HOMEOWNERSHIP

Information on

Mortgage Options and

Effects on

Accelerating Home

Equity Building

Report to the Honorable Richard Shelby,

U.S. Senate

March 2018

GAO-18-297

United States Government Accountability Office

United States Government Accountability Office

Highlights of GAO-18-297, a report to the

Honorable Richard Shelby, U

.S. Senate

March 2018

HOMEOWNERSHIP

Information on Mortgage

Options and Effects on

Accelerating Home Equity Building

What GAO Found

Federal homeownership assistance programs generally are not designed to

accelerate equity building (home equity is the difference between the value of a

home and the amount owed on a mortgage). For example, programs that offer

grants for down-payment assistance can provide a one-time boost to home

equity. However, these programs are not specifically designed to accelerate

equity building—that is, increasing the pace of paying off principal more quickly

than would be the case with a 30-year fixed-rate mortgage. Instead, the focus of

federal programs is on providing affordable access to homeownership, including

through grants, loans, and mortgage insurance or guarantees. For instance,

federal mortgage insurance programs help provide market liquidity by protecting

lenders from losses, in turn increasing access to credit and homeownership, and

ultimately, the opportunity for equity building for home buyers.

Borrowers have options to accelerate equity building that include obtaining

shorter-term mortgages, making more frequent or additional payments, or

choosing a mortgage product designed to accelerate equity building. For

example, a mortgage product introduced by private lenders in 2014—the Wealth

Building Home Loan (WBHL)—has features designed to accelerate equity

building, including shorter terms (15 or 20 years) and the option to buy down the

interest rate. The product also allows for no down payment. However, these

products have trade-offs, including the following:

• Shorter-term loans build home equity (in terms of principal reduction) at a

faster rate, but require higher monthly payments (see fig.). Payments for a

15-year fixed-rate mortgage can be more than 40 percent higher than for a

30-year fixed-rate mortgage.

• Higher payments may make mortgages less affordable or limit access for

lower-income borrowers. For example, higher payments may result in a

higher debt-to-income ratio for some home buyers, which may prevent them

from qualifying for a mortgage unless they buy a less expensive home.

• In contrast, all else equal, loans with a shorter term generally have reduced

credit risk—the likelihood of a home buyer defaulting on a mortgage—for

lenders.

Principal Reduction Pace: 15-Year Fixed-Rate Wealth Building Home Loan (WBHL) versus 30-

Year Fixed-Rate Loan

Note: Monthly mortgage payments do not include property tax or any type of insurance. Interest rates

used are generally consistent with market rates in September and October 2017.

View GAO-18-297. For more information,

contact

Daniel Garcia-Diaz, 202-512-8678 or

GarciaDiazD@gao.gov

Why GAO Did This Study

The federal government has a number

of programs to help increase access to

affordable homeownership for first-time

buyers and lower-income households,

including programs that provide

guarantees for certain types of

mortgages and funding that can be

used for down-payment assistance.

Generally, homeowners can build

home equity by making payments on a

mortgage to reduce the outstanding

principal (assuming home value does

not depreciate). Recently, there has

been interest in mortgage products that

accelerate home equity building.

GAO was asked to explore options for

building equity through

homeownership. This report discusses

(1) how federal homeownership

assistance programs affect home

equity building; and (2) options,

including private-sector mortgage

products, through which borrowers can

accelerate home equity building and

the trade-offs of these options for both

borrowers and lenders.

GAO analyzed relevant laws and

program guidance of federal

homeownership assistance programs.

GAO attended housing conferences

and interviewed relevant federal and

state agency officials, academics, and

industry stakeholders, including

mortgage insurers and lenders, to

identify existing and proposed

accelerated equity-building products

and mechanisms and to better

understand the benefits and trade-offs

of accelerated equity building. GAO

also developed examples of mortgage

scenarios to illustrate the trade-offs of

accelerated equity building. Federal

agencies provided technical

comments, which were incorporated

where appropriate.

