Performance Variation in the NBA:

Guaranteed Contracts and the Contract

Year Phenomenon

Neal Jean

Professor Peter Arcidiacono, Faculty Advisor

Honors Thesis submitted in partial fulfillment of the requirements for Graduation with

Distinction in Economics in Trinity College of Duke University.

Duke University

Durham, North Carolina

2010

2

Acknowledgments

I would like to thank my faculty advisor, Professor Peter Arcidiacono, an avid follower of

the NBA in his own right. Without his insights and ideas, much of the quality of my

paper would not have been possible. I would also like to thank Professor Kent

Kimbrough, who encouraged me to pursue a topic that I was truly interested in and

helped to guide the formulation of my research goals and objectives. My gratitude goes

out to Professor Michelle Connolly who, despite having no prior interest in basketball,

spent hours reading and discussing my paper with me, and helped with everything from

the development of theoretical hypotheses to the empirical analysis. Finally, I am

indebted to my Economics 198S and 199S classmates for their patience and comments.

In the spirit of this paper, all fouls are my own.

3

Abstract

Asymmetric information in the typical principal-agent model may create

incentives for workers to participate in opportunistic or strategic behavior. This paper

examines evidence for the existence of ex ante and ex post strategic behavior in the

National Basketball Association (NBA), where multi-year guaranteed contracts give

players incentive to vary their effort level over the course of the contract cycle. I

hypothesize that players will increase effort in a contract year, the season prior to signing

a new contract, and decrease effort in the following season, with the assumption that

variations in effort are expressed through variations in performance. Player productivity

is found to increase significantly in a contract year, while no evidence is found to support

the presence of shirking behavior. The resulting model may serve to guide NBA teams in

structuring contracts, as appropriate performance incentives built into individual player

contracts could positively influence team success.

4

I. Introduction

In the principal-agent models present in most organizations, inefficiencies may

arise from the creation of long-term contract agreements. Knowing that their future

wages are guaranteed, workers have an incentive to participate in opportunistic or

strategic behavior, generally referred to as shirking behavior (Alchian and Demsetz 1972;

Holmstrom 1979). The moral hazard problem leading to the occurrence of shirking

behavior results from asymmetrical information between the parties involved.

1

In

general, opportunistic behavior may occur under the following conditions:

2

1. The principal and the agent enter into a binding, long-term contract,

through which the agent is compensated by the principal for expending

effort at some cost to himself.

2. The principal’s level of utility or profit is a function of the agent’s

level of effort expended.

3. The principal is unable to monitor the effort of the agent directly.

Under these conditions, the agent may decide that he has sufficient incentive to

strategically vary his effort level. This paper will examine the question of whether this

type of strategic behavior exists in the context of long-term guaranteed contracts in the

National Basketball Association (NBA).

Maxcy et al. (2002) introduces the terminology ex ante strategic behavior and ex

post shirking to describe potential worker behavior under circumstances of asymmetrical

1

Regarding asymmetrical information, Holmstrom (1979) mentions that situations in which the private

actions of individuals affect the outcome distribution have long been recognized for the risk of moral

hazard. Since individual actions cannot be observed and contracted upon, contracts are written without

complete information.

2

As described by Krautmann and Donley (2009).

5

information. Ex ante strategic behavior refers to an increase in effort expended by the

agent prior to the signing of a new contract. In attempting to increase his perceived value

to the principal, the agent seeks to maximize the level of compensation guaranteed him

by the impending contract. Ex post opportunistic behavior, or shirking, is defined as a

decrease in effort expended by the agent once the contract is signed. Since compensation

is then guaranteed, regardless of effort level, the agent has no incentive to continue

performing with maximal effort.

3

A key point here is that the employer is unable to

observe employee effort level directly; if effort-monitoring were possible, the employer

would be able to structure contracts accordingly and guarantee an efficient outcome.

4

Strategic behavior as a result of long-term guaranteed contracts has been widely

cited in academic economic literature and also carries significant real-world implications,

arising in such diverse situations as manufacturing sales, political decisions, nuclear

power plants, and the academic institution of tenure (Krautmann 1990).

56

3

A brief note on terminology: Strategic behavior and opportunistic behavior will be used interchangeably

to describe any type of changing behavior as a result of information asymmetry during the contract cycle.

The term shirking will be used to describe ex post strategic or opportunistic behavior.

Whenever

agents are faced with the incentives created by long-term contracts, they are also

presented with motivation to vary their effort to maximize their own utility. Consider the

example of university professors and tenure: One can imagine that a professor seeking

4

If a principal were able to observe effort directly, he could simply compensate agents directly for the level

of effort that they contribute toward the principal’s production. In reality, the principal must make an

estimate of the agent’s future effort level and productivity that may be unmet by the agent’s actual

contribution.

5

Oyer (1998) examines the impact of incentives as they relate to the sales of manufacturing firms, and

finds that sales are often boosted near the end of the fiscal year as salesmen try to hit their incentive targets

and increase their own compensation.

6

Krautmann (1990) gives an interesting example illustrating the usefulness of being able to distinguish

shirking behavior from the outcome of a stochastic process. He says to imagine a safety regulation scheme

for nuclear power plants that induces the socially optimal maintenance and safety effort. Even with this

optimized system, he argues that accidents can still occur as the result of random processes. In these cases,

regulators would be better served to categorize these failures as random events rather than assigning fault to

and punishing the individual plant, as this would cause the plant to respond by overspending on future

maintenance and accident prevention, rather than simply spending the original, optimal amount.

6

tenure would be very productive, publishing original research on a regular basis, but upon

achieving tenure, might lose motivation and kick back, enjoying the flexible lifestyle

afforded him. We of course hope that most professors are more scrupulous and resist the

temptation to take advantage of the opportunity to exert effort strategically, but this

example makes it clear that such opportunities exist.

7

Professional sports offer an ideal setting to study the incentive effects of long-

term contracts, as players are carefully observed by teams, fans, and media, resulting in

an expansive and thorough set of productivity data that is widely available for analysis.

Already, a number of researchers have utilized the unique environment of professional

sports to search for evidence supporting the shirking hypothesis, with varying results.

8

Most of these studies have focused on Major League Baseball (MLB), as performance

metrics that measure player productivity are more widely agreed-upon in baseball,

although a few have also examined the NBA.

9

7

Stiroh (2007) points out that in other situations involving long-term contract cycles (e.g., professors

working for tenure or politicians seeking election), the inefficiencies caused by incentivized strategic

behavior could be even higher than in the NBA, due to greater information asymmetry and less monitoring

ability.

Perhaps as a result of employing different

empirical specifications, research concerning professional sports has drawn conflicting

conclusions. Stiroh (2007) claimed that there is strong evidence that players engage in

strategic behavior, while many others have refuted the existence of such behavior

(Krautmann 1990; Maxcy et al. 2002; Berri and Krautmann 2006; Krautmann and

8

Krautmann and Donley (2009) give a brief description of the typical study in professional sports. Usually

the researchers examine the player’s performance in proximity to contract negotiations. Conclusions about

the presence of shirking behavior are drawn from the discrepancies between observed ex ante and ex post

performance and expected performance.

9

Berri and Krautmann (2006) remark that baseball has a number of indices that have been designed

specifically to capture the productivity of an individual player in a single number.

7

Donley 2009).

