FEDERAL ENERGY REGULATORY COMMISSION

D

E

P

A

R

T

M

E

N

T

O

F

E

N

E

R

G

Y

F

E

D

E

R

A

L

E

N

E

R

G

Y

R

E

G

U

L

A

T

O

R

Y

C

O

M

M

I

S

S

I

O

N

A Handbook for Energy Market Basics

Energy Primer

This report is a product of the sta of the Federal Energy Regulatory Commission (Commission or FERC). The opinions and

views expressed in this paper represent the preliminary analysis of the Commission sta. This report does not necessarily

reect the views of the Commission, its Chairman, or individual Commissioners, and is not binding on the Commission.

FEDERAL ENERGY REGULATORY COMMISSION

D

E

P

A

R

T

M

E

N

T

O

F

E

N

E

R

G

Y

F

E

D

E

R

A

L

E

N

E

R

G

Y

R

E

G

U

L

A

T

O

R

Y

C

O

M

M

I

S

S

I

O

N

A Handbook for Energy Market Basics

Energy Primer

n n FEDERAL ENERGY REGULATORY COMMISSION

The Energy Market Primer was originally issued in 2012 and has been updated several times since

its rst issuance. This update to the Energy Market Primer is the result of the combined eorts

of many dedicated individuals throughout the Federal Energy Regulatory Commission (FERC or

Commission). The team consisted of individuals from the Commission’s Oice of Energy Policy

and Innovation, Oice of Enforcement, Oice of Energy Market Regulation, and Oice of External

Aairs. We specically wanted to recognize the primary contributors to each chapter.

n n FEDERAL ENERGY REGULATORY COMMISSION

Lance Hinrichs

Federal Energy Regulatory Commission

Oice of Energy Policy and Innovation

Lance was instrumental in the creation and publication of the Energy Market Primer.

He will forever be remembered as a dedicated public servant whose knowledge

of energy markets was unsurpassed.

n n FEDERAL ENERGY REGULATORY COMMISSION

03 | Natural Gas Industry

04 | Natural Gas Demand

06 | Natural Gas Supply

14 | Liqueed Natural Gas

16 | Natural Gas Processing and Transportation

25 | Natural Gas Storage

29 | Natural Gas Markets and Trading

31 | Price Discovery

34 | Electric Power Industry

37 | Electricity Demand

44 | Electricity Supply and Delivery

53 | Wholesale Electricity Markets and Trading

60 | Traditional Electricity Systems

60 | Southeast Wholesale Market Region

62 | Western Wholesale Market Regions

66 | RTO and ISO Markets

n n FEDERAL ENERGY REGULATORY COMMISSION

75 | ISO-New England

79 | New York Independent System Operator

83 | PJM

87 | Midcontinent Independent System Operator

90 | Southwest Power Pool

94 | California Independent System Operator

111 | Petroleum Characteristics

113 | U.S. Crude Oil Supply

114 | Crude Oil and Petroleum Products Demand

115 | Crude Oil Rening

116 | Crude Oil and Petroleum Products Transportation

117 | Crude Oil and Petroleum Products Markets and Trading

120 | Trading Physical and Financial Natural Gas and Electricity

124 | Markets for Trading Physical and Financial Natural Gas and Electricity

126 | Trading Concepts and Terminology

128 | Trading Analysis and Strategy

130 | Capital Markets

135 | Manipulative Trading Techniques and Cross-Product Manipulation

136 | Information-Based Manipulation

136 | Gaming

137 | Witholding

137 | Representative Matters

n v n FEDERAL ENERGY REGULATORY COMMISSION

n n FEDERAL ENERGY REGULATORY COMMISSION

Natural gas, electricity, and crude oil are forms of

energy that are of particular interest to the Federal

Energy Regulatory Commission (FERC) pursuant to

its authority under the Natural Gas Act, the Federal

Power Act, and the Interstate Commerce Act. This

primer explores the workings of the wholesale markets

for these forms of energy, as well as energy-related

nancial markets.

Energy markets consist of both physical and nancial

elements. The physical markets contain the natural

resources, infrastructure, institutions and market

participants involved in producing energy and delivering

it to consumers. The nancial markets include the

buying and selling of nancial instruments that derive

value from the price of the physical commodity. These

nancial markets have their own set of market structures

and institutions, market participants, and traded

products which have their own drivers of supply and

demand. In general, physical and nancial markets

can be distinguished by the products and by the

intentions of the market participants involved.

Much of the wholesale natural gas and electric power

industry in the United States trades competitively,

while some markets and their prices are established

through administrative processes based on the cost

of providing service. In competitive markets, prices

are largely driven by the economic concepts of supply

and demand. Underlying the supply and demand

for energy are physical fundamentals - the physical

realities of how markets produce and deliver energy

to consumers and how they form prices. These physical

fundamentals will be covered in Chapter 1 (Wholesale

Natural Gas Markets), Chapter 2 (Wholesale Electricity

Markets), and Chapter 4 (U.S. Crude Oil and Petroleum

Products Markets).

The signicant shi in the U.S. fuel mix has heightened

the importance over the past decade of the

interdependence of the natural gas and electric systems.

Given the importance of natural gas in electricity

generation, integration of market operations between

the natural gas and electricity industries is critical.

The primer provides an overview of natural gas and

electric system interdependencies in Chapter 3, Gas-

Electric Interdependency.

Market participants buy and sell energy based nancial

contracts for a number of reasons. Physical market

participants, such as producers and large consumers,

usually use nancial contracts to manage price risk

and to protect against price volatility. That is, nancial

contracts can serve as a tool for managing risk akin

to insurance. Other market participants use the energy

markets to speculate, or to assume a market risk in

hope of proting from market uctuations. Additionally,

companies turn to the capital markets if they need

to raise or invest money. This primer explores the

market participants, products, market mechanisms

and trading at work for natural gas and electricity

in the nancial markets in Chapter 5, Financial Markets

and Trading.

Where there are markets, there will be those who

attempt to manipulate the markets for their own benet.

These practices undermine the market’s ability to

operate eiciently, reduce other market participants’

condence in the markets and distort market outcomes,

including prices. Some of these practices are discussed

in Chapter 6, Market Manipulation.

This primer is written to be used either as a traditional

text – read front to back – or as a reference guide.

Consequently, some material is repeated in dierent

sections and references are provided to other

parts of the primer where a concept is addressed in

greater detail.

Further information about various aspects of energy

markets and FERC regulation can be found at www.ferc.

gov; then navigate to the Market Oversight tab. You can

nd the market oversight pages here: https://www.ferc.

gov/market-assessments.

n n FEDERAL ENERGY REGULATORY COMMISSION

Chapter 1

Wholesale Natural Gas Markets

n n FEDERAL ENERGY REGULATORY COMMISSION

Natural gas markets have a signicant eect on the economy and on the individuals who rely on the fuel for electric

generation, manufacturing, heating, cooking, and other purposes. The Department of Energy’s (DOE) Energy

Information Administration (EIA) estimates that natural gas supplies approximately 32 percent of the energy used in

the U.S.

Under the Natural Gas Act (NGA), the Federal Energy Regulatory Commission (FERC) has jurisdiction over the

transportation and sale of natural gas in interstate commerce and the companies engaged in those activities.

The natural gas market is an amalgamation of a number of subsidiary markets. There is a physical market, in which

natural gas is produced, transported, stored, and consumed. There is also a nancial market that focuses on the

purchase and sale of nancial instruments whose price is linked to the price of natural gas in the physical market,

but that rarely result in the physical delivery of natural gas. Additionally, natural gas markets are regional, with prices

for natural gas varying with the demand characteristics of the market, the region’s access to dierent supply basins,

pipelines, and storage facilities.

1 Derived from EIA, Monthly Energy Review, Primary Energy Consumption by Source, Table 1.3 (accessed August 2022), https://www.eia.gov/

totalenergy/data/monthly/pdf/mer.pdf.

