EXPORT-IMPORT BANK

of the UNITED STATES

ANNUAL REPORT 2014

ii I

What is

Ex-Im Bank?

independent

agency

Ex-Im Bank is an independent,

self-sustaining federal agency

which operates

at no cost to U.S. taxpayers.

benefiting

small businesses

Nearly 90 percent of the number

of Ex-Im Bank’s authorizations

directly benefit small businesses,

which does not include small

businesses benefiting indirectly

as suppliers to Ex-Im’s

larger customers.

earning for

taxpayers

In FY 2014

Ex-Im Bank generated

a surplus of $674.7 million

for U.S. taxpayers.

promoting

job creation

Over the past five years,

Ex-Im Bank authorizations

supported more than 1.3

million American jobs.

ii I

2014 ANNUAL REPORT I 1

What is

Ex-Im Bank?

Mission

The Export-Import Bank of the United States (Ex-Im Bank) is the official

export credit agency of the United States. Ex-Im Bank is an independent,

self-sustaining federal agency that exists to support American jobs by

facilitating the export of U.S. goods and services.

When businesses in the United States or their customers are unable to access private export financing,

Ex-Im Bank fills in the gaps for American businesses by equipping them with the tools necessary to

compete for global sales. In doing so, the Bank levels the playing field for U.S. exporters facing foreign

competition in overseas markets.

Because it is backed by the full faith and credit of the United States, Ex-Im Bank assumes credit and

country risks that the private sector is unable or unwilling to accept. The Bank’s charter requires that

all transactions it authorizes demonstrate a reasonable assurance of repayment. The Bank consistently

maintains a low default rate, and closely monitors credit and other risks in its portfolio.

2014 Ex-Im Bank Leadership Team

Left to right: Chairman and President Fred P. Hochberg, Vice Chair and First Vice President Wanda Felton, Board Director Patricia Loui, and

Board Director Sean Mulvaney.

2 I

Table of Contents

$2.3t

Overall exports of American

goods and services reached a

record $2.3 trillion this year,

up from $1.4 trillion only

five years ago.

We’re getting

results.

Ex-Im Bank is working

with the private sector to

support U.S. jobs.

Fred P. Hochberg

Chairman and President

Mission and Leadership 1

Global Map of Success Stories and Markets 4

Chairman’s Message 6-8

FY 2014 Highlights 9

Supporting American Jobs 10

Success Story: Fritz-Pak 11

Keeping America Competitive 12-13

Success Story: SpaceX

14-15

Responsible Risk Management 16-17

A Focus on Our Customers 18

Success Story: SynTouch 19

Empowering American Small Businesses 20-21

U.S. Map of Ex-Im Small Business Support by State 22

Success Story: Ace Pump Corp. 23

Success Story: Howe Corp. 24-25

Supporting America’s Most Critical Industries 26

Success Story: Decas Cranberry Products 27

Building Infrastructure in Emerging Markets 28-29

Realizing Opportunities in Sub-Saharan Africa 30-31

CONTENTS

Ex-Im Bank

insurance powers

exports from an

innovative American

start-up.

Vikram Pandit

Research and Development

Technician, SynTouch

A small business is still

a leader in refrigeration

100 years later.

Mary Howe

President, Howe Corp.

24

19

6

EXPORT-IMPORT BANK

of the UNITED STATES

2 I

2014 ANNUAL REPORT I 3

Success Story: W.S. Darley & Company 32-33

Financing Environmentally Beneficial Exports 34

Environmental Dynamics Success Story 35

A Commitment to the Environment 36

Generating Revenues for the American Taxpayer 37

FY2014 FINANCIAL REPORT

FY 2014 Financial Report Table of Contents 38

Ex-Im Bank Portfolio 39

FY 2014 Authorizations 40

Management’s Discussion and Analysis of Results

of Operations and Financial Condition 50

Management Report on Financial Statement

and Internal Accounting Controls 72

Financial Statements’ Table of Contents 73

Balance Sheets 74

Statements of Net Costs 75

Statements of Changes in Net Position 76

Combined Statements of Budgetary Resources 77

Notes to the Financial Statements 78

Independent Auditors’ Report 95

Independent Auditors’ Report on Internal Control 97

Directors and Officers 100

EX-IM BANK REGIONAL EXPORT

FINANCE CENTERS

Inside Back Cover

“

We may be small,

but we think big. In an age where

everything seems to be made

someplace else, we’re thriving here

in Texas. Our success is due to hard

work, attention to customers’ needs

and belief in the future. Yet there’s no

doubt this success is also in no small

part due to the services provided by

Ex-Im Bank.

Gabriel Ojeda, President,

Fritz-Pak

”

Fritz-Pak success story on page 11

Ex-Im Bank finances

the export of

American-made fire

trucks to Nigeria.

32

Peter Darley

Part-Owner, Chief Operating

Officer and Executive Vice

President,

W.S. Darley & Co.

4 I

Ex-Im Featured 2014 Success Stories

MADE IN THE USA, SOLD WORLDWIDE

ACE PUMP CORP. I Memphis, TN

EXPORT: Industrial Pumps

MARKETS: Paraguay, Chili, France, Belgium

and Mexico

Ex-Im Bank Product: Small Business Export Credit

Insurance

See page 23

FRITZ-PAK I Mesquite, TX

EXPORT: Concrete Additives and Plasters

MARKETS: Worldwide, including Mexico, Brazil,

India, and Taiwan

Ex-Im Bank Product: Small Business Export Credit

Insurance

See page 11

DECAS CRANBERRY PRODUCTS I Carver, MA

EXPORT: Cranberries

MARKETS: Worldwide, including South Africa,

Thailand, Bosnia and Herzegovina

Ex-Im Bank Product: Multibuyer Export Credit

Insurance

See page 27

HOWE CORP. I Chicago, IL

EXPORT: Ice-Making Equipment

MARKETS: Worldwide, primarily Latin America

Ex-Im Bank Product: Multibuyer Export Credit

Insurance

See page 24

EXPORT-IMPORT BANK

of the UNITED STATES

4 I

2014 ANNUAL REPORT I 5

Ex-Im Featured 2014 Success Stories

68%

of our authorizations this year

supported U.S. exports to

emerging markets, where

commercial banks are often more

reluctant to lend.

SYNTOUCH I LOS ANGELES, CA

EXPORT: Tactile-Sensing Technologies

MARKETS: Worldwide, including China,

Netherlands, Germany, and Australia

Ex-Im Bank Product: Export Credit Insurance

See page 19

ENVIRONMENTAL DYNAMICS

INTERNATIONAL INC. (EDI) I Columbia, MO

EXPORT: Water and Wastewater Treatment

MARKETS: India, China and Turkey

Ex-Im Bank Product: Working Capital Loan Guarantee

See page 35

W.S. DARLEY & CO. I ITASCA, IL

EXPORT: Firefighting Trucks

MARKETS: Nigeria

Ex-Im Bank Product: Direct Loan

See page 32

SPACEX I HAWTHORNE, CA

EXPORT: Spacecraft Launches

MARKETS: Israel, Hong Kong and Bulgaria

Ex-Im Bank Product: Direct Loan

See page 14

For more small business success stories, visit:

www.exim.gov/about/whatwedo/successstories

6 I CHAIRMAN’S MESSAGE

EXPORT-IMPORT BANK of the UNITED STATES

Chairman’s Message

$27.5b

In FY 2014, Ex-Im Bank supported

$27.5 billion worth of U.S. exports

and 164,000 export-related American

jobs. Over the past six years, the Bank

has supported over 1.3 million jobs in

communities across the country.

With the U.S. economy on the move—and with worldwide demand for

quality, innovative goods on the rise—there have never been greater

opportunities for American small businesses to prosper on the global

stage.

Of course, there are obstacles, too—that’s something I can tell you from

20 years of firsthand experience running a small business. Withstanding

swings in the general economy, obtaining lines of credit, and reaching

customers in new markets can pose a challenge to even the savviest and

most innovative entrepreneurs.

Ex-Im Bank exists to equip American businesses with the tools they need

to become more successful exporters. We know that when entrepreneurs

are empowered to win export sales against their foreign competitors,

businesses grow, our economy improves, and layoffs are replaced with

‘Now Hiring’ signs in communities across our country.

In the following pages, you can see for yourself how Ex-Im Bank has made

a positive impact for just a few of the thousands of American businesses

that come to us for export credit tools. If you’re a business owner, these

are the results we stand ready to deliver for you, too.

THEY’RE ‘PLAN A’

Let’s be clear: America’s private sector capital markets are the highest-

functioning, most efficient in the world, and do a great job of financing

U.S. exports.

But commercial banks don’t always have the capacity or willingness to

equip American businesses that want to sell their goods and services

overseas. Even in strong economic periods, small businesses generally

have trouble securing working capital loans or insurance packages to back

their exports—and when the economy dips, banks can become even more

reluctant to finance export orders of any size.

6 I CHAIRMAN’S MESSAGE 2014 ANNUAL REPORT I 7

Chairman’s Message

WE’RE ‘PLAN B’

Ex-Im Bank’s role is to fill in those gaps. We don’t compete with

the private sector (in fact, about 98 percent of our transactions

include a partnering private financial entity). Instead we provide

a backstop to ensure that the American export economy remains

vibrant in a world of fluctuating markets and global ebbs and

flows. U.S. businesses know that Ex-Im Bank will be there to

support their growth during all kinds of economic weather,

girding small businesses and picking up the slack when uncertain

times force commercial financiers to scale down—a bank for all

seasons.

So we expect occasional drop-offs in our total authorizations—

that’s often another signal of an economy in recovery and an

increasingly fertile private lending environment. While Ex-Im

Bank’s total financing decreased in FY 2014, overall exports

of U.S. goods and services are poised for a fifth consecutive

record-breaking year. We’re proud to be a part of that growth,

particularly when it means opening doors to the world’s most

promising markets for American small businesses—and, on a

number of fronts, we had a strong 2014.

SUPPORTING JOBS, SERVING TAXPAYERS

• This year, we authorized $20.5 billion of financing in support

of $27.5 billion worth of U.S. exports and more than 164,000

American jobs.

