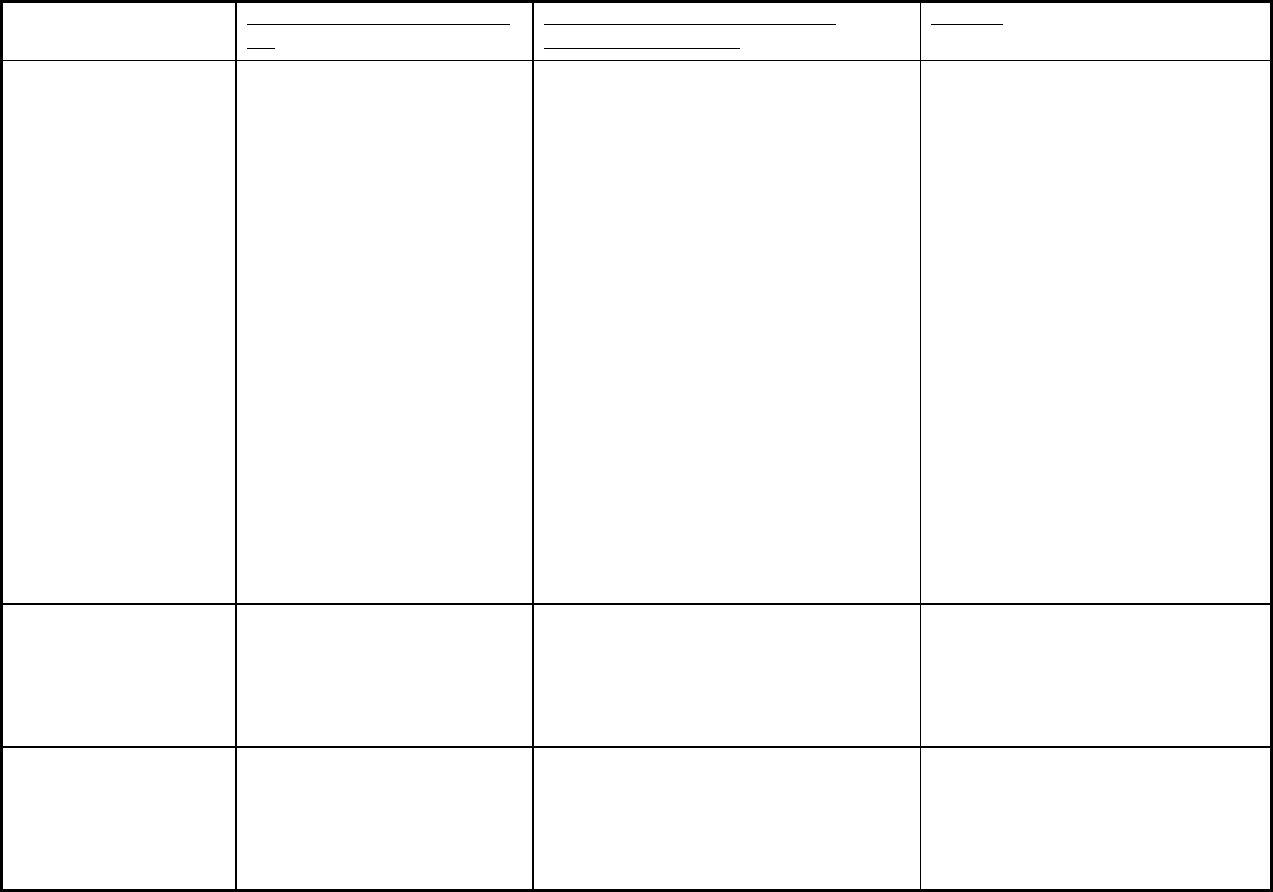

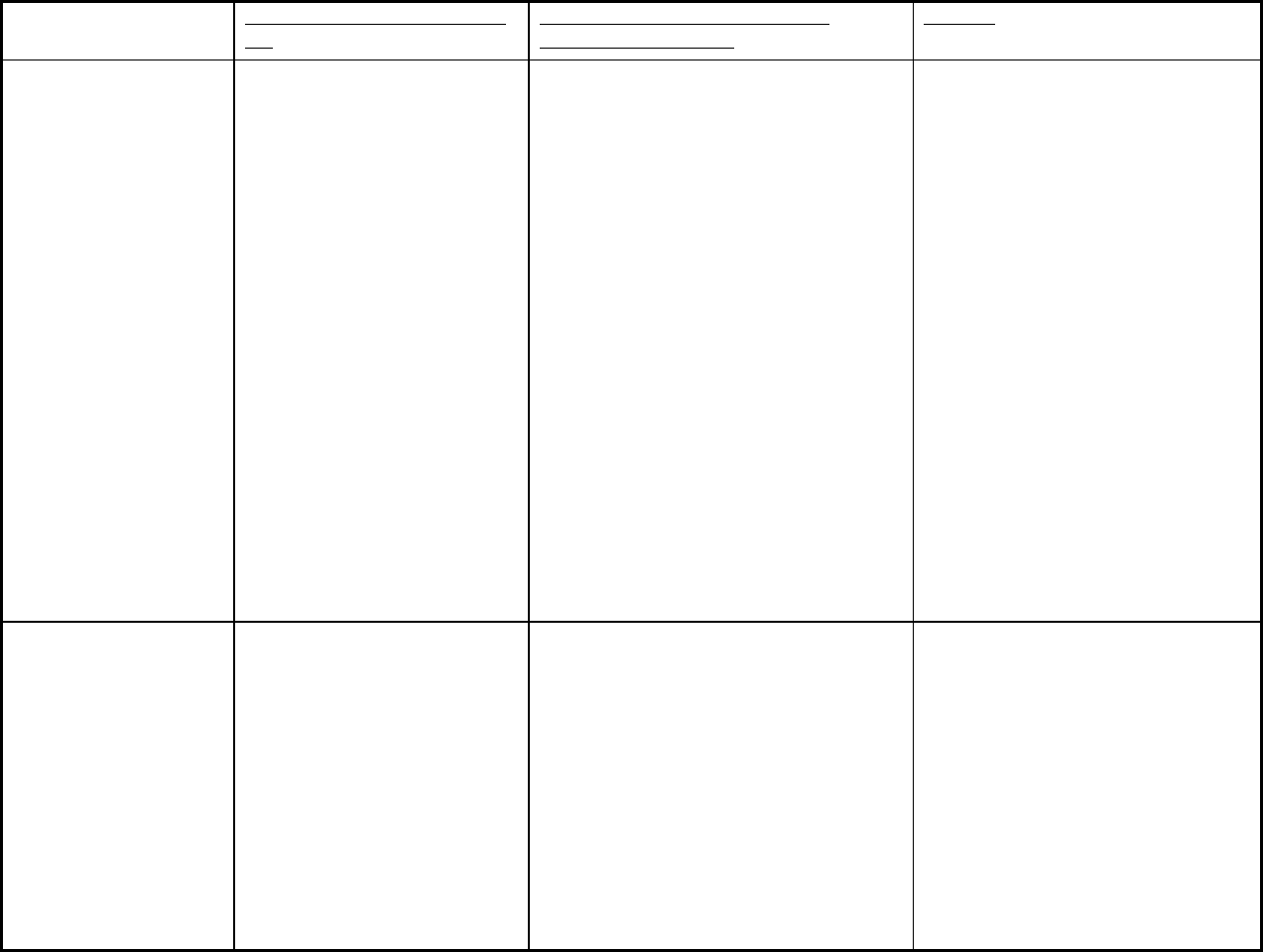

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

1

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

A. Central Insurance Co.

“A” program only

3% and 5%

The Catastrophe Windstorm deductible is

subject to:

A higher percentage amount that applies to

Windstorm loss that occurs within a period of

12 hours before or 12 hours after the storm

which caused the loss makes landfall

anywhere in New York State as a declared

Category 2, 3, 4 or 5 hurricanes.

“Declared” means declared by the National

Weather Service.

3% - Applicable in Nassau County,

Kings, Queens, Richmond, Bronx, New

York and within 1500 feet of the shore in

Westchester county.

5% - Applicable in Suffolk county.

Optional 4% and 10% are available.

AAIS

Optional, See Note A

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible is applicable when a

windstorm loss occurs 12 hours before or 12

hours after a Category 2 hurricane, as

determined by the National Weather Service,

makes landfall anywhere in NYS.

See Note A.

ACA Insurance Company

1%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

% deductible applies to windstorm loss that

occurs within a period of 12 hours before or

12 hours after the storm which caused the

loss makes landfall anywhere in NYS as

declared Category 2, 3, 4 or 5 hurricanes.

Fixed dollar AOP deductible applies to

Category 1 hurricane.