Page i GAO-18-297 Homeownership

Letter 1

Background 3

Federal Homeownership Assistance Programs Can Have Equity-

Building Effects, but Are Not Specifically Designed to

Accelerate Equity Building 11

Options and Mechanisms That Accelerate Equity Building Present

Trade-offs for Homeowners and Lenders 18

Agency Comments 37

Appendix I Objectives, Scope, and Methodology 38

Appendix II CoreLogic Home Equity Data, by State 41

Appendix III GAO Contact and Staff Acknowledgments 43

Tables

Table 1: Examples of Federal Homeownership Assistance

Programs and Effects on Equity Building 12

Table 2: Examples of Mortgage Loan and Refinancing Fees and

Cost Estimates 20

Table 3: Examples of Different Mortgages’ Effects on Debt-to-

Income Ratio 31

Table 4: Example of Different Mortgage Type’s Effect on

Purchasing Power 33

Figures

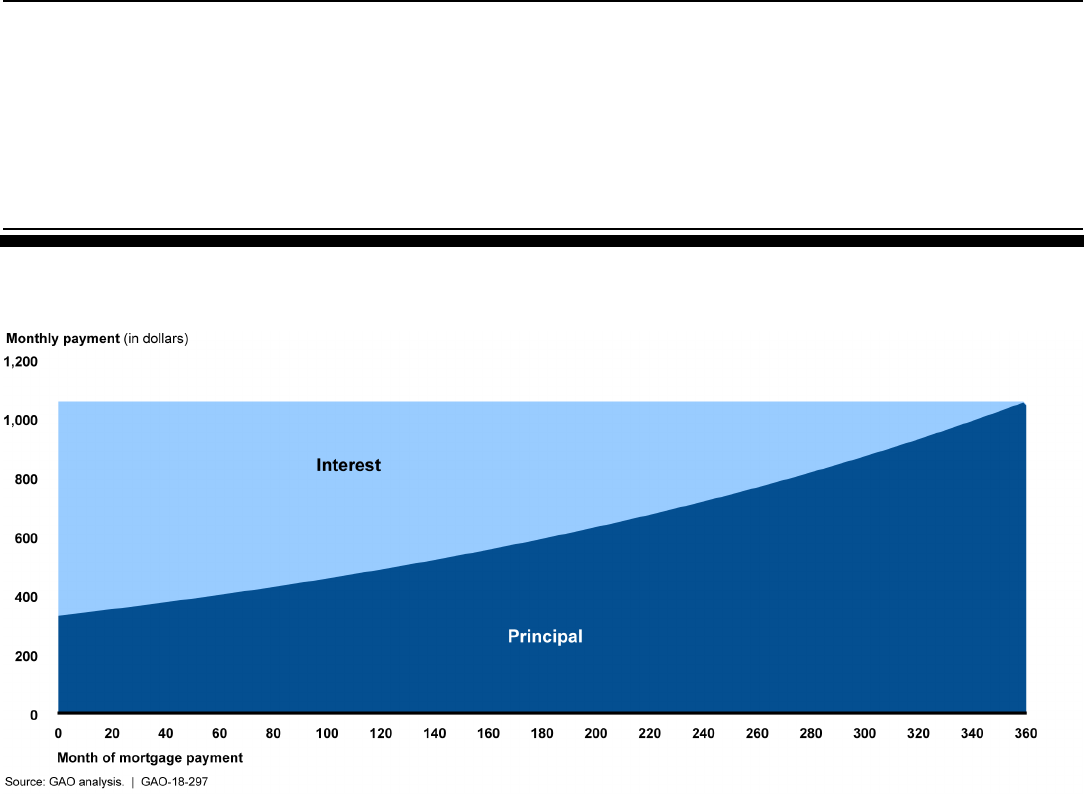

Figure 1: Example of the Allocation of Monthly Mortgage Payment

to Interest and Principal, for a Selected 30-Year Fixed-

Rate Mortgage 6

Figure 2: Example of Home Equity Built over Time for a $225,000,

30-year Fixed-Rate Mortgage: Required Payment versus

Additional $100 Payment Each Month 19

Figure 3: Examples of the Effects of Select Refinancing Scenarios

on Home Equity 21

Contents

Page ii GAO-18-297 Homeownership

Figure 4: Comparison of Home Equity Built over Time: 15-year

Wealth Building Home Loan (WBHL) versus 15- and 30-

Year Fixed-Rate Mortgages 23

Figure 5: Overview of Monthly Payment Scenarios for Fixed-

Payment Cost-of-Funds Index (Fixed-COFI) Mortgage 26

Figure 6: Example of Loan-to-Value (LTV) Ratio over 5.5 years,

15-Year Fixed-Rate Mortgage (103 Percent LTV Ratio at

Origination), and 30-year Fixed-Rate Mortgage (80

Percent LTV Ratio at Origination) 28

Figure 7: Total Interest Paid on a $250,000 Mortgage under

Different Scenarios 29

Figure 8: Percentage of Residents with Less Than 20 Percent in

Home Equity, by State, as of First Quarter 2017 42

Page iii GAO-18-297 Homeownership

Abbreviations List

AHP Affordable Housing Program

ARM adjustable-rate mortgage

CDBG Community Development Block Grant

Dodd-Frank Dodd-Frank Wall Street Reform and Consumer

Protection Act

enterprises Fannie Mae and Freddie Mac

Federal Reserve Board of Governors of the Federal Reserve

FHA Federal Housing Administration

FHFA Federal Housing Finance Agency

FHLBanks Federal Home Loan Banks

Fixed-COFI Fixed-Payment Cost-of-Funds Index

HUD Department of Housing and Urban Development

LTV loan-to-value

QM qualified mortgage loans

RHS Rural Housing Service

USDA Department of Agriculture

VA Department of Veterans Affairs

WBHL Wealth Building Home Loan

This is a work of the U.S. government and is not subject to copyright protection in the

United States. The published product may be reproduced and distributed in its entirety

without further permission from GAO. However, because this work may contain

copyrighted images or other material, permission from the copyright holder may be

necessary if you wish to reproduce this material separately.

Page 1 GAO-18-297 Homeownership

441 G St. N.W.

Washington, DC 20548

March 15, 2018

The Honorable Richard Shelby

United States Senate

Dear Senator Shelby:

The federal government has a number of programs to help increase

access to affordable homeownership for first-time buyers and lower-

income households, including programs that provide guarantees for

certain types of mortgages and funding that can be used for down-

payment assistance.

1

Homeownership has long been perceived to

provide a number of financial and nonfinancial benefits. For example,

homeownership can build wealth through the accumulation and

appreciation of home equity—the difference between the value of a home

and the amount owed on the mortgage.

2

Home equity can serve as a

financial cushion in times of hardship or financial emergencies, especially

among lower-income households for whom housing generally constitutes

a larger percentage of assets than for higher-income households.

3

According to the U.S. Census Bureau, the homeownership rate was

about 64 percent at the end of the third quarter 2017, and according to

the Board of Governors of the Federal Reserve (Federal Reserve), the

total outstanding mortgage debt in the same period was $10.5 trillion. In

addition, more than 21 percent of homeowners had less than 20 percent

equity in their homes (see app. II for more information). According to our

analysis, for a borrower who bought a home with a 30-year fixed-rate

mortgage and a small down payment, it could take more than 8 years in

the current interest rate environment to achieve 20 percent equity in the

home (assuming the home’s value remained unchanged from loan

1

We use “lower-income” to refer to households for which federal homeownership

assistance programs are generally targeted, though many programs have specific income

eligibility requirements.

2

Although there are many ways to build equity and wealth—including saving and investing

in other types of financial assets—this report will focus on building equity through

homeownership.

3

Board of Governors of the Federal Reserve System, Survey of Consumer Finances

(Washington, D.C.: 2016).

Letter

Page 2 GAO-18-297 Homeownership

origination).

4

Homeownership can build wealth, but it also entails risks

(such as depreciating home values) and costs (such as for maintenance,

taxes, and insurance). Recently there has been some interest in

mortgage products designed to accelerate equity building—that is,

products that increase the ongoing pace of paying off the loan principal

compared to a traditional 30-year fixed-rate mortgage—and improve

access to homeownership.

5

You asked us to explore options for building equity through

homeownership.

6

This report describes (1) how federal homeownership

assistance programs affect home equity building, and (2) options,

including private-sector mortgage products, through which borrowers can

accelerate home equity building and the trade-offs of these options for

both borrowers and lenders. You also asked us to include regional data

on equity building, which is included in an appendix to this report.

To address these objectives, we reviewed relevant literature, including

prior GAO reports on housing assistance and homeownership, housing

finance, and mortgage reforms.

7

We interviewed officials with knowledge

of federal homeownership assistance programs from the Department of

Housing and Urban Development (HUD), Federal Housing Finance

Agency (FHFA), Department of Agriculture (USDA), Department of

Veterans Affairs (VA), Fannie Mae, Freddie Mac, Federal Home Loan

Banks (FHLBanks), and state housing finance agencies. We attended

housing conferences and met with housing experts and stakeholders from

academia, housing advocacy organizations, and industry, including

mortgage lenders and insurers, selected because they made proposals to

increase homeownership or build home equity faster, wrote on

4

For this scenario, we assumed that a homeowner purchased a $250,000 home with 3

percent down and that the interest rate on the loan was 3.875 percent.

5

For purposes of our report, we are defining accelerated equity building as increasing the

ongoing pace of paying down principal, and not just a one-time extra payment towards

principal.

6

This review was conducted in response to a 2016 request from Senator Richard

Shelby—then Chairman, Senate Committee on Banking, Housing, and Urban Affairs.

7

For example, see GAO, Housing Assistance: Opportunities Exist to Increase

Collaboration and Consider Consolidation, GAO-12-554 (Washington, D.C.: Aug. 16,

2012); Housing Finance System: A Framework for Assessing Potential Changes,

GAO-15-131 (Washington, D.C.: Oct. 7, 2014); and Mortgage Reforms: Actions Needed to

Help Assess Effects of New Regulations, GAO-15-185 (Washington, D.C.: June 25,

2015).

Page 3 GAO-18-297 Homeownership

homeownership issues, were recommended by government officials, or

were involved in providing mortgage products designed to accelerate

equity building. From interviews with industry stakeholders and housing

conferences we attended, we were able to identify and review information

on two private-sector mortgage products—one existing and one

proposed—designed to accelerate home equity building. We used

examples from those products to illustrate effects and trade-offs on home

equity of select scenarios. See appendix I for more information on our

scope and methodology.

We conducted this performance audit from January 2017 to March 2018

in accordance with generally accepted government auditing standards.

Those standards require that we plan and perform the audit to obtain

sufficient, appropriate evidence to provide a reasonable basis for our

findings and conclusions based on our audit objectives. We believe that

the evidence obtained provides a reasonable basis for our findings and

conclusions based on our audit objectives.

A homeowner can build home equity immediately by making a down

payment on their home, assuming the down payment is not financed

separately as a loan.

8

Throughout the life of a mortgage, homeowners

can continue to build equity (1) by making regular mortgage payments to

reduce the principal amount outstanding, (2) by making additional

payments to further reduce the principal amount outstanding, and (3)

through appreciation in their home’s value. Additionally, the components

of a mortgage (discussed below) may affect the pace of home equity

building.

Throughout this report, for the purposes of illustrating home equity

building, we assumed that a home’s value remained unchanged from the

time of the loan origination. However, home values are highly contingent

on market conditions and other factors that are beyond a homeowner’s

control. For example, although homes can appreciate in value, homes

also can depreciate in value, which can have a negative effect on

8

This assumes the homeowner purchased the home at or below the appraised market

value. If a homeowner paid more than the appraised market value, the homeowner might

have negative equity in the home.

Background

Home Equity Building

Page 4 GAO-18-297 Homeownership

homeowners’ equity. Homeowners also could lose money on their home if

they sold it shortly after purchasing because principal reduction in the

initial years of a mortgage is relatively small and the benefit of any home

value appreciation would be limited. Additionally, selling a home incurs

transaction costs, such as realtor commissions. To avoid losing money on

a home sale, homeowners would need to sell their home at an amount

higher than their purchase price plus transactions costs. For example, if a

homeowner buys a home for $250,000 (all fees included) and plans to

sell it 3 years later, assuming transaction costs of 10 percent (or

$25,000), the homeowner would have to sell the home for at least

$275,000 to break even, meaning an annual appreciation in home value

of more than 3 percent. If the home’s value did not appreciate at that rate,

or depreciated, the homeowner would lose money on the sale.

