2018 Annual Report

Voluntary Agreement for

Ongoing Improvement to

the Energy Eciency of

Set-Top Boxes

August 13, 2019

Prepared on behalf of the

Steering Committee by:

D+R International

1100 Wayne Avenue, Suite 700

Silver Spring, Maryland 20910

TABLE OF CONTENTS

Executive Summary .............................................................................................................................................. 3

Overview of the Voluntary Agreement ................................................................................................................. 7

Voluntary Agreement Objectives .................................................................................................................... 8

Voluntary Agreement Signatories and Steering Committee ........................................................................... 8

Service Provider Commitments .................................................................................................................... 10

Independent Administrator and Auditor Role ................................................................................................ 10

New Feature Allowances .............................................................................................................................. 10

Increased Energy Efficiency of Set-Top Boxes ....................................................................................................11

Report on Procurement Commitments ...............................................................................................................11

Impact on National Energy Consumption ........................................................................................................... 12

Audit and Verification .......................................................................................................................................... 16

Procurement Audit ........................................................................................................................................ 16

Verication Testing ........................................................................................................................................ 16

Progress on Other Energy Efficiency Commitments .......................................................................................... 17

Whole-Home Systems .................................................................................................................................. 17

Consumer Access to Energy Efciency Information .................................................................................... 18

Next-Generation Video Delivery .................................................................................................................... 18

Automatic Power Down ................................................................................................................................ 19

Satellite Study on Residential Premises Equipment ..................................................................................... 19

Viewing Without Operator-Supplied Set-Top Boxes ............................................................................................ 20

Conclusion .......................................................................................................................................................... 24

Appendix A: Voluntary Agreement Commitments .............................................................................................. 25

Appendix B: Set-Top Boxes Purchased by Voluntary Agreement Signatories in 2018 ........................................ 26

Appendix C: Consumer-Facing Set-Top Box Energy Efficiency Information ........................................................ 31

Appendix D: 2018 Procurement Audit Report ..................................................................................................... 32

D+R International • The Energy Efficiency Market Experts 1

LIST OF TABLES

Table ES-1: Voluntary Agreement Energy Savings 2013-2018 ............................................................................... 4

Table ES-2: Weighted Average Typical Energy Consumption for Major Set-Top Box Categories .......................... 5

Table 1: Weighted Average Typical Energy Consumption for Major Set-Top Box Categories ...............................11

Table 2: Voluntary Agreement Signatory Set-Top Box Procurement 2018 .......................................................... 12

Table 3: Base Case – 2012 Estimated Energy Consumption .............................................................................. 12

Table 4: Change in Subscribers from 2012-2018 ................................................................................................. 13

Table 5: Estimates of Total Deployed Units in the Market in 2013-2018 ............................................................. 13

Table 6: National Energy Consumption for Devices Based Upon Year of Purchase ............................................ 15

Table 7: National Energy Consumption of Installed Set-Top Boxes 2012-2018 ................................................... 15

Table 8: Platforms and Apps Used by Customers to View Content Without Set-Top Boxes .............................. 21

Table 9: Voluntary Agreement Commitments ..................................................................................................... 25

Table 10: Set-Top Boxes Procured by Voluntary Agreement Signatories in 2018 ................................................ 27

Table 11: Set-Top Box Base Allowances .............................................................................................................. 29

Table 12: Set-Top Box Feature Allowances ......................................................................................................... 30

Table 13: Consumer-Facing Energy Efficiency Information ................................................................................. 31

LIST OF FIGURES

Figure ES-1: Annual Energy Saved by the Voluntary Agreement Procurement Commitments ............................ 4

Figure 1: Distribution of Current Inventory by Year of Procurement (Percentage of Units) ................................ 14

D+R International • The Energy Efficiency Market Experts 2

E

XECUTIVE SUMMARY

In 2012, the pay television industry, led by NCTA - The Internet & Television Association and the Consumer Technology

Association, signed the Voluntary Agreement for Ongoing Improvement to the Energy Efficiency of Set-Top Boxes with the

goal of increasing the energy efficiency of set-top boxes while protecting rapid innovation and timely introduction of new

features. Signatories include major manufacturers of set-top boxes and the largest cable, satellite, and telco service

providers serving 82.1 million U.S. video subscribers, accounting for 94.3% of the market in 2018. In 2013, leading energy

efficiency advocates joined with the pay television industry in an expanded version of the Voluntary Agreement.

One of the requirements of the Voluntary Agreement is the publication of an annual report. This sixth annual report provides

a summary of developments for the previous calendar year, 2018. Annual reports for the previous five years as well as this

report can be found at http://www.energy-efficiency.us.

The Voluntary Agreement has reduced the national set-top box annual energy consumption from 32 TWh in 2012 to 19.4

TWh in 2018, a reduction of 39% over the life of the Agreement, even as functionality and features of set-top boxes have

increased. This 12.6 TWh reduction is more power than is generated by four typical 500 megawatt coal-run power plants in a

year.

1

Also, in 2018 alone consumers saved more than $1.6 billion

2

and avoided 8.9 million metric tons of CO

2

emissions.

3

During the six years of the Voluntary Agreement, cumulative energy consumption has been reduced by an estimated 40.4

TWh, saving consumers approximately $5.15 billion and avoiding 28.6 million metric tons of CO

2

emissions. The energy

saved during this six-year period is enough to power all homes in the entire state of Pennsylvania with electricity for a year.

4

1 - A common

unit in measuring energy efficiency savings is the “Rosenfeld” (3 terawatt hours per year), the same amount of electricity generated by a conventional

500 megawatt coal-run power plant each year. See https://www.scientificamerican.com/article/rosenfeld-energy-savings/.

2 - This calculation is based on national average energy cost of $0.1289 per kWh. See U.S. Energy Information Administration, Electric Power Monthly, available at

https://www.eia.gov/outlooks/steo/report/electricity.cfm.

3 - Emission reduction estimates in this report are based on the U.S. Environmental Protection Agency’s Greenhouse Gas Equivalencies Calculator, available at

https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator.

4 - 40.4 TWh is equivalent to the annual energy usage of 3,421,015 households and the annual electricity usage of 4,982,028 households. See

https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator.

D+R International • The Energy Efficiency Market Experts

3

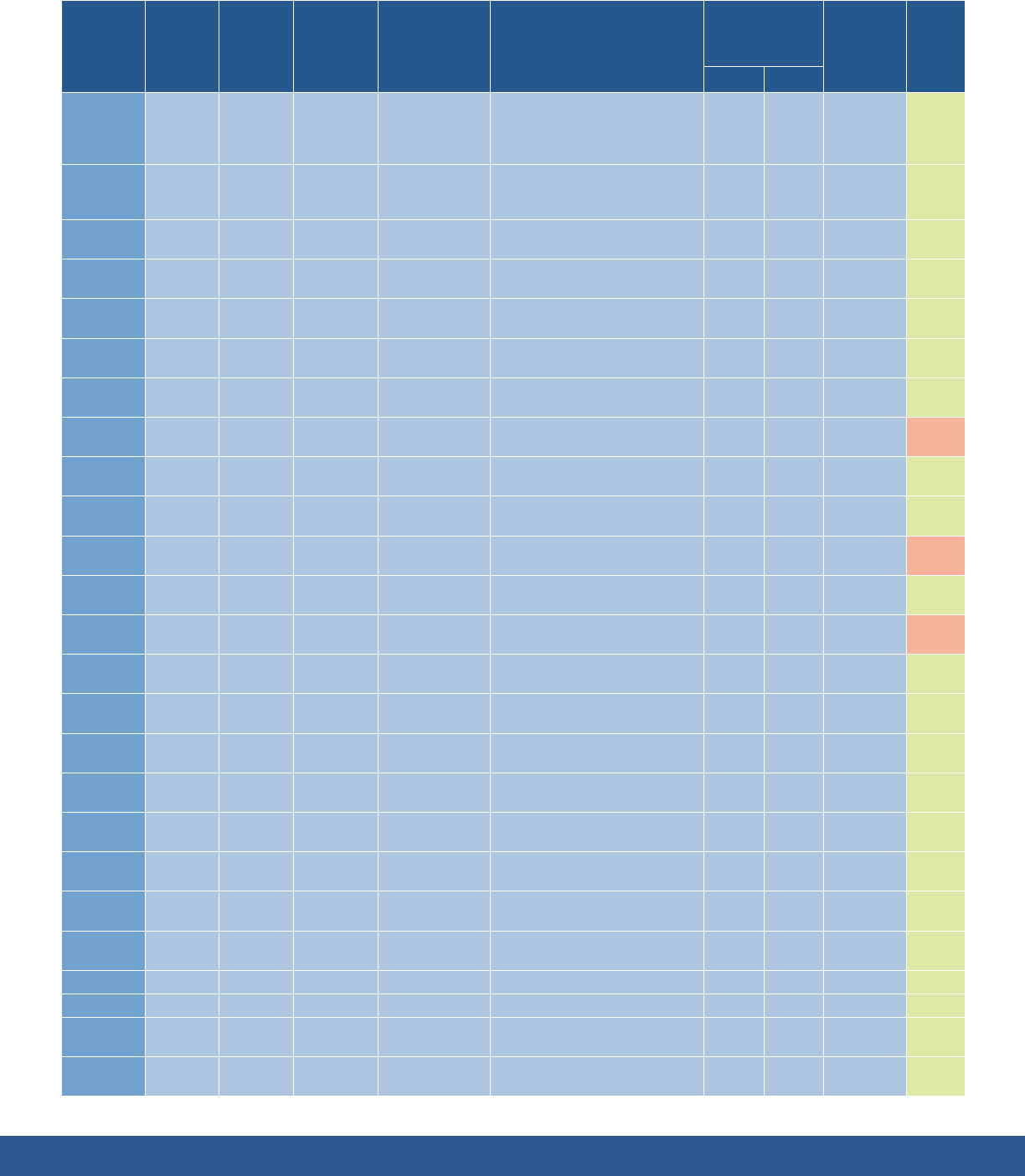

Table ES-1: Voluntary Agreement Energy Savings 2013-2018

2013 2014 2015 2016 2017 2018

Lifetime

of VA

National Energy Consumed

(TWh/yr) Total

30.6 29.2 26.9 24.5 21.0 19.4 151.6

National Energy Saved

(TWh/yr)

