CERTIFICATE OF ADOPTION

Notice of the proposed report for the financial examination of

SURETY LIFE INSURANCE COMPANY

13520 California Street, Suite 290

Omaha, Nebraska 68154

dated as of December 31, 2018, verified under oath by the examiner-in-charge on

May 8, 2020 and received by the company on May 27, 2020, has been adopted

with modification as the final report pursuant to Neb. Rev. Stat. § 44-5906(3) (a).

Dated this 8

th

day of June 2020.

STATE OF NEBRASKA

DEPARTMENT OF INSURANCE

Justin C. Schrader, CFE

Chief Financial Examiner

STATE OF NEBRASKA

Department of Insurance

EXAMINATION REPORT

OF

SURETY LIFE INSURANCE COMPANY

as of

December 31, 2018

TABLE OF CONTENTS

Item Page

Salutation .........................................................................................................................................1

Introduction ......................................................................................................................................1

Scope of Examination ......................................................................................................................2

Description of Company:

History........................................................................................................................................4

Management and Control:

Holding Company ................................................................................................................5

Shareholder ..........................................................................................................................5

Board of Directors................................................................................................................6

Officers ................................................................................................................................7

Committees ..........................................................................................................................7

Transactions with Affiliates:

Services Agreement .............................................................................................................8

Territory and Plan of Operation .................................................................................................8

Reinsurance:

Ceded ...................................................................................................................................9

General .................................................................................................................................9

Body of Report:

Growth .....................................................................................................................................10

Financial Statements ................................................................................................................10

Examination Changes in Financial Statements ........................................................................12

Compliance with Previous Recommendations ........................................................................12

Commentary on Current Examination Findings:

Intercompany Settlement ...................................................................................................13

Subsequent Event:

Stop Loss Agreement ...............................................................................................................13

Summary of Comments and Recommendations ............................................................................13

Acknowledgment ...........................................................................................................................15

Lee’s Summit, Missouri

May 4, 2020

Honorable Bruce R. Ramge

Director of Insurance

Nebraska Department of Insurance

1135 M Street, Suite 300

Lincoln, Nebraska 68508

Dear Sir:

Pursuant to your instruction and authorizations, and in accordance with statutory

requirements, an examination has been conducted of the financial condition and business affairs of:

SURETY LIFE INSURANCE COMPANY

which has its Statutory Home Office located at:

13520 California Street, Suite 290

Omaha, Nebraska 68154

with its Principal Executive Office located at:

310 NE Mulberry Street

Lee’s Summit, Missouri 64086

(hereinafter also referred to as the “Company”) and the report of such examination is respectfully

presented herein.

INTRODUCTION

The Company was last examined as of December 31, 2013 by the State of Nebraska. The

current financial condition examination covers the intervening period to, and including, the close

of business on December 31, 2018, and includes such subsequent events and transactions as were

considered pertinent to this report. The State of Nebraska participated in this examination and

assisted in the preparation of this report.

2

SCOPE OF EXAMINATION

This examination was conducted pursuant to and in accordance with both the NAIC

Financial Condition Examiners Handbook (Handbook) and Section §44-5904(1) of the Nebraska

Insurance Statutes. The Handbook requires that examiners plan and perform the examination to

evaluate the financial condition and identify prospective risks of the Company by obtaining

information about the Company including, but not limited to: corporate governance, identifying

and assessing inherent risks within the Company, and evaluating system controls and procedures

used to mitigate those risks. The examination also includes assessing the principles used and

significant estimates made by management, as well as evaluating the overall financial statement

presentation and management’s compliance with Statutory Accounting Principles and Annual

Statement Instructions, when applicable to domestic state regulations.

A general review was made of the Company’s operations and the manner in which its

business has been conducted in order to determine compliance with statutory and charter

provisions. The Company’s history was traced and has been set out in this report under the

caption “Description of Company”. All items pertaining to management and control were

reviewed, including provisions for disclosure of conflicts of interest to the Board of Directors

and the departmental organization of the Company. The Articles of Incorporation and By-Laws

were reviewed, including appropriate filings of any changes or amendments thereto. The minutes

of the meetings of the Shareholder, Board of Directors and committees, held during the

examination period, were read and noted. Attendance at meetings, proxy information, election of

Directors and Officers, and approval of investment transactions were also noted.

