THE PRESIDENT’S PLAN TO

HELP MIDDLE-CLASS AND

WORKING FAMILIES GET AHEAD

Executive Office of the President and

U.S. Treasury Department

April 2015

This report was prepared by the Council of Economic Advisers,

the National Economic Council, the Office of Management and

Budget, and the Treasury Department.

The President’s Plan to Help Middle-

Class and Working Families Get Ahead

Contents

Executive Summary ......................................................................................................................... 2

I. Progress to Date in Reforming the Tax System ........................................................................... 7

II. Making Child Care, Education, and Retirement Tax Benefits Work for Middle-Class Families 10

Child Care .................................................................................................................................. 10

Higher Education ....................................................................................................................... 16

Retirement Saving ..................................................................................................................... 21

III. Encouraging and Supporting Work .......................................................................................... 24

Second Earner Credit ................................................................................................................ 25

Expanding the EITC for Workers Without Children and Non-Custodial Parents ...................... 26

IV. Paying for Pro-Middle Class and Pro-Work Reforms by Making Sure the Wealthy Pay Their

Fair Share ...................................................................................................................................... 31

Rising Income and Wealth Inequality ....................................................................................... 31

Capital Gains Tax Reform .......................................................................................................... 32

Financial Sector Tax Reform ..................................................................................................... 37

Closing a Loophole That Takes Billions Away from the Social Security and Medicare Trust

Funds ......................................................................................................................................... 38

V. Republicans’ Approach: Tax Cuts for the Wealthy at the Expense of the Middle Class .......... 39

Large Tax Cuts for High-Income Households and Corporations ............................................... 39

Letting Taxes Rise for Some 25 Million Working Families and Students .................................. 41

Appendix 1: State-by-State Estimates .......................................................................................... 43

Appendix 2: Cost Estimates for the President’s Proposals to Help Middle-Class and Working

Families ......................................................................................................................................... 48

1

The President’s Plan to Help Middle-

Class and Working Families Get Ahead

“Let’s close the loopholes that lead to inequality by allowing the top one percent to avoid paying

taxes on their accumulated wealth. We can use that money to help more families pay for childcare

and send their kids to college. We need a tax code that truly helps working Americans trying to

get a leg up in the new economy, and we can achieve that together.”

- President Obama, State of the Union, January 20, 2015

Executive Summary

A fair, simple, and pro-growth tax system is an important part of making the economy work for

all Americans. Unfortunately, the current tax system is complex, outdated, and full of inefficient

loopholes and tax breaks that mostly benefit the wealthy. Tax benefits that help the middle class

are too complicated and do too little to address the challenges today’s working families face,

including paying for child care, sending a child (or a parent) to college, and saving for retirement.

Meanwhile, over the last several decades, wages for typical workers have stagnated, while

income and wealth inequality have risen to levels not seen since before the Great Depression.

Yet over the same period, tax rates fell for the top 1 percent, and taxes are especially low on

unearned income and wealth.

Under the President’s leadership, we have made substantial progress in overcoming these

challenges. During his first term in office, the President cut taxes by $3,600 for a typical middle-

class family, helping families weather the Great Recession and getting the economy back on track.

He created the American Opportunity Tax Credit (AOTC), providing college students with up to

$10,000 of assistance over four years, and he strengthened the Earned Income Tax Credit (EITC)

and Child Tax Credit (CTC), helping 16 million working families with children make ends meet.

Finally, as part of the “fiscal cliff” deal at the end of 2012, the President pushed to end expensive

tax cuts for the wealthiest Americans, reducing the deficit by almost $800 billion over the next

10 years. At the same time, he pushed to continue tax cuts for middle-class families. As a result,

middle-class taxes are at historically low levels, with the typical middle-income family paying

lower federal income taxes than in almost any other period in the last 60 years.

But much more can be done to help working families get ahead in today’s economy. The

President is proposing to simplify our complex tax code, make it fairer by eliminating some of the

largest tax loopholes, and reinvest the savings in measures that will grow the economy and

expand opportunity. The President’s plan would make paychecks go further in covering the cost

of child care, college, and a secure retirement and would create and improve tax credits that

support and reward work. These proposals would be fully paid for, primarily by closing the

“stepped-up basis” loophole, increasing the top capital gains and dividend tax rate to 28 percent,

2

and imposing a fee on large, highly leveraged financial institutions. While not the focus of this

report, the President is also proposing to reform our business tax system to help working families

get ahead by boosting U.S. job creation and investing in our nation’s infrastructure.

By contrast, Congressional Republicans have chosen different priorities. The Republican Budget

Resolutions would balance the budgets on the backs of the middle class and those struggling to

get into the middle class, while cutting taxes for the wealthy and well-connected. The proposals

specified in the House Republican budget would cut taxes for millionaires by an average of more

than $50,000, before even adding the proposed cuts to tax rates. Meanwhile, House Republicans

have advanced a bill to repeal the estate tax, adding hundreds of billions of dollars to the deficit

in order to cut taxes for the wealthiest top fraction of the top one percent of Americans.

How the President’s Proposals Would Benefit Middle-Class Families

The President’s proposals detailed below would provide significant benefits for a wide range of

middle-class and working families, from a boost for minimum-wage workers by increasing the

EITC to substantial tax cuts for middle-income parents with children in daycare or in college.

Examples of the benefits include:

• A two-earner middle-class family with two young children in child care would get an

additional tax cut of more than $5,000 under the President’s proposal from a larger

child care tax credit and a new second earner tax credit. A married couple with two

children under age 5, with each parent earning $50,000 per year and annual child care

expenses of $12,000, would receive a $500 second earner credit, and be eligible for the

new maximum child care tax credit of $3,000 per child – or $6,000 in total – compared to

the $1,200 total credit they can claim under current law.

• A middle-class family with two college-age children could claim an additional tax cut of

up to $5,000 over the course of their children’s college education. Under the President’s

plan, the AOTC would be available for five calendar years, the norm for students who start

a four-year program in the fall semester, rather than four calendar years as under the

current AOTC. For example, students who enroll in the fall of 2015 and graduate in the

spring of 2019 will have college costs over five calendar years, even though they are

graduating on time. The President would therefore increase lifetime AOTC eligibility from

$10,000 per student to $12,500 per student and ensure that the value of that credit keeps

up with inflation – in addition to making the AOTC permanent. If the AOTC is allowed to

expire as scheduled after 2017, it will revert to the less generous Hope credit which is only

available for two years.

• 30 million workers would gain access to a workplace retirement savings option. Workers

without access to a savings plan at work rarely benefit from the tax incentives for

retirement saving. The President’s plan makes it easier for firms to provide access to

retirement accounts for their workers. The plan especially benefits employees of small

3

businesses and part-time workers who are disproportionately unlikely to have access to

work-based retirement benefits.

• A 23-year old without custodial children working full time at the minimum wage would

become eligible for an EITC of $560. Under current law, this worker would be completely

ineligible for the EITC, because the EITC for workers without custodial children (including

non-parents) is only available to workers 25 and older. Under the President’s proposal,

he would be eligible for an EITC of just over $560.

Combined, the President’s proposed tax cuts would provide over 44 million working families

with an average tax cut of nearly $600. All income groups below $200,000 would receive net tax

cuts from the President’s proposals.

The President’s Middle-Class Tax Plan

The President’s plan makes responsible investments to help the paychecks of middle-class and

working families go further, while streamlining and simplifying tax incentives to make it easier

for families to access them.

Making Child Care, Education, and Retirement Tax Benefits Work for Middle-Class Families

• A simplified and dramatically expanded child care tax credit. For families with children

under 5, the President’s plan would triple the maximum Child and Dependent Care Tax

Credit, increasing it to $3,000 per child. It would also make the maximum credit available

to families with incomes up to $120,000, benefiting families with young children as well

as those with older children, elderly dependents, and dependents with disabilities; and

would eliminate complicated child care flexible spending accounts. The President’s child

4

care tax reform proposal would give 5.1 million families an average tax cut of $900,

helping them cover child care costs for 6.7 million children. (See state-by-state estimates

for child care costs in Appendix 1.) This tax proposal would complement major new

investments in child care access and quality for working families, including expanding

federal child care subsidies to serve all eligible families with young children, versus the

small fraction served today. Together, these proposals would represent an

unprecedented federal investment in child care.

