REPORT

MARKET STUDY

May 14, 2023

Houston Lake Homes

1705 Houston Lake Road

Perry, GA 31069

For

Brian Parent

4110 Southpoint Blvd., Suite 206

Jacksonville, FL 32216

And

Georgia Department of Community Affairs

60 Executive Park South, N.E.

Atlanta, Georgia 30329-2231

Prepared By:

Gibson Consulting, LLC

1651 E 70th ST, PMB 403

Shreveport, LA 71105-5115

Gibson.gibco@fgibsonconsulting.com

Houston Lake Homes, Perry, GA

2023

i

Gibson Consulting, LLC

i

A. TABLE OF CONTENTS

B. EXECUTIVE SUMMARY ................................................................................................................. 3

1. DESCRIPTION .......................................................................................................................................... 3

2. SITE DESCRIPTION ................................................................................................................................. 5

3. MARKET AREA DEFINITION .................................................................................................................... 6

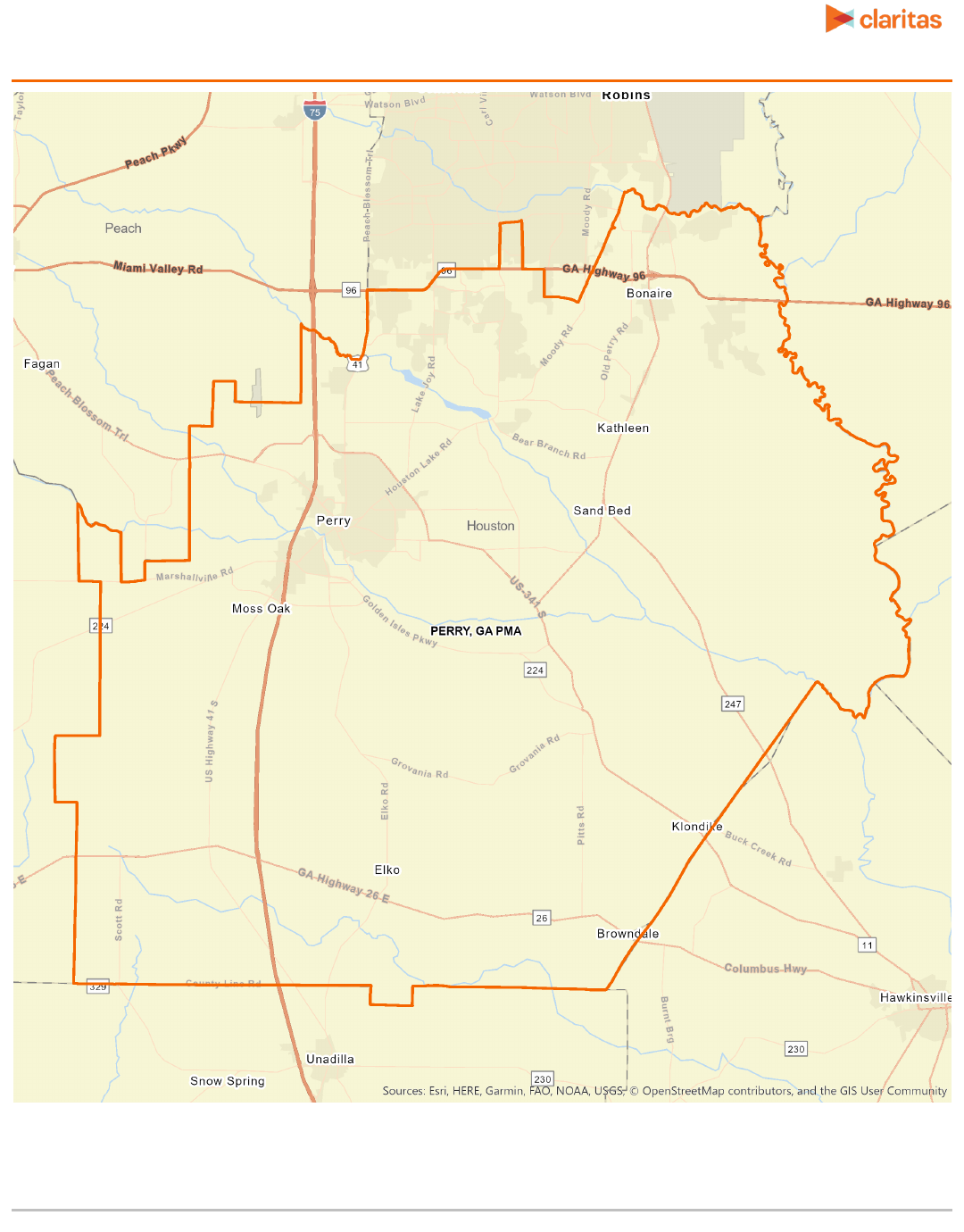

PRIMARY MARKET AREA MAP ................................................................................................................... 7

4. COMMUNITY DEMOGRAPHIC DATA ........................................................................................................ 8

5. ECONOMIC DATA .................................................................................................................................... 8

6. PROJECT SPECIFIC AFFORDABILITY AND DEMAND ANALYSIS: ............................................................... 8

7. COMPETITIVE RENTAL ANALYSIS ......................................................................................................... 10

8. ABSORPTION/STABILIZATION ESTIMATE .............................................................................................. 11

9. OVERALL CONCLUSION ........................................................................................................................ 11

C. PROJECT DESCRIPTION .................................................................................................................. 14

D. SITE EVALUATION ............................................................................................................................ 16

2. SITE AND NEIGHBORHOOD PHOTOS ...................................................................................................... 17

3. MAPS AND SERVICES. ........................................................................................................................... 23

LOCATION MAP ........................................................................................................................................ 24

SERVICES MAP ......................................................................................................................................... 25

SURVEYED COMPLEXES MAP INCLUDING LOW INCOME .......................................................................... 27

E. MARKET AREA ................................................................................................................................... 29

Primary Market Area Map .................................................................................................................. 30

F. COMMUNITY DEMOGRAPHIC DATA ........................................................................................... 31

METHOD OF ANALYSIS ...................................................................................................................... 32

DEMOGRAPHIC SUMMARY ........................................................................................................................ 35

1. POPULATION TRENDS ................................................................................................................ 38

TOTAL POPULATION .......................................................................................................................... 38

POPULATION DETAILS ....................................................................................................................... 39

2. HOUSEHOLD TRENDS ....................................................................................................................... 40

PERSONS PER HOUSEHOLD .............................................................................................................. 40

HOUSEHOLD GROWTH ....................................................................................................................... 41

HOUSEHOLDS BY HOUSEHOLD INCOME ....................................................................................... 42

RENTER HOUSEHOLDS BY HOUSEHOLD SIZE ............................................................................................ 44

AGE OF HOUSING ................................................................................................................................ 45

HOUSING UNIT CHARACTERISTICS ................................................................................................ 46

G. EMPLOYMENT TREND ..................................................................................................................... 47

2. TOTAL JOBS BY INDUSTRY ............................................................................................................... 49

EMPLOYMENT TRENDS ............................................................................................................................. 51

H. PROJECT-SPECIFIC AFFORDABILITY & DEMAND ANALYSIS ............................................ 59

LIHTC REQUIREMENTS............................................................................................................................ 59

MAXIMUM RENTS ..................................................................................................................................... 59

LIHTC INCOME LIMITS ............................................................................................................................ 60

I. COMPETITIVE RENTAL ANALYSIS (EXISTING COMPETITIVE RENTAL

ENVIRONMENT) ...................................................................................................................................... 71

