Accumulation Indexed Universal Life Insurance

About This Illustration

This illustration is intended to assist you in understanding how your policy may perform over time given a specified set of

assumptions applied to the features of the policy. The illustration is not intended to predict your actual policy performance.

Certain values shown in this illustration are guaranteed, and other values are not guaranteed. Unless

otherwise stated, amounts credited and other values set forth in this illustration are not guaranteed.

Your policy’s guaranteed values are determined at policy issue and are guaranteed not to change over the life of the

policy. Non-guaranteed values may change from time-to-time in response to actions that you or the insured take, changes

that we make, or changes in the Index Segment Interest Credits. For example, the interest rate credited to the Fixed

Account may exceed the guaranteed rate, the Segment Growth Rate may exceed the Segment Floor Rate, and monthly

charges may be less than their corresponding maximum guaranteed charges. In addition, John Hancock ("we") may

change the Segment Cap Rate and the Participation Rate. Illustrated values that are based upon non-guaranteed

assumptions may be more favorable to you than the values shown based upon guaranteed assumptions.

We recommend that you request multiple illustrations that assume different Segment Growth Rates to better

understand the policy performance under different scenarios.

Also, please review your policy’s performance periodically to ensure you are on track to meet your goals.

The illustrated Segment Growth Rate used to calculate the illustrated values is hypothetical. If the assumed

Segment Growth Rate in an illustration is not achieved, this can have a significant effect on the Policy Value,

with the result that you may have to pay more premiums than you had anticipated, or your policy may lapse.

We also suggest you request in force illustrations from time to time which will also provide you with an

updated projection of policy performance. You should review these documents with your financial

professional.

This illustration is not a contract and will not become part of the policy. Descriptions provided in this illustration summarize

some of the policy features; however, it does not supersede, nor should it be considered a substitute for, the policy

contract. The policy constitutes the actual agreement of coverage and contains the entire terms of the contract.

Capitalized terms referred to in this illustration have the meanings given in this illustration or in the policy contract.

The information provided by John Hancock to you or your financial professionals in connection with this sale is not

intended as tax, legal, or investment advice or a recommendation to purchase John Hancock products and services. John

Hancock and its representatives will receive compensation derived from such sales or services.

Brief Description of the Policy

The Accumulation Indexed Universal Life Insurance policy which you are considering provides death benefit protection

and premium payment flexibility. Actions you or the insured take can affect your policy and the premium required to

maintain coverage, such as:

• The amount and timing of premiums you pay

• Your allocation of policy values among the options available in the policy

• Any loans, withdrawals, or material changes you make to your policy

Your policy can also be affected by:

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 1 of 48

• Changes that we make to the current declared interest rate of the Fixed Account

• Changes in the Index Segment Interest Credits earned by Segments in an Index Account on a Segment Maturity

Date

• Changes to the current Cost of Insurance rates

Premiums You Pay

One of the advantages of Accumulation Indexed Universal Life Insurance is premium payment flexibility, allowing you to

vary the amount and frequency of your payments as long as the premiums you pay, less premium charges, and interest

amounts credited to your policy are sufficient to cover the Monthly Deductions and any other charges. Premiums are

subject to maximum guidelines allowed by the Internal Revenue Code, and premium payments in excess of the Planned

Premium are subject to our approval. Policy loans, withdrawals or changes in crediting rates to the Fixed Account or the

Indexed Accounts could necessitate additional premium payments to maintain your insurance coverage. Premium limits

and requirements may change after issue if unscheduled changes are made or if planned changes are made at different

times than originally assumed.

This illustration assumes an initial Planned Premium of $25,000.00 and that all subsequent premium payments are made

at the beginning of each modal period you selected (e.g., monthly, annually). Paying less than the Planned Premium can

have a negative impact on the policy and its guarantees. Reduced or discontinued premiums in future years are only

possible if the premiums paid and amounts credited are sufficient to cover the Monthly Deduction and any other charges.

The Minimum Initial Premium is shown on the Basic Illustration Summary page and is the minimum premium needed to

put the policy in force.

Based on the initial Death Benefit and other policy assumptions shown in the illustration, the level annual premium to

guarantee coverage for life is $25,000.00. Premiums are subject to maximum guidelines allowed by the Internal Revenue

Code.

Please refer to the Basic Illustration Summary page for your initial premium allocation.

Your Death Benefit

This illustration reflects an initial Death Benefit of $391,567 (Option 2). The initial Death Benefit is composed of $391,567

in Base Face Amount and $0 in Supplemental Face Amount. Starting in Policy Year 20 the Death Benefit illustrated is the

Face Amount plus any Required Additional Death Benefit (Option 1). The Net Death Benefit reflects the reduction of the

Death Benefit by any Policy Debt (total loans plus any loan interest due).

The greater the proportion of Base Face Amount at issue to the Total Face Amount at issue, the higher the Total Face

Amount charge will be. This means for the same Total Face Amount at issue, your charge per $1,000 of Total Face

Amount will be higher if you elected a policy without Supplemental Face Amount as opposed to a policy with it. On the

other hand, the No-Lapse Guarantee Period will be longer for Base Face Amount coverage than for the Supplemental

Face Amount coverage.

If your priority is to reduce your Face Amount charges, you may wish to maximize the proportion of the Supplemental Face

Amount. However, if your priority is to take advantage of the No-Lapse Guarantee feature after the fifth Policy Year or to

maximize the death benefit when the insured person reaches age 121, then you may wish to maximize the proportion of

the Base Face Amount. The No-Lapse Guarantee for the Base Face Amount under any policy that has elected an

increasing Supplemental Face Amount, or the Return of Premium Death Benefit Rider is limited to the first five Policy

Years.

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 2 of 48

This policy illustration shows the No-Lapse Guarantee keeping the policy’s Base Face Amount in force for 15 years. If

increasing Supplemental Face Amount coverage or the Return of Premium rider are elected, No-Lapse Guarantee

protection for the Base Face Amount coverage is limited to the first five Policy Years. During the No-Lapse Guarantee

Period, if the Net Cash Surrender Value should fall to zero or below, Base Face Amount coverage will continue provided

that the No-Lapse Guarantee Cumulative Premium Test is satisfied. After the expiration of the No-Lapse Guarantee

Period, if the Net Cash Surrender Value falls to zero or below, you must pay sufficient additional premiums to keep the

policy in force. In this illustration, this test is satisfied if the sum of all premiums paid, net of withdrawals and any Policy

Debt, is greater than or equal to $4,431.89 multiplied by the number of years coverage has been in effect.

The No-Lapse Guarantee protects the Supplemental Face Amount coverage and the Return of Premium rider (both if

elected) for the first five Policy Years, provided that the No-Lapse Guarantee Cumulative Premium Test is satisfied. In

Policy Years six and after, if the Net Cash Surrender Value falls to zero or below, you must pay sufficient additional

premiums to keep these coverages in force. If you do not pay additional premiums, the Supplemental Face Amount and

the Return of Premium rider may lapse even though your Base Face Amount does not.

Death Benefit Option changes; adding, terminating or changing a rider; an unscheduled increase or decrease to the

Supplemental Face Amount coverage; a Base Face Amount decrease; or a change to the Life Insured's Risk Classification

or Additional Rating may all cause the No-Lapse Guarantee Premium to be recalculated, or in some cases result in the

No-Lapse Guarantee terminating. Note that if a policy loan is outstanding at the time your Net Policy Value falls to zero,

the No-Lapse Guarantee will not prevent the policy from lapsing.

