REPORT

January 2016

The Burden of Medical Debt:

Results from the

Kaiser Family Foundation/New York Times

Medical Bills Survey

Prepared by:

Liz Hamel, Mira Norton, Karen Pollitz, Larry Levitt, Gary Claxton and Mollyann Brodie

Kaiser Family Foundation

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey

Introduction ........................................................................................................................................................ 1

Section 1: Who Has Medical Bill Problems and What Are the Contributing Factors? ....................................... 1

Prevalence of problems paying medical bills among different groups ........................................................... 1

Circumstances leading to problems paying medical bills .............................................................................. 3

Financial status of those with medical bill problems .................................................................................... 8

Section 2: The Role of Health Insurance...........................................................................................................10

Medical bill problems among those with health insurance ..........................................................................10

The Uninsured and attempts to get coverage ............................................................................................... 13

Section 3: Consequences of Medical Bill Problems........................................................................................... 14

The impact of medical bills on families ........................................................................................................ 14

Sacrifices made to pay medical bills ............................................................................................................. 15

Effects of medical bills on ability to get needed health care ......................................................................... 16

Effects of medical bills on household finances and ability to afford basic needs ......................................... 17

Financial consequences of struggling to make payments ........................................................................... 20

Section 4: Patients as Consumers .................................................................................................................... 22

Conclusion ........................................................................................................................................................ 26

Appendix 1: Reported Problems Paying Medical Bills By Demographic Group .............................................. 27

Appendix 2: Survey Methodology .................................................................................................................... 28

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 1

The cost of health care has long been a concern in the U.S., on both a national and a personal level. For

individuals, this concern plays out most prominently among those who face difficulty paying medical bills or

who are unable to pay such bills at all. For people who are uninsured, lack of coverage not only hinders access

to care but also leaves them vulnerable to medical bills that cannot be paid. While insurance provides financial

protection, that protection can be incomplete for a number of reasons, including rising deductibles and other

forms of cost-sharing, out-of-network charges, the growing complexity of insurance that can leave consumers

with unexpected bills, and the fact that many people have only modest financial assets to cover medical

expenses.

Previous Kaiser surveys have found that about a quarter of people say they or someone in their household had

problems paying medical bills in the past year, and a 2014 Kaiser report provided a qualitative look at some of

the circumstances and consequences of unpaid medical bills through interviews with people who had sought

credit counseling for medical debt.

1

But to date, there has been little research providing a quantitative look at

the causes of medical bill problems and the impacts they have on people’s families, their finances, and their

access to health care.

To fill this gap, the Kaiser Family Foundation and The New York Times conducted an in-depth survey with

1,204 adults ages 18-64

2

who report that they or someone in their household had problems paying or an

inability to pay medical bills in the previous 12 months. To provide context, we also conducted a shorter

companion survey with 1,371 adults ages 18-64 who do not report having medical bill problems.

Overall, about a quarter (26 percent) of U.S. adults ages 18-64 say they or someone in their household had

problems paying or an inability to pay medical bills in the past 12 months. Though certain groups are more

likely than others to report such problems, the survey finds that people from all walks of life can and do

experience difficulty paying medical bills.

Insurance status has a strong association with medical bill difficulties, with over half (53 percent) of the

uninsured saying they had problems paying household medical bills in the past year. However, as previous

surveys have shown, insurance is not a panacea against these problems. Roughly one in five of those with

health insurance through an employer (19 percent), Medicaid (18 percent), or purchased on their own (22

percent) also report problems paying medical bills. In fact, overall among all people with household medical

bill problems, more than six in ten (62 percent) say the person who incurred the bills was covered by health

insurance, while a third (34 percent) say that person was uninsured. Among those with private insurance

(either through an employer or self-purchased), their plan’s deductible makes a difference in ability to afford

health care bills, with those in higher deductible plans more likely to report medical bill problems than those in

plans with lower deductibles

3

(26 percent versus 15 percent).

Not surprisingly, problems paying medical bills are also more common among those with lower or moderate

incomes. Just under four in ten (37 percent) of those with annual household incomes below $50,000 report

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 2

experiencing such problems, compared with about a quarter (26 percent) of those with moderate incomes

between $50,000 and $100,000, and 14 percent of those in the highest income category.

4

Those with poorer

health status and greater health needs are also more likely to report facing medical bill problems. This is true

among those who say they have a disability that prevents them from participating fully in daily activities (47

percent report problems versus 22 percent of those without such a disability), among those who rate their own

health as fair or poor (45 percent versus 22 percent of those in excellent, very good, or good health), and among

those who say they’re receiving regular or ongoing medical treatment for a chronic condition (34 percent

versus 23 percent of those who are not receiving such treatment).

Beyond insurance, income, and health status, several other demographic differences emerge in the rates at

which people report experiencing problems paying medical bills. Women are somewhat more likely than men

to report having such problems (29 percent versus 23 percent), as are adults under age 30 compared with those

ages 30-64 (31 percent versus 24 percent) and those with children in their household versus those without (29

percent versus 24 percent). Looking by region, residents of the South have the highest share reporting

problems (32 percent), while those in the Northeast have the lowest (18 percent). Likely due to differences in

income and insurance status, those without a college degree are more likely than college graduates to report

medical bill problems, as are Blacks and Hispanics compared with whites. (See Appendix Table 1 for more

detail).

To explore these relationships further, we used a statistical technique called logistic regression analysis to

isolate which demographic characteristics are the strongest predictors of problems paying medical bills when

holding other factors constant. In that analysis, income, insurance status, and all 3 measures of health status

(being in fair or poor health and having a disability or chronic condition) had a significant and strong

association with problems paying medical bills, even after accounting for the influence of the other

demographic factors. Having a private insurance plan with a high deductible also remained a significant

predictor, even after controlling for other factors, as did being under age 25 and having minor children at

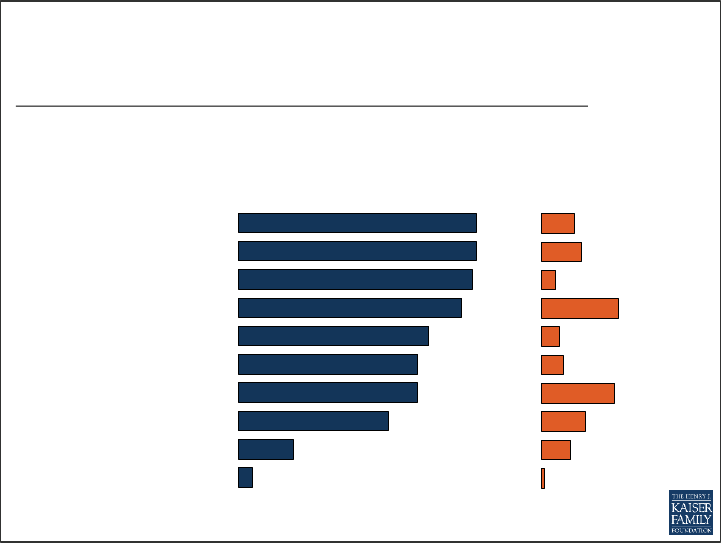

26%

37%

26%

14%

53%

20%

26%

15%

47%

22%

Total adults ages 18-64

Less than $50,000

$50,000 to $99,999

$100,000 or more

Uninsured

Insured

Private insurance, high deductible*

Private insurance, low deductible

Have a disability

No disability

Figure 1

Shares Reporting Problems Paying Medical Bills In Past Year

Percent who say they or someone in their household had problems paying medical bills in the past 12 months:

*High deductibles defined as $1,500 and above for an individual or $3,000 and above for a family.

