FIFTH SCHEDULE

TO THE CUSTOMS ACT 1969

(IV OF 1969)

THE FIFTH SCHEDULE

[see section 18(1A)]

Part-I

Imports of Plant, Machinery, Equipment and Apparatus,

including Capital Goods for various industries/sectors

Note: - For the purposes of this Part, the following conditions shall apply, besides the conditions as specified in column (5) of the

Table below:-

(i). the imported goods as are not listed in the locally manufactured items, notified through a Customs General

Order issued by the Federal Board of Revenue (FBR) from time to time or, as the case may be, certified as

such by the Engineering Development Board:

Provided that the condition of “local manufacturing” shall not be applicable on import of machinery,

equipment and other capital goods imported as plant for setting up of a new power unit of 25 MW and above

duly certified by Ministry of Water and Power in respect of those power projects which are on IPP mode meant

for supply of electricity to national grid;

Provided further that condition of local manufacturing shall not be applicable for a period of three

years, commencing on 1st July, 2018 and ending on 30th June, 2021, against Sr.No.12 of Table under Part-I of

Fifth Schedule to the Customs Act, 1969, on import of machinery, equipment and other capital goods imported

for new private transmission lines projects under the valid contract (s) or letter (s) of credit and the total C&F

value of such imports for the project is US $ 50 million or above duly certified by the Ministry of Energy (Power

Division);

(ii) except for S. Nos. 1(H), 14, 20,21 and 22 of the Table, the Chief Executive, or the person next in hierarchy duly

authorized by the Chief Executive or Head of the importing company shall certify in the prescribed manner and

format as per Annex-A that the imported items are the company’s bona fide requirement. He shall furnish all

relevant information online to Pakistan Customs Computerized System against a specific user ID and password

obtained under section 155D of the Customs Act, 1969 IV of 1969). In already computerized Collectorates or

Customs stations where the Pakistan Customs Computerized System is not operational, the Director Reforms

and Automation or any other person authorized by the Collector in this behalf shall enter the requisite

information in the Pakistan Customs Computerized System on daily basis, whereas entry of the data obtained

from the customs stations which have not yet been computerized shall be made on weekly basis;

(iii) in case of partial shipments of machinery and equipment for setting up a plant, the importer shall, at the time of

arrival of first partial shipment, furnish complete details of the machinery, equipment and components required

for the complete plant, duly supported by the contract, lay out plan and drawings; and

(iv) For "Respective Headings" entries in column (3) of the Table against which more than one rate of customs duty

has been mentioned in column (4), the rate of 3% or 11% shall be applicable only for such goods which are

chargeable to 3% or 11% duty under the First Schedule to Customs Act, 1969.

Explanation.-Capital Goods mean any plant, machinery, equipment, spares and accessories, classified in

Chapters 84, 85 or any other chapter of the Pakistan Customs Tariff, required for-

(a) the manufacture or production of any goods, and includes refractory bricks and materials required for

setting up a furnace, catalysts, machine tools, packaging machinery and equipment, refrigeration

equipment, power generating sets and equipment, instruments for testing, research and development,

quality control, pollution control and the like; and

(b) use in mining, agriculture, fisheries, animal husbandry, floriculture, horticulture, livestock, cool chain,

dairy and poultry industry;

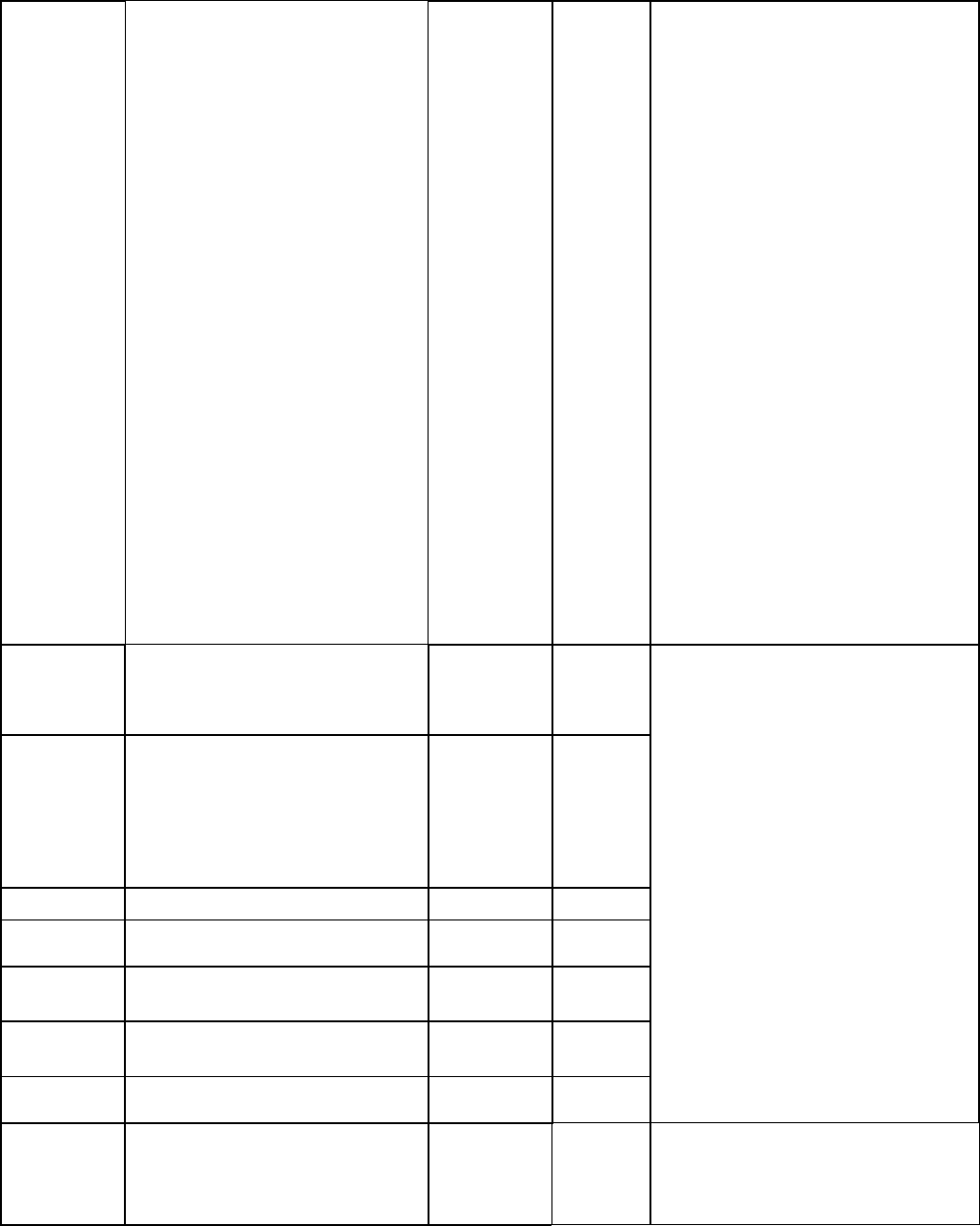

TABLE

S. No.

Description

PCT Code

Customs

Duty (%)

Conditions

(1)

(2)

(3)

(4)

(5)

1

Agricultural Machinery

A) Tillage and seed bed preparation

equipment.

If used for agriculture sector.

(1). Rotavator.

8432.8010

2%

(2). Cultivator.

8432.2910

2%

(3). Ridger.

8432.8090

2%

(4). Sub soiler.

8432.3900

2%

(5). Rotary slasher.

8432.8090

2%

(6). Chisel plough

8432.1010

2%

(7). Ditcher.

8432.1090

2%

(8). Border disc.

8432.2990

2%

(9). Disc harrow.

8432.2100

2%

(10). Bar harrow.

8432.2990

2%

(11). Mould board plow.

8432.1090

2%

(12). Tractor rear or front blade.

8430.6900

2%

(13). Land leveler or land planer.

8430.6900

2%

(14). Rotary tiller.

8432.8090

2%

(15). Disc plow.

8432.1090

2%

(16). Soil scrapper.

8432.8090

2%

(17). K.R. Karundi.

8432.8090

2%

(18). Tractor mounted trencher

8701.9220

8701.9320

2%

(19). Land leveler.

8430.6900

2%

(20). Laser land leveler.

8432.8090

2%

B) Seeding or Planting Equipment.

If used for agriculture sector.

(1). Seed-cum-fertilizer drill (wheat,

rice barley, etc).

8432.3100

0%

(2). Cotton or maize planter with

fertilizer attachment

8432.3900

0%

(3). Potato planter.

8432.3900

0%

(4). Fertilizer or manure spreader or

broadcaster.

8432.4100

8432.4200

0%

(5). Rice transplanter.

8432.3900

0%

(6). Canola or sunflower drill.

8432.3100

0%

(7). Sugar cane planter

8432.3900

0%

C) Irrigation, Drainage and Agro-

Chemical Application Equipment

If used for agriculture sector.

(1). Submersible pumps (up to 75 lbs

and head 150 meters) and field

drainage pumps.

8413.7010

0%

(2). Sprinklers including high and low

pressure (center pivotal),

system, conventional sprinkler

equipment, water reel traveling

sprinkler, drip or trickle irrigation

equipment, mint irrigation

sprinkler system.