1.4 2.8 5.1 7.5 11.0 12.6 40.4

500 MW Power Plant

Equivalents Saved (Rosenfelds)

0.47 0.93 1.70 2.50 3.67 4.20 13.47

a

Electricity Costs Saved

(Dollars/yr)

$169,820,000 $350,560,000 $645,150,000 $941,250,000 $1,417,900,000 $1,624,140,000 $5,148,820,000

CO

2

Avoided (Metric tons) 990,011 1,980,023 3,606,470 5,303,633 7,778,661 8,910,103 28,568,900

a

The electricity generated by a typical 500 MW power is measured in Rosenfelds, which represents annual electricity output. Even at the 2012 peak, set-top boxes used

10.67 Rosenfelds annually, and that gure declined to 6.47 Rosenfelds in 2018. The Agreement has not replaced annual demand of 13 distinct power plants.

Figure ES-1 Annual Energy Saved by the Voluntary Agreement Procurement Commitments

0

2

4

6

8

10

2.8

5.1

7.5

11.0

1.4

2013 2014 2015 2016 2017

Total 6 years

savings 40.4 TWh

12

12.6

2018

14

16

These savings are driven primarily by the service providers’ commitment to procure energy-efcient set-top boxes. Under

the Voluntary Agreement, 90% of new set-top boxes procured by service providers after December 31, 2016 must meet the

efciency levels referred to as “Tier 2” in the Voluntary Agreement, replacing the Tier 1 levels that became effective in 2014.

This report is the second in which the Tier 2 levels were in effect. In 2018, 97.7% of service providers’ set-top box purchases

met the Tier 2 levels, thereby meeting the procurement commitments in the Voluntary Agreement, and all service providers

met the 90% commitment individually.

5

Contributing to the increase in savings is the fact that service providers met the

more rigorous Tier 3 levels in 78.1% of set-top boxes procured in 2018, two years ahead of the effective date of Tier 3 in

2020, according to D+R’s calculations and veried test results.

5 - As set forth below, this calculation is based on 2018 procurement data submitted to D+R by service providers and corroborated by the results of independent verication

testing and by the procurement audit conducted by D+R.

D+R International • The Energy Efficiency Market Experts 4

The procurement of energy-efcient set-top boxes under the Voluntary Agreement has resulted in a substantial decrease

in average energy consumption by the major types of set-top boxes. In particular, the new-unit average power usage of the

most energy-intensive type of set-top box, the DVR, has fallen by 48% since 2012, and the number of DVR devices in DVR

homes has declined through support for whole-home and/or cloud DVR offerings. In addition, the energy usage of each of

the other two major categories of set-top boxes have also fallen sharply over that time, as shown in Table ES-2.

Table ES-2: Weighted Average Typical Energy Consumption for Major Set-Top Box Categories

Category

TEC (kWh/yr)

Percent Change

in Weighted

Average

Pre-VA

(Existing

Stock)

2018 Stock

Weighted Average Pre-VA to 2018

DVR 267 138.71 -48%

Non-DVR 119 91.76 -23%

Thin Client 90 45.39 -50%

DTAs and Multi-Service Gateways were each purchased only by one service

provider in 2018 in relatively small quantities.

Another major trend of note in 2018 is the continued decline in the number of new set-top boxes. The signatories purchased

only 23 million new set-top boxes in 2018, half of the 46 million new set-top boxes they purchased during the rst year of

the Voluntary Agreement’s commitments in 2014. This decline is likely attributable to a mix of factors, including subscriber

losses and the increasing prevalence and usage of options for customers to watch their programming using apps rather

than through an operator-supplied set-top box. Consumers used more than 36 million customer-owned and managed

devices such as Smart TVs, smartphones, tablets, personal computers, and streaming devices such as Apple TV, Roku,

Google Chromecast and Amazon Fire to access the providers’ video services via apps in 2018, up by 33% from 27 million

in 2017. The service provider signatories are continuing to work to enhance the functionality of their apps such as through

new support for cloud DVR offerings, and investing in customer education and employee training to promote the use and

awareness of apps. The growth in adoption of energy-efcient app streaming solutions further reduces the overall energy

used by the signatories’ set-top boxes.

The Voluntary Agreement contains additional commitments and verication tools, including deployment of automatic power

down and whole-home systems, efforts to improve energy efciency in future-generation equipment, posting of information

for consumers and other stakeholders at www.energy-efciency.us and on company websites, verication testing of

randomly-selected set-top boxes from each reported category, and an audit of a randomly-selected service provider’s set-top

box procurements. The signatories’ satisfaction of all of these commitments are summarized in Table 9 in Appendix A of this

report.

All of the verication results support the overall ndings of this report that the signatories met their commitments in 2018.

The audit of the randomly-selected signatory veried its reported data, and 100% of the verication testing results were

within the accepted tolerances of the measurements reported by the companies. The details of the verication results and

an update on each of these measures are presented in the full report below.

D+R International • The Energy Efficiency Market Experts 5

The Voluntary Agreement prescribes that if a service provider signatory fails to meet a procurement commitment, it shall

implement a remedial plan approved by a review panel that includes the Energy Advocates with new savings measures that

offset the extra energy associated with the set-top boxes that caused it to miss its commitment. As previously reported,

one service provider missed its procurement commitment in 2017. The review panel continues to oversee the

implementation of this party’s remedial plan that is expected before the end of 2019 to secure ongoing savings of the

required offset of more than 7 million kWh/year. The service provider will be providing quarterly updates to the review panel

until the review panel is satisfied that the required energy savings are achieved.

As part of the revised Voluntary Agreement, the largest service provider signatories committed to engage directly with their

supply chains, including component suppliers, to explore approaches in 2018 to further improve the energy efciency of

set-top boxes in all power states in advance of starting discussions in late 2019 to develop proposed Tier 4 energy levels.

These service providers had extensive meetings and engagement with key suppliers and the Energy Advocates in 2018 to

study further improvements in key components and power scaling, and expect to achieve further new efficiencies in the

2020s as a result.

Under the extension of the Voluntary Agreement, the Independent Administrator will continue to monitor these

developments and publish these annual reports through the 2021 report to be issued in 2022.

D+R International • The Energy Efficiency Market Experts 6

OVERVIEW OF THE VOLUNTARY AGREEMENT

Cable, satellite, and telco service providers offer pay television to approximately 87.1 million U.S. households using customer

premises equipment, often referred to as set-top boxes.

6

Each device contains hardware and software to receive television

programming and related services from service providers and process them for home networks, display devices, and

recording devices. The underlying delivery network and the types of service provided vary widely among service providers.

As a result, set-top boxes operate as highly specialized components, and the devices change frequently as the service

providers introduce new services.

All set-top boxes have one thing in common: they require power to operate. In aggregate, set-top boxes in the United

States consumed an estimated 32 TWh of electricity in 2012, constituting 18% of residential consumer electronics

electricity consumption and 2.2% of all residential electricity consumption.

7

To reduce the amount of energy consumed by

set-top boxes while protecting rapid innovation and timely introduction of new features, the pay television industry crafted

the Voluntary Agreement for Ongoing Improvement to the Energy Efficiency of Set-Top Boxes. The Voluntary Agreement

provides a framework for the pay television industry to deliver market-based energy efficiency gains that keep pace with

technological innovation. The signatories of the Voluntary Agreement represent all of the major pay-TV service providers,

equipment vendors, and related industry organizations in the United States. Combined, these companies provided

multichannel video service to approximately 82.1 million American households in 2018, accounting for 94.3% of the market.

8

This figure represents an increase from 93.1% in 2017, with the increase mostly attributable to the addition of the

Suddenlink systems owned by signatory Altice USA.

