1

Preparations for an

Intra-Scotland Air Services Review

Scoping Exercise

2

Contents

1 Executive Summary ................................................................................................ 3

2 Background ............................................................................................................. 7

3 Strategic Objectives ............................................... Error! Bookmark not defined.

4 Overview – Baselining and Audit ........................................................................ 13

4.2 Recommended Next Steps .............................................................................. 15

5 Costs and affordability ......................................................................................... 16

5.2 PSO Routes ..................................................................................................... 17

5.3 Air Discount Scheme ........................................................................................ 21

5.4 Recommended Next Steps .............................................................................. 24

6 Reliability / Punctuality / Utility ............................................................................ 25

6.2 Recommended Next Steps .............................................................................. 32

7 Forecasting ........................................................................................................... 33

7.2 Recommended Next Steps .............................................................................. 35

8 Future Proofing ..................................................................................................... 36

8.2 Recommended Next Steps .............................................................................. 36

9 Governance, Consultation, Engagement, Collaboration and Competition .. 37

9.2 Competition ...................................................................................................... 38

9.3 Recommended Next Steps ........................................................................... 39

10 Affordability and Sustainability for Public Sector .......................................... 40

10.2 Recommended Next Steps ........................................................................... 40

11 Value for Money and Cost Benefit Assessment ............................................. 41

11.2 Recommended Next Steps ........................................................................... 41

12 Bibliography ........................................................ Error! Bookmark not defined.

3

1 Executive Summary

A discussion paper on a number of transport issues relating to air services, ferry services, fixed

links and governance, collaboration and partnership arrangements was tabled at a meeting of

the Island Areas Ministerial Working Group held on 2nd June 2015 in Kirkwall. A key focus for

the meeting was a number of issues concerning air services between the island local authorities

and the Scottish mainland.

Following the meeting, it was agreed that the Island Local authorities prepare a scoping paper

to establish evidence and data around the key issues that were identified including the

affordability and reliability of the air services. It was also agreed at this meeting that a forum be

set up to consider all strategic transport issues affecting Scotland’s islands.

The Islands Transport Forum which will meet biannually and will include representatives from

local authorities with island communities had its inaugural meeting on January 12th 2016. At this

meeting it was agreed that the Air Services Scoping Paper be brought to the next Islands

Transport Forum.

With the exception of the Wick to Aberdeen/Edinburgh and Campbeltown to Glasgow services

all scheduled Intra-Scotland air services involve links to or between islands.

This Scoping paper therefore builds upon previous work and proposes a more detailed

and comprehensive outline review of Intra Scottish Air Services that addresses a number

of short, medium and long term priorities including;

Affordability of services for passengers

Affordability for Scottish Government / Local Authorities

Evidence on the reliability of the different air services

Improving collaboration between Transport Scotland, Regional Transport

Partnerships and the Islands Councils.

Establishing a process that fully accounts for island-specific views.

Considers all air services between Islands and the Scottish mainland.

Current and potential aircraft deployed on island to mainland routes

Airfield infrastructure and staffing

In preparing this Scoping Paper a working group of officers from each of the Local Authorities

with air Services (Orkney Islands Council, Shetland Islands Council, Comhairle nan Eilean Siar,

The Highland Council and Argyll and Bute Council), together with the Regional Transport

Partnership, HITRANS and ZETTRANS have reviewed recent available data, undertaken new

research including a review of the reliability and punctuality of air services between Scottish

Islands and the Mainland and also commissioned the Scottish Council for Development and

Industry (SCDI) to undertake an Islands Air Connectivity Survey. The survey received over

1400 responses and provided evidence of many of the recent problems encountered by

the island communities using each of 23 Island to Mainland air services.

4

Context of Scoping Paper

1.1.1 Through Our Islands Our Future campaign Scotland’s three island unitary authorities

have laid out a vision for a stronger future with a commitment that the needs and status

of island areas are clearly recognised in Scotland.

1.1.2 In response to the Our Islands: Our Future campaign and as a key output of the Island

Areas Ministerial Working Group chaired by Derek Mackay MSP, Scottish Government

published the Empowering Scotland’s Island Communities Prospectus in June 2014.

The key message within the Prospectus is the recognition that all of Scotland’s island

communities can benefit from greater empowerment whilst also emphasising that

increased power brings increased responsibility and accountability.

1.1.3 With regard to issues associated with transport provision to and within the island areas,

key areas of commitment relate to air services, ferry services, fixed links and

governance, collaboration and partnership arrangements.

Intra-Scotland Air Services Review

1.1.4 Progress has already been made on a number of the commitments given and a

discussion paper was tabled at a meeting of the Islands Area Ministerial Working Group

in Kirkwall on 2

nd

June 2015.

1.1.5 Among the issues discussed in relation to air services were;

• Production of a “costed and legally compliant business case” for inclusion of

business use in the Scottish Government’s Air Discount Scheme

• Undertake a review of air services from mainland airports to the Western Isles,

Orkney and Shetland, the objective of which would be to identify and appraise

options associated with addressing widespread and growing concerns within the

island communities relating to high and increasing air fares (despite the

availability of the Air Discount Scheme), the lack of meaningful competition on

these routes resulting in their monopolisation by a single operator, and the

continuing reliance of that operator on a very small range of ageing and outdated

aircraft

• Development of revised governance, consultation and engagement

arrangements for transport services (ferry, air and other) to facilitate more

effective and efficient working relationships between Transport Scotland, the

Islands Councils, the Regional Transport Partnerships (HITRANS and ZetTrans),

service operators and other key stakeholders; including the establishment of an

Islands Transport Forum

1.1.6 It was subsequently agreed that scoping work considering a number of issues relating

specifically to intra-Scottish air services research be undertaken by the Island Local

Island Local Authorities. HITRANS agreed to support the process by preparing an initial

draft report to facilitate further discussion and consideration at the Islands Transport

Forum.

5

1.1.7 This Scoping exercise builds upon previous research and available information, and

proposes a more detailed and comprehensive review of Scotland’s scheduled internal

Air Services. Part of this preparatory work has been to review recent data and relevant

reports so as to establish the scale of particular issues and also identify any gaps in

knowledge could usefully be addressed.

1.1.8 Air links from and between Scotland’s Islands make up the vast majority of Scotland’s

internal scheduled air services – the exceptions being Wick to Aberdeen / Edinburgh and

Campbeltown to Glasgow which also operate in a very similar context and experience

common challenges to the island based services.

1.1.9 This Scoping Paper proposes a comprehensive review of aviation policy and

delivery to, from and within the Highlands and Islands. It proposes additional

elements are included in any subsequent review. For instance an examination of

appropriate governance and consultation mechanisms is suggested as well as some

high level examination of policy interventions.

1.1.10 This report identifies some case studies and practices of potential relevance from other

parts of the world that face similar challenges, including Iberian Atlantic island groups,

Norway, Sweden and Canada.

1.1.11 The headings under which the issues have been considered are as follows:

Overview and Background – Baselining and Audit

Short Term Priorities

Affordability for passengers

Reliability / Utility / Punctuality

Broader and Longer Term Issues

Thirty year forecasts of future passenger demand.

Future proofing of air services

Investigations into Governance, Consultation, Engagement, Collaboration and

Competition.

Affordability and Sustainability for Public Sector

Value for Money and Cost Benefit Assessment

Conclusions and Recommendations

Considering five, ten and thirty year time horizons.

1.1.12 The report concludes with proposed next steps and an outline scope for further work that

will help address both short and longer term issues and opportunities. Discussion on

the prioritisation of the proposed work to improve the outcomes is required but the Island

Local Authorities and Regional Transport Partnerships charged with developing this

review have identified the following seven key areas.

6

Proposed Action Plan

1. A full review of the affordability of the air services for both the passenger and local and

national governments similar to that undertaken in the Scottish Ferries Plan

2. Consider the merits of extending the Air Discount Scheme based on the recently

commissioned research on behalf of HITRANS, ZetTrans and the Island based local

authorities.

3. A review of the reliability and punctuality of all scheduled internal Scottish air services

with the publication of an annual report on the performance of these services.