8424.8200

8424.2010

0%

(3). Air release valves, pressure

gauges, water meters, back flow

preventers and automatic

controllers.

8481.1000

8481.3000

9026.2000

9032.8990

0%

(4). Tubewells filters or strainers.

8421.2100

2%

(5). Knapsack sprayers.

8424.2010

2%

(6). Granular applicator.

8424.2010

2%

(7). Boom or field sprayers.

8424.2010

2%

(8). Self-propelled sprayers.

8424.2010

2%

(9). Orchard sprayers.

8424.2010

2%

(D) Harvesting, Threshing and Storage

Equipment.

If used for agriculture sector.

(1). Wheat thresher

8433.5200

2%

(2). Maize or groundnut thresher or

Sheller.

8433.5200

2%

(3). Groundnut digger.

8433.5900

2%

(4). Potato digger or harvester.

8433.5300

0%

(5). Sunflower thrasher.

8433.5200

2%

(6). Post hole digger.

8433.5900

2%

(7). Straw balers.

8433.4000

2%

(8). Fodder rake.

8201.3000

8433.5900

2%

(9). Wheat or rice reaper.

8433.5900

2%

(10). Chaff or fodder cutter.

8433.5900

2%

(11). Cotton picker.

8433.5900

2%

(12). Onion or garlic harvester.

8433.5200

0%

(13). Sugar harvester.

8433.5200

0%

(14). Reaping machines.

8433.5900

2%

(15). Combined harvesters (Upto five

years old).

8433.5100

0%

(16). Pruner/sheers.

8433.5900

2%

(17). Fodder/forage wagon.

8716.8090

5%

E) Fertilizer and Plant Protection

Equipment.

If used for agriculture sector

(1). Spray pumps (diaphragm type).

8413.8100

5%

(2). All types of mist blowers.

8414.5990

5%

F) Dairy, Livestock and poultry,

machinery

If used for Agriculture, Dairy, Livestock and

Poultry sector

(1). Milk chillers.

8418.6910

8418.6990

2%

(2). Tubular heat exchanger (for

pasteurization).

8419.5000

2%

(3). Milk processing plant, milk spray

drying plant, Milk UHT plant.

8419.8100

8419.3900

2%

(4). Grain storage silos for poultry.

Respective

headings

2%

(5). Insulated sand witch panels

Respective

headings

2%

(6). Dairy, livestock and poultry

sheds.

9406.1020

9406.9020

2%

(7). Milk filters.

8421.2900

2%

(8). Incubators, brooders and other

poultry equipment

8436.2100

8436.2900

2%

(9). Machinery for animal feed stuff

8436.1000

2%

(10). Any other machinery and

equipment for manufacturing of

dairy products

Ch. 84

&

85

3%

If imported by manufacturers which are

members of Pakistan Dairy Association.

(11) Fans for use in dairy sheds

8414.5990

3%

If imported by members of Corporate Dairy

Farmers Association.

(G) Post-harvest Handling and

Processing and Miscellaneous

Machinery.

If used for agriculture sector.

(1). Vegetable and fruits cleaning

and sorting or grading

equipment.

8437.1000

2%

(2). Fodder and feed cube maker

equipment.

8433.4000

2%

(3). Milking machines.

8434.1000

2%

(4). Pre-fabricated CO

2

Controlled

Stores.

9406.1090

9406.9090

2%

In respect of goods mentioned in Column (2)

read with PCT mentioned in Column (3), the

Ministry of National Food Security and

Research shall certify in the prescribed

manner and format as per Annex-B to the

effect that the imported goods are bona fide

requirement for use in the Agriculture sector.

The Authorized Officer of the Ministry shall

furnish all relevant information online to

Pakistan Customs Computerized System

against a specific user ID and password

obtained under section 155D of the Customs

Act, 1969.

H) Green House Farming and Other

Green House Equipment.

1. In respect of goods of mentioned in

Column (2) read with PCTs mentioned in

Column (3), the Ministry of National Food

Security and Research shall certify in the

prescribed manner and format as per Annex-

B to the effect that the imported goods are

bona fide requirement for use in the

Agriculture sector. The Authorized Officer of

the Ministry shall furnish all relevant

information online to Pakistan Customs

Computerized System against a specific user

ID and password obtained under section

155D of the Customs Act, 1969.

2. The goods shall not be sold or otherwise

disposed of within a period of five years of its

import except with the prior approval of the

FBR.

(1). Geo-synthetic liners (PP/PE Geo

synthetic films of more than 500

microns).

3921.9010

3921.9090

3%

5%

(2). Greenhouses (prefabricated).

9406.1010

9406.9010

0%

(3). Tunnel farming equipment

consisting of the following:-

(a) Plastic covering and mulch

film

(b) Anti-insect net.

(c) Shade net.

3920.1000

3926.9099

5608.1900

5608.9000

0%

0%

0%

(I) Machinery, Equipment and Other

Capital Goods for Miscellaneous

Agro-Based Industries like Milk

Processing, Fruit, Vegetable or

Flowers Grading, Picking or

Processing etc.

1. In respect of goods of mentioned in

Column (2) read with PCTs mentioned in

Column (3), the Ministry of National Food

Security and Research shall certify in the

prescribed manner and format as per Annex-

B to the effect that the imported goods are

bona fide requirement for use in the

Agriculture sector. The Authorized Officer of

the Ministry shall furnish all relevant

information online to Pakistan Customs

Computerized System against a specific user

ID and password obtained under section

155D of the Customs Act, 1969.

2. Condition (iv) of the preamble.

(1). Evaporators for juice

concentrate.

8419.8990

5%

(2). Machinery used for dehydration

and freezing.

8419.3100

8418.6990

3%

5%

(3). Heat exchange unit.

8419.5000

5%

(4). Machinery used for filtering and

refining of pulps/juices.

8421.2200

5%

(5). Complete Rice Par Boiling Plant.

8419.8990 &

5%

other

Respective

Headings

3%, 5%

(J) Horticulture and Floriculture

1. If used for agriculture sector.

(1). Machines for making cartons,

boxes, cases, tubes, drums or

similar containers, other than by

moulding

8441.3000

5%

2. Condition (iv) of the preamble.

(2). PU panels (Insulation).

Respective

headings

5%

(3). Generator sets 10 to 25 KVA.

8502.1120

8502.1130

5%

5%

(4). Refrigerating machines with

engine fitted on common base

for refrigerated containers.

8418.6920

5%

(5). Other refrigerating or freezing

chests, cabinets.

8418.5000

5%

(6). Tubes, pipes and hollow profiles

of iron and steel.

7304.3100

7304.3900

5%

5%

(7). Hand tools.

Respective

Headings

3%, 5%

(K) Fish or shrimp farming and

seafood processing machinery and

equipment.

If used for agriculture or aquaculture/Fish

farming sector.

(1). Compressor

8414.8090

5%

(2). Generator

8502.1130

8502.1190

5%

5%

(3). Condenser

8502.1200

5%

(4). Flat freezer

8418.9990

5%

(5). Boast freezer

8418.3000

5%

(6). Fiber glass tubs

8418.4000

5%

(7). Insulated plants

7019.9090

5%

(8). Flake ice plants

8418.6990

5%

(9). Water aerators

8414.8090

2%

(10). Feed pellet (Floating Type)

