also agreed to

mitigation and compliance monitoring.

Arizona-Southern California Outage (Imperial Irrigation District), Docket No.

IN14-7-000. On August 7, 2014, the Commission issued an order approving the settlement of a

reliability investigation of Imperial Irrigation District (IID). The investigation arose out of a

joint FERC/NERC inquiry into the September 8, 2011 outage in Arizona, Southern California

and Baja California, Mexico that caused over 30,000 MWh of lost firm load. In the settlement,

IID stipulated to the facts, neither admitted nor denied violations of ten Requirements of four

Reliability Standards, and agreed to a civil penalty of $12,000,000, with $3,000,000 to be paid in

equal shares to the Treasury and NERC, and a $9,000,000 investment in reliability enhancement

measures beyond Reliability Standards requirements (utility-scale energy storage facilities). IID

2014 Staff Report on Enforcement 11

also agreed to mitigation and compliance monitoring.

Louis Dreyfus Energy Services L.P., Docket No. IN12-6-000. On February 7, 2014, the

Commission approved a settlement between Enforcement, Louis Dreyfus, and one of its traders,

Xu Cheng. The settlement resolved a formal investigation in which Enforcement concluded that

Louis Dreyfus violated the Commission’s Anti-Manipulation Rule when it made certain virtual

trades in the Midcontinent Independent System Operator, Inc. (MISO) market from November

2009 through February 2010 that increased the value of its nearby financial transmission rights

(FTRs). Specifically, Enforcement found that Louis Dreyfus engaged in market manipulation at

Velva (a node representing a North Dakota wind farm) by placing virtual demands to create

artificial congestion, thus enhancing the value of its nearby FTR positions. Under the terms of

the settlement, Louis Dreyfus stipulated to the facts, neither admitted nor denied that they

constituted a violation, and agreed to disgorge $3,334,000 in unjust earnings, plus interest, and

pay a civil penalty of $4,072,257. Cheng, who had previously crafted and described the

manipulative scheme in his doctoral dissertation, agreed to pay a civil penalty of $310,000. In

addition, Louis Dreyfus prohibited Cheng from virtual trading on behalf of the company

anywhere in the United States and agreed that he would not be permitted to resume such trading

for at least two years.

International Transmission Company, et al., Docket No. IN14-2-000. On March 11, 2014, the

Commission approved a settlement resolving Enforcement’s investigation of International

Transmission Co. and its subsidiaries Michigan Electric Transmission Co., LLC, ITC Midwest,

LLC, and ITC Great Plains, LLC (the ITC Companies) for violations of the Federal Power Act

(FPA) and Commission regulations. Specifically, Enforcement found that the ITC Companies

violated Section 203(a)(1)(B) of the FPA and Part 33 of the Commission’s regulations, 18 C.F.R.

Part 33, by acquiring certain Commission-jurisdictional transmission assets without prior

Commission approval on 20 occasions during the period 2005 to 2011. Enforcement also found

that the ITC Companies violated Section 205 of the FPA and Part 35 of the Commission’s

regulations by failing in 174 instances to timely file certain Commission-jurisdictional

documents between 2003 and 2011. The ITC Companies stipulated to the facts, admitted their

violations, agreed to pay a civil penalty of $750,000 and to make compliance reporting.

Indianapolis Power and Light Company, Docket No. IN14-12-000. On July 3, 2014, the

Commission approved a settlement resolving Enforcement’s investigation of Indianapolis Power

and Light Company (IPL) for violating MISO tariff provisions requiring that capacity offers

from generation resources “reflect the actual known physical capabilities and characteristics” of

the resource on which the offer is based. IPL stipulated to the facts and admitted that it violated

MISO’s tariff by failing to adjust real time offers for its Petersburg 2 generating unit during two

days in 2012, when the unit’s capability fell below IPL’s offered levels. IPL agreed to pay a

civil penalty of $32,500 and to disgorge $301,000 to MISO (occasioned by IPL’s receipt of Day-

Ahead Margin Assurance Payments for which it was ineligible and avoidance of Revenue

Sufficiency Guarantee charges). IPL also agreed to a one-year compliance plan. As noted in the

Commission’s order, a factor considered in IPL’s penalty assessment was its accepting

responsibility for its actions.

