0

Independence you can rely on

August 2021

Laura L. Doud

City Auditor

James Lam

Assistant City Auditor

Alvin Chu

Deputy City Auditor

Jennifer Lopez

Senior Performance Auditor

Airport Fees Performance Audit:

Processes to Manage Fees Used for

Operations and Facility Improvements

Can Be Strengthened

1

Table of Contents

Report Summary ...................................................................................................................... 2

I. Background ........................................................................................................................... 3

The Airport collects fees and reinvests them into operations and facility

improvements aimed to enhance the passenger experience. .................. 3

Fees Assessed by Long Beach Airport ......................................................................... 3

Long Beach Airport’s Fee Management ........................................................................ 4

II. Findings & Recommendations ............................................................................................ 5

Finding #1: Reconciliations of Airport fees are not performed consistently or

effectively, while reconciliations of rental car charges are not

performed. The audit identified missed airline fee revenues but did

not identify any unpaid car rental charges. ............................................... 5

Finding #2: The Airport lacks strong contract management practices, leading to

unenforced contract terms. ....................................................................... 17

III. Objective, Scope & Methodology ......................................................................................19

IV. Appendices ........................................................................................................................20

Appendix A: Reconciliation Results .......................................................................... 20

Appendix B: Contract Language Differences ............................................................ 21

V. Management Response ......................................................................................................23

2

Report Summary

What We Found

The Airport collects an average of $14 million in airline fees and

customer facility charges annually, representing 33% of the Airport’s

annual operating revenue. These airline fees and customer facility

charges are self-reported, creating an inherent risk that the total fee

amounts may be inaccurate. The Airport’s current processes to

review and reconcile the accuracy of fee amounts and the timely

collection of fees owed can be improved. The inconsistent nature of

the fee collection process is caused by a lack of existing policies and

procedures resulting in:

• Airline revenue reconciliations were not completed for four

years. By completing reconciliations, this audit found an

additional $72,827 in revenue owed to the Airport. While this

uncollected amount is very small relative to the collection

total, we believe that the inconsistent reconciliation of fees is

an important internal control deficiency and should be

addressed through process improvements without significant

ongoing cost to operations.

• Fee rates were not reviewed to ensure all correct rates were

applied, resulting in airlines sometimes paying fees based on

incorrect rates.

• Overnight aircraft parking spreadsheets were not transcribed

with accurate data. Had reconciliations been completed,

incorrect airline fees would have been assessed.

• Contractual terms with car rental companies and airlines are

inconsistent. Lack of enforcement led to a 10-month overdue

payment without any late fees being charged.

What We Recommend

Why This Audit Is Important

The Long Beach Airport

(Airport) fees form a significant

portion of the Airport’s

operating revenue and are

used to fund operations and

facility improvement projects

which help optimize passenger

traffic. Maintaining a high level

of passenger traffic helps

support the Long Beach

economy.

Audit Objective

Our audit evaluated the

Airport’s management of airline

fees and customer facility

charges to ensure fees are

properly assessed, collected,

reconciled, and deposited in

their entirety.

Acknowledgement

We thank management and

staff at the Airport for their

collaboration, assistance, and

cooperation during this audit.

Airport Fees Performance Audit: Processes to Manage Fees Used

for Operations and Facility Improvements Can Be Strengthened

August 2021

We recommend that the Airport create

written policies to establish consistent

procedures for oversight of airline fees

and customer facility charges revenue.

Additionally, the Airport needs to

ensure that contracts are updated to

reflect current practices and that

contract stipulations are followed.

3

I. Background

The Airport collects fees and reinvests them into operations and

facility improvements aimed to enhance the passenger

experience.

The Long Beach Airport (Airport) was established in 1923 as the first

municipal airport to serve Southern California and has since grown to be well-

recognized, ranking among the top 10 small airports in the United States in

2020, according to USA Today’s Readers’ Choice poll. The Airport has a

positive impact on the City of Long Beach and in the local economy. In Fiscal

Year (FY) 2019, 3.5 million passengers passed through the Airport, with each

passenger contributing $546 to our local economy, as outlined in the Airport’s

2019 Economic Impact Report.

To operate out of the Airport, companies must pay fees associated with their

use of the premises. Airline fees and customer facility charges paid by car

rental companies are among the several fees collected by the Airport. Airline

fees are reinvested back into Airport operations by funding capital projects,

such as a new ticketing lobby and a baggage claims area, aimed to maintain

modern facilities and enhance customer experience. Customer facility

charges could be used to construct consolidated airport vehicle rental

facilities and other car-rental related facility improvements.

