E/C.18/2019/CRP.4

Distr.: General

2

April 2019

Original: English

Committee of Experts on International

Cooperation in Tax Matters

Eighteenth session

New York, 23-26 April 2019

Item 3(c)(i) of the provisional agenda

Environmental tax issues

Note by the Secretariat

Summary

This note includes two draft chapters that it is proposed would form part of a handbook on

carbon taxation, FOR DISCUSSION by the Committee.

The two chapters deal with the design of a carbon tax; and administrative issues arising from

the introduction of a carbon tax.

The Subcommittee will also provide an oral presentation on the experience of Chile in

implementing a carbon tax, to illustrate the relevance of the inclusion of country experiences

in the handbook. Committee members are encouraged to liaise with the Coordinator in case

they would like to facilitate the inclusion of additional case studies in the handbook.

1. The Committee, during its 16

th

Session (New York, 14-17 May 2018), endorsed the

recommendation of the coordinator of the Subcommittee on Environmental tax issues

(Subcommittee), for their work to initially focus on issues related to carbon taxation.

2. Within this framework, the Subcommittee presented the Committee, at its 17th Session

(Geneva, 16-19 October 2018), with a summary outline of a handbook aimed to provide

guidance on the design and implementation of carbon taxation. Such guidance would be

primarily directed at developing countries which are considering the introduction of a carbon

tax.

3. To advance discussion on the content of specific chapters of the handbook, the

Subcommittee met in Paris on 21-22 January 2019, hosted by the International Chamber of

Commerce). The following topics were discussed in detail:

a. Designing a carbon tax, including (i) issues related to taxing power; (ii) the definition

of the scope and tax base; (iii) the determination of tax rates; and (iv) the identification

of the taxpayer.

E/C.18/201

9/CRP.4

Page 2 of 75

b. Interaction of carbon tax with other measures, including (i) other environmental policy

instruments; (ii) other relevant taxes; (iii) tax subsidies and competition policies; (iv)

consumption subsidies; and (v) existing international agreements.

c. Conceptual approach to carbon taxation, including economic theory framework,

environmental issues, and the definition of carbon tax.

d. Administrative issues arising from the introduction of the carbon tax.

e. Country experiences: Chile and Sweden.

4. Following discussion, two draft chapters (on design and administration) were substantially

advanced, and are ready for discussion by the Committee to provide guidance. Issues which

will need further discussion within the Subcommittee are indicated in [square brackets] in the

text below.

5. Additionally, for the information of the Committee, the Secretariat requested inputs from

the Subcommittee in view of a capacity development Workshop on Selected Issues in Tax Base

Protection and Tax Measures in Support of the SDGs For Developing Countries, to be held in

Nairobi on 10-14 June 2019. The regional workshop will feature the participation of

approximately 40 tax officials of countries in Sub-Saharan Africa, and include a peer-learning

session on environmental taxation. The Secretariat will design a questionnaire, in consultation

with the Subcommittee, to survey the experiences of participating countries in implementing

taxes with an environmental component, and identify needs for capacity development. The

questionnaire might also be a useful instrument to explore additional case studies to be included

in the handbook.

6. During the Committee Session, the Subcommittee will also provide an oral presentation on

the experience of Chile in implementing a carbon tax, to illustrate the practical relevance of the

inclusion of country experiences in the handbook. Committee members are encouraged to liaise

with the Coordinator in case they would like to facilitate the inclusion of additional case studies

in the handbook.

E/C.18/2019/CRP.

4

Page 3 of 75

Handbook on Carbon Taxation – Chapters for discussion

Table of Contents

Chapter VII: Designing a Carbon Tax ............................................................................................. 6

7.1 Taxing power [Draft in progress] ......................................................................................... 7

7.2 Scope of the carbon tax and defining the tax base [Draft as of 28 March 2019] ................. 7

7.2.1. What are we going to tax? ............................................................................................ 7

7.2.2 The Fuel Approach ........................................................................................................ 8

7.2.2.1 Basic concept

............................................................................................................ 8

7.2.2.2 What fuels can be taxed with the Fuel Approach? ................................................. 9

7.2.3.1 Basic concept .......................................................................................................... 10

7.2.3.2 What fuels can be taxed with the Direct Emissions Approach? .......................... 11

7.2.3 When will the carbon tax be levied and who faces the price of the tax? .......................... 12

7.2.3.1 A carbon tax vs direct taxation

.............................................................................. 12

7.2.3.2 Methodologies to calculate the tax ........................................................................ 13

Basing the tax on carbon content ............................................................................... 13

Hands-on – how to do calculate the tax ..................................................................... 14

The tax rates are in tax law expressed in weight or volume units ............................. 15

It is possible to differentiate based on fuel quality .................................................... 16

Measuring actual emissions ....................................................................................... 16

7.2.3.3 Who will pay the carbon tax and when?

............................................................... 17

Basics to consider when deciding on the tax payer ................................................... 17

Ensure that there is a price signal .............................................................................. 18

When will the tax be due – point of regulation ......................................................... 18

Let the tax be due later in the distributional chain ..................................................... 20

When a carbon tax is based on the Direct Emissions Approach ............................... 24

7.2.3.4 Who faces the price of a carbon tax?

..................................................................... 24

7.2.4 Tax coverage, possible exemptions and thresholds........................................................... 25

7.2.4.1 Theory and practice

................................................................................................ 26

7.2.4.2 Policy options to address concerns over competitiveness, carbon leakage and

distributional effects

............................................................................................................ 28

Exemptions and other measures to reduce carbon tax rates ...................................... 31

7.2.4.3 Other measures to protect competitiveness and address distributional risks

...... 32

7.2.4.4 Introducing a carbon tax: Two-level tax systems and setting of thresholds ....... 33

7.2.5 How to treat carbon content in fuels of biomass origin? ................................................... 35

E/C.18/201

9/CRP.4

Page 4 of 75

7.2.5.1 IPCC Climate Change Emission Reporting .......................................................... 36

7.2.5.2 Low blends of ethanol and biodiesel into petrol and diesel ................................. 36

7.2.5.3 Take account of the biomass part of petrol and diesel when calculating the

carbon tax rate

..................................................................................................................... 37

7.2.5.4 Finland – an example of a jurisdiction with an innovative view of future carbon

taxation

................................................................................................................................. 37

7.2.6 Checklist for defining a tax base ....................................................................................... 38

7.3 Tax Rates [Draft as of 1 April 2019] ....................................................................................... 39

7.3.1 Introduction ....................................................................................................................... 39

7.3.2 Setting the Rates ................................................................................................................ 41