4. Establish a Working Group to address these short term priorities of affordability and

reliability of the air services. This would need the full support of the operators.

5. A review of current and possible aircraft types to serve the network and possible

adaptions to supporting infrastructure including airfields and terminals and staffing.

6. The development of a longer term coordinated and structured approach to

engagement, consultation and participation across the islands authorities, Transport

Scotland and other key stakeholders.

7. Development of an Intra-Scottish aviation strategy as part of the commitment to update

the National Transport Strategy

Twin Otter landing at Barra

7

2 Background

2.1.1 In 2013, Comhairle nan Eilean Siar, Orkney Islands Council and Shetland Islands

Council launched the Our Islands – Our Future (OIOF) campaign. The campaign sought

to ensure that: “…the position and needs of island areas are adequately taken into

account and the particular nature of Scotland’s three main islands’ areas acknowledged

and recognised.” In relation to transport the mission called for effective transport links to

maximise Island resources, and effective engagement with the EU to seek appropriate

targeting of structural fund assistance.

2.1.2 In 2014 the Scottish Government produced a prospectus entitled Empowering

Scotland’s Island Communities which set out the Government’s response to the issues

raised through Our Islands Our Future and the subsequent discussions that were

facilitated through the Island Areas Ministerial Working Group.

2.1.3 Subsequently to the Empowering Scotland’s Islands Communities (ESIC) prospectus, a

commitment was made at the Islands Area Ministerial Working Group (IAMWG) that the

case could be made by OIOF and their partners for a review of island air services to be

undertaken through the development of a scoping paper setting out the issues that any

later review might cover.

Empowering Scotland’s Island Communities report observed that, “Our remoteness

means that connectivity of all kinds is fundamental to us, be it grid connections, postal

services, digital communications, or crucially transport by sea or air, both internal to our

Island Areas and external to the Scottish mainland.” The aim it claimed should be to

work toward more democratic (in the sense of facilitating subsidiarity in decision

making), fairer and more prosperous communities.

2.1.4 In a subsequent and derivative June 2015 report to the IAMWG that focussed

specifically on TRANSPORT it was suggested it would be helpful to:

Undertake a review of air services from mainland airports to the Western Isles, Orkney

and Shetland, the objective of which would be to identify and appraise options

associated with addressing widespread and growing concerns within the island

communities relating to high and increasing air fares (despite the availability of the Air

Discount Scheme), the lack of meaningful competition on these routes resulting in their

monopolisation by a single operator, and the continuing reliance of that operator on a

very small range of ageing and outdated aircraft.

2.1.5 It is proposed that key action areas be developed on a project basis including;

Establishment of specific project governance and management arrangements,

Agreement of clear and unambiguous aims, objectives and measures of

success,

Clarification of roles and responsibilities relating to project sponsorship and

management, and

8

Development of a coordinated and structured approach to engagement,

consultation and participation across the islands authorities, Transport Scotland

and other key stakeholders.

2.1.6 At the IAMWG the decision was made to prepare a scoping paper to guide the

development of a suitable Research brief and that this paper be taken for consideration

on the agenda of the Islands Transport Forum.

2.1.7 By February 2016 the Group were able to add more detail to the intentions stating that

any review should involve the development of a scoping paper to establish evidence and

data around a number of the key issues which had been identified including the

affordability and reliability of the services.

2.1.8 It was also agreed at this meeting that a forum be set up to consider all strategic

transport issues affecting Scotland’s islands. The Islands Transport Forum will consider

opportunities and difficulties, including:

Improving collaboration between Transport Scotland, Regional Transport

Partnerships and the Islands Councils.

Establishing a process that fully accounts for island-specific views.

Ensuring efficient and effective lines of communication between all key

stakeholders.

Consider all air services between Islands and the Scottish mainland.

Current and potential aircraft deployed on island to mainland routes

Evidence on the reliability of the different air services

Affordability for passengers

Affordability for Scottish Government / Local Authorities

Roles and responsibilities

2.1.9 It was also agreed to undertake an online survey to help gather views on the existing

services and information on what issues were most important to passengers. SCDI were

subsequently engaged to support the development, distribution and analysis of the

survey which has received over 1400 responses. The survey closed on 4

th

January.

2.1.10 The survey information has been augmented by HIAL sharing further up to date

statistical information which has helped shape the outline brief for a Scoping study.

Other opportunities are considered in more detail within the supporting documentation.

2.1.11 At this point it is considered likely that key elements of a more comprehensive review of

internal Scottish air services would include the following;

9

Overview and Background

Outline baseline information on route structure and timetable with trends and

likely developments without interventions including a review of relevant Council,

Scottish, UK and EU roles and policies (currently and post Brexit) and

acknowledgement of role of airfreight and the oil sector with its rotary activity

and Scatsta.

Audit of current airfields and their challenges.

Consider issues highlighted by stakeholders

Review of relevant emergent technologies and trends (eg Global Navigation

Satellite Systems (GNSS), Single Engine Turbines, Regional and LCC airlines,

Current and potential Scottish air operators, New runway in UK south East,

Scottish short and long haul route developments, tourist and local economic

trends and opportunities, multi-modal transport developments, network usage

forecasts, requisite staffing, training and skills, security, sustainability

considerations and environmental impacts)

Reliability / Utility

A review of the following data for each airline and route;

o Punctuality data

o Reliability data

o User Survey

Operator’s Rectification and Quality Assurance Plans

Interlining and onward travel

Ticketing and marketing

Publication of an annual report

Affordability for passengers

Analysis of the range of fares on each route including the average fare, and the

full price fare for last minute bookings. (The SCDI survey highlighted that some

special discount fares could be more expensive than the “normal” fares on sale

at particular times).

Benchmarked comparisons, if suitable ones can be identified.

Consider merits of extending Air Discount scheme for certain types of business

travel.

Review of other options for encouraging more competition on the routes and

improving the affordability for passengers and where applicable government at

both a local and national level.

Affordability for Public Sector

A review of all known costs including;

Operating and capital costs for supporting airfields

Current and likely capital costs on publicly owned aircraft

Costs of Public Service Obligations (PSOs)

Cost of Air Discount Scheme

Travel budgets, where available, of key users such as Health,

Education, Public Administration.

Consider opportunities for collaborative procurement and marketing of services

10

Regulation, Licensing, Security and SGEI certification

State Aid Issues and possible adjustments to mix of instruments used

Other possible sources of funding

Airfield Infrastructure and Operation

Undertake a review of current and possible aircraft types to serve the network

now, and in the future, and possible adaptions to supporting infrastructure /

airfields / terminals / access roads and services to accommodate.

Address problems relating to the recruitment and training of airport staff on

islands where there has difficulty in recruiting firefighters on islands (which are

mainly volunteers through Scottish Fire and Rescue in the case of Argyll

managed airstrips)

Conclusions and Recommendations

Development of an Intra-Scottish aviation strategy within an updated National

Transport Strategy that considers short medium and long term time horizons.

11

3 Strategic Objectives

3.1.1 It is useful to consider issues connected with air transport in relation to the three high

level aims highlighted in the 2014 Empowering Scotland’s Island Communities

prospectus namely working toward more democratic, fairer and more prosperous

communities.

3.1.2 More Democratic in the sense of facilitating subsidiarity in decision-making implies that

island communities should have a significant say in the specification and running of their

transport systems, recognising that central government support funding is also required

to achieve these ambitions. This democratic impulse must also recognise that central

government have wider responsibilities and obligations both to the national electorate

and taxpayer that have to be balanced with the more specific interests and ambitions of

the island communities.

3.1.3 This aspiration can be addressed by considering what more permanent and occasional

consultation mechanisms are required and how key stakeholders and service users

should best be involved. Surveys and other time limited interventions would also be

required to ensure that island communities are fully engaged in the development and

delivery of air transport solutions.

3.1.4 Fairer. It should be recognised that this term and aspiration can mean different things to

different people and would likely inspire varied responses in different circumstances. To

clarify thinking we outline how fairness, equity, equality and equivalence can all lead to

different outcomes. Stakeholders should agree a common objective of fairness.

