Barclays PLC

Corporate Transition

Risk Forecast Model

2021

Contents

Inside this book

Introduction

01

1 Input Data

02

2 Assessment

05

3 Financial and Credit Risk Outputs

16

4 Known Enhancements

22

Scenario analysis plays an important role in

assessing the future implications of potential

climate change pathways on Barclays’, and is a

key part of the organization’s approach to

climate risk management.

If the transition to a low-carbon economy

happens too slowly, climate change could have

devastating eects on our planet. If the

transition is disorderly, there could be very real

social and economic costs for families and

businesses around the world – from

unemployment and nancial hardship, to

insucient food and fuel to meet their daily

needs. We must weigh and balance those risks in

order to maximise our contribution to

addressing the climate challenge.

Against this backdrop is an evolving regulatory

landscape, with many regulators increasing

theiroversight and expectations of climate risk

management in recent years. In 2019, Barclays’

principal regulator, the PRA, published a

Supervisory Statement outlining requirements

for a strategic approach to the management

ofthe nancial risks posed by climate change.

These were enhanced in July 2020, setting a

deadline for implementation of end2021.

Central Banks and regulators are also

increasingly engaging in supervisory stress

teststo understand the climate vulnerabilities

ofparticipants, including the Bank of France/

French Prudential Supervision and Resolution

Authority, the Netherlands Bank (DNB), the

Bankof England and the Prudential Regulation

Authority, and the European Central Bank.

Climate change is a global and pervasive risk

andopportunity to companies and there will

inevitably be winners and losers across all

sectors. Assessing this impact requires new

approaches and tools, which consider both

climate, macro-economic and sector and

company specic factors. Barclays started

assessing those impacts in 2018, initially

qualitatively and has since aimed to create

quantitative methodologies for several of its

keyportfolios. These new approaches and

toolsfocus on company level analysis,

whichdiers from more traditional stress

testingexercises, conducted at portfolio or

sector level, as a counterparty unit of analysis

better captures the novel risk driver’s climate

change presents. To support this, Barclays

developed a methodology to assess the impacts

of future climate transition scenarios on

corporate companies from economic sectors

that Barclays considers to besubject to elevated

climate risk (as dened in our TCFD report). This

methodology produces revised future nancial

metrics impacted by such scenarios, which can

in turn be used in credit risk assessments.

This methodology is rst generation and is

focused on capturing the directionality and

magnitude of climate change impacts to

companies, rather than achieving a high degree

of accuracy. Over time it is expected that this

approach will evolve and be rened as data

availability improves and methodological

techniques are rened. This whitepaper is

shared in this spirit, to add to the growing body

of literature on how to assess the risks arising

from climate change, to invite feedback and to

support other actors in developing their

approaches to this eld.

The key design principles of the methodology

are outlined below, across the input data

required, the assessment performed and

theresulting nancial and credit impacts.

Greater detail is included in subsequent

sectionsoutlining how each of these steps

isoperated and integrated into the overall

methodological approach.

Introduction

1. Input Data 3. Financial and Credit Risk Impact2. Assessment

Financial Impact

■

Forecast future revenue, gross prots,

earnings and net debt

Credit Scorecard

■

Assess 3 factors:

– Size

– Protability

– Leverage

Downstream models

■

Climate adjusted future credit rating

Adaptation

■

Actions to mitigate climate risks

■

Impacts to revenues and emissions

■

CapEx from shift in low/high

carbonactivities

Carbon Costs

■

Carbon tax from GHG emissions

■

% carbon costs passed to

nextconsumer

Gross Prot

■

Changing prices for fossil fuels

■

Changing demand for goods and

services on revenue and costs

Scenario Variables

■

Commodity demand and prices

■

Low/high carbon product demand

■

Carbon prices

Company Data

■

Revenue, costs and earnings

■

Net debt

■

GHG emissions

Internal Credit Metrics

■

Credit ratings (Default Grade)

■

Exposure at default

■

Loss given default

Barclays PLC

home.barclays/annualreport 01

Barclays PLC Corporate Transition Risk Forecast Model 2021

1.1 Scenarios

The purpose of the methodology is to calculate

future company level nancial and credit metrics,

impacted by the climate specic transition

scenario being assessed. To that end, it is

capable of consuming a wide range of scenarios

depending on the objective of the assessment.

It has in particular been designed to utilise

scenarios developed by the Bank of England in

the context of its 2021 Climate Biennial

Exploratory Scenario (CBES) and by the Network

for Greening the Financial System (NGFS),

including Orderly and Disorderly transitions.

Whilst the methodology is capable of running

various transition scenarios, in order to support

the assessment granularity, the scenarios being

used should include a wide variety of demand

and price curves for commodities and products

and services. This includes for example, power

capacity, fossil fuels, transport capacities and

products such as cement and steel. Throughout

this report, NGFS scenarios are used to

demonstrate examples of the methodology,

specically the Orderly Net Zero 2050 scenario,

which informed the Bank of England’s Early

Action scenario. It is worth noting that Barclays

expanded certain scenario variables that were

not published.

1.2 Company Data

To perform granular assessments of the

impacts of future climate scenarios on

corporate companies, the methodology requires

detailed information on the company, including

i)nancial metrics, ii) emissions data and iii)

internal credit metrics. It is important that

relevant information about the company is

isolated as of today, to subsequently apply

theimpact of future climate scenario variables.

Obtaining data is challenging, across a number

of dierent dimensions including data sourcing,

granularity, and format. As a result, estimation

techniques and proxies are often required in

order to perform the assessment. The increase

in companies disclosing climate risk information

in TCFD reports has driven a signicant increase

in the number of data points available to perform

the assessment, in turn lowering the reliance

onestimations. This should increase the validity

of the assessments performed.

1.2.1 Company Financial Data

For nancial data, the corporate population is

segmented into dierent sectors according to

the principal business activity they perform.

Company’s activities are further attributed to

key sector specic technologies, according to

the revenues they generate from these

products/services. These technologies have

been chosen as they are deemed to be the most

important business segments impacted from a

climate change perspective. It is noted that

some companies operate across a multitude of

activities, and in the future the methodology

aims to make these technologies sector

agnostic so that revenues can be attributed to

any technology irrespective of the sector in

which the company operates. However, these

instances are small in number and in many cases

additional operations for companies within a

sector, not captured within the chosen

technologies, will face minimal impacts from

climate change. In such cases, increasing the

number of the possible technologies per sector

does not add additional analytical value. The

methodology currently treats these Revenues

as “Other” and holds these constant over the

scenario forecast.

This segmentation and attribution generates a

detailed picture of the companies’ starting

business model that can be used to forecast the

impact of scenario variables. The below table

demonstrates sectors and technologies

considered:

Technology

Type 1 Type 2 Type 3 Type 4 Type 5

Agriculture Crop Production Animal Production Trading

Automotive

Manufacturing

Internal Combustion

Engine

Hybrid Electric Vehicle

Aviation Air Travel

Cement Cement

Chemicals PetroChem Non-PetroChem

Coal Mining and

CoalTerminals

Coal Mining Other Mining

Mining Coal Mining Transition Metal

Mining

Other Mining

Oil & Gas Oil (Margin based) Gas (Margin Based) Oil (Production

based)

Gas (Production

Based)

Renewables

Power Utilities Coal Power Gas Power and

Distribution

Nuclear Power Renewable Power Electricity

Transmission and

Distribution

Road Haulage Road Haulage Logistics

Shipping Shipping Logistics

Steel Steel

1 Input Data

Barclays PLC

home.barclays/annualreport02

Barclays PLC Corporate Transition Risk Forecast Model 2021

As an example, for a company operating in the

Automotive Manufacturing sector, current

nancial performance is segmented into

revenues generated through the sale of internal

combustion engine (ICE), hybrid and electric

vehicles (EV). This enables a better

understanding of the company’s current

exposure to products and services that will

beimpacted by the transition to a low carbon

economy, in this case the increase in sales of

EVs versus the decline in the sale of ICE vehicles.

