2 UK Customer Satisfaction Index | July 2023

Organisations have not always invested

sufficiently in developing skills, capabilities, long-

term workforce planning, or in enabling career

pathways to retain employees. The number of

problems experienced by customers is similar

to last year but remains stubbornly high. The

drop in satisfaction with complaint handling

suggests a need to refocus on the essentials of

customer service. Deployment of technology

can be a great enabler of service, to speed up

and improve handling of routine customer issues

and interactions. But many organisations may

be overestimating their capacity to integrate

data, systems and processes to deliver seamless,

satisfying customer experiences.

This matters because customer service is at the

heart of a successful economy and society. In the

UK we are a service nation: 60% of employees

work in customer-facing roles and 80% of our

GDP is generated from services. In sectors like

manufacturing and construction, service is key

to revenue growth and reputation. In public

services and the third sector, the quality of the

customer experience is central to well-being and

social cohesion.

I believe that there are four pillars that underpin

the service nation and need to shape our

thinking.

The latest UK Customer Satisfaction Index results

present a sobering, if perhaps unsurprising

picture. Average customer satisfaction in the

UK has fallen compared to last year and is at

its lowest level since 2015. While the overall

index has declined by 1.8 points, several findings

give cause for concern. Every sector has lower

customer satisfaction than a year ago, with the

biggest downturn in Utilities and Transport. More

than half of the 275 organisations that appear

in the UKCSI have received a lower customer

satisfaction rating than they did a year ago. The

adverse impact of a poor customer experience

appears to have got worse, with customers more

likely to experience a negative reaction when

they report a problem and wait longer for their

problem to be resolved. The consequences of

organisations failing to understand and respond

to a customer’s personal situation are especially

apparent for people who are experiencing low

levels of financial well-being.

There are of course significant ongoing

challenges that affect organisations: rising

costs; supply chain disruption; skills shortages;

recruitment and retention. But we should

reflect honestly on the causes of the decline in

customer satisfaction, what this means for our

organisations and the wider economy, and how,

as leaders, we need to respond. This is not all

about price - in hard times we all want to see

greater value from organisations. That value is

linked to how we serve and support customers

and how we demonstrate our purpose, relevance

and long-term impact.

Foreword

Joanna Causon Chief Executive

3UK Customer Satisfaction Index | July 2023

Customer service is key to our nation’s long-

term growth and prosperity.

This is why The Institute continues to work

with the All Party Parliamentary Group on

Customer Service, government departments

and regulators, to raise awareness of the role of

customer service in enabling productivity and

economic performance and ensure that this is

reflected in policymaking on skills, training, and

apprenticeships.

This UKCSI highlights immediate and long-

term challenges for organisations, but I believe

it also shows the opportunity for sustainable

improvement in productivity, customer

satisfaction and business performance. We

need to take the latest UKCSI results seriously as

customer satisfaction is a predictive indicator of

performance: when we see a drop in customer

satisfaction, we will, in time, see an impact on

customer loyalty, financial performance and

productivity. Smart companies understand and

are addressing these issues and they will be

best placed to weather economic shocks and

uncertainty.

This is a time to drive the service agenda so that

we a build service nation that delivers a better

future for all. As always, if you would like to

know more about The Institute, or the UKCSI,

please do get in touch.

Customer service is a business asset.

Organisations that consistently earn higher levels

of customer satisfaction than peers in their

sector achieve better financial results, greater

productivity by reducing costs associated with

problems, and higher levels of trust and reputation

– key sources of long-term value. Our next set

of data looking at the links between customer

satisfaction and financial results, to be published in

September, will provide new evidence about this.

Customer service needs to be recognised as

a valued profession.

The convergence of digitisation, greater use of

technology and analytics, and changing customer

needs and behaviours means that diverse roles,

skills, knowledge and behaviours are required to

deliver an organisation’s customer service and

business objectives. Almost every organisation I talk

to is experiencing real challenges in recruitment

and retention. There is a need to address this by

developing and building recognition for skills and

career pathways and focusing seriously on future

resource and workforce planning.

Customer service can play an important role

in enabling a fairer and more cohesive society.

The UKCSI shows evidence of a growing

polarisation in financial well-being. 18% of

customers feel their financial well-being is poor or

very poor, up from 12% a year ago. The number

of customers who rate their financial well-being as

very good or good has dropped. There is a growing

expectation that organisations demonstrate fairness

and a social purpose in relationships with all their

stakeholders, including customers, employees,

suppliers, shareholders and the wider community.

5UK Customer Satisfaction Index | July 2023

Executive summary

Part 1 The state of customer satisfaction in the UK

Part 2 Customer satisfaction and business performance

Part 3 Understanding and responding to

customers’ personal situation and needs

Part 4 How and why customers use social media to learn

about and engage with organisations

Part 5 Recommendations for organisations

UKCSI Key facts

Organisations in the UKCSI

About the UKCSI

UKCSI sector reports

Breakthrough research from The Institute

About The Institute

Contents

6

26

48

60

74

84

92

93

94

95

96

98

Executive

Summary

7UK Customer Satisfaction Index | July 2023

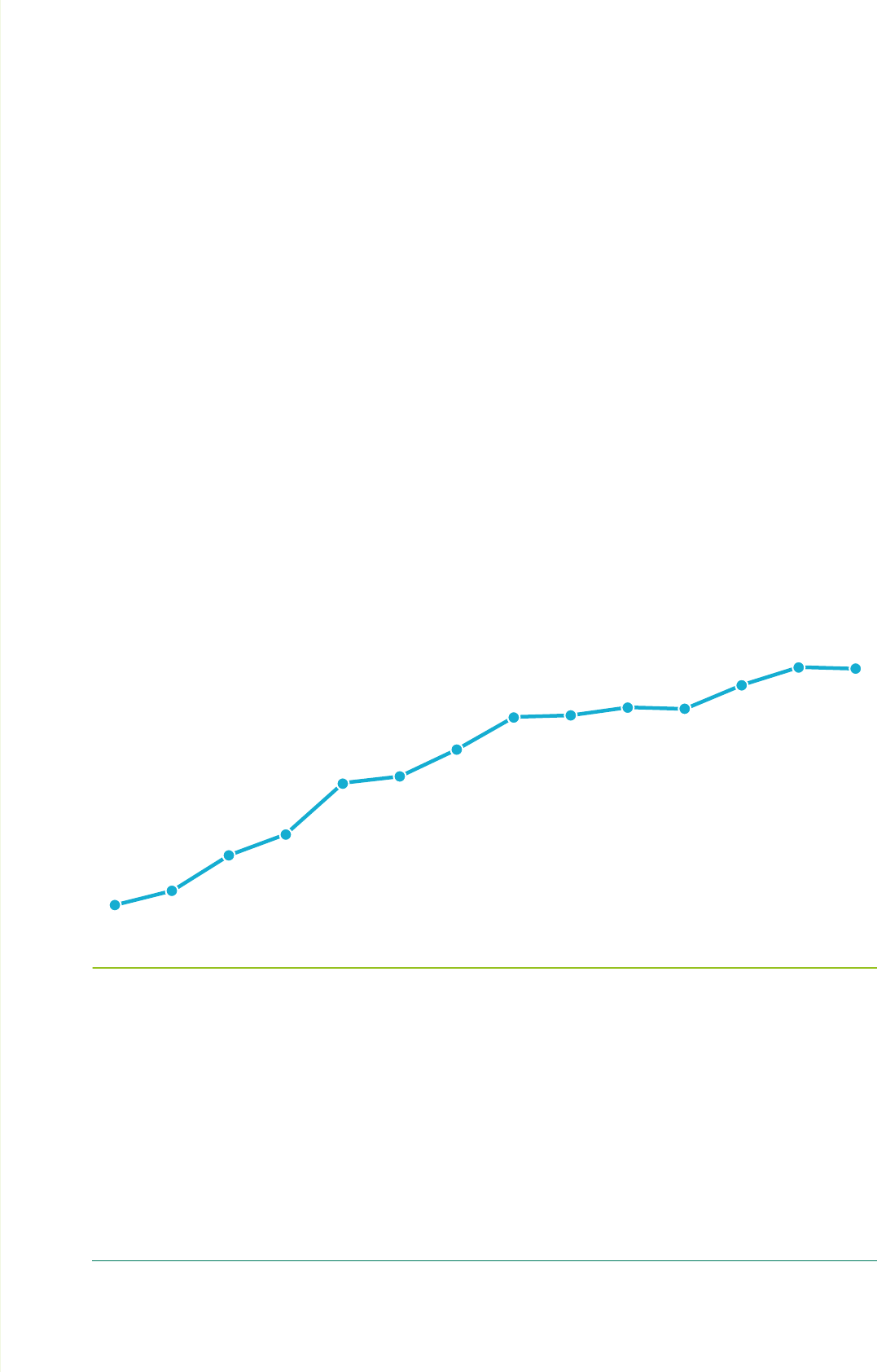

The July 2023 UKCSI is 76.6 (out of 100), a drop of 1.8

points compared to July 2022 and the lowest score for 8

years (76.2 in July 2015)

Jul-21 Jan-22 Jan-23 Jul-23Jul-22Jan-21Jul-20Jan-20Jul-19Jan-19Jul-18Jan-18Jul-17Jan-17Jul-16Jan-16Jul-15Jan-15Jul-14Jan-14Jul-13