After extensive negotiations among the initial signatories and energy efficiency advocates, an expanded Voluntary

Agreement was launched in 2013. The Natural Resources Defense Council (NRDC), the American Council for an Energy-

Efcient Economy (ACEEE), the Appliance Standards Awareness Project (ASAP), the Consumer Technology Association

(CTA), and NCTA - The Internet & Television Association announced this expansion in December 2013. The revised Voluntary

Agreement included additional energy efciency commitments, coverage of whole-home multifunction gateway devices,

expanded provisions for transparency and accountability, and participation by energy efciency advocates in the Steering

Committee for the Voluntary Agreement.

That version of the Voluntary Agreement expired at the end of 2017. In March 2018, the signatories unanimously amended

the Voluntary Agreement and extended its term for an additional four years through the end of 2021. The revised Voluntary

Agreement includes new, more rigorous Tier 3 energy levels that will become applicable to the 90% procurement

commitment in 2020. The signatories have estimated that these new levels are 20% more efcient, on average, than

the current Tier 2 levels and will save consumers an additional $600 million annually once the benets of the Tier 3

commitments are fully realized. Service providers have demonstrated they are already on track to meet these Tier 3

commitments, with 78.1% of devices procured in 2018 meeting Tier 3 levels two years early, according to D+R’s calculations

which are supported by verication testing. The four largest service provider signatories also agreed to engage directly with

their supply chains, including component suppliers, to explore approaches to further improve the energy efciency of set-

top boxes in all power states in advance of starting discussions in late 2019 to develop proposed levels for a Tier 4. These

service providers had extensive meetings and engagement with key suppliers and the Energy Advocates in 2018 to study

further improvements in key components and power scaling, and expect to achieve further new efficiencies in the 2020s as

a result.

6 - Based on data provided by NCTA and CTA.

7 - Bryan Urban; Victora Shmakova; Brian Lim; Kurt Roth, Energy Consumption of Consumer Electronics in U.S. Homes in 2013, Final Report to the Consumer Electronics

Association (CEA

®

), Fraunhofer USA Center for Sustainable Energy Systems (2014). This report estimated 31 TWh of use in 2013, which is consistent with the annual report’s

estimate of ongoing declines under the Voluntary Agreement since set-top boxes used 32 TWh in 2012.

8 - See supra note 6.

D+R International • The Energy Efficiency Market Experts 7

Voluntary Agreement Objectives

The primary objective of the Voluntary Agreement is to continue improvements in the energy efciency of set-top boxes

without jeopardizing their intended uses and functionalities. Further, energy efciency improvements are expected to

preserve or enhance the customer experience and be sufciently exible to adapt to technological innovations and market

competition, while also improving functionality, offering service enhancements, and fostering rapid innovation.

The signatories originally estimated that consumers would save at least $1 billion annually in energy costs several years

after the 2017 effective date of Tier 2, once Tier 2 set-top boxes had largely replaced the set-top boxes in use in 2012. That

objective has been surpassed, with more than $1.6 billion in annual savings estimated in 2018.

9

These 2018 energy savings

exceed the power generated by four typical 500 megawatt coal-run power plants

10

annually and will avoid 8.9 million metric

tons of CO

2

emissions per year.

11

Voluntary Agreement Signatories and Steering Committee

The current signatories and participants in the Voluntary Agreement are listed below. Each of these entities participates in

the Steering Committee.

Energy Efficiency Advocates

• American Council for an Energy-Efcient Economy (ACEEE)

• Natural Resources Defense Council (NRDC)

Cable Service Providers

• Altice

• Charter

• Comcast

• Cox Communications

Satellite Service Providers

• AT&T/DIRECTV

• DISH Network

Telco Service Providers

• AT&T

• CenturyLink

• Frontier

• Verizon

9 - See supra note 2. This calculation is based on national average

energy cost of $0.1289 per kWh. See U.S. Energy Information Administration, Electric Power Monthly,

available at https://www.eia.gov/outlooks/steo/report/electricity.cfm.

10 - See supra note 1. A common unit in measuring energy efficiency savings is the “Rosenfeld” (3 terawatt hours per year), the same amount of electricity generated by a

conventional 500 megawatt coal-run power plant. See https://www.scientificamerican.com/article/rosenfeld-energy-savings/.

11 - See supra note 3. Emission reduction estimates in this report are based on the U.S. Environmental Protection Agency’s Greenhouse Gas Equivalencies Calculator, available

at https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator.

D+R International • The Energy Efficiency Market Experts 8

Other Organizations

• ARRIS

• Technicolor

• NCTA – The Internet & Television Association

• Consumer Technology Association (CTA)

• Cable Television Laboratories (CableLabs)

Effective January 1, 2019, Altice USA (the parent company of the original signatory Cablevision) joined the Voluntary

Agreement, which had the effect of bringing into the Voluntary Agreement the cable systems operated by another of Altice’s

subsidiaries, Suddenlink Communications in addition to its Cablevision/Optimum system that already participated in the

Agreement. Suddenlink was previously the largest non-participating pay-TV provider in the United States, so its admission

has meaningfully increased the percentage of U.S. consumers covered by the Agreement to more than 94%. Suddenlink’s

systems previously used a different mix of set-top boxes than Altice’s Cablevision system, but in connection with its entry

into the Agreement, Altice committed to accelerate the deployment in its Suddenlink systems of the more energy-efcient

equipment used in its Cablevision system.

The composition of the Steering Committee allows the Voluntary Agreement to offer a multi-stakeholder approach while

permitting rapid adjustments as the technology landscape changes.

In 2018, in accordance with their commitments, representatives of the signatories provided updates to state and federal

regulators and other stakeholders regarding the ongoing execution of the Voluntary Agreement.

Additional responsibilities of the Steering Committee include the following:

• Managing the Voluntary Agreement

• Hiring the Independent Administrator

• Reviewing proposals for energy allowances based on new features, which the Steering Committee can

approve, reject, or add to the Voluntary Agreement, as appropriate

• Evaluating the effectiveness of the Voluntary Agreement in achieving its purposes

• Adopting new or revised efciency measures, courses of action, and amendments to the Voluntary Agreement

as technologies advance

In accordance with their obligations under the Voluntary Agreement, CTA and NCTA provided the following two reports to

the Independent Administrator for 2018:

• The estimated total number of U.S. residential multichannel video subscribers and the number served by

service providers participating in the Voluntary Agreement during the reporting period (due by April 1 of each

year, beginning in 2014).

• Information on progress with respect to other energy efciency commitments (due by May 1 of each year,

beginning in 2014).

D+R International • The Energy Efficiency Market Experts 9

Service Provider Commitments

The primary service provider commitment is that at least 90% of its set-top box purchases will meet specied energy

efciency levels. The original levels were replaced by a more rigorous Tier 2 set of levels for devices purchased after

December 31, 2016. This is the second annual report in which the Tier 2 levels were in effect. Progress on these

commitments is discussed in Report on Procurement Commitments, below. Service providers also made commitments

relating to automatic power down, whole-home systems, engagement with the Energy Advocates and key vendors to

explore approaches to further improve the energy efciency of set-top boxes in all power states in the 2020s, a report

on additional satellite-delivery customer premises equipment, and public posting of energy efciency information for

consumers. Additional information on these commitments is outlined in Progress on Other Energy Efciency Commitments,

below. All service provider commitments are outlined in Appendix A.

Independent Administrator and Auditor Role

The Voluntary Agreement obligates the Steering Committee to designate an Independent Administrator and an Independent

Auditor. The Steering Committee designated D+R as the Independent Administrator and Auditor in 2013. D+R has continued

in this role since its appointment. Under the Voluntary Agreement, the Independent Administrator must aggregate and

compile condential procurement data submitted by service providers and assess whether there is substantial compliance

with the service provider commitments. If these commitments are not met, the Independent Administrator initiates a

remedial process following the procedures set out in the Voluntary Agreement. The Independent Administrator is required to

publish its ndings in an annual report. This is the sixth annual report. D+R is also required to conduct a random audit of one

service provider’s procurement gures each year. The 2018 audit report presented in Appendix D concluded that the service

provider data supported this report’s conclusion of substantial compliance with its commitments.

New Feature Allowances

The Tier 2 levels were adopted in 2013, long before they rst became effective in 2017. To assure that the Voluntary

Agreement did not deprive consumers of the benets of innovation, the Tier 2 program includes a process for establishing

allowances for new energy-efcient features. This process enables new features to be deployed without advance notice or

permission, so that companies can secure the competitive benets of rst-mover advantages and so that consumers are

not delayed from accessing new features. At the same time, the process assures that such new features are promptly and

transparently brought within the bounds of the Voluntary Agreement’s commitments to energy efciency.

If a service provider deploys a set-top box that includes a new feature with no allowance, and the presence of the feature

causes the set-top box to exceed the allowable TEC, the new feature process permits the service provider to set and report

an appropriate initial allowance based upon its best estimate of the amount of energy consumed by the new feature. One

new feature allowance was proposed in 2019, for set-top boxes with embedded cable modems with up to twenty-four

downstream DOCSIS channels (the current allowance covers up to eight downstream channels). The Steering Committee

has convened a subcommittee to review this allowance and has indicated that it intends to establish an initial allowance and

effective date by the end of this year.