2 Natural gas liquids (NGLs) are hydrocarbons—in the same family of molecules as natural gas and crude oil— composed exclusively of carbon and

hydrogen. Ethane, propane, butane, isobutane, and pentane are all NGLs. There are many uses for NGLs, including inputs for petrochemical plants,

burned for space heat and cooking, and blended into vehicle fuel.

3 Dry gas contains “insuicient quantities of hydrocarbons heavier than methane to allow their commercial extraction or to require their removal

in order to render the gas suitable for fuel use.” Society of Petroleum Engineers, Glossary of Terms Used in Petroleum Reserves and Resources

Denitions (n.d.), https://www.spe.org/en/industry/terms-used-petroleum-reserves-resource-denitions/.

FERC Jurisdiction

FERC is responsible for the regulation of the siting,

construction and/or abandonment of interstate

pipelines, gas storage facilities, and Liquied Natural

Gas (LNG) terminals, regulation of the transmission and

sale of natural gas for resale in interstate commerce,

establishing rates for pipeline and storage services

and assessing the safe operation and reliability of LNG

facilities. We explain FERC’s jurisdiction over natural gas

related activities in more detail throughout this chapter.

Natural Gas

Natural gas is primarily methane, which is a molecule

made of one carbon atom and four hydrogen

atoms (CH4), and is among the materials known as

hydrocarbons. Natural gas is colorless and odorless in its

natural pure form, but is oen odorized with mercaptan

or other odorants to allow for easy detection. It is also

highly combustible, giving o a great deal of energy and

fewer emissions than fuels such as coal and oil. Natural

gas occurs in geological formations in dierent ways: as

a gas phase associated with crude oil, as a gas dissolved

in the crude oil, as a gas phase not associated with any

signicant crude oil, or as a supercritical uid. Natural

gas is “rich” or “wet” if it contains signicant amounts

of natural gas liquids (NGL) – e.g., ethane, propane and

pentane

– mixed with the methane. In contrast, natural

gas is “lean” or “dry” if it consists of mostly methane.

Excess NGLs are separated from the methane and sold

separately. Natural gas reservoirs oen contain other

elements and compounds, such as carbon dioxide,

hydrogen sulde, nitrogen, helium, water, dissolved

salts, and other dissolved gases. The natural gas is

further processed to remove the impurities from the

methane to make the natural gas suitable for sale. While

natural gas is typically a gas, it can be cooled to a liquid

and transported in trucks or ships. In this form, it is

referred to as liqueed natural gas, or LNG.

n n FEDERAL ENERGY REGULATORY COMMISSION

Natural Gas Industry

The markets of the natural gas industry are both physical

and nancial. This chapter focuses on the physical natural

gas markets, but it should be noted that nancial markets

can have a signicant inuence on the physical natural

gas market.

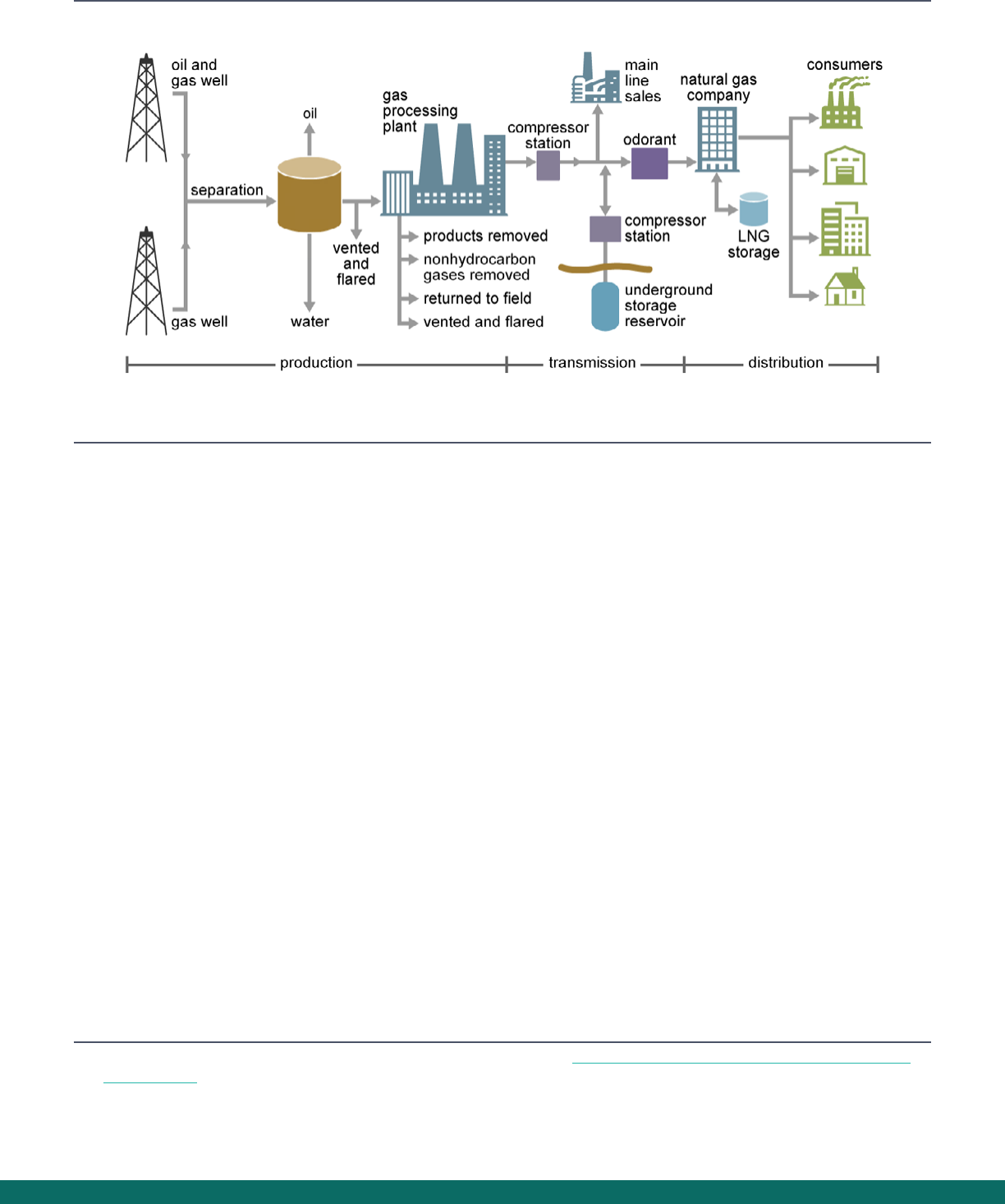

The natural gas industry has three major segments,

the upstream (supply), the midstream (transportation),

and the downstream (consumption). The upstream

segment includes exploration, which is the process

of attempting to nd accumulations of natural gas

resources, production, which includes recovering

natural gas resources through drilling and extraction

at the wellhead, and nally gathering. Gathering entails

using small diameter pipeline systems to transport

the gas from the wellhead to local pooling points or

to natural gas processing facilities, where impurities

and NGLs are removed to create pipeline-quality natural

gas. The midstream segment includes transportation

on intrastate and interstate pipeline systems that move

natural gas through large-diameter pipelines to storage

facilities and a variety of consumers. The downstream

segment includes large gas consumers, such as power

plants and industrial facilities, and local distribution

companies (LDCs), which deliver the natural gas to

retail consumers.

Each component of the supply chain is critical in serving

customers. The quantity of reserves and production

can aect market participants’ expectations about

current and future supply, and thus can aect prices.