3.1.5 Indeed each of the current air support schemes responds to different priorities. The

Highlands and Islands Airport Ltd (HIAL) subsidy can be seen as providing necessary

infrastructure; the Air Discount Scheme (ADS) is justified as a measure of social

inclusion and Public Service Obligation (PSO) air services has historically been

understood in Scotland as providing services that would not be economically viable for

commercial provision on a frequency that meets community needs (facilitating social and

economic development combined with the notion of providing a minimum level of

provision). The Air Passenger Duty (APD) exemption is a Treasury response that

recognises the special challenges of the region, and the potential double and triple

whammy taxation required to reach another UK or international destination via the

requisite connecting flights. The Treasury should also be mindful of the relatively small

amount of revenue this exemption foregoes. Route Development Funding (RDF) is

usually perceived as a time limited facilitative intervention to achieve a self-sustaining

route enhancement.

3.1.6 Shetland Islands Council (SIC) and Orkney Islands Council (OIC) and Transport

Scotland have set themselves the task of working towards a mutually agreed ‘fair

funding’ position on internal transport by June 2017.

12

3.1.7 More Prosperous. There is a tendency amongst some to consider transport as a fixed

piece of infrastructure like roads or harbours that governments should supply as a basic

requirement. However it is recognised that the causal relationship between air services

and economic development is two way and indeed there is emerging evidence that in

less developed economies improvements in connectivity speedily translate into

improvements in economic performance. This provides a stronger rationale for state

investment in transport, where services could potentially lead, rather than just follow or

respond to, demand.

Westray airstrip

13

4 Overview – Baselining and Audit

4.1.1 Various aspects of the intra-Scotland air service route structure and timetable have been

subject to previous review, but these need updated with trends identified and likely

developments highlighted and interpreted.

14

4.1.2 The recent draft Appraisal of Inclusion of All Business Travel Within the Air Discount

Scheme work examined frequency and timings on the main intra Scottish routes with a

particular emphasis on their utility for business use.

4.1.3 A review of relevant Council, Scottish, UK and EU roles and policies and an

acknowledgement of role of airfreight, the oil sector with its rotary activity and Scatsta,

and other non-scheduled aviation activity including aeronautical activity such as Air

Charter and Inclusive Travel flights, General Aviation, Business Aviation, Flight Training,

aero-engineering and aerial work (remote sensing, reconnaissance, emergency

response etc.) is also required.

4.1.4 Recent profiles of Orkney and Shetland airfields has been undertaken for their current

inter island transport reviews. These need to be combined with the latest information

from Argyll and Bute and HIAL airfields; ideally in similar formats and with key

characteristics selected and documented. Further integrative work is required.

4.1.5 A review of pertinent aviation industry, tourist and local economic trends would be

helpful in providing fuller context to aid understanding and insight.

15

It is likely that any substantial study should include some level of key stakeholder

consultation so that additional issues can be identified and their relative importance

better assessed. As an example, NHS is a major user of intra Scottish air services for

the efficient delivery of island passengers, chaperones, and staff. Efforts to effectively

involve them in the provision of transport services are important in optimising PSO,

timetable, disabled and patient aircraft and airport access solutions. PSO specification

reductions can for example impose extra costs and inconvenience on the service and

the arrangement of patient appointments that may not be fully appreciated by transport

planners. Changes in the way NHS organizes itself such as their Highlands and Islands

Travel Scheme (HITS) scheme has seen a related increased focus on transport cost and

demand for NHS reductions.

4.1.6 Another approach is to create some understanding of the differing multi-modal

connectivity scores / indices of the different parts of Scotland. Being able to visualise

and quantify the challenge may help guide policy Developing some sort of index of

connectivity for Scotland and then tying this to a commitment to meeting certain

minimum standards of accessibility could provide a model for Scottish remote and

peripheral regions.

4.2 Recommended Next Steps

Overview – Baselining and Audit including;

o Outline of route structure and timetable with trends including a review of

relevant Council, Scottish, UK and EU roles and policies (currently and

implications of post Brexit) and acknowledgement of role of airfreight,

the oil sector (eg rotary activity & Scatsta), and other non scheduled

aviation activity including air cargo, Air Charter and Inclusive Travel

flights, General Aviation, Business Aviation, Flight Training, aero-

engineering and aerial work (remote sensing, reconnaissance,

emergency response etc.)).

Audit of current airfields and their challenges.

Consideration of issues highlighted by key stakeholders during a study

consultation exercise.

Review of aviation industry, tourist and local economic trends.

Evaluate against measures of connectivity – eg Reachability and Accessibility.

16

5 Costs and affordability (personal / leisure, business & public sector)

5.1.1 An Islands Air Connectivity Survey was commissioned by HITRANS and ZetTrans and

undertaken by SCDI between 10

th

December 2015 – 3

rd

January 2016. The survey

raised a series of issues relevant to this scoping exercise, but it is clear from this

summary (below) that punctuality, reliability and affordability were the three top

concerns.

Q. Thinking about the route you've used most often over the past 12 months how would you

rate your overall experience from 1-5?

5.1.2 It would be useful to gain some clearer information on what fares are currently being

paid. This could be accomplished by sampling ticket prices on routes using online next

day, next week and next month itinerary interrogations. A comparison of the various

Scottish PSO programme ticket prices should also be included.

5.1.3 In specific relation to PSO programmes, they have several explicit or implicit socio

economic aims which could be expressed as;

Aiming to ensure the travelling public (its citizens and guests) enjoy competitive

pricing and good service as a result of the tender competition, and operator

selected.

Transport integration to facilitate social, business, educational, (Visiting Friends

and Relatives (VFR), sporting, public administration and other purposes,

including addressing social inclusion of poor, aged, job seekers and other

marginalised groups.

Diversifying the economy by improving / maintaining connectivity with the rest of

Scotland, United Kingdom and beyond.

Supporting more balanced development across all Scotland’s regions.

45%

45%

66%

13%

17%

4%

18%

20%

18%

21%

18%

20%

14%

6%

17%

18%

24%

23%

12%

41%

38%

24%

40%

36%

9%

8%

21%

21%

32%

19%

19%

4%

4%

6%

10%

35%

6%

7%

Reliability

Punctuality

Affordability

Availability (how easy is it to book your first

choice of flight time/date)

Transport connectivity to/from the airport

(Island)

Transport connectivity to/from the airport

(Mainland)

Availability of flight information (pre airport

arrival)

Availability of flight information (at the

airport terminal)

1. Poor

2. Below

Average

3. Average

4. Above

Average

5. Excellent

17

Supporting the development of SMEs

i

and entrepreneurship on the islands.

Endeavouring to counter depopulation.

Supporting inward, business and tourist investment and providing certainty for

such investment by demonstrating the government’s commitment to protecting

and enhancing national and international connectivity.

Supporting economic vitality in the tourism sector by:

Increasing the catchment of tourists able to access the Scottish islands

Facilitating trips from metropolitan centres to regions

Attracting more lucrative long haul and emergent market tourists

ii

Extending tourist season into shoulder months and winter.

5.2 PSO Routes

5.2.1 As a result public authorities desire affordable fares on the PSO routes. Cranfield

University’s good work on comparative PSO practice illustrates the wide diversity in PSO

fare levels across the continent.

Figure 1: Highest return fare comparisons on selected PSO routes

18

5.2.2 The comparative study concludes that, “In many cases the line between PSO and non-

PSO designation is arbitrary and often the product of how successful regional lobby

groups have been at influencing national policy. Such decisions rest strongly on whether

a government’s aviation policy is inherently interventionist or market-orientated.

Differences in approach are very apparent when the attitudes to PSOs of decision-

makers in both Scotland and the UK as a whole are compared with those prevailing in

France. The route linking Nice and Figari (Corsica), for example, can be compared with

Aberdeen-Sumburgh in terms of distance, frequency, aircraft size and overall capacity.

Both services link airports on the respective mainland with island communities. The

French air service however is subsidised while the comparable Scottish route is not.”

January 2004

5.2.3 A 2013 PSO paper examined how transport authorities dealt with the affordability issue

in their PSO programmes.