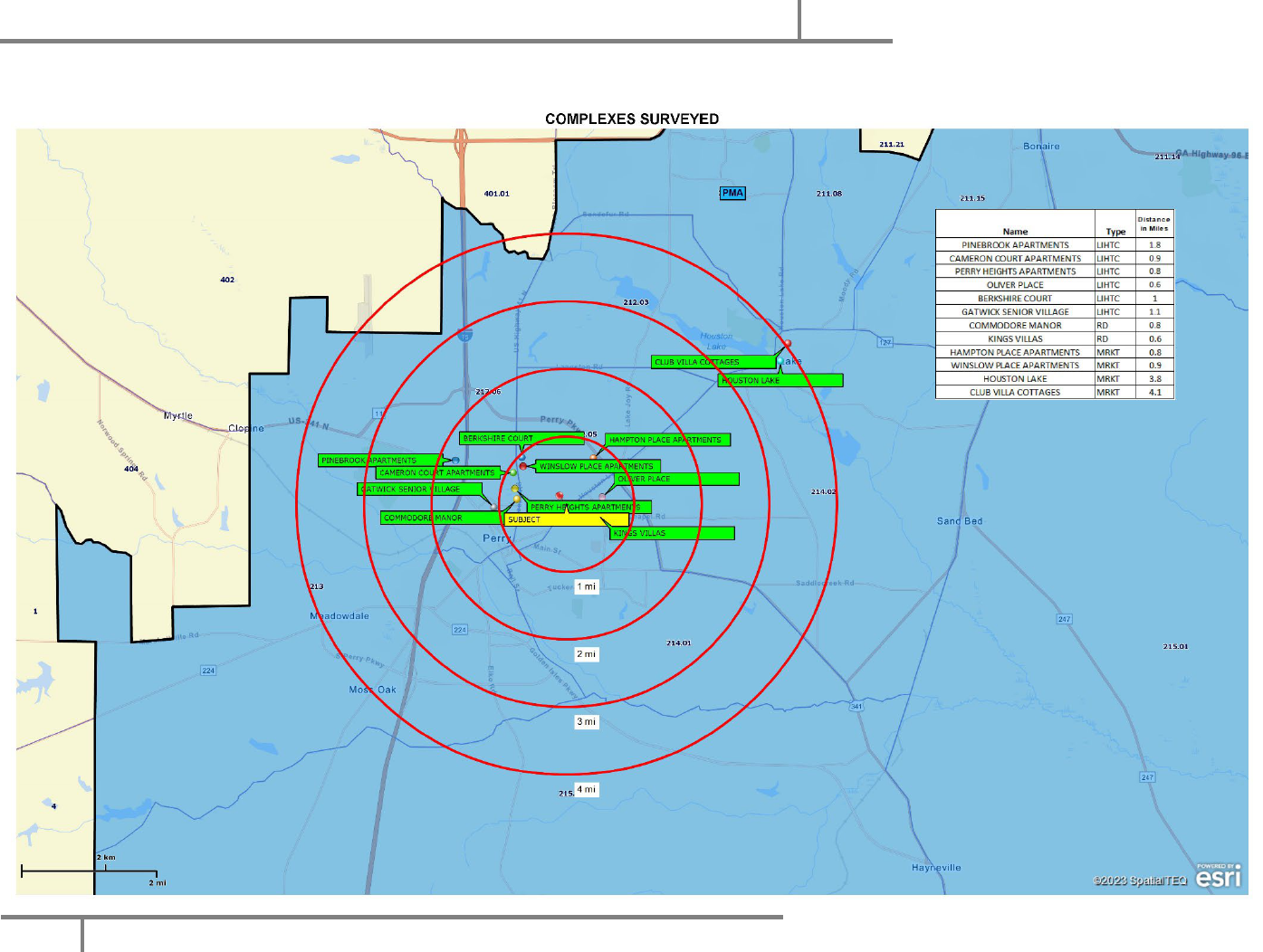

Map of Surveyed Complexes ............................................................................................................... 73

CHART OF SURVEYED COMPLEXES ............................................................................................. 74

Houston Lake Homes, Perry, GA

2023

ii

Gibson Consulting, LLC

ii

J. ABSORPTION AND STABILIZATION RATES ............................................................................... 76

ABSORPTION ANALYSIS.................................................................................................................... 76

MARKET IMPACT STATEMENT ........................................................................................................ 77

K. INTERVIEWS ....................................................................................................................................... 78

L. CONCLUSIONS AND RECOMMENDATION ............................................................................ 79

M. SIGNED STATEMENT REQUIREMENTS .................................................................................. 80

DATA SOURCES ....................................................................................................................................... 81

APPENDICES ............................................................................................................................................ 82

COMPLEXES SURVEYED ........................................................................................................................... 83

MARKET STUDY TERMINOLOGY ............................................................................................................... 84

DEMOGRAPHIC DATA ............................................................................................................................... 85

Houston Lake Homes, Perry, GA

2023

3

Gibson Consulting, LLC

3

B. EXECUTIVE SUMMARY

1. Description

The project is a new construction development of housing for general occupancy that will be built

with LIHTC financing.

1. The site is located at 1705 Houston Lake Rd, Perry, Houston County, GA

2. Project Construction Type: New Construction

3. Occupancy Type: Families

4. Special Population Target: n/a

5. Units by bedroom type and income targeting (AMI)

Bedrooms

Baths

# of Units

AMI Level *

1

1

2

50%

3

2

13

50%

4

2

13

50%

1

1

1

80%

3

2

3

80%

4

2

2

80%

1

1

2

60%

3

2

7

60%

4

2

7

60%

TOTAL

50

6. Unit size, number of bedrooms and structure type:

Bedrooms

Baths

# of Units

Sq. Feet

1

1

5

850

3

2

23

1500

4

2

22

1520

TOTAL

50

STRUCTURE TYPE :walk-up

7. Rents and Utility allowances

UNIT CONFIGURATION

Bedrooms

Baths

# of Units

AMI Level *

Sq. Feet

Net Rents

Utility Allow.

Gross Rents

1

1

2

50%

850

636

114

750

3

2

13

50%

1500

844

181

1025

4

2

13

50%

1520

927

223

1150

1

1

1

80%

850

936

114

1050

3

2

3

80%

1500

1219

181

1400

4

2

2

80%

1520

1327

223

1550

1

1

2

60%

850

806

114

920

3

2

7

60%

1500

1019

181

1200

4

2

7

60%

1520

1102

223

1325

TOTAL

50

Houston Lake Homes, Perry, GA

2023

4

Gibson Consulting, LLC

4

UTILITY RESPONSIBILITY

UTILITY RESPONSIBILITY (Check Box of Responsible Party)

Party

Water/Sw

Trash

Electricity

Elec Heat

Gas Heat

Water Heat

Cooking (G/E)

Landlord

X

Tenant

X

X

X

X

X electric

8. Existing or proposed project based rental assistance: NONE

9. Proposed Development Amenities:

The amenities are superior to the market.

10. Project is not rehab.

11. Projected placed in-service date:10-1-2025.

The units will be constructed using LIHTC financing and therefore the tenants will have income

restrictions and there will be rent limits.

Range ( X )

Refrigerator ( X )

D

ishwasher (X )

Disposal ( X ) Security Gate ( )

Business Center ( )

Carpet ( ) Computer Center ( )

A/C-Wall ( ) Car Wash Area ( )

Picnic Area ( )

Craft Room ( )

Cable Sat Provided ( )

Library ( )

Wheelchair ramps ( ) I

nternet Provided ( ) Vaulted Ceilings ( ) Storage ( )

Safety bars ( ) Cable Sat Wired (X ) Internet Wired ( x ) View ( )

Pets Allowed ( X ) Hardwood Flooring ( ) Vinyl Flooring (X ) LVP Other* ( X )

Pet Fee (X ) *Detail "Other" Amenities:

Pet Rent ( )

Playground ( X )

Tennis Court ( )

UNIT AND PROJECT AMENITIES

Jacuzzi/Sauna ( )

Microwave Oven (X )

A/C-Central (X )

Window Blinds ( X )

On-site Maint. ( x )

Elevator ( )

Fitness Center ( )

Swimming Pool ( )

W/D Hookups ( X )

Security Syst. ( )

Furnishings ( )

Sports Court ( )

Wash/Dryer (X )

E-Call Button ( )

Patio/Balcony ( X )

Ceiling Fan ( X )

Fireplace ( )

Basement ( )

Intercom ( )

attached garage

Lake/Pond ( )

Laundry Facility ( )

Club House (X )

Community Facility ( )

On-site Mgt. ( x )

Houston Lake Homes, Perry, GA

2023

5

Gibson Consulting, LLC

5

2. Site Description

The site is a developed urban site that is mildly sloping. It is approximately 30.25acres of vacant

land. The area is residential and commercial. There are no obvious environmental or other visible

concerns. Adjoining east is residential; adjoining north is residential; adjoining west is commercial

and vacant; adjoining south is Houston Lake Road, followed by residential.

The site will have frontage access on Houston Lake Road.

The site will make a good location for affordable rental housing.

Houston Lake Homes, Perry, GA

2023

6

Gibson Consulting, LLC

6

3. Market Area Definition

The Primary Market Area (PMA) is the geographic area from which the property is expected to

draw 85% of its residents. We determined the PMA for the project to be an area encompassed by

the boundaries of the following census tracts.

The map below shows the boundaries of the PMA. The site is approximately 12 miles from the

farthest boundary of the PMA. The use of census tracts is appropriate for this type of housing in

this urban area. The site is located in the central part of the PMA and is expected to attract

applicants from the entire county.

Tract County FIPS code

211.08 Houston County 13153021108

211.14 Houston County 13153021114

211.15 Houston County 13153021115

212.03 Houston County 13153021203

212.04 Houston County 13153021204

212.05 Houston County 13153021205

212.06 Houston County 13153021206

213 Houston County 13153021300

214.01 Houston County 13153021401

214.02 Houston County 13153021402

215.01 Houston County 13153021501

215.02 Houston County 13153021502

Houston Lake Homes, Perry, GA

2023

7

Gibson Consulting, LLC

7

Primary Market Area Map

Houston Lake Homes, Perry, GA

2023

8

Gibson Consulting, LLC

8

4. Community Demographic Data

Households and population have increased since 2000 as shown in the charts in the body of the

report. Rental rates are increasing, and household incomes are increasing in the area. There should

be no impact to the project of foreclosed, abandoned and vacant single family and multi-family

homes and commercial properties in the PMA.