By the estimates of the Airports Council International-North America, U.S.

airports will require $128 billion in improvements through 2023 to meet the

demands of travelers as well as airlines. Continued modernization and

improvement of the Airport’s facilities is critical to enhancing customer

satisfaction, maintaining consistent passenger levels, and attracting airlines

and ensuring that they continue to see Long Beach as a destination.

Figure 1.

Airport fees are reinvested into airport operations and improvements,

impacting passengers’ experience and contributing to the Long Beach

economy

Fees Assessed by Long Beach Airport

Three types of airline fees and a car-rental charge are included in this audit:

• Landing Fees – Charged to the airline on each landing of commercial

aircraft carrying persons or cargo.

Airline fees and

customer facility

charges are

reinvested into

the Airport.

Airline fees

affect airport

operations,

airport

improvements,

and passenger

satisfaction.

The Airport has a

positive impact on

Long Beach’s local

economy.

4

• Gate Use Fees – Charged to the airline on each aircraft using the

terminal building apron for enplanement or deplanement of

passengers or cargo.

• Overnight Aircraft Parking Fees – Charged to the airline for any

aircraft parked on the terminal building apron overnight.

• Customer Facility Charges – Assessed by the rental car companies

and paid by car rental customers. These fees are remitted to the

Airport and can be used to construct consolidated car rental facilities,

and other car-rental related facility improvements, which in turn

enhance the experience for passengers who rent a car at the Airport.

During the audit scope of October 2015 through March 2019, airline fees

amounted to $41.8 million and customer facility charges amounted to $6.3

million. In total, airline fees and customer facility charges revenue amounted

to approximately one-third (33%) of the Airport’s annual operating revenue.

Long Beach Airport’s Fee Management

Airlines submit a monthly report of their airline fees owed to the Airport and

remit payment for the associated fees. According to expected practice,

Airport Accounting should independently reconcile the airline fees on an

annual basis using independent third-party data to ensure that the self-

reported fees are accurate and complete. Airline fees reported by the airlines

and reconciled by the Airport should be based on the following formula:

Figure 2.

Landings, gate use, or overnight parking is multiplied by aircraft weight and

approved rates to arrive at the total amount due to the Airport

Car rental companies also self-report customer facility charges in a monthly

report and pay a set rate of $10 per each car rental transaction. There is

currently no independent data source to verify the accuracy of these car

rental payments. Unlike the availability of third-party airline data to the Airport,

there is no third-party rental car data and, therefore, the Airport cannot

perform an independent reconciliation of the customer facility charge fees. In

our benchmark analysis, we found that other airports also do not have access

to third-party data and, thus, do not perform fee reconciliations. However,

both the Reno and Spokane airports utilize audits of the car rental companies

to confirm rental car transactions and fees owed to the airports.

Landing, gate use,

overnight aircraft

parking fees, and

customer facility

charges make up

33% of the Airport’s

annual operating

revenue.

5

II. Findings & Recommendations

The findings described below are related to the Airport’s management of

airline fees and customer facility charges. Many of the issues can be

remedied through the creation and enforcement of clear policies requiring the

consistent performance of procedures to effectively manage such fees.

Additionally, this audit found that contract terms are not always enforced and

that they can be made more consistent for airlines and for car rental

companies. We believe that the audit recommendations are likely to involve

upfront costs in the form of reallocation of staff time to create written policies

and procedures, but minimal ongoing costs once clear protocols are

established and being followed.

Finding #1: Reconciliations of Airport fees are not performed

consistently or effectively, while reconciliations of rental

car charges are not performed. The audit identified

missed airline fee revenues but did not identify any

unpaid car rental charges.

To ensure that the self-reported airline fees received by the Airport were

accurate, this audit reconciled both airline fees and customer facility charge

fees that should have been paid during the audit scope of October 2015 –

March 2019. Our reconciliations consisted of comparing airlines’ self-reported

fees versus a re-calculation of fees based on third-party data of each airline’s

activity level from the Airport Noise and Operations Monitoring System (Noise

System, described below). We also reconciled car rental companies’ self-

reported fees versus car rental company transaction data. We did not identify

any significant differences between the revenues reported by car rental

companies and the re-calculated amounts.

The Airport utilizes the Noise System to reconcile airline reported revenues.