Richmond, Kings, Queens, New York,

Bronx, Nassau, Suffolk and Westchester

Counties.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

2

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

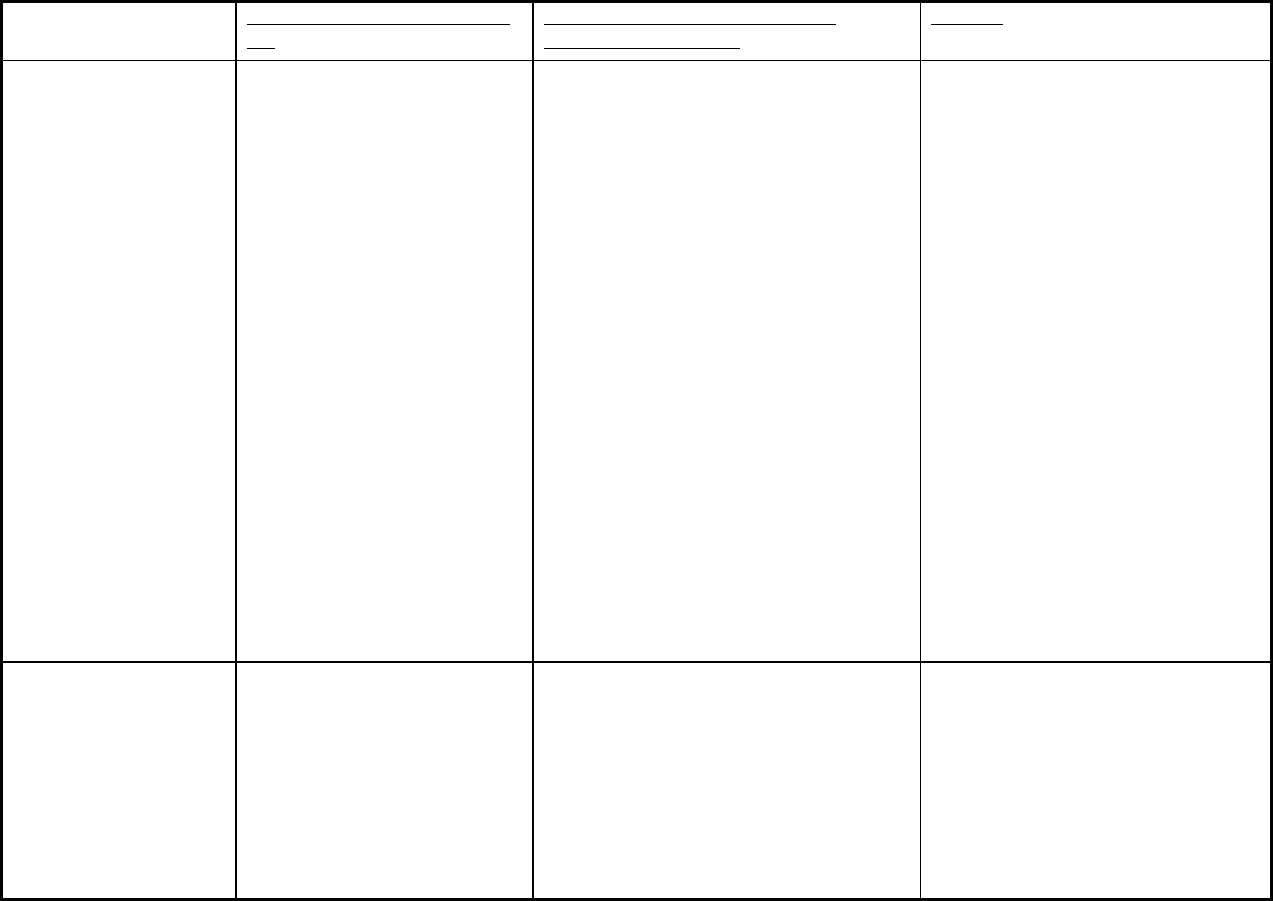

Adirondack Ins. Exchange

All Forms except HO 4000 and

HO 6000)

OPTIONAL deductible amounts

of 1%, 2%, 3%, 4%, or 5%

Applies when a windstorm loss occurs within

a period of 12 hours before or 12 hours after

the Category 1, 2, 3, 4 or 5.

HO 2000 and HO 3000

Kings, Queens, Richmond, New York,

Nassau, Suffolk and the Bronx and

within 2 miles of the coastline in

Westchester.

Forms HO 4000 and HO 6000

In the counties of Kings, Queens,

Richmond, Nassau, Suffolk and the

Bronx, and within 2 miles of the

coastline in Westchester, a $1,000

deductible

AIG – Private Client

Group

American International

Insurance Company

(Standard)

AIG Premier Insurance

Company

(Premier)

AIG Preferred Insurance

Company

(Preferred)

This hurricane deductible is a flat

$ amounts: $25,000 & $10,000,

depending upon distance from

shore.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

Applies in the event of direct physical loss to

property by hurricane that occurs within a

period of 12 hours before or 12 hours after

the storm which caused the loss makes

landfall anywhere in NYS as declared by

NWS as Category 1, 2, 3, 4 or 5.

$25,000 deductible within 1 ml. of south

shore for Nassau and Suffolk counties.

$10,000 deductible within 1 ml. of north

shore for Nassau and Suffolk counties.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

3

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

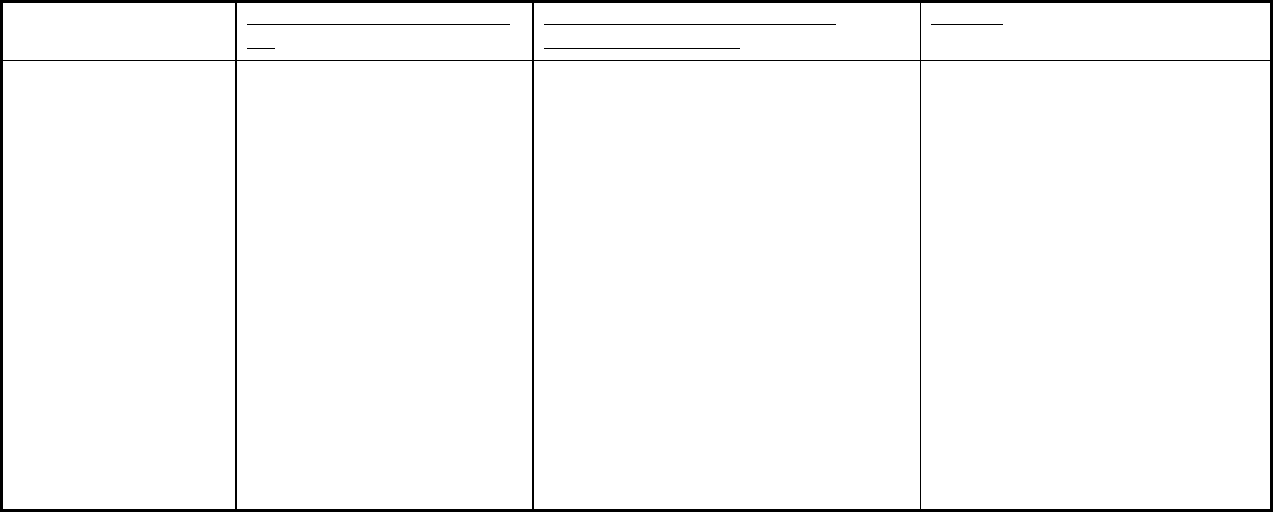

Allstate Insurance Co.

Allstate Indemnity Co.

5% for the coastal areas except

Westchester.

For Westchester – 0%, 3% or 5%

- depending on zip code of

insured property.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The hurricane deductible applies in the event

of covered loss caused by wind, hail, rain, or

by any object(s) driven by wind, if:

a) such wind, hail or rain accompanied a

weather system declared at any time during

its existence by the National Weather Service

to be a hurricane;

b) extreme winds accompanying the weather

system referenced in a), above, occur in any

part of the state of New York (regardless of

what the actual wind speed at your residence

premises or anywhere else in the state was at

the time of loss); and

c) the loss occurs during the time period: i)

beginning 24 hours prior to the first time that

the extreme winds occur in any part of the

state of New York; and ii) ending 12 hours

after the last time that the extreme winds

occur in the state of New York.

Extreme winds – means sustained winds of

74 miles per hour or higher (as measured or

reported by the National Weather Service).