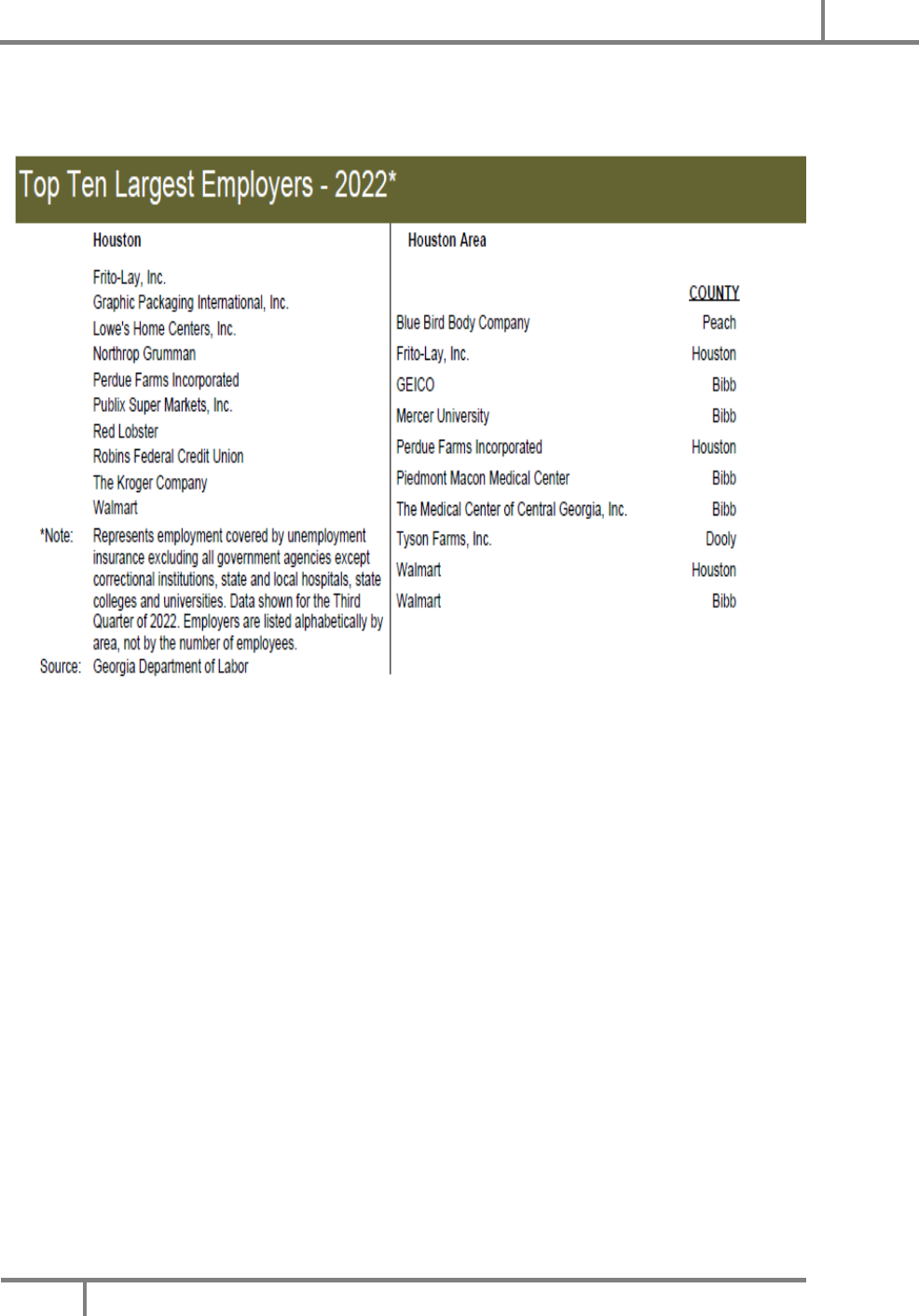

5. Economic Data

The County unemployment rate declined to 3.1% in March 2023, from 3.7% in 2021 and up from

3.0% in March of 2022. The annualized total employment increased 1.9% in 2019, decreased by

2.7% in 2020, increased 2.4% in 2021 and declined 0.1% in 2022. The annualized unemployment

rate decreased 0.7% in 2019, increased 1.7% in 2020, decreased 1.5% in 2021 and decreased 0.6%

in 2022. Total employment in March 2023 has increased by 702 over annualized 2022. The large

decrease in employment in 2020 was due to the COVID-19 safer at home actions taken by the

state.

The area has a concentration of employment in the manufacturing, educational services and retail

sectors. These jobs have incomes that would make the worker eligible for the proposed housing.

Current employment is increasing in these areas.

A review of the commuting patterns shows that 48.83% of those working in Houston County do

not live in Houston County. This may be due to a lack of decent affordable housing.

The increases in the numbers of employed will cause upward pressure on rents and occupancy

levels as people are able to improve their housing situations. New households will be formed as a

result of the increased employment. The employment conditions and trends are supportive of the

need for more affordable housing.

6. Project Specific Affordability and Demand Analysis:

In the body of the report we provide detailed calculations of demand by unit size and income level.

The affordability analysis shows the proposed project to be in compliance with LIHTC and DCA

requirements for affordability. The capture rate analysis chart summarizes the demand.

Houston Lake Homes, Perry, GA

2023

9

Gibson Consulting, LLC

9

Based upon all of the data and field work, it is our opinion that the capture rates are achievable.

AMI

Income

Limits

Unit Size

Units

Proposed

Total

Demand

Supply

Net

Demand

Capture

Rate

Absorption

Average

Market

Rent

Market

Rents Band

Min-Max

Proposed

Rents

50% AMI

25714

32950 1BR 2 236 236 0.85% <6 months $ 1,200 1025-1343 $636

35143

44450 3BR 13 191 191 6.81% <6 months $ 1,500 1170-2030 $844

39429

47750 4BR 13 171 171 7.62% <6 months $ 1,600 1170-2030 $927

80% AMI

36000

52720 1BR 1 342 342 0.29% <6 months $ 1,200 1170-2030 $936

48000

71120 2BR 3 468 468 0.64% <6 months 1,500$ 1170-2030 $1,219

53143

76400 3BR 2 471 471 0.42% <6 months 1,600$ 1170-2030 $1,327

60%AMI

31543

39540 1BR 2 206 206 0.97% <6 months 1,200$ 1025-1343 $806

41143

53340 2BR 7 249 249 2.81% <6 months 1,500$ 1170-2030 $1,019

45429

57300 3BR 7 241 241 2.90% <6 months 1,600$ 1170-2030 $1,102

TOTAL 50% AMI 28 565 0

565 4.96% <6 months

FOR 80% AMI 6 821 0

821 0.73% <6 months

60% AMI 16 568 0

568 2.82%

PROJECT

TOTAL

LIHTC

50 1,145 0

1,145 4.37% <6 months

Houston Lake Homes, Perry, GA

2023

10

Gibson Consulting, LLC

10

7. Competitive Rental Analysis

In the demographics section of the report, we include detailed information on the existing housing

stock for the PMA. The renter percentage is 22.73% which is low. One-unit detached homes make

up 83.52% of the housing units, while units while structures with 5 or more units make up 6.39%

of the housing units. Mobile Homes or Trailers make up 6.55% of the units.

We surveyed 12 complexes with a total of 1,385 units. This include 5 reported LIHTC projects

with a total of 396 units and 7 market rate and other subsidized units with a total of 989 units. The

LIHTC complexes had occupancy of 97.98%, while the other units had occupancy of 98%. The

overall occupancy rate is 97.98%. The amenities in the majority of the market rate units surveyed

are equal or inferior to the proposed units. Almost all of the complexes surveyed reported that they

had waiting lists of applicants. Some of the rental units are aging with complexes built in the 1970s

and 1980s. There are market rate multifamily units that are comparable to the subject. We

contacted real estate agents and researched rental properties online and found that homes and

mobile homes rent quickly. Based upon this information and assessing the amenities and features

of the proposed complex, we have determined the market rates to be $1,200 for one-bedroom units,

$1,500 for three-bedroom units and $1,600 for four-bedroom units. The chart below compares the

subject rents to the LIHTC maximums and the net market rent.

UNIT

LIHTC

MAX

RENT

UA

NET

LIHTC

RENT

MAX

PROPOSED

LIHTC

RENT

Net

Market

Rent

Advantage

over

market

1 Bedroom--50% AMI

772

$114

658

$636

1200

88.7%

3 Bedroom--50%AMI

1070

$181

889

$844

1500

77.7%

4 Bedroom--50% AMI

1193

$223

970

$927

1600

72.6%

1 Bedroom--80%AMI

1236

$114

1122

$936

1200

28.2%

3 Bedroom--80% AMI

1712

$181

1531

$1,219

1500

23.1%

4 Bedroom--80% AMI

1910

$223

1687

$1,327

1600

20.6%

1 Bedroom 60% AMI

927

$114

813

$806

1200

48.9%

3 Bedroom 60% AMI

1284

$181

1103

$1,019

1500

47.2%

4 Bedroom 60% AMI

1432

$223

1209

$1,102

1600

45.2%

The proposed project should not have any adverse impact on other affordable housing in the area,

including DCA projects. All of the properties surveyed had sustaining occupancy and most had

waiting lists.

In the last five years, rental rates and occupancy levels have been increasing. Rental trends in the

area include rising rents and level occupancy in the 95-100% range. We project rents to increase

3% per year for the next two years and we project occupancy to be stable, with slight

improvements. Foreclosures and abandoned homes are not a factor for this development due to the

high rental occupancy in the area. There is no way at this point in time to determine the effect, if

Houston Lake Homes, Perry, GA

2023

11

Gibson Consulting, LLC

11

any, of the COVID-19 pandemic upon the future economy and rental and occupancy rates.

Generally, during economic downturns, the need for affordable housing increases.

There are two housing voids in Houston County. The first is new market rate housing for general

occupancy. The income levels are sufficient to support this type of rental housing yet there is still

a large demand for it. The second is affordable housing for families. This project will help fill the

void for decent affordable housing for families but not for market rate housing.

8. Absorption/Stabilization Estimate

We project the following absorption (i.e. leasing) of the new units:

Date

Total #

Leased

%

Construction Completion

4

8%

30 Days Post Completion

12

24%

60 Days Post Completion

20

40%

90 Days Post Completion

28

56%

120 Days Post Completion

36

72%

150 Days Post Completion

44

88%

180 Days Post Completion

50

100%

The absorption rate is estimated to be 8 units per month, based upon the interviews with the

property managers. Preleasing is projected to result in 4 units rented during construction. 93%

occupancy should be achieved approximately 180 days after construction completion.

9. Overall Conclusion

We recommend that the proposed project be awarded an allocation of Low-Income Housing Tax

Credits based upon our review and analysis of current market conditions, economics,

demographics, current occupancy of existing complexes and supply and demand estimates. The

proposed design and amenities will enhance the relative marketability.

The site has no adverse conditions and is marketable. There is very little comparable in the area,

so the complex will be able to operate as the nicest rental complex available. The standard

calculated capture rate for each type of unit is within DCA guidelines for feasibility in a rural area.

We project the units will be absorbed fully within 180 days of completion. The new units will have

an advantage over other units in the area due to a superior amenities package.

The high occupancy rates, waiting lists, acceptable capture rates and interviews with local persons

knowledgeable about the housing needs of the area were the major factors that led to these

conclusions.