The Noise System’s primary use is to provide the Airport with noise activity

data to enforce the City’s noise ordinance. The System contains airline

activity data such as aircraft types and landing times for each aircraft, making

it a useful resource in conducting airline revenue reconciliations. Being able

to use the Noise System data for reconciliation purposes is a secondary

benefit of the system.

Our reconciliation was conducted using such Noise System data and found

that the reconciliation method used by the Airport is incomplete and flawed

because the Airport’s calculation does not include all airline activity that

should be included in their calculation of fees. This means that any errors

with the portion of airline activity that is not included in the Airport’s

calculation are undetectable by the reconciliation (an incorrect rate paid on

that activity, for example). Moreover, the reconciliation does not include

charter airline data, does not include a verification of aircraft weights, and

does not include a thorough validation of Noise System data.

Auditors did not

identify any missing

car rental charges.

6

Between October 2015 – March 2019, the Airport did not consistently

reconcile airline fees. During the audit period, only calendar year 2018 was

fully reconciled. The Airport partially reconciled calendar year 2017 but did

not finalize the reconciliation. In total, the airport identified and collected an

additional $35,257 in airline fees for 2018 and identified $23,592 for calendar

year 2017 which was not collected because the reconciliation was not

finalized. See amounts fully or partially reconciled by the Airport below:

Figure 3.

The Airport identified $58,849 through its reconciliations, of which $35,257 has

been collected and $23,592 remains outstanding

The City Auditor’s Office (CAO) reconciled airline revenues for the entire

audit scope period to confirm that the Airport’s reconciliation was accurate

and to identify outstanding revenues for the years that the Airport did not

reconcile. Figure 4 below shows an additional $49,235 identified by the City

Auditor’s Office in addition to the $23,592 identified by the Airport that was

not collected, resulting in a total of $72,827 owed to the Airport for the audit

period

1

.

Figure 4.

Combined, Airport and CAO reconciliations identified $72,827 in airline fees

owed

The uncollected $72,827 is 0.17% of the total $41.8M collected during the

entire audit period. While the uncollected amount represents a very small

fraction of the total amount collected during the audit period, we conduct our

audits based on the internal audit industry’s definition of materiality, and the

understanding that materiality can be quantitative or qualitative and should

not be necessarily determined by meeting a set or arbitrary dollar threshold.

1

See Appendix A for more information regarding owed revenues and specific examples regarding issues causing

the underpaid amounts.

Combined, Airport

and CAO

reconciliations

identified $72,827 in

airline fees owed.

7

In our audits, we assess materiality and significance for a variety of matters

and risk areas that often do not have a quantifiable cost to their impact,

including those regarding operational efficiency and effectiveness,

safeguarding assets, customer service, public perception, service continuity,

and compliance with laws and regulations.

Within this context, we raise these audit findings because: 1) these fees are

self-reported by the airlines and are more prone to errors; and 2) more

importantly, the uncollected amounts highlight ineffectiveness and

inconsistency in the Airport’s fee-collection process which must be addressed

to ensure accurate revenue collection. The audit concluded that the $72,827

in airline fees owed were the result of a) a lack of a written policy and

procedures document to ensure that reconciliation-related procedures are

completed, and b) a reconciliation method that is incomplete and flawed

because it does not ensure that all the calculation inputs are correct.

A. The Airport lacks clear, written policies and procedures on

revenue reconciliations. As a result, the Airport is not completing

reconciliations consistently or effectively.

As a best practice, reconciliations of expected revenue and actual revenue

received should be conducted on a regular basis. Timely and regular

reconciliations ensure that any differences are addressed promptly. A

benchmark conducted during this audit also found that three other similarly-

sized airports - Albany, Reno, and Spokane - are reconciling their airline

revenues either monthly or annually. Two airports – Boise and Ontario – do

not perform a reconciliation beyond verifying that reported revenues are

received.

While the Airport acknowledges the need for revenue reconciliations, the

Airport currently does not have written policies and procedures surrounding

airline and car rental revenue reconciliations to ensure they are completed

accurately and consistently. Written policies and procedures are

management best practices. They ensure that organizations operate

effectively by providing guidance, instruction, and accountability to staff on

their responsibilities for day-to-day operations, and by saving the organization

time and resources and streamlining internal processes. The audit found that

Airport staff, operating without written policies, do not always complete

necessary reconciliation-related procedures:

• The Airport does not complete all airline revenue reconciliations.

• The Airport does not regularly update its overnight aircraft parking

records.

• Airport Accounting staff do not obtain necessary data needed for

annual reconciliations.