Those operating in this sector will be subject to

these demand shifts, which will in turn have a

knock on impact on revenues, whereby those

able to produce greater volume of EVs will be

better able to benet from the transition and

outperform peer competitors. Likewise, in the

Mining sector, companies with signicant coal

activity are likely to face more challenging

business environments than those with less, and

vice versa for companies with greater transition

metal activities.

The choice to focus on revenue generation as

the underlying performance metric represents a

key design choice, where revenue is used as a

substitute to modelling underlying production.

This is recognition of the cross-sector

application of this approach, and the lack of

readily available data on company’s performance

in terms of production, meaning that revenue

generation provides a consistent and reliable

metric on which to forecast future nancial

performance across sectors. The implication

within this is that margins associated with

production are both the same across

technologies within a sector and remain

constant over time, which given the long term

nature of these scenarios and dierentiation of

technologies within sectors, is in reality likely to

be variable. However, the ability to model such

changing margins is currently beyond the scope

of this methodology.

A number of data sources are used to

breakdown revenues by technology type. Such

data can be challenging to obtain, and certain

sectors are less prone to disclose revenue split

across these technologies. A waterfall

hierarchical approach is used to capture actual

revenue share data, or estimations with the

proportion of total revenue across technologies,

where this is not available.

Is company revenue share data available? S&P CAPIQ

Yes

No

Is company production data available? Asset Resolution

Yes

No

Do company disclosures include revenue

or production share data?

Company Disclosures

Yes

No

Sector Average

Barclays PLC

home.barclays/annualreport 03

Barclays PLC Corporate Transition Risk Forecast Model 2021

1.2.2 Company emissions data

The greenhouse gas emissions of corporate

companies, both current and future, also

represents a key metric when assessing the

future nancial impact of the transition to a low

carbon economy. As governments around the

world seek to reduce GHG emissions through

greater regulation, the resultant policy decisions

are likely to generate winners and losers

depending on how signicantly companies can

reduce their emissions footprint.

Data availability for company emissions is

continuously improving, as more companies

begin to disclose this information as well as

greater numbers of external third party providers

providing estimation methodologies. This

methodology combines both company level

disclosures where available and sector-level

estimate where not. These estimation

approaches are in line with the methodologies

taken by many leading third party vendor

approaches. It sums both the scope 1 and 2

emissions of companies, but does not capture

the direct impact of scope 3 emissions, as these

are assumed to be indirectly factored into the

demand shocks inherent in the scenario (see

section 2.1 for more detail).

Company disclosure data on emissions is used

as the primary source, noting that it is most likely

to represent the in-scope GHG emissions the

company would face under carbon pricing

regimes. Where this is not available, a two-step

estimation based on nancial intensity is used:

■

Calculate sectoral level nancial intensity

metrics, using revenues per tonne of carbon

dioxide equivalent emissions for companies

within those sectors.

■

For companies with missing emissions data,

multiply revenues by the nancial intensity

metric to obtain estimation of the company’s

emissions.

The above approach represents a simplifying

method for obtaining emissions estimates,

given that with nancial emissions intensities

within a sector may well deviate on a company by

company basis, as GHG emissions are driven by

alarge number of factors. One of its key benets

is that it can be implemented consistently

across a wide range of sectors, company sizes

and organisational types.

1.3 Internal Credit Metrics

The use of internal credit metrics such as

Default Grade (DG), Loss Given Default (LGD)

and Exposure at Default (EAD) is not required to

calculate nancial impacts to companies,

however this information is used when

translating future nancial impacts to credit

impacts. These data inputs are obtained from

existing internal credit systems. Barclays DG is

the internal credit metric used as part of

company credit assessment and provides an

integer representation of the probability of

default of a company from DG1 (least risky) to

DG22 (default). Further information on the

assessment of credit risk impact can be found in

section 3.2, and on Barclays DG scoring from

Barclays Pillar 3 report.

1 Input Data continued

Barclays PLC

home.barclays/annualreport04

Barclays PLC Corporate Transition Risk Forecast Model 2021

2 Assessment

2.1 Gross Prot Calculation

The methodology treats future scenario

impacts on nancial performance as a sensitivity

to a starting jump o point. In essence, the

calculation takes the attributed revenues to

each technology, and then calculates future

revenue by using the appropriate scenario

variable curve. For a hypothetical Mining

company, Coal Mining, Transition Metals Mining

and Other Mining are the technologies and the

demand curve for each of these products can

be applied to their starting revenues to indicate

future revenues. In some sectors, this general

approach has been further enhanced to include

sector specic assumptions and dynamics. This

currently covers Oil & Gas, Power Utilities and

Automotive sectors given their central role in the

transition to a low carbon economy. Further

sectors would likely benet from an enhanced

approach as well, and the intention is that the

methodology will evolve over time to include

these.

2.1.1 General Approach

The approach projects income statement and balance sheet line items by establishing a link between

the jump-o nancial statements and scenario variables.

For total revenue projections, the equation is given below.

TotalRevenue

t

=∑

s

s

[Δ

s,t

× Π

s,t

] × AllocatedRevenue

s,t

(1)

Where delta represents the demand scenario

variable and pi represents the price scenario

variable for technology s (values are rebased as a

ratio of the latest jump-o level).

AllocatedRevenue represents the jump-o

revenue in the forecast (the latest actuals

values), multiplied by the share of revenues a

company expects to generate from a given

technology as a fraction of its total revenues.

Implicit in this calculation is the assumption that,

absent of any companies within a sector

changing their business model, market share

would remain constant for all market participants

and that any increasing demand for goods and

services is met by rms. This is a simplication,

and incorporation of assumptions on the

interplay between market incumbents and new

entrants is currently being considered as an

additional module.

Cost of sales is modeled in a similar approach,

with the notable dierence that the market price

of each technology is not considered as a factor

for cost of sales. In other words, if the price of oil

falls in the market, then a given oil producer will

not incur decreasing cost of sales from its oil

production based on the lower market price.

Again, this is a simplication as it eectively

assumes that the cost per unit of production

remains static.

CostOfSales

t

=∑

s

s

[θ

s,t

× Δ

s,t

] × CostOfSales

t=0

(2)CostOfSales

t

=∑

s

s

[θ

s,t

× Δ

s,t

] × CostOfSales

t=0

(2)

Note that the formula for cost of sales is similar to that of (1), with the notable exception that pi does

not factor into the formula.

The net dierence between total revenues and cost of sales is dened as gross prots.

GrossProt

t

= TotalRevenue

t

− CostOfSales

t

(3)

This includes variable costs directly incurred

during the production of goods and services.