Direct Energy Services, LLC, Docket No. IN14-22-000. On August 11, 2014, the Commission

approved a settlement resolving Enforcement’s investigation of whether Direct Energy violated

the Commission’s Anti-Manipulation Rule, 18 C.F.R. § 1c.1 (2014), by manipulating natural gas

prices at three hubs in 2011 and 2012. Enforcement concluded that Direct Energy engaged in

manipulation in May 2012 at Algonquin and Transco Zone 6 to benefit its related financial

positions. Specifically, Direct Energy lowered prices at Algonquin and Transco Zone 6 by

buying next-day physical index gas and selling comparable volumes of fixed-price gas, losing

money and, in the process, lowering the Gas Daily index. Simultaneously, Direct Energy held

2014 Staff Report on Enforcement 12

financial positions that benefited from this lowered Gas Daily index. Direct Energy stipulated

and agreed to the facts but neither admitted nor denied that it violated 18 C.F.R. § 1c.1, agreed to

pay a $20,000 civil penalty, to disgorge $31,935, to continuing existing compliance measures,

and to compliance monitoring. The Commission’s order notes that Direct Energy’s strong

compliance program led to a self-report of what Enforcement determined to be market

manipulation. Moreover, Direct Energy’s quick action due to its strong compliance program and

its cooperation with Enforcement’s investigation resulted in relatively small civil penalty and

disgorgement payments.

D. Self-Reports

From issuance of the first Policy Statement on Enforcement in 2005

12

through the end of

FY2014, staff has received a total of 667 self-reports. Of those, 566 have been reviewed and

closed without action; 61 have been converted to an investigation.

In FY2014, staff received 73 new self-reports and closed 70 self-reports, including some

pending from fiscal years 2009 and 2011. As of the end of FY2014, 40 self-reports received

then and in prior fiscal years remained pending. Staff received self-reports from a variety of

market participants, including power marketers, electric utilities, natural gas companies, wind

and solar energy companies, refining companies, and RTO/ISOs. The Penalty Guidelines

emphasize the importance of self-reporting, providing credit that significantly mitigates a penalty

when a self-report is made.

13

An example of this credit resulting in a lower penalty is the Direct

Energy settlement, discussed above. Staff continues to encourage the submission of self-reports

and views self-reports as evidence of a company’s commitment to compliance.

12

Enforcement of Statutes, Regulations and Orders

, 113 FERC ¶ 61,068 (2005) (2005 Policy Statement).

13

Revised Policy Statement on Penalty Guidelines

, 132 FERC ¶ 61,216, at P 127 (2010).

0

20

40

60

80

100

Closed in Fiscal Year

with No Action

Converted to a

Preliminary

Investigation, Closed

in Fiscal Year with No

Action

Pending a Review at

Fiscal Year End

Converted to a

Preliminary

Investigation,

Pending Review at

Fiscal Year End

Converted to an

Investigation, Settled

at Fiscal Year End

Number of Self-Reports

Disposition

Self-Report Dispositions at End of Fiscal Year

FY2012 - FY2014

FY2014

FY2013

FY2012

2014 Staff Report on Enforcement 13

The following charts depict the types of violations for which staff received self-reports from

FY2010 through FY2014. In FY2014, Tariff/OATT violations accounted for a significant

portion of self-reports received.

0

5

10

15

20

25

Number of Self-Reports

Type of Violation

Self-Reports Closed in FY2014 by Type of Violation

0

5

10

15

20

25

30

35

40

Number of Self-Reports

Type of Violation

Self-Reports Closed in FY2013 by Type of Violation

2014 Staff Report on Enforcement 14

0

5

10

15

20

25

30

35

Number of Self-Reports

Type of Violation

Self-Reports Closed in FY2012 by Type of Violation

0

5

10

15

20

25

30

35

40

Number of Self-Reports

Type of Violation

Self-Reports Closed in FY2011 by Type of Violation

2014 Staff Report on Enforcement 15

1. Illustrative Self-Reports Closed with No Action

In a continuing effort to promote transparency while encouraging the compliance efforts of

regulated entities, Enforcement presents the following illustrations summarizing some of the

self-reports that DOI staff closed in FY2014 upon review and without conversion to

investigation. One of the various factors staff considered in closing the following self-reports

was the absence of significant harm to the market. These summaries are intended to provide

guidance to the public and to regulated entities as to why staff chose not to pursue an

investigation or enforcement action, while preserving the non-public nature of the self-reports.