D+R International • The Energy Efficiency Market Experts 10

INCREASED ENERGY EFFICIENCY OF SETTOP BOXES

Table 1 highlights the progress made by the signatories in improving the energy efciency for each set-top box product

category.

Table 1: Weighted Average Typical Energy Consumption for Major Set-Top Box Categories

Category

TEC (kWh/yr)

Percent Change in Weighted Average

Pre-VA

(Existing

Stock)

Procurement Data

Weighted Average

Weighted

Average

2013 2014 2015 2016 2017 2018

2012 to

2018

2013 to

2018

2014 to

2018

2015 to

2018

2016

to 2018

2017 to

2018

DVR 267 195.37 179.39 170.61 161.28 142.90 138.71 -48% -29% -23% -19% -14% -3%

Non-DVR 119 108.55 103.27 92.57 85.61 90.83 91.76 -23% -15% -11% -1% 7% 1%

Thin Client 90 51.42 49.98 49.13 46.91 44.33 45.39 -50% -12% -9% -8% -3% 2%

DTA

a

39 57.60 49.26 46.50 49.91 54.86 55.85 43% -3% 13% 20% 12% 2%

a

While the increase in DTA power has previously been explained by the addition of HD and advanced video processing (AVP) capabilities after 2012, the continued increases in

recent years and the fact that only 71% of 2018 DTA purchases met Tier 2 could potentially be a cause for concern if DTA purchases were continuing at high levels. However,

DTA purchases have declined by 95%, from 9.2 million in 2015 to 427,480 in 2018. Since DTAs use relatively little power and are being purchased only in small and declining

quantities, the change in new DTA power has only a very small effect on national energy consumption.

The continuation in 2018 of the small increase in energy consumption in the non-DVR category seen in 2017 after the

downward trend in previous years is likely attributable to new functionalities such as Ultra High Denition 4K Video, High

Efciency Video Processing, and multiple tuners to stream live video to client devices.

One service provider, Altice (the parent company of Cablevision), reported the purchase of a single model of a multi-service

gateway in 2017 and 2018 that met the applicable Tier 2 levels, as noted in Appendix B. The multi-service gateway category

is excluded from the above table because there is no baseline with which to compare these devices and no change

between 2017 and 2018 since the model is the same. In accordance with the condentiality requirements of the Voluntary

Agreement, this report also excludes multi-service gateways from all calculations showing the number of units purchased

by category because that gure would reveal Altice’s individual purchase gures.

12

The model is reported in Appendix B

and meets the applicable Tier 2 levels, and the relatively small quantity purchased would not have a material impact on this

report’s assessment of the overall national energy consumption of set-top boxes.

REPORT ON PROCUREMENT COMMITMENTS

Under the Voluntary Agreement, the service providers committed that 90% of set-top boxes they purchased after December

31, 2016 would meet the Tier 2 efciency levels. This is the second year in which this Tier 2 procurement commitment has

been evaluated, and the fth year in which the procurement commitment is in force. All service providers that signed the

Voluntary Agreement submitted procurement data for 2018 on time. These providers are: Altice, AT&T (separately for AT&T/

DIRECTV and its U-verse telco services), Charter, Comcast, Cox, CenturyLink, DISH, Frontier, and Verizon. Details about

the set-top boxes purchased by these providers are shown in Appendix B. 97.7% of the set-top boxes purchased by these

service providers met the Tier 2 commitment, as shown in Table 2 below.

12 - Section 8.6 of the Voluntary Agreement seeks to protect the condentiality of Altice’s procurement gures by precluding this report from disclosing the number of Multi-

Service Gateway units it purchased in 2018, which could readily be deduced if a total national gure were reported.

D+R International • The Energy Efficiency Market Experts 11

Table 2: Voluntary Agreement Signatory Set-Top Box Procurement 2018

Category

Units

Percent

Meeting Tier 2

Total Procured

Number

Meeting Tier 2

a

DVR 6,304,346 6,133,497 97.3%

Non-DVR 10,066,928 9,837,380 97.7%

Thin Client 6,316,550 6,316,550 100.0%

DTA 427,480 302,400 70.7%

Totals 23,115,304 22,589,827 97.7%

a

In 2018, all reported Multi-Service Gateway devices met Tier 2 levels.

All service providers met the Voluntary Agreement procurement commitment in 2018.

The service provider that missed its 2017 procurement proposed a remedial plan to offset the extra energy associated

with its 2017 deployments that exceeded the commitment level, as required by the Agreement.

13

D+R calculated that

the provider needs to offset more than 7 million kWh/year under this standard. Remediation plans must be approved by

a unanimous vote of a review panel that includes the Energy Advocates and the two trade association members of the

Steering Committee. The service provider’s rst remediation proposal was not accepted, but its second proposal was

unanimously approved and remediation efforts remain ongoing under the plan. The service provider will be providing

quarterly updates to the review panel until the energy savings target is achieved, which it expects to occur by the end of

2019. Further details of the plan are not included in this report because they would reveal the identity of the service provider.

IMPACT ON NATIONAL ENERGY CONSUMPTION

In 2012, service providers began working with energy efciency advocates to estimate the energy consumption of set-top

boxes and the number of units installed in subscriber households. Using service provider and energy efciency advocate

reports and data on product trends, the signatories developed the base case shown in Table 3, representing the market in

2012.

Table 3: Base Case – 2012 Estimated Energy Consumption

Segment Category

TEC Units

National Energy

Consumption

500 MW

Power Plant

Equivalents

kWh/yr Millions TWh/yr Rosenfelds

Cable DVR 282 27 7.5 2.5

Non-DVR 139 57 7.9 2.6

Thin Client 90 2 0.1 0.0

DTA 39 33 1.3 0.4

Satellite DVR 283 21 5.9 2.0

Non-DVR 110 58 6.4 2.1

Telco DVR 140 6 0.8 0.3

Non-DVR 90 21 1.9 0.6

U.S. Total - 225 32 10.6

13 - As previously reported, one service provider fell short of its procurement commitment in 2017, with only 71% of its purchases meeting Tier 2 due to a delay in the availability

of its Tier 2 solution until after the start of 2017.

D+R International • The Energy Efficiency Market Experts 12

To gauge the Voluntary Agreement’s impact on energy consumption at the national level, D+R estimates energy savings

over the base case. The rst step is to estimate changes in set-top box stock levels. Under the terms of the Voluntary

Agreement, D+R does not collect a census of deployed legacy equipment. Instead, it has employed a model that assumes

that newly purchased devices generally replace older (less energy-efcient) and broken equipment from the same category

rather than add to total deployed stock.

14

However, the total deployed stock estimate is adjusted to account for changes in

subscriber levels as shown in Table 4 below.

Table 4: Change in Subscribers from 2012-2018

Segment

Percent Change

a

2012

to 2013

2013

to 2014

2014

to 2015

2015

to 2016

2016

to 2017

2017

to 2018

2012

to 2018

Cable -4.5% -0.3% -0.5% -1.7% -3.7% -2.2% -12.3%

Satellite 1.0% 0.1% -1.9% 3.0% -9.2% -7.5% -14.3%

Telco 25.4% 8.2% -0.9% -20.9% 2.0% -3.5% 4.7%

a

Based on data provided by the Steering Committee (for 2012) and service providers (for 2013-2018).

As a result of the changes in subscribership levels and replacement assumptions, D+R estimates total stock levels as

shown in Table 5.

Table 5: Estimates of Total Deployed Units in the Market in 2013-2018

Category

Units

2013

a

2014

a

2015

a

2016

a

2017

a,b

2018

a,b

DVR 54,038,000 54,599,000 53,890,000 52,674,000 49,892,000 47,672,000

Non-DVR 130,344,000 122,650,000 112,668,000 96,327,000 92,563,000 89,139,000

Thin Client 10,561,000 20,299,000 28,774,000 39,784,000 34,958,000 32,447,000

DTA 31,633,000 31,543,000 31,396,000 30,866,000 29,722,000 29,074,000

Total 226,576,000 229,092,000 226,727,000 219,651,000 207,135,000 198,331,000

a

Units are rounded for this table, but D+R did not round any gures when calculating the national footprint estimate.

b

Altice’s Multi-Service Gateways purchased in 2017 and 2018 are excluded from this table. See supra note 12.

The next step in estimating national energy consumption is to account for products procured in 2018. The signatories

purchased nearly 10 million fewer set-top boxes in 2018 than in 2017, likely due at least in part to a decline in subscribership

and also to the increasing prevalence and usage of options for customers to watch their programming without a set-top

box, as discussed below. D+R subtracts 2018 set-top box procurements from the total units listed in Table 6, using the new

replacement assumptions described above. This methodology yields multiple sets of stock – one for each purchase year –

each with its own weighted average TEC values. The weighted average TEC values for each of the purchase year sets are

shown in Figure 1.

14 - From 2013 to 2016, purchases of thin clients were assumed to replace non-DVRs since this category was relatively new to the market. It is now more reasonable to assume

that thin clients are generally replacing like devices, rather than non-DVRs, since the earlier generations of these categories of set-top boxes have reached replacement age.