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

By household income

By insurance status

By plan deductible

By disability status

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 3

home. Gender, race, and ethnicity were not statistically significant predictors of problems paying medical bills

when controlling for other factors, suggesting that the higher rates of reported problems among women,

Blacks, and Hispanics have to do with underlying differences in income and insurance status between these

groups and their counterparts.

Among those who report problems paying medical bills, two-thirds (66 percent) say the bills were the result of

a one-time or short-term medical expense such as a hospital stay or an accident, while 33 percent cite bills for

treatment of chronic conditions that have built up over time. These shares are similar for people who faced

medical bill problems with and without insurance coverage.

Many are still struggling to pay off bills for treatment that occurred in the past. Over six in ten (63 percent) say

they are no longer receiving the medical treatment that led to their problems paying bills, and almost half (46

percent) say the illness or injury that led to the bills occurred more than one year ago.

Most of those with medical bill problems say the bills are the result of their own or their spouse’s medical care.

One-quarter (44 percent of those with children under age 18 in their household) say they had problems paying

a child’s medical bills, and 10 percent cite another family member. Thirty-five percent say they’ve had problems

paying bills for more than one family member.

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS: Which of the

following comes closer to describing the medical bills you’ve had problems paying:

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

Bills that have built

up over time, such

as treatment for a

chronic illness like

diabetes or cancer

33%

Don't know/

Refused

2%

Bills for a one-time

or short-term

medical expense,

such as a single

hospital stay or

treatment for an

accident

66%

Figure 2

More Say Medical Bill Problems Stem From One-Time Events

Than Treatment For Chronic Illnesses

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 4

The medical bills people report facing also come from a variety of sources. More than six in ten of those who

had difficulty paying say the medical bills were for doctor visits (65 percent), diagnostic tests (65 percent), lab

fees (64 percent) and emergency room visits (61 percent). About half say they had problems with bills for

prescription drugs (52 percent), hospitalization (49 percent), and outpatient services (49 percent), while four

in ten (41 percent) report problems with bills for dental care. Nearly all of those who had problems paying

medical bills (91 percent) report having trouble with bills from at least two of these categories, and over half (53

percent) had problems with bills from five or more different sources.

Asked which types of bills made up the largest share of what they owed, the most common responses are

emergency room visits (21 percent) and hospitalization (20 percent), followed by dental care (12 percent) and

diagnostic tests like X-rays and MRIs (11 percent). In general, people who had problems paying medical bills

with or without insurance report having similar types of bills, however the uninsured are more likely than the

insured to say that emergency room bills were the largest source of their bill problems (35 percent versus 15

percent), while those with insurance are more likely than the uninsured to point to diagnostic tests like X-rays

and MRIs (14 percent versus 6 percent).

59%

18%

12%

11%

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

Figure 3

Most Who Had Problems Paying Medical Bills Say The Bills

Were For Their Own Medical Care

73%

33%

25%

10%

Bills for their own medical care

Bills for their spouse or partner's medical care

Bills for their child's medical care

Bills for another family's members medical

care

Percent who say each of the

following represents the

largest share of the bills they

had problems paying:

Percent who say they’ve had

problems paying the following

types of bills:

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS:

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 5

When asked to describe in their own words the illness or injury that led to their medical bill problems, people

give a variety of responses. Overall, the largest share (36 percent) name a specific disease, symptom or

condition like heart disease or gastrointestinal problems, followed by issues related to chronic pain or injuries

(16 percent), accidents and broken bones (15 percent), surgery (10 percent), dental issues (10 percent), and

infections like pneumonia and flu (9 percent). Five percent each cite mental health or substance abuse issues

and pregnancy or childbirth as the cause of their bills.

Among who say their bill problems were the result of a one-time or short-term medical expense, just under one

in five (18 percent) cite an accident as the main cause. Most of the others name illnesses, pain, dental issues, or

surgery, suggesting that although most bill problems are caused by one-time events, these events are often

acute episodes of illness or expensive surgeries, medications or tests, rather than injuries caused by accidents.

Those who say their bills have built up over time are even more likely to cite specific diseases, the most

common being cancer (14 percent), heart disease (11 percent), and diabetes (11 percent).

9%

11%

4%

21%

5%

6%

20%

12%

8%

1%

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

Figure 4

Doctor Visits, Tests, Lab Fees Are Most Common Source Of Bills,

But Hospital And ER Make Up Largest Dollar Amount

65%

65%

64%

61%

52%

49%

49%

41%

15%

4%

Doctor Visits

Diagnostic tests, such as X-rays/MRIs

Lab fees

Emergency room

Prescription drugs

Outpatient services

Hospitalization

Dental care

Some other type of medical service

Nursing home/long-term care services

Percent who say each represents

the largest share of the bills they

had problems paying:

Percent who say they’ve had

problems paying the following

types of bills:

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS:

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 6

Heart disease/heart attack/stroke

8

6

11

Cancer/tumors

6

2

14

Gastrointestinal/stomach

6

6

8

Allergies/asthma/respiratory disease

5

4

7

Diabetes

4

1

11

High blood pressure

4

2

6

Neurological problems

3

2

4

Auto-immune disease

2

1

4

Kidney disease/problems

2

2

1

Cervical/ovarian/gynecologic

problems

2

2

<1

Thyroid issues

1

<1

1

Arthritis/joint pain/problems

8

8

9

Back/neck pain/problems

6

5

6

Chronic pain, other/unspecified

3

3

4

Broken bones

5

6

2

Accident, car/vehicle

5

6

1

Accident, unspecified

5

6

2

Accident, job-related

1

1

<1

Pneumonia/lung infection

3

2

4

Viral infections

3

5

1

Other/unspecified infection

2

3

1

Note: Percentages add up to more than 100 because multiple responses were accepted.