RTO/ISO Violation. An RTO/ISO violated its tariff when a control room employee

inadvertently emailed confidential generator information to an individual outside the company

who had a similar name to the RTO/ISO intended recipient. The RTO/ISO promptly contacted

the unintended recipient and instructed him to delete the email without opening it. No harm

resulted from this inadvertent disclosure. In response to this occurrence, the ISO/RTO made

changes to its default email settings to reduce the likelihood of a future similar incident. Thus,

staff closed this matter without further action.

RTO/ISO Violation. An RTO/ISO self-reported that it potentially violated its tariff by disclosing

to NERC data and information about market participants that entered projects in the

interconnection queue. The RTO/ISO’s tariff indicated that the name of project sponsors should

remain confidential until a Large Generator Interconnection Agreement is signed, even though

project data is not otherwise confidential. Upon discovering this disclosure, the RTO/ISO

requested that NERC remove the information from its website, to which NERC agreed. The

RTO/ISO updated its internal procedures to ensure prevention of future such violations. Thus,

staff closed this matter without further action.

0

5

10

15

20

25

30

35

Number of Self-Reports

Type of Violation

Self-Reports Closed in FY2010 by Type of Violation

2014 Staff Report on Enforcement 16

Certificate Violation. A utility company self-reported its failure to obtain appropriate certificate

exemptions for a small portion of intrastate pipeline facilities crossing state lines. The company

discovered the omission during its preparation to sell the facilities. To resolve the issue, the

company filed with the Commission a request for a Limited Jurisdiction Blanket Certificate to

exempt the facilities from Commission jurisdiction while the sale was pending. The purchaser

filed for a NGA Section 7(f) exemption to exempt the facilities from Commission jurisdiction

after the sale. Staff closed the matter without action because the violation was unintentional.

Price Reporting Violation. A public utility self-reported its failure to fully comply with price

reporting requirements under 18 C.F.R. § 284.403, which requires, in part, that Sellers who

report transactions to natural gas index publishers provide accurate and factual information.

Specifically, the company failed to timely report certain daily and Bid-week trades to price index

publishers but since cured the deficiency. Staff agreed with the company’s characterization of

harm from these violations as immaterial and unintentional because the volumes were minimal

compared to the liquidity of the hubs at which the transactions occurred. To avoid recurrence,

the company enhanced its processes for capturing all trades and their reporting to index

publishers. Staff closed this matter without further action because the violations were

inadvertent (due to process gaps and human error) and caused no harm to market participants.

Market Behavior Rule Violation. An electric energy provider reported that it made improper

power sales under a reserve sharing group (RSG) sales agreement. Unbeknownst to the

reporting company, reserve sales on two occasions were made to a counter-party that failed to

renew its RSG membership, thereby violating the filed RSG agreement. Upon discovering the

issue, the reporting company notified its counter-party, which immediately took action to remedy

the situation. The oversight by the counter-party involved a small number of improper

transactions with minimal financial impact, but caused no negative third-party impact. Thus,

staff closed the self-report without further action.

Failure to Obtain Market-Based Rate Authority and Regulatory Filing Violations. A wind

energy company self-reported that several public utility and qualifying facility (QF) subsidiaries

failed to comply with FPA § 205 and/or various Commission filing requirements. The violations

included: 1) inadvertent sales without Market-Based Rate (MBR) authority, 2) MBR tariffs

inconsistent with conditions in Commission Orders accepting them, 3) failure to file or erroneous

EQRs, 4) failure to file Form 566 reports identifying the 20 largest electricity purchasers, 5)

failure to file Form 556 re-certifications reflecting changes in QF upstream ownership, 6) failure

to report entity reports of transactions to publishers of price indices, and 7) failure to provide or

update corporate contact information. The subsidiaries cured the violations, including by

refunding unauthorized sales. To ensure future compliance, the company appointed two

experienced senior management compliance individuals, engaged an experienced law firm to

centralize FERC compliance work, established formal corporate compliance and timely filing

goals, and implemented a deadline tracking procedure. Though the violations were widespread,

staff closed the matter because they were promptly and effectively cured. The company

significantly improved its processes and procedures.