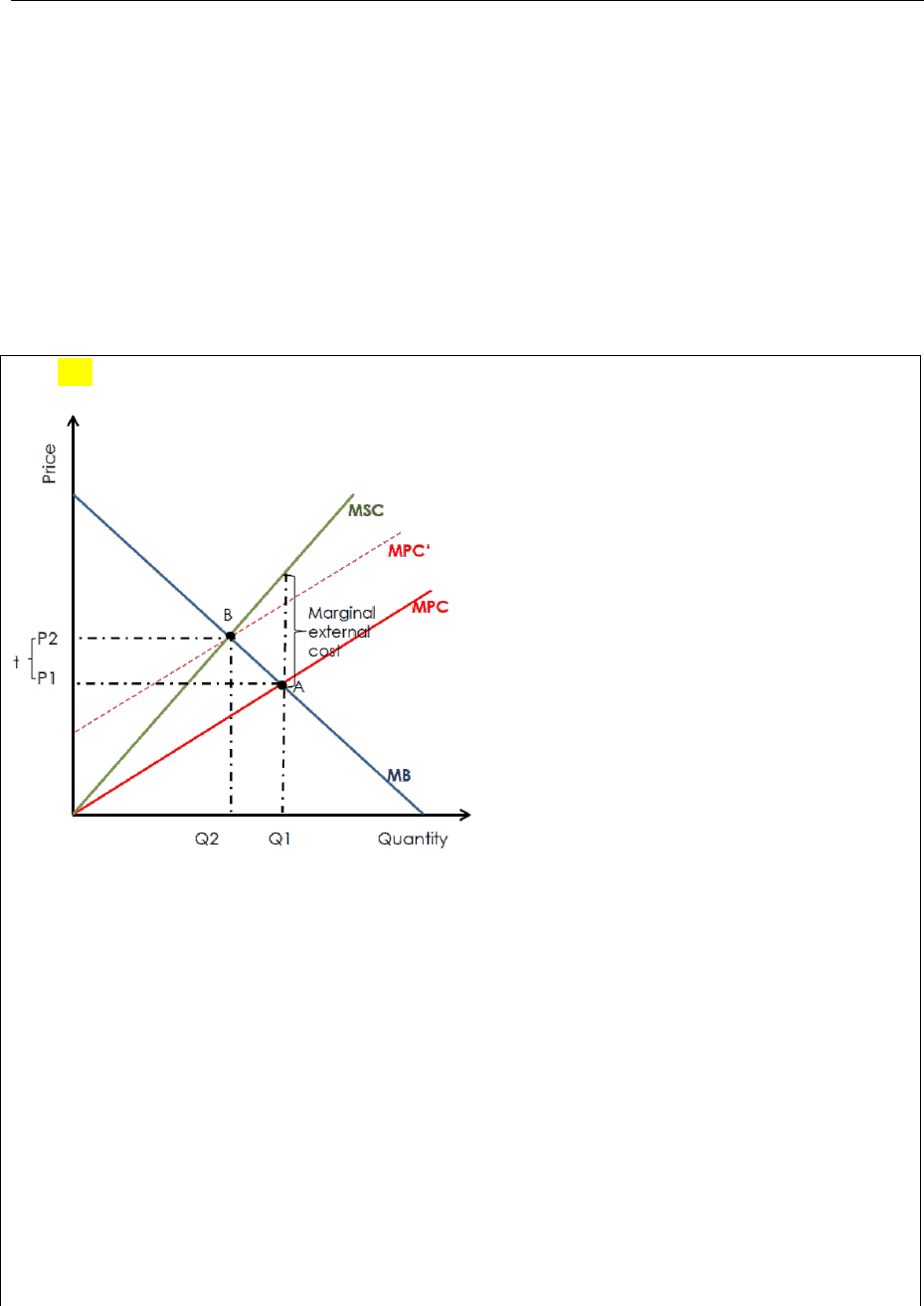

7.3.2.1 Pigouvian Approach – internalising external costs

.............................................. 41

7.3.2.2 Standards and Price Approach – to reach a specific carbon reduction target ..... 44

7.2.2.3 Revenue Target Approach ...................................................................................... 45

7.2.3.4 Benchmarking Approach ........................................................................................ 47

7.2.3.5 Benchmark comparison with trading partners ...................................................... 50

7.3.3 Temporal Development of the Tax Rate ........................................................................... 51

7.3.3.1 The role of politics

.................................................................................................. 51

7.3.3.2 Tax Rate during the Initial Phase of a Carbon Tax .............................................. 51

7.3.3.3 Development of the Tax Rate after its implementation........................................ 53

7.3.4 Tax Rates and Country Specific Considerations ............................................................... 54

7.3.5 Key Considerations ........................................................................................................... 55

Chapter IX: Administrative Issues in the context of Carbon Taxation [draft as of 1 April 2019] . 57

9.1 Introduction .............................................................................................................................. 57

9.2 Types of administrative issues to consider .............................................................................. 57

9.2.1 Domestic issues ................................................................................................................. 58

9.2.1.1 Regions and municipalities

.................................................................................... 59

9.2.1.2 Utilize the existing taxation systems ..................................................................... 59

9.2.1.3 Capacity building .................................................................................................... 60

9.2.1.4 Stakeholder involvement ........................................................................................ 60

9.2.1.5 Clarify roles and expectations, communicate ....................................................... 60

9.2.2 International ...................................................................................................................... 60

9.3 When to address the administrative issues ............................................................................... 61

9.3.1 Before implementation ...................................................................................................... 62

9.3.1.1 Regulation

............................................................................................................... 62

E/C.18/2019/CRP.

4

Page 5 of 75

9.3.1.2 Data availability ...................................................................................................... 62

9.3.1.3 Timing ..................................................................................................................... 62

9.3.2 During implementation ..................................................................................................... 63

9.3.2.1 Tax audit and collection

......................................................................................... 63

9.3.3 After implementation ........................................................................................................ 64

9.4 Operational hints ...................................................................................................................... 65

9.4.1 Optimize the process of digitalization ............................................................................... 65

9.4.2 Enhance Corporate Social Responsibility in the private sector ........................................ 66

9.4.3 Other hands-on hints ......................................................................................................... 66

9.5 Solutions found in a comparative analysis ............................................................................... 67

9.5.1 The Swedish fuel approach ............................................................................................... 67

9.5.2 The Emissions Approach in Chile ..................................................................................... 67

9.6 Conclusion ............................................................................................................................... 68

9.7 References for Chapter 9 ......................................................................................................... 68

Annex 1 – Economic theory background ....................................................................................... 70

A1.1 Pigouvian Approach: Theory versus reality .......................................................................... 70

A1.2 Marginal Abatement Cost Curves ......................................................................................... 70

A1.3 Revenue Target Approach wrestling with Theory ................................................................ 72

A1.4 Carbon Tax Rates .................................................................................................................. 73

A1.5 Bibliography for Annex 1 ..................................................................................................... 74

E/C.18/201

9/CRP.4

Page 6 of 75

Chapter VII: Designing a Carbon Tax

Motives for introducing carbon dioxide taxation, commonly referred to as a carbon tax, has

been discussed in chapter xxx. Once a decision has been made to consider such a tax, the

policymaker is faced with a number of choices, see a brief overview in figure below.

Figure: Stages of Carbon Tax Design and Interlinkages between Design Options

Source: Partnership for Market Readiness. 2017. Carbon Tax Guide: A Handbook for Policy Makers. World

Bank, Washington, DC.

[Figure provisionally placed in this section; however, as it shows the whole process of designing a

carbon tax, it might be moved to an earlier chapter (for example the conceptual framework) and

referred to here.]

E/C.18/2019/CRP.

4

Page 7 of 75

7.1 Taxing power [Draft in progress]

7.2 Scope of the carbon tax and defining the tax base [Draft as of 28 March 2019]

7.2.1. What are we going to tax?

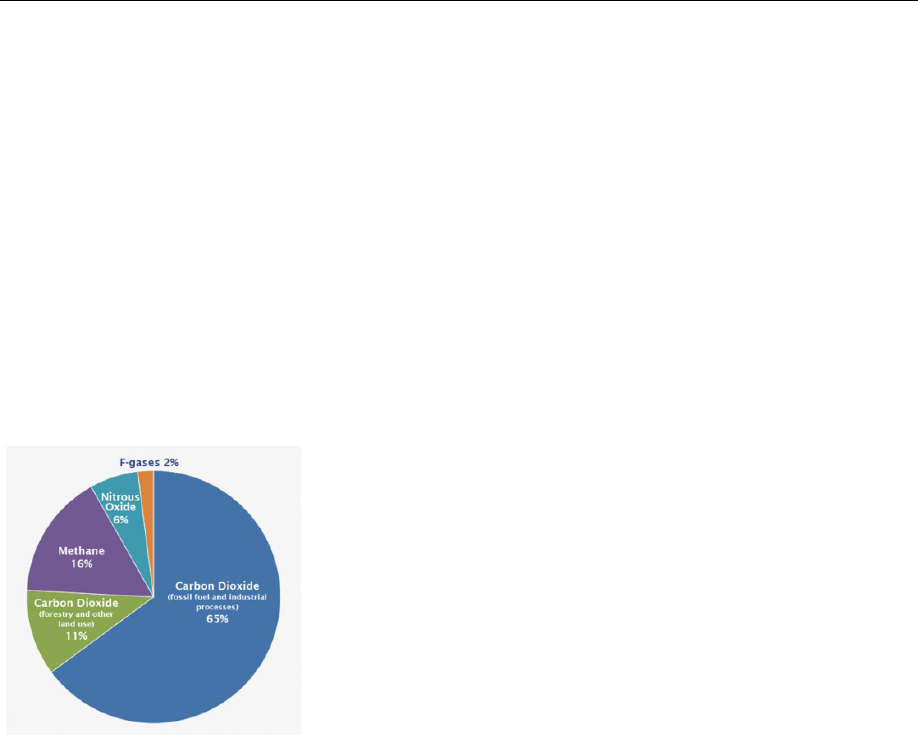

The simple answer, to the question of what we are going to tax, is emissions of carbon dioxide.