• Airport staff do not always identify errors in the reports submitted by

the airlines.

• The Airport does not require standardized reports from all airlines.

The Airport does not

have written policies

and procedures to

ensure

reconciliations are

completed correctly.

8

• The Airport does not reconcile customer facility charge fees due to the

lack of third-party car rental transaction data.

Our benchmark identified one similar airport that is following the best practice

of having policies and procedures relating to fee reconciliations in place.

Given the lapses identified, it is important that the Airport also adopt this best

practice.

The Airport does not complete all airline revenue reconciliations.

Without any specific documents requiring reconciliations of airline revenues

and customer facility charges, reconciliations have not always been

performed for airline fees and have never been done for customer facility

charge revenues. During the period audited, only airline fees for calendar

year 2018 were fully reconciled by the Airport. Calendar year 2017 was

partially reconciled, but the reconciliation was not finalized.

Figure 5.

Airport staff only fully reconciled 2018 airline fee revenue which represents

only a fraction of all revenue that should have been reconciled for the audit

period

Prior to 10/1/2015, airline revenues were last reconciled for calendar year

2013. Therefore, there may be additional underpaid fees not identified

between January 2014 - September 2015 that this audit does not capture.

Airport staff attributed the lack of reconciliations to staff turnover and

understaffing. In 2019, the Airport assigned a staff member to retroactively

complete the 2018 reconciliation, but the staff member transferred to another

department within the year, leaving the Airport without anyone assigned or

properly trained to complete the reconciliations, including the 2017

reconciliation which was in progress. This situation left the Airport with neither

staff trained to complete the reconciliations, nor written guidelines for

remaining staff to perform the task. Our benchmark shows that reconciliations

are a manual process not just at Long Beach Airport, but also at other

airports. To ensure that reconciliations are completed annually moving

forward, the Airport must assign and train staff as backup in case of future

turnover.

The Airport does not regularly update its overnight aircraft

parking records.

Airlines that park their aircraft at the terminal building apron overnight pay

overnight parking fees. Airport Operations staff conduct two daily walk-

throughs of the Airport’s ramp area and record a count of all the aircraft

parked overnight. Airport Accounting receives these daily logs and is

Of the last 84

months (2014 -

2020), only 12

months of airline

fees were fully

reconciled. There

may be additional

fees owed for years

not reconciled.

9

expected to enter the data into a monthly spreadsheet to reconcile against

the airlines’ self-reported overnight parking counts.

According to Airport Accounting, overnight aircraft parking spreadsheets are

to be updated monthly or quarterly and submitted to a supervisor for review.

However, this audit found that the monthly overnight aircraft parking

spreadsheets were not updated by Airport Accounting staff for the period of

January 2019 through December 2019. As of February 2020, the monthly

overnight aircraft parking spreadsheets had not been updated for the months

of January 2019 through December 2019. This extended period when

records were not updated demonstrates the need for policies and procedures

to hold staff accountable for certain tasks and procedures. Correct airline fee

reconciliations depend on accurate and timely overnight aircraft parking

spreadsheets; otherwise, potential revenues to the City could be lost, and the

reconciliation process could be lengthened if the data requires correction.

Airport Accounting staff do not obtain necessary data needed for

annual reconciliations.

Data from the Noise System is a key component of the annual reconciliations.

The Airport currently uses the Noise System to monitor aircraft noise levels

according to the City’s noise ordinance and has also adopted the Noise

System as the third-party data source for airline fee reconciliations. The

Noise System tracks airline landings, aircraft type, and landing time.

To complete the reconciliations, Airport Accounting staff must obtain the data

from the Airport’s Noise Office. However, the Noise System data had not

been obtained by Airport Accounting staff after 2013. The Airport staff cited

the absence of this data as one of the reasons that the reconciliations for

2014–2017 were not completed. Per the Airport Noise Office, the data for the

years in question was available. According to the Airport’s Noise Office, noise

data may have stopped being provided to Accounting after 2013 because of

changes in management which may have led to gaps in communication

between Airport Noise and Airport Accounting. Airport Accounting has stated

that the Noise System data had some errors and therefore the reliability of

the data was being assessed. Regardless of the cause, policies and

procedures requiring that staff request, verify, and provide the Noise System

data can remedy this issue.

Airport staff do not always capture errors in the reports submitted

by the airlines.