The majority of American families achieve homeownership by taking out a

loan—a mortgage—to cover at least some of the purchase price.

9

The

primary components of a mortgage loan are the following:

• Term (duration). The most common term is 30 years. According to

the Urban Institute, the 30-year fixed-rate mortgage represented

approximately 90 percent of the fixed-rate purchase mortgages (that

is, not for refinancing an existing mortgage) originated every month

from January 2010 through July 2017, and 15-year fixed-rate

purchase mortgages represented about 6 percent.

10

• Down payment. Most mortgage lenders require borrowers to make a

down payment (of 3 percent or more of the purchase price, depending

on the mortgage) that is applied to the purchase price of the home. A

down payment also helps a borrower build home equity, assuming the

down payment is not financed as a separate loan.

• Interest rate. Lenders charge borrowers a percentage of the

mortgage amount, in exchange for providing funds to buy a home. An

interest rate can be fixed or adjustable for the life of the mortgage

9

For purposes of this report, a mortgage or mortgage loan refers to both a promissory

note and a security interest. A promissory note evidences the debt and a borrower’s

agreement to make principal and interest payments to the lender for a period of time. To

secure the debt, lenders obtain a lien or security interest in the underlying property as

collateral against borrower default.

10

The 15-year fixed-rate mortgage is more commonly used for refinancing. Urban Institute,

Housing Finance at a Glance: A Monthly Chartbook (Washington, D.C.: October 2017).

Mortgage Loan

Components

Page 5 GAO-18-297 Homeownership

(adjustable-rate mortgage or ARM). Because a fixed-rate mortgage’s

interest rate does not change regardless of prevailing rates, a

borrower’s payments for principal and interest remain the same for the

life of the mortgage. In contrast, an adjustable-rate mortgage’s

interest rate, for which the initial interest is generally lower than for a

fixed-rate mortgage, will adjust at agreed-upon intervals.

11

As a result,

adjustable-rate mortgage payments can increase or decrease

depending on the changes in interest rates and terms of the loan.

• Payment frequency and amount. Payments are generally made on

a monthly basis. Fixed- and adjustable-rate mortgages generally have

fully amortizing payment schedules—that is, the regularly scheduled

payments will fully pay down the principal and interest over the life of

the mortgage, with the amounts allocated to reducing principal and

interest changing over time (see fig. 1).

11

Adjustments generally are based on a specific index rate, and the adjusted rate will fall

within an agreed maximum and minimum range.

Page 6 GAO-18-297 Homeownership

Figure 1: Example of the Allocation of Monthly Mortgage Payment to Interest and Principal, for a Selected 30-Year Fixed-Rate

Mortgage

Note: This scenario is based on an amortized monthly payment for a $225,000, 30-year mortgage

with a fixed annual interest rate of 3.875 percent. The monthly payment amount does not include

taxes, insurance, or any condominium or association fees.

Page 7 GAO-18-297 Homeownership

The U.S. markets for single-family housing finance include a primary

market, in which lenders make (originate) or refinance mortgage loans,

and a secondary market, in which mortgage loans are purchased from

lenders and packaged into securities—known as mortgage-backed

securities—that are sold to investors.

12

The federal government

participates in the primary and secondary mortgage markets.

In the primary market, federal agencies provide homeownership

assistance programs and products intended for increasing access to and

affordability of homeownership. Relevant federal agencies and a

government-sponsored enterprise that provide homeownership

assistance and their primary housing-related policy goals include the

following:

• Department of Housing and Urban Development provides housing

assistance to low-and moderate-income families and promotes urban

development.

• Federal Housing Administration (FHA) seeks to broaden

homeownership, strengthen the mortgage marketplace, and

increase access to credit by providing mortgage insurance.

• Public and Indian Housing helps ensure safe, decent, and

affordable housing through programs such as housing choice

vouchers.

• Community Planning and Development seeks to develop viable

communities and provide decent housing and a suitable living

environment through block grant assistance.

• Department of Veterans Affairs assists service members, veterans,

and eligible surviving spouses of veterans to become homeowners

through guaranteeing and issuing (in limited circumstances)

mortgages for home purchases.

• Rural Housing Service (RHS), which is an agency within USDA,

insures and guarantees housing loans for home purchases, repair,

and rental housing development.

12

In the secondary market, institutions purchase loans from primary market mortgage

originators and then hold the loans in portfolio or bundle the loans into mortgage-backed

securities that are sold to investors. According to FHFA officials, mortgage products,

including mortgage-backed securities, must have features attractive to investors for

securitizing and trading in the secondary market. For example, products must be scalable

in terms of volume, uniformity, and performance data.

The Federal Role in

Mortgage Markets

Page 8 GAO-18-297 Homeownership

• Federal Home Loan Banks help provide liquidity to each bank’s

member financial institutions to support housing finance and

community investment. FHLBank members include commercial

banks, thrifts, and credit unions. FHLBanks provide 10 percent of their

earnings for affordable housing programs, including grants for

affordable housing for households with incomes at or below 80

percent of the area median.

Federal homeownership assistance programs can be categorized in

terms of the products or services they offer or the mechanisms they use.

The categories include mortgage guarantees and insurance, down-

payment assistance, vouchers, and direct loans (discussed in more detail

later in this report). In addition to these categories of homeownership

assistance, tax expenditures, such as exclusions, exemptions, deductions

(including the mortgage interest deduction), credits, deferrals, and

preferential rates, can promote homeownership. For example,

homeowners can take advantage of tax deductions (by choosing to

itemize deductions on their tax returns) to help lower their taxable income.

Taxpayers who itemize deductions may deduct qualified interest they pay

on their mortgage. Taxable income may be reduced by the amount of

interest paid on first and second mortgages of up to $750,000 for homes

purchased generally after December 15, 2017.

13

Additionally, taxpayers

generally may deduct up to $10,000 for state and local taxes, including

property taxes paid by homeowners on their homes.

14

Participation in the secondary mortgage market occurs through the

following entities:

• Fannie Mae and Freddie Mac. Fannie Mae and Freddie Mac are

government-sponsored enterprises (enterprises)—congressionally

chartered, for-profit, shareholder-owned companies. They are the two

13

For homes purchased on or before December 15, 2017, taxpayers can deduct interest

on the total mortgage, generally for debt up to $1 million. Prior to 2018, homeowners

generally could also deduct interest payments on up to $100,000 of home equity debt. For

2017, the mortgage interest deduction cost an estimated $64 billion in forgone income tax

revenue, according to the Joint Committee on Taxation. For taxable years beginning after

December 31, 2025, taxpayers may deduct interest on up to $1 million, regardless of

when the indebtedness is incurred.

14

Prior to 2018, there were no dollar limits on the amounts of property taxes that

homeowners could deduct. The new limitation is applicable to tax years beginning after

December 31, 2017, and before January 1, 2026. For 2017, the deduction of property

taxes for owner-occupied homes cost an estimated $33.3 billion in forgone income tax

revenue, according to the Joint Committee on Taxation.

Page 9 GAO-18-297 Homeownership

largest participants operating in the secondary mortgage market.

15

Generally, Fannie Mae and Freddie Mac purchase mortgage loans

that meet certain criteria for size, features, and underwriting

standards—known as conforming loans—from lenders.

16

In

purchasing loans, the enterprises provide market liquidity, so lenders

can provide more loans to borrowers.

• Ginnie Mae. Ginnie Mae is a wholly-owned government corporation.

Ginnie Mae guarantees the timely payment of principal and interest on

mortgage-backed securities supported by pools of loans backed by

government-insured mortgages, including mortgages insured by FHA,

VA, and USDA.