D+R International • The Energy Efficiency Market Experts 13

Figure 1: Distribution of Current Inventory by Year of Procurement (Percentage of Units)

100%

DTA

Thin Client

Non-DVR

DVR

2015 Shipments

2013 Shipments

2017 Shipments

0% 20% 40% 60% 80% 100%

10% 30% 50% 70% 90%

2016 Shipments

Pre-VA Existing Stock2014 Shipments

2018 Shipments

Multiplying the number of units purchased each year that still remained in the eld at the end of 2018 and the average TEC

for that category of device at the time of its purchase produces the estimated national energy consumption shown in Table

6. Table 7 displays this calculation year over year for the lifetime of the VA.

D+R International • The Energy Efficiency Market Experts 14

Table 6: National Energy Consumption for Devices Based Upon Year of Purchase

Category

Pre-VA

(before

2013)

2013 2014 2015 2016 2017 2018

2018 National

Energy Consumption

(TWh/yr)

DVR Purchases from Each

Year Remaining in Field

0 0 10,207,886 11,671,180 11,219,933 8,268,205 6,304,346

DVR TEC Average (kWh/yr) 267.0 195.4 179.4 170.6 161.3 142.9 138.7 7.7

Non-DVR Purchases from

Each Year Remaining in

Field

10,162,478 12,360,006 18,646,064 10,977,499 11,535,694 15,390,556 10,066,928

Non-DVR TEC Average

(kWh/yr)

119.0 108.6 103.3 92.6 85.6 90.8 91.8 8.8

Thin Client Purchases from

Each Year Remaining in

Field

0 0 0 6,832,030 11,010,506 8,287,414 6,316,550

Thin Client TEC Average

(kWh/yr)

90.0 51.4 50.0 49.1 46.9 44.3 45.4 1.5

DTA Purchases from Each

Year Remaining in Field

6,771,048 1,334,238 5,201,332 9,169,913 4,831,980 1,337,930 427,480

DTA TEC Average (kWh/yr) 39.0 57.6 49.3 46.5 49.9 54.9 55.8 1.4

Total 2018 National Energy Consumption (TWh/yr) 19.4

Table 7: National Energy Consumption of Installed Set-Top Boxes 2012-2018

2012 (Pre-VA) 2013 2014 2015 2016 2017 2018

Estimate of Total Deployed

Units in the Market

225,000,000 226,576,000 229,092,000 226,727,000 219,651,000 207,135,000 198,331,000

National Energy Consumed

(TWh/yr)

32.0 30.6 29.2 26.9 24.5 21.0 19.4

500 MW Power Plant

Equivalents (Rosenfelds)

10.67 10.20 9.73 8.97 8.17 7.00 6.47

CO

2

Emitted

(Metric Tons)

22,628,832 21,638,821 20,648,809 19,022,362 17,325,200 14,850,171 13,718,729

These improvements in energy efficiency spurred by the Voluntary Agreement have had an increasingly significant role in

reducing national energy consumption. The Voluntary Agreement reduced national set-top box energy consumption from

32 TWh/year in 2012 to 19.4 TWh/year in 2018, which is a reduction of 39%. This 12.6 TWh reduction represents

consumer savings of over $1.6 billion

15

and avoidance of 8.9 million metric tons of CO

2

in 2018 alone.

16

During the six

years of the Voluntary Agreement, cumulative energy consumption has been reduced by an estimated 40.4 TWh, saving

consumers approximately $5.15 billion and avoiding 28.6 million metric tons of CO

2

emissions.

15 - See supra note 2.

16 -

See supra note 3.

D+R International • The Energy Efficiency Market Experts 15

AU

DIT AND VERIFICATION

Procurement Audit

D+R is required to conduct an audit of one randomly-selected service provider’s procurement gures each year. The audit

report for the 2018 reporting year is presented in Appendix D. D+R determined that the data submitted by the service

provider for the audit is consistent with the annual report submitted by that service provider.

Verification Testing

2018 marks the rst year in which lab verication testing replaced the historical eld verication testing program. The

objective of lab verication testing is to compare tested energy usage determined by an accredited, independent third party

to the modal power and annual energy use values reported by the service providers to the Independent Administrator and

to the energy levels applicable to the procurement commitment. The verication testing program requires the Independent

Administrator to randomly select one model from each category of set-top boxes reported by service providers to be tested

by an accredited third-party approved by the Steering Committee, or under a supervised signatory testing program with an

accredited observer approved by the Steering Committee. As demonstrated below, the 2018 test results submitted by

service providers to D+R confirmed that the energy usage of service providers’ set-top boxes observed by the independent

third parties is consistent with the energy information provided to consumers and is in substantial compliance with the

procurement commitments of the Voluntary Agreement.

The verication test results are measured in two ways: against the Voluntary Agreement’s energy allowances and also

against the energy levels reported by the service providers. The rst measurement assures compliance with the Voluntary

Agreement’s procurement commitment, and the second assures the accuracy of the savings calculations included in this

report, as well as the accuracy of gures reported to consumers. One hundred percent (100%) of tested set-top boxes

measured within the applicable Tier 2 energy efciency levels, and one hundred percent (100%) of the devices tested were

at or below the values reported by service providers, with the applicable tolerance levels applied.

The TEC measured across all verication tests performed in 2018 was 8.84 kWh/year less than the TEC levels reported by

the service providers, compared to 5.52 kWh/year less in 2017 eld verication results. These test results corroborate the

energy savings calculations to be included in the Independent Administrator’s annual report because they suggest that the

actual energy usage of the new-model set-top boxes in the home are, on average, less than have been reported by the

service providers.

D+R International • The Energy Efficiency Market Experts 16

PROGRESS ON OTHER ENERGY EFFICIENCY COMMITMENTS

The Voluntary Agreement established other energy efciency commitments, some of which are specic to certain industries

or providers.

Whole-Home Systems

Whole-home set-top boxes use home network interfaces (HNIs) to share content with other video client devices over a high-

bandwidth home network. HNIs can provide the following functions while consuming a fraction of the energy required by

stand-alone fully-featured set-top boxes with built-in tuners and DVRs:

• Shared DVR functionality to set-top boxes without DVR capability

• Transcoding to serve a variety of customer-owned video devices

• Channel tuning capabilities to thin client devices that do not need to connect directly to the service provider’s

headend

The satellite signatories committed to make energy-efcient whole-home servers and clients available to all new and existing

subscribers in 2013, and since then AT&T/DIRECTV and DISH have offered nationwide availability of their DIRECTV “Genie”

(https://www.att.com/directv/experience/genie.html) and DISH “Hopper” and “Joey” (https://www.dish.com/equipment/

dvrs/hopper-3/#) whole-home DVR servers and clients, and these energy-saving devices have been widely adopted by

consumers. These congurations continue to become even more energy-efcient. The EPA ENERGY STAR program has

noted the efciency of whole-home architectures, stating that households “can experience signicant energy savings

through the deployment of multi-room thin-client devices in homes that are currently served by two or three high-power

STBs with DVR functionality.”

17

AT&T (with respect to its U-verse services), CenturyLink, Frontier, and Verizon continued to meet their commitment that

energy-efcient whole-home architectures will be available to all new and existing subscribers. Whole-home architectures

serve content to multiple remote or client devices within a consumer’s home more efciently than congurations involving

multiple DVR set-top boxes throughout the home.

Although not required by the Voluntary Agreement, cable operators have also deployed new whole-home solutions.

Comcast customers can use the whole-home capabilities of a single X1 DVR to perform recording and playback functions

from their non-DVRs rather than needing additional DVRs. Cox continues to employ a similar arrangement in a majority of its

New Contour installations. Altice has eliminated DVR hard disk drives in the home altogether for new installations through

the use of cloud DVR services available to all of its set-top boxes within the home.

The successful implementation of whole-home DVRs or cloud DVR in most of the signatories’ systems has likely

contributed to a decline in the purchases of new DVRs over the past two years. From 2013 through 2016, the signatories

purchased between 11.2 and 12.7 million DVRs annually. In the early years of whole-home DVR, the decline in the number of

DVRs deployed per DVR household was at least partly offset by increased demand for DVR functionality. However, with DVR

adoption now more mature and stable, DVR purchases declined to 8.3 million in 2017 and 6.3 million in 2018. While new

DVRs in 2018 are much more energy-efcient than in 2012 (using 48% less power as calculated above), DVRs with hard-

drives are still the most energy-intensive set-top boxes in a home, so their replacement with non-DVRs, thin clients or apps

saves even more energy.

17 - U.S. Environmental Protection Agency, Set-Top Boxes, available at https://www.energystar.gov/products/electronics/set_top_boxes_cable_boxes.

D+R International • The Energy Efficiency Market Experts 17

Consumer Access to Energy Efficiency Information

All service providers committed to provide subscribers and potential customers with reasonable access to energy efciency

information for set-top boxes purchased since January 1, 2014. This information makes it easier for consumers to learn about

energy-efcient set-top boxes and typical set-top box energy consumption. This information has been posted on company

websites since 2014. In 2015, service providers worked to enhance the accessibility of such information on their websites,

for example by optimizing related terms in their search tools. D+R annually conrms that this information is readily available

to the public from the links listed in Appendix C of this report. D+R again reviewed all links provided by the signatories to

ensure that they still worked and presented the required information. When the service provider website did not contain

all of the required information, D+R reached out to the relevant company to update the information, and then conrmed

that the update was made. To make the information even more readily accessible, in 2016, the signatories published a new

website, www.energy-efciency.us, which offers a single site from which the public may conveniently link to each provider’s

information, the Independent Administrator’s annual reports, the Voluntary Agreement, and related news and information.