77.4

78.4 78.4

76.9 77.0

76.8

77.1

77.7

77.9

78.1

78.2

77.8

77.4

77.0

76.2

76.0

76.3

77.1

77.9

77.7

76.6

Index scores out of 100

8 UK Customer Satisfaction Index | July 2023

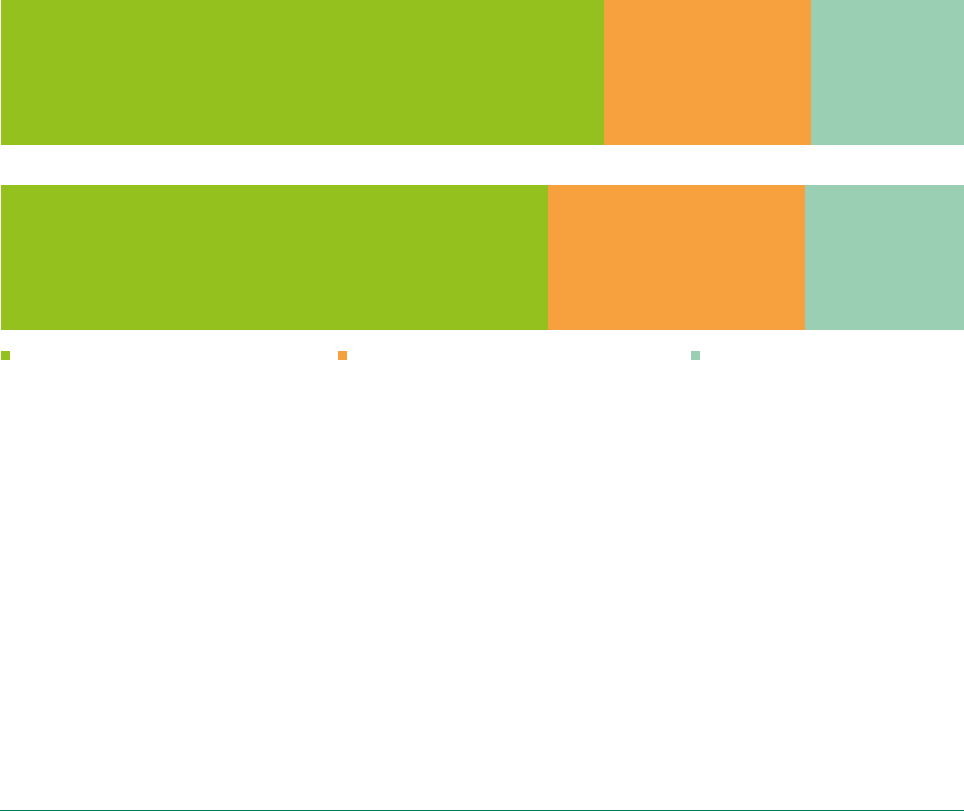

The UKCSI score is based on how customers rate organisations across 26 measures which are

summarised in 5 dimensions of customer satisfaction

1

. The Complaint Handling dimension has fallen

by 7.2 points compared to a year ago and the Emotional Connection and Ethics dimensions have each

declined by at least 2 points.

Experience

Measures the quality of customers’ experiences and

interactions with organisations

Dimension (score out of 100)

July

2023

Ethics

Reputation, openness and transparency and the extent

to which an organisation is deemed to “do the right thing”

Customer Ethos

Extent to which customers perceive that organisations

genuinely care about customers and build the experience

around their customers’ needs

Complaint Handling

How organisations respond and deal with problems and

complaints

Emotional Connection

The extent to which an organisation engenders feelings

of trust and reassurance

77.6

74.6

75.8

59.2

75.5

July

2022

79.4

76.6

77.7

66.4

77.6

Year-on-

year

change

-1.8

-2.0

-1.9

-7.2

-2.1

1

See About the UKCSI at the back of this report.

9UK Customer Satisfaction Index | July 2023

The average satisfaction of a customer who had a problem or bad experience with an organisation is

60.9 (out of 100), a drop of 6.3 points compared to July 2022. Amongst customers who did not have a

problem or bad experience, average satisfaction with organisations is 79.7, a smaller decline, of 1 point

compared to a year ago.

The adverse impact of bad customer experiences with

organisations appears to have increased compared to

a year ago

60.9

79.7

67.2

80.7

Average customer satisfaction of customers who

have had a problem or bad experience with an organisation

Average satisfaction of

other customers

Jul-23

Jul-22

Index scores out of 100

10 UK Customer Satisfaction Index | July 2023

48% of customers who experienced a problem said that it took longer than they expected for the

problem to be resolved, compared to 37% in July 2022. Just 17% of problems were resolved quicker

than expected: in July 2022 it was 28%. As a result, average satisfaction with speed of resolving a

complaint fell by 0.8 points to 5.8 (out of 10).

Organisations have taken longer to resolve complaints

and more problems remain unresolved

How long did it take to resolve your problem?

27.7% 35.1% 37.3%

July 2022

16.5% 35.9% 47.6%

July 2023

Quicker than expected As expected Longer than expected

11UK Customer Satisfaction Index | July 2023

In most cases, organisations react positively when customers report a problem, but there were fewer

positive reactions and more negative ones compared to a year ago. 57% of customers making a

complaint said the organisation responded positively, (for example, by listening to the problem, taking

responsibility, explaining next steps), down from 63% in July 2022. 27% said they experienced a

negative behaviour when reporting a problem, up by 5 percentage points compared to a year ago.

Negative behaviours include making excuses, passing the problem to someone else, or seeming

uninterested in the problem.

When making a complaint, customers are more

likely than a year ago to have experienced negative

behaviours

How did the organisation react when you made a complaint?

% positive behaviours experienced % negative behaviours experienced

% mixed behaviours experienced

July 2023

56.8% 26.7% 16.5%

July 2022

62.6% 21.4% 16%

12 UK Customer Satisfaction Index | July 2023

Each of the 13 UKCSI sectors has lower customer

satisfaction than a year ago

Jul-22 Jan-23 Jul-23 Change from

Jul-22 to Jul-23

Change from

Jan-23 to

Jul-23

Retail (Non-food)

81.9 81.7 80.8 -1.1 -0.9

Tourism

80.7 80.9 80.4 -0.3 -0.5

Banks & Building Societies

80.3 80.3 80.0 -0.3 -0.3

Leisure

81.8 80.8 80.0 -1.8 -0.8

Retail (Food)

81.7 80.5 79.5 -2.2 -1.0

Automotive

81.0 80.1 79.4 -1.6 -0.7

Insurance

80.8 80.0 78.7 -2.1 -1.3

Telecommunications & Media

76.6 75.8 75.4 -1.2 -0.4

Services

76.7 76.3 74.4 -2.3 -1.9

Public Services (National)

75.3 75.1 74.3 -1.0 -0.8

Transport

75.8 74.1 71.9 -3.9 -2.2

Public Services (Local)

72.3 72.2 71.3 -1.0 -0.9

Utilities

74.1 71.7 69.5 -4.6 -2.2

Customer satisfaction by sector July 2022 – July 2023

q Fall in UKCSI score by at least one point q Fall in UKCSI score by more than 2 points

13UK Customer Satisfaction Index | July 2023

Average satisfaction with Utilities organisations

is down by 4.6 points (out of 100) compared to

July 2022. Customer satisfaction in the Energy

sector has fallen by 5.3 points to 67.9. Average

satisfaction with price / cost fell by 1 point to

5.6 (out of 10) and the perception that Energy

companies do the right thing in their business

practices slipped 0.8 points to 6.4 (out of 10): in

both cases this is the lowest score of any sector.

Average satisfaction with Water companies has

declined by 3.5 points to 72.6.

The Transport sector has an average UKCSI score

of 71.9, down by 3.9 points compared to July

2022. Customer satisfaction with Rail companies

fell by 4.3 points to 71.2: average satisfaction

with Airlines is 73.7, a drop of 4.6 points

compared to a year ago.

The biggest decline in customer satisfaction compared

to July 2022 is in the Utilities and Transport sectors

Average

satisfaction

with Utilities

organisations is down

by 4.6 points compared

to July 2022. Customer

satisfaction in the

Energy sector has

fallen by 5.3

points to 67.9

14 UK Customer Satisfaction Index | July 2023

275

Organisations and

organisation

types in the UKCSI

15

Organisations have

improved yoy by

at least 2 points,

compared to July 2022

132

Organisations have

experienced a yoy

drop of at least 2 points,

compared to July 2022

Just 15 organisations (5% of those receiving a UKCSI

score) have improved by at least 2 points compared to

July 2022: 7 of these are from the Tourism sector

132 organisations (48% of those receiving a UKCSI score) have declined by at least 2 points compared to

a year ago. More than 80% of organisations in the Utilities and Transport sectors and over half of Retail

(Non-food) organisations have received a UKCSI score that is at least 2 points lower than in July 2022.

Jul-23

Rank

Organisation Sector Jul-23

Score

Jul-22

Score

Jul-22

Rank

Change

in score

Jul-22 to

Jul-23

1

rst direct

Banks & Building Societies 86.7 85.3 10 1.4

2

Starling Bank

Banks & Building Societies 86.1

NO DATA NO DATA NO DATA

3

M & S (food)

Retail (Food) 84.8 85.1 11 -0.3

4=

Hotels.com

Tourism 84.7 82.1 57 2.6

4=

John Lewis

Retail (Non-food) 84.7 86.3 3 -1.6

4=

Ocado

Retail (Food) 84.7 85.8 7 -1.1

7=

Jet2holidays.com

Tourism 84.5 83.7 22 0.8

7=

Tesco Mobile

Telecommunications & Media 84.5 86.1 4 -1.6

9

Amazon.co.uk

Retail (Non-food) 84.4 83.7 22 0.7

10

Nationwide

Banks & Building Societies 84.3 83.0 37 1.3

10 highest rated organisations

p Increase in UKCSI score of less than one point q Fall in UKCSI score p Increase in UKCSI score of one point or more

15UK Customer Satisfaction Index | July 2023

The biggest differences between the top 50 organisations and the rest relate to: satisfaction with

complaint handling; price / cost; and a range of emotional and perception measures including an

organisation caring about its customers, designing experiences around its customers, trust, reputation,

openness and transparency, providing reassurance and keeping promises.