machine

8438.8020

2%

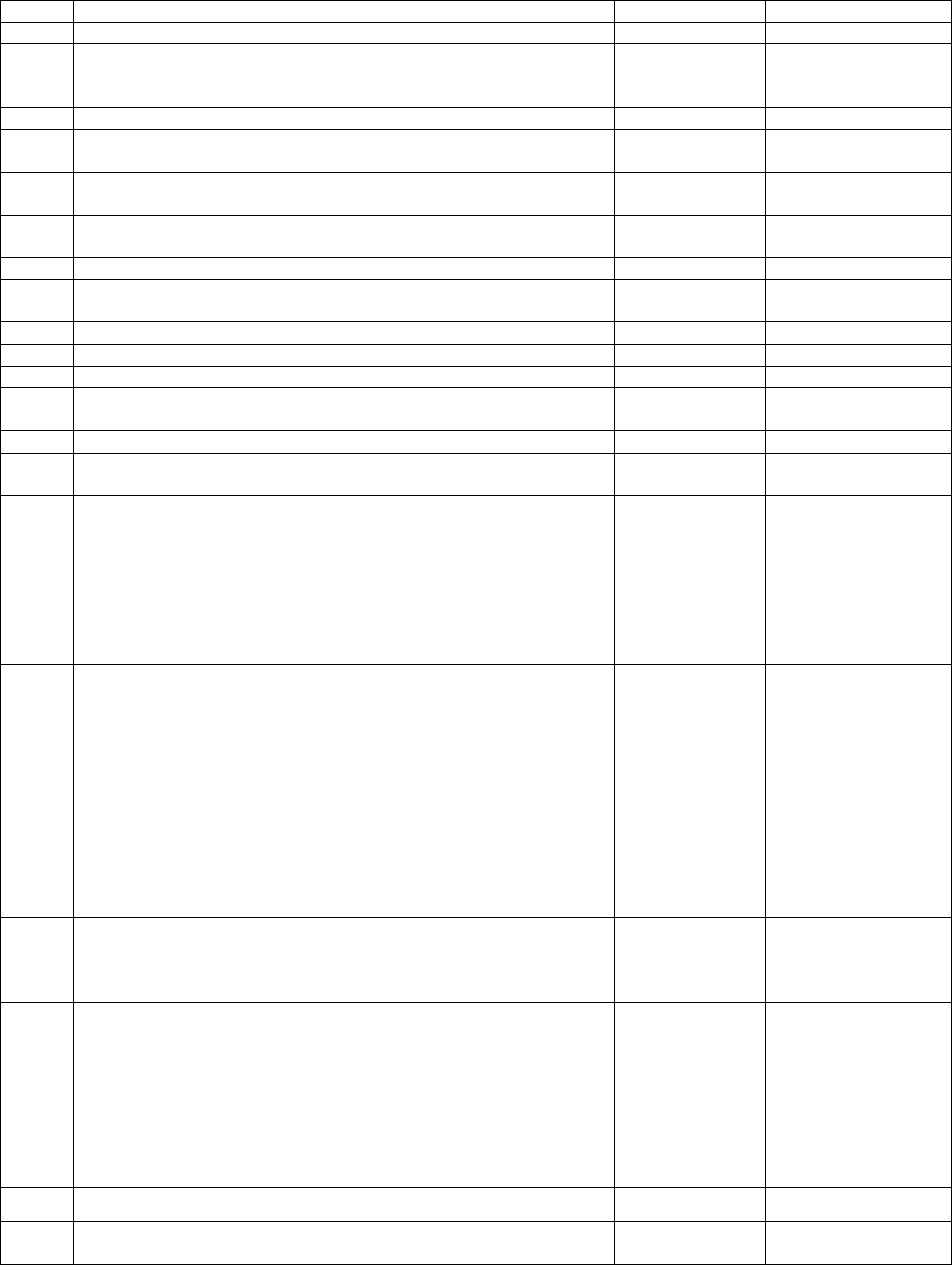

2

Machinery and equipment for

development of grain handling and

storage facilities including silos.

Respective

Headings

3%,5%

Condition (iv) of the preamble.

3

Cool chain machinery, equipment

including Capital goods.

Respective

Headings

3%,5%

1. If imported by Cool Chain Industry

including such sectors engaged in establishing or

providing cool chain activities or part thereof.

2. Condition (iv) of the preamble.

4

Machinery and equipment for initial

installation, balancing, modernization,

replacement or expansion of

desalination plants, coal firing

system, gas processing plants and oil

and gas field prospecting.

Respective

Headings

3%, 5%

Condition (iv) of the preamble.

5

Following machinery, equipment,

apparatus, and medical, surgical,

dental and veterinary furniture,

materials, fixtures and fittings

imported by hospitals and medical or

diagnostic institutes: -

1. The project requirement shall be approved

by the Board of Investment (BOI). The

Authorized Officer of BOI shall certify the

item wise requirement of the project in the

prescribed format and manner as per Annex-

B and shall furnish all relevant information

Online to Pakistan Customs Computerized

System against a specific user ID and

password obtained under Section 155D of

the Customs Act, 1969 (IV of 1969);

2. The goods shall not be sold or otherwise

disposed of without prior approval of the FBR

and the payment of customs-duties and

taxes at statutory rates be leviable at the

time of import. Breach of this condition shall

be construed as a criminal offence under the

Customs Act, 1969 (IV of 1969).

3. For sub-entry at serial A (6) and sub-entry

at serial D (2) Condition (iv) of the preamble.

A. Medical Equipment.

1) Dentist chairs.

9402.1010

5%

2) Medical surgical dental or

veterinary furniture.

9402.9090

5%

3) Operating Table.

9402.9010

5%

4) Emergency Operating Lights.

9405.4090

5%

5) Hospital Beds with mechanical

fittings.

9402.9020

5%

6) Gymnasium equipment.

Respective

Headings

3%,5%

7) Cooling Cabinet.

9506.9100

5%

8) Refrigerated Liquid Bath.

8418.5000

5%

9) Contrast Media Injections (for

use in Angiography & MRI etc).

3824.9999

3822.0000

5%

5%

B. Cardiology/Cardiac Surgery

Equipment

-do-

1) Cannulas.

9018.3940

5%

2) Manifolds.

8481.8090

5%

3) Intra venous cannula i.v.

catheter.

9018.3940

5%

C. Disposable Medical Devices

-do-

1) Self-disabling safety sterile

syringes.

9018.3110

5%

2) Insulin syringes.

9018.3110

5%

D. Other Related Equipment

-do-

1) Fire extinguisher.

8424.1000

5%

2) Fixtures & fittings for hospitals

Respective

Headings

3%,5%

6.

1. Machinery, equipment, materials,

capital goods, specialized vehicles

(4x4 non luxury) i.e. single or double

cabin pickups, accessories, spares,

chemicals and consumables meant

for mineral exploration phase.

2. Construction machinery, equipment

and specialized vehicles, excluding

passenger vehicles, imported on

temporary basis as required for the

exploration phase.

Respective

Headings

0%

1. This concession shall be available to

those Mineral Exploration and Extraction

Companies or their authorized operators or

contractors who hold permits, licenses,

leases and who enter into agreements with

the Government of Pakistan or a Provincial

Government.

2. Temporarily imported goods shall be

cleared against a security in the form of a

post-dated cheque for the differential amount

between the statutory rate of customs duty

and sales tax and the amount payable under

this Schedule, along with an undertaking to

pay the customs duty and sales tax at the

statutory rates in case such goods are not

re-exported on conclusion of the project.

3. The goods shall not be sold or otherwise

disposed of without prior approval of the FBR

and the payment of customs duties and

taxes leviable at the time of import. These

shall however be allowed to be transferred to

other entitled mining companies with prior

approval of the Board.

7

1. Machinery, equipment, materials,

capital goods, specialized vehicles

(4x4 non luxury) i.e. single or double

cabin pickups, accessories, spares,

chemicals and consumables meant

for mine construction phase or

extraction phase. Imports made for

mine construction phase shall also be

entitled to deferred payment of duty

for a period of five years. However a

surcharge @ 6% per annum shall be

charged on the deferred amount.

2. Construction machinery, equipment

and specialized vehicles, excluding

passenger vehicles, imported on

temporary basis as required for mine

construction or extraction phase.

Respective

Headings

3%,5%

1.This concession shall be available to those

Mineral Exploration and Extraction

Companies or their authorized operators or

contractors who hold permits, licenses,

leases and who enter into agreements with

the Government of Pakistan or a Provincial

Government.

2. Temporarily imported goods shall be

cleared against a security in the form of a

post-dated cheque for the differential amount

between the statutory rate of customs duty

and sales tax and the amount payable under

this Schedule, along with an undertaking to

pay the customs duty and sales tax at the

statutory rates in case such goods are not

re-exported on conclusion of the project.

3. The goods shall not be sold or otherwise

disposed of without prior approval of the FBR

and the payment of customs duties and

taxes leviable at the time of import. These

shall however be allowed to be transferred to

other entitled mining companies with prior

approval of the Board.

4. Condition (iv) of the preamble.

8

Coal mining machinery, equipment,

spares, including vehicles for site use

i.e. single or double cabin pickups

imported for Thar Coal Field.

Respective

Headings

0%

1. This concession shall be available to

those Mining Companies or their authorized

operators or contractors who hold permits,

licenses, leases and who enter into

agreements with the Government of Pakistan

or a Provincial Government.

2. The goods shall not be sold or otherwise

disposed of without prior approval of the

Board and the payment of customs duties

and taxes leviable at the time of import.

These shall, however, be allowed to be

transferred to other entitled mining

companies with prior approval of the Board.

9

1. Machinery, equipment and spares

meant for initial installation,

balancing, modernization,

replacement or expansion of projects

for power generation through oil, gas,

coal, wind and wave energy including

under construction projects, which

entered into an implementation

agreement with the Government of

Pakistan.

Respective

Headings

3%,5%

1. This concession shall also be available to

primary contractors of the project upon

fulfillment of the following conditions,

namely:-

(a)the contractor shall submit a copy of the

contract or agreement under which he

intends to import the goods for the project;

(b) the chief executive or head of the

contracting company shall certify in the

prescribed manner and format as per Annex-

A that the imported goods are the project’s

bona fide requirements; and

(c) the goods shall not be sold or otherwise

disposed of without prior approval of the FBR

2. Construction machinery, equipment

and specialized vehicles, excluding

passenger vehicles, imported on

temporary basis as required for the

construction of project.

on payment of customs-duties and taxes

leviable at the time of import;

2. Temporarily imported goods shall be

cleared against a security in the form of a

post-dated cheque for the differential amount

between the statutory rate of customs duty

and sales tax and the amount payable under

this Schedule, along with an undertaking to

pay the customs duty and sales tax at the

statutory rates in case such goods are not

re-exported on conclusion of the project.

3. Condition (iv) of the preamble.

10

1. Machinery, equipment and spares

meant for initial installation,

balancing, modernization,

replacement or expansion of projects

for power generation through gas,

coal, hydel and oil including under

construction projects.

Respective

Headings

3%,5%

-do-

2. Construction machinery, equipment

and specialized vehicles, excluding

passenger vehicles, imported on

temporary basis as required for the

construction of project.

11.

1. Machinery, equipment and spares

meant for initial installation,

balancing, modernization,

replacement or expansion of projects

for power generation through nuclear

and renewable energy sources like

solar, wind, micro-hydel, bio-energy,

ocean, waste-to-energy and hydrogen

cell etc.

