The Internal Revenue Service Mission

Provide America’s taxpayers top quality service by helping them understand and meet their tax

responsibilities and by applying the tax law with integrity and fairness to all.

Table of Contents

Processing Year 2024 Nature of Substantive Changes ......................................... 1

1

Introduction and General Information ........................................................... 2

1.1 What is Modernized e-File (MeF)? .................................................................................................................... 2

1.2 Using Publication 4163 ...................................................................................................................................... 2

1.3 General Information ........................................................................................................................................... 2

1.4 Authorized IRS e-File Providers ....................................................................................................................... 2

1.4.1

Electronic Filing Identification Numbers (EFINs), Electronic Transmitter Identification Numbers (ETINs), and

Passwords ........................................................................................................................................................... 3

1.4.2

Electronic Return Originator ................................................................................................................................. 3

1.4.3

Transmitter ........................................................................................................................................................... 4

1.4.4

Software Developer .............................................................................................................................................. 5

1.4.5

Online Provider ..................................................................................................................................................... 5

1.4.6

Intermediate Service Provider .............................................................................................................................. 6

1.4.7

Reporting Agent ................................................................................................................................................... 6

1.4.8

Large Taxpayer .................................................................................................................................................... 6

1.5 Communicating with IRS ................................................................................................................................... 7

1.5.1

MeF Status Page .................................................................................................................................................. 7

1.5.2

Helpful Publications and Information .................................................................................................................... 8

1.6 Overview and Benefits of MeF .......................................................................................................................... 9

1.7 New for Processing Year ................................................................................................................................ 10

1.7.1

Forms ................................................................................................................................................................. 10

1.7.2

Schema Updates .............................................................................................................................................. 11

1.7.2.1

Form 1120-S Schedule K-1 .................................................................................. Error! Bookmark not defined.

1.8 Forms for Processing Year 2024 .................................................................................................................... 11

1.8.1

Withholding Tax Returns .................................................................................................................................... 11

1.8.2

Corporation Returns ........................................................................................................................................... 11

1.8.3

Employment Tax Returns ................................................................................................................................... 11

1.8.4

Estate and Trust Returns .................................................................................................................................... 12

1.8.5

Excise Tax and e-Filing Compliance Returns (ETEC) ........................................................................................ 12

1.8.6

Extension Applications ....................................................................................................................................... 12

1.8.7

Partnership Return ............................................................................................................................................. 12

1.8.8

Tax Exempt/Government Entity (TEGE) Returns ............................................................................................... 12

1.9 Preparer Tax Identification Number (PTIN) Procedures ............................................................................... 13

1.10 Tax Relief in Disaster Situations..................................................................................................................... 13

1.11 The Requirement to E-File ............................................................................................................................... 13

1.11.5

Partnerships ....................................................................................................................................................... 14

1.11.7

Withholding Tax Returns .................................................................................................................................... 14

2

MeF Rules and Requirements ...................................................................... 16

2.1 Participating in the IRS e-File Program.......................................................................................................... 16

2.2 Maintaining Your IRS e-File Application ........................................................................................................ 16

2.3 Adherence to MeF Rules ................................................................................................................................. 16

2.4 Protecting Taxpayer Information: Gramm-Leach-Bliley Act of 1999 and Federal Trade Commission

Rules ................................................................................................................................................................. 17

2.5 Safeguarding MeF Data from Fraud and Abuse ............................................................................................ 17

2.5.1

Safeguarding Taxpayer Information ................................................................................................................... 17

2.5.2

Safeguarding Against Fraud and Abuse ............................................................................................................. 18

2.6 Disclosure of Tax Return Information ............................................................................................................ 18

2.7 Submitting a Timely-Filed Electronic Tax Return ......................................................................................... 18

2.8 Preparer Penalties ............................................................................................................................................ 19

2.9 Paperwork Reduction Act Notice ................................................................................................................... 19

2.10 Provider Responsibilities in Obtaining, Handling, and Processing Return Information .......................... 19

2.10.1

Making Substantive Changes to the Return ....................................................................................................... 20

2.10.2

Providing a Copy of the Return to the Taxpayer ................................................................................................ 20

3

MeF Information Applicable to All Form Types .......................................... 21

3.1 Preparing Your Return ..................................................................................................................................... 21

3.2 Validating Your Return .................................................................................................................................... 21

3.3 Return/Extension Due Date Tables ................................................................................................................ 22

3.4 Short Period Returns for Corporate, Partnership and Estate and Trust Tax Returns .............................. 22

3.4.1

Current Year Software is Available ..................................................................................................................... 22

3.4.2

Current Year Software is Not Available .............................................................................................................. 22

3.4.3

Valid Reasons for Form 1041 Short Period Returns .......................................................................................... 23

3.4.4

Valid Reasons for Form 1120 or 1120-F Short Period Returns .......................................................................... 23

3.4.5

Valid Reasons for Form 1120-S Short Period Returns ....................................................................................... 24

3.4.6

Form 1065 Technical Termination Returns ........................................................................................................ 24

3.5 Superseding and Amended Returns .............................................................................................................. 24

3.5.1

Superseding Returns ....................................................................................................................................... 25

3.5.2

Amended Returns .............................................................................................................................................. 26

3.5.3

Form 2290 Vehicle Identification Number (VIN) Correction ................................................................................ 27

3.6 Signing an Electronic Return .......................................................................................................................... 27

3.6.1

Practitioner Personal Identification Number (PIN) Signature Method— Form 8879 .......................................... 28

3.6.2

Form 1041 Multiple Tax Return Listing (MTRL) ................................................................................................. 29

3.6.3

Scanned Form 8453 Signature Method .............................................................................................................. 29

3.6.4

Reporting Agents Personal Identification Number (PIN) Signature Method—Form 8655 ................................. 31

3.6.5

94x Online e-Filer Signature Method (IRS Authorized Signer) This method is not acceptable for tax

professionals. (See other signature options) ..................................................................................................... 31

3.7 Applications for Extension of Time to File—Form 7004 and 8868 .............................................................. 32

3.8 Other Forms and Elections Requiring Signatures ........................................................................................ 32

3.8.1

Signature Requirements for Elections ................................................................................................................ 33

3.9 Attaching Portable Document Format Files .................................................................................................. 33

3.10 Special Instructions for Supporting Data Required by Form 8865 ............................................................. 33

3.11 Name Controls .................................................................................................................................................. 33

3.11.1

Form 1041 Name Control Information ................................................................................................................ 37

3.12 Addresses ......................................................................................................................................................... 39

3.12.1

Domestic Address Changes ............................................................................................................................... 39

3.12.2

Foreign Addresses ............................................................................................................................................. 40

3.12.3

Address Format .................................................................................................................................................. 40

3.12.4

Foreign Country Codes for Form 8858 and 926 ................................................................................................. 42

3.13 North American Industry Classification System (NAICS) Codes ................................................................ 42

3.14 Refunds ............................................................................................................................................................. 42

3.15 Payments .......................................................................................................................................................... 43

3.15.1

General Payment Information ............................................................................................................................. 43

3.15.2

Electronic Funds Withdrawal (EFW) ................................................................................................................... 44

3.15.3

Electronic Federal Tax Payment System (EFTPS) ............................................................................................. 45

3.15.4

Check or Money Order ....................................................................................................................................... 46

3.16 Special Instructions When Copies of Original Forms are Required ........................................................... 46

3.17 Submitting the Electronic Return to the IRS ................................................................................................. 46