2014 Staff Report on Enforcement 17

Failure to Obtain Market-Based Rate Authority. Four utilities engaged in wholesale balancing

transactions without FPA § 205 MBR authority. The parent company that owned the four

utilities self-reported the violations when it discovered the unauthorized sales during a corporate

restructuring. The utilities filed their requests for MBR authorization promptly upon discovering

the deficiencies, and the Commission granted the requests and directed the utilities to submit

refund reports for the unauthorized sales. The refund reports demonstrated that all sales occurred

at a loss and the utilities did not receive any profits from their balancing transactions. Staff

closed the self-report because the violation was unintentional, the utilities promptly self-reported,

and the utilities have taken steps under new management to prevent recurrence of these

violations.

Failure to Obtain Market-Based Rate Authority. A refining and marketing company self-

reported unauthorized market based sales from a newly-acquired qualifying facility (QF)

pursuant to a power sales contract predating that QF’s acquisition. The contract relied on the

seller’s corporate MBR authority, which remained with the seller when the reporting company

acquired the QF assets. The company attributed its unauthorized sales to controls on its access

to information that prevented conducting customary due diligence at the time of QF purchase.

After discovering that it had no MBR authority, the company self-reported and filed a late MBR

application. The Commission granted the company’s MBR request but denied the requested

retroactive effective date, instead ordering refunds of the difference between cost-based rates and

market-based rates. Staff closed the self-report without further action because unauthorized

power sales were limited, the company provided a plausible reason for error, the company

quickly self-reported the matter and filed and obtained MBR authorization, and made appropriate

refunds.

Regulatory Filing Violation. A company notified Staff that it failed to submit correct EQRs on

behalf of five of its subsidiaries for the previous two reporting years. Staff reviewed the

submittals and found that only one of the reports was correct. Staff then reviewed EQR

submittals, or lack thereof, for five additional subsidiaries that the company failed to mentioned

in the written report. Working with Market Oversight, DOI found that submittals for several of

the additional subsidiaries required corrections, from as early as 2005. After working with the

company for over two years and concluding that all subsidiaries have now substantially complied

with the Commission’s EQR requirements and are capable of submitting future correct

EQRs

, Staff closed the matter without further action.

Regulatory Filing Violation. A pipeline failed to make a prior notice filing with the Commission

before operating a new gas delivery point, as required by 18 C.F.R. § 157.211(a)(2). Upon

learning of the violation, the pipeline immediately shut down the delivery point. The pipeline

offered to credit a portion of the customer’s gas purchases from the customer’s prior source of

gas, and also agreed to not operate the delivery point until fulfilling its regulatory

obligations. After the pipeline submitted its new delivery point application, the Commission

approved the application. The pipeline also implemented enhanced controls and procedures to

prevent similar future violations. DOI staff closed the self-report without action because the

violation was isolated and inadvertent, recurrence of the violation is unlikely, and the company

quickly remedied the violation upon its discovery.

2014 Staff Report on Enforcement 18

Regulatory Filing Violations. Pursuant to Commission authorization, a parent company acquired

a generator with market-based rate authorization in 2008. In 2013, during due diligence for

possible sale of the generator, the company discovered that the generator had failed to file a

triennial market update by 2010 as required by Order No. 607 and FPA section 205. During its

internal investigation, the parent company also discovered that for several other generators

acquired during 2008 and 2009, it carried forward incorrect regional and category designations in

their respective triennial updates. The companies promptly filed corrections and triennial

updates in the appropriate proceedings, which the Commission accepted. The parent company

modified its compliance processes. Staff closed the matter because the violations were self-

reported and promptly remedied.