When the Airport receives the airlines’ monthly revenue reports, staff review

the mathematical accuracy of the payment received to ensure that when

multiplied, the count of airline activity (e.g. landings, gate use, and overnight

aircraft parking), the rate paid, and the aircraft weight equal the dollar amount

paid by the airline. During this process, fee rates paid by the airlines should

be reviewed to ensure they correspond with the rates applicable for the

month being paid, given that rates may change annually or semi-annually

with the approval of City Council.

Overnight aircraft

parking records

were not regularly

updated. Outdated,

inaccurate data can

cause errors in

reconciliation.

10

This audit found that in 2017, there were instances where airlines applied an

incorrect rate when reporting fees owed, and the Airport did not catch the

error. For example, JetBlue used an incorrect mid-year adjusted rate of $9.05

for nighttime landings between May and September of 2017. The City

Council-approved fee for that time period was $10.06. The use of incorrect

rates by JetBlue resulted in a $23,951 underpayment for the five-month

period during which the incorrect rate was used.

Given the significant difference that an incorrect rate can yield, it is critical

that there are clear guidelines requiring staff verification of rates used by the

airlines to ensure they match City Council-approved rates. This requirement,

as well as a verification of all other components of the payment calculation,

should be included in written policy and procedures to ensure that these

errors are consistently detected.

In our benchmarking analysis, we found that the five airports that responded

to our survey did not employ technology solutions that would automatically

detect errors in fee reporting and calculations. Reconciliations were generally

manually performed.

The Airport does not require standardized reports from all

airlines.