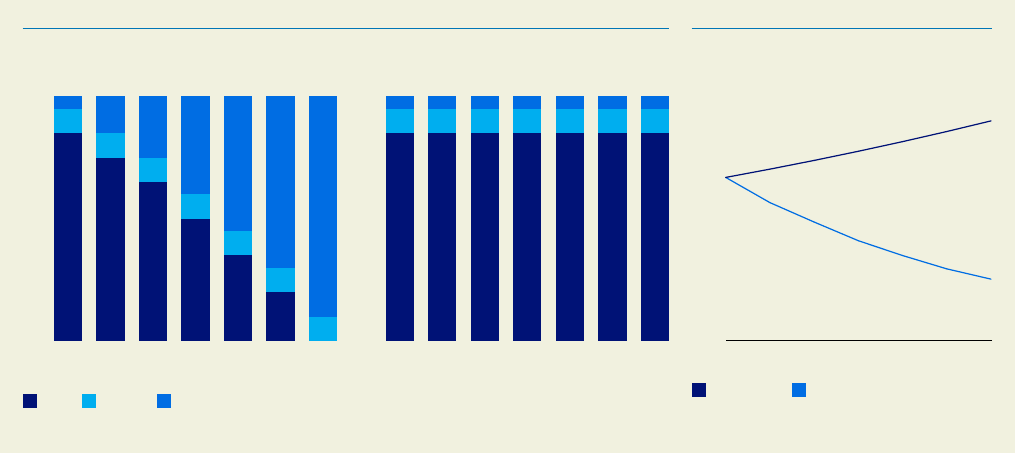

The below graph demonstrates a hypothetical

example for a Mining company, where the

dierence between two peer companies is only

the starting business operations split across

three technologies; Coal Mining, Transition

Metals Mining and Other Mining. Given the

dierence in the future demand for these

products, the fortunes of these two companies

will diverge over time should neither take steps

to evolve their business model.

Barclays PLC

home.barclays/annualreport 05

Barclays PLC Corporate Transition Risk Forecast Model 2021

In the below example, Company A generates

40% of its revenues from coal with only 20%

from transition metals, whereas Company B is

better positioned with half of its business

revenue generated from transition metals and

only 10% from coal. In both cases the remaining

percentage of revenue is from "Other Mining"

products, the demand for which is held at over

the scenario. As a result, Company B is well

placed to take advantage of the transition and

inturn grow its revenues substantially.

2 Assessment continued

Mining Commodity Demand

%

Company Revenues

£mn

2020 2025 2035 2045 20502030 2040

800

600

400

200

0

Thermal Coal Other Mining Transition Metals

2020 2025 2030 2035 2040 2045 2050 2020 2025 2030 2035

Company A Company B

2040 2045 2050

50,000

40,000

30,000

20,000

10,000

0

Thermal Coal Transition MetalsOther Mining

2.1.2 Oil & Gas Approach

Within this sector, revenue generation is split at a

more granular level, to reect two dierent

revenue types. The rst is where the Oil & Gas

products that drive the revenue have initially

been purchased by the company from a third

party. These products may then be sold on

immediately, for example in the case of Trading,

or where the company transforms the product in

some way before onward sale, for example in the

case of Rening. In this instance, it is assumed

that price dynamics in the scenario are less

material, as broadly prices going up/down will

aect both revenues and costs, and therefore

cancel one another out with respect to overall

nancial performance (eg. prot/earnings). In

contrast, revenue generation driven by raw Oil &

Gas products that have been developed by the

company themselves, for example Upstream

production, will be more sensitive to price

dynamics as falls/rises in price will impact

revenues more signicantly than costs.

For Oil & Gas (Margin Based) revenue, the

formula given in (1) is simplied as follows:

:

CostOfSales

t

=∑

s

s

[θ

s,t

× Δ

s,t

] × CostOfSales

t=0

(2)TotalRevenue

t

=∑

s

s

[Δ

s,t

] × AllocatedRevenue

s,t

(4)

For Costs, given the large reduction in oil & gas

consumption in transition scenarios, it is

reasonable to expect that companies would

seek to manage down their cost base and their

unit cost, for example by reducing production

from their most expensive elds rst. To reect

this, the methodology applies a scalar to reduce

cost of sales, with γ in the formula below

representing the cost eciency measures.

Theextent to which a company can reduce

these costs is calibrated based on the size of the

company as a proxy for the extent to which cost

eciencies can be made i.e. the larger the

company, the greater the cost eciency

improvements possible. For Oil & Gas Upstream

sector, the cost of sales formula given in (2) is

extended to the below.

CostOfSalesUpstream

t

= UpstrCostOfSales

t

× (1–1

t,scen

× y)

(5)

Barclays PLC

home.barclays/annualreport06

Barclays PLC Corporate Transition Risk Forecast Model 2021

2.1.3 Power Utility Approach

Power Utilities is an important sector for the transition, both because of the projected electrication

of the economy (leading to more electricity being consumed) and of the need to decarbonise the

electricity grids by switching technology types.

For Power Utilities, total revenues are projected by linking jump-o total revenues to the growth in

total electricity capacity. This contrasts to the general methodology where each technology is driven

by its own demand driver.

TotalRevenue

t

= Φ

ElectricityDemand,t

× TotalRevenue

t=0

(6)

Φ

ElectricityDemand,t

= ElectricityDemand

t

(7)

ElectricityDemand

t=2020

The break-out between polluting sources of

power and renewable sources of power is

dependent on the credibility of the company’s

adaptation plan (see section 2.3 for how

adaptation plans are assessed). For companies

with credible adaptation plans, total revenue

break-out will be based on the technology splits

given in the company’s adaptation plan, and

scaled by the growth in total electricity demand.

For companies with adaptation plans that are

not considered credible, the generation capacity

of polluting technologies will be held constant at

today’s level, and any increases in total electricity

capacity is assumed to be met via new

renewable capacity.

While under the methodology, the production

technology does not impact revenue,

companies that can adapt benet from lower

carbon taxes (see section 2.2 for details on

carbon taxes). Companies with credit adaptation

plans are able to replace fossil fuel power

generation with renewables, as well as add new

renewable power sources, whereas companies

with non-credible plans can only add new

renewable power. For the former, the

replacement of fossil fuel sources lowers

emissions and resulting carbon taxes. However,

for companies with non-credible plans, the

constant fossil fuel generation will lead to

constant carbon emissions and higher taxes.

Finally, it is assumed that revenue generation is

not directly linked to generation type as

electricity prices are materially agnostic to

generation fuel.

Cost of sales is linked to the percentage change

in total revenues (i.e. the percentage change in

total electricity demand), which implicitly

assumes that unit cost remains constant.

2.1.4 Automotive Approach

For the Automotive sector, total revenue is

based on the mix of technology across EVs,

hybrid and ICE vehicles. The revenue forecast

depends on whether the company has a credible

or non-credible adaptation plan.

For companies with non-credible adaptation

plans, revenues from ICE and hybrid vehicles are

forecasted by linking jump-o revenues to the

reducing demand in ICE vehicles and EV

revenues are linked to the growth in total car

demand. Their overall market share hence

reduces over time.

Φ

AutoDemand,t

=

AutoDemand

t

(8)

AutoDemand

t=0

For companies with credible adaptation plans,

the revenue split by technology is driven by the

adaptation plan, and is scaled by the growth in

total auto demand. Credible adaptation plans are

seen as enabling existing manufacturers to

remain in line with the market demand for

vehicles, whereas those unable to adapt will nd

their sales shrinking.

Cost of sales for all companies is linked to the

change in overall auto demand times the

jump-o cost of sales amount, which implies a

constant unit cost.

Barclays PLC

home.barclays/annualreport 07

Barclays PLC Corporate Transition Risk Forecast Model 2021

2.2 Carbon Costs

A carbon price is the nancial cost associated

with a unit of GHG emissions and can be

implemented in a number of ways, including

carbon taxes, cap-and-trade schemes and

wider regulation on carbon intensive activities.

