Governor Tony Evers

Secretary Emilie Amundson

dcf.wisconsin.gov

TO: Income Maintenance Supervisors

Income Maintenance Lead Workers

Income Maintenance Staff

W-2 Agencies

TMJ Contractors, Subcontractors, and Staff

TJ Contractors, Subcontractors, and Staff

Training Staff

Child Care Coordinators

FROM: Jonelle Brom, Director

Bureau of Eligibility Operations and Training

Division of Medicaid Services

Department of Health Services

Patara Horn, Director

Bureau of Working Families

Division of Family and Economic Security

Department of Children and Families

Jori Mundy, Director

Bureau of Eligibility and Enrollment Policy

Division of Medicaid Services

Department of Health Services

Junior Martin, Director

Bureau of Child Care Subsidy Administration

Division of Early Care and Education

Department of Children and Families

SUBJECT: Earned Income, Homestead, and Other Tax Credits

CROSS REFERENCE: TMJ/TJ Policy Manual, Section 2.3.1.2 Disregarding Annual Income

and 3.12 Tax Credits

W-2 Manual, Sections 3.2.9.1 Disregarded Income, 3.3.4.5 Federal

Income Tax Refunds

Wisconsin Shares Handbook, Section 6.3 Disregarded Income

BadgerCare Plus Handbook, Section 16.2 Income Types Not Counted

Medicaid Eligibility Handbook, Sections 15.5.7 Income Tax Refunds,

15.5.15 Earned Income Tax Credit, 16.7.7 Income Tax Refunds, and

16.7.8 Earned Income Tax Credit

SSI Caretaker Supplement (CTS) Handbook, Section 3.2 Financial

BWF OPERATIONS MEMO

No: 23-J1

DATE: 02/15/2023

FS MA BC+ FSET

W-2 EA TJ TMJ

CF JAL RCA CC

Other EP

OM 23-J1 Page 2 of 8

FoodShare Wisconsin Handbook, Sections 4.3.2.2 Disregarded Earned

Income, 4.4.1.4 Disregarded Assets, and 4.5.5 Nonrecurring Lump

Sum Payment

EFFECTIVE DATE: Immediately

PURPOSE

This operations memo provides information on the following:

•

Tax year 2022 information on tax credits and tax preparation services available to

working families in Wisconsin.

•

A reminder to Wisconsin Works (W-2) and Income Maintenance (IM) agencies of the

importance of notifying program participants of the financial advantages of federal

and state tax credits.

•

A reminder on how to count federal and state tax refunds when determining

financial eligibility for assistance.

BACKGROUND

There are several federal and state tax credits available to eligible working families that may

reduce their tax burden and increase their income. The table below provides a summary of

the maximum tax credit amounts that may be available to working individuals and families.

The Child Tax Credit (CTC), Earned Income Tax Credit (EITC), and Child and Dependent Care

Credit (CDCC) have been reduced to 2019 levels, meaning that affected taxpayers will likely

receive a significantly smaller refund than the previous tax year.