2. Construction machinery, equipment

and specialized vehicles, excluding

passenger vehicles, imported on

temporary basis as required for the

construction of project.

Respective

Headings

0%

1.This concession shall also be available to

primary contractors of the project upon

fulfillment of the following conditions, namely:

-

(a)the contractor shall submit a copy of the

contract or agreement under which he

intends to import the goods for the project;

(b) the chief executive or head of the

contracting company shall certify in the

prescribed manner and format as per Annex-

A that the imported goods are the project’s

bona fide requirements; and

(c)the goods shall not be sold or otherwise

disposed of without prior approval of the FBR

on payment of customs-duties and taxes

leviable at the time of import;

2. temporarily imported goods shall be

cleared against a security in the form of a

post-dated cheque for the differential amount

between the statutory rate of customs duty

and sales tax and the amount payable under

this Schedule, along with an undertaking to

pay the customs duty and sales tax at the

statutory rates in case such goods are not

re-exported on conclusion of the project.

Explanation:-The expression “projects

for power generation” means any

project for generation of electricity

whether small, medium or large and

whether for supply to the national grid

or to any other user or for in house

consumption.

12

1. Machinery and equipment meant for

power transmission and grid stations

including under construction projects.

Respective

Headings

3%, 5%

1.This concession shall also be available to

primary contractors of the project upon

fulfillment of the following conditions,

namely:-

(a)the contractor shall submit a copy of the

contract or agreement under which he

intends to import the goods for the project;

(b) the chief executive or head of the

contracting company shall certify in the

prescribed manner and format as per Annex-

A that the imported goods are the project’s

bona fide requirements; and

(c)the goods shall not be sold or otherwise

disposed of without prior approval of the FBR

on payment of customs-duties and taxes

leviable at the time of import;

2. temporarily imported goods shall be

cleared against a security in the form of a

post-dated cheque for the differential amount

between the statutory rate of customs duty

and sales tax and the amount payable under

this Schedule, along with an undertaking to

pay the customs duty and sales tax at the

statutory rates in case such goods are not

re-exported on conclusion of the project.

3. Condition (iv) of the preamble.

Explanation.- For the purpose of this

concession “machinery and equipment”

shall mean:-

(a) machinery and equipment operated

by power of any description, such as

used in the generation of power;

(b) apparatus, appliances, metering and

testing apparatus, mechanical and

electrical control, transmission gear and

transmission tower, power transmission

and distribution cables and conductors,

insulators, damper spacer and hardware

and parts thereof adapted to be used in

conjunction with the machinery and

equipment as specified in clause (a)

above; and

c) Components parts of machinery and

equipment, as specified in clauses (a)

and (b) above, identifiable for use in or

with machinery imported for the project

and equipment including spares for the

purposes of the project.

2. Construction machinery, equipment

and specialized vehicles, excluding

passenger vehicles, imported on

temporary basis as required for the

construction of the project.

13

Following machinery, equipment and

other education and research related

items imported by technical institutes,

training institutes, research institutes,

schools, colleges and universities:-

Nil

1) Quartz reactor tubes and holders

designed for insertion into diffusion

and oxidation furnaces for

production of semiconductor

wafers.

7017.1010

0%

2) Other dryers.

8419.3900

0%

3) Filtering or purifying machinery and

apparatus for water.

8421.2100

0%

4) Other filtering or purifying

machinery and apparatus for

liquids.

8421.2900

0%

5) Personal weighing machines,

including baby scales; household

scales.

8423.1000

0%

6) Scales for continuous weighing of

goods on conveyors.

8423.2000

0%

7) Constant weighing scales and

scales for discharging a

predetermined weight of material

into a bag or container, including

hopper scales.

8423.3000

0%

8) Other weighing machinery having a

maximum weighing capacity not

exceeding 30 kg.

8423.8100

0%

9) Other weighing machinery having a

maximum weighing capacity

exceeding 30 kg but not exceeding

5,000kg.

8423.8200

0%

10) Other weighing machinery.

8423.8900

0%

11) Weighing machine weights of all

kinds; parts of weighing machinery

of machines of heading 8423.2000

& 8423.3000.

8423.9000

0%

12) Other weighing machine weights of

all kinds; parts of weighing

machinery of machines of heading

8423.2000 & 8423.3000.

8423.9000

0%

13) Networking equipment like routers,

LAN bridges, hubs excluding

switches and repeaters.

8517.6970

0%

14) Other furnaces and ovens.

8514.3000

0%

15) Electronic balances of a sensitivity

of 5 cg or better, with or without

weights.

9016.0010

0%

16) Other balances of a sensitivity of 5

cg or better, with or without

weights.

9016.0090

0%

17) Thermostats of a kind used in

refrigerators and air-conditioners.

9032.1010

0%

18) Other thermostats.

9032.1090

0%

19) Manostats.

9032.2000

0%

20) Other instruments and apparatus

hydraulic or pneumatic.

9032.8100

0%

21) Other instruments and apparatus.

9032.8990

0%

22) Parts and accessories of automatic

regulating or controlling

instruments and apparatus.

9032.9000

0%

23) Spares, accessories and reagents

for scientific equipment.

Respective

Headings

0%

14

Machinery, equipment, raw materials,

components and other capital goods

for use in buildings, fittings, repairing

or refitting of ships, boats or floating

structures imported by Karachi

Shipyard and Engineering Works

Limited.

Respective

Headings

0%

Condition (iv) of the preamble.

15

Machinery, equipment and other

capital goods meant for initial

installation, balancing, modernization,

replacement or expansion of oil

refining (mineral oil, hydro-cracking

and other value added petroleum

Respective

Headings

3%, 10%

Condition (iv) of the preamble.

products), petrochemical and

petrochemical downstream products

including fibers and heavy chemical

industry, cryogenic facility for

ethylene storage and handling.

16

Machinery and equipment imported by

an industrial concern.

Respective

Headings

3%, 11%,

15%

Nil

17

Following machinery and equipment

for marble, granite and gem stone

extraction and processing industries.

1. For the projects of Gem Stone & Jewelry

Industry, CEO/COO, Pakistan Gem and

Jewelry Company shall certify in the

prescribed format and manner as per Annex-

B that the imported goods are bona fide

project requirement. The authorized person

of the Company shall furnish all relevant

information online to Pakistan Customs

Computerized System against a specific user

ID and password obtained under section

155D of the Customs Act, 1969.

2. For the projects of Marble & Granite

Industry, CEO/COO, Pakistan Stone

Development Company shall certify in the

prescribed format and manner as per Annex-

B that the imported goods are bonafide

project requirement. The authorized persons

of the Company shall furnish all relevant

information online to Pakistan Customs

Computerized System against a specific user

ID and password obtained under section

155D of the

Customs Act, 1969.

3. The goods shall not be sold or otherwise

disposed of within a period of five years of

their import except with the prior approval of

the FBR and payment of customs duties and

taxes leviable at the time of import.

4. Condition (iv) of the preamble.

1) Polishing cream or material.

3405.4000

3405.9000

3%

5%

2) Fiber glass mesh

7019.5190

5%

3) Chain saw/diamond wire saw in

all sizes and dimensions and

spares thereof, diamond wire

joints all types and dimensions,

chain for chain saw and diamond

wires for wire saw and spare

widia.

8202.4000

8202.9100

5%

5%

4) Gin saw blades.

8202.9910

5%

5) Gang saw blades/ diamond saw

blades/ multiple blades or all

types and dimensions.

8202.9990

5%

6) Air compressor (27cft and

above).

8414.8010

5%

7) Machine and tool for stone work;

sand blasting machines;

tungsten carbide tools; diamond

tools & segments (all type &

dimensions), hydraulic jacking

machines, hydraulic manual

press machines, air/hydro

pillows, compressed air rubber

pipes, hydraulic drilling

machines, manual and power

drilling machines, steel drill rods

and spring (all sizes and

dimensions), whole finding

system with accessories, manual

portable rock drills, cross cutter

and bridge cutters.

8464.9000

3%

&

Respective

headings

3%,5%

8) Integral drilling steel for

horizontal and vertical drilling,

extension thread rods for

pneumatic super long drills, tools

and accessories for rock drills.

8466.9100

5%

18

1. Machinery, equipment and other

project related items including capital

goods, for setting up of power

generation plants, water treatment

plants and other infrastructure related

projects located in an area of 30 km

around the zero point in Gwadar.

Respective

Headings

0%

1. Ministry of Industries, Production &

Special Initiatives, shall certify in the

prescribed manner and format as per Annex-

B that the imported goods are bona fide

project requirement. The authorized officer of

the Ministry shall furnish all relevant

information online to Pakistan Customs

Computerized System against a specific user

ID and password obtained under section

155D of the Customs Act, 1969.

2. Machinery, equipment and other

project related items for setting up of

hotels located in an area of 30 km

around the zero point in Gwadar.

Respective

Headings

3%,5%

2. The goods shall not be sold or otherwise

disposed of without prior approval of the FBR

and payment of customs duties and taxes

leviable at the time of import.

3. Condition (iv) of the preamble.

19

Effluent treatment plants.

Respective

headings

3%,5%

Condition (iv) of the preamble.

20

Following items for use with solar

energy:-

Nil

Solar Power Systems.