Allocation of Your Policy Values and Interest Credits

You may allocate premium or transfer policy value to the Fixed Account or to one or more of the Indexed Accounts

described below.

The Fixed Account

The Fixed Account (referred to as the Guaranteed Interest Account in your policy) credits interest daily at a current annual

rate that we declare, subject to the Minimum Guaranteed Interest Account Annual Rate of 1%. The Fixed Account is not

linked to the performance of any index, and thus is likely to experience lower volatility than the Indexed Accounts. At the

same time, the long-term performance of the Fixed Account may be expected to be lower than the Indexed Accounts.

Illustrated values for the current assumptions show an increase in the crediting rate to the Fixed Account beginning with

Policy Year 11. This increase is referred to as a "persistency bonus," and it is not guaranteed. We are currently illustrating

this increase to be 0.35%. We will only apply the persistency bonus to the portion of your Policy Value that is allocated to

the Fixed Account, and to any amount allocated to the Indexed Account that is not yet designated to a Segment (a

"Holding Segment").

The Indexed Accounts

The Indexed Accounts offered in the policy are the Select Capped Indexed Account, the Base Capped Two Year Indexed

Account, the Barclays Global MA Bonus Indexed Account, the Barclays Global MA Classic Indexed Account, the Capped

Indexed Account, the High Capped Indexed Account, the High Par Capped Indexed Account, the Enhanced Capped

Indexed Account and the Enhanced High Capped Indexed Account. We also offer a Loaned Indexed Account, which is

only available if you have taken a Fixed Index Loan.

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 3 of 48

This illustration assumes amounts are allocated to the Indexed Accounts to form new Segments on the Issue Date.

However, amounts allocated to the Indexed Accounts only form new Segments on the Segment Initiation Date (generally,

the 15th of the month), subject to a Lock In Date of three Business Days prior to the Segment Initiation Date. Depending

on the date we receive your premium, there may be a delay of up to one month between the premium receipt date and the

Segment Initiation Date when any allocated portion of the premium is included in a new Segment.

Index Segment Interest Credit

For any Indexed Account that you elect, an Index Segment Interest Credit will be calculated using a formula described in

your policy that references an external index ("Index") and Indexed Account parameters:

• The Indices that the Indexed Accounts reference are the Standard & Poor's 500 Composite Price Index and the

Barclays Global MA Index. While the Indexed Accounts refer to these Indices, the policy does not directly participate

in any stock or equity investments. Each Indexed Account tracks the Index and measures the performance of the

Index from the Segment Initiation Date to the Segment Maturity Date, without including dividends.

•

The S&P 500 Index

includes 500 large cap common stocks actively traded in the United States.

• The Barclays Global MA Index (the Index) is a rules-based index that has twelve components that provide

diversification across asset classes and geographic regions in recognition that the components react differently to

the same market or economic environment. The components and the maximum and minimum weights to each

component are the following Barclays Bank PLC or its affiliates' indexes or commodities futures:

Barclays Bank PLC or its affiliates' indexes or commodities futures

Component

Min/Max

Barclays US Tracker ER Index (BXIIUSER)

7.5% / 25%

Barclays US Tech Tracker ER Index (BXIITTER)

5% / 20%

Barclays Europe Tracker USD ER Index (BXIIETUE)

5% / 20%

Barclays GERMANY Tracker USD ER Index (BXIIDEUE)

2.5% / 15%

Barclays Japan Tracker USD Index (BXIIJTUE)

2.5% / 15%

Barclays MSCI Emerging Market Tracker ER Index (BXIIMEER)

2.5% / 10%

Gold Futures (BCC2GC0P)

0% / 20%

Barclays US 5yr Treasury Futures Index (BXIIUS05)

0% / 50%

Barclays US 10yr Note Futures Index (BXIIUS10)

0% / 50%

Barclays Euro-Bobl Alt Roll Futures in USD (BXIIE05D)

0% / 50%

Barclays Euro-Bund Alt Roll Futures Index in USD (BXIIE10D)

0% / 50%

Barclays JGB Alt Roll 10yr Futures ER Index in USD (BXIIJTED)

0% / 50%

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 4 of 48

The Index’s rules create a component portfolio that allocates among the components based on the Modern Portfolio

Theory, on performance momentum, and the volatility of each component, subject to the maximum and minimum

weights for each component and a portfolio target volatility of 7%. Allocations based on Modern Portfolio Theory

seek to find the allocation among the components that provide the maximum return at a given risk level. Allocations

based on performance momentum seek to increase allocations to components with stronger recent performance,

and reduce allocation to components with weaker recent performance. Based on these allocation rules, the sum of

each component allocation may be as high as 150%. The component portfolio may change daily.

The higher the allocation to fixed income components or the lower exposure to the component portfolio, the lower

the potential increase in the Index value. In addition, if at a time the Index has a higher allocation to fixed income

components or a lower exposure to the component portfolio, equities experience a rapid upswing, the Index will not

increase in value in the same manner as the increase in equities. Moreover, in a rapidly rising interest rate

environment, the higher the allocation to fixed income components, the lower the potential increase in the Index

value.

Once the component portfolio is constructed, the Index will adjust the exposure to the component portfolio to

maintain "volatility control". If the recent volatility of the component portfolio is greater than 7%, the component

portfolio exposure will be less than 100%, and may be as low as 25%. If it is less than 7%, the component portfolio

exposure can be greater than 100%, and may be as high as 150%. The impact of the maximum sum of the

components allocation of 150% together with the maximum volatility control exposure may result in a maximum total

component portfolio exposure of 225%. The exposure may change daily.

The change in the Barclays Global MA Index in up market conditions will not be as high, and in down market

conditions as low, had there not been the volatility control. Note that the indexed accounts provide down market

protection through the Segment Floor Rate of 0%. Thus, the volatility control feature of the Barclays Global MA

Index may benefit John Hancock through reduced hedging costs.

The Index’s rationale may not be successful and the ability to construct the component portfolio may not be possible

or subject to being recreated on another computer. The Index also takes into account for each component a "running

cost" ranging from 0.20% to 0.30% per annum and a "rebalancing cost" ranging from 0.02% to 0.05% depending on

the component, and is deducted on the relevant trading day. These costs reduce the daily Index value.

• The Indexed Account parameters of each Indexed Account may include a Segment Floor Rate, a Segment Cap

Rate, a Participation Rate, a Segment Term, a Guaranteed Fixed Bonus, and a Guaranteed Indexed Account

Multiplier. Discuss these parameters with your financial professional to ensure you understand how they may affect

the Index Segment Interest Credit.

The Segment Cap Rate limits the rate that is used in calculating the Index Segment Interest Credit. If the positive index

change multiplied by the Participation Rate results in a rate that is higher than the Segment Cap Rate, we will use the

Segment Cap Rate to determine the Index Segment Interest Credit. If the positive index change multiplied by the

Participation Rate is less than the Segment Cap Rate but greater than the Segment Floor Rate, we would use the index

change multiplied by the Participation Rate to determine the Index Segment Interest Credit. Any positive return is further

enhanced by a Guaranteed Indexed Account Multiplier, if applicable, in the Index Segment Interest Credit calculation.

