User Manual for

Direct Tax

Online Payments

Author: Electronic Banking Solutions Team

Version : 1.0

Date: 23/02/2008

1

Introduction:

ENet acts as a secured, user friendly single point of access for various payments

like Vendor Payments/ Employee Payments / Collections and Taxes.

HDFC Bank is the leading bank in collection of various tax payments (CBDT /

CBEC) via electronic mode.

Ministry of Finance has made TDS Payments mandatory via the Electronic Mode

from 1

st

April 2008.

Workflow:

Step1 - Log on to HDFC Bank Ltd.

Step2 - Click on NSDL Site Link and Input the required Tax Information

Step3 - Select HDFC Bank as a Corporate User

Step4 - Login to ENet and confirm the payment

Step5 - Authorise the payment as per the Board Resolution’s Requirements.

Step6 - Check if the payment is Executed /Rejected

Step7 - Print the online Challan instantaneously

Important Point:

A TDS payment transaction gets automatically value dated for the next 30

calendar days i.e. the authorizer can authorise at any time during the next

30 days However, pls note the date of debit would be the date of final

authorisation

2

Process

The following steps need to be to be followed to make tax payments:

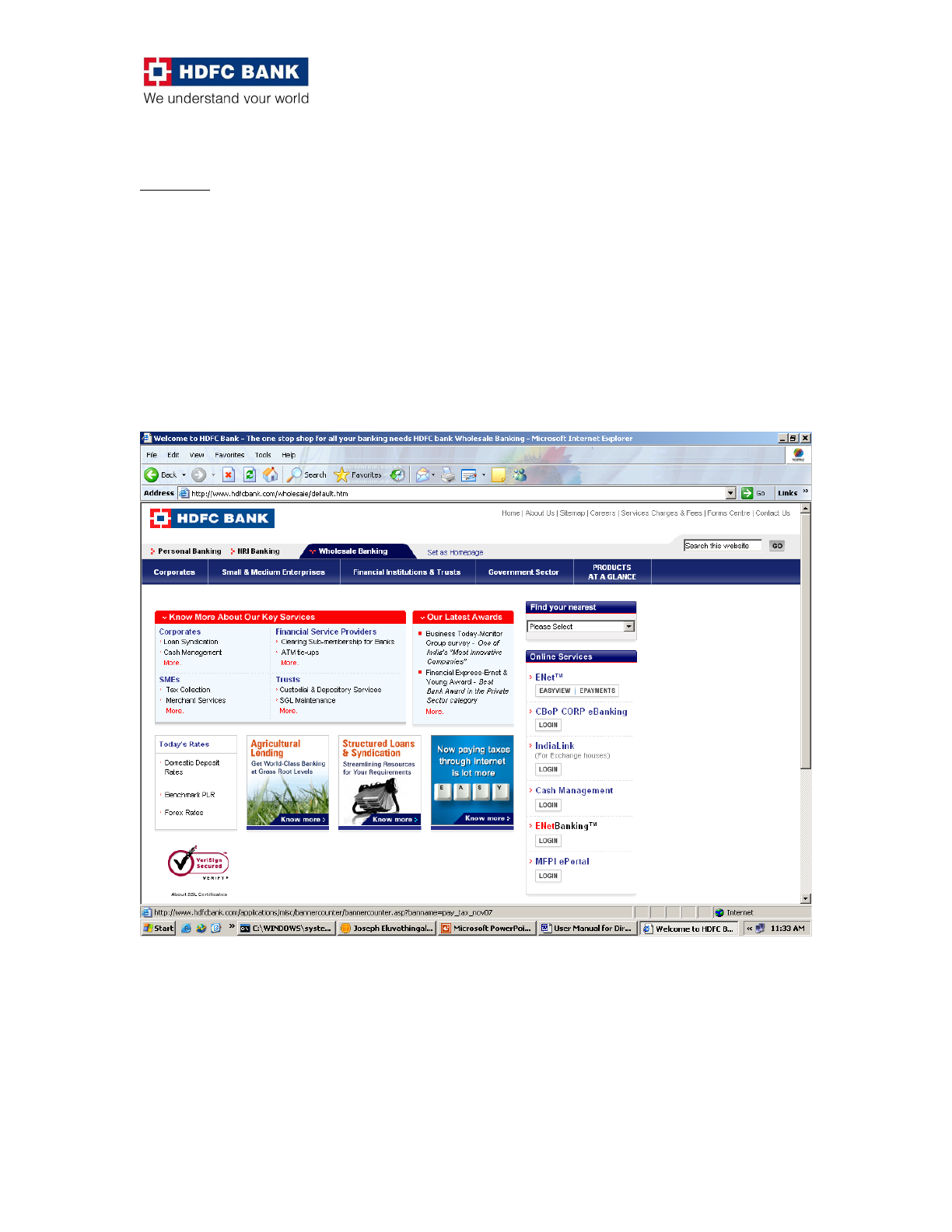

1.Log-on to the Website : http://www.hdfcbank.com/

• Under Wholesale Banking Section

•

Click on Tax Banner “Now Paying Taxes through internet is lot more

EASY”, which appears towards the bottom on the right hand side of the

screen.

