Webinar: Complying with

Form AP Rules

Jennifer Rand, Deputy Chief Auditor, OCA

Lisa Calandriello, Associate Chief Auditor, OCA

Caveat

The views we express today are our

own and do not necessarily reflect the

views of the Board, individual Board

members, or other members of the

Board’s staff.

Polling Question

Polling question, what does the “AP”

in Form AP represent?

A. Audit Partner

B. Additional Procedures

C. Audit Participants

D. Another Process

3

Polling Question

Polling question, what does the “AP”

in Form AP represent?

A. Audit Partner

B. Additional Procedures

C. Audit Participants

D. Another Process

4

Learning Objectives

Describe the elements of Form AP

Understand disclosure requirements regarding

information about other accounting firms that went

effective on June 30, 2017

Understand general filing requirements and when

to amend Form AP

Locate the resources and tool available to assist

with the implementation of Rule 3211 and Form AP

5

Today’s Topics

Basic Elements of the Form

Other Accounting Firm Disclosures

Filing Requirements

Deadlines

Amendments

Special Circumstances

Form AP – Resources

6

Basic Elements of the Form

Part I – Identify of the Firm

Legal name of the firm

Different name if used

Part II – Amendments

Used when a Form AP is being amended

Describes what sections are the subject of the

amendment

7

Basic Elements of the Form

(cont’d)

Part III – Audit Client and Audit Report

Item 3.1 – Information about the Audit Client

and the Audit Report, includes:

Type of issuer (e.g., issuer, investment company,

employee benefit plan)

Issuer information

CIK, if any

Fund series, if any, for investment companies

Name of the issuer

Engagement partner information

Name

Partner ID, including any previously used Partner IDs

Information from the audit report

Audit report date

End date of the most recent period’s financial statements

8

Basic Elements of the Form

(cont’d)

Item 3.2 – Other Accounting Firms

Indicate, by checking the box, if one or more

other accounting firms participated in the audit

Statement that the firm signing the audit report

(that is, the firm filing Form AP) takes

responsibility for the work of all other

accounting firms that participated in the audit

Item 3.3 – Divided Responsibility

Indicate, by checking the box, if responsibility

for the audit was divided

9

Basic Elements of the Form

(cont’d)

Part IV – Responsibility for the Audit is not

Divided

Disclosures about other accounting firms

Part V – Responsibility for the Audit is

Divided

Disclosure of the referred-to auditor

Part VI – Certification

10

Other Accounting Firm

Disclosures

Disclosure of other accounting firms is

based on percentage of total audit hours:

If 5% or greater of total audit hours: the name,

location, and extent of participation of each

other accounting firm; and

If individually less than 5% of total audit hours:

the number and aggregate extent of

participation of all other accounting firms

11

What is an "other accounting firm?"

A registered public accounting firm other than the

firm filing Form AP, or

Any other person or entity that opines on the

compliance of any entity's financial statements with

an applicable financial reporting framework

.

Participants that do not meet the definition of

an “other accounting firm” are considered

“nonaccounting firm” participants in the audit.

These firms are not identified on Form AP but are

included in the computation of total audit hours.

12

Other Accounting Firm

Disclosures

(cont’d)

An other accounting firm “participated” in an

audit if:

The principal auditor assumes responsibility for

the work and report of the other accounting firm

as described in paragraphs .03-.05 of AS 1205,

Part of the Audit Performed by Other

Independent Auditors, or

The other accounting firm or any of its principals

or professional employees was subject to

supervision under AS 1201, Supervision of the

Audit Engagement.

13

Other Accounting Firm

Disclosures

(cont’d)

Other Accounting Firm

Disclosures

(cont’d)

Excluded from Form AP's disclosure requirements

and computation of total audit hours are:

The engagement quality reviewer;

The person who performed the review pursuant to SEC

Practice Section ("SECPS") 1000.45 Appendix K;

Specialists engaged, not employed, by the auditor;

An accounting firm performing the audit of the entities in

which the issuer has an investment that is accounted for

using the equity method;

Internal auditors, other company personnel, or third parties

working under the direction of issuer management or the

audit committee who provided direct assistance in the audit

of internal control over financial reporting; and

Internal auditors who provided direct assistance in the audit

of the financial statements.