Similarly, the availability of pipeline and storage capacity

determines which supply basins are used and the

amount of gas that can be transported from producers

to consumers. All of these factors aect the supply

chain, but they also aect the supply-demand balance,

both nationally and regionally. More specically, the

dierences in supply and demand result in dierent

prices for natural gas at various locations. Prices have

historically tended to be lower in regions supplied

by multiple production areas with robust pipeline

infrastructure, such as the Gulf Coast, Southwest, and

Midwest. In contrast, prices tend to be highest in areas

where production or transportation and storage are

limited and demand is high, such as New England

and Southern California. Transportation costs and

limitations in pipeline capacity from supply to demand

areas are generally the major factors driving regional

price dierentials.

Various factors have shied the dynamics of natural

gas supply and demand since 2007, when shale gas

production began to grow signicantly. These include,

but are not limited to:

Development of modern hydraulic fracturing and

horizontal drilling techniques that have enabled

producers to access unconventional resources,

such as those in shale formations. These

techniques have expanded the amount of available

economically accessible natural gas reserves and

have increased domestic natural gas production.

These newer resources are located closer to eastern

population centers and have provided those regions

with access to lower cost natural gas supplies and

transportation costs.

Natural gas demand for power generation has

expanded considerably over the past decade.

Power plant demand for natural gas reects the

operating exibility of natural gas-red generators

and the environmental benets of the fuel. Natural

gas-red power plants emit less air pollution than

power plants using coal or oil. These plants are also

relatively easier to site, can be built in a range of

sizes, and can increase or decrease output exibly.

The ability to quickly change output provides

electric system grid operators with the exibility

to support variations in output from renewable

energy resources, changes in demand from

customer load, as well as unexpected power

system events and disruptions.

Pipeline expansions linking the new supply regions

to markets have enabled regions such as the

Northeast and Mid-Atlantic to access new supply

sources, expanding the amount of natural gas

that can ow from traditional supply sources, and

enhancing the amount of natural gas that can ow

to markets.

n n FEDERAL ENERGY REGULATORY COMMISSION

Rising natural gas production combined with

increasing international natural gas demand has

led to the construction of several LNG export

terminals. As a result, U.S. LNG export capacity

and international cargo deliveries have grown

signicantly since 2016.

Natural Gas Demand

Natural gas is the fuel of choice for many sectors of the

U.S. economy. Over the long-term, natural gas use is

driven by overall economic and population growth,

environmental policy, energy eiciency, technological

changes and prices for natural gas and substitute energy

sources such as oil, coal and electricity. In the short-

term, natural gas demand can uctuate substantially

due to weather, economic activity, and competition from

other fuel sources such as coal and oil.

WEATHER

Weather is the most signicant factor aecting seasonal

natural gas demand, which can swing considerably

within a given day, especially during periods of extreme

temperatures. Short-term changes in weather, such as

heat waves and winter storms, can send demand and

prices soaring – or dropping – within the course of a day,

sometimes unexpectedly. The weather’s unpredictability

challenges suppliers and pipelines, especially when

demand is high and pipelines are full.

ECONOMIC ACTIVITY AND GROWTH

Economic growth can increase the amount of natural gas

used by industry, power plants, and commercial entities

as consumers want more of their products and services.

During a recession, natural gas use typically declines.

Structural changes in the economy can also aect natural

gas demand, such as varying levels of manufacturing

and service sector activity. Additionally, new domestic

markets for products and services may increase the

consumption of natural gas, whereas movement of

manufacturing overseas may reduce demand. Lastly,

demand for exports of natural gas, to Mexico and Canada

via pipeline and globally via LNG shipping, have also had

a signicant eect on aggregate demand.

Daily and weekly economic activity creates cyclical

demand patterns. During the work day, demand rises

as people get up and go to work or school. Similarly,

it declines as they go to sleep. On the weekend, demand

tends to vary less over the course of the day.

PRICES OF NATURAL GAS AND COAL

Just as a homeowner may decide to invest in a furnace

and associated piping to use natural gas for heating, so,

too, a power producer may decide to make long-term

investments in natural gas-red generators. Decisions

requiring long-term capital investments are easiest to

make at the time a home or power plant is being built

and are more complicated to changelater. Thus, over

the long term, demand for natural gas can be aected

by the expected costs of alternative energy sources: the

cost of a natural gas furnace versus an electric one; the

cost of a coal-red generating plant versus one fueled by

natural gas.

In the short-term, the opportunity for fuel switching

has been signicant in power generation. Electric

grid operators have choices as to which power plant

to dispatch to meet electric demand. As explained in

greater detail in the electric chapter, dispatch is oen

based on the marginal cost of generation at each

available plant in the generation eet. While the degree

to which these fuels are used varies regionally, plants

with lower marginal costs, such as nuclear plants, are

typically dispatched before plants with higher marginal

costs, such as natural gas plants. As natural gas prices

drop relative to coal prices, natural gas-red generation

may be dispatched ahead of coal-red generation,

increasing natural gas demand from the power sector.

DEMOGRAPHICS AND SOCIAL TRENDS

Long-term demand can also be aected by shiing

demographics and social trends. Population growth

in warmer climates and population declines in certain

areas of the North have aected natural gas use. So

has the trend toward larger houses, which have greater

n n FEDERAL ENERGY REGULATORY COMMISSION

heating and cooling needs, yet are generally more

energy eicient.

ENVIRONMENTAL CONCERNS

AND ENERGY EFFICIENCY

Natural gas emits much fewer pollutants than other

competing fossil fuels, including carbon and other

greenhouse gases, which has been an important

factor in some decisions to use natural gas for power

generation. This is particularly signicant in states and

regions that have experienced challenges in meeting air

quality standards.

The natural gas emissions prole has also encouraged

some urban mass transit bus systems, West Coast port

operations, and other vehicle eets to shi to natural

gas from gasoline or diesel fuel.

CUSTOMER SECTORS AND DEMAND

On an annual basis, power generation makes up about

37 percent of total U.S. natural gas demand.

Industrial,

residential, and commercial consumers represent

approximately 27 percent, 15 percent, and 11 percent

of total U.S. natural gas demand, respectively.

An

additional 6 percent is used for lease and plant fuel

operations and 3 percent is used for pipeline and

distribution activities.

See FERC’s State of the Markets

Report and Seasonal Assessments for analyses on recent

natural gas demand sector trends.

7

Each customer sector has a unique demand prole, both

in the amount that the demand varies over a season

and whether its peak demand coincides with the overall

system peak. Residential demand, for example, can be

highly variable in colder climates, and its peak coincides

with the overall system peak. Power generation’s peak

does not coincide with the overall winter gas-demand

peak, but the use of natural gas to produce electricity for

4 Derived from EIA, Natural Gas Consumption by End Use, U.S., Annual (accessed October 2022), https://www.eia.gov/dnav/ng/ng_cons_sum_dcu_

nus_a.htm.

5 Id.

6 Id.

7 See FERC, Reports & Analyses (n.d.), https://www.ferc.gov/reports-analyses.

air conditioning has created robust summer demand,

which competes with natural gas supply that traditionally

would ow into underground storage for later use.

Industrial demand is fairly constant year-round.

In the short term, residential and commercial natural gas

use tends to be inelastic – consumers use what they need,

regardless of the price. Power plant demand, on the other

hand, is more price-responsive as natural gas competes

with other fuels, especially coal. Price inelasticity implies

that a potential for price spikes exists during periods of

supply constraints. In the longer term, residential and

commercial natural gas use can change, with changes

in space heating or cooking from fuel oil to natural gas

(increasing demand for natural gas) or from natural gas to

electric (decreasing demand for natural gas).

Consequently, the mix of customers in a region can

aect system operations and costs. Pipelines and other

equipment are sized to account for peak demand.

Load that has fairly constant demand presents fewer

operational challenges to suppliers and usually enjoys

lower prices. Highly variable demand will result in

pipelines and equipment being used at less than full

capacity for much of the year. As a result, the cost to

provide service may be higher because the pipelines may

become constrained during peak times and because the

capacity is not consistently utilized.