There is no currently agreed global standard on

how carbon pricing should work, however a

number of governments and regulatory

authorities have introduced such schemes,

suchas the EU Emissions Trading Scheme,

South Africa’s Carbon Tax and China’s Emissions

Trading Scheme. In addition, carbon price

regimes can either target the source or use of

GHG emissions by taxing fossil fuels based on

carbon content when the fuel is burned, or

through cap-and-trade schemes, which permit

a certain level of emissions across a country

orregion, and use permits to ensure this level

isachieved.

For simplicity, the methodology assumes that

carbon price – which is typically provided in

climate scenarios - takes the form of a carbon

tax payable by the company. It applies a nancial

amount to each tonne of carbon dioxide

equivalent emissions, across a company’s Scope

1 (emissions associated with the burning of

fossil fuels under their own operations) and

Scope 2 emissions (those emissions associated

with the provision of electricity and heat to their

operations). This represents a key design choice;

for the purposes of forecasting the impact of

carbon pricing, it is assumed that carbon price

regimes will avoid the potential double counting

of including Scope 3 emissions, and therefore

the approach does not include Scope 3 to

improve the accuracy of the resulting nancial

impacts to a company. There are additional

potential issues here, such as Scope 2 emissions

reducing indirectly as power grids decarbonize,

however such dynamics are not currently

considered.

The approach also considers how these

emissions will change over the scenario horizon.

In the case where companies credibly commit to

reduce emissions, the tax will be reduced

accordingly. In addition, in the normal course of

business, emissions will change as operational

activity changes, even where no credible eort is

made to reduce emissions. For example, an Oil &

Gas Upstream company facing declining

production as demand falls, will logically also see

emissions fall. For a Power company, emissions

are a function of the company’s reliance on

power generation from fossil fuel sources to

continue to provide electricity to meet demand.

Therefore, emissions will reduce if the company

can replace fossil fuel based power sources with

renewables, whilst remain at if fossil fuel

sources remain in place.

Carbon taxes may either aect the company’s

protability or may be passed on to the

company’s customers in the form of higher

prices for the goods they sell. The ability of a

company to pass these additional costs through

to its consumers will depend on factors such as

the price elasticity of demand for the products,

or the markets in which sectors operate.

The methodology uses dierentiated pass-

through rates for each industry, which has been

determined based on a simple approach aiming

to capture the perceived dynamics of the sector.

Research done by Cambridge Energy Policy

Research Group has been used to support the

calibration of the extent of this pass through

within industrial sectors, and then been

extended out to all sectors in scope, using the

formula below. These cost pass through rates

are applied on a sector level.

p = (1 – s%) N

(9)

N + 1 + h

Where:

■

N: Number of rms

■

s: Scope of carbon cost-pass through -

degree of unregulated rms dominate the

market. Unregulated rms refer to those that

are not subject to carbon tax due to the

jurisdiction they operate in.

■

h: Production constraint vs demand elasticity.

Calibrations have been made to this formula to

reect inherent data limitations as well as the

theoretical nature of this formula compared to

the practical application within this

methodology. For example, arriving at a

consistent denition of demand elasticity and

marginal cost, on a sector level, for the

production constraint factor was too dicult as

dierent researchers show dierent demand

elasticities for dierent time scales and

geographic locations. Given the data issues

above the below modications have been made:

1. A range of 0 – 100 has been applied to h and

N. This is to:

a. Provide a simpler expert judgement

based approach to determine the value

ofh and N, indicating the extent of

production constraint and the level of

competition.

b. Remove extreme values from the input

variables which could lead to large

variants in cost pass through rates (more

extreme values close to 100% and 0%).

2. Assumed s to be 0 under the assumption

there is a global regulation of carbon tax,

hence there is no ‘carbon leakage’ across

jurisdictions. This means the market is fully

regulated, corresponding to a value of 0.

Given the long term nature of climate

scenarios this is a simplifying assumption to

reect the challenges in calibrating this

component with so many unknowns across

the policy sphere.

2 Assessment continued

Barclays PLC

home.barclays/annualreport08

Barclays PLC Corporate Transition Risk Forecast Model 2021

Using this approach and the associated modications, the following pass through rates have

beenestablished:

Sector/Sub-Sector Cost pass through rate to nearest 5%

Oil & Gas 100%-50%*

Power Utilities 75%-25%**

Chemicals 75%

Aviation 75%

Mining 70%

Cement 65%

Steel 55%

Agriculture 50%

Shipping 50%

Road Haulage 50%

Automotive 30%

Coal mining and terminals 40%

*set according to value chain segment

**set according to Regulated status of entity

The below example demonstrates the nancial performance (earnings) of the Chemicals sector, under

alternative cost pass through percentage assumptions whilst holding all other variables constant:

Carbon Price

£/tCO

2

e

Chemical Sector Earnings

£mn

2020 2025 2035 2045

2050

630

2030 2040

700

600

500

400

300

200

100

0

2020 2025 2035 2045 20502030 2040

2,500

2,000

1,500

1,000

500

0

Earnings 0% Earnings 75% Earnings 100%

Barclays PLC

home.barclays/annualreport 09

Barclays PLC Corporate Transition Risk Forecast Model 2021

The below formula is used to estimate carbon taxes for a given company.

CarbonTax

t

= Emissions

t=0

× CarbonPrice

t

×

(10)

Revenue

t

× (1 − Passthru) × (1 − Abate

t

)

In the above equation, future carbon taxes are

forecasted by multiplying the jump-o CO2

emissions for a given company, by the price of

carbon (i.e. the carbon tax per tCO2e) times the

company’s forecasted revenues ratio (rebased

to t=0), times the cost pass through ratio and

emissions abatement ratio. In this formula, the

relative impact that carbon taxes will have on

a given company will be determined primarily by

the company’s carbon intensity, as that is

assumed to be held constant in the forecast. A

company with low intensity will have a relatively

lower impact from carbon taxes than a company

with higher intensity.

2 Assessment continued

2.3 Company Adaptation

The long term time horizon involved in modelling

future climate change risks on corporate

companies means that it is important to

consider the actions and commitments

companies will take in reaction to the risks

arising from a transition to a low carbon

economy. Consideration of the adaptation

actions is inherently challenging, as making

adjustment to company’s business model at

agranular level far into the future is fraught

withdiculties.

The assessment of company adaptation

considers commitments across two separate

dimensions:

1. How will a companies Adaptation Plan

change their business operations mix in the

future? In such cases, companies will shift

their revenue generation from one

technology to another.

2. How will a companies Adaptation Plan cause

their GHG emissions to reduce i.e. those

deemed in scope of carbon price regimes?

This will reduce the overall level of carbon

price costs the company will face.

This approach reects the complex nature of

adaptation plans. In some cases, companies

may commit to reduce their emissions and not

change their business operations mix. For

example, a cement producer may continue

producing cement but make the process more

ecient, thereby reducing emissions but

continuing with their current business model. In

contrast, an Automotive Manufacturer may

choose to produce more EVs and fewer ICE

vehicles, but their actual manufacturing

processes are made no more ecient and

emissions remain unchanged. Finally, there are

examples where changes to one are directly

related to the other. A Power Utilities company

moving towards renewable power generation like

solar and wind and away from fossil fuels such as

coal and gas, will both change its business

operations mix, and as a result also reduce

emissions. Within this assessment, one

assumption is that companies do not make any

further commitments from those made to date,

despite the signicant changes occurring in the

economy. In practice, companies would have the

ability to amend their business plans.