10

The NBA was chosen from among the three major professional sports leagues in

the United States as the league to be studied for several reasons. From a practicality

standpoint, the prevalence of long-term guaranteed contracts in the NBA provides a

textbook setting in which to study shirking behavior––unlike, for example, the National

Football League (NFL), in which large portions of a player’s contract are not guaranteed,

and players can be cut or released at the team’s discretion. The relative scarcity of

performance-based incentives in the NBA also contributes to an environment that would

support the shirking hypothesis.

The goal of this paper is to explore the ex ante and ex post phenomena

of opportunistic behavior in a specific labor market, the National Basketball Association

(NBA).

In terms of impact, the question of whether or not strategic behavior exists in the

NBA is arguably more important, and certainly more complex, than in the NFL or MLB.

Team sizes are much smaller in the NBA, making each athlete—and accordingly, each

athlete’s contract—that much more important to the success of the team. Think back to

the 2006-07 season, when Lebron James carried a team of largely mediocre players all

the way to the NBA Finals, or the next season, when the Celtics’ acquisition of Kevin

Garnett and Ray Allen led to a year-on-year improvement of 42 wins and culminated in

the 2007-08 NBA Championship. Unlike football, in which the vast majority of players

play either offense or defense but not both, or baseball, where most players spend only a

10

Stiroh (2007) found evidence of shirking behavior in the NBA, while studies refuting the shirking

hypothesis have been conducted using both NBA and MLB data. Maxcy (2002) rejects strategic behavior,

citing that the data suggests that mechanisms incorporated into the structure of MLB contracts intended to

prevent players from strategically adjusting their effort seem to be fulfilling their role. Examples of such

mechanisms include performance incentives, team success bonuses, and clauses that allow for

performance-based contract renegotiation.

8

fraction of the game directly participating in the action, basketball is a game in which

players are constantly involved.

11

While individual contributions are generally more important in basketball, an

added layer of complexity arises when one attempts to quantify these contributions.

Compared to baseball, the other prominent arena for studying shirking behavior, player

effort in basketball is notoriously difficult to measure. To illustrate, imagine a baseball

player who is up to bat. Presumably, there are players who care more than others about

whether or not they get a hit, but it seems unlikely that this will affect their effort to hit

the ball. It is debatable whether or not a player can hit a curveball more effectively

simply by trying harder. In basketball, the effect of effort on player performance is

intuitively apparent, though not always easy to discern through statistical analysis. It

makes perfect sense that a basketball player can play better defense by exerting more

effort, getting into a lower defensive stance, and rotating to help his teammates. A player

can also help his team by diving for loose balls or boxing out on offense to earn extra

possessions. Of course, since teams cannot monitor the effort of their players directly—

one of the conditions under which strategic behavior can occur—they must determine

effective methods to indirectly measure player effort.

While on the court, NBA players are continuously

contributing to both the offensive and defensive efficiency of their team. Individual

athletes make a greater impact in basketball than in any other major team sport popular in

the United States.

11

One could make the argument that starting pitchers in baseball are able to affect the outcome of an

individual game to a greater extent than any player in a basketball game. Though it is difficult to quantify

contributions across sports to allow for comparison, intuitively this claim is not without merit. However,

the key is that starting pitchers can influence an individual game. Since most pitchers start once every four

to five games during the regular season, they are limited to affecting the team’s performance at most 25%

of the time.

9

Generally, teams resort to using statistics of player performance as a proxy for

effort. The paradox here, however, is that while an individual can make a greater impact

in basketball than in baseball, basketball is simultaneously a more team-oriented sport. If

a baseball player wishes to improve his performance, he can easily see where he should

focus his efforts. Hitting and fielding, the primary components of the game for most

position players, are largely individual capacities. In basketball, however, the answer is

much less easily defined. Consider two average and equally dedicated NBA players,

Player A and Player B. Suppose Player A chooses to focus on improving his scoring

ability; any improvement in this domain will show up in the box score at the end of the

game. Now suppose Player B concentrates his effort on playing effective help defense or

on boxing out for offensive rebounds; even the most dramatic improvements in these

areas might not be reflected in the statistics. We see here that two players who devote an

equal amount of energy may not appear to benefit the team in equal measure. A

successful general manager, then, must discern a player’s true value to his team in the

face of divergent statistical inputs. Furthermore, how players decide to allocate effort

may change over time. Clearly, these complexities will be problematic in determining an

effective measure of player productivity to be used as a proxy for effort.

The two pieces of literature most relevant to my current research are Stiroh (2007)

and Berri and Krautmann (2006). Both of these studies look for evidence of

opportunistic behavior in the NBA, with Stiroh (2007) concluding that the hypothesis

was strongly supported, and Berri and Krautmann (2006) claiming that there was no

evidence that NBA players engaged in shirking behavior. My research will attempt to

synthesize and build on the methods of Stiroh (2007) and Berri and Krautmann (2006),

10

ultimately arriving at a more effective method of determining the presence of strategic

behavior in the context of NBA player contracts. Two main objectives will be pursued

through this study: First, I hope to evaluate several methods of measuring player

performance and then identify the measure that I believe to be most appropriate for this

study. Second, I will determine whether or not sufficient evidence exists to support the

hypothesis that players engage in strategic behavior, answering the original research

question that was the inspiration behind this study.

Using a playing-time adjusted measure of player performance, I find that evidence

for the contract year phenomenon, or ex ante strategic behavior, does exist in a dataset

that includes more recent observations than those used in the aforementioned studies. Ex

post shirking, however, is not supported by the data, although shirking behavior may be

masked by confounding factors. Additionally, in the course of this study, I develop a

method for separating the interrelated effects of age and experience on player

productivity by measuring experience in such a way that it is no longer perfectly

correlated with the passage of time.

The rest of this paper will be organized as follows: Section II will review the

existing body of literature and discuss its relevance to the current research. Section III

will describe the economic theory of shirking and its implications for my empirical

analysis. Section IV will provide an overview of my data set and discuss any limitations

that it might impose. Section V will establish my empirical specification. This section

will include my expectations for the results of the study, as well as the actual results

obtained. Section VI will conclude the paper, and discuss possibilities for further

improvement and research on the topic.

11

II. Literature Review

Long-term Guaranteed Contracts in the NBA

Shirking behavior has the potential to occur when an agent is signed to a long-

term, guaranteed contract, in which he is compensated by the principal for the

expenditure of costly effort (Krautmann and Donley 2009). The NBA provides a large

sample of these types of situations, as well over half of all players are under contract for

two or more seasons.

12

Stiroh (2007) offers a discussion about why long-term contracts have not been

replaced with alternatives such as incentive-based contracts or short-term contracts.

Instead of fixing future compensation at the moment that the contract is signed, an

alternative to the guaranteed contract would be to offer players long-term, incentive-

based contracts. Incentive-based contracts compensate players for reaching certain

Since contracts in the NBA are largely multi-year and guaranteed,

players could choose to raise their effort prior to signing a long-term contract, then

reduce their effort level substantially after locking in a guaranteed salary for the ensuing

several years. Since opportunistic behavior is associated with the presence of long-term

guaranteed contracts, one may reasonably wonder why the NBA continues to utilize

multi-year contracts. Given that the nature of the industry limits the accuracy of

information that employers can obtain about their workers’ behavior, why wouldn’t they

simply eliminate the types of contracts that promote strategic behavior altogether?

12

Unlike contracts in the NFL, NBA contracts are fully guaranteed (Berri and Krautmann 2006).

Regardless of whether or not a player plays in games, or even if the player is with the team, the team must

continue to pay the player under the original terms of the contract.