3.18 Record Keeping and Documentation Requirements .................................................................................... 47

3.19 Acknowledgements of Transmitted Return Data .......................................................................................... 47

3.19.1

Acknowledgement Alerts for Form 1120-F ......................................................................................................... 48

3.20 Transmission Perfection Period ..................................................................................................................... 48

3.20.1

How to Determine IRS Received Date ............................................................................................................... 49

3.21 Rejected e-Filed Returns ................................................................................................................................. 50

3.21.1

Resubmission of Rejected Applications for Filing Extensions ............................................................................ 51

3.22 Integrating Data/Elections into Your Return ................................................................................................. 51

3.22.1

Special Instructions for Consolidated Returns .................................................................................................... 52

3.23 Preparing Supporting Data Required by IRS Forms or Form Instructions ................................................ 56

3.23.1

Example 1—Supporting data required by IRS forms .......................................................................................... 57

3.23.2

Example 2—Supporting data required by IRS form instructions. ........................................................................ 57

3.23.3

Example 3—Supporting data required as another IRS form ............................................................................... 58

3.23.4

Example 4—Supporting data required for tables on IRS forms .......................................................................... 58

3.24 General Dependency ........................................................................................................................................ 59

3.25 Creating Elections Required by Forms or Form Instructions...................................................................... 59

3.26 Creating Elections/Disclosure Statements Required by Regulations or Publications ............................. 60

3.26.1

Example 1—Creating Elections and Disclosure Statements With No Columnar Data ...................................... 60

3.26.2

Example 2—Creating Elections and Disclosure Statements That Apply to Multiple Subsidiaries ..................... 60

3.26.3

Example 3—Creating Elections and Disclosure Statements With Columnar Data ............................................ 61

3.27 Preparing Elections and Disclosure Statements That Require Supporting Data ...................................... 61

3.28 Electronic Postmark ........................................................................................................................................ 62

3.29 MeF Routine Maintenance ............................................................................................................................... 63

3.30 Ensuring Taxpayer Data Integrity ................................................................................................................... 63

3.31 MeF Fed/State Program ................................................................................................................................... 63

4

MeF Information for Specific Forms ............................................................ 65

4.1 Employment Tax Returns ................................................................................................................................ 65

4.2 Tax-Exempt Organization and Other Tax Exempt Entity Returns ............................................................... 65

4.2.1

TY2023, 2022, 2021 Form 990-N (e-Postcard) .................................................................................................. 66

4.3 Estate and Trusts ............................................................................................................................................. 66

4.4 Withholding Tax Returns ................................................................................................................................. 66

4.5 Partnership Returns ......................................................................................................................................... 66

4.5.1

1120 Family Forms that cannot be e-Filed as a Standalone Return at the Parent Level .................................. 67

4.5.2

Special Instructions for Form 1120 Section 847, Special Estimated Tax Payments ......................................... 68

4.5.3

Special Instructions for Form 8838 When Filed with Form 1120 ........................................................................ 68

4.6 Application for Automatic Extension of Time to File Certain Business Income Tax, Information and

Other Returns—Form 7004 ............................................................................................................................. 68

4.7 Application for Extension of Time to File an Exempt Organization Return— Form 8868 ........................ 69

4.8 Excise Tax e-File and Compliance (ETEC) .................................................................................................... 69

4.8.1

ETEC Extension Requests: ................................................................................................................................ 69

4.9 Return Due Dates and Accepted Forms and Schedules .............................................................................. 70

5

IRS e-File for Large Taxpayers Filing Their Own Corporate Income Tax

Return ............................................................................................................ 71

5.1 Purpose of Section 5 ....................................................................................................................................... 71

5.2 Why Certain Large Taxpayers are Required to e-File ................................................................................... 71

5.3 How to Meet the Requirement to e-File .......................................................................................................... 72

5.4 How to Register and Apply to e-File as a Large Taxpayer ........................................................................... 75

5.4.1

Register with e-Services ..................................................................................................................................... 75

5.4.2

Apply to e-File .................................................................................................................................................... 75

5.5 What is Different in Preparing Returns to e-File ........................................................................................... 77

5.5.1

Traditional Paper Filing Process ......................................................................................................................... 77

5.5.2

MeF Filing Process ............................................................................................................................................. 78

5.5.3

Consolidated Returns ......................................................................................................................................... 78

5.5.4

Aggregation of Data from Different Sources ....................................................................................................... 78

5.5.5

Attaching Data Not Defined in XML Schemas .................................................................................................... 79

5.5.6

Attaching Data in PDF Format ............................................................................................................................ 79

5.5.7

T.D. 9300 - Eliminating Signature Requirements for Certain Forms .................................................................. 79

5.5.8

Return Address and Name Control .................................................................................................................... 80

5.5.9

Signing the Electronic Return ............................................................................................................................. 80

5.6 How to Transmit Electronic Returns to the IRS ............................................................................................ 81

5.6.1

Transmission Channels ...................................................................................................................................... 81

5.6.2

Methods of Transmission ................................................................................................................................... 82

5.6.3

Retrieving an Acknowledgement ........................................................................................................................ 82

5.6.3.1

Elements of the Acknowledgement .................................................................................................................... 83

5.7 Timely Filed Electronic Returns ..................................................................................................................... 84

6

Appendix ........................................................................................................ 86

6.1 References ........................................................................................................................................................ 86

1

Processing Year 2024 Nature of Substantive Changes

Page Change

Throughout

This publication was updated to reflect tax returns processed in 2024;

this includes TY2021, 2022, 2023, and a few TY2024 returns.

Throughout 2020 tax year products were removed.

Throughout 2023 and 2024 tax year products were added.

Note: When reading this Publication “We” refers to the IRS, while “You” refers to the reader.

2

1

Introduction and General Information

1.1 What is Modernized e-File (MeF)?

MeF is a system that uses standardized Extensible Mark-Up Language (XML) constructs, which provide

certain businesses the capability to e-File. MeF processes the following business forms: 720, 940, 940-

PR, 941, 941-PR, 941-SS, 943, 943-PR, 944, 945, 94x Online Signature PIN Registration, 990, 990-EZ,

990-N, 990-PF, 990-T, 1041, 1042, 1065, 1120, 1120-F, 1120-POL, 1120-S, 2290, 4720, 7004, 8038-CP,

8849, and 8868. Additional forms supported by MeF can be found at Modernized e-File (MeF) Forms on

IRS.gov.

1.2 Using Publication 4163

This document addresses Tax Years 2021, 2022, 2023 and some Tax Year (TY) 2024 business returns

filed during Processing Year (PY) 2024. Publication 4163 provides Authorized IRS e-File Providers

(Providers) and Large Taxpayers with specific requirements and procedures for electronic filing through

the MeF system. E-file instructions for Large Taxpayers filing their own corporate income tax returns are

included in Section 5 of this publication. The procedures in this publication apply to all MeF business e-

File programs. All publications referenced in this document are available at Forms and Publications on

IRS.gov.

1.3 General Information

When a new tax form is added to the MeF platform, it may only be filed electronically during the current

and future processing years. For example, if Form ABC was added to the MeF platform during PY2023, it

may only be e-Filed for PY2023 and subsequent processing years. For existing forms in the MeF

platform, the most recent tax year and two prior tax years may be e-Filed. For example, during PY2023

Form 1120 can only be e-Filed for TY2023, 2022 and 2021.