•

Out of over 3,700 authorizations in 2014, more than 3,300—

or nearly 90 percent—directly served U.S. small businesses,

which accounted for one quarter of authorizations by dollar

volume.

•

Our support for U.S. manufactured exports reached nearly

$16.6 billion.

•

About one out of every five authorizations we completed this

year directly served minority- or women-owned businesses.

•

In sub-Saharan Africa, we authorized a record of more than $2

billion for U.S. exports—the strongest year we’ve ever had.

•

Nearly $14 billion—more than 68 percent—of our authorizations

this year supported U.S. exports to emerging markets, where

commercial banks are often more reluctant to lend.

•

From a risk management perspective, we had an historically

low default rate of 0.175 percent as of September 30, 2014.

•

Once again this year, we generated a surplus for American

taxpayers above and beyond the cost of our operating

expenses and prudent reserve requirements. In October, we

wired $674.7 million to the U.S. Treasury to support deficit

reduction, while over the last two decades we have generated a

surplus of 6.9 billion for American taxpayers.

Nearly

of the n

90%

umber of authorizations

in 2014 directly served U.S. small

businesses.

1out of every5

authorizations we completed

this year directly served

minority- or women-owned

businesses.

in support of U.S.

manufactured exports

$16.6b

Nearly

88 I I CHAIRMAN’S MESSAGE

EXPORT-IMPORT BANK of the UNITED STATES

We’re always striving to better manage our business and

improve our operations. As a result, this year we recalibrated

our business development efforts to more expertly serve our

customers based on industry sectors rather than geography.

We also opened a new customer contact center and rolled out

new online tools to make it easier than ever to do business with

Ex-Im Bank. On the risk management side, we established an

Enterprise Risk Committee charged with the comprehensive and

systematic oversight of the full range of risks faced by the Bank.

We’ve also cut our internal budget expenses to levels 19 percent

lower than they were five years ago. And we achieved all of

these results with an efficient, dedicated staff of approximately

450 employees—I couldn’t be more proud of our team of public

servants.

WHAT’S AHEAD

When FY 2014 began, my hope was that I would be able to

announce in our annual report that Congress had put into place

a long-term reauthorization of Ex-Im Bank—one that would

deliver five years of certainty and confidence to U.S. exporters

and their employees. Regrettably, I can’t do that.

I can say that we’ve made some progress: Congress has

extended our charter until June of 2015, and I’m optimistic that

we’ll be able to work out a long-term, bipartisan solution. As

a former businessman, I know that exporters large and small

need more than month-to-month solutions in order to win

deals, invest in innovation, and add new jobs locally. There’s

more than enough uncertainty out there when you’re running

a business without having to worry about the availability of

financing.

The conversation surrounding Ex-Im Bank’s reauthorization has

meant that we’ve had more public attention this year than ever

before—and a positive side effect has been that more American

small businesses have had the opportunity to learn about how

Ex-Im Bank tools can empower them to reach global markets and

add local jobs.

So we look forward to serving many more new customers in the

year ahead—and that’s critical given the vast opportunities for

American businesses that lie beyond our borders. Two hundred

million people are forecasted to join the global middle class each

year for the next five years, and they’ll be eager to buy quality,

innovative products stamped “made in USA”.

The opportunities ahead in emerging markets are without

precedent, but every country will be racing to seize them in

order to add jobs and grow their economies. Of course, we face

enormous challenges to win that race. We’ve seen a dramatic

rise in the proportion of global export financing that fails to play

by international lending and transparency rules in China, Russia,

and other countries. We’ve also seen an increased emphasis

on exports as an economic silver bullet in countries around the

world. And we’re facing the specter of new multilateral export

financiers in the form of the Asian Infrastructure Investment Bank

and the New Development Bank.

These challenges are stark, but they do nothing to shake my

optimism about America’s future. We can win the global export

race—after all, American workers still produce the highest quality,

most innovative goods and services in the world. But U.S.

businesses and their buyers abroad need certainty and confidence

if we’re going to lead the world in export-fueled growth.

For 80 years, Ex-Im has been a vital tool for expanding

opportunity, promoting American leadership on the global stage,

and adding middle class jobs here at home—and we want to

continue to be there to support U.S. businesses in strengthening

their communities through jobs. So we’re going to keep focusing

on our customers, keep making it simpler for small businesses to

access our products, and keep getting the word out about a fact

that thousands of entrepreneurs from Maine to Hawaii already

know to be true—exports create jobs.

Sincerely,

Fred P. Hochberg

Chairman and President

8 I

2014 ANNUAL REPORT I 9

8 I CHAIRMAN’S MESSAGE

FY2014

Highlights

MAJOR HIGHLIGHTS:

American jobs supported

164,000

of U.S. exports supported

at no cost to American

taxpayers

$27.5b

in direct support for

small business exporters

$5b+

OTHER KEY FY2014 HIGHLIGHTS:

Total Ex-Im Bank Financing

• Authorized$20.5billioninnancingtosupport

$27.5 billion of U.S. exports worldwide

Supporting U.S. Jobs

• Ex-ImBank’sauthorizationssupported

approximately 164,000 American jobs.

Small Business Support

• Authorizedmorethan$5billionin

financing and insurance for American

small business exporters

• Nearly90percentofthenumberofEx-ImBank’s

authorizations were for small businesses.

Minority- and Woman-Owned Support

• AlmostoneinveEx-ImBankauthorizations

were for minority- and/or woman-owned

businesses.

Prudent Financial Management

• InFY2014,Ex-ImBanksent$674.7millionto

the U.S. Treasury for deficit reduction.

Supporting America’s Manufacturers

• TheBankauthorizednearly$16.6billion

to support exports from America’s

manufacturing industries.

Building Trade with Sub-Saharan Africa

• AuthorizationssupportingU.S.exportsto

sub-Saharan Africa topped a record-breaking

more than $2 billion.

10 I

SUPPORTING

American Jobs

Ex-Im Bank plays a key role in supporting good-paying, export-

backed American jobs all across the country, contributing to a fifth

consecutive year of record-breaking exports for the United States.

In FY 2014, the United States exported a total of $2.3 trillion

in goods and services—47.5 percent above 2009 levels, and

the best year ever for American exports. More and more,

exports are fueling America’s economic resurgence—and

Ex-Im Bank’s support is playing a pivotal role in that trend,

particularly when it comes to empowering U.S. small

businesses to reach global markets.

Through our financing, Ex-Im Bank fulfills its mission to

support American job growth. Over the past six years,

Ex-Im Bank has financed the sale of just under $217 billion in

U.S. exports, supporting over 1.3 million American jobs.

In FY 2014, Ex-Im Bank approved over 3,700 authorizations

with a total estimated export value of nearly $27.5 billion.

This support equipped U.S. businesses to create or sustain

approximately 164,000 export-related U.S. jobs.

Over the past six years,

Ex-Im Bank has supported more

than 1.3 million American jobs

across the country.

1.3m

AMERICAN JOBS

JOBS CALCULATION METHODOLOGY

Ex-Im Bank began calculating the jobs associated with

its financing in FY 2010. Ex-Im Bank’s jobs estimate

methodology follows the standard government-wide

jobs calculation methodology designated by the Trade

Promotion Coordinating Committee (TPCC), which

uses employment data computed by the Bureau of

Labor Statistics (BLS) to calculate the number of jobs

associated with Ex-Im Bank supported exports of goods

and services.

Ex-Im Bank uses the latest available domestic

employment requirements table (ERT) as computed by

the BLS to calculate the number of jobs associated with

Ex-Im Bank supported goods and services. The ERT

quantifies the number of direct and indirect production

related jobs associated with a million dollars of final

demand for 196 detailed industries.

The ERT is derived from a set of data showing the

relationship between industries, known as input-output

tables. These tables are based on historical relationships

between industry inputs (e.g., labor) and outputs (e.g.,

goods for consumption). For more information, see

“Management’s Discussion and Analysis.”

For jobs estimates based on FY 2014 authorizations,

Ex-Im Bank supports a baseline average of 6,190 jobs

per $1 billion of U.S. exports. This average is weighted,

however, based on each industry’s relative jobs per $1

billion average at time of calculation.

10 I

2014 ANNUAL REPORT I 11

Ex-Im Bank Insurance

Empowers Texas Family

Business to Go Global

and Rehire Workers

Fritz-Pak is a family-owned business that

manufactures 40 dierent made-in-America specialty

products for the global construction industry, including

concrete additives and plasters for swimming pools.

Today, Gabriel Ojeda’s company is a growing small

business, eyeing an expansion. But times weren’t

always so great. After tripling sales throughout the

2000s, the global recession hit Fritz-Pak hard, and

they were forced to lay o employees.

Gabriel began looking abroad for overseas sales

opportunities that could replace lost domestic sales.

Equipping themselves with Ex-Im Bank’s export credit

insurance, the Ojedas were able to oer their new

foreign buyers credit terms while protecting against the

risk of not being paid.

Today, exports account for 35 percent of Fritz-Pak’s

total sales—and they have been able to hire their laid

o employees back.

EXPORTER:

Fritz-Pak, Mesquite, Texas

Markets:

Worldwide, including Mexico, Brazil, India, and Taiwan

Ex-Im Bank Product:

Export Credit Insurance

Pictured: Delvin Dorrough,

Fritz-Pak

“

We may be small,

but we think big. In an age where

everything seems to be made

someplace else, we’re thriving here

in Texas. Our success is due to hard

work, attention to customers’ needs

and belief in the future. Yet there’s no

doubt this success is also in no small

part due to the services provided by

Ex-Im Bank.

Gabriel Ojeda, President,

Fritz-Pak

”

12 I

KEEPING AMERICA

Competitive

For more than 80 years, Ex-Im Bank has leveled the playing field for U.S.

exporters facing off against financing offered by foreign governments.

As other countries double down on exports—and, in particular, as they

operate outside of established financing rules—the need for Ex-Im Bank

is greater than ever.

