2000 ANNUAL REPORT

ABOUT

HEAD

We have a rich heritage. Founded in 1950 by inventor Howard Head, today Head NV is a leading global manufacturer

and marketer of branded sports equipment serving the skiing, tennis and diving markets. We have a world-class portfolio

of premium brands, which includes Head (alpine skis, ski boots and snowboard products, tennis, racquetball and squash

racquets, athletic and outdoor footwear and apparel); Tyrolia (ski bindings); Penn (tennis balls and racquetballs) and Mares

and Dacor (diving equipment).

Our strategic focus is to target the high margin, premium segments of our markets by developing highly innovative products

sold at premium prices, a policy that we call “Superior Performance through Superior Technology.” This strategic focus has

driven our growth and enabled us to achieve the highest operating margins among our peers in the year 2000.

We have created several new segments within our product categories including the Head Cyber ski line, the EZ-on ski boots,

the Titanium and Intelligence lines of lightweight tennis and squash racquets, the Tyrolia Super Light bindings and the Mares

and Dacor H.U.B. scuba system.

We are a global company diversified in terms of both products and geography. We are one of the top suppliers of

branded sports equipment to sporting goods retailers worldwide. Head offers a broad product range through over

27,000 accounts in over 80 countries.

We hold leading market share positions in all three of our product categories: Winter Sports, Racquet Sports and Diving.

We have a Licensing division to leverage value from and increase visibility of our brands outside the product categories

covered by our product divisions.

Based on our fully integrated sales, marketing and distribution units in our major markets, as well as the strength of our

innovative new products, we have been able to increase our market share.

Our high performance products are used and endorsed by many of today’s top athletes.

Please visit our website: www.head.com

R

R

S

D

R

S

N

A

W

B

Passion and Innovation Make the Greatest Force

Passion and Innovation Make the Greatest Force

Winter Sports Division

Our Winter Sports division includes Head alpine skis, ski boots and snowboard products,

along with Tyrolia ski bindings . We are one of only a handful of winter sports companies

that offer a full line of products, making us an important supplier to sporting goods

retailers worldwide.

We initiated and led the “carving revolution,” which revitalized the entire ski industry

and made skiing more fun and enjoyable. In Europe, which is the largest market for winter

sports, we hold the top position in bindings and leading positions in skis as well as ski boots.

2000 was a very good year, with units up 5% in bindings, 7% in skis and 16% in ski boots.

We are very excited about our product offering for the 2001/02 ski season. Some

examples are the Mad_Trix skis: two skis in one with a pre-mounted binding which

rotates 180 degrees, allowing the skier to switch mode on the slopes, our next generation

of EZ-on boots, and our new Free Flex PLUS line of bindings. In addition, we introduced

a complete line of Head snowboard products to an enthusiastic and receptive winter

sports trade.

Hannes Trinkl, the 2001 Downhill World Champion, endorses our skis and bindings.

In the US, World Free Style Ski Champion Jonny Moseley endorses our products.

Racquet Sports Division

Our Racquet Sports division includes Head tennis, squash and racquetball racquets,

footwear and accessories, and Penn tennis balls and racquetballs. Worldwide, Head is the

number two racquet brand and Penn is the number one tennis ball company worldwide.

Having both racquets and balls in our product range makes us one of the most impor-

tant suppliers to the spor ting goods trade and allows us to benefit from synergies in

sales, marketing and distribution.

We introduced all of the major tennis innovations in the last decade. With Head

Titanium Tennis, we created a whole new category of high performance super light

racquets and our Ti.S6 is the best selling tennis racquet in the world. We launched the

revolutionary line of Head Intelligence tennis racquets powered by the piezoelectric

Head intellifibers. The top of the line model, the i.S18 incorporates the breakthrough

“Chip System,” the world’s first chip powered and electronically dampened racquet,

designed to enhance power and eliminate vibration “smarter racquet—better game.” This

line has received tremendous media and racquet sports trade response globally.

2000 was an excellent year, with racquet sales up almost 20% in local currencies.

Our racquets are used and endorsed by some of the most successful athletes in the

game of tennis, like Andre Agassi, Gustavo Kuerten and Bjorn Borg. Head racquets are

the number one used racquet on the ATP Tour and Penn is the official ball used in over

80 top tennis tournaments world wide including the ATP and WTA events. Head/Penn

is now the official sponsor of the prestigious Tennis Master Series.

Brands

AND

products

2 .

Winter Sports Division

Our Winter Sports division includes Head alpine skis, ski boots and snowboard products,

along with Tyrolia ski bindings . We are one of only a handful of winter sports companies

that offer a full line of products, making us an important supplier to sporting goods

retailers worldwide.

We initiated and led the “carving revolution,” which revitalized the entire ski industry

and made skiing more fun and enjoyable. In Europe, which is the largest market for winter

sports, we hold the top position in bindings and leading positions in skis as well as ski boots.

2000 was a very good year, with units up 5% in bindings, 7% in skis and 16% in ski boots.

We are very excited about our product offering for the 2001/02 ski season. Some

examples are the Mad_Trix skis: two skis in one with a pre-mounted binding which

rotates 180 degrees, allowing the skier to switch mode on the slopes, our next generation

of EZ-on boots, and our new Free Flex PLUS line of bindings. In addition, we introduced

a complete line of Head snowboard products to an enthusiastic and receptive winter

sports trade.

Hannes Trinkl, the 2001 Downhill World Champion, endorses our skis and bindings.

In the US, World Free Style Ski Champion Jonny Moseley endorses our products.

Racquet Sports Division

Our Racquet Sports division includes Head tennis, squash and racquetball racquets,

footwear and accessories, and Penn tennis balls and racquetballs. Worldwide, Head is the

number two racquet brand and Penn is the number one tennis ball company worldwide.

Having both racquets and balls in our product range makes us one of the most impor-

tant suppliers to the sporting goods trade and allows us to benefit from synergies in

sales, marketing and distribution.

We introduced all of the major tennis innovations in the last decade. With Head

Titanium Tennis, we created a whole new category of high performance super light

racquets and our Ti.S6 is the best selling tennis racquet in the world. We launched the

revolutionary line of Head Intelligence tennis racquets powered by the piezoelectric

Head intellifibers. The top of the line model, the i.S18 incorporates the breakthrough

“Chip System,” the world’s first chip powered and electronically dampened racquet,

designed to enhance power and eliminate vibration “smarter racquet—better game.” This

line has received tremendous media and racquet sports trade response globally.

2000 was an excellent year, with racquet sales up almost 20% in local currencies.

Our racquets are used and endorsed by some of the most successful athletes in the

game of tennis, like Andre Agassi, Gustavo Kuerten and Bjorn Borg. Head racquets are

the number one used racquet on the ATP Tour and Penn is the official ball used in over

80 top tennis tournaments world wide including the ATP and WTA events. Head/Penn

is now the official sponsor of the prestigious Tennis Master Series.

Brands

AND

products

2 .

Diving Division

Our Diving division has two brands Mares and Dacor with a strong heritage among diving

enthusiasts. With Mares, we have the world’s leading diving brand.

We offer a complete range of products under each brand, making us unique in the div-

ing industry. Diving products are highly technical and we are perceived as the diving

industry’s innovation and technology leader. We have introduced many revolutionary

new products such as plastic fins, underwater guns and high performance regulators. In

late 1999, we launched the H.U.B (human underwater breathing system) which com-

bined five previously separate items, including buoyancy vest and regulator, into one

unit. The H.U.B. system was awarded “Product of the Year” at the Antibes World

Diving Festival.

In 2000, our Diving division made good progress, with sales in local currency up 4%. We

expect the diving market to continue to grow as the sport reaches new markets in

regions such as Asia, Africa and Brazil.

Most free diving records including those set by Francisco “Pipin” Ferreras and Audrey

Mestre have been set using Mares equipment. For the past three years, Mares has been

awarded “Brand of the Year” by “Divers” magazine.