Following are the Indexed Accounts currently offered and their respective Indexed Account parameters:

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 5 of 48

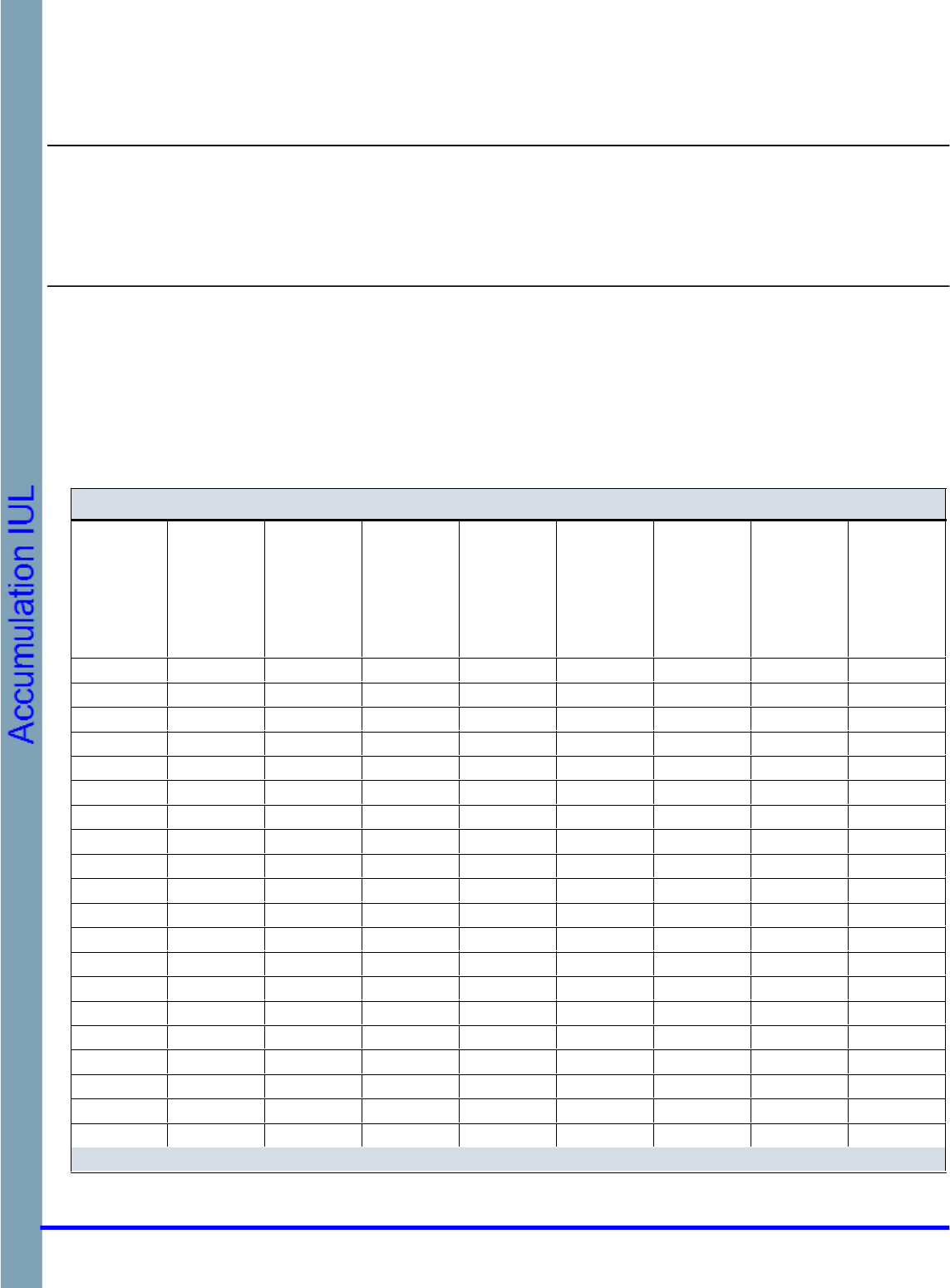

Indexed Account Parameters

Index

Account

Index

Current

Segment Cap

Rate

Guaranteed

Segment

Minimum Cap

Rate

Current

Participation

Rate

Guaranteed

Indexed

Account

Multiplier

Index

Performance

Charge

Select Capped

S&P 500

8.00%

3.00%

100%

5%

0.00%

Base Capped Two

Year

(2-Year Segment

Term)

S&P 500

21.00%

3.00%

100%

0%

0.00%

Barclays Global MA

Bonus

Barclays Global MA

N/A**

N/A

100%

(10% minimum)

0% *

0.00%

Barclays Global MA

Classic

Barclays Global MA

N/A**

N/A

125%

(20% minimum)

0%

0.00%

Capped

S&P 500

8.75%

3.25%

100%

45%

1.98%

High Capped

S&P 500

10.00%

3.75%

100%

30%

1.98%

High Par Capped

S&P 500

7.50%

3.00%

160%

(140% minimum)

45%

1.98%

Enhanced Capped

S&P 500

9.50%

3.50%

100%

106%

4.98%

Enhanced High

Capped

S&P 500

12.00%

4.25%

100%

80%

4.98%

Loaned Indexed

S&P 500

8.75%

3.25%

100%

45%

1.98%

* This account has a 0.65% guaranteed Fixed Bonus Interest Rate.

** While there is no contractual segment cap rate for these accounts, there is a volatility control mechanism built into the Index rules that will

impact the returns on these accounts. As described above, the change in the Barclays Global MA Index in up market conditions will not be as

high as it would be had there not been the volatility control.

Unless these Indexed Account parameters are guaranteed, the Indexed Account parameters may be

changed from time to time by John Hancock for any Segment created after the date of the change. If the

Indexed Account parameters are lower than illustrated, the amount of Index Segment Interest Credit applied

to your Policy Value will be less. This may affect the long-term performance of your policy and you may

need to make additional premium payments in order to keep your policy in force.

John Hancock reserves the right to add Indexed Accounts or cease offering one or more of the Indexed Accounts at any

time. We also reserve the right for any Indexed Account to substitute an Index with another Index for any reason. If we

substitute an Index for another Index, the Indexed Account will continue to offer the same guaranteed Indexed Account

Multiplier and guaranteed Indexed Account parameters. We will give you notice when we do so. Depending on what we

add, substitute, or remove, the expected return and volatility relationship among Indexed Accounts might change. You

should contact your financial professional to select an allocation that is best for you.

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 6 of 48

Each Indexed Account has different parameters that presents you with a different risk and return profile and a different

range of potential outcomes.

Following are hypothetical examples showing each Indexed Account that is available with this life insurance policy. The

examples are using the hypothetical cap rate, participation rate, guaranteed multipliers, guaranteed fixed bonus interest

and index performance charge and show how the Indexed Accounts would perform under three different index returns,

over the Segment Term for the given Indexed Account. The Segment Growth Rate is the index change multiplied by the

participation rate, subject to the hypothetical cap rate. The crediting rate is the Segment Growth Rate multiplied by one

plus the Guaranteed Indexed Account Multiplier.The guaranteed Fixed Bonus Interest (if applicable) is added to the

crediting rate.