14

Case Study: Background

ABC Audit Firm US located in the United

States is the firm signing the audit report

for Company Z.

Company Z has operations in the United

States, France, Germany, Italy, and China.

ABC Audit Firm US uses work performed

by its affiliates in France, Germany, Italy,

and China, who also perform statutory

audits of Company Z’s subsidiaries in these

jurisdictions.

15

Case Study: Background

(cont’d)

ABC Audit Firm US does not make reference

to another public accounting firm in its audit

report.

Time is not tracked separately by the French

or German affiliates for work on the issuer

audit and the work on the statutory audits, as

such the actual number of audit hours related

to Company Z’s audit is unknown for these

firms.

Time is separately tracked by the Italian and

Chinese affiliates for the work performed on

the issuer audit.

16

Case Study: Background

(cont’d)

Also involved in the audit were:

An engagement quality reviewer

A specialist engaged by ABC Audit Firm US

A shared service center in India that assisted

the US and Chinese firms.

17

Case Study: Background

(cont’d)

Audit Participants and Audit Hours

Audit Participant

Firm ID (if

applicable)

Audit Hours

Incurred

Hours Attributed to

Company Z's Audit

A. ABC Audit Firm US 99876 2,500 2,500

B. ABC Audit Firm France 97654 1,200 unknown

C. ABC Audit Firm China Not registered 800 250

D. ABC Audit Firm Italy 98012 500 125

E. ABC Audit Firm Germany 99125 500 unknown

F. Shared Service Center n/a 500 500

G. Engagement Quality Reviewer n/a 80 80

H. Specialist Engaged by ABC Audit Firm US n/a 300 300

18

Case Study (cont'd)

Which of the audit participants are "other

accounting firms" in this case study?

A. Audit Firms US, France, China, Italy, &

Germany

B. Audit Firms France, China, Italy, &

Germany, and Shared Service Center

C. Audit Firms France, China, Italy, &

Germany

D. All participants listed

19

Case Study (cont'd)

Which of the audit participants are "other

accounting firms" in this case study?

A. Audit Firms US, France, China, Italy, & Germany

B. Audit Firms France, China, Italy, & Germany,

and Shared Service Center

C. Audit Firms France, China, Italy, & Germany

D. All participants listed

20

Case Study (cont'd)

The shared service center is not a registered firm

and does not opine on the compliance of an

entity's financial statements with an applicable

financial reporting framework. How should the

shared service center be considered for Form AP?

A. As an other accounting firm

B. As a non-accounting firm

C. None of the above

21

Case Study (cont'd)

The shared service center is not a registered firm

and does not opine on the compliance of an

entity's financial statements with an applicable

financial reporting framework. How should the

shared service center be considered for Form AP?

A. As an other accounting firm

B. As a non-accounting firm

C. None of the above

22

Case Study (cont'd)

Should any of the participants be excluded from

disclosure and the computation of total audit

hours?

A. No. All participants would be included in the

computation of total audit hours.

B. Yes, only the engagement quality reviewer

would be excluded.

C. Yes, only the auditor-engaged specialist would

be excluded.

D. Yes, both the engagement quality reviewer

and the auditor-engaged specialist would be

excluded.

23

Case Study (cont'd)

Should any of the participants be excluded from

disclosure and the computation of total audit

hours?

A. No. All participants would be included in the

computation of total audit hours.

B. Yes, only the engagement quality reviewer

would be excluded.

C. Yes, only the auditor-engaged specialist would

be excluded.

D. Yes, both the engagement quality reviewer

and the auditor-engaged specialist would

be excluded.

24

Case Study (cont'd)

Summary of results

Audit Participant

Type of Participant

A. ABC Audit Firm US

Firm Signing the Audit Report

B. ABC Audit Firm France

Other Accounting Firm

C. ABC Audit Firm China

Other Accounting Firm

D. ABC Audit Firm Italy

Other Accounting Firm

E. ABC Audit Firm Germany

Other Accounting Firm

F. Shared Service Center

Non-accounting firm

G. Engagement Quality Reviewer

Excluded from disclosure and computation

H. Specialist Engaged by ABC Audit Firm US

Excluded from disclosure and computation

25

Total audit hours in the current period's audit

are comprised of hours attributable to:

The financial statement audit;

Reviews pursuant to AS 4105, Reviews of

Interim Financial Information for the fiscal year

covered by the audit; and

The audit of internal control over financial

reporting pursuant to AS 2201, An Audit of

Internal Control Over Financial Reporting That Is

Integrated with An Audit of Financial Statements.