Biggest differences between the top 50 and other organisations in the UKCSI

Top 50

Organisations

Remaining

Organisations

Difference

UKCSI (out of 100)

82.5 75.4 7.1

Proportion of customers giving a 9 or 10 out of 10

35.2% 23.7% 11.5% points

Speed of resolving your complaint

6.9 5.6 1.3

The handling of the complaint

7.0 5.8 1.2

The attitude of staff (complaints)

7.2 6.1 1.1

Price/cost

8.1 7.2 0.9

XX cares about their customers

8.1 7.3 0.8

XX designs the experience around its customers

8.1 7.3 0.8

XX is open and transparent

8.1 7.3 0.8

Reputation of the organisation

8.2 7.4 0.8

XX keeps their promises

8.2 7.4 0.8

XX makes you feel reassured

8.2 7.4 0.8

You trust XX

8.2 7.4 0.8

% experiencing a problem

10.6% 16.9% -6.3% points

% experiences right rst time

87.3% 78.9% 8.4% points

16 UK Customer Satisfaction Index | July 2023

In the Retail (Food) sector, organisations with a UKCSI

score at least 1 point above sector average have grown

sales by an average of 17.6%, compared to the market

average of 10.8%

2

.

Food retailers with

UKCSI at least 1 point

below sector average

Food retailers with

UKCSI within + / - 1 point

of sector average

Food retailers with

UKCSI at least

1 point above sector average

5.8%8.1%17.6%

Annual sales growth for the 12 weeks to 14 May 2023

Against a backdrop of rising costs and prices, average customer satisfaction in the Retail (Food) sector

has declined by 2.2 points, from 81.7 in July 2022 to 79.5 (out of 100). All 11 Retail (Food) organisations

that appear in the UKCSI have lower customer satisfaction than they did a year ago. Organisations

that have suffered the biggest decreases in overall satisfaction compared to a year ago have generally

received lower ratings across a range of measures relating to price / cost, transactional experiences, trust

and doing the right thing in business practices.

2

UKCSI scores are mapped alongside Kantar’s data on annual sales growth for the 12 weeks to 14 May 2023, see

www.kantar.com/uki/inspiration/fmcg/2023-wp-uk-grocery-sees-218-million-royal-sales-bump-as-inflation-inches-down

17UK Customer Satisfaction Index | July 2023

8

See Current Account Switching Service Dashboard Issue 38

In the Banks and Building Societies sector, a rise in

switching activity

3

is likely to have been inuenced

by an increase in competitive switching incentives,

consumers’ desire to maximise their income, and

quality of customer service

Volume of current account switching 2020 - 2023

234,767

327,249

395,345

445,866

413,885

717,182

April 2020

- Sept 2020

Oct 2020

- March 2021

April 2021

- Sept 2021

Oct 2021

- March 2022

April 2022

- Sept 2022

Oct 2022

- March 2023

In this UKCSI we have reviewed data from the latest Current Account Switch Service (CASS) dashboard,

covering switches between organisations completing between October and December 2022, alongside

the corresponding UKCSI period (January 2023).

Nationwide was the biggest beneficiary of current account switching: between October and December

2022 it achieved over 111,000 net current account gains, the strongest ever quarterly performance

recorded by the Current Account Switching Service. In the January 2023 UKCSI, average customer

satisfaction with Nationwide was 82.6 (out of 100), more than 2 points above the sector average. (In the

July 2023 UKCSI, Nationwide’s average customer satisfaction is rated at 84.3, over 4 points above the

sector average).

Service benefits remain the core reasons that customers prefer their new current account to their old

one, with online or mobile app banking (41%) and customer service (29%) listed as the top two reasons

for people preferring their new current account.

18 UK Customer Satisfaction Index | July 2023

The number of customers who feel their financial well-being is poor or very poor has increased from

12% in July 2022, to 18%. 41% customers claimed that their financial well-being is either good or very

good, down from 53% a year ago. As a result, the number of customers describing their financial well-

being as average has grown from 34% to 40% of respondents.

This UKCSI shows that the impact of bad customer

experiences is often most acute for customers with

low levels of nancial well-being

Very poor Poor Average Good Very good Prefer not to say

6% 12% 40% 30% 11% 1%

Jul-23

4% 8% 34% 34% 19% 1%

J

ul-22

How would you describe your financial well-being?

19UK Customer Satisfaction Index | July 2023

When dealing with XX, did you feel that they responded to your personal situation and needs?

Customers who feel an organisation responded to their personal situation and needs have relatively

high and similar levels of satisfaction, whatever their claimed state of financial well-being. For customers

who suffer from poor or very poor financial well-being, the impact of an organisation failing to respond

to personal needs and context is stark. These customers’ average satisfaction of 44.1 (out of 100) is

37 points lower than that of similar customers who dealt with an organisation that understood and

responded to their personal needs.

Yes,

they responded

to my personal needs

and situation

No,

they did not respond

to my personal needs

and situation

Gap

Very good / good nancial well-being

83.7 29.454.3

Average nancial well-being 81.5 32.149.4

Poor / very poor nancial well-being

81.1 44.1 37.0

Yes,

they responded

to my personal needs

and situation

Average customer satisfaction index scores out of 100

20 UK Customer Satisfaction Index | July 2023

In the UKCSI customers are asked to select the top 3 things the organisation they dealt with should

focus on, in order to improve customer service. Customers with poor or very poor financial well-being

are more likely than other customers to feel that organisations need to make it easier to contact the

right person to help, have more staff, branches or stores and greater availability of opening times.

From the perspective of customers, the leading

priorities for organisations to improve are making

it easy to contact the right person to help, employee

behaviours and competence, and website navigation

Customers with very poor

/

poor nancial well-being

All customers in the UKCSI

Have more branches/stores available

7.3%

4.4%

Opening times

8.3%

4.5%

Better app design

7.3%

7.8%

Better choice of ways to contact them

8.6%

6.0%

Friendly / helpful staff

11.4%

12.9%

Better website navigation

10.6%

11.8%

Have more staff available

11.6%

8.2%

Easier to contact the right person to help me

15.5%

14.3%

Reliability of product / service

9.1%

9.7%

Quality of product / service

9.2%

9.6%

Availability of product / service

9.1%

8.9%

Speed of response / resolution

10.1%

9.1%

More knowledgeable staff

9.7%

11.8%

What should the organisation you dealt with do to improve its customer service?

21UK Customer Satisfaction Index | July 2023

In the UKCSI, most recorded customer

experiences with organisations

4

are conducted

in person, over the phone, on an organisation’s

website or via email. But social media has

become a significant and highly visible feature

of the customer service landscape. Alongside

this UKCSI, we conducted an additional survey

of 1,000 customers in May 2023 exploring how

and why customers learn about or engage with

organisations through social channels and how

this engagement influences buying behaviour.

How and why customers

use social media to learn

about and engage with

organisations

On average, 25% of customers regularly (either most days, or 2 – 4

times a month) follow specic companies or brands on social media

NeverOccasionally e.g. less than once a month2-4 times a monthMost days

55%20%14%11%

How often do you follow specific companies or brands on social media, to learn about them

and their products and services?

4

The breakdown of customer experiences by channel is available in the 13 sector reports available at www.instituteofcustomerservice.com/ukcsi

22 UK Customer Satisfaction Index | July 2023

Several factors prompt customers to use a social

channel or platform for information about an

organisation rather than use the organisation’s

website. These include the desire to get another

opinion (cited by 42% of customers), difficulty

in navigating the organisation’s website (40%),

or seeking feedback from others who have

experienced the brand or product (36%). In

addition, over 30% of customers consulted an

alternative source because they didn’t trust the

organisation, or because the information available

on the organisation’s website was too complex.

Our research found evidence

that customers’ engagement

and experiences with

organisations on social channels

has inuenced their buying

behaviour and likelihood to

recommend the organisation

15% of respondents often recommend an

organisation they follow on social media (and

39% do so occasionally). 54% of customers

often (9%) or occasionally (45%) buy from an

organisation for the first time as a result of

following them on social media. On the other

hand, 9% say that their experiences following

an organisation on social media have created

a negative impression and 7% have switched

supplier of a product or service they purchase

regularly.

23UK Customer Satisfaction Index | July 2023

Based on the insight and findings in the UKCSI we have highlighted 5 areas that organisations should

address to improve customer satisfaction and business performance. Key actions and recommendations

for each of these areas are included in the full report, July 2023 UK Customer Satisfaction Index: the

state of customer satisfaction in the UK

5

.

Preventing problems and

improving complaint handling

1

Making it easier for customers to

access help and expertise

2

Responding to customers’ personal

situations and needs

3

Doing the right thing in business practice:

balancing the needs of shareholder,

customer, employee and wider society

5

Professionalising customer service

4

5

The full report is available at www.instituteofcustomerservice.com/ukcsi

Recommendations

for organisations

A drop in satisfaction with complaint handling

across most sectors is a feature of this UKCSI.

Problems and complaints are costly for

organisations: they consume time and resources

that could be deployed more productively for

improving service, developing products or winning

new business. In regulated sectors, poor customer

service and complaint handling can lead to

increased regulatory scrutiny, resulting in financial

penalties and reputational damage. Consistently

high levels of complaints make it harder to recruit

and retain employees, as well as customers.

Reducing the number of problems experienced

by customers and effective complaint handling

are fundamental to customer service and business

performance. Evidence from this UKCSI suggests

there is an urgent need for many organisations to

renew their focus on complaint handling.

1) Preventing problems

and improving complaint

handling

24 UK Customer Satisfaction Index | July 2023

Many organisations have invested in technology

to speed up and improve handling of routine

customer issues and interactions. At its most

effective, deployment of technology in customer

service generates a win-win scenario for

customer and organisation: cost to serve and

failure rates are reduced; customers get rapid

access to key information; employees are freed

up to focus on helping customers with complex

or sensitive issues.

However, evidence from this UKCSI suggests that

many organisations may be overestimating their

capacity to integrate data, systems and processes

to deliver seamless, efficient and satisfying

customer experiences. Improving customer

satisfaction requires that organisations review

how effectively they enable customers to get

access to the help, advice and expertise they need.