In a process called underwriting, mortgage lenders evaluate the

creditworthiness of potential borrowers in making mortgage loans, among

other things. Amid concerns that risky mortgage products and poor

underwriting standards contributed to the recent housing crisis, Congress

included mortgage reform provisions in the Dodd-Frank Wall Street

Reform and Consumer Protection Act (Dodd-Frank Act). The Dodd-Frank

Act generally requires lenders to determine consumers’ ability to repay

home mortgage loans before extending credit and provides a

presumption of compliance with the ability-to-repay requirement for

qualified mortgages.

The ability-to-repay regulations set forth lenders’ responsibilities to

determine a borrower’s ability to repay a residential mortgage loan, and

special payment calculation rules apply for loans with balloon payments,

15

The FHFA is an independent agency responsible for oversight of Fannie Mae, Freddie

Mac, and the FHLBanks. FHFA has a statutory responsibility to ensure that these entities

operate in a safe and sound manner and that their operations and activities foster liquid,

efficient, competitive, and resilient national housing finance markets. On September 6,

2008, FHFA placed Fannie and Freddie into conservatorship, due to a substantial

deterioration in their financial condition.

16

The conforming loan limit for single-family homes in 2018 is $453,100 ($679,650 in high-

cost areas) in the contiguous United States, District of Columbia, and Puerto Rico. In

areas outside of the contiguous states, the limit is $679,650 ($1,019,476 in high-cost

areas). Mortgages that are larger than the conforming loan limit are known as “jumbo

loans.”

Mortgage-Related

Regulations

Page 10 GAO-18-297 Homeownership

interest only payments, or negative amortization.

17

The regulations

require lenders to make a reasonable and good faith determination of a

consumer’s reasonable ability to repay a loan. The regulations establish a

safe harbor and a presumption of compliance with the ability-to-repay rule

for certain qualified mortgage loans (QM). The rule generally prohibits

loans with negative amortization, interest-only payments, or balloon

payments from being qualified mortgages, and limits the points and fees a

lender may charge borrowers on a qualified loan.

18

The regulations

establish general underwriting criteria for qualified mortgages. For

example, under QM requirements borrowers generally cannot exceed a

maximum monthly debt-to-income ratio of 43 percent, unless the loan is

eligible for sale to an enterprise.

19

If a mortgage loan meets the

requirements of a QM loan, it is eligible for the safe harbor and the lender

is deemed to have complied with the ability-to-pay requirement unless the

loan is a higher priced mortgage loan. A higher priced mortgage loan that

otherwise meets the definition of a QM is presumed to have complied with

the ability-to-pay requirements, but the presumption can be rebutted if the

consumer proves that the lender did not make a good faith and

reasonable determination of the consumer’s ability to repay.

20

17

When making the ability-to-pay determination, lenders generally must consider at least

eight underwriting factors: (1) current or reasonably expected income or assets; (2)

current employment status; (3) the monthly payment on the covered transaction (the

monthly payment must be calculated based on any introductory rate or fully indexed rate

for the loan, whichever is higher, and substantially equal, fully amortizing monthly

payments); (4) the monthly payment on any simultaneous loan; (5) the monthly payment

for mortgage-related obligations; (6) current debt obligations, alimony, and child support;

(7) the monthly debt-to-income ratio or residual income; and (8) credit history.

18

A point is equal to 1 percent of the amount of a loan.

19

The rule provides for a temporary category of qualified mortgages that have a more

flexible underwriting requirement if they meet the general product feature prerequisites for

a qualified mortgage and are eligible to be purchased by the enterprises. The monthly

debt-to-income ratio represents the percentage of a borrower’s total monthly income that

goes toward total monthly debt obligations, including the mortgage payments,

simultaneous loans, mortgage-related obligations, current debt obligations, alimony, and

child support. A higher ratio is generally associated with a higher risk that the borrower will

have cash flow problems and may miss mortgage payments.

20

In general, a higher-priced mortgage has an annual rate exceeding the prime offer rate

by 1.5 percentage points or more for a first-lien transaction.

Page 11 GAO-18-297 Homeownership

Additionally, federal mortgage insurance is included in the determination

of whether an FHA-insured loan is a higher priced mortgage loan.

21

Existing federal homeownership assistance programs use features and

mechanisms that can have equity-building effects, but the programs are

not specifically designed to accelerate equity building. The programs can

assist homeowners to build equity over time by providing access to

homeownership, but the programs do not have an explicit focus on

accelerating the ongoing pace of paying down the loan principal faster

than a 30-year fixed-rate mortgage. Rather, the overall focus of the

programs is on providing affordable access to homeownership, according

to officials of relevant agencies and entities and based on their mission

goals. For example, the goal of FHA’s mortgage insurance program is to

facilitate access to affordable mortgages for home buyers who might not

be well-served by the private market. FHA implements this goal by

providing insurance to lenders to facilitate access to mortgage financing

for lower-income home buyers.

See table 1 for examples of federal homeownership assistance programs,

by major program types and potential for affecting equity building, either

at a point in time or throughout the life of a mortgage.

21

Qualified Mortgage Definition for HUD Insured and Guaranteed Single Family

Mortgages, 78 Fed. Reg. 75215 (December 11, 2013). Generally, HUD incorporated by

reference certain Bureau of Consumer Financial Protection’s rules and definitions, but

made a specific decision to allow for a higher annual percentage rate than that adopted by

the Bureau for the definition of a safe harbor qualified mortgage. This would remediate the

fact that some FHA loans would fall under the Bureau’s higher priced mortgage loan

definition as a result of the mortgage insurance premium. Including the mortgage

insurance premium in the calculation of the threshold that distinguishes the safe harbor

from the rebuttable presumption mortgage allows the threshold to float as the mortgage

insurance premium fluctuates. 78 Fed. Reg. 75235. HUD did not want the mortgage

insurance premium to be the factor that determines whether a loan is a higher-priced

mortgage loan. 78 Fed. Reg. 75235.

Federal

Homeownership

Assistance Programs

Can Have Equity-

Building Effects, but

Are Not Specifically

Designed to

Accelerate Equity

Building

Page 12 GAO-18-297 Homeownership

Table 1: Examples of Federal Homeownership Assistance Programs and Effects on Equity Building

Type of

homeownership

assistance

Implementing

entity(ies)

Examples of

programs

Potential equity-

building effects

Mortgage insurance

and loan guarantees

Federal Housing Administration

(FHA)

FHA: Single-family mortgage

insurance program

a

Help provide market liquidity with

equity loss protection to lenders,

in turn increasing access to credit

and to homeownership and

opportunity for home equity

building for home buyers.

Department of Veterans Affairs

(VA)

VA: Home Loan Guaranty

Program

b

Rural Housing Service

(RHS)

RHS: Single Family Housing

Guaranteed Loan Program

c

Down payment

assistance

d

Department of Housing and

Urban Development (HUD)

HUD: HOME Investment

Partnership Program, Community

Development Block Grants, and

self-help housing projects

Can immediately increase a

homeowner’s equity. Some down-

payment assistance programs

also allow assistance to be used

to buy down the mortgage interest

rate, which can have ongoing

equity-building effects. A lower

interest rate allows a greater

portion of each monthly mortgage

payment to be applied to the

mortgage principal.

Federal Home Loan Banks

(FHLBanks)

FHLBanks: Grants

provided through each FHLBank’s

members

(financial institutions)

RHS

RHS: Self-help

housing projects

e

Vouchers

HUD

HUD: Housing Choice

Voucher program

Can be used towards down

payment and monthly mortgage

payments, and increase

homeowner’s equity as payments

reduce the mortgage principal.

Direct loans

VA

VA: Direct loans for Native

American veterans

Can help targeted borrowers

access homeownership, which in

turn allows for home equity

building.

RHS

RHS: Single Family Housing

Direct Loan Program

Source: GAO analysis of agency documents. | GAO-18-297

a

FHA’s guarantee provides 100 percent coverage of eligible losses when borrowers default. This

guarantee covers the unpaid principal balance, interest costs, and certain costs of foreclosure and

conveyance.

b

VA guarantees vary, depending on the amount of the loan. At loan levels at or below $45,000, VA

guarantees 50 percent of the loan. Above $45,000 and up to and including $56,250, VA guarantees

$22,500. Above $56,250 and up to and including $144,000, VA guarantees the lesser of $36,000 or

40 percent of the loan. For loan levels above $144,000, the guarantee is the lesser of 25 percent of

the loan or the Freddie Mac conforming loan limit of $417,000 ($625,500 for high-cost areas), which

are adjusted yearly.

c

RHS guarantees are limited to borrowers in rural areas with incomes of less than 115 percent of the

area median income.

d

State and local housing finance agencies also provide down-payment assistance.

e

Self-help housing projects require future homeowners to help build their own houses, and their

“sweat equity” serves as a down payment to reduce the mortgage loan amount.