Index Returns 0% or Lower

Index

Account

Hypothetical

Cap

Hypothetical

Participation

Rate

Guaranteed

Indexed

Account

Multiplier

Index

Performance

Charge

Segment

Growth

Rate

Crediting

Rate

Crediting

Rate minus

Index

Performance

Charge

Select Capped

8.00%

100%

5%

0.00%

0.00%

0.00%

0.00%

Base Capped

Two Year

(2-Year Segment

Term)

21.00%

100%

0%

0.00%

0.00%

0.00%

0.00%

Barclays Global

MA Bonus

N/A**

100%

0% *

0.00%

0.00%

0.65%

0.65%

Barclays Global

MA Classic

N/A**

125%

0%

0.00%

0.00%

0.00%

0.00%

Capped

8.75%

100%

45%

1.98%

0.00%

0.00%

-1.98%

High Capped

10.00%

100%

30%

1.98%

0.00%

0.00%

-1.98%

High Par Capped

7.50%

160%

45%

1.98%

0.00%

0.00%

-1.98%

Enhanced

Capped

9.50%

100%

106%

4.98%

0.00%

0.00%

-4.98%

Enhanced High

Capped

12.00%

100%

80%

4.98%

0.00%

0.00%

-4.98%

* This account has a 0.65% guaranteed Fixed Bonus Interest Rate.

** While there is no contractual segment cap rate for these accounts, there is a volatility control mechanism built into the Index rules that will

impact the returns on these accounts. As described above, the change in the Barclays Global MA Index in up market conditions will not be as

high as it would be had there not been the volatility control.

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 7 of 48

Index Returns 5%

Index

Account

Hypothetical

Cap

Hypothetical

Participation

Rate

Guaranteed

Indexed

Account

Multiplier

Index

Performance

Charge

Segment

Growth

Rate

Crediting

Rate

Crediting

Rate minus

Index

Performance

Charge

Select Capped

8.00%

100%

5%

0.00%

5.00%

5.25%

5.25%

Base Capped

Two Year

(2-Year Segment

Term)

21.00%

100%

0%

0.00%

5.00%

5.00%

5.00%

Barclays Global

MA Bonus

N/A**

100%

0% *

0.00%

5.00%

5.65%

5.65%

Barclays Global

MA Classic

N/A**

125%

0%

0.00%

6.25%

6.25%

6.25%

Capped

8.75%

100%

45%

1.98%

5.00%

7.25%

5.27%

High Capped

10.00%

100%

30%

1.98%

5.00%

6.50%

4.52%

High Par Capped

7.50%

160%

45%

1.98%

7.50%

10.88%

8.90%

Enhanced

Capped

9.50%

100%

106%

4.98%

5.00%

10.30%

5.32%

Enhanced High

Capped

12.00%

100%

80%

4.98%

5.00%

9.00%

4.02%

* This account has a 0.65% guaranteed Fixed Bonus Interest Rate.

** While there is no contractual segment cap rate for these accounts, there is a volatility control mechanism built into the Index rules that will

impact the returns on these accounts. As described above, the change in the Barclays Global MA Index in up market conditions will not be as

high as it would be had there not been the volatility control.

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 8 of 48

Index Returns 20%

Index

Account

Hypothetical

Cap

Hypothetical

Participation

Rate

Guaranteed

Indexed

Account

Multiplier

Index

Performance

Charge

Segment

Growth

Rate

Crediting

Rate

Crediting

Rate minus

Index

Performance

Charge

Select Capped

8.00%

100%

5%

0.00%

8.00%

8.40%

8.40%

Base Capped

Two Year

(2-Year Segment

Term)

21.00%

100%

0%

0.00%

20.00%

20.00%

20.00%

Barclays Global

MA Bonus

N/A**

100%

0% *

0.00%

20.00%

20.65%

20.65%

Barclays Global

MA Classic

N/A**

125%

0%

0.00%

25.00%

25.00%

25.00%

Capped

8.75%

100%

45%

1.98%

8.75%

12.69%

10.71%

High Capped

10.00%

100%

30%

1.98%

10.00%

13.00%

11.02%

High Par Capped

7.50%

160%

45%

1.98%

7.50%

10.88%

8.90%

Enhanced

Capped

9.50%

100%

106%

4.98%

9.50%

19.57%

14.59%

Enhanced High

Capped

12.00%

100%

80%

4.98%

12.00%

21.60%

16.62%

* This account has a 0.65% guaranteed Fixed Bonus Interest Rate.

** While there is no contractual segment cap rate for these accounts, there is a volatility control mechanism built into the Index rules that will

impact the returns on these accounts. As described above, the change in the Barclays Global MA Index in up market conditions will not be as

high as it would be had there not been the volatility control.

These three hypothetical examples show how the combination of an Indexed Performance Charge and an Indexed

Account Multiplier results in a wider range of potential outcomes compared to the Indexed Accounts that do not include

these parameters. These examples do not take into account the other charges that may be deducted and credits that may

be applied to your policy value, or that the Indexed Accounts may be tied to different external indices, which may have

different upside potential. You should request multiple illustrations that assume different Segment Growth Rates to

better understand the policy performance under different scenarios. When the Index Segment Interest Credit for

any Segment of an Indexed Account is less than the annualized Indexed Performance Charge applicable for that

Segment, the effective annual return on the portion of the Policy Value in that Segment will be negative.

Your financial professional can help you understand how these Indexed Accounts will operate under different scenarios,

and which of the Indexed Accounts, or the Fixed Account, might be best given your financial objectives and risk tolerance.

Your financial professional can also help you to understand how the policy might be expected to perform in adverse

scenarios, such as where Indexed Account parameters are changed so that they are closer to their respective guarantees,

and how those changes to the Indexed Account parameters will impact the amount of premium that you will have to pay to

maintain the policy in force.