1.4 Authorized IRS e-File Providers

Providers are firms and organizations that develop software, originate or transmit electronic returns to the

IRS, and provide services to taxpayer clients. The roles and responsibilities of Providers vary according to

the e-File activities. A firm identifies its e-File activity by selecting the appropriate Provider Option in the

IRS e-File application. Each Provider Option includes a different role and may have different

responsibilities that relate to the e-File activity. For example, an Electronic Return Originator (ERO) may

also be a Transmitter. Providers must adhere to all IRS e-File rules and requirements applicable to their

roles. The following details the roles and responsibilities of each Provider Option.

3

1.4.1

Electronic Filing Identification Numbers (EFINs), Electronic

Transmitter Identification Numbers (ETINs), and Passwords

All Providers must protect their EFINs, ETINs, and passwords from unauthorized use. Providers must

never share the numbers and passwords with others. A Transmitter must not transfer its EFIN or ETIN by

sale, merger, loan, gift, or any other transaction to another entity. If the IRS learns a Provider’s EFIN or

ETIN is compromised, the IRS inactivates it and the provider must call to have a new one issued. See the

EFINs and ETINs section in Publication 3112, IRS e-File Application and Participation, for additional

information.

1.4.2

Electronic Return Originator

The ERO is the Provider who originates the submission and usually the first point of contact for most

taxpayers filing a return using IRS e-File. See Publication 3112 and Revenue Procedure (Rev.

Proc.) 2007-40, Internal Revenue Bulletin (IRB) 2007-26 for additional information. Rev. Proc. 2007-40

informs Providers of their obligations to the IRS, taxpayers, and other participants in the IRS e-File

Program, and combines the rules governing IRS e-File.

1.4.2.1

ERO Responsibilities

Origination: Although an ERO may also engage in return preparation, the activity is separate and distinct

from the origination of the submission to the IRS. An ERO originates the submission after the taxpayer

authorizes the filing via IRS e-File. An ERO may only originate the submissions the ERO prepared or

collected from a taxpayer. An ERO originates the submission by any one of the following:

■

Electronically sending the return to a Transmitter that will transmit to the IRS (most taxpayers

use this method)

■

Directly transmitting the return to the IRS (rarely used), or

■

Providing a return to an Intermediate Service Provider (ISP) for processing, prior to

transmission to the IRS (rarely used).

In originating, the ERO has responsibilities including, but not limited to:

■

Timely originating the electronic submission of returns

■

Submitting required supporting paper documents to the IRS

■

Providing copies to taxpayers

■

Retaining records and making records available to the IRS

■

Accepting returns only from taxpayers and Providers, and

■

Working with the taxpayer or the Transmitter to correct rejected returns.

If the taxpayer chooses not to have the electronic portion of a return

corrected and retransmitted to the IRS, or if it cannot be accepted for processing,

the taxpayer must file a paper return. See Section 3.20, Transmission Perfection

Period for detailed instructions about filing a paper return.

4

Taxpayers required to e-File a return under Treasury Decision (T.D.) 9363 or Section 1224 of the

Taxpayer Relief Act of 1997 must contact the e-help Desk for authorization to file a paper return.

1.4.3

Transmitter

A Transmitter sends the return data directly to the IRS. EROs may apply to be Transmitters, or may

contract an accepted third-party.

1.4.3.1

Transmitter Responsibilities

A Provider participating in MeF as a Transmitter has responsibilities that include, but are not limited to:

■

Conducting a one-time communication test – no further testing is required as additional forms

are added to MeF – this applies to MeF Transmitters using Software Developers’ software to

prepare and transmit returns,

■

Transmitting all electronic portions of returns to the IRS within three calendar days of receipt,

■

Retrieving the acknowledgement file within two business days of transmission,

■

Matching the acknowledgement file to the original transmission file and sending, or making

available, the acknowledgement file to the ERO, ISP, or Large Taxpayer for all rejected and

accepted returns, within two business days of receipt,

■

Retaining an acknowledgement file received from the IRS until the end of the calendar year in

which the electronic return was filed, or (for fiscal year filers) for nine (9) months after the

transmission date, whichever is later,

■

Immediately contacting the IRS e-help Desk toll-free number 1-866-255-0654 for further

instructions, if an acknowledgement hasn’t been received within 24 hours of transmission,

■

Working with the ERO or Large Taxpayer to promptly correct any error that caused a

transmission to reject,

■

Contacting the IRS e-help Desk if the electronic portion of the return has rejected after three

transmission attempts,

■

Ensuring the security of all transmitted data, and

■

Ensuring against the unauthorized use of its EFIN or ETIN. Do not transfer EFIN or ETIN to

another entity.

The Transmitter must notify the ERO, ISP, or taxpayer of the following:

Accepted Returns

■

Date the return was accepted.

Rejected Returns

■

Date the return rejected,

■

Business Rule(s) explaining why the return rejected, and

■

Steps the ERO or taxpayer need to take to correct any errors that caused the reject.

5

1.4.4

Software Developer

A Software Developer creates software that formats electronic return information, according to IRS e-File

specifications, and transmits that information directly to the IRS. IRS e-File specifications are found in

Publication 4164, Modernized e-File (MeF) Guide for Software Developers and Transmitters. Additional

resources, such as the Automated Enrollment (AE) External User Guide, MeF Submission Composition

Guide, and MeF State and Trading Partners Reference Guide can be found on the Modernized e-File

(MeF) User Guides and Publications page.

Software Developers must pass the Assurance Testing System (ATS). If a Provider is a Software Developer

whose only role in IRS e-File process is software development, the Principals and Responsible Officials

need not pass a suitability check during the application process. However, if a Software Developer

performs any Provider Options functions, in addition to development, then suitability checks will apply.

Software Developers are not required to retest when new schemas, either major or minor, are

released, but the IRS strongly recommends Software Developers use the ATS system to test all forms

supported by the software prior to the filing season and to retest when there are Schema changes. All

forms included in each schema package are available for testing in ATS. Software Developers are not

limited to testing only the forms provided in the scenarios.

1.4.4.1

Software Developer Responsibilities

A Software Developer has responsibilities that include, but are not limited to:

■

Adhering to specifications provided in official IRS publications,

■

Ensuring its software creates accurate returns,

■

Promptly correcting all software errors that cause returns to reject, and

■

Distributing the corrections to all affected parties.

1.4.5

Online Provider

An Online Provider transmits individual or business income tax return information prepared by a taxpayer

using commercially purchased software or software provided by an Internet site.

1.4.5.1

Online Provider Responsibilities

An Online Provider has responsibilities that include, but are not limited to:

■

Ensuring the use of an EFIN or ETIN obtained for online filing,

■

Ensuring the EFIN of the ISP is included in the electronic return data, when applicable,

■

Transmitting returns electronically to the IRS,

■

Notifying the taxpayer of the status of a return by:

■ Sending a transmission to the taxpayer, or ISP when applicable, within two business

days of receiving the acknowledgment from the IRS, or

■ Mailing a written notification to the taxpayer within one business day of receiving the

acknowledgment file,

6

■

Providing the Internet Protocol (IP) information: IP Address, IP Date, IP Time, and IP Time

Zone,

■

Entering into agreements with companies to allow access to online filing only if the company

correctly captures the IP Address submitting the return, as well as the date, time, and time

zone of the computer receiving it, and

■

Including the Originator Type “Online Filer” in the Return Header.

1.4.6

Intermediate Service Provider

An Intermediate Service Provider assists with processing return information between an ERO, or the

taxpayer in the case of Online Filer, and a Transmitter.