• Education tax reform to simplify duplicative and confusing incentives and improve

college affordability. The President’s plan would consolidate and simplify overlapping

education tax provisions. Building on bipartisan reform proposals, his proposal would

make the American Opportunity Tax Credit permanent, index the credit for inflation,

increase the refundable portion to $1,500, expand eligibility for part-time students, and

allow students to claim the credit for up to five years. The President’s plan would also

make it easier for students and families to apply for tax credits and would better target

and simplify tax relief for student debt. Overall, the President’s education tax reform

proposal would cut taxes by an average of $750 for 8.5 million families and students and

would simplify taxes for the more than 25 million families and students who claim

education tax benefits. This tax proposal would complement the President’s plan to

partner with states to make community college free for responsible students, as well as

other student aid reforms proposed in the President’s Budget – including a proposal to

significantly simplify the Free Application for Federal Student Aid (FAFSA).

• Retirement tax reform that dramatically expands access to employer-based retirement

savings options. The President’s plan would give 30 million more workers access to a

workplace savings opportunity through his proposed “auto-IRA” and would create new

and expanded incentives for small employers to offer retirement plans and incorporate

automatic enrollment into their plans. His plan would also expand access to retirement

savings options for part-time workers, simplify certain retirement account withdrawal

rules for middle-class savers, and close loopholes that have allowed 300 extraordinarily

wealthy individuals to accumulate more than $25 million each in IRAs. These reforms

would complement the President’s actions over the past year to make retirement saving

easier, for example by creating the simple, risk-free, and no-fee “myRA” starter

retirement savings vehicle.

Reforming the Tax System to Better Support and Reward Work

• A new “second earner credit” for two-earner families. Building on bipartisan

Congressional proposals, the President’s plan would create a new second earner credit

that recognizes the additional costs faced by families when both spouses work. Nearly 24

million couples would benefit from this proposal, which would provide them with a

second earner credit of up to $500. The credit reduces the high marginal tax rates some

second earners face on their first $10,000 of earnings by allowing families to claim a credit

equal to 5 percent on a second earner’s first $10,000 of earnings. The maximum credit

5

would be available to families with incomes up to $120,000, with a partial credit available

up to $210,000. (See state-by-state estimates in Appendix 1.)

• An expanded childless worker EITC and permanent extension of the EITC and CTC

improvements enacted in the Recovery Act. The President’s plan would double the

childless worker EITC and expand eligibility, reducing poverty and hardship for 13.2

million low-income workers. Ways and Means Committee Chairman Paul Ryan has

endorsed the President’s proposed expansion, while other members of Congress have

put forward similar proposals. The President’s plan would also make permanent EITC and

CTC improvements currently set to expire after 2017, preventing a tax increase on 16

million families with children. (See state-by-state estimates in Appendix 1.)

Eliminating the Biggest Loopholes that Let the Wealthiest Avoid Paying Their Fair Share

and Reforming Financial Sector Taxation

All of the above proposals, including the direct investments in community college and child care,

would be fully paid for through the reforms below. (For detailed cost estimates, see Appendix 2.)

• Reforming capital gains taxation by closing the largest capital gains loophole and

restoring the 28 percent top rate in place in the Reagan Administration. Under current

law, accrued capital gains on assets held until death are never subject to income taxes,

letting the wealthy pass appreciated assets on to their heirs tax free. The President’s

proposal would close the single largest capital gains tax loophole that allows hundreds of

billions in capital gains income to escape taxation each year. It would also increase the

top capital gains and dividend rate to 28 percent. 99 percent of the impact of the

proposed capital gains reforms would be on the top 1 percent of the income distribution,

and more than 80 percent on the top 0.1 percent.

• Introducing a fee for large, highly-leveraged financial institutions. The President’s plan

would make it more costly for the largest financial firms to finance their businesses with

excessive borrowing by imposing a 7 basis point fee on covered liabilities for the roughly

100 largest U.S. financial firms (those with assets over $50 billion).

• Eliminating a loophole that lets high-paid professionals avoid payroll taxes. All workers,

including those who are self-employed, owe payroll taxes on their earnings to support

Social Security and Medicare. The President’s plan would close a loophole that lets some

high-paid professionals escape this responsibility by reclassifying their earnings as

distributions from pass-through businesses – costing the Social Security and Medicare

Trust Funds almost $10 billion per year by the end of the decade.

6

I. Progress to Date in Reforming the Tax System

Since taking office, the President has worked with Congress to enact tax cuts and reforms that

helped end the recession, support working families with children, and bring down the deficit. The

result is a tax system that is much more progressive than when the President took office – though

with more work to be done to promote opportunity and growth and to raise the revenue needed

to achieve fiscal sustainability.

Middle-Class Tax Cuts That Helped End the Recession and Start the Recovery

During his first term in office, the President cut taxes by $3,600 for a typical middle-class family

of four. As part of the Recovery Act, the President and Congress enacted a simple, temporary

Making Work Pay credit that provided 95 percent of workers with a tax cut of $400 ($800 for

couples) in 2009 and 2010. In 2011 and 2012, the Making Work Pay credit was replaced with a

payroll tax cut that provided a $1,000 tax cut for a typical worker making $50,000 per year.

Along with other measures in the Recovery Act and subsequent legislation, the Making Work Pay

credit and the payroll tax cut added significantly to growth. The Council of Economic Advisers

estimated that the Recovery Act and other economic stimulus measures increased employment

by an average of 2.3 million jobs for 2009-2012, while boosting GDP by an average of 2.4

percent.

1

Tax Credits That Support Work, Strengthen Opportunity, and Reduce Poverty

Also as part of the Recovery Act, the President worked with Congress to enact critical expansions

of tax credits for working families that continue to promote work, reduce hardship, and make

college more affordable for some 25 million families and students each year.

The Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) are among the nation’s most

effective policies for increasing employment and reducing poverty. In 2013, they kept 8.8 million

people out of poverty, including 4.7 million children.

2

The EITC and CTC also increase the returns

to work by offsetting payroll taxes and boosting earnings, resulting in higher labor force

participation, particularly for single parents. Roughly half a million single mothers entered the

labor force in the 1980s and 1990s because of the EITC,

3

accounting for more than half of the

1

Council of Economic Advisers, Economic Report of the President. 2014. See Chapter 3,

http://www.whitehouse.gov/sites/default/files/docs/erp_2014_chapter_3.pdf

2

Calculations from U.S. Census Bureau data. See U.S. Census Bureau, “Press Kit: Supplemental Poverty Measures,”

16 October 2014. http://www.census.gov/newsroom/press-kits/2014/20141016_spm.html

.

3

See for example, Jeffrey Grogger, “The Effects of Time Limits, the EITC, and Other Policy Changes on Welfare Use,

Work, and Income Among Female-Headed Families,” Review of Economics and Statistics. 2003; and Jeffrey

Liebman and Nada Eissa, “Labor Supply Responses to the Earned Income Tax Credit.” Quarterly Journal of

Economics, 1996.

7

increase in employment among single mothers during this time period.

4

Today, the EITC likely

leads about 1 in 10 parents who otherwise would not be working to enter the labor force.

5

Research also suggests that the EITC and CTC lead to better health and educational outcomes for

children, helping promote economic mobility (see the box on page 9).

The Recovery Act improvements to the EITC and CTC build on this success by strengthening work

supports for married couples, larger families, and low-wage workers with children. These

improvements include:

• Making the CTC available to working parents with low earnings. In the absence of the

Recovery Act improvements, working parents with earnings below about $14,000 would

not be eligible for the Child Tax Credit in 2015, and a single parent with two children would

need earnings of about $25,000 to benefit in full (a married couple would need earnings

close to $28,000). The Recovery Act extended eligibility for the Child Tax Credit to working

parents with low earnings.

• Expanding the EITC for families with more than two children and married couples.

Families with more than two children face higher costs and have higher poverty rates than

smaller families but until 2009 were not eligible for additional help from the EITC. The

Recovery Act increased the maximum EITC for these families, while also expanding EITC

eligibility for married couples, reducing EITC marriage penalties.

Together, these improvements benefit 16 million working families each year – including 29

million dependent children – providing these families with an average tax cut of $900. (See state-

by-state estimates in Appendix 1.) These tax credit improvements directly lift 1.4 million

Americans out of poverty.