Licensing Division

Our Licensing division was created to leverage the worldwide recognition of Head and

now includes all of our brands. Licensing enables us to expand our brands to other

product categories such as sportswear, sport bags, watches, eyewear, golf equipment

and accessories.

In 2000, we generated approximately $8 million of licensing revenues. Measured at

wholesale prices this would equate to $125 million of additional brand sales globally. We

believe that substantial licensing growth oppor tunities exist in new product areas and

new regions around the world. We intend to protect and maintain the premium image

of our brands by licensing only high quality goods within brand compatible product lines.

“Head,” “Head Titanium Tennis,” “Head Intelligence,” “Tyrolia,” “EZ-on,” “Penn,” “Mares,”

“Dacor,” “Cyber,” “Super Light,” “Mad_Trix,” “Free Flex PLUS,” “Blax,” “Generics” and

“Munari” are our trademarks.

3

To our Shareholders, Customers and Employees

2000 was a memorable year for Head. It was a year of record breaking

operating performance and we completed our Initial Public Offering, listing

Head N.V. on the New York and Vienna Stock Exchanges. Here are some

of the highlights:

• Revenues rose 2.5% in dollars to $398.6 million and 19% in euros

• EBIT margins rose to 9.7%

• EBITDA margins rose to 13.2%

• Net income before tax increased to $24.4 million

We commenced a share buyback program to enhance shareholder value.

We launched the Head Intelligence racquets, arguably the most innovative

product in sporting goods history.

It is with great pleasure that I write this first annual letter to our shareholders,

customers and employees. Completing our Initial Public Offering in October 2000

was a significant milestone for Head NV—a company with a rich heritage in sports

equipment. We have developed world-class brands, are a top performer in our industry

and strive for excellence in everything we do. Above all, we are committed to delivering

excellent financial performance and shareholder value.

2000 was a record year for us. Despite the unprecedented weakness of the euro against

the dollar, our revenues were up. Measured in euro currency, revenues were up 19%

over 1999.

Over the past three years, we have achieved a compound annual revenue growth of

14.4%. New products have helped boost gross profit margins each year and gross profit

has grown at compound annual rate of 17.7% since 1998.

LETTER

TO THE

SHAREHOLDERS

4 .

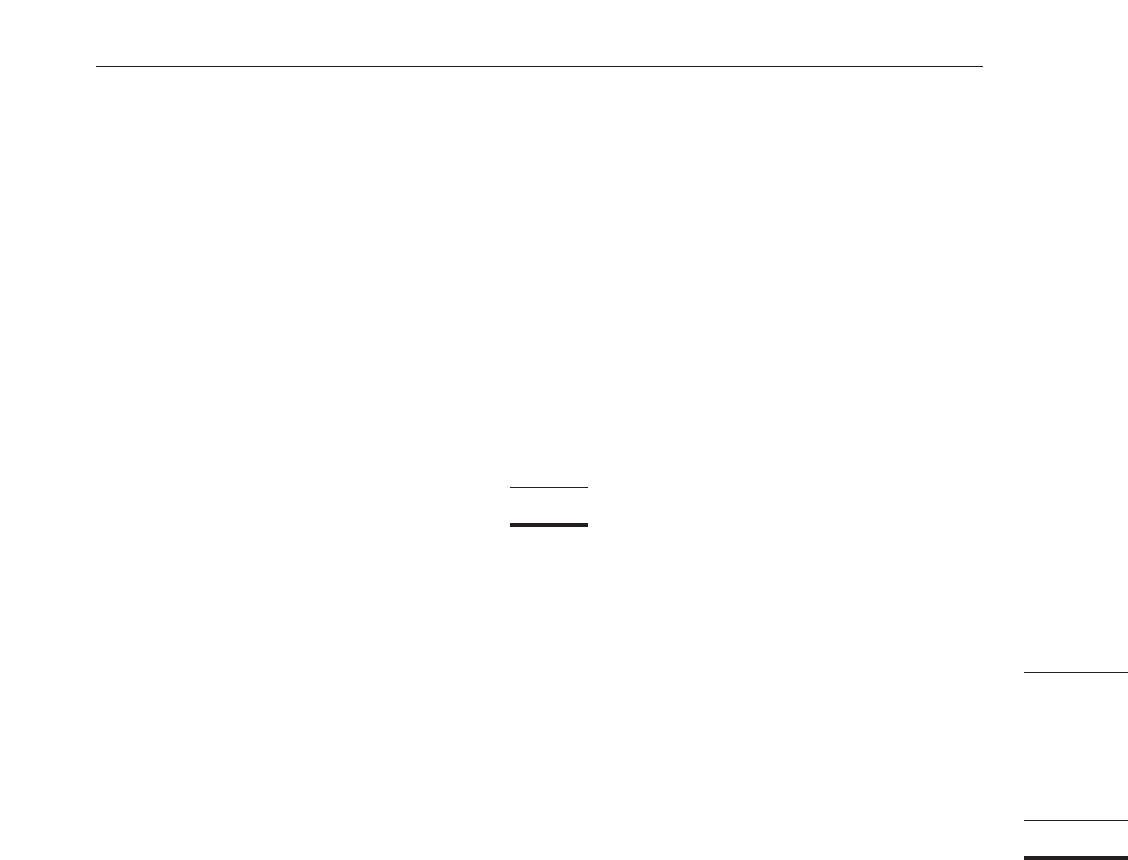

$

304.6

$

388.8

$

398.6

1998

2000

CAGR ’98-’00

14.4%

1999

6.0%

% increase

2.5%

27.7%

NET SALES

(in millions)

$

123

.6

$

160.3

$

17

1

.2

1998

2000

CAGR ’98-’00

17.7%

1999

40.6%

% margin

42.9%

41.2%

GROSS PROFIT

(in millions)

Johan Eliasch

Chairman and CEO Head NV

Our profitability has increased significantly over the last three years, both in margin and

absolute terms. The acquisition of Penn and the streamlining of our cost base, combined

with the increase in our sales, have resulted in a compound annual growth rate of 29.9%

and 46.0% for EBITDA and EBIT respectively since 1998. Net income (before tax and

extraordinary items) has increased at an average compound rate of 85.5% over the

same period.

While it is not realistic to expect this level of income growth indefinitely, I am optimistic

about 2001. I believe we have the products, organization and momentum to outper-

form our industry peers.

Over the past several years we have upgraded our infrastructure, streamlined our cost

base, established a licensing division to leverage our brands and solidified our capital base.

However, this is just the beginning. We are passionate sports enthusiasts driven to

achieve ever higher standards. Product innovations have been and will continue to drive

our business forward. We are very proud of our achievements. We pioneered two of

the most significant new categories of sports products in the past decade with the carving

ski and the high performance lightweight Head Titanium Tennis Series of racquets. These

breakthrough technologies helped revolutionize and reinvigorate the alpine ski and tennis

markets from recreational participants through to professionals. This spirit will continue

to drive us forward.

Being an avid sportsman, I personally test many of our new products all the way

through to the final stages of product development. I am very excited about our new

products for 2001 and beyond. Late last year we began to ship our revolutionary Head

Intelligence Tennis Series of racquets. The entire line, including the world’s first chip

powered and electronically dampened racquet, the i.S18, which we will ship this fall, has

met with tremendously positive media and trade response. In winter sports, we have

introduced to enthusiastic retailers our 2001/02 product-line: the next generation of

comfortable EZ-on ski boots, our ground-breaking Mad_Trix line of skis and the new

Free Flex PLUS line of bindings. Also, we launched a complete new line of Head snow-

board products from which we expect very strong order progress. In diving, we intro-

duced the H.U.B. diving system, which won “Product of the Year” at the Antibes World

Diving Festival.