Carbon dioxide amounts to roughly 80 per cent of the total greenhouse gas emissions (GHG)

emitted globally and already this fact speaks highly in favour of starting out by focusing

taxation on these emissions. This limitation as to the type of emissions to be covered in this

handbook has already been set in chapter II.

Figure Global Greenhouse Gas Emissions by Gas [to be updated with more recent graph

and figure]

Figure: Global Greenhouse Gas Emissions by Gas

Source: IPCC 2010.

Carbon dioxide enters the atmosphere mainly through burning of fossil fuels (such as coal,

natural gas, and oil), solid waste, trees and wood products. Carbon dioxide is removed from

the atmosphere when it is absorbed by plants or in ocean waters as part of the biological carbon

cycle or artificially in a framework of carbon capture and storage. Taking these facts into

account, there are two basic approaches when considering what to tax. One is focusing on a tax

by volume or weight units of the fuels giving rise to emissions when combusted (“the Fuel

Approach”), where the tax rate is based on standardized amounts of carbon content in those

fuels. The other includes measuring the emissions directly as they occur from the burning of

such fuels (“the Direct Emissions Approach”). There are pros and cons with both approaches

and the design choice depends on the national prerequisites in a specific jurisdiction. A

discussion will follow below, where also examples will be given from tax systems currently in

force in different jurisdictions.

While carbon dioxide by far accounts for the vast part of greenhouse gases emitted from

combustion of fuels and thus merits the focus of this handbook, also smaller amounts of nitrous

oxide and methane are emitted during the combustion, depending on the type of fuel and

method of combustion. Emissions of other greenhouse gases than carbon dioxide can be

E/C.18/201

9/CRP.4

Page 8 of 75

converted into carbon dioxide equivalents (CO

2

e) to enable a comparison between the

emissions and some jurisdictions using the Direct Emissions Approach in their carbon tax

design are applying this method to also include these other greenhouse gases in their tax

scheme.

True enough, there are examples of jurisdictions, which have introduced taxation of also

fluorinated greenhouse gases, so-called f-gases, the most common ones being

hydrofluorocarbons (HFC) and perfluorocarbons (PFC).

1

However, f-gases are generally used

for refrigeration systems. This means that such taxation would not relate to the burning of fuels

and the tax design would need to be found outside of a system of taxing fuel products or actual

emissions from the combustion of the fuels and therefore merit different considerations that

are beyond the scope of this document.

7.2.2 The Fuel Approach

7.2.2.1 Basic concept

Currently the predominant method of carbon taxation in jurisdictions worldwide is to levy a

carbon tax on specific fossil fuels, primarily oil, gas and coal, and their derivative products.

The tax would in principle be levied at a point close to the extraction of the fuel (in a mine or

crude oil extraction site) or at importation into the jurisdiction. However, most tax schemes

applicable today to some extent allow that the tax due upon extraction or importation is

suspended during part of the distributional chain, if the fuels are handled by approved bodies.

This means that the tax in these cases is levied when the fuels are leaving such an established

tax suspension arrangement.

A general tax rate has been pre-calculated and laid down in the tax law, based on the average

fossil carbon content of the fuels, not on the actual emissions occurring from the consumption

nor considering any emissions occurring during the production of the fuel. It should be stressed,

however, that in the case of fuel combustion there is a sufficiently close relation between carbon

content and carbon dioxide emissions. The tax rates of different fossil fuels are usually

presented in the national tax law expressed in commonly used trade units. This is a transparent

and well-established practice to express tax rates on fuels. Such tax rates are easy to apply for

operators as well as for the Tax Agency. The calculation of the tax rates will be further outlined

in more detail in chapter 3.2.

Some jurisdictions have chosen to limit the scope to only certain fuels or cover only the

consumption in certain sectors.

[Possible to add a picture of fossil fuels, such as oil, natural gas and coal]

1

Denmark and Norway for instance, tax emissions of carbon dioxide as well as f-gases, while Spain is an

example of a jurisdiction with a tax solely on f-gases at national level.

E/C.18/2019/CRP.

4

Page 9 of 75

7.2.2.2 What fuels can be taxed with the Fuel Approach?

Box: Examples of fuels subject to a Fuel Approach carbon tax in different jurisdictions

Seven states in the European Union have introduced national carbon taxes covering all motor

fuels, coal and the bulk of commercially available liquid and gaseous fuels used for heating

purposes. The carbon tax has been added to an already existing general excise duty scheme,

either as part of the general excise duty or as a separate tax.

For various reasons, countries may choose to only tax certain fuels. Iceland only taxes petrol,

diesel and heating gas oil. In India and the Philippines only coal is taxed, while Mexico taxes

coal and petroleum products (not natural gas) and Costa Rica all fossil hydrocarbons. On the

other hand, natural gas as motor fuel and coal are exempted from the carbon tax coverage in

Colombia. The carbon tax in Argentina covers all major fossil fuels used in motor fuels or for

heating purposes with the exemption of natural gas and liquified petroleum gas used for heating

purposes.

Basing carbon taxation on fuels has the administrative advantage of being able to use the

general system of fuel taxation. Such systems already exist in some form in many jurisdictions.

The naming of this instrument may vary between jurisdictions – tax, excise duty, levy being

the most common ones.

For the Member States of the European Union, there is a harmonized tax framework for

taxation of fuels,2 which the EU Member States are obliged to follow in their national tax

implementation. This means that the seven EU Member States which have chosen to introduce

a specific carbon tax are using the fuel tax base of this EU directive. It consists of all motor

fuels, coal and the bulk part of all commercially available liquid and gaseous fuels used for

heating purposes. The current EU framework does not oblige the Member States to levy a

carbon tax, but if a Member State decides to introduce such as tax it is considered as a duty

covered by the harmonized EU tax framework.3

The EU Member States which have introduced a carbon tax have generally added it to an

already existing general excise duty (sometimes referred to as an energy tax), either as part of

the general excise duty (e.g. in France) or as a separate tax (e.g. in the Nordic countries4). The

same situation can apply in non-EU jurisdictions, as taxing energy to some extent has over the

years become a common source of revenue raising across the world. There are different

2

Council Directive 2003/96/EC of 27 October 2003 restructuring the Community framework for the taxation of

energy products and electricity, see

https://eur-

lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2003:283:0051:0070:EN:PDF. The products to be taxed

are listed in Article 2 of the directive. For more info on carbon tax rates in the EU Member States, see the

European Commission’s on-line information tool Taxes in Europe Database (TEDB) at

https://ec.europa.eu/taxation_customs/economic-analysis-taxation/taxes-europe-database-tedb_en.

3

See Article 4.2 of Directive 2003/96/EC.

4

The legal provisions for the separate taxes are in some Nordic countries laid down in the same legal act and in

others in separate legal acts.

E/C.18/201

9/CRP.4

Page 10 of 75

approaches of how to treat the interaction between these two different taxes. Sweden, for

instance, over the years has chosen to significantly increase its carbon tax share of the total tax

on energy products. Most other EU countries have, however, added a smaller – but in most

cases increasing level – carbon tax on top of their already existing taxation of energy products.

The same goes for Lichtenstein, Norway and Switzerland, which are European countries

outside the EU. Although the carbon taxes in Switzerland and Lichtenstein are not levied on

road fuels, which are only subject to an excise duty not specifically based on the carbon content

of the fuels.

The carbon tax base in Iceland consists of petrol, diesel and heating gas oil, as these are the

only fossil fuels available in the market in that country. Outside the EU, some countries, for

instance India, Mexico, the Philippines and Zimbabwe, have chosen to tax only a few fuels. In

the case of India and the Philippines only coal is being taxed, while Mexico taxes coal and

petroleum products. The Colombian carbon tax base consists of natural gas and other petroleum

products. Although not specifically designed as a carbon tax, an example of a country having

introduced a levy only on certain fuels is Zimbabwe, where only petrol and diesel are taxed.