The Recovery Act also significantly improved tax benefits for higher education through the

enactment of the American Opportunity Tax Credit (AOTC), which replaced the less generous

Hope credit. The enactment of the AOTC increased the maximum tax credit to $2,500, made the

credit available for four years, and made it partially refundable to help low-income families and

students who are working their own way through college. Compared to the Hope credit, the

4

Bruce D. Meyer and Dan T. Rosenbaum, “Welfare, the Earned Income Tax Credit, and the Labor Supply of Single

Mothers,” Quarterly Journal of Economics 116(3): 1063-2014.

5

See Raj Chetty, John N. Friedman, and Emmanuel Saez (2013) cited in Executive Office of the President and U.S.

Treasury Department, “The President’s Proposal to Expand The Earned Income Tax Credit,” March 2014,

http://www.whitehouse.gov/sites/default/files/docs/eitc_report.pdf

.

8

AOTC will provide 12 million families in 2015 with an average of more than $1,100 in additional

financial aid for college.

Reducing the Deficit by Asking High-Income Households to Pay Their Fair

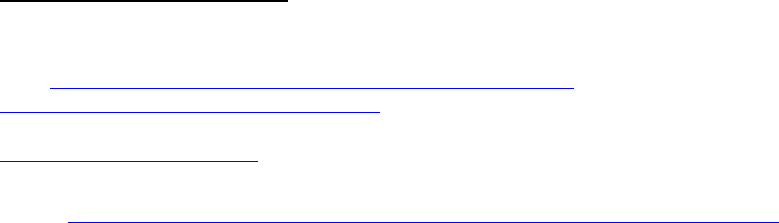

Share

The President took office after a decade of large and skewed tax cuts that added more than a

trillion dollars to deficits and brought effective tax rates for top income groups to their lowest

levels in more than 50 years. As part of the 2012 fiscal cliff debate, the President successfully

fought to roll back these tax cuts for the highest-income 2 percent of Americans. These tax

increases will reduce the deficit by nearly $800 billion over the next 10 years, and they helped

bring the 2014 deficit down to 2.8 percent of GDP, below the historical average.

E

VIDENCE ON THE

EITC

AND

C

HILDREN

’

S

O

UTCOMES

Not only do tax credits for working families reward and encourage work, they also help lead to better

outcomes for children. The extra support helps working parents better provide for their children, and

research suggests that the EITC improves infant health, children’s academic achievement, and college

attendance. Ultimately, better health and education outcomes improve children’s future earnings

potential, increasing economic mobility.

• Infant health. Researchers have found that each $1,000 of additional EITC reduces the

incidence of low birth weight by 2-3 percent, with part of the mechanism being increased

prenatal care.*

• Academic achievement. The EITC and refundable Child Tax Credit have been found to improve

math and reading test scores, with gains of a third of a standard deviation or more for families

eligible for the maximum EITC.** (To put these numbers in context, moving up a third of a

standard deviation would be equivalent to moving from the median to about the 63

th

percentile on a test.)

• College enrollment. For older children, researchers have found that the EITC increases college

enrollment, with a 2-3 percentage point increase in enrollment per $1,000 of parents’ EITC in

the spring of a student’s senior year of high school. This is comparable to the impact of state

grant programs like the Georgia HOPE Scholarship and implies that the Recovery Act EITC and

CTC improvements may have increased enrollment by 2-3 percentage points for affected

families.***

* Hilary W. Hoynes, Douglas L. Miller, and David Simon, “Income, the Earned Income Tax Credit, and Infant Health,” American

Economic Journal: Economic Policy 7(1): 172–211, February 2015.

** Raj Chetty, John N. Friedman, and Jonah E. Rockoff, “New Evidence on the Long-Term Impacts of Tax Credits,” Internal

Revenue Service Statistics of Income Working Paper, November 2011,

http://www.irs.gov/pub/irs-

soi/11rpchettyfriedmanrockoff.pdf; Gordon B. Dahl and Lance Lochner, “The Impact of Family Income on Child Achievement:

Evidence from the Earned Income Tax Credit,” American Economic Review, 2012,

http://dss.ucsd.edu/~gdahl/papers/children-and-EITC.pdf.

*** Dayanand S. Manoli and Nicholas Turner, “Cash-on-Hand and College Enrollment: Evidence from Population Tax Data

and Policy Nonlinearities,” National Bureau of Economic Research Working Paper, January 2014,

http://www.nber.org/papers/w19836

.

9

The President fought equally hard to prevent middle-class tax cuts from being held hostage to

continuing tax cuts for the wealthy. The same legislation that restored Clinton-era tax rates for

the top 2 percent also made tax cuts permanent for the other 98 percent of Americans. As a

result, middle-class income taxes remain at historically low levels, with the typical middle-income

family paying lower federal income taxes than in almost any other period in the last 60 years.

6

II. Making Child Care, Education, and Retirement Tax Benefits Work

for Middle-Class Families

The tax system includes provisions intended to help middle-income families with some of the

major economic challenges they face, including paying for child care, sending children to college,

and saving for retirement. Unfortunately, these provisions add up to less than the sum of their

parts because they are complicated, overlapping, and sometimes poorly designed and targeted.

The President’s plan would simplify, expand, and improve tax incentives in these three key areas.

Child Care

Access to high-quality child care and early education promotes child development and helps

support parents who are struggling to balance work and family obligations. Early childhood

investments also generate long-term social benefits, since improvements in child development

6

Chuck Marr and Nathaniel Frentz, “Federal Income Taxes on Middle-Income Families Remain Near Historic Lows,”

Center on Budget and Policy Priorities. Revised April 15, 2014, http://www.cbpp.org/cms/?fa=view&id=3151

.

10

lead to higher earnings and employment in adulthood.

7

Yet despite the high returns to spending

on quality childcare, access is too often limited by high and rising costs, particularly in the case of

high-quality, center-based care.

Throughout much of the country, child care is the largest single expense families face (this is true

for every region except the West, where housing accounts for a larger share of expenses). A year

of center-based child care costs more than a year of in-state tuition at public universities in many

states, putting a significant strain on parents. In 2013, the average cost of full-time care for an

infant at a child care center was about $10,000 per year – and much higher in some locations –

with costs ranging from $5,496 in Mississippi to $16,549 in Massachusetts. Families with multiple

young children face even higher costs. In 2013, the average annual cost of full-time, center-based

child care for an infant and a four-year old exceeded $10,000 in every state, and exceeded

$20,000 in 18 states plus the District of Columbia (see map and state-by-state estimates in

Appendix 1).

8

7

Council of Economic Advisers, “The Economics of Early Childhood Investments,” Executive Office of the President.

January 2015.

http://www.whitehouse.gov/sites/default/files/docs/early_childhood_report_update_final_non-

embargo.pdf.

8

Child Care Aware, “Parents and the High Cost of Child Care: 2014 Report.” 2014.

http://usa.childcareaware.org/costofcare

.

11

Access to affordable, quality child care is important for both economic growth and economic

mobility – strengthening parents’ ability to go to work, advance their careers, and increase their

earning potential, while at the same time helping children prepare for school and succeed later

in life.

First, helping families better afford quality child care will help boost parents’ labor force

participation by removing disincentives to work. Women with young children are the most likely

to leave the workforce, and child care makes it easier for women to choose to stay in the

workforce, earning higher wages in the long run. Although estimates vary depending on program

specifics, most studies find that reducing the cost of child care increases maternal employment.

9

For example, the Lanham Act, which provided affordable, universal child care in the U.S. during

World War II, increased both labor force participation and the number of hours worked among

mothers with young children.

10

Evidence from recent programs similarly show that lower child

care costs increase maternal employment: child care subsidies that reduce the cost of care by 10

percent lead to a 0.5 percentage point increase in employment among single mothers.

11

Meanwhile, a substantial body of research suggests that high-quality care in early childhood leads

to better outcomes and higher wages later in life for children.

12

For example, the high-quality

child care offered through the Lanham Act provided children with healthy meals and snacks and

focused on educational enrichment activities. At the time of the program, mothers noted

improvements in their children’s social behaviors, and the benefits continued long after: children

who were eligible to participate in the program were more likely to graduate from high school,

earn a college degree, and work full-time as adults. Overall, the program increased participants’

earnings by 1.8 percent a year by the time they reached their 40s to 50s.

13

Likewise, evidence

9

Chris M. Herbst, “The Labor Supply Effects of Child Care Costs and Wages in the Presence of Subsidies and the

Earned Income Tax Credit.” 2010. Review of Economics of the Household, 8(2): 199-230; Michael Baker, Jonathan

Gruber, and Kevin Milligan. “Universal Childcare, Maternal Labor Supply, and Family Well-being.” 2005. Working

Paper 11832. Cambridge, Mass.: National Bureau of Economic Research (December). Rachel Connelly and Jean

Kimmel. “The Effects of Child Care Costs on the Employment and Welfare Recipiency of Single Mothers.” 2003.