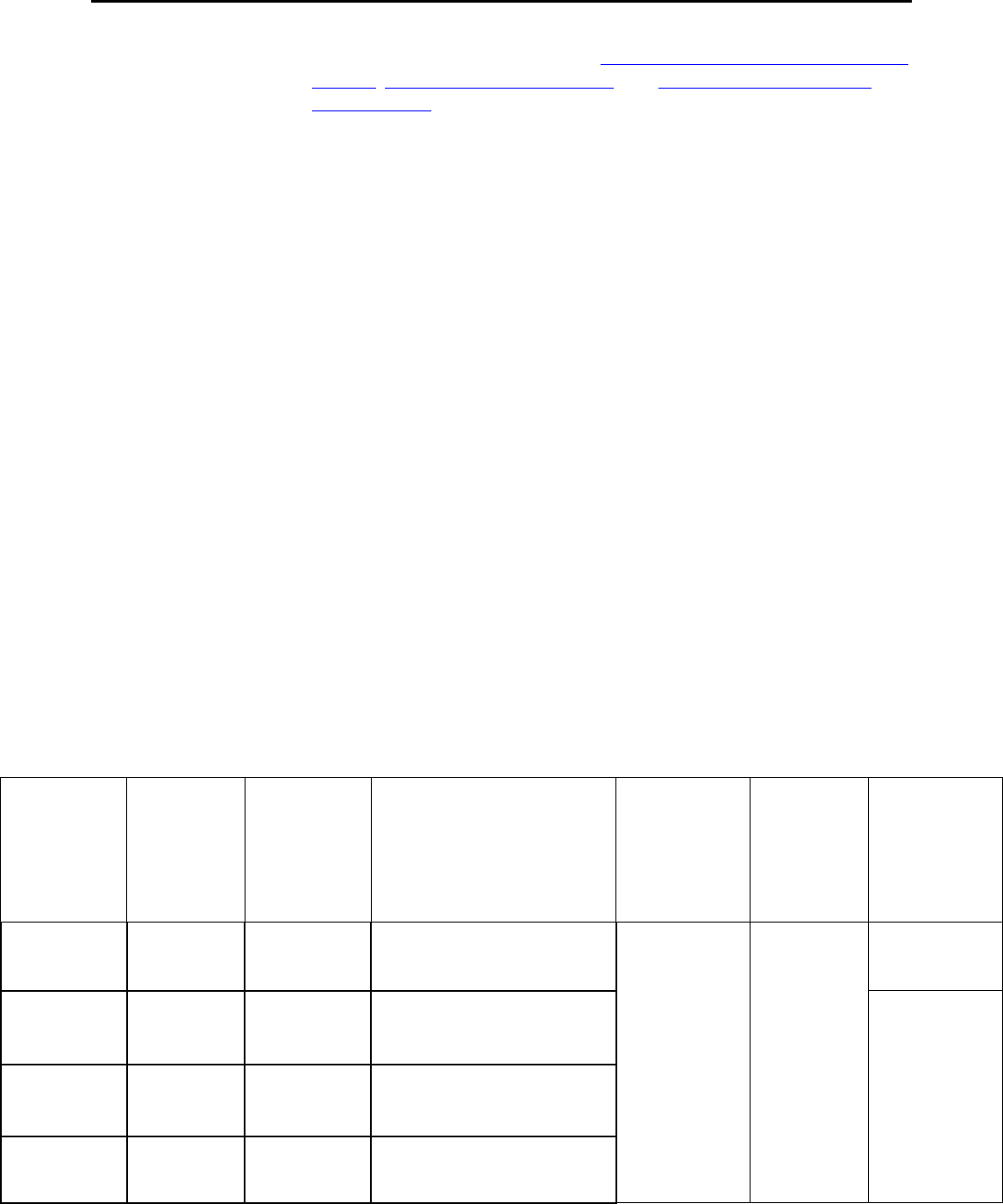

Summary of Tax Year 2022 Maximum Tax Credits with Income Eligibility Limits

Number of

Qualifying

Children

Federal

EITC

Wisconsin

Earned

Income Credit

(EIC)

EITC and EIC Income Limits

(Federal and State)

Wisconsin

Homestead

Credit (HC)

Wisconsin

HC

Income

Limits

Federal

CTC

0 $560

No credit

available

$16,480 (single)

$22,610(married)

$1,168

$24,680

$0

1 $3,733 $150

$43,492 (single)

$49,662 (married)

$2,000/child

under 17

2

$6,164 $678

$49,399 (single)

$55,529 (married)

3

or more

$6,935 $2,358

$53,057 (single)

$59,187 (married)

OM 23-J1 Page 3 of 8

RELATED INCOME POLICIES

Federal tax refunds are disregarded income and will not disqualify working families from the

programs listed below. Where applicable, agencies must continue to follow current policy

when counting state tax refunds.

W-2 AND OTHER PROGRAMS

1

W-2 agencies must disregard the entire amount of any federal income tax refund, including

from tax credits, as income in the month received and as an asset for 12 months following

the date of receipt. If there is a remaining, unspent portion of the refund after the 12-month

disregard period has passed, the agency must count that portion as an available asset.

W-2 agencies must disregard as income the portion of a state income tax refund resulting

from the Wisconsin EIC in the month received. Agencies must count any remaining amount

in a subsequent month as an available asset.

W-2 agencies and Financial and Employment Planners need to be aware that W-2 paid

placement benefits (i.e., Community Service Job, W-2 Transition, At Risk Pregnancy, Stipends

for Noncustodial Parents, and Custodial Parent of an Infant payments) are not considered

earned income and are not subject to income tax credits. However, employment outside of W-2

and any pay received from an employer through participation in Transform Milwaukee Jobs

(TMJ), Transitional Jobs (TJ), or the Trial Employment Match Program during 2022 are

applicable for income tax credits.

REFUGEE CASH ASSISTANCE PROGRAM

W-2 agencies must disregard the entire amount of any federal income tax refund as income

in the month received and as an asset for 12 months following the date of receipt for Refugee

Cash Assistance program. Agencies must disregard as income the portion of a state income

tax refund resulting from the Wisconsin EIC in the month received.

WISCONSIN SHARES CHILD CARE SUBSIDY PROGRAM

Wisconsin Shares Child Care agencies must disregard federal and state income tax

refunds (including the credits listed in the table on page two) as income.