3

2.

Click on the link ‘Online payment of Direct Tax’ at the bottom of the page

.

4

3. Select the type of challan based on the type of tax payment being made.For

payment of TDS (Tax Deducted At Source) by Corporate, please click on the

hyperlink – CHALLAN NO.- ITNS281

5

4. Fill in all the key details like TAN No.etc and then select HDFC Bank Name.

Then click on the tab “Proceed”

Note: Please note that the Asterisk (*) marked fields are mandatory.

6

5. The details inputted by the Corporate will be displayed. The Tax Assesment

No. is verified and displayed in Red Font as showcased below.

To confirm the details and proceed with the transaction, click on “Submit to the

Bank”. OR

Click on “Edit” to change details, if required

7

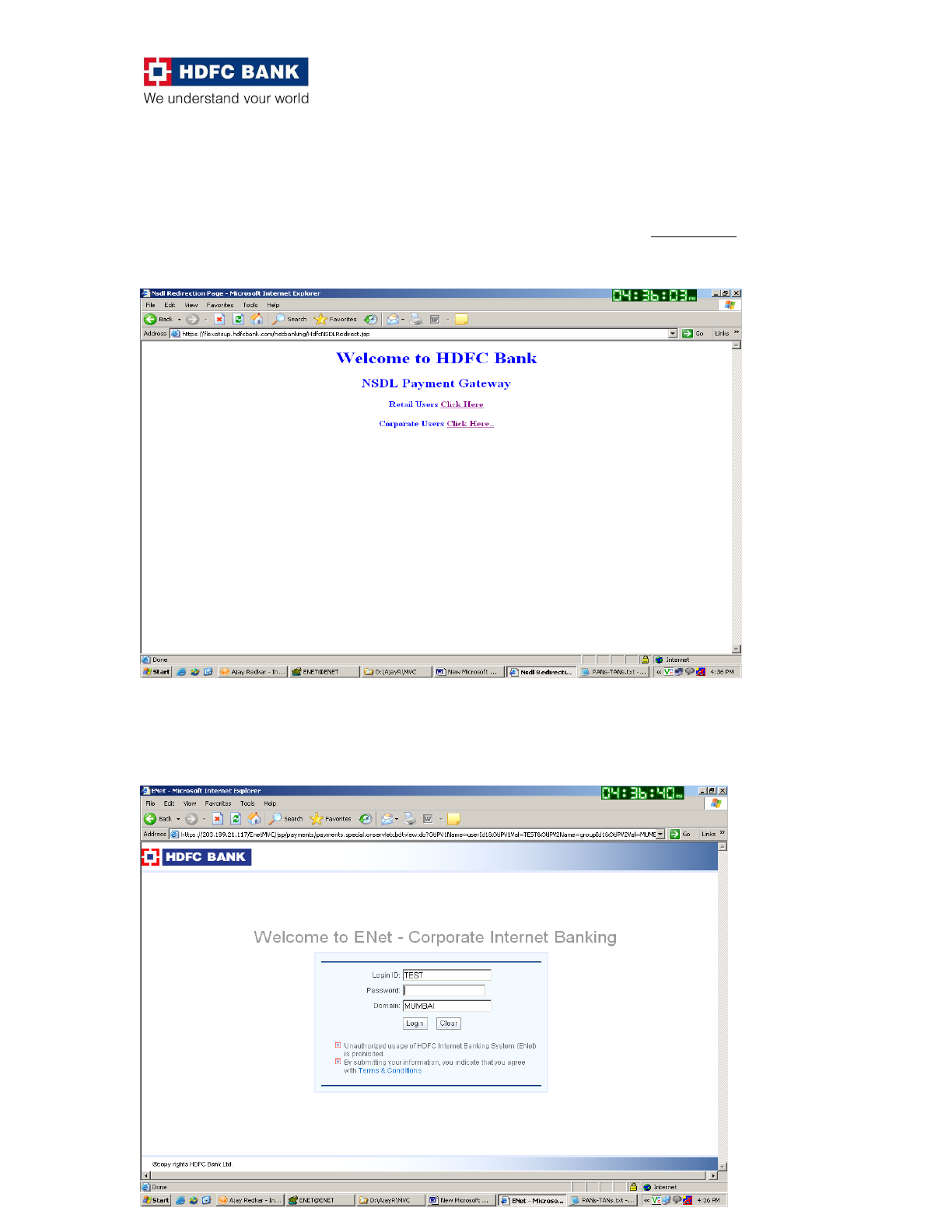

6. On clicking on the “Confirm” button, the user is redirected from NSDL site to

the Internet banking site of the bank. Click on the Hyper Link “Click Here beside

“Corporate Users”

This will lead the corporate to the login screen of the Bank. The user will input his

/ her login ID & Domain and click on “Submit”