The fidelity bond and other insurance coverages protecting the Company’s property and

interests were reviewed. Certificates of Authority to conduct the business of insurance in the

3

various states were inspected and a survey was made of the Company’s general plan of

operation.

Data reflecting the Company’s growth during the period under review, as developed from

the Company’s filed annual statements, is reflected in the financial section of this report under

the caption “Body of Report”.

The Company’s reinsurance facilities were ascertained and noted, and have been

commented upon in this report under the caption “Reinsurance”. Accounting records and

procedures were tested to the extent deemed necessary through the risk-focused examination

process. The Company’s method of claims handling and procedures pertaining to the adjustment

and payment of incurred losses were also noted.

All accounts and activities of the Company were considered in accordance with the risk-

focused examination process. This included a review of workpapers prepared by BKD, LLP, the

Company’s external auditors, during their audit of the Company’s accounts for the years ended

December 31, 2018. Portions of the auditor’s workpapers have been incorporated into the

workpapers of the examiners and have been utilized in determining the scope and areas of

emphasis in conducting the examination. This utilization was performed pursuant to Title 210

(Rules of the Nebraska Department of Insurance), Chapter 56, Section 013.

Any failure of items to add to the totals shown in schedules and exhibits appearing

throughout this report is due to rounding.

4

DESCRIPTION OF COMPANY

HISTORY

The Company, originally named Commercial Travelers Insurance Company, was

organized on March 14, 1936, as a mutual benefit assessment association under the laws of the

State of Utah and received a Certificate of Authority on March 31, 1936.

In 1943 and 1944, the Company acquired, through reinsurance agreements, the assets and

liabilities of the following Utah mutual benefit associations; Guaranty Indemnity Association,

National Life and Casualty, and Surety Mutual Life Insurance Company.

Conversion of the Company from a mutual benefit assessment association to a stock life

insurance company was accomplished by a vote of the policyholders at a special meeting held on

October 30, 1950. The Company’s name was changed to Surety Life Insurance Company on

March 1, 1957. Legal Reserve Life Insurance Company of California was merged into the

Company on November 2, 1965.

In December 1976, Dean Witter Reynolds Organization, Inc. (DWR Organization) of San

Francisco, California, acquired the Company. During 1981, DWR Organization contributed the

Company’s stock to Dean Witter Reynolds Insurance Holdings, Inc., a Delaware corporation.

The Company became a member of the Sears, Roebuck and Company holding company

system on December 29, 1981 with the merger of Sears, Roebuck and Company and DWR

Organization. The outstanding stock of the Company was ultimately transferred to Allstate Life

Insurance Company (ALIC), a subsidiary of Sears, Roebuck and Company, on January 1, 1984.

Effective December 31, 1987, the Company entered into a reinsurance treaty with ALIC

whereby ALIC assumed 100% of the Company’s policyholder related liabilities, excluding

certain single premium deferred annuity policies issued from 1979 through 1987.

5

Effective September 1, 1997, the Company re-domesticated to the State of Nebraska,

relocating its home office from Salt Lake City, Utah to its sister company, Lincoln Benefit Life

Company’s facility located in Lincoln, Nebraska.

Effective August 1, 2012, Government Employee Health Association, Inc. (GEHA),

acquired control of the Company through GEHA’s wholly-owned subsidiary, GEHA Holdings,

Inc. (GHI), a Missouri corporation. As a result of the acquisition, the Company is a wholly-

owned, direct subsidiary of GHI and a wholly-owned indirect subsidiary of GEHA. The

Company cedes all in-force business to ALIC who also administers this business for the

Company. The in-force business has been in run-off since 1999.