26

Total Audit Hours

Total Audit Hours (cont'd)

When more than 1 period presented was audited

during a single audit engagement, total audit hours

and hours of other accounting firms are calculated

for the single audit engagement.

The firm would not separate the hours related to the

current year’s audit from the hours related to audits of

prior periods if they were incurred in the same audit

engagement.

When an audit report is dual-dated, total audit

hours and the hours of other accounting firms are

computed through the latest report date.

Nonaccounting firms, for purposes of Form AP,

are entities that participate in the audit that do

not meet the definition of "other accounting firm"

Examples may include offshore service centers, tax

consulting firms, or other types of entities

These firms are not identified on Form AP

The hours incurred by them should be

Included in the computation of total audit hours and

Allocated among the principal auditor and the other

accounting firms participating in the audit on the basis

of which accounting firm commissioned and directed

the applicable work of the nonaccounting firm

28

Treatment of Nonaccounting

Firm Participants

Case study (cont'd)

The shared service center in India

assisted both the US and Chinese

accounting firms. How would the hours of

the shared service center be allocated?

A. All hours are allocated to the US firm

B. All hours are allocated to the Chinese firm

C. Hours are allocated between the US and

Chinese firms

29

Case study (cont'd)

The shared service center in India

assisted both the US and Chinese

accounting firms. How would the hours of

the shared service center be allocated?

A. All hours are allocated to the US firm

B. All hours are allocated to the Chinese firm

C. Hours are allocated between the US and

Chinese firms

30

Case study (cont'd)

According to the case facts, the

shared service center tracked hours

incurred associated with the work

commissioned by the US and

Chinese firms separately and

reported actual hours.

Audit Participant ABC Audit Firm US

ABC Audit Firm

China

Hours Related to Company Z's Audit 2,500 250

Shared Service Center 350 150

Hours to Include in Total Audit Hours 2,850 400

31

If actual audit hours are unavailable, the firm

may use a reasonable method to estimate the

components of this calculation

For example, a firm may know all the audit hours

(based on its timekeeping system) for the audit

up until the last month before Form AP is

required to be filed and may estimate the

remaining month's hours based on its experience

from prior years on this audit or experience on

similar audits

32

Estimating Audit Hours

Case Study (cont'd)

Based on the case facts, actual audit

hours are unknown for ABC Audit

Firm France and ABC Audit Firm

Germany. ABC Audit Firm US will

estimate those hours.