The carbon tax in Argentina covers all major fossil fuels used as motor fuels or for heating

purposes with the exemption of natural gas and liquified petroleum gas used for heating

purposes.

Costa Rica is the Latin American pioneer in carbon taxation, as the country has had such a tax

since 1997. The Costa Rican tax base is fossil hydrocarbons, which means an application of

the Fuel Approach. However, the carbon tax rate is not related to the fossil carbon content of

the hydrocarbons, but rather by a percentage (currently 3.5) of the market price of the

hydrocarbons.

The reasons behind these different approaches are often found in the national contexts, such as

existent administration systems or the fact that the chosen fuels amount to the bulk part of

carbon emissions. Competitive concerns for certain sectors or geographical parts of society can

also play a role, see further discussion on possible tax exemptions below in section XXXX.

7.2.3 The Direct Emissions Approach

7.2.3.1 Basic concept

An approach, which has attracted increasing attention, is to rely on direct measurements of

emissions from certain types of stationary installations/facilities. This is the case in Chile and

Singapore.

Normally emissions from large electricity and industrial plants are targeted by the tax and those

facilities may often already by subject to requirements to measure emissions by IPCC

regulations or even more stringent national environmental codes.

[Maybe an illustration showing emissions from a stationary installation?]

E/C.18/2019/CRP.

4

Page 11 of 75

Another approach is to structure a carbon tax to target carbon dioxide emissions regardless of

the type of fuel being used, normally from a certain group of stationary installations such as

factories, power plants and oil refineries. A variation on this approach is to focus on certain

processes and types of emissions. This approach allows for coverage of activities beyond fossil

fuel combustion and, therefore, also of GHGs other than carbon dioxide as well as of other

sources of pollution from certain installations. In this way, jurisdictions may be able to ensure

broader coverage, especially where a large part of their emissions are not fuel-based.

7.2.3.2 What fuels can be taxed with the Direct Emissions Approach?

Box: Examples of fuels subject to a Direct Emissions Approach carbon tax in different

jurisdictions

Chile introduced a green tax reform in 2017, which included a carbon tax, targeting emissions

from facilities with stationary sources comprised of boilers or turbines with a combined thermal

power of 50 MW. It covers around 40 per cent of emissions affecting 94 facilities from a range

of sectors. The carbon tax can be viewed as a Direct Emissions Approach carbon tax

In the San Francisco Bay Area and Singapore, the carbon tax is calculated from measured

emissions from certain large stationary installations. Several different greenhouse gases are

measured and converted into carbon dioxide equivalents.

An example can be found in Chile, which introduced a green tax reform in 2017. The reform

included the introduction of two new green taxes, namely a carbon tax and a local pollution

tax. Both taxes targets emissions from facilities with stationary sources comprised of boilers

or turbines, which individually or together have a thermal power of at least 50 MW. Even with

this fairly high threshold, over 40 per cent of the carbon dioxide emissions are covered by the

tax. While the carbon tax covers emissions of carbon dioxide, the local pollution tax covers

other local pollutants, namely PM (particulate matters, such as e.g. dust or smoke), NOX

(oxides of nitrogen) and SO2 (sulphur dioxide).

Although not as common as taxation of fuels, there are jurisdictions that have chosen to tax

direct emissions of carbon dioxide. The already mentioned Chilean carbon tax affect the same

establishments taxed for local emissions, excepting stationary sources which use renewable,

non-conventional means in which the primary energy source is biomass. In other words, also

by using a Direct Emissions Approach, the Chilean carbon tax only covers fossil carbon

emissions.

Other examples include the San Francisco Bay Area, which is the first local urban carbon tax

in the USA (in force since 2008) and the recently (1 January 2019) introduced carbon tax in

Singapore. Both these jurisdictions calculate the tax on measured emissions arising from

combustion of fuels in certain large stationary installations. By converting emissions from also

other greenhouse into carbon dioxide equivalents (CO2e) also such other greenhouse gases are

included in the taxation scheme.

E/C.18/201

9/CRP.4

Page 12 of 75

The San Francisco Tax is charged on emissions from installations which are subject to local

environmental regulations (permits), while the Singapore carbon tax requires any industrial

facility that emits direct emissions equal to or above 25,000 tCO2e annually to register as a

taxable facility and pay the carbon tax.

A similar approach is to focus on emissions from certain processes, as is done in South Africa,

where a carbon tax will come into force on June 1, 2019. The South-African carbon tax5 will

target CO2e emissions above a certain level from fuel combustion, electricity generation and

industrial processes as well as estimated fugitive emissions. While in principle using a Direct

Emissions Approach, the emissions taxed will be calculated based on emissions factors pre-

determined according to a methodology approved by the relevant authority. The tax law also

lays downs standard values in case such a methodology does not exist for a specific activity.

These installations in many cases are already obliged to measure their emissions and report

them according to the IPCC framework. There may also be national requirements in place,

following environmental regulation schemes. To implement the Direct Emissions Approach a

measurement, reporting and verification system is necessary (so-called MRV). This requires

cooperation between national tax administrating authorities and agencies with environmental

and technical knowledge to be able to control and monitor the measurement of the emissions

to ensure tax control. All parties to the Paris Agreement will be obliged from 2024 to report

their emissions using the guidelines of the Paris Rulebook. Although developing countries with

limited capacity initially may report with flexibilities, parties will over time increase the

accuracy of the inventory of national emissions, thereby also increasing the possibility to

implement a well-designed carbon tax. One of the principal advantages of the Direct Emissions

Approach would therefore, while more difficult to implement, be that it will strengthen the

countries’ MRV capabilities which is required for a range of international commitments and

local policies.

[For feedback by the Committee: as the direct emissions approach is less diffused, should the

Subcommittee keep the current level of detail presented in this chapter throughout the

handbook, or expand discussion further?]

7.2.3 When will the carbon tax be levied and who faces the price of the tax?

7.2.3.1 A carbon tax vs direct taxation

Box: Special characteristics of a carbon tax compared to a direct tax

5

For further information about the South-African carbon tax, see Republic of South Africa Carbon Tax Bill B-

46-2018

http://www.treasury.gov.za/comm_media/press/2018/2018112101%20Carbon%20Tax%20Bill%202018-B46-

2018.pdf.

E/C.18/2019/CRP.

4

Page 13 of 75

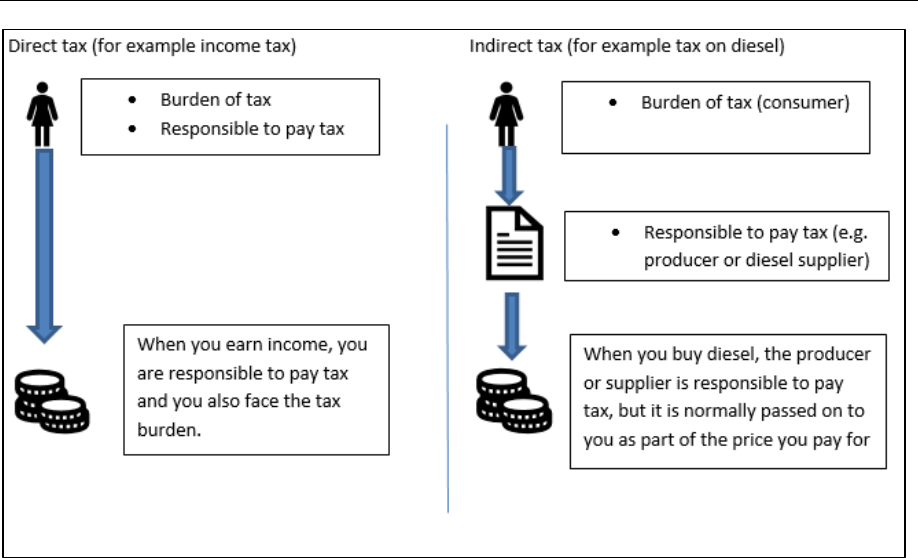

Direct taxes are normally paid directly by an individual or business relating to for example real

estate owned, or income gained by the individual or business. An indirect tax is levied on

particular goods or services and normally collected by a producer or retailer, not the final

consumer. The cost of the tax is passed on to the consumer as part of the purchase price of the

good or service. A carbon tax is thus an indirect tax.

