BUILDING

ELECTRIFICATION:

PROGRAMS AND

BEST PRACTICES

February 2022

ACEEE Report

Charlotte Cohn and

Nora Wang Esram

BUILDING ELECTRIFICATION © ACEEE

i

Contents

About ACEEE............................................................................................................................................................. iii

About the Authors .................................................................................................................................................. iii

Acknowledgments .................................................................................................................................................. iii

Suggested Citation ................................................................................................................................................. iv

Executive Summary ................................................................................................................................................. v

Introduction ............................................................................................................................................................... 1

Overview of This Report ........................................................................................................................... 4

Drivers of Change ....................................................................................................................................... 5

Findings from Existing Studies ........................................................................................................... 11

Building Electrification Programs Landscape ............................................................................................. 13

Methodology ............................................................................................................................................ 13

Updated Review of Programs in the United States .................................................................... 14

Measures and Incentives Breakdown............................................................................................... 24

Integration with Other Clean Energy Technologies ................................................................... 34

Budgets, Participation, and GHG Impacts ...................................................................................... 36

Program Examples and Experience ................................................................................................................ 44

Discussion ................................................................................................................................................................ 49

Barriers and Opportunities for Building Electrification ............................................................. 49

Homeowners and Building Managers ............................................................................................. 51

Low- and Moderate-Income (LMI) Customers ............................................................................. 54

HVAC Contractors ................................................................................................................................... 57

BUILDING ELECTRIFICATION © ACEEE

ii

Manufacturers and Distributors ......................................................................................................... 59

Regulators and Policymakers .............................................................................................................. 60

Conclusions and Recommendations ............................................................................................................. 64

References ............................................................................................................................................................... 67

Appendix A. Program Details ........................................................................................................................... 74

Appendix B. Data Collection Sheet ................................................................................................................ 89

BUILDING ELECTRIFICATION © ACEEE

iii

About ACEEE

The American Council for an Energy-Efficient Economy (ACEEE), a nonprofit research

organization, develops policies to reduce energy waste and combat climate change. Its

independent analysis advances investments, programs, and behaviors that use energy more

effectively and help build an equitable clean energy future.

About the Authors

Charlotte Cohn is a research analyst at ACEEE who conducts research and analysis on utility

energy efficiency policy. Prior to joining ACEEE, she worked with the Vermont Law School

Institute for Energy and the Environment on building community solar projects for low- and

moderate-income communities in New Hampshire. She holds a master’s degree in energy

regulation and law from the Vermont Law School and a bachelor’s degree from the

University of Vermont.

Nora Wang Esram is ACEEE’s senior director for research. She oversees the organization’s

research agenda in a range of topic areas including buildings, industry, transportation, and

behavior. She leads, supports, and coordinates the work of all research programs and

contributions to policy activities. Before joining ACEEE, she worked at the Pacific Northwest

National Laboratory as a chief engineer and team lead in the Electricity Infrastructure &

Buildings Division for 10 years. She has led numerous large-scale projects and initiatives on

building efficiency and sustainability and has published more than 50 papers, including in

Nature Energy. Nora is a licensed architect. She holds a Ph.D. in architecture from the

University of Illinois, Urbana-Champaign and a master of arts in architecture from the

National University of Singapore.

Acknowledgments

This report was made possible through the generous support of the U.S. Department of

Energy (DOE), National Grid, Eversource, Pacific Gas & Electric Company (PG&E), and the

New York State Energy Research and Development Authority (NYSERDA). The authors

gratefully acknowledge the external reviewers, internal reviewers, colleagues, and sponsors

who supported this report. External expert reviewers included Monica Neukomm and Ed

Vineyard from the DOE Building Technologies Office; Courtney Moriarta, Carley Murray, and

Mary Chick from NYSERDA; Maggie Molina and Maureen McNamara from the U.S.

Environmental Protection Agency; Ana Sophia and Sherri Billimoria from the Rocky Mountain

Institute; Jeffrey Deason from the Lawrence Berkeley National Laboratory; Miguel Yañez-

Barnuevo from the Environmental and Energy Study Institute; Viraj Sheth, Ghani Ramdami,

and Michael Doucette from Eversource/United Illuminating; and Lester Sapitula from PG&E.

External review and support do not imply affiliation or endorsement. Internal reviewers

included Rachel Gold, Steve Nadel, Dan York, and Amber Wood. The authors also gratefully

acknowledge the assistance of organizations that contributed data and case studies to this

report, including the DC Sustainable Energy Utility (DCSEU), Sacramento Municipal Utility

Department (SMUD), Association for Energy Affordability (AEA), Vermont Energy Investment

BUILDING ELECTRIFICATION © ACEEE

iv

Company (VEIC), and others. Last, we would like to thank Mary Robert Carter and Mariel

Wolfson for managing the editorial process, Elise Marton for copy editing, Roxanna Usher

for proofreading, Kate Doughty for graphics design, and Wendy Koch and Alex Kellogg for

their help in launching this report.

Suggested Citation

Cohn, C., and N. W. Esram. 2022. Building Electrification: Programs and Best Practices.

Washington, DC: American Council for an Energy-Efficient Economy.

aceee.org/research-

report/b2201.

BUILDING ELECTRIFICATION © ACEEE

v

Executive Summary

KEY FINDINGS

Programs to promote the electrification of space heating, water heating, and other

end uses of fossil fuels in buildings are expanding across the country. In a previous

study, in 2020, ACEEE identified 22 programs with total annual spending of $108

million. This updated and expanded study—assessing the inventory of building

electrification efforts to date—includes 42 programs. Of these, 32 programs reported

budget data, with a collective annual budget of $166 million.

Air-source heat pumps for single-family residential space heating were the primary

technology focus in 90% of the building electrification programs included in this study,

primarily because space heating, as the largest fossil fuel energy use in the typical

American home, presents a huge decarbonization opportunity.

When building efficiency upgrades (such as weatherization to improve building

envelopes) are paired with electrification of space- and water-heating systems, those

systems can be designed to serve a smaller thermal load, reducing upfront cost,

improving comfort, and lowering peak electric demand.

Typical utility-run electrification programs usually involve technology-based rebates to

residential customers. Nonutility program administrators are more likely to offer more

comprehensive program models, including whole-home retrofit programs, financing

for upgrades, workforce training programs, low- and moderate-income programs,

market development, and other strategies.

Upstream incentives for heat pump manufacturers are not widely represented in this

survey of programs but present an opportunity for even more cost-effective energy

savings and greenhouse gas reductions because they are scalable and savings can be

passed on to end-use customers.

Low- and moderate-income (LMI) customers and renters face significant obstacles to

enjoying the benefits of building electrification. While some programs specifically

target the needs of these customers, this segment of the market requires increased

attention.

Where possible, electrification programs, measures, and incentives should be braided

into existing energy efficiency programs to increase their reach and engagement with

hard-to-reach customer groups such as low-income and multifamily households.

Contractors play a key role in building electrification. Expanding the workforce and

educating and motivating contractors to install and service heat pumps is a critical

strategy for scaling up capacity for electrification in buildings.

BUILDING ELECTRIFICATION © ACEEE

vi

Electrification—the process of converting fossil fuel–based equipment used in heating,

cooking, and transportation into efficient electric equivalents—is a critical step in addressing

anthropogenic climate change. As the United States transitions away from burning fossil

fuels for electricity generation, we must also carry out this same transition in our buildings

and our daily lives to reduce emissions of greenhouse gases (GHGs). By creating incentives

and programs to promote accelerated, widespread, and equitable electrification of fossil

fuels, we can take steps to address the existential threat of global warming without

compromising our safety, comfort, and quality of life.