POWER GENERATION

Natural gas-red generators can exibly manage

their output and are frequently called on to respond

to changes in demand or when called upon by power

grid operators. Seasonally, generating plants tend

to consume more natural gas in the summer to meet

air conditioning loads, but also increase output in

the winter to provide electric heating and lighting.

Generation demand can also be inuenced by the

n n FEDERAL ENERGY REGULATORY COMMISSION

relative prices for natural gas and other fuels, especially

coal. Since late 2008, natural gas-red generators

generally have been dispatched before many of the

less eicient coal plants because of the relatively low

natural gas prices seen over the past decade. In 2016,

electricity generation from natural gas overtook coal

generation for the rst time on an annual basis.

8

INDUSTRIAL

Natural gas as a fuel is used to produce items such

as steel, glass, paper, clothing and brick. It also is

an essential raw material for paints, fertilizer, plastics,

antifreeze, dyes, medicines, and explosives. As noted

earlier, industrial load tends to show the least seasonal

variation of natural gas use.

RESIDENTIAL

Despite population growth, natural gas used in the

residential sector has remained fairly at over the past

decade. This has primarily occurred because homes and

appliances like furnaces, water heaters, and clothes dryers

have become more energy eicient. Slightly more than

half of the homes in the U.S. use natural gas as their main

heating fuel.

9

Separately, much of the year-to-year demand

variation in this sector can be attributed to the weather

during a particular year. A year with a long, cold winter

will see higher gas demand than a year with a mild winter,

especially in cold-winter regions where demand soars

during winter months as consumers turn on their furnaces.

COMMERCIAL

Like the residential sector, commercial consumption

experiences year-to-year variation based on weather.

Commercial consumers include hotels, restaurants,

wholesale and retail stores, and government agencies,

which use natural gas primarily for heat. Consequently,

its demand varies over the seasons, weeks, and days.

8 See EIA, Total Energy, Electricity, Table 7.2b Electricity Net Generation: Electric Power Sector (accessed October 2022), https://www.eia.gov/

totalenergy/data/browser/?tbl=T07.02B.

9 EIA, Natural gas explained (May 24, 2022), https://www.eia.gov/energyexplained/natural-gas/use-of-natural-gas.php.

10 Probabilistic reserves are oen used, for instance a P90 reserve gure indicates there should be at least a 90 percent probability that quantities

actually recovered will equal or exceed the estimate. Society of Petroleum Engineers, World Petroleum Congresses, and American Association

of Petroleum Geologists, Guidelines for the Evaluation of Petroleum Reserves and Resources, at 45 (2001), https://www.spe.org/industry/docs/

Guidelines-Evaluation-Reserves-Resources-2001.pdf.

Natural Gas Supply

NATURAL GAS RESOURCES,

RESERVES AND PRODUCTION

The amount of natural gas in the ground is estimated by

a variety of techniques, including seismic studies and

drilling exploration wells. Estimating the technically

recoverable oil and natural gas resources in the U.S. is

an evolving process. Analysts use dierent methods

and systems to make natural gas estimates. Natural gas

supplies are broadly characterized as resources, proved

reserves, and production.

Resources, the largest category of supply, refers to

the quantity of a natural resource that is known to

exist with a reasonable degree of certainty and can

be extracted using existing or feasibly commercial

technology. Proved reserves are a subset of resources

which are known to exist with a reasonable degree

of certainty and can be economically extracted under

current or assumed prices. Resources and proved

reserves are dynamic as both change when new natural

resources are discovered via exploration, as natural

resources are extracted, and as prices uctuate. All

estimates of proved reserves involve some degree of

uncertainty, which depends primarily on the amount

of reliable geologic and engineering data available

at the time of the estimate. According to the Society

of Petroleum Engineers, “proved reserves are those

quantities of petroleum which, by analysis of geological

and engineering data, can be estimated with a

reasonable certainty to be commercially recoverable,

from a given date forward, from known reservoirs and

under current economic conditions,operating methods,

and government regulations.”

Lastly, production

describes the amount of a natural gas that is actually

extracted over a period of time.

n n FEDERAL ENERGY REGULATORY COMMISSION

Source: U.S. Energy Information Administration and U.S. Geological Survey

11 EIA, Today in Energy, The geology of natural resources (February 14, 2011), https://www.eia.gov/todayinenergy/detail.php?id=110.

12 Pub. L. No. 101-60 (1989); 15 U.S.C. § 3431(b)(1)(A). The Natural Gas Wellhead Decontrol Act of 1989 amended the Natural Gas Policy Act of 1978 to

declare that the price guidelines for the rst sale of natural gas do not apply to: (1) expired, terminated, or post-enactment contracts executed aer

the date of enactment of this Act; and (2) certain renegotiated contracts. Specically, as of May 15, 1991, the act, decontrolled natural gas produced

from newly spudded wells and also repealed permanently wellhead price controls beginning on January 1, 1993.

FERC Jurisdiction

Section 1(b) of the Natural Gas Act (NGA) exempts

production and gathering facilities from FERC

jurisdiction. Moreover, the Wellhead Decontrol Act

of 1989 completely removed federal controls on new

natural gas and eventually all wellhead price controls,

except sales for resale of domestic natural gas by

interstate pipelines, LDCs, or their ailiates.

In Order

No. 636, FERC required interstate pipelines to separate,

or unbundle, their sales of gas from their transportation

service, and to provide comparable transportation

service to all shippers whether they purchase natural gas

from the pipeline or another gas seller.

UNCONVENTIONAL AND

CONVENTIONAL NATURAL GAS

Natural gas is a fossil fuel. It has historically been found

in underground reservoirs formed when organic material

was buried and pressurized. The remains of that

organic material were trapped in the surrounding rock

as oil or natural gas, and the two fuels are oen found

together. The depth of the organic materials and the

temperatures at which they are buried oen determine

whether the organic matter turns into oil or natural gas.

Oil is generally found at depths of 3,000 to 9,000 feet,

while organic materials at greater depths and higher

temperatures result in natural gas.