2) Making it easier

for customers to

access help and expertise

The consequences of high inflation and Covid-19

have exposed a polarisation in levels of financial

and mental well-being and heightened the

importance of understanding and responding to

a customer’s unique situation and needs.

For customers who suffer from poor or very

poor financial well-being, the impact of an

organisation failing to respond to personal

needs and context is stark. But indicators of

a customer’s status of well-being, or personal

circumstances may not always be obvious.

Sometimes organisations and employees need to

look beyond segmentation and data and act in

the moment to deliver genuine personalisation.

3) Responding to customers’

personal situations and needs

25UK Customer Satisfaction Index | July 2023

A convergence of digitisation, greater use

of technology and analytics, and changing

customer needs and behaviours mean that

diverse roles, skills, knowledge and behaviours

are required to deliver an organisation’s

customer service and business objectives. But

many potential employees

6

are more likely to

think of working in customer service roles as

a foundation for other careers rather than as

a respected and valued profession. Action is

needed to promote professional development

and career pathways and improve the perception

and recognition of roles and careers in customer

service.

4) Professionalisng

customer service

A growing range of issues - environmental

sustainability, working conditions, voice and

engagement, diversity and inclusion, data

security and transparency, the application of

artificial intelligence, risk management and

resilience - have become more prominent

considerations in corporate governance. High

levels of inflation and the rise in the cost of

living have often required organisations to make

difficult decisions affecting the interests of

customers, employees and shareholders.

Doing the right thing in business practice –

beyond meeting legal and regulatory obligations

– has become more complex and exposed

to greater scrutiny. It is therefore critical

that organisations and leaders are guided by

consistent values in making decisions that

balance short and long-term objectives and

satisfy the needs of shareholders, regulators,

customers and employees.

5) Doing the right thing in

business practice: balancing

the needs of shareholders,

customers, employees,

suppliers or partners and

wider society

6

See Building the Service Nation: changing perceptions about the profession of customer service, Institute of Customer Service, 2023

26 UK Customer Satisfaction Index | July 2023

The state of

customer

satisfaction

in the UK

1

27UK Customer Satisfaction Index | July 2023

The July 2023 UKCSI is 76.6 (out of 100), a drop of 1.8

points compared to July 2022 and the lowest score for 8

years (76.2 in July 2015)

Jul-21 Jan-22 Jan-23 Jul-23Jul-22Jan-21Jul-20Jan-20Jul-19Jan-19Jul-18Jan-18Jul-17Jan-17Jul-16Jan-16Jul-15Jan-15Jul-14Jan-14Jul-13

77.4

78.4 78.4

76.9 77.0

76.8

77.1

77.7

77.9

78.1

78.2

77.8

77.4

77.0

76.2

76.0

76.3

77.1

77.9

77.7

76.6

The UKCSI has

recorded its lowest score

since July 2015

Index scores out of 100

28 UK Customer Satisfaction Index | July 2023

Experience

Measures the quality of customers’ experiences and

interactions with organisations

Dimension (score out of 100)

July

2023

Ethics

Reputation, openness and transparency and the extent

to which an organisation is deemed to “do the right thing”

Customer Ethos

Extent to which customers perceive that organisations

genuinely care about customers and build the experience

around their customers’ needs

Complaint Handling

How organisations respond and deal with problems and

complaints

Emotional Connection

The extent to which an organisation engenders feelings

of trust and reassurance

77.6

74.6

75.8

59.2

75.5

July

2022

79.4

76.6

77.7

66.4

77.6

Year-on-

year

change

-1.8

-2.0

-1.9

-7.2

-2.1

The UKCSI score is based on how customers rate organisations across 26 measures which are

summarised in 5 dimensions of customer satisfaction. The Complaint Handling dimension has fallen

by 7.2 points compared to a year ago and the Emotional Connection and Ethics dimensions have each

declined by at least 2 points.

29UK Customer Satisfaction Index | July 2023

% customer experiences rated as being right first time

79.6% of customer experiences were rated as being right first time, practically the same level as in July

2022 (79.7%). The number of customers who experienced a problem with an organisation fell slightly

compared to a year ago, by 0.9 percentage points, to 16.4%.

% customers experiencing a problem or bad experience

13.6

14.1

14.6

14.9

16.4

17.3

16.5

16.4

Jan-20 Jul-20 Jan-21 Jul-21 Jan-22 Jul-22 Jan-23

Jul-23

80.6

81.0

80.5

79.8

79.9

79.7

79.8

79.6

J

an-20 Jul-20 Jan-21 Jul-21 Jan-22 Jul-22 Jan-23

Jul-23

30 UK Customer Satisfaction Index | July 2023

The average satisfaction of customers who had a problem or bad experience with an organisation is

60.9 (out of 100), a drop of 6.3 points compared to July 2022. Amongst customers who did not have a

problem or bad experience, average satisfaction with organisations is 79.7, a smaller decline, of 1 point,

compared to a year ago.

The adverse impact of bad customer experiences

with organisations appears to have increased

60.9

79.7

67.2

80.7

Average customer satisfaction of customers who

have had a problem or bad experience with an organisation

Average satisfaction of

other customers

Jul-23

Jul-22

Index scores out of 100

31UK Customer Satisfaction Index | July 2023

48% of customers who experienced a problem said that it took longer than they expected for the

problem to be resolved, compared to 37% in July 2022. Just 17% of problems were resolved quicker

than expected: in July 2022 it was 28%.

Organisations have taken longer to resolve complaints

and more problems remain unresolved

How long did it take to resolve your problem?

27.7% 35.1% 37.3%

July 2022

16.5% 35.9% 47.6%

July 2023

Quicker than expected As expected Longer than expected

32 UK Customer Satisfaction Index | July 2023

When making a complaint, customers are more likely

to have experienced a negative reaction than a year ago

In most cases, organisations react positively when customers report a problem, but there were fewer

positive reactions and more negative ones compared to a year ago. 57% of customers making a

complaint said the organisation responded positively, (for example, by listening to the problem, taking

responsibility, explaining next steps), down from 63% in July 2022.

27% of customers reporting a problem to an organisation said they experienced a negative behaviour(s),

up by 5 percentage points compared to a year ago. Negative behaviours include making excuses,

passing the problem to someone else, or seeming uninterested in the problem.

How did the organisation react when you made a complaint?

% positive behaviours experienced % negative behaviours experienced

% mixed behaviours experienced

July 2023

56.8% 26.7% 16.5%

July 2022

62.6% 21.4% 16%

33UK Customer Satisfaction Index | July 2023

Each of the 13 UKCSI sectors has lower customer

satisfaction than a year ago

5 sectors down

by more than 2 points

Utilities

Transport

6 sectors down by

between 1 - 1.8 points

Leisure

Automotive

2 sectors down by

less than 1 point

Banks & Building

Societies

Tourism

Services Retail (Non-food)

Retail (Food) Public Services (National)

Insurance

Public Services (Local)

Telecomms & Media

Change in customer satisfaction compared to July 2022, by sector

34 UK Customer Satisfaction Index | July 2023

Jul-22 Jan-23 Jul-23 Change from

Jul-22 to Jul-23

Change from

Jan-23 to

Jul-23

Retail (Non-food)

81.9 81.7 80.8 -1.1 -0.9

Tourism

80.7 80.9 80.4 -0.3 -0.5

Banks & Building Societies

80.3 80.3 80.0 -0.3 -0.3

Leisure

81.8 80.8 80.0 -1.8 -0.8

Retail (Food)

81.7 80.5 79.5 -2.2 -1.0

Automotive

81.0 80.1 79.4 -1.6 -0.7

Insurance

80.8 80.0 78.7 -2.1 -1.3

Telecommunications & Media

76.6 75.8 75.4 -1.2 -0.4

Services

76.7 76.3 74.4 -2.3 -1.9

Public Services (National)

75.3 75.1 74.3 -1.0 -0.8

Transport

75.8 74.1 71.9 -3.9 -2.2

Public Services (Local)

72.3 72.2 71.3 -1.0 -0.9

Utilities

74.1 71.7 69.5 -4.6 -2.2

q Fall in UKCSI score by at least one point q Fall in UKCSI score by more than 2 points

Customer satisfaction by sector July 2022 – July 2023

35UK Customer Satisfaction Index | July 2023

Jan-23

Jul-23

Jul-22

74.1

71.7

69.5

Utilities

75.8

74.1

71.9

Transport

80.7

80.9

80.4

Tourism

76.6

75.8

75.4

Telecommunications & Media

76.7

76.3

74.4

Services

81.9

81.7

80.8

Retail (Non-food)

81.7

80.5

79.5

Retail (Food)

75.3

75.1

74.3

Public Services (National)

72.3

72.2

71.3

Public Services (Local)

81.8

80.8

80.0

Leisure

80.8

80.0

78.7

Insurance

80.3

80.3

80.0

Banks & Building Societies

81.0

80.1

79.4

Automotive

Customer satisfaction by sector July 2022 – July 2023

Index scores out of 100

36 UK Customer Satisfaction Index | July 2023

Customer satisfaction with Rail companies

is 71.2 (out of 100), a drop of 4.3 points

compared to July 2022. Each of the 4 complaint

handling measures is rated at least 1 point (out

of 10) lower than a year ago. The number of

experiences rated as being right first time fell

by 2.7 percentage points to 75.8%. Satisfaction

with price / cost, xx makes you feel reassured

and trust in organisations has declined by 0.6

points (out of 10) compared to July 2022.

Average satisfaction with Airlines fell by 4.6

points to 73.7 and 3 of the 4 complaint handling

measures (handling of the complaint, staff attitude

and speed of resolving your complaint) have

dropped by at least 2 points (out of 10) compared

to July 2022. Average satisfaction with xx makes it

easy to contact the right person to help, providing

reassurance, being open and transparent and

doing the right thing in business practices has

declined by 0.6 points, compared to a year ago.