Houston Lake Homes, Perry, GA

2023

12

Gibson Consulting, LLC

12

The proposed project when completed will have no appreciable impact on the tax credit and other

existing affordable housing in the area. It will have a positive impact on those that are seeking

affordable housing in that they will have an additional choice and availability that prior to the

completion they will not have. As with any new addition or newly rehabilitated units to a market,

this complex may cause other properties to provide a better product and a higher level of customer

service and appreciation.

Houston Lake Homes, Perry, GA

2023

13

Gibson Consulting, LLC

13

50

50

12

#

Units

#

Beds

#

Baths

2 1 1

13 3 2

13 4 2

1 1 1

3 3 2

2 4 2

2 1 1

7 3 2

7 4 2

$ 1.36

$ 1.36

$ 1.36

$ 1.36

$ 1.40

$ 1.36

$ 1.36

$ 1.40

47%

45%

$ 2,030

$ 2,030

$ 1,343

$ 2,030

$ 2,030

$ 1,343

$ 2,030

$ 2,030

$1,219

$1,327

$806

23%

21%

49%

$ 1,500

$ 1,600

$ 1,200

$1,019

$1,102

4.37%

$ 1,500

$ 1,600

$ 1.00

$ 1.05

$ 1.41

$ 1.00

$ 1.05

$ 1.41

$ 1.00

$ 1.05

$ 1,500

$ 1,600

$ 1,200

78%

73%

28%

$844

$927

$936

2023 Market Study Manual DCA Housing Finance and Development Division 3 of 10

1500

1520

850

1500

1520

850

1500

1520

Capture Rate

4.96%

0.73%

2.82%

CAPTURE R

ATES (found on page

)

Targeted Population

50%

80%

60%

Market

Rate

Market

Rate

Overall

LIHTC

Per SF

850

$636

$ 1,200

$ 1.41

89%

$ 1,343

$ 1.40

Size

(SF)

Proposed

Rent

Per

Unit

Per

SF

Adv an

-tage

Per Unit

Properties in Construction &

Lease Up

Subject Development

Average Market Rent

Highest Unadjusted

Comp Rent

LIHTC

5

396

8

97.98%

Stabilized Comps

5

396

8

97.98%

Market-Rate Housing

5

846

19

97.75%

Assisted/Subsidized Housing not

to include LIHTC

2

143

1

99.30%

T ype

# Properties

Total

Units

Vacant Units

Average

Occupancy

All Rental Housing

12

1,385

28

97.98%

PMA Boundary:

Listed census tracts

South Boundary Line

Farthest Boundary Distance to

Subject:

miles

RENTAL HOUSING STOCK (found on page

)

Summary T able :

Development Name:

Houston Lake Homes

Total # Units:

Location:

1705 Houston Lake Road, Perry, GA

# LIHTC Units:

Houston Lake Homes, Perry, GA

2023

14

Gibson Consulting, LLC

14

C. PROJECT DESCRIPTION

The project is a new construction development of housing for general occupancy that will be built

with LIHTC financing.

1. The site is located at 1705 Houston Lake Rd, Perry, Houston County, GA

2. Project Construction Type: New Construction

3. Occupancy Type: Families

4. Special Population Target: n/a

5. Units by bedroom type and income targeting (AMI)

Bedrooms

Baths

# of Units

AMI Level *

1

1

2

50%

3

2

13

50%

4

2

13

50%

1

1

1

80%

3

2

3

80%

4

2

2

80%

1

1

2

60%

3

2

7

60%

4

2

7

60%

TOTAL

50

1. Unit size, number of bedrooms and structure type:

Bedrooms

Baths

# of Units

Sq. Feet

1

1

5

850

3

2

23

1500

4

2

22

1520

TOTAL

50

STRUCTURE TYPE :walk-up

2. Rents and Utility allowances

UNIT CONFIGURATION

Bedrooms

Baths

# of Units

AMI Level *

Sq. Feet

Net Rents

Utility Allow.

Gross Rents

1

1

2

50%

850

636

114

750

3

2

13

50%

1500

844

181

1025

4

2

13

50%

1520

927

223

1150

1

1

1

80%

850

936

114

1050

3

2

3

80%

1500

1219

181

1400

4

2

2

80%

1520

1327

223

1550

1

1

2

60%

850

806

114

920

3

2

7

60%

1500

1019

181

1200

4

2

7

60%

1520

1102

223

1325

TOTAL

50

Houston Lake Homes, Perry, GA

2023

15

Gibson Consulting, LLC

15

UTILITY RESPONSIBILITY

UTILITY RESPONSIBILITY (Check Box of Responsible Party)

Party

Water/Sw

Trash

Electricity

Elec Heat

Gas Heat

Water Heat

Cooking (G/E)

Landlord

X

Tenant

X

X

X

X

X electric

6. Existing or proposed project based rental assistance: NONE

7. Proposed Development Amenities:

The amenities are superior to the market.

8. Project is not rehab.

9. Projected placed in-service date:10-1-2025.

The units will be constructed using LIHTC financing and therefore the tenants will have income

restrictions and there will be rent limits.

Range ( X )

Refrigerator ( X )

D

ishwasher (X )

Disposal ( X ) Security Gate ( )

Business Center ( )

Carpet ( ) Computer Center ( )

A/C-Wall ( ) Car Wash Area ( )

Picnic Area ( )

Craft Room ( )

Cable Sat Provided ( )

Library ( )

Wheelchair ramps ( ) I

nternet Provided ( ) Vaulted Ceilings ( ) Storage ( )

Safety bars ( ) Cable Sat Wired (X ) Internet Wired ( x ) View ( )

Pets Allowed ( X ) Hardwood Flooring ( ) Vinyl Flooring (X ) LVP Other* ( X )

Pet Fee (X ) *Detail "Other" Amenities:

Pet Rent ( )

Playground ( X )

Tennis Court ( )

UNIT AND PROJECT AMENITIES

Jacuzzi/Sauna ( )

Microwave Oven (X )

A/C-Central (X )

Window Blinds ( X )

On-site Maint. ( x )

Elevator ( )

Fitness Center ( )

Swimming Pool ( )

W/D Hookups ( X )

Security Syst. ( )

Furnishings ( )

Sports Court ( )

Wash/Dryer (X )

E-Call Button ( )

Patio/Balcony ( X )

Ceiling Fan ( X )

Fireplace ( )

Basement ( )

Intercom ( )

attached garage

Lake/Pond ( )

Laundry Facility ( )

Club House (X )

Community Facility ( )

On-site Mgt. ( x )

Houston Lake Homes, Perry, GA

2023

16

Gibson Consulting, LLC

16

D. Site Evaluation

1. The site visit including comparable market area developments was made on May 12, 2023

by Debbie Amox.

2. The site is a developed urban site that is mildly sloping. It is approximately 30.25 acres of

vacant land. The area is residential and commercial. There are no obvious environmental

or other visible concerns. Adjoining east is residential; adjoining north is residential;

adjoining west is commercial and vacant; adjoining south is Houston Lake Road, followed

by residential.

3. The site will have frontage access on Houston Lake Road.

4. The site will make a good location for affordable rental housing.

Houston Lake Homes, Perry, GA

2023

17

Gibson Consulting, LLC

17

2. Site and Neighborhood Photos

All photographs were taken May 12, 2023.