Staten Island, Bronx Queens, New York,

Brooklyn, Nassau and Suffolk and

Westchester.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

4

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

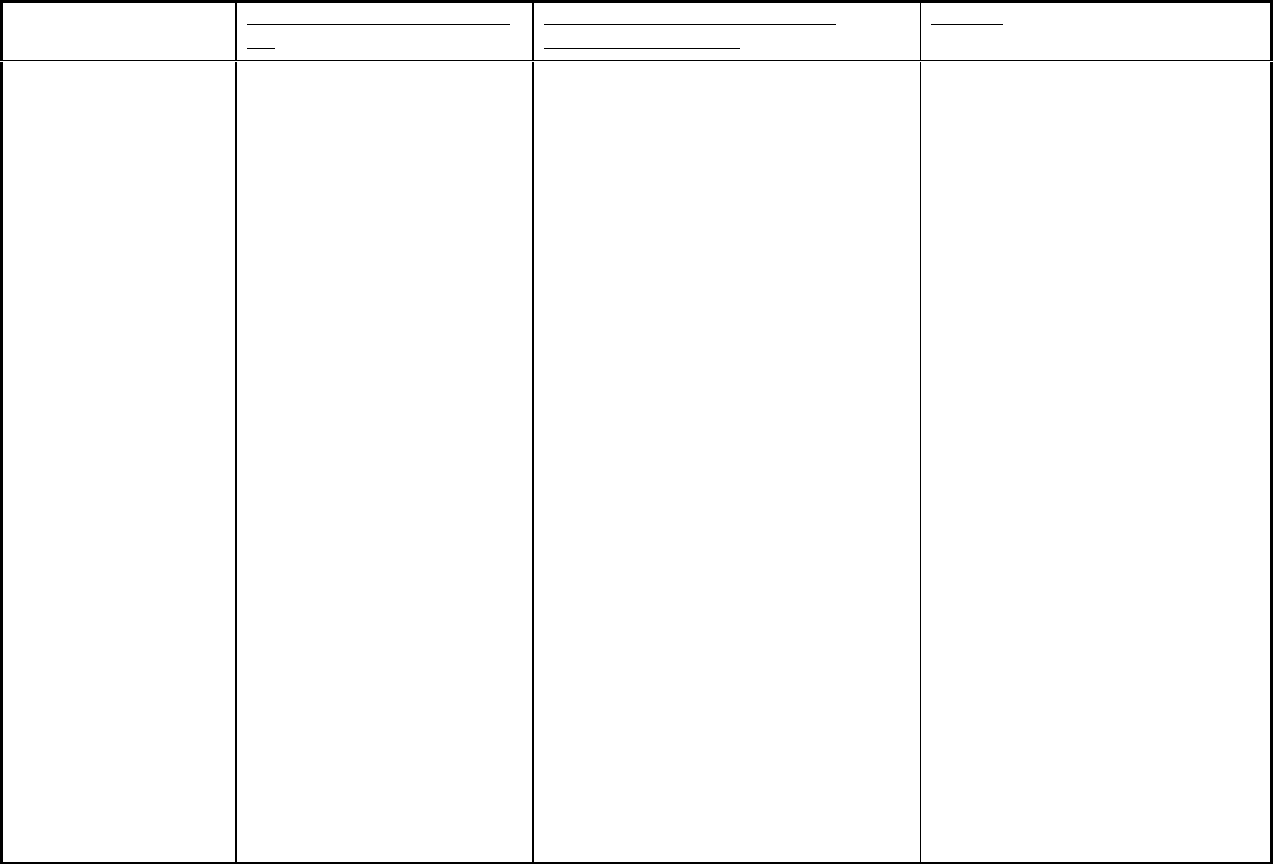

Allstate Vehicle and

Property

5% of Coverage A limits applies

for Zones 1, 3, 4 and 5.

Exception: A minimum Hurricane

deductible equal to 3% of

Coverage A limits applies for the

following zip codes in Hurricane

Deductible Zone 1:

10502, 10530, 10595 10701,

10504, 10532 10601, 10702,

10506 10533, 10602, 10703

10510, 10570, 10603 10704,

10514, 10576 10604, 10705,

10522 10591, 10606, 10706

10523 , 10594, 10607 10710

The hurricane deductible applies in the event

of covered loss caused by wind, hail, rain, or

by any object(s) driven by wind, if:

a) such wind, hail or rain accompanied a

weather system declared at any time during

its existence by the National Weather Service

to be a hurricane;

b) extreme winds accompanying the weather

system referenced in a), above, occur in any

part of the state of New York (regardless of

what the actual wind speed at your residence

premises or anywhere else in the state was at

the time of loss); and

c) the loss occurs during the time period: i)

beginning 24 hours prior to the first time that

the extreme winds occur in any part of the

state of New York; and ii) ending 12 hours

after the last time that the extreme winds

occur in the state of New York.

Extreme winds – means sustained winds of

74 miles per hour or higher (as measured or

reported by the National Weather Service).

Zones 1, 3, 4 and 5 comprise the 5

Boroughs

(Bronx, Kings, Manhattan, Queens

and Richmond), the counties of Nassau

and Suffolk and the southern portion of

Westchester County.

American European Ins.

Co.

5% of Coverage A limit

A windstorm loss that occurs within a period

of 12 hours before and 12 hours after the

storm which caused the loss makes landfall

anywhere in New York State as a declared

Category 1, 2, 3, 4 or 5 hurricane.

Richmond, Queens, Bronx, Kings,

Suffolk, Westchester and Nassau

American Modern Home

$500

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible is applicable when a

windstorm loss occurs 12 hours before or 12

hours after a Category 2 hurricane, as

determined by the National Weather Service,

makes landfall anywhere in NYS.

Staten Island, Bronx Queens,

Westchester, Brooklyn, Nassau and

Suffolk

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

5

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Am Motorists

5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible is applicable when a

windstorm loss occurs 12 hours before or 12

hours after a Category 2 hurricane, as

determined by the National Weather Service,

makes landfall anywhere in NYS.

Staten Island, Bronx Queens, New York,

Brooklyn, Nassau and Suffolk.

Amica Mutual Insurance

Co.

1%, 2%, 3% and 5% of Coverage

A Limit for Territories 3,4,6,7,46

and 50, 47-49

(Richmond, Queens, Bronx,

Kings, Nassau, Suffolk,

Westchester)

Trigger is a period of 12 hours before or 12

hours after a declared category 2, 3, 4 or 5

hurricane makes landfall anywhere in New

York State

1% Deductible:

Mandatory for territories 3,4, 7, 46 and

50 (South Shore and Long Island’s

Forks) if the distance from the shore is

over 2,500 feet to

1 mile

Optional for territories 6 and 47-49 if the

distance from the shore is greater than

1,000 feet.

2% Deductible:

Mandatory for territories 3, 4, 7, 46 and

50 (South shore and Long Island Forks)

if the distance from the shore is up to

2,500 feet.

Mandatory for territories 6, 46 and 50

(North Shore along the Long Island

Sound) and 47-49 if the distance from

the shore is up to 1,000 feet.

Atlantic Mutual

5% applicable within 1000 feet of

the shore or on a barrier island

and 2% for the rest of Long

Island.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible is applicable when a

windstorm loss occurs 12 hours before or 12

hours after a Category 2 hurricane, as

determined by the National Weather Service,

makes landfall anywhere in NYS.

Nassau and Suffolk.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

6

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Balboa

5% applicable up to 1 mile from

the coastal areas and 2%

applicable from 1 mile to the rest

of the coastal areas.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible is applicable to a windstorm

loss if, according to the National Weather

Service, a Category 2, 3, 4 or 5 hurricane

makes landfall anywhere in New York State

within 12 hours before or 12 hours after the

windstorm loss.

Bronx, Kings, Queens, Nassau, Suffolk,

Richmond and Westchester counties.

Bankers Standard

Insurance Company

For Nassau & Suffolk

$25,000 or 2%, (whichever is

less) for dwellings up to 1 mile

from the North Shore

$50,000 or 5%, (whichever is

less) for dwellings up to 1 mile

from the South Shore

$10,000 or 2%, (whichever is

less) for Remainder of Nassau &

Suffolk Counties

A catastrophe windstorm means a Category 1

or higher hurricane which makes landfall:

(1) In any part of the state of New York as

declared by the National Weather Service; or

(2) Outside of the state of New York but

hurricane force winds are present in the New

York county in which the loss occurs as

declared by the National Weather Service;

and which:

(1) Begins 24 hours prior to determination by

the National Weather Service that hurricane

force winds with wind speeds measuring

Category 1 or higher exist in any part of the

state of New York;

(2) Continues for the timeframe during which

hurricane conditions exist anywhere in the

state of New York; and

(3) Ends 12 hours after Category 1 or higher

hurricane force winds cease to be present in

any New York county as declared by the

National Weather Service.

Richmond, Queens, Bronx, Kings, New

Rochelle-Westchester, Mt Vernon -

Westchester, Nassau, Suffolk counties

Bay State

2%

Applies when a windstorm loss occurs within

a period of 12 hours before or 12 hours after

the Category 1 or higher (landfall anywhere

in NY State).

Richmond, Queens, Bronx, Kings,

Suffolk and Nassau

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

7

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Berkley Insurance

Company

5%

$10,000

$5,000

Category 1 or higher hurricane that makes

landfall in any part of New York or outside

of New York as declared by the National

Weather Service, and which

begins 24 hours prior to determination by the

National Weather Service that hurricane

force winds with wind speeds measuring

category 1 or higher exist in any part of the

state of New York;

continues for the timeframe during which

hurricane conditions exist anywhere in the

state of New York; and

ends 12 hours after category 1 or higher

hurricane force winds cease to be present in

any “county” as declared by the National

Weather Service. “County” means any one or

more of the following states of New York

counties: Bronx, Kings, Nassau, New York,

Queens, Richmond, Suffolk and Westchester.