5.2.4 Most sponsoring authorities (14/16) try to influence affordability by specifying a

maximum fare. However, by weighting the responses by number of routes the picture is

reversed to some extent (39 routes without a cap), suggesting that in some of the larger

PSO programmes (possibly more concerned about regional development than lifeline

links) the affordability issue is less key.

TABLE 1: SUMMARY OF WHAT MAXIMUM FARES INCLUDE

AIRPO

RT

TAXES

PASSEN

GER

TAXES

LUGGA

GE

CHARG

ES

CREDIT

CARD

PAYME

NT

CHARG

ES

DATE

CHANGE

FLEXIBIL

ITY

NAME

CHANG

ES

PRIORIT

Y

BOARDI

NG

IN-FLIGHT

REFRESHM

ENT

AUTHORIT

IES

10

9

7

5

3

1

1

2

ROUTES

36

30

34

36

3

1

1

8

NOTE: THE OPTION “OTHER” WAS NOT SELECTED BY ANY OF THE RESPONDENTS

5.2.5 Among those authorities who specify maximum fares, there is a strong view that

these fares must include primarily airport and passenger taxes, but a significant

proportion also includes other aspects as standard, as shown in Table 2. As free

market aviation continues to disaggregate / unbundle the fare there is therefore a

tendency for established PSO routes to continue with practices that are becoming

less commonplace around the industry. One potential unintended consequence of

these requirements is the complexity this could inadvertently impose on a bidding

airline, which does not have the capability to easily cater for these additional

impositions in their IT and booking systems.

19

Impacts of Expense

“I only use the air services if it's an emergency, otherwise, I spend £50 return from Edinburgh to

Stornoway (that includes the ferry) and it takes me 13 hours to complete.”

Location: Edinburgh

“Due to recent unreliability of flights and them regularly being delayed or cancelled for technical

reasons I now travel the day before I need to for connecting flights / meetings / appointments etc this

means extra accommodation expense and having to use extra days holiday from work.”

Location: Stornoway

“They are always late, usually technical, they cannot be depended on for onward travel so usually have

added expense of extra days away to ensure getting where you want to go.”

Location: Shetland

“The flights are continually delayed or cancelled and it is having a devastating effect on the Island

economy”

Location: Lewis

“Prices are crippling users, I had to return home urgently from Edinburgh. I had to pay VIP prices and

it was really hard to recover from this cost.”

Location: Sanday

“Unreliable and expensive. If you have an onward journey you sometimes need to leave the day before

and incur costs of overnight stays in hotels as the service from the Island is so unreliable!”

Location: Stornoway

Extracts from Air Connectivity Between The Scottish Islands And Mainland – SCDI online survey 2016

20

Table 2: Summary of type of fare concessions that the PSOs specify

iii

Pensioners

Student

and

child

Other

social

Discounted

(advanced

booking)

Local

residents

None

specified

Other

Authorities

5

6

1

2

6

7

1

Routes

31

61

21

2

41

21

30

5.2.6 Similarly, although not unexpected, the typical PSO contract also includes various

requirements and types of fare concessions that are pre-specified by the authorities.

Beneath the maximum fare price it is then left to the discretion of the operator to

offer further discounted fares. That PSO contracts are pre-specified by the

authorities to support particular socio-economic aims is similar to general public

transport policy. What is different in the aviation context is, however, for local

residents to enjoy favoured treatment, particularly in the larger programmes (on not

less than 41 routes).

Figure 2: Inner Hebrides Air Service

21

5.3 Air Discount Scheme

5.3.1 The Scottish Air Discount Scheme (ADS) is managed by Transport Scotland. It provides

discounted fares on eligible routes to people whose main residence is in Orkney,

Shetland, the Western Isles, Islay, Colonsay, Jura, Caithness and north-west

Sutherland. The scheme was extended to include Colonsay residents in the light of the

new non-PSO service between Colonsay and Islay. The scheme withdrew eligibility to

non-private users in April 2011, but then permitted a reinstatement for Third Sector and

charity organisations in July 2012. Communities argue that business users should also

benefit, but there are some state aid concerns. There has been a recent increase of the

rate from 40% to 50% from January 2016.

5.3.2 Those not eligible include people whose residence is not in the specified geographic

area, except students that are studying away from home and their main residence is in

an eligible area.

People travelling on Public Service Obligation (PSO) flights

People travelling for the purpose of business. Business related travel is

considered any journey where there is a business component, regardless of

whether there is also a leisure-related component

People travelling on NHS-funded trips

Anyone in the eligible geographic area who does not have a live, valid card

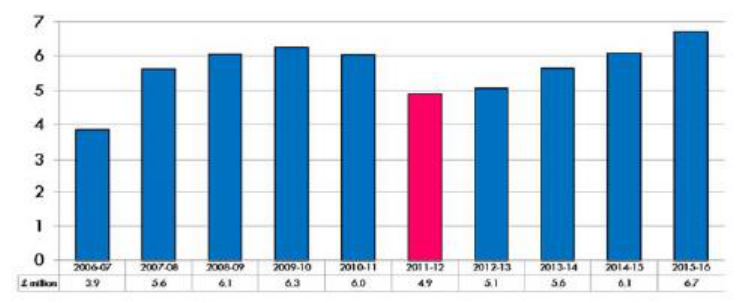

Figure 3: ADS Annual Expenditure (£ millions)