America enjoys the single greatest competitive advantage

there is: Products stamped “made in the U.S.A.” are

still known the world over for their reliability, quality, and

innovation. That’s a hard-earned distinction—and a testament

to the ingenuity of U.S. entrepreneurs and workers.

If purely free market elements such as quality and price were

the only factors at play for international buyers deciding how

to source their projects, most American exporters would

have little to worry about. But too often, government-backed

financing can become an overriding factor that tilts the playing

field away from U.S. businesses in favor of foreign companies

backed by their respective governments.

Ex-Im Bank is one of about 60 export credit agencies

(ECAs) operating around the world today. While every ECA

supports its domestic businesses through financing, not

everyone plays by the same rules when it comes to lending or

transparency.

As recently as 1999, nearly 100 percent of official export

credit support worldwide adhered to the internationally

agreed-upon lending and transparency standards outlined by

the Organisation for Economic Cooperation and Development

(OECD). Under the terms of the OECD’s Arrangement on

Officially Supported Export Credits, countries abided by

agreed-upon financing rules establishing loan term limits,

minimum fees and a number of other best practices.

But as countries that were not party to the OECD

Arrangement began to escalate their official export support,

the global landscape shifted. By 2004, only about two-thirds

of official support for exports around the world was governed

by OECD standards; by 2013—as described in Ex-Im Bank’s

most recent Competitiveness Report to Congress—that

number had dropped to one-third.

Today, U.S. exporters are facing a competitive landscape in

which the vast majority of official export financing is routinely

opaque and unchecked by basic, prudent standards. Instead

of putting their quality products up against other countries’

quality products, more and more, American businesses

are being forced to pit their goods and services against

unconstrained guarantees, aggressive financing, and flexible

payment schedules promised by foreign governments.

This trend disadvantages American businesses, threatens

U.S. job growth, and distorts global markets. Ex-Im Bank

exists to support U.S. companies by leveling the playing

field—by equipping American exporters with financing that is

both competitive and reflective of global best practices, Ex-Im

Bank helps level the global export playing field and return it as

much possible to one driven by free market principles such

as quality and price. The competitive edge that Ex-Im Bank

provides to U.S. businesses empowers them to more readily

compete on the merits of their goods and services.

Globally, countries are turning to exports as a means to grow

their economies and spur job creation—their elevated ECA

activity is a reflection of that commitment. At the same time,

even as the economy has recovered, commercial banks are

still somewhat reluctant to wholly finance certain areas of the

export finance arena, especially in emerging markets.

These gaps in the private sector, combined with rising global

competition, have made ECAs such as Ex-Im Bank more vital

than ever. As competition continues to heat up in markets

around the world, Ex-Im Bank will continue to stand behind

12 I

2014 ANNUAL REPORT I 13

American exporters, so that global sales and U.S. jobs aren’t

lost over access to competitive financing.

For more information on competitiveness in export finance,

please find Ex-Im Bank’s 2013 Report to the U.S. Congress at

www.exim.gov.

THE WORLD OF OFFICIAL MEDIUM- AND LONG-TERM EXPORT CREDIT

OECD Countries:

Australia

Austria

Belgium

Canada

Croatia*

Czech Republic

Denmark

Estonia*

Finland

France

Japan

Germany

Greece*

Hungary

Israel**

Italy

Latvia*

Luxembourg*

Netherlands

New Zealand*

Norway

Poland

Portugal

Romania*

Slovenia

Slovak Republic

South Korea

Spain

Sweden

Switzerland

Turkey**

United Kingdom

United States

Non-OECD Countries:

Belarus

Bosnia

Brazil***

(non-aircraft)

China

India

Indonesia

Jamaica

Macedonia

Malaysia

Philippines

Russia

Saudi Arabia

South Africa

Thailand

Ukraine

United Arab Emirates

* Very little or no medium- or long-term financing activity reported

** OECD countries not participating in the OECD General Arrangement: Israel and Turkey

*** Non-OECD countries participating in the Aircraft Sector Understanding (ASU) but not the OECD General Arrangement: Brazil

14 I

EMPLOYEE

GROWTH

4,000

EMPLOYEES MAKE UP

THE SPACEX

WORKFORCE...UP

FROM 150 EMPLOYEES

A DECADE AGO

AUTHORIZING

LOAN TO HELP FINANCE

THE 2015 SPACEX

LAUNCH OF THE AMOS-6

COMMUNCATIONS SATELLITE

$105m

+

Ex-Im Bank Boosts

Spacecraft Launching

Company in Global Markets

Founded in a garage in 2002, SpaceX was created to

design, manufacture and launch advanced spacecraft. With

export financing options limited, the company faces intense

competition from French, Russian and Chinese companies

in sales of overseas satellite launches. To overcome these

obstacles, SpaceX is relying on Ex-Im Bank to support them.

SpaceX is turning international opportunities into realities in

markets in Asia, South Asia, and Europe. The company has

grown from about 150 employees a decade ago to nearly

4,000 today. Their manufacturing facilities and supply chains

are here in America—and that means U.S. jobs.

Most recently, Ex-Im Bank authorized a $105.4 million loan

to Space Communication Ltd. of Ramat Gan, Israel, to finance

the 2015 SpaceX launch of the Amos-6 communications

satellite. The transaction is Ex-Im Bank’s third in support

of a SpaceX launch, and it will support approximately 600

quality U.S. jobs in California and elsewhere.

EXPORTER:

SpaceX, Hawthorne, California

Markets:

Israel, Hong Kong, and Bulgaria

Ex-Im Bank Product:

Direct Loan

EXPORT-IMPORT BANK of the UNITED STATES

14 I

2014 ANNUAL REPORT I 15

“

We appreciate Ex-Im Bank’s

support of both SpaceX and the

U.S. space industry. Ex-Im Bank

helps SpaceX compete success-

fully with international launch service

providers, bringing overseas satellite

launch business and high-tech jobs

back to American soil.

Gwynne Shotwell, President and COO,

SpaceX

”

16 I

RESPONSIBLE

Risk Management

As we support U.S. jobs wherever and whenever we can, safeguarding

taxpayer dollars remains a quintessential part of our DNA. As a result, we

have a robust risk management system based on vigilance, transparency,

and accountability, which has resulted in our extremely low default rate.

Ex-Im Bank’s framework is built on a foundation of effective

underwriting in order to satisfy our congressional mandate

that every authorization we approve comes with “a reasonable

assurance of repayment.” To that end, almost 80 percent of our

exposure in FY 2014 was backed by collateral or a sovereign

guarantee.

Ex-Im Bank delivers to Congress quarterly reports on our

portfolio default rate—an important measure of the Bank’s

“

At Ex-Im Bank, we are protecting U.S.

taxpayers by taking a comprehensive and

systematic approach to risk management.

While our rigorous underwriting and

portfolio management procedures have

resulted in very low default rates, we

continue to focus on reducing operational

risks as well, in areas such as information

systems and staffing.

C.J. Hall, Executive Vice President and

Chief Risk Ocer

”

C.J. Hall, Executive Vice President and Chief Risk Officer

16 I

2014 ANNUAL REPORT I 17

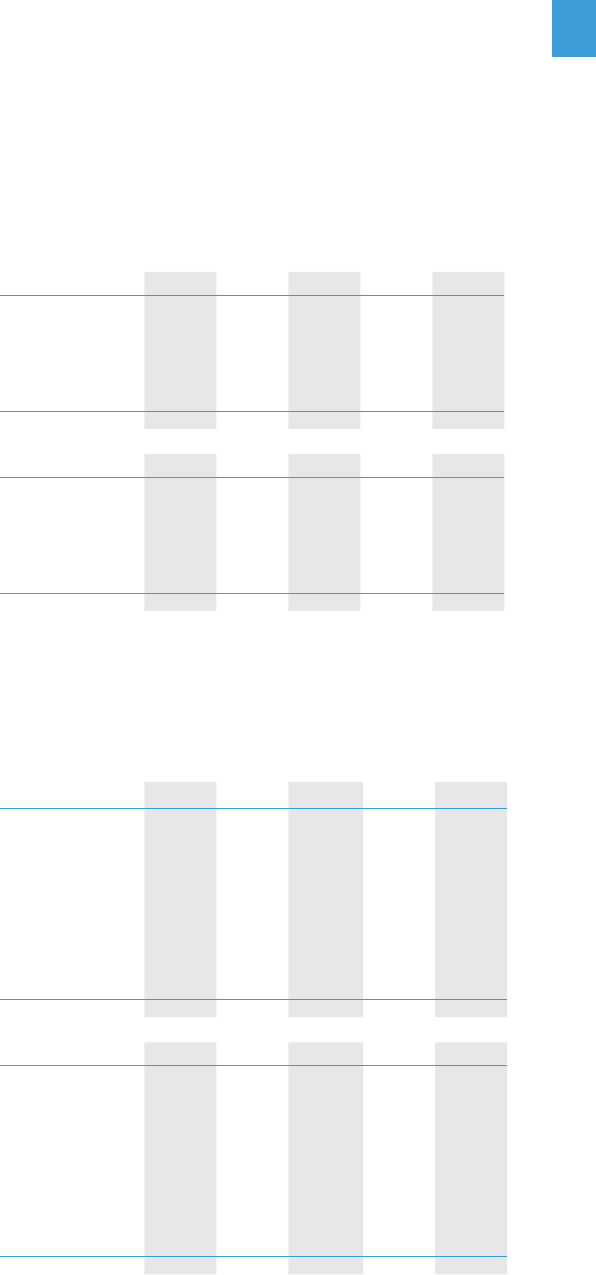

$113.8

$112.0

$106.6

$89.2

$75.2

0.60%

0.40%

0.29%

0.24%

0.18%

120

110

100

90

80

70

60

50

0.7%

0.6%

0.5%

0.4%

0.3%

0.2%

0.1%

0.0%

FY 2010 FY 2011 FY 2012 FY 2013 FY2014

FY 2010-FY2014 Exposure and Default Rate

Exposure ($billions)

Default Rate (percentage)

success on the risk management front. The active default rate

reflects the total amount of overdue required payments (claims

paid on guarantees and insurance transactions plus loans that

are past due) divided by the total amount of disbursed financing

involved. Our active default rate as of September 30, 2014,

was 0.175 percent.