Page 13 GAO-18-297 Homeownership

Federal mortgage insurance and guarantee programs increase market

liquidity, which ultimately expands access to homeownership. The federal

government commits to pay part or all of a loan’s outstanding principal

and interest loss to a lender or other mortgage holder if the borrower

defaults. Because they obtain insurance or a guarantee against the

possibility of loss from borrower default, lenders are more willing to

provide loans to borrowers who might not otherwise be served by the

private market, allowing more homeowners—particularly lower-income

borrowers—an opportunity to build home equity.

22

FHA offers mortgage insurance and RHS and VA provide loan

guarantees. For example, FHA will insure loans with a down payment as

low as 3.5 percent from most borrowers, and conventional mortgages will

allow down payments as low as 3 percent.

23

FHA-insured loans also have

more lenient credit requirements that particularly benefit minority

households and first-time home buyers who might otherwise find it difficult

or more expensive to take out a mortgage.

24

Among federal mortgage

insurance programs, FHA has the highest volume of mortgages insured.

25

Federal and federally mandated programs that provide funding for grants

and loans for down-payment assistance can have equity-building effects.

Although accelerated equity building is not the policy goal of these

programs, down-payment assistance can lower the barrier to

homeownership for some lower-income home buyers so that the equity-

22

Mortgage insurance or guarantees are available to eligible home buyers. “Insurance”

and “guarantee” generally have the same meaning in the context of our review.

23

Conventional mortgages are mortgages that are not insured by FHA or guaranteed by

another government agency, such as VA or USDA. See Congressional Research Service,

FHA-Insured Home Loans: An Overview, RS20530 (Washington, D.C.: Dec. 23, 2016).

24

One-third of all FHA loans were obtained by minority households in fiscal year 2016. In

calendar year 2015, FHA-insured loans accounted for about 47 percent of all home

purchase mortgages obtained by African-American home buyers and 49 percent of all

home purchase mortgages obtained by Hispanic home buyers. In fiscal year 2016, 82

percent of FHA-insured mortgages for home purchases were obtained by first-time home

buyers. See Federal Housing Administration, Annual Report to Congress: The Financial

Status of the Mutual Mortgage Insurance Fund Fiscal Year 2016, (Washington D.C.:

November 2016).

25

According to Home Mortgage Disclosure Act data, FHA insured 865,897 purchase

mortgages for 1-4 family residences in calendar year 2016, RHS guaranteed 113,944

mortgages, and VA guaranteed 359,811 loans.

Federal Mortgage

Insurance and Loan

Guarantees Increase

Market Liquidity

Federal Down-Payment

Assistance Programs Can

Have Equity-Building

Effects

Page 14 GAO-18-297 Homeownership

building effects of homeownership can accrue. Examples of programs

include the following:

• HUD’s HOME Investment Partnership Program is a block grant

program that provides funding to states and localities to be used

exclusively for affordable housing activities to benefit low-income

households.

26

Funds can be used for down-payment assistance for

eligible low-income home buyers. According to HUD data, more than

75 percent of low-income home buyers who have received assistance

from the HOME program have used HOME funds for purchasing a

home (which includes down-payment assistance) since the program’s

inception in 1992, directly contributing to homeowner equity building.

• HUD’s Community Development Block Grant (CDBG) program also

provides funding to eligible states and localities for community and

economic development efforts, including housing assistance.

27

Eligible uses of home-buyer assistance include grants for down

payments and closing costs. In fiscal year 2016, CDBG funds

provided direct housing assistance for down payment and closing

costs to 2,483 households.

• FHLBanks contribute funding to the Affordable Housing Program

(AHP), which can provide grants for down-payment assistance

through either the AHP competitive or set-aside program.

28

Member

financial institutions of the FHLBanks can apply for the set-aside

funds and then distribute the funds as grants to eligible households.

Set-aside grants may be no greater than $15,000 per household, and

at least one-third of the FHLBanks’ annual set-aside allocation must

be used for eligible first-time home buyers. According to FHFA, the

FHLBanks funded about $77 million for down-payment or closing-cost

26

The HOME Investment Partnerships Program was authorized by the Cranston-Gonzalez

National Affordable Housing Act of 1990 (Pub. L. No. 101-625). Low-income households

are generally defined as households with income at or below 80 percent of area median

income.

27

The Housing and Community Development Act of 1974 created the CDBG program to

develop viable urban communities by providing decent housing and a suitable living

environment and by expanding economic opportunities, principally for low- to moderate-

income persons. See Pub. L. No. 93-383, tit. I, § 101(c), 88 Stat. 633, 634 (codified as

amended at 42 U.S.C. § 5301(c)).

28

The Federal Home Loan Bank Act requires each FHLBank to establish an Affordable

Housing Program. See 12 U.S.C. § 1430(j). An FHLBank may allocate a portion of its

annual AHP contribution to homeownership set-aside programs, which provides grants for

down-payment and closing-cost assistance as well as rehabilitation assistance in

conjunction with a home purchase. See 12 C.F.R § 1291.6(c)(4).

Page 15 GAO-18-297 Homeownership

assistance in 2016 (almost 90 percent of total set-aside program

funding). The down-payment assistance grants have an immediate

equity-building effect.

• RHS and HUD administer self-help grant programs that provide

opportunities for very-low and low-income home buyers to purchase

subsidized homes: Program participants help construct homes in

exchange for subsidies, including down-payment assistance.

29

RHS

officials told us that the home buyer’s labor serves as a down

payment for the home, providing the home buyer with equity at the

time of purchase. RHS’s program also includes a subsidized interest

rate determined by the home buyer’s income, as well as a 33-year

mortgage duration that can be extended up to 38 years, to reduce the

monthly mortgage payment and make the loan as affordable as

possible.

HUD officials raised concerns about the extent to which down-payment

assistance promotes home equity building. For example, some

mortgages with down-payment assistance can be associated with higher

delinquency rates. Specifically, HUD officials pointed to data indicating

that FHA has experienced higher loan delinquency rates for loans with

down-payment assistance.

30

As with any homeownership-assistance

programs or mortgages, the potential for home equity building requires a

homeowner to sustain and pay down the mortgage.

29

Participating families in RHS’s self-help program generally are required to contribute 65

percent of the construction labor. For households with more than one adult, HUD requires

a minimum of 100 hours of labor to participate in its self-help program.

30

According to HUD’s 2017 FHA Mutual Mortgage Insurance Fund Report, FHA-insured

new-purchase mortgages with down-payment assistance experienced higher rates of loan

delinquency than loans without assistance. See Department of Housing and Urban

Development, Annual Report to Congress Regarding the Financial Status of the FHA

Mutual Mortgage Insurance Fund, Fiscal Year 2017 (Washington, D.C.: Nov. 15, 2017). In

2005 GAO reported that FHA-insured loans with down-payment assistance had higher

delinquency and claim rates than similar loans without such assistance. See GAO,

Mortgage Financing: Additional Action Needed to Manage Risks of FHA-Insured Loans

with Down Payment Assistance, GAO-06-24 (Washington, D.C.: Nov. 9, 2005). In

particular, loans with seller-funded down-payment assistance performed more poorly than

those with assistance from other sources, such as government programs. However, seller-

funded down-payment assistance was prohibited for FHA loans by the Housing and

Economic Recovery Act of 2008, Pub. L. No. 110-289, § 2113, 122 Stat. 2654, 2831

(2008).

Page 16 GAO-18-297 Homeownership

In addition to down-payment assistance, HOME, CDBG, and AHP funds

can be used for buying down the mortgage interest rate.