12

standards of performance.

13

A reduction in the guaranteed portion of the contract would

motivate players because their pay would then be dependent upon their performance,

rather than remaining fixed, as in the guaranteed contracts that currently prevail in the

NBA. Many NBA contracts already contain performance-based incentives, though these

usually compose only a small fraction of the total value of the contract.

14

Unlike other

professional sports leagues that make extensive use of performance incentives, such as

the NFL or MLB, bonuses in the NBA are generally limited to far less than 25% of the

player’s total salary (Heubeck 2003; Stiroh 2007).

15

Prendergast (1999), in his work on firms providing incentives to their workers,

discusses the benefits and drawbacks of pure incentive contracts.

Consider the example of Peyton

Manning, the star quarterback of the NFL’s Indianapolis Colts. In 2004, Manning signed

a 7-year contract worth $99.2 million. Manning could also earn up to an additional $19

million in contract incentives. Of this total, only $34.5 million was guaranteed money in

the form of a signing bonus. In contrast, contracts in the NBA are almost fully

guaranteed.

16

13

For example, it might be specified in a player’s contract that he would be paid a base salary of $10

million for the season, and incentives of $1.5 million for averaging 20 points per game (ppg), $1 million for

averaging 10 rebounds per game (rpg), and $1.25 million for averaging 5 assists per game (apg). If the

player averaged 19 ppg, 12 rpg, and 4 apg, he would be paid the $10 million base salary plus the extra $1

million for averaging over 10 rpg for a total of $11 million in compensation for the season.

By construction, a

contract that is entirely composed of performance incentives is far riskier than a contract

in which all future payments are guaranteed. It follows that a risk-averse worker would

14

Incentives can be included for achievements that are not purely statistical. For example, a player may

have bonuses written into his contract that would reward him for winning league awards such as the Most

Valuable Player (MVP), or for being voted onto the conference All-Star team or the All-NBA team.

15

Salary structure in the NBA is regulated by the collective bargaining agreement (CBA) between the

National Basketball Players’ Association (NBPA), which is the players’ union, and the NBA. The CBA

distinguishes between “likely bonuses” and “unlikely bonuses” in the incentives clauses included in player

contracts, and state that “unlikely bonuses” cannot exceed 25% of the player’s salary.

16

This would be the limiting case, in which all compensation is contingent on the agent fulfilling the terms

of the incentive clauses written into the contract and there is no guaranteed compensation.

13

require the expected value of the total compensation under a pure incentive contract to be

higher than the amount guaranteed by a fixed-wage long-term contract. This is especially

true in professional sports leagues such as the NBA, where a highly volatile environment

limits the ability of the player to accurately forecast his own future performance (Stiroh

2007). For example, for most players, playing time is distributed at the discretion of the

team’s coach, meaning that there is no guarantee that an individual player will even have

the opportunity to accumulate the necessary statistics to meet their contract incentives.

Additionally, injury is a common and unpredictable limit on the productivity of

professional athletes, and as such, also presents a risk to a player’s compensation. Given

such high levels of uncertainty, if NBA teams wanted to implement incentive-based

compensation schemes, they would have to pay players a much higher average salary to

convince them to accept the increase in volatility from riskless guaranteed contracts. We

can infer that the corresponding productivity gains from increased player effort would not

be enough to offset the increased financial expense of incentive-based contracts for NBA

teams.

Stiroh (2007) also considers short-term contracts as an alternative to long-term

contracts. If teams are worried that players might increase their effort in contract years

and then decrease it after signing a long-term contract, why not make every season a

contract year, and motivate players to play hard every year to earn a lucrative deal for the

next season?

17

17

A contract year is defined here as the last season before signing a new contract. It is in the contract year

that ex ante strategic behavior is hypothesized to occur.

However, this solution of year-by-year contracts is not as ideal as it

sounds. There are many advantages to long-term contracts in the NBA, both for the

teams and for the players. From the team’s perspective, signing a player for the long-

14

term can provide positive returns in excess of the player’s on-court contributions—

professional athletes also serve as commercial commodities. By signing popular players,

teams can create fan interest and develop loyalty among supporters, which over time

results in increased box office revenues, as well as profits from sales of jerseys or other

team paraphernalia. In terms of winning games, keeping players for multiple seasons can

also have positive effects on team performance. It is commonly accepted—and anyone

who has ever played competitive team sports would agree—that players learn to play

more effectively with specific teammates over time, a performance-enhancing

consequence that results naturally when a core group of players stays with a team for

multiple seasons.

From the player’s perspective, long-term guaranteed contracts are preferable to

short-term contracts for the same primary reason that they are preferable to incentive-

based contracts. Simply put, long-term contracts reduce volatility in compensation by

smoothing out the risks posed by injury concerns and other unpredictable circumstances.

Suppose a player is given a choice between guaranteeing a relatively high salary for the

next few years and playing for a new, more profitable contract each season—but at the

same time exposing himself to the risk of not earning any new contracts beyond the

current season, as in the event of a career-ending injury. It is clear that in most situations

the player would choose the guaranteed money over multiple seasons. There are other,

less significant concerns that would predispose a player to prefer longer-term contracts,

such as not having to make new living arrangements if moving to a new city, building a

relationship with the team and city that he is currently playing for, and so forth.

Opportunistic Behavior in the NBA

15

As mentioned before, the two previous studies on incentive effects of long-term

guaranteed contracts in the NBA reached conflicting conclusions. Both provide

significant insights on the topic, and the theoretical framework supporting this paper has

drawn on components of each previous study. We will begin with a review of Stiroh

(2007), in which the author found strong evidence of opportunistic behavior by using

both individual statistics and a composite statistic as measures of player performance.

We will then examine Berri and Krautmann (2006), in which the authors found weak

evidence supporting the shirking hypothesis using the NBA’s measure of player

productivity, and evidence against shirking when using a measure of each player’s

marginal productivity.

The motivating hypothesis in Stiroh (2007) is that imperfect information and

multi-year contracts create an implicit incentive for workers to strategically alter their

effort over the contract cycle. Stiroh defines information asymmetry as the condition

under which an employer cannot perfectly distinguish between effort and ability in his

employees, but rather sees only an indicator that results from a combination of the two.

Using this instrument, the principal must form perceptions about the quality of the agent,

and then structure long-term compensation using these incomplete perceptions. From the

other side of the strategic game, theory tells us that a rational worker should choose to

exert an optimal level of effort in each year of the contract cycle. Returning to the

specific case of the NBA, Stiroh continues to explain that players in their contract year

should choose their effort level by balancing the gains from higher wages in future

contracts with the disutility that arises from increasing effort. Similarly, in the season

following the signing of a new contract, players should have incentives to decrease their

16

effort level. At this point, the cost of exerting effort is not balanced by any marginal

benefit, since compensation levels have already been fixed by the terms of the contract.

Applying these theoretical results, his goals are to test for two indicators that he believes

would support the shirking hypothesis: whether players exert above-average effort in

contract years and whether players exert less effort after the new contract is signed.

In his study, Stiroh (2007) uses contract data from the 2000-2001 NBA season

and player statistics from 1988 through 2002.

18

He estimates the following weighted

OLS regression in order to test his hypotheses:

P, the dependent variable, is a performance metric that depends on the dummy variables

PRE and POST, which determine whether or not the performance occurs in a contract

year or in the season immediately following. NAGE is a standardized measure of the

player’s age relative to the league average, and each of the α’s corresponds to dummy

variables to control for unobserved individual ability, player position, year, and team.