5

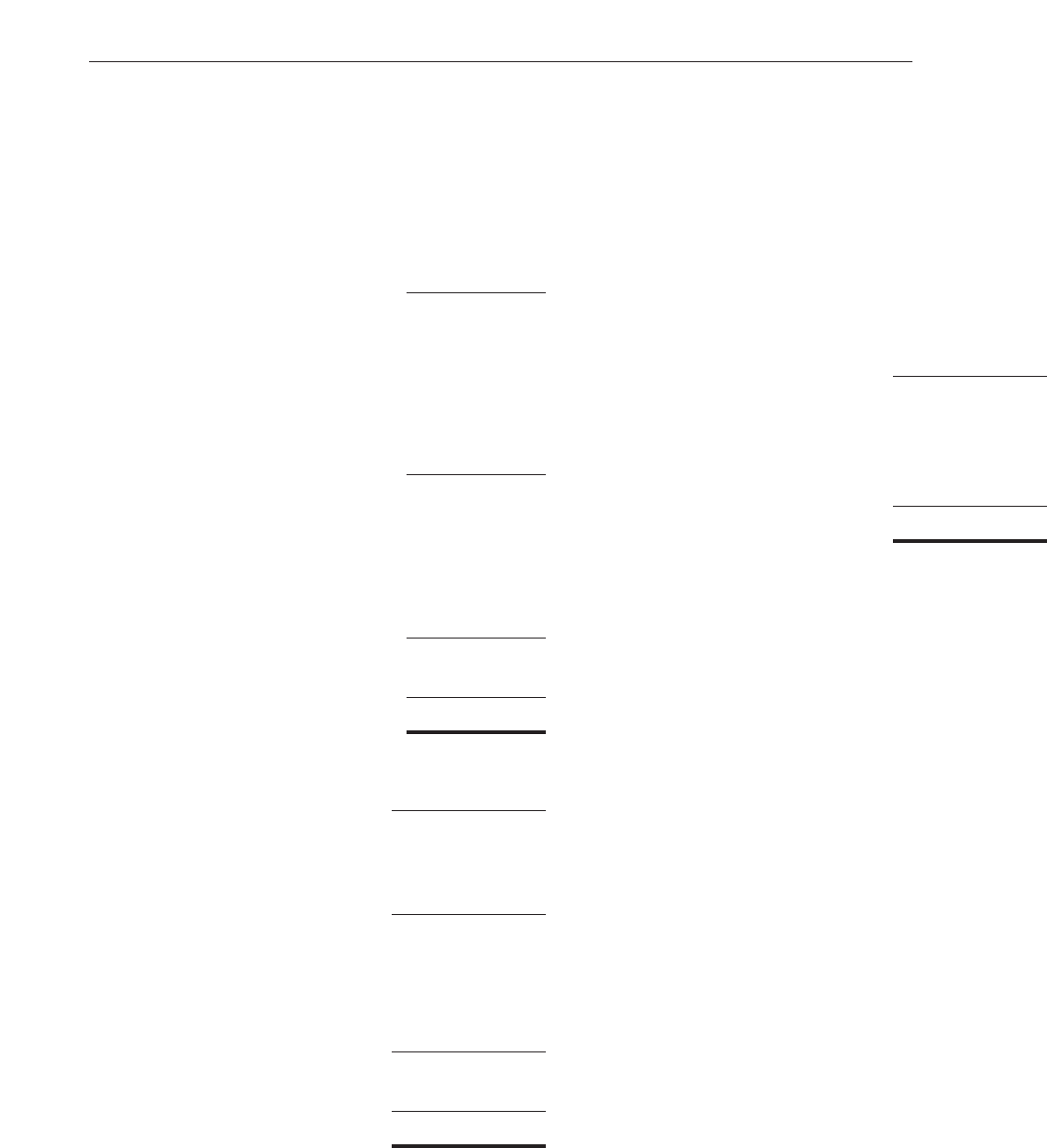

$

31.1

$

42

.3

$

52.5

1998

2000

CAGR ’98-’00

29.9%

1999

10.2%

% margin

13.2%

10.9%

EBITDA

(in millions)

$

18.1

$

25.2

$38

.6

1998

2000

CAGR ’98-’00

46.0%

1999

6.0%

% margin

9.7%

6.5%

EBIT

(in millions)

(1)

INCOME BEFORE TAX

(in millions)

Note: (1) Income from continuing operations

before income taxes and extraordinary items

$

7.1

$

18.6

$

24.4

1998

2000

1999

2.3%

% margin

4.8%

CAGR ’98-’00

85.5%

NM

% growth

31.3%

162.2%

6.1%

6

Winter

Sports

36%

Licensing

2%

Diving

18%

Racquet

Sports

44%

DIVERSIFIED PRODUCT MIX

2000 Sales by Division

Europe

51%

World

5%

Asia

11%

North

America

33%

GLOBAL COMPANY

2000 Net Sales by Geography

Our global manufacturing, sales, marketing and distribution networks are among the best in the business. We are also one

of the most important global suppliers to the sporting goods trade. This means that our new product launches can be rolled

out globally and gain rapid market penetration.

Our athlete endorsement program yielded great success in 2000 and we had tremendous brand visibility and media expo-

sure. In 2000 our tennis stars like Gustavo Kuerten and Marat Safin were the number 1 and number 2 players respectively

in the ATP Champions Race. Andre Agassi and Gustavo Kuer ten started 2001 in great form by between them winning the

Australian Open and every Master Series Tournament to date this year. Each of them has already won more tournaments

this year than any other player on the tour. Our racquets are the “choice of the pros”—the number one racquet used on

the ATP Tour. In skiing and snowboarding, we sponsor some of the top athletes including 2001 Downhill World Champion

Hannes Trinkl and World Free Style Champion Jonny Moseley. Most Free Diving records have been set using our equipment,

including those set by Francisco “Pipin” Ferreras and Audrey Mestre.

Being the largest shareholder, I would like to say a few words about our investor relations program. We are working very

hard to establish Head in the equity markets and create shareholder value. We are actively meeting with research analysts,

institutional investors and speaking at various investor conferences to tell our story. We have a new investor relations page

on our website for dissemination of financial information and are holding quarterly Web Casts to announce our results and

answer questions from the market. We hope that the market will recognize the value of our shares. Also, we have under-

taken a share buy back program. So far, we have repurchased about 1.4 million shares.

Our plan for the future includes looking for growth beyond our existing business. We have successfully integrated three

acquisitions in the past two years and we have the internal resources, capital base and experience to acquire additional com-

panies if we believe that they add to shareholder value. We have strict criteria for evaluating acquisitions, including, financial

impact, brand fit and culture fit. I know that many of our shareholders are also sports enthusiasts and I have heard from

many of you who are using and enjoying our products! Please visit our website www.head.com to see our new products—

your feedback is welcome.

To paraphrase George Allen, the legendary US football coach, “winning is the science of being totally prepared.” We

are prepared!

Sincerely,

Johan Eliasch, Chairman and CEO Head NV

Head N.V. and Subsidiaries

Selected Financial Data

The following table provides our selected consolidated financial data for the periods indicated. The historical financial data for the years

ended December 31, 1996, 1997, 1998, 1999 and 2000 have been derived from our consolidated financial statements which have been

prepared in accordance with accounting principles generally accepted in the United States, or U.S. GAAP, and have been audited by

PricewaterhouseCoopers AG, our independent accountants. Historical results are not necessarily indicative of the results that may be

expected for any future period.

In October 2000, London Films was distributed to Head Spor ts Holdings N.V., an entity controlled by Johan Eliasch, our controlling share-

holder. As a result, prior years’ financial statements have been restated to present London Films as a discontinued operation.

The selected financial data should be read in conjunction with our historical consolidated financial statements, the notes thereto and

“Item 5—Operating and Financial Review and Prospects” included elsewhere in this annual report.