Southern Economic Journal, 69(3): 498-519.; Patricia M. Anderson and Philip B. Levine. 2000. “Child Care and

Mothers’ Employment Decisions.” In Finding Jobs: Work and Welfare Reform, pp. 420-462. Russell Sage

Foundation.

10

Chris M. Herbst, “Universal Child Care, Maternal Employment, and Children's Long-Run Outcomes: Evidence

from the U.S. Lanham Act of 1940.” 2014. IZA Discussion Paper No. 7846 (Revised November 2014).

http://www.chrisherbst.net/files/Download/C._Herbst_Lanham_Act_Child_Care.pdf

.

11

Chris M. Herbst, “The Labor Supply Effects of Child Care Costs and Wages in the Presence of Subsidies and the

Earned Income Tax Credit.” 2010. Review of Economics of the Household, 8(2): 199-230

12

See for example Leak et al., 2013; Gorey, 2001; Barnett, 2006; Sylva et al., 2004.

13

Chris M. Herbst, “Universal Child Care, Maternal Employment, and Children's Long-Run Outcomes: Evidence

from the U.S. Lanham Act of 1940.” 2014. IZA Discussion Paper No. 7846 (Revised November 2014).

http://www.chrisherbst.net/files/Download/C._Herbst_Lanham_Act_Child_Care.pdf

.

12

from Norway shows that access to high-quality child care can not only improve children’s

academic performance when children are in care, but also increase educational attainment,

reduce receipt of public assistance, and increase labor force participation in adulthood.

14

Overall, research shows that money spent on young children is a worthwhile investment, yielding

immediate benefits for parents and long-term benefits for children and society. For example, the

President’s Council of Economic Advisers concluded that investments in high-quality early

education can generate economic returns of over $8 for every $1 spent.

15

The President’s Plan to Simplify and Expand Child Care Tax Benefits

While the tax code offers benefits for child care expenses, these benefits are typically small

compared to the costs faced by middle-class families, especially those with young children. For

example, the average Child and Dependent Care Tax Credit ( “child care tax credit”) is just $550

– not enough to put a dent in the cost of infant and toddler care, which runs several thousands

of dollars per year. Child care tax benefits are also unnecessarily complex. Families may need to

both claim the child care tax credit and use a child care flexible spending account (FSA) to

maximize their tax benefits, with the latter requiring additional paperwork, advance planning,

14

Sandra E. Black, Paul J. Devereux, and Kjell G. Salvanes. "Too Young to Leave the Nest? The Effects of School

Starting Age." 2011. The Review of Economics and Statistics, 93(2): 455-467.; Havnes, Tarjei, and Magne Mogstad.

"No Child Left Behind: Subsidized Child Care and Children's Long-run Outcomes." 2011. American Economic

Journal: Economic Policy: 97-129

15

Council of Economic Advisers, “The Economics of Early Childhood Investments,” Executive Office of the

President, January 2015.

http://www.whitehouse.gov/sites/default/files/docs/early_childhood_report_update_final_non-embargo.pdf

.

13

and care to avoid losses from the “use-or-lose-it” rules. Moreover, this tax benefit is only

available to workers whose employers elect to provide FSAs as part of their benefits package,

resulting in unequal access. In fact, only one-third of private-sector employees have access to a

child care FSA.

16

As a result of this complexity, determining the tax savings from these benefits and what it means

for a family’s ability to afford quality child care can be difficult. Almost no families qualify for the

maximum child care tax credit, and middle-income families may have trouble predicting how

much tax assistance they will receive.

The President’s child care plan offers every working family meaningful assistance with child care

costs for young children, whether through direct subsidies for low-income families (see the box

on pages 15-16) or through an expanded and simplified child care tax credit. The President’s tax

proposal would streamline child care tax benefits and triple the maximum child care credit for

middle-class families with young children, increasing it to $3,000 per child. The proposal would

benefit 5.1 million families, helping them cover child care costs for 6.7 million children (including

3.5 million children under 5), through the following reforms:

• Triple the maximum child care tax credit for families with children under 5, increasing it

to $3,000 per child. Families with young children face the highest child care costs. Under

the President’s proposal, they could claim a 50 percent credit for the first $6,000 of

expenses each for up to two children under 5 – covering up to half the cost of child care

for preschool-age children.

• Make the full credit available to most middle-class families. Under current law, almost no

families qualify for the maximum child care tax credit. The President’s proposal would

make the maximum credit available to families with incomes up to $120,000, meaning

that most middle-class families could easily determine how much help they can get. This

would benefit families with young children, older children, and elderly or disabled

dependents.

• Eliminate complex child care flexible spending accounts and reinvest the savings in the

improved child care tax credit. The President’s proposal would replace the current system

of complex and duplicative incentives with one generous and simple child care tax benefit.

16

Eli R. Stoltzfus, “Access to dependent care reimbursement accounts and workplace-funded childcare,” January

2015, Pay & Benefits, Vol. 4, No. 1, U.S. Bureau of Labor and Statistics.

http://www.bls.gov/opub/btn/volume-

4/access-to-dependent-care-reimbursement-accounts-and-workplace-funded-childcare.htm.

14

H

ELPING

A

LL

W

ORKING

F

AMILIES WITH

Y

OUNG

C

HILDREN

A

FFORD

C

HILD

C

ARE

Access to affordable, quality child care is essential for working families. Parents who work in low-wage

jobs can face real difficulties affording quality child care; the average cost of full-time care for an infant

at a child care center was about $10,000 in 2013, and can be much higher. Without help, many

families may face the untenable choice of not working or leaving their children in unsafe, unstable, or

poor quality child care arrangements.

The federal Child Care and Development Fund (CCDF) helps low- and moderate-income families with

the cost of child care and increases the availability and quality of that care. States also contribute

matching resources for a portion of the CCDF funding they receive. But currently, federal and state

funding for child care assistance falls well short of need, and only a small share of young children

receive federally-funded child care subsidies. Access to child care subsidies has been declining steadily

since 2001 due to funding constraints, resulting in waiting lists in some states.*

Just as important as child care access is quality. Learning begins at birth, and the earliest years of a

child’s life are among the most critical for building foundational cognitive skills, social and emotional

skills, and patterns of engagement in school and learning. Studies show that children who attend high-

quality early learning programs – including high-quality child care – are more likely to do well in school,

find good jobs, have fewer interactions with the justice system, and have greater earnings as adults

than those who don’t. The recently reauthorized bipartisan child care legislation includes much-

needed reforms that will help raise the bar on child care quality. But high-quality care, especially for

young children, is costly, and places additional burdens on families as well as state budgets.

For these reasons, the President is proposing the following historic investments in child care, in

addition to his proposed tax reforms:

• Expand child care assistance to all eligible families with children under age four by the end

of ten years. A significant investment of $82 billion in new funding over 10 years will ensure

that all low- and moderate-income families (those with incomes below 200 percent of the

poverty line, or approximately $40,000 for a family of three) with children age three and under

have access to a subsidy to pay for quality child care so they can work, attend school, or

participate in training. By 2025, this investment will expand access to high-quality care to more

than 1 million additional young children, reaching a total of more than 2.6 million children

served monthly through the child care subsidy system. Each state will be required to develop

a sound plan for how they will build the supply of quality care for infants and toddlers and

ensure that the subsidies they provide (when combined with reasonable copayments families

can afford) will cover the cost of quality care. States will also be required to contribute

matching funds to receive these federal funds.

• Improve the quality of child care. Last year Congress acted on a bipartisan basis to pass child

care legislation that includes much-needed reforms to improve the quality and safety in child

care settings, including requiring training for providers to prevent sudden infant death

syndrome, instituting annual inspections of child care facilities, and comprehensive

background checks of all providers. This proposal would provide resources to help states

implement those important reforms and support the expansion of access to quality child care

15

Higher Education

The American Opportunity Tax Credit (AOTC) the President signed into law in 2009 took a major

step toward improving education tax benefits for both low- and middle-income students,

providing 12 million families with more than $1,100 in additional tax assistance in 2015, on

average. Despite this substantial progress, tax benefits for college expenses remain unnecessarily

complex. Families must choose among overlapping benefits, while scholarships and other direct

financial aid can interact with college tax benefits in complicated ways – the result being that

families often do not claim the education tax benefits they are entitled to. In addition, tax

benefits do not provide enough financial aid to the students who need it most.