Average satisfaction with Rail Companies and Airlines is

more than 4 points lower than a year ago

Customer satisfaction in the Transport sector

Coach / Bus

Rail / Train

Air

71.2

73.7

70.3

75.5

78.3

72.8

Jul-23

Jul-22

Index scores out of 100

37UK Customer Satisfaction Index | July 2023

Customer satisfaction in the Energy sector has

fallen by 5.3 points to (67.9) out of 100. Just

66.7% of experiences were rated as being right

first time, a decrease of 4.5 percentage points

compared to July 2022. Average satisfaction for

each of the 4 complaint handling measures is at

least 1 point (out of 10) lower than a year ago.

Average satisfaction with price / cost fell by 1

point to 5.6 (out of 10) and the perception that

Energy companies do the right thing in their

business practices slipped by 0.8 points to 6.4

(out of 10): in both cases this is the lowest score

of any sector.

Average satisfaction with Water companies has

declined by 3.5 points to 72.6. The number of

customer experiences rated as being right first

time slipped by 2.7 percentage points to 73%.

Average satisfaction with speed of resolving a

complaint dropped by 1 point to 6.4 (out of 10),

though this is 0.6 points above the UK all-sector

average.

Average satisfaction with Utilities organisations is down

by 4.6 points compared to July 2022

Customer satisfaction in the Utilities sector

Energy Water

67.9

73.2

72.6

76.1

Jul-23

Jul-22

Index scores out of 100

38 UK Customer Satisfaction Index | July 2023

Within the Services sector, average satisfaction with Postal / Courier organisations is 71.4, a drop of 3.3

points compared to July 2022. Average satisfaction with Automotive related services declined by 1 point

to 78.2.

The Services Sector has received its lowest ever UKCSI

score, down 2.3 points to 74.4

Customer satisfaction in the Services sector

Automotive Related Services

78.2

71.4

79.2

74.7

Postal/Courier

Jul-23

Jul-22

Index scores out of 100

39UK Customer Satisfaction Index | July 2023

In the Retail (Food) sector, the average customer

satisfaction index score declined by 2.2 points to

79.5. Every Retail (Food) organisation receiving

a UKCSI score has lower customer satisfaction

than in July 2022, especially Waitrose (down by

5.6 points to 80.0), Iceland (down by 5.3 points

to 77.4) and Morrisons (down by 4.3 points to

74.4).

Customer satisfaction with Insurance organisations

is 78.7, a fall of 2.1 points compared to a year

ago. 7 of the 26 Insurance organisations that

received a UKCSI score are at least 3 points below

their July 2022 level. The biggest drop in customer

satisfaction is for complaint handling: each of the

4 complaint handling measures fell by at least 0.6

points (out of 10).

Elsewhere, 6 sectors – Automotive, Leisure, Public

Services (Local), Public Services (National), Retail

(Non-food) and Telecommunications and Media -

have received an average UKCSI score between 1

and 1.8 points below their July 2022 level.

Average satisfaction in the Banks and Building

Societies sector is 80.0, a slight fall, of 0.3 points,

compared to July 2022. Average customer

satisfaction in the banking sector appears to

be relatively stable: only 3 organisations have

moved, up or down, by 2 points or more

compared to a year ago.

In the Tourism sector, average customer

satisfaction is 80.4, slightly lower, by 0.3 points

than a year ago. However, the small movement

in the overall score conceals a wide range of

organisational scores. 7 organisations have

improved by at least 2 points compared to July

2022, whereas 5 organisations have declined

by 2 points or more compared to a year ago.

The gap between the highest and lowest rated

organisations in this sector has increased by 8.7

points to 17.5 points.

40 UK Customer Satisfaction Index | July 2023

275

Organisations and

organisation

types in the UKCSI

15

Organisations have

improved yoy by

at least 2 points,

compared to July 2022

132

Organisations have

experienced a yoy

drop of at least 2 points,

compared to July 2022

Just 15 organisations (5% of those receiving a UKCSI

score) have improved by at least 2 points compared to

July 2022: 7 of these are from the Tourism sector

18%

16%

26%

52%

42%

13%

5%

20%

27%

14%

6%

8%

22%

48%

Jul-20

Jan-21 Jul-21 Jan-22 Jul-22 Jan-23

Jul-23

% of organisations whose UKCSI

has improved yoy by at least two points

% organisations whose UKCSI score

has declined yoy by at least 2 points

% of organisations that have improved or fallen by at least 2 points compared to the previous year

41UK Customer Satisfaction Index | July 2023

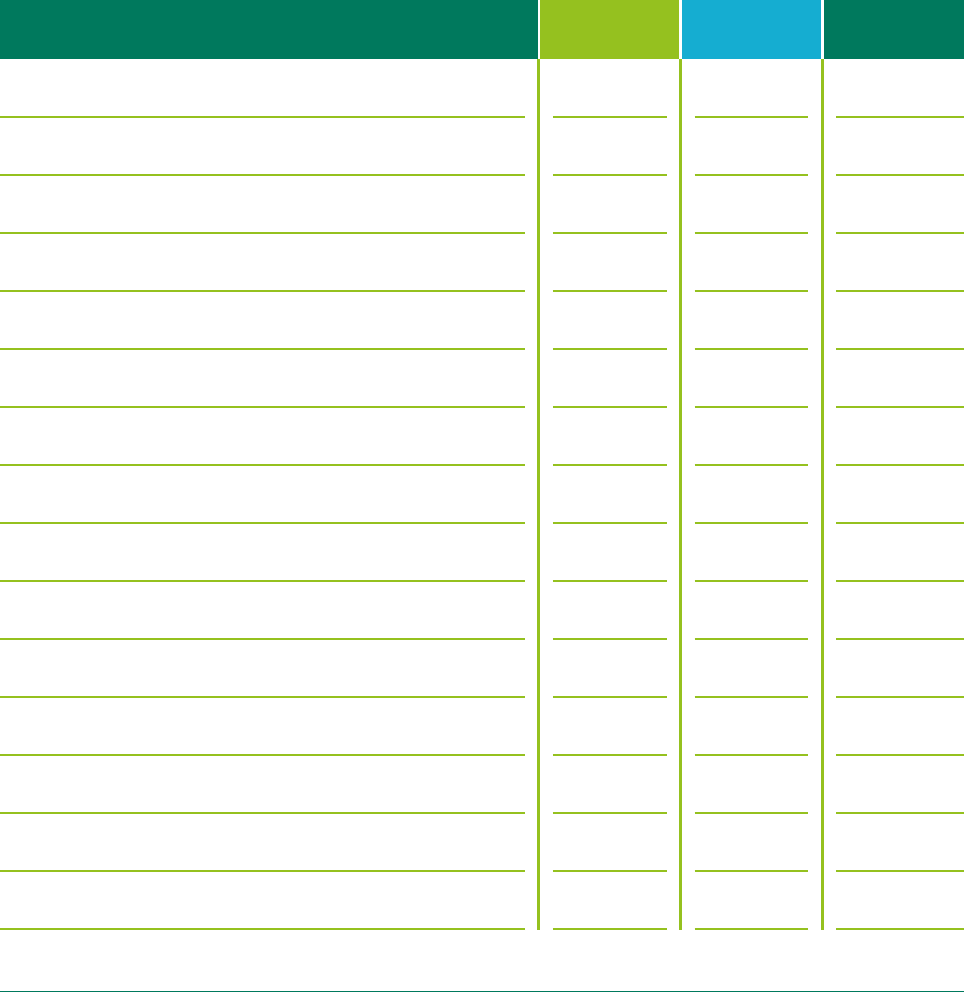

Extent of change in organisations’ customer satisfaction scores in each sector, July 2022 – July 2023

Sector Total

number of

organisations

Number of

organisations

that have

improved by 2

points or more

Number of

organisations

that have

moved by less

than 2 points

Number of

organisations

that have

dropped by 2

points or more

Gap between

highest

and lowest

organisation

Change in the

gap between

the highest

and lowest

organisation,

compared to

July 2022

Automotive

26 1 13 12 6.4 -5.1

Banks & Building Societies

18 1 13 2 10.1 -1.8

Insurance

26 0 14 10 8.6 0.8

Leisure

27 1 15 8 15.8 4.5

Public Services (Local)

9 0 3 4 17.4 -2.3

Public Services (National)

13 1 5 6 16.9 1.0

Retail (Food)

11 0 6 5 10.4 2.6

Retail (Non-food)

26 2 7 14 13.5 5.3

Services

18 1 8 8 20.1 1.2

Telecomms & Media

13 1 8 4 16.4 0.4

Tourism

22 7 10 5 17.5 8.7

Transport

36 0 7 29 19.4 4.0

Utilities

30 0 5 25 21.7 0.9

42 UK Customer Satisfaction Index | July 2023

The top

50 organisations

p Increase in UKCSI score of less than one point q Fall in UKCSI score p Increase in UKCSI score of one point or more

Jul-23

Rank

Organisation Sector Jul-23

Score

Jul-22

Score

Jul-22

Rank

Change

in score

Jul-22 to

Jul-23

1

rst direct

Banks & Building Societies 86.7 85.3 10 1.4

2

Starling Bank

Banks & Building Societies 86.1

NO DATA NO DATA NO DATA

3

M & S (food)