Next-Generation Video Delivery

The four largest service provider signatories committed to continue to engage with the Energy Advocates, the manufacturer

signatories, component suppliers and software developers to explore approaches to further improve the energy efciency

of set-top boxes in all power states, with a special emphasis on efciencies in standby power, while preserving a good

consumer experience. The cable operators committed, as they had under the prior version of the Voluntary Agreement

adopted in 2013, to continue to work with suppliers to develop specications for new model set-top boxes that operate

in a reduced power consumption mode while still functioning with cable system architectures and meeting consumer

expectations for quick start-up time and functionality.

The efforts undertaken to date under the Voluntary Agreement to reduce set-top box power in standby modes have

contributed to signicant improvements in energy efciency, though not always in the ways that were initially envisioned.

Pursuant to their 2013 commitments, the cable operators attempted to develop “deep sleep” modes in which most

functionalities were turned off, with a goal of reducing power draw to approximately three watts or less. Trials of set-top

boxes in these deep sleep modes were unsuccessful because of the intolerable length of time for the devices to wake

and display video services. When the time required to wake devices from deeper sleep modes is too long, dissatised

customers seek to disable sleep modes altogether. However, associated development efforts led to improved abilities to

tailor and reduce power usage for various functions even when the set-top box is turned on. As a result, the power usage

of newer model set-top boxes in all modes has declined signicantly since adoption of the initial Voluntary Agreement. The

cable operators had extensive meetings and engagement with key suppliers in 2018 to build upon these developments, and

expect to achieve further new efciencies in the 2020s as a result.

D+R International • The Energy Efficiency Market Experts 18

The revised Voluntary Agreement also recognized emerging technology changes in the video marketplace by providing that

in addition or in the alternative to the above power scaling commitment, cable operators may pursue strategies to reduce

the overall energy usage in typical homes through other means such as IP delivery or architectures that reduce the number

of operator-supplied devices in the home. Charter now offers low-power Apple TV IP devices as one of its equipment

options.

18

Comcast and Cox now offer very low-power IP set-top boxes; these devices currently must be connected to

a higher-powered, fully-featured set-top box in the home, but in the future will instead be able to connect directly to the

customer’s Internet router when the companies complete their transitions to all-IP delivery. This migration to IP will therefore

eliminate a higher-powered set-top box from the home. Altice offers a multi-service gateway that combines the modem,

Wi-Fi router, primary cable set-top box and telephone adapter all into a single device that uses much less energy than its

features would as separate devices. As detailed in the next section, all of the service provider signatories are supporting

apps that enable customers to access live and on-demand content on a screen such as a television or tablet without any

operator-supplied set-top box. The cable operators are committed to continuing to pursue these strategies that improve the

overall energy efciency in the delivery of their services.

Automatic Power Down

Automatic power down (APD) monitors parameters related to viewing and user activity. If the parameters indicate that no

user activity or viewing is occurring, APD enables the device to transition to sleep mode. For example, DIRECTV’s HR54-700

Genie Whole Home DVR APD implementation reduces power by approximately 10%, from 12.10W in on mode to 11.01W

in APD mode. The satellite signatories committed that, effective January 1, 2013, at least 90% of new set-top boxes will

include an “Automatic Power Down” (APD) feature with a default value of four hours or less. In 2018, 100% of the set-top

boxes purchased by DISH and AT&T/DIRECTV met this requirement.

Satellite Study on Residential Premises Equipment

The satellite service providers completed their commitment to prepare a joint study on the energy use of all additional

residential premises equipment that they deploy to support their multichannel video services. The study was rst presented

to the Energy Advocates and then to the Steering Committee. The study evaluated the energy usage of outdoor units

(ODUs), low noise block downconverters (LNBs), multi-switches, broadband converters, video wireless access points

(VWAPs), and wireless video bridges (WVBs). The Energy Advocates and satellite service providers discussed approaches

that reduce the energy footprint of a satellite installation by streamlining the number of separate power-drawing devices in

the home, such as:

• Multi-switch devices, which have been needed to support multiple direct connections of more than three set-

top boxes to a single ODU, have been phased out of most new installations because thin clients can be

connected to the whole-home set-top box rather than to the ODU, and also because the satellite service

providers have integrated RF switching into their LNBs.

• Broadband converters have been used to interface with the customer’s home network to deliver on-demand

services to the set-top box. Newer set-top box models have integrated MoCA (Multimedia Over Coax) and Wi-

Fi which eliminates the need for these separate devices in most homes.

• Wireless video bridges are occasionally used to enable thin clients to be connected to the whole-home set-top

box via Wi-Fi. AT&T/DIRECTV integrated this capability into its newest whole-home DVR model, eliminating the

need for a separate bridge device.

18 - This offering started in 2019 so Apple TV is not listed in Table 10, but will be in the next report.

D+R International • The Energy Efficiency Market Experts 19

The study found that the aggregate energy use of additional premises equipment is trending downwards due to the

phase-out of these equipment types, as well as the decreasing number of satellite subscribers. The Energy Advocates and

satellite service providers also discussed measures that generally guard against continued power draw by this equipment

after the discontinuance of services.

VIEWING WITHOUT OPERATORSUPPLIED SETTOP BOXES

All of the service provider signatories are continuing to enable their customers to watch video programming without the

use of operator-supplied set-top boxes through their support of apps. These apps can be used on hundreds of millions

of consumer-owned Internet-connected devices, such as smartphones, tablets, personal computers, select Smart TVs,

game consoles, and streaming devices such as Apple TV, Roku, Google Chromecast and Amazon Fire. Nearly all U.S. TV

households have at least one of these devices,

19

and three-quarters can stream video to their televisions.

20

The service providers reported that consumers used more than 36 million of these customer-owned and managed devices

to access the providers’ video services via apps in 2018, up by 33% from 27 million in 2017.

21

Table 8 lists the supported

TV and other platforms and devices used by consumers to view each service provider’s content using its app without an

operator-supplied set-top boxes in 2018. The table indicates whether the service provider’s app on each platform supports

access to linear (live TV) content, on demand content, and/or recording capability, which are among the features that help

make apps an attractive alternative to a set-top box. The service provider signatories are continuing to work to enhance the

functionality of their apps such as through new support for cloud DVR offerings, and investing in customer education and

employee training to promote the use and awareness of apps.

19 - Nielson, The Nielsen Total Audience Report Q3 2018 (2019), available at

https://www.nielsen.com/us/en/insights/2019/q3-2018-total-audience-report/#.

20 - Jeff Baumgartner, Study: 74% of U.S. TV Homes Have at Least One Connected TV Device (Jun. 2018), available at

https://www.multichannel.com/blog/study-74-u-s-tv-homes-have-at-least-one-connected-tv-device (includes Smart TVs and TVs connected to the Internet with a connected device).

21 - The 2017 gure has been revised from the original version of D+R’s prior report to better reect actual customer usage of devices to watch video, and the 2018 gure is

based on the same revised methodology.