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 9 of 48

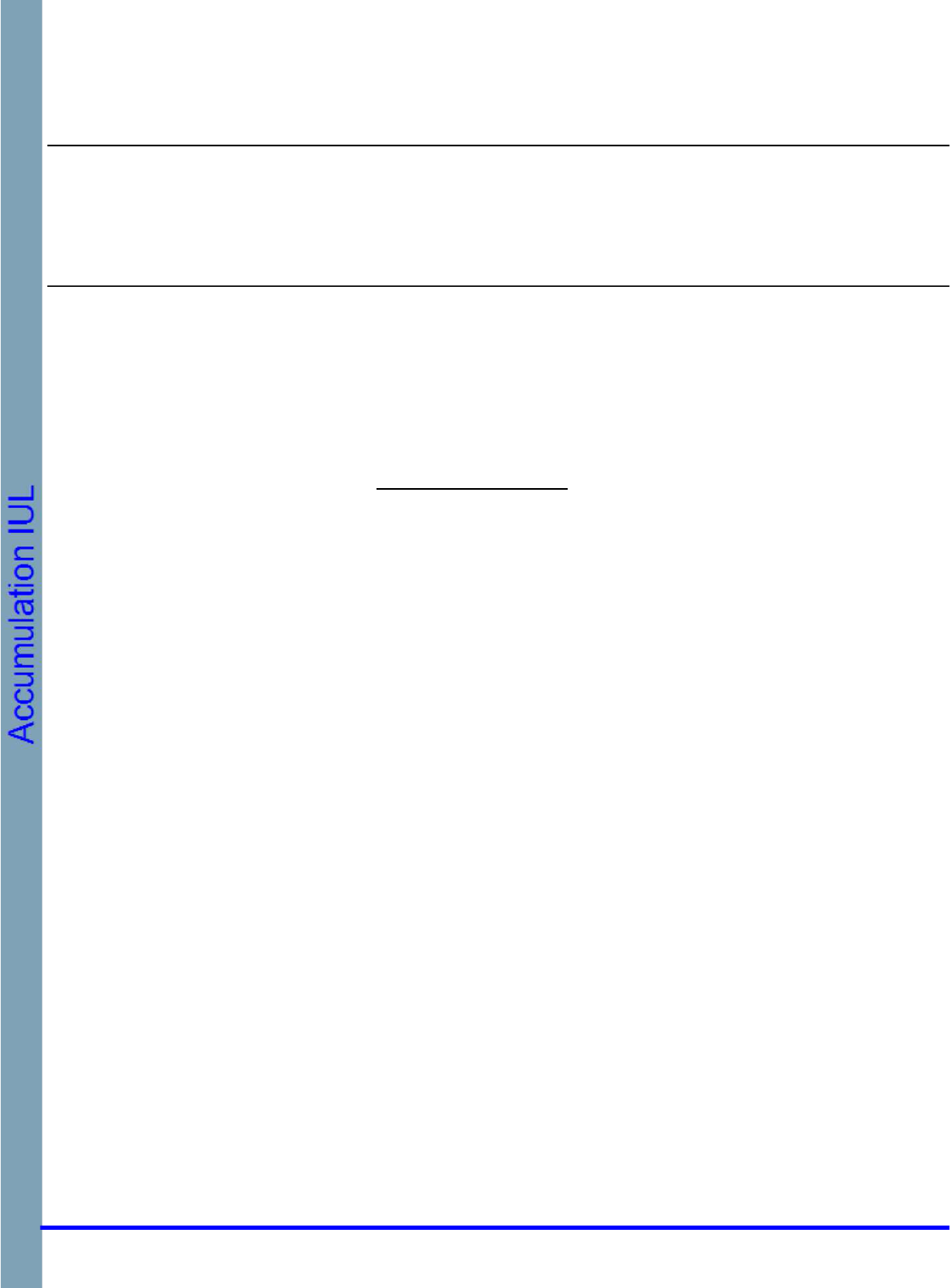

Historical Performance of the S&P 500 and the corresponding hypothetical Index Segment Interest Credit for an

Indexed Account that references the S&P 500

The following tables show the actual historical Index Change in the S&P 500 Index and the corresponding hypothetical

Index Segment Interest Credit for each Indexed Account that references the S&P 500 Index over the most recent 20-year

period. These values should not be considered a representation of past or future performance of the Indexed Accounts

available in a policy. The table assumes the current Indexed Account parameters for the applicable Indexed Accounts

shown above.

Historical Performance of an Index

Year*

S&P 500

Index Point-

to-Point

Performance

Select

Capped

Indexed

Account

(8.0% cap)

Capped

Indexed

Account

(8.75% cap)

High

Capped

Indexed

Account

(10.0% cap)

High Par

Capped

Indexed

Account

(7.5% cap)

Enhanced

Capped

Indexed

Account

(9.5% cap)

Enhanced

High

Capped

Indexed

Account

(12.0% cap)

Loaned

Indexed

Account

(8.75% cap)

2001-2002

-20.80%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

2002-2003

20.76%

8.40%

12.69%

13.00%

10.88%

19.57%

21.60%

12.69%

2003-2004

12.03%

8.40%

12.69%

13.00%

10.88%

19.57%

21.60%

12.69%

2004-2005

5.76%

6.05%

8.35%

7.49%

10.88%

11.87%

10.37%

8.35%

2005-2006

12.00%

8.40%

12.69%

13.00%

10.88%

19.57%

21.60%

12.69%

2006-2007

2.98%

3.13%

4.32%

3.87%

6.91%

6.14%

5.36%

4.32%

2007-2008

-40.07%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

2008-2009

26.64%

8.40%

12.69%

13.00%

10.88%

19.57%

21.60%

12.69%

2009-2010

11.44%

8.40%

12.69%

13.00%

10.88%

19.57%

20.59%

12.69%

2010-2011

-2.40%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

2011-2012

16.65%

8.40%

12.69%

13.00%

10.88%

19.57%

21.60%

12.69%

2012-2013

25.59%

8.40%

12.69%

13.00%

10.88%

19.57%

21.60%

12.69%

2013-2014

12.79%

8.40%

12.69%

13.00%

10.88%

19.57%

21.60%

12.69%

2014-2015

0.98%

1.03%

1.42%

1.27%

2.27%

2.02%

1.76%

1.42%

2015-2016

11.44%

8.40%

12.69%

13.00%

10.88%

19.57%

20.59%

12.69%

2016-2017

17.70%

8.40%

12.69%

13.00%

10.88%

19.57%

21.60%

12.69%

2017-2018

-1.96%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

2018-2019

21.88%

8.40%

12.69%

13.00%

10.88%

19.57%

21.60%

12.69%

2019-2020

15.11%

8.40%

12.69%

13.00%

10.88%

19.57%

21.60%

12.69%

2020-2021

27.05%

8.40%

12.69%

13.00%

10.88%

19.57%

21.60%

12.69%

* Source: S&P 500 Index Data from 12/14/2001 to 12/14/2021

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 10 of 48

Historical Performance of an Index

Year*

S&P 500 Index

Point-to-Point

Performance

Base Capped Two Year

Indexed Account

(21.0% cap)

2000 - 2002

-33.67%

0.00%

2001 - 2003

-4.36%

0.00%

2002 - 2004

35.29%

21.00%

2003 - 2005

18.49%

18.49%

2004 - 2006

18.46%

18.46%

2005 - 2007

15.34%

15.34%

2006 - 2008

-38.29%

0.00%

2007 - 2009

-24.10%

0.00%

2008 - 2010

41.13%

21.00%

2009 - 2011

8.77%

8.77%

2010 - 2012

13.85%

13.85%

2011 - 2013

46.50%

21.00%

2012 - 2014

41.65%

21.00%

2013 - 2015

13.89%

13.89%

2014 - 2016

12.53%

12.53%

2015 - 2017

31.16%

21.00%

2016 - 2018

15.39%

15.39%

2017 - 2019

19.49%

19.49%

2018 - 2020

40.29%

21.00%

2019 - 2021

46.24%

21.00%

*S&P 500 Index Data from 12/14/2000 to 12/14/2021

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 11 of 48

Historical Performance of the Barclays Global MA Index and the corresponding hypothetical Index Segment

Interest Credit for an Indexed Account that references the Barclays Global MA Index

The following table shows hypothetical Index Change in the Barclays Global MA Index because the Index was created in

2021. The hypothetical Index Change is based on hypothetical values of the Barclays Global MA Index using the Index’s

rules as applied to the market conditions in prior periods and the values of the underlying components from December

2006 to December 2020. For periods prior to when these components were available, the values are based upon the

hypothetical values using the securities or commodities that would have comprised the underlying components based

upon their respective objectives. The hypothetical Index Change is shown to reflect how the Barclays Global MA Index

values could have changed during these prior periods. The hypothetical values of the Barclays Global MA Index are

prepared with the benefit of hindsight. There can be no assurances that the Barclays Global MA Index values will actually

perform in the same manner as the hypothetical values. There are numerous factors which will impact actual performance,

including general market conditions as well as whether the Index’s rationale is successful or whether the Index can be

constructed according to the Index’s rules. These Index Changes shown in the Table should not be considered a

representation of past or future Index Change for the Barclays Global MA Index or the performance of the Indexed

Accounts available under the policy. The table assumes the current Indexed Account parameters for the applicable

Indexed Accounts.