7. The user will have to input the password and click on “Login”

Private & Confidential

8

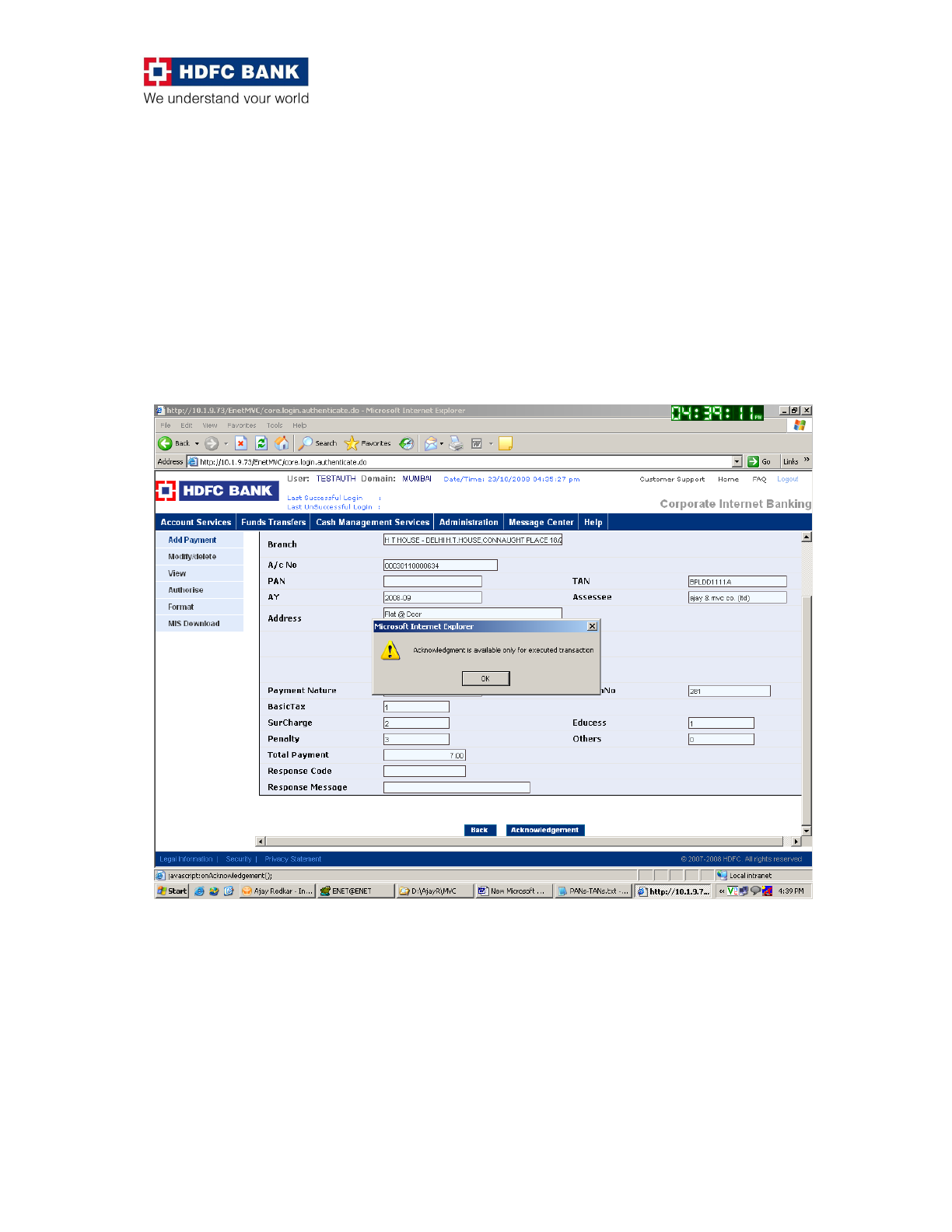

The User will be directed to the payment screen with relevant data already filled

in by them. The users will select the account and fill in Basic tax, Surcharge,

Penalty, Education Cess (if applicable) and click on “Confirm”

9

8. The Payment Confirmation screen is displayed to user, with the narration

“Records are successfully inserted”. The transaction will show Pending

Authorization (PA) Status and the User (Inputter) will logout from Enet.

9. The Authoriser will login directly through the bank site and follow steps 6 &

7 (mentioned above). This will lead the user to the service page designed

for Corporates and the user will have to click on “Funds Transfer” to view

the CBDT transactions.

10. The authorizer will select the respective entry and click on “Password” to

authorize the transaction.

Please Note : The date of authorization will be the “Value Date” & “Debit

Date” of the transaction. The amount will be immediately debited from the

account and hence the corporate should ensure that the account is funded

adequately on the day & time of authorization.

10

11. Incase of single authroisation mode, the transaction completion message

is displayed (refer point 12). In case of Joint Authorisation or Dual

Authorisation mode, the transaction is saved for the second authorization.

A message is displayed “ The transaction is partly authorised and pending

for second authorisation”.

12.After the complete authorisation as per mandate the payment is fully

authorized and a confirmation page is displayed indicating the same.

11

13.

Once the transaction is complete, the user need to generate and save

the acknowledgement of the transaction.

14. Kindly save & Print the ‘Taxpayers Counterfoil’ for future records.

Please Note : The E-net Platform will be available from 8am to 9.30pm to

make payments.

12