Year Ended December 31,

1996 1997 1998 1999 2000

Statement of Operations Data:

(in thousands, except per share data)

Total revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $342,125 $286,945 $304,504 $388,755 $398,639

Cost of sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 233,275 178,175 180,894 228,453 227,442

Gross profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 108,850 108,770 123,610 160,302 171,197

Selling and marketing expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 89,258 73,902 75,551 95,906 97,743

General and administrative expense (excluding non-cash

compensation expense and restructuring charge) . . . . . . . . . . . . . . . . 44,058 30,074 29,911 36,910 33,488

Non-cash compensation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ——21 548 1,378

Restructuring charge . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . —— —1,691 —

Operating income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (24,466) 4,794 18,127 25,246 38,588

Interest expense

(1)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (21,368) (16,455) (10,573) (14,092) (18,642)

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,398 3,138 1,349 947 1,118

Foreign exchange gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,146 (73) (2,279) 4,574 7,502

Other income (expense), net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 994 216 459 1,899 (4,181)

Minority interests in earnings of subsidiaries . . . . . . . . . . . . . . . . . . . . . . (7) 38 2 — —

Income (loss) from continuing operations before

income taxes and extraordinar y items . . . . . . . . . . . . . . . . . . . . . . . . . (38,303) (8,342) 7,084 18,574 24,386

Income tax benefit (expense)

(2)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (637) (360) (1,812) 35,887 1,934

Income (loss) from continuing operations before extraordinary items . . (38,940) (8,702) 5,273 54,463 26,321

Income (loss) from discontinued operations . . . . . . . . . . . . . . . . . . . . . . (174) (298) 243 (60) (644)

Extraordinary gain

(3)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ——58,203 — 2,104

Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (39,114) $ (9,000) $ 63,718 $ 54,402 $ 27,781

Pro forma earnings per share—basic

(4)

Income (loss) from continuing operations before extraordinar y items

. . $ (1.95) $ (0.44) $ 0.26 $ 2.46 $ 0.94

Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (1.96) $ (0.45) $ 3.19 $ 2.46 $ 0.99

Pro forma earnings per share—diluted

(4)

Income (loss) from continuing operations before extraordinar y items

. . ——$ 0.26 $ 2.23 $ 0.86

Net income (loss) ——$ 3.15 $ 2.23 $ 0.91

Pro forma weighted average shares outstanding

(4)

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,000 20,000 20,000 22,132 28,071

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ——20,232 24,370 30,679

Other Financial Data:

Cash provided by operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 55,377 $ 27,650 $ 13,531 $ 28,444 $ 6,452

Cash provided by (used for) investing activities . . . . . . . . . . . . . . . . . . . . $ 4,744 $ (9,346) $ (17,824) $ (57,517) $ (17,178)

Cash provided by (used for) financing activities . . . . . . . . . . . . . . . . . . . . $ (41,087) $ (11,393) $ (27,432) $ 43,066 $ 20,073

Balance Sheet Data:

Cash

(5)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 48,832 $ 45,288 $ 12,860 $ 23,624 $ 15,848

Working capital

(6)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (53,885) $ (61,599) $ 29,351 $ 73,432 $151,241

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $404,958 $330,099 $344,618 $434,660 $434,304

Total debt

(7)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $322,056 $268,730 $199,335 $240,108 $114,819

Total stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (24,075) $ (25,888) $ 38,816 $ 82,547 $229,987

(1) Interest expense for the year ended December 31, 1998 and the periods thereafter excludes capitalized future interest payments as required by SFAS No. 15. See “Item 5: Operating and Financial Review

and Prospects—Liquidity and Capital Resources—Treatment of Bank Waivers Under SFAS No. 15.”

(2) Includes for the year ended December 31, 1999 a non-cash deferred income tax benefit of $38.8 million resulting from the release of a substantial portion of a valuation allowance relating to operating

loss carryforwards.

(3) Includes for the year ended December 31, 1998 a gain of approximately $58.2 million as a result of the application of SFAS No. 15. See “Item 5: Operating and Financial Review and Prospects—Liquidity

and Capital Resources—Treatment of Bank Waivers Under SFAS No. 15.”

(4) Pro forma earnings per share and pro forma weighted average shares outstanding represent our historical amounts as adjusted to reflect the two for one split of our outstanding ordinary shares upon

the closing of the public offering in September 2000. Pro forma earnings per share and pro forma weighted average shares outstanding on a diluted basis give effect to all outstanding options and war-

rants calculated under the treasury stock method. Options and warrants have been excluded from the pro forma earnings per share calculations for the two years ended December 31, 1996 and 1997

because their effect would be anti-dilutive.

(5) Cash includes cash and cash equivalents and restricted cash.

(6) Working capital is computed as current assets, excluding restricted cash, less current liabilities.

(7) Total debt excludes capitalized future interest payments which is required by SFAS No. 15. See “Item 5: Operating and Financial Review and Prospects—Liquidity and Capital Resources—Treatment of

Bank Waivers Under SFAS No. 15.” These amounts are $8.0 million and $6.3 million respectively, as of December 31, 1998 and December 31, 1999. Due to the repayment of the restructured debt in

the fourth quar ter of 2000, all capitalized future interest payments have been released,

7

Management’s Discussion and Analysis . . . . . . . . . . . . . . . . . . . . . . . . . 9

Consolidated Balance Sheets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

Consolidated Statements of Operations . . . . . . . . . . . . . . . . . . . . . . . . 13

Consolidated Statements of Stockholders’ Equity . . . . . . . . . . . . . . . . . 14

Consolidated Statements of Cash Flows . . . . . . . . . . . . . . . . . . . . . . . . 15

Notes to the Consolidated Financial Statements . . . . . . . . . . . . . . . . . 16

Report of Independent Accountants . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

List of Significant Participation’s . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

Listing Details . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34

Shareholder Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

Corporate Directory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

Financial Review

8

9

Overview:

We are a leading global manufacturer and marketer of

branded sporting goods serving the skiing, tennis and diving

markets. We have created or acquired a portfolio of brands—

Head (alpine skis and boots, snowboard equipment, tennis

and squash racquets and athletic and outdoor footwear),

Tyrolia (ski bindings), Mares and Dacor (diving equipment) and

Penn (tennis balls and racquetball balls)– which are among the

most widely recognized names within their respective markets.

We generate revenues in our principal markets by selling

goods directly to sports retailers and, to a lesser extent, by

selling to distributors. We also receive licensing and royalty

income. As many of our goods, especially Winter Sports

goods, are shipped during a specific part of the year, we expe-

rience highly seasonal revenue streams. Following industry

practice, we begin to receive orders from our customers in

the Winter Sports division from March until June, during

which time we book approximately three quarters of our

orders for the year. We will typically begin shipment of skis,

boots and bindings in July and August with the peak shipping

period occurring in October and November. At this time, we

will begin to receive re-orders from customers, which consti-

tute the remaining quarter of our yearly orders. Re-orders are

typically shipped in December and January. Racquet Sports

and diving product revenues also experience seasonality, but

to a lesser extent than Winter Sports revenues.

The skiing market had declined until 1998 due to a shift in

consumer preference from skiing to snowboarding in the early

1990s, an absence of significant product innovation prior to

the introduction of the carving ski and the severe decline in

the Japanese market caused by economic difficulties. Since the

1998/1999 winter season we have experienced a modest

recovery in the skiing market which we believe is mainly due

to the introduction of the carving ski technology. We believe

we are well positioned in the skiing market as we are at the

forefront of the development of the carving segment. The

market for tennis equipment also has declined in recent years

as a result of reduced interest in the sport due to the presence

of fewer exciting professional stars, the increased durability

of tennis racquets and competing leisure activities, such as

alternative sports, computer games and the Internet. How-

ever, we have benefited from a significant increase in the sales

of Head Titanium Tennis racquets.

In May 1999 we acquired Penn, a manufacturer and distributor

of tennis and racquetball balls. Penn revenues also experience

seasonality, and are typically highest during the months of

January through March.

In October 1999 we acquired the Blax and Generics snow-

board equipment business. We now market these products

under the Head brand.