iv

22

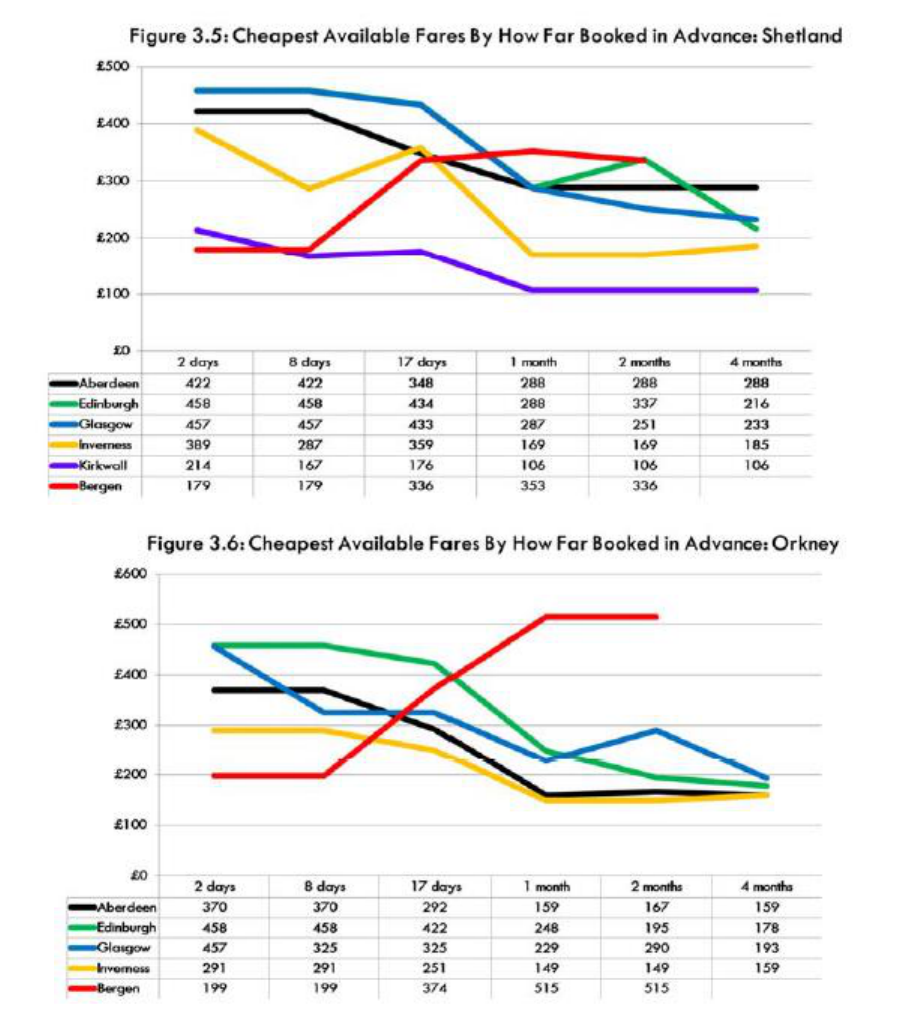

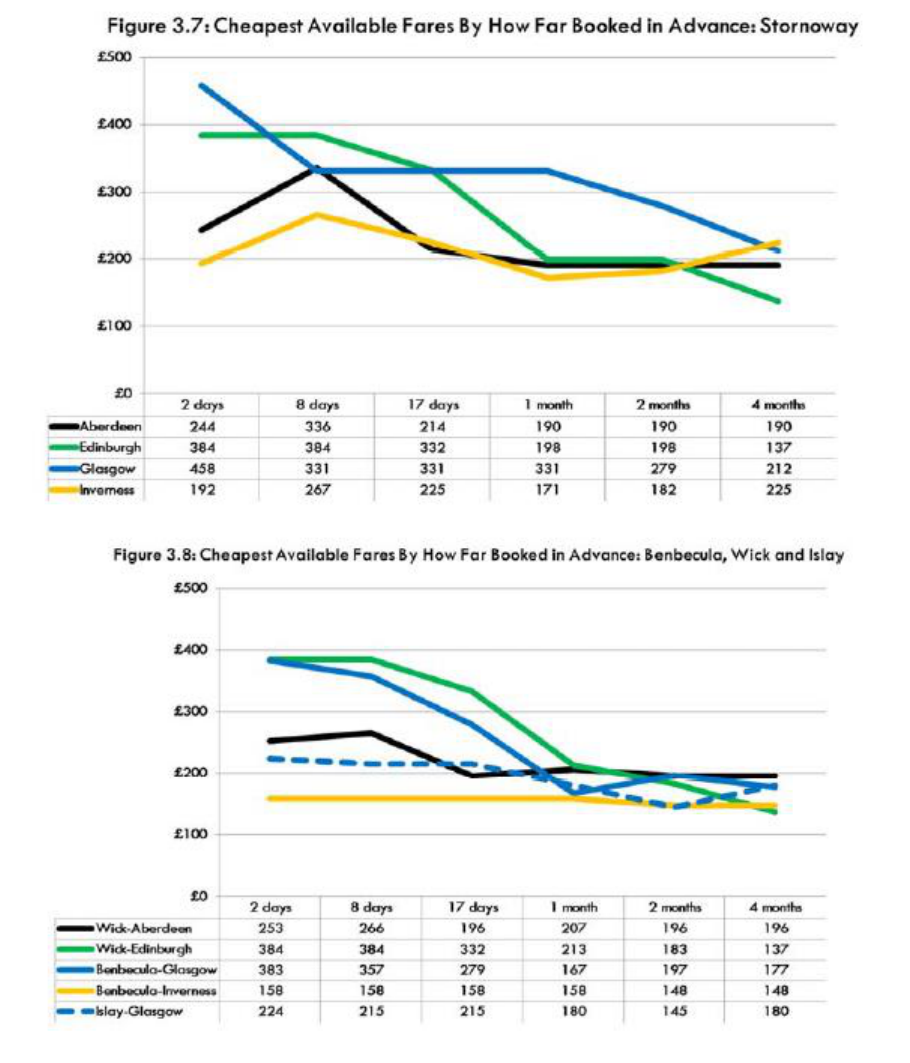

5.3.3 Research is currently being undertaken to explore the case for business user eligibility.

This draft report has produced some interesting analysis on cost of tickets based upon

advance booking. Some charts are extracted from the report without explanation and

comment (which are required to better understand), but they underline how a consistent

analysis across PSO and ADS qualifying routes would be helpful in appreciating how

affordable intra Scottish air services are.

23

24

5.3.4 The Appraisal of Inclusion of All Business Travel Within the Air Discount Scheme

Report examines the effect on both private sector and public sector business and

makes an estimate of both the potential cost to Transport Scotland (c. £3.4m) of

extending the scheme to business, and also explores justifications / mechanisms,

whereby this could be achieved in a state aid compliant way. The data and insights

produced by this study, which was supported by an extensive business consultation

exercise, could become one of the scenarios that a bespoke intra Scottish forecasting

model (see below) could incorporate, especially as estimates of price elasticity were

produced. A subsequent value for money, or cost benefit calculation could then be

made.

5.3.5 In Cabrera, Betancor & Jiménez’s 2011 paper

v

the researchers found evidence that

where the fares were subsidised the air operators were adept at not passing on the full

benefit to passengers in the form of comparable fare reductions.

5.3.6 The Scottish Air Discount Scheme currently subsidises remote region residents on open

market flights but not on PSOs as this is considered as double subsidy. However our

understanding is that such a double subsidy is not forbidden. For example, Dubrovnik

residents enjoy discounts, on their already nationally subsidised PSO flights to the

capital. Could ADS be applied to Scottish PSO routes as a way to better distinguish

between business and private users and improve affordability on PSO, whilst charging

business users more?

5.3.7 The intra island PSO services have found several ways to deliver further discounts to

local island residents. There are OAPs, children and Student categories and via

cheaper uni-directional return tickets (from the outer isles). There have also been a per

head allocation of free travel vouchers approach for outer island residents. All these

mechanisms need documented and their impacts assessed.

--------------------------------

5.3.8 Loganair’s recently announced a compassionate travel policy on its 19 Scottish routes

giving eligible customers access to a 50 per cent discounted fare in times of a family

emergency is a voluntary attempt to address some concerns and underlines the socially

important role these services perform and the airline’s understanding of this.

5.4 Recommended Next Steps

Review of the affordability of internal Scottish air services for passengers

through;

o Analysis of the range of fares on each route to establish the current

situation

o Benchmarked comparisons, if suitable ones can be identified.

Consider merits of extending Air Discount Scheme for certain types of business

travel.

Seek recommendations potentially relating to PSO fare specifications, detailed

operation of ADS scheme, operator yield management policies and appropriate

incentives for both travellers and operators.

25

6 Reliability / Punctuality / Utility

6.1.1 Based upon data on reliability supplied by Loganair and data on punctuality (time off

chocks) supplied by HIAL we have been able to prepare the following analyses.

Reliability refers to whether the flight was operated, delayed or cancelled, and

Punctuality refers to the difference between the flight’s scheduled departure time and the

flight’s actual departure time.

Table 3: 2014 & 2015 Punctuality Statistics for each HIAL Airport (Delays of 15 mins+)

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Annual

PERCENTAGES

0-5

6-10

11-

20

21-

30

31-

40

40+

COLOUR

KEY

Barra

25%

12%

21%

32%

14%

19%

12%

28%

23%

42%

24%

33%

23%

2014

Barra

78%

19%

32%

33%

25%

29%

17%

20%

15%

35%

38%

20%

28%

2015

Benbecula

16%

14%

16%

14%

12%

22%

21%

15%

20%

19%

15%

40%

19%

2014

Benbecula

41%

20%

21%

17%

23%

25%

22%

19%

26%

29%

34%

28%

25%

2015

Campbeltown

7%

8%

2%

2%

1%

13%

5%

10%

6%

16%

8%

19%

8%

2014

Campbeltown

21%

10%

17%

19%

10%

21%

10%

20%

9%

24%

37%

15%

18%

2015

Inverness

19%

11%

15%

10%

11%

18%

21%

16%

20%

15%

25%

33%

18%

2014

Inverness

31%

18%

21%

17%

20%

19%

23%

21%

25%

25%

30%

10%

23%

2015

Islay

17%

13%

15%

10%

13%

28%

16%

17%

19%

31%

18%

33%

19%

2014

Islay

41%

13%

25%

31%

26%

24%

25%

23%

18%

19%

36%

29%

25%

2015

Kirkwall

17%

11%

24%

12%

20%

26%

19%

15%

20%

15%

11%

34%

34%

2014

Kirkwall

25%

14%

30%

19%

16%

16%

21%

20%

23%

20%

19%

15%

20%

2015

Stornoway

16%

6%

12%

15%

14%

23%

19%

19%

20%

15%

14%

37%

18%

2014

Stornoway

33%

17%

22%

16%

19%

22%

22%

19%

25%

24%

32%

17%

23%

2015

Sumburgh

25%

20%

18%

22%

25%

34%

30%

18%

23%

28%

22%

45%

26%

2014

Sumburgh

37%

23%

28%

23%

20%

26%

29%

16%

24%

26%

32%

19%

25%

2015

Tiree

13%

25%

0%

15%

30%

21%

24%

24%

10%

31%

16%

29%

20%

2014

Tiree

34%

21%

19%

23%

15%

33%

17%

25%

21%

45%

32%

40%

27%

2015

Wick

7%

8%

15%

18%

21%

25%

26%

38%

46%

22%

14%

20%

22%

2015

Wick

30%

17%

31%

15%

12%

20%

32%

12%

38%

10%

8%

0%

20%

2015

NB: December 2015 statistics are not fully complete. Eastern’s performance on ABZ-SYY and ABZ-WIC have not been

included.