Under the current tax system, students and families must choose among multiple tax benefits to

offset current education expenses: (1) the AOTC, (2) the Lifetime Learning Credit, and (3) the

tuition and fees deduction. In 2009, 27 percent of families that claimed the tuition and fees

deduction would have gotten a bigger benefit had they claimed a tax credit instead, while 14

percent of apparently eligible filers failed to claim any tax benefit at all.

17

In addition, education tax benefits provide relatively little assistance to the students for whom

they could make the most difference in attending college. While the enactment of the AOTC

made education tax benefits partially refundable – making them available to many working

families for the first time – these students are still eligible only for very limited benefits.

Meanwhile, the current tax break for student loans, a deduction for student loan interest, is

poorly targeted to borrowers and working families struggling to afford their student loan debt.

The student loan interest deduction is also complicated – so much so that many eligible

17

Calculated based on U.S. Government Accountability Office, “Higher Education: Improved Tax Information Could

Help Families Pay for College,” May 2012. Report to the Committee on Finance, U.S. Senate, GAO-12-560.

programs staffed by early educators that can provide developmentally appropriate

services that promote the healthy development and school readiness of young children.

• Promote Innovation in the Child Care Subsidy System. The President will also invest $100

million in new competitive grants to states, territories, tribes and communities to develop,

implement and evaluate models of providing child care to address the unmet needs for

families who face unique challenges to securing child care. These pilots could be used to

develop promising practices for families in rural communities, families with children with

disabilities, parents who work non-traditional hours, and other families that struggle to

find and use high-quality child care.

* U.S. Department of Health and Human Services administrative data, FY 1998-2013.

16

borrowers fail to claim it – and provides very limited assistance to a broad group of borrowers,

rather than targeting more meaningful assistance to those who need it most. The average benefit

from the student loan interest deduction is small for all income groups, and especially so for low-

and middle-income borrowers. In 2011, the average annual tax cut from the student loan interest

deduction was little more than $100 per borrower.

18

By comparison, the President’s Pay-As-You-

Earn (PAYE) income-based repayment plan can provide a meaningful reduction in student loan

payments for borrowers who are working but nonetheless struggle with burdensome debt. For

example, a college graduate earning about $39,000 a year as a fourth year teacher, with student

loan debt of $26,500, would see a reduction in annual loan payments of over $1,500 under

PAYE.

19

The President’s Plan for Higher Education Tax Reform

The President’s higher education plan would consolidate a complicated set of credits and

deductions into a single, improved AOTC – while making it easier for students to apply for

financial aid and claim assistance to which they are entitled. The plan builds on bipartisan

Congressional reform proposals, including legislation passed by the House of Representatives in

2014 that, like the President’s plan, would make permanent and expand the AOTC while

eliminating duplicative provisions.

20

It would simplify and improve higher education tax benefits

in the following ways.

Simplify, consolidate, and better target tax benefits through an improved AOTC

• Make permanent and expand the $2,500 AOTC, while repealing duplicative and less

effective provisions. Under current law, the AOTC is scheduled to expire after 2017 and

revert to the less generous Hope tax credit. Under the President’s plan, the AOTC would

be a permanent feature of the tax code, so that students in school today would not have

to worry that these benefits will expire before they graduate; the credit would also grow

with inflation. The Lifetime Learning Credit and the tuition and fees deduction would be

consolidated into the more generous AOTC.

• Increase the refundable portion of the AOTC to $1,500. The President’s plan adopts

Congressional proposals – from members of both parties – to increase the refundable

18

Calculated based on Urban-Brookings Tax Policy Center, “Tax Benefits of the Student Loan Interest Deduction,

Baseline: Current Law, Distribution of Federal Tax Change by Cash Income Level, 2011,” Table T11-0309, August

2011. Average total benefit among tax units with the benefit is $118.

19

The White House, “FACTSHEET: Making Student Loans More Affordable,” 9 June 2014.

http://www.whitehouse.gov/the-press-office/2014/06/09/factsheet-making-student-loans-more-affordable

.

20

Representative Diane Black (R-TN), Press release on H.R. 3393, The Student and Family Tax Simplification Act, 24

July 2014.

http://black.house.gov/press-release/house-passes-congressman-black%E2%80%99s-legislation-make-

tax-code-simpler-students-and; and Congressional Budget Office (CBO), “Cost Estimate of H.R. 3393, Student and

Family Tax Simplification Act,” 7 July 2014. http://www.cbo.gov/publication/45506.

17

portion of the AOTC so that more working families and students can qualify. Like

legislation that passed the House in 2014 and a separate bill recently proposed by

Congressional Democrats, the President’s plan would increase the refundable portion

from a maximum of $1,000, or 40 percent of the total AOTC benefit, to a maximum of

$1,500. The plan would also remove the 40 percent calculation so that all families that

qualify can claim at least the first $1,500 of their AOTC credit.

• Expand AOTC eligibility for non-traditional students. Currently, students must attend at

least half-time to qualify for the AOTC, and families can claim the credit for no more than

four years. Under the President’s plan, part-time students would be eligible for a $1,250

AOTC (up to $750 refundable) and all eligible students would be able to claim the AOTC

for up to five years.

Make it easier for students and families to apply for tax credits and financial aid

• Improve information reporting. The proposal would require colleges and universities to

provide students with the tuition and fee information they need to claim the AOTC.

• Simplify taxes for approximately 9 million Pell Grant recipients. Currently, eligible families

leave tens of millions of dollars on the table every year because the rules related to Pell

Grants and the AOTC are so complicated.

21

Like bipartisan reform proposals, the

President’s plan would exempt Pell Grants from taxation and the AOTC calculation,

making it easier for Pell recipients to claim tax benefits already available to them.

• Remove burdensome and complicated questions from the FAFSA. The President’s tax

reform plan will complement new proposals in the 2016 Budget to simplify the process of

applying for financial aid using the FAFSA by restructuring it to rely on financial

information already available from families’ tax returns.

Better target and simplify tax relief for student debt

• Eliminate tax on student loan debt forgiveness under Pay-As-You-Earn (PAYE) and other

income-based repayment plans. The President has worked hard to make student debt

affordable for struggling borrowers by offering PAYE: an income-based repayment plan

that lets students limit student loan payments to no more than 10 percent of their

discretionary income and qualify for forgiveness after 20 years of repayments. The

Department of Education is currently amending its rules to extend this option to all direct

student loan borrowers. However, under current law, borrowers who qualify for

forgiveness could face a large tax bill – likely a surprise to most borrowers, and for others

21

Adam Looney, “Helping students and families access college tax benefits,” 10 June 2014. Treasury Notes Blog,

U.S. Department of Treasury.

http://www.treasury.gov/connect/blog/Pages/Helping-students-and-families-access-

college-tax-benefits.aspx.

18

a concern in choosing PAYE. The President’s tax reform plan would exempt student loan

forgiveness from taxation.

• Repeal the student loan interest deduction for new borrowers. The President’s plan

would retain the student loan interest deduction for current borrowers. But for new

students, his plan would repeal this tax break and instead provide more generous and

more targeted tax relief through the improved AOTC while students are in school and

through PAYE once they graduate.

The President’s education tax reform plan would cut taxes for 8.5 million working families and

students by an average of $750, and simplify taxes for the more than 25 million families and

students that claim education tax benefits. These tax credit improvements would be on top of

the President’s longstanding proposal to make the AOTC permanent to prevent taxes from going

up on millions of families.

Higher education tax reform will complement the President’s other proposals to make college

more affordable, including by partnering with states to make a quality community college

education free for responsible students. See the box on page 20.