5%

Nassau& Suffolk: South Shore

$10,000

Rest of Nassau & Suffolk Counties

$5,000

Richmond, Kings, Queens Counties

Cambridge Mutual Fire

2%

Applies when a windstorm loss occurs within

a period of 12 hours before or 12 hours after

the Category 1 or higher (landfall anywhere

in NY State).

Richmond, Queens, Bronx, Kings,

Suffolk and Nassau

Castle Point Insurance

5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible applies to windstorm loss that

occurs within a period 12 hours before or 12

hours after the storm makes landfall

anywhere in NYS as declared by the National

weather Service to be a Category 1, 2, 3, 4

hurricane.

‘Declared” means declared by the National

Weather Service.

Richmond, Queens, Kings, Bronx,

Nassau and Suffolk County.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

8

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Chubb

5% mandatory hurricane

deductible to be applicable up to

1 mile on the North Shore of

Nassau & Suffolk & up to 5 miles

on the South Shore of Nassau and

Suffolk.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

Category 1 hurricane Trigger.

Nassau and Suffolk.

Cigna Ind & Ind Co. of

North America

3%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The hurricane deductible applies to

windstorm loss that occurs within a period of

12 hours before or 12 hours after the storm

which caused the loss makes landfall

anywhere in NYS as declared the National

Weather Service to be category 1,2,3,4 or 5

hurricanes.

Nassau, Suffolk, Brooklyn, & Queens.

Cigna - applicable to the

rest of the companies

other than those approved

for the Special LI

Program

3% -

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

Category 1 or higher hurricane

Applicable within 2500 feet of an ocean,

sound, bay or similar body of water in

the following counties: Nassau and

Suffolk Kings, Queens, Richmond,

Westchester and Bronx

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

9

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Citizens Ins. Co. of

America

HO-4 Wrap Around Endorsement

for risks less than 1 mile.

5% and 2% applies to risks 1 to 3

miles and greater.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

(a) To a windstorm loss that occurs within a

period of 12 hours before or 12 hours after

the storm which caused the loss makes

landfall anywhere in New York State as a

declared Category 1, 2, 3, 4 or 5 hurricanes

by the national Weather Service.

(b) To a windstorm loss that occurs within a

period of 12 hours before or 12 hours after

the storm which caused the loss makes

landfall outside of New York State, but

which is determined to be a Category 1 or

higher force winds by the national Weather

Service in the area (territory) within New

York State in which the loss occurs.

“Declared” means declared by the National

Weather Service.

For Nassau and Suffolk Counties: a 5%

windstorm deductible for risks located 1

to 3 miles or greater from distance to

nearest shore line.

HO-4 Windstorm Wrap Around

endorsement for risks located less than 1

mile form the distance to nearest shore

line.

For Kings, New York, Bronx, Queens,

Richmond and Westchester Counties:

2% Windstorm deductible for risk

located 1 to 3 miles and greater from

distance to nearest shore line.

HO-4 Windstorm Wrap around

endorsement for risks less than 1 mile

from distance to nearest shore line.

Clarendon

Optional hurricane deductibles,

ranging from 2%, 5% &10%.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

Trigger is a category 2 hurricane, making

landfall in NYS.

Available only for the coastal areas

Clear Blue

1%, 2%, 3%, 5%

$500, $1,000, $2,500

The deductible applies to windstorm loss that

occurs within a period of 12 hours before or

12 hours after the storm which caused the

loss makes landfall anywhere in New York

State as a declared Category 1, 2, 3, 4 or 5

hurricane as determined by the National

Weather Service, or makes landfall outside of

New York State, which is determined by the

National Weather Service - Category 1 or

higher force winds in the area within New

York State in which the losses occur.

Suffolk, Nassau, Queens, Kings,

Richmond, Bronx, New York,

Westchester

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

10

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

CNA Companies

5% & 3%

5% for risks located 1 mile or less

from the shore of the entire

counties of Queens, Kings,

Richmond New York and Bronx

and the entire Southern Shore of

Nassau county and Suffolk

county, including the forks and

the Northern Shore of Suffolk east

of and including zip code 11778.

3% for risk located in the

remainder of the above-mentioned

areas and for risks located within

1500 feet from shore in

Westchester county.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

Category 2 or higher hurricane as designated

by the National Weather Service, at the time

it impacts anywhere in New York.

Brooklyn, Queens, Westchester, Nassau,

Suffolk, Bronx, Richmond, & New York

counties.

Colonial Penn

See Note A.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible is applicable to a windstorm

loss if, according to the National Weather

Service, a Category 2, 3, 4 or 5 hurricane

makes landfall anywhere in New York State

within 12 hours before or 12 hours after the

windstorm loss.

See Note A.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

11

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Commercial Mutual

Insurance Company

(3 to 4 Family risks)

2% and 5%

$1000

New York City and Westchester a

2% Nassau and Suffolk a 5%

$1000

The deductible is $1000 for Category 1

hurricane of 74 mph and 2% and 5% for

category 2 hurricanes of 96 mph.

Will apply to any windstorm loss that occurs

12 hours before a hurricane begins resulting

in Category 1 hurricane force winds or

hurricane force winds of a greater velocity in

any coastal county, regardless of the specific

location of your property, and ends 12 hours

after a hurricane resulting in category 1

hurricane force winds or hurricane force

winds of a greater velocity in any coastal

county, regardless of the specific location of

your property.

The deductible is $1000 for Category 1

hurricane of 74 mph

Category 2 hurricanes of 96 mph.

Mandatory $1000 applicable for

category 1 and 2% for category 2 in

Bronx, Kings, New York, Queens,

Richmond and Westchester.

Mandatory $1000 applicable for

category 1 and 5% for category 2 in

Nassau and Suffolk.

Mandatory $1000 applicable for

category 1 and 2% for 2 in New York

and Westchester.

Mandatory $1000 applicable for

category 1 and 5% for category 2 in

Nassau and Suffolk.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

12

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Constitution Insurance

Company

2%, 3%, 5%

The deductible applies to windstorm loss that

occurs within a period of 12 hours before or

12 hours after the storm which caused the

loss makes landfall anywhere in New York

State as a declared Category 1, 2, 3, 4 or 5

hurricanes.

5% - Northwest Suffolk (within 0.25

miles and 1 mile of nearest coast),

Southwest Suffolk (within 0.25 miles

and 1 mile of nearest coast) and East

Suffolk (within 0.25 miles and 1 mile of

nearest coast).

3% - Northwest Suffolk (between 1 & 2

miles of nearest coast), Southwest

Suffolk (between 1 & 2 miles of nearest

coast), East Suffolk (between 1 & 2

miles of nearest coast), North Nassau

(within 0.25 miles and 1 mile of nearest

coast), South Nassau (within 0.25 miles

and 1 mile of nearest coast).

2% - North Nassau (between 1 & 2 miles

of nearest coast), South Nassau (between

1 & 2 miles of nearest coast).

Continental,

3% and 5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

Category 2

(1) Beginning 24 hrs prior to the time that ha

wind exceed 100 m/p/h occurs in any part of

NY during a hurricane, as estimated by the

NWS;

(2) During the duration of such hurricane;

and

(3) Ending 12 hours after the last time the

NWS declares that the hurricane has been

downgraded to a tropical storm.

Kings, Queens, New York, Richmond,

Westchester, Bronx, Nassau and Suffolk

Delos Insurance Company

(Introductory HO filing)

2% and 5%

The deductible amount applies to

the dwelling’s insured value.

The deductible is applicable when a

windstorm loss occurs 12 hours before or 12

hours after a Category 1 hurricane, as

determined by the National Weather Service,

makes landfall anywhere in NYS.

2% - New York, Bronx, Westchester,

and located within 3 miles of the coast.

5% - Richmond, Queens, Kings, Nassau,

Suffolk, and located within 3 miles of

the coast.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

13

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Economy Premier

Assurance Company

Bronx: 3%

Kings: 5% within 1 mile of coast:

3% elsewhere

Nassau: 55 within 1 mile of coast:

3% elsewhere

New York: 3%

Queens: 5% within 1 mile of

coast: 3% elsewhere

Richmond: 3%

Suffolk 5% within 1 mile of coast;

3% elsewhere

Westchester: 3%; selected zip

codes: 2% selected zip codes: All

other peril deductible elsewhere.

Category 1

1. beginning 12 hours prior to the time that a

wind speed exceeding 74 miles per hour

occurs in any part of New York State during

a hurricane, as estimated by the NWS.

2. during the duration of such

Hurricane

3. and ending 12 hours after the last

time the NWS declares that the hurricane has

been downgraded to a tropical storm.