1920

The performance metrics employed by Stiroh (2007) are quite elementary, as the

regression is estimated several times using individual measures of performance, and once

using a composite rating. The following individual statistics were used: points scored,

total rebounds, assists, blocked shots, shots attempted, free throws attempted, and

The shirking hypothesis predicts that the coefficients on the dummy variables PRE and

POST will be positive and negative respectively, showing that performance increases in

the contract year and decreases following the signing of the contract.

18

The year 1988 corresponds to the 1988-99 NBA season.

19

The variable NAGE is used to control for predictable age-related effects (Stiroh 2007).

20

Player position refers to the position that the player primarily plays when he is on the court. Position is

relevant because players who play different positions can be expected to accumulate different distributions

of statistics. Players in this study were classified as guards, forwards, or centers.

tijtpiAGEPOSTPREti

NAGEPOSTPREP

,,

εααααβββ

+++++++=

17

minutes played. The reasoning behind including shots and free throws attempted as

dependent variables is that attempts might be a better proxy for player effort, as the

player is able to control these statistics more directly. The composite rating used was

designed to summarize a wide range of performance statistics and provide a

comprehensive measure of overall performance.

21

Using the composite statistic, Stiroh finds statistically significant evidence of both

performance increases in the contract year and performance decreases in the following

year. Using the seven independent statistics, he discovers that the data strongly supports

an increase in performance during the contract year, but fails to provide evidence for a

decrease in production after the contract has been signed, instead showing that player

performance regresses to the long-run mean. In other words, these results support the ex

ante strategic behavior hypothesis, but find no evidence in the data that players also

display shirking behavior after signing a new contract.

The Berri and Krautmann (2006) study is motivated by the same hypothesis as

Stiroh (2007), namely that opportunistic behavior can occur when there is incomplete

information in the labor contract between principal and agent. Berri and Krautmann

approach the problem differently in several important ways, beginning with the objective

of the research. Instead of searching for evidence of opportunistic behavior both before

and after the signing of a contract, they only look for evidence that supports ex post

shirking behavior.

21

The composite rating is calculated as (field goals made*1.4 + blocked shots*1.4 + free throws made*1.0

+ assists*1.0 + steals*1.0 + offensive rebounds*0.85 + defensive rebounds*0.5 – turnovers*0.8 – field

goals missed*0.6) / (minutes played / 48).

18

The model estimated by Berri and Krautmann (2006) is listed below:

The chosen measure of productivity is the dependent variable, regressed on dummy

variables D2 and D12 for the years of experience that the player has in the NBA, the

change in games played from the previous season to the current season as a proxy for

injury, the years of experience that the coach has, the lifetime winning percentage of the

coach, the change in the number of team wins, a variable that accounts for the roster

turnover, and the dummy variable that indicates that a player is in their first season after

signing a new long-term contract.

22

Berri and Krautmann (2006) note that from prior

work, they have discovered that player productivity is nearly constant over the course of

a player’s career, with two notable exceptions. Productivity increases sharply in the first

two seasons of a player’s career, and then decreases steadily once the player reaches his

12

th

22

The ΔROSTER variable was calculated by first determining which players were on the team in both the

previous season and the current season, adding up the minutes played by those players in both seasons, and

then dividing by the total number of player minutes available in both seasons. This measure was developed

in Berri and Jewell (2004).

year of experience. Therefore, a dummy is included for players with more than 2

years of experience, and another for players with more than 12 years. The change in

team wins variable is designed to account for the impact of teammate quality on player

productivity. The assumption is that a player’s productivity falls with increasing

teammate quality, as his teammates contribute a greater portion of the team’s overall

production.

∆PROD =

β

0

+

β

1

D2+

β

2

D12+

β

3

∆GP +

β

4

CEXP +

β

5

CWPCT

+

β

6

TMWINS +

β

7

∆ROSTER+

θ

1

SHIRKING +

ε

19

The term designated SHIRKING was tested by Berri and Krautmann using three

different variables. In the first model, the simple SIGNED variable was used, a dummy

equal to 1 when a player was in the season immediately following the signing of a new

contract. Next, they tested the interaction with contract length (SIGNED × LENGTH),

and the interaction with salary (SIGNED × SALARY). If the ex post shirking hypothesis

is supported by the data, then we would expect to see a negative coefficient on whichever

variable was being used for the SHIRKING variable in the test. As stated previously,

Berri and Krautmann (2006) found weak evidence supporting the shirking hypothesis

when using the NBA’s measure of player productivity, and evidence refuting the shirking

hypothesis when using a marginal productivity measure, with the additional result that

the coefficients on SIGNED and (SIGNED × LENGTH) were significant, while the

coefficient on (SIGNED × SALARY) was not. From their study, they concluded that

signing a new long-term contract would decrease player productivity by about 2-4%,

while increasing the size of the contract signed had no effect on productivity.

Using the marginal product method of measuring player efficiency, the evidence

obtained by Berri and Krautmann (2006) refutes the shirking hypothesis. They conclude

that in the argument over whether opportunistic behavior takes place in professional

basketball, the answer is largely dependent on the measure of player productivity chosen.

However, they hint that the conventional methods of measuring player efficiency, such as

that employed by the NBA, may be lacking in their ability to fully capture a player’s

contributions to his team’s success. From their implication that the marginal product

metric better represents the productivity of an individual player, we can infer that Berri

20

and Krautmann believe that shirking behavior in the NBA is not supported by the

available data.

III. Theoretical Framework

Testing for Strategic Behavior

The underlying foundation of this paper is the theoretical prediction that the

principal-agent model present in the NBA provides incentives for players to strategically

alter their effort and therefore their performance over the course of the contract cycle.

23

Choosing a Model of Player Productivity

Testing for the presence of ex ante strategic behavior and ex post shirking, terms

introduced by Maxcy et al. (2002), will be the main goal of this study. In theory, players

will exert more effort in the season prior to signing a long-term contract; their incentive

for doing so is the promise of higher compensation over the duration of their new

contract as a result of their increased productivity. In the following season, we would

expect performance to drop; since their salary is no longer tied to their contemporaneous

production, players lose the incentive to play hard and give maximum effort. I will

follow Stiroh (2007) in testing for the existence of both ex ante and ex post strategic

behavior, unlike Berri and Krautmann (2006), which only tested for shirking behavior.

Evidence from Stiroh (2007) hinted that the ex ante effect of increased performance

before a new contract may be stronger than the ex post effect, suggesting that a

statistically significant relationship may be easier to uncover if we test for both instances

of performance variation.

23

The straightforward hypotheses of the principal-agent model in the presence of long-term contracts will

only be reviewed briefly in this section, as they have already been discussed at length in previous sections.

21

The problem with picking a single model of player productivity is that it is

unlikely that we will ever find a combination of performance metrics that perfectly

measures the level of effort expended by an individual player.

24

Although we must control for additional variables regardless of our choice of

productivity measure, I assume here that players will expend effort in a way that helps

their team win. If this assumption is largely true, then by picking a measure of

productivity that is related to team success, we hope to find a reliable proxy for effort. In

this way, we can ensure the consistency and accuracy of the results without an

overreliance on the selection of perfect controls.

Thus, we must choose

some productivity measure that is a function of effort, among other variables, and then

attempt to control for those other variables to the best of our ability. The remaining

variation in productivity—provided we have chosen a valid and thorough set of

controls—can be attributed to fluctuations in player effort throughout the contract cycle.