19

A

MERICA

’

S

C

OLLEGE

P

ROMISE

P

ROPOSAL

:

T

UITION

-F

REE

C

OMMUNITY

C

OLLEGE FOR

R

ESPONSIBLE

STUDENTS

Nearly a century ago, a movement that made high school widely available helped lead to rapid

growth in the education and skills training of Americans, driving decades of economic growth and

prosperity. Last month, the President unveiled his America’s College Promise proposal to make two

years of community college free for responsible students to earn the first half of a bachelor’s degree

or to learn valuable skills needed in the workforce at no cost. The program would be a “first dollar”

funding source – allowing students to use Pell grants and other financial aid to pay for books,

supplies, transportation, and living expenses. These costs average about $13,000 for full-time

students. The program would be undertaken in partnership with states and is inspired by new

programs in Tennessee and Chicago. If all states participate, an estimated 9 million students could

benefit. For students that transfer to a four-year institution to complete their bachelor’s degree,

their final two years would be even more affordable with the help of the higher education tax

reforms described in this report. The President’s plan would:

• Enhance student responsibility and cut the cost of college for all Americans: Students who

attend at least half-time, maintain a 2.5 GPA while in college, and make steady progress

toward completing their program will have their tuition eliminated. These students will be

able to earn half of the academic credit they need for a four-year degree or earn a certificate

or two-year degree to prepare them for a good, well-paying job.

• Build high-quality community colleges: Community colleges will be expected to offer

programs that either (1) are academic programs that fully transfer to local public four-year

colleges and universities, giving students a chance to earn half of the credit they need for a

four-year degree, or (2) are occupational training programs with high graduation rates and

that lead to degrees and certificates that are in demand among employers. Other types of

programs will not be eligible for free tuition. Colleges must also adopt promising and

evidence-based institutional reforms to improve student outcomes, such as the effective

Accelerated Study in Associate Programs (ASAP) programs at the City University of New

York, which waive tuition, help students pay for books and transit costs, and provide

academic advising and supportive scheduling programs to better meet the needs of

participating students, resulting in greater gains in college persistence and degree

completion.

• Ensure shared responsibility with states: Federal funding will cover three-quarters of the

average cost of community college. States that choose to participate will be expected to

contribute the remaining funds necessary to eliminate community college tuition for eligible

students. States that already invest more and charge students less can make smaller

contributions, though all participating states will be required to put up some matching

funds. States must also commit to continue existing investments in higher education;

coordinate high schools, community colleges, and four-year institutions to reduce the need

for remediation and repeated courses; and allocate a significant portion of funding based on

performance, not enrollment alone. States will have flexibility to use some resources to

expand quality community college offerings, improve affordability at four-year public

universities, and improve college readiness, through outreach and early intervention.

20

Retirement Saving

While Social Security continues to provide a solid foundation for Americans’ retirement, the

employer-based pension system has changed dramatically over the last 40 years. The number of

traditional defined benefit pension plans in the private sector has fallen from 103,000 in 1975 to

44,000 in 2012, and the number of active participants in such plans has fallen from 27 million to

16 million – even as the workforce has grown by 50 million people.

22

Employers are increasingly

providing defined contribution plans instead. Defined contribution plans and individual

retirement accounts (IRAs) now account for nearly $14 trillion in retirement savings – more than

half of Americans’ total retirement wealth.

23

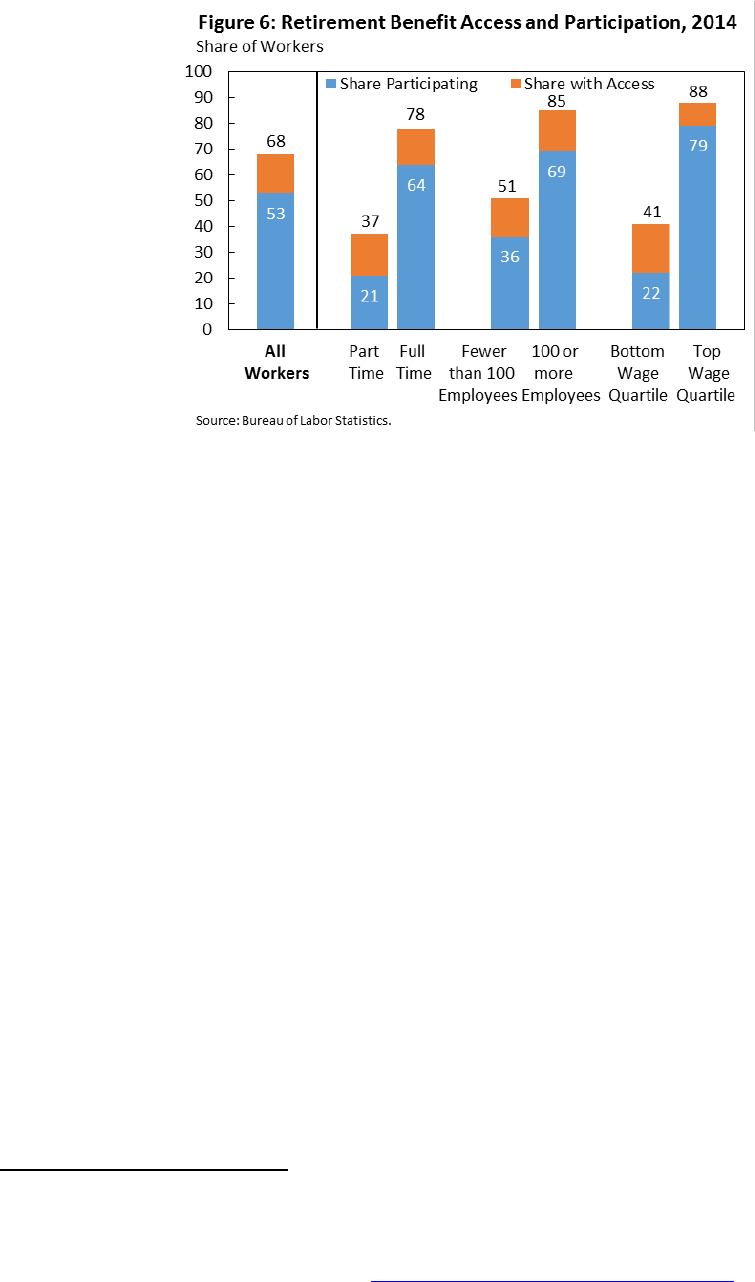

Shortcomings in the employer-based system, however, mean that many Americans are being left

behind. As many as 78 million working Americans – about half the workforce – do not have a

retirement plan at work, largely because they do not have access to an employer-based savings

option. Part-time workers and employees of small businesses are particularly unlikely to have

access to retirement benefits.

24

Many Americans with access to a plan do not participate and,

even if they do participate, many lack the time and information necessary to make the complex

financial decisions necessary to maximize the impact of their contributions. While workers

without access to a workplace plan can save on their own using an IRA, only a tiny fraction of

Americans do so.

25

22

Department of Labor, “Private Pension Plan Bulletin Historical Tables and Graphs.” December 2014. Employee

Benefits Security Administration, Table E1: “Number of Pension Plans” and Table E8: “Number of Active

Participants in Pension Plans.” http://www.dol.gov/ebsa/pdf/historicaltables.pdf

; St. Louis Fed. “All Employees:

Total Private.” Updated 6 March 2015. FRED Economic Data.

http://research.stlouisfed.org/fred2/series/CEU0500000001

23

Quarterly Retirement Market Data for Third Quarter 2014, updated 17 December 2014. Investment Company

Institute (ICI). http://www.ici.org/research/stats/retirement

24

Bureau of Labor Statistics (BLS). “Table 2: Retirement benefits: Access, participation, and take-up rates, civilian

workers.” March 2014. National Compensation Survey.

http://www.bls.gov/ncs/ebs/benefits/2014/ownership/civilian/table02a.pdf

25

Internal Revenue Service. “Accumulation and Distribution of Individual Retirement Arrangements, 2010.” Fall

2013. Statistics of Income Bulletin, Washington, DC. http://www.irs.gov/pub/irs-soi/13inirafallbul.pdf

21

Meanwhile, the current tax rules around retirement savings can unnecessarily burden middle-

class families. For example, minimum distribution rules are important to limit the inappropriate

use of tax-preferred retirement accounts for tax planning rather than retirement saving, but they

apply to all Americans, even those with modest balances for whom abuse is not a concern.

Americans with the misfortune to lose their jobs and become unemployed for long periods may

not be able to access an important source of savings without paying significant costs, making it

difficult to keep up with fixed costs such as mortgage payments.

Yet even as the system leaves many working Americans behind, loopholes allow high-income

Americans to shelter incredibly large sums inside tax-preferred retirement accounts. A recent

GAO report estimated that more than 1,000 taxpayers have IRAs worth more than $10 million

each, including 300 with IRAs worth more than $25 million each.

26

The GAO concluded that

taxpayers likely accumulate these large balances by investing in assets unavailable to most

investors, such as stock in start-up companies that is not publicly traded and available only to

certain insiders.