1.4.6.1

ISP Responsibilities

An ISP has responsibilities that include, but are not limited to:

■

Including its EFIN and the ERO’s EFIN with all return information forwarded to a Transmitter,

■

Serving as a contact point between its client ERO and the IRS, if requested,

■

Providing the IRS with a list of each client ERO, if requested, and

■

Adhering to all applicable rules applying to Transmitters.

1.4.7

Reporting Agent

A Reporting Agent originates the submission of certain returns for its clients and transmits to the IRS.

They must be an accounting service, franchiser, bank, or other entity that complies with Rev. Proc. 2012-

32, IRB 2012-34 and is authorized to perform one or more of the acts listed in Rev. Proc. 2012- 32 on

behalf of a taxpayer. They must submit Form 8655, Reporting Agent Authorization, to the IRS prior to

updating or submitting an IRS e-File application.

1.4.8

Large Taxpayer

For purposes of electronic filing, the IRS defines a Large Taxpayer as a business or other entity (excluding

partnerships) with assets of $10 million or more, or a partnership with more than 100 partners (asset criteria

does not apply to partnerships), which originates the submission of its own return(s).

Large Corporations should carefully read Section 5 of this publication for specific information. A Large

Taxpayer is also a Provider Option on the IRS e-File Application, but it is not a Provider. The creation of an

IRS e-File Application for Large Taxpayers is different from the Authorized IRS e-File Providers Application.

Note: Large Taxpayers can now include their 94x employment tax returns when electronically filing, using

Form 8453-EMP, Employment Tax Declaration for an IRS e-file Return.

7

1.5 Communicating with IRS

The IRS e-help Desk assists in support of MeF software and communication testing for corporate,

partnership, estates and trusts, employment, excise, and tax-exempt returns throughout the filing season.

The e-help Desk also assists with the IRS e-File application processes. Contact the e-help Desk at 1-866-

255-0654 or, if outside the U.S. and U.S. Territories, 1-512-416-7750. You may also contact the e-help

Desk with comments or suggestions regarding Publication 4163, or if you have technical questions

regarding the e-Filing of forms.

1.5.1

MeF Status Page

The MeF Status page provides information on:

■

Current system status including Production and ATS

■

System maintenance, and

■

Unplanned system interruptions and processing delays.

MeF uses QuickAlerts, an IRS email service, to distribute information quickly to subscribers. This service

keeps tax professionals up to date on MeF issues throughout the year.

The subject line of QuickAlerts will usually identify targeted providers, as well as taxpayer types.

Subscribers receive communications about issues like processing delays, program updates, and early

notification of seminars and conferences. New subscribers may sign up through the subscription page

link located on the QuickAlerts “More” e-File Benefits for Tax Professionals page.

For additional information and assistance on MeF and forms and publications, refer to Table 1–1.

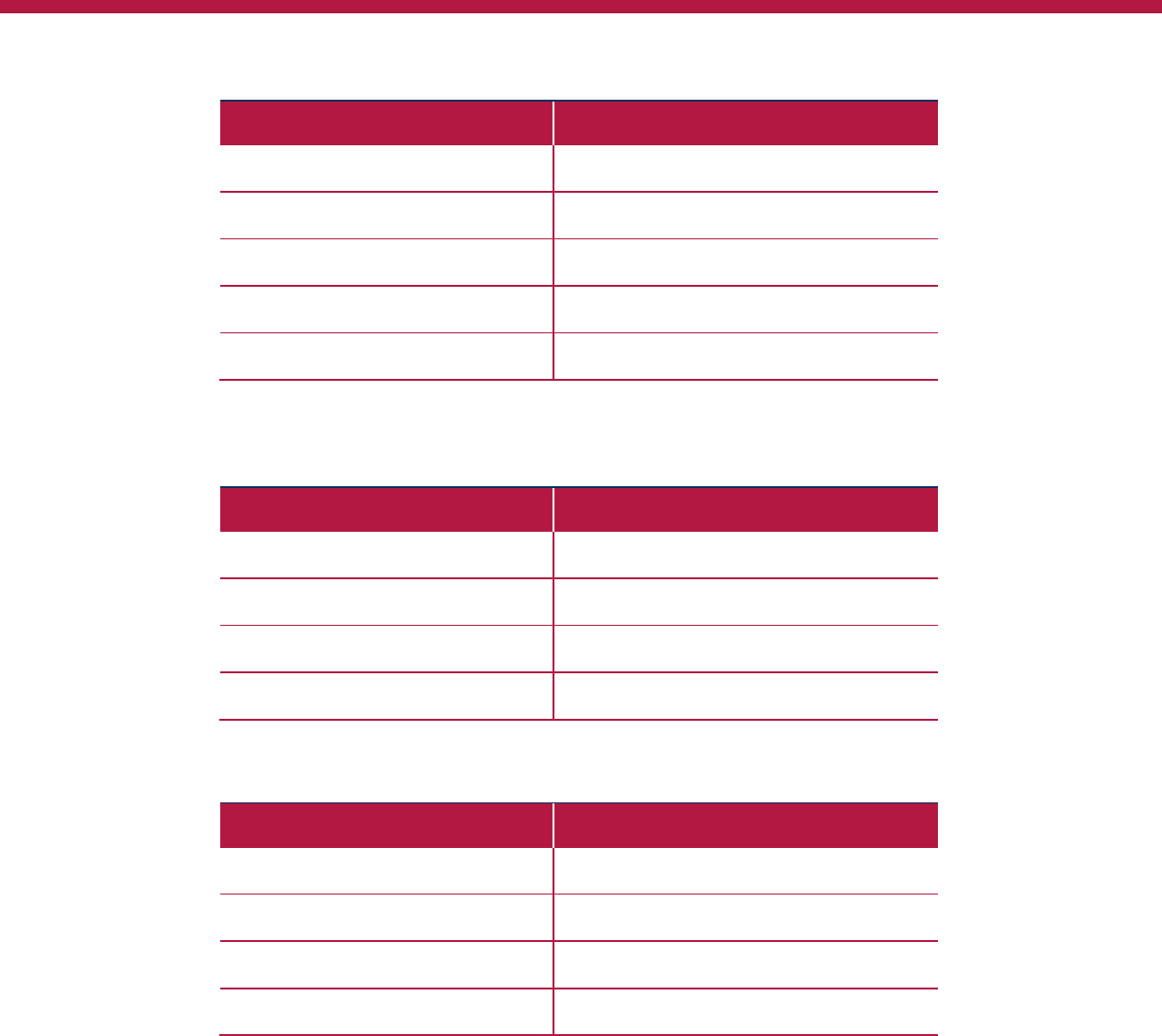

TABLE 1–1: MeF INFORMATION

Topic Service Phone Number

Electronic Funds

Withdrawal (Direct

Debit) Payments

Check the status of payments or cancelled deferred

payments. Visit the Electronic Funds Withdrawal

page for more information.

1-888-353-4537

Publications and Tax

Forms

Obtain IRS publications and tax forms by phone or go to

the Forms and Publications page. Obtain draft

versions of IRS tax forms and instructions on the Draft

Tax Forms page.

1-800-829-3676

Business and

Specialty Tax Help

Request IRS Tax Assistance for corporate, partnership,

tax exempt, employment, or excise returns.