Furthermore, increases and decreases in productivity in the ex ante and ex post seasons, if

found, will serve as evidence supporting the existence of strategic behavior in the NBA.

As a starting point, I began by comparing the productivity measures used in Berri

and Krautmann (2006). Using the NBA measure of player efficiency as the performance

measure, Berri and Krautmann found statistical evidence supporting the shirking

hypothesis at the 5% significance level. However, this measure of productivity may have

several deep flaws. The NBA measure of player efficiency is calculated as follows:

25

( )( )

NBA

PROD PTS TREB STL BLK AST TO FGMS FTMS= + ++ + −+ +

24

Of course, if this were possible, the hypothetical perfect measure would directly indicate whether players

vary their effort level over the contract cycle, and this study would be unnecessary.

25

The variables in this equation are defined as follows: PTS = points scored, TREB = total rebounds, STL =

steals, BLK = blocked shots, AST = assists, TO = turnovers, FGMS = field goals missed, and FTMS = free

throws missed.

22

We immediately see that there are weaknesses in using this measure of performance.

Because all of the statistics used to construct this overall measure of player efficiency are

weighted equally, we cannot discern the relative value of any single statistic with respect

to any of the others.

26

Berri’s approach to measuring player productivity hinges on the idea that team

performance can be connected to player statistics through marginal productivity. This

idea is developed in Berri (1999), Berri and Jewell (2004), and several other sources, and

then reevaluated in Lee (2008). The general idea is to express team winning percentage

as a function of points per possession employed and points given up per possession

acquired. By differentiating this equation with respect to the independent variables, it is

possible to determine the marginal impact of each individual player statistic. For

example, through this method, it is possible to calculate the contribution toward winning

of a single offensive rebound by a specific player. Summing all the individual statistics

that impact team performance, we recover a formula that is very similar to the

productivity measure used by the NBA:

In an attempt to develop a more robust measure of player

productivity, Berri and Krautmann turn to an economics-inspired model that relies on the

player’s marginal contribution to team winning percentage.

27

)44.0()( FTAFGATOSTLTREBPTSPROD

MP

++−++=

The key difference is that this measure, derived from marginal productivity, punishes

players for shooting inefficiently. By the NBA’s measure, a player can boost his

performance just by taking a large number of shots, but in this measure, each shot attempt

26

For example, we would not expect a missed field goal to have the same effect as a missed free throw.

27

For a more detailed explanation of this derivation, refer to the Appendix of Berri and Krautmann (2006).

23

deducts from the player’s productivity rating, forcing him to make a higher percentage of

his attempts.

28

Adhering to the assumption that players funnel effort into production that

increases their team’s likelihood of winning, the marginal productivity measure of player

efficiency used by Berri and Krautmann (2006) provides the basis for the measure of

productivity that I will use to estimate my regressions. In order to compare player

productivity across different seasons, during which players may not always play the same

number of minutes, I will adjust marginal productivity to account for playing time. The

final measure of productivity used in my base regression will be the player’s marginal

productivity per 48 minutes (MP48), the duration of a regulation NBA game.

29

Choosing Independent Variables and Controls

To control for any factors that might influence a player’s productivity other than

the contract cycle, it is important to choose appropriate independent variables for the

model. As before, I rely on the previous literature to guide my choices of independent

variables. To begin with the most important, a player’s age and experience will clearly

have some kind of impact on his productivity. Surprisingly, both of the previous studies

included either age or experience in their regressions, but neither included both.

Although no explicit explanation is given, I surmise that the authors assumed that age and

experience would be highly correlated, and that including either one would largely

28

Using the NBA’s measure of player efficiency, in order for a player to improve his rating, he must

attempt more field goals while making them at rates above 33% for 2-point FGs and 25% for 3-point FGs.

Since most players in the NBA shoot above those percentages, a player need only take more shots to

improve his productivity. Using the marginal product method, which punishes players for the shots that

they take instead of just the shots that they miss, a player must make at least 50% of 2-point FGs and 33%

of 3-point FGs to improve his rating.

29

Since player statistics are recorded on a per-game basis, I will divide the calculated marginal productivity

by the number of minutes played per game, and then multiply by 48.

24

capture the effects of the other as well.

30

Age is representative of a player’s physical condition, which includes factors such

as athleticism, accumulated injuries, daily wear and tear, and the natural aging process.

As such, I expect the relationship between player age and performance to be generally

parabolic, with performance increasing with age up until some critical age—the average

age at which a player reaches his physical prime—and then decreasing as a player begins

to lose athleticism and feel the effects of the figurative “miles” that he has put on his

body over the course of his career.

However, in theory, age and experience should

have quite different effects on player productivity.

On the other hand, I expect that experience falls under the category of “you can

never have too much of a good thing.” If age is controlled for separately from experience,

I would anticipate the effect of experience on productivity to be monotonically increasing,

although probably with decreasing returns. Upon entering the NBA, it makes sense that a

player would learn and improve quickly, with marginal improvement slowing over his

career, as there remains less and less to be gained from additional experience. As with

age, experience should have a nonlinear relationship with productivity, so both will be

included in the model with first and second order terms.

31

One variable from Berri and Krautmann (2006) that I chose to include in my

model is the change in games played from one season to the next. This variable will

serve as a proxy for injuries, which have a definite impact on player performance. I

30

Stiroh (2007) chooses to include player age in his regression using the NAGE variable, while Berri and

Krautmann (2006) include experience using the variables D2 and D12. It is possible that these variables

are designed to account for the effects of both experience and age together (more likely to be the case with

D2 and D12).

31

Age will be controlled for with variables AGE and AGE

2

while experience will be controlled for with

variables EXP and EXP

2

.

25

expect that if a player is healthy for a larger portion of one season than the previous

season, his performance should also increase, as he generally will not have to deal with

minor injuries that may not stop him from playing, but can still inhibit his productivity.

Finally, it is important to control for the player’s team, the season in which the

performance measure was recorded, and individual player characteristics. Different

teams in the NBA can have widely varying styles of play, not to mention differences in

coaching, so a player’s current team during a given season must also be accounted for.

32

Similarly, league-wide characteristics such as pace and style may also change from

season to season, so it may be important to control for the season in which player

performance is recorded. Individual players will of course have different characteristics;

for example, talent level, commitment, career ambition, and let’s admit it, greed, may all

differ among players. We expect there to be variation in productivity between players

who play different positions, so player position must be accounted for as well.

33

Confounding Variables / Potential Difficulties

Stiroh (2007) discusses at length two confounding variables that he believes will

work against the incentive effects and perhaps diminish the strength of his results. First,

there is a selection effect that determines the population of players who are signed to

long-term contracts. It is in the best interest of each team to make a significant effort to

determine which players are truly high-ability—and thus deserving of long-term

contracts—and which are merely opportunistically increasing their effort level in their

contract season. If teams are at all successful in distinguishing between ability and effort,

then the players being signed to long-term contracts will disproportionately be those who

32

Players can be traded in the middle of a season, so in order to determine a player’s team for a particular

season, I simply chose the team for which the player played the majority of his games in that season.

33

Players are categorized under one of five positions: C, F-C, F, G-F, and G.

26

have high levels of natural ability. This type of high-ability player will have more

potential than a similarly productive player who is producing at that level because of

increased effort, and this potential will likely be expressed through higher levels of future

production, even if effort levels still fall after the signing of the contract. The idea is that

teams try to sign high-ability players who have the potential to continue improving, a

strategy that, if successful, will work against the hypothesized decline in performance in

the year following the new contract.