As a result of our recent acquisitions, our employee numbers

have increased from 2,808 in 1999 to 3,097 in 2000.

Results of Operations:

The following table sets forth certain consolidated statements

of operations data:

For the Years Ended

December 31,

1999 2000

(in thousands)

Revenues

Total revenues . . . . . . . . . . . . . . . . . . . . . . . $388,755 $398,639

Cost of sales . . . . . . . . . . . . . . . . . . . . . . . . 228,453 227,442

Gross profit . . . . . . . . . . . . . . . . . . . . . . . 160,302 171,197

Gross margin . . . . . . . . . . . . . . . . . . . . . . 41.2% 42.9%

Selling and marketing expense . . . . . . . . . . 95,906 97,743

General and administrative expense

(excluding non-cash compensation

expense and restructuring charge) . . . . 36,910 33,488

Non-cash compensation expense . . . . . . . . 548 1,378

Restructuring charge . . . . . . . . . . . . . . . . . . 1,691 —

Operating income . . . . . . . . . . . . . . . . . . 25,246 38,588

Interest expense . . . . . . . . . . . . . . . . . . . . . (14,092) (18,642)

Interest income . . . . . . . . . . . . . . . . . . . . . . 947 1,118

Foreign exchange gain (loss) . . . . . . . . . . . . 4,574 7,502

Other income (expense), net . . . . . . . . . . . 1,899 (4,181)

Income from continuing operations

before income taxes and

extraordinary items . . . . . . . . . . . . . . . . . 18,574 24,386

Income tax benefit . . . . . . . . . . . . . . . . . . . 35,887 1,934

Income (loss) from discontinued

operation (Note 3) . . . . . . . . . . . . . . . . . (60) (644)

Extraordinary gain (Note 16) . . . . . . . . . . . — 2,104

Net income . . . . . . . . . . . . . . . . . . . . . . . $ 54,402 $ 27,781

Head N.V. and Subsidiaries

Management’s Discussion and Analysis of

Financial Statements and Results of Operations

Head N.V. and Subsidiaries

Management’s Discussion and Analysis of

Financial Statements and Results of Operations

(continued)

10

Twelve Months ended December 31, 1999

and 2000:

Total Revenues

For the twelve months ended December 31, 2000, total rev-

enues increased by $9.9 million, or 2.5%, to $398.6 million

from $388.8 million in 1999. This increase was due to the con-

solidation of Penn for twelve months in 2000 versus seven

months in 1999 and, to a lesser extent, the revenues of our

snowboard business acquired in October 1999. Net of Penn

and the snowboard business, revenues decreased by $15.0

million, or 3.9%, to $373.7 million for the twelve months

ended December 31, 2000 from $388.8 million for the com-

parable 1999 period. This development should be seen in light

of the adverse impact of currency translation adjustments

resulting from the depreciation of the euro against the US dollar.

At comparable exchange rates, total revenues for the twelve

months ended December 31, 2000 increased by $50.8 million,

or 13.2% to $436.3 million from $385.5 million in 1999. Net of

Penn and snowboard, revenues at comparable rates increased

by $25.1 million, or 6.5% to $410.6 million for the twelve months

ended December 31, 2000 from $385.5 million in 1999.

For the Years ended

December 31,

1999 2000

(in thousands)

Product category:

Winter Sports . . . . . . . . . . . . . . . . . . . . . . . . $151,360 $144,542

Racquet Sports . . . . . . . . . . . . . . . . . . . . . . . 152,825 174,010

Diving . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76,691 72,232

Licensing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,879 7,855

Total Revenues . . . . . . . . . . . . . . . . . . . . . $388,755 $398,639

Winter Sports revenues for the twelve months ended

December 31, 2000 decreased by $6.8 million, or 4.5%, to

$144.5 million from $151.4 million in 1999 mainly due to the

weakness of the euro against the US dollar. At comparable

exchange rates revenues from Winter Sports increased by

$12.5 million, or 8.4%, to $161.5 million for the twelve months

ended December 31, 2000 from $149.0 million in 1999. Net

of Blax and Generics, revenues from Winter Sports increased

by $9.0 million, or 6.0%, to $158.0 million for the twelve

months 2000 from $149.0 million in 1999. This improvement

results from the increased units sales of our skis (+7%), bind-

ings (+5%)and ski boots (+16%).

Racquet Sports revenues for the twelve months ended

December 31, 2000 increased by $21.2 million, or 13.9%, to

$174.0 million from $152.8 million in 1999. Of this increase

$21.8 million resulted from the consolidation of the Penn busi-

ness. At comparable exchange rates Racquet Sports products

revenues without Penn increased by $11.7 million, or 7.7%, to

$163.9 million for the twelve months ended December 31,

2000 from $152.2 million in 1999 due primarily to a 27.4%

increase in the number of units of tennis racquets sold, offset

by declines in sales of footwear.

Diving product revenues for the twelve months ended

December 31, 2000 decreased by $4.5 million, or 5.8%, to

$72.2 million from $76.7 million in 1999. This decrease was due

to the weak euro. At comparable exchange rates revenues

from diving increased by 4.3%.

Licensing revenues for the twelve months ended December

31, 2000 remained stable.

Gross Profit

For the twelve months ended December 31, 2000, gross

profit increased by $10.9 million, or 6.8%, to $171.2 million

from $160.3 million in 1999. Gross margin increased to 42.9%

in 2000 from 41.2% in 1999. The increase in gross margin is

due to favorable currency impact as a portion of our dollar

revenues are generated from products manufactured on a

euro cost basis.

Selling and Marketing Expenses

For the twelve months ended December 31, 2000, selling and

marketing expenses increased by $1.8 million, or 1.9%, to

$97.7 million from $95.9 million in 1999. This increase was

primarily due to selling and marketing expenses attributable

to the consolidation of Penn.

General and Administrative Expenses

For the twelve months ended December 31, 2000, general

and administrative expenses decreased by $3.4 million, or

9.3%, to $33.5 million from $36.9 million in 1999. Of this

decrease, $1.2 million was attributable to the gain on the sale

11

of a building used in operations in Italy. The balance was due

to the favorable euro/dollar impact as a majority of our expenses

are in euros.

We also recorded $1.4 million and $0.5 million for the twelve

months ended December 31, 2000 and 1999, respectively, of

non-cash compensation expense due to the grant of stock

options under our existing stock option plan and the resulting

amortization of compensation expense.

Operating Income

As a result of the foregoing factors, for the twelve months

ended December 31, 2000, operating income increased by

$13.3 million to $38.6 from $25.2 million in 1999.

Interest Expense

For the twelve months ended December 31, 2000, interest

expense increased by $4.6 million, or 32.3%, to $18.6 million

from $14.1 million in 1999. The increase was due to higher

levels of debt resulting from the Penn acquisition in May 1999

and the Senior Note offering in July 1999 as a portion of the

proceeds from this offering was used to refinance debt bear-

ing lower interest rates. The increase in interest expense was

offset, to a lesser extent, by the repayment of some of our

debts following the initial public offering, which took place in

October 2000.

Interest Income

For the twelve months ended December 31, 2000, interest

income increased by $0.2 million, or 18.0%, to $ 1.1 million

from $0.9 million in 1999.

Foreign Currency Exchange

For the twelve months ended December 31, 2000, primarily due

to the weakness of the euro against the US dollar, we had a for-

eign currency exchange gain of $7.5 million, compared to $4.6

million in 1999. We operate in a multi-currency environment

and are subject to the effects of fluctuation in exchange rates.

Other Income/(Expense)

For the twelve months ended December 31, 2000, we had

other expense of $4.2 million mainly attributable to the one

time payment to Austria Tabak compared to other income of

$1.9 million in 1999 primarily attributable to a profit resulting

from the disposal of a building in Italy in 1999.