The President’s Retirement Tax Proposals

The President’s retirement tax proposals simultaneously improve the retirement savings system

for working Americans and implement reforms that close loopholes and ensure that retirement

tax benefits achieve their intended purpose of promoting retirement security. Specifically, the

President proposes to:

26

U.S. Government Accountability Office (GAO). “Individual Retirement Accounts: IRS Could Bolster Enforcement

on Multimillion Dollar Accounts, but More Direction from Congress is Needed.” October 2014. Report to the

Chairman, Committee on Finance, US Senate. http://www.gao.gov/assets/670/666595.pdf

22

• Automatically enroll Americans without access to a workplace retirement plan in an IRA.

Under the proposal, every employer with more than 10 employees that does not currently

offer a retirement plan would be required to automatically enroll their workers in an IRA.

Auto-IRAs would let workers opt out of saving if they choose, but would also let them

start saving without sorting through a host of complex options. Auto-IRA proposals have

been endorsed by independent scholars across the ideological spectrum, including

affiliates of both the Brookings Institution and the Heritage Foundation.

27

• Provide tax cuts for auto-IRA adoption, as well as for businesses that choose to offer full

employer plans or switch to auto-enrollment. To minimize the burden on small

businesses, the President’s auto-IRA proposal would provide employers with 100 or fewer

employees that offer an auto-IRA a tax credit of up to $4,500 (up to $1,000 per year for

three years plus $25 per enrolled employee up to $250 for six years), which would cover

the entire cost of setting up and maintaining an auto-IRA. The President also proposes to

triple the existing “start up” credit, so small employers who newly offer a retirement plan

would receive a $4,500 tax credit ($1,500 per year for three years)– more than enough to

offset administrative expenses. And because auto-enrollment is the most effective way

to ensure workers with access to a plan participate, small employers who already offer a

plan and add auto-enrollment would get an additional $1,500 tax credit ($500 per year

for three years).

• Ensure long-term, part-time workers can contribute to their employer’s retirement plan.

Only 37 percent of part-time workers have access to a workplace retirement plan.

28

That’s

partly because employers offering retirement plans are allowed to exclude employees

who work less than 1,000 hours per year, no matter how long they’ve worked for the

employer. The President proposes to expand access for part-time workers by requiring

employers who offer plans to permit employees who have worked for the employer for

at least 500 hours per year for 3 years or more to make voluntary contributions to the

plan.

• Expand penalty-free withdrawals for the long-term unemployed. IRA account holders

who have been unemployed for 3 months can withdraw funds without penalty to pay for

health insurance, but not for other expenses. The President proposes to expand the

27

J. Mark Iwry and David C. John, “Pursuing Universal Retirement Security Through Automatic IRAs,” 2009. The

Retirement Security Project. http://www.brookings.edu/research/papers/2009/07/automatic-ira-iwry

. See also

David C. John, “Pursuing Universal Retirement Security Through Automatic IRAs and Account Simplification,” April

12, 2012. Testimony before the Committee on Ways and Means, U.S. House of Representatives.

http://www.heritage.org/research/testimony/2012/04/pursuing-universal-retirement-security-through-automatic-

iras-and-account-simplification

28

Bureau of Labor Statistics (BLS). “Table 2: Retirement benefits: Access, participation, and take-up rates, civilian

workers.” March 2014. National Compensation Survey.

http://www.bls.gov/ncs/ebs/benefits/2014/ownership/civilian/table02a.pdf

23

exception to allow individuals unemployed for at least 27 weeks to make penalty-free

withdrawals of up to $50,000 for two years for any use and from either an IRA or plan.

• Simplify minimum required distribution rules. Individuals with aggregate IRA and tax-

favored retirement plan assets of less than $100,000 at the beginning of the year in which

they turn 70 ½ would be exempt from the minimum required distribution rules. The rules

for minimum required distributions would be harmonized for Roth IRAs and other tax-

favored accounts, with Roth IRAs generally treated in the same manner as all other tax-

favored accounts.

• Prevent wealthy individuals from using loopholes to accumulate huge amounts of tax-

favored retirement benefits. Tax-preferred retirement plans are intended to help working

families save for retirement. But loopholes in the tax system have let some wealthy

individuals convert tax-preferred retirement accounts into tax shelters. The President

proposes to prohibit contributions to and accruals of additional benefits in tax-preferred

retirement plans and IRAs once balances are sufficient to provide an annual income of

$210,000 in retirement for the lifetime of the saver and a spouse, about $3.4 million at

age 62.

Under the President’s plan, restoring tax-preferred retirement accounts to their intended

purpose by limiting the accrual of tax-favored retirement benefits and closing other loopholes

funds a more robust system for middle-class workers. Under current law, low- and middle-

income Americans (defined as those in the 80

th

percentile and below), collectively receive less

than one-third of retirement tax benefits.

29

The President’s plan would provide 30 million additional American workers with access to easy,

payroll-based retirement savings, helping to spread retirement tax benefits more widely and

better achieve their intended purpose: improving retirement security for those for whom it is at

risk.

III. Encouraging and Supporting Work

The tax system already includes powerful tools for supporting and rewarding work. As discussed

above, the EITC has a strong track record of encouraging hundreds of thousands of low-income

parents to enter the workforce, and supporting and rewarding work for millions more. But it can

and should be strengthened, and the tax code should also do more to support and reward work

for two-earner couples.

29

Calculation based on U.S. Department of Treasury, “Distribution of Selected Tax Expenditures; Selected

Retirement Savings,” http://www.treasury.gov/resource-center/tax-policy/Pages/Tax-Analysis-and-Research.aspx

.

See also Tax Policy Center, “Tax Benefit of Certain Retirement Savings Incentives (Present value Approach),” Table

T13-0265, December 2013.

24

Second Earner Credit

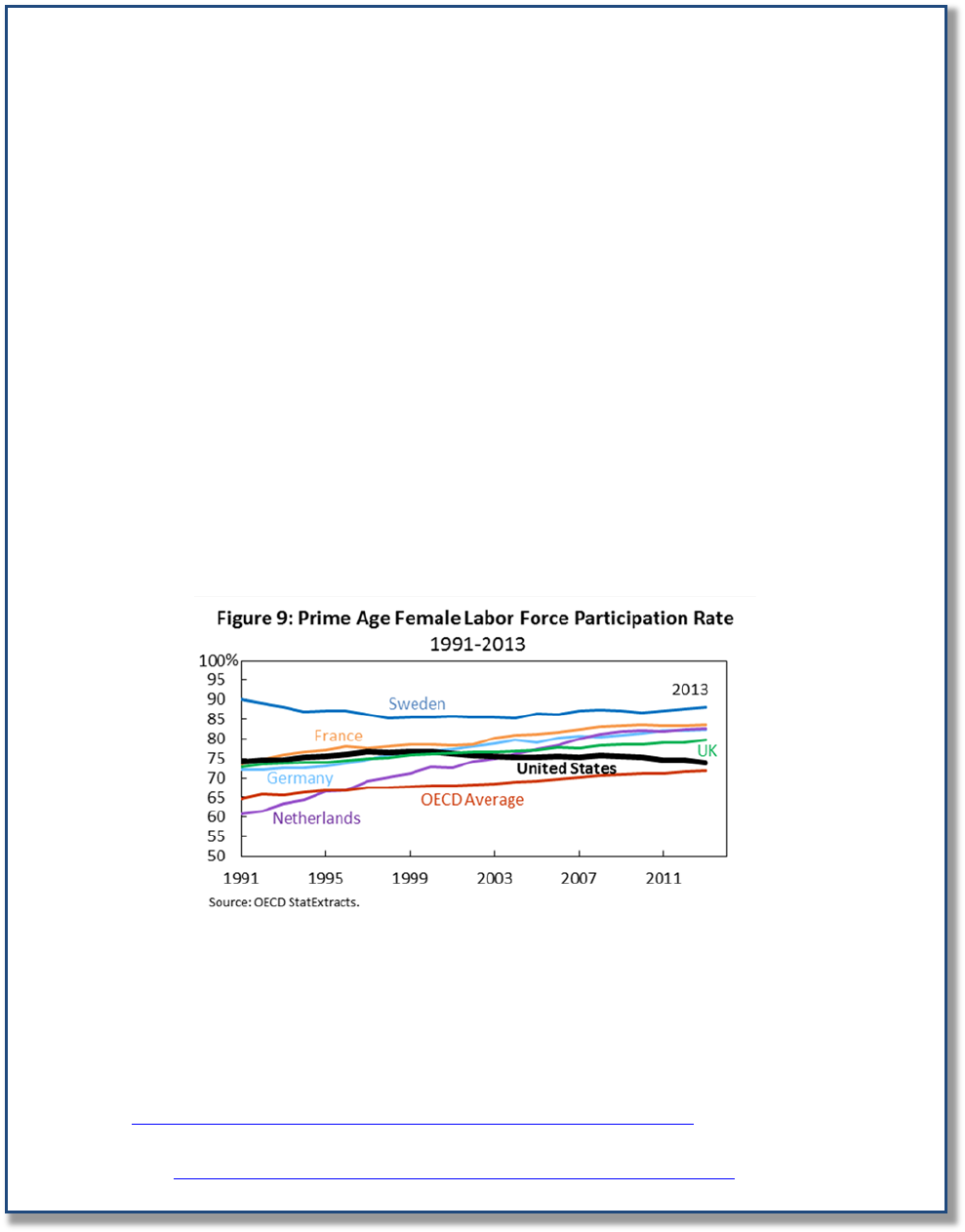

Two-earner couples face unique challenges in the workforce. When both spouses work, the