26

6.1.2 This data demonstrates a significant amount of timing delays (exact length not covered

here) over a cut off of 15 minutes. Table 3 illustrates in some detail the punctuality of

Loganair’s flights at HIAL airports. Seven of the ten airports reported an increase in

delays of 15 minutes or more in 2015 compared to 2014, with Kirkwall, Sumburgh and

Wick the few airports reporting an increase in on-time flights.

6.1.3 Nevertheless airlines should be aiming for 95%+ punctuality dispatch rates. Some

caution is required in interpreting HIAL figures as these may refer to departure times

rather than off chock times, and aircraft can often be held by ATC outside of the

operator’s own control.

6.1.4 A delay of 15 minutes is not too serious as onward connections and business plans

should not be compromised. However it is the longer delays that are most disruptive

and concerning and these will tend to be more closely associated with technical

problems and typically take more time to rectify, and sometimes involve a replacement

aircraft being deployed. We were able to analyse HIAL data for 2014 and 2015 with the

following picture emerging.

Figure 4: Severity of delays 2014

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

Jan Feb Mar Apr May Jun July August Sept Oct Nov Dec

Severity of Loganair Delays at HIAL Airports 2014

120+ minutes 60 - 119 minutes 30 - 59 minutes 15 - 29 minutes

27

Figure 5: Severity of delays 2015

6.1.5 No clear trends are apparent, except that longer delays appear to have increased in

2015 over 2014. However another analysis (averaging the year’s delays by severity)

captures an apparently clearer picture, suggesting that all delays have increased in

number and severity over the survey period. Once again caution with what HIAL figures

are actually measuring is required, but the trends do not look particularly positive.

Figure 6: Delays over last four years

0

500

1000

1500

2000

2500

3000

3500

2012 2013 2014 2015

Loganair Delays at HIAL Airports

120+ minutes 60 - 119 minutes 30 - 59 minutes 15 - 29 minutes

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

Jan Feb Mar Apr May Jun July August Sept Oct Nov Dec

Severity of Loganair Delays at HIAL Airports 2015

120+ minutes 60 - 119 minutes 30 - 59 minutes 15 - 29 minutes

28

6.1.6 As this report was being finalised some more recent punctuality data was able to be

analysed which covered the first six months of 2016. The point of interest was what

trends in punctuality were at work. The high level comparison of the first six months of

the last three years seems to indicate that the worst winter punctuality was experienced

last year whilst spring punctuality is the same or slightly worse than previous years – a

mixed picture. However this total percentage figure does not tease out the severity of

the delays or the reasons thereof.

Figure 7

6.1.7 By sampling two months (January and June) we can gain further insight into the severity

of the delays.

Figure 8

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

Jan Feb Mar Apr May Jun

First six months of last three years % Flight delays

on Loganair Flights at HIAL airports

2014 2015 2016

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

90.0%

120+ minutes 15 - 29 minutes 30 - 59 minutes 60 - 119 minutes On-Time

January - % delays by Severity - Loganair

2014 2015 2016

29

Figure 9:

6.1.8 The general impression was that 2015 was the worst year for delays, but 2014 appears

the best and 2016 somewhere in between. This may be reflected as a dip and then

partial recovery.

6.1.9 Please note that consistent Punctuality and Reliability data has not been collected

in an accessible way on the Scottish BN2 Island inter island PSOs.

6.1.10 It would make sense that punctuality data was more easily available and easier to

analyse and the study could consider how best this might be achieved.

6.1.11 Indeed there are also issues with punctuality and reliability in the BN2 Islander services

apparent in the current review in the Northern Isles. Some consistent trans Scotland

and trans operator data collection would be helpful if it delivered a consistent means of

monitoring punctuality and reliability. Prima facie for instance it appears that 34% of

DirectFlight’s inter island Shetland services are delayed, although the definition of ‘delay’

is not clear and likely will not be consistent across all operators. It would for instance be

instructive to compare the performance of the BN2 operators across Scotland to see if

there are differences in their punctuality and reliability performance. Eastern Airways

services to Wick and Stornoway should also be included in such a review.

6.1.12 In a recent press release Loganair made mention of their “previously announced

initiatives to ensure punctuality and customer service are fully returned to the levels our

customers have rightly come to expect over many years

vi

.” The scoping exercise it is

suggested should examine more closely the company’s Rectification and Quality

Assurance (QA) Plans.

6.1.13 Punctuality refers to the difference between the flight’s scheduled departure time and the

flight’s actual departure time, although one stakeholder reflected that perhaps arrival

times might be a more pertinent metric.

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

120+ minutes 15 - 29 minutes 30 - 59 minutes 60 - 119 minutes On-Time

June - % of delays by Severity - Loganair

2014 2015 2016

30

6.1.14 Reliability on the other hand refers to whether the flight was operated, delayed or

cancelled, and Loganair provided some analysis on this for this exercise.

6.1.15 Loganair reported a 97.5% reliability rate on its services between December 2014-

November 2015, with the majority of its cancellations reported as a result of weather

issues (61% of all cancellations) and technical difficulties (29% of all cancellations).

6.1.16 If we examine the other reason recorded for delay during this survey period the data

reports a lower weather causing component, and the reason for the discrepancy is not

clear at the time of writing.

Figure 10: Reasons for Delays and Cancellations

6.1.17 As can be appreciated in this summary pie chart weather is only responsible for 20% of

delays and operational, other and technical reasons for the rest.

6.1.18 The definitions of these three categories of course is worthy of further investigation but

the 18% ‘technical delays’ is particularly of interest, and operational delays may also

cover some downstream delays caused by earlier failures, some of which may be

technical. Inconsistencies by reporter, and consistency in the application of

classifications are always a challenge with performance reports. This preliminary data

raises questions that further research should be able to address.

6.1.19 Many of the respondents to the SCDI survey highlighted the challenge of missed

hospital appointments and extensive delays to treatment as a result. They seemed also

to suggest that whilst air service reliability is a key part of this, there also seems a clear

need for greater flexibility to be shown on the part of hospitals towards island patients.

49%

13%

18%

20%

Reasons for Delayed & Cancelled Flights Across Loganair Flights at

H&I Airports (sampled Aug 14 - Aug 15)

OPERATIONAL OTHER TECHNICAL WEATHER

31

Impacts of Poor Reliability

“I usually end up driving and taking the boat because

the flights are so overpriced. I can fly to the continent

cheaper than flying home.... I would use it 5x the

amount if it was 50% cheaper”

Location: Aberdeen Source

“I have missed three health appointments in the last

year due to delayed or cancelled flights.”

Location: Lewis

“Service can be really hit or miss. Sometimes there

have been no issues, other times there have been lots of

impact due to late flights, such as missing an

appointment for an MRI scan for a family member or

missing connecting transport.”

Location: Kirkwall

“We have had far more disruption due to flights being

cancelled coming in to Orkney. I have had two

significant business related events cancelled this year

because Flybe flights were cancelled. I have

significantly reduced my air travel because of poor

links.”