Over the last few years, an increasing number of

companies have made future commitments in

line with the above two categories, including

short to medium term targets and longer term

more ambitious goals. With such a large number

of commitments and goals, across diering time

horizons, the credibility of commitments and the

ability of a company to meet them must be

assessed. The methodology takes a

conservative approach with this assessment,

and sets a high bar for company plans to be

considered credible. These assessments are

made separately across both categories of

adaptation; business operations and emissions

reductions. For example, a company’s ability to

reduce its operational emissions may be higher

than to shift business operations, or vice versa.

This credibility assessment involves reviewing

and assessing company commitments including

supporting evidence, documentation and

evaluating the company’s current position within

the sector and past track record in this space.

Barclays recent involvement in the Bank of

England’s Climate Biennial Exploratory Scenario

has shaped the consideration of credibility of

commitments, and the below assessment has

been developed in line with this exercise’s

objectives and aims. Credibility considerations

are distilled down to four pillars:

Pillar 1 The company must have stated a commitment to change their business strategy, or reduce their emissions.

Pillar 2 The technology needed to achieve the change in business strategy or reduction in emissions must already exist in the

form and at the scale needed to achieve the commitment. In addition, the company must already be using this

technology internally.

Pillar 3 For any given commitment, the company must have in place interim targets towards meeting the overall

commitment. These interim targets should be appropriate in terms of scale and speed i.e. they should not assume

that rapid steps towards meeting the commitment occur near the end of the time horizon.

Pillar 4 The company must already be meeting or exceeding progress towards interim targets and its overall commitment.

Historical evidence must be available to show this progress.

Barclays PLC

home.barclays/annualreport10

Barclays PLC Corporate Transition Risk Forecast Model 2021

If, and only if, a company meets the above four

criteria, is the commitment deemed credible. In

some cases, these questions can be addressed

objectively; where a company has a 2050 net

zero emissions target, and has 2030 and 2040

supporting targets separately assessed and

deemed credible, it is logical to assume that they

have appropriate interim targets in place (Pillar

3). However, if their 2040 target itself is not

deemed credible, then it is not an appropriate

interim target, and thus 2050 is not credible

either. Equally, where a company has provided

historic data on emission reductions between

2015 and 2020 (eg. a 10% drop over 5years), it is

logical to assume that a 20% targetfrom 2020

to 2030 is on track given thatextending their

current progress would achieve this.

To support the assessment of company

commitments and credibility, a number of

dierent data gathering techniques are utilized,

to both capture the target and the supporting

information behind it. This aims to overcome a

number of data challenges associated with this

assessment:

■

Commitments are not stated in quantitative

terms, and therefore requires interpretation

as to what the most likely numeric impact

those commitments have on nancial

metrics.

■

Commitments are stated quantitatively, but

not in terms that align to the methodology

and/or categorization of business operations

(technologies) at a sectoral level.

■

Commitments do not exactly align to the

assessment time periods or horizons,

meaning its impacts must be interpolated to

those time periods relevant to the

methodology.

■

Commitments have a corporate scope that

is dierent from the entity Barclays lends to,

meaning those commitments made across

parts of the company’s operations must be

extrapolated to the relevant entity being

assessed.

Data is captured both quantitatively from

company commitments (in the case of numeric

emission reductions) and by subjective and

qualitative review of the company’s disclosures,

particularly where commitments focus on

shifting business models. For example, where an

Automotive Manufacturer credibility commits to

achieve 50% of new car production in EVs by

2040, the assessment of their business model

for 2040 would be based on this commitment.

The below example demonstrates the impact

ofadaptation in this sector, where the transition

to EVs increases the demand for these types

ofcars, whilst ICE demand falls away. Hybrid

demand initially increases before falling.

Whilstoverall car demand stays relatively

at,because Company A is able to adapt, it

eectively protects its revenues and market

share by adjusting in line with the demand for

EVs, whilstCompany B is unable to adapt and

experiences falling market share with a

signicant decline in revenues.

Auto OEM – Fleet Mix

%

Auto OEM – Revenue

£mn

2020 2025 2030 2035 2040 2045 2050 2020 2025 2030 2035

Company A Company B

2040 2045

2050

100

80

60

40

20

0

ICE EVHybrid

2020 2025 2035 2045

2050

2030 2040

30,000

25,000

20,000

15,000

10,000

5,000

0

Company A Company B

Where companies transition their operations or

implement eciency measures, the additional

capital expenditures (CapEx) required to achieve

these changes are calculated as ‘Proactive

CapEx’. This captures company actions over and

above those taken in the normal course of doing

business to actively transition and mitigate

climate risks. These costs are calculated

separately for the two components of

adaptation; companies that transition into new

technologies (business operations change), and

those that decarbonise their existing operations

(emissions reductions).

Barclays PLC

home.barclays/annualreport 11

Barclays PLC Corporate Transition Risk Forecast Model 2021

2.3.1 Business Operations CapEx

There are three sectors of focus for calculating

the shift of business operations to low carbon

products and services; Oil and Gas, Power

Utilities and Automotive. For the rst two, it

centers around costing the investment cost

required to move into Renewable Power, whilst

for the latter it is to ramp up production of EVs

given their increase in the sales eet mix.

For Renewable Power, the calculation considers

the current level of company investment in

renewable power, and then scales this up. This

scaling up is both a function of the level of

increase implied in the company’s commitments

as well as the increase implied by the projected

electricity capacity for renewable power. As

these increase, the supporting investment

amount required will increase proportionally.

For EVs, the marginal cost of increasing the

percentage of EVs in the sales eet mix by 1%

has been calculated by reviewing a sample of

major Automotive Manufacturers transition

plans. The resulting average marginal cost for

the sector is then applied consistently to all

companies. Whilst the application of an average

may result in a cost being applied which diers to

company commitments, given the long term

nature of these commitments (10+ years) there

is a strong likelihood that the amounts

committed by companies today will dier from

the resulting spend in reality. Creating a sector

wide metric by utilizing the estimations of many

Automotive Manufacturers should generate a

representative cost across the whole sector,

increasing both consistency of modelling and

validity over time.

2.3.2 Emissions Reductions CapEx

A simple approach is used to consistently assess

the investment costs associated with

implementing GHG emissions eciencies. It

estimates the costs according to the size of the

company based on its current emissions and

CapEx intensity. Calibration of these costs was

done by analyzing a wider set sectors than those

considered as elevated risk, to ensure that the

calculated costs were representative for

elevated sectors when considering the total

costs to economies to decarbonize.

1. Sectors were categorised High, Medium and

Low according to carbon intensity as well as

for CapEx intensity of a typical rm, indicated

by the proportion of CapEx to sales at a

sector level. Sectors are assigned to one of

four Bands, with Band 1 being those sectors

where investment costs to reduce emissions

would be highest to Band 4 where they would

be lowest.

2. Sample analysis of individual sectors was

performed to understand the sector level

investment costs required to achieve a

certain level of emissions reductions at a

point in time in the future. This analysis

provided the marginal cost of reducing that

sectors emissions by 1%. These marginal

costs were then calculated as a proportion of

sector level revenue, to produce a relative

metric for the marginal cost of reducing

emissions scaled for size.

3. This cost was then reviewed in line with other

sample sectors to establish, for each Band,

an average proportional marginal cost of

emissions reduction. This cost, depending

on the Band, could then be applied to

credible company commitments, by using

company revenues, sector banding and

thebanding percentage.