Oil

Conventional

Associated Gas

Tight

sand gas

Coalbed Methane

Sandstone

Gas rich shale

Seal

Conventional

Non-Associated

Gas

Land Surface

n n FEDERAL ENERGY REGULATORY COMMISSION

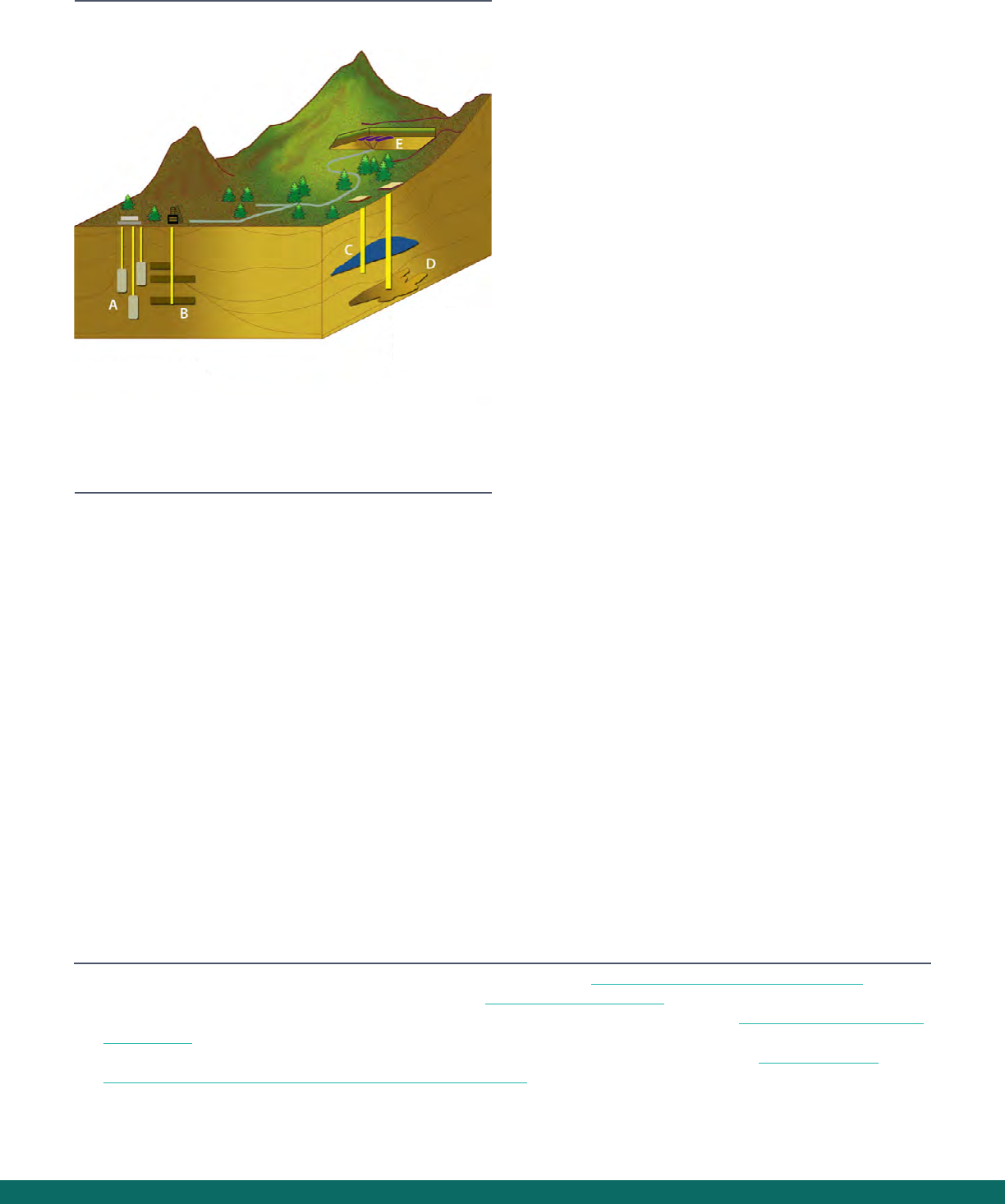

Natural gas basins are frequently referred to as

unconventional or conventional basins or plays. These

basins dier in the geology of the basin and the depth at

which gas can be found. The schematic illustrates diering

geologic formations in which natural gas can be found.

UNCONVENTIONAL NATURAL GAS

Innovations in exploration and drilling technology have

led to rapid growth in the production of unconventional

natural gas. The majority of unconventional natural gas

production in the U.S. comes from shale and tight sands.

Unconventional natural gas is a found in shale, and

tight, low-permeability rock formations (also referred

to as tight sands) and coal seams (also referred to as

coal beds). The National Petroleum Council (NPC)

denes unconventional gas as “natural gas that cannot

be produced at economic ow rates nor in economic

volumes unless the well is stimulated by a large

hydraulic fracture treatment, a horizontal wellbore, or by

using multilateral wellbores or some other technique to

expose more of the reservoir to the wellbore

SHALE AND TIGHT SANDS

Shale gas is natural gas found in ne-grained sedimentary

rock with low permeability, including mudstone, clay

stone, and what is commonly known as shale. Natural

gas in shale formations tends to concentrate in natural

fractures and the rock adjacent to them. Historically,

extraction of natural gas from shale formations has been

diicult to achieve. Growth in shale resources is discussed

further below (see “The Shale Revolution”).

Tight sands gas is natural gas contained in sandstone,

siltstone, and carbonate reservoirs of such low

permeability that it will not naturally ow at economic

production rates when a well is drilled. There are about

20 shale and tight sands basins in the U.S. (see map).

13 See National Petroleum Council Global Oil & Gas Study, Topic Paper

#29 Unconventional Gas, at 5 (July 18, 2007), http://www.energybc.

ca/cache/naturalgas/www.npc.org/Study_Topic_Papers/29-TTG-

Unconventional-Gas.pdf.

The presence of natural gas in

unconventional plays had been common

knowledge for decades. Historically,

the lower permeability of rock in shale

formations typically yielded too little natural

gas for a company’s investment when using

traditional drilling methods. In the early

1990s, aer years of experimenting in the

Barnett Shale in Texas, George Mitchell

and Mitchell Energy Co. developed new

techniques that made production from these

types of formations more economically

feasible. The new techniques combined

horizontal drilling with slickwater hydraulic

fracturing (slickwater hydraulic fracturing

uids are water-based uids, generally

containing a friction reducer, that facilitate

rapid pumping of the uid into the well),

allowing Mitchell to drill into specic target

areas and release the natural gas trapped

in the formation. Horizontal drilling allows

producers to target the specic cross-

sections of rock formations where the

natural gas is trapped, greatly improving the

likelihood of a productive well.

Horizontal and

Directional Drilling

with Hydraulic Fracturing

n n FEDERAL ENERGY REGULATORY COMMISSION

Growth in shale gas in particular has been substantial

since 2007 and has contributed to a signicant increase

in U.S. proved natural gas reserves. Proven shale reserves

are approximately 13 times larger than 2007 levels.

Shale and tight sands require a special technique known

as hydraulic fracturing (fracking) to release the natural

gas. This technique involves fracturing the rock in the

horizontal sha using a series of radial explosions and

water pressure. Since 2007, the processes for nding

geological formations have improved, and producers

have accumulated knowledge of subsurface oil and gas

deposits over that span of time. As a result, most wells

targeting shale and tight sands formations result in drill

14 Derived from EIA, U.S. Shale Proved Reserves, Annual (accessed October 2022), https://www.eia.gov/dnav/ng/hist/res_epg0_r5301_nus_bcfa.htm.

15 See EIA, Drilling Productivity Report, Production by Region (accessed October 2022), https://www.eia.gov/petroleum/drilling/#tabs-summary-2.

16 Derived from EIA, Natural Gas Gross Withdrawals and Production, U.S., Annual-Million Cubic Feet (accessed October 2022), https://www.eia.gov/

dnav/ng/ng_prod_sum_dc_NUS_mmcf_a.htm.

17 Derived from EIA, Natural Gas Gross Withdrawals and Production, Gross Withdrawals from Shale Gas, Annual-Million Cubic Feet (accessed October

2022), https://www.eia.gov/dnav/ng/NG_PROD_SUM_A_EPG0_FGS_MMCF_A.htm.

18 See EIA, Annual Energy Outlook 2022, Table 14. Oil and Gas Supply (March 3, 2022), https://www.eia.gov/outlooks/aeo/tables_ref.php.

contact with formations and successful new natural

gas production. Improved exploration techniques,

coupled with improved drilling and production methods,

have lowered the cost of nding and producing

shale gas, and have resulted in a signicant increase

in production.

The largest gas producing unconventional shale plays in

the U.S. are the Appalachia, Permian, Haynesville, Eagle

Ford, Anadarko, Niobrara, and Bakken basins (see map

below for shale locations).

Other shale formations have

experienced heavy exploration activity and depending

on economic conditions may become major contributors

of natural gas supply.

THE SHALE REVOLUTION

The estimated resources, proven reserves, and

production of shale gas has risen rapidly since 2005,

and the development of shale gas has transformed

gas production in the U.S. Shale gas continues to be

the dominant source of domestically produced gas,

providing 70 percent of the gross production of natural

gas. By comparison, coalbed methane accounts for

about 2 percent of production, while nearly 11 percent

of the natural gas came from oil wells and 17 percent

was produced from conventional natural gas wells.

Production from shale gas plays is 13 times larger

than 2007 levels.

According to the EIA, shale gas

and production from tight formations will account for

greater than 92 percent of U.S. natural gas production

by 2050.