Regulatory Filing and Tariff Violations. Following an internal review of processes, an interstate

pipeline self-reported its failure to file five negotiated rate contracts with the Commission. As

required by NGA Section 4(c), 18 C.F.R. § 154.1(d), and the pipeline’s tariff, the pipeline is

required to file negotiated rate agreements with the Commission prior to their effective date. The

pipeline explained that the omission was inadvertent and no market harm occurred because it

disclosed the existence of these agreements on its Internet Website as required by 18 C.F.R. §

284.13. The Commission accepted the agreements filed by the pipeline in September 2013.

Staff closed this matter because the pipeline reinforced its procedures to ensure future timely

filing of negotiated rates contracts with the Commission.

Regulatory Filing Violation. In December 2013, a wind project self-reported that in 2011 it had

amended a 1997 bi-lateral Commission-approved power purchase agreement without filing it

with the Commission for prior approval as required by section 205 of the FPA. The Commission

approved the agreement after it had been filed, but noted that future filings should be made on a

timely basis. Because the rates do not go into effect until 2016, there was no harm to the market.

The company modified its compliance processes and procedures to avoid such violations in the

future. Because the violation was isolated and inadvertent, the matter was closed without

additional enforcement action.

Regulatory Filing Violation. Following an internal review, an electric utility self-reported its

failure to file FERC Form 715 for reporting years 2012 and 2013. FERC Form 715, which is due

by April 1 of each year, describes the filing entity’s transmission system and planning. The

utility regularly coordinated with regional organizations responsible for and/or overseeing

transmission networks. Although some of those organizations would have indirectly accounted

in their 2012 and 2013 filings for the self-reporting utility’s facilities, the Form 715 information

at issue still should have been included more formally in the utility’s own filing. Staff closed the

matter after the utility submitted the missing filings and implemented processes to prevent such

future oversights.

Regulatory Filing Violation. A parent company with multiple utility subsidiaries failed to file

Form No. 561 (Annual report of interlocking positions) for certain officers who retired and only

served during part of a calendar year, as required by 18 C.F.R. §§ 46.4 and 46.6 (although the

company did correctly file notices of change for the officers as required by 18 C.F.R. § 45.5(b)).

The company also incorrectly filed certain FERC Form No. 561s by enclosing relevant

information in footnotes instead of in the correct lines on the form. After an internal compliance

audit, the company disclosed the violations and made curative filings. DOI staff closed this

matter because it confirmed that no undue affiliate preferences or other harm occurred to the

market as a result of the company’s filing failures and that the company had instituted

compliance measures to prevent future recurrence of this type of violation.

2014 Staff Report on Enforcement 19

Regulatory Filing Violation. A gas producing company reported that it failed to file its four

required EQRs for calendar year 2013. The company learned of this failure in June 2014 after a

FERC EQR team contacted them. The company explained that the employee responsible for

making these EQR filings in prior years had left the firm, and that it inadvertently overlooked

appointing a replacement. Staff confirmed that the company since filed all required EQR’s and

is current in its obligations. Staff closed this matter because the error was inadvertent, corrected,

and did not result in any financial loss or gain.

Qualifying Facility Violations. The owner of two small generation QFs self-reported that it

failed to self-certify their status to the Commission as required by 18 C.F.R. § 292.203(a)(3), a

requirement before claiming the benefits of QF status. As a result of the owner’s failure to

certify, its jurisdictional sales of power violated § 205 of the FPA because the facilities were not

QF-exempt and did not otherwise receive market based sales authorization from the

Commission. Staff closed the self-report with no action because the owner’s failure to certify

was inadvertent, it promptly self-reported the matter to staff, subsequently adopted compliance

measures to prevent future recurrence, and because the company made refund payments

consistent with Commission precedent for unauthorized sales of power.

Qualifying Facility Violation. A solar photovoltaic generation facility self-reported violation of

FPA section 205 due to its failure to self-certify as a QF before making wholesale power sales.