31

Interest-rate

buy-downs have accelerated equity-building effects throughout the life of

the mortgage because a higher proportion of monthly mortgage payments

are applied to the mortgage principal. However, agency and enterprise

officials and housing experts with whom we spoke said the down payment

is the biggest barrier to homeownership, and in the current environment

of low interest rates, buy-downs of interest rates are not common.

In addition to federal programs, some state housing finance agencies also

provide down-payment assistance grants and loans that have accelerated

equity-building effects. For example, the Minnesota Housing Finance

Agency provides a monthly payment loan (in addition to the mortgage) of

up to $12,000 to be used for down payments or closing costs.

32

The

monthly payment loan has an interest rate equal to the rate on the

borrower’s first mortgage, and the loan can be paid back over a 10-year

period.

33

According to Minnesota Housing Finance Agency officials, by

making payments directly on the monthly payment loan, the borrower is

effectively accelerating equity building on that part of the home purchase

because of the shorter term compared to a 30-year mortgage.

HUD’s Housing Choice Voucher Program provides assistance in helping

a homeowner pay for monthly mortgage and other homeownership

expenses, which facilitate homeownership and equity building.

34

Vouchers are administered locally by public housing agencies, but not all

public housing agencies participate in the program. A home buyer would

have to apply for a housing choice voucher with a participating public

housing agency to use the funding for a mortgage instead of rent. First-

time homeowners who meet income limits and receive homeownership

31

Jurisdictions and FHLBanks have some discretion in how they implement HOME and

Affordable Housing Program.

32

The Minnesota Housing Finance Agency finances some of its lending activities through

the sale of tax-exempt and taxable bonds. Its loans are targeted to low-income borrowers.

33

The Minnesota Housing Finance Agency also offers a deferred down-payment

assistance loan, which is an interest-free loan of up to $8,000 that is repaid when the

property is sold, refinanced, or when the first mortgage becomes due. Although the

deferred payment loan does not accelerate equity building, the zero-interest loan

effectively subsidizes the cost of equity for that portion of the home purchase.

34

Monthly mortgage and homeownership expenses include mortgage principal and

interest, mortgage insurance premium, and real estate taxes and homeowner insurance.

Federal Voucher Program

Can Facilitate Equity

Building

Page 17 GAO-18-297 Homeownership

counseling can qualify for the program.

35

The payment assistance

generally continues as long as the family resides in the home, and the

maximum term for the assistance is 15 years if the home purchase is

financed with a mortgage longer than 20 years.

36

According to HUD,

about 11,000 homeowners were receiving assistance from the

Homeownership Voucher Program as of September 2017, about 0.5

percent of all vouchers.

RHS and VA both offer direct loans for home purchases to eligible

borrowers who may otherwise be unable to obtain financing in the private

marketplace, providing access to homeownership and equity building.

RHS offers direct loans to borrowers in rural areas with incomes of

generally not more than 80 percent of the area median income. Loan

funds can be used to build, repair, renovate, or relocate a home, or to

purchase and prepare sites, including providing water and sewage

facilities. RHS provided 7,089 direct loans for single-family homes in fiscal

year 2016.

VA provides direct home loans to eligible Native American veterans to

finance the purchase, construction, or improvement of homes on federal

trust land, or to refinance a prior direct loan to reduce the interest rate.

According to VA, 13 direct loans were provided to Native Americans in

fiscal year 2016.

35

Generally, except in the case of disabled families, the qualified annual income of the

adult family members who will own the home must not be less than the federal minimum

hourly wage multiplied by 2,000 hours. The local public housing agency also may

establish a higher minimum income requirement.

36

In all other cases, the maximum term for assistance is 10 years, with exceptions for

elderly and disabled homeowners. See 24 C.F.R. § 982.634.

Federal Direct Loans Can

Provide Access to

Homeownership

Page 18 GAO-18-297 Homeownership

Borrowers have options to accelerate equity building that include

obtaining shorter-term mortgages, making more frequent or additional

payments, or choosing a mortgage product available in the private

mortgage market designed to accelerate equity building. These options

accelerate equity building by affecting the key components of a

mortgage—term (duration), down payment, interest rate, or payment

frequency or amount. The advantages of building equity faster can

include using home equity as a financial cushion in emergencies, like

unexpected medical expenses. However, there are trade-offs to these

options, such as higher monthly payments for shorter-term mortgages.

Additionally, stakeholders identified key trade-offs and considerations in

introducing new products and mechanisms for accelerating home equity

building that could affect the success of the products or mechanisms.

Home buyers and homeowners may take actions on their own to

accelerate home equity building. For example, home buyers can choose

a 15- or 20-year mortgage rather than a 30-year mortgage. The shorter-

term product will increase the relative pace of equity building. In July

2017, almost 6 percent of all new purchase mortgage originations were

for 15-year fixed-rate mortgages, according to the Urban Institute.

37

However, shorter-term loans may present trade-offs for borrowers, which

we discuss later in the report.

Homeowners also can make extra mortgage payments to further reduce

the principal balance, which can accelerate equity building and shorten

the mortgage term. For example, according to our analysis, a homeowner

making an extra monthly payment of $100 on a 30-year fixed-rate

mortgage for $225,000 would accelerate equity building and reduce the

mortgage duration by more than 4 years (see fig. 2). Homeowners

generally have the flexibility to make extra payments at their discretion

and could discontinue the extra payments at any time if they need the

funding for other priorities.

38

37

See Housing Finance at a Glance: A Monthly Chartbook (October 2017).

38

According to Black Knight, a financial services firm that analyzes the mortgage market,

borrowers made additional principal payments of about 1 percent of their mortgages in

September 2017. See Black Knight, Mortgage Market Monitor (September 2017).

Options and

Mechanisms That

Accelerate Equity

Building Present

Trade-offs for

Homeowners and

Lenders

Home buyers and

Homeowners May Take

Actions on Their Own to

Accelerate Equity Building

Page 19 GAO-18-297 Homeownership

Figure 2: Example of Home Equity Built over Time for a $225,000, 30-year Fixed-Rate Mortgage: Required Payment versus

Additional $100 Payment Each Month

Note: We compared equity building in two payment scenarios for a $250,000 home, bought with a 10

percent down payment: (1) Only required payments were made on a 30-year mortgage of $225,000

and a fixed annual interest rate of 3.875 percent, and (2) Additional monthly payments of $100

applied to the principal balance were made on the same mortgage. For illustration purposes, we

assumed the home’s value remained unchanged from the time of the origination of the loan.

Homeowners also can refinance their mortgage to take advantage of

lower interest rates, shorter mortgage terms or both. Lower-interest and

shorter-term loans can help build equity faster. About 27 percent of

mortgage refinances were for 15-year fixed-rate mortgages in October

2017, according to enterprise data reported by FHFA. However,

refinancing (similar to purchase loans) incurs transaction costs (see table

2).

39

A lender may offer low- or no-cost refinancing, but likely would

charge a higher interest rate in exchange for lowering or eliminating fees.

Additionally, other payments might be required at closing (which would be

39

Under the QM regulations, a lender cannot charge a borrower more than 3 percent in

total points and fees on most loans if a lender wants legal liability protection from

distressed borrowers. The cap varies for loan amounts less than $100,000, with a

maximum of 8 percent for a loan amount of less than $12,500.

Page 20 GAO-18-297 Homeownership

out-of-pocket expenses unless they were financed), including upcoming

mortgage insurance and property taxes.

Table 2: Examples of Mortgage Loan and Refinancing Fees and Cost Estimates

Type

Reason for charge

Estimated fee ranges

a

Application fee

To cover the initial costs of processing a loan request and

checking an applicant’s credit report.

$75–$640

Loan origination fee

To evaluate and prepare a loan.

0–1.5% of loan principal

Points

A point is equal to 1 percent of the amount of a loan.

(1) A loan-discount point is a one-time charge paid to

reduce the interest rate of a loan.

(2)

Some lenders also charge points to earn money on the

loan.

0–3.0% of loan principal

Appraisal fee

To pay for an appraisal of a home (to assure the lenders

that the property is worth at least as much as the loan

amount). If a homeowner is refinancing and has had a

recent appraisal, the homeowner can ask the lender to

waive the requirement for a new appraisal.