8501.3110

8501.3210

0%

(1) Off–grid/On-grid solar power system

(with or without provision for

USB/charging port) comprising of :

i. PV Module.

8541.4000

ii. Charge controller.

9032.8990

iii. Batteries for specific utilization

with the system (not exceeding

50 Ah in case of portable

system).

8507.2090

8507.3000

8507.6000

iv. Essential connecting wires

(with or without switches).

8544.4990

v. Inverters (off-grid/ on-grid/

hybrid with provision for direct

connection/ input renewable

energy source and with

Maximum Power Point

Tracking (MPPT).

8504.4090

vi. Bulb holder

8536.6100

(2) Water purification plants operating on

solar energy.

8421.2100

21

Following systems and items for

dedicated use with renewable source

of energy like solar, wind, geothermal

etc.

Nil

1. (a) Solar Parabolic Trough Power

Plants.

8502.3900

0%

(b) Parts for Solar Parabolic Power

Plants.

(i). Parabolic Trough collectors

modules.

8503.0010

0%

(ii). Absorbers/Receivers tubes.

8503.0090

0%

(iii). Steam turbine of an output

exceeding 40MW.

8406.8100

0%

(iv). Steam turbine of an output not

exceeding 40MW.

8406.8200

0%

(v). Sun tracking control system.

8543.7090

0%

(vi). Control panel with other

accessories.

8537.1090

0%

2. (a) Solar Dish Stirling Engine.

8412.8090

0%

(b) Parts for Solar Dish Stirling

Engine.

(i). Solar concentrating dish.

8543.7000

0%

(ii). Sterling engine.

8543.7000

0%

(iii). Sun tracking control system.

8543.7090

0%

(iv). Control panel with accessories.

8406.8200

0%

(v). Stirling Engine Generator

8501.6100

0%

3. (a) Solar Air Conditioning Plant

8415.1090

0%

(b) Parts for Solar Air Conditioning

Plant

(i). Absorption chillers.

8418.6990

0%

(ii). Cooling towers.

8419.8910

0%

(iii). Pumps.

8413.3090

0%

(iv). Air handling units.

8415.8200

0%

(v). Fan coils units.

8415.9099

0%

(vi). Charging & testing equipment.

9031.8000

0%

4. (a) Solar Desalination System

8421.2100

0%

(b) Parts for Solar Desalination

System

(i). Solar photo voltaic panels.

8541.4000

0%

(ii). Solar water pumps.

8413.3090

0%

(iii). Deep Cycle Solar Storage

batteries.

8507.2090

0%

(iv). Charge controllers.

9032.8990

0%

(v). Inverters (off grid/on grid/

hybrid) with provision for direct

connection/input from

renewable energy source and

with Maximum Power Point

Tracking (MPPT)

8504.4090

0%

5. Solar Thermal Power Plants with

accessories.

8502.3900

0%

6. (a) Solar Water Heaters with

accessories.

8419.1900

0%

(b) Parts for Solar Water Heaters

(i). Insulated tank

7309.0000

7310.0000

0%

0%

(ii). Vacuum tubes (Glass)

7020.0090

0%

(iii). Mounting stand

Respective

headings

0%

(iv). Copper and Aluminum tubes

Respective

heading

0%

(c) Accessories:

(i). Electronic controller

Respective

headings

0%

(ii). Assistant/ Feeding tank

(iii). Circulation Pump

(iv). Electric Heater/ Immersion

Rod (one piece with one solar

water heater)

(v). Solenoid valve (one piece with

one solar water heater)

(vi). Selective coating for absorber

plates

7. (a) PV Modules.

8541.4000

0%

(b) Parts for PV Modules

(i). Solar cells.

8541.4000

0%

(ii). Tempered Glass.

7007.2900

0%

(iii). Aluminum frames.

7610.9000

0%

(iv). O-Ring.

4016.9990

0%

(v). Flux.

3810.1000

0%

(vi). Adhesive labels.

3919.9090

0%

(vii). Junction box & Cover.

8538.9090

0%

(viii). Sheet mixture of Paper and

plastic

3920.9900

0%

(ix). Ribbon for PV Modules (made

of silver & lead).

Respective

headings

0%

(x). Bypass diodes.

8541.1000

0%

(xi). EVA (Ethyl Vinyl Acetate)

Sheet (Chemical).

3920.9900

0%

8. Solar Cell Manufacturing

Equipment.

(i). Crystal (Grower) Puller (if

machine).

8479.8990

0%

(ii). Diffusion furnace.

8514.3000

0%

(iii). Oven.

8514.3000

0%

(iv). Wafering machine.

8486.1000

0%

(v). Cutting and shaping machines

for silicon ingot.

8461.9000

0%

(vi). Solar grade polysilicon

material.

3824.9999

0%

(vii). Phosphene Gas.

2853.9000

0%

(viii). Aluminum and silver paste.

Respective

headings

0%

9. Pyranometers and accessories for

solar data collection.

9030.8900

3%

10. Solar chargers for charging

electronic devices.

8504.4020

5%

11. Remote control for solar charge

controller.

8543.7010

3%

12. Wind Turbines.

(a)Wind Turbines for grid connected

solution above 200 KW (complete

8412.8090

0%

system).

(b) Wind Turbines upto 200 KW for off-

grid solutions comprising of:

8412.8090

0%

(i). Turbine with Generator/

Alternator.

Respective

headings

0%

(ii). Nacelle with rotor with or

without tail.

(iii). Blades.

(iv). Pole/ Tower.

(v). Inverter for use with Wind

Turbine.

(vi). Deep Cycle Cell/ Battery (for

use with wind turbine).

8507.2090

0%

13. Wind water pump

8413.8100

5%

14. Geothermal energy equipment.

(i). Geothermal Heat Pumps.

8418.6100

0%

(ii). Geothermal Reversible

Chillers.

8418.6990

0%

(iii). Air handlers for indoor quality

control equipment.

8418.6990

0%

(iv). Hydronic heat pumps.

8415.8300

0%

(v). Slim Jim heat exchangers.

8418.6100

0%

(vi). HDPE fusion tools.

8419.5000

0%

(vii). Geothermal energy Installation

tools and Equipment.

8515.8000

8419.8990

0%

0%

(viii). Dehumidification equipment.

8479.6000

0%

(ix). Thermostats and IntelliZone.

9032.1090

0%

15. Any other item approved by the

Alternative Energy Development Board

(AEDB) and concurred to by the FBR.

Respective

headings

0%

22

Following items for promotion of

renewable energy technologies or for

conservation of energy:-

Nil

(i). SMD/LED/LVD lights with or

without ballast, fittings and

fixtures.

9405.1090

8539.3290

8539.5010

8539.5020

0%

(ii). SMD/LED/LVD lights, with or

without ballast, PV module,

fitting and fixtures

9405.4090

8539.3290

8539.5010

8539.5020

0%

(iii). Tubular Day lighting Device.

9405.5010

0%

(iv). Wind turbines including

alternators and mast.

8502.3100

0%

(v). Solar torches.

8513.1040

0%

(vi). Lanterns and related

instruments.

8513.1090

0%

(vii). LVD induction lamps.

8539.3290

0%

(viii). LED Bulb/Tube lights.

8539.5010

8539.5020

0%

(ix). PV module, with or without, the

related components including

invertors (off-grid/on grid/

hybrid) with provision for direct

connection/input from

renewable energy source and

with Maximum Power Point

Tracking (MPPT), charge

controllers and solar batteries.

8541.4000

8504.4090

9032.8990

8507.0000

0%

0%

0%

0%

(x). Light emitting diodes (light

emitting in different colors).

8541.5000

0%

(xi). Water pumps operating on

solar energy along with solar

pump controllers

8413.7010

8413.7090

8504.4090

0%

0%

0%

(xii). Energy saver lamps of varying

voltages

8539.3110

8539.3210

0%

0%

(xiii). Energy Saving Tube Lights.

8539.3120

8539.3220

0%

0%

(xiv). Sun Tracking Control System

8543.7090

0%

(xv). Invertors (off-grid/on

grid/hybrid) with provision for

direct connection/input from

renewable energy source and

with Maximum Power Point

Tracking (MPPT).

8504.4090

0%

(xvi). Charge controller/ Current

controller.

9032.8990

0%

23

Parts and Components for

manufacturing LED lights:-

If imported by LED Light and Bulbs

manufacturers registered under the Sales

Tax Act, 1990 subject to annual quota

determination by the Input Output Co-

efficient Organization (IOCO).

(i). Aluminum Housing/ Shell for

LED (LED Light and Bulbs

Fixture)

9405.1090

0%

(ii). Metal Clad Printed Circuit

Boards (MCPCB) for LED

8534. 0000

0%

(iii). Constant Current Power

Supply for of LED Lights and

Bulbs (1-300W)

8504.4090

0%

(iv). Lenses for LED lights and

Bulbs

9001.9000

0%

24

Plant, machinery and equipment used

in production of bio-diesel.

Respective

headings

0%

The Alternative Energy Development Board

(AEDB), Islamabad shall certify in the

prescribed manner and format as per Annex-

B that the imported goods are bona fide

project requirement. The goods shall not be

sold or otherwise disposed of within a period

of five years of their import except with the

prior approval of the FBR and payment of

customs duties and taxes leviable at the time

of import.