Taxes

Direct taxes Indirect Taxes

Income Tax

Corporate Tax

Property Tax

Inheritance Tax

Wealth Tax

Excise Duties, e.g.

alcohol, tobacco, fuels,

emissions

Service Tax

Sales Tax/Value

Added Tax

Figure Direct vs Indirect taxes

Taxes are generally divided into direct taxes and indirect taxes. Direct taxes are imposed upon

a person or property and are normally paid directly by that person or property owner to a local

or national tax authority. Examples are property tax, income tax and tax on assets. An indirect

tax, on the other hand, is levied on particular goods or services and is collected and paid to the

tax authority by an entity in the supply chain (usually a producer or retailer). However, being

an indirect tax means that the producer or seller who pays the levy to the tax authority is passing

the cost of the tax on to the consumer as part of the purchase price of a good or service. There

are basically two kinds of indirect taxes, sales taxes (or value-added taxes) and excise taxes

which are typically imposed in addition to a sales tax or value-added tax.

This means that a carbon tax – whether levied on fuels by weight or volume or on actual

emissions – is an indirect tax and more precisely an excise tax (or in some jurisdictions is

labelled an excise duty). An excise is typically a per unit tax, costing a specific amount for a

volume or unit of the item, whereas a sales tax or value-added tax is an ad valorem tax and

proportional to the price of the goods. Another difference is that an excise tax typically applies

to a narrow range of products (such as alcohol or tobacco products or petroleum products).

Compared with a direct taxation system, there are some aspects that merit special consideration

when assessing how a carbon tax system may be set up in a country with little or no experience

of levying excise taxes. Aspects relating to when in the supply chain a carbon tax can be levied

and who faces the price of the tax are of particular interest and will be further discussed below.

7.2.3.2 Methodologies to calculate the tax

Basing the tax on carbon content

The most generally used choice of tax base is the carbon content of fuels, what we in this

handbook call the Fuel Approach. Such an approach has a high level of accuracy and can be

E/C.18/201

9/CRP.4

Page 14 of 75

used to design an administratively simple tax system, which serves the policy purpose of being

a cost-effective instrument to reduce emissions.

Most jurisdictions having introduced a carbon tax have relied on emission factors expressed in

terms of average carbon content of fuels to calculate the tax. What makes this simple, is that

there is a sufficiently close relation between carbon content and carbon dioxide emissions. This

major simplification does not imply any large errors in providing incentive to switch fuels to

reduce carbon dioxide emissions. Calculations made by Government officials based on the

average carbon content of the fuels can determine the tax rates laid down in the tax legislation.

No measurements of actual emissions are necessary. A jurisdiction introducing a carbon tax

can could thus choose to express their carbon tax rates by volume or weight units (such as litre

of petrol or tonne of coal) based on calculations of the average carbon content of the relevant

fuel. These are standard trade units and such an approach facilitates tax administration. The

method also broadly corresponds to the guidelines countries follow when reporting carbon

dioxide emissions to the UNFCCC (IPPC National Greenhouse Gas Inventories).

Hands-on – how to do calculate the tax

It is often relatively straight forward for a jurisdiction to select the appropriate emission factors

to be used for the tax calculations (see further box xx below

6

). This is the case if the number

of fuel qualities available on the market are limited and it could thus make sense to use an

average emission factor for several different heating gas oil products. In general, jurisdictions

are taxing the fuels only when they are used as motor fuels or for heating purposes, not when

the fuel product is used for non-combustion purposes – such as coal or natural gas being a

necessary component in certain industrial reduction processes or coal used in purification

filters. However, the calculation method as such does not prevent taxing also the fuel products

when used for such purposes.

To facilitate the understanding of implementing a carbon tax, an example is given in the box

below of how to calculate a tax rate per litre of petrol, by way of the prevailing method used

by jurisdictions having introduced a carbon tax.

6

Carbon dioxide (CO

2

) emissions can be expressed in kg/MJ since it is assumed that all the carbon content is

transformed to carbon dioxide after combustion (complete combustion in dry air). The carbon content of the

fuel is known. The emission factor is calculated by dividing the carbon content of the fuel (e.g. per m

3

) with

the percentage of carbon in carbon dioxide. The percentage of carbon in CO

2

is 27 per cent and is calculated

by dividing the molecular weight of carbon with the molecular weight of CO

2

. Since all carbon content in the

fuel is assumed to be converted to CO

2

, the same amount of carbon is present in CO

2

after combustion as in

the fuel before combustion.

E/C.18/2019/CRP.

4

Page 15 of 75

Box: How to calculate the actual carbon tax rate for a fuel with the Fuel Approach

Calculation of tax rates when based on standard carbon content of fuels

The rationale is that the carbon tax is applied to fuels and the tax rate expressed in the tax

legislation is calculated based on the fossil standard carbon content of the fuels but expressed

in volume or weight units (such as litre for petrol).

Carbon content [kg /unit] / 0,27

7

= Emission of CO

2

[kg/unit]

Emission of CO

2

[kg/unit] * general CO

2

tax level [currency/kg fossil CO

2

] = Tax rate

[currency/unit]

The carbon content of respective fuel is divided with the share of carbon in carbon dioxide

(0,27) in order to attain the emission factor of the fuel. The emission factor is then multiplied

with the general tax level, expressed in terms of currency per kilo of fossil carbon. The tax rate

is expressed as currency per unit.

Example, calculation of carbon tax rate on petrol in Sweden 2018

General carbon tax rate: 1.15 SEK per kg fossil carbon (=approx. xxxx US cents)

0.627 kg/litre / 0,27 = 2.323 kg/litre

2.323 kg/litre * 1.15 SEK kg/fossil CO

2

= 2.67 SEK/litre (= approx. xxxx US cents)

The tax rates are in tax law expressed in weight or volume units

There is no need to express the method of calculation in the legal carbon tax provisions.

However, to increase transparency the amount of tax per kg of fossil carbon, which is the basis

of the tax calculation, can be mentioned in the tax law or in other official regulations. For

example, the Swedish legislative tradition is to keep statutes as short and simple as possible

and provide additional explanations in the preparatory works (Government Bills). When the

carbon tax was first introduced in in Sweden in 1991, the relevant Government Bill thus

contained a detailed description of the method and emission values used by the Government

when calculating the actual tax rates for the description included a list of emission values used

for the different fossil fuels.

8

The actual tax rates in the law is expressed in commonly used trade units, which is a transparent

and well-established method in Sweden. This means weight or volume units. Such tax rates are

easy to apply for operators as well as for the tax authorities. The units used in Sweden are litre

7

0.27 is the share of carbon in CO

2

, calculated by dividing the molecular weight of carbon with the molecular

weight of CO

2

.

8

See Governmental Bill 1989/90:111 p. 150 (in Swedish), https://data.riksdagen.se/fil/0F185476-F338-4003-

A794-012E457C3B52.

E/C.18/201

9/CRP.4

Page 16 of 75

for petrol, m

3

(1 000 litres) for gas oil, kerosene and heavy fuel oil, 1 000 kg for LPG (liquefied

petroleum gas), 1 000 m

3

for natural gas and 1 000 kg for coal and coke.

It is possible to differentiate based on fuel quality

If, on the other hand, different coal qualities with significant differences in carbon content are

major energy sources in a country, it could make sense to set different tax rates based on the

carbon content for the various coal qualities. Further, the increased use in some jurisdictions

of motor fuels consisting of mixtures of fossil and biomass components can be a further

challenge to an administratively simple and easily controllable system, if the fossil carbon

content of the fuel is the base of the tax. Whether the biomass components add complexity to

a tax system is, however, dependent on the choice of the taxable event. If a finished product is

not established until it is leaving a fuel depot and is due to be taxed, regular bookkeeping will

enable the tax payer to pay the correct tax. Such a system has been applied in Sweden for many

years. An important political decision is whether the tax base ought to relate to the fossil carbon

content of fuels (which is the way the current IPCC (Intergovernmental Panel on Climate

Change) emission reporting is done today), or to carbon content in general, which also would

include biomass-based fuels, as for instance ethanol and biodiesel.