33

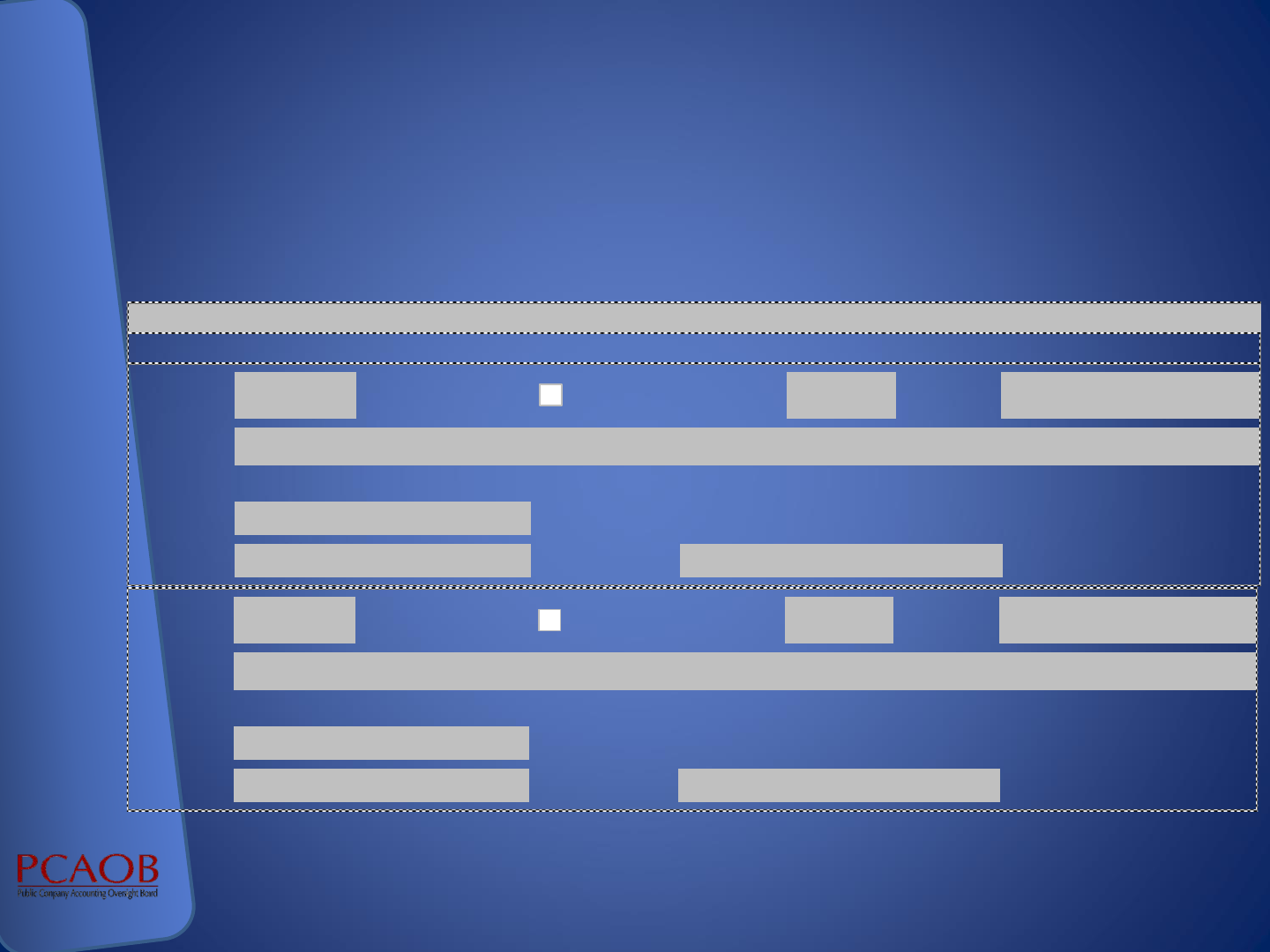

Audit Participant

Audit Hours

Incurred

Approximate

Percentage of Work

Related to Company

Z's Audit

Hours to Include in

Total Audit Hours

ABC Audit Firm France 1,200 45% 540

ABC Audit Firm Germany 500 15% 75

The computation of total audit hours should be

documented in the firm’s files and include the

method used to estimate hours when actual

audit hours are unavailable and the computation

of total audit hours on a basis consistent with AS

1215, Audit Documentation.

Under AS 1215, the documentation should be in

sufficient detail to enable an experienced auditor,

having no previous connection with the engagement,

to understand the computation of total audit hours

and the method used to estimate hours when actual

hours were unavailable.

34

Documentation

Case Study: Disclosure

Total audit hours and extent of

participation:

35

Audit Participant

Audit Hours

Incurred Extent of Participation

ABC Audit Firm US 2,850 71.4%

ABC Audit Firm France 540 13.5%

ABC Audit Firm China 400 10.0%

ABC Audit Firm Italy 125 3.2%

ABC Audit Firm Germany 75 1.9%

Total Audit Hours 3,990 100%

Case Study: Disclosure

(cont'd)

36

Firm ID

97654

Check here if no

Firm ID is available

% or range 10% to less than 20%

Legal name

Headquarters' Office Location

Country France

City Paris State

Percentage participation

ABC Audit Firm France

ITEM 4.1—OTHER ACCOUNTING FIRM(S) INDIVIDUALLY 5% OR GREATER OF TOTAL AUDIT HOURS

Firm ID

Check here if no

Firm ID is available

% or range 10% to less than 20%

Legal name

Headquarters' Office Location

Country

China

City Beijing State

Percentage participation

ABC Audit Firm China

X

Case Study: Disclosure

(cont'd)