Bronx, Kings, Nassau, New York,

Queens, Richmond, Suffolk, Cities of

Yonkers, Remainder of Westchester

County (excluding zip codes 10511,

10535, 10547, 10548, 10566, 10567 and

10588).

Electric

2%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible will apply when a windstorm

loss occurs within a period of 12 hours

before and 12 hours after a Category 2

hurricane or higher, as determined by the

National Weather Service, makes landfall

anywhere in NYS.

Brooklyn, Queens, Staten Island, Bronx,

Nassau and Suffolk.

Empire

5% for risks up to 1 mile of the

south shore of LI and within 1000

feet of the north shore of LI and

Westchester. A 3% will apply to

the remainder of the Bronx,

Brooklyn, New York, Queens,

Richmond, Nassau and Suffolk

counties.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible applies to losses which occur

as a result of either: a) a Category 1 or higher

hurricane making landfall in NYS, or b) a

hurricane making landfall outside of NYS,

but which is determined by the National

Weather Service to be a Category 1 or higher

hurricane force winds in the area within NYS

in which the losses occur.

Brooklyn, Queens, Westchester, Nassau,

Suffolk, Bronx, Richmond, & New York

counties.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

14

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Encompass

A 5% hurricane deductible will be

mandatory for risks located 1 mile

or less from shore of the

following areas: I. The counties

of Queens, Kings, Richmond,

New York and Bronx.

II. The entire southern shore of

Nassau County, but not the

northern shore.

III. The entire southern shore of

Suffolk County, the shore in the

Suffolk County forks, and

the northern shore of Suffolk

County east of and including zip

code 11778.

A 3% hurricane deductible will be

mandatory for risks located in

Kings, Queens, Nassau and

Suffolk (Long Island), New York,

Richmond (Staten Island) and

Bronx counties not having a 5%

hurricane deductible as defined in

above.

For risks located 1,500 feet or less

from shore: (Applicable to

Westchester County only) A 3%

hurricane deductible will be

mandatory. The deductible

amount applies to the dwelling’s

insured value of the dwelling.

Category 2 or higher hurricane as designated

by the National Weather Service, at the time

it impacts anywhere in New York.

Brooklyn, Queens, Westchester, Nassau,

Suffolk, Bronx, Richmond, & New York

counties.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

15

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Farm Family Casualty

Insurance Company

Homeowners’ Program -

1% and 2%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

Applies to loss to property caused by wind,

wind gusts, rain, tornadoes, or cyclones

during a catastrophic windstorm occurrence

(time period that occurs within a period of 12

hours before or 12 hours after the storm

which caused the loss makes landfall

anywhere in NYS and is declared by the

National Hurricane Center of the NWS as a

Category 2, 3, 4, or 5 hurricanes.

1% (but not less than $1,000) - Kings,

Queens, Richmond, Bronx and

Westchester counties

2% (but not less than $2,000) - Nassau

and Suffolk counties.

Farmers New Century,

Band I 5%

Band II 2%

Band III 1%

Band IV no special deductible

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

Applies to windstorm loss within a period of

12 hrs. before or 12 hrs. after the storm

which caused the loss makes landfall

anywhere in New York State as declared by

NWS as Category 2 or higher hurricane.

Suffolk, Nassau, Queens, Kings,

Richmond and Westchester counties.

Fidelity and Deposit Co.

of MD

2%, 3% and 5 %

A percentage deductible applies to

windstorm loss that occurs within a period of

12 hours before or 12 hours after that storm

which caused the loss makes landfall

anywhere in New York State as a declared

Category 1, 2, 3, 4 or 5 hurricanes.

New York, Bronx, Kings, Westchester:

2%

Richmond, Queens: 3%

Suffolk, Nassau: 5%

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

16

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Fidelity National Ins. Co.

2% or 5% (see Territory)

A percentage deductible applies to

windstorm loss that occurs within a period of

12 hours before or 12 hours after the storm

which caused the loss makes landfall

anywhere in New York State as a declared

Category 1, 2, 3, 4 or 5 hurricanes.

Richmond, Queens, Kings, Nassau,

Suffolk Counties:

(1) All risks located on a barrier island

or within 2 miles of the south shore or 1

mile of the north shore: 5% hurricane

deductible in combination with an All

Other Perils deductible of at least $500.

(2) All other areas: 2% hurricane

deductible in combination with an All

Other Perils deductible of at least $500.

New York, Bronx, Westchester:

2% hurricane deductible in

combination with an All Other Peril

deductible of at least $500.

Fireman’s Fund

2% or 1%.

5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible applies to losses which occur

as a result of either: a) a Category 1 or higher

hurricane making landfall in NYS, or b) a

hurricane making landfall outside of NYS,

but which is determined by the National

Weather Service to be a Category 1 or higher

hurricane force winds in the area within NYS

in which the losses occur.

Mandatory 2% for Nassau and Suffolk.

Mandatory 1% for SI, Queens, &

Brooklyn.

Mandatory 5% on risks located within 3

miles of the Atlantic Shore in Suffolk

and Nassau counties. For the remainder

of these risks in these territories (those

located more than 3 miles away from the

Atlantic Shoreline), the Mandatory

Deductible will remain at 2%.

First American Specialty

5%

Catastrophe windstorm percentage deductible

applies to loss to property caused by wind,

wind gusts, rain, tornadoes, or cyclones

during a catastrophic windstorm occurrence

(time period that occurs within a period of 12

hours before or 12 hours after the storm

which caused the loss makes landfall

anywhere in New York State and is declared

by the National hurricane Center of the

National Weather Service as a Category 1, 2,

3, 4, or 5 hurricane.

Kings (Brooklyn), Queens, Richmond

(Staten Island), New York (Manhattan),

Bronx, Nassau or Suffolk

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

17

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

First Liberty Ins. Corp

2% and 5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The mandatory hurricane deductible applies

to a windstorm loss that occurs within a

period of 12 hours before or 12 hours after

the storm which caused the loss makes

landfall anywhere in NYS as declared by the

National Weather Service to be a Category 2

hurricane or higher; or makes landfall outside

of NYS, but which is determined by the

National Weather Service to be a Category 2

or higher hurricane force winds in the area

within NYS in which the loss occur.

Policies effective prior to 9/11/2006: A

5% mandatory hurricane deductible will

apply to all properties located within one

mile of the coastline on the South-shore

only of Kings, Nassau, Queens, and

Suffolk counties.

2% mandatory hurricane deductible will

apply to all other properties located in

Kings, Nassau, Queens, and Suffolk

counties.

2% mandatory deductible will apply to

all properties located in Richmond

County.

New business policies effective between

9/11/2006 and December 10, 2006:

5% mandatory hurricane deductible will

apply to all properties located in Nassau

and Suffolk counties.

5% mandatory hurricane deductible will

apply to all properties located within one

mile of the coastline in Bronx, Kings,

New York, Queens, Richmond, and

Westchester counties

For new business effective on or after

December 11, 2006: A mandatory 5%

hurricane deductible will apply to all

policies in Bronx, Kings, Nassau, New

York, Queens, Richmond, Suffolk and

Westchester counties.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

18

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Garrison P& C Ins. Co

2% - Coverage A - $100,000 or

higher

$2,000 – Coverage A $99,999 or

less

The deductible applies to windstorm loss that

occurs within a period of 12 hours before or

12 hours after the storm which caused the

loss makes landfall anywhere in New York

State as a declared Category 1, 2, 3, 4 or 5

hurricanes.

Category 1 hurricane is a storm that

originates in the tropics and results in either a

sustained wind speed of at least 74 miles per

hour or a storm surge of at least six feet

above normal.

Richmond, Queens, New York, Bronx,

Kings, Nassau, Suffolk

Gen Accident

See note A.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible is applicable to windstorm

loss to covered property, that occurs within a

period of 12 hours before or 12 hours after

the storm which caused the loss makes

landfall anywhere in New York State as

declared to be a Category 2, 3, 4 or 5

hurricanes by the National Weather Service.

See Note A.

General Casualty

Company of Wisconsin

5%

For the Windstorm Deductible –

New York Catastrophe

Percentage and Non-Catastrophe

Fixed dollar.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

Windstorm losses that occur within a period

of 12 hours before or 12 hours after a storm

that causes a loss that makes landfall

anywhere in New York state as a declared

Category 2, 3, 4, or 5 hurricanes.

For all dwellings located in Bronx,

Kings, Nassau, Queens, Richmond,

Suffolk, and the cities of Larchmont,

Mamaroneck, Mount Vernon, New

Rochelle, Port Chester and Rye in

Westchester County.

Greater NY Mut. & Ins.

Co. of Greater NY

3%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

Category 2 hurricane.

3% hurricane deductible to be applicable

to all risks located within 2500 feet and

1000 feet from the waterfront in

Brooklyn, Queens, Nassau and Suffolk.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

19

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Hanover Ins. Co.