Location: Orkney

We would like to do a day trip to Edinburgh, as the

times of the flights theoretically allow for this:

however, the unreliability of Loganair makes this

totally impossible, as there is currently no guarantee

that we would arrive in good time, or actually get

home on the same day.”

Location: Orkney

Extracts from Air Connectivity Between The Scottish Islands

And Mainland – SCDI online survey 2016

6.1.20 The Islands Transport Forum could play a role in monitoring punctuality and reliability

and in monitoring operator’s Quality Assurance programmes. This could perhaps be

achieved through the sub group referred to in earlier sections of this report. If there is a

view that there are specific short term problems which are not being sufficiently

addressed by the operator(s) – potentially including reliability and punctuality, and other

areas of passenger experience – then it might be worthwhile suggesting a Working

Group is established to address these. This would need the full support of the operators

to be at all effective, but it could be argued that as the indirect beneficiaries of

Government funds through airports, ADS, PSOs etc, that Transport Scotland should be

able to formally request and ensure attendance, and that airlines are suitably open and

transparent about problems with their services, and are willing to engage with the

Working Group to discuss solutions. It could be that such a Working Group would have a

short-term role, but there is perhaps also an argument that it should become a

permanent feature, meeting at least twice per year with a network-wide remit, and

including relevant airport operators as well as airlines?

6.1.21 Interlining and onward travel is an

important component of intra

Scottish flights. Lack of interlining

for passengers tends to result in

higher combined fares, no through

ticketing of baggage, and no

protection if connections are missed.

6.1.22 It should be noted that

Loganair/Flybe offer a range of

codeshare and interline connections,

which are a major positive for Island

travellers. Apart from the BA

codeshares, they now also offer

connections (either through

codeshare or interline) with a

number of international services at

Glasgow and Edinburgh including

those operated by Air France/Hop,

American Airlines, Emirates, Etihad

and Virgin Atlantic). Eastern operate

a codeshare with Wideroe providing

connections via Aberdeen to a range

of destinations in Norway, although

do not provide interlining with the

likes of BA or KLM – which would

arguably be more attractive.

32

6.1.23 In other parts of the world such as Canada and the USA public authorities encourage

operators in remoter areas to interline with operators at larger hubs to facilitate such

onward travel. The extent to which interlining is used and whether it could be further

facilitated either at the larger airports into which island services feed, or from the outer

islands into intra Scottish services should be reviewed in the research.

6.1.24 It should also be noted that punctuality and reliability also impact on the appetite of

operators to develop codeshares as one downside for them of such collaborations is

they are taking responsibility for missed flights with financially and organisationally

onerous denied boarding obligations.

6.1.25 Additionally multi modal, rover or season ticketing might well be attractive to travellers in

the region. Air/Ferry cooperation could be of benefit to both visitors and residents.

6.1.26 Collaborative and consistent destination marketing efforts appear to be another useful

role that state actors could play by increasing demand for the air services. The Islands’

Transport Forum should foster, or at least be informed on, such efforts.

6.2 Recommended Next Steps

A review of the following data for each airline and route

o Reliability

o Punctuality

o User Survey

Operators’ Rectification and Quality Assurance (QA) Plans

Interlining and onward travel

Ticketing and marketing

Publication of an annual report with recommendations for a Regional air

service QA monitoring and intervention mechanisms (eg a Working Group that

takes this role under its wing)

Recommendations and Conclusions considering five, ten and thirty year time

horizons. This allow short term, medium term and long term issues to be aired

and considered. Operators tend to work to a five year horizon whilst it is the

responsibility of government to consider longer term, systemic and strategic

view on matters.

Sumburgh Airport Departure Lounge

33

7 Forecasting

7.1.1 Undertaking demand forecasting would be useful to gain an idea of future passenger

demand and how that will feed into air services and potentially aircraft types. A route by

route output would be particularly useful for assessing future appropriate aircraft

capacity. This would have parallels with the work being led by Transport Scotland on

Ferry Vessel Replacement and Demand Planning.

7.1.2 This implies building a Scottish Airports Forecasting model with the capability to be used

for a variety of purposes, including:

Challenging the Scottish outputs from DfT’s UK wide model;

Understanding the impact of external environmental changes (e.g. macro-

economic conditions, carbon-trading);

Assessing the effects of different policy interventions – such as the reduction of

APD, pro-active route support, airport closures; and

Evaluating the return on different forms of investment in connectivity via airports,

airlines, specific infrastructure projects or direct support for travellers.

Figure 11:

0

50

100

150

200

250

300

350

400

450

500

Scottish H&I Airports Historic Pax Throughput 1994-2015

BARRA BENBECULA CAMPBELTOWN

ISLAY KIRKWALL LERWICK (TINGWALL)

SCATSTA STORNOWAY SUMBURGH

TIREE WICK JOHN O GROATS

34

7.1.3 Passenger data on the inter-island services in Orkney, Shetland and the Inner Hebrides

are gathered from various sources, but show recent decline in Shetland, re-established

plateau of usage in Orkney after a recession led downturn, and recently reported growth

in the Inner Hebrides air service out of Oban (see Figures 5 – 6 and Table 1).

Figure 12: Orkney Inter island Carryings

Figure 13: Shetland Inter island carryings

0

5000

10000

15000

20000

25000

30000

35000

Annualised Orkney inter island Pax Carried in

Year Ending

4474

5113

4942

4755

4743

4883

4360

3706

0

1000

2000

3000

4000

5000

6000

2006 2007 2008 2009 2010 2011 2012 2013 2014

Shetland Inter Island Service Pax Carryings

35

Table 4: Inner Hebrides Air Service

Passenger Figures from Services Operated out of Oban airport

(excluding scholar flights)

Month

2008

2009

2010

2011

2012

2013

2014

2015

2016

January

-

200

100

173

216

241

249

223

379

February

-

168

145

249

215

258

287

335

373

March

-

233

-

244

336

357

390

456

284

April

-

181

86

131

195

256

296

330

266

May

-

181

88

147

310

328

311

232

334

June

137

223

189

251

279

304

279

362

379

July

137

207

210

212

317

353

318

378

236

August

197

206

246

201

327

286

293

379

September

153

227

221

216

236

260

313

414

October

189

133

151

246

308

287

292

262

November

159

137

239

294

282

235

325

461

December

151

195

151

146

203

169

163

430

Total

1,123

2,291

1,826

2,510

3,224

3,334

3,516

4,262

Source: Hebridean Air Services

7.1.4 In 2012, the volumes using Oban services, excluding scholars, has risen to 3,224

passengers compared to 2,510 during 2011; a 28% annual increase. In addition, some

304 scholar trips were made using these services. Carryings to/from Tiree are the

highest in the Inner Hebrides at over 1,000 per annum. Those for Colonsay total over

900, followed by Coll with approaching 800 passengers per annum. The services to Islay

see around 550 passengers.

7.2 Recommended Next Steps

A thirty year forecast of future passenger demand under baseline conditions, and

with selected intervention options applied to assist future planning and policy at a

strategic level.

36

8 Future Proofing

8.1.1 There are a range of emerging technologies and equipment that could dramatically

change costs and services in the next thirty years.

8.1.2 A review of these factors and their likely timelines will help guide investment decisions.

8.1.3 Exciting areas of relevance including changes to air traffic practices and navigation aids,

less expensive runway lighting systems, next generation smaller aircraft. Some high

level overview of relevant topics are listed below, but as each topic requires access to

specialist knowledge and insight a further synthetic exercise in drawing these all

together and assessing their relevance is required.

8.1.4 Future proofing should also consider human resources in terms of recruitment, training

and retention (which is often a particular challenge on the islands) and options with

regard to state involvement in the funding of infrastructure and assets.

8.1.5 Looking to the future should include consideration of business development efforts to

broaden the income base of smaller airports, and thereby reduce their burden on the

public purse, and potentially facilitating the development of aviation and non aviation

employment clusters at the region’s airfields.