SHALE GAS PRODUCTION BY REGION

Shale gas well productivity improved considerably

since 2007, with technological advances in drilling

and fracking technology reducing exploration, drilling,

Source: FERC sta, 2012

Geologic Basin

Exploration

Land and Lease

Geological and Geophysical

Development

Production

Resource Base

New Field Discovery

• Seismic

Reserve Extensions

and Revisions

Delineation Wells

Production

Land and Lease

n n FEDERAL ENERGY REGULATORY COMMISSION

Source: U.S. Energy Information Administration

19 EIA, Maps: Exploration, Resources, Reserves, and Production (June 2016), https://www.eia.gov/maps/images/shale_gas_lower48.pdf.

20 See EIA, NGL 101 – The Basics (June 6, 2012), https://www.eia.gov/conference/ngl_virtual/eia-ngl_workshop-anne-keller.pdf.

and production expenses. Rising well productivity and

falling costs resulted in larger amounts of shale gas

production at lower costs to the producers.

The presence of NGLs, or natural gas liquids, in addition

to natural gas in many shale gas plays, may add to shale

gas well protability. NGL prices are more closely linked

to oil prices than natural gas prices, and natural gas

wells with high liquids content are oen more protable

than wells producing natural gas alone. A typical barrel

of NGL might contain 40-45 percent ethane, 25-30

percent propane, 5-10 percent butane and 10-15

percent natural gasoline (gasoline derived from natural

gas).

This can make the production of NGLs from so-

called “wet shale gas wells” less sensitive to natural

gas prices than wells solely producing natural gas, as

NGLs tend to trade at higher prices than natural

gas. Thus, there may be an incentive to drill from

wet shale gas wells even when natural gas prices

are relatively low because of the relatively high

value of the associated NGLs that are also produced

when drilling.

The Marcellus Shale formation in Appalachia is

particularly noteworthy because of its location, size

and resource potential. The formation extends from

West Virginia to New York, near the high population

centers of the Northeast and Mid-Atlantic. Although

the Marcellus Shale has produced gas for decades,

it has produced signicant amounts of gas only since

2008, where production has been prolic, with high

initial well pressures and high production rates.

n n FEDERAL ENERGY REGULATORY COMMISSION

The growth in production in the Marcellus Shale has

signicantly aected U.S. natural gas transportation.

As more natural gas has owed out of Marcellus, less

has been needed from the Rockies or the Gulf Coast to

serve the eastern U.S. This has resulted in changing ow

patterns of natural gas on pipelines that traditionally

served eastern and midwestern markets. In some

instances, pipelines that transport natural gas into

northeastern markets and have relied on production

from outside of the region, have reversed ow direction

to export natural gas produced in the Marcellus and

Utica to markets across the U.S.

COALBED METHANE

Coalbed methane (CBM) is natural gas trapped in coal

seams. Coalbeds are usually lled with water that

naturally enter coal seams through fractures in the

formation; the deeper the coalbed, the less water is

present. To release the gas from the coal, pressure

in the fractures is created by removing water from the

coalbed. While the venting of methane from coal mines

had been in practice for years, commercial production of

this resource began in earnest in the 1980s. According to

a U.S. Geological Survey released in October 2000, there

is more than 700 Tcf of domestic CBM, but less than

100 Tcf of it may be economically recoverable.

Most

CBM production in the U.S. is concentrated in the Rocky

Mountain area, although there is also some activity in

the Midcontinent and Appalachian area.

CONVENTIONAL NATURAL GAS

Natural gas has been historically produced from what is

traditionally known as conventional natural gas resources.

These supplies are found in geologica basins or reservoirs

made of porous and permeable rock, holding signicant

amounts of natural gas in spaces in the rock.

For more

21 See U.S. Geological Society, Coal-Bed Methane: Potential and

Concerns (October 2000), https://pubs.usgs.gov/fs/fs123-00/fs123-00.

pdf.

22 Permeability refers to the ability of a porous medium to transport

a uid. The natural gas found in permeable rock formations

contains trapped or slowly migrating natural gas molecules, where

the migration of the gas molecules takes place over the course of

millions of years.

The rig count is used to measure exploration

activity by assessing the number of rotary

drilling rigs actively drilling for oil and gas.

Historically, rig counts were used as a rough

predictor of future production. However,

improvements in drilling technology and

practices have caused a decoupling between

rig count and production. The adoption of

horizontal drilling signicantly increased

production per rig, making historical

comparisons of rig counts problematic

as horizontal rigs are considerably more

productive than vertical rigs. Within the total

rig count, the use of horizontal drilling rigs,

used in the production of natural gas and oil

in shale formations, has been growing for

years, while the traditional vertical rig count

has steadily declined.

Rig Count and Rig Productivity

n n FEDERAL ENERGY REGULATORY COMMISSION

23 EIA, Maps: Exploration, Resources, Reserves, and Production (April 8, 2009), https://www.eia.gov/oil_gas/rpd/coalbed_gas.pdf.

24 Derived from EIA, U.S. Natural Gas Gross Withdrawals and Production (accessed October 2022), https://www.eia.gov/dnav/ng/ng_prod_sum_a_

EPG0_FGW_mmcf_a.htm.

25 Florida and Texas were provided an exemption to the federal government’s jurisdiction over natural resource beyond three nautical miles of state

coastlines, up to a 9 nautical mile limit, because each state proved the further boundary based on its constitution or laws prior to when it came

into the Union or was approved by Congress. See Submerged Lands Act of 1953. 43 U.S.C. § 1301-1315 at § 1312 (2002).

Source: U.S. Energy Information Administration

than a century, up until the early 2000s, nearly all of the

country’s production of natural gas was obtained from

conventional sources.

Conventional resources have been found both on land

and oshore (see map below), with the major elds in

an arc from the Rocky Mountains to the Gulf of Mexico

to Appalachia. The largest conventional elds reside

in Texas, Wyoming, Oklahoma, New Mexico, and the

federal oshore area of the Gulf of Mexico.

In 2000,

oshore

natural gas production represented 24 percent

of total U.S. production; it has since fallen to 3 percent of

total U.S. production.

Federal oshore natural gas wells are drilled into the

ocean oor o the coast of the U.S. in waters that are

jurisdictional to the federal government. Most states

have jurisdiction over natural resources within three

nautical miles of their coastlines; Florida and Texas

claim nine nautical miles of jurisdiction.

Roughly 1,650 oil and gas platforms are producing in

federal waters at water depths approaching 7,500 feet (at

total well depths of 25,000-30,000 feet) and at distances

Coos Bay

Field

Gulf Coast

Coal Region

Williston

Basin

Illinois

Basin

Forest City

Basin

Northern

Appalachian

Basin

Powder River

Basin

Uinta Basin

Cherokee Platform

San Juan

Basin

Central Appalachian

Basin

Michigan

Basin

Greater Green

River Basin

Black Warrior

Basin

North Central

Coal Region

Arkoma

Basin

Denver

Basin

Southwestern

Coal Region

Piceance Basin

Big Horn

BasinWind River Basin

Raton

Basin

Black Mesa

Basin

Terlingua

Field

Kaiparowits

Basin

Deep River

Basin

SW Colorado

Coal Area

Park Basin

Hannah-Carbon Basin

Wyoming

Overthrust

0 200 400100 300

Miles

±

Coal Basins, Regions & Fields

Coalbed Methane Fields

!

n n FEDERAL ENERGY REGULATORY COMMISSION

Source: U.S. Energy Information Administration

26 EIA, Maps: Exploration, Resources, Reserves, and Production (April 8, 2009), https://www.eia.gov/oil_gas/rpd/conventional_gas.pdf.

27 Derived from Bureau of Safety and Environmental Enforcement, Oshore Statistics by Water Depth, Totals table (accessed October 2022), https://

www.data.bsee.gov/Leasing/OshoreStatsbyWD/Default.aspx.

28 Derived from EIA, Natural Gas Summary, Imports and Exports, U.S., Annual (accessed October 2022), https://www.eia.gov/dnav/ng/ng_sum_lsum_

dcu_nus_a.htm.

29 Id.

as far as 200 miles from shore.