1%, 2%, 3% and 5%

The Hurricane percentage deductible

applies to a windstorm loss that occurs

within a period of 12 hours before or 12

hours after the storm which caused the

loss makes landfall anywhere in New

York State as a declared Category 1, 2,

3, 4

or 5 hurricane by the National Weather

Service.

2% Deductible Mandatory for:

• Westchester (greater than or equal

to 0.2 miles and less than 2 miles)

• Bronx, Queens, Kings, Richmond,

Manhattan (greater than or equal to 1

mile)

3% Deductible Mandatory for:

• Nassau

- North Shore - greater than or equal

to 0.5 miles

- South Shore - greater than or

equal to 1 mile

• Suffolk

- North Shore - greater than 1 mile

- South Shore - greater than 3 miles

5% Deductible Mandatory for Suffolk:

- North Shore - greater than or equal

to 0.5 miles and less than 1 mile

- South Shore - greater than or

equal to 1 mile and less than 3 miles

- Any risk located on the North or

South fork East of Riverhead

Harleysville Ins.

Company of NY

5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible is applicable to a windstorm

loss if, according to the National Weather

Service, a Category 1, 2, 3, 4 or 5 hurricane

makes landfall anywhere in New York State

within 12 hours before or 12 hours after

windstorm loss to covered property first

occurs.

Brooklyn, Bronx, Queens, Nassau,

Suffolk & Richmond.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

20

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Harleysville Preferred Ins.

Co.

5%

Homeowners: The deductible

amount is based on the insured

value Coverage A.

Dwelling Fire: The deductible

amount is based on the insured

value of Coverage A or B,

whichever is greater.

Applies to Windstorm loss that occurs within

a period of 12 hours before or 12 hours after

the storm which caused the loss makes

landfall anywhere in New York State as a

“declared” Category 1, 2, 3, 4 or 5

hurricanes.

"Declared" means declared by the National

Weather Service.

Bronx, Kings, Nassau, Queens,

Richmond, Suffolk and Westchester

(within 2 of salt water)

Harleysville- Worcester

5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible is applicable to a windstorm

loss if, according to the National Weather

Service, a Category 1, 2, 3, 4 or 5 hurricane

makes landfall anywhere in New York State

within 12 hours before or 12 hours after

windstorm loss to covered property first

occurs.

Brooklyn, Queens, Nassau, Suffolk &

Richmond.

Hartford Cas. Ins. Co.

Hartford Ins. Co. of

Illinois

5% & 2%.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The Hurricane Deductible applies to covered

losses caused by hurricane that occurs within

a period of 12 hours before or 12 hours after

the storm which caused the loss: 1) makes

landfall anywhere in New York State as a

Category 2, 3, 4 or 5 hurricanes as declared

by the National Weather Service; or 2)

creates hurricane force winds to category 2 or

higher, as determined by the National

Weather Service, anywhere in the county

within New York State, in which the covered

property is located

5% -

Suffolk: all locations

Nassau: all locations

Kings: all locations

2% -

Queens: all locations

Richmond: all locations

Bronx: all locations

New York: all locations

Westchester: all locations within 2 miles

of the shore

Holyoke Mutual in Salem

Based on Coverage A limit:

$124,000 & Under N/A

$125,000-$300,000 $2,500

$300,001-$600,000 $5,000

$600,001-$$1,000,000 $7,500

$1,000,000 & Over $10,000

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

Hurricane deductible applies to a hurricane

loss that occurs within a period of 12 hours

before or 12 hours after the storm which

caused the loss makes landfall anywhere in

NYS as a declared Category 2, 3, 4 or 5

hurricanes by the National Weather Service.

2,500 ft from south areas along the shore

of Kings, Queens, Richmond and Suffolk

counties.

1,000 ft. from north shore areas along

the shores of Bronx, Nassau,

Westchester and Suffolk counties.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

21

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Homesite Insurance

Company of New York

HO Program II

2% and 5% of Coverage A limits

for Standard and Deluxe Policies.

5% - Coverage A

2% - Coverage A

The hurricane deductible applies to

windstorm loss that occurs within a period of

12 hours before or 12 hours after the storm

which caused the loss makes landfall

anywhere in New York State as a declared

Category 1, 2, 3, 4 or 5 hurricanes, or

makes landfall outside of New York State,

but which is determined by the

National Weather Service to provide

Category 1 or higher force winds in the

area within New York State in which the

losses occur.

"Declared" means declared by the National

Weather Service.

The deductible applies to windstorm loss that

occurs within a period of 12 hours before or

12 hours after the storm which caused the

loss makes landfall anywhere in New York

State as a declared Category 1, 2, 3, 4 or 5

hurricanes. Category 1 hurricane is a storm

that originates in the tropics and results in

either a sustained wind speed of at least 74

miles per hour or a storm surge of at least six

feet above normal.

“

5%: Richmond, Queens, New York,

Bronx, Kings, Nassau, and Suffolk; and

specific zip codes in Westchester

County.

2%: Specific zip codes in Westchester

County.

Richmond, Queens, New York, Bronx,

Kings, Nassau, Suffolk

Selected Areas in Westchester

Hyundai Marine & Fire

Ins. Co

2%

Windstorm loss that occurs within a period of

12 hours before or 12 hours after the storm

which makes landfall anywhere in the New

York State as a declared Category 2, 3, 4, or

5 hurricanes.

“Declared” means declared by the national

Weather Service.

Richmond, Queens, Bronx, Kings,

Suffolk, Westchester, and Nassau

Counties.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

22

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

ISO

Optional See Note A

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible is applicable when a

windstorm loss occurs 12 hours before or 12

hours after a Category 2 hurricane, as

determined by the National Weather Service,

makes landfall anywhere in NYS.

See Note A.

Kansas City Fire &

Marine

3% and 5%, depending on

distance from shore.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

Category 2

Westchester: 1,500’ or less from shore =

3%;

1 ml. or less from shore in following

areas: Queens, Kings, Richmond, New

York and Bronx, entire southern shore of

Suffolk County, the Suffolk County

forks and northern shore of Suffolk

County east of and including zip code

11778 = 5%;

All other areas in the above counties

(except Westchester county) = 3%.

Kemper Group

2% & 5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible is applicable when a

windstorm loss occurs 12 hours before or 12

hours after a Category 2 hurricane, as

determined by the National Weather Service,

makes landfall anywhere in NYS.

5 NYC boroughs, Nassau, Suffolk and

Westchester counties

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

23

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Kemper Independence

Insurance Co.

3% and 5%

Applies to windstorm loss that occurs in the

time period:

• Beginning at the time a category 1 or higher

hurricane determined and declared by the

National Weather Ser-vice makes landfall in

any part of the “state” of New York

• In which a hurricane makes landfall outside

of New York State but is determined by the

National Weather Service to have Category 1

or higher force winds in the territory within

New York State in which the losses occur.

If a hurricane produces a minimum

hurricane wind speed at any NWS

measuring site in the county in which the

dwelling is located, this deductible will

apply.

5%:

- 1000’ of the shore in Richmond

- 2500’ of the northern shore of

LI; and

- 1 mile of the southern shore of

LI.

3%:

- Nassau, Suffolk, Queens,

Kings, New York, Bronx,

Richmond Counties where the

5% deductible is not required;

and

- Original policy effective date

prior to 07/09/2009: Within

1,500 feet of the shore in

Westchester County; or

Original policy effective date on

or after 07/09/2009: Within

two miles of the shore in

Westchester County

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

24

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Kingstone Insurance Co.

Category 1: $1,000

Category 2: 2% or 5%

The deductible is $1000 for Category 1

hurricane of 74 mph and 2% and 5% for

Category 2 hurricanes of 96 mph.

Will apply to any windstorm loss that occurs

12 hours before a hurricane begins resulting

in Category 1 hurricane force winds or

hurricane force winds of a greater velocity in

any coastal county, regardless of the specific

location of your property, and ends 12 hours

after a hurricane resulting in category 1

hurricane force winds or hurricane force

winds of a greater velocity in any coastal

county, regardless of the specific location of

your property.

Bronx, Kings, Nassau, New York,

Queens, Richmond, Suffolk and

Westchester: 2%

Lancer

See Note A.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible shall be activated only in the

event a Category 2 Storm, as defined by the

National Weather Service, makes landfall

within the geographic boundaries of the State

of New York and shall apply only to losses as

a result of that storm for damage and loss

covered under the peril of windstorm.

See Note A.

Lemonade Insurance

Company

1%, 2%, and 5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

A higher percentage or fixed dollar

deductible amount that applies to Windstorm

loss that occurs within a period of 12 hours

before or 12 hours

after the storm which caused the loss makes

landfall anywhere in New York State as a

declared Category 2,

3, 4 or 5 hurricanes.

"Declared" means declared by the National

Weather Service.

Nassau and Suffolk counties:

Minimum mandatory

Hurricane Deductible equal to 5% if

the insured property is located within

1 mile of the North shore or within 5

miles of the South shore. A

Hurricane Deductible equal to 2% for

all other property.