$225–$700

Survey fee

To confirm the location of the property and improvements

on the land. A loan applicant may not have to pay this fee

if a survey recently had been conducted for the property.

$150–$400

Inspection fee

To meet lender and governmental requirements. A lender

may require an inspection of the structural condition of the

property, and the state in which the property is located

may require additional, specific inspections.

$175–$350

Attorney review and closing fee

To pay for services of lawyers or other parties who

conduct the closing for the lender.

$500–$1,000

Title search and title insurance

To pay for search of property records to ascertain

ownership/clear legal title and check for liens. Title

insurance covers the lenders against errors in the results

of the title search. If a problem arises, the insurance

covers the lender’s investment in a mortgage.

$700–$900

Recording and transfer fees

To pay for filing by local government of official records of a

real-estate transaction.

0–3.0% of loan principal (costs vary

regionally)

Source: GAO analysis of Housing and Urban Development, Bureau of Consumer Financial Protection, and Federal Reserve documentation. | GAO-18-297

a

Estimates of fee ranges are drawn from mortgage settlement costs guides from HUD, Bureau of

Consumer Financial Protection, and the Federal Reserve.

Also, homeowners who refinance to take advantage of lower interest

rates could extend their mortgage term or choose to cash out some of the

existing home equity, thereby eliminating the potential for accelerated

equity-building effects in refinancing. See figure 3 for a comparison of

how different refinancing options can affect home equity building.

Page 21 GAO-18-297 Homeownership

Figure 3: Examples of the Effects of Select Refinancing Scenarios on Home Equity

Note: We compared equity building in three scenarios for a $250,000 home, bought with a 3 percent

down payment: (1) refinancing a 30-year fixed-rate (3.875 percent) mortgage after 5 years to a 15-

year mortgage with a lower interest rate (3.125 percent), with no cash out at refinancing, (2) a 30-year

fixed-rate (3.875 percent) mortgage with no refinancing, and (3) refinancing a 30-year fixed-rate (4

percent) mortgage after 5 years to a 30-year mortgage with the same interest rate (3.875 percent),

with $25,000 cash out at refinancing. For illustration purposes, we assumed the home’s value

remained unchanged from the time of the origination of the loan.

Page 22 GAO-18-297 Homeownership

The Wealth Building Home Loan (WBHL) is a relatively new private-

sector mortgage product that incorporates a number of features

specifically designed to accelerate equity building (see fig. 4). The WBHL,

which has been offered commercially on a limited basis for about 3 years,

has shorter mortgage terms (15 or 20 years), can have a fixed or

adjustable rate, and allows the interest rate to be bought down.

40

A lower

interest rate would allocate a greater portion of each monthly payment to

reduce mortgage principal and also reduce the amount of the monthly

payments.

41

Moreover, the WBHL allows for no down payment (including allowing the

financing of closing costs). The no down-payment feature is designed to

facilitate access to homeownership. According to lenders we spoke with

who offer WBHLs, allowing for no down payment is the key feature that

distinguishes the WBHLs from standard 15- or 20-year mortgage loans

available in the private-sector mortgage marketplace.

42

Consistent with

what we heard from lenders, officials from Fannie Mae and Freddie Mac

told us loans that do not require a down payment generally are not

available in the private-sector mortgage marketplace. Additionally,

because of the low or no down-payment features, lenders we spoke with

who offer WBHLs typically require private mortgage insurance, which is

provided by a major mortgage insurer.

40

This mortgage product was developed by Edward Pinto and Stephen Oliner of the

American Enterprise Institute, See, for example, Edward Pinto, A Housing Primer: Wealth

Building for the 21st Century (Washington, D.C.: 2015).

41

Developers of the loan envisioned borrowers using the funds available for a down

payment to buy down the mortgage interest rate. The developers of the loan also

recommend using VA’s credit underwriting guidelines, which include consideration of

residual income. VA’s residual income underwriting standards evaluate all of a borrower’s

sources of income and expenditures, including living expenses. According to VA officials,

the standard allows lenders greater flexibility in considering compensating factors in

making loan approval decisions.

42

Actual features of WBHLs may vary, depending on a lender’s product offerings and

terms.

A Recently Introduced

Mortgage Product

Accelerates Equity

Building through Shorter

Terms and Lower Interest

Rates

Page 23 GAO-18-297 Homeownership

Figure 4: Comparison of Home Equity Built over Time: 15-year Wealth Building Home Loan (WBHL) versus 15- and 30-Year

Fixed-Rate Mortgages

Note: We compared equity building for (1) a 15-year Wealth Building Home Loan for $250,000 with

no down payment and a fixed annual interest rate bought down to 2.5 percent, (2) a 15-year

mortgage for $225,000 with a $25,000 down payment and a fixed annual interest rate of 3.125

percent, and (3) a 30-year mortgage for $225,000 with a $25,000 down payment and a fixed annual

interest rate of 3.875 percent. For illustration purposes, we assumed the home’s value remained

unchanged from the time of the origination of the loan. Interest rates used for illustration purposes are

generally consistent with market rates in September and October 2017.

As shown in figure 4, the monthly mortgage payments of a WBHL can

increase substantially, compared with the payments of a 30-year fixed-

rate mortgage.

Some lenders we interviewed offer WBHLs with the option to buy down

the interest rate, and some require a minimum buy-down.

• One lender requires borrowers to pay 2 points (or 2 percent of the

mortgage loan amount), which buys down one-half of a percentage

point of the interest rate.

• Another lender offers a 15-year loan with an option to pay 3 points to

buy down the interest rate to 1.75 percent for the first 7 years. Rates

Page 24 GAO-18-297 Homeownership

increase to 5 percent for the remaining 8 years. The lender also offers

a 20-year loan with the option to pay 2 points to buy down the interest

rate to 2.99 percent for the first 7 years. Rates increase to 5.25

percent for the remaining 13 years.

Although the option to buy down the interest rate has been advanced as a

feature that accelerates equity building, some lenders we interviewed said

that borrowers tend to pay the minimum required points only, because

borrowers generally prefer to pay as little cash as possible at loan

origination. Additionally, some lenders and other stakeholders have said

that, in a low interest-rate environment, the incentive for borrowers to buy

down the mortgage interest rate is greatly reduced.

Another mortgage product that we identified during our review—the

Fixed-Payment Cost-of-Funds Index (Fixed-COFI) Mortgage—has been

proposed by two economists, but has not yet been offered by private-

sector lenders.

43

This type of mortgage is intended to provide another

option for consumers that encourages equity building and limits exposure

for borrowers and lenders to interest rate fluctuations. The Fixed-COFI

would allow borrowers with little or no money down to obtain an

adjustable-rate mortgage that features a fixed monthly mortgage payment

and an equity savings account.

44

Funds in the equity savings account

could be used to pay down the mortgage principal, thereby accelerating

home equity building. According to the economists of this proposed

product, the low to no down-payment feature may help individuals with

little to no savings access homeownership, particularly those who live in

high-cost areas where the rent payment is comparable to a mortgage.

In addition to the borrower’s fixed monthly payments, the Fixed-COFI

mortgage also would determine how the borrower’s fixed payments would

be allocated, including to the equity savings account. The borrower’s fixed

monthly payment would be fully amortizing and be calculated based on

43

This product was proposed by Wayne Passmore and Alexander H. von Hafften. See

Wayne Passmore and Alexander H. von Hafften, “Financing Affordable and Sustainable

Homeownership with Fixed-COFI Mortgages” (Washington, D.C.: 2017).

44

The authors define COFI as the nationwide average cost-of-funds index for the banking

system, which is equal to the total interest expenses of domestic commercial banks

divided by their total interest-bearing liabilities. They use quarterly data compiled by the

Federal Financial Institutions Examination Council to calculate the COFI rate, which is the

adjustable rate that underpins the mortgage. Because it is a short-term rate, it is generally

lower than the 30-year fixed mortgage rate.

A Proposed Mortgage

Product May Accelerate

Equity Building through an

Equity Savings Account

Page 25 GAO-18-297 Homeownership

prevailing rates for a 30-year fixed-rate mortgage at the time of loan

origination. But the interest portion of the payment due to the lender

would be separately calculated each month, based on a rate derived from

COFI plus a gross margin to account for lenders’ costs and insurance risk

premiums.