Historical Performance of an Index

Year*

Barclays Global MA

Index Point-To-Point

Performance

Barclays Global MA

Bonus (No Cap; 0.65%

Fixed Bonus**)

Barclays Global MA

Classic (No Cap)

2006-2007

6.66%

6.66%

8.32%

2007-2008

-10.68%

0.00%

0.00%

2008-2009

12.83%

12.83%

16.03%

2009-2010

12.63%

12.63%

15.78%

2010-2011

11.93%

11.93%

14.92%

2011-2012

10.39%

10.39%

12.99%

2012-2013

15.20%

15.20%

19.00%

2013-2014

13.97%

13.97%

17.46%

2014-2015

-2.07%

0.00%

0.00%

2015-2016

7.77%

7.77%

9.72%

2016-2017

11.60%

11.60%

14.49%

2017-2018

-2.30%

0.00%

0.00%

2018-2019

17.69%

17.69%

22.12%

2019-2020

8.43%

8.43%

10.54%

2020-2021

2.60%

2.60%

3.25%

* Source: Barclays Global MA Index Data from 12/14/2006 to 12/14/2021

** Fixed Bonus is not included in the index return

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 12 of 48

Illustrated Segment Growth Rate

Illustrations of indexed universal life insurance policies are developed starting with an assumed hypothetical rate of return

that you or your financial professional select, subject to a maximum hypothetical rate of return that is determined by

regulation (the "Maximum Segment Growth Rate"). This regulation sets a limit based upon the historical returns of the

Index. The Indexed Account parameters are then applied to this hypothetical rate of return to determine the hypothetical

maximum crediting rate that will be used to illustrate the values related to your policy. These illustrated values will then be

adjusted by any credits added to--and any charges deducted from–your policy value.

The following table shows the 25-year geometric average annual Segment Growth Rate, as well as its minimum and

maximum. Note the Barclays Global MA Index was created in 2021 and does not have data for these 25-year Segment

Growth Rates.

Maximum Segment Growth Rate

Min

Average

Max

Benchmark Indexed Account

3.77%

5.90%

7.33%

Select Capped Indexed Account

(8.0% Cap)

3.42%

5.21%

6.58%

Base Capped Two Year Indexed Account

(21.0% Cap)

4.27%

6.32%

8.12%

Barclays Global MA Bonus Indexed Account

N/A

N/A

N/A

Barclays Global MA Classic Indexed Account

N/A

N/A

N/A

Capped Indexed Account

(8.75% Cap)

3.59%

5.58%

7.03%

High Capped Indexed Account

(10.0% Cap)

3.91%

6.22%

7.70%

High Par Capped Indexed Account

(7.5% Cap) and Participation Rate

(160% Current)

3.58%

5.14%

6.53%

Enhanced Capped Indexed Account

(9.5% Cap)

3.74%

5.92%

7.39%

Enhanced High Capped Indexed

Account (12.0% Cap)

4.30%

7.05%

8.84%

Loaned Indexed Account

(8.75% Cap)

3.59%

5.58%

7.03%

It's important to keep in mind that:

• Illustrating the same hypothetical maximum crediting rate each year over the life of the policy may not be not

realistic.

• The policy illustration is a presentation of hypothetical values that are based upon assumptions that you or your

financial professional determine. The illustration is designed to show how the policy is expected to perform under

various conditions, rather than to be a projection of the policy’s actual performance.

You should review your policy’s performance periodically to ensure you are on track to meet your goals. As an example, if

the returns assumed in an illustration are not achieved, this can have a significant effect on the policy value, with the result

that you will have to pay more premiums to maintain the policy in force than you had anticipated.

Accessing Your Policy Value

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 13 of 48

Surrenders

You can surrender your policy for its cash value at any time. We will pay you the Policy Value less a Surrender Charge and

any Policy Debt you may have.

Withdrawals

After your policy has been in force for one year, you can make partial cash withdrawals. Withdrawals reduce the Policy

Value and the Death Benefit, and the amount of the withdrawal may be subject to a Surrender Charge. Withdrawals and

any related Surrender Charge amounts are first deducted from the Fixed Account, and then from Segments in the Indexed

Accounts (excluding the Loaned Indexed Account) on a proportionate basis. If illustrated, withdrawals are assumed to be

taken at the beginning of the month.

A withdrawal from the Indexed Accounts that was not pre-scheduled using the Systematic Withdrawal program will initiate

a one-year Lock Out Period during which no new Segments in an Indexed Account may be created except for those

resulting from a maturing Segment.

Loans

Policy loans may be taken against the Policy Value at any time. The maximum loan amount available is the policy's Cash

Surrender Value at the time of request, less any existing Policy Debt, less Monthly Deductions through the remainder of

the Policy Year, all multiplied by one minus the rate of Loan Interest Charged for a policy loan. Interest is charged on the

outstanding Policy Debt, and in the event that you do not pay the Loan Interest Charged in any Policy Year, it will be

borrowed against the policy and added to the Policy Debt in arrears at the Policy Anniversary.

Your policy offers a choice between a Standard Loan, a Fixed Index Loan, or an Index Loan, though only the Standard

Loan option is available during the first Policy Year and only one loan option may be utilized at a time.

The choice of a Standard Loan, Fixed Index Loan or Index Loan can have a significant effect on the net cost

of a loan and your Policy Value. Fixed Index Loans and Index Loans can have the effect of amplifying – both

positively and negatively – the impact that the performance of the Indexed Accounts have on the policy.

Therefore, the risk of policy lapse with a Fixed Index Loan or an Index Loan is greater than it would be with a

Standard Loan.

The cost of a Fixed Index Loan or an Index Loan can vary much more substantially than that of a Standard Loan. The net

cost of a Fixed Index Loan or an Index Loan equals the Loan Interest Charged less the sum of any Index Segment Interest

Credits earned for portions of the loan that are secured by the Indexed Accounts and the Loan Interest Credited to the

Loan Account. For instance, assuming there is no Loan Account, a Fixed Index Loan or Index Loan with a loan charged

rate of 5% and Index Segment Interest Credit(s) of 0% would result in a net loan cost of 5% – much higher than the cost of

a Standard Loan. Conversely, a loan charged rate of 5% and Index Segment Interest Credit(s) of 10% would result in a net

loan gain of 5% to the policy.

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 14 of 48

If projected, policy loans are assumed to be taken at the beginning of the month, and the loan interest rate used in this

policy illustration is shown in the Policy Summary. The illustrated values for the guaranteed assumption illustrations reflect

the Standard Loan Interest Charged Annual Rate for the Standard Loan; the Fixed Index Loan Interest Charged Annual

Rate and Index Segment Interest Credits of 0% for the Fixed Index Loan; and the Maximum Loan Interest Charged Annual

Rate of 15% and Index Segment Interest Credits of 0% for the Index Loan. If there is a loan that is collateralized by policy

value in the Indexed Accounts, illustrative values for all non-guaranteed assumption illustrations reflect, for the portion of

the policy value in the Indexed Accounts used as collateral for loans, a credited rate that takes into account any applicable

adjustment for Indexed Account Multipliers but is no greater than the Loan Interest Charged rate plus 0.50% and any other

applicable current charges and current credits. The illustrative values are hypothetical.