Most of these oshore

wells are in the Gulf of Mexico.

Oshore wells have produced natural gas for decades.

As close-in, shallow-water wells became less economic

to produce, companies looked to reserves at greater

water depth. Technological improvements contributed

to continuing production from deep oshore wells.

IMPORTS AND EXPORTS

The U.S. has historically been a net importer of natural

gas by pipeline from Canada, with shipments of LNG

from foreign nations playing an important role in serving

pipeline capacity-constrained regions during periods

of peak natural gas demand. However, the increase

in U.S. natural gas production, spurred by the shale

revolution, has reduced the need for imports and

enabled greater exports.

Net natural gas imports peaked in 2007, when natural

gas imports represented approximately 20 percent

of the natural gas used in the U.S.

Since then, imports

have declined and now represent approximately 9

percent of total U.S. consumption.

The vast majority

of imports are delivered by pipeline from Canada,

with additional waterborne shipments of liqueed

!

!!!!!!

!

!!

!

!

!! !

!!

!

!

!

!

!

!

!

!

!

!

!

!!

!!

!

!

!!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!! !

!

!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

!!

!

!!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!

!!!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

!

!

!!!!!!!!!!

!

!

!

!!

!!

!

!

! !!

!!

!

!

!

!!

!

!

!

!!

!!

!!!!

!!

!!

!

! !!!

!

!!

!!!

!!!

!

!

!

! !!

!

!!

!!!

!

!!

!!!

!!!!!

!

!

!!

!!

!

!!

!

!

!

!

!!

!!

!!

!

!

!!!

!!

!

!

!

!!

!

!! !

! !!

!!

!

!

!!

!

!

!!

!

!!

!

!

!!!!

!

!!

!!

!

!!

!

!

!

!!

!

!!!!!!!!

!

!

!!

!

! ! !!

!!

!!

!!!!!

! !!

!

!!!!!

!

!!

!

!!

!

!

!

!

!

!!!!!!!!

!!

!!

!!!

!

!

!!

! !!

!

!!

!

!!!!

!

!

!

!

!!

!

!

!

! !!!!!!!

!!

!

!

!

!!!! !

!!

!!

!

!

!

!

!!!! !

! !!

!!! !!!!

!!

!!! !!

!

!!

!

!

!

!!!!

!

!!

!

!

!

!!

!

!

!

!!

!!!

!!

!!

!

!

!

!

! !!!!! !

!!

!! !

!

!!!!

!

!!!!! !!! !!!!!! !!!! ! !!!! !!!!!!

!

!!!!

!

!

!

!!

!

! !!!!!! !!!!

!!

!!

!

!

!

!

!

!

!

!

!!

! !!!!! !!!! !

!

!!

!

!

! ! ! !! !!

!

!!

!!!

!

!

!

!!!!

!

!! ! !

!

! !! ! !

!!

!

!!!!!

!

!

!

!! !! !

!

!! ! ! !

!

!!! !!! !!!!! !!

!

!!

!

!

!

!

!!!!

!

!!

!

!!!!!!! !!!! !!

!!

!!

!

!

!

! !!!!

!!

!

!!

!

!

!!

!!

!

!

!!

!

!

!! !! !

!

!

!

!!

!

!!!!!

!

!!

!

!

!!

!

!

!!

! !!

!

! !!!! !!

!

!!

!

!

!!

!!!! !

!

!

!

!

!

!

!

!!

!

!

!

!

!

!! !

!

!

!

!!!!

!

!

!!!

!!

!

! !!! !!!!

!! !

!

!

!

!

!! !

!

!

!

!

!

!

!

!!

! !!!!

!

!

!!

!

!! !

!

!!

!!

!

!

!

!

!

!!

! !!

!

!! !

!

!

! !!!

!

!!!! !!!

!

! !! !

!!

!

!!

!!

!!!!!!!!!

!

!

!

!

!!

!

!

!!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!!!!!

!!

!

!!

!

!! !

! !!

!

!!

!

!

!

!

!

!

!!!!

!

!

!

!

!

!

!

! !!

!

!

!

!

!

!

!

!

! !!!! !!

!

!!

!

!!

!

!!

!

!

!!

!

!

!

!

! !!

!!

!

!

!

!! !

!

!

!!

!!

!

!!!

!

!

!

! !!

!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!!

!

!

!!

!

!

!

!

!

!

!

!

!!

!

!

!

!!

!

!

!

!

!

!!!

!

!

!

!

!

!!

!

! !!

!!

!

!

!!

!

! ! !!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

! !!

!!

!

!

! !!

!! !

!

!

!!

!

!

!

!

!

!

!

!

!

!

!! !

!! !

!!

!

!!

!

!!

!!

!!

!

! ! !!

!

!

!

!

!

!

!

!

!

!!

!

!

!!

!

!

!

!!

!

!

!

!!

!! !!

!! !

!!

! !! !

!

!

!

!!

! !! !!

!!

!!

!!

!

!

!

!! ! ! !

!

!

!

!

!

! !!

!

!

!

!!!

!

!

!

!

!

!

!!!

!!

!

!

!!!

! !! !

!

!

!

!!!!! !!!!!

!

!

!

!!

!

!!!!!!!!!!

!! !

!

!!!!

!

!

!!

! !! ! !!

!!!! !

!

!

!

!

! !!

!!

!

!! !

!!!!!!!!!!!

!

!

!

!!

!!

! !! !!

!!

!!!! !

!

!

!!!

!!

! !!

!!

!

!

!

!

!

!

!

!

!!

!

!

!!

!

! !!

!

!!

!

!

!

!!!!

!

!! !!!

!

!!

!!

!!!

!

!

!

!!

!!

!!

!!

!

!!

!

!

!

!

!

! !

!!!

!

!

!

!

!

!

!!

!!

!

!! !

! ! !!

!!

!

!!

!

!!

!!

!!

!!!

!

!!

!

!

!! !

!

!

!!!

!

!

!

!!

!!

!

!

!

!!

!

!!

!

!! !

!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!!

!

!

!

! !! !

!

!

!!

!

! !!

!

!!

!

!

!

!

!!! !!

!

!

!

!! !

!

!

!

!

!

!! !

!!

!!!

!

!

!

!

!!

!

!

!

!

!

!

!

!

! ! !!

!

!!

!

!!

!! !!!!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

! !!

! !!

!

!!

!

!!!!

! !

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

!

!

!!

!

!

!

!

!! !!!! !

!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!!

!

!

!!!!!!!!!!!

!

!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

! !! !! ! ! !

!

!

!

!

!

!

!

!!!

!

!

!

!!

!!!!!!!

!!

!!

!

!!

!

!

!

!

!

!

!!

!!!

!

!

!!

!

!

!

!

!

!

!!

!

!!

!

!

!

!

!

!!

!

!!

!

!!!

!

!

!!!

!

!

!

!! !

!

!

!

!! !!!

!!!

!

!

!!!

!

!!

!

!

!

!

!

!!!!! !!

!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!!

!

!!

!

!!

!!

!

!!

!

!

!

!

!

!

!

!!

!

!

!

!!

!!!

!!

!!

!!!

!

!

!!

!

!

!!!

!

!

!!

!!!

!

!

!

!

!!

!

!!

!

!

!

!

!!

!

! !!!!

!! ! !!

!

!

!!!

!

!

!

!

!!!!!!

!!!

!

!

!

!

!!

!!

!!

!

!

!

!

!

!

!

! !!!

!

!!!

!

!

!

!

!

!

!

!

!!!

!

! ! !!

!

!

!

!!

!! !

!

!

!

!

!

!!

!

!

!!!!

!

!

!!

!

!

!!

!

!!! !

!

!

!

!!

!

!!

!

!

!! !

!

!

!

!

!

!

!

!

! ! !!

!

!!

!

!!

!!

!

!!

!

!

!

!

!

!!

!

!

!!

!!

!!

!

!

!!

!!!!!

!

!

!

!