1-800-829-4933

8

1.5.2

Helpful Publications and Information

Use any of the following methods to access publications and information:

Access the Telephone Assistance Contacts for Business Customers page

Access the Forms and Publications page

Access the Modernized e-File (MeF) User Guides & Publications

Search on IRS.gov “Search” box

Access the links in Table 1–2:

TABLE 1–2: HELPFUL PUBLICATIONS AND INFORMATION

Process Provider Option Publication Description and Link

E-Services Secure Access

Registration

All E-Services allows individuals to conduct

business electronically with the IRS. All e-

Services users must register and create an

account. E-Services requires users to register or

sign in with ID.me: an account created,

maintained, and secured by a private provider.

To complete this process, go to the e-Services

page and select the link for the family of

products you want to access (for example, e-

File Provider Services or Transcript Delivery

System (TDS)), then the link for the appropriate

Application/Product and follow the online

guidance.

Creating an IRS e-File

Application

EROs, Transmitters,

Software

Developers, Online

Providers, ISPs and

Reporting Agents

Publication 3112: Provides information on how

to create an IRS e-File application. Successful

completion of the IRS e-File application

provides an EFIN and ETIN necessary to

originate and transmit returns to IRS.

Large Taxpayers Section 5 of Publication 4163, IRS e-File for

Large Taxpayers Filing Their Own Corporate

Income Tax Return, provides information on

how to create an IRS e-File application specific

to Large Taxpayers. Successful completion of

the IRS e-File application provides an EFIN and

ETIN necessary to originate and transmit

returns to IRS.

Current Known e-File Issues

and Solutions

Software

Developers and

Transmitters

Known e-File Issues and Solutions

Contains

temporary workarounds for known issues

for each

tax year: issues are posted by form.

9

Process Provider Option Publication Description and Link

Assurance Testing System

(ATS) Testing

All Publication 5078, Modernized e-File (MeF)Test

Package Business Submissions, Contains

testing information for Corporations,

Partnerships, Estates and Trusts, Employment,

Excise, and Tax Exempt returns. Test

Scenarios can be found on the Modernized e-

File (MeF) Assurance Testing System (ATS)

Update page.

Technical Information Software

Developers and

Transmitters

Publication 4164: Contains communications

procedures, transmission formats, Business

Rules, and validation procedures for returns e-

Filed through MeF.

Attachments to:

Unique Tax Returns: Form

720/2290/8849

Exempt Organization and

Other Tax Exempt Entity

returns: Form 990/990-

EZ/990- PF/990-T/1120-

POL/4720/5227/5330/8038-

CP.

Estate and Trust Tax

Returns: Form 1041

Partnership Tax Returns:

Form 1065

Corporate Tax Returns:

Form 1120/1120-S/1120-F

EROs, Software

Developers, and

Transmitters

Each form family’s Schemas and Business

Rules page on IRS.gov contains a list of all

attachments, forms, and schedules that can be

filed for each tax year.

Attachments to Employment

Tax returns: Form 940, 940-

PR, 941, 941- PR, 941-SS,

943, 943-PR, 944, and 945.

EROs, Reporting

Agents, Software

Developers, and

Transmitters

Attachments to Withholding

Tax returns: Form 1042

EROs, Reporting

Agents, Software

Developers, and

Transmitters

1.6 Overview and Benefits of MeF

The MeF system provides XML formatting and standardized transmission methods for e-Filed returns.

IRS works regularly with stakeholders, including accounting firms, practitioners, Software Developers,

and the states to identify and resolve issues relative to MeF returns and downstream processing.

10

MeF also provides:

■

More explicit error conditions: Plain English explanations in the Acknowledgement File

pinpoint the location of the error(s) in the return and provide complete information.

■

Faster acknowledgements: Transmissions are processed upon receipt, and

acknowledgments are returned in near real-time.

■

Integrated refund and payment options: Refunds can be electronically deposited in bank

accounts, or balance due payments can be electronically withdrawn from bank accounts.

Payments are subject to limitations of the Federal Tax Deposit Rules found in Publications

3151, The ABCs of Federal Tax Deposits, and 3151A, The ABC's of Federal Tax Deposits

(Resource Guide).

■

The capability to attach supporting forms and schedules: Form 720, 940, 940-PR, 941,

941-PR, 941-SS, 943, 943-PR, 944, 94x Online Signature PIN Registration, 945, 990, 990-

EZ, 990-N, 990-PF, 990-T, 1041, 1042, 1065, 1120, 1120- F, 1120-S, 1120-POL, 2290,

4720, 5227, 5330, 7004, 8038-CP, 8868, 8849, and their supporting forms and schedules

can be e-Filed in MeF. See each form family’s Schemas and Business Rules page at

IRS.gov for tax year accepted forms and schedules.

■

24/7 transmissions: MeF allows Transmitters to send data to the IRS year-round, except for

a short cutover period at the end of the calendar year.

■

A paperless process: Taxpayers using a third-party practitioner can use the Practitioner

Personal Identification Number (PIN) option; see Section 3.6.

■

Signing an Electronic Return: Form 8453-CORP, 8453-PE, 8453- B, 8453-EX, 8453-TE,

8453-EMP, 8453-WH, and 8453-FE can be printed and signed by the Corporate Officer,

Principal or Fiduciary, and (when applicable) the ERO or Paid Preparer. Then the form can

be scanned and attached to the return as a Portable Document Format (PDF) file. Form

8655 is used by Reporting Agents to sign and file certain returns electronically. All other

attachments for which XML Schemas have not been developed can be attached as PDF files.

■

Support for filing prior-year returns: MeF can process the current and two previous years

of returns. For PY2024, taxpayers can e-File returns for TY2023, 2022, 2021, and some

TY2024 returns.

1.7 New for Processing Year

1.7.1

Forms

Beginning in PY2024, new XML forms include:

■

(Reserved) 940 Amended (e-Filed beginning June 2024)

■

940-X (e-Filed beginning June 2024)

■

941-X / 941-X (SP) (e-Filed beginning June 2024)

■

943-X / 943-X (SP) (e-Filed beginning June 2024)

■

944-X (e-Filed beginning June 2024)

■

945-X (e-Filed beginning June 2024)

■

1116 Sch B

11

■

1116 Sch C

■

1118 Sch L

■

4626 (e-Filed beginning March 2024)

■

7203

■

7204 (e-Filed beginning June 2024)

■

7205 (e-Filed beginning March 2024)

■

7207

■

7208

■

7210

■

7213 (e-Filed beginning June 2024)

■

8936 Sch A

■

8985

■

8986

■

1120-S Sch B-1 (e-Filed beginning June 2024)

No longer available in XML forms include:

■

(Reserved)

1.7.2

Schema Updates

There are several schema updates every year. These updates are relayed to stakeholders via e-Services Secure

Object Repository (SOR) distribution and Quick Alerts. Please subscribe to Quick Alerts and review schema

distributions routinely.

1.8 Forms for Processing Year 2024

MeF can process all the following parent forms in XML. Check IRS.gov for the exact date MeF will begin

processing. A complete listing of forms, including new forms, MeF accepts can be found at IRS.gov/mef

on each form family’s Schemas and Business Rules page.