Standard Loan Under the Standard Loan option, loan proceeds and any capitalized loan interest are, to the extent

possible, secured by amounts you have in the Fixed Account that are transferred to a Loan Account. Any amount

borrowed in excess of amounts in the Fixed Account is secured by the Indexed Accounts, and as Indexed Account

Segments mature those proceeds will be transferred to the Loan Account.

The net cost of a Standard Loan equals the Loan Interest Charged less the sum of the Loan Interest Credited to the Loan

Account and any Index Segment Interest Credits earned for portions of the loan that may be secured by the Indexed

Accounts. The loan interest rate charged is guaranteed not to exceed 3.25% in years 1-10, and 3.00% thereafter, and the

loan crediting rate is guaranteed not to be less than 1.25% in years 1-10 and 1.00% in years 11+. The difference between

the Loan Interest Charged rate and the Loan Interest Credited rate to the Loan Account is known as the Loan Interest

Credited Differential. The Loan Interest Credited Differential is guaranteed to be no greater than 2.00%.

Fixed Index Loan Under the Fixed Index Loan option, loan proceeds and any capitalized loan interest are, to the

extent possible, secured by amounts you have in the Indexed Accounts that are transferred to the Loaned Indexed

Account. As Segments of the Indexed Accounts mature, Segment Proceeds of the Indexed Accounts are transferred

to the Loaned Indexed Account to the extent that Index Loan Principal is greater than the Loaned Indexed Account.

Any amounts borrowed in excess of the Indexed Accounts are secured by the Fixed Account.

The net cost of a Fixed Index Loan equals the Loan Interest Charged less the sum of any Index Segment Interest Credit

earned for portions of the loan that are secured by the Loaned Indexed Account and the Loan Interest Credited to the

Loan Account. The loan interest rate charged is guaranteed not to exceed the Fixed Index Loan Interest Charged Annual

Rate in all years and the loan crediting rate is guaranteed not to be less than the Segment Floor Rate. If a Fixed Index

Loan is illustrated, the Loan Interest Credited rate to the Loaned Indexed Account will not be any greater than the Loan

Interest Charged rate plus 0.5%.

We may restrict your ability to take an additional Fixed Index Loan if your request for such a loan is made within 12

months of repaying all or a portion of a Fixed Index Loan. If the limitation on Fixed Index Loan is in effect, you may still

take a Standard Loan or an Index Loan by requesting a Loan Option Change.

Index Loan Under the Index Loan option, loan proceeds and any capitalized loan interest are, to the extent

possible, secured by amounts you have in the Indexed Accounts. Amounts from the Indexed Accounts used to

secure a loan remain in Indexed Account Segments, where those Segments may earn a Segment Interest Credit

upon Segment Maturity. Any amount borrowed in excess of the Indexed Accounts is secured by the Fixed Account.

Index Loan interest rates are variable and subject to change annually on the Annual Processing Date.

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 15 of 48

The net cost of an Index Loan equals the Loan Interest Charged less the sum of any Index Segment Interest Credit

earned for portions of the loan that are secured by the Indexed Accounts and the Loan Interest Credited to the Loan

Account. The loan interest rate charged is guaranteed not to exceed 15% in all years, and the loan crediting rate is

guaranteed not to be less than the Segment Floor Rate. If an Index Loan is illustrated, the Loan Interest Credited rate to

the Indexed Accounts will not be any greater than the Loan Interest Charged rate plus 0.5%.

Other Policy Features and Benefits

Policy Credit

On each monthly Processing Date, beginning in the Policy Year 21 and continuing for 20 years, we will calculate a Policy

Credit to be applied to the Fixed Account and Indexed Accounts in the same manner as we take monthly deductions from

these accounts. Policy Credits are not applied to amounts in the Loan Account, or the Loaned Indexed Account. The

Policy Credit equals 0.09% times the minimum of the Policy Value or the Policy Credit Limit as defined in your Policy.

Policy Continuation at Age 121

Provided your coverage is in effect on the policy anniversary nearest the date on which the Life Insured reaches attained

age 121, coverage will continue thereafter. We will continue to credit interest to the Fixed Account, and when applicable,

apply Index Segment Interest Credits to any Index Account Segments at each Segment Maturity Date. No additional

charges, other than those for any outstanding policy loans, will be deducted.

Tax implications with respect to policies that continue beyond age 121 are not clear at the present time. We urge you to

consult with your tax advisor regarding this issue.

Overloan Protection Rider

The Overloan Protection Rider will prevent your policy from lapsing when, on any monthly processing date, the

outstanding indebtedness on the policy equals or exceeds the Policy Value multiplied by a set percentage (varying by

attained age), not to exceed 95%. Exercise of this rider will result in a "paid up" status. This rider may be exercised

anytime after the insured reaches age 75 if the following criteria are met. The policy must have been inforce for at least 15

years and may not be a Modified Endowment Contract. Policy Indebtedness must exceed the Total Face Amount of your

policy but be less than the Policy Value less the one-time charge for exercising the rider. Your policy will also need to have

a Level Death Benefit upon execution of the rider. After deduction of the one-time rider charge, all policy value will be

transferred to the Fixed Account, if necessary at Segment Maturity. No additional policy transactions or policy changes will

be allowed and no further monthly deductions will be taken. Your total Net Death Benefit will now be equal to the Total

Face Amount plus any Required Additional Death Benefit less any indebtedness. This rider may not be available in all

states.

When the Overloan Protection Rider is exercised, the entire Policy Value is immediately transferred to the Fixed Account.

Since the Internal Revenue Service ("IRS") has not ruled on the tax consequences of exercising the Overloan Protection

Rider, it is possible that the IRS could assert that the policy has been effectively terminated and that the outstanding loan

balance should be treated as a distribution. If this were to occur, all or a portion of the outstanding loan balance could be

taxable when the rider is exercised. You should consult your tax advisor regarding these possible tax consequences.

TAXATION OF LIFE INSURANCE

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 16 of 48

Important Notice

The information contained in this illustration is based on certain tax and legal assumptions. We suggest that you seek

professional tax counsel regarding the interpretation of current tax laws and accounting practices as they relate to your

actual situation. This material does not constitute tax or legal advice and neither John Hancock nor any of its agents,

employees or registered representatives are in the business of offering such advice. You should consult with your own tax

advisor.

Definition of Life Insurance

Definition of Life Insurance testing has been performed on the assumed scale only and is dependent on the assumptions

in that projection. It may not be applicable to the alternate projections shown.

In order to qualify for the income tax advantages of life insurance, a life insurance policy must satisfy one of two Definition

of Life Insurance tests under Internal Revenue Code (IRC) Section 7702. This illustration uses the Guideline Premium Test

which requires that the sum of premiums paid reduced by non-taxable withdrawals and other non-taxable distributions at

any time does not exceed the Guideline Premium Limit. It also requires that the Death Benefit be increased if the Policy

Value grows too large relative to the Death Benefit. Guideline Premiums Limits are determined at issue and are

recalculated upon policy changes. In some cases, a recalculation of the Guideline Premiums may cause the Guideline

Premium Limit to reduce either immediately or over time. This may require us to force out a portion of your Policy Value.

The additional death benefit (described above) that Is required in order to satisfy the Definition of Life Insurance Is referred

to as Required Additional Death Benefit.