This research examines the status and progress of electrification in buildings in the United

States through the lens of local electrification programs and incentives. These programs,

developed and administered by states, cities, utilities, and nongovernment organizations,

aim to accelerate building electrification through incentives, education, job training and

certification, and increased supply chain capacity. We collected a range of data from these

electrification programs, including the end uses and measures that were incentivized, the

sectors that were targeted, the level of spending and program budgets, and the anticipated

or achieved impacts (measured by total participation and GHG reductions). In addition, we

conducted interviews with program managers and technical experts to identify emerging

trends, barriers, and best practices in program design and implementation. The objective of

this report is to provide a high-level snapshot of electrification progress to date and to

identify obstacles and opportunities to accelerate building electrification across the United

States and beyond.

ACEEE published prior research on this subject in a 2020 paper surveying 22 local and

regional programs to electrify space heating.

1

Our updated survey includes data from 42

programs providing strategies and incentives for increasing the amount of new electric

heating, water heating, and cooking devices to replace fossil fuel systems in single-family

residential, multifamily residential, and small to medium-size commercial building

applications.

2

This report describes many of the largest and most comprehensive building

electrification efforts as of 2021, including programs that are ongoing and those that have

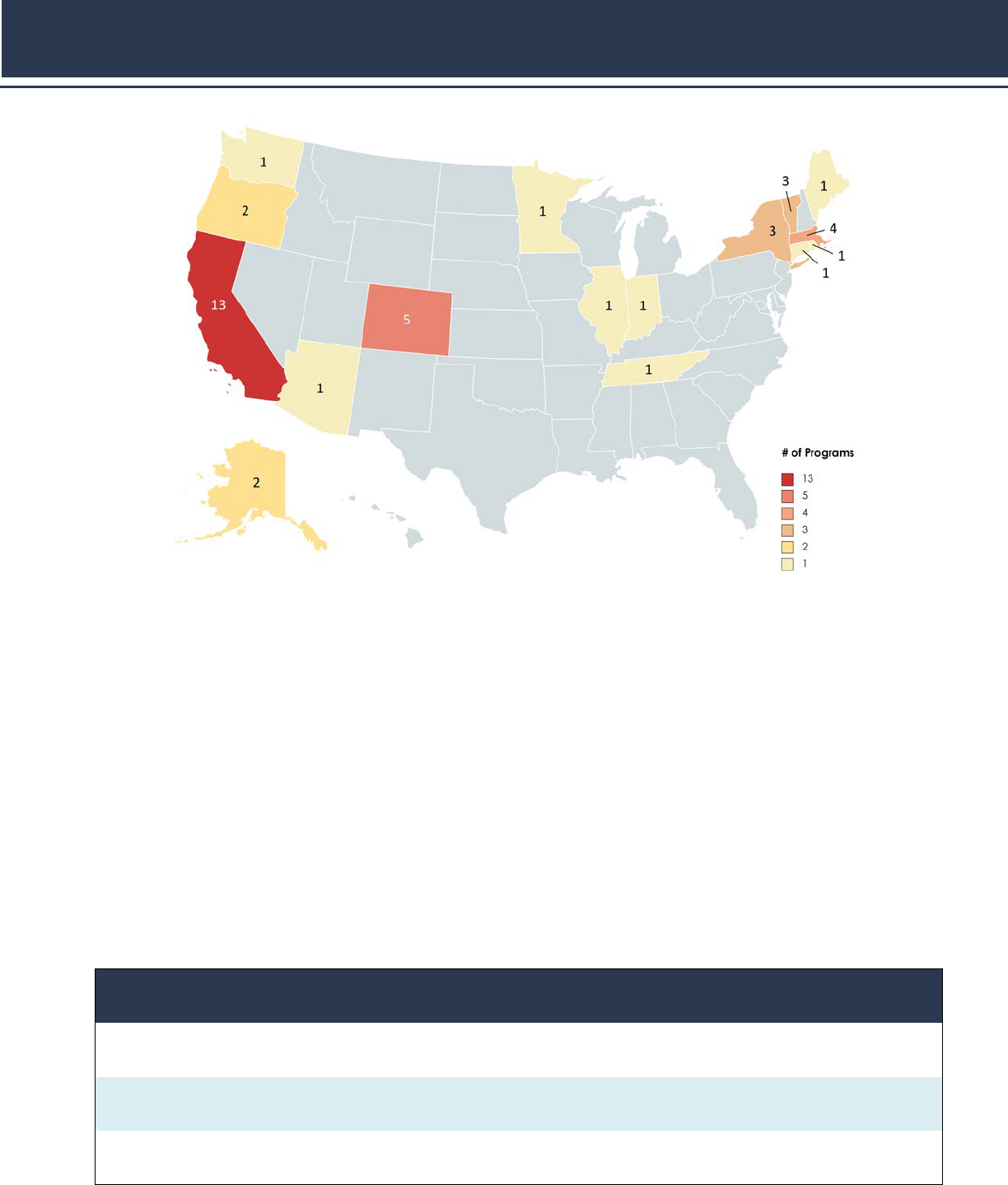

concluded. These programs, although not an exhaustive list, cover 17 states and 35 program

administrators (24 utilities and 11 nonutility administrators) in the United States, as shown in

figure ES1.

1

Nadel 2020. Programs to Electrify Space Heating in Homes and Buildings. aceee.org/topic-

brief/2020/06/programs-electrify-space-heating-homes-and-buildings.

2

To keep the scope of this report manageable, we do not include industrial programs. While industrial process

end uses are a significant opportunity for electrification, these applications are often specific to the industry in

question. ACEEE has published a body of research specific to electrification in the industrial sector, such as

Rightor, Whitlock, and Elliott 2020. Beneficial Electrification in Industry. aceee.org/research-report/ie2002

.

BUILDING ELECTRIFICATION © ACEEE

vii

Figure ES1. Number of building electrification programs in this report, by state

Space heating is the most targeted end use, with 90% of programs in this study offering

incentives for air-source and/or ground-source heat pumps. Certain programs, particularly

those in cold-weather states such as New York and Minnesota, offer specific incentives for

cold-climate air-source heat pumps, which are designed to provide ample space heating

even at low ambient temperatures. Heat pump water heaters are another major end use for

electrification, incentivized in 71% of programs. Electrification of cooking equipment

(typically via induction stoves, which are more efficient than their conventional electric

resistance cousins) is incentivized in 31% of programs. Other electric end uses, such as

clothes dryers, lawn mowers, and industrial forklifts, also receive incentives in specific cases,

but less frequently than the other applications mentioned above. Beyond direct incentives,

certain programs include market development efforts to boost the capacity and technical

skills of contractors and the knowledge base of both contractors and consumers.

The most common type of incentive is a direct rebate to utility customers for purchasing

qualifying equipment. Some programs offer tiered rebates based on factors like the

efficiency of equipment, its performance in cold climates, the type of fuel being displaced,

customer income level, and other factors. A smaller percentage of programs deliver

incentives in other ways. For example, six new-building programs offer incentives to help

home builders lower the cost of all-electric new construction. Two programs provide

incentives and specialized training to contractors who install equipment in customers’

homes. Eight programs use multiple channels to provide incentives.

BUILDING ELECTRIFICATION © ACEEE

viii

In this updated review, annual budgets total more than $166 million among the 32 programs

reporting data, a 53% increase relative to the 2020 study. The average program spends

approximately $5.2 million per year. Programs vary from small-scale pilots in fewer than 10

homes to statewide incentives and market transformation efforts with thousands of

participants. Most utility-led programs are funded by ratepayers. Programs run by state-

based organizations or other nonprofits rely on various funding methods, such as cap-and-

trade funds, capacity market revenues, grants, and donations. The programs with the largest

spending are most often found in states that prioritize electrification in policy and

regulation, such as California, New York, and Colorado.