Queens, Kings, Richmond counties:

Minimum mandatory Hurricane

deductible equal to 5% if the insured

property is located within one mile of the

coast, 2% if the insured property is

located between 1‐5 miles of the coast,

and 1% for all other property.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

25

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Liberty Mutual Fire;

Liberty Insurance Corp.;

LM Ins. Corporation; and

The First Liberty Ins.

Corporation

5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

Bronx, Kings, Nassau, New York, Queens,

Richmond and Suffolk counties

A “Hurricane” is defined as a storm system

that has been declared a Hurricane by the

National Weather

Service and which causes sustained winds of

greater than or equal to 74 miles per hour in

any part of the state of New York. It includes

the wind, wind gusts, hail, rain, lightning,

snow or sleet, tornadoes or cyclones or any

other weather conditions caused by or

resulting from the storm system.

Westchester County

A “Hurricane” is defined as a storm system

that has been declared a Hurricane by the

National Weather

Service and which causes sustained winds of

greater than or equal to 96 miles per hour in

any part of the state of New York. It includes

the wind, wind gusts, hail, rain, lightning,

snow or sleet, tornadoes or cyclones or any

other weather conditions caused by or

resulting from the storm system.

The “Duration of a Hurricane” means the

time period beginning 12 hours before and

ending 12 hours after

the hurricane which caused the loss makes

landfall anywhere in New York State as

determined by the

National Weather Service, or makes landfall

outside of New York State, but which is

determined by the

National Weather Service to provide

Category 1 (Category 2 for Westchester) or

higher force winds in the area within New

York State in which the losses occur.

Bronx, Kings, Nassau, New York,

Queens, Richmond, Suffolk, and

Westchester counties.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

26

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Massachusetts Bay Ins

Co.

HO-4 Wrap Around Endorsement

for risks less than 1 mile.

5% and 2% applies to risks 1 to 3

miles and greater.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

(a) To a windstorm loss that occurs within a

period of 12 hours before or 12 hours after

the storm which caused the loss makes

landfall anywhere in New York State as a

declared Category 1, 2, 3, 4 or 5 hurricanes

by the national Weather Service.

(b) To a windstorm loss that occurs within a

period of 12 hours before or 12 hours after

the storm which caused the loss makes

landfall outside of New York State, but

which is determined to be a Category 1 or

higher force winds by the national Weather

Service in the area (territory) within New

York State in which the loss occurs.

“Declared” means declared by the National

Weather Service.

For Nassau and Suffolk Counties: a 5%

windstorm deductible for risks located 1

to 3 miles or greater from distance to

nearest shore line.

HO-4 Windstorm Wrap Around

endorsement for risks located less than 1

mile form the distance to nearest shore

line.

For Kings, New York, Bronx, Queens,

Richmond and Westchester Counties:

2% Windstorm deductible for risk

located 1 to 3 miles and greater from

distance to nearest shore line.

HO-4 Windstorm Wrap around

endorsement for risks less than 1 mile

from distance to nearest shore line.

Merchants Mutual

Insurance Company

Adopted ISO’s deductible with

the exception of a mandatory

$500 windstorm deductible for

the affected areas.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

3% and 5%

The deductible is applicable when a

windstorm loss occurs 12 hours before or 12

hours after a Category 1 hurricane, as

determined by the National Weather Service,

makes landfall anywhere in NYS.

5% - within 1 mile of the south shore in

Nassau, Suffolk, Queens, Kings, Bronx,

New York and Richmond Counties;

- any property east of East Hampton on

the South Branch of LI; and

- any property east of Southold on the

North Fork of LI.

3% - within 1 ml of the shore in

Westchester County; and

- remainder of properties located in

Nassau, Suffolk, Queens, Kings, Bronx,

New York and Richmond Counties.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

27

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Merchants Preferred

Insurance Company

Adopted ISO’s deductible with

the exception of a mandatory

$500 windstorm deductible for

the affected areas.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

3% and 5%

The deductible is applicable when a

windstorm loss occurs 12 hours before or 12

hours after a Category 1 hurricane, as

determined by the National Weather Service,

makes landfall anywhere in NYS.

5% - within 1 mile of the south shore in

Nassau, Suffolk, Queens, Kings, Bronx,

New York and Richmond Counties;

- any property east of East Hampton on

the South Branch of LI; and

- any property east of Southold on the

North Fork of LI.

3% - within 1 ml of the shore in

Westchester County; and

- remainder of properties located in

Nassau, Suffolk, Queens, Kings, Bronx,

New York and Richmond Counties.

Mercury Casualty

5% mandatory for risks located

less than 1 mile of the shore.

3% mandatory for risks located 1

mile or greater from the shore.

Category 1 or higher as designated by the

National Weather Service.

Kings, Queens, Westchester, Nassau,

Suffolk, Bronx, Richmond and New

York.

Merrimack Mutual Fire

2%

When a windstorm loss occurs within a

period of 12 hours before or 12 hours after

the Category 1 or higher (landfall anywhere

in NY State).

Richmond, Queens, Bronx, Kings,

Suffolk and Nassau

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

28

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Metropolitan P&C

Economy Premium

Assurance Co.

2%, 3%, 5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

Category 1

1. beginning 12 hours prior to the time

that a wind speed exceeding 74miles

per hour occurs in any part of New York

State during a hurricane, as estimated by the

NWS.

2. during the duration of such Hurricane

3. and ending 12 hours after the last time the

NWS declares that the hurricane has been

downgraded to a tropical storm.

Bronx, New York, Richmond: 3%

Kings, Queens, Nassau, Suffolk: 5%

within 1 mile of coast; 3% elsewhere

Westchester: 3% selected zip codes; 2%

selected zip codes; and AOP deductible

elsewhere.

MIC General Ins. Corp.

5%

Applies to Windstorm loss that occurs within

a period of 12 hours before or 12 hours after

the storm makes landfall anywhere in New

York State as a declared Category 1, 2, 3, 4,

or 5 hurricanes. “Declared” means declared

by the National Weather Service.

Kings, Queens, Richmond, Suffolk,

Westchester and Nassau

Mountain Valley

Indemnity Company

5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible applies to windstorm loss that

occurs within a period 12 hours before or 12

hours after the storm makes landfall

anywhere in NYS as a declared Category 1,

2, 3, 4 hurricanes.

“Declared” means declared by the National

Weather Service.

Richmond, Queens, Kings, Bronx,

Nassau, Westchester and Suffolk

County.

Narragansett Bay Ins Co

5%, 3% ,2%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

A percentage of the Coverage A dwelling

limit of liability deductible applies to

windstorm loss that occurs within a period of

12 hours before or 12 hours after the storm

which caused the loss makes landfall

anywhere in the residence premises state of

New York as a declared Category 1, 2, 3, 4

or 5 hurricanes.

5% - Suffolk

3% Suffolk – greater than 1 mile of

nearest coast;

Nassau

2% - Nassau - greater than one mile of

nearest coast

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

29

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

National General Ins. Co.

Owners:

3% - Kings, Queens,

Richmond, Nassau and

the Bronx and within 2

miles of the coastline in

Westchester

5% - Suffolk

Tenants/Co-ops and

Condo: $1,000

Windstorm loss that occurs within a period

of 12 hours before or 12 hours after the

Category 1, 2, 3, 4 or 5 hurricane which

caused the loss:

-makes landfall anywhere in the state of New

York as determined by the National Weather

Service; or

-makes landfall outside of the state of New

York State but which is determined by the

National Weather Service to provide

Category 1 or higher force winds in the

territory within New York State in which the

losses occur.

Bronx, Suffolk, and within 2 miles of

the coastline in Westchester

National Grange

2%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible is applicable to a windstorm

loss that occurs within a period of 12 hours

before or 12 hours after the storm, which

caused the loss, makes landfall anywhere in

New York State as declared Category 2, 3, 4

or 5 hurricanes by the National Weather

Service.

Long Island

Nationwide Property &

Casualty Ins co

Nationwide Mutual Fire

Insurance

Nationwide General

Insurance Company

2%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The hurricane deductible is applicable to

hurricane losses, as defined below, that occur

within a period of 12 hours before or 12

hours after the storm which caused the loss

makes landfall anywhere in New York State.

“Hurricane" means any one storm which:

1. Is declared to be a "hurricane" by the

National Hurricane Center/Tropical

Prediction Center; and

2. As a declared "hurricane", produces

"hurricane" force sustained winds:

a. Over land in the state of New York in the

county in which losses occur; or

b. The eye of the "hurricane" moves on shore

in the state of New York.

Any storm, including a tropical storm, which

does not become a "hurricane" as declared by

the National Hurricane Center/Tropical

Prediction Center will not be considered a

"hurricane.”