Measuring actual emissions

An alternative to a tax based on the carbon content of the fuel would be to measure the actual

emissions. This might seem to be a more accurate approach, but the number of emission sources

is often large and measurement systems are not precise, which implies high administration

costs. Also, in the case of taxes based on actual emissions rather than on the carbon content of

fuels, jurisdictions often need to establish new systems for monitoring, reporting and

verification. While such requirements already exist as regards to large industrial and power

installations in the UNFCCC national reporting guidelines, this is not the case for emissions

from either smaller plants or vehicles.

There are examples when a jurisdiction has chosen to let its carbon tax only cover emissions

from certain kinds of stationary installations, where the consumption of fuels take place. This

could be the case of large power plants. Here a tax on actual emissions may be an option. Chile

and Singapore are jurisdictions which have opted for this approach. In many cases such

installations would, due to regulations following the UNFCCC national reporting guidelines or

additional national environmental requirements, are obliged to measure their emissions and

using these values to determine the tax could be appropriate. However, if and when a

jurisdiction decides to enlarge the scope of the tax to also e.g. propellants, the measurement of

actual emissions arising from the combustion at the point of consumption would no longer be

feasible.

E/C.18/2019/CRP.

4

Page 17 of 75

Table. Some pros and cons of different methodologies to calculate the tax

Pros Cons

Average emission factors Administratively simple

Scope can include large part of

CO

2

emissions, in stationary

facilities as well as transport

Incentive is clear – Polluter

Pays (as tax is normally

included in fuel price)

No incentive to choose higher

quality fuels within the same

tax group

Other types of CO2e emissions

are outside scope

Does not develop MRV

Measuring actual emissions

Exact (not really) measurement

is probably less exact

Incentive is clear – polluter

pays

Develops MRV

Possibility of developing other

more complex instruments e.g.

Offsets, this may be important

for developing countries

Scope of non-fuel combustion

emissions

Costly to measure

Cannot be applied to small

facilities

Cannot be applied to transport

fuels

Administratively complex

7.2.3.3 Who will pay the carbon tax and when?

(Some illustration/graph including money/revenues might be included)

Box: What determines the choice of who will pay the tax and when?

Who will pay the tax depends on national conditions, such as for example if already existing

taxation of fuel exists, tax control capacity available, the organization of fuel distribution or

the types of fuels targeted by the tax. Degrees of the complexity of tax administration vs the

need to be able to carry out tax controls are key issues to consider.

For a Fuel Tax Approach design, there are examples globally of countries having chosen tax

payers in different stages of the distributional chain.

For countries having chosen a Direct Emissions Approach a close link to existing

environmental performance legislation has often been desirable.

Basics to consider when deciding on the tax payer

Emissions typically involves a range of actors operating at different points in the fuel supply

chain. In addition to determining which sectors or activities will be subject to the tax,

jurisdictions must also determine who will be responsible for paying the carbon tax to the

authorities. The actual payment of the tax – when and by whom – is a matter to be regulated in

E/C.18/201

9/CRP.4

Page 18 of 75

the carbon tax legislation. These issues are of interest to authorities set to administer the carbon

tax and in consequence also legislators considering how to design their tax legislation. This is

essential, contrary to what up until now seems to have been the key focus of literature namely

the issue of economic incentives for people and businesses to promote ecologically sustainable

activities. The latter discussion depends e.g. on the possibilities for the tax payer to transfer the

cost of the tax down the fuel supply chain and is not the key focus of this handbook.

There is no simple answer to which entity is best suited to be held responsible to pay a carbon

tax to the authorities and when that event is to occur. It obviously primarily depends on the tax

design approach chosen, but also to a large extent on already existing administration structures

in the jurisdiction and to what extent the jurisdiction would like to build on such existing

administration. It can also be noticed that many developing countries are adopting digital tax

declarations systems, which can significantly facilitate the tax administration while labour

resources can be concentrated on ex-post tax control in the forms of tax audits and spot-checks.

Jurisdictions choosing to design a carbon tax levied on fuels are likely to explore existing excise

duties on the relevant fuels and who is responsible for the tax payment. Choosing the same tax

payer for the new carbon tax will mean low additional administrative costs for both the tax

payers and the tax authorities.

If a Direct Emissions Approach is chosen for the design of a new carbon tax it would be natural

to choose as the tax payer the entity that generates the emissions. However, such a tax system

would most likely require new administrative practices for the tax authorities, including

necessary cooperation with environmental authorities to be able to carry out tax control. The

pros and cons of different administrative approaches will be further discussed in chapter xxx.

Ensure that there is a price signal

In determining the point of regulation, it is crucial to analyse which actors will bear the burden

of the tax and if they are responsive to the price signal. To ensure efficiency and environmental

effectiveness agents should respond by changing their behaviour. For a fuel distributor the price

signal is passed on to the final consumer, as the tax normally is fully transferred to the retail

price of the fuel. However, this is a consequence of trade agreements between sellers and

buyers of the fuel and nothing that is regulated in a tax act. If no change in behaviour occurs

the carbon tax will only raise revenues and not decrease emissions.

Another important aspect is the challenge associated with administering the tax, including

difficulties in monitoring, reporting and verification, often referred to as MRV. Due to

administrative complexities and the number of taxpayers, it would not make sense to let each

individual consumer, for example private persons consuming petrol in their car, be responsible

for paying the tax to the Government or other official body.

When will the tax be due – point of regulation

A distinction between upstream, midstream or downstream points of regulation is sometimes

used in economic literature to identify the point at which the tax is controlled or collected.

E/C.18/2019/CRP.

4

Page 19 of 75

However, we are refraining from using this terminology as it risks adding to confusion,

especially as these terms may have different meanings when used in different contexts.

A general principle for carbon tax systems levying a certain tax amount on fuels by weight or

volume unit, is that the fuels shall be taxed at the time of when the fuels enters the economy.

This normally coincides with production or importation. A strict application of such a system

is illustrated in figure xx below and it may be a good starting point for a country which already

administers some other kind of excise duty on the taxable fuels or has no prior experience of

administering excise duties.

Administrative simplicity along with good possibilities for tax control are key issues to

consider. Keeping the number of tax payers to a minimum is another aspect to keep

administrative costs low, which often is desirable to the authorities as well as to the tax payers.

One option would be to establish a tax collection point very early in the fuel distribution chain,

that is the point of extraction (such as coal mine, oil drill, natural gas pipeline) or importation.

Choosing a taxation point at importation would also have administrative advantages, as the tax

collection can be combined with the collection of applicable customs duties to be paid upon

importation. Further, a resource-rich country can choose to let the tax, at least from the start,

be levied at the point of extraction, while a resource-poor country may feel it appropriate to

start with only taxing fuels at the point of importation.

However, while choosing a tax point as illustrated in figure xx could offer administrative

advantages in terms of a relatively few tax payers and better opportunities to conduct an

effective tax control, there are also some other aspects to consider. Crude oil and natural gas

largely dominate the imports of fuels to most countries and choosing a taxation point at

importation can make it difficult to differentiate the carbon tax between different qualities of

refined petroleum products (such as petrol, diesel, heavy fuel oil etc.). Although, here

Colombia offers an interesting example.

Example Colombia’s Carbon Tax

9

[May be put in a box]

Colombia introduced a carbon tax in 2017. The tax base consists of different refined petroleum

products, namely natural gas, liquified petroleum gas, petrol, kerosene, diesel and fuel oil and

the importer or producer of such products is the body responsible for paying the carbon tax to

the Government. In certain cases, the tax law gives the final consumer the right to ask for a tax

reimbursement.

Possible to coordinate tax collection with import duties

9

For more information on Colombia’s carbon tax please refer to the carbon tax legislation (Law 1819 of 2016

and the Decree 926 of 2017( Congreso de la República, 2016; Ministerio de Hacienda y Crédito Público, 2017)

http://es.presidencia.gov.co/normativa/normativa/DECRETO%20926%20DEL%2001%20DE%20JUNIO%20

DE%202017.pdf and Gutierrez Torres, Daniela (2017): Interaction between the carbon tax and renewable

energy support schemes in Colombia- Complementary or overlapping?, The International Institute for

Industrial Environmental Economics,

http://lup.lub.lu.se/student-papers/record/8927410.