BADGERCARE PLUS AND FAMILY PLANNING ONLY SERVICES

IM agencies must disregard federal and state income tax refunds (including the credits listed

in the table on page two) as income for BadgerCare Plus and Family Planning Only Services.

1 TJ/TMJ, Emergency Assistance, and Job Access Loans

OM 23-J1 Page 4 of 8

MEDICAID AND CARETAKER SUPPLEMENT

IM agencies must disregard the federal EITC and Wisconsin EIC as income in the month

received and for 12 months following the month of receipt for the Medicaid programs. If there

is a remaining, unspent portion of the refunds after the 12-month disregard period has passed,

agencies must count that portion as an available asset. All other federal and state income tax

refunds, rebates, and credits are disregarded as income, but are considered available assets.

For Caretaker Supplement, the federal EITC and Wisconsin EIC are disregarded in the month

of receipt and the following month.

FOODSHARE

IM agencies must disregard federal and state income tax refunds (including the credits listed

in the table on page two) as income. For households that include an elderly, blind, or disabled

member with income over 200% of the federal poverty level and that are subject to regular

FoodShare rules, IM agencies must disregard any remaining portion of a federal and state

income tax refund, rebate, or credit from the asset test for 12 months following the month the

refund is received. Count the remaining EITC as an asset for elderly, blind, or disabled

households with income over 200% of the federal poverty limit when the household has lost

eligibility for more than 30 days and is reapplying for benefits.

AVAILABLE TAX CREDITS

FEDERAL AND WISCONSIN EITCS

The federal EITC and Wisconsin EIC are available to working individuals with low or moderate

incomes. To qualify for these tax credits, individuals must have earned income from

employment or self-employment. When an individual’s tax credit exceeds the amount of taxes

he or she owes, the individual qualifies for a tax refund. To qualify for a tax refund, individuals

must meet certain requirements and file a tax return, even if they do not owe any taxes.

The Internal Revenue Service (IRS) has an interactive EITC Assistant tool

that assists individuals

with determining if they can claim the federal EITC and with calculating the amount of the credit.

For more information about the federal EITC, refer to the IRS website

.

For more information on the Wisconsin EIC, refer to the

Wisconsin Department of Revenue

(DOR) website.

WISCONSIN HC

The Wisconsin HC is available to low-income Wisconsin residents who rent or own their home.

This credit is meant to lessen the impact of property taxes and rent.

The following provisions apply to individuals who received a W-2 payment in tax year 2022:

•

If an individual received any amount of a W-2 payment in 2022, the individual’s property

taxes and rent are reduced by one-twelfth for each month the individual received

OM 23-J1 Page 5 of 8

payment.

•

If an individual received a W-2 payment for all 12 months of 2022, the individual is not

eligible for the HC.

Similar provisions apply to county relief payments of $400 or more received in tax year 2022.

For more information about the HC, refer to the Wisconsin DOR website

.

FEDERAL CTC

The federal CTC is available to families with a qualifying child. If the amount of the CTC is

greater than the amount of income tax a family owes, the family may receive up to $1,500 of the

credit as a refund.

The IRS has an interactive interview

that assists families with determining if they are eligible

for the CTC.

For more information about the CTC, refer to the IRS website

.

FEDERAL CDCC

The federal CDCC is available to families who pay out-of-pocket expenses for the care of

children, adult dependents, or an incapacitated spouse in order to work or look for work. If a

family does not earn enough money to owe federal income taxes, or if the family’s CDCC

exceeds the amount of taxes it owes, the family cannot benefit from the credit.

The IRS has an interactive interview

that assists families with determining if they are eligible

for the CDCC.

For more information about the CDCC, refer to the IRS website

.

FILING TAXES FOR PREVIOUS YEARS

Individuals may file for federal tax credit refunds for the three previous tax years (i.e., 2019,

2020, and 2021) even if they have not filed tax returns for these years. If applicable to their

situation, they would still be eligible to receive EITCs and CTCs for those previous years.

For more information on how to file a tax return for a prior year, call the IRS phone number for

individual assistance at 1-800-829-1040 or visit the IRS website

.

TAX PREPARATION RESOURCES

VOLUNTEER INCOME TAX ASSISTANCE

The Volunteer Income Tax Assistance (VITA) program offers tax preparation help to low-income

individuals, individuals with disabilities, and limited English speaking taxpayers. IRS-certified

volunteers provide free basic income tax return preparation with electronic filing at various sites

in local communities. VITA sites are generally located at community and neighborhood centers,

OM 23-J1 Page 6 of 8

libraries, schools, shopping centers, and other convenient locations. Most VITA sites are open

from February 1 through April 15, and some require an appointment.