Income Tax Treatment of Distributions from a Life Insurance Policy

Pre-death Distributions

The Cash Surrender Value in a life insurance policy grows on a tax-deferred basis. The Cash Surrender Value growth

(gain) is not taxed unless it is distributed to the policyholder. If properly structured, you can access your Cash Surrender

Value to provide a tax-free income subject to the limitations described below.

A policyholder may access their Cash Surrender Value prior to death by surrendering the policy, by taking a withdrawal or

by taking a loan. Force outs under the Guideline Premium Test and certain rider charges are also treated as distributions

from the policy’s Cash Surrender Value. If the policy is not a Modified Endowment Contract (described below), these pre-

death distributions are generally treated as a return of the policyholder’s investment in the contract (cost basis). Most

distributions reduce the policyholder’s investment in the contract (cost basis) until it has been reduced to $0. Any further

distributions would be considered to be paid from the gain in the policy and are includible in gross income.

Exceptions:

• A loan is not considered to be a distribution from the policy for tax purposes unless the policy lapses or is

surrendered with an outstanding loan or the policy is a MEC. The outstanding loan is included in the Cash

Surrender Value used for determining the gain in the policy, which may result in the loan being taxable upon

surrender or lapse, even if net Cash Surrender Value paid to the policyholder at that time is $0.

• Withdrawals and guideline premium force outs in the first 15 years from heavily funded non-MECs are taxed on a

gain-first basis under the recapture ceiling of IRC Section 7702(f)(7).

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 17 of 48

Modified Endowment Contract (MEC)

The Technical and Miscellaneous Revenue Act (TAMRA) of 1988 classifies some policies as Modified Endowment

Contracts (MECs). A policy is classified as a MEC if it fails to satisfy the 7-Pay Test of IRC section 7702A. The test is

failed if the sum of premiums paid reduced by non-taxable withdrawals and other non-taxable distributions at any time in

the first 7 years exceeds the sum of the annual 7-Pay premiums (the 7-Pay Limit). The annual 7-Pay Premium is the

premium that would fund the policy under prescribed assumptions in the first 7 years. Certain policy changes will require

adjustments to the 7-Pay Premiums and may require the test to be performed again. Pre-death distributions from a MEC,

and those taken during the two years before a policy has become a MEC, are subject to less favorable (gain-first) income

tax treatment than a non-MEC Life Insurance Contract and may also be subject to a 10% penalty tax. Your policy is in a

gain position when the Policy Value is greater than the investment in the contract (cost basis). Unlike non-MEC tax

treatment, loans from and assignments of a policy are also distributions from a MEC and are subject to gain-first taxation.

We recommend you consult your tax advisor prior to taking any action on your policy that may cause it to become a MEC.

TAMRA testing has been performed on the assumed scale only and is dependent on the assumptions in that projection. It

may not be applicable to the alternate projections shown. The initial annual 7-pay premium for this policy is $28,782.00.

Based on our interpretation of TAMRA, this policy as illustrated would not be considered a Modified Endowment Contract

(MEC). Whether and when your policy might become a MEC depends on the timing and amounts of premium payments,

withdrawals you take, changes in the policy's non-guaranteed elements, your actual use of the policy's options, and any

policy changes you make. For more information please select the TAMRA Optional Report.

Payment or Accelerations of Death Benefits

Subject to certain exceptions described in Employer-owned Life Insurance below, payments of the Death Benefit

(including accelerations of the Death Benefit under a Long-Term Care or Terminal Illness Rider) are intended to be income

tax free, regardless of whether or not your policy is classified as a MEC. With appropriate planning, Death Benefits may

also be received estate tax free.

Employer-owned Life Insurance

If the owner of the policy is the employer of the life insured, Section 101(j) of the Internal Revenue Code specifies a

number of requirements that must be satisfied in order for life insurance death benefits to be excluded from income

taxation. The life insureds must be the employer’s directors and "highly compensated" employees (as is defined by law). If

the life insured is not a director or highly compensated employee, then the policy's death benefit must be paid out to the

life insured (or to the life insured's designated beneficiary) or used to redeem an equity interest in the employer. Before

the issuance of the policy, the insured must (1) be notified in writing that the employer/policy owner intends to insure the

employee's life and the maximum face amount for which the employee could be insured; (2) give his/her written consent to

being insured under the policy and agree that such coverage may continue after the life insured terminates employment;

and (3) be informed in writing that the employer/policy owner will be a beneficiary of any proceeds payable upon the death

of the life insured. Finally, the employer/policy owner is required to keep records and make an annual report concerning its

employer-owned life insurance policies. Taxpayers should seek the counsel of qualified tax advisors to determine the

applicability of IRC Section 101(j) or other provisions of federal tax law and/or compliance with the requirements of any

such law or regulation.

Other Considerations

This illustration assumes that the currently illustrated non-guaranteed elements will continue unchanged for all years

shown. This is not likely to occur, and the actual results may be more or less favorable. Non-guaranteed elements are

subject to change by the insurer. Future credits and deductions can vary at the company’s discretion depending upon

factors such as death claims, investment earnings and expenses, as well as policy owner actions such as timing and

amount of premium payments, policy lapse and reinstatement, loans and withdrawals, and contractual charges.

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 18 of 48

Important Disclosure

No information provided by John Hancock to you or your financial professional in connection with this sale is intended as

tax, legal or investment advice. This illustration and all other information and materials provided by John Hancock as part

of this sale are not intended to be nor shall they be construed as providing impartial advice or recommendations in

connection with this policy. John Hancock and its representatives will receive compensation derived from such sales or

services.

Accumulation IUL is issued by John Hancock Life Insurance Company (U.S.A.) of Boston, MA 02116. John Hancock Life

Insurance Company (U.S.A.) consistently receives high financial credit ratings from independent rating agencies. For

more information, please visit our website at

www.JohnHancock.com

.

For more than a century, JH has offered security and high-quality products to its customers. The company's experience

and resources allow it to provide first class financial solutions to customers in every market in which it operates.

John Hancock Life Insurance Company (U.S.A.)

A LIFE INSURANCE POLICY ILLUSTRATION

A Flexible Premium Universal Life Insurance Policy

Valuable Information About Your Life Insurance Illustration (cont'd)

Illustration Assumptions

Sample

Male - Preferred NonSmoker

Age: 45

Initial Death Benefit $391,567

Base Face Amount $391,567

Initial Planned Premium: $25,000.00 / Billing Mode: Annual

Initial Death Benefit Option 2; Death Benefit Option 1 Starting In Year 20

Guideline Premium Test; State: Alabama

Based on Current Charges and Initial Assumed Segment Growth Rate of 5.90%

Accumulation IUL Form: 21AIUL

Presented By: Mr Agent

This is your Basic Illustration and is valid only if all illustration pages are included.

Version: 18.2.0 S[0-0-24576-2560-8192] - 199

Winflex

07/18/2022 12:04:13 PM Page 19 of 48

Coverage Summary

Initial Initial

Coverage Description Amount Premium

Base Face Amount

Supplemental Face Amount - Specified Schedule

$391,567

$656,970

$25,000.00

From 21 Thru 76

Additional Coverage On Insured

Overloan Protection Rider †

Policy Summary

State Alabama

Death Benefit Option 2 From 1 Thru 19

1 From 20 Thru 76