!

!!

!

!

!

!

!!!

!

!

!

!

!

!

!

!!!

!!

!

!!

!

!

!!

!

!

!

!!!

!!

!!

!

!

!

!

!

!

!

!

!

!!

!

!

!!

!! !

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!!!!

!

!

!!

!

!

!

!

!

!!

!!

!

!

!

!!

!

!

!!

!!!

!

!

! !!

!!

!

!!

!

!

!!

!

!!

!!

! !!!!!

!

!

!

!

!

!

!!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

!!

!

!

!

!

!!

!

!

!

!

!

!

!

!

!

!!

!

!! !

!

!

!

!

!!

!!

!

!

!

!

!!

!

!

!

!!

!

!

!

!

!

!

!

!

!

!

!! !

!

!

!

!

!!

!

!

!

!! !

!

!

!

!!

!

!

!!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!

!

!

!!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

!

!! !

!

!

! !! ! ! !!

!

!!!!

!!!!

!

!!!!!!!!

!

!!!!!!!!

!

!!

!!

! !!

!!!!!!

!

!!!

!

!

!

!!!!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!!

!

!!!

!

!!

!

!!!

!! !

!

!

!!!!

!

!

!

!!

!

!

!

!

!

!

!

!!! !

!

!!!

!

!!!!

!

!! !

!

!!!

!

!!!

!!!

!

!!

!!

!

!

!

!! !

!

!!!

!

!

!

!

!

!

!

!

!

!!

!!!!

!

!!!

!

!!!

!

!

!!

!

!!

!

!

!

!

!

!

!!

!

!

! !!

!

!

!

!

!

!

!

!!

!

!!

!

! ! !!

!

!

!

!

!

!!

!

!

!

!!

!

!

!

!

!

!!

!!

!

!

!

!!

!

! !!

!!

!

! ! !! !

!

!

!!

!

!

!!

!!

!! !!

!! !

!!

!

!

!

!

!

!!

!

!

!

!

!

!

!

!!

!!

!

!

!

!

!

!

!

!!

!

!

!

!!

!

!

!

!

!

!

!

!

!! !

!

!!

!

!

!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!

!

!! !!

!

! !!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!!

!

!

!

!!!

!

!!

!

!

!

!

!

!

!

!

! !!

!

!

!!

!

!

!

!! !!!!

!

!

!!

!!

!

!

!!

!!

!

!

!

!

!

!!

!

!

!

!! !

!

!

!

!

!

!

!!

!

!

!

!

!

!

!!

!!

!

!

!

!

!

!

!!

!!

!!

!

!

!

!

!

! !!

!

!!

!

!

!!

!

!

!

!!

!

!

!

!

!

!

!

!! !

!

!

!

!!

!!

!

!

!

!

!

!

!!

!!

!

!

!

!

!!

!

!

!!

!

!

!

!

!!

!!

!!!!

!

!!!!

!!

!!

!!!!

!

!

! ! !!

!!

!!

!!!!!

!

!!

!

!!!!

!

!

!

!

!

!!!

!

!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!!

!

!

!

!

!!

!

!!

!

!!

!

!

!

!

!

!!

!

!

!

!!!

!

!

!

!!

!

!

!

!

!

!

!

!

!

!!

!

!!

!

!

!!

!

!

!

!

!!! !!!

!

!

!!

!

!

!

!

!

!

!

!

!

!

!!

!

!!

!

!!

!!

!

!

!

!

!

!

!!!!

!!

!

!

!

!

!! !

!!

!

!

!

!

!!

!

!

!!

!!

!

!!

!

!

!!

!

!!!!!

!

! !!

!!!

! !!!!

!

!

!!

!!

!!

!

!! !

!!!

!! !

!

!!

!

!

! !!! !!!!!!

!!

!!!!!!

!

!!

!

!! !

!!!!!

!

!!

!

!

!

!!

!

!!!!! !

!!!!

!

!!

!!!

!!

!!

! !!!

!!

!

!

!

!

!

!

!!

!

!

!

!!

!

!

!! !!

!!!!

!

!

!

!!!!

!

!!!!

! !!

!

!

!!

!!

!

!

!

!

!!

!

!

!

!

!

!!

!

!

!

!

!

!

!

!

! !

!

!

!

!!

! !!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!! !

!

!

!

!

!

!!

!

!

!

!

!

!

!! !

!

!

!

!

!

! !!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

!!

!

!

!

!

!!

!

!

!

!!

!!

!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!

! !

!

!

!!!

!

!

!

!!

!

!

!!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!!

!

!

!

!

!!

!

!

!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!!

!

!

!

!

!

!

! !!

!!

!!

!

!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!!

!

!

!

!

!

!!

!

!

!

!

!

!!!!!!

!

!!

!

!

!

!

!! !

!

!

!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!!

! !!

!

!

!! !!

!

!!

!

! !!

!

!

!

!!

!

! !

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!!

!

!!

!

!! !

! ! !!

!!

!! !

!

!

!!

!

!

!

!

!

!

!!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!!

!!

!!

!!

!!

!

!

!

!

!

!!

!!

!

!!

!

!

!

!!

!!

!!

!

!

!

!

!

!!

!

!

!

!!

!

!!

!

!

!!

!

!!

!!

!

!! ! !

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!!

!

!

!

!!

!!

!

!

!

!!!

!

!

!

!

!

!

!

!

!

!

!

! !!!!!

!

!

!

!

!!

!

!

!!

!!

!

!

!

!

!

!

!

!

!!

!

!

!

!!

!

!

!

!

!!

!

!

!

!

!!

!

!

!!

!! ! !!

!

!

!

!

!!

!

!

!

!!

!! !

!

!

!

!

!

!

!!

!

!

!!

!

!!!

!

!!

!

!! !

!!

! !!!

!

!!

!

! !!

!

!

!

! !!!!

!

!

!!!!

!!

!

!!!!!!!!

!!!!!

! !!

!

!

!

!

!

!

!

!

!

!!!!!!!!! !

!!!

!

!!

!

!! !

!

!

!

!

!

!!!! !!!

!! !!

!!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!

!!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

! !!!

!

!!

!

!

!!

!

!

!!

!

!!

!!

!

!

!!!

!

!

!

!

!!!!!!! !

!

!

!

!

!!

!

!

!

!

!

!

!

!

!!

!

!!!

!

!

!

!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

!!

!

!!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!

!!

!

!

!

!

!

!!

!

!

!

!

!!

!

!

!

!

!

!!

!

!

!

!

!

!!

!

!

!

!

!

!

!!

!

!

!

!

!

!

!!

!!

!

!

!

!

!

!

!!

!

!

!

!

!

!!

!

!!

!

!

!

!

!

!

!

!

!!

!

! !!

!!

!!

!

!

!

!! !

!

!

!

!

!!

!

!!

!!

!

!!

!

!!

!!! !

!

!

!!

!

!

!

!

!

! !! !

!

!!

!

!

!

!

!

!

!

!

!!

!!

!!

!

!

!

!

!!

!!

!

!

!

!

!

!

!

!! !

!!

!!

!

!

!

!

!

!

!

!!

!

!!

!!!!!! !

!

! ! !!! !!

!!

!

!!

!! !! ! ! ! !

!!

!!!!!

!!

!! !!! !!!

!

!

!

!

!

!

!

!

!

!!

!

!!

!

!

!!

!

!

!

!

!

!

!

!

!

!!

!!

!

!

!

!

!

!

!!

!

!

!

!

!

!!

!

!!

!

!

!

!

!!!!

!

!!

!

!

!!

!

!!

!

!

!

!

!

!

!

!

!!

! ! !!

!

!!

!

!

!!!

!

!

!

!

!

!!

!

!!

!

!

!

! !!!!!!!!! !!! !

!

!!!

!

!

!

!

!

!

!

!

!!!! ! !!! !! !!! !!

!

!! !!!!!!!!!!!!! !

!