E/C.18/201

9/CRP.4

Page 20 of 75

Coordinating tax collection with other tax objectives, such as import duties, could facilitate tax

administration. For a country choosing to collect a carbon tax upon importation, to coordinate

the collection with the collection of import duties due on the taxable fuels. Although not being

an explicit carbon tax, Zimbabwe applies a Petroleum Importers Levy on petrol and diesel,

which is collected in this way.10 Companies or individuals holding a procurement license to

import petroleum products in bulk into Zimbabwe are liable to pay this levy, which amounts

to USD 0.04 per litre.

Figure Example of a fuel tax design – tax payment early in the distributional chain

Note. Not applicable within the EU, as the major part of taxable events occur within a tax suspension regime system with

authorized traders under Directive 2008/118/EC, see further figure 2.

Let the tax be due later in the distributional chain

Choosing the same tax payer for the new carbon tax as an already existing excise duty on fuels

will mean low additional administrative costs. The carbon tax can be implemented as a new,

separate tax or be incorporated as part of an already existing excise duty levied on fuels. A

separate tax can be administrated in the same way as the already existing excise duty and would

not give rise to much more administration. As we have seen from the previous chapter, a carbon

tax designed by the Fuel Approach means that the tax is levied by weight or volume units, that

is the same as other excise duties are normally levied. Introducing a separate carbon tax will

10

https://www.zimra.co.zw/index.php?option=com_content&view=article&id=1201&Itemid=139.

E/C.18/2019/CRP.

4

Page 21 of 75

also make it possible for a Government to more clearly advocate to the public that the tax is a

climate tax.

Even if the general principle still is to levy a tax close to production or importation, many

jurisdictions have deviated from this principle. There may be several reasons for this. One is

the desire to be able to differentiate the tax rates depending on final use of a fuel, such as

between different sectors of the economy

11

. Another, which may be especially interesting in a

country with high tax rates, may be to facilitate trading of the fuels between approved operators

before reaching the final consumer. Negative liquidity effects on business may be avoided by

such a construction, as the tax will not need to be paid before the fuel has been sold to the final

consumer.

Example Norway’s Carbon Tax [May be put in a box]

Norway

12

is an example, where the liability to pay the carbon tax normally arises when the

goods are imported or produced. However, this is not always the case in practice. First,

production of taxable products in Norway must take place in and by an entity which has been

approved by the tax authorities, known as an approved tax warehouse. Liability to pay tax does

not occur until the goods leave the tax warehouse. An importer may choose to register in the

same way. This means that the registered tax payers can store the fuels without having to pay

the tax. The Norwegian tax system includes certain cases of exemptions and reduced rates.

These are either implemented as direct exemptions, which means that the registered importer

or producer sells the product without paying tax or at a lower tax rate. In other cases, a situation

like the abovementioned Colombian case, it is accounted for as an end-user can ask for

reimbursement of the tax.

Example Carbon Taxes within the EU Energy Taxation Framework

The bulk part of all commercially available fuels is subject to excise duty in the EU Member

States. Following the choice of the Member State, the excise duty may include a specific carbon

tax, currently seven Member States have chosen to do this. Such carbon taxes are in principle

chargeable at the time of:

• Production, including, where applicable, their extraction, of taxable goods within the

territory of the EU

• Importation of taxable goods into the territory of the EU.

However, a carbon tax in an EU country does not become chargeable until it is released for

consumption the Member State. This means:

• The departure of taxable goods, including irregular departure, from a tax suspension

arrangement.

11

See example Sweden different carbon tax rates for heating fuels used by industry and households and service

sector companies in chapter xxxx.

12

For more information, see for example https://www.oecd.org/ctp/tax-policy/taxing-energy-use-2018-

norway.pdf.

E/C.18/201

9/CRP.4

Page 22 of 75

• The holding of taxable goods outside a tax suspension arrangement where carbon tax

has not been levied pursuant to the applicable provisions of EU law and national

legislation.

• The production of taxable goods, including irregular production, outside a tax

suspension arrangement.

• The importation of taxable goods, including irregular importation, unless the goods are

placed, immediately upon importation, under a tax suspension arrangement.

This model is very similar to the one used in Norway. However, within the EU each Member

State has discretion as to where in the distribution chain the tax is liable, that is there is

flexibility in determining the extent of the tax suspension regime.

Some EU countries are applying rules which result in a relatively few tax payers, normally to

be found early in the distributional chain and operators further down the distributional chain

will not be involved in the tax collection. Tax rebates are in those cases normally administered

by the end users asking for a tax reimbursement. Another way could be to introduce approval

procedures for businesses, which under tax control may receive the fuels tax exempted.

While some EU countries, for example of Sweden (see below), allow large business consumers

to be tax payers, the EU legislation does not allow private individuals to register as tax payers.

This means, for example, that petrol stations selling motor fuels to households are not tax

payers but buy the fuels already taxed in a previous leg of the distributional chain.

Example Sweden – a system with low administrative costs

Sweden is a country with a population of 10 million people and has about 900 000 registered

business companies, among them about 55 000 industrial companies However only around 300

companies are registered warehouse keepers, who are authorised by the Tax Agency to

produce, receive and hold fuels under tax suspension and may also move such products under

the suspension regime to other warehouse keepers within Sweden or in other EU countries

without tax becoming chargeable. Criteria which determine if a company may be approved a

warehouse keeper status relates to for example its economic situation and being able to put

forward a sound and reliable business idea. The fuels must be stored in a specially approved

tax warehouse and the warehouse keeper must leave security, for example in the form of a bank

guarantee, for each movement of energy products as well as for 10 per cent of the fuels stored

on average for one year.

The fact that registered taxpayers are obliged to supply a guarantee to cover potential losses in

storage or transport provides a secure and tested system for ensuring that tax obligations are

met. Carbon taxes on fuels in other EU countries are also levied in this way.

Sweden is an example of a jurisdiction which extends the possibility to register as tax payers

also to large consumers, notably heavy industrial companies. The Swedish system is illustrated

in figure xx below. The Swedish system allows for these industrial companies to store fuels

under tax suspension and declare the tax once the actual consumption has occurred. If the

E/C.18/2019/CRP.

4

Page 23 of 75

consumption involves a tax exempted area of activity this means that the tax payer declares

zero tax, thus avoiding negative liquidity effects for the company which would have arisen if

the company would have had to buy the fuels at a price including the tax and ask for a tax

reimbursement after the consumption has taken place. A non-tax payer would have bought the

fuel at a price including the tax but can, if being eligible for a tax rebate, ask for a

reimbursement of the tax paid.

The Swedish carbon tax is collected in the same way as the energy tax applicable to fuels. This

means that the administrative costs can be kept low, both for the tax authority and for

businesses. The administration costs for the tax Authority amounts to 0,1 per cent of the total

revenues from energy and carbon taxes.

Figure Example Taxation points for the carbon tax in Sweden

Example – British Colombia’s Carbon Tax

British Colombia

13

is an example of a jurisdiction that has moved the event when the tax

becomes liable for payment and consequently also the tax payer down in the distributional

chain, by enlisting the fuel distributors as tax collectors. Any natural gas retail dealer or fuel

vendors must be appointed as tax collectors by the revenue authorities and are then responsible

13

For more information about the carbon tax in British Colombia, please refer to

http://www.bclaws.ca/civix/document/id/lc/statreg/08040_01

.

E/C.18/201

9/CRP.4

Page 24 of 75

for charging the tax to purchasers upon sale. Like the EU rules, the British Colombia scheme

allows for sales between registered dealers or vendors without tax becoming chargeable.

When a carbon tax is based on the Direct Emissions Approach

A carbon tax based on a Direct Emissions Approach requires the measurement or estimation

of actual emissions at the source. Therefore, the tax payers are likely to be those who controls

the production process that generates the emission, this can either the owner/renter of the

installation where the emissions occur or the business carrying out the activity requiring the

process from the installation giving rise to the emissions.

Measuring emissions at source does not necessarily involve actual measurement – although it

is better to do so – emissions can still be estimated, based on fuel inputs and carbon content

emission factors, but it does require the development of a measurement, reporting, and

verification (MRV) systems for emissions at source. This will inevitably require close

cooperation between Tax and Environmental Authorities, which may many times be difficult.