8.2 Recommended Next Steps

Review of relevant emergent technologies and trends (eg Remote Tower, Global

Navigation Satellite Systems (GNSS), Airfield Lighting and Markings, Airport

Collaborative Decision Making (ACDM) initiatives, Greening Aviation, Threat to

or reformulation of AvGas, Single Engine Turbines, Rotary, Regional and LCC

airlines, Current and potential Scottish air operators, New runway in UK south

East, Scottish short and long haul route developments and opportunities.

Consider Multi-modal transport developments, requisite staffing, training and

skills and security.

Review of current and possible aircraft types to serve the network now, and in

the future, and possible adaptions to supporting infrastructure / airfields /

terminals / access roads and services to accommodate.

Consideration of best ways to secure capital investments for the modernisation

of airports and aircraft.

Develop Route and Business Development Strategy including non-scheduled

aeronautical activity such as air cargo, Air Charter and Inclusive Travel flights,

General Aviation, Business Aviation, Flight Training, aero-engineering and aerial

work (remote sensing, reconnaissance, emergency response etc.)

Identify opportunities to optimise airports as business and employment clusters /

facilitators and potential to increase non-scheduled revenue to reduce burden on

public purse.

37

9 Governance, Consultation, Engagement, Collaboration

and Competition

9.1.1 A review of these strategic issues in relation to the supervision, specification and

provision of appropriate air services and in the management of airports / airfields, ideally

supported by best practice or benchmarking insights.

9.1.2 Consultation with key stakeholders would highlight other issues that could inform the

optimal means for improving engagement of stakeholders in the region. Inverness City

Region Bid for instance has outlined a model for more effective key stakeholder

engagement to support route development in the Highland area (Inverness, Wick and

potentially Skye). The islands working with HIAL and the Regional Transport

Partnerships could adapt such an engagement model to their own needs and this could

feature in an Islands Deal.

9.1.3 In order to address some of the specific short term problems which this report has

identified including reliability and punctuality, and potentially other areas of passenger

experience it is proposed that a Working Group is established. This would need the full

support of the operators to be at all effective. It could be that such a Working Group

would have a short-term role, but there is also a strong case that it should become a

permanent feature, meeting at least twice per year with a network-wide remit, and

including relevant airport operators as well as airlines?

9.1.4 The BN2 Islander operations reviews in both Orkney and Shetland are also producing

common recommendations along these lines. Some of these are extracted from draft of

reports under preparation as part of the STAG 2 Internal transport studies currently

being undertaken for the Northern Isles.

Collaborative Action - The similarities between the Orkney, Shetland and Inner

Hebrides PSOs suggest that collaborative investigations would deliver benefits

on a range of matters. HITRANS and ZetTRANS and other agencies working

together can help support a more integrated approach. Opportunities for jointly

funding and procuring services and developing combined applications for

additional funding for strategic enhancements also need explored.

Technological enhancements to improve reliability - Air service reliability rates

and night-time (dusk) operations need to be improved particularly in the winter.

GNSS, LED battery powered runway lights, runway markings and approvals for

GNSS use at the relevant airfields should permit flying in lower visibility than

currently possible.

A possible Scottish Summit with BN2 Islander operators may help identify the

most cost beneficial nationwide investments to make. The three air operators

currently operating in Scotland (Loganair, DirectFlight and Hebridean Airways)

have now all developed considerable operational, engineering and other

expertise in the Islander aircraft type.

Seek economies of scale in acquisition, wherever possible and improve

systemic resilience and future proofing air systems e.g. by sharing a backup

BN2 islander aircraft across the three BN2 Islander operations.

38

There are cross Council synergies in RFFS

vii

recruitment, retention and training

and in accountable management and safety managements systems and there

may be benefit in more exchanges of their various approaches and solutions.

HITRANS / ZetTRANS may provide a platform for such discussions. IT would

be advantageous if the other bodies such as the CAA, HIAL and the Scottish

Fire and Rescue Service could also input into such a forum or collaboration.

Demand for air services could be lifted by increased resourcing of marketing,

and a recognition that the regional island services have great similarity and are

attractive to similar niche visitor groups. Solutions such as integrated or

interchangeable ticketing with ferries may also require broader solutions rather

than solely within Council areas.

Implicit in this is the potential to develop better destination branding (ideally

acting collectively with other Scottish Islands, and other Agencies including

VisitScotland.

Cooperate with agencies and other analogous EU areas, to address common

issues (marketing, seeking additional sources of funding – such as INTERREG

ERDF, UK and Scottish agencies, EU cohesion funding, Lottery

1

and Heritage

2

funding. The funding of GNSS approaches and runway lighting and terminal

infrastructure are other possible elements that have been and could further be

addressed through collaborative funding from a range of sources.

9.1.5 An open ended workshop of all the relevant parties where issues were aired and new

solutions sought would help to identify priorities. Perhaps separate airport management

and air operator QA workshops could be convened.

9.2 Competition

9.2.1 The lack of meaningful competition on island routes has been commented upon by the

Islands Area Ministerial Working Group and in discussions at the Islands Transport

Forum. This is a concern as the effect is a dependency on a single supplier. Concerns

have been raised and gained significant media profile on the issue of high fares and

concerns over service reliability.

9.2.2 The study should be tasked to review mechanisms to facilitate more competition in the

system and the development of measures to ensure that in the absence of competition

fares are reasonable and reliability meets a median industry level.

9.2.3 This study could review the effectiveness of PSO competitions, the use of other

mechanisms such as Memorandum of Understanding (MOUs), quality partnerships and

service level agreements, periodic reviews and the availability of KPI data can also play

a role in sustaining and improving service levels.

1

The Big Lottery Fund awards grants to UK organisations to help improve their communities

2

“We give grants to sustain and transform our heritage in the UK”

39

9.3 Recommended Next Steps

9.3.1 An intra-Scottish air services review should include a review of governance, consultation

mechanisms, engagement, collaboration on funding, procurement and competition with

the aim of making recommendations for improvement. The aim to improve local

democratic involvement in the delivery of air services will also be implicit in such a

review.

9.3.2 This review can be informed by a baseline review, key stakeholder consultations,

(perhaps even involving workshops) and reviewing relevant benchmarking and best

practice on both the local and national government’s involvement with airports and their

management, and its interface with air operators.

Sumburgh flight (Saab 340b) being prepared for departure

40

Total Cost Quantification

TS PSO Cost

HIAL Support

ADS

OIC PSO, CapEx and OpEx

ABC PSO, CapEx and OpEx

SIC PSO, CapEx and OpEx

CnES PSO

NHS and other public bodies

air travel budgets

10 Affordability and Sustainability for Public Sector

10.1.1 It would be useful to bring together all known public costs connected with Aviation in the

Highlands and islands (H&I). This would include subsidy to HIAL, PSO subsidies, the

cost of ADS, any route development funding and the estimated benefit of the Highlands

and Islands Air Passenger Duty (APD) dispensation. A similar approach has been

undertaken by the Scottish Government with regard to the provision of ferry services. It

should also include depreciation on the publicly owned aircraft, and any other direct or

indirect costs, and public sector time spent on managing these various programmes.

10.1.2 Alongside this the costs that key public sector

departments spend on intra Scottish flights / travel

would be of interest and relevance (See HITRANS

Appraisal of Inclusion of All Business Travel within the

Air Discount Scheme, August 2016)

10.1.3 Some awareness of significant upcoming maintenance

and renewal costs and risks connected with regulation

and compliance needs to be quantified. This includes

the renewal of aircraft or potential migration to new

types and how that might be achieved with or without

state aid.

10.1.4 An understanding of how taxpayers’ funds are allocated through various intermediaries

such as HIAL and the Councils, and if there are any bottlenecks, risks or hotspots in that

process.

10.1.5 The study should also profile the environmental impacts of aviation (including land

access issues) and document any ameliorations that are being applied or planned.

10.1.6 In assembling this information, and in discussion with budget holders, suggestions for

improvement and savings would be assessed.

10.2 Recommended Next Steps

The review should assemble all known costs including;

o Operating and capital costs for supporting airfields

o Current and likely capital costs on publicly owned aircraft

o Costs of PSOs

o Cost of Air Discount Scheme

o Travel budgets, where available, of key users such as Health, Education,

Public Administration.

Regulation, Licensing, Security and SGEI certification