Details of the band calibration matrix, the

sectors per band, as well as the costs per band,

are shown below:

CapEx Intensity/

Carbon Intensity

Low Medium High

Low Band 4 Band 4 Band 3

Medium Band 3 Band 3 Band 2

High Band 2 Band 1 Band 1

2 Assessment continued

Barclays PLC

home.barclays/annualreport12

Barclays PLC Corporate Transition Risk Forecast Model 2021

Sector Band

Proportional

Marginal Cost

Agriculture Band 1 0.33%

Aviation Band 1 0.33%

Cement Band 1 0.33%

Chemicals Band 1 0.33%

Coal Mining and Coal Terminals Band 1 0.33%

Mining Band 1 0.33%

Oil & Gas Band 1 0.33%

Power Utilities Band 1 0.33%

Shipping Band 1 0.33%

Steel Band 1 0.33%

Automotive Band 2 0.10%

Road Haulage Band 2 0.10%

Telecom Utilities Band 2 0.10%

Water Utilities Band 2 0.10%

Food, Bev & Tobacco Band 3 0.01%

Homebuilding and Property Development Band 3 0.01%

Manufacturing Band 3 0.01%

Pharmaceuticals Band 3 0.01%

Real Estate Band 3 0.01%

Retailers Band 3 0.01%

Banks and Finance Companies Band 4 0%

Business and Consumer Services Band 4 0%

Education, Health Care, and Not-for-Prots Band 4 0%

Equipment and Transportation Rentals Band 4 0%

Media, Broadcasting & Gaming Band 4 0%

1 EBA Climate Stress Test 2020

2 Stern Business School 2020

2.3.3 Reactive CapEx

Investment costs in the form of CapEx will also

change over the scenario horizon even where

companies do not adapt (i.e. ‘Reactive CapEx’).

There is signicant complexity in modelling

CapEx from existing operations over a long term

time horizon and therefore it requires a

simplifying approach. ‘Reactive CapEx’ is

calculated as a change in investment as

revenues shift from falls or rises in market

demand for goods and services. Where demand

falls, it is assumed that the company will

recognise that the market is declining and

reduce investment expenditure, thus reducing

CapEx. Where demand rises, CapEx would rise

to support increases in production to meet this

market demand.

When modelling investment costs, and the

impact of whether a company adapts or not, a

similar approach is taken to modelling revenues

and costs, whereby the methodology includes a

general approach for most sectors and a sector

specic approach for key sectors.

Barclays PLC

home.barclays/annualreport 13

Barclays PLC Corporate Transition Risk Forecast Model 2021

2 Assessment continued

2.3.4 General Approach

CapEx is broken down into three sources. First, CapEx from technologies that are deemed to

increase in demand as a low-carbon transition occurs ('Low Carbon'). The second source is CapEx

from technologies that will decrease in demand as a low carbon-transition occurs ('High Carbon').

Lastly, emissions CapEx measures the CapEx of any company plans to reduce their level of

emissions. CapEx is linked to the future growth in demand for low and high carbon technologies.

Low Carbon CapEx

t

= Low Carbon CapEx

t=0

× Revenue

Low Carbon,t

(11)

Revenue

Low Carbon,t=0

High Carbon CapEx

t

= High Carbon CapEx

t=0

× Δ

High Carbon,t

(12)

Emissions CapEx is assessed based on a company’s projected revenues, the average unit cost of

abatement (estimated at sector level) and the projected abatement:

EmissionsCapEx

t

= Revenue

t

× Band

sector

× (Abate

t

– Abate

t–1

) × 10

(13)

Total CapEx is the summation of the above three individual sources of CapEx. There is an assumption

that part of CapEx will be nanced partly by debt issuances and partly by equity issuances:

CostOfSales

t

=∑

s

s

[θ

s,t

× Δ

s,t

] × CostOfSales

t=0

(2)CumulCapExChanges

t

=∑

T

t=1

(TotalCapEx

t

− TotalCapEx

t–1

)

(14)

NetDebt

t

= max (NetDebt

t=0,

0) + CumulCapExChanges

t

× CapExMultiplier

s

(15)

The cumulative sum of CapEx Changes is multiplied by the CapEx Multiplier, which represents the

portion of CapEx that is funded by net debt, and added to the starting net debt gure. Net debt is

oored at zero, to disallow any negative net debt gures for conservatism.

2.3.5 Oil & Gas Approach

For the Upstream sector, CapEx is reduced by a scalar as shown below.

CapExUpstream

t

= CapEx

t

× (1-1

scen

× 0.5)

(16)

The adjustment considers that in scenarios where the market is known to be structurally declining,

companies will no longer pursue new investment opportunities to replenish reserves. As such, those

CapEx costs associated with new developments, in this case simplistically calculated as half of total

CapEx, will be reduced as the company focuses on maintenance costs in a run-down scenario.

2.3.6 Power Utility Approach

For companies with non-credible plans, CapEx is given below.

High Carbon CapEx

t

= High Carbon CapEx

t=0

(17)

Low Carbon CapEx

t

= Low Carbon CapEx

t=0

× Revenue

Low Carbon,t

(18)

Revenue

Low Carbon,t=0

Barclays PLC

home.barclays/annualreport14

Barclays PLC Corporate Transition Risk Forecast Model 2021

CapEx here is held at for fossil fuel technologies (i.e. high carbon technologies), in line with the

approach for Revenue as in equation (6). For renewable technologies, CapEx is linked to the growth in

revenues in those technologies. Specically, as demand for electricity increases, Regulated Power

Utilities who enjoy a monopolistic position for the regions they serve, will be required to increase their

provision of power to meet increasing demand. This will require additional sources of generation and

additional CapEx to develop these new assets.

For companies with credible adaptation plans, CapEx is given below.

High Carbon CapEx

t

= High Carbon CapEx

t=0

×

Revenue

coal+gas,t

(19)

Revenue

coal+gas,t=0

Low Carbon CapEx

t

= Low Carbon CapEx

t=0

× Revenue

renewable,t

(20)

Revenue

renewable,t=0

OtherCapEx

t

= Other CapEx

t=0

× Revenue

nuclear+non-relevant,t

(21)

Revenue

nuclear+non-relevant,t=0

As can be seen in (19), (20) and (21) above, CapEx for each technology is driven by the corresponding

revenue growth in that technology.

2.3.7 Automotive Approach

For companies without adaptation plans, CapEx is forecasted to grow in line with respective

revenues. For companies with adaptation plans, CapEx is split by Proactive CapEx (including the

marginal cost of increasing the percentage of EVs in the sales eet mix by 1%, shown in the following

equation as ρ) and Reactive CapEx (growth in market auto demand). The equations are given below.

Proactive Capex

Low Carbon,t

= Low Carbon CapEx

t=0

×

BusSplit

Low Carbon,t=0

+CapEx

t=0

× ρ × ΔBusSplit

(22)

Proactive Capex

High Carbon,t

= High Carbon Capex

t=0

× Revenue

High Carbon,t

(23)

Revenue

High Carbon,t=0

Total Reactive Capex

t

= Total Proactive Capex

t

× (Φ

AutoDemand,t

− 1)

(24)

Total CapEx is then computed as the sum of Total Reactive and Total Proactive CapEx.

Barclays PLC

home.barclays/annualreport 15

Barclays PLC Corporate Transition Risk Forecast Model 2021

3 Financial and Credit Risk Outputs

3.1 Financial Impact

These building blocks are assessed in

combination to forecast the future nancial

performance of a company. To illustrate this, a

range of pairwise example companies within the

Oil & Gas sector are presented below, where the

outcomes of the modelling vary on the relative

calibration of key design choices outlined in

section 2. All examples assume a transition

occurs imminently and in an orderly fashion, and

show indexed earnings (EBITDA) to demonstrate

relative impacts.