Although 18 C.F.R. § 292.601 affords an exemption from section 205 for small QFs like the

company (i.e., under 20MW), the Commission’s regulations require owners of such QFs to either

file a notice of self-certification or apply for a Commission certification in order to obtain QF

status pursuant to 18 C.F.R § 292.207. To remedy this violation, the company submitted to the

Commission a Form 556 to certify the facility as a QF, refunded its customer time value refunds

amounting $10,847.99, and investigated the circumstances leading to the violation. Going

forward, the company implemented measures to formalize its regulatory compliance program,

including developing a written compliance policy and retaining FERC counsel. Staff closed this

self-report because the violation was isolated and inadvertent, and the company made refund

payments consistent with Commission precedent for unauthorized sales of power.

Tariff/OATT Violation. In April 2011, an electric company that previously received a waiver of

the requirement to file an OATT self-reported that it received a request for transmission and

interconnection service triggering the requirement to file an OATT within 60 days. The

company was approximately 6 months late in filing the OATT. The company claimed that it

initiated an interconnection study after receiving the request, which would have been required

had it timely filed the OATT. The company further represented that it had since implemented

procedures to avoid recurrence of this type of violation. Staff kept the self-report open until the

pending OATT proceeding was fully resolved, and then closed it.

Tariff/OATT Violation. A public utility self-reported its failure to fully comply with certain

Interconnection Agreement (IA) timelines for submitting final accounting reports to customers,

violating 18 C.F.R. § 35.1(e). This regulation, in part, prohibits a public utility from imposing

any practice that differs from the rate schedule on file with the Commission. By sending final

accounting reports outside of the timelines set in certain IAs, the public utility imposed a practice

that differed from the rate schedule on file. Staff closed this self-report without sanctions

because the violations were inadvertent (resulted from human error caused by a poorly

implemented change in process). Further, where the a final accounting report was late and a

refund due to an Interconnection Customer, the public utility added interest at the FERC rate to

compensate for the delay. The company updated its procedures so future recurrence of the

violation is unlikely.

2014 Staff Report on Enforcement 20

Tariff/OATT Violation. An RTO/ISO self-reported that incorrect software code in its

settlements system caused overpayment of various generating units for their dispatch to offer

real-time energy for reliability reasons, thereby violating the RTO/ISO’s tariff. Because the

violation was inadvertent and limited to two very unusual scenarios for generators, and because

the RTO/ISO quickly implemented a manual screen for the issue as well as a permanent software

correction to prevent recurrence, staff closed the matter with no action.

Tariff/OATT Violation. A public utility inadvertently omitted the text of its small generator

interconnection procedures and small generator agreement as an attachment to the OATT it filed

with the Commission in 2010. Inclusion of these pro forma documents was required by the

Commission in 2006, but delayed until conclusion of the Commission’s electronic tariff filing

rulemaking. When that event occurred some four years later, the public utility inadvertently

failed to make the appropriate filing. Because the Division of Audits was already examining

tariff compliance by the public utility, this matter was included in the audit and closed as a self-

report.

Tariff/OATT Violation. An interstate pipeline self-reported that it violated the General Terms

and Conditions of its transportation tariff by purchasing natural gas for its own operational

purposes (to maintain a minimum system pressure) at a receipt point not authorized by the tariff

for such a purpose. The pipeline nevertheless solicited competitive bids for the operational gas

purchase, and otherwise complied with its tariff. Staff closed the matter without action because

the violation was inadvertent, minor, and technical, and because the violation did not result in

monetary benefit.

Tariff/OATT Violation. A pipeline’s tariff required it to post notification of “suspense gas”

(e.g., unscheduled gas delivered to a delivery point), after which the recipient of the suspense gas

would have 60 days to either (a) inform the pipeline of the agreement to which the gas should be

allocated or (b) pay a specified amount for the gas. The pipeline reported that it failed to post

suspense gas for several months during which a recipient repeatedly received suspense gas,

effectively depriving the recipient the opportunity to timely advise the pipeline of the agreement

to which it should allocate the gas. Staff closed this matter without action because the pipeline

(a) did not charge the recipient for the gas, (b) properly accounted for the gas in its books as

required by the Commission’s regulations, and (c) implemented a procedure to reduce greatly the

likelihood of a future similar mistake.