1.8.1

Withholding Tax Returns

■

Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons

1.8.2

Corporation Returns

■

Form 1120, U.S. Corporation Income Tax Return

■

Form 1120-F, U.S. Income Tax Return of a Foreign Corporation

■

Form 1120-S, U.S. Income Tax Return for an S Corporation

1.8.3

Employment Tax Returns

12

■

Form 94x Online Signature PIN Registration,

■

Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return,

■

Form 940-PR, Planilla para la Declaración Federal Anual del Patrono de la Contribución

Federal para el Desempleo (FUTA),

■

Form 941, Employer’s QUARTERLY Federal Tax Return,

■

Form 941-PR, Planilla para la Declaración Federal TRIMESTRAL del Patrono,

■

Form 941-SS, Employer’s QUARTERLY Federal Tax Return (American Samoa, Guam, the

Commonwealth of Northern Mariana Islands, and the U.S. Virgin Islands),

■

Form 943, Employer’s Annual Federal Tax Return for Agricultural Employees,

■

Form 943-PR, Planilla para la Declaración Anual de la Contribución Federal del Patrono de

Empleados Agrícolas, and

■

Form 944, Employer’s ANNUAL Federal Tax Return Form 945, Annual Return of Withheld

Federal Income Tax.

1.8.4

Estate and Trust Returns

■

Form 1041, U.S. Income Tax Return for Estates and Trusts.

1.8.5

Excise Tax and e-Filing Compliance Returns (ETEC)

■

Form 2290, Heavy Highway Vehicle Use Tax Return,

■

Form 720, Quarterly Federal Excise Tax Return, and

■

Form 8849, Claim for Refund of Excise Taxes (All Schedules available).

1.8.6

Extension Applications

■

Form 7004, Application for Automatic Extension of Time To File Certain Business Income

Tax, Information, and Other Returns,

■

Form 8868, Application for Extension of Time To File an Exempt Organization Return.

1.8.7

Partnership Return

■

Form 1065, U.S. Return of Partnership Income.

1.8.8

Tax Exempt/Government Entity (TEGE) Returns

■

Form 990, Return of Organization Exempt From Income Tax,

■

Form 990-EZ, Short Form Return of Organization Exempt From Income Tax,

■

Form 990-N, Electronic Notice (e-Postcard) for Tax-Exempt Organizations Not Required To

File Form 990 or 990-EZ,

■

Form 990-PF, Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private

Foundation,

■

Form 990-T, Exempt Organization Business Income Tax Return (and proxy tax under section

6033(e),

■

Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations,

13

■

Form 4720, Return for Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue

Code,

■

Form 5227, Split-Interest Trust Information Return,

■

Form 5330, Return of Excise Taxes Related to Employee Benefit Plans, and

■

Form 8038-CP, Return for Credit Payments to Issuers of Qualified Bonds.

1.9 Preparer Tax Identification Number (PTIN) Procedures

All paid preparers and enrolled agents must have a PTIN before preparing returns. All PTINs expire on

December 31 of each year. PTIN renewal open season begins approximately October 16 each year.

Additional information on the PTIN process can be found on IRS.gov.

1.10 Tax Relief in Disaster Situations

Special tax provisions may help businesses recover financially from the impact of disasters. For additional

information, please access Disaster Assistance.

1.11 The Requirement to E-File

Certain corporations, partnerships, employment tax, and tax-exempt organizations are required to e-File.

The Department of the Treasury issues regulations requiring certain entities to e-File. Complete

regulations and the history of the requirement to e-File can be found on the IRS.gov website.

1.11.1

Large Business and International (LB&I) Corporations

1.11.1.1

Form 1120-F Foreign Corporations

T.D. 9363 provides authorization to extend the requirement to e-File for certain corporations, including

Form 1120-F. Be sure to check the IRS.gov website for the latest information on the requirement to e-File

this form.

1.11.2

Employment Tax Returns

1.11.2.1

Forms 94x filers

The Tax Increase Prevention Act of 2014 (Pub. L. 113–295) requires approved Certified Professional

Employer Organizations (CPEOs) to file Form 940, Form 941 and Form 943 (with required schedules,

including Schedule R, Allocation Schedule for Aggregate Filers) electronically, unless granted a waiver.

The CPEO program is a voluntary program; a person that does not wish to file these forms electronically

is not obligated to obtain CPEO certification. However, once certification is obtained as a CPEO, the

consequence of any failure to file these forms and associated schedules electronically is potential

suspension or revocation of CPEO certification. For additional information on CPEOs and how to

request a waiver from electronic filing requirements, go to IRS.gov/CPEO and Rev. Proc. 2017- 14.

14

1.11.3

Estates and Trusts

Any tax preparer who anticipates filing 11 or more Form 1041 during a calendar year must use IRS e-File.

Section 6011(e)(3) of the Internal Revenue Code, which requires specified tax return preparers to e-File

certain federal income tax returns they prepare and file for individuals, trusts, or estates. Final

Regulations provide further guidance on this requirement. See T.D. 9518. See also Modernized e-File

(MeF) Program Information on IRS.gov.

1.11.4

Excise Tax Returns

Any taxpayer who files a Form 2290, with 25 or more vehicles for any taxable period, shall file

electronically.

1.11.5

Partnerships

Treasury Regulations Section 301.6011-3(a) provides that if a partnership with more than 100 partners is

required to file a partnership return, the information required by the applicable forms and schedules must

be filed electronically, unless a waiver from the electronic filing requirement has been granted. Returns

filed electronically must be prepared in accordance with revenue procedures or publications.

1.11.6

Tax Exempt/Government Entities (TEGE)

Form 990, 990-EZ, 990-PF, 990-T, and 4720 must be filed electronically.

Note for Form 4720: Notice 2021-01 provides that, while subject to a delay, private foundations must e-

File Form 4720, Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code:

required by Section 3101 of the Taxpayer First Act of 2019 (Pub. L. No. 116-25), which amended Section

6033 of the Internal Revenue Code.

Private foundations may no longer rely on Treas. Reg. 53.6011-1(c) as a result of this electronic filing mandate.

The electronic filing requirement does not apply to Form 8868, Application for Extension of Time To File an

Exempt Organization Return; it can be filed electronically or in paper format.

Annual Electronic Filing Requirement for Small Exempt Organizations, Form 990-N (e-Postcard): Most

small tax-exempt organizations, whose annual gross receipts are normally $50,000 or less, are required

to electronically submit Form 990-N, unless they choose to file a complete Form 990 or Form 990- EZ.

There is no requirement to file e-File Form 1120-POL.

1.11.7

Withholding Tax Returns

The IRS issued a notice (REG–102951–16) that includes amendments to the rules for the electronic filing

of withholding tax returns. Under these regulations, a new section under IRC section 6011(e) was added:

Treas. Reg. sec. 301.6011-15. It requires electronic filing of Form 1042, Annual Withholding Tax Return

for U.S. Source Income of Foreign Persons, for certain withholding agents meeting specified criteria

within the regulations.

In addition, the Treas. Reg. sec. 301.1474-1 to require withholding agents that are financial institutions to

16

2

MeF Rules and Requirements

2.1 Participating in the IRS e-File Program

To apply for IRS e-File, you must first register with e-Services. To register for e-Services, follow the

guidance in Section 5.4.1, Register with E-Services.

Applications to become an IRS e-File Provider must be submitted online.

Once successfully registered, complete an online IRS e-File application for the business location. Section

1.4 of this publication and Publication 3112, explain the different types of provider options, as well as the

roles and responsibilities of being a Provider. Information on passing suitability and other requirements is

available.

Note: Software Developers with no other provider options (ERO, Transmitter, and so on) are not required

to undergo suitability.

We recommend registration and IRS e-File Application completion at least 45 days before e-Filing

returns. At least two Responsible Officials should be assigned for back-up purposes.