Neighborhood view east

Houston Lake Homes, Perry, GA

2023

18

Gibson Consulting, LLC

18

Neighborhood view north

Houston Lake Homes, Perry, GA

2023

19

Gibson Consulting, LLC

19

Neighborhood view South

Houston Lake Homes, Perry, GA

2023

20

Gibson Consulting, LLC

20

Neighborhood view west

View east to west

Houston Lake Homes, Perry, GA

2023

21

Gibson Consulting, LLC

21

View north to south

View south to north

Houston Lake Homes, Perry, GA

2023

22

Gibson Consulting, LLC

22

View west to east

Houston Lake Homes, Perry, GA

2023

23

Gibson Consulting, LLC

23

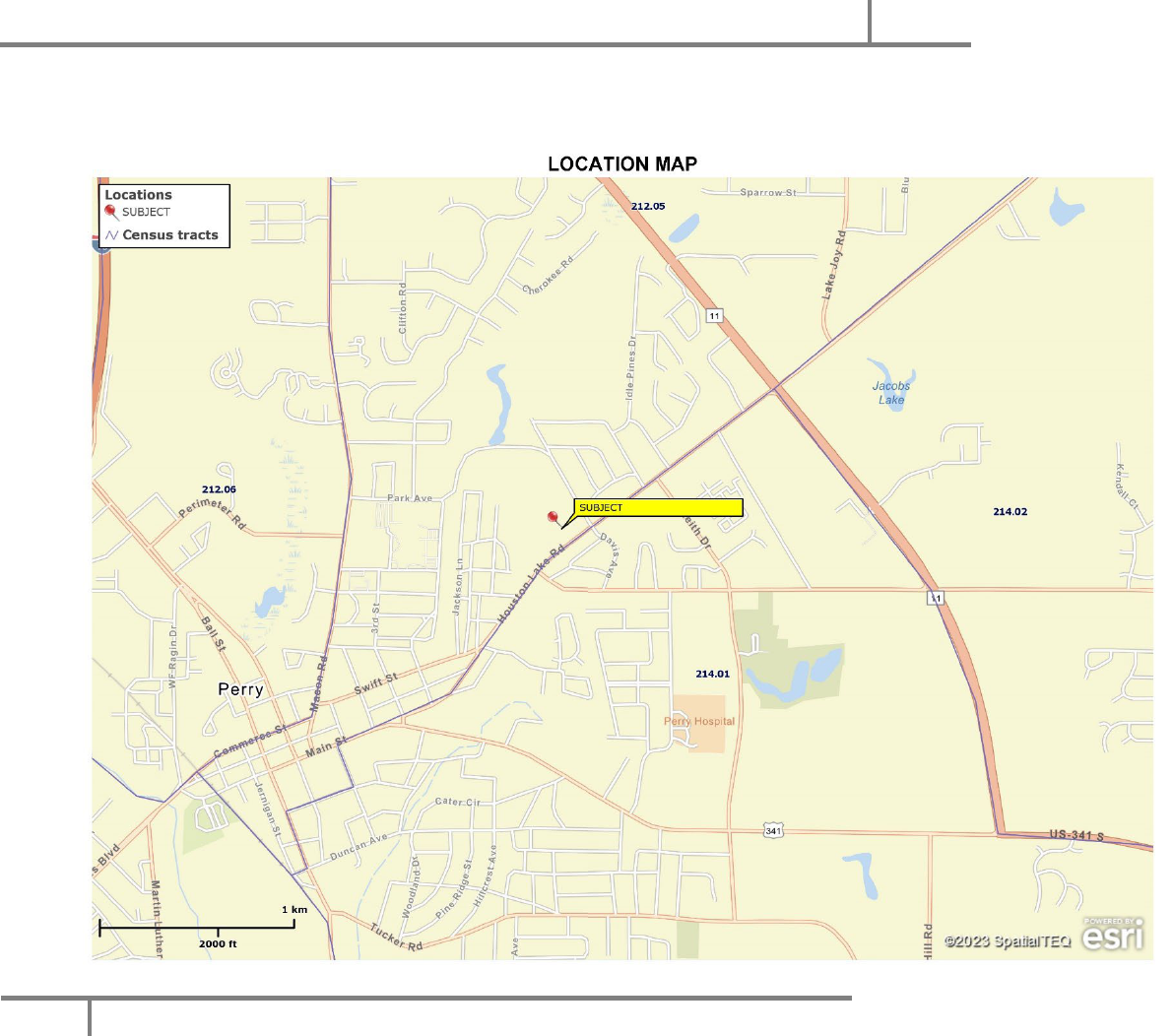

3. Maps and services.

Houston Lake Homes, Perry, GA

2023

24

Gibson Consulting, LLC

24

Location Map

Houston Lake Homes, Perry, GA

2023

25

Gibson Consulting, LLC

25

Services Map

Houston Lake Homes, Perry, GA

2023

26

Gibson Consulting, LLC

26

Service

Name/Address

Distance

Full-Service Grocery Store

Publix Super Market

275 Perry Parkway

0.7

Perry

Pharmacy/Drug Store

Publix Pharmacy

275 Perry Parkway

0.7

Perry

Doctor's Office/Emergency

Houston Healthcare-Perry

Clinic/Urgent Care Facility/

1120 Morningside Dr

0.6

Hospital

Perry

Shopping Center

Paradise Shops of Perry

275 Perry Parkway

0.7

Perry

Bank

Synovus Bank

916 Main Street

1

Perry

Public School

Perry High School

1307 North Ave

0.5

Perry

All of the above services and amenities are also employment opportunities.

1. The site is a developed urban site that is mildly sloping. It is approximately 30.67 acres of

vacant land. The area is residential and commercial. There are no obvious environmental

or other visible concerns. Adjoining east is residential; adjoining north is residential;

adjoining west is commercial and vacant; adjoining south is Houston Lake Road, followed

by residential.

2. According to information from neighborhoodscout.com, the crime index is 43. This should

not be a negative marketing factor and this new housing will improve the area.

3. See map below that shows existing low-income housing.

Houston Lake Homes, Perry, GA

2023

27

Gibson Consulting, LLC

27

Surveyed Complexes Map Including Low Income

Houston Lake Homes, Perry, GA

2023

28

Gibson Consulting, LLC

28

4. There are no known road or infrastructure improvements planned or under construction in the area of the

site.

5. Ingress and egress and access to the site is excellent via the hard-surfaced street that it faces. Pedestrian

access is from the unpaved road right of way. Visibility from the access street will be excellent.

6. There are no obvious environmental or other visible concerns. The site is well located for an affordable

housing development for families. Proximity to services is good and visibility is excellent. The site should

attract those seeking this type of housing.

Houston Lake Homes, Perry, GA

2023

29

Gibson Consulting, LLC

29

E. MARKET AREA

The Primary Market Area (PMA) is the geographic area from which the property is expected to

draw 85% of its residents. We determined the PMA for the project to be an area encompassed by

the boundaries of the following census tracts.

The map below shows the boundaries of the PMA. The site is approximately 12 miles from the

farthest boundary of the PMA. The use of census tracts is appropriate for this type of housing in

this urban area. The site is located in the central part of the PMA and is expected to attract

applicants from the entire county.

Tract County FIPS code

211.08 Houston County 13153021108

211.14 Houston County 13153021114

211.15 Houston County 13153021115

212.03 Houston County 13153021203

212.04 Houston County 13153021204

212.05 Houston County 13153021205

212.06 Houston County 13153021206

213 Houston County 13153021300

214.01 Houston County 13153021401

214.02 Houston County 13153021402

215.01 Houston County 13153021501

215.02 Houston County 13153021502

Houston Lake Homes, Perry, GA

2023

30

Gibson Consulting, LLC

30

Primary Market Area Map

Houston Lake Homes, Perry, GA

2023

31

Gibson Consulting, LLC

31

F. COMMUNITY DEMOGRAPHIC DATA

Gibson Consulting, LLC, Phone Number (318) 524-0177 was retained by the developer to provide a market

analysis that could be used to ascertain whether the project as proposed would have a likelihood of success.

In performing a market analysis, the analyst must perform a field study, the market must be defined, suitable

data must be obtained from Census and other sources, interviews must be conducted, competing properties

must be surveyed, and any special requirements of lenders or allocating agencies must be addressed. The

report should be taken as a whole, which forms the basis of the opinion expressed by the analyst.

As an appendix we have attached a market study terminology section for the reader’s use.

Houston Lake Homes, Perry, GA

2023

32

Gibson Consulting, LLC

32

METHOD OF ANALYSIS

The purpose of a market analysis is to objectively and professionally analyze the potential success of a

remodeled and refreshed or newly constructed housing development. Typically an affordable housing

development must maintain approximately 85-90% occupancy in order to be successful. Income and rent

restrictions placed upon the project by utilization of the LIHTC program make necessary a specific analysis

of the affordable housing market, not simply a study of the general housing market. The general rental housing

market in a market area may reveal that the existing rental units have low occupancy or high occupancy.

Vacancy rates alone are not sufficient for analyzing the need for affordable housing. For example, vacancies

may be high in a market area, but there may be an overwhelming need for additional affordable units. If the

units with vacancies are not affordable to LIHTC qualified applicants, those units are not serving the target

market. Therefore, introduction of additional affordable housing units may be advisable without affecting the

vacancies at the existing units. Conversely, low vacancy rates themselves are not necessarily indicative of

the need for additional affordable housing. The nature of the rental rates, occupancy demographics and other

factors such as services and amenities are also contributing factors to the overall need for affordable housing.

The mere existence of a property does not make it comparable or a factor in the analysis of the market. The

characteristics of the property are the determinant of whether the review of it is relevant to the report.

The source of residents and the need for additional housing units may come from:

1. New Households

By definition, households need housing to be a household. Household creation in a market area will create a

need for housing units. The trend in Georgia (as well as most other states) since 1970 has been that the

household contains fewer persons. In other words, household size is decreasing. Because of this fact, even

if a market area experiences negative population growth the number of households may increase due to the

shrinking number of persons per household. The projected household growth, rather than simple population

change is the factor that affects demand for housing.

2. Inadequate Supply of Existing Affordable Housing

A shortage of housing that is in the affordable range for LIHTC eligible renters may mean that these persons

are living in households with other family members. The simple fact of unavailability of sufficient affordable

housing means that an increase in supply of affordable housing will be utilized by those that are not currently

able to acquire housing in the existing overpriced market. Lower income families generally pay a higher

percentage of income for shelter when there is a shortage of affordable housing. They may be forced to accept

rent overburden because of this factor. A comparison of the income characteristics of the market area universe

with the rental rates of the market can signal pent-up demand for affordable housing.

3. Substandard and Overcrowded Housing Units

Persons living in overcrowded units or substandard housing are an excellent source of demand for new

affordable housing. A unit may be substandard because of lack of adequate plumbing facilities, or other

factors. An overcrowded unit is generally considered to be a unit that contains more than 1 person per room.

Besides the traditional definitions of substandard, demand for affordable housing can come form those who

simply wish to upgrade their housing conditions. For example, a family receiving housing assistance from a

Houston Lake Homes, Perry, GA

2023

33

Gibson Consulting, LLC

33

Section 8 voucher may be living in a unit that is less desirable and convenient than the new or remodeled

units. They might choose to move to the more desirable unit.

4. Special Needs

Large families, single parent households, elderly, disabled, homeless or handicapped persons are examples of

special needs populations which may be a source of demand for new units. The units that address the special

need may be more desirable than the housing they use now.

5. Population Growth

General population growth will cause a need for additional housing through creation of household growth

(see 1 above).

6. Favorable Comparability of New or Renovated Units

In the first several years of a new or renovated project, there will be a source of demand that comes from

households which would prefer the newer, more modern housing to the older, less modern place they live

now. In every market there is a demand from this group. The market analyst uses the above sources to

calculate a demand for new units in the market area for the proposed first year of operation. The demand

calculated is only demand from income eligible persons. The units in the pipeline as determined from building

permit information reduce the total demand. The penetration of this calculated demand that is necessary for

the new and remodeled units to be successful is determined and used in the final recommendation.

7. Primary Market Area and Secondary Market Area

The market is further analyzed by the analysis of the Primary Market Area (PMA) (Submarket or

Neighborhood) and the Secondary Market Area (SMA) (City, MSA or County). The major reasons for moving

into the subject project are for affordability of the units, safer community environment and to be closer to new

jobs. Demographic information and demand calculations from the PMA form the basis of the

recommendations in the report. The comparable project data are mainly from the PMA since the majority of

the renters in the proposed project should come from the PMA.