The historically low default rates Ex-Im Bank has accrued of

late are due to a comprehensive risk management framework

with a strong emphasis on continuous improvement. This has

led to a relatively low number of defaults, coupled with high

recovery rates on those credits that have entered default.

Since the Federal Credit Reform Act went into effect in 1992,

the Bank has succeeded in recovering approximately 50 cents

for every dollar defaulted in the portfolio.

To further strengthen our risk management program,

in FY 2014 Ex-Im Bank established an Enterprise Risk

Committee comprised of senior vice presidents of the Bank

and chaired by the Bank’s executive vice president and chief

risk officer. The mandate of the Enterprise Risk Committee

is to maintain oversight of the comprehensive and systematic

risk management regime within the Bank. This regime extends

beyond repayment risk in the portfolio to include operational

risk—such as systems and staffing risk—as well as the full

range of legal, market, and strategic risks faced by the Bank.

The Enterprise Risk Committee meets at least once per month,

and incorporates oversight of several subordinate committees

focused on specific areas of risk.

Although Ex-Im Bank always strives to support U.S. exporters

in winning deals and adding jobs, we also go to great lengths to

ensure that we’re not taking undue risks—and that the credits

we extend routinely result in solid performance for exporters

and taxpayers alike.

as of September 30, 2014

0.175%

DEFAULT RATE

18 I

A FOCUS ON

Our Customers

We can’t fulfill our mission of supporting U.S. job growth if we’re not

providing customers with a seamless, efficient experience from start to

finish. We work every day to ensure that doing business with Ex-Im Bank

is as simple and productive as possible.

In the past year, Ex-Im Bank has seen major progress when it

comes to better serving our customers: the businesses that

equip themselves with Ex-Im Bank financing in order to pursue

sales abroad and add jobs here at home. Whether it’s cutting red

tape, rolling out new tools, or finding smarter ways to connect

businesses with the products we offer, we’re constantly

listening to our customers and seeking out ways to improve.

As a customer-oriented organization, we survey our customers

in order to serve them better. The 2014 survey of our small

business customers revealed strong results: 86 percent

reported that they were “satisfied” or “extremely satisfied”

with Ex-Im Bank, while 95 percent indicated that they would

recommend Ex-Im Bank to other exporters.

EX-IM BANK CUSTOMER SURVEY RESULTS

Question:

During the past five years,

have your U.S. exports

grown, stayed about the

same size or decreased?

SMALL BUSINESS GROWTH

Statement:

Ex-Im Bank assistance

helped to expand my

export business.

HOW EX-IM IMPACTS

SMALL BUSINESS

The survey also found that exports have increased during

the past five ye

ars for the majority of respondents, with 65

percent reporting growth in their export business. Those

responses aligned with our renewal levels for our most popular

small business products—one potential measure of customer

satisfaction. Small businesses renewed a total of 722 Express

Insurance policies in FY 2014, as compared with 421 the prior

year, and Working Capital Delegated Authority renewals (used

by our private financial institution partners to provide customers

with rapid response under strict guidelines and audits) jumped

to 195 from 113 over that time span as well.

A major objective this year was to speed up claims processing

cycle times, which had been flagged by our customers in years

past as the operational area most in need of improvement.

Thanks to the hard work of our team, average claims

processing times have been cut by 40 percent in just two

years, dropping from 73 days in 2012 to 44 days in 2014—

without compromising due diligence.

Another major development has been the creation of a

customer contact center. The contact center serves as a single

point of entry for export ready customers seeking information

and guidance via telephone, e-mail, and—starting in 2015—

live online chat. The goal of the contact center is to improve

communications with customers by answering questions in

real time.

Additionally, we now hold quarterly webinars with the Bankers’

Association for Finance and Trade (BAFT), a forum that has

proven to be helpful for bringing Ex-Im Bank together with

the voices of our customers and partners. The number of

participants has tripled over the course of the year.

In the year ahead, we’ll continue listening to our customers,

implementing new reforms and doing everything we can to

improve the ease of doing business with Ex-Im Bank.

65%

Agree/Strongly Agree

21%

Neither Agree nor

Disagree

9%

Disagree/Strongly

Disagree

5%

N/A

75% TO 100%

SMALL BUSINESS

64.5%

Exports have grown

26%

Stayed about

the same

9.5%

Decreased

18 I

2014 ANNUAL REPORT I 19

Ex-Im Bank Insurance

Powers Exports

from an Innovative

American Startup

When innovative American manufacturers are

looking to go global, Ex-Im Bank is there. That’s the

case with SynTouch, a pioneering technology firm

in southern California. Founded in 2008, SynTouch

develops and makes the only technology in the world

that replicates—and sometimes exceeds—the human

sense of touch. The company provides tactile sensing

solutions for industrial and medical applications.

Because the costs of manufacturing each advanced

fingertip-sized sensor can run into the thousands,

SynTouch cannot aord buyer nonpayment—particularly

when buyers are located thousands of miles away in

global markets. That’s why the company purchased

Ex-Im Bank’s Express Insurance, which protects

against losses due to commercial and political risks,

covering 95 percent of invoice sales to customers

overseas.

Instead of losing sleep over whether they’ll get paid,

the engineers at SynTouch can focus on researching

manufacturing improvements, developing new uses for

their groundbreaking technology and growing sales.

Today, SynTouch has 25 international customers in 14

countries.

EXPORTER:

SynTouch, Los Angeles, California

Markets:

Worldwide, including China, Netherlands,

Germany, and Australia

Ex-Im Bank Product:

Express Insurance

“

The services Ex-Im Bank provides

are critical for small business to

expand exports into international

markets. Payment terms are an

important part of the equation in

working with distributors, and Ex-Im

Bank’s insurance policy allows

us to remain competitive.

David Groves, Chief Operating Ocer,

SynTouch

”

20 I

EMPOWERING AMERICAN

Small Businesses

Small businesses are the engine of the American economy, responsible

for creating two out of every three new jobs. At Ex-Im Bank, we’re

committed to supporting that job growth by equipping small businesses

with the financing they need to reach new customers and win sales

overseas.

Ex-Im Bank Small Business Group

Pictured left to right: Tamara Maxwell, Business Development,

Minority- and Women-Owned Businesses; James Burrows, Senior

Vice President; and Sean Luke, Business Development Specialist

Ex-Im Bank helps U.S. small businesses to achieve the

kind of growth that can only come from reaching beyond

our nation’s borders to customers abroad, particularly in

emerging markets where demand for reliable “made in the

USA” goods and services is strong.

We are expanding our small business portfolio and

reaching new customers through the coordinated efforts

of the Bank’s Small Business Group, state and local trade

organizations, lenders, and brokers.

In FY 2014, 545 U.S. small businesses were first-time users

of Ex-Im Bank products. Nearly half of our small business

authorizations—over 1,600 out of more than 3,300—

involved authorized amounts under $500,000.

Increased Support for Minority- and Women-Owned

Businesses

Since FY 2009, Ex-Im Bank has significantly increased its

financing to support the growth of minority-owned and

women-owned businesses, approving more financing over

the past six years than in the previous 16 years combined.

EXPORT-IMPORT BANK

of the UNITED STATES

20 I

2014 ANNUAL REPORT I 21

EX-IM BANK’S FINANCING

BENEFITING SMALL BUSINESS

$5b+

DIRECT SUPPORT

Measured by total dollar volume, Ex-Im

Bank’s small business authorizations in

FY 2014 were more than $5 billion, nearly

25 percent of the total dollar volume

of overall authorizations.

Ex-Im Bank’s direct small business support accounts for

the overwhelming majority of the Bank’s authorizations. In

FY 2014, the Bank approved more than 3,300 small business

authorizations—nearly 90 percent of the total number of Ex-

Im Bank authorizations.

SMALL BUSINESS OUTREACH

Throughout FY 2014, Ex-Im Bank leadership and staff

engaged small businesses across the country in town hall

style discussions known as Global Access Forums—a

chance for small companies to gain insight into how they can

expand sales by reaching foreign buyers. Since Ex-Im Bank

joined with the U.S. Chamber of Commerce and the National

Association of Manufacturers to launch the Global Access

for Small Business initiative in January 2011, the Bank has

sponsored more than 75 Global Access Forums nationwide.

To reach more companies that are often underserved by

export credit, Ex-Im Bank staff have participated in seminars

nationwide sponsored by women business centers, small

business associations, minority-focused chambers of

commerce, and other organizations.

Ex-Im Bank’s 12 regional export finance centers focus

exclusively on small business. Our three regional

headquarters are located in Miami, Chicago, and Irvine,

California.

PRIVATE SECTOR PARTICIPATION

Ex-Im Bank leverages its resources by working with private

sector lenders, insurance brokers, and other financial

and trade institutions. The Bank works to expand these

partnerships to make its financing products more accessible

to small businesses.

By the end of FY 2014, 123 lenders were enrolled in Ex-Im

Bank’s Working Capital Guarantee Program, 97 of which

have delegated authority, under rigorous audit and lending

guidelines, to provide Ex-Im Bank’s guarantee of working

capital loans without prior Bank approval. A total of 13 new

lenders were added in FY 2014.

An additional five brokers were added to the Bank’s roster of

80 active brokers providing Ex-Im Bank’s insurance to small

businesses.

KNOWN INDIRECT SMALL BUSINESS

SUPPORT IN LONG-TERM TRANSACTIONS

When Ex-Im Bank authorizes a long-term loan or loan

guarantee to support U.S. exports from a large U.S. exporter,

Ex-Im Bank is also unleashing opportunity for American small

business suppliers to grow their sales.

While Ex-Im Bank is limited in in its ability to gather supply

chain data from large U.S. exporters due to trade secrets

and other business concerns, Ex-Im Bank can estimate that,

at a minimum, the $12.7 billion authorized for long-term

transactions in FY 2014 supported American small business

exports worth at least $650 million. These small businesses

were identified to Ex-Im Bank as suppliers of the principal

exporters in these long-term authorizations. This figure is in

addition to the direct support for small businesses included

in long-term authorizations, which spurred small business

exports valued at an estimated $330 million.