MANAGEMENT AND CONTROL

Holding Company

The Company is a member of an insurance holding company system as defined by

Nebraska Statute. An organizational listing flowing from the “Ultimate Controlling Person”, as

reported in the 2018 Annual Statement, is represented by the following (subsidiaries are denoted

through the use of indentations, and unless otherwise indicated, all subsidiaries are 100%

owned):

Government Employees Health Association, Inc.

GEHA Holdings, Inc.

PPO USA Inc.

Surety Life Insurance Company

Shareholder

Article IV of the Company’s Articles of Incorporation states that, “the aggregate number

of shares which the Corporation shall have authority to issue is three million (3,000,000) shares

of common stock having a par value of one dollar ($1.00) per share.” At the exam date,

Company records indicated that 2,500,000 shares were issued and outstanding in the name of

6

GHI. The Company’s parent, GHI, made a $4,300,000 capital contribution in 2014, and a

$10,000,000 capital contribution to the Company in 2015. The GHI Annual Shareholder and

Directors Meeting was conducted May 17, 2018 at the GEHA home office.

Board of Directors

Article I, Section 1, of the Company’s By-Laws states that, “the property, business and

affairs of the Company shall be managed and controlled by a Board of Directors composed of

not less than five nor more than twenty-one members. The number of Directors may be fixed or

changed from time to time, within the minimum and maximum, by the Board without further

amendment to these By-Laws. The Directors shall be elected at each annual meeting of the

Shareholders of the Company for a term of one year.” Section 10 states that, “an annual meeting

of the Board shall be held each year immediately after the adjournment of the annual meeting of

the Shareholders. Other meetings of the Board may be held at such time as the Board may

determine or when called by the Chairman of the Board or by a majority of the Board.”

The following persons were serving as Directors at December 31, 2018:

Name and Residence Principal Occupation

Cecil D. Bykerk President, CDBykerk Consulting LLC

Omaha, Nebraska

Laura J. Cook Retired, Former Special Agent for U.S. Food and

Gardner, Kansas Drug Administration, Criminal Investigations Unit

Thomas L. Handley Retired, Former Vice President, Lewis & Ellis, Inc.

Overland Park, Kansas

Shannon J. Horgan President, Surety Life Insurance Company

Minneapolis, Minnesota

Michael P. Horton Retired, Former Vice President, Kansas City Life

Olathe, Kansas Insurance Company

Joseph Witkowski Retired, Former Vice President, Corporate Services,

Liberty, Missouri Government Employees Health Association, Inc.

7

Officers

Article II, Section 1, of the By-Laws states that, “the general Officers of the Company

shall consist of a Chairman of the Board, President, two or more Vice Presidents, a Secretary, a

Treasurer, and a Controller, who shall be elected annually by the Board at the stated annual

meeting held upon adjournment of the annual shareholders’ meeting, and if not elected at such

meeting, such Officers may be elected at any meeting of the Board held thereafter. Such Officers

shall be elected by a majority of the Directors, and shall hold office for one year and until their

respective successors are elected and qualified, subject to removal at will by the Board.” Section

1 also states that, “any two of the aforesaid offices may be filled by the same person, with the

exception of the offices of President and Vice President, or President and Secretary.”

The following is a listing of Officers elected and serving the Company at December 31,

2018:

Name Office

Shannon J. Horgan President

Joe Witkowski Secretary

Angela D. Johnson Assistant Treasurer

Lynn M. Ballantyne Assistant Secretary

It is recommended that the Company document the election of a Chairman of the Board,

two or more Vice Presidents, a Treasurer, and a Controller, to comply with the existing By-

Laws, or amend the By-Laws to reflect the current arrangement utilized by the Company.

Committees

Article I, Section 8 of the By-Laws states that, “the Board shall have the power to appoint

committees, including but not limited to an Executive Committee, and to grant them powers not

inconsistent with the laws of Nebraska, the Articles of Incorporation of the Company, or these

8

By-Laws.” The Board does not have an Executive Committee but it does have an Audit and

Investment Committee.