family incurs additional costs: commuting, professional expenses, child care, and, increasingly,

elder care. When layered on top of other costs, including federal and state taxes, these work-

related costs can contribute to a sense that it isn’t worth it for both spouses to work.

While women, including married women, are increasingly family breadwinners, the fact remains

that women are still much more likely to be the ones who withdraw from the labor force in these

circumstances. Among couples where both spouses worked in 2000, female primary earners

were 10 percentage points more likely than male primary earners to have left the workforce for

at least one year by the end of the decade. Among secondary earners, women were 17

percentage points more likely to have left the workforce compared to men.

30

Interruptions in

work participation can take a toll on future job options and earnings, a toll currently borne

disproportionately by women.

In recognition of the unique challenges faced by two-earner families and as part of a broader

focus on female labor force participation (see the box on page 30), the President proposes the

creation of a new second earner credit. The credit would provide families with a nonrefundable

tax credit equal to 5 percent of the first $10,000 of earnings for the lower-earning spouse in a

married couple and would be available in full to all families making less than $120,000. The credit

would benefit nearly 24 million families each year, providing them with an average tax cut of

30

Robert McClelland, Shannon Mok, and Kevin Pierce, “Labor Force Participation Elasticities of Women and

Secondary Earners within Married Couples,” September 2014. Working Paper 2014-06, Congressional Budget

Office, http://www.cbo.gov/publication/49433

25

almost $400. More than 60 percent of working-age married couples where both spouses are

between 25 and 64 have two earners, and 80 percent of these families would benefit from the

new credit. (See Appendix 1 for state-by-state estimates.)

This President’s second earner credit builds on similar proposals advanced by independent

organizations and both Democrats and Republicans in Congress. For example, Democratic

Senator Patty Murray proposed a second earner deduction that would allow married couples

with children under 12 to deduct 20 percent the earnings of the lower-earning spouse up to a

maximum deduction of $12,000, and recently proposed a second earner credit for families with

children under 12.

31

Republican Congresswoman Cathy McMorris Rodgers proposed a second

earner deduction that would be available to married couples regardless of whether they had

children in the home.

32

Expanding the EITC for Workers Without Children and Non-Custodial Parents

While tax credits like the EITC and CTC help reduce taxes for working families and increase labor

force participation, the tax system could do more to build on their success.

Instead, we are in danger of moving backward. The improvements to the EITC and CTC discussed

above are currently scheduled to expire after 2017, raising taxes on 16 million families and

increasing poverty. For example, if these improvements are allowed to expire, a full-time

minimum wage worker with two children would see a tax increase of about $1,700. The

President’s plan would make these improvements permanent, locking in the gains they have

helped achieve in decreasing poverty, promoting work, and improving economic mobility.

Meanwhile, workers without qualifying children largely miss out on the anti-poverty and

employment effects of the EITC. The EITC available to workers without children and non-custodial

parents (the “childless worker EITC”) is small and phases out at very low incomes. As such, it

provides little assistance to childless individuals at or near the poverty line and little incentive to

enter the workforce. While the tax system has reversed its role from increasing poverty to

decreasing poverty among families with children through improvements to the EITC and CTC,

childless workers remain the only group taxed deeper into poverty by federal income and payroll

taxes.

31

Senator Patty Murray (D-WA), “21

st

Century Worker Tax Cut Act,” 26 March 2014. Press release.

http://www.murray.senate.gov/public/index.cfm/2014/3/senator-patty-murray-introduces-the-21st-century-

worker-tax-cut-act; Senator Patty Murray (D-WA), “Middle Class Tax Cuts: Murray Introduces Bills to Put More

Money in Pickets of Working Families, Reduce Costs of College, Child Care,” 4 March 2015. Press release.

http://www.murray.senate.gov/public/index.cfm/newsreleases?ID=5b56ec34-14d6-49bf-b6ca-ff4b2eb430c8

32

House Republicans, “Empowering Americans to Work” Act, 7 August 2014. Press release.

http://www.gop.gov/you-cant-legislate-more-hours-in-the-day-but-heres-something-we-can-do/

26

Moreover, the current age restrictions prevent workers younger than 25 from claiming the

childless worker EITC, excluding young workers living independently from their parents from its

pro-work effects. For individuals at this formative stage of life, encouraging employment and

on-the-job experience could help establish patterns of labor force attachment that would

persist throughout their working lives.

Last year, the President proposed to address these problems by doubling the EITC for workers

without qualifying children, increasing the income level at which the credit is fully phased out,

and making it available to workers ages 21 to 66. Specifically, his proposal would double the

maximum childless EITC to about $1,000 and increase the income level at which the credit is

fully phased out to about $18,000 (roughly 150 percent of the Federal poverty line for a single

adult). The proposal would also make the credit available to young adult workers age 21 and

older and would raise the EITC’s upper age limit from 64 to 66, harmonizing it with the recent

and scheduled increases in the Social Security full retirement age.

In July 2014, Ways and Means Committee Chairman (then Budget Committee Chairman) Paul

Ryan endorsed the President’s proposed EITC expansion as part of his poverty plan.

33

In

February 2015, Chairman Ryan noted his endorsement of the President’s childless EITC

expansion, stating “I actually endorsed the idea of EITC reform... I think that’s something that

actually pulls people into the workforce… And so that is something that I think we should work

together on.”

34

Other members of Congress have put forward similar proposals, while outside

33

Chairman Paul Ryan, House Budget Committee Majority Staff, “Expanding Opportunity in America: A Discussion

Draft from the House Budget Committee,” 24 July 2014.

http://budget.house.gov/uploadedfiles/expanding_opportunity_in_america.pdf

.

34

NBC News, “Meet the Press Transcript – February 1, 2015.” http://www.nbcnews.com/meet-the-press/meet-

press-transcript-february-1-2015-n302111.

27

experts from across the political spectrum have endorsed expanding the childless worker EITC

as a way to encourage labor force participation.

The President’s proposal to expand the childless worker EITC would directly reduce poverty and

hardship for 13.2 million low-income workers. Among the groups that would benefit most from

the EITC expansion are a number of groups with low or declining labor force participation rates

or for whom there are other compelling reasons to strongly subsidize work. These groups

include men without a college education, especially minority men; women working at low-wage

jobs; young adults not enrolled in school; workers with disabilities; and older workers.

35

35

Executive Office of the President and U.S. Department of Treasury, “The President’s Proposal to Expand the

Earned Income Tax Credit,” March 2014. http://www.whitehouse.gov/sites/default/files/docs/eitc_report_0.pdf

.

B

IPARTISAN

S

UPPORT FOR

P

ROPOSALS IN THE

P

RESIDENT

’

S

B

UDGET

As discussed throughout this report, many of the proposals in the President’s tax plan build on

bipartisan ideas or have bipartisan support. For example:

Simplifying and Improving Student Aid

The President’s proposal to streamline and improve education tax credits builds on a proposal that

passed the Republican-led House in July 2014. Like the President’s plan, the House-passed bill

would make the AOTC permanent, increase AOTC refundability, and consolidate overlapping

education credits into an improved AOTC.

1

In March 2015, Congressional Democrats also put forth

a proposal to expand the AOTC and increase the refundable portion to $1,500.

2