22 I

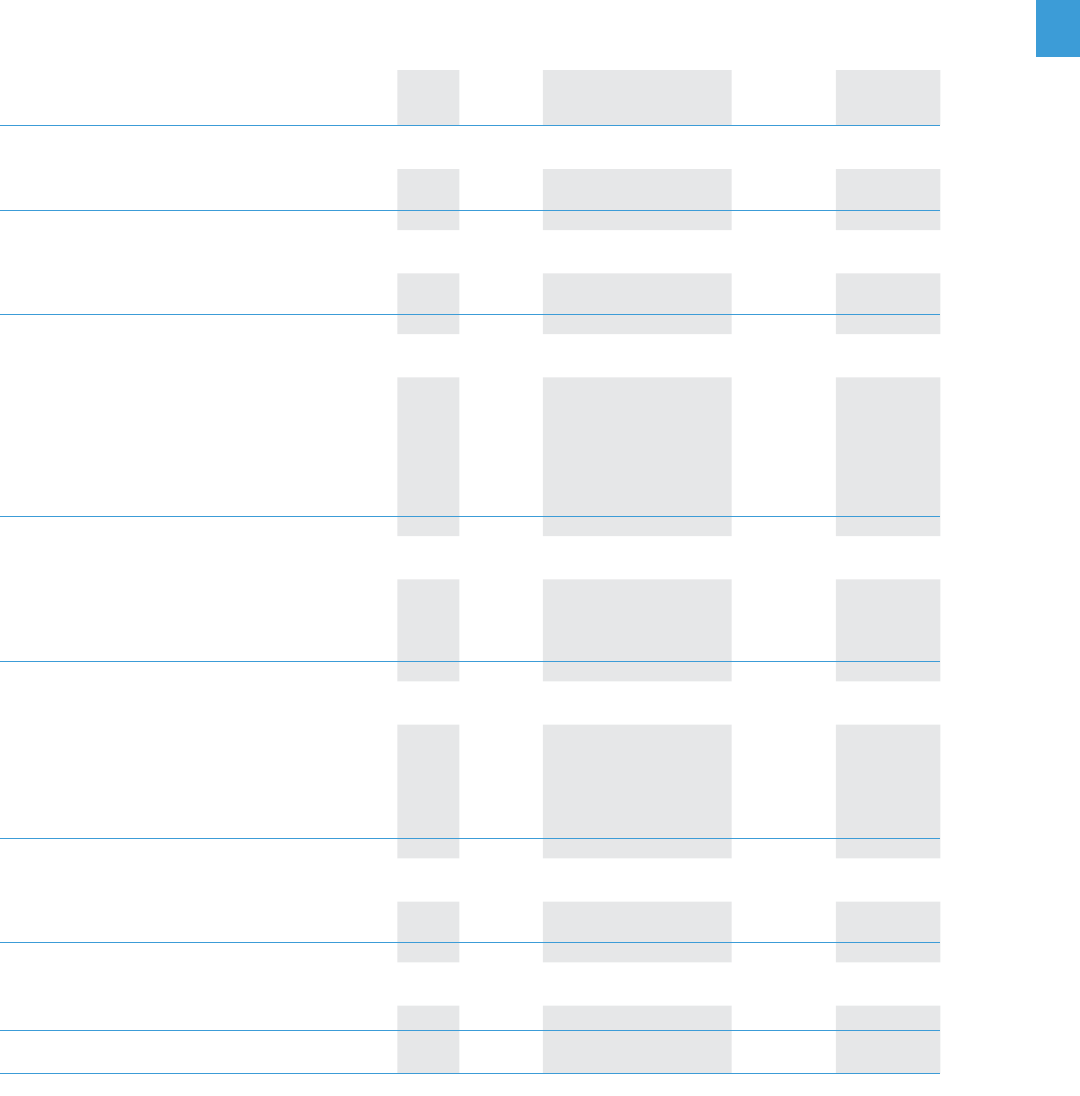

SMALL BUSINESS SUPPORT BY STATE IN FY 2014

WA

OR

CA

ID

NV

AZ

UT

WY

MT

ND

SD

CO

NM

TX

OK

KS

MN

IA

MO

AR

LA

MS

TN

IL

WI

MI

IN

OH

PA

NY

VA

WV

NC

SC

GA

AL

FL

ME

KY

VT

NH

AK

NE

MD

RI

NJ

CT

MA

DE

PR

HI

DC

SMALL BUSINESS EXPORTS MAKE UP 20 PERCENT OR MORE

OF EX-IM SUPPORTED EXPORTS IN 42 STATES.

75% TO 100%

SMALL BUSINESS

STATE

TOTAL

EXPORTS

SMALL

BUSINESS

HI

$1.6 MILLION 100%

IA

$14.6 MILLION 93%

ME

$5.3 MILLION 100%

MD

$110.6 MILLION 86%

MS

$20.5 MILLION 75%

MT

$478,000 100%

OK

$140.9 MILLION 92%

OR

$132.3 MILLION 86%

RI

$5.7 MILLION 80%

VT

$11.1 MILLION 93%

WV

$802,000 99%

50% TO 74%

SMALL BUSINESS

STATE

TOTAL

EXPORTS

SMALL

BUSINESS

FL

$785.7 MILLION 70%

IN

$118.4 MILLION 72%

KY

$41.3 MILLION 72%

LA

$114 MILLION 60%

MO

$83.9 MILLION 67%

NH

$29.2 MILLION 60%

ND

$1.8 MILLION 67%

OH

$277.7 MILLION 60%

SD

$5.1 MILLION 66%

UT

$12.7 MILLION 73%

20% TO 49%

SMALL BUSINESS

STATE

TOTAL

EXPORTS

SMALL

BUSINESS

AL $46.7 MILLION 48%

AZ

$203.4 MILLION 42%

AR

$69.3 MILLION 26%

CA

$1.6 BILLION 32%

CO

$30 MILLION 49%

CT $145.7 MILLION 24%

GA

$469.7 MILLION 42%

ID

$26.5 MILLION 26%

MA

$191.9 MILLION 30%

MI $266.8 MILLION 47%

MN $252.9 MILLION 39%

NE

$106.8 MILLION 49%

NV $11.3 MILLION 36%

NJ

$292.5 MILLION 34%

NM

$14.8 MILLION 39%

NY

$574.4 MILLION 45%

NC

$256.2 MILLION 26%

PA

$568.7 MILLION 42%

PR

$41.4 MILLION 31%

TN

$159.3 MILLION 36%

TX $1.2 BILLION 43%

WI $210.2 MILLION 46%

0% TO 19%

SMALL BUSINESS

STATE

TOTAL

EXPORTS

SMALL

BUSINESS

AK

$9.6 MILLION 0%

DE

$5.6 MILLION 13%

DC $46.8 MILLION 4%

IL

$962.5 MILLION 13%

KS

$119 MILLION 14%

SC

$983.9 MILLION 3%

VA

$306.2 MILLION 17%

WA

$7.2 BILLION 1%

WY

$19.9 MILLION 15%

NOTE: Map data shows estimated Ex-Im-assisted exports per state

with percentages of these sales by small businesses. Estimates are

based on disbursements of Ex-Im financing in FY 2014.

EXPORT-IMPORT BANK

of the UNITED STATES

22 I

2014 ANNUAL REPORT I 23

A Small Business

Pumps Up Sales with

Ex-Im Bank’s Financing

Roy Bell III runs Ace Pump Corp., the small industrial

pump company his grandfather started at the end of

World War II. You can find their pumps on everything

from tractors and concrete trucks to highway anti-icing

vehicles and asphalt milling machines.

Since 2009, Ace Pump has used Ex-Im Bank’s export

credit insurance to protect against the risk of buyer

nonpayment in faraway markets and to extend open

credit terms to foreign customers that lack access

to aordable working capital financing. Today, export

sales represent one-fifth of total business, and Ace has

expanded its workforce in Tennessee by 10 percent.

But insurance isn’t the only way Ex-Im Bank supports

Ace Pump. Roy’s small business is also a supplier to CNH

Industrial, a larger American company that uses Ex-Im

Bank financing to win sales in global markets. Each time

CNH Industrial makes use of Ex-Im financing to a win a

deal overseas, Ace Pump is one of the hundreds of small

business suppliers that see an uptick in their business

as well. It’s an example of how Ex-Im Bank is supporting

U.S. small businesses indirectly through direct export

financing, as part of larger businesses’ supply chains.

EXPORTER:

Ace Pump Corp.