Houston Lake Homes, Perry, GA

2023

34

Gibson Consulting, LLC

34

This section of the market study considers housing statistics with the subject’s market area. The market area

is defined as the area in which similar properties compete with the subject property for tenants or homeowners.

The geographic boundaries are determined by physical factors such as highways, water bodies as well as

socioeconomic factors such as traditional neighborhood composition recognized by local residents, average

home prices, and established employment center.

The demographic data was obtained and compiled by Environics Analytics and the United States 2010 and

2020 Census. The current year update is a shorthand term for the massive set of demographic estimates and

projections produced multiple times per year for the Environics Analytics products. Estimates consist of data

prepared for the current year, and projections (sometimes called forecasts) are prepared for dates five years in

the future.

American Community Survey (ACS) estimates are released every year by the Census, and Environics

Analytics continues to make use of ACS estimates of median income and home value to guide estimates at

these levels.

To take full advantage of methodological refinements and new data resources, each set of updates begins not

with the previous year’s estimates, but with data from the most recent decennial census. For this reason, the

difference between estimates for consecutive years is not an estimate of change from one year to the next.

Change is estimated with reference to the previous census numbers.

In the charts that follow, all 2025 projections (year of project entry) are interpolated from the 2023-2028

projections provided by Environics Analytics.

Houston Lake Homes, Perry, GA

2023

35

Gibson Consulting, LLC

35

Demographic Summary

Pop-Facts® Executive Summary | Population & Household

Trade Area: PERRY, GA PMA

POPULATION

The population in this area is estimated to change from 60,532 to 63,998, resulting in a growth of 5.7%

between 2020 and the current year. Over the next five years the population is expected to grow by 8.4%

The population in the base area is estimated to change from 331,449,281 to 334,500,069, resulting in a growth

of 0.9% between 2020 and the current year. Over the next five years, the population is projected to grow by

2.1%.

The current year median age for this area is 38.0, while the average age is 39.1. Five years from now, the

median age is projected to be 39.2.

The current year median age for the base area is 39.2, while the average age is 40.2. Five years from now, the

median age is projected to be 40.3.

Of this area's current year estimated population:

62.3% are White Alone, 26.0% are Black or African American Alone, 0.3% are American Indian and Alaska

Nat. Alone, 2.4% are Asian Alone, 0.1%are Nat. Hawaiian and Other Pacific Isl. Alone, 1.7% are Some Other

Race, and 7.2% are Two or More Races.

Of the base area's current year estimated population:

60.1% are White Alone, 12.5% are Black or African American Alone, 1.2% are American Indian and Alaska

Nat. Alone, 6.2% are Asian Alone, 0.2%are Nat. Hawaiian and Other Pacific Isl. Alone, 9.0% are Some Other

Race, and 10.9% are Two or More Races.

This area's current estimated Hispanic or Latino population is 5.4%, while the base area's current estimated

Hispanic or Latino population is 19.9%.

HOUSEHOLD

The number of households in this area is estimated to change from 22,055 to 23,244, resulting in an increase

of 5.4% between 2020 and the current year. Over the next five years, the number of households is projected

to increase by 8.0%.

The number of households in the base area is estimated to change from 126,817,580 to 128,298,155, resulting

in an increase of 1.2% between 2020 and the current year. Over the next five years, the number of households

is projected to increase by 2.4%.

EDUCATION

Currently, it is estimated that 10.2% of the population age 25 and over in this area had earned a Master's

Degree, 1.3% had earned a Professional School Degree, 1.3% had earned a Doctorate Degree and 19.9% had

earned a Bachelor's Degree.

In comparison, for the base area, it is estimated that for the population over age 25, 9.1% had earned a Master's

Degree, 2.2% had earned a Professional School Degree, 1.5% had earned a Doctorate Degree and 20.2% had

earned a Bachelor's Degree.

INCOME

The average household income is estimated to be $103,630.646 for the current year, while the average

household income for the base area is estimated to be $104,972 for the same time frame.

The average household income in this area is projected to change over the next five years, from $103,630.646

to $111,606.208.

Houston Lake Homes, Perry, GA

2023

36

Gibson Consulting, LLC

36

The average household income in the base area is projected to change over the next five years, from $104,972

to $118,758.

HOUSING

Most of the dwellings in this area (77.3%) are estimated to be Owner-Occupied for the current year. For the

base area the majority of the housing units are Owner-Occupied (64.4%).

The majority of dwellings in this area (83.5%) are estimated to be structures of 1 Unit Detached for the current

year. The majority of the dwellings in the base area (61.4%) are estimated to be structure of 1 Unit Detached

for the same year.

The majority of housing units in this area (28.2%) are estimated to have been Built 2000 to 2009 for the

current year.

The majority of housing units in the base area (14.6%) are estimated to have been Built 1970 to 1979 for the

current year.

LABOR

For this area, PERRY, GA PMA, 96.5% of the labor force is estimated to be employed for the current year.

The employment status of the population age 16 and over is as follows:

2.7% are in the Armed Forces, 61.3% are employed civilians, 2.3% are unemployed civilians, and 33.7%

are not in the labor force.

The occupational classification for this area are as follows:

21.6% hold blue collar occupations, 61.2% hold white collar occupations, and 17.2% are occupied as

service & farm workers.

For the civilian employed population age 16 and over in this area, it is estimated that they are employed in

the following occupational categories: 2.9% are in Architecture and Engineering, 1.7% are in Arts,

Entertainment and Sports, 7.2% are in Business and Financial Operations, 3.7% are in Computers and

Mathematics, 6.0% are in Education, Training and Libraries, 6.5% are in Healthcare Practitioners and

Technicians, 3.4% are in Healthcare Support, 0.7% are in Life, Physical and Social Sciences, 9.0% are in

Management, 13.4% are in Office and Administrative Support.

1.1% are in Community and Social Services, 6.0% are in Food Preparation and Serving, 0.9% are in Legal

Services, 2.6% are in Protective Services, 8.1%are in Sales and Related Services, 2.7% are in Personal Care

Services.

2.4% are in Building and Grounds Maintenance, 4.1% are in Construction and Extraction, 0.3% are in

Farming, Fishing and Forestry, 7.0% are in Maintenance and Repair, 5.0% are in Production, 5.5% are in

Transportation and Moving.

For the base area, USA, 95.3% of the labor force is estimated to be employed for the current year.

The employment status of the population age 16 and over is as follows:

0.4% are in the Armed Forces, 60.1% are employed civilians, 3.0% are unemployed civilians, and 36.5%

are not in the labor force.

The occupational classification for the base area are as follows:

21.3% hold blue collar occupations, 60.5% hold white collar occupations, and 18.2% are occupied as

service & farm workers.

For the civilian employed population age 16 and over in the base area, it is estimated that they are employed

in the following occupational categories: 2.0% are in Architecture and Engineering, 2.0% are in Arts,

Entertainment and Sports, 5.4% are in Business and Financial Operations, 3.3% are in Computers and

Mathematics, 6.2% are in Education, Training and Libraries, 6.1% are in Healthcare Practitioners and

Technicians, 3.3% are in Healthcare Support, 1.0% are in Life, Physical and Social Sciences, 10.6% are in

Management, 11.0% are in Office and Administrative Support.

Houston Lake Homes, Perry, GA

2023

37

Gibson Consulting, LLC

37

1.8% are in Community and Social Services, 5.6% are in Food Preparation and Serving, 1.1% are in Legal

Services, 2.2% are in Protective Services, 9.9% are in Sales and Related Services, 2.7% are in Personal

Care Services.

3.7% are in Building and Grounds Maintenance, 5.1% are in Construction and Extraction, 0.6% are in

Farming, Fishing and Forestry, 3.1% are in Maintenance and Repair, 5.6% are in Production, 7.6% are in

Transportation and Moving.

Source: Environics Analytics

Houston Lake Homes, Perry, GA

2023

38

Gibson Consulting, LLC

38

1. POPULATION TRENDS

a. Total Population

TOTAL POPULATION

PMA

Population

2010 Census

44047

2020 Census

60532

2023 Estimate

63998

2025 Projection

66,145

2028 Projection

69366

Percent Change: 2010 to 2020

37.43%

Percent Change: 2020 to 2023

5.73%

Percent Change: 2020 to 2023

3.36%

Percent Change: 2023 to 2028

8.39%

Annualized change: 2000-2010

3.74%

Annualized change: 2010-2020

0.64%

Annualized change: 2023-2025

1.68%

Annualized change: 2023-2028

1.68%

Change 2000-2010

16485

Change 2010-2020

3466

Change 2023-2025

2147

Change 2023-2028

5368

Source: US Census Database; Environics Analytics, Gibson Consulting, LLC

Houston Lake Homes, Perry, GA

2023

39

Gibson Consulting, LLC

39

b. Population by age group

POPULATION DETAILS

PMA

2023

2025

Population by Age

63,998

0.0%

66,145

Age 0 - 4

3,762

5.9%

3,888

Age 5 - 9

3,982

6.2%

4,116

Age 10 - 14

4,492

7.0%

4,643

Age 15 - 17

2,716

4.2%

2,807

Age 18 - 20

2,482

3.9%

2,565

Age 21 - 24

3,281

5.1%

3,391

Age 25 - 34

8,791

13.7%

9,086

Age 35 - 44

8,043

12.6%

8,313

Age 45 - 54

8,029

12.5%

8,298

Age 55 - 64

8,341

13.0%

8,621

Age 65 - 74

6,157

9.6%

6,364

Age 75 - 84

2,997

4.7%

3,098

Age 85 and over

925

1.4%

956

Age 16 and over

50,865

79.5%

52,572

Age 18 and over

49,046

76.6%

50,692

Age 21 and over

46,564

72.8%

48,126

Age 65 and over

10,079

15.7%

10,417

Est. Median Age

38.04

Est. Average Age

39.06

Persons age 55+

18,420

36.21%

19,038

Source: US Census Database; Environics Analytics, Gibson Consulting, LLC

*Persons age 55+ are 36.21% of the total number of persons age 16+. Since persons under age 16 do not

typically form households, we use this percentage to calculate age 55+ demand.