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 7

The open-ended responses to this question show that medical bill problems can arise from single health events

or chronic, ongoing conditions. Problems occur among people with and without insurance. They can affect one

person or multiple family members at a time. Unexpected bills may arise when people don’t realize how many

providers will bill separately for a single treatment event, or when insurance doesn’t pay for care people

thought would be covered. Medical bill problems may be short term, or drag on for years.

“A heart attack (MI) requiring 4 stents being placed. Also an appendectomy. Ongoing: diabetes and heart

disease that require monthly visits and prescriptions. My son also has epilepsy which has impacted our

medical expenses.”

“In 2002 I had a pancreatic attack, a tumor in my pancreas removed and my spleen removed, and I broke

2 arms at the same time, partial hysterectomy. And hepatitis.”

“Cancer. Current treatment not FDA approved for certain cancers, so even though the treatment is

working, it is no longer covered by insurance and costs approximately $11,000 per month.”

“It's a whole lot. Diabetes and claustrophobic and everything. TIA, a mini stroke, depression, anxiety.”

“I had a tooth that went bad and had to have it pulled. I now need another tooth in its place. The dentist

wants all the money for the procedure up front. I do not have thousands of dollars to give.”

“Was treated by my family doctor for a MRSA infection which led to C-Diff which I went to the ER for.

They ran several tests and diagnosed the illness but sent me home with no treatment. I had made

arrangements to pay the bill monthly and came to realize there were several other bills associated with the

visit that were specific to Doctor, CT scan, Lab all being separate bills.”

“I have been diagnosed with osteoarthritis throughout my body, as well as degenerative disc disease. I

have had to have at least 6 MRI's in past 5 years, 3 back injections, 5 foot surgeries, 2 knee surgeries, wrist

surgery, torn tendon repair, several joint replacement surgeries, etc.”

“I was pregnant and miscarried when I was 10.5 weeks a long. Prior to losing the baby, I had an

ultrasound which cost $636 and I don't have insurance. I was eligible for pregnancy-related Medicaid, but

it wasn't billed right and a year and a half later I got the bill. I am still trying to get it straightened out.”

“Eye glasses not covered. Orthotics not covered. Many different problems with feet.”

“Insurance not paying for wellness care of any kind, blood work, labs, physical and only 8o% of a

mammogram.”

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 8

About three in ten (31 percent) of those with medical bill problems say the total amount of the bills they had

problems paying was $5,000 or more, including 13 percent who report bills adding to at least $10,000.

Insurance appears to provide some protection from the highest bills, as the insured are less likely than the

uninsured to report having bills of $10,000 or more (8 percent versus 21 percent).

Many of those with medical bill problems report struggling with bills of lower amounts, including 24 percent of

the insured and 22 percent of the uninsured who say their bills amounted to less than $1,000. While these

lower amounts may seem small, even a bill of $500 or less can present a major problem for someone who is

living paycheck to paycheck. In fact, when asked to describe their financial situation, about six in ten (61

percent) of those who’ve had problems paying medical bills say they either just meet their basic expenses (43

percent) or don’t have enough to meet basic expenses (18 percent). Among the comparison group who did not

report problems paying medical bills, just a quarter (24 percent) report such a tenuous financial situation,

while the majority say they either live comfortably or meet their basic expenses with a little left over for extras.

Given their differing demographic profiles, it’s not surprising that those with health insurance are less likely

than those without insurance to say they struggle to meet basic expenses. However, even among the insured,

those who have faced medical bill problems are significantly more likely than their counterparts who haven’t

had such problems to say they are either just getting by or don’t have enough to make ends meet (55 percent

versus 22 percent).

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS: What was the

TOTAL amount owed for the medical bills you’ve had problems paying?

NOTE: Don’t know/Refused responses not shown.

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

Figure 5

People Report Problems Paying Medical Bills of Varying Dollar

Amounts

10%

10%

8%

14%

14%

14%

19%

21%

17%

24%

26%

20%

18%

17%

21%

13%

8%

21%

Total

Insured

Uninsured

Less than $500 $500 to less than $1000 $1000 to less than $2500

$2500 to less than $5000 $5000 to less than 10,000 $10,000 or more

By Insurance Status

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 9

Live comfortably

8%

35%

9%

37%

6%

18%

Meet your basic expenses with

a little left over for extras

31

41

36

42

20

36

Just meet your basic expenses

43

18

41

16

46

38

Don’t have enough to meet

basic expenses

18

6

14

6

26

8

NOTE: Don’t know/Refused responses not shown.

The financial accounts held by people who’ve had problems paying medical bills also paint a picture of a more

fragile financial situation. A large majority (78 percent) say they have a checking or savings account, though

this is lower than among those who have not had medical bill problems (90 percent). Compared to those

without medical debt, those who’ve had medical bill problems are also less likely to say they have a credit card

(53 percent versus 77 percent), a retirement savings account (43 percent versus 62 percent), or some other type

of savings (17 percent versus 38 percent). Again, not surprisingly, among those with medical bill problems, the

uninsured are less likely than the insured to report having each of these types of accounts.

Income loss due to illness is another complicating factor for some of those who face medical bill difficulties.

About three in ten (29 percent) say that someone in their household had to take a cut in pay or hours as a result

of the illness that led to the medical bills, either because of the illness itself or in order to care for the person

who was sick. Most of these (19 percent of the total who had problems paying medical bills) say their household

income decreased a lot as a result.

78%

53%

43%

17%

90%

77%

62%

38%

A checking or savings account at a

bank or credit union

A credit card

An IRA, 401K or similar kind of

retirment account

Another type of savings or

investment, such as stocks, bonds,

or mutual funds

Those who had problems paying household medical bills

Those who DID NOT have problems paying household medical bills

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

Figure 6

Those with Medical Bill Problems Less Likely to Report Having

Various Financial Accounts

Percent who say they or their spouse currently have each of the following:

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 10

The uninsured who had medical bill problems (36 percent) are somewhat more likely to report job losses or pay

cuts, but still about a quarter (26 percent) of the insured who had medical bill problems report facing such an

adverse employment outcome as a result of the illness that led to their bills.

While problems paying medical bills are more common among the uninsured, more than six in ten (62 percent)

of those who had problems paying medical bills say the person who incurred the bills was covered by health

insurance when treatment began, with most of that coverage (39 percent of the total) coming through an

employer. The vast majority (83 percent) of those who were insured when treatment began say they kept their

coverage throughout the treatment period, but 15 percent of them (9 percent of the total) say they lost or

dropped coverage at some point, mainly because of job loss or change or because they were no longer eligible

for coverage.

Among those with private insurance through an insurer or purchased on their own (46 percent of the total who

had problems paying medical bills), about half report having plans with high deductibles (at least $1500 for an

individual of $3000 for a family), while the other half report having lower-deductible plans.