Memphis, Tennessee

Markets:

Paraguay, Chile, France, Belgium,

and Mexico

Ex-Im Bank Product:

Multibuyer Export Credit Insurance

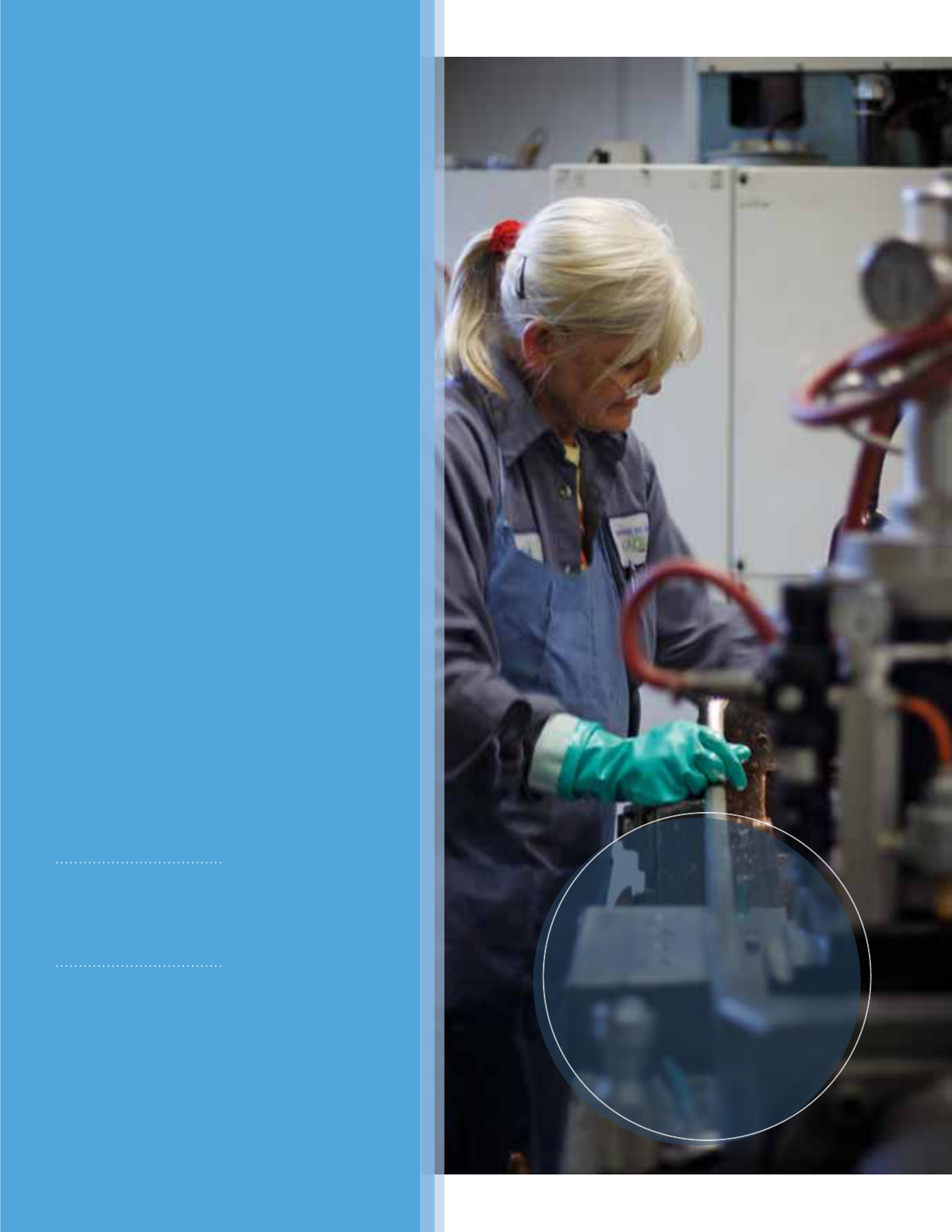

Pictured: Christine Howry,

Ace Pump Corp.

“

There’s no doubt that Ex-Im Bank

products have empowered us twice over—

allowing us to grow our own international

sales, while also supporting our U.S.

customers who incorporate our products

into their larger equipment that is exported

worldwide. Exports are now a foundational

part of our business, and Ex-Im Bank is an

indispensable tool in winning deals that

add jobs here in Tennessee.

Roy Bell III,

owner, Ace Pump Corp.

”

24 I

sales

$5.9

numBers

MIllION

IN EXPORT SAlES

emploYee

30+

growtH

MORE THAN

30 EMPlOyEES

A Woman-Led

Small Business is Still

a Leader in Refrigeration

100 Years Later

In 1912, William Henry Howe and his sons began designing,

producing, and servicing state-of-the-art refrigeration and

ice-making equipment. Today, William Henry Howe’s great-

gran

ddaughter Mary runs Howe Corp., overseeing a team of

about 30 employees to manufacture commercial and industrial

refrigeration equipment in the heart of Chicago.

In 2007, Mary Howe’s international customers began asking if

they could have more time to pay—but as a small manufacturer,

Howe Corp. didn’t have the cash on-hand to aord longer terms

for payment. Mary began covering her export sales with Ex-Im

Bank insurance starting in late 2008. This insurance enabled

the company to fulfill sales orders and keep the factory running.

As a result, the company has obtained new customers in Latin

America. Howe’s policy has been renewed six times, and the

company has recently added two additional employees due to

the Bank’s support of $5.9 million in export sales.

EXPORTER:

Howe Corp., Chicago, Illinois

Markets:

Worldwide, primarily Latin America

Ex-Im Bank Product:

Multibuyer Export Credit Insurance

EXPORT-IMPORT BANK

of the UNITED STATES

24 I

2014 ANNUAL REPORT I 25

“

The interesting thing is when

domestic sales drop off, often the

export sales pick up, and it fills

the gap. With the economy the

way it is, Ex-Im Bank’s support

helps our sales remain steady.

Mary Howe, President,

Howe Corp.

”

26 I

SUPPORTING AMERICA’S MOST

Critical Industries

The United States has always produced goods, technologies and services

that are able to compete and win in global markets based on their quality,

innovation, and price—and Ex-Im Bank is there to ensure that they can

compete on financing as well.

Satellites – $941 million authorized to support As part of our mission to promote U.S. jobs, Ex-Im Bank has

identified ke

y industrial sectors with high potential for U.S.

export growth. These sectors include agribusiness, aircraft

and avionics, satellites, mining, oil-and-gas development,

and power generation, including renewable energy.

Competitive financing is a necessary component for U.S.

exporters to succeed in these sectors abroad, particularly

when foreign competitors are backed by financing and other

aid from their respective governments. By equipping U.S.

businesses with financing tools, Ex-Im Bank is leveling the

playing field for large and small exporters alike.

FY 2014 AUTHORIZATIONS* HIGHLIGHTS:

Manufacturing (non-aircraft) – $8.1 billion

authorized in support of U.S. manufacturing

other than aircraft, including other transportation

vehicles, large agricultural equipment, product-

manufacturing machinery, consumer products,

and much more

Forty-three percent of the dollar value of non-

aircraft manufacturing-related authorizations

directly supported small business exports.

•

$149 million authorized to provide liquidity

and risk protection to U.S. textile mills

• $93 million authorized to support U.S.

exports of medical equipment and products

Services – $1.1 billion authorized to finance

exports of all types of U.S.-produced services,

including engineering, design, construction,

aircraft engine maintenance, computer software,

oil and gas drilling, architecture, transportation

services, legal services, training, and consulting

(This aggregate amount includes authorizations

that are also reported under other sectors.)

exports of U.S.-manufactured satellites and launch

services

Agribusiness – $501 million authorized to support

more than $1.2 billion of U.S. exports of agricultural

goods and services, including commodities, livestock,

foodstuffs, farm equipment, chemicals, supplies, and

services

Eighty-three percent of the dollar value of the Bank’s

agribusiness authorizations directly supported small

business exports.

Aircraft and Avionics – $8.4 billion authorized

to support exports of U.S.-manufactured large

commercial aircraft, business aircraft and

helicopters, aircraft engines, avionics, and related

services provided by American workers

•

$7.2 billion in financing to support the export of

61 new U.S.-manufactured commercial aircraft

• $915.5 million in support of U.S.-manufactured

business aircraft and helicopters

• $243.1 million to support the export of aircraft

spare engines and engine maintenance, repair, and

overhaul (MRO) services

Oil and Gas – $1.3 billion authorized to support

U.S. goods and services exports related to the

development of onshore and offshore oil- and

gas-field projects

Power Generation – $462 million authorized to

support U.S. exports related to power-generation

projects

•

$198 million to support U.S. exports related to

renewable energy sources such as wind and solar

Mining – $746 million authorized for U.S. exports of

mining-related equipment and services

*Authorizations amounts reported are not necessarily mutually exclusive

by category but indicate overall breakout of financing by industry.

EXPORT-IMPORT BANK

of the UNITED STATES

26 I

2014 ANNUAL REPORT I 27

A Family-Owned

Business Refuses to Let

their Sales Get Bogged

Down

In 1934, a trio of Greek brothers immigrated to

Massachusetts and began producing one of the world’s

most iconic American products: cranberries. Now into

its eighth decade, Decas Cranberry Products is still a

family-owned business with 450 acres of cranberry

bogs and seven warehouse locations throughout the

United States. Decas contracts with over 120

independent growers nationwide, and produces more

than 30 million pounds of cranberry products annually.

Decas Cranberry came to Ex-Im Bank because they knew

that achieving the next 80 years of success would require

reaching more customers in global markets. Using Ex-Im

Bank’s insurance to protect against the risk of buyer

nonpayment, Decas now confidently sells to customers in

over 35 countries.

As an exporter in the produce sector, Decas is not alone

as an Ex-Im Bank customer. Demand for grown- and

made-in-America agricultural and foodstus products

is expanding, and Ex-Im Bank is there to make sure

companies like Decas Cranberry can stock global grocery

store shelves around the world.

EXPORTER:

Decas Cranberry Products,

Carver, Massachusetts

Markets:

Worldwide, including South Africa, Thailand,

Bosnia and Herzegovina

Ex-Im Bank Product:

Multibuyer Export Credit Insurance

“

Decas has benefitted greatly

because Ex-Im Bank was there to

provide us security with all our

foreign sales.

Norman Beauregard, Chief Financial Ocer,

Decas Cranberry Products

”

28 I

BUILDING INFRASTRUCTURE IN

Emerging Markets

Worldwide demand is rising in emerging markets for all kinds of

infrastructure development, including civil aviation, roads and bridges,

power plants, telecommunications, and other vital capital goods and

services. Ex-Im Bank empowers America to seize these tremendous

opportunities, meeting global demand, and adding quality jobs here

at home.

Working on behalf of U.S. exporters, Ex-Im Bank has

financed more global infrastructure projects in the past four

years than in the previous 17 years combined, helping to

keep the United States competitive against foreign rivals in

some of the world’s fastest-growing markets.

In FY 2014, $13.9 billion (more than 68 percent) of Ex-Im Bank’s

authorizations supported U.S. exports to emerging markets,

in comparison with more than $6.5 billion (nearly 32 percent)

authorized for exports to advanced economies.