25

Plant, machinery and equipment

imported for setting up fruit

processing and preservation units in

Gilgit-Baltistan, Balochistan and

Malakand Division.

Respective

headings

0%

The plant, machinery and equipment

released under the said serial number shall

not be used in any other area which is not

eligible for the said concession. In case of

violation, duty and taxes shall be recovered

beside initiation of penal action under the

Customs Act, 1969.

26

Plant, machinery and equipment

imported during the period

commencing on the 1

st

July, 2014 and

ending on the 30

th

June, 2019 for

setting up Industries in FATA.

Respective

headings

0%

The plant, machinery and equipment under

the said serial number shall be released on

certification from Additional Chief Secretary,

FATA that the goods are bona fide project

requirement of the Unit as per Annex-B. The

goods shall not be sold or otherwise

disposed of without prior approval of the

Board.

27

Following motor vehicles for the

transport of goods and special

purpose motor vehicles imported by

the Construction Companies:-

This concession shall be available to motor

vehicles for the transport of goods and

special purpose motor vehicles imported by

Construction Companies registered with

Security and Exchange Commission of

Pakistan (SECP) and Pakistan Engineering

Council.

1. Dumpers designed for off highway

use.

8704.1090

20%

2. Super swinger truck conveyors.

8705.9000

20%

3. Mobile canal lining equipment.

8705.9000

20%

4. Transit mixers.

8705.4000

20%

5. Concrete Placing trucks.

8705.9000

20%

6. Crane lorries.

8705.1000

20%

28

Plant, machinery and production line

equipment used for the manufacturing

of mobile phones.

Respective

headings

0%

This exemption is available to local

manufacturers of mobile phones duly

certified by Pakistan Telecommunication

Authority.

29

Charging station for electric vehicle

8504.4030

0%

Nil

30

Pre-fabricated room/structures for setting

up of new hotels /motels in Hill Stations,

Gilgit-Baltistan, AJK, and Coastal Areas of

Baluchistan (excluding Hub)

9406.1090

9406.9090

11%

(i) The concerned ministry or department

shall approve the project. The

Authorized Officer of the ministry or

department shall certify in the prescribed

format and manner as per Annex-B that

the imported goods are bona fide project

requirement and shall furnish all relevant

information online to Pakistan Customs

Computerized System against a specific

user ID and password obtained under

section 155D of the Customs Act, 1969.

(ii) IOCO shall verify and determine the

requirement of such Pre-fabricated

structures in the form of finished rooms

for setting up new hotels/motels in the

specified areas.

31

Micro feeder equipment for food

fortification

8437.8000

0%

Nil

32.

Cinematographic equipment imported

during the period commencing on the 1

st

July, 2018 and ending on the 30

th

June,

2023.

i. The Ministry of Information, Culture and

Broadcasting shall certify in the prescribed

manner and format as per Annex-B to the effect

that the imported goods are bona-fide

requirement. The Authorized Officer of Ministry

shall furnish all relevant information online to

Pakistan Customs Computerized System against

specific user ID and password obtained under

section 155D of the Customs Act, 1969.

ii. The goods shall not be sold or otherwise

disposed of within a period of five years of their

import except with the prior approval of the FBR.

(ii) IOCO shall verify and determine quota

requirement of such equipment.

(1) Projector

9007.2000

3%

(2) Parts and accessories for projector

9007.9200

3%

(3) Other instruments and apparatus for

cinema

9032.8990

3%

(4) Screen

9010.6000

3%

(5) Cinematographic parts and

accessories

9010.9000

3%

(6) 3D Glasses

9004.9000

3%

(7) Digital Loud Speakers

8518.2200

3%

(8) Digital Processor

8519.8190

3%

(9) Sub-woofer and Surround Speakers

8518.2990

3%

(10) Amplifiers

8518.5000

3%

(11) Audio rack and termination board

7326.9090

3%

8537.1090

(12) Music Distribution System

8519.8990

3%

(13) Seats

9401.7100

3%

(14) Recliners

9401.7900

3%

(15) Wall Panels and metal profiles

7308.9090

3%

(16) Step Lights

9405.4090

3%

(17) Illuminated Signs

9405.6000

3%

(18) Dry Walls

6809.1100

3%

(19) Ready Gips

3214.9090

3%

33.

New Fire-fighting vehicles manufactured as

such by OEMs

8705.3000

10%

The goods shall not be sold or otherwise

disposed-off within a period of five years of its

import without prior approval of the FBR and

payment of customs duties and taxes leviable at

the time of import.

34

Plant and machinery excluding consumer

durable goods and office equipment as

imported by greenfield industries, intending

to manufacture taxable goods, during their

construction and installation period.

Chapters 84 and

85

0%

This exemption shall be available subject to

fulfillment of following conditions, namely: -

(a) the importer is registered under the Sales Tax

Act on or after the first day of July, 2019;

(b) the industry is not established by splitting up

or reconstruction or reconstitution of an

undertaking already in existence or by transfer of

machinery or plant from another industrial

undertaking in Pakistan.

(c)exemption certificate issued by the

Commissioner Inland Revenue having

jurisdiction; and

(d) the goods shall not be sold or otherwise

disposed of without prior approval of the FBR

and the payment of customs duties and taxes

leviable at the time of import.

Annex-A

Header Information

NTN/FTN of Importer

Regulatory authority no.

Name of Regulatory authority

(1) (2)

(3)

Details of Input goods (to be filled by the chief executive of the importing company)

Goods imported (Collectorate of import)

HS Code

Description

Specs

Custom

Duty rate

(applicable

)

Sales Tax

rate

(applicable

)

WHT

Quantity

UOM

Quantity

imported

Collectorate

GD. No.

GD date &

Mach.No.

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

(12)

(13)

(14)

(15)

CERTIFICATE BY THE CHIEF EXECUTIVE, OR THE PERSON NEXT IN HIERARCHY DULY AUTHORIZED BY THE CHIEF

EXECUTIVE: It is certified that the description and quantity mentioned abovecommensurate with the project requirement and that

the same are not manufactured locally. It is further certified that the above items shall not be used for any other purpose.

Signature ______________________

Name ______________________

C.N.I.C. No. ______________________

NOTE:- In case of clearance through Pakistan Customs Computerized System, the above information shall be furnished on line

against a specific user I.D. and password obtained under section 155D of the Customs Act, 1969( IV of 1969).

Explanation.-

Chief Executive means.-

1. owner of the firm, in case of sole proprietorship; or

2. partner of firm having major share, in case of partnership firm; or

3. Chief Executive Officer or the Managing Director in case of limited company or multinational

organization; or

4. Principal Officer in case of a foreign company.

Annex-B

Header Information

NTN/FTN of Importer

Approval No.

(1)

(2)

Details of Input goods (to be filled by the authorized officer of the Regulatory Authority)

Goods imported (Collectorate of import)

HS

Code

Description

Specs

Custom

Duty rate

(applicabl

e)

Sales Tax

rate

(applicable

)

WHT

Quantity

UOM

Quantity

imported

Collectora

te

GD. No.

GD date &Mach

No.

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

(12)

(13)

(14)

CERTIFICATE BY THE AUTHORIZED OFFICER OF THE REGULATORY AUTHORITY: It is hereby certified that the imported

goods are genuine and bonafide requirement of the project and the same are not manufactured locally.

Signature& Seal of the Authorized Officer ________________________

Designation ________________________

NOTE:- In case of clearance through Pakistan Customs Computerized System, the above information shall be furnished on line

against a specific user I.D. and password obtained under section 155D of the Customs Act, 1969( IV of 1969).

Part-II

Import of Active Pharmaceutical Ingredients, Excipients/Chemicals,

Drugs, Packing Material/ Raw Materials for Packing and Diagnostic Kits and

Equipment, Components and other Goods

The Imports under this part shall be subject to following conditions, namely.-

(i). The active pharmaceutical ingredients, Excipients /chemicals, packing material and raw material for packing

shall be imported only for in-house use in the manufacture of specified pharmaceutical substances, as

approved by the Drug Regulatory Agency of Pakistan.

(ii). The requirement for active pharmaceutical ingredients and Excipients/chemicals, drugs as specified in Table A,

B & C, shall be determined by the Drug Regulatory Agency of Pakistan;

(iii). The requirement for packing materials/raw materials for packing, as specified in Table-D, shall be determined

by Input Output Coefficient Organization;

(iv). The designated/authorized representative person of Drug Regulatory Agency of Pakistan shall furnish all

relevant information, as set out in this part, online to the Customs computerized system, accessed through the

unique user identifier obtained under section 155 d of the Customs Act 1969, along with the password thereof.

(v). For "Respective Headings" entries in column (3) of the Table against which two rates of customs duty 3% and

5% have been mentioned in Column (4), the rate of 3% shall be applicable only for such goods which are

chargeable to 3% duty under the First Schedule to the Customs Act 1969.