Shipper-Must-Have-Title Violation. An independent oil and natural gas exploration and

production company self-reported that it violated the Shipper-Must-Have-Title Requirement

when one of its subsidiaries over an eleven day period transported 151,800 MMBtus of natural

gas titled to another subsidiary. The company reported that the violation resulted from an

inadvertent administrative error. Staff closed the matter with no action because the violation was

inadvertent, of limited duration, and the company quickly took corrective action and provided

Staff notice of the violation.

Statement of Operating Conditions Violations. In March 2012 after an internal investigation, a

local distribution company and Hinshaw pipeline self-reported its failure to comply with the

cost-based rate provisions of its statement of operating conditions (SOC) under section 311 of

the NGPA and 18 C.F.R. § 284.224. The company’s SOC authorized transporting gas at a cost-

based rate linked to a state-approved rate and transporting gas at a negotiated rate even though

the Commission-approved blanket certificate did not authorize negotiated rates. During 2009-

2010, the company entered into two transactions above the cost-based rate and over-collected

approximately $500 in revenues. The company promptly refunded the two customers and filed

with the Commission to remove the negotiated rate provision from its SOC. Staff closed the

2014 Staff Report on Enforcement 21

matter with no action because the company self-reported and promptly remedied the violations,

which were not of sufficient gravity, scope or impact to warrant the imposition of sanctions.

Force Majeure. In September 2014, two interstate natural gas pipelines separately self-reported a

31-hour outage on their respective electronic bulletin boards and nomination systems (EBB

Systems) because of an unanticipated database failure. The outage caused the pipelines to

violate various Commission and NAESB standards for posting requirements normally met by the

EBB Systems. During the outage, the pipelines declared a

force majeure

emergency and

communicated with customers by e-mail and telephone as well as extended nomination and other

deadlines as permitted by their tariffs. No gas receipts or deliveries were interrupted or curtailed

and no customer lost gas service because of the outage. Following the outage, the pipelines

provided cross-training in key infrastructure areas, and enhanced their disaster recovery systems.

Staff closed the matter because the violations were isolated, inadvertent, and outside the

pipelines’ control; the pipelines quickly notified customers, expended efforts to ensure

uninterrupted gas flow, and ensured no customers were harmed by the outage of their EBB

Systems. The pipelines also implemented measures to prevent a recurrence of this type of event.

E. Investigations

During FY2014, DOI staff opened 17 investigations, as compared to 24 investigations in

FY2013. Over half of these new investigations arose from referrals based on conduct observed

through surveillance by the Division of Analytics and Surveillance or the RTO/ISO Market

Monitoring Units. In FY2014, 15 pending investigations resulted in settlement or closure

without enforcement action. Enforcement also was active on an additional four matters

involving orders to show cause issued in prior fiscal years.

1. Statistics on Investigations

Of the 17 investigations staff opened this fiscal year, some of which involve more than one

type of violation or multiple subjects, 9 involve market manipulation, 8 involve false statements

to the Commission or an RTO/ISO, 11 involve tariff violations, and 1 involves Commission

accounting standards and orders.

Of the 15 investigations closed in FY2014, staff closed 8 via settlement and 7 either upon

finding no violation or because staff concluded that the evidence was insufficient to support

finding a violation. The Commission-approved settlements of investigations are summarized

above in subsection C; investigations closed without enforcement action are discussed below in

subsection E.2.

The following charts show the disposition of investigations that closed in fiscal years 2011

through 2014.

2014 Staff Report on Enforcement 22

Disposition of Investigations, FY2014

Closed - Finding of Violation/No

Sanctions

Closed - Insufficient Evidence or

No Violation

Settlement

Other

Disposition of Investigations, FY2013

Closed - Finding of Violation/No

Sanctions

Closed - Insufficient Evidence or

No Violation

Settlement

Proceeded to Order to Show Cause

Other

2014 Staff Report on Enforcement 23

Disposition of Investigations, FY2012

Closed - Finding of Violation/No

Sanctions

Closed - Insufficient Evidence or

No Violation

Settlement

Proceeded to Order to Show Cause

Disposition of Investigations, FY2011

Closed - Finding of Violation/No

Sanctions

Closed - Insufficient Evidence or

No Violation

Settlement

Proceeded to Order to Show

Cause

Other

2014 Staff Report on Enforcement 24

The following charts summarize the nature of the conduct at issue for those investigations

that were closed without action in fiscal years 2011 through 2014.