Retail (Food) 84.8 85.1 11 -0.3

4=

Hotels.com

Tourism 84.7 82.1 57 2.6

4=

John Lewis

Retail (Non-food) 84.7 86.3 3 -1.6

4=

Ocado

Retail (Food) 84.7 85.8 7 -1.1

7=

Jet2holidays.com

Tourism 84.5 83.7 22 0.8

7=

Tesco Mobile

Telecommunications & Media 84.5 86.1 4 -1.6

9

Amazon.co.uk

Retail (Non-food) 84.4 83.7 22 0.7

10

Nationwide

Banks & Building Societies 84.3 83.0 37 1.3

11

UK Power Networks

Utilities 84.1 86.5 1 -2.4

12

Hoseasons

Tourism 83.8 76.4 203 7.4

13=

Costco

Retail (Non-food) 83.6 84.7 14 -1.1

13=

Timpson

Services 83.6 86.4 2 -2.8

15

Greggs

Leisure 83.5 84.0 19 -0.5

16

Sky Mobile

Telecommunications & Media 83.4 82.1 57 1.3

17

Green Flag

Services 83.1 84.6 15 -1.5

18

booking.com

Tourism 83.0 82.7 42 0.3

19

Monzo Bank

Banks & Building Societies 82.9

NO DATA NO DATA NO DATA

20

Next

Retail (Non-food) 82.7 83.5 30 -0.8

21

Premier Inn

Tourism 82.5 82.4 49 0.1

22=

Jet2

Transport 82.3 83.2 34 -0.9

22=

Suzuki

Automotive 82.3 85.9 5 -3.6

24

Toby Carvery

Leisure 82.2 83.3 32 -1.1

25

Argos

Retail (Non-food) 82.1 79.2 148 2.9

25

Western Union

Services 82.1 80.5 113 1.6

27=

Expedia

Tourism 82.0 79.6 136 2.4

43UK Customer Satisfaction Index | July 2023

Jul-23

Rank

Organisation Sector Jul-23

Score

Jul-22

Score

Jul-22

Rank

Change

in score

Jul-22 to

Jul-23

27=

Hyundai

Automotive 82.0 81.3 82 0.7

27=

M & S

Retail (Non-food) 82.0 85.9 5 -3.9

30=

1st Central

Insurance 81.9

NO DATA NO DATA NO DATA

30=

Holiday Inn

Tourism 81.9 78.9 154 3.0

32=

eBay

Retail (Non-food) 81.8 79.3 143 2.5

32=

Home Bargains

Retail (Non-food) 81.8 81.2 90 0.6

34=

Amazon Prime Video

Leisure 81.7 84.0 19 -2.3

34=

Apple

Retail (Non-food) 81.7 85.4 9 -3.7

34=

giffgaff

Telecommunications & Media 81.7 81.9 67 -0.2

34=

Hilton

Tourism 81.7 78.4 170 3.3

38=

Kia

Automotive 81.5 82.8 39 -1.3

38=

Specsavers

Retail (Non-food) 81.5 82.6 47 -1.1

40

P&O Cruises

Tourism 81.4 79.3 143 2.1

41=

Domino's Pizza

Leisure 81.3 80.9 102 0.4

41=

LV=

Insurance 81.3 82.8 39 -1.5

43

Trivago

Tourism 81.2 82.7 42 -1.5

44

Caffe Nero

Leisure 81.1 83.6 25 -2.5

45=

Halifax

Banks & Building Societies 81.0 81.6 76 -0.6

45=

SAGA Insurance

Insurance 81.0 84.6 15 -3.6

47

Starbucks

Leisure 80.9 78.0 177 2.9

48=

NatWest

Banks & Building Societies 80.8 82.0 62 -1.2

48=

Superdrug

Retail (Non-food) 80.8 82.8 39 -2.0

50=

Aldi

Retail (Food) 80.7 83.3 32 -2.6

50=

Audi

Automotive 80.7 82.4 49 -1.7

50=

Lidl

Retail (Food) 80.7 81.3 82 -0.6

50=

Pets at Home

Retail (Non-food) 80.7 85.1 11 -4.4

p Increase in UKCSI score of less than one point q Fall in UKCSI score p Increase in UKCSI score of one point or more

44 UK Customer Satisfaction Index | July 2023

The top 50 organisations in the UKCSI include

6 banks or building societies, 3 of whom – first

direct, Starling Bank and Nationwide - are

amongst the 10 highest rated organisations.

16 of the 50 highest rated organisations are from

the Retail (Non-food or Food) sectors:

M & S (Food), John Lewis, Ocado and

Amazon.co.uk are the highest rated retailers for

customer satisfaction. Argos and eBay have each

improved by more than 2 points compared to

July 2022.

10 Tourism organisations feature in the

UKCSI top 50, compared to just 6 a year ago.

Jet2holidays.com continues to be one of the

UK’s highest rated organisations for customer

satisfaction. Hotels.com, Hoseasons and Expedia

have received their highest ever UKCSI scores.

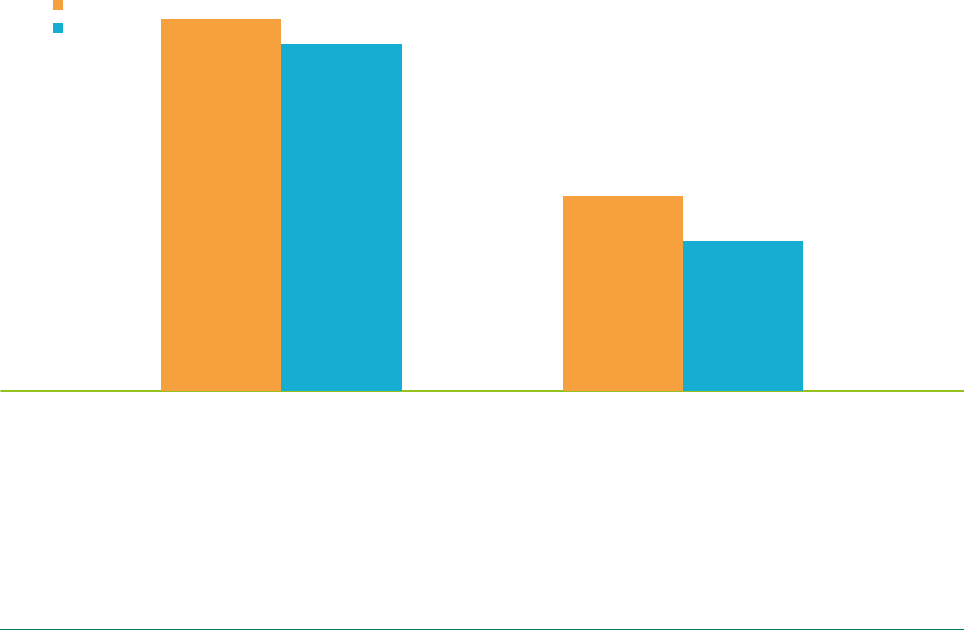

The average UKCSI score of the top 50

organisations is 82.5 (out of 100), a drop of 1.2

points compared to July 2022 but 7.1 points

higher than the average of other organisations in

the UKCSI.

Average UKCSI scores of top 50 and other organisastions

82.5

75.4

83.7

77.7

Top 50 organisations Other organisations

Jul-23

Jul-22

45UK Customer Satisfaction Index | July 2023

Biggest differences between the top 50 and other organisations in the UKCSI

Top 50

Organisations

Remaining

Organisations

Difference

(out of 10

unless stated)

UKCSI (out of 100)

82.5 75.4 7.1

Proportion of customers giving a 9 or 10 out of 10

35.2% 23.7% 11.5% points

Speed of resolving your complaint

6.9 5.6 1.3

The handling of the complaint

7.0 5.8 1.2

The attitude of staff

7.2 6.1 1.1

Price/cost

8.1 7.2 0.9

XX cares about their customers

8.1 7.3 0.8

XX designs the experience around its customers

8.1 7.3 0.8

XX is open and transparent

8.1 7.3 0.8

Reputation of the organisation

8.2 7.4 0.8

XX keeps their promises

8.2 7.4 0.8

XX makes you feel reassured

8.2 7.4 0.8

You trust XX

8.2 7.4 0.8

% experiencing a problem

10.6% 16.9% -6.3% points

% experiences right rst time

87.3% 78.9% 8.4% points

The biggest differences between the top 50 organisations and the rest are concerned with satisfaction

with complaint handling; price / cost; and a range of emotional and perception measures including an

organisation caring about its customers, designing experiences around its customers, trust, reputation,

openness and transparency, providing reassurance and keeping promises.

46 UK Customer Satisfaction Index | July 2023

20 most improved

organisations

20 most improved organisations

over one year

UKCSI

score July

2022

UKCSI

score July

2023

YOY

Change

Sector Compared

to sector

average

Hoseasons

76.4 83.8 7.4

Tourism

3.4

Plusnet

73.4 77.1 3.7 Telecommunications & Media 1.7

Land Rover

74.4 78.0 3.6 Automotive -1.4

DVLA

70.4 73.8 3.4 Public Services (National)

-0.5

Haven Holidays

76.1 79.4 3.3 Tourism -1.0

Hilton

78.4 81.7 3.3 Tourism 1.3

M & S (Bank)

73.4 76.6 3.2 Banks & Building Societies -3.4

Holiday Inn

78.9 81.9 3.0 Tourism 1.5

Starbucks

78.0 80.9 2.9 Leisure

0.9

Argos

79.2 82.1 2.9 Retail (Non-food) 1.3

Hotels.com

82.1 84.7 2.6 Tourism 4.3

eBay

79.3 81.8 2.5 Retail (Non-food)

1.0

Expedia

79.6 82.0 2.4 Tourism 1.6

P&O Cruises

79.3 81.4 2.1 Tourism

1.0

P&O Ferries

71.8 73.6 1.8 Transport 1.7

Manchester Metrolink

75.0 76.7 1.7 Transport 4.8

DHL

76.9 78.6 1.7 Services 4.2

Western Union

80.5 82.1 1.6 Services 7.7

AA

77.3 78.8 1.5 Services 4.4

rst direct

85.3 86.7 1.4 Banks & Building Societies 6.7

Organisation is at least 1 point higher than the sector average Organisation is at least 1 point lower than the sector average

47UK Customer Satisfaction Index | July 2023

7 of the most improved organisations compared

to July 2022 are from the Tourism sector. Each of

these organisations, except for Haven Holidays,

has a UKCSI score that is at least 1 point above

the Tourism sector average.

Across the UKCSI, only 1 organisation (Hoseasons)

has improved by more than 5 points compared to

a year ago: an additional 7 organisations (Plusnet,

Land Rover, DVLA, Haven Holidays, Hilton, M & S

(Bank) and Holiday Inn) have improved by at least

3 points. The average year on year UKCSI score

increase of the 20 most improved organisations

is just 2.8 points, a smaller improvement than in

recent UKCSI reports.