Table A

(Active Pharmaceutical Ingredients)

S No

Description

HS Code

Customs duty (%)

(1)

(2)

(3)

(4)

1

Flurbiprofen

2916.3990

5%

2

Aspirin

2918.2210

5%

3

Amlodipine

2933.3990

5%

5

Deferiprone

2933.3990

5%

6

Lamivudine

2933.3990

5%

7

Loratadine

2933.3990

5%

8

Pantoprazole Sodium (Injec Grade)

2933.3990

5%

9

Risedronate Sodium

2933.3990

5%

10

Fexofenadine

2933.3990

5%

11

Ebastine

2933.3990

5%

12

Isoniazid

2933.3990

5%

13

Omeprazole Pellets

2933.3990

5%

14

Moxifloxacin

2933.4990

3%

15

Protacine (Proglumet, Dimaleate)

2933.5990

5%

16

Sparfloxacin

2933.5990

5%

17

Atorvastatin

2933.9990

5%

18

Amiloride HCL

2933.9990

5%

19

Candesartan Cilextle

2933.9990

5%

20

Pheneramine Maleate

2933.9990

5%

21

Pioglitazone HCL

2934.1090

5%

22

Sulphanilamide

2935.9050

5%

23

Gliclazide

2935.9090

5%

24

Piperazine Anhydrous (Pharmaceutical grade).

2935.9090

5%

25

Celecoxib

2935.9090

5%

26

Glibenclamide

2935.9090

5%

27

Thiocolchicoside

2935.9090

5%

28

Hydrochlorothiazide

2935.9090

5%

29

Alfacalcidole

2936.9000

3%

30

(i) Amoxicillin sodium sterile BP

2941.1000

5%

(ii) Ampicillin sodium sterile USP/BP

(Pharmaceutical grade)

(iii) Bacampicillin HCL

(iv) Carbenicillin and its salts

(v) Carfecillin

(vi) Cloxacillin and its salts excluding sodium

(compacted/ powder form for oral use)

(vii) Flucloxacillin sodium

(viii) PencillinV.Potassium

(ix) Benzyl pencillin sodium/potassium

(x) Cloxacillin sodium sterile USP/BP

(xi) Pencillinbenzathin

(xii) Procaine pencillinG.fortified,

sodium/potassium

(xiii) Sultamicilliatosylate

(xiv) Sultamicillin (Pharmaceutical grade)

(xv) Ticarcilin disodium

(xvi) Piperacillin Sodium

31

Clarithromycin Powder

2941.5000

5%

32

Roxithromycin

2941.5000

5%

33

Clarithromycine Granules

2941.5000

5%

34

Azithromyein

2941.9090

5%

35

Fusidic Acid

2941.9090

5%

36

Gentamyein

2941.9090

5%

37

Rifampicin

2941.9090

5%

38

Ceftriaxonesodium

2941.9090

5%

39

Cefotaximesodium

2941.9090

5%

40

D-Cycloserine

2941.9090

5%

41

Acrinol Pad

3005.9010

5%

42

Benzalkonium Chloride Pad (BKC)

3005.9090

5%

43

Sodium Casinate

3501.9000

5%

44

Activated Glucuronate

3824.9999

5%

45

Losartan Potassium

3824.9999

5%

46

ChondrotinSulphate

3913.9090

5%

47

Polyethylene Film

3920.9900

5%

48

Acid Hypophosphorous:

Respective

heading

3%,5%

Acid PipmidcTrydae

5%

Acid Citric Anhydrous

5%

Propylparaben (Aseptoform-P)

5%

MethylparabenAseptoform-M)

5%

Carbinoxamine Maleate

5%

EuflavineBp (Acriflavine)

5%

VancomycinHcl

5%

Dextro-MethorphHbr

3%

Acyclovir Usp

5%

Sodium Benzoate

3%

Sodium Sulfate

5%

Cupric Chloride

5%

EnoxacinSesquihfrtae

5%

Mama Copolymer

5%

Sodium Valproate

3%

Sodium Cyclamate

5%

Magnesium Hydroxide Paste

5%

Diphenhydramine

3%

Alprazolam

3%

Bacitracin Usp Powder Microniz

5%

ChloromycetinPalmitate

5%

Chlorpheniramine Maleate

5%

Esmomeprazole Magnesium Ec

5%

Fluconazole

3%

Glipizide

5%

Neomycin Sulphate

5%

Polymyxin B Sulphate USP Micro

5%

Lorazepam

5%

NystatinUsp Powder

5%

Ferric Pyrophosphate Nf

5%

Alprazolam

5%

Pyritinol Base Fine Powder

5%

Pyritinol Di-Hcl Mono Hydrate

5%

Bisacodyl

5%

Sodium Picosulphate

5%

Carbamazepine

5%

Co-DergocrineMs (Gram) A 01

5%

Clemastine Hydrogen Fumarate

5%

Calcium Lactobionate Oral

5%

ClamipramineHclEp

5%

Imipramine Hydrochlor/Ds 01

5%

Oxcarbazepine Fine/Ds 05

5%

Calcium Lactobionate Special Grade

5%

TemazepamUsp 28/Ep 4th Ed

5%

LevocetirizineDihydrochloride

5%

BromocriptineMs(G) Msa/Ds 01

5%

Pindolol Base/Ds Pur

5%

Clopamide Base/Ds 01

5%

Pindolol Base

5%

Nimesulide

5%

Enalapril Maleate Usp 23

5%

CetirizinDihydrocholorideEp

5%

Famotidine

3%

Fluoxetine Hcl

5%

Doxycycline Hydrochloride Bp

5%

Captopril

5%

Simvastatin Ep

5%

Cefaclor Monohydrate

5%

Lactulose

3%

Albendazole - Human Grade

5%

Clobetasol Propionate

5%

Betamethasone Base

5%

Betamethasone 17-Valerate

5%

Bacitracin Zinc Bp (69 Mcg/Mg)

5%

Hydrcortisone Acetate Micronised

3%

Hydrocortisone Usp Micro

5%

Clotrimazole

3%

Clindamycin Phosphate

5%

Cetirizine Dihydrochloride

5%

Fluconazole

5%

Minocycline Hydrochloride

5%

Neomycin SulphBp 700 U/Mg Mic

5%

Nystatin (MycostatinMicropul)

5%

TriprolidineHcl B.P (94%)

5%

Ferrous Sulphate

3%

Polymyxin B SulphBp 8000 U/Mg

5%

ProcyclidineHcl

5%

Mupirocin

5%

Artemether

3%

Lumefantrine

3%

Desmoder H/Hexamethylen Di-Iso

5%

Erythrocin J

5%

Furosemide (Imp)

5%

Glimepiride Granules 0.606% (W/W (1 Mg)

5%

Ketoprofen

5%

Table B

(Excipients/Chemicals)

S No

Description

HS Code

Customs Duty (%)

(1)

(2)

(3)

(4)

1

Worked grains of other cereals. (Pharmaceutical grade)

1104.2900

5%

2

Sterillisable maize (corn) starch (Pharmaceutical grade)

1108.1200

5%

3

Gum Benjamin BP (Pharmaceutical grade)

1301.2000

5%

4

(i). Balsam, Tolu BP/USP.

(ii). Gum acacia powder BP

(iii). Gumbenzoin, Styrax, Tragacanth,Xanthan(Pharmaceutical

grades)

1301.9090

5%

5

Other vegetable saps and extracts (Pharmaceutical grade)

1302.1900

5%

6

Other mucilages and thickeners (Pharmaceutical grade)

1302.3900

5%

7

(i). Rhubarb leaves or roots.

(ii). Valerine roots (Pharmaceutical grade)

1404.9090

5%

8

Refined palm kernel or babassu oil (Pharmaceutical grade)

1513.2900

5%

9

Other fixed vegetable fats and oils (Pharmaceutical grade)

1515.1900

5%

10

Castor oil (Pharmaceutical grade)

1515.3000

5%

11

Vegetable fats and oils (Pharmaceutical grade)

1516.2010

1516.2020

5%

12

Sugar (pharmaceutical grade) if imported by manufacturer of

pharmaceutical Products on the quantity to be determined by Ministry of

Health

1701.9910

5%

13

(i). Dextrate(Pharmaceutical grade).

(ii). Dextrose (injectable grade and pharmaceutical grade)

1702.3000

5%

14

Malt extract (Pharmaceutical grade)

1901.9010

5%

15

Ethyl alcohal

2207.1000

5%

16

(i). Sodium chloride (NaCl).

(ii). Sodium chloride (injectable grade) (Pharmaceutical grades)

2501.0090

5%

17

Oils and other products of the distillation of high temperature coal tar

(Pharmaceutical grade)

2707.9990

5%

18

Liquid paraffin (Pharmaceutical grade).

2710.1995

5%

19

Plastibase (Pharmaceutical grade)

2710.9900

5%

20

Microcrystalline petroleum wax, ozokerite, lignite wax, peat wax and

other mineral waxes (Pharmaceutical grade)

2712.9090

5%

21

Iodine (Pharmaceutical grade)

2801.2000

5%

22

Boric acid (Pharmaceutical grade)

2810.0020

5%

23

Phosphorous pentachloride (Pharmaceutical grade)

2812.9000

5%

24

(i). Sodium hydroxide

(ii). Sodium hydroxide solid or aqueous solution (Pharmaceutical

grade)

2815.1100

5%

25

Disodium sulphate (Pharmaceutical grade)

2833.1100

5%

26

Sodium sulphate anhydrous (Pharmaceutical grade)

2833.1900

5%

27

Sodium hydrogen carbonate (sodium bicarbonate) (Pharmaceutical

grade)

2836.3000

5%

28

Dglucitol (Sorbitol) (Pharmaceutical grade).