The Airport receives the airlines’ monthly revenue reports that detail the

airline fees owed by each airline. The benchmark conducted during this audit

found that three other airports (Albany, Boise, and Reno) require that airlines

use standardized revenue reports. The Long Beach Airport did not require

that all airlines use the same standardized reporting template and some

airlines are using a template of their own. One airline that is using its own

template is SkyWest/Delta. SkyWest/Delta’s template does not

separate daytime and nighttime landings, which incur different rates, resulting

in inaccurate fee reporting. SkyWest/Delta’s report provides a count of all

their landings and calculates fees owed to the Airport based only on the lower

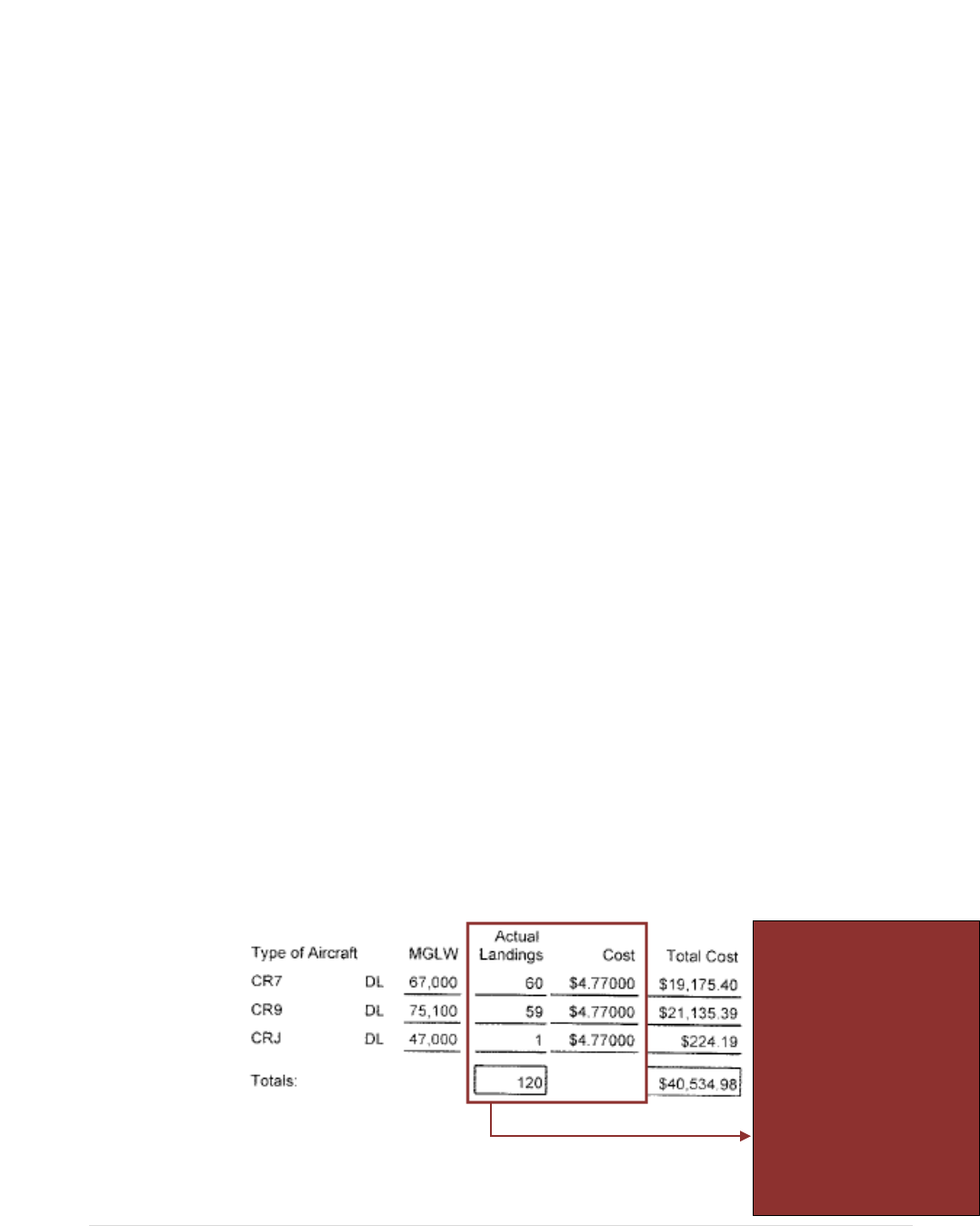

daytime rate. Below is an example of their reported numbers for March

2016.

Figure 6.

SkyWest/Delta needs to differentiate between daytime and nighttime landings

to ensure it pays the correct fee rates as they are only paying day rates

Airlines’ use of

incorrect landing

rates was not

detected by the

Airport, leading to

unidentified unpaid

revenues.

SkyWest/Delta

reported 120 landings

at a daytime rate of

$4.77. The Noise

System identified 12

nighttime landings

subject to the

nighttime rate of

$10.06, but they were

not identified in

SkyWest/Delta’s

report.

11

To illustrate this issue, during the month of March 2016, SkyWest/Delta

reported 120 landings with the daytime rate of $4.77, as shown above, but

the Noise System data specified 108 daytime landings and 12 nighttime

landings. The 12 nighttime landings should have been charged a higher rate

of $10.06, which is more than double the daytime fees the airline actually

paid. In total, the use of the incorrect rate resulted in $4,686 underpaid by

SkyWest/Delta during March 2016.

If the Airport had required all airlines to use a template separating daytime

and nighttime landings, the SkyWest/Delta reporting error would have likely

been prevented. A report template that separates daytime and nighttime

flights would provide guidance for the airlines and would set an expectation

that flights are to be separated appropriately by time of day. This issue was

not identified by the Airport because the 2015 reconciliation was not yet

performed. An additional benefit of standardized reporting is increased Airport

Accounting efficiency in performing annual reconciliations, as the

standardized reporting would clearly delineate daytime versus nighttime

landings by each individual airline. As a result, it is important that airlines are

required to utilize standardized reports and that this requirement is included

in the Airport’s written policies and procedures.

The Airport does not reconcile customer facility charge fees due

to the lack of third-party car rental transaction data.

Per California law, car rental companies are responsible for collecting $10 per

car rental contract and reporting and remitting that revenue to the Airport on a

monthly basis. At the Airport, car rental companies submit monthly reports

that detail the total number of car rental transactions for the reporting month

multiplied by the $10 rate.

The Airport currently does not have a third-party data system that can be

used to verify that the transaction count reported by the car rental companies

is accurate. In the absence of such third-party data, which appears to be

common across airports as revealed by our benchmark analysis, the Airport

has relied on the car rental companies to report the customer facility charge

fees accurately. For this reason, according to Airport staff, the Airport does

not reconcile these fees.

However, the Airport has the contractual right to request transaction data to

ensure that the payment remitted to the Airport is supported, but the Airport

has not historically requested this information. In the absence of third-party

data, requesting the car rental companies’ transaction data for reconciliation

purposes can give the Airport some level of confidence that the transaction

count and payment for those transactions is, at a minimum, supported.

To verify customer facility charge revenues remitted to the Airport, this audit

reconciled three months’ worth of customer facility charge transaction

records from the major car rental companies operating at the Airport. The

Misreported data

from

SkyWest/Delta

was undetected

due to the

absence of

standardized

revenue reports.

Customer facility

charge revenue

reconciliations can

increase

transparency into

car rental

operations and

revenue reporting.