Income Tax Benefit

For the twelve months ended December 31, 2000, we had an

income tax benefit of $1.9 million, a decrease of $34.0 million

from the same period in 1999. This decrease was due to the

recognition of non-cash deferred tax asset of $38.8 million in

1999 versus $5.2 million in 2000.

Extraordinary Gain

For the twelve months ended December 31, 2000 we

reported an extraordinary gain of $2.1 million which resulted

from a release of $3.0 million (net of $1.6 million of tax) of

accrued interest expense according to FAS15 following the

repayment of our restructured long-term loans in October

2000, partially offset by the write off of $0.9 million of capital-

ized debt issuance cost in connection with the refinancing of

our US-subsidiaries in April 2000.

Net Income

As a result of the foregoing factors, for the twelve months

ended December 31, 2000, we had a net income of $27.8 mil-

lion, compared to $54.4 million in 1999.

Liquidity and Capital Resources:

For the twelve months ended December 31, 2000, cash gen-

erated from operating activities decreased to $6.5 million

from $28.4 million in 1999, which is mainly due to increased

working capital requirements. The proceeds from operating

activities, cash on hand and net drawdowns of $25.2 million

under lines of credit were used to purchase property, plant

and equipment of $17.2 million, to repay a due portion of

senior loan in March 2000 of $2.7 million and to make a dividend

payment to Head Sports Holdings N.V. (our sole shareholder

at the time) of $15.7 million.

Net proceeds from our initial public offering of $134.4 million

were used to repay $63.3 million under our lines of credit, to

repay the outstanding portion of our senior loan of $29.9 mil-

lion, to repurchase senior notes of $30.0 million and to buy back

our ordinary shares of $5.2 million under an existing resolution.

Head N.V. and Subsidiaries

Consolidated Balance Sheets

December 31,

1999 2000

(in thousands, except shares)

Assets:

Cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 17,948 $ 15,848

Restricted cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5, 676 —

Accounts receivable, net of allowance for doubtful accounts of $10,054 and $10,509 . . . . . . . . . . . . . . . 157,987 158,424

Inventories, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78,295 83,701

Prepaid expense and other current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,796 12,894

Total current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 270,702 270,867

Marketable securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,347 2,174

Property, plant and equipment, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59,503 60,943

Intangible assets, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,900 19,850

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69,889 72,168

Other non-current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,320 8,301

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $434,660 $434,304

Liabilities and Stockholders’ Equity:

Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 36,286 $ 34,436

Accrued expenses and other current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56,094 41,837

Short-term borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93,906 41,822

Current portion of long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,308 1,531

Total current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 191,594 119,626

Long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 147,240 71,466

Other long-term liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,270 13,215

Total liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 352,104 204,307

Minority interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 9

Commitments and contingencies (Note 18)

Stockholders’ Equity:

Ordinary shares: 0.01 NLG and 0.20EUR par value at 1999 and 2000, respectively;

24,227,820 and 39,820,677 shares issued at 1999 and 2000, respectively . . . . . . . . . . . . . . . . . . . . . . . 64 7,067

Additional paid in capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,221 143,999

Treasury stock, at cost; 956,300 shares at 2000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (5,211)

Retained earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 64,834 75,620

Accumulated other comprehensive income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,428 8,512

Total stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82,547 229,987

Total liabilities and stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $434,660 $434,304

The accompanying notes are an integral part of the consolidated financial statements.

12

13

Head N.V. and Subsidiaries

Consolidated Statements of Operations

For the Years Ended December 31,

1998 1999 2000

(in thousands, except per share data)

Revenues:

Product revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $298,325 $380,876 $390,784

Licensing revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,178 7,879 7,855

Total revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 304,504 388,755 398,639

Cost of sales (the year ended December 31, 1999 included $2,187

related to the step-up of inventory from acquisitions—see Note 5) . . . . . . . . . . . . . . . . . 180,894 228,453 227,442

Gross profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 123,610 160,302 171,197

Selling and marketing expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75,551 95,906 97,743

General and administrative expense (excluding non-cash

compensation expense and restructuring charge) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29,911 36,910 33,488

Non-cash compensation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 548 1,378

Restructuring charge . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 1,691 —

Operating income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,127 25,246 38,588

Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10,573) (14,092) (18,642)

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,349 947 1,118

Foreign exchange gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,279) 4,574 7,502

Other income (expense), net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 459 1,899 (4,181)

Minority interests in earnings of subsidiaries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 — —

Income from continuing operations

before income taxes and extraordinary items . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,084 18,574 24,386

Income tax benefit (expense):

Current . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,812) (2,929) (3,231)

Deferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 38,816 5,165

Income tax benefit (expense) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,812) 35,887 1,934

Income from continuing operations before extraordinary items . . . . . . . . . . . . . . . . . . . . . . . 5,273 54,463 26,321

Income (loss) from discontinued operation (Note 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 243 (60) (644)

Extraordinary gain (net of income tax of $1,559 in 2000—see Note 16) . . . . . . . . . . . . . . . 58,203 — 2,104

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 63,718 $ 54,402 $ 27,781

Earnings per share-basic

Income from continuing operations before extraordinary items . . . . . . . . . . . . . . . . . . . . . $ 0.26 $ 2.46 $ 0.94

Income (loss) from discontinued operation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.01 (0.00) (0.02)

Extraordinary gain . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.91 — 0.07

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.19 2.46 0.99

Earnings per share-diluted

Income from continuing operations before extraordinary items . . . . . . . . . . . . . . . . . . . . . $ 0.26 $ 2.23 $ 0.86

Income (loss) from discontinued operation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.01 (0.00) (0.02)

Extraordinary gain . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.88 — 0.07

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.15 2.23 0.91

Weighted average shares outstanding

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,000 22,132 28,071

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,232 24,370 30,679

The accompanying notes are an integral part of the consolidated financial statements.

Head N.V. and Subsidiaries

Consolidated Statements of Stockholders’ Equity

Retained Accumulated

Additional Earnings Other Total

Ordinary Shares Paid-in Treasury (Accumulated Comprehensive Stockholders’

Shares Amount Capital Stock Deficit) Income Equity

(in thousands, except per share data)

Balance at December 31, 1997 . . . . . . . . 20,000,000 $ 1,010 $ 9,609 $ — $(48,247) $11,705 $ (25,923)

Capital contributions . . . . . . . . . . . . . . . . — 53 2,212 — — — 2,265

Stock-based compensation . . . . . . . . . . . — — 21 — — — 21

Transfer of capital from registered

capital to capital contribution . . . . . . . — (1,010) 1,010 — — — —

Comprehensive income:

Net income . . . . . . . . . . . . . . . . . . . . . . . — — — — 63,718 — 63,718

Foreign currency translation

adjustments . . . . . . . . . . . . . . . . . . . . . — — — — — (1,266) (1,266)

Comprehensive income . . . . . . . . . . . . . . 62,452

Balance at December 31, 1998 . . . . . . . . 20,000,000 53 12,853 — 15,471 10,439 38,816

Issuance of warrants . . . . . . . . . . . . . . . . — — 1,820 — — — 1,820

Stock-based compensation . . . . . . . . . . . — — 548 — — — 548

Consideration in excess of historical

cost of assets acquired from

common control entity . . . . . . . . . . . . 4,227,820 11 — — (5,040) — (5,029)

Comprehensive income:

Net income . . . . . . . . . . . . . . . . . . . . . . . — — — — 54,402 — 54,402

Foreign currency translation

adjustments . . . . . . . . . . . . . . . . . . . . . — — — — — (7,951) (7,951)

Minimum pension liability . . . . . . . . . . . . — — — — — (60) (60)

Comprehensive income . . . . . . . . . . . . . . 46,391

Balance at December 31, 1999 . . . . . . . . 24,227,820 64 15,221 — 64,834 2,428 82,547

Dividend paid . . . . . . . . . . . . . . . . . . . . . . — — — — (15,717) — (15,717)

Stock-based compensation . . . . . . . . . . . — — 1,378 — — — 1,378

Conversion to a par value

from NLG 0.01 to euro 0.20 . . . . . . . — 4,414 (4,414) — — — —

Exercise of warrants . . . . . . . . . . . . . . . . 1,009,524 4 (4) — — — —

Purchase of treasury stock . . . . . . . . . . . (956,300) — — (5,211) — — (5,211)

Issuance of ordinary shares under public

offering, net of issuance costs . . . . . . . 14,583,333 2,585 131,817 — — — 134,402

Spin-off of London Films . . . . . . . . . . . . . — — — — (1,277) 632 (645)

Comprehensive income:

Net income . . . . . . . . . . . . . . . . . . . . . . . — — — — 27,781 — 27,781

Foreign currency translation

adjustments . . . . . . . . . . . . . . . . . . . . . — — — — — 5,452 5,452

Comprehensive income . . . . . . . . . . . . . . 33,233

Balance at December 31, 2000 . . . 38,864,377 $7,067 $143,999 $(5,211) $75,620 $8,512 $229,987

The accompanying notes are an integral part of the consolidated financial statements.