Average yoy increase in UKCSI score

of the 20 most improved organisations

Jul-23

2.8

Jan-23

4.1

Jul-22

8.3

Jan-22

9.3

Jul-21

5.8

Jan-21

4.7

Jul-20

4.8

Jan-20

3.8

48 UK Customer Satisfaction Index | July 2023

Customer

satisfaction

and business

performance

2

In this section we examine evidence of the relationship between customer satisfaction and business

performance in the Retail (Food) and Banks and Building Societies sectors.

49UK Customer Satisfaction Index | July 2023

Rising ination and

falling customer

satisfaction in the Retail

(Food) sector

The impact of rising inflation has been especially severe in the Retail (Food) sector: the rate of food

inflation rose from 5.9% in March 2022 to 19.1% in April 2023. Rising costs have created significant

challenges for organisations and customers and exposed a polarisation in customer needs and

behaviours.

Rate of food inflation in the UK

5.9

6.7

8.7

9.8

12.7

13.1

14.6

16.4

16.5

16.9

16.8

18.2

19.2 19.1

Mar-22

Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23 Feb-23 Mar-23

Apr-23

Source: ONS

50 UK Customer Satisfaction Index | July 2023

7

ONS: https://www.ons.gov.uk/economy/inflationandpriceindices/articles/costoflivinginsights/food

8

Customers were asked, to score the balance of price and service they would prefer to accept. A score of 8 - 10 implies a preference for excellent service, even if it

costs more. A score of 1 - 3 is interpreted as a preference for low-cost, no-frills service.

ONS has reported that during March, April and May 2023, around 50% of adults said they were buying

less food than in the previous two weeks

7

. Meanwhile the UKCSI shows that 31% of customers in the

Retail (Food) sector would prefer to receive excellent service, even if it costs more, while only 16%

would prefer the lowest cost option, even it means sacrificing quality of service

8

.

Contrasting buying and service preferences in the Retail (Food) sector

30.0%

31.3%

16.6%

15.9%

Customers with a preference for excellent

service, even if it costs more

Customers who prefer no-frills,

lowest cost

Jul-23

Jul-22

51UK Customer Satisfaction Index | July 2023

All 11 Retail (Food) organisations that appear in the

UKCSI have lower customer satisfaction than they did

a year ago

Against a backdrop of rising costs and prices, average customer satisfaction in the Retail (Food) sector

has declined by 2.2 points, from 81.7 in July 2022 to 79.5 (out of 100).

All 11 Retail (Food) organisations that appear in the UKCSI have lower customer satisfaction than they

did a year ago: 4 organisations – Waitrose, Co-op Food, Iceland and Morrisons – have a UKCSI score

that is at least 3 points lower than in July 2022.

Across the sector as whole, the biggest fall in customer satisfaction is for price / cost. Organisations that

have suffered the biggest decreases in overall satisfaction have generally received lower ratings than a

year ago for a range of measures relating to price / cost, transactional experiences, trust and doing the

right thing in business practices.

Customer satisfaction measures

(scale of 1 - 10)

Retail (Food) average Retail (Food) yoy

change

Average yoy change

of organisations

whose UKCSI score

has fallen by at least

3 points

Price / cost

7.7

-0.4 -0.6

Ease of dealing with xx

8.3

-0.2 -0.6

Handling of the complaint

6.7 -0.1 -0.2

You trust xx

7.9

-0.3 -0.6

xx does the right thing in business practices

7.7 -0.3 -0.7

% experiences right rst time

86% +1.0% points -2.1% points

52 UK Customer Satisfaction Index | July 2023

9

UKCSI scores are mapped alongside Kantar’ data on sales growth, see:

www.kantar.com/uki/inspiration/fmcg/2023-wp-uk-grocery-sees-218-million-royal-sales-bump-as-inflation-inches-down

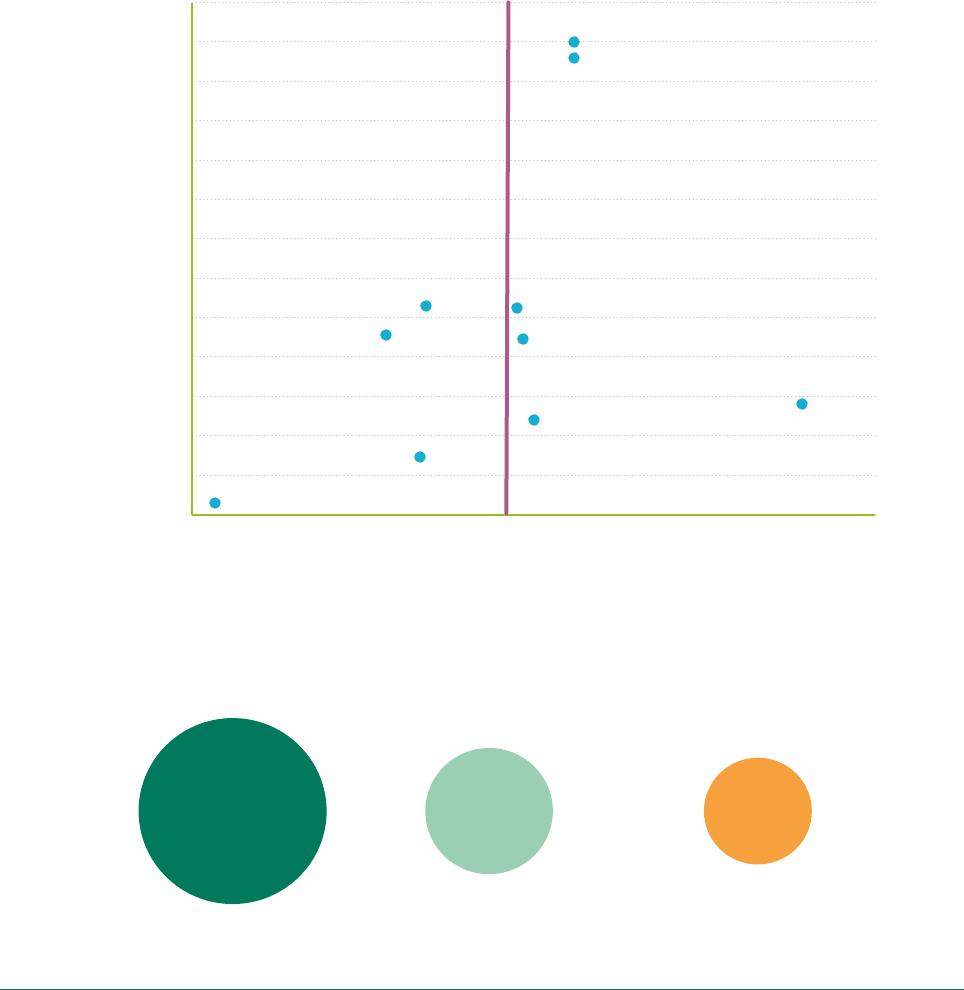

In a context of rising prices and intense competition,

organisations with the highest customer satisfaction

have generally achieved the strongest sales growth

Organisations with a UKCSI score at least 1 point above sector average have grown sales by an average

of 17.6%

9

. Organisations that are within 1 point of the sector average have grown by 8.1%. Food

retailers with a UKCSI score that is at least 1 point below the sector average grew by an average of 5.8%.

Retail (Food) July 2023 UKCSI = 79.5

Aldi

Ocado

Co - op Food

Waitrose

Sainsbury's

Iceland

Tesco

ASDA

Morrisons

Lidl

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

22%

24%

26%

74 76 78 80 82 84 86

Annual sales growth for the 12 weeks to 14 May 2023

Source: Kantar Worldpanel

UKCSI score

Customer satisfaction and sales growth: the Retail (Food) sector

Food retailers with

UKCSI at least 1 point

below sector average

Food retailers with

UKCSI within + / - 1 point

of sector average

Food retailers with

UKCSI at least

1 point above sector average

5.8%8.1%17.6%

Annual sales growth for the 12 weeks to 14 May 2023

53UK Customer Satisfaction Index | July 2023

M & S is the highest rated Retail (Food)

organisation and is the third highest rated

organisation in the UKCSI overall, behind first

direct and Starling Bank. M & S food’s UKCSI

score of 84.8 is 5.3 points above the sector

average and slightly lower, by 0.3 points, than it

was in July 2022. M & S is not included in Kantar’s

analysis of sales growth in the supermarket sector

but the company reported that food sales were

up 8.7% in the 52 weeks up to 1 April 2023

10

.

Sales of its Remarksable budget food range

increased by 40% during the year as M & S tried

to reduce the impact of rising inflation on basics

such as milk, butter and bread

11

.

Ocado has a UKCSI score of 84.7, down by

1.1 points compared to July 2022 but just 0.1

points below M & S and 5.2 points above the

sector average. Although Ocado’s sales have

continued to grow (by 5.6% in Kantar’s research

for the 12 weeks preceding 5 May 2023), the

joint venture with M & S reported a loss of

£29.5 million. However, M & S has signalled

that it plans to deepen the collaboration with

Ocado, by improving the customer experience,

introducing cost-cutting measures and leveraging

the potential of the M&S customer base

12

.

Average satisfaction of Aldi’s customers in the

July 2023 UKCSI fell by 2.6 points to 80.7 but

is 1.2 points above sector average. In Kantar’s

analysis, Aldi was the fastest growing grocer in

the 12 weeks preceding 5 May 2023: its sales

increased by 24% compared to the same period

in 2022, giving a market share of 10.1%.

Average customer satisfaction with Lidl fell

slightly, by 0.6 points, to 80.7, the same level as

Aldi. Lidl’s sales increased by 23.2%: its market

share is reported as 7.7%.

Waitrose’s UKCSI score fell by 5.6 points to 80.0,

its lowest score since January 2021 and just

above the sector average, 79.5. Kantar reports

that Waitrose grew sales by 4.8% in in the 12

weeks preceding 14 May 2023.