Bronx County, Kings County, Nassau

County, New York County, Queens

County, Richmond County, Suffolk

County and zip codes 10538, 10543,

10573, 10580, 10801, 10802, 10803,

and 10805 in Westchester County.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

30

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

NGM

2%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible is applicable to a windstorm

that occurs within a period of 12 hours before

or 12 hours after the storm which caused the

loss makes landfall anywhere in New York

State as a declared Category 2, 3, 4 or 5

hurricanes.

"Declared" means declared by the National

Weather Service.

Minimum 2% Catastrophe deductible will

be applied to Homeowner risks located

in Nassau and Suffolk Counties that

do not have a minimum 2% Standard

Windstorm Deductible.

Norfolk & Dedham

5%, 2% or 1%, depending from

the distance from shore.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible applies to losses which occur

as a result of either: a) a Category 1 or higher

hurricane making landfall in NYS, or b) a

hurricane making landfall outside of NYS,

but which is determined by the National

Weather Service to be a Category 1 or higher

hurricane force winds in the area within NYS

in which the losses occur.

Long Island, Westchester, Brooklyn and

Queens :

0-1 mile = 5%

1-2 miles = 2%

over 3 miles = 1%

NY Casualty

1%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The hurricane deductible applies to

windstorm loss that occurs within a period of

12 hours before or 12 hours after the storm

which caused the loss makes landfall

anywhere in NYS as declared by the National

Weather Service to be a category 1,2,3,4 or 5

hurricanes.

Kings, Queens, Richmond, Suffolk, &

Nassau Counties.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

31

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

NY Central Mut.

For “A” program only

3% & 5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

3% and 5%

The deductible applies to windstorm loss that

occurs within a period of 12 hours before or

12 hours after the storm which caused the

loss makes landfall anywhere in NYS as

declared by the National Weather Service to

be a Category 2, 3, 4, or 5 hurricanes.

The Catastrophe Windstorm deductible is

subject to:

A higher percentage amount that applies to

Windstorm loss that occurs within a period of

12 hours before or 12 hours after the storm

which caused the loss makes landfall

anywhere in New York State as a declared

Category 2, 3, 4 or 5 hurricanes.

“Declared” means declared by the National

Weather Service.

3% - Applicable to Bronx, Kings,

Queens, Richmond, New York, Nassau

County and within 1500 feet from the

shore in Westchester County.

5% - Applicable in Suffolk County.

3% - Applicable in Nassau County,

Kings, Queens, Richmond, Bronx, New

York and within 1500 feet of the shore

in Westchester county.

5% - Applicable in Suffolk county.

Optional 4% and 10% are available.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

32

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Occidental F & C

5% Category 1 &

3% Category 2

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

5%, Category 1 for risks located

2500 feet from the north shore of

Nassau, Suffolk, and Queens;

2500 feet from the shore of the

Bronx and Westchester; 1 mile

from the south shore of Nassau,

Suffolk, Queens, Kings and

Richmond; and throughout the

following zip codes in Suffolk

County: 11935, 11939, 11944,

11948, 11952, 11957 11958,

11964, 11937, 11946, 11954,

11963, 11968, 11976, 11965 and

11971.

3%, Category 2 for all remaining

risks in the applicable territories

The 5%, Category 1 deductible will apply to

such loss caused by a hurricane windstorm to

an insured location during the following time

period:

a) beginning 24 hours prior to the time

that a wind speed exceeding 73

miles per hours that occurs in any

part of the state of New York during

a hurricane, as estimated by the

National Weather Service;

b) during the duration of such

hurricane; and

c) ending 12 hours after the last time

the National Weather Service

declares that the hurricane has been

downgraded to a tropical storm.

The 3 %, Category 2 deductible will apply to

such loss caused by a hurricane windstorm to

an insured location during the following time

period:

a) beginning 24 hours prior to the time

that a wind speed exceeding 95

miles per hours that occurs in any

part of the state of New York during

a hurricane, as estimated by the

National Weather Service;

b) during the duration of such

hurricane; and

c) ending 12 hours after the last time

the National Weather Service

declares that the hurricane has been

downgraded to a tropical storm.

Nassau, Suffolk, Kings, Queens, Bronx,

Richmond, New York and Westchester.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

33

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

One Beacon

3% and 5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible applies to windstorm loss that

occurs within a period of 12 hours before or

12 hours after the storm which caused the

loss makes landfall anywhere in NYS as

declared by the National Weather Service to

be a Category 2, 3, 4, or 5 hurricanes.

Long Island, Staten Island, Queens,

Bronx, Brooklyn and NY.

3% for dwellings located in Richmond,

Queens, Bronx, Kings and Nassau

Counties.

5% for all dwellings located in Suffolk

County

Pacific Employers

5%

2%

1%

Optional higher 2%, 5% 10%

Category One or higher hurricane making

landfall anywhere in the State of NY or,

any hurricane making landfall outside the

State of NY, provided there are Category 1or

higher Hurricane force winds in the area

within NYS as determined by the National

Hurricane Center or the National Weather

Service.

Nassau and Suffolk

5% hurricane deductible if within 3

miles of the Atlantic shore

2% hurricane deductible if more than 3

miles away from Atlantic shore

Richmond, King, Queens

1% hurricane

Optional 1%, 2%, 5%, 10% in Bronx

and Westchester Counties (excluding

Yonkers)

Peerless Insurance

Company

Mandatory 5%

The company will continue to

write new business if the distance

is greater than one mile from

shore, and between 2,500 feet and

one mile from the shore if the risk

elevation is greater than 15 feet.

Category 2

The hurricane deductible applies to

windstorm loss that occurs within a period of

12 hours before or 12 hours after the storm

which caused the loss makes landfall

anywhere in NYS as declared by the National

Weather Service to be a Category 2, 3, 4 or 5

hurricanes.

5% in territories of Richmond, Queens,

Bronx, Kings, Suffolk, Nassau.

2% in Westchester County if the insured

dwelling is less than two(2) miles from

the coast

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

34

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Pennsylvania General

$1000, 3% & 5%.

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible applies to windstorm loss that

occurs within a period of 12 hours before or

12 hours after the storm which caused the

loss makes landfall anywhere in NYS as

declared by the National Weather Service to

be a Category 2, 3, 4, or 5 hurricanes.

3% for Kings, Queens, Nassau,

Richmond and the Bronx and a 5% for

and Suffolk counties and 3% within one

mile in Westchester county for forms

HO-2 and HO-3.

For forms HO-4 and HO-6, a $1,000

deductible will be applied in the counties

of Westchester, Kings, Queens,

Richmond, Nassau, Suffolk and the

Bronx.

Preserver Ins. Co.

Owners:

3% - Kings, Queens, Richmond,

Nassau and the Bronx and within

2 miles of the coastline in

Westchester

5% - Suffolk

Tenants/Co-ops and Condo:

$1,000

Windstorm loss that occurs within a period

of 12 hours before or 12 hours after the

Category 1, 2, 3, 4 or 5 hurricane which

caused the loss:

a.-makes landfall anywhere in the state of New

York as determined by the National Weather

Service; or

b.-makes landfall outside of the state of New

York State but which is determined by the

National Weather Service to be a category 1

or higher force winds in the territory within

New York State in which the losses occur.

Kings, Queens, Richmond, Nassau,

Bronx, Suffolk, and within 2 miles of the

coastline in Westchester

Property & Casualty of

Hartford

5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible applies to losses which occur

as a result of either: a) a Category 2 or higher

hurricane making landfall in NYS, or b) a

hurricane making landfall outside of NYS,

but which is determined by the National

Weather Service to be a Category 2 or higher

hurricane force winds in the area within NYS

in which the losses occur.

Staten Island, Queens, Brooklyn, Nassau

and Suffolk.

Providence Washington

1%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible applies to windstorm loss that

occurs within a period of 12 hours before or

12 hours after the storm which caused the

loss makes landfall anywhere in NYS as

declared by the National Weather Service to

be a Category 1, 2, 3, 4, or 5 hurricanes.

See Note A.

NEW YORK STATE HOMEOWNERS COVERAGE

APPROVED INDEPENDENT MANDATORY HURRICANE DEDUCTIBLES: REVISED AS OF 12/13/2019

35

Company Name

% Deductible based on Dwelling

(A)

Trigger (Circumstances under which

deductible is applicable)

Territory

Prudential

2%, 3% and 5%

The deductible amount applies to

the dwelling’s insured value of the

dwelling.

The deductible is applicable to a windstorm

loss caused by winds in New York from at

least a Category 2 hurricane as classified by

the National Weather Service.

2% for Bronx and Westchester Counties;

For the remainder of the Coastal areas: a

3% beyond one mile of southern

shoreline; or

a 5% in the Forks of Suffolk County and

within 1 mile of the southern shoreline.

Quincy Mutual

(Introduction of

mandatory hurricane

deductible)

Same as ISO (except differences

noted in Comments).

The deductible amount applies to

the dwelling’s insured value

The deductible is applicable when a

windstorm loss occurs 12 hours before or 12

hours after a Category 2 hurricane, as

determined by the National Weather Service,