The following persons were serving on the Audit and Investment Committee at

December 31, 2018:

Thomas L. Handley, Chairman Laura J. Cook Joseph Witkowski

TRANSACTIONS WITH AFFILIATES

Services Agreement

The Company entered into a service agreement with GEHA for administrative services

such as general corporate services, underwriting, policyholder, and regulatory affairs services,

financial services, and other services. GEHA will also provide employees, bank accounts,

tradenames and trademarks, and facilities. The term of the agreement began on August 1, 2012,

and will automatically renew each year. The Company will pay GEHA a service fee that is based

on actual cost without profit factor being built into the cost. Indirect or shared expenses will be

allocated in accordance with a method of cost allocation in conformity with SSAP No. 70 and

will be mutually agreeable to the parties. GEHA will provide the Company a statement of

expenses incurred no later than the twentieth calendar day of the month following the end of the

month in which the services were provided. The balance will be settled within thirty calendar

days after the receipt of the statement. Any late payments will be subject to an interest rate of

1.5% per month until fully paid.

TERRITORY AND PLAN OF OPERATION

As evidenced by current or continuous Certificates of Authority, the Company is licensed to

transact business in all states, with the exception of New York. The Company is also licensed in the

District of Columbia, Guam, and the U.S. Virgin Islands.

9

Effective August 31, 1999, the Company discontinued the sale of new business. The

Company previously sold universal life, single premium deferred annuities, flexible premium

deferred annuities, and ordinary life and term policies. The Company cedes all premiums to

ALIC, which continues to administer all in-force business in run-off.

REINSURANCE

Ceded

In 2012, the Company entered into an Amended and Restated Coinsurance Agreement

with ALIC. The Amended and Restated Coinsurance Agreement replaces and supercedes the

Coinsurance Agreement which was entered into on December 31, 2001. In the agreement, the

Company is to cede one-hundred percent of the reinsured liabilities, under all policies, to ALIC.

The policies include life insurance, accident and health insurance, annuity, and supplemental

benefit polices, contracts, and certificates. The reinsured liabilities are the sum of benefits

payable by the Company with respect to the policies; commissions and other sales compensation

payable by the Company with respect to the polices; net reinsurance premiums payable by the

Company to another reinsurer with respect to the policies, and guaranty fund and similar charges

and premium taxes payable by the Company relating to premiums and fees received with respect

to the policies. Statements will be sent quarterly to ALIC and payments will be made within 30

days after receipt.

General

All contracts reviewed contained standard insolvency, arbitration, errors and omissions, and

termination clauses where applicable. All contracts contained the clauses necessary to assure

reinsurance credits could be taken.

10

BODY OF REPORT

GROWTH

The following comparative data reflects the growth of the Company during the period

covered by this examination:

2014 2015 2016 2017 2018

Bonds $10,482,343 $ 9,004,277 $ 7,527,841 $ 6,888,637 $11,876,785

Admitted assets 16,941,100 23,247,500 19,738,471 19,081,489 19,651,380

Total liabilities 713,004 1,460,980 756,080 535,719 1,470,168

Capital and surplus 16,228,096 21,786,520 18,982,391 18,545,769 18,181,213

Net investment income 468,896 719,508 460,752 274,287 321,074

Net income (823,119) (4,398,534) (2,690,147) (417,862) (368,582)

FINANCIAL STATEMENTS

The following financial statements are based on the statutory financial statements filed by

the Company with the State of Nebraska Department of Insurance and present the financial

condition of the Company for the period ending December 31, 2018. The accompanying

comments on financial statements reflect any examination adjustments to the amounts reported

in the annual statements and should be considered an integral part of the financial statements. A

reconciliation of the capital and surplus account for the period under review is also included.