Customer satisfaction with Tesco (79.8),

Sainsbury’s (79.7) and Asda (78.1) fell by more

than 1 point compared to July 2022. However,

each of these organisations grew sales by more

than the grocery market average.

Morrisons has the lowest average customer

satisfaction in the sector, with a UKCSI score of

74.4. In Kantar’s analysis, Morrisons registered

0.6% sales growth in the 12 weeks to 14 May

2023, the lowest rate of any supermarket. A key

focus for Morrisons is converting former McColls

store to its Morrisons Daily fascia, which could

provide opportunities for future growth

13

.

10

www.corporate.marksandspencer.com/media/press-releases/marks-and-spencer-group-plc-full-year-results-52-weeks-ended-1-april-2023

11

www.theguardian.com/business/2023/may/24/marks-and-spencer-puts-profit-jump-down-to-better-clothing-styles-and-more-affordable-food

12

www.proactiveinvestors.co.uk/companies/news/1015951/marks-and-spencer-might-own-ocado-retail-one-day-as-it-doubles-down-on-the-joint-venture-1015951.html

13

The Times, 3 June 2023

54 UK Customer Satisfaction Index | July 2023

Evidence from the UKCSI, ONS and other market data suggests that Retail (Food) organisations will need to

maintain their focus on competitive pricing, employee skills, engagement and retention, quality of products

and transactional experiences and supply chain management.

Retail (Food): Customers' key priorities for organisations to improve

20.2%

13.9%

12.8%

11.2%

10.0%

9.9%

9.0%

8.8%

19.7%

14.4%

13.1%

10.3%

9.3%

10.6%

11.0%

8.5%

Availability of product / service

Product / service range

More friendly / helpful staff

Have more staff available

Quality of product / service

More knowledgeable staff

Better website navigation

Easier to contact the right person to help me

Jul-23

Jul-22

55UK Customer Satisfaction Index | July 2023

14

See Current Account Switching Service Dashboard Issue 38

The Current Account Switching Dashboard has

reported that the volume of customer account

switching is at its highest ever recorded level

14

The rise in switching activity is likely to have been influenced by an increase in competitive switching

incentives, consumers’ desire to maximise their income (switching bonuses and cashbacks offered by

providers do not count towards the £1,000 annual tax-free personal savings allowance), and quality of

customer service.

Service benefits remain the core reasons that customers prefer their new current account to their old

one, with online or mobile app banking (41%) and customer service (29%) listed as the top two reasons

for people preferring their new current account. Financial benefits including interest earned (29%) and

spending benefits (25%) are also rated as important advantages of an account switch.

Volume of current account switching 2020 - 2023

234,767

327,249

395,345

445,866

413,885

717,182

April 2020

- Sept 2020

Oct 2020

- March 2021

April 2021

- Sept 2021

Oct 2021

- March 2022

April 2022

- Sept 2022

Oct 2022

- March 2023

56 UK Customer Satisfaction Index | July 2023

Just 3 organisations that

appear in the UKCSI

gained more current

accounts than they lost

In this UKCSI we have reviewed data from

the latest Current Account Switch Service

(CASS) dashboard, covering switches between

organisations completing between October and

December 2022, alongside the corresponding

UKCSI period (January 2023). In the context

of increased levels of account switching just

3 organisations that appear in the UKCSI

gained more current accounts than they lost –

Nationwide, Starling Bank and Natwest.

Nationwide was by the far the biggest beneficiary

of current account switching: between October

and December 2022 it achieved over 111,000

net current account gains, the strongest ever

quarterly performance recorded by the Current

Account Switching Service. During October

and November 2022, Nationwide offered new

account joiners a £200 cash incentive to be paid

within 10 days, considered to be the biggest

cash incentive offered by any provider up to

that point

15

. In the January 2023 UKCSI, average

customer satisfaction with Nationwide was 82.6

(out of 100), more than 2 points above the sector

average. (In the July 2023 UKCSI, Nationwide’s

average customer satisfaction is rated at 84.3,

over 4 points above the sector average).

Santander, Barclays and Halifax – all of whom

received a UKCSI score within 1 point of the

sector average in January 2023 – suffered

the biggest net current account losses. Every

organisation that received a UKCSI score at least

2 points below the sector average sustained

more current account losses than gains between

October and December 2022.

15

See This is Money, 27 April, 2023: www.thisismoney.co.uk/money/saving/article-12016865/Nationwide-spent-29m-gobbling-147-000-new-customers.html

57UK Customer Satisfaction Index | July 2023

Banks & Building Societies January 2023 UKCSI: 80.3

UKCSI January 2023

Nationwide

The Co-operative

Bank

Starling Bank

Halifax

NatWest

Lloyds

Barclays

Santander

Bank of

Scotland

HSBC

16

TSB

RBS

Virgin

Money

Monzo

Bank

-40,000

-30,000

-20,000

-10,000

0

10,000

20,000

30,000

40,000

50,000

60,000

70,000

80,000

90,000

100,000

110,000

120,000

76 78 80 82 84 86

Current Account Net Gains / Losses

Average current account quarterly net gains

Customer satisfaction and current account net gains and losses

Banks & Building Societies

with UKCSI within 1 point

( +/- ) of sector average

Banks & Building Societies with

a UKCSI at least 1 point above

sector average

Net current account gains Net current account gains

20,460 -14,607

Banks & Building Societies

with a UKCSI at least 1 point

below sector average

Net current account losses

-5,788

16

HSBC includes switching figures for first direct and M & S Bank

58 UK Customer Satisfaction Index | July 2023

There is growing scrutiny of the interest rates offered

by banks and building societies to savers

Alongside the upsurge in current account

switching activity, there is a growing scrutiny of

the interest rates offered by banks to savers. The

Bank of England has reported that the average

interest rate available on instant access savings

accounts rose by just 1.42 percentage points

between November 2021 and March 2023,

despite its base rate rising from 0.1 per cent

to 4.25 per cent in that period. Meanwhile the

interest rate on a two-year fixed mortgage with

a 25 per cent deposit had increased by 3.22

percentage points. MPs and campaigners have

called on banks to be more proactive in passing

on higher interest rates to savers. In May 2023 the

Commons Treasury committee wrote to a number

of leading retail banks, asking them to explain

why savings rates are below the current interest

rate and whether they inform loyal customers that

higher savings rates are available

17

.

The FCA’s chief executive, Nikhil Rathi, said in a

letter to the Treasury Select Committee: “We have

made clear that firms should be able to justify and

explain the rationale for the speed and degree

to which they make changes to their various

savings rates.” The FCA has also indicated that

the Consumer Duty will give it greater flexibility to

react to market developments, without needing

to introduce additional detailed and prescriptive

rules. The FCA has previously consulted on

whether to introduce a single “easy-access” rate

on cash savings to prevent a “loyalty penalty” in

cash savings markets: the regulator has indicated

that it could revisit the idea of single easy-access

rate, or other interventions, if there is persistent

evidence that existing savers receive unfair

savings rates compared to those offered in new

accounts

18

.

17

See inews 11 May 2023 https://inews.co.uk/news/politics/high-street-banks-told-to-pass-latest-bank-of-england-interest-rate-rise-on-to-savers-2335474

18

See This is Money 20 April 2023 www.thisismoney.co.uk/money/saving/article-11994691/Banks-FORCED-pay-savers-new-rules.html

59UK Customer Satisfaction Index | July 2023

Concerns about availability of bank branches,

especially amongst customers with poor or very poor

nancial well-being

Evidence from the UKCSI suggests that customers’ leading priority for organisations in the banks and

building societies sector is the same as the average of the 13 UKCSI sectors: making it easier to contact

the right person to help. In addition, almost 13% of customers highlighted availability of bank branches

as a leading priority for banks and building societies to improve: this is the top priority for customers who

describe their financial well-being as “average”, “poor” or “very poor”.

Customers’ key priorities for banks and building societies to improve

8.5%

11.2%

9.2%

8.0%

Have more staff available

12.8%

11.4%

6.7%

8.2%

Opening times

10.2%

7.6%

9.7%

9.0%

Better app design

8.2%

6.5%

12.9%

10.9%

More friendly / helpful staff

6.9%

8.0%

12.3%

11.2%

More knowledgeable staff

9.2%

8.9%

12.2%

11.3%

Better website navigation

15.7%

17.2%

11.4%

12.7%

Have more branches/stores available

13.4%

11.6%

14.9%

13.8%

Easier to contact the right

person to help me

Very good / good

nancial well-being

All customers

Average nancial well-being

Very poor / poor

nancial well-being

60 UK Customer Satisfaction Index | July 2023

Understanding

and responding

to customers’

personal situation

and needs

3

In this section we review changes and differences in customer satisfaction by age group and for

customers with a disability or long-term health condition. We examine the extent to which organisations

understand and respond to customers’ personal needs and situation and how this affects customer

satisfaction. We also highlight the priorities which customers believe organisations should focus on to

improve customer service.

61UK Customer Satisfaction Index | July 2023

Customer satisfaction has

fallen across all age groups

compared to a year ago

Whilst the average satisfaction with organisations of customers aged over 55 has fallen slightly (by

between 0.4 and 0.6 points), there has been a larger drop in customer satisfaction, of at least 3 points,

amongst 18 – 34 year olds.

Customer satisfaction by age group

77.8

78.7

77.8

77.9

77.7

79.6

83.2

74.4

75.7

75.5

76.3

77.3

79.0

82.6

80 and above65 to 7955 to 6445 to 5435 to 4425 to 3418 to 24

Jul-23

Jul-22

Index scores out of 100

62 UK Customer Satisfaction Index | July 2023

In the 18 – 34 year old age cohort the biggest decline in customer satisfaction compared to a year ago

is for complaint handling, followed by satisfaction with price / cost, ease of contacting the right person

to help, trust, and an organisation doing the right thing in its business practices. Younger customers are

more likely than others to have experienced a problem with an organisation but despite the overall fall in