2905.4400

5%

29

Acetone (Pharmaceutical grade)

2914.1100

5%

30

Formic acid (Pharmaceutical grade)

2915.1100

5%

31

Acetic acid

2915.2100

5%

32

Acetic anhydride (Pharmaceutical grade)

2915.2400

5%

33

Ethyl acetate (Pharmaceutical grade)

2915.3100

5%

34

Stearic acid (Pharmaceutical grade)

2915.7010

5%

35

(i). Butyl phthalate

(ii). Dibutylphthalate (Pharmaceutical grade)

2917.3410

5%

36

Hydroxy benzoic acid (Pharmaceutical grade)

2918.2900

5%

37

Propyl Paraben Sodium Salt

2918.2900

5%

38

{[(4-ethyl-2,3-dioxo-1-piperazinyl)Carbonyl amino}-4 hydroxy-benzene

acetic acid (HO-EPCP) (Pharma grade)

2933.5990

5%

39

N-Methyl morpholine (Pharmaceutical grade)

2933.9100

5%

40

Methanone

2933.9100

5%

41

1-H-tetrazole-1-acetic acid[TAA](Pharmaceutical grade)

2933.9990

5%

42

(i). 2-Methyl-5-mercepto 1,3,4- hiazole[MMTD];

2934.1090

5%

(ii). (Z)-2)2-aminothiazole-4-yl)-2-Tert-Butoxycarbonyl)

methoxyimnno Acetic acid (ATMA);

5%

(iii). (Z)-2-(2-aminothaizole -4-yl)2-2(tert-Butoxycarbonyl)-

isopropoxyimino Acetic Acid[ATIBAA or ATBA;

5%

(iv). Sin-methoxyiminoFuranyl Acetic acid Ammonium Salt(SIMA);

5%

(v). 7-{[2-Furany(sin- methoxyimino)acetyl]amino}-3-hydroxymethyl

ceph-3-em-4- carboxyclic acid(Pharma grade);

5%

43

Mica Ester

2934.1090

5%

44

(+)-(IS,2S)-2-methylamino-1- phenylpropan-I-ol base

2939.4900

5%

45

Chlorophyll (Pharmaceutical grade)

3203.0090

5%

46

Edible ink (Pharmaceutical grade)

3215.1990

5%

47

Non-ionic surface-active agents

3402.1300

5%

48

Other surface-active agents (Pharma grade)

3402.1990

5%

49

(i). Alkyl aryl sulfonate.

(ii). Ampnocerin “K” or “KS” (Pharma grade)

3402.9000

5%

50

Casein

3501.1000

5%

51

(i)Modified starches (Pharmaceutical grade).

(ii)Rich starch

3505.1090

5%

52

Pencillin G. Amidase enzyme

3507.9000

5%

53

Activated carbon (Pharmaceutical grade).

3802.1000

5%

54

Other activated natural mineral products (Pharmaceutical grade).

3802.9000

5%

55

Stearic acid (Pharmaceutical grade)

3823.1100

5%

56

Industrial fatty alcohols (Pharmaceutical grade)

3823.7000

5%

57

Polyglycerylricinoleates (Pharmaceutical grade)

3907.9900

5%

58

Cellulose nitrates non-plasticised

3912.2010

5%

Table C

(Drugs)

S No

Description

HS Code

Customs duty (%)

(1)

(2)

(3)

(4)

1

Dextrose (injectable grade and pharma grade)

1702.3000

10%

2

Sodium chloride (injectable grade) (Pharmaceutical grade).

2501.0090

5%

3

Oseltamivir

2922.4990

0%

4

Zanamivir

2924.2990

0%

5

All types of vaccines, Interferon and medicines for Hepatitis.

Respective

headings

0%

6

All vaccines and antisera

Respective

0%

headings

7

Antihemophilic factor ix (Human)

3002.2090

0%

8

Blood fraction & immunological products (biological products) including

rabies immunological (150 IU per ml) (Human)

3002.2090

0%

9

Factor viii & plasma derived fibrin sealant. (Human)

3002.2090

0%

10

Hepatits B immunoglobuline (Human)

3002.2090

0%

11

Human albumin (Human)

3002.2090

0%

12

Intravenous immunoglobuline (Human)

3002.2090

0%

13

Intramuscular immunoglobuline (Human)

3002.2090

0%

14

Tatanusimmunoglobuline (250 IU/ml) (Human)

3002.2090

0%

15

Injection Anti-Dimmunoglobulin (human) 300mcg/vial

3002.9010

0%

16

Medicinal eye Drops

3004.9050

10%

17

Ointments, medicinal

3004.9060

10%

18

Alfacalcidole Injection

3004.9099

0%

19

All medicines of cancer. An illustrative list is given below, namely:-

3004.9099

0%

(i). Aminoglutethimide

(ii). Anastrazole

(iii). Asparaginase

(iv). Azathioprine

(v). BCG strain 2-8x108 CFU per vial

(vi). Belomycin

(vii). Bevacizumab

(viii). Bicalutamide

(ix). Bortezomib

(x). Busulfan

(xi). Capecitabine

(xii). Carboplatin

(xiii). Cetuximab

(xiv). Chlorambucil

(xv). Chlormethine

(xvi). Cisplatin

(xvii). Cladribine

(xviii). Cyclophosphamide

(xix). Cyproterone acetate

(xx). Cytarabine

(xxi). Dacarbazine

(xxii). Dactinomycin

(xxiii). Danunorubicin

(xxiv). DocetaxelTrihydrate

(xxv). Diethylstilbestrol-DiphosphateSodium

(xxvi). Disodium Clodronatetetrahydrate

(xxvii). Disodium Pamidronate

(xxviii). Doxorubicin

(xxix). Epirubicin

(xxx). Erlotinib

(xxxi). Etoposide

(xxxii). Filgrastim

(xxxiii). Fludarabine

(xxxiv). 5-Fluorouracil

(xxxv). Flutamide

(xxxvi). Folinic Acid, calcium salt

(xxxvii). Gemcitabine

(xxxviii). Goserelin

(xxxix). Granisetron

(xl). Hydroxyurea

(xli). Ibandronic acid

(xlii). Ifosfamide

(xliii). Imatinibmisilate

(xliv). Irinotecan

(xlv). Lenograstim

(xlvi). Letrozole

(xlvii). Leuprorelin

(xlviii). Lomustine

(xlix). Medroxyprogesterone

(l). Megestrol

(li). Melphalan

(lii). Mercaptopurine

(liii). Methotrexate

(liv). Mitomycine

(lv). Mitoxantrone

(lvi). Octreotide

(lvii). Ondensetron

(lviii). Oxaliplatin

(lix). Paclitaxel

(lx). Pemetrexed

(lxi). Procarbazine

(lxii). Rituximab

(lxiii). Sorafenib (as tosylate)

(lxiv). Tamoxifen

(lxv). 6-Thioguanine

(lxvi). Topotecan

(lxvii). Trastuzumab

(lxviii). Tretinoin

(lxix). Triptorelin Acetate

(lxx). Tropisetron

(lxxi). Vinblastine

(lxxii). Vincristine

(lxxiii). Vinorelbine

(lxxiv). Zoledronic Acid

(lxxv). Tasigna(Nilotinib)

0%

(lxxvi). Temozolomide

0%

20

All medicines of Cardiac. An illustrative list is given below, namely:-

3004.9099

0%

(i). Abeiximab

(ii). Adenosine

(iii). Contrast Media for angiography MRI (lopamidol and lohexol Inj.

and etc.)

(iv). Dopamine/Dobutamiune

(v). Glyceryltrinitrate infusion or tablets

(vi). Isosorbid Injection 8(Mono/dinityrate)]

(vii). Heparin

(viii). Lopromide (Ultravist)

(ix). Nitroglycerine spray

(x). Nitroglycerin tablets

(xi). Streptokinase

(xii). Sodium AmidotrizoateMeglumine

Amidotrizoate (Urograffin)

(xiii). Reteplase (Thrombolytic treatment of suspected myocardial

infarction)

(xiv). Urokinase

21

All medicines for HIV/AIDS. An illustrative list is given below, namely:-

3004.9099

0%

(i). Atazanavir

(ii). Darunavir

(iii). Diadanosine

(iv). Efavirenz

(v). Indinavir

(vi). Lamivuldine

(vii). Lopinavir

(viii). Navirapine

Table D

(Packing Materials/Raw Materials for Packing/Bandages)

S No

Description

HS Code

Customs duty (%)

(1)

(2)

(3)

(4)

1

Blood Bags CPDA-1: With blood transfusion set pack in Aluminum foil with

set.

Respective

Heading

0%

2

Surgical tape in jumbo rolls

3005.1010

5%

3

Cetylpyridinium chloride pad

3005.9090

5%

4

Polyacrylate (Acrylic Copolymers)

3906.9090

5%

5

PVC non-toxic tubing (Pharmaceutical grade)

3917.2390

5%

6

PVC lay flat tube material grade (Pharmaceutical grade)

3917.3100

5%

7

Pre-printed polypropylene tubes with tamper proof closures (with or

without dessicant) indicating particulars of registered drug and

manufacturer (Pharmaceutical grade)

3917.3910

3%

8

Other self-adhesive plates, sheets, film, foils, strip and other flat shapes of

plastic (Pharmaceutical grade)

3919.1090

5%

9

Rigid PVC Film (Pharmaceutical grade)

3920.4910

10%

10