11

FINANCIAL STATEMENT

December 31, 2018

Assets Net

Assets Not Admitted

Assets Admitted Assets

Bonds $11,876,785 $11,876,785

Real estate 2,340,508 2,340,508

Cash 1,432,834 1,432,834

Cash equivalents 2,531,214 2,531,214

Subtotal, cash and invested assets $18,181,341 $18,181,341

Investment income due and accrued 109,436 109,436

Other amounts receivable under reinsurance 1,358,767 1,358,767

Electronic data processing equipment 1,836 1,836

Furniture and equipment 78,686 $78,686 __________

Totals $19,730,066 $78,686 $19,651,380

Liabilities, Surplus, and Other Funds

Interest maintenance reserve $ 99,058

Federal income taxes 1,011,328

Asset valuation reserve 110,219

Payable to parent and affiliates 243,151

Lessee deposits 6,412

Total liabilities $ 1,470,168

Common capital stock $ 2,500,000

Gross paid in and contributed surplus 14,300,000

Unassigned funds 1,381,213

Total capital and surplus $18,181,213

Total liabilities, capital and surplus $19,651,381

12

SUMMARY OF OPERATIONS – 2018

Net investment income $ 321,074

Amortization of interest maintenance reserve 50,625

Commissions and expense allowances on reinsurance ceded 580,336

Total income $ 952,034

Commissions on premiums and annuity considerations $ 580,336

General insurance expenses 734,307

Insurance taxes, licenses and fees 117,346

Total expenses $1,431,989

Net gain from operations before federal income taxes $ (479,955)

Federal income taxes incurred (111,373)

Net income $ (368,582)

CAPITAL AND SURPLUS ACCOUNT

2014 2015 2016 2017 2018

Capital and surplus,

beginning $12,756,834 $16,228,094 $21,786,516 $18,982,391 $18,545,770

Net income (823,119) (4,398,534) (2,690,147) (417,862) (368,582)

Change in nonadmitted

assets (580) (86,778) (16,829) 25,500

Change in asset

valuation reserve (5,621) (42,425) (27,204) (1,931) (21,475)

Surplus paid in 4,300,000 10,000,000 __________

Net change in capital and

surplus for the year 3,471,260 5,558,461 (2,804,128) (436,622) (364,556)

Capital and surplus

ending $16,228,094 $21,786,516 $18,982,391 $18,545,770 $18,181,214

EXAMINATION CHANGES IN FINANCIAL STATEMENTS

Unassigned funds (surplus) in the amount of $1,381,213, as reported in the Company’s

2018 Annual Statement, has been accepted for examination purposes. Examination findings, in

the aggregate, were considered to have no material effect on the Company’s financial condition.

COMPLIANCE WITH PREVIOUS RECOMMENDATIONS

No recommendations were made as a result of the previous examination.

13

COMMENTARY ON CURRENT EXAMINATION FINDINGS

Intercompany Settlement

The exam team reviewed the Services Agreement between the Company and its ultimate

parent, GEHA, effective August 1, 2012. Article 4.2 of the Services Agreement states that,

“GEHA shall provide each company a statement of expenses incurred no later than the twentieth

(20

th

) calendar day of the month following the end of the month in which services were provided.

Each company must settle these intercompany balances within (30) calendar days following such

company’s receipt of such statement.” The exam team noted that settlements currently occur on a

quarterly basis. It is recommended that the Company settle intercompany balances in compliance

with the existing Services Agreement.

SUBSEQUENT EVENT

STOP LOSS AGREEMENT

In conjunction with its indirect parent, GEHA, the Company submitted and received

approval on a stop loss policy form in Missouri in 2019. Effective January 1, 2020, the Company

issued an aggregate stop loss policy to GEHA.

SUMMARY OF COMMENTS AND RECOMMENDATIONS

The following comments and recommendations have been made as a result of this

examination:

Compliance with By-Laws – It is recommended that the Company document the

election of a Chairman of the Board, two or more Vice Presidents, a Treasurer, and a

Controller, in order to comply with the existing By-Laws, or amend the By-Laws to

reflect the current arrangement utilized by the Company.

14

Intercompany Settlement – It is recommended that the Company settle intercompany

balances in compliance with the existing Services Agreement.

15

ACKNOWLEDGMENT

The courteous cooperation extended by the Officers and employees of the Company

during this examination is hereby acknowledged.

In addition to the undersigned, Skyler Lawyer, CFE, and John Wiatr, Financial

Examiners; Linda Scholl, CFE, CISA, APIR, Financial Examiner and Information Systems

Specialist; and Derek Wallman, Actuarial Specialist; all with the Nebraska Department of

Insurance, participated in this examination and assisted in the preparation of this report.