To transmit returns directly to IRS, all providers must designate one or more representatives on the IRS

e-File application as their MeF Internet Transmitter, Internet Filing Application (IFA), or MeF System

Enroller, Application-to-Application (A2A).

2.2 Maintaining Your IRS e-File Application

Maintain your IRS e-File Application: Update your IRS e-File application to remove any Principal,

Responsible Official, or Delegated User who no longer works with your organization or assigned the

designated responsibility on the application. Ensure business and mailing addresses are updated on the

IRS e-File application.

Maintain active Secure Access Authentication: You must have an active Secure Access Authentication

account to maintain your IRS e-File application.

Keep information (for example, addresses, phone numbers) on the application current to avoid having

your ETIN/EFIN disabled.

2.3 Adherence to MeF Rules

All providers must adhere to IRS e-File rules and requirements to continue participation in IRS e-File.

Some rules and requirements are specific to the activities performed by the Provider and included in this

publication. The following list of requirements, while not all-inclusive, applies to all Providers of corporate

income, tax-exempt organization, excise, partnership, estate and trust, and employment returns. These

rules do not apply to Software Developers who do not engage in any IRS e-File activity other than software

development, such as transmitting returns. Authorized IRS e-File Providers requirements:

■

Maintain an acceptable cumulative error or reject rate,

■

Adhere to the requirements for ensuring tax returns are properly signed,

17

■

Include the ERO’s EFIN as the return EFIN for returns the ERO submits to an ISP or

Transmitter,

■

Include the ISP’s EFIN in the designated ISP field in the electronic return record, and

■

Submit an electronic return to the IRS with information identical to the information provided to

the taxpayer.

2.4 Protecting Taxpayer Information: Gramm-Leach-Bliley

Act of 1999 and Federal Trade Commission Rules

Title V of the Gramm-Leach-Bliley Act (GLB Act) of 1999 established the policy stating that “financial

institutions” have an obligation to respect the privacy of and protect the security and confidentiality of their

customers’ nonpublic personal information. Financial institutions are defined in GLB Act—15 USC

Subchapter II, as “any institution engaged in the business of providing financial services to customers who

maintain a credit, deposit, trust, or other financial account or relationship with the institution,” and are

significantly engaged in financial activities. Financial institutions include tax preparation firms as well as their

affiliates. Refer to 16 CFR 313.2 and 313.3 for more information on the definition of financial institutions.

The GLB Act directed the Federal Trade Commission (FTC) to establish the Financial Privacy Rule and

the Safeguards Rule. The Financial Privacy Rule requires companies to give consumers privacy notices

explaining the institutions' information-sharing practices. In turn, consumers have the right to limit some—

but not all—sharing of their information. The Safeguards Rule requires financial institutions under FTC

jurisdiction to have measures in place, such as a written information security plan, to keep customer

information secure. The Safeguards Rule also applies to recipients of and service providers to financial

institutions. Thus, tax preparation firms that collect nonpublic personal information from customers have

an obligation to make sure their service providers safeguard the information.

FTC advises, “The Financial Privacy Rule does not supersede the restrictions in Section 7216. The GLB

Act and the Agencies' implementing regulations do not authorize a ‘financial institution’ to disclose

nonpublic personal information in a way that is prohibited by some other law. Therefore, you [financial

institutions] may not avoid the restrictions of Section 7216 by providing customers with an opt-out notice

and a reasonable opportunity to opt out.”

The GLB Act, the Financial Privacy Rule and the Safeguards Rule cover volunteer tax assistance

services. The Financial Privacy Rule does not apply to businesses such as Payroll Service Providers

whose customers are other businesses and not individual consumers.

For additional information please visit the Federal Trade Commission website where you can find

documents, guidance, and useful information about the GLB Act.

2.5 Safeguarding MeF Data from Fraud and Abuse

2.5.1

Safeguarding Taxpayer Information

IRS Publication 4557, Safeguarding Taxpayer Data: A Guide for Your Business provides guidance on

federal and state information security laws and regulations, as well as industry standards and best

practices. Providers should read this publication to ensure they are handling taxpayer data in the manner

prescribed by law.

18

If you have any comments on Publication 4557, please send an email to [email protected].

2.5.2

Safeguarding Against Fraud and Abuse

A potentially abusive return is one the taxpayer is required to file but contains inaccurate information that

may lead to an understatement of a liability or the overstatement of a credit resulting in a refund to which

the taxpayer may not be entitled.

Safeguarding of IRS e-File from fraud and abuse is the shared responsibility of the IRS and Providers.

Providers must be diligent in recognizing and preventing fraud and abuse in IRS e-File.

Each Principal, Responsible Official, and Delegated User is accountable for ensuring IRS e-File rules and

requirements are followed. Providers with problems involving fraud and abuse may be suspended or

expelled from the IRS e-File program, assessed civil and preparer penalties, or subject to legal action.

To learn about the integrity of MeF data and security during transmission of MeF returns over the Internet

access the Security During Transmission of MeF Returns Using the Internet

page.

2.6 Disclosure of Tax Return Information

Under 26 CFR 301.7216, disclosure of tax return information among Providers for the purpose of

preparing a tax return is permissible. For example, an ERO may pass on tax return information to an ISP

or a Transmitter for the purpose of having an electronic return formatted and transmitted to the IRS.

However, if the tax return information is disclosed or used in any other way, an ISP or a Transmitter may

be subject to penalties described in 301.7216 and Internal Revenue Code (IRC) 6713 for unauthorized

disclosure or use of tax return information.

2.7 Submitting a Timely-Filed Electronic Tax Return

All due dates for filing paper income tax returns apply to e-Filed returns. All Providers must ensure

returns, or applications for extensions, are timely processed. See Section 3.28 for information concerning

Electronic Postmarks.

The IRS must acknowledge the electronic portion of the return as “accepted” for processing before an e-

Filed return is considered filed. To be accepted, all e-Filed returns must have a signature, including:

■

An attached PDF signature document (Form 8453 series)

■

The Practitioner PIN method (Form 8879 series)

■

The Reporting Agent PIN method (94x family, Form 8655), or

■

The 94x Online Signature PIN Method.

See Section 3.6 for more information.

Transmitters may provide electronic postmarks to taxpayers if the Transmitters adhere to the

requirements in Section 3.28 of this publication. The receipt of an electronic postmark will provide

taxpayers with confidence of a timely filing. All requirements for signing the return, as well as resubmitting

a rejected timely filed return, must be adhered to for the electronic postmark to be considered the date of

filing.

19

2.8 Preparer Penalties

Preparer penalties may be asserted against an individual or firm meeting the definition of an income tax

preparer under IRC 7701(a)(36) and IRC 301.7701-15. Preparer penalties asserted under appropriate

circumstances include, but are not limited to, those found in IRC 6694, 6695, and 6713.

Under IRC 301.7701-15(d), Providers are not income tax return preparers for the purpose of assessing

most preparer penalties, as long as their services are limited to “typing, reproduction, or other mechanical

assistance in the preparation of a return or claim for refund.” If an ERO, ISP, Transmitter, or the tax

preparation product of a Software Developer alters the return information in a non-substantive way, this

alteration will be considered under the “mechanical assistance” exception described in IRC 301.7701-

15(d). A non-substantive change is a correction or change limited to a transposition error, misplaced

entry, spelling error, or arithmetic correction.