14

15

Head N.V. and Subsidiaries

Consolidated Statements of Cash Flows

For the Years Ended December 31,

1998 1999 2000

(in thousands)

Operating Activities:

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 63,718 $ 54,402 $ 27,781

Adjustments to reconcile net income

to net cash provided by operating activities:

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,019 17,502 16,110

Provision for leaving indemnity and pension benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . 716 1,399 772

Gain on sale of property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (459) (438) (1,160)

Gain on debt restructuring . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (58,203) — (2, 104)

Gain applicable to minority interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2) — —

Non-cash interest expense (income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 1,820 (1,023)

Non cash compensation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 548 1,378

Deferred tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (38,816) (5,165)

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 268 89 (31)

Changes in operating assets and liabilities (net of effects of acquisitions):

Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (16,447) (18,271) (7,457)

Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8, 841) ( 468) (13,277)

Prepaid expense and other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,648 4,704 (31)

Accounts payable, accrued expenses and other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . 14,093 5,973 (9,341)

Net cash provided by operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,531 28,444 6,452

Investing Activities:

Purchase of property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (17,459) (24,131) (20,571)

Proceeds from sale of property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,100 5,762 3,303

Acquisition of Dacor, net of cash acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1, 892) — —

Acquisition of Penn, net of cash acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (40,191) —

Other acquisitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (753) —

Maturities (purchases) of marketable securities, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (288) 2,783 90

Acquisition of minority interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (285) (987) —

Net cash used for investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (17,824) (57,517) (17,178)

Financing Activities:

Change in short-term borrowings, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (30,804) (16,384) (38,032)

Proceeds from long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22,810 132,362 1,789

Payments on long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (25,131) (71,047) (61,970)

Proceeds from initial public offering . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,265 — 134,402

Purchase of treasury stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (5,211)

Dividend paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (15,717)

Change in restricted cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,428 (1,865) 4,812

Net cash provided by (used for) financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (27,432) 43,066 20,073

Effect of exchange rate changes on cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . 2,708 (4,401) (11,446)

Net increase (decrease) in cash and cash equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (29,017) 9,592 (2,099)

Cash and cash equivalents at beginning of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37,373 8,356 17,948

Cash and cash equivalents at end of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8,356 $ 17,948 $ 15,848

Supplemental Cash Flow Information:

Cash paid for interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8,622 $ 8,485 $ 17,283

Cash paid for income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,418 $ 1,895 $ 3,230

Spin-off of London Films . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $645

The accompanying notes are an integral part of the consolidated financial statements.

Head N.V. and Subsidiaries

Notes to the Consolidated Financial Statements

Note 1—The Company

Head N.V. (“Head” or the “Company”) was incorporated in

Rotterdam, Netherlands, on August 24, 1998. With effect

from this date, Head Holding Unternehmensbeteiligung GmbH

(“Head Holding”) merged with a wholly owned subsidiary of

the Company in a transaction treated as a merger of entities

under common control and accounted for on an “as if pooling”

basis. As such, prior to August 24, 1998 the financial statements

presented herein reflect the operations of Head Holding

Unternehmensbeteiligung GmbH and its subsidiaries.

On January 1, 1996, Head Holding Unternehmensbeteiligung

GmbH, a subsidiary of Head N.V., acquired 100% of the out-

standing shares of HTM Sport- und Freizeitgeräte AG (HTM).

The acquisition has been accounted for as a purchase and

accordingly the operating results of HTM have been included

in the Company’s consolidated financial statements since the

date of acquisition. On June 6, 2000, in order to discharge any

current or future payment obligations under the share pur-

chase agreement by which the Company acquired HTM, the

Company made a payment of ATS 52.5 million ($3.5 million)

to the former owner of HTM and amended the share purchase

agreement. The terms of the share purchase agreement may

have entitled the former owner to 15% of any profits realized

on the subsequent sale of the HTM shares. The amendment

eliminated this provision. This payment is included in other

income (expense), net in the accompanying consolidated state-

ment of operations for the year ended December 31, 2000.

On June 15, 1999, entities controlled by the Company’s prin-

cipal shareholder contributed all of the outstanding share cap-

ital of London Films Ltd. to the Company. The transaction has

been accounted for on an “as if pooling” basis and, accord-

ingly, the combined financial statements have been presented

for all periods in which common control existed. The

Company issued 4,227,820 shares against this contribution in

kind. Subsequently, the Company contributed the shares in

London Films Ltd. in kind to its Austrian subsidiary, HTM

Sport- und Freizeitgeräte AG. London Films, a company duly

established in London, U.K., owns or has the rights to over

125 feature films and television programs, which it markets on

a world-wide basis. London Films was discontinued in 2000

(see Note 3—Discontinued operations).

The Company is engaged, through its subsidiaries, in the

design, engineering, manufacturing and marketing of a line of

alpine skis, boots, bindings and snowboards, tennis and squash

racquets, tennis balls, scuba and snorkel diving equipment and

tennis, squash and trekking footwear. The Company’s prod-

ucts are marketed globally under the internationally recog-

nized brand names of Head, Tyrolia, Mares, Penn, Dacor, San

Marco, Blax and Generics.

Note 2—Summary of Significant

Accounting Policies

Basis of Presentation

The Company maintains its accounting records and publishes

its statutory financial statements in accordance with Dutch

corporate regulations and has made certain adjustments to

these records to present the accompanying financial state-

ments in conformity with generally accepted accounting prin-

ciples in the United States of America.

Consolidation Policies

The consolidated financial statements of Head include the

accounts of all majority-owned subsidiaries. All intercompany

transactions and balances have been eliminated in consolidation.

Cash and Cash Equivalents

Cash and cash equivalents comprise cash and short-term,

highly liquid investments with an original maturity of three

months or less.

Restricted Cash

Restricted cash comprises deposits pledged as collateral on

outstanding lines of credit. The amounts are collateralized

with several financial institutions.

Inventories

Inventories are stated at the lower of cost or market. Cost is

determined on a first-in first-out basis.

Marketable Securities

Debt securities are classified as held-to-maturity and are

reported at amortized cost.

Property, Plant and Equipment

Property, plant and equipment is recorded at cost and

includes expenditures for new facilities and expenditures

16

17

which substantially increase the useful lives of existing facilities.

The cost of maintenance, repair and minor renewals is

expensed as incurred. When plant and equipment is retired

or otherwise disposed, the cost and related accumulated

depreciation are eliminated, and any gain or loss on disposition

is recognized in earnings. Depreciation is calculated using the

straight-line method over the estimated useful lives of the assets.

Intangible Assets

Identifiable intangible assets comprise trademarks and good-

will. Trademarks are amortized using the straight-line method

over a period of 20 to 40 years. Goodwill is amortized using

the straight-line method over a period of 15 to 30 years. The

Company periodically reviews the carrying value of its intangi-

bles based primarily upon an analysis of undiscounted cash

flows. Any impairment would be recognized when the expected

future operating cash flows derived from such intangible

assets are less than their carrying value. The impairment to be

recognized is measured by the amount by which the carrying

amount of the asset exceeds the fair value of the asset.