PERCENTAGE OF

TOTAL AUTHORIZATIONS

PERCENTAGE OF TOTAL

SMALL BUSINESS AUTHORIZATIONS

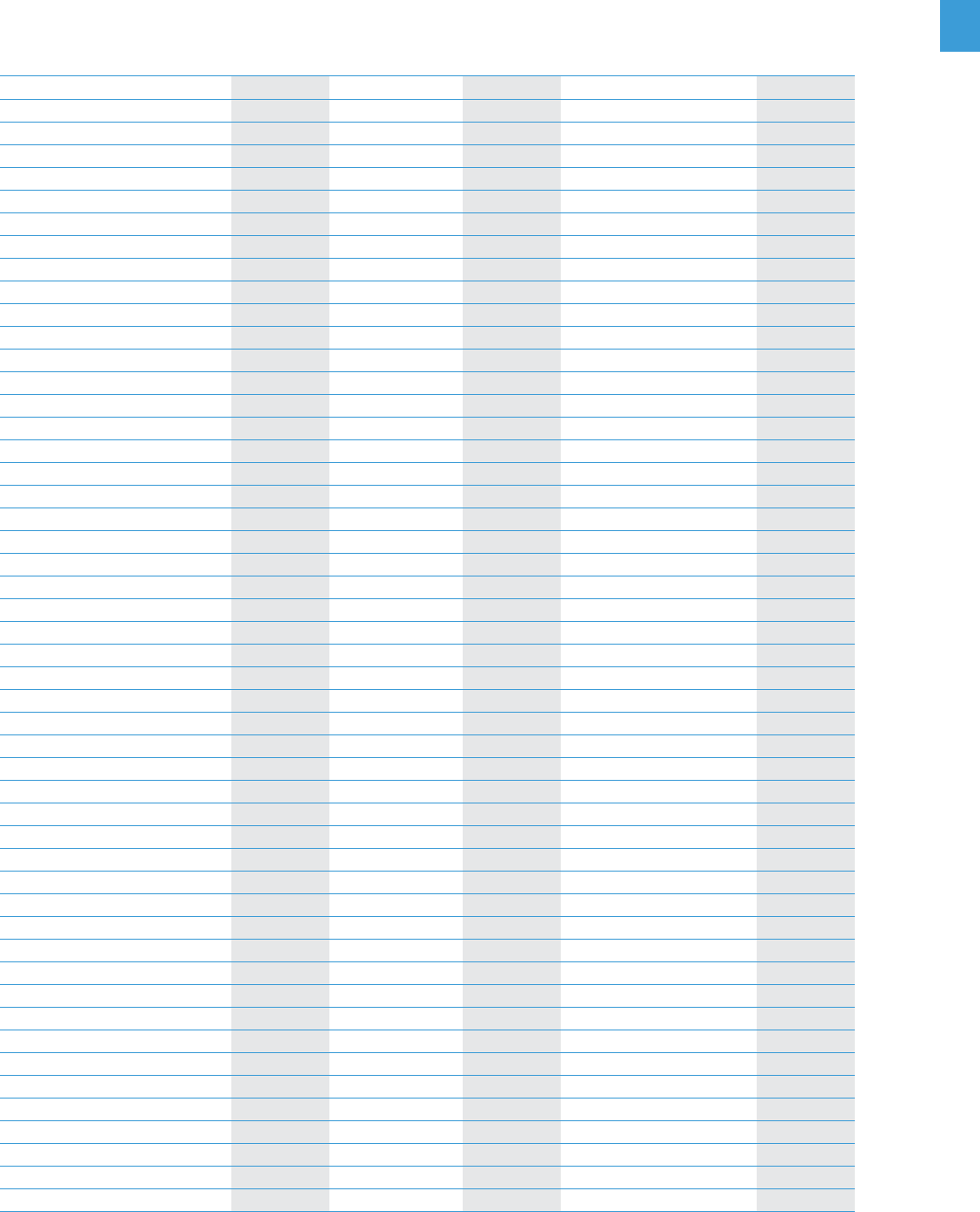

EX-IM BANK FY2014 AUTHORIZATIONS: EXPORT DESTINATION BREAKOUT

(in millions)

Total Authorizations Percent of T

otal Authorizations Small Business Authorizations

Percentage of Total Small

Business Authorizations

Advanced Economies 6,528.5 31.9% 1,915.8 37. 9%

Emerging Markets 13,939.4 68.1% 3,134.4 62.1%

Grand Total

20,467.9 100% 5,050.2 100%

75% TO 100%

SMALL BUSINESS

68.1%

Emerging Markets

31.9%

Advanced

Economies

62.1%

Emerging Markets

37.9%

Advanced

Economies

EXPORT-IMPORT BANK

of the UNITED STATES

28 I

2014 ANNUAL REPORT I 29

FY 2014 AUTHORIZATIONS BY REGION

● NORTH AMERICA: $3.1 BILLION ● LATIN AMERICA/CARIBBEAN: $2.5 BILLION ● AFRICA: $2.1 BILLION

● EUROPE: $2.4 BILLION ● ASIA: $4.9 BILLION ● OCEANIA: $0.8 BILLION —ALL OTHER: $4.7 BILLION

LATIN AMERICA/

CARIBBEAN

$2.5b

AFRICA

$2.1b

NORTH

AMERICA

$3.1b

ASIA

$4.9b

EUROPE

$2.4b

OCEANIA

$0.8b

KEY FY2014 AUTHORIZATIONS:

• $ 11.6 billion to support U.S. exports in infrastructure projects,

including large transportation equipment. This financing

represents nearly 56.6 percent of total authorizations for FY 2014.

• $3.4billionforlong-termstructuredandproject-nance

authorizations, including financing for a range of infrastructure

projects, such as oil and gas development, power generation,

mining projects, liquefied natural gas production and

telecommunications.

Approximately 58.5 percent of these authorizations are related

to emerging markets.

• $8.1 billion to support U.S. exports of aircraft and aviation-related

exports. Approximately 75.9 percent of these authorizations are

for exports to emerging markets.

DEFINING INFRASTRUCTURE:

Consistent with the World Bank and the Organisation for

Economic Cooperation and Development, Ex-Im Bank

defines infrastructure to include the large physical networks

necessary for the functioning of commerce, such as

highways, railroads, power generation plants, pipelines,

satellites, and radio transmission systems. Infrastructure

also includes the goods and services essential to

maintaining a country’s health, cultural, and social

standards, including educational and healthcare equipment

and services. Also included in the Bank’s definition of

infrastructure are transportation components, such as

aircraft and locomotives, and equipment and services

related to mining industries.

30 I

REALIZING OPPORTUNITIES IN

Sub-Saharan Africa

Ex-Im Bank plays a critical role in enabling American exporters to tap the

tremendous sales opportunities in sub-Saharan Africa—home to seven out

of 10 of the fastest-growing economies in the world.

In the past five years, Ex-Im Bank has approved more

than $6.3 billion in financing for U.S. exports to sub-

Saharan Africa, including a record-topping $2.1 billion in

authorizations in FY 2014.

Ex-Im Bank-supported U.S. exports to sub-Saharan Africa

accounted for approximately 8 percent of an estimated

more than $25 billion of total U.S. manufacturing exports to

the region in FY 2014.

Relative to American exports writ large, Ex-Im Bank

finances a higher proportion of U.S. goods and services in

sub-Saharan Africa than in any other region. In FY 2014,

10 percent of Ex-Im Bank’s authorizations by dollar volume

supported U.S. exports to sub-Saharan Africa.

NOTEWORTHY FY2014 AUTHORIZATIONS:

• $563 million loan guarantee to finance the sale

of nearly 300 electric-diesel locomotives from GE

Transportation in Erie and Grove City, Pa., to Transnet

SOC Ltd., South Africa’s leading rail, port, and freight

company—supporting approximately 2,500 U.S. jobs

in Pennsylvania and other states

• $842millionloanguaranteetonanceBoeingaircraft

to Kenya Airways—supporting an estimated 5,400 jobs

throughout Boeing’s supply chain in states across

America

• $17millionloanguaranteefortheWestAfrican

Development Bank (BOAD) to finance U.S. exports of

power-generation equipment to the Azito power

project in Côte d’Ivoire—supporting 100 jobs in

Schenectady, N.Y., and Bangor, Maine.

Rick Angiuoni

Director, Africa

Global Business Development Division

Ben Todd

Senior Business Development Ocer, Africa

Global Business Development Division

EXPORT-IMPORT BANK

of the UNITED STATES

30 I

2014 ANNUAL REPORT I 31

KENYA

ETHIOPIA

SUDAN

SOUTH SUDAN

ERITREA

NIGER

MAURITANIA

MALI

NIGERIA

SOMALIA

NAMIBIA

CHAD

SOUTH AFRICA

TANZANIA

ANGOLA

MADAGASCAR

COMOROS

MOZAMBIQUE

BOTSWANA

ZAMBIA

GABON

CENTRAL

AFRICAN

REPUBLIC

UGANDA

SWAZILAND

LESOTHO

MALAWI

BURUNDI

RWANDA

TOGO

BENIN

GHANA

CÔTE

D'IVOIRE

LIBERIA

SIERRA LEONE

GUINEA

BURKINA FASO

GAMBIA

CAPE

VERDE

CAMEROON

SAO TOME & PRINCIPE

ZIMBABWE

CONGO

DEM. REP.

OF CONGO

EQUATORIAL GUINEA

DJIBOUTI

SENEGAL

GUINEA-

BISSAU

EXPORTER:

W.S. Darley & Company, Itasca, IL

Export: Fire-Fighting Trucks

Market: Nigeria

Ex-Im Bank Product:

Direct Loan

EXPORTER:

Cargill Inc., Minneapolis, MN

Export: Wheat

Market: Liberia

Ex-Im Bank Product:

Export Credit Insurance

EXPORTER:

General Electric Co.

Schenectady, NY

Export: Steam Turbines

Market:

Côte d’Ivoire (Azito Power Project)

Ex-Im Bank Product:

Loan Guarantee for BOAD

EXPORTER:

The Boeing Co., Everett, WA

Export: Commercial Aircraft

Market: Kenya

Ex-Im Bank Product:

Loan Guarantee

for Kenya Airways

EXPORTER:

Strength of Nature Co.