12

reconciliations did not find major discrepancies; however, the reconciliations

did identify some areas for improvement. For example, reconciliations

for Alamo, Enterprise, and National resulted in these companies overpaying

$960 in customer facility charges revenue during the review period. Company

representatives explained the $960 difference as transaction adjustments

made outside of their point-of-sales system, resulting in revenue remitted to

the Airport that is not reflected in transaction data. This practice would not

have been uncovered without reconciliation.

Airport staff indicated that there is no incentive for car rental companies

to improperly report customer facility charges, because the revenue is

reinvested into facility improvements beneficial to them. However, conducting

revenue reconciliations is a best practice and helps identify and correct any

issues that may otherwise go unnoticed. Per the City’s commercial use

permits and contracts with car rental companies, monthly reports submitted

by car rental companies must show the business transacted and other data

as may be required by the Airport. As such, the Airport has the right to

request more detailed transaction information for the completion of CFC

reconciliations. It is important that the Airport begins requesting more detailed

transaction data and utilizing this data for its reconciliation. The Airport should

also include this requirement into their policies and procedures to ensure that

this task is completed.

Alternatively, the Airport may require that the car rental companies submit

copies of financial audits specific to CFCs completed by an independent

third-party. Per the Airport, car rental companies are audited, thereby

mitigating the risk of financial misstatements. Requesting that such audits are

submitted to the Airport provides assurance that revenues have been

properly reported to the Airport. Our benchmark found that two other airports

(Reno and Spokane) use audits of their car rental companies to verify the

revenues reported by the car rental companies.

1.1 Create policies and procedures that assign tasks and

responsibilities to specific individuals in the area of airline fee

management. Policies and procedures should include the

following:

• Airline revenue reconciliations must be completed

annually.

• Airport Accounting must compile overnight aircraft

parking records on a monthly basis.

• Noise System data used in the reconciliations must

be obtained annually.

• Fee rates and other payment calculation inputs must

be verified when the monthly revenue reports are

received and during the reconciliation process.

• Require that airlines utilize standard reporting

templates that separate daytime and nighttime

Recommendations

13

landings.

1.2 Create policies and procedures assigning tasks and

responsibilities to specific individuals in the area of customer

facility charge revenue. Policies and procedures should include

at least one of following:

• Customer facility charge transactions records should

be requested from car rental companies annually. The

Airport should complete an annual reconciliation of

transaction reports requested and revenues received.

• The Airport should request and confirm that an

independent audit of car rental companies was

performed which verifies that CFC revenues have

been reported accurately.

B. The method used to reconcile airline fee revenue is flawed.

When a revenue reconciliation is conducted, it is important that the

reconciliation includes all required data inputs and that the data is accurate.

When working with data, it is also best practice to perform data quality

reviews to ensure that all data used in an analysis is accurate and complete

to yield reconciliation results that are reliable and correct.

In addition to finding that revenue reconciliations are not regularly performed,

this audit found that the annual airline revenue reconciliation does not take

into account all necessary factors to ensure that all outstanding revenues

owed by the airlines are captured. The current reconciliation process:

• Does not analyze all airline activity and, therefore, potentially

miscalculates additional fees owed,

• Does not include revenues from charter airlines,

• Does not include a review of reported aircraft weights, and

• Does not include a thorough validation of Noise System data.

The annual reconciliation does not analyze all airline activity and,

therefore, potentially miscalculates additional fees owed.

The annual reconciliation identifies differences between the self-reported

airline activity counts and the counts observed in the Noise System and in the

monthly overnight parking spreadsheets. The annual reconciliation then

determines additional revenues due based only on any unreported airline

activity. The reconciliation is flawed and incomplete because it does not take

into consideration that there may be errors in the information and revenue

reported by the airlines’ resulting from the use of incorrect fee rates or aircraft

weights, both of which are integral components to the airline fee calculation.

Figure 6 below is a visual representation of a fee calculation error that may

occur with this incomplete method. If the Noise System captured 5 landings,

The reconciliation

does not verify all

actual airline

activity counts to

ensure all revenue

has been received.

14

but the airline only reported 2 landings, the reconciliation would only identify

additional fees owed on 3 landings that remain unpaid by the airline (5 Noise

System landings minus 2 reported landings equals 3 outstanding landings). If

the airline used the incorrect rate for the 2 landings they reported, this

reconciliation would not identify additional money owed for those 2 landings.

Figure 7.