D+R International • The Energy Efficiency Market Experts 20

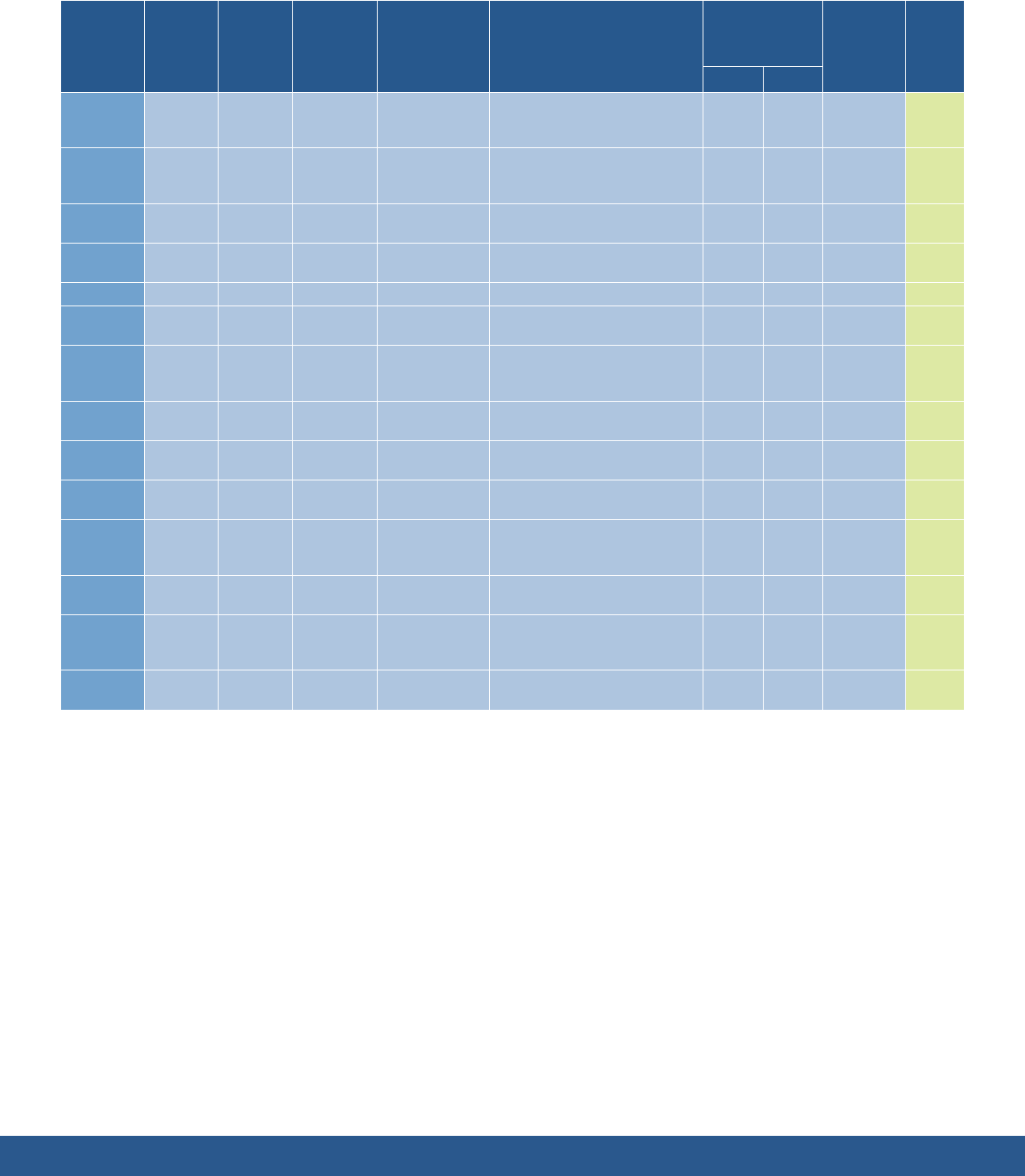

Table 8: Platforms and Apps Used by Customers to View Content Without Set-Top Boxes

Service Provider Platform App Name

Live TV

(YES/NO)

On-Demand

(YES/NO)

DVR

(YES/NO)

Altice

Amazon Kindle

Fire HD

Optimum Yes Yes No

Android Optimum Yes Yes No

Apple iOS Optimum Yes Yes No

PC Optimum Yes Yes No

AT&T/DIRECTV

Android TV DIRECTV Now Yes Yes Yes

Apple TV DIRECTV Now Yes Yes Yes

Google

Chromecast

DIRECTV Now Yes Yes Yes

Roku DIRECTV Now Yes Yes Yes

Roku TV DIRECTV Now Yes Yes Yes

Samsung TV DIRECTV Now Yes Yes Yes

Amazon Kindle

Fire HD

DIRECTV, U-Verse Yes Yes Yes

Android DIRECTV, U-Verse, DIRECTV Now Yes Yes Yes

Apple iOS DIRECTV, U-Verse, DIRECTV Now Yes Yes Yes

MAC DIRECTV, U-Verse, DIRECTV Now Yes Yes Yes

PC DIRECTV, U-Verse, DIRECTV Now Yes Yes Yes

Amazon Fire TV U-Verse, DIRECTV Now Yes Yes No

CenturyLink

Amazon Kindle

Fire HD

Prism TV app Yes Yes No

Android Prism TV app Yes Yes No

Apple iOS Prism TV app Yes Yes No

Roku Prism TV app Yes Yes No

Roku TV Prism TV app Yes Yes No

Charter

Android Spectrum TV Yes Yes No

Apple iOS Spectrum TV Yes Yes No

Roku Spectrum TV Yes Yes No

Roku TV Spectrum TV Yes Yes No

Samsung TV Spectrum TV Yes Yes No

Xbox One Spectrum TV Yes Yes No

MAC Spectrum.net Yes Yes No

PC Spectrum.net Yes Yes No

Comcast

Amazon Kindle

Fire HD

Stream Yes Yes Yes

Android Stream Yes Yes Yes

Apple iOS Stream Yes Yes Yes

MAC Stream Yes Yes Yes

PC Stream Yes Yes Yes

Roku Stream Yes Yes Yes

Samsung TV Stream Yes Yes Yes

Cox

Amazon Kindle

Fire HD

Contour Yes Yes No

Android Contour Yes Yes No

Apple iOS Contour Yes Yes No

Mac Contour Yes Yes No

PC Contour Yes Yes No

D+R International • The Energy Efficiency Market Experts 21

Table 8: Platforms and Apps Used by Customers to View Content Without Set-Top Boxes (cont.)

Service Provider Platform App Name

Live TV

(YES/NO)

On-Demand

(YES/NO)

DVR

(YES/NO)

DISH

Amazon Kindle

Fire HD

DISH Anywhere Yes Yes Yes

Apple iOS DISH Anywhere Yes Yes Yes

Android DISH Anywhere, SlingTV Yes Yes Yes

MAC DISHAnywhere.com, SlingTV Yes Yes Yes

PC DISHAnywhere.com, SlingTV Yes Yes Yes

Amazon Fire TV SlingTV Yes Yes Yes

Android TV SlingTV Yes Yes Yes

Apple TV SlingTV Yes Yes Yes

Google

Chromecast

SlingTV Yes Yes Yes

LG TV SlingTV Yes Yes Yes

Roku SlingTV Yes Yes Yes

Roku TV SlingTV Yes Yes Yes

Samsung TV SlingTV Yes Yes Yes

Xbox One SlingTV Yes Yes Yes

Frontier

Android FrontierTV Yes Yes Yes

Apple iOS FrontierTV Yes Yes Yes

PC FrontierTV Yes Yes Yes

Verizon

Amazon Kindle

Fire HD

Fios TV Yes Yes Yes

Android Fios TV Yes Yes Yes

Apple iOS Fios TV Yes Yes Yes

MAC tv.verizon.com Yes No No

PC tv.verizon.com Yes Yes No

Number of unique customer owned and managed

devices that have accessed video services via apps during

Reporting Period

36,532,394

D+R International • The Energy Efficiency Market Experts 22

The impact of consumer adoption of pay-TV apps on set-top box energy usage is starting to show through a precipitous

decline in operator purchases of new set-top boxes. The signatories purchased only 23 million new set-top boxes in

2018, only half of the 46 million new set-top boxes they purchased during the rst year of the Voluntary Agreement’s

commitments in 2014. While some of this reduction is due to subscriber losses and other factors, app usage can replace or

reduce demand for set-top boxes in a variety of ways. For example, the use of apps to view MVPD content on televisions

can render a set-top box unnecessary for that television. It was estimated that in 2017, for the rst time, a majority of all

streaming content is viewed on televisions rather than PCs and mobile devices.

22

One analyst concluded that “there has

been an enormous surge in the use of connected televisions” and that “[n]ew data shows many subscribers prefer the app

experience” to operator set-top boxes even on their TVs.

23

App usage on other devices can replace set-top boxes as well.

While the use of apps on mobile devices outside the home typically would expand consumer access to providers’ video

services rather than replace set-top boxes, mobile devices are also often used by consumers inside the home to watch

programming in rooms that do not have, and now do not need, a set-top box.

In addition, as of the end of 2018, approximately 4 million consumers subscribed to DISH’s SlingTV service or DIRECTV

Now service, neither of which use a service provider supplied set-top box. Cable operators have started to offer similar

services to their Internet subscribers. The energy-efficient IP streaming devices used to receive these services, which may

be purchased at retail or provided by the service provider, further reduce the overall energy used by set-top boxes.

24

22 - Conviva, All-Screen Streaming TV Census Report Q1 2018 (Apr. 2018),available at https://www.conviva.com/research/convivas-screen-streaming-tv-census-report-q1-2018.

23 - Colin Dixon, nScreenMedia, Connected TV dominates premium streamed video viewing, (Apr. 25, 2018), available at

http://www.nscreenmedia.com/conviva-streaming-tv-connected-tv-growth/ and TV Everywhere users prefer apps to operator set-top boxes (Apr. 24, 2017) available at

http://www.nscreenmedia.com/tv-everywhere-users-prefer-apps/, citing Adobe, Adobe Digital Insights 2017: The State of Digital Video (Apr. 18, 2017).

24 - This report has not attempted to estimate any incremental energy usage in service providers’ networks that may be associated with the increased use of apps to watch

video.

D+R International • The Energy Efficiency Market Experts 23

CONCLUSION

In 2018, 97.7% of set-top boxes purchased by the signatories met the Tier 2 energy efciency levels of the Voluntary

Agreement, with all service providers meeting the individual 90% commitment. As a result, the Voluntary Agreement

reduced national energy consumption of set-top boxes from 32 TWh/year in 2013 to 19.4 TWh/year in 2018, a reduction

of 39%, even as the functionality of set-top boxes increased. These savings have been conrmed year-by-year through

independent verication testing and procurement audits. The signatories are expected under the terms of the Voluntary

Agreement to continue to work toward additional savings through their implementation of Tier 3 efciency levels in 2020 and

continued efforts to improve the energy efciency of set-top boxes in all power states through ongoing engagement with

key suppliers that can lay the foundation for discussions, scheduled to begin in 2019, of possible Tier 4 energy levels in the

future.