Savannah, GA

Export:

Hair Care Products

Markets:

Ghana, Tanzania, Nigeria, Senegal

Ex-Im Bank Product:

Export Credit Insurance

EXPORTER:

GE Transportation,

Erie, Grove City, PA

Export: Locomotive Kits

Market: South Africa

Ex-Im Bank Product:

Loan Guarantee

WORKING TOGETHER WITH OTHER

U.S. GOVERNMENT AGENCIES

U.S.-Africa Leaders Summit – Ex-Im Bank played a key

role in this first-of-its kind event, held in August 2014 in

Washington, D.C., where President Obama welcomed leaders

from across the African continent to strengthen ties with the

United States and promote U.S.-African trade and investment.

Ex-Im Bank hosted events for young African leaders and

African heads of state and CEOs to discuss trade opportunities.

Power Africa – President Obama launched this innovative

public-private initiative in 2013 to expand electric power

generation in sub-Saharan Africa, where more than 600 million

people lack regular access to electricity. Through Power Africa,

the president has set a goal of adding more than 30,000

megawatts (MW) of new, cleaner electricity-generating

capacity, and increasing access to electricity for at least 60

million households and businesses.

Ex-Im Bank has pledged up to $5 billion in support of this

initiative and has approved financing for projects that will

contribute to Power Africa’s goals.

Doing Business in Africa – Ex-Im Bank participates in this

campaign with other U.S. agencies to raise awareness among

American businesses—including members of African Diaspora

communities—about the continent’s potential for expanding

U.S. exports. For this initiative, Ex-Im Bank has pledged to

support $3 billion in financing for sub-Saharan Africa over the

next two years and participate in 50 related events.

The Bank has partnered on export-focused events with the

U.S. Foreign Service, Foreign Commercial Service, U.S. Trade

and Development Agency, U.S. Agency for International

Development, the Millennium Challenge Corp., and other U.S.

government entities to encourage economic engagement

pursuant to the Africa Growth and Opportunity Act.

BUILDING RELATIONSHIPS WITH AFRICAN

INSTITUTIONS

Ex-Im Bank maintains strong ties with a number of banks in

the sub-Saharan region. This year, we worked with BOAD on

the Azito power project and with the African Export-Import

Bank (Afreximbank) on support for the export of U.S.-

manufactured aircraft to Kenya Airways. The Bank also signed

a memorandum of understanding (MOU) with PTA Bank.

During the U.S.-African Leaders Summit, Ex-Im Bank signed a

$1 billion MOU for the financing of U.S. exports to Angola.

In Partnership with:

32 I

EXPORT-IMPORT BANK of the UNITED STATES

A DIRECT

LOAN OF

$15m+

TO THE GOVERNMENT OF

LAGOS TO UNDERWRITE

THE PURCHASE OF 32

DARLEY FIREFIGHTING

VEHICLES

EMPLOYEE

GROWTH

MANUFACTURING

JOBS SUPPORTED

100

Ex-Im Bank Finances

Export of American-Made

Fire Trucks to Nigeria

In 1926, a conversation with Henry Ford helped prompt

Chicago businessman William Stuart Darley to transform his

business from an equipment manufacturer to a producer of

fire trucks. Today, W.S. Darley & Co. still manufactures and

distributes fire trucks and pumps to a range of customers,

including overseas buyers.

One of those overseas buyers is the state of Lagos, Nigeria.

The governor of Lagos declared the state of the region’s

firefighting capacity an urgent matter of state security.

That’s when the city of Lagos turned to W.S. Darley to

upgrade its fleet of fire trucks.

When private financing proved to be unavailable, Darley

sought support from Ex-Im Bank, which authorized a

$15.7 million direct loan to the government of Lagos in

order to underwrite the purchase of 32 state-of-the-art

Darley firefighting vehicles. The fire trucks—built at Darley’s

manufacturing center in Chippewa Falls, Wis.—will support

approximately 100 U.S. manufacturing jobs.

EXPORTER:

W.S. Darley & Co., Itasca, Illinois

Markets:

Nigeria

Ex-Im Bank Product:

Direct Loan

STATES

32 I

2014 ANNUAL REPORT I 33

“

Ex-Im Bank has helped us

compete globally. The ability of a

buyer to obtain a loan due to Ex-Im

Bank’s support is critical to beating

competition. Our ability to sell

internationally is enhanced with

the U.S. government by our side.

Peter Darley, Part-owner,

Chief Operating Ocer

and Executive Vice President

W.S. Darley & Co.

”

34 I

EXPORT-IMPORT BANK of the UNITED STATES

FINANCING ENVIRONMENTALLY

Beneficial Exports

At Ex-Im Bank, we’re not only committed to fiscal responsibility,

we’re committed to the environment as well. We’ve long been

recognized as a global leader among financial institutions when it

comes to supporting environmentally beneficial exports.

Since 1992, Ex-Im Bank has fulfilled a congressional mandate

to promote the use of its financing products for U.S. exports

that are environmentally beneficial, including those related to

the production of renewable sources of energy.

Renewable energy means jobs – more than a million clean

energy jobs and counting in the United States alone, generated

by industries such as solar, wind, and biomass.

In support of these high-tech jobs, Ex-Im Bank is a committed

partner of U.S. exporters of renewable energy and other

environmentally beneficial technologies. We provide export

financing that empowers exporters to seize sales opportunities

in global markets, many of which are investing substantially in

clean energy development.

RENEWABLE ENERGY FINANCING

Ex-Im Bank has significantly increased its support of American

exports related to renewable energy production of late,

authorizing an aggregated total of nearly $2 billion in financing

for these exports since 2009. This total dwarfs the $210.9

million in renewable energy authorizations the Bank financed

between 2002 and 2008.

Because we can offer payment terms up to 18 years in the

renewable sector, Ex-Im Bank has a unique role to play in

supporting clean energy exporters to win deals in rising

renewable markets such as India and Central America. This

makes a world of difference on renewable energy projects,

which tend to be more front-loaded when it comes to capital

requirements.

FY2014 AUTHORIZATIONS:

• $336millioninnancingtosupportnearly$550million

of U.S. exports of environmentally beneficial goods

and services. Nearly 60 percent of these authorizations

supported renewable energy exports.

• $198millionforrenewableenergyexportsinwind,solar,

and other industries, primarily to Central and Latin America

• $25millionsupportingexportsforsolarenergyproduction

and expansion of production capacity for related materials

and equipment

• $151millionforexportsforwindenergyproduction,

including a 50-megawatt wind farm in Uruguay and two

wind farms in Peru

• $22millionforexportsrelatedtoenergygenerationby

other renewable technologies including hydroelectric,

geothermal, and biomass

Ex-Im Bank authorized $336 million

to support nearly $550 million in

environmentally beneficial U.S. exports

in FY 2014 – almost 60 percent of which

supported exports related to

renewable energy production.

$550m

Nearly

34 I

2014 ANNUAL REPORT I 35

A Small Business in

Missouri Brings Clean

Water to the World

The United Nations has estimated that more than

three-quarters of a billion people lack access to safe

drinking water worldwide, and there is a global demand

for clean water resources. For Environmental Dynamics

International Inc. (EDI), based in Columbia, Mo., Ex-Im

Bank’s financing products have made it possible to help

meet that demand by reaching customers in developing

markets with its water and wastewater treatment

technologies.

EDI began using Ex-Im Bank’s insurance policy in

1997 to expand into new markets in Latin America and

Asia. Now they use the Bank’s working capital loan

guarantee through Regions Bank. These funds give EDI

the flexibility to purchase materials in advance and also

cover the long lead time for payments.

With Ex-Im Bank’s support, EDI’s export orders

surpassed its U.S. domestic volume in 2008, and now

account for about 55 percent of the small business’s

total volume—about $15 million annually. EDI sells their

products in over 100 countries on all seven continents.

EXPORTER:

Environmental Dynamics International Inc.

(EDI), Columbia, Missouri

Markets:

India, China, Turkey, and many more

Ex-Im Bank Product:

Working Capital Loan Guarantee and Export Credit

Insurance

Pictured: Albert Jesse,

Environmental Dynamics International Inc.

“

Ex-Im Bank’s export credit

insurance has enabled

Environmental Dynamics

International to offer

competitive credit terms to a

larger foreign customer base

while minimizing the risk.

Charles E. Tharp, President,

Environmental Dynamics

International, Inc.

”

36 I

EXPORT-IMPORT BANK of the UNITED STATES

A COMMITMENT TO

The Environment

A global leader in environmental stewardship, Ex-Im Bank is committed

to promoting U.S. exports and jobs with an eye towards environmental

responsibility. When it comes to assessing, monitoring, and reporting on

environmental impacts, Ex-Im Bank is the most transparent export credit

agency in the world.

In response to 1992 legislation reauthorizing the Bank, in

1994 Ex-Im Bank became the first export credit agency (ECA)

to adopt a set of environmental guidelines applicable to the

projects that it finances. The Bank subsequently entered into

negotiations with the other ECAs under the Organisation for

Economic Cooperation and Development (OECD) to develop

a set of common environmental guidelines, referred to as the

“Common Approaches,” that have been adopted by all of the

official export credit agencies of the OECD.

Ex-Im Bank is the only ECA to provide transparency on

greenhouse gas emissions. We report the level of carbon

dioxide (CO

2

) emissions associated with approved and

requested projects in our annual report and on our website,

respectively. Tracked projects are those associated with fossil-

fuel exploration and/or production, or those in which CO

2

production is expected to exceed more than 25,000 tons

per year.

FY2014 CO

2

EMISSIONS REPORTING:

•

Approved a total of 62 loans, guarantees, and working

capital guarantees, as well as approximately 84 new

and renewed export credit insurance policies, to

finance U.S. exports related to foreign energy

development, production, and transmission.

These activities include electric power generation and

transmission, coal mining, oil-and-gas field exploration

and development, production, pipelines, and refineries.

The estimated export value of these transactions

exceeded $3.4 billion, supporting more than 20,300

U.S. jobs.

• Authorized $278 million for U.S. exports for two

new fossil fuel power plants. The Bank estimates

that the aggregate amount of CO

2

emissions produced