Disposition of Investigations - All to Date,

FY2007 - FY2014

Closed - Finding of

Violation/No Sanctions

Closed - Insufficient Evidence

or No Violation

Settlement

Proceeded to Order to Show

Cause

Other

0

0.5

1

1.5

2

2.5

3

3.5

Standards of

Conduct/Tariff Violation

Market Manipulation Market

Manipulation/Separation

of Functions

Market

Manipulation/Tariff

Violation

Types of Alleged Violation in Investigations Closed With

No Action, FY2014

2014 Staff Report on Enforcement 25

0

1

2

3

4

5

6

Market

Manipulation/False

Statement &

OATT/Tariff

Market

Manipulation/False

Statement

Reliability Tariff/OATT MBR

Types of Alleged Violation in Investigations Closed With

No Action, FY2013

0

1

2

3

4

5

6

7

8

Market Manipulation/False

Statement & OATT/Tariff

Market Manipulation/

False Statement

Reliability Tariff/OATT

Types of Alleged Violation in Investigations Closed With

No Action, FY2012

2014 Staff Report on Enforcement 26

Illustrative Investigations Closed with No Action 2.

The following describes the 7 investigations Enforcement closed in FY2014 without action.

Like the self-report illustrations, these are intended to provide guidance to the public while

preserving the non-public nature of DOI’s investigations.

Interstate Commerce Act and Pipeline Tariff Violations. Staff investigated a Hotline tip that oil

pipeline affiliates of a company violated the Interstate Commerce Act (ICA) and various tariffs

by curtailing or interrupting interstate common carrier service and demanding concessions from

another party before resuming service. The tip also claimed that various affiliates stopped

scheduled deliveries without explanation, violating ICA section 1(6) (prohibiting unjust and

unreasonable practices by jurisdictional pipelines); section 3(1) (prohibiting discriminatory

service cancellation); section 6(3) (prohibiting service interruptions based on conditions not

contained in tariffs); section 6(1) (requiring compliance with tariffs); and also various affiliate

tariffs. Staff deferred action until a parallel agency investigation closed without action. After

meeting with the company, reviewing relevant materials and tariffs, and mediating a dispute

involving the company, staff concluded that no violation occurred and closed the investigation.

Separation of Functions. Following an anonymous Hotline tip alleging potential tariff violations

relating to a transmission outage, staff investigated a utility to determine whether it had

committed either market manipulation or violated the Commission’s separation of functions

requirement. At issue was the utility’s allowing marketing function employees to provide input

on curtailments of power flowing into the utility’s system. After reviewing company

communications, transactions, and audio recordings, staff determined that while the protocol for

these curtailments was confusing, market function employees were not involved in curtailment

decisions and that such curtailments were necessary from a reliability standpoint. Staff

determined no violation occurred and closed the investigation.

0

1

2

3

4

5

6

Market

Manipulation/False

Statement

Hydropower Reliability Natural Gas

Transportation

Tariff/OATT

Types of Alleged Violation in Investigations Closed With

No Action, FY2011

2014 Staff Report on Enforcement 27

Market Manipulation (Electricity). An RTO/ISO Market Monitor reported that an entity and

affiliate engaged in market manipulation when they obtained Congestion Revenue Rights

(CRRs) for two months in 2011 at an intertie that experienced import congestion. Two days

after receiving the CRRs for the second month, the entity applied for a Resource ID for the

intertie, which would enable it to schedule imports at that location. Later that month, as

congestion abated at the intertie, the entity self-scheduled imports, daily increasing the import

amounts until the end of the month, when the intertie experienced twelve hours of congestion

that benefited the entity’s position by over $30,000. Staff met with the entity’s counsel, who

offered valid reasons for the trading activity in question, and also met with the market monitor to

discuss the case. Staff also analyzed data provided by the company and took testimony from the

key trader. Staff closed the investigation with no further action after deciding that the evidence

was insufficient to support a violation of the Commission’s Anti-Manipulation Rule.

Market Manipulation (Electricity). Staff opened an investigation into whether a company and its