There are pros and cons of such an approach. The most obvious is that the tax on emissions is

explicit, which can facilitate the introduction of a carbon tax in a country where new taxes are

not easy to implement. On the other hand, it can lead to increased institutional complexity and

conflict in the shared responsibility for tax administration and tax control between Tax and

Environmental Authorities. Other advantages include that the MRV system developed will be

useful for a number of purposes over and above those necessary for green taxes, such as

developing inventories, enhancing domestic and international comparability, facilitating

management within companies, and even generating conditions to move towards more

sophisticated policy instruments such as such as compensation mechanisms, offsets, and/or an

emissions trading system.

7.2.3.4 Who faces the price of a carbon tax?

Box: Difference between who pays the tax and who bears the cost of the tax

In a carbon tax legislation rules are laid down as to what legal entity that will be responsible to

pay the tax to the Government (tax payer). A carbon tax is aimed to give consumers an incentive

to change their behaviour and consume less fossil fuels. Whether this effect is achieved depends

on if the tax payer can pass the cost of the carbon tax on to the consumers or not.

There is a difference between who is targeted by the tax and legally responsible for paying it,

and who bears the incidence of the tax. In economics, tax incidence or tax burden is the effect

of a particular tax on the distribution of economic welfare. The introduction of a tax drives a

wedge between the price consumers pay and the price producers receive for a product, which

typically imposes an economic burden on both producers and consumers. Tax incidence is said

to "fall" upon the group that ultimately bears the burden of the tax. The key concept is that the

tax incidence or tax burden does not depend on where the revenue is collected, but on the price

elasticity of demand and price elasticity of supply.

E/C.18/2019/CRP.

4

Page 25 of 75

Figure Direct vs indirect tax – who pays the tax and who faces the tax burden

In the case of a carbon tax, the tax incidence depends on whether the entities obligated to pay

the carbon tax can pass it on to consumers or not. If the entities can raise the product price to

compensate for the full amount of the tax, the whole tax incidence can be considered to fall on

the consumers. In this discussion, it is important to emphasize that changed consumer

behaviour is needed for the tax to fulfil the purpose of reducing emissions. If the product price

is not raised the producer will bear the full incidence of the tax, the consumption will remain

unaffected and the emissions of carbon dioxide will not be reduced.

There are several important issues to consider in this discussion. For instance, if a price

regulation exists, the entities might not have the possibility to increase the price to pass on the

burden of the tax. In this case the tax burden falls on the entities, reducing their profits. A

carbon tax under these circumstances will not reduce emissions in the short term, but solely

work as a fiscal tax. However, most entities act in markets where they will have possibilities

to pass on at least part of the increased cost of the tax to consumers. That means, in most

scenarios the incidence of the carbon tax will be split between the entities and the consumers.

There are, however, circumstances where companies are less able to transfer increasing costs

to consumers, for instance when facing an international competition. In these cases, it might be

plausible to discuss the need for exemptions and/or lower tax rates for certain sectors of the

economy. These issues will be further discussed in chapter X.X.

7.2.4 Tax coverage, possible exemptions and thresholds

One way of deciding the carbon tax coverage is to base it on targeted sectors, subsectors or

certain economic activities. In jurisdictions without any carbon pricing system already in place,

E/C.18/201

9/CRP.4

Page 26 of 75

a broader carbon tax will typically provide more opportunities and thus a more efficient

emission reduction. Circumstances will differ between jurisdictions and the most suitable

coverage of the carbon tax will depend on a range of factors, including e.g. the emissions profile

of the jurisdiction; other relevant tax policies; the structure of key sectors; and government

capacities for administering the tax. To attain emission reductions, it is important to analyse

what reductions are possible to achieve in the targeted sectors, and to what costs.

14

[This section

will be expanded in a later version of the draft]

7.2.4.1 Theory and practice

Although economic theory suggests a uniform carbon tax with wider base in terms of its

coverage would be the most efficient design, concerns commonly raised among stakeholders

that additional tax burden would lead to adverse effects on the competitiveness of domestic

industries – especially energy-intensive and trade-exposed firms – cause carbon taxes

introduced in practice to deviate from the theoretically ideal carbon tax. Several jurisdictions

have strived for a balance between fulfilling environmental objectives and accounting for the

risks of carbon leakage and securing the competitiveness of certain sectors being subject to

international competition. Despite the risk of undesired effects from carbon taxes on firm

competitiveness and carbon leakage in many cases are limited, such risks can constitute

significant political obstacles for the implementation of a carbon tax and need therefore to be

considered in the process of designing the tax. The impact of a carbon tax in different income

groups and geographical regions are other factors determining the acceptability of the tax.

The table below illustrates how carbon taxes in selected jurisdictions are designed with regards

to coverage and exemptions.

14

The influence of differences in marginal abatement cost curves is further discussed in relation to the use of

different tax rates in section 7.d.

E/C.18/2019/CRP.

4

Page 27 of 75

Table Carbon pricing mechanisms in selected countries

Country Year Description

GHGs

covered

Sectorial/fuel

coverage

Competitiveness considerations

or exemptions

Argentina 2019

The Argentina

carbon tax was

adopted 2017

as part of a

comprehensive

tax reform

proposal, and

entered into

force on

January 1,

2019. The tax

partially

replaces a fuel

tax that was

present before.

20 %

The Argentina

carbon tax

applies to CO2

emissions

from all

sectors and

covers almost

all liquid fuels

and coal.

The use of fossil fuels in certain

sectors and/or for certain purposes

is (partially) exempt from the

carbon tax, including international

aviation and international

shipping, export of the fuels

covered, the share of biofuels in

mineral oil and raw materials in

(petro)chemical processes. To

offset the fuel price increase by

the carbon tax, the tax on liquid

fossil fuels are adjusted at the

introduction. For mineral coal,

petroleum, and fuel oil, the tax

rate will start in 2019 at 10

percent of the full tax rate,

increasing annually by 10 per cent

to reach 100 per cent in 2028.

Colombia 2017

The Colombia

carbon tax was

adopted as part

of a structural

tax reform.

The Colombia

carbon tax was

launched in

2017.

24 %

The Colombia

carbon tax

applies to

GHG

emissions

from all

sectors with

some minor

exemptions,

and covers all

liquid and

gaseous fossil

fuels used for

combustion.

Tax exemptions apply to natural

gas consumers that are not in the

petrochemical and refinery

sectors, and fossil fuel consumers

that are certified to be carbon

neutral. Income tax does not need

to be paid over costs incurred as a

result of the carbon tax.

Mexico 2014

The Mexican

carbon tax is

an excise tax

under the

special tax on

production and

services. It is

not a tax on the

full carbon

content of

fuels, but on

the additional

CO2 emission

content

46 %

The Mexican

carbon tax

applies to CO

2

emissions

from all

sectors. The

tax covers all

fossil fuels

except natural

gas.

The tax is capped at 3 per cent of

the fuel sales price. Since 2017,

companies liable to pay the

carbon tax may choose to pay

with credits from CDM projects

developed in Mexico, equivalent

to the market value of the credits

at the time of paying the tax.

E/C.18/201

9/CRP.4

Page 28 of 75

compared to

natural gas

South

Africa

2019

The South

Africa carbon

tax is

scheduled to

come into

effect by June

1, 2019.

80 %

The South

Africa carbon

tax applies to

GHG

emissions

from the

industry,

power,

buildings and

transport

sectors

irrespective of

the fossil fuel

used, with

partial

exemptions for

all these

sectors.

For many sectors tax exemptions

starting from 60 per cent up to 95

per cent will apply. The level of

tax exemption depends on the

presence of fugitive emissions,

level of trade exposure, emission

performance, offset use and

participation in the carbon budget

program. Also, residential

transport is exempt from the

carbon tax. Companies may be

eligible for either a 5 or 10 per

cent offset allowance to reduce

their carbon tax liability.

Further examples…

Source: The World Bank Carbon Pricing Dashboard

7.2.4.2 Policy options to address concerns over competitiveness, carbon leakage and

distributional effects

There are several policy options that seek to address concerns related to the potentially adverse

effects of a carbon tax, see table below. The most popular set of policies focus on different

types of carbon tax payment reductions lowering the effective carbon tax via exemptions,

thresholds and reduced rates. Another set of policies in use include different support measures

to affected firms or sectors: output-based rebates or targeted support for resource efficiency