Yes

29%

Don't

know/

Refused

1%

No

70%

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS:

Figure 7

About Three in Ten Report Job Loss Or Pay Cut Due to Illness

That Led to Medical Bill Problems

19%

9%

1%

Yes, decreased a lot

Yes, decreased a little

No, did not decrease

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

ASKED OF THE 29% WHO SAY SOMEONE LOST A JOB OR

TOOK A CUT IN PAY/HOURS: Did your overall household

income decrease as a result of this change in work status,

or not? Would you say it decreased a little or a lot?

(Percentages shown based on total who had problems

paying medical bills)

Did you or anyone else in your household lose a job or

have to take a cut in pay or hours due to the illness or

injury that led to these bills?

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 11

Of those who were insured when the bills were incurred, three-quarters (75 percent) say that the amount they

had to pay for their insurance copays, deductibles, or coinsurance was more than they could afford.

Interestingly, this is true among people in plans with higher deductibles (83 percent) and among those in plans

with lower deductibles (76 percent), suggesting that other types of cost-sharing can present a problem even for

people in lower-deductible health plans. For example, even under a plan with a relatively low deductible, large

medical bills could arise from repeated co-pays or from out-of-network coinsurance. This finding should not

be confused with the finding shown in the first section of this report – that people in plans with higher

deductibles are more likely to report problems paying medical bills in the first place. However, among insured

people who have medical bill problems, most find cost sharing unaffordable regardless of the deductible level.

Employer

coverage

39%

Self-

purchased

coverage

7%

Public/Other

Coverage

16%

Don't know/

Refused

4%

Uninsured

34%

Figure 8

Insurance Status of Those Who Had Problems Paying Medical

Bills

NOTE: *High deductibles defined as $1,500 and above for an individual or $3,000 and above for a family.

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

Fell short of

expectation

s

Met

expectatio

ns

2%

22%

22%

High deductible plan*

Lower deductible plan

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS:

ASKED OF THE 46% WITH EMPLOYER OR SELF-PURCHASED

COVERAGE: Percentages shown based on total who had

problems paying medical bills

Deductible level of those with employer-sponsored or self-

purchased coverage:

Unknown deductible amount

Insurance status of the person who was the main

source of the bills at the time treatment began:

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 12

About three in 10 (32 percent) of those who had problems paying medical bills while insured say they received

care from an out-of-network provider that their insurance wouldn’t pay for. For many, these bills came as a

surprise. Seven in 10 (69 percent) of those who had problems paying for care received from an out-of-network

provider say they were unaware that the provider was not in their plan’s network when they received the care.

Denied claims also contribute to medical bill problems among those with insurance. About a quarter (26

percent) of the insured who had medical bill problems say they had a claim denied by their insurance company.

Common reported reasons for denial include a particular treatment not being covered (25 percent of those with

75%

32%

26%

Copays, deductibles, or coinsurance were more than they

could afford

Received care from an out-of-network provider, and

insurance would not cover or would only cover a portion

Submitted a claim to insurance company but the claim

was denied

Figure 9

Most Who Had Problems Paying Medical Bills While Insured Say

Cost-Sharing Was More Than They Could Afford

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS WHO WERE

INSURED WHEN TREATMENT BEGAN: Percent who say each of the following was a reason they had problems paying

medical bills:

NOTE: Question wording abbreviated. See topline for full question wording.

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS AND RECEIVED

CARE FROM AN OUT-OF-NETWORK PROVIDER THAT INSURANCE WOULD NOT COVER: Did you know that the health

care provider was not in your plan’s network at the time you received care, or not?

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

Yes, knew the

health care

provider was not

in their plan's

network

28%

Don't know/

Refused

4%

No, did NOT

know the health

care provider was

not in their plan's

network

69%

Figure 10

Most Who Received Out-Of-Network Care Did Not Know the

Provider Was Out-Of-Network at Time of Treatment

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 13

denied claims) and receiving care from an out-of-network provider (14 percent); 21 percent of those who say

they had a claim denied did not know or could not provide a reason for the denial.

About a third (34 percent) of those who had problems paying medical bills say they were uninsured when the

treatment that led to their medical bill problems began. However, many of these (39 percent, or 13 percent of

the total who had problems paying medical bills) say they got coverage at some point while they were receiving

treatment, mainly from Medicaid (36 percent of those who were uninsured and gained coverage).

Among those who remained uninsured throughout the time they were receiving the treatment that led to their

medical bills, many say they tried to get coverage from Medicaid (52 percent), the health insurance

marketplace (28 percent) or directly from an insurance company or broker (16 percent). Most of those who

tried but were not able to get coverage from Medicaid say they were told they were not eligible for the program,

while the most commonly reported reason for not getting private coverage was because it was too expensive.

Covered by

health

insurance

62%

Don't know/

Refused

4%

Uninsured

34%

Figure 11

Six in Ten Had Insurance When Treatment Began, One-Third

Were Uninsured

52%

9%

Had insurance

coverage the

entire time

Lost or dropped

health insurance

coverage at some

time

ASKED OF THE 62% WHO WERE

INSURED WHEN TREATMENT BEGAN:

Did you have insurance coverage for the

entire time you were receiving

treatment, or did you lose or drop your

health insurance coverage at any time

during this period?

[Were you/Was the person who received

the bills] covered by any form of health

insurance or health plan at the time

treatment began, or were you uninsured?

ASKED OF THE 34% WHO WERE

UNINSURED WHEN TREATMENT

BEGAN: Were you uninsured the

entire time you were receiving the

treatment that led to the problems

paying medical bills, or did you get

health insurance at some point?

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS:

20%

13%

Uninsured the

entire time

Got health

insurance at

some point

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 14

Among the roughly one-quarter of Americans ages 18-64 who report having problems paying medical bills,

roughly equal shares say the impact of those bills on their families has been major (44 percent) and minor (47

percent). Relatively few (7 percent) say there has been no real impact. The survey shows that while insurance

may protect people from having medical bills problems in the first place, once those problems occur the

consequences are similar regardless of insurance status. Among those with medical bill problems, almost

identical shares of the insured (44 percent) and uninsured (45 percent) say the bills have had a major impact

on their families. Similarly, among those who had problems paying medical bills, those with higher incomes are

just as likely to report that the bills had a major impact as those with lower incomes (though as noted above,

people with lower incomes are more likely than those with higher incomes to report problems paying medical

bills in the first place).

A few groups among those with medical bill problems are more likely to say the medical bills have had a major

impact on their families, including people with bills amounting to $5,000 or more (66 percent), those who say

the family member who generated the bills has a disability (57 percent), and those who describe their financial

situation as not having enough to meet basic expenses (56 percent).