Revenue Recognition

Revenues from product sales are recognized at the time of

product shipment, which represents transfer of title to the

customer. Revenues from licensing agreements are recognized

as earned. Provisions are recorded for estimated product

returns at the time revenues are recognized. Costs associated

with product shipment and handling are classified in selling and

marketing expense in the consolidated statement of operations.

Translation of Foreign Currency

Finished goods sales to customers in Austria, Italy, Germany,

Japan, France, Switzerland, Canada, Spain and the United

States of America are generally billed in local currency. The

local currency is the functional currency in these countries.

Foreign currency (functional currency) assets and liabilities are

translated into U.S. dollars (the reporting currency) at the

exchange rate on the balance sheet date, with resulting trans-

lation adjustments recorded in other comprehensive income.

Revenue and expenses are translated at average rates pre-

vailing during the year. Foreign exchange gains and losses

arising from transactions denominated in a currency other

than the functional currency are included in income. The

effect of exchange rate changes on intercompany transac-

tions of a long-term investment nature are included in

other comprehensive income.

Financial Instruments

The Company enters into forward foreign currency contracts

principally to hedge currency fluctuations in transactions denom-

inated in foreign currencies, thereby limiting the Company’s

risk that would otherwise result from changes in exchange

rates. The Company periodically enters into forward foreign

exchange contracts to hedge firm commitments and it buys

foreign exchange options contracts to hedge anticipated trans-

actions. Gains and losses on purchased option contracts and

forward foreign exchange contracts are deferred and recorded

in the period in which the underlying sales transactions are

recognized. The Company does not utilize financial instruments

for trading or speculative purposes.

Research and Development Costs

Research and development costs are expensed as incurred.

Advertising Costs

Advertising costs are expensed as incurred.

Stock-Based Compensation

The Company accounts for its stock option plan using the fair

value method in accordance with Statement of Financial

Accounting Standards No. 123 (“SFAS 123”), Accounting for

Stock-Based Compensation.

Debt Issuance Costs

Debt issuance costs are capitalized and amortized over the

term of the debt.

Income Taxes

The provision for income taxes is based on income recog-

nized for financial statement purposes and includes the effects

of temporary differences between such income and that rec-

ognized for tax return purposes. With the exception of Head

Holding Unternehmensbeteiligung GmbH, all of the Company’s

Austrian subsidiaries are included in a consolidated Austrian

federal income tax return. Separate provisions for income taxes

have been prepared for the Company’s other subsidiaries.

Share Split

In October 2000, the Company effected a two-for-one stock

split of its ordinary shares. All references in the consolidated

financial statements and notes thereto to numbers of shares

and per share amounts have been restated to reflect the

stock split.

Computation of Net Income per Share

Net income per share is computed under Statement of

Financial Accounting Standards No. 128, Earnings per Share.

Basic net income per share is computed by dividing the net

income for the period by the weighted average number of

ordinary shares outstanding during the period. Diluted net

income per share is computed by dividing the net income for

the period by the weighted average number of ordinary

shares and potential ordinary shares outstanding during the

period. Potential ordinary shares are composed of incremen-

tal shares issuable upon the exercise of share options and

warrants, and are included in diluted net income per share to

the extent such shares are dilutive.

The following table sets forth the computation of diluted

weighted average shares outstanding for the periods indicated:

For the Years Ended

December 31,

1998 1999 2000

(in thousands)

Weighted average shares

outstanding—basic . . . . . . . . . . . . 20,000 22,132 28,071

Dilutive effect of stock options . . . . 70 1,402 1,858

Dilutive effect of warrants . . . . . . . . 162 836 750

Weighted average shares

outstanding—diluted . . . . . . . . . . 20,232 24,370 30,679

Use of Estimates

The preparation of financial statements in conformity with

generally accepted accounting principles in the United States

of America requires management to make estimates and

assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at

the date of the financial statements and the reported amounts

of revenues and expenses during the reporting period. Actual

results could differ from those estimates.

Reclassifications

Certain reclassifications have been made in prior years’ con-

solidated financial statements to conform to classifications

used in the current year.

Recent Accounting Pronouncements

Statement of Financial Accounting Standard No. 133 ’Account-

ing for Derivative Instruments and Hedging Activities’ (“SFAS

133”), as amended by FAS 138 is effective for fiscal years

beginning after 15 June 2000, (1 January 2001 for the

Company). The standard requires that all derivative financial

instruments be recorded on the Consolidated Balance Sheet

at their fair values. Changes in fair values of derivative will be

recorded each period in earnings, other comprehensive

income, or the cumulative translation adjustment in equity

depending on whether a derivative is designated as part of a

hedge transaction and, if it is, the type of hedge transaction.

For cash-flow transactions in which the Company is hedging the

variability of cash flows related to variable-rate asset, liability,

firm commitment (for foreign currency cash flow hedging) or

a forecasted transaction, changes in the fair value of the hedging

instrument that are reported initially in other comprehensive

income will be reclassified into earnings in the periods in

which earnings are impacted by the variability of the cash

flows of the hedged items. The ineffective portions of all

hedges will be recognized in current-period earnings.

On January 1, 2001, the Company will record a transition

adjustment in its accounting records to bring the accounting

for its derivatives into compliance with SFAS 133. The Company

estimates that it will record a net-of-tax-effect-type adjust-

ment of $1.8 million in accumulated other comprehensive

income to recognize at fair value all derivative instruments

that will be designated as cash-flow hedging instruments.

At this time, Head NV plans no significant change in its risk

management strategies due to the adoption of SFAS 133.

Head N.V. and Subsidiaries

Notes to the Consolidated Financial Statements (continued)

18

19

Note 3—Discontinued Operations

In August 2000, the Company granted its parent and 100%

shareholder, Head Sports Holdings N.V., the option to receive

all outstanding shares of London Films as a shareholder distri-

bution. Head Sports Holdings N.V. is controlled by Johan

Eliasch. On October 31, 2000, London Films, with net assets

of $0.6 million, was distributed in accordance with this option.

The results of operations of London Films have been pre-

sented as a discontinued operation in the accompanying con-

solidated statements of operations for the years ended

December 31, 1998, 1999 and 2000. Revenues of London

Films were $1.2 million, $1.5 million and $0.5 million for the

years ended December 31, 1998, 1999 and 2000, respectively.

No income tax expense has been recorded on the income

from discontinued operations due to the availability of net

operating loss carryforwards.

Note 4—U.S. Sportswear Business

During 1995, the Company announced a plan to discontinue

its U.S. sportswear manufacturing and distribution business

and to enter into an agreement whereby Head Sportswear

would be manufactured under license in the U.S. Included in

operating income are the following revenues and costs

incurred in connection with the discontinuation of the U.S.

sportswear business and the establishment of a licensing

agreement (in thousands):

For the Years Ended

December 31,

1998 1999 2000

Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . $1,985 $— $—

Cost of sales . . . . . . . . . . . . . . . . . . . . . . . 1,378 — —

Gross profit . . . . . . . . . . . . . . . . . . . . . . . . 607 — —

Selling and marketing expenses . . . . . . . . 378 — —

General and administrative expense . . . . . 267 — —

Operating loss . . . . . . . . . . . . . . . . . . . . . . $ (38) $— $—

In March 1998, the Company entered into two U.S. sports-

wear licensing agreements. The agreements are for a term of

5 years and provide for the Company to receive minimum

royalties totaling approximately $5.5 million over the term of

the agreements.

Note 5—Acquisitions

Dacor Acquisition

On November 19, 1998, one of the Company’s subsidiaries

acquired 100% of the outstanding common stock of Dacor

Corporation, a U.S. manufacturer of diving equipment, for a