Another confounding effect might stem from players’ concerns about their careers,

specifically about future compensation. Although compensation may be guaranteed for

the duration of the current contract, all players, particularly younger players, must keep in

mind that they will likely be signing new contracts within the next few years. Even

though their recent effort and performance will not affect their current pay, it could have

adverse affects on their reputation or perceived ability level, which would result in a

lower-valued subsequent contract than they could otherwise earn. Stiroh points out that

this effect leads to two additional testable hypotheses: variation in effort should be

correlated with both the length of the contract signed and the age of the player. The

longer the contract, the less the player has to worry about negatively impacting future

contracts, and the older the player is, the smaller the proportion of his career he has left to

worry about.

It is important to note that both of these confounding effects, the selection effect

and future career concerns, are hypothesized to act in the opposite direction of ex post

shirking. Thus, we theorize that evidence for performance increases during contract

27

seasons may be easier to uncover than evidence for shirking in the season following the

signing of a new contract.

IV. Data

Both Stiroh (2007) and Berri (2006) take their contract data from the USAToday

website, as do I. This source provides the annual salary, the total value of the contract,

the length of the contract, and also the end date of the contract for each player in the

NBA. The database contains data from the 2001-02 season through the 2008-09

season.

34

I plan to use contract data from the 2008-09 season to determine the players who

will be included in my sample. The USAToday database contains data for 463 players

who were signed to an NBA contract by any of the 30 different teams at some point

during the season; I will keep the ones under multi-year contracts for my empirical study.

In this case, multi-year is defined as two or more seasons.

One shortcoming of these data is that they do not differentiate between the

guaranteed portion of the contract and any incentives that might be included. However,

incentives are usually a small portion of the total contract, if they are included at all, so

the results should not be greatly affected.

35

34

If only one year is given to designate a season, it will be the year in which the season began. For

example, the 2008-09 season would be referred to as the 2008 season.

After eliminating players

under contract for only one season, the dataset was narrowed to 397 players.

Furthermore, players who were currently in their first NBA contract will not be included

35

Players signed to shorter term contracts, specifically one-year deals, may be inherently different from

those players who sign multi-year contracts. These differences may lead to complications in analysis, and

difficulties in drawing conclusions. For example, many players signed to one-year contracts do not play in

many games, or if they do, receive far fewer minutes. As such, they may have a disproportionally large

impact on the results of regressions in which they are included.

28

in the dataset, as shirking behavior cannot be checked for without the existence of pre-

contract, NBA statistics.

36

After cross-checking the list with data from various sources

and eliminating players with incomplete or inconsistent records, I finally arrived at a list

of 231 players with contract characteristics that are ideal for this study.

37

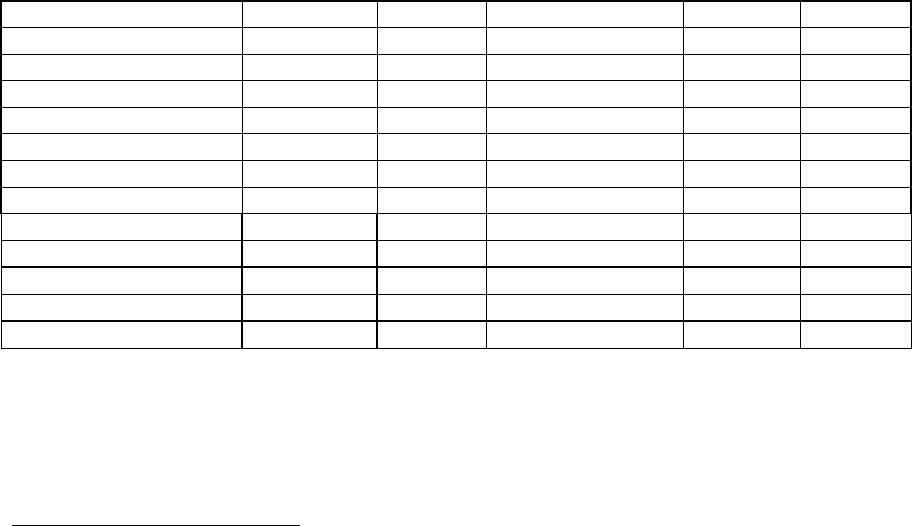

The top panel of Table 1 reports contract data summary statistics for the 231

players with multi-year contracts. The mean contract length is 4.409 years, with a

standard deviation of 1.436 years. The longest contract in the dataset was for 7 years,

and the highest total value was a 7-year, $136 million deal for Kobe Bryant with the Los

Angeles Lakers. The average annual salary for an NBA player was $7.76 million, with

standard deviation of approximately $4.88 million.

Table 1: Summary statistics

Observations Mean Standard Deviation Minimum Maximum

Contract data

Ex ante season

231

2005.17

1.68

2001

2010

Ex post season

231

2006.17

1.68

2002

2011

Contract end season 231 2009.58 1.29 2007 2013

Contract length 231 4.41 1.44 2 7

Total value (millions)

231

$37.00

$27.56

$2.00

$136.40

Annual salary (millions)

231

$7.76

$4.88

$1.00

$20.67

Player data

Age

1864

25.61

3.55

18

36

Experience 1864 5.09 3.17 1 17

∆GP

1864

0.41

20.33

-77

80

MP48 1864 8.24 4.57 -48 49.15

Player performance statistics have all been acquired from www.basketball-

reference.com, a Sports Reference LLC site that keeps an extensive database of NBA

36

Generally this subset of players is composed of players still in their rookie contracts, international players,

or players called up from the NBDL (National Basketball Developmental League). It is important that

players were active in the NBA prior to their current contract, as statistics cannot be accurately compared

across leagues (NCAA, European leagues, NBDL, etc.).

37

I had also planned on estimating my model using players under contract for three or more years, in case a

two-year contract cycle was not long enough to provide the necessary incentive for shirking behavior.

After running both datasets and finding nearly identical results, I decided to use the full dataset of players

with multi-year contracts exclusively.

29

statistics. Statistics for each individual player over the course of his career are organized

by season, in a per-game format. Combining these with the USAToday data, I have a

panel including the performance and contract data for every season of each of the 231

players’ careers. The panel is sorted by player and season, so each individual observation

will be referred to as a player-season, and will include performance statistics and contract

cycle data for that player, in that season. The lower panel of Table 1 reports some of the

relevant summary statistics for individual player characteristics and productivity. In total,

there are 1864 player-season observations, so the average player in the dataset has been

in the NBA for approximately 8 seasons.

V. Empirical Specification

My base regression is similar to the one described in Stiroh (2007) in that it has

the same objective of testing for both ex ante and ex post strategic behavior in the NBA

labor market. Testing for the possibility of increased effort in the contract year provides

an advantage over the model used in Berri and Krautmann (2006), which only tested for

ex post shirking behavior, since Stiroh found that ex ante strategic behavior had a larger

effect on player productivity. The change in games played variable from the Berri and

Krautmann (2006) model will be added as a proxy for injury, which was unaccounted for

in the Stiroh (2007) model. Unfortunately, this proxy is unable to distinguish between

games missed for injury and games missed for other reasons, such as league and team

suspensions, personal matters, or coaching decisions. However, suspensions are rare in

the NBA, and games played as a result of coaching decisions may largely be controlled

for by the individual player fixed effect, meaning that the effects of changes in the

30

number of games played result primarily from injury patterns. I also plan to use several

new variables unaddressed by either of the previous studies on this topic. As stated

before, experience and age can mean quite different things in the context of the NBA, so

separate controls are needed, and since I expect the effects of age and experience to be

nonlinear, second order terms are included for each. The base form of the regression that

I plan to estimate is the following fixed effects model:

38

tijtiGPEXPEXP

AGEAGEPOSTANTE0ti

GPEXPEXP

AGEAGEPOSTANTEP

,

2

2

2

2,

εαααβββ

βββββ

++++∆+++

++++=

The α’s correspond to fixed effects controlling for unobserved individual ability, and

dummy variables for season and team respectively.