To find a VITA site, call 1-800-906-9887 or use the VITA Locator Tool on the IRS website

. For

more information about the VITA program, visit the IRS website.

TAX COUNSELING FOR THE ELDERLY

The Tax Counseling for the Elderly (TCE) program offers free tax preparation help for all

taxpayers who are 60 years of age or older. The TCE program specializes in questions about

pensions and retirement-related issues unique to seniors. The American Association of Retired

Persons (AARP) Foundation operates the majority of TCE sites through its Tax-Aide program

which provides tax assistance for all taxpayers, with a special focus on taxpayers who are 50

or older. AARP’s volunteer tax preparers are IRS-certified.

To find an AARP Tax-Aide site, call 1-888-687-2277 or visit the AARP website.

For more

information about the TCE program, visit the IRS website.

FEES AND COMMERCIAL TAX PREPARATION

Some tax preparation companies take advantage of taxpayers by offering money up front to

individuals seeking tax refunds but charge high interest rates and fees to access the money.

Some companies also charge preparation fees that reduce an individual’s tax refund amount,

while others offer the refund amount via a high-fee debit card.

Agencies should inform participants about these types of tax preparation services and

encourage participants not to sign anything without fully understanding the terms and

conditions of the contract. Agencies should encourage participants to use VITA sites. These

sites are free and have free electronic tax filing, which can result in a speedier tax return.

TAX-RELATED SCAMS

The IRS maintains a webpage listing consumer alerts and common scams during tax season,

some to be aware of, include:

• Callers claiming to be IRS employees who tell victims they owe money which must be

paid by gift card, debit, or wire transfer.

• Fraudulent emails using the IRS logo or with links to fake websites intended to mirror the

official IRS website; these emails seek to obtain an individual’s personal and financial

information.

The IRS will never call taxpayers to demand immediate payment using a specific payment

method, and will not contact taxpayers by email, text, or social media to request personal or

financial information.

For more information regarding tax scams and consumer alerts, visit the

IRS Tax

Scams/Consumer Alerts webpage. To report tax-related scams and learn what to do if a

OM 23-J1 Page 7 of 8

suspicious communication is received, visit the IRS Report Phishing and Online Scams

webpage.

TAX INFORMATION IN OTHER FORMATS

The IRS website can be displayed in Spanish, Chinese, Korean, Russian, Haitian Creole, and

Vietnamese. The IRS operates local Tax Assistance Centers (TACs) that provide free over-the-

phone interpreter services in over 170 languages. To find a list of TACs in Wisconsin, refer to

the IRS website

. To use a Telecommunications Relay Service for persons with hearing or speech

disabilities, dial 711.

AGENCY ACTION

All

W-2 and IM agencies must inform program participants of the advantages of claiming

available tax credits and of free tax return preparation services available in the community.

Agencies may provide the information in any combination of methods including face-to-face

contact, posting of information in customer service areas, handing out information sheets,

including information in an existing mailing to the participant, and any other suitable means that

provide increased awareness to families requesting or

receiving ass

istance.

A sample h

andout is provided as an attachment to this memo.

NOTE: The Department of Children and Families no longer completes a mass mailing of the

attached handout to W-2 program participants. W-2 agencies are responsible for sharing

this information with program participants. This includes sharing it with job seekers and

employed participants.

Each year, the Center for Budget and Policy Priorities leads the national Get It Back Campaign to

assist local agencies in publicizing the EITC, the CTC, and free tax filing assistance. The Get It

Back Campaign website provides an outreach kit that includes tax credit information, outreach

tools and strategies, and other helpful information. The website also provides printable fact

sheets, printable posters in English and Spanish, and printable flyers in 24 languages. The kit

and outreach materials are available at the campaign website

.

ATTACHMENT

2023 Tax Credits Flyer

CONTACTS

CARES Problem Resolution Team

Bureau of Eligibility Operations and Training (BEOT)

For Wisconsin Shares Child Care policy questions outside of Milwaukee County, contact your

Bureau of Regional Operations (BRO), Child Care Coordinators at

BROCCPolicyHe[email protected]

.

OM 23-J1 Page 8 of 8

For Child Care CARES/CWW and CSAW processing questions statewide and policy questions in

Milwaukee County, contact the Child Care Subsidy and Technical Assistance line at

childcare@wisconsin.gov

or 608-422-7200.

For W-2 Policy Questions: DCFW2PolicyQuestions@wisconsin.gov

For W-2 CARES Processing Questions: BWF Work Programs Help Desk

DHS/DMS/BEEP/RW/JT/EB

DCF/DFES/BWF/AE

DCF/DECE/BCCSA/EM