If an ERO, ISP, Transmitter, or the tax preparation product of a Software Developer alters the return in a

way that does not come under the “mechanical assistance” exception, the Provider may be considered

“income preparers” for purposes of asserting income tax return preparer penalties. See IRC 301.7701-

15; Rev. Rul. 85-189, 1985-2 C.B. 341 which describes a situation in which the Software Developer was

determined to be an income tax return preparer and subjected preparer penalties.

The IRS reserves the right to assert all appropriate preparer and non-preparer penalties against a

Provider as warranted. For further information about rules for tax preparers who are authorized to e-File,

see Publication 3112.

2.9 Paperwork Reduction Act Notice

The information contained in this publication has been reviewed and approved by the Office of

Management and Budget in accordance with the Paperwork Reduction Act (44 U.S.C. 3507) under

control number 1545-1708.

An agency may not conduct or sponsor—and a person is not required to respond to—a collection of

information unless it displays a valid control number. Books or records relating to a collection of

information must be retained as long as their contents may become material in the administration of

internal revenue law. Generally, tax returns and tax return information are confidential, as required by 26

U.S.C. 6103.

This information is required to implement IRS e-File and to enable taxpayers to file their corporate,

partnership, excise, estate and trust, employment, and tax-exempt organization income tax returns

electronically. It’s used to ensure taxpayers receive accurate and essential information regarding the filing

of their electronic returns and to identify the persons involved in the return filing. The collection of

information is required to retain the benefit of participating in IRS e-File. The likely respondents are

business or other for-profit institutions.

2.10 Provider Responsibilities in Obtaining, Handling, and

Processing Return Information

Large Taxpayers required to e-File their own income tax return, see Section 5 of this publication. For

purposes of electronic filing, the IRS defines a Large Taxpayer as a business or other entity (excluding

partnerships) with assets of $10 million or more, or a partnership with more than 100 partners (asset

20

criteria does not apply to partnerships), which originates the electronic submission of its own return(s).

2.10.1

Making Substantive Changes to the Return

An ERO who chooses to originate returns collected, but not prepared, becomes an “income tax return

preparer” when, as a result of entering the data, discovers errors on the return that require substantive

changes and then makes the changes to correct those errors. A non-substantive change is a correction

limited to a transposition error, misplaced entry, spelling error, or arithmetic correction. The IRS considers

all other changes substantive. As such, the ERO may be required to sign the tax return as the preparer.

A substantive change is one in which the “Total Income” amount differs by more than $150 or the

“Taxable Income” amount differs by more than $100. If the electronic return data on a corporate income

tax return is changed after the taxpayer signed the jurat, the taxpayer must sign a new Form 8453, as

applicable to the form type.

2.10.2

Providing a Copy of the Return to the Taxpayer

An ERO is required to submit an electronic return to the IRS with information identical to that provided by

the taxpayer and provide a complete copy to the taxpayer. The copy given to the taxpayer may be in any

media acceptable to both the taxpayer and the Provider. A complete copy of a taxpayer's return consists

of the electronic portion of the return, including schedules, forms, PDF attachments, and jurats (or forms

with disclosure text/language) filed with the IRS. It must include all information submitted to the IRS and

show all material filed with the return.

The copy doesn’t need the taxpayer identification number of the Paid Preparer. The electronic portion of

the return can be contained on a replica of an official form or on an unofficial form. On an unofficial form,

data entries must reference the line numbers or descriptions of an official form.

The taxpayer should be advised to retain a complete copy of the return and any supporting information.

It is recommended to retain this information for a minimum of three years from the due date or extended

due date of the tax return. This corresponds to the Statute of Limitations for that tax period, which is

generally three years from the date the tax return is filed.

21

3

MeF Information Applicable to All Form

Types

3.1 Preparing Your Return

Ensure the software has all forms and schedules necessary to file. Not all software providers support all

forms and schedules. It is the taxpayer’s responsibility to verify software capabilities, including the ability

to file amended tax returns and short period returns.

Find Software Developers who have passed ATS on the Approved IRS e-File for Business Providers

page.

3.2 Validating Your Return

Validating an e-File return involves running the diagnostics built into the software used to prepare a

return. IRS provides Software Developers all the Business Rules and XML Schema requirements needed

for each form and schedule to build into their software.

Schemas and Business Rules are distributed through SOR Mailbox. To access, have an active e-

Services account and be listed on an e-File application with the provider option of Software Developer or

State Government Agency. The role must be Principal, Responsible Official, or Delegated User with MeF

authorities (MeF System Enroller or MeF Internet Transmitter). These mailbox messages are purged after

30 days; download as soon as possible. The link Instructions for accessing the SOR Mailbox were

created for users.

To ensure that the electronic return is complete and contains all required information, please follow the

steps below:

1. Prepare the return using IRS-approved software that has all the forms and schedules

necessary to file.

2. Check/validate the return to make sure it includes all forms, schedules, and attachments

required to be filed with the return.

3. Check/validate the return to make sure the IRS will accept it.

4. Receive proper authorization to e-File the return.

5. Transmit the return.

When the return is transmitted to IRS, each of the XML Schema requirements and Business Rules are

checked. Without errors, the return will be accepted. If the return fails any of the Business Rules or

Schema requirements, the Transmitter receives an acknowledgement from the IRS with the error

description(s). When third-party Transmitters are used, they must notify their clients of the rejection.

22

3.3 Return/Extension Due Date Tables

Links to the return due date and extended due date tables for each tax year can be found in each form

family’s tax year Schemas and Business Rules page on IRS.gov.

3.4 Short Period Returns for Corporate, Partnership and

Estate and Trust Tax Returns

MeF accepts short period corporate, partnership, and estate and trust tax returns.

3.4.1

Current Year Software is Available

When a taxpayer needs to file a short period return and the current year software is available, ensure the

Tax Year in the Return Manifest and Return Header reflect the Tax Year of the Schemas being used.

Enter the actual Beginning and Ending Date of the short period return: for example, 11/01/2023–

01/31/2024.

3.4.2

Current Year Software is Not Available

In certain situations, a taxpayer may need to file a short period return before their software is ready for the

next tax year. For instance, at the beginning of calendar year 2024, a taxpayer may need to file a short

period TY2024 return with Tax Period Beginning Date 01/01/2024 and Tax Period Ending Date

01/31/2024. Such a return would normally be filed on TY2024 software, but in this scenario, the TY2024

software may have not been developed.

In this case, the taxpayer may use TY2023 software. Ensure the Tax Year in the Return Manifest and

Return Header reflect the Tax Year of the TY2023 Schema, and then enter the actual Beginning and

Ending Dates of the short period return (for example, 01/01/2024 - 01/31/2024). The return must reflect

the laws applicable to the TY2024 return even though the Schema being used is a TY2023 Schema.

When a short period corporate return is filed, regulations may require the taxpayer to attach Form 1128,

Application to Adopt, Change, or Retain a Tax Year, provide an explanation of why the short period return

is being filed and cite the applicable revenue procedure.

Note: Once current year TY2024 software becomes available, it must be used to prepare the short period

TY2024 return.

If you use the Form 1128, attach it to the top-level of the return as a PDF file and describe it as “Form

1128 for Short Period Return.”

If a revenue procedure is required to be cited on the tax return, then the Schema provides the ability to

indicate “Pursuant to Rev. Proc. 2006-45” or “Pursuant to Rev. Proc. 2006-46.”

To prevent processing delays, a number of indicators have been added to the 1041, 1120, 1120-S, and