Respectfully submitted,

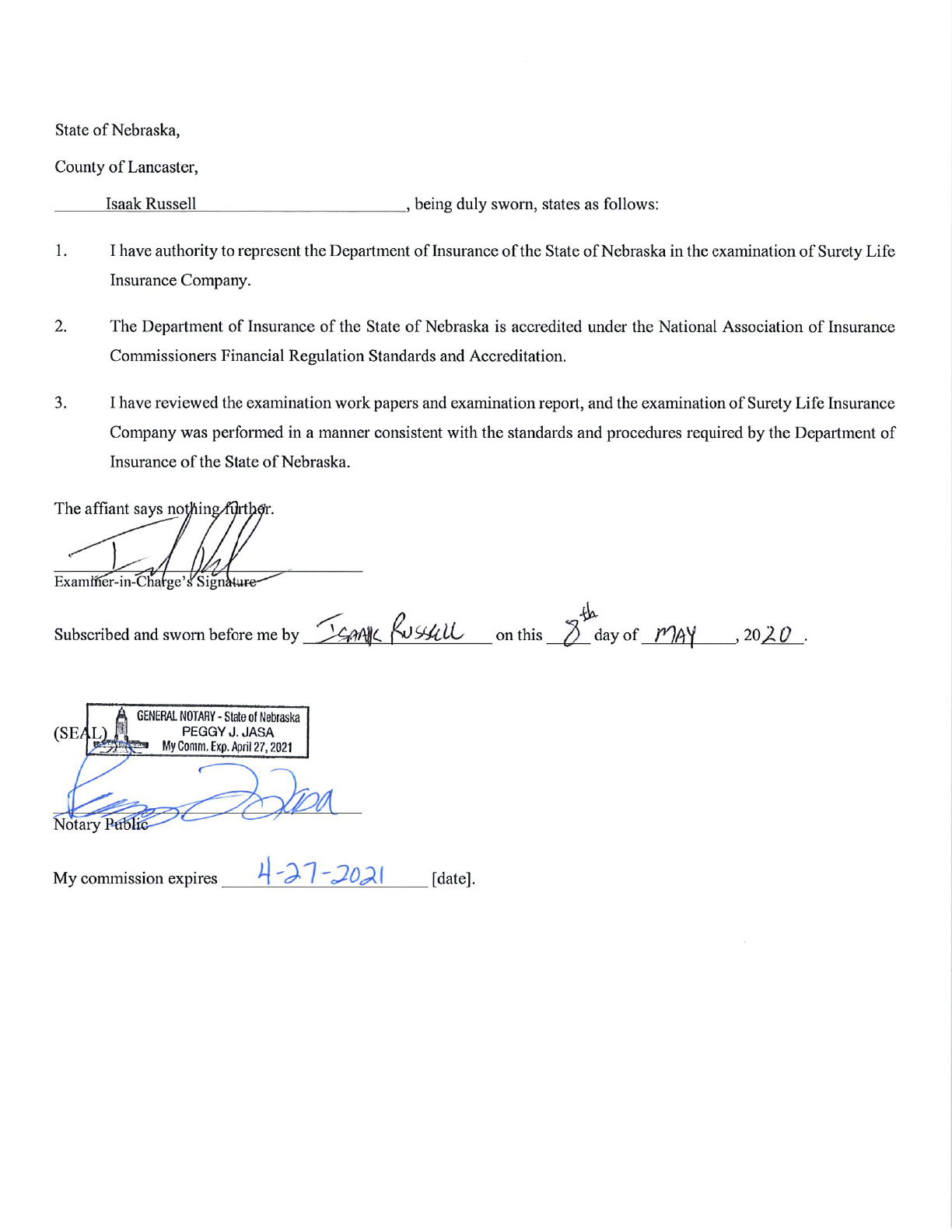

_____________________________

Isaak Russell, CFE

Supervisory Examiner

Department of Insurance

State of Nebraska