D+R International • The Energy Efficiency Market Experts 24

APPENDIX A: VOLUNTARY AGREEMENT COMMITMENTS

Table 9 lists the commitments of the signatories of the Voluntary Agreement along with the status of the signatories’

progress toward these commitments.

Table 9: Voluntary Agreement Commitments

Commitments Group Status

90% of set-top boxes purchased after December 31, 2016 meet Tier 2. All Service

Providers

Each signatory met its 90% commitment individually.

Overall, 97.7% of set-top boxes purchased by the signatories

in 2018 met Tier 2.

Prepare annual procurement report for prior year by April 1. All Service

Providers

All service providers submitted to Independent

Administrator in 2018.

Provide energy efficiency information to subscribers and potential

subscribers of set-top boxes purchased since January 1, 2014.

All Service

Providers

D+R verified that the information is available from the

website energy-efficiency.us and company websites listed in

Appendix C, and followed up and confirmed changes with

the signatories that needed to update the information.

90% procurement of set-top boxes with automatic power down

feature.

Satellite 100% deployment in 2018.

Make whole-home servers and clients available to all new and existing

subscribers.

Satellite Offered throughout the United States 2013-2018.

Prepare joint report on energy use of all additional residential

premises equipment that they deploy to support their multichannel

video service.

Satellite The report was delivered and is summarized in this annual

report.

Work with suppliers to develop set-top boxes with next-generation

power management, and deploy such economically feasible new

models that successfully perform on a cable operator’s network

and support all of the operator’s services in its ordinary set-top box

replacement cycle. In addition to or in lieu of the foregoing efforts in

regards to traditional QAM set-top boxes, a cable operator may pursue

strategies to reduce the overall energy usage in typical homes through

other means such as IP delivery or architectures that reduce the

number of operator-supplied devices in the home.

Cable The cable operators had extensive meetings and

engagement with key suppliers in 2018 to pursue continued

improvements in energy efficiency in all power states.

Charter is offering Apple TV as one of its equipment

options. Comcast and Cox are offering very low-power IP

client devices for secondary TVs. Altice has integrated the

modem, router, and set-top box into a single device. All of

the service provider signatories are supporting apps that

enable customers to access live and on-demand content on

a screen such as a television or tablet without any operator-

supplied set-top box.

Use reasonable efforts to design and manufacture equipment to

enable improved set-top box energy efficiency while meeting the

service providers’ functional and operational specification.

Equipment

Manufacturers

Manufacturers’ efforts to date are reflected in the energy

savings reported by service providers, and there is ongoing

development of next-generation set-top boxes with lower-

power silicon solutions.

Whole home architectures will be available to all new and existing

subscribers. Whole-home architectures serve content to multiple

remote or client devices within a consumer’s home more efficiently

than configurations involving multiple DVR set-top boxes throughout

the home.

Telco Deployed throughout the United States 2014-2018.

D+R International • The Energy Efficiency Market Experts 25

APPENDIX B: SETTOP BOXES PURCHASED BY VOLUNTARY AGREEMENT

SIGNATORIES IN 2018

Table 10 lists the reported typical energy consumption (TEC) for each model of set-top box purchased by Voluntary

Agreement signatories in 2018. These values are reported TEC, rather than calculated TEC. In the Voluntary Agreement,

service providers have the option to publish a “reported TEC” that rounds up calculated TEC values for reporting purposes

to account for production variances. Modal power and reported TEC gures in this Appendix are rounded up to the next

one-tenth digit (e.g., 99.11 kWh/year would be rounded up to 99.2 kWh/year). Please note that the same model could

have variances in TEC for several reasons, including differences in reported versus calculated TEC, enabling of different

product features, and/or deployment of the device by service providers running different software. The Voluntary Agreement

calculates maximum allowable TEC for a product using the base-type allowances outlined in Table 11 and the feature

allowances outlined in Table 12. Table 12 also includes descriptions of the features abbreviated in Table 10 in the “Claimed

Allowances” column. The Voluntary Agreement sets forth rules for how to claim feature allowances, so the column for

claimed allowances lists only the features used when calculating the maximum allowable TEC for the specic product.

The template used to collect the information reported in this Appendix is posted at https://www.energy-efciency.us/library/

pdf/2018-STB-VA-Reporting-Template.xlsx. Procurement data submitted by service providers is subject to one random audit

per year and the Steering Committee has the option to direct the Independent Administrator to conduct additional audits

as necessary. An asterisk indicates models that were evaluated through third-party verication testing under the Voluntary

Agreement.

D+R International • The Energy Efficiency Market Experts 26

Table 10: Set-Top Boxes Procured by Voluntary Agreement Signatories in 2018

Service

Provider

Base

Type

Primary

Function

Brand Model No. Claimed Allowances

Modal

Characteristics

(W)

TEC

(kWh/yr)

Meets

Tier 2

On Sleep

Altice Cable

Multi-

Service

Gateway

Sagemcom DGCI384*

APD (hrs)(4), Adv Video(2), D3, HD,

Multi-room, MS, MS-A, W-HNI,

MIMO-2.4(3), MIMO-5(4), RTG,

HEVP

28.50 26.44 236.8 Yes

Altice Cable Non-DVR Sagemcom DCIWA384*

APD (hrs)(4), Adv Video(2), HD, HNI,

MS, W-HNI, MIMO-2.4(3), MIMO-

5(4), HEVP

10.88 9.05 84.0 Yes

AT&T IP DVR ARRIS VIP 2262V2

Adv Video(2), DVR, HD, HNI, S-DVR,

MS, MS-A

12.06 10.33 99.4 Yes

Charter Cable Non-DVR Humax 101H - ODN

APD (hrs)(4), Adv Video, D3, HD,

HEVP

12.86 12.47 110.1 Yes

Charter Cable DVR Humax 201H - ODN

APD (hrs)(4), Adv Video, DVR, D3,

HD, MS, MS-A, HEVP

16.17 15.63 138.7 Yes

Charter Cable Non-DVR Technicolor 101T - ODN*

APD (hrs)(4), Adv Video, D3, HD,

HEVP

13.48 12.33 111.1 Yes

Charter Cable DVR Technicolor 201T - ODN*

APD (hrs)(4), Adv Video, DVR, D3,

HD, MS, MS-A, HEVP

16.79 14.16 133.6 Yes

Charter Cable DVR Technicolor 8640HDC2 - P*

APD (hrs)(4), Adv Video, CableCARD,

DVR, D2, HD, MS

20.37 17.35 159.9 No

Charter Cable Non-DVR Technicolor 4640HDC2 - P*

APD (hrs)(4), Adv Video, CableCARD,

D2, HD

13.03 9.72 93.7 Yes

Charter Cable Non-DVR ARRIS

DCX3200M/P3 -

ODN*

APD (hrs)(4), Adv Video, CableCARD,

D2, HD, HNI, M-HNI

13.72 11.55 106.5 Yes

Charter Cable DVR ARRIS

DCX3520E -

iGuide*

Adv Video, DVR, D2, HD, MS 20.70 20.14 179.3 No

Charter Cable Non-DVR Samsung SMT-H3362 - ODN

APD (hrs)(4), Adv Video, CableCARD,

D2, HD, HNI, M-HNI

12.75 11.99 107.1 Yes

Charter Cable Non-DVR ARRIS

DCX3220E -

iGuide*

Adv Video, D2, HD 10.88 10.57 94.2 No

Charter Cable DVR ARRIS DCX3510 - ODN*

APD (hrs)(4), Adv Video, CableCARD,

DVR, D2, HD, HNI, M-HNI, S-DVR, MS

19.73 15.28 145.6 Yes

Charter Cable Non-DVR ARRIS 110A - Spectrum

APD (hrs)(4), Adv Video, D3, HD,

HEVP

11.50 11.06 97.7 Yes

Charter Cable DVR ARRIS 210A - Spectrum

APD (hrs)(4), Adv Video, DVR, D3,

HD, MS, MS-A, HEVP

15.79 11.80 113.6 Yes

Charter Cable Non-DVR Technicolor 110T - Spectrum

APD (hrs)(4), Adv Video, D3, HD,

HEVP

14.14 13.12 118.5 Yes

Charter Cable DVR Technicolor 210T - Spectrum

APD (hrs)(4), Adv Video, DVR, D3,

HD, MS, MS-A, HEVP

17.77 13.60 130.4 Yes

Charter Cable Non-DVR Humax 110H - Spectrum*

APD (hrs)(4), Adv Video, D3, HD,

HEVP

13.54 12.97 115.2 Yes

Charter Cable DVR Humax 210H - Spectrum*

APD (hrs)(4), Adv Video, DVR, D3,

HD, MS, MS-A, HEVP