45

Each month, the difference between the borrower’s fixed

payment and interest due the lender based on the COFI rate plus a gross

margin would determine if any funds from the borrower’s payment would

be added to the equity savings account.

The funds allocated to the equity savings account are designed to be

used to pay down the principal. However, the ways in which the home

equity funds could be used to pay down mortgage principal depend on

the terms of each loan. If the home equity account were depleted, lenders

might cover any payment shortfalls and seek insurance reimbursements.

In addition, the accelerated equity-building effect of the Fixed-COFI

mortgage product would rely on the historical difference between the

COFI rate and 30-year fixed rate (see fig. 5). If the difference between the

rates narrowed, the savings allocated to the equity savings account would

lessen, and equity-building effects would be reduced. That is, in months

in which the COFI rate plus the gross margin was lower than the 30-year

fixed rate used to calculate the monthly payments, the difference between

the COFI-based and fixed amounts would be deposited into a home

equity savings account.

46

In months in which the fixed payment would not

cover the interest payment (because the COFI rate plus the gross margin

is higher than the 30-year fixed rate used to calculate the fixed monthly

payment), funds could be withdrawn from the equity savings account to

cover any shortfall. If the equity savings account had a zero balance, the

lender could seek an insurance payout.

45

The gross margin is constant over the life of a loan and covers servicing costs,

insurance against credit risk, a return on equity, and premiums for “payment shortfall”

insurance and “balloon payment” insurance. Payment shortfall insurance would cover any

monthly shortfalls over the life of the mortgage, and balloon payment insurance would

cover any outstanding mortgage principal after 30 years. Estimates of the gross margin

range between 1.75 percent and 2.5 percent.

46

In a recent update to the Fixed-COFI proposal (dated Nov. 15, 2017), Mr. Passmore and

Mr. von Hafften also proposed an “affordable” Fixed-COFI variation, in which the excess

funds can be rebated to homeowners, which may help lessen monthly financial burdens

for homeowners.

Page 26 GAO-18-297 Homeownership

Figure 5: Overview of Monthly Payment Scenarios for Fixed-Payment Cost-of-Funds Index (Fixed-COFI) Mortgage

Note: The excess funds allocated to the equity savings account (see scenario 1) can be used to pay

down the mortgage principal or can be rebated to homeowners.

According to the economists, some details of the Fixed-COFI contract can

be modified for different rules concerning refinancing and savings. For

example, a borrower and a lender can agree to how and when funds in

the home equity savings account could be applied to pay down the

mortgage principal. However, the Fixed-COFI mortgage contract would

place limits on a borrower’s options to refinance—for instance, only in the

Page 27 GAO-18-297 Homeownership

case of the loss of a job—because it is designed to protect borrowers and

lenders from fluctuations in interest rates.

47

If interest rates drop significantly, benefits from the rate decrease for a

borrower with a Fixed-COFI mortgage would be limited as compared with

the benefits of a borrower with a 30-year fixed-rate mortgage who

refinances. For example, the additional savings from lower interest rates

for the borrower with a Fixed-COFI mortgage could only be used to pay

down the mortgage principal. In contrast, although refinancing has costs,

borrowers with a traditional 30-year fixed-rate mortgage would be able to

refinance to take advantage of the lower rate and reduce their monthly

payment. They could use the resulting difference in monthly payments

from the new, refinanced loan to pay down mortgage principal, build up

savings, or for any other purposes.

For some homeowners, building home equity faster can provide financial

benefits. Home equity can serve as a financial asset to fund retirement,

education expenses, or absorb financial emergencies like the loss of a

job.

48

All else being equal, having more home equity also can help sustain

homeownership through a downturn in the housing market. For example,

default rates are generally higher for loans with higher loan-to-value (LTV)

ratios.

Although some accelerated equity-building options are designed to be

originated with high LTV ratios (in some cases exceeding 100 percent),

the accelerated equity-building effect can lower the LTV ratio at a faster

pace than for a 30-year fixed-rate mortgage. As shown in figure 6,

according to our analysis, LTV ratios can converge after about 5 years for

a 15-year fixed-rate mortgage with a high LTV and a 30-year fixed-rate

mortgage with a higher down payment. More specifically, in about 5 years

47

In a traditional fixed-rate mortgage, a borrower compensates a lender or investor for the

option to prepay (or refinance) as part of the interest rate charged to borrowers. Borrowers

with a 30-year fixed-rate mortgage can experience savings if interest rates fall

substantially and they exercise their option to refinance to a lower rate. If interest rates do

not fall, or do not rise appreciably enough to cover the amount borrowers compensated

lenders or investors for the option to prepay, they would “lose” and the lenders or

investors would “win.”

48

Home equity generally can be accessed through a home equity line of credit or a home

equity loan. The costs associated with accessing home equity can include interest

expenses and transaction expenses. Additionally, borrowing against home equity would

deplete rather than build equity.

Advantages of Accelerated

Home Equity Building

Include a Financial

Safeguard

Page 28 GAO-18-297 Homeownership

a 15-year fixed-rate loan with an LTV ratio of 103 percent at origination

will reach the same LTV ratio as a 30-year fixed-rate loan with an LTV

ratio of 80 percent at origination. Borrowers under both mortgage

scenarios would have accrued close to 30 percent equity in about 5

years, assuming no change in the home’s value.

Figure 6: Example of Loan-to-Value (LTV) Ratio over 5.5 years, 15-Year Fixed-Rate Mortgage (103 Percent LTV Ratio at

Origination), and 30-year Fixed-Rate Mortgage (80 Percent LTV Ratio at Origination)

Note: For each scenario the home value is $250,000, and we assume the home’s value remains

constant. The 30-year fixed-rate loan has an interest rate of 3.875 percent, and at origination the

loan-to-value ratio is 80 percent (for a loan amount of $200,000). The 15-year fixed-rate loan has an

interest rate of 3.125 percent, and at origination the loan-to-value ratio is 103 percent (for a loan

amount of $257,500). Interest rates used for illustration purposes are generally consistent with market

rates in September and October 2017.

Lenders and proponents of accelerated equity building with whom we

spoke said that having substantial equity in a home provides more

options for remediation in the event the homeowner encounters difficulties

making mortgage payments. For instance, a lender with whom we spoke

said that having more equity in a home provides a borrower with a better

opportunity to refinance to get a better interest rate and also extend their

loan term, both of which would lower their monthly payment. Two lenders

with whom we spoke also said that accelerated equity-building options

Page 29 GAO-18-297 Homeownership

can provide financial discipline and serve as a forced savings mechanism

by, for example, paying additional principal on the mortgage. In addition,

proponents of accelerated equity building have suggested that

homeowners with more equity at stake may have more incentive to stay

in their home because they have more invested in the home.

In addition to building equity, borrowers with shorter-term mortgages or

those opting to make extra payments on 30-year mortgages would reduce

overall loan expenditures—relative to the interest they would pay on a 30-

year loan (see fig. 7). However, the overall higher mortgage payments

can make these options less affordable for lower-income borrowers or

limit financial flexibility, as discussed below.

Figure 7: Total Interest Paid on a $250,000 Mortgage under Different Scenarios

Note: The interest rate for the 30-year fixed-rate loan scenarios is 3.875 percent, and the interest rate

for the 15-year fixed-rate loan is 3.125 percent. Interest rates used for illustration purposes are

generally consistent with market rates in September and October 2017.

Page 30 GAO-18-297 Homeownership

Accelerated equity-building products, such as a 15-year fixed-rate

mortgage or a WBHL, may not be accessible for all borrowers, partly due

to tighter credit requirements. Officials from a state housing finance

agency told us that minimum credit score requirements for some WBHLs

limit access for borrowers with lower credit scores, which includes many

lower-income borrowers. For example, a private mortgage insurer for

WBHLs requires a minimum credit score of 680, compared with the

minimum for the state housing finance agency of 640 for 30-year fixed-

rate mortgages. The average score for WBHLs insured by the private

mortgage insurer is 749.

Moreover, requirements for a minimum debt-to-income ratio may also