39

The dependent variable used in my base regression, MP48, will be similar to the

PROD

A fixed effects model was chosen

to account for any unobserved differences in ability between individual players. For

example, it could be the case that unobserved player ability is correlated with contract

length, meaning that players of varying ability levels in our sample would exhibit

systematic differences in their contract characteristics. Such systematic variation could

interfere with our capacity to attribute changes in player effort level solely to varying

incentives throughout the contract cycle.

MP

38

Here, the dependent variable P represents the measure of productivity chosen for each individual model.

developed by Berri, with the adjustments mentioned in Section III. The

productivity measure will be adjusted to reflect a per-minute rate of productivity, as

players often switch teams when they sign new contracts; changing teams also changes

players’ roles and their playing time, which could potentially interfere with the effects

39

Fixed effects and random effects models were both estimated, with a Hausman test showing that the

random effects model was not consistent. All following models will be estimated using fixed effects.

31

that we hope to measure. The per-minute productivity will then be multiplied by 48,

reflecting the marginal product that each player would contribute to his team over the

course of a full 48-minute game. Figure 1 shows a histogram of the distribution of MP48

values for all player-seasons:

40

Figure 1: MP48 Distribution

Using this playing-time-adjusted measure of marginal productivity, I hope to provide a

clearer answer to the question of whether or not long-term guaranteed contracts in the

NBA provide incentives for players to vary their effort levels strategically over the course

of the contract cycle.

A major advancement of this paper with respect to the existing literature is the

inclusion of age and experience as separate inputs in estimating player productivity. As

40

As the distribution of MP48 values looks roughly normal, I see no reason to take logs or otherwise scale

or normalize the values before running the regression.

32

stated before, high correlation between the two presents a problem of multicollinearity.

41

The breakthrough comes in devising a way to measure player experience that does not

rely heavily on the passage of time. For each player-season observation, instead of using

the number of seasons played in the NBA, I record the total number of minutes played up

until that point in the player’s career. By dividing first by the number of minutes in a

game (48) and then by the number of games in a full season (82), I arrive at the

equivalent number of full seasons of experience if each player had played every minute

of every game.

42

Since I expect the overall shapes of the graphs of productivity versus age and

experience to be downward-opening parabolas, the coefficients on AGE and EXP should

be positive while the coefficients on the corresponding squared terms should be negative.

For values within our dataset range of 1 to 17, I expect that performance should be

monotonically increasing with respect to experience. For age, I expect to see a maximum

in performance somewhere within our age range of 18 to 36, representing the age at

Using this full season equivalent definition of experience has several

benefits. It not only breaks down the correlation between age and experience, but also

measures the experience gained by a player actually playing in the NBA, not just the

amount of time that the player has spent employed by an NBA team. It is more intuitive

to assume that players benefit from varying amounts of experience as a function of the

number of minutes that they play, rather than believing that all players accumulate similar

gains each season, regardless of playing time.

41

Most players in the NBA enter the league at around the same age, and experience is typically measured

by simply counting the number of seasons that the player has been in the league. Clearly, age and

experience by this measure increase hand in hand, leading to a correlation between the two of ρ = 0.874.

42

In a simple example, if Player X had played a total of 7872 minutes over a 6 season career, EXP would

be recorded as 2, since 7872 = 2*82*48. Although he has been in the NBA for a total of 6 seasons, by my

measure of experience, Player X has played the equivalent of 2 full seasons.

33

which players tend to reach their physical peak. Finally, for the ∆GP variable, I expect

the coefficient to be positive, as an increase in games played should correspond to greater

health, a condition under which we expect the player to be more productive.

43

The driving hypotheses behind this paper are that the coefficients on the ANTE

and POST variables will be positive and negative respectively. Such results would

confirm that NBA players do indeed demonstrate increased productivity in the contract

season and decreased productivity after signing a long-term contract. Before estimating

any regressions, I ran a few simple summary statistics on the dependent variable (MP48)

to determine if these hypotheses were reasonable. Table 2 below contains these statistics,

sorted by player position:

44

Table 2: MP48 by Player Position

Ex Ante MP48 Ex Post MP48 All Other Seasons

Position

Mean

SD

Mean

SD

Mean

SD

C

12.877

3.326

12.252

4.174

12.216

4.508

F

10.337

2.909

9.725

3.079

9.389

3.247

F-C

12.872

2.980

12.039

3.090

11.431

5.435

G

5.353

2.330

4.863

2.436

4.692

2.711

G-F

6.985 2.110 5.920 3.872 6.349 2.716

As we can see, in all cases, the mean marginal productivity is higher in the ex ante season

than in the ex post season, while both ex ante and ex post averages are higher than the

averages in all other seasons, except in the case of G-F.

45

43

If the change in games played is negative, then since the coefficient is positive, we will see a decrease in

predicted productivity, which follows our intuition.

This leads us to believe that,

after controlling for experience, age, and other independent variables, we may find

evidence supporting the existence of strategic behavior in the NBA. The results in this

table seem to strengthen my belief that contract year increases in performance may be

44

SD columns list standard deviations.

45

The category All Other Seasons refers to any season that is not an ex post or ex ante season.

34

more prevalent than shirking behavior. One potential concern is the obvious systematic

differences in productivity between players who play different positions. Although

player position will be controlled for in the fixed effects model, it is possible that such a

large difference in productivities across positions is a sign that MP48 does not accurately

capture different players’ contributions towards their team’s success.

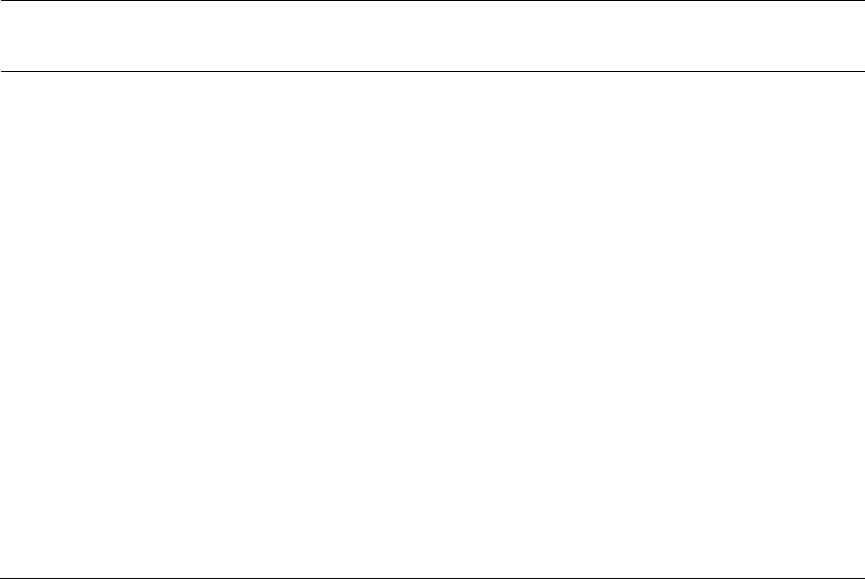

Table 3: Fixed Effects Models with Different Controls

Using MP48 as Dependent Variable

Standard errors in parentheses

*** p<0.001, ** p<0.01, * p<0.05

Table 3 above reports the results of my base regression, along with the results for

several other regressions with different sets of controls. Starting with the base regression

in column (1) of the table, the results seem to support the hypothesis that players increase

performance in the ex ante season, although there is no evidence that they decrease