Houston Lake Homes, Perry, GA

2023

40

Gibson Consulting, LLC

40

2010 Population by Age

Age 0 - 4

2,834

6.43

Age 5 - 9

3,164

7.18

Age 10 - 14

3,434

7.80

Age 15 - 17

2,182

4.95

Age 18 - 20

1,698

3.85

Age 21 - 24

1,867

4.24

Age 25 - 34

5,667

12.87

Age 35 - 44

6,320

14.35

Age 45 - 54

7,219

16.39

Age 55 - 64

4,844

11.00

Age 65 - 74

2,809

6.38

Age 75 - 84

1,522

3.46

Age 85+

487

1.11

Age 15+

34,615

78.59

Age 16+

33,876

76.91

Age 18+

32,433

73.63

Age 21+

30,735

69.78

Age 25+

28,868

65.54

Age 65+

4,818

10.94

Median Age

--

36.95

Source: US Census Database; Environics Analytics, Gibson Consulting, LLC

2. Household Trends

a. Total number of households and average household size

PERSONS PER HOUSEHOLD

PMA

2010 Census

2.71

2020 Census

2.74

2023 Estimate

2.75

2025 Projection

2.76

2028 Projection

2.76

Source: US Census Database; Environics Analytics, Gibson Consulting, LLC

Houston Lake Homes, Perry, GA

2023

41

Gibson Consulting, LLC

41

HOUSEHOLD GROWTH

PMA

Households

2010 Census

16,261

2020 Census

22,055

2023 Estimate

23,244

2025 Projection

23,990

2028 Projection

25,109

Percent Change: 2010 to 2020

35.63%

Percent Change: 2020 to 2023

5.39%

Percent Change: 2020 to 2023

3.21%

Percent Change: 2023 to 2028

8.02%

Annualized change: 2000-2010

3.56%

Annualized change: 2010-2020

0.60%

Annualized change: 2023-2025

1.60%

Annualized change: 2023-2028

1.60%

Change 2000-2010

5,794

Change 2010-2020

1,189

Change 2023-2025

746

Change 2023-2028

1,865

Source: US Census Database; Environics Analytics, Gibson Consulting, LLC

b. Household by tenure

PMA

2010

2023

2025

Total Households

16,261

23,244

23,990

Renter Occupied

3,917

24.09%

5,283

22.73%

5453

Owner Occupied

12,344

75.91%

17,961

77.27%

18537

Source: US Census Database; Environics Analytics, Gibson Consulting, LLC

Houston Lake Homes, Perry, GA

2023

42

Gibson Consulting, LLC

42

c. Households by Income

HOUSEHOLDS BY HOUSEHOLD INCOME

PMA

PMA

2021

%

2023

Total:

21,285

23,244

Owner occupied:

16,292

17,961

Less than $5,000

239

1.47%

263

$5,000 to $9,999

180

1.10%

198

$10,000 to $14,999

220

1.35%

243

$15,000 to $19,999

506

3.11%

558

$20,000 to $24,999

407

2.50%

449

$25,000 to $34,999

727

4.46%

801

$35,000 to $49,999

1,099

6.75%

1212

$50,000 to $74,999

2,350

14.42%

2591

$75,000 to $99,999

2,523

15.49%

2781

$100,000 to $149,999

4,268

26.20%

4705

$150,000 or more

3,773

23.16%

4160

Renter occupied:

4,993

5,283

Less than $5,000

225

4.51%

238

$5,000 to $9,999

197

3.95%

208

$10,000 to $14,999

360

7.21%

381

$15,000 to $19,999

316

6.33%

334

$20,000 to $24,999

302

6.05%

320

$25,000 to $34,999

562

11.26%

595

$35,000 to $49,999

529

10.59%

560

$50,000 to $74,999

870

17.42%

921

$75,000 to $99,999

885

17.72%

936

$100,000 to $149,999

523

10.47%

553

$150,000 or more

224

4.49%

237

Source: U.S. Census Bureau, American Community Survey B25118, Gibson Consulting LLC

Houston Lake Homes, Perry, GA

2023

43

Gibson Consulting, LLC

43

Households by HH Income

2020

Total:

19518

Owner occupied:

15215

77.95%

Less than $5,000

150

0.99%

$5,000 to $9,999

154

1.01%

$10,000 to $14,999

298

1.96%

$15,000 to $19,999

439

2.89%

$20,000 to $24,999

382

2.51%

$25,000 to $34,999

772

5.07%

$35,000 to $49,999

955

6.28%

$50,000 to $74,999

2495

16.40%

$75,000 to $99,999

2587

17.00%

$100,000 to $149,999

3523

23.15%

$150,000 or more

3460

22.74%

Renter occupied:

4303

22.05%

Less than $5,000

178

4.14%

$5,000 to $9,999

379

8.81%

$10,000 to $14,999

307

7.13%

$15,000 to $19,999

247

5.74%

$20,000 to $24,999

327

7.60%

$25,000 to $34,999

585

13.60%

$35,000 to $49,999

429

9.97%

$50,000 to $74,999

687

15.97%

$75,000 to $99,999

702

16.31%

$100,000 to $149,999

290

6.74%

$150,000 or more

172

4.00%

Source: U.S. Census Bureau, American Community Survey b25118

Houston Lake Homes, Perry, GA

2023

44

Gibson Consulting, LLC

44

d. Renter Households by number of persons in the household

Renter Households by Household Size

PMA

2021

%

2023

Total:

21,285

23244

Owner occupied:

16,292

17961

1-person household

3,290

20.19%

3627

2-person household

5,387

33.07%

5939

3-person household

3,489

21.42%

3846

4-person household

2,581

15.84%

2845

5-person household

1,276

7.83%

1407

6-person household

211

1.30%

233

7-or-more person household

58

0.36%

64

Renter occupied:

4,993

0

5283

1-person household

1,653

33.11%

1749

2-person household

1,218

24.39%

1289

3-person household

1,062

21.27%

1124

4-person household

706

14.14%

747

5-person household

102

2.04%

108

6-person household

179

3.59%

189

7-or-more person household

73

1.46%

77

Source: U.S. Census Bureau, 5-Year American Community Survey B25009, Environics Analytics, Gibson Consulting, LLC

Houston Lake Homes, Perry, GA

2023

45

Gibson Consulting, LLC

45

The chart below shows the age of existing housing in the PMA

AGE OF HOUSING

PMA

2023 Est. Housing Units by Year Structure Built

Built 2014 or Later

3,895

15.80

Built 2010 to 2013

1,512

6.13

Built 2000 to 2009

6,944

28.18

Built 1990 to 1999

4,351

17.65

Built 1980 to 1989

2,663

10.80

Built 1970 to 1979

1,970

7.99

Built 1960 to 1969

1,501

6.09

Built 1950 to 1959

993

4.03

Built 1940 to 1949

226

0.92

Built 1939 or Earlier

591

2.40

2023 Housing Units by Year Structure Built

2023 Est. Median Year Structure Built

--

2000

Source: US Census Database; Environics Analytics, Gibson Consulting, LLC

Houston Lake Homes, Perry, GA

2023

46

Gibson Consulting, LLC

46

The chart below shows existing housing characteristics of the market area.

HOUSING UNIT CHARACTERISTICS

PMA

Count

%

2023 Est. Housing Units by Units in Structure

1 Unit Attached

127

0.52

1 Unit Detached

20,585

83.52

2 Units

235

0.95

3 to 4 Units

500

2.03

5 to 19 Units

1,274

5.17

20 to 49 Units

141

0.57

50 or More Units

159

0.65

Mobile Home or Trailer

1,615

6.55

Boat, RV, Van, etc.

10

0.04

Source: US Census Database; Environics Analytics, Gibson Consulting, LLC

Houston Lake Homes, Perry, GA

2023

47

Gibson Consulting, LLC

47

G. Employment Trend

1. Total Jobs:

Houston County

Source: Bureau of Labor Statistics (BLS)

Year

Total Employed

2010

61498

2011

62446

2012

63085

2013

62345

2014

61332

2015

61086

2016

64005

2017

66524

2018

67613

2019

68906

2020

67032

2021

68638

2022

68554

Houston Lake Homes, Perry, GA

2023

48

Gibson Consulting, LLC

48

Houston Lake Homes, Perry, GA

2023

49

Gibson Consulting, LLC

49

2. Total Jobs by Industry:

Area Time Period Industry Industry Code Establishments Month 1 Month 2 Month 3 Average Average Weekly Wage

Houston County Q3 2022 Agriculture, Forestry, Fishing and Hunting 11 23 99 101 104 101 $896.00

Houston County Q3 2022 Utilities 22 5 206 206 205 206 $1,389.00

Houston County Q3 2022 Construction 23 204 1,714 1,707 1,718 1,713 $1,112.00

Houston County Q3 2022 Manufacturing 31-33 74 6,027 5,947 5,948 5,974 $1,119.00

Houston County Q3 2022 Wholesale Trade 42 62 377 369 377 374 $1,137.00

Houston County Q3 2022 Retail Trade 44-45 532 7,667 7,755 7,760 7,727 $643.00

Houston County Q3 2022 Transportation and Warehousing 48-49 76 1,137 1,122 1,173 1,144 $1,019.00

Houston County Q3 2022 Information 51 24 292 292 290 291 $1,205.00

Houston County Q3 2022 Finance and Insurance 52 163 1,106 1,106 1,096 1,103 $1,215.00

Houston County Q3 2022 Real Estate and Rental and Leasing 53 111 332 335 279 315 $929.00

Houston County Q3 2022 Professional, Scientific, and Technical Servi 54 376 4,461 4,377 4,396 4,411 $1,618.00

Houston County Q3 2022 Management of Companies and Enterprises 55 13 198 212 224 211 $862.00