Airport’s reconciliation method only captures a portion of additional revenues

owed by airlines because it only considers a portion of all landings, gate uses,

and aircraft parked overnight

In the example above, the airline used a landing rate of $10 rather than the

accurate $11 rate. The current reconciliation method would capture $33 in

additional fees for the 3 unreported landings using the $11 rate. The correct

method would capture $35 in additional fees, because it calculates all fees

expected based on the correct $11 rate and subtracts amounts already

reported by the airline ($55 - $20 = $35). A correct reconciliation results in an

additional $2 for the Airport.

The example above is a demonstration of the issue on a small scale. The

impact of this method, however, can be much larger. For example, JetBlue

reported an incorrect rate of $9.05 per nighttime landing for the period of May

2017 – September 2017, instead of the actual rate of $10.06. The Airport’s

reconciliation method did not capture additional money on the landings

already reported by the airline because it only calculated additional revenues

for any unreported activity rather than applying the correct landing rate to all

the airline activity captured by the Noise system. This flaw in the

reconciliation method resulted in not identifying an additional $23,951 in

underpaid revenue for this issue alone.

The reconciliation

method used by the

Airport is flawed

and under-

calculates the

money owed by

airlines.

15

For a complete and correct reconciliation, the Airport’s process should also

compare recalculated revenue amounts against revenues actually deposited

in the City’s bank account. While Airport Accounting does perform verification

of airline fee revenues deposited into the City’s bank account, this process is

not incorporated in the reconciliation, which would ensure that all revenues

are reported and received accurately.

The annual reconciliation does not include revenues from charter

airlines.

Charter airlines are smaller airlines that do not have regularly scheduled

flights. These airlines are also subject to landing, gate use, and overnight

parking fees that the larger airlines pay. While these airlines are subject to

fees, they are not currently included in the Airport’s annual reconciliation.

Between October 2015 and December 2016, charter airlines reported a total

airline fee amount of $13,380. This audit reconciled some charter airline

revenues and found reporting issues, such as differences in landing counts,

gate use, and remain overnight aircraft parking counts. Airport staff has the

ability to obtain and use Noise System landing counts for these

airlines. If staff is reconciling airline revenue, charter airline revenue should

also be included to ensure completeness.

The annual reconciliation does not include a review of reported

aircraft weights.

Aircraft maximum landing weights are a key component in calculating the

airline fees owed to the Airport, as most airline fees are based on the weight

of the aircraft. The annual reconciliations do not currently include a

verification of aircraft weights to ensure that the weights reported by the

airlines are accurate.

Per our benchmark, two other airports rely on electronic systems that

automatically identify aircraft weights to be used for revenue reconciliations,

thus ensuring that the aircraft weights are accurate. The Airport does not

have an electronic system that provides them with this level of detail. While

the Airport has access to third-party information guides

2

that provide the

certified landing weight of different aircraft types and models, it does not use

the guides to verify aircraft weights. While our audit did not identify any

material differences in the airline-reported aircraft weights, using the third-

party guides to ensure the accuracy of weights reported is important because

the weight is a key component of the fees paid by the airlines.

2

This audit utilized the Burns & McDonnell guide titled “Aircraft Characteristics”, 12

th

Edition. A website and cell

phone application are also available and can be found here: https://info.burnsmcd.com/aircraft-characteristics-

app.

Reconciliations

must include a

comparison of

recalculated

revenues and

revenue received in

the bank.

The Airport can use

third-party data

guides to verify

aircraft weights for

reconciliation

purposes.

16

The annual reconciliation does not include a thorough validation

of Noise System data.

The Airport currently uses the Noise System as the third-party data source for

airline fee reconciliations. The benchmark comparison found that only one

other airport is using a third-party system to verify self-reported data from

airlines. With the Noise System, the Airport has a valuable resource.

However, it must ensure that the data captured by the system is as complete

and accurate as possible.

Testing data accuracy before relying on it for any analysis or determinations,

such as fee calculations, is a best practice. The U.S. Government

Accountability Office (GAO) states that data tests can include checking

missing data, checking for duplicate records, and testing for relationships

between data elements such as patterns in the data.

While the Airport conducts some procedures to ensure data completeness,

our review, which incorporated the tests recommended by U.S. GAO, found

that some inconsistencies remained in the data that was used for the

reconciliations. For example:

a. There were 13 instances in which aircraft tail numbers, a unique

code used to identify each and every registered aircraft, were

missing in the Noise System data.

b. There were 8 instances in which an aircraft’s arrival or departure