37

2

Aggregate percentage of participation

% or range

5% to less than 10%

ITEM 4.2—OTHER ACCOUNTING FIRM(S)

INDIVIDUALLY LESS THAN 5% OF TOTAL AUDIT HOURS

a. State the number of

other accounting firm(s) individually representing less than 5% of total audit hours.

b. Indicate the aggregate percentage of participation of the other accounting firm(s) that individually represented less than 5% of total

audit

hours by filling in a single number or by selecting the appropriate range:

A secondment arrangement for purposes of reporting on

Form AP is one in which a professional employee of an

accounting firm in one country:

Is physically located in another country, in the offices

of another accounting firm, for at least three

consecutive months

Performs audit procedures with respect to entities in

that other country

Does not perform more than de minimis audit

procedures over the term of the secondment in

relation to entities in the country of his or her employer

These employees should be treated as if they were

employed by the accounting firm to which they are

seconded

38

Secondment Arrangements

Form AP requires certain information to be

disclosed regarding the other accounting firm's

audit, including:

The identification of the referred-to auditor (including

its legal name;

City and state (or, if outside the United States, city

and country) of its office; and Firm ID, when

applicable) and

The magnitude of the portion of the financial

statements audited by the referred-to auditor

The firm filing Form AP should not include hours of

the referred-to auditor in its computation of total

audit hours for Part IV

39

Divided Responsibility Audits

Filing Requirements

Firms are required to file Form AP with the

PCAOB for public company audit reports

issued on or after January 31, 2017:

Engagement partner names started being

disclosed on January 31, 2017.

Information about other accounting firms that

participated in the audit started being disclosed

for audit reports issued on or after June 30,

2017.

40

Form AP is required to be filed by:

The 35

th

day after the date the audit report is

first included in a document filed with the SEC;

or

The 10

th

day after the date the audit report is

first included in a registration statement under

the Securities Act filed with the SEC

41

Filing Requirements: Deadlines (cont’d)

Situations where no Form AP filing is

required:

Attestation engagements, for example,

compliance with servicing criteria pursuant to

Exchange Act Rules 13a-18 and 15d-18—

Regulation AB;

Reports issued for interim reviews; and

Non-issuer audits conducted in accordance with

PCAOB standards, including audits of --

Brokers and dealers reporting under Exchange Act

Rule 17a-5 and

Non-issuers under SEC rules, such as Regulation

Crowdfunding and Regulation A

42

Filing Requirements: No Filing Required

Amendments to Form AP are required to:

Correct information that was incorrect at the time

the form was filed, or

Provide information that was omitted from the

form and was required to be provided at the time

the form was filed.

43

Filing Requirements:

Amendments

Dual-dated audit reports

When an audit report is reissued and dual-dated, a new

Form AP filing is required

If the engagement partner has changed after the original

audit report is issued, Form AP will disclose both the name

of the engagement partner who was responsible for the

original audit report and the name of the engagement

partner responsible for the dual-dated content

Reissued reports, including consents

If the firm issues an audit report that is included in an

issuer's Form 10-K filing and the firm subsequently consents

to inclusion of that same audit report in the issuer's Form S-3

filing, the firm is not required to file a new Form AP in

connection with the Form S-3 filing

44

Filing Requirements: Special

Circumstances

Form AP – Resources

Rule 3211, Auditor Reporting of Certain Audit Participants,

and Form AP Instructions

Staff guidance for Form AP Implementation (February 16,

2017): Auditor Reporting of Certain Audit Participants and

Related Voluntary Audit Report Disclosure

Fact Sheet:

https://pcaobus.org/News/Releases/Pages/transparency-

adoption-fact-sheet-12-15-15.aspx

Sample form:

https://pcaobus.org/Registration/Documents/Form-AP-

Sample.pdf

45

These materials, as well as how to contact the staff with

questions, are available on the Form AP Resource Page -

https://pcaobus.org/Pages/form-ap-reporting-certain-audit-

participants.aspx.

Wrap-Up & Key Take-Aways

Elements of Form AP

Disclosure of other accounting firms

Filing requirements and

Amending a form

46

Staff guidance addresses practical

implementation questions.

Questions???

47