Houston County Q3 2022 Administrative and Support and Waste Manageme 56 201 2,016 2,013 2,015 2,015 $882.00

Houston County Q3 2022 Educational Services 61 92 Confidential Confidential Confidential Confidential Confidential

Houston County Q3 2022 Health Care and Social Assistance 62 424 7,502 7,518 7,457 7,492 $929.00

Houston County Q3 2022 Arts, Entertainment, and Recreation 71 39 780 658 595 678 $347.00

Houston County Q3 2022 Accommodation and Food Services 72 405 7,916 7,747 7,740 7,801 $391.00

Houston County Q3 2022 Other Services (except Public Administration) 81 201 1,022 1,020 1,013 1,018 $941.00

Houston County Q3 2022 Public Administration 92 38 Confidential Confidential Confidential Confidential Confidential

Quarterly Census of Employment and Wages (QCEW)

Downloaded: Mon May 15 2023 16:33:03 GMT-0500 (Central Daylight Time)

Source: Georgia Dept. of Labor, Workforce Statistics & Economic Research, Quarterly Census of Employment and Wages Program

Houston Lake Homes, Perry, GA

2023

50

Gibson Consulting, LLC

50

3. Major Employers:

Houston Lake Homes, Perry, GA

2023

51

Gibson Consulting, LLC

51

4. Unemployment Trends:

Employment Trends

Houston County Annualized Total Employment and Annualized Unemployment Rates

year

Total

Change

Unemployment Rate

Rate Change

2010

61498

-6.0

8.6

1.0

2011

62446

1.5

8.5

-0.1

2012

63085

1.0

7.9

-0.5

2013

62345

-1.2

7.5

-0.5

2014

61332

-1.6

6.8

-0.6

2015

61086

-0.4

5.9

-0.9

2016

64005

4.8

5.4

-0.5

2017

66524

3.9

4.8

-0.7

2018

67613

1.6

4.1

-0.7

2019

68906

1.9

3.5

-0.6

2020

67032

-2.7

5.2

1.7

2021

68638

2.4

3.7

-1.5

2022

68554

-0.1

3.1

-0.6

Source: Bureau of Labor Statistics

Houston County Monthly Total Employment and Monthly Unemployment Rates

Month

Total

Change

Unemployment Rate

Rate Change

Jan-21

68347

-1.9

4.5

1.0

Feb-21

68769

-2.2

4.2

0.8

Mar-21

69260

-0.4

4.1

0.4

Apr-21

68948

12.2

3.7

-6.0

May-21

68775

6.4

3.7

-3.6

Jun-21

68780

5.7

4.2

-2.3

Jul-21

68819

5.2

3.5

-2.5

Aug-21

67675

4.1

3.7

-1.5

Sep-21

68638

4.6

3.0

-1.7

Oct-21

68232

-1.3

3.7

-0.7

Nov-21

68694

-0.9

2.9

-1.1

Dec-21

68714

-0.7

2.8

-1.6

Jan-22

68937

0.9

3.3

-1.2

Feb-22

69059

0.4

3.2

-1.0

Mar-22

69359

0.1

3.0

-1.1

Apr-22

68864

-0.1

2.5

-1.1

May-22

68708

-0.1

2.9

-0.8

Jun-22

68825

0.1

3.5

-0.7

Jul-22

68574

-0.4

3.3

-0.2

Aug-22

67464

-0.3

3.6

-0.2

Sep-22

68103

-0.8

3.0

0.0

Oct-22

68103

-0.2

3.2

-0.5

Houston Lake Homes, Perry, GA

2023

52

Gibson Consulting, LLC

52

Nov-22

68140

-0.8

2.9

0.0

Dec-22

68517

-0.3

2.8

0.0

Jan-23

68663

-0.4

3.3

-0.1

Feb-23

68987

-0.1

3.1

-0.1

Mar-23

69256

-0.2

3.1

0.2

Commute Patterns:

PMA

2023 Est. Workers Age 16+ by Travel Time to Work

Less than 15 Minutes

7,284

24.22

15 - 29 Minutes

14,116

46.93

30 - 44 Minutes

6,170

20.51

45 - 59 Minutes

703

2.34

60 or more Minutes

1,804

6.00

2023 Est. Avg Travel Time to Work in Minutes

--

25.88

2023 Est. Workers Age 16+ by Transp. to Work

2023 Est. Workers Age 16+ by Transp. to Work

31,436

100.00

Drove Alone

26,910

85.60

Carpooled

2,656

8.45

Public Transport

47

0.15

Walked

236

0.75

Bicycle

22

0.07

Other Means

197

0.63

Worked at Home

1,368

4.35

Source: Environics Analytics

Houston Lake Homes, Perry, GA

2023

53

Gibson Consulting, LLC

53

EMPLOYMENT and OCCUPATION

2023 Est. Civ. Employed Pop 16+ by Class of Worker

2023 Est. Civ. Employed Pop 16+ by Class of

Worker

31,169 100.00

For-Profit Private Workers

17,698

56.78

Non-Profit Private Workers)

1,450

4.65

Local Government Workers

2,499

8.02

State Government Workers

1,427

4.58

Federal Government Workers

5,201

16.69

Self-Employed Workers

2,890

9.27

Unpaid Family Workers

4

0.01

2023 Est. Civ. Employed Pop 16+ by Occupation

Architecture/Engineering

915

2.94

Arts/Design/Entertainment/Sports/Media

530

1.70

Building/Grounds Cleaning/Maintenance

737

2.37

Business/Financial Operations

2,237

7.18

Community/Social Services

344

1.10

Computer/Mathematical

1,148

3.68

Construction/Extraction

1,278

4.10

Education/Training/Library

1,862

5.97

Farming/Fishing/Forestry

85

0.27

Food Preparation/Serving Related

1,863

5.98

Healthcare Practitioner/Technician

2,013

6.46

Healthcare Support

1,061

3.40

Installation/Maintenance/Repair

2,170

6.96

Legal

293

0.94

Life/Physical/Social Science

226

0.72

Management

2,794

8.96

Office/Administrative Support

4,177

13.40

Production

1,561

5.01

Protective Services

799

2.56

Sales/Related

2,531

8.12

Personal Care/Service

827

2.65

Transportation/Material Moving

1,718

5.51

2023 Est. Pop Age 16+ by Employment Status

In Armed Forces

1,379

2.71

Civilian - Employed

31,205

61.35

Civilian - Unemployed

1,148

2.26

Not in Labor Force

17,133

33.68

Source: Environics Analytics

Houston Lake Homes, Perry, GA

2023

54

Gibson Consulting, LLC

54

Houston Lake Homes, Perry, GA

2023

55

Gibson Consulting, LLC

55

Houston Lake Homes, Perry, GA

2023

56

Gibson Consulting, LLC

56

Houston Lake Homes, Perry, GA

2023

57

Gibson Consulting, LLC

57

5. Site Location and Major Employers:

Houston Lake Homes, Perry, GA

2023

58

Gibson Consulting, LLC

58

6. Analysis and Conclusions:

The County unemployment rate declined to 3.1% in March 2023, from 3.7% in 2021 and

up from 3.0% in March of 2022. The annualized total employment increased 1.9% in 2019,

decreased by 2.7% in 2020, increased 2.4% in 2021 and declined 0.1% in 2022. The

annualized unemployment rate decreased 0.7% in 2019, increased 1.7% in 2020, decreased

1.5% in 2021 and decreased 0.6% in 2022. Total employment in March 2023 has increased

by 702 over annualized 2022. The large decrease in employment in 2020 was due to the

COVID-19 safer at home actions taken by the state.

The area has a concentration of employment in the manufacturing, educational services

and retail sectors. These jobs have incomes that would make the worker eligible for the

proposed housing. Current employment is increasing in these areas.

A review of the commuting patterns shows that 48.83% of those working in Houston

County do not live in Houston County. This may be due to a lack of decent affordable

housing.

The increases in the numbers of employed will cause upward pressure on rents and

occupancy levels as people are able to improve their housing situations. New households

will be formed as a result of the increased employment. The employment conditions and

trends are supportive of the need for more affordable housing.

Houston Lake Homes, Perry, GA

2023

59

Gibson Consulting, LLC

59

H. PROJECT-SPECIFIC AFFORDABILITY & DEMAND ANALYSIS

1. Income Restrictions

The demand analysis must begin with a discussion of the requirements of the Low Income

Housing Tax Credit program.

LIHTC Requirements

Section 42 of the Internal Revenue Code allows a credit against income tax for

development of low-income housing. As such, the project developed, to be eligible for the

credit, must meet certain requirements. Two of the requirements are:

1. Rent restriction

2. Income restrictions

These two restrictions impact upon the market needs when calculating demand for

affordable housing. The universe of potential residents is limited by the above restrictions.

Generally, the rent (including an allowance for utilities) is limited to 30% of the maximum

income limit, adjusted for family size. The proposed development will have units targeted

to, 60% and 0% of the area median income, as determined by the Department of Housing

and Urban Development, adjusted for family size. The charts below summarize these

limits for the market area. It will also have market rate units that have no statutory limits.

Maximum Rents

Bedrooms (People)

60.00%

80.00%

50.00%

FMR

Efficiency (1.0)

865

1154

721

778

1 Bedroom (1.5)

927

1236

772

855

2 Bedrooms (3.0)

1111

1482

926

974

3 Bedrooms (4.5)

1284

1712

1070

1297

4 Bedrooms (6.0)

1432

1910

1193

1587

Source: HUD 2022 Income Limits, Gibson Consulting, LLC

Houston Lake Homes, Perry, GA

2023

60

Gibson Consulting, LLC

60

LIHTC Income Limits

% of Area Median

LIHTC Income Limits for 2022

(Based on 2022 MTSP/VLI Income Limits)

60.00%

80.00%

50.00%

1 Person

34,620

46,160

28,850

2 Person

39,540

52,720

32,950