Equity is an objective in several programs. Seven programs have an explicit requirement that

some or all participants in the programs be low-income customers. Several additional

programs offer higher financial incentives to income-qualified customers. Our research

shows, however, that multiple barriers remain for these customers, including an inability to

afford high upfront costs of fuel switching (even with incentives), a lack of understanding or

awareness of incentive opportunities and the multiple benefits of electrification, and a lack

of control over their home energy systems in a rental unit.

3

The “Discussion” section in this

report identifies additional barriers as well as strategies that some program administrators

have adopted to address these issues.

Our interviews with program managers and experts revealed that contractors play a vital role

in expanding building electrification efforts. Because heat pumps still represent a small

(although growing) segment of the HVAC market, many contractors have limited experience

with and understanding of heat pump technologies, particularly heat pump water heaters,

which require both electrical and plumbing expertise. This unfamiliarity, along with lack of

established methods to sell heat pumps to end customers, makes many contractors hesitant

to incorporate heat pumps into their existing businesses. Contractor education and

incentives targeting installers are key components of the largest market transformation

efforts to date, such as in Maine and New York.

In addition, while new building electrification is a path to create long-term cost savings and

emissions reduction, retrofits for existing homes and businesses present a variety of

challenges. Efficiency, weatherization and building shell improvements, wiring and panel

upgrades, and providing customer service all create additional complexity and can increase

costs in building electrification efforts. By offering “comprehensive” incentives that combine

electrification with building energy assessments, weatherization, panel upgrades, demand

response and distributed energy generation, whole-building programs can offer solutions

that are tailored to fit the unique needs of the building in question. Combining multiple

3

More in-depth research on decarbonization for affordable housing will be published in a forthcoming ACEEE

report (York et al. 2022).

BUILDING ELECTRIFICATION © ACEEE

ix

energy solutions can enable program managers to lock in long-term energy savings and

benefits that go beyond a simple technology replacement.

Our recommendations for expanding and scaling up electrification based on the findings of

this study are detailed by actor in table ES1.

Table ES1. Recommendations by actor

Actor

Key recommendations

State legislatures

•

Include explicit building electrification targets within larger climate plans, and

prioritize access to resources and support for marginalized communities when

setting goals

• Provide consistent funding streams for building electrification programs,

particularly whole-building retrofits for underserved communities

• Capture electrification opportunities in new buildings through building codes and

standards, such as requiring new buildings to be all-electric or “ready to electrify”

• Enact a price on carbon via a tax or by joining a regional carbon cap-and-trade

market. Utilize carbon market revenues to create sustainable funding streams for

building decarbonization programs

Regulators

•

Enable a rapid and smooth transition to a carbon-free power supply

• Ensure that the grid has adequate transmission/distribution capacity to reliably

accommodate additional electricity load from buildings

• Allow program managers to offer fuel-switching measures and incentives

• Set targets for utilities to provide building electrification incentives to their

customers, including performance-based incentives where appropriate, and

establish fuel-neutral impact tracking and reporting methods

• Consider nonenergy benefits (e.g., environmental impacts) in cost-effectiveness

testing and evaluations for building electrification programs

• Encourage utilities to explore the integration of building electrification

technologies with the grid in order to increase variable renewable energy

resource utilization and reduce systemwide costs

• Develop a transition plan for gas utilities, including gas distribution system

downsizing and zero net carbon alternatives to natural gas

• Consider impacts on electric rates, particularly for energy-burdened customers,

and require utilities to offer programs specifically targeting hard-to-reach sectors

BUILDING ELECTRIFICATION © ACEEE

x

Utilities

•

Incorporate building electrification into the integrated resource planning process

• Develop pilots and expand existing building electrification program offerings

• Incorporate demand response, distributed generation, energy storage, and other

demand-side resources to mitigate grid impacts of electrification

• Combine electrification incentives with existing in-home energy efficiency

programs to streamline the delivery progress

• Offer incentives for electric panel and service upgrades to support electrification

• Phase out incentive programs for fossil fuel equipment

Manufacturers/

distributors

•

Expand production and distribution of building electrification technologies,

particularly for whole-home systems designed for use in cold climates and for

homes with hot-water distribution systems.

• Provide contractor education programs and work with installers to broaden

understanding and expertise in heat pump technologies for buildings

• Ensure that heat pump equipment is widely available and stocked in distribution

centers to allow replacement of fossil fuel equipment on an emergency basis

Contractors, home

builders, architects,

and engineers

• Participate in education, job training, and certification programs to incorporate

building electrification technologies in building design and installations

• Develop specialized product and service offerings to integrate heat pump

technologies into existing business models and sales processes

• Join local/regional business groups to share knowledge and receive support for

building electrification

• Combine electrification with energy efficiency to reduce total system cost and

ongoing energy costs for customers

• Educate customers on heat pump technologies, incentives, and benefits

Homeowners and

property managers

•

Learn about building electrification technologies and share this information with

neighbors and peers

• Understand the local utility incentives for building electrification measures

• Plan to replace existing fossil fuel equipment as it nears the end of its useful life

span to avoid an emergency replacement when existing equipment fails

• Implement energy efficiency measures, such as improving building envelopes,

along with building electrification to reduce lifetime energy cost and improve comfort

BUILDING ELECTRIFICATION © ACEEE

1

Introduction

In the past year, many states and utilities have ramped up their commitments to reducing

greenhouse gas (GHG) emissions. To address global climate change, we must reduce these

emissions from every part of our energy system. The energy used in residential and

commercial buildings accounts for 40% of total energy use in this country (EPA 2021). The

burning of fossil fuels in buildings alone accounts for 13% of total U.S. emissions. Reducing

these numbers through efficiency and electrification is a critical step toward reaching total

decarbonization.

Electrification in the context of building decarbonization refers to the replacement of fossil-

fueled equipment (such as for space heating, water heating, and cooking) with electric

equivalents. When building electrification reduces overall emissions and energy costs, it is

often termed beneficial or strategic electrification (Farnsworth et al. 2018). Today, replacing a

natural gas furnace with an electric heat pump will reduce carbon emissions in 46 out of the

48 contiguous United States—that is, in 99% of all U.S. households—while switching from a

propane or fuel oil furnace to a heat pump will reduce carbon emissions essentially

anywhere in the Lower 48 (McKenna, Shah, and Silberg 2020). As the power sector generates

more and more electricity from carbon-free sources, electrifying fossil-fueled end uses will

increasingly reduce carbon emissions.

Several studies have found that building electrification is more cost effective than fossil fuels

for most new home construction, especially when considering the avoided cost of gas mains,

services, and meters in all-electric homes and neighborhoods (McKenna, Shah, and Louis-

Prescott 2020). For existing home retrofits, electrification is most cost effective at the time

when existing equipment reaches the end of its useful life and needs to be replaced. Space-

heating electrification also tends to be more economically favorable when replacing

equipment that runs on delivered fuels (i.e., oil and propane) with heat pumps, since

electricity rates are regulated and are therefore more stable than unregulated fuel prices

(Nadel 2018). Heat pumps are also significantly more efficient than fossil-fueled and electric

resistance heating systems; moreover, they provide air-conditioning as well as space heating,

making them attractive from a cost savings as well as a comfort perspective (Nadel 2016).

The economics of electrification may be more challenging when replacing existing gas

heating systems, due in particular to the historically low price of natural gas.

1

However, heat pumps can still be favorable relative to natural gas in mild climates where

heating needs are moderate and where electricity cost is often lower than the national

average (Nadel 2020; Kaufman et al. 2019). In a previous study, ACEEE concluded that 27%

1

These economics may change, as the price of natural gas is expected to fluctuate and increase beginning in the

winter of 2022.

BUILDING ELECTRIFICATION © ACEEE

2

of existing commercial floor space heated with fossil fuel systems can be electrified today

with a simple payback of less than 10 years on average and without any rebates or carbon

pricing; with additional incentives, the share increases to 60% (Nadel and Perry 2020).

Some end uses in buildings may be partially electrified or electrified in stages due to the

limitations of today’s technology or cost constraints in some regions. For example, while

cold-climate air-source heat pumps work for space heating to temperatures well below 10

°F, efficiency may be reduced. Therefore, in some cases, heat pump space heating in cold

climates may need a source of backup heating depending on the condition of the building

envelope and selection of heating equipment. Another example is electrifying water heating

in multifamily buildings. A central heat pump water heating system can be designed to

displace a portion of the hot-water load in a multiunit dwelling and still remain cost effective

(Ceci 2021). In any event, heat pump technologies continue advancing; this will be discussed

in the “Improved Heat Pump Performance” section of this report.

Policies and incentives often play a critical role in catalyzing new technology uptake.

Electrifying buildings is an essential part of many local, state, and national climate strategies,

and utilities and program administrators across the nation are working to accelerate

adoption of electric replacements for fossil fuel equipment. Their efforts often come in the

form of financial incentives and other programs that aim to address the cost and knowledge

barriers and other obstacles to conversion to efficient electric end uses, generally in tandem

with efforts to “green the grid” by replacing fossil fuel generation with zero-carbon

renewables. The benefits of electrification will only increase as the carbon intensity of the

grid is reduced.

This study is intended to identify emerging trends and best practices in building

electrification programs. It updates and expands on past ACEEE research on building

electrification. In June 2020, ACEEE published a topic brief on programs to electrify space

heating in homes and buildings (Nadel 2020). The 2020 study reviewed 22 utility programs

and identified a trend of rapid growth in electrification programs, which primarily use high-

efficiency heat pumps to displace fossil fuels and electric-resistance space heating. The total

program budget in 2020 was nearly $109 million, up 70% from the prior year.

2

The

continuing rising interest and rapid growth in electrification programs and policies since

then warrant a new report on electrification programs nationwide. For example, the

Minnesota Energy Conservation and Optimization (ECO) Act, passed in May 2021, provides

2

For comparison, U.S. customer-funded energy efficiency expenditures in 2018 totaled $7.2 billion (Cooper,

Shuster, and Watkins 2020).

BUILDING ELECTRIFICATION © ACEEE

3

an incentive pathway for fuel switching

3

(Minnesota Legislature 2021). Colorado SB21-246,

signed into law in June 2021, requires investor-owned electric utilities to incentivize building

electrification (Colorado General Assembly 2021b). Colorado SB21-264, passed in the same

session, requires investor-owned gas utilities to reduce greenhouse gas emissions through a

variety of “clean heat” strategies, of which electrification is one (Colorado General Assembly,

2021a). Illinois’s Climate and Equitable Jobs Act (CEJA) allows utilities to meet some of their

annual energy efficiency goals through efficient electrification measures.

This report provides an overview of the building electrification programs offered nationwide

to date, including program budgets, types, and savings. We requested updated information

from all of the programs included in the 2020 ACEEE study, reached out to administrators of

new electrification programs, and collected more detailed program information (such as

participation and savings) from program administrators. We added 20 programs from a total

of 36 utilities and administrators to our research. We also conducted interviews to compile

success stories and gain insight into lessons learned. Our study includes both commercial

programs and residential programs (for both single-family and multifamily buildings, but not

including manufactured homes). Similar to ACEEE’s previous findings reported by Nadel

(2020), the existing electrification programs are by and large aimed at residential and small

commercial buildings. Figure 1 shows which sectors have been targeted by programs in this

study. We elaborate on program details, including end uses, measures, budgets, and more,

in the “Electrification Programs Landscape” section below.

Figure 1. Number of electrification programs in target sectors

3

Fuel switching is the practice of replacing an end-use customer-facing technology (such as space heating or

water heating) with one that uses a different fuel. In the context of decarbonization, fuel switching encourages

moving away from fossil fuel technologies, such as those using oil, propane, or natural gas, through the

installation of an electric air-source heat pump.

Single-family

residential, 21

Single and

multifamily, 8

Multifamily, 2

All sectors (single

and multifamily,

commercial), 8

Commercial, 2

Single-family and commercial, 1

BUILDING ELECTRIFICATION © ACEEE

4

Since our focus is on electrification, heat pump programs that do not include fuel switching,

such as programs to replace electric resistance heating with heat pumps, are excluded from

this study. These other heat pump programs offer multiple benefits such as cost savings and

carbon reductions; however, we exclude them in order to concentrate specifically on the

unique needs and attributes of electrification programs.

Whole-building energy efficiency provides a strong foundation for electrification because it

reduces a building’s thermal load and peak demand. A smaller overall heating load makes

electrification more cost effective by reducing HVAC size, and a building’s demand flexibility

and resilience improve when a constant indoor temperature can be maintained for a longer

period of time. As electrification increases electric load during peak times, it may raise

carbon emissions for some periods when carbon-intensive units, such as coal, are used for

marginal generation. A lower peak demand reduces these marginal emissions. With an

emphasis on efficiency, our study also looked into the integration of electrification program

and weatherization measures, which reduce building energy loads and costs, especially for

low-income families. More in-depth research on how to align energy efficiency with climate

goals and how electrification will affect low-income families in residing in affordable housing

is available in two other ACEEE reports (Specian and Gold 2021; York et al., forthcoming).

OVERVIEW OF THIS REPORT

This report begins by providing its readers with necessary background information, key

terms, and context in terms of electrification policies, technologies, and drivers of change.

We also summarize findings from the existing literature to illustrate the sphere of knowledge

and information on this topic to date.

Following this introductory section, we describe our methods and key findings in the

“Electrification Programs Landscape” section. We present our analysis of the 42

electrification programs in terms of general program information; targeted end uses; target

customer sectors; measures and incentives; delivery pathways; integration with

weatherization, demand response, and other clean energy technologies; program budgets

including administrative and incentive costs; and program impacts including participation,

energy savings, and greenhouse gas reductions.

After the analysis of electrification programs across the nation, we present four case studies

in California, New York, and Washington, DC, based on our in-depth interviews with program

managers. We then discuss our research findings and the emerging barriers and

opportunities for electrification across four levels of decision making: homeowners,

contractors, manufacturers, and policymakers. We conclude with our recommendations for

strategies that various actors can employ to accelerate electrification of buildings in the

United States.

The full set of data for each program can be found in Appendix A. Appendix B presents the

survey we used to collect data for this study.

BUILDING ELECTRIFICATION © ACEEE

5

DRIVERS OF CHANGE

Uptake of electrification programs needs multiple drivers, including a supporting policy

environment to enable program development and implementation; a cleaner utility grid to

achieve the intended carbon reduction goals; and reliable, efficient technologies to meet

customer needs and deliver consumer benefits. Consumer interest and motivation certainly

play a critical role. For example, one big driver of heat pump installation in some regions

(such as Northern California and the Pacific Northwest) is encouraging homeowners to

consider heat pumps when they are thinking of installing central air-conditioning, since heat

pumps can provide cooling as well as space heating.

STATE POLICIES

A growing number of states are updating their policies to enable electrification through

customer-funded efficiency and other demand-side management programs. ACEEE

presented a landscape of the state policies and rules for beneficial electrification in a policy

brief published in May 2020 (Berg, Cooper, and Cortez 2020) and updated in January 2022.

The 2020 policy brief showed that six states (California, Hawaii, New York, Vermont,

Tennessee, and Massachusetts) were encouraging fuel switching

through guidelines or fuel-

neutral goals. Three states (Minnesota, Colorado, and Illinois) have since passed similar

legislation. For example, Minnesota recently lifted its prohibition on fuel switching in its ECO

legislation, creating opportunities for utilities such as Xcel Energy and Otter Tail Power to

expand their existing heat pump offerings and begin providing additional incentives for

conversion (Minnesota Legislature 2021). Three more states (New Jersey, Maine, and Rhode

Island) have supportive policy in place with pending guidelines or rules. The rest of the

states have no policy or specifically prohibit fuel switching.

Some policy changes in the last year have paved the way for more aggressive electrification

in certain regions. As of July 2021, 49 municipalities in California had passed measures to

require all-electric new construction (commercial and/or residential) or pre-wiring for future

electric appliance installation (CEC 2021b; Gough 2021). The California Energy Commission

released the new Title 24 Building Energy Efficiency Standards in August 2021 with rules that

will give builders strong incentives to choose electric over natural gas–fired heating for

residential and small commercial buildings starting in 2023 (CEC 2021a). At the national

level, the U.S. Environmental Protection Agency (EPA) announced in September 2021 that

gas appliances would not be included in its “most efficient” designation list starting in 2022

(EPA 2021).

4

Energy efficiency resource standards (EERS)—policies requiring utilities to meet long-term

(three or more years) energy savings targets—have also been revised in some states (such as

4

The EPA notice did leave the door open for potentially including gas heat pumps in the future.

BUILDING ELECTRIFICATION © ACEEE

6

Massachusetts, Vermont, Minnesota, New York, and California), with more states following

suit (such as Maryland and Connecticut), to better align with state climate goals (Berg et al.

2020; Specian and Gold 2021). The two primary approaches, which are often used in

combination, are multiple goals, directing energy efficiency programs to meet a number of

policy objectives, and fuel-neutral goals, enabling program administrators to prioritize the

highest-potential GHG mitigation measures across fuels and sectors) (Gold, Gilleo, and Berg

2019). In Colorado, SB21-246, signed into law in June 2021, establishes electrification goals

for investor-owned utilities, requiring them to develop plans for building electrification and

submit them to the Colorado Public Utilities Commission for approval (Colorado General

Assembly 2021b). This policy, the first of its kind in the United States, will promote the use of

energy-efficient electric equipment in place of less efficient fossil fuel–based systems.

CHANGING GRID MIX

Reducing the carbon intensity of the power grid (in terms of carbon emissions per

megawatt-hour of electricity) is crucial to maximizing the environmental benefits of end-use

electrification. While electric appliances are generally more efficient than fossil-fueled

versions, the overall environmental and GHG benefits of electrification depend on the grid

mix that provides power to these systems. Over the last 20 years, the percentage of total

electricity generated from renewable sources (including wind, solar, hydroelectric, biomass,

and geothermal) has increased from 9% of the grid in 2000 to 20% in 2020, as shown in

figure 2.

Figure 2. U.S. electricity generation by major energy source, 2000–2040. Values past 2020 are based on

forecast data (EIA 2021a).

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Coal Natural gas Nuclear Petroleum and other Renewables

BUILDING ELECTRIFICATION © ACEEE

7

Electricity generated from renewable energy sources exceeded that generated from coal-

fired power plants in 2020, for the first time since the U.S. Energy Information Administration

(EIA) started tracking nationwide energy generation data, in 1950 (EIA 2021c). The fuel mix

nationwide for electricity generation in 2020 was 40% natural gas, 21% renewables, 20%

nuclear, and 19% coal. According to EIA, the growth of renewables came primarily from

gains in wind (up 14%) and solar (up 26%). EIA predicts renewable generation to continue to

steadily grow in 2022 (10% increase relative to 2021) and in future years (EIA 2021d). Over

the long term, to 2050, EIA projects a robust competition between renewable energy and

natural gas, with renewables supported by incentives and falling technology costs and

potentially benefiting from rising costs of natural gas. The agency also predicts that coal and

nuclear power will continue decreasing in the electricity mix (EIA 2021a). A Lazard analysis

shows that selected renewable generation technologies are cost competitive with

conventional generation technologies under certain circumstances (Lazard 2020).

Electrification can lead to lower emissions today—in all but the most coal-heavy systems—

and will achieve greater reductions as the electric grid becomes cleaner (McKenna, Shah, and

Silberg 2020). A study of co-op electrification programs estimates that electrification can

reduce co-op members’ fossil fuel consumption by more than 30% (Yañez-Barnuevo et al.

2019). Nationally, the fuel mix of co-ops is 68% fossil fuel (a slightly higher percentage than

the national average), 15% nuclear, and 17% renewable (Yañez-Barnuevo et al. 2019).

As electrification increases electric load, it may also increase peak demand on the power

grid. This may lead to greater carbon emissions during specific times and in certain regions

where carbon-intensive power generation units, such as coal peaker plants, are used to

maintain reliability during peak demand times. Also, increasing peak demand can spur

utilities to invest in supply-side generation and electric transmission and distribution

upgrades, leading to increased costs throughout the power system. Therefore, demand

reduction and flexibility are critical to realize the projected emission reductions of

electrification and to keep costs manageable.

Demand flexibility can come in the form of grid-connected device controls, “smart”

thermostats, preheating and precooling, battery storage, and more. With demand flexibility,

electrification can become a valuable grid resource as opposed to a potential liability.

Connected heat pump equipment with smart controls and variable-speed motors can

respond to grid signals and reduce its energy use during these peak times. Flexible demand

can also support renewable energy growth by better utilizing intermittent resources like

solar and wind. It can help balance the grid by shifting load away from peak demand hours,

thereby reducing the need for peaker plants and helping to maximize GHG reductions. As of

2020, the ENERGY STAR® version 3.3 standard includes “connectedness” criteria for

residential water heaters that will allow them to participate in utility demand response

programs (ASAP 2021).

In addition to “active” demand flexibility measures, “passive” measures such as home

envelope upgrades can also contribute to demand-side management and provide

meaningful benefits in tandem with electrification. Comprehensive energy efficiency

BUILDING ELECTRIFICATION © ACEEE

8

measures, particularly weatherization that includes air sealing and insulation, can reduce the

overall energy required to heat and cool a building. This allows installers to downsize HVAC

equipment, leading to reduced equipment costs and more energy savings and mitigating

the impact on peak electric demand. This is particularly important in cold-climate regions

where rising winter peaks are a concern, such as the Northeast (Specian, York, and Cohn

2021).

IMPROVED HEAT PUMP PERFORMANCE

Heat pumps are among the foundational technologies to enable building electrification.

Figure 3 illustrates the basic structure of a heat pump system, which relies on a closed loop

of evaporation and condensation using a refrigerant liquid that has a very low boiling point.

By exchanging heat with an outdoor source (air, ground, or water), a heat pump can provide

both heating and cooling, based on the needs of the indoor space at the time.

Figure 3. Basic characteristics of a heat pump system with a vapor condensation-evaporation cycle

The applications of heat pumps have been expanding with technology advancement. The

following section details various heat pump technologies and uses.

Air-source heat pumps are the most common type of heat pump for residential

applications. There are two types of air-source heat pumps, ducted and ductless

systems. Ducted systems fill the role of a central furnace and air conditioner

simultaneously, delivering heating and cooling for a building with centralized HVAC

BUILDING ELECTRIFICATION © ACEEE

9

ducts. A ductless system, also called a mini-split system, is a version of an air-source heat

pump for homes without HVAC ducts. Mini-splits can provide heating or cooling within a

zone such as a room, floor, or attached unit. Air-source heat pumps can also heat or cool

water rather than air (these are called air-to-water heat pumps) and may be used with

radiant floor heating systems for more efficient space heating.

Cold-climate air-source heat pumps (ccASHPs) are a specialized model of air-source

heat pump that can operate in colder temperatures. Both ducted and ductless systems

offer cold-climate models. Modern ccASHPs are capable of delivering 100% rated

heating capacity at 5°F and up to 76% capacity at –13°F (Mitsubishi 2020). Below those

temperatures, the heat pump may switch to an electric resistance or fossil fuel backup

heating system. Heat pump efficacy in cold climates has improved in recent years due to

advancements in inverter-driven compressors and refrigerants (Shoenbauer et al. 2017).

Geothermal heat pumps, also called ground-source heat pumps (GSHPs), rely on

relatively stable temperatures underground or underwater to provide heating and

cooling. Because geothermal systems do not depend on the temperature of the outside

air, these heat pumps have more efficient and stable energy performance than air-source

systems. However, the installation cost is generally several times higher than air-source

heat pumps due to the cost of drilling underground wells. Some pilot studies have

examined the possibility of retrofitting stranded natural gas distribution infrastructure to

distribute geothermal heat on a neighborhood level (HEET 2019). However, this

application is not currently included in any of the programs featured in this study.

Water-source heat pumps (WSHPs) operate by rejecting heat to a water-pipe system

during the summer or by absorbing heat from the same water loop during the winter.

WHSPs are more efficient than air-source heat pumps because water has a higher

capacity to carry heat than air does. They are also more applicable to large commercial

buildings. Other advantages include quiet operation, a small system footprint, and the

ability to meet simultaneous heating and cooling demand in multiuse buildings

(Halbhavi 2016). Due to the highly specific siting and infrastructure required, this type of

heat pump system is not widely represented in our study.

Hybrid (dual-fuel) heat pump systems combine a heat pump with a backup gas or

propane furnace that operates when the heat pump cannot provide adequate heat.

These systems may be used in new construction or building retrofits as full load

replacements for the existing heating system. An alternative dual-fuel approach involves

installation of a new heat pump system while the previous legacy fossil fuel system is left

behind as a backup until it reaches the end of its useful life. Some programs are pursuing

this option where customers are uncertain about a heat pump’s ability to provide reliable

full-load heating, while others, like New York, are developing strategies to mitigate the

need for backup heat even in the coldest climates to fully achieve their decarbonization

goals. Some market actors have suggested dual-fuel systems are a good solution to have

a backup system in the event of a power outage, but the fossil fuel furnace still requires

BUILDING ELECTRIFICATION © ACEEE

10

electricity to operate some form of onsite generation would be needed to fulfill that

need.

Improved performance of heat pumps for water heating and space heating, especially cold-

climate air-source heat pumps, is an essential driver for heat pump adoption.

5

Regulations

and technology advancements have been key forces driving heat pump efficiency

improvement. The average seasonal performance factor of heat pumps sold in the United

States rose by 13% in 2006 and 8% in 2015 following two increases in minimum energy

performance standards (IEA 2020). The technological upgrades in recent years include

advances in refrigerant composition and volume, improved compressors (two-speed

compressors, scroll compressors), dual-speed/variable-speed motors, and waste heat

recovery for integrated space-heating/water-heating systems using a desuperheater

6

to

further increase efficiency (DOE 2021).

Most heat pumps use electric resistance heaters as a backup in very cold weather. Some

heat pumps are equipped with backup burners that use fossil fuels to provide

supplementary heat and reduce the use of electricity during the winter peak season. These

dual-fuel heat pumps may be cheaper to operate in some regions while still reducing fossil

fuel consumption (relative to a 100% fossil fuel heater). In climates where temperatures fall

below 0 °F, a dual-fuel heat pump system can still significantly cut onsite fossil fuel use by

50% or more (Yañez-Barnuevo et al. 2019). However, with advancements in refrigerant

technology, heat pumps with minimal electric backup heating can meet users’ needs in most

applications. A study in Minnesota found that current ccASHP technology performs well and

can deliver 55% savings (compared with electric resistance heating) in Minnesota’s climate

(McPherson, Smith, and Nelson 2020).

7

Elsewhere, a study in Vermont that examined a total

of 77 ccASHPs (all electric) installed at 65 residential locations showed an average seasonal

efficiency of 314% and annual fuel savings of approximately $200 after upgrading to heat

pumps (Walczyk 2017). These savings could have been even higher if paired with consumer

education about efficient operation of ccASHPs. None of the surveyed homeowners

expressed dissatisfaction with their system.

5

We use heat pump here to refer to general heat pump technologies. When we discuss heat pump applications

and case studies, it refers primarily to air-source heat pumps, which are the most popular application, unless we

specify ground-source heat pumps (GSHP).

6

A desuperheater is a secondary heat exchange device that uses excess heat generated from the refrigeration

cycle on a heat pump to heat water in a connected water-heating system.

7

In this Minnesota study, air-source heat pumps were installed in six occupied homes where natural gas was

unavailable. Propane furnaces were used for backup at four sites, and the existing electric resistance baseboards

were used for backup in two homes.

BUILDING ELECTRIFICATION © ACEEE

11

FINDINGS FROM EXISTING STUDIES

This study builds on existing research and analysis of the potential impacts of electrification

in buildings. Findings from prior studies—summarized below—can also provide useful

insights for policymakers and program administrators striving to design and operate

electrification programs more effectively. The following list describes key findings from prior

studies of electrification programs and practices.

Program maturity: Many electrification programs are still in their infancy. Program

administrators continue refining their approaches and adjusting incentives (Nadel 2020).

Heavily rebated heat pump water heater programs (not specific to electrification) are

prevalent across the nation. (Yañez-Barnuevo et al. 2019).

Benefits: Additional load from added electrical end-use equipment increased revenue

for utilities, especially co-ops, which have been experiencing flat sales or low sales

growth for the past decade. Beneficial electrification is seen as a new investment

opportunity for some utilities (Yañez-Barnuevo et al. 2019).

Locations: Electrification programs are most extensive on the West Coast and in the

Northeast (Nadel 2020).

Full versus partial electrification: The bulk of program participants (i.e., utility

customers) use heat pumps alongside existing fossil fuel systems (Nadel 2020).

Weatherization: Most programs encourage—but do not require—weatherization to

reduce loads in conjunction with the purchase of a new heat pump (Nadel 2020).

Target customers: Many programs emphasize the residential sector and target

customers who use fuel oil and propane because the economics of electrification in

these situations are often better than when displacing natural gas at current retail energy

prices (Nadel 2020).

Participation: Midstream incentives to contractors, distributors, and/or retailers have

been found to increase participation, but come with additional challenges, including

difficulty tracking sales and ensuring high-quality installations.

8

Higher incentives have

also led to higher participation. A study on Northeast electrification with a focus on

ductless mini-splits showed that among 10 programs, Efficiency Vermont’s offering using

a midstream incentive model had the highest installation rate (1.26% of homes).

8

Throughout this report, “midstream” incentives are incentives that are delivered in the middle of the supply

chain to vendors or contractors. Upstream refers to program incentives delivered early in the supply chain, such

as incentives to manufacturers and distributors. Downstream incentives mostly target end-use customers.

BUILDING ELECTRIFICATION © ACEEE

12

Efficiency Maine, which had the second-highest rate (0.82%), offered substantial

incentives of at least $500 per unit (Levin 2018).

Cost and financing: The economics of electrification are challenging in many cases,

especially in cold climates and regions with relatively low gas prices, such as the upper

Midwest. However, the economics may change if the price of natural gas rises. The EIA

estimates that midwestern natural gas customers could pay on average 49% more for

natural gas in the winter of 2021–22 (EIA 2021d). ACEEE conducted a study to evaluate

the feasibility of electrifying water heaters in multifamily buildings (Perry, Khanolkar, and

Bastian 2021). The results of this study showed that, while water-heating system retrofits

for multifamily are an effective way to reduce greenhouse gas emissions, the average

payback period for water heater electrification in a multifamily building was 20 years for

an in-unit water heater or 30 years for a central water heater. These findings were

specific to a retrofit context; the economics for all-electric new buildings are much more

favorable in many areas.

In general, while many electric heat pump

programs are offered across the nation, they are

not often specifically designed to align with the goals of beneficial electrification. First, fuel-

switching requirements are not clearly stated in most heat pump incentive programs. For

example, in a 2021 study, the Pacific Northwest National Laboratory compiled information

from 244 utility programs that provide incentives for heat pump water heaters. Nearly 88%

(214 in total) do not specify the fuel used by the water heater being replaced. Only seven

programs (less than 3%) target fuel switching from natural gas to electricity. The remaining

9% prohibit fuel switching, in effect offering rebates only for replacing electric water heaters.

Second, heat pump programs generally do not provide additional incentives for fuel

switching. An analysis by the Environmental and Energy Study Institute (EESI) of the

programs offered by Midwest co-ops found that no existing programs can be characterized

as full beneficial electrification programs per EESI’s definition (Yañez-Barnuevo et al. 2019).

9

The co-op members do not receive a rebate for fuel switching (from propane to electric), nor

do the co-ops track whether fuel switching has occurred. EESI has since helped co-ops

launch full beneficial electrification programs nationwide. For example, the Orcas Power and

Light Cooperative (OPALCO) and Mountain Park Electric are successfully operating on-bill

9

The EESI report defines beneficial electrification as “switching fossil-fuel end-use equipment to electric

equipment in a way that reduces overall carbon emissions, while providing benefits to the environment and to

members.” It defines a fully beneficial electrification program as one that includes the following elements: 1)

incentives and/or financing to cost effectively convert fossil fuel–powered equipment to electric equipment, 2) a

central program goal of reducing net carbon emissions, 3) a verification process to check that the replacement

has indeed occurred, and 4) energy audits to calculate estimated energy and monetary savings resulting from the

switch-out.

BUILDING ELECTRIFICATION © ACEEE

13

tariff programs for beneficial electrification to help their members switch to electric

equipment for residential and commercial space and water heating.

In summary, electrification program design and implementation is still in its infancy,

particularly when compared with traditional efficiency programs that focus primarily on

energy use reductions and cost savings. Learning the achievements and pain points of

existing electrification programs will help states and utilities design more effective incentive

programs.

Building Electrification Programs Landscape

Our data collection covered both electrification program characteristics and performance.

We gathered data on which end uses (space heating, water heating, cooking, etc.) are being

targeted in these programs, whether the programs are designed to replace a specific source

fuel (natural gas, oil, propane, etc.), what measures are included in the programs, and what

incentives are being provided. We also investigated whether these electrification programs

were integrated with other demand-side programs, such as those for conventional energy

efficiency upgrades, weatherization, demand response, or solar and battery storage.

To evaluate program performance, we used metrics including participation, budget, and

energy and greenhouse gas savings. We also sought to determine the extent to which

programs are reaching customers in low-income areas.

In addition to aggregating data on program characteristics and performance, this report

identifies the strategies program administrators are using to overcome market barriers to

electrification. On the basis of interviews we conducted with a select group of program

administrators, we developed a set of emerging best practices.

METHODOLOGY

The data collection process for this research began with updating and expanding the data

gathered for a previous ACEEE review of 22 electrification programs (Nadel 2020). We

reached out to program managers for updated data as of 2021 and expanded the data set

to include measures beyond space heating, such as hot-water heating, induction cooking,

and other electrification end uses. Furthermore, we contacted research institutes, advocacy

organizations, and state and utility program implementers to identify additional

electrification programs and efforts in their respective regions. We also examined program

offerings in states where electrification policies have been enacted.

Beyond adding more programs to our study and collecting quantitative data on cost

effectiveness, energy savings, and GHG savings, we also collected qualitative data around

barriers to accelerating electric technology adoption, the strategies program administrators

use to address these barriers, and practices to integrate electrification with weatherization,

demand response, distributed solar, and EV charging. Our data collection and qualitative

survey form can be found in Appendix B.

BUILDING ELECTRIFICATION © ACEEE

14

These data requests were supplemented by interviews with program managers and other

experts in the field. We sought to interview program managers from a diverse range of

implementers—including large investor-owned utilities, smaller co-op utilities, and nonutility

administrators—representing a range of geography, climate, and market conditions. The

purpose of these interviews was to learn more about program goals and to gain a deeper

understanding of barriers and lessons learned in the process of administering the programs.

Our findings from these interviews are discussed in the “Program Examples and Experience”

and “Discussion” sections below.

UPDATED REVIEW OF PROGRAMS IN THE UNITED STATES

Electrification efforts across the United States vary in their targets, scales, strategies, and

outcomes. The common aspects across many programs include an emphasis on air-source

heat pumps and a focus on rebates to end users as a delivery strategy. Beyond these

aspects, program enrollment, budgets, delivery strategies, target sectors, source fuels,

energy savings, and GHG impacts vary substantially.

We limited our survey to programs that specifically offer incentives for converting fossil-

fueled end uses to electric equivalents. Although hundreds of utility incentives for heat

pumps exist, and some customers may have used them for fuel switching, we considered

these to be conventional energy efficiency measures, as opposed to electrification measures,

because these programs are not specifically designed to replace fossil fuel end uses. We

focused specifically on electrification programs with a fuel-switching component, or

incentives for all-electric new buildings. Some electrification programs in our study also

include components that incentivize electric-to-electric conversions (e.g., replacing electric

resistance equipment with heat pumps). Those components are included in our data

collection and analysis.

Figure 4 shows the geographical distribution of the programs in our study. The state with

the most programs represented in this report is California, with 13 programs offered by 6

different administrators. Other states with robust electrification program offerings include

Colorado, New York, Massachusetts, and Vermont.

BUILDING ELECTRIFICATION © ACEEE

15

Figure 4. Map of electrification programs included in this study

We identified 42 different building electrification programs. Twenty-three of them are still

ongoing, while 19 concluded prior to this study. These were generally pilots and

demonstration projects with an intentionally limited run, or programs that transitioned to a

new administrator (such as the New York State Energy Research and Development

Authority’s heat pump rebate program, which transferred to the New York State Investor-

Owned Utilities in 2020). Table 1 lists the basic characteristics of each program, including its

name, the name of the utility or administrative organization, the primary state in which the

program operates, and years of operation. Each program is assigned an abbreviated name

that is used throughout this report. All programs are or were in operation; planned and

forthcoming initiatives, such as California’s BUILD program, were excluded from our study.

Throughout this report, “n/d” indicates where no data could be found.

Table 1. List of electrification programs – basic characteristics

#

Short

program name Full program name

Program

administrator/implementer State Years

1 AEA LIWP

Low Income Weatherization

Program Multifamily

Association for Energy

Affordability

CA 2016–2021

2 AK Heat $mart

Alaska Heat Smart and

Thermalize Juneau

Alaska Heat Smart AK 2020–2021

3

APS Reserve

Rewards

Reserve Rewards Arizona Public Service AZ n/d

BUILDING ELECTRIFICATION © ACEEE

16

#

Short

program name Full program name

Program

administrator/implementer State Years

4

Avangrid

Energize CT

Energize CT Eversource CT CT n/d

5 BayREN Home+ Home+

Bay Area Regional Energy

Network

CA 2020–2021

6

BED Net Zero

City

Net Zero Energy City Burlington Electric Department VT n/d

7 City of Ashland

Conservation Division

Incentive Programs

City of Ashland, Oregon OR n/d

8

ComEd Electric

New Homes

Electric Homes New

Construction

Commonwealth Edison IL n/d

9

Comfort365

Comfort365

City of Boulder, CO

CO

2018–2021

10 DCSEU LIDP

Low Income

Decarbonization Pilot

DC Sustainable Energy Utility DC 2020–2020

11 Efficiency VT

Efficiency Vermont

Electrification Incentives

Efficiency Vermont VT n/d

12

EFG Hudson

Valley HP*

Hudson Valley Heat Pump

Program

Energy Futures Group NY 2017–2019

13

EFG MA Solar

Access

Massachusetts Solar Access

Program

Energy Futures Group MA 2017–2019

14

EFG Zero Energy

Now

Zero Energy Now Energy Futures Group VT 2016–2018

15 EMT HP Rebate

Efficiency Maine Trust Heat

Pump Rebates

Efficiency Maine Trust ME n/d

16

EWEB Smart

Electrification

Smart Electrification Eugene Water and Energy Board OR n/d

17

Holy Cross BE

Rebates

Beneficial Electrification Holy Cross Energy CO n/d

18

MA CEC ASHP

Pilot

Whole-Home Air-Source

Heat Pump Pilot

Massachusetts Clean Energy

Center

MA n/d

19

MA DOER Home

MVP

Home MVP

Massachusetts Department of

Energy Resources

MA n/d

20

Mass Save Fuel

Optimization

Mass Save Fuel Optimization

for Residential, Small

Business, and Income

Eligible

Mass Save (National Grid, Cape

Light Compact, Unitil, Eversource)

MA 2019–2021

21 MN ASHP

Minnesota ASHP

Collaborative

Minnesota ASHP Collaborative MN 2020–2021

BUILDING ELECTRIFICATION © ACEEE

17

#

Short

program name Full program name

Program

administrator/implementer State Years

22

MPE Electrify

Everything*

Electrify Everything Mountain Parks Electric, Inc. CO 2018–2021

23 NG RI HVAC HVAC Program National Grid Rhode Island RI n/d

24 NYS Clean Heat

NYS Clean Heat: Statewide

Heat Pump Program

NYS Electric Utilities NY 2020–2021

25

NYSERDA HP

Rebate

NYSERDA Heat Pump

Rebates and Clean Heat

Challenge

New York State Energy Research

and Development Authority

NY 2017–2019

26

OPALCO Switch

It Up!

Switch It Up! On-Bill

Program

Orcas Power & Light Co-op WA n/d

27 Palo Alto HPWH

Heat Pump Water Heater

Rebate

City of Palo Alto Utilities CA 2019–2021

28 PG&E/SCP AER Advanced Energy Rebuild

Pacific Gas & Electric, Sonoma

Clean Power, Bay Area Air Quality

Management District

CA 2017–2019

29

Renewable

Juneau

Juneau Carbon Offset Fund Renewable Juneau AK 2019–2021

30

SCAQMD

CLEANair

CLEANair Furnace Rebate

Program

South Coast Air Quality

Management District

CA 2020–2021

31 SCE CLEAR

Clean Energy and Resiliency

(CLEAR)

Southern California Edison CA n/d

32

SCE Residential

Upstream

Plug Load and Appliance

(Residential Upstream

Incentives for Space and

Water Heat Pumps)

Southern California Edison CA n/d

33

SMUD Advanced

Homes

Advanced Homes

Electrification

Sacramento Municipal Utility

Department

CA 2018–2021

34

SMUD

Commercial

Commercial

Sacramento Municipal Utility

Department

CA 2019–2021

35

SMUD Home

Appliance

Home Appliance

Sacramento Municipal Utility

Department

CA 2018–2021

36

SMUD Low

Income

Low Income Electrification

Sacramento Municipal Utility

Department

CA 2019–2021

37

SMUD

Multifamily

Existing Multifamily

Sacramento Municipal Utility

Department

CA 2018–2021

38

SMUD New

Homes

New Homes Electrification

Single and Multifamily

Sacramento Municipal Utility

Department

CA 2018–2021

BUILDING ELECTRIFICATION © ACEEE

18

#

Short

program name Full program name

Program

administrator/implementer State Years

39

Tri-State Heat

Pump

Heat Pumps

Tri-State Generation and

Transmission

CO 2014–2021

40 Tri-State HPWH Heat Pump Water Heaters

Tri-State Generation and

Transmission

CO 2018–2021

41 TVA C&I

Electrification Rebates for

Commercial and Industrial

Tennessee Valley Authority TN 2017–2020

42

WVPA Power

Moves

Power Moves

Wabash Valley Power Alliance

(WVPA)

IN 2010–2021

* Two programs were funded all or in part by other programs on this list, namely, EFG Hudson Valley is

funded through competitive grants from NYSERDA and MPE Electrify Everything is partially funded

through rebates provided by Tri-State Generation and Transmission.

SUMMARY OF PROGRAMS AND FINDINGS

The programs identified in table 1 provide a range of incentives among several distinct end

uses, including space heating, water heating, cooking, and others. Below we include several

figures that summarize these programs in terms of commonly targeted end uses (figure 5),

source fuels for conversion (figure 6), target sectors (figure 7), and method of incentive

delivery (figure 8). A detailed breakdown of these characteristics for each individual program

can be found in Appendix A.

TARGETED END USES

Figure 5. Targeted end uses across 42 electrification programs. Note: For space heating, many programs

included more than one equipment type or did not specify the type of equipment included.

BUILDING ELECTRIFICATION © ACEEE

19

Most programs in this study targeted space-heating electrification. Out of 42 programs, 38

(90%) provided incentives for space heating via heat pumps of various types, and some of

these 38 programs offered specific incentives for certain heat pump technologies and/or

applications. The most common type of heat pump incentive was for ductless/mini-split

systems, with 21 programs offering this type. Nine programs offered incentives for ground-

GSHP systems. Ducted systems received specific incentives in five programs.

Some programs offered scaling incentives based on factors such as equipment efficiency,

ability to perform in cold climates, or customer income level. In these cases, more efficient

equipment and/or cold-climate equipment was typically eligible for a higher incentive. Four

programs specifically incentivized ccASHP through this method. A more detailed breakdown

of measures and rebates can be found in the “Measures and Incentives Breakdown” section,

below.

Water heating was the second-most targeted end use, included in a total of 30 programs

(71%). Many programs provided incentives for both space and water heating with heat

pumps. These two end uses consume the largest share of energy in buildings. On a total Btu

basis, space heating represents 43% of all residential site energy consumption, and water

heating 19% (EIA 2018). This makes these uses the highest priorities for electrification from

both carbon and energy standpoints.

Thirteen programs offered incentives for efficient electric cooking equipment in the form of

induction stovetops. While induction stoves offer multiple advantages over both gas and

electric resistance stoves, program managers noted challenges with overcoming some

customers’ preference for gas stoves and ovens and their unfamiliarity with induction

cooking equipment.

10

To address this barrier, some program administrators, such as Sonoma

Clean Power, offered equipment loan programs that allowed customers who had never used

induction stoves before to familiarize themselves with the technology.

Only one program, run by the City of Ashland Conservation Division, targeted clothes drying

as an end use for electrification. Dryer conversions were not included in most programs

likely because electric dryers (using electric resistance heating elements) already represent

almost 80% of the existing market for clothes dryers (Statista 2011) and are often less

10

Induction stoves require specialized cookware (pots and pans) that many customers do not have in their

kitchens. Customers may assume induction cooktops are like electric resistance stoves, which can take a long

time to heat up, and that they provide less precise control of the heating element (Bartholomy et al. 2020).

Induction cookware is more precise and is quicker to heat than electric and cools off rapidly after use, providing a

much safer cooking environment.

BUILDING ELECTRIFICATION © ACEEE

20

expensive than gas dryers without incentives.

11

Heat pump clothes dryers are still new to the

market.

Certain programs combined electrification of space and water heating with other clean

energy technologies. These were often “whole-home” programs whose aim was to reduce

overall building energy consumption and GHG emissions. The most common technology

incorporated in these programs was solar power, with eight programs providing incentives

for rooftop installations or off-site community solar subscriptions. Combining solar with

electrification can help make up for the higher electric consumption that results from fuel

switching, reducing customer energy bills in the long run. However, it also contributes to a

higher upfront cost. Some of these programs combined incentives for solar and battery