(1)

(2)

(3)

(4)

(5)

Variables

Age and

experience

Age only

No season or

team controls

Season only

Team only

Ante

0.684***

0.685***

0.666***

0.649**

0.677***

(0.202)

(0.202)

(0.195)

(0.201)

(0.195)

Post

-0.049

-0.044

-0.071

-0.049

-0.076

(0.203)

(0.203)

(0.200)

(0.202)

(0.202)

∆GP

0.020***

0.020***

0.019***

0.020***

0.019***

(0.003)

(0.003)

(0.003)

(0.003)

(0.003)

Age

0.787*

1.089***

1.055**

0.876*

1.005**

(0.395)

(0.303)

(0.348)

(0.383)

(0.359)

Age

-0.018**

2

-0.022***

-0.018**

-0.019**

-0.018**

(0.006)

(0.005)

(0.006)

(0.006)

(0.006)

Exp

0.303

0.288

0.292

0.282

(0.269)

(0.261)

(0.265)

(0.265)

Exp

-0.024

2

-0.024

-0.023

-0.024

(0.020)

(0.019)

(0.019)

(0.020)

Season controls

Yes

Yes

No

Yes

No

Team controls

Yes

Yes

No

No

Yes

Constant

-0.152

-4.386

-6.980

-1.338

-6.579

(7.144)

(6.089)

(4.910)

(6.947)

(5.112)

Observations

1864

1864

1864

1864

1864

Number of players

231

231

231

231

231

R-squared

0.107

0.106

0.070

0.077

0.099

Adj. R-squared

-0.051

-0.051

-0.066

-0.067

-0.051

35

productivity in the following season. Examining the variables of primary interest, we can

see that the coefficient on the ANTE variable has a positive coefficient and is statistically

significant at the 0.1% level. This confirms our hypothesis that players hoping to sign a

new contract will tend to outperform, exerting maximum effort in order to lock in the

highest possible salary. The evidence for ex post shirking behavior is not nearly as strong:

We do find a negative coefficient on the POST variable in each case, as expected, but the

magnitude of the effect is not close to being statistically significant.

These findings agreed with those of Berri and Krautmann, and might be explained

by the confounding effects described in the theoretical framework. In theory, the ex post

shirking effects might be overcome by two confounding variables acting in the opposite

direction. First, teams attempt to sign players that they believe have the potential to

continue performing at a high level, or even to improve, which would lead to an increase

in productivity after the new contract is signed. Secondly, each player also has an

economic incentive to perform well after signing a new contract. Unless the player

knows that the current contract will be the last of his career, he must remember that his

present productivity can affect his reputation and future valuation. Both of these

confounding effects would work against the shirking hypothesis, so perhaps the

incentives to shirk are balanced out by effective player valuation by NBA teams and

players’ awareness that present production may dictate future compensation.

Looking at the other independent variables in the base regression, we see that the

calculated ΔGP, AGE, and AGE

2

variables are also statistically significant. The

coefficient on ΔGP is positive, as we expected; players are likely to be more productive

when they spend less time injured and on the bench.

36

In order to understand the effects of age and experience on productivity, I start

with the results of column (2), which are based on a model in which only age is used to

account for the combined effects of age and experience.

46

By including AGE and AGE

2

,

I expected the graph of productivity versus age to be an inverted parabola, reaching a

maximum within the domain of the sample.

47

Qualitatively, this maximum should

correspond to the age at which a combination of the player’s athleticism, knowledge of

the game, experience in the NBA, and overall physical condition allow him to reach his

peak productivity. Figure 2 graphs productivity against age for this model, which does

not include experience as a separate variable:

Figure 2: Productivity vs. Age

48

The effect of age on productivity peaks around 24.6 years, which is a reasonable

estimate of when most NBA athletes reach their physical prime. After this point, the

marginal decrease in productivity as a result of declining athletic abilities or wear and

46

This model, with only age, is similar to both Stiroh (2007) and Berri and Krautmann (2006) in that the

effects of age and experience are explained by variation in only one of the two highly correlated variables.

Unlike either of the previous studies, however, I allowed for the possibility of a nonlinear relationship

between age and experience and productivity.

47

Players in the sample ranged from ages 18 through 36.

48

The gain in productivity with respect to age follows the graph y = 1.089*x – 0.022*x

2

. The domain of

the graph includes values of experience in the interval [15,40]. This graph represents the model which

includes only age and not experience.

37

tear from the daily grind of practicing and playing a professional sport begins to outweigh

the positive but decreasing marginal returns from the accumulation of experience.

Although this simpler model seems to capture the combined effects of age

and experience fairly accurately, one of the goals that drove the specification of my base

regression was to create a new model of player productivity in which the entangled

effects of age and experience on productivity could be identified and separated. By

measuring experience with the equivalent number of seasons played by each player rather

than the total number of seasons the player has been in the NBA, I can include both age

and experience in my base model, which allows for more specific insight into their

individual effects on productivity. Figure 3 at the top of the following page graphs

productivity against age in the base regression, which also includes experience as an

input of productivity.

Again, the results closely match our theoretical expectations. According to the

model, productivity as a function of age increases until it peaks around 22.21 years, and

then decreases at an increasing rate as the player continues to age. Comparing this result

to the previous model, which only includes age, it is quite believable that the average

player actually reaches his maximum athleticism or physical prime around 22 rather than

25, as the effect of age on productivity is now isolated from productivity gains due to

increases in experience.

49

49

When age is used to account for the effects of both age and experience, the increases in experience that

begin upon the player entering the NBA have a monotonically increasing effect on production, so it is not

until the player is older that the negative effect of aging begins to overcome the positive effect of gaining

experience. In the base model, age captures the pure physical effect of aging, so as soon as the player

begins to lose physical ability, it is reflected through decreasing productivity with respect to age.

38

Figure 3: Productivity vs. Age

50

Figure 4: Productivity vs. Experience

51

The effect of experience on productivity in the base regression is displayed in

Figure 4 above. Since the players in the sample have equivalent levels of experience,

ranging from 0 to 11 seasons, it is clear that productivity is not monotonically increasing

in experience as postulated earlier. However, it may be that there are again two factors at

50

The gain in productivity with respect to age follows the graph y = 0.787*x – 0.018*x

2

. The domain of

the graph includes values of age in the interval [15,40].

51

The gain in productivity with respect to experience follows the graph y = 0.303*x – 0.024*x

2

. The

domain of the graph includes values of experience in the interval [0,11].

39

work here. On the one hand, there is the positive effect that experience has on players

both mentally and psychologically, which could in fact continuously increase with

experience.

52

In models (3) through (5), I remove one or both of the team and season controls,

finding that the removal of these controls from the model has no significant effect on the

results. For all subsequent models, both season and team controls are included.

Furthermore, note that the coefficients and standard errors on the ANTE and POST

variables are almost exactly the same in the base regression and the regression using only