Example 1: Oil company vs Gas company

In this example, Company A operates predominantly in Oil with revenues dominated from

thesale of Oil based products. In contrast Company B is focused on Gas with a majority of

revenue from this commodity. In this example, the scenario causes a divergence immediately

as Oil prices are forecast to recover post COVID, leading to higher revenues for Oil sales. In

addition the scenario forecasts that Gas as a commodity declines in demand more rapidly

than Oil, leading to earnings declining more swiftly for Company B. However, in both cases, the

structural decline in demand for fossil fuels leads to negative earnings for both companies in

the long run.

250%

200%

150%

100%

50%

0%

-50%

-100%

-150%

2020 2030 2040 2045 20502025 2035

Company A Company B

Scenario Variables: Orderly NCFS Scenario

The below graphs oil & gas price and demand curves in index form, alongside the carbon price

curve showing £ per tonne of CO2e

2020 2025 2035 2045 20502030 2040

140%

120%

100%

80%

60%

40%

20%

0%

Oil Price Oil Demand

Gas Price Gas Demand

2020 2025 2035 2045

2050

2030 2040

700

600

500

400

300

200

100

0

DATA TO BE SUPPLIED

Barclays PLC

home.barclays/annualreport16

Barclays PLC Corporate Transition Risk Forecast Model 2021

Example 2: Company moves to renewables vs Company does not adapt

In this example, Company A makes the strategic decision to shift away from fossil fuels and

towards renewable power as its main source of revenue generation. In contrast Company B

does not make this transition and focuses instead on competing in the fossil fuel space. At the

start of the scenario the impact of this is minimal as Company A has not yet transitioned a

large portion of its business operation towards renewables, nor has the demand for renewable

power increased substantially. However from 2030 onwards, a clear divergence occurs where

Company A is able to drive new revenue generation from renewables and increase earnings,

whereas Company B suers from declining demand and resulting falling earnings.

250%

200%

150%

100%

50%

0%

-50%

-100%

-150%

2020 2030 2040 2045 20502025 2035

Company A Company B

Example 3: Company pursues emissions abatement vs Company does not act

In this example, Company A pursues initiatives to reduce it’s GHG emissions, through new

technology and eciency measures, leading to net-zero scope 1 and 2 emissions by 2050. In

contrast, Company B does not invest in these measures and their emissions remain high

throughout the scenario. Despite these changes in emissions proles, the resulting impact on

company performance is muted, as structurally declining fossil fuel demand has an

overwhelmingly negative impact on the companies earnings, In addition, this graph of

earnings does not indicate the additional investment costs faced by Company A to achieve

these reductions, which may lead to greater debt and leverage.

2020 2030 2040 2045 20502025 2035

250%

200%

150%

100%

50%

0%

-50%

-100%

-150%

Company A Company B

Barclays PLC

home.barclays/annualreport 17

Barclays PLC Corporate Transition Risk Forecast Model 2021

Example 5: Company with high starting prot margins vs Company with low starting prot margin

In this example, Company A has a higher starting prot margin for a given level of revenue vs

Company B. This implies that Company A has a lower level of costs for its operations than

company B. This leads to Company A being able to generate positive earnings longer into the

scenario than Company B given it’s stronger starting nancial position that can better

withstand the introduction of carbon taxes and declining demand for fossil fuels. Whilst both

companies end up with negative earnings by the end of the scenario, the atter curve

ofCompany A implies lower volatility in its earnings and thus lower level of risk throughout

thescenario.

2020 2030 2040 2045 20502025 2035

250%

200%

150%

100%

50%

0%

-50%

-100%

-150%

Company A Company B

3 Financial and Credit Risk Outputs continued

Example 4: Company passes through carbon taxes vs Company unable to pass through

In this example, Company A is able to pass through to the end consumer the majority of the

additional costs associated with carbon taxation. In contrast Company B is unable to pass

these costs through. The driver of these dierences is varied, but could include for example

the geographic jurisdiction in which the company operates, as well as the companies starting

cost eciency eg. a lower cost per barrel versus peers. In addition, the relative carbon

emissions intensity of the companies operations may lead to dierence in their capacity to

pass through costs. Companies with lower carbon intensities will face lower relative carbon

taxes, and thus be better able to pass through a higher proportion of their carbon taxes

compared to their current sales.

2020 2030 2040 2045 20502025 2035

250%

200%

150%

100%

50%

0%

-50%

-100%

-150%

Company A Company B

Barclays PLC

home.barclays/annualreport18

Barclays PLC Corporate Transition Risk Forecast Model 2021

3.2 Credit Assessment and Scorecards

The nal assessment step involves translating

nancial impacts from future climate scenarios

into credit metrics that can be used to assess

the company’s future credit quality. As with

calculating nancial impacts, the long term time

horizon creates signicant challenges in

calibrating a credit metric. These challenges

include existing credit models using a large

number of variables to calculate credit output,

but where the ability to make these variables at

future time points is currently not feasible. In

addition, these models include factors which

arenot necessarily impacted by climate change,

and thus the understanding of climate change

risks on credit standing may be hidden by less

relevant factors.

As a result, a scorecard has been developed to

assess the impact of the climate adjusted

nancials on credit rating. This allows us to

better understand the impacts from climate

change, without incorporating additional

dynamics from complex and probabilistic

modelling that pose challenges when evaluating

how climate risks drive credit impacts.

The approach includes three key rating factors

and metrics:

Factor Metric Rationale

Scale Revenue Scale allows for analysis of company’s ability to withstand negative impacts arising from

climate change, as a result of greater nancial resources. Their greater size is often correlated

with increased diversication, both geographically and sectorally, which provides a bulwark

against negative climate risk impacts.

Protability Revenue/Gross

Prot

Companies with greater protability are better positioned to absorb the increased costs that

climate change risks can cause; those companies with low protability may nd the impact of

climate change can push them into a negative nancial position very quickly. In addition, in

analysing intra-sector, companies with greater protability in competitive industries will

likely outcompete others, allowing for analysis of winners and losers from climate change.

Leverage EBITDA/Net Debt Leverage allows for an analysis of the company’s ongoing viability as it relates to:

1 The ability of the company to support its existing long term debt, as climate change risks

impact nancial performance

2 The ability of the company to fund increased investments to transition to a low-carbon

economy

These factors are readily available outputs from

the nancial impact assessment. Additional

non-quantitative factors, such as the company’s

business model and nancial policies were

considered, however it was deemed that such

considerations would be captured when the

outputs of the assessment are reviewed by

subject matter experts, and where these factors

would materially change the outcome, they

would be incorporated at that stage.

The mapping of nancial metrics to credit

ratings for each factor is calibrated based upon

the observable population as of today, including

existing company’s nancial ratios and the

associated company credit rating. This allows for

a scale to be established, for each factor within

each sector, which in turn provides the

foundation for future assessments as

company’s nancial metrics change.

These rating factors are then weighted to

produce a nal credit output, and the weighting

assigned to each is sector dependent. This

reects the fact that certain sectors exhibit

greater reliance on one factor or another when

determining credit rating. The calibration of

these weights has considered both current

importance of the factor in a sector credit

assessment, but also likely future assessments

of credit. This reects the fact that for many

sectors, carbon price costs are not a material

consideration at this time, and so factors such

as Scale (total revenues) may currently play an

outsized role in determining credit strength.