Among people with private health insurance, those in high-deductible plans are more likely than those in

lower-deductible plans to say the bills had a major impact on their family (49 percent versus 35 percent), which

may be related to the fact that high deductible plan enrollees report having higher bills on average. About two-

thirds (64 percent) of those in high-deductible plans say their bills amounted to $2,500 or more, compared to

four in ten with lower-deductible plans (40 percent).

44%

44%

45%

47%

47%

47%

7%

8%

6%

A major impact A minor impact No real impact

NOTE: Don’t know/Refused responses not shown.

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

Figure 12

Over Four in Ten with Medical Bill Problems Report a Major

Impact on Their Family

Uninsured

By Insurance Status

Total

Insured

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS: Overall, how much

of an impact have these medical bills had on you and your family?

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 15

Even among those with health insurance, people who’ve faced medical bill problems report making various

sacrifices in order to pay these bills, including significant changes to their employment, financial situation, or

lifestyle. Overall, about seven in ten report cutting back or delaying vacations or major household purchases

(72 percent) as well as reducing spending on food, clothing and basic household items (70 percent). About six

in ten (59 percent) say they used up all or most of their savings in order to pay medical bills. Substantial shares

say that someone in their household took on an extra job or worked more hours (41 percent), borrowed money

from family and friends (37 percent), or increased their credit card debt (34 percent). Roughly a quarter (26

percent) say they took money out of a retirement, college, or other long-term savings account. Smaller – but

not inconsequential – shares say they changed their living situation (17 percent), took out another type of loan

(15 percent), borrowed from a payday lender (13 percent), or sought the aid of a charity or non-profit (12

percent) in order to pay medical bills. Very few (2 percent) report taking out a second mortgage on their home.

These sacrifices are reported by people in all walks of life, and not just the uninsured or those with precarious

financial situations. In fact, people who have problems paying medical bills despite having health insurance are

more likely than the uninsured with medical bill problems to say they’ve put off vacations or major household

purchases (77 percent versus 64 percent), cut back spending on food, clothing, or basic household items (75

percent versus 62 percent), used up all or most of their savings (63 percent versus 51 percent), increased their

credit card debt (38 percent versus 24 percent), or taken money out of long-term savings (31 percent versus 17

percent) in order to pay medical bills. The opposite is true in one case; the uninsured with medical bill

problems are more likely than those with insurance to say they had to change their living situation in order to

pay these bills (23 percent versus 14 percent).

Put off vacations or other major household purchases

72%

77%

64%

Cut back spending on food, clothing, or basic

household items

70

75

62

Used up all or most of savings

59

63

51

Taken an extra job or worked more hours

41

42

40

Borrowed money from friends or family

37

37

38

Increased credit card debt

34

38

24

Taken money out of retirement, college, or other long-

term savings accounts

26

31

17

Changed your living situation

17

14

23

Taken out another type of loan

15

17

11

Borrowed money from a payday lender

13

15

12

Sought the aid of a charity or non-profit organization

12

11

15

Taken out another mortgage on home

2

1

2

Made other significant changes to way of life

15

15

16

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 16

In addition to the sacrifices listed above, fifteen percent of people who had problems paying medical bills

report making other significant changes to their way of life in order to pay these bills.

“Apartment instead of house. Not getting groceries some weeks to get by.”

“Charges for my insulin exceeded $1200 a month (3 times the amount of my house payment). I had to

reduce the amount of insulin I took based on what I could afford; my health was negatively impacted as a

result.”

“Cold showers, can't fix plumbing. Other needed repairs have been patched as best as possible but not

fixed.”

“Medical Insurance / bills was the deciding factor in a job change. I gave up other benefits to choose a job

that had the best medical coverage.”

“Sold everything we could spare.”

“Can’t take the kids anywhere. Wish I could do more for my kids!”

“I need physical therapy after shoulder repair but I couldn't afford to finish it. I wish I could have.”

“I am losing my house.”

“I've cut back on just about everything for my family and the way we live.”

For many, problems paying household medical bills can impact their ability to get (or continue getting) the

health care services they need. Overall, about three in ten (31 percent) of those who faced problems paying

medical bills say they had problems getting other health care they needed directly as a result of these problems.

While the problem is worse for those without insurance – among whom 41 percent say they had trouble getting

needed care care because of medical bills – it is also reported by about a quarter (26 percent) of those who had

insurance when their medical bill problems occurred.

More broadly, many of those with medical bill problems report delaying or skipping health care over the past

12 months because of the cost – at rates 2 to 3 times those of their counterparts who did not have problems

paying medical bills, regardless of their insurance status. For example, among those with health insurance, 43

percent of those with medical bill problems say there was a time in the past year when they or a family member

did not get a recommended medical test or treatment because of the cost, compared with just 13 percent of

those without such medical bill problems. Similarly, 41 percent of the insured who faced medical bill problems

say they did not fill a prescription in the past 12 months because of the cost, compared with 14 percent of those

with health insurance who did not have bill problems. Access to dental care can be affected, too; among those

with health insurance, 62 percent of those with medical bill problems report postponing dental care in the

previous year due to cost, compared with 29 percent of those without such problems.

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 17

Put off/postponed getting dental

care/check-ups

65%

31%

62%

29%

72%

42%

Relied on home remedies/over the

counter drugs instead of going to

see a doctor

62

32

58

30

71

44

Put off/postponed getting health

care you needed

60

22

58

21

65

37

Not filled a prescription for medicine

43

14

41

14

45

13

Not gotten a medical test/treatment

that was recommended by a doctor

43

13

43

13

43

13

Chosen a less expensive treatment

than the one your doctor

recommended

40

15

38

14

47

26

Cut pills in half/skipped doses of

medicine

34

9

32

9

39

13

Skipped/postponed rehabilitation

care that your doctor recommended

22

5

20

5

28

6

Medical bills can also lead to problems meeting other financial obligations and paying for basic necessities.

Among those with medical bill problems, about six in ten of both the insured (62 percent) and the uninsured

(62 percent) say they’ve had difficulty paying other bills as a result of medical debt. Over a third in each group

(34 percent of the insured and 39 percent of the uninsured) say they were unable to pay for basic necessities

like food, heat, or housing as a result of medical bills.

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 18

Although this survey focuses on the problems Americans face in paying medical bills, for many, medical bills

represent just one source of bills or debt. Most of those with medical bill problems report having other kinds of

debt, including credit card debt (56 percent), car loans (46 percent), student loans (33 percent), mortgages (32

percent), payday loans (17 percent), and other outstanding loans (31 percent). Among those with medical bill

problems, those with health insurance are more likely than those without insurance to report having credit

card debt (63 percent versus 43 percent), a car loan (52 percent versus 33 percent), or a mortgage (41 percent

vs. 16 percent), which may reflect better access to these types of credit among the insured group. However,

similar shares of the insured and uninsured report having a student loan (34 percent of the insured and 32

percent of the uninsured) and a loan owed to a payday lender (17 percent each).

35%

61%

34%

62%

39%

62%

Been unable to pay for basic necessities

like food, heat or housing

Had difficulty paying other bills (besides

basic necessities)

Total Insured Uninsured

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

Figure 13

Reports of Difficulty Paying Other Bills and Basic Needs As A

Result Of Medical Bills

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS: Percent who say

they have experienced any of the following in the past 12 months as a result of these medical bills:

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 19

For some of those with problems paying medical bills, medical debt makes up a large share of their total debt.

About one in five (22 percent, including 17 percent of the insured and 34 percent of the uninsured) say their

medical bills represent all or almost all of their total non-mortgage debt. By contrast, just over half (56 percent)

of the insured and about a third (36 percent) of the uninsured say they have either paid off all their medical

bills, or that medical debt makes up less than half of their total debt.

The survey also finds that once medical bill problems start, it can be difficult to make them stop, and that for

some, medical bills can start a cascade of other bill problems. Six in ten (60 percent) say this is not the first

56%

46%

33%

32%

31%

17%

63%

52%

34%

41%

32%

17%

43%

33%

32%

16%

29%

17%

Credit card debt

A car loan

A student loan

A mortage or home loan

Any other outstanding debts/loans

(besides medical bills)

A loan owed to a payday lender

Total

Insured

Uninsured

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

Figure 14

Many People With Medical Bill Problems Report Having Other

Types Of Debt

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS: Percent who say

they currently have the following types of loans or debt:

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS: Not counting

your mortgage, what share of your total debt would you estimate is due to medical bills?

NOTE: All or almost all includes those who still owe money for medical bills and have no other loans or debts. None or almost none includes

those who have paid off all medical bills. Don’t know/Refused responses not shown.

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

Figure 15

Share of Total Debt Due to Medical Bills

26%

30%

19%

24%

26%

17%

12%

12%

13%

14%

14%

15%

22%

17%

34%

None or almost none Less than half About half More than half All or almost all

Uninsured

By Insurance Status

Total

Insured

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 20

time they’ve faced medical bill problems, a share that is even higher among those who say their bills are the

result of an ongoing health problem (67 percent) and those who say the family member who generated the bills

has a disability (69 percent).

Further, while almost half (47 percent) say they’ve also had problems paying other unrelated bills in the past

year, medical bills appear to be either the sole problem or the main trigger of bill problems for the other half,

including 31 percent who say they’ve only had problems with medical bills, not other types of bills, and 19

percent who say their problems paying other bills started as a result of their medical bills.

Many of those who’ve faced household medical bill problems report struggling to make payments, both for

their medical bills and for other bills. Six in ten (61 percent) say they have been late on a payment for a medical

bill, and almost as many (56 percent) say they’ve missed a payment. Similar shares report being late or missing

payments for other (non-medical) bills (56 percent and 46 percent, respectively). Once a person has problems

paying medical bills, their insurance status appears to make little difference in their ability to pay bills on time.

Among those with medical bill problems, similar shares of the insured and uninsured say they’ve been late on a

payment (62 percent and 63 percent, respectively) or missed a payment (55 percent and 61 percent) for a

medical bill in the past year.

Far fewer, though still roughly two in ten, say they’ve defaulted on a loan for a medical bill (17 percent),

including a somewhat higher share of the uninsured (23 percent) compared to those with insurance (15

percent).

This is NOT the

first time you

have had such

problems

60%

Don't know/

Refused

3%

This is the first

time you have

had such a

problem

36%

Thinking about your most recent problem with medical bills,

would you say this was first time you had such a problem, or

have you had problems paying medical bills before that?

Figure 16

Many with Medical Bill Problems Have Problems with Other

Bills

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS:

No other bill

problems

besides

medical bills

31%

Have had

other bill

problems,

result of

medical bills

19%

Don't know/

Refused

2%

Have had

other bill

problems,

not a result

of medical

bills

47%

In addition to problems paying medical bills, have you also

had problems paying other types of bills in the past 12

months, or not? / Did your problems paying other types of

bills start as a result of your medical bills, or for some other

reason?

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 21

Likely as a result of missed or late payments, almost six in ten (58 percent) of those with medical bill problems

say they’ve been contacted by a collection agency in the past year, mostly because of medical bills alone (25

percent) or a combination of medical bills and some other type of debt (20 percent). Again, once medical bill

problems start, insurance offers little protection against such follow-up, with similar shares of the insured (56

percent) and uninsured (63 percent) saying they’ve been contacted by a collections agency in the past 12

months.

Yes, contacted by collection agency

58%

56%

63%

Because of medical bills

25

26

22

Because of some other type of bills

12

10

15

Because of both

20

19

24

No, not contacted by collection agency

41

44

34

NOTE: Don’t know/Refused responses not shown.

An indication of more serious financial problems, a small share (2 percent) of those with household medical

bill problems say they’ve declared personal bankruptcy in the past year, and another 16 percent report

declaring bankruptcy longer than 12 months ago. Overall, 11 percent say they’ve declared bankruptcy at some

point and that medical bills were at least a partial contributor to their bankruptcy. Among those with medical

57%

46%

19%

56%

48%

21%

62%

55%

15%

63%

61%

23%

Been late on a

payment for a

medical/other bill

Missed a

payment for a

medical/other bill

Defaulted on a

loan for a

medical/other bill

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS: Percent who say

they’ve done any of the following in the past 12 months:

Figure 17

Many of Those With Medical Bill Problems Report Being Late

and Missing Payments, But Fewer Have Defaulted

Medical bills Other types of bills

Insured

Uninsured

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 22

bill problems, reports of having declared bankruptcy are similar among the insured (21 percent) and those

without health insurance (14 percent).

Declared bankruptcy in the past 12 months

2%

3%

1%

Declared bankruptcy more than 12 months ago

16

18

12

Because of medical bills

3

3

3

Because of some other type of bills

7

9

4

Because of both

8

10

7

Never declared bankruptcy

82

79

86

NOTE: Don’t know/Refused responses not shown.

In today’s health care environment where information about the cost of health care services can be difficult to

find, patients and families often need to be savvy consumers in terms of estimating the cost of care (or their

share of the cost if insured), finding the best price, and working out a payment plan after services have been

received. The survey finds that some of those who faced medical bill problems found health care providers

willing to cooperate with them in setting up payment plans or reducing the amount they owed, while others

attempted to engage in cost-conscious health care shopping behaviors and met with little success.

Broadly, the survey finds that a majority of people both with medical bill problems (61 percent) and without

(63 percent) say doctors rarely, if ever, discuss the costs of recommended treatments and whether they would

be covered by insurance.

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 23

The survey does find, however, that those who’ve had difficulty paying medical bills are more likely than their

peers to report taking extra measures to negotiate prices or shop around for health care.

Compared to those who have not experienced medical bill problems, those who have faced such problems are

more likely to say that in the past 12 months, they have checked with a doctor’s office about the cost a visit

beforehand (49 percent versus 34 percent), shopped around to find the best price for a medical service (34

percent versus 17 percent), or negotiated with a provider to get a lower price before receiving services (22

percent versus 6 percent). However, those with medical bill problems are also more likely than those without

such problems to say they have been told by a provider they must pay in full up front before services are

provided (36 percent versus 14 percent).

Figure 18

Few in Either Group Say Doctors Regularly Explain Costs of

Procedures

16%

16%

22%

21%

26%

29%

35%

34%

Those who had problems

paying household medical

bills in the past 12 months

Those who did NOT have

problems paying

household medical bills in

the past 12 months

Almost always Sometimes Rarely Never

When you visit a doctor, how often does the doctor explain to you the costs associated with recommended procedures,

and whether they would be covered by your health insurance?

NOTE: Don’t know/Refused responses not shown.

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 24

Despite these extra efforts, many of those who say they tried to engage in cost-conscious behaviors found it

difficult or unproductive. Seven in ten (69 percent) of those who shopped around for a lower price on medical

services say it was difficult to find information about how much they would have to pay, and 67 percent of

those who attempted to negotiate with a provider for a lower price say they were unsuccessful in doing so.

Just over half (53 percent) of those who had problems paying medical bills say they worked out a payment plan

with a provider for at least some of what they owed. Most of these (28 percent of the total) say they did not pay

34%

14%

17%

6%

12%

49%

36%

34%

22%

21%

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

Figure 19

Those with Medical Bill Problems More Likely to Report

Engaging in Cost-Conscious Behaviors

Percent who say they have done each of the following in the past 12 months:

AMONG THOSE WHO HAD

PROBLEMS PAYING HOUSEHOLD

MEDICAL BILLS IN THE PAST 12

MONTHS:

AMONG THOSE WHO DID NOT

HAVE PROBLEMS PAYING

HOUSEHOLD MEDICAL BILLS IN

THE PAST 12 MONTHS:

Received free care or reduced fees from a doctor,

hospital, or health care clinic

Been asked to pay up front for the full cost of

medical care (not just your insurance copay)

Tried to negotiate with a doctor, hospital, or other

health care provider to get a lower price before

receiving services

Attempted to shop around at different providers

to find the best price for a medical service

Checked with a doctor’s office or health plan

before a visit to find out how much you would

have to pay

Yes

32%

Don't know/

Refused

<1%

No

67%

Very easy

8%

Somewhat

easy

21%

Don't know/

Refused

1%

Somewhat

difficult

46%

Very difficult

23%

Figure 20

Many Say Shopping and Negotiating for Health Care Services

Can Be Difficult and Unproductive

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD

MEDICAL BILLS IN THE PAST 12 MONTHS AND SAY THEY

SHOPPED AROUND FOR HEALTH CARE PRICES: When you

shopped around for prices or checked before a visit, how

easy or difficult was it to find the information about how

much you would have to pay?

AMONG THOSE WHO HAD PROBLEMS PAYING

HOUSEHOLD MEDICAL BILLS IN THE PAST 12 MONTHS

AND SAY THEY TRIED TO NEGOTIATE FOR A LOWER PRICE

FOR HEALTH CARE SERVICES: When you negotiated with a

health care provider, were you able to get a lower price,

or not?

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 25

a finance charge to the provider, while 12 percent say they did pay a finance charge and another 12 percent are

not sure.

[My wife] had an issue in her lower abdomen with chronic pain and went to see her OB/GYN for a

professional opinion. She had the initial visit and needed to have some diagnostic lab testing done as well as a

further ultrasound. She got no notification of the fees that were expected to be paid and the doctor told her

that there was nothing to pay except the co-pay. Fast forward a few months and she gets a notice from the

office saying that her unpaid bill is being forwarded to collections and will need to be paid immediately. She

was never given notice before this collections notice and the fees seemed to be hidden or unknown to the

doctor's office. The disconnect between the medical services provided, and payment processing for those

services provided, seems to be one of the largest issues, where one party is unaware of what the other needs

to charge and does not give the patient the appropriate financial information in regards to the services being

rendered.

Many hospitals have programs available to reduce or waive bills for people who have trouble paying, and non-

profit hospitals are required to have such programs.

5

Among those who report problems paying hospital bills,

about half (47 percent) do not know if the hospital where they received care has such a program or not. Over a

quarter (27 percent) say the hospital does have such a program, and 15 percent signed up for it. Additionally,

fourteen percent of those who had problems paying medical bills other than hospital bills say a health care

provider agreed to reduce the amount they owed.

12%

28%

12%

Yes

53%

Don't know/

Refused

5%

No

43%

Figure 21

More Than Half of Those with Medical Bill Problems Have

Worked Out a Payment Plan with a Health Care Provider

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

AMONG THOSE WHO HAD PROBLEMS PAYING HOUSEHOLD

MEDICAL BILLS IN THE PAST 12 MONTHS: Did you work out a

payment plan with any health care provider for at least some

of what you owed, or not?

ASKED OF THE 53% WHO SAY THEY WORKED OUT A

PAYMENT PLAN: (Percentages shown based on total who

had problems paying hospital bills)

Are you or were you paying interest or a finance charge to

the provider, or not?

Yes, paying interest or

a finance charge

No, not paying

interest or a finance

charge

Not sure

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 26

These survey findings confirm that problems related to unaffordable medical bills and medical debt are

prevalent, affecting roughly 1 in 4 non-elderly adults in the United States. Certain groups are more vulnerable,

including individuals and families with lower incomes and limited financial assets, people with chronic medical

conditions and disabilities, the uninsured, and people insured by plans with high deductibles. Even so, people

are not immune who have higher incomes, who are insured, or who are otherwise in good health and then

experience unexpected health problems.

Insurance features like cost-sharing, provider networks, and confusing billing practices can all lead to medical

bill problems among the insured. While higher deductibles and other forms of cost-sharing have helped to keep

health insurance premium growth at historically low levels in recent years, the survey highlights the

consequences these changes can have for people. Price transparency is another issue; while many say they tried

to research treatment option costs in advance, most say such information was difficult to find.

The survey also shows that medical bill problems can have real and often lasting impacts on individuals and

families in terms of their standard of living, their financial stability, and their ability to access needed health

care. While insurance provides some protection against incurring medical bill problems in the first place, once

these problems occur, the effects on individuals and families are often as serious for the insured as they are for

the uninsured. As the nation moves beyond the debate over the Affordable Care Act, issues of health care costs

and affordability like those highlighted by this survey are likely to play a prominent role in health policy

discussions. Information about the causes of medical debt and its impacts on people can play an important part

in these discussions and help policymakers and others as they work on solutions to alleviate the burden of

medical debt on American families.

12%

15%

Yes

27%

No

25%

Don't know

47%

Figure 22

Many Who Had Hospital Bill Problems Are Unaware of Hospital

Fee Reduction Programs

SOURCE: Kaiser Family Foundation/New York Times Medical Bills Survey (conducted August 28-September 28, 2015)

AMONG THOSE WHO HAD PROBLEMS PAYING HOSPITAL

BILLS IN THE PAST 12 MONTHS: Does any hospital where

you received care have a program to reduce or waive

bills for people who have trouble paying, or not?

ASKED OF THE 27% WHO HAD PROBLEMS PAYING

HOSPITAL BILLS IN THE PAST 12 MONTHS AND SAY THEIR

HOSPITAL HAS A PROGRAM TO REDUCE BILLS:

(Percentages shown based on total who had problems

paying hospital bills)

Did you enroll or sign up for the program, or not?

Yes, enrolled or signed up for

the program

No, did not enroll or sign up

for the program

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 27

Insurance status

Uninsured

53

Employer coverage

19

Non-group coverage

22

Medicaid

18

Deductible level (among those with

employer or non-group coverage

Private insurance, high deductible

6

26

Private insurance, lower deductible

15

Annual household income

Less than $50,000

37

$50,000-$99,999

26

$100,000 or more

14

Disability prevents from participating

fully in work, school, housework, other

activities

Yes

47

No

22

Self-reported health status

Fair/poor

45

Excellent/very good/good

22

Receiving regular medical treatment

for any chronic health problem

Yes

34

No

23

Gender

Male

23

Female

29

Age

18-29

31

30-49

24

50-64

25

Children in household

Yes

29

No

24

Education

High school or less

32

Some college

30

College graduate

16

Race/ethnicity

White, non-Hispanic

24

Black, non-Hispanic

31

Hispanic

32

Other/mixed race

25

Census Region

Northeast

18

Midwest

23

South

32

West

26

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 28

The Kaiser Family Foundation/New York Times Medical Bills Survey is based on interviews with a probability-

based sample of 2,575 respondents between the ages of 18 and 64 conducted August 28 through September 28,

2015. Interviews were administered online and by telephone in English and Spanish, including a longer

interview with 1,204 adults who reported problems paying household medical bills in the past 12 months and a

shorter comparison survey with 1,371 who did not report such problems. Teams from the Foundation and The

Times worked together to develop the questionnaire and analyze the data, and both organizations contributed

financing for the survey. Each organization is solely responsible for its content.

NORC at the University of Chicago conducted sampling, interviewing, and tabulation for the survey using the

AmeriSpeak Panel, a representative panel of adults age 18 and over living in the United States. AmeriSpeak

Panel members are recruited through probability sampling methods using the NORC National Sample Frame,

an address-based sampling frame. Panel members who do not have internet access complete surveys via

telephone, and internet users complete surveys via the web (for the current survey, 619 respondents completed

via phone and 1,956 via web).

The combined results have been weighted to adjust for the fact that not all survey respondents were selected

with the same probability, to address the implications of sample design, and to account for systematic

nonresponse along known population parameters. The first weighting stage addressed differences in

probability of selection for the AmeriSpeak Panel and to account for differential nonresponse to the

AmeriSpeak screening interview. At this stage, an adjustment was also made to account for the undersampling

of panelists who did not report problems paying household medical bills and to account for differential

nonresponse to the survey screening interview.

In the second weighting stage, the sample was adjusted to match known demographic distributions of the U.S.

population ages 18-64 by age, gender, education, race/ethnicity, Census region, and household income.

Demographic weighting parameters were based on the U.S. Census Bureau’s 2015 March Supplement to the

Current Population Survey.

The margin of sampling error including the design effect for the full sample is plus or minus 3 percentage

points. All statistical tests of significance account for the effect of weighting. Numbers of respondents and

margin of sampling error for key subgroups are shown in the table below. For results based on other

subgroups, the margin of sampling error may be higher. Sample sizes and margins of sampling error for other

subgroups are available by request. Note that sampling error is only one of many potential sources of error in

this or any other public opinion poll.

Group

N (unweighted)

M.O.S.E.

Total adults ages 18-64

2,575

±3 percentage points

Problems paying household medical bills past 12 months

1,204

±4 percentage points

No problems paying household medical bills past 12 months

1,371

±4 percentage points

Insured

802

±5 percentage points

Uninsured

369

±8 percentage points

Kaiser Family Foundation public opinion and survey research and NORC at the University of Chicago are both

charter members of the Transparency Initiative of the American Association for Public Opinion Research.

The Burden of Medical Debt: Results from the Kaiser Family Foundation/New York Times Medical Bills Survey 29

1

Medical Debt Among People With Health Insurance, Kaiser Family Foundation, January 2014. http://kff.org/private-

insurance/report/medical-debt-among-people-with-health-insurance/

2

People ages 65 and older also experience problems paying medical bills. However, since nearly all of them have access to health

insurance coverage through Medicare, and since their family budget considerations are often quite different from those of younger

adults, we limited this survey to those ages 18-64.

3

Throughout this report, higher deductibles are defined as $1,500 and above for an individual or $3,000 and above for a family.

4

Results are similar if respondents are grouped by an estimate of their income as a percentage of the federal poverty level (FPL) using

information on income and family size, rather than based on household income alone.

5

New Requirements for 501(c)(3) Hospitals Under the Affordable Care Act, Internal Revenue Service, https://www.irs.gov/Charities-&-

Non-Profits/Charitable-Organizations/New-Requirements-for-501(c)(3)-Hospitals-Under-the-Affordable-Care-Act

6

Throughout this report, higher deductibles are defined as $1,500 and above for an individual or $3,000 and above for a family.

the henry j. kaiser family foundation

Headquarters

2400 Sand Hill Road

Menlo Park, CA 94025

Phone 650-854-9400 Fax 650-854-4800

Washington Oces and

Barbara Jordan Conference Center

1330 G Street, NW

Washington, DC 20005

Phone 202-347-5270 Fax 202-347-5274

www.k.org

This publication (#8806) is available on the Kaiser Family Foundation’s website at www.k.org.

Filling the need for trusted information on national health issues, the Kaiser Family Foundation is

a nonprot organization based in Menlo Park, California.