However, in the future it is likely that companies

less exposed to carbon pricing, through lower

emissions, will be better positioned, and

therefore erode the outsized inuence of the

Scale factor. An example of this would be in the

Power Utilities sector,

where currently the scale of a company is one

ofthe most material factors. However, under

scenarios which include signicant carbon taxes,

such scale, if accompanied by associated large

emissions, may work in the opposite direction

and cause rating deterioration as carbon costs

increase. Whilst such changing dynamics may be

challenging to forecast, it is important that

assessments are made sensitive to how credit

rating methodologies may evolve as climate

risks materialize.

Barclays PLC

home.barclays/annualreport 19

Barclays PLC Corporate Transition Risk Forecast Model 2021

The calculation of credit rating, using Barclays DG scale, is as below, where α is the weight on each

factor, for a given sector.

Modeled_DG_t = DG_(levg,t) × α_levg + DG_(prot,t) × α_prot

+ DG_(scale,t) × α_scale ΔModeledDG_t

(24)

This is calculated for all periods in the forecast, as well as the jump-o point. The model then

calculates the delta from the prior period in the modeled DG score, applies the delta to the actual

jump-o DG score from Barclays existing credit systems.

ΔModeledDG_t = ModeledDG_t − ModeledDG_(t−1)

(25)

DG

t

= DG

t-1

+ ΔModeledDG

t

(26)

The approach taken here is in line with the

methodologies aim to capture directionality and

magnitude of impact over a long term time

horizon rather than a very specic degree of

accuracy. There are limitations to such an

approach, including that the DG produced by the

model methodology may dier to the actual DG

on a spot basis, driven principally as outlined

above by the variety of factors the scorecard

does not account for currently.

The below example shows the ratings progression for Company A and B in Example 2 in section 3.1.

For the Oil & Gas sector, the weightings for the scorecard components are as follows:

Factor Metric Weight

Scale Revenue 36%

Protability Revenue/Gross Prot 18%

Leverage EBITDA/Net Debt 46%

3 Financial and Credit Risk Outputs continued

Barclays PLC

home.barclays/annualreport20

Barclays PLC Corporate Transition Risk Forecast Model 2021

Example 2 continued: Company A

In this example, Company A makes the strategic decision to shift away from fossil fuels and towards renewable power as its main source of revenue

generation. The initial increase in Oil Prices at the start of the scenario leads to improved nancial metrics and an improvement in credit grading. As

the scenario progresses and the company transitions to renewables, these new streams of revenue replace fossil fuels bases revenues driving

improvements in the Scale metric. The Leverage metric deteriorates in the middle of the scenario as the rm enacts its transition plans, causing

increased capital expenditure and resulting increase in net debt.

Protability Scale (£mn)

40%

30%

20%

10%

0%

2020 2030 2040 2045 20502025 2035

50,000

40,000

30,000

20,000

10,000

0

2020 2030 2040 2045 20502025 2035

Leverage DG

2.00

1.50

1.00

0.50

0.00

2020 2030 2040 2045 20502025 2035

22

20

18

16

14

12

10

8

6

4

2

0

2020 2030 2040 2045 20502025 2035

Example 2 continued: Company B

In this example, Company B does not transition into renewable power generation, and focuses instead on competing in the fossil fuel space. Whilst

the initial increase in Oil Prices causes improvements in the nancial metrics, resulting in an improved credit rating, the rapid increase in carbon

prices and the falling demand for fossil fuels causes signicant declines in the Scale and Protability metric, whilst Leverage increases before

turning negative as earnings fall below zero. These factors drive a declining credit rating, leading to the company defaulting in 2040.

Protability Scale (£mn)

40%

30%

20%

10%

0%

2020 2030 2040 2045 20502025 2035

25,000

20,000

15,000

10,000

5,000

0

2020 2030 2040 2045 20502025 2035

Leverage DG

6.00

3.00

0.00

-3.00

-6.00

-9.00

2020 2030 2040 2045 20502025 2035

22

20

18

16

14

12

10

8

6

4

2

0

2020 2030 2040 2045 20502025 2035

Barclays PLC

home.barclays/annualreport 21

Barclays PLC Corporate Transition Risk Forecast Model 2021

4 Known Enhancements

The approach is intentionally simplistic,

recognizing that modelling the nancial

performance of companies over a long term

time horizon is inherently fraught with issues and

methodological challenges. Focus has been on

achieving directionality and magnitude of impact

rather than accuracy. To that end, a number of

assumptions are designed to identify potential

winners and losers, rather than the specic

credit rating of a company. There are however a

number of areas of known enhancements to

consider in the future to improve the

performance of the methodology and better

identify and quantify risks.

4.1 Data

The most signicant limitations with the

methodology stem from the lack of consistently

available input data. This is an issue spanning

multiple data types and sources, but is most

acute in terms of nancial data and emissions.

4.1.1 Financial Data

The methodology follows a consistent approach

across a wide breadth of sectors and large depth

of the company types within those, and

therefore it seeks to use consistent data types

and formats, which may not be available for all

companies. For example, within Oil and Gas, cost

of sales data is a less relevant metric for certain

value chain participants (eg. Upstream) and

therefore it is challenging to obtain a meaningful

metric or estimation to integrate into the

methodology. Alternatively, in the case of

smaller private companies, the suite of nancial

metrics produced may not include those

required to perform modelling.

Attributing revenues to specic technology

types presents issues given that this data is

rarely disclosed in the format required. Various

estimation techniques are utilized to derive this

information however there are limitations to

these approaches. For example, in the Power

Utilities sector, the type of generation fuel (eg.

coal vs renewables) is not directly linked to the

generation of revenues, and therefore it is less

clear the direct impact a reduction in demand of

one technology type will have to revenue.

Finally, given the methodology uses jump-o

values to forecast future impacts from climate

scenarios, it is change to: sensitive to the

magnitude of these starting values, that are

unrepresentative of the long run nancial

performance of the company eg. the impact of

COVID-19. When considering a long term time

horizon, a representative starting position for

the company is required from which the impacts

of climate change can be isolated. Using running

averages as a starting point may enhance the

representativeness of the jump-o, to ensuring

it is a fair reection of the company prior to

climate scenarios being applied.

4.1.2 Emissions Data

In order to calculate the impact of carbon prices

to companies, accurate GHG emissions data is

required. Carbon taxes represent one of the

most material drivers of transition risk and

therefore accuracy of emissions is important.

Certain sectors however, and in many cases

smaller companies, are less prone to disclose

their emissions data. In such instances, the

methodology estimates emissions using sector

level nancial intensities. This approach may lead

to discrepancies between emissions utilized by

the methodology and those emitted in reality,

leading to punitive or favorable carbon taxes and

nancial impacts that may be less accurate.

4.2 Modelling Production Vs Revenue

The segmentation and attribution of company

revenues to technologies, and the subsequent

modelling of those revenues over time

depending on changes in relevant scenario

variables, can cause modelling issues. In

particular, there are challenges when considering

the interaction between changing market

dynamics through scenario variables and

company specic actions through adaptation

plans. Calculations of future nancial

performance where the number of assessment

dimensions increase (i.e. starting nancial

performance, scenario variables and company

business operations) becomes challenging as

there are feedback loops and interactions

between them that are not easily isolated.

Future enhancements may consider moving the

modelling approach to focus on production

metrics rather than revenue generation, to

assess revenues sequentially rather than as a

sensitivity. Further work is required to

understand the conceptual requirements for

such an approach, as well as the availability of

data that would support this form of modelling.

4.3 Incorporating Dierent Margins

The approach currently considers prot margins

to be static. Costs are modeled as changing in

line with revenues, which in turn causes margins

to stay the same. The one exception to this is for

Oil & Gas companies where the approach allows

an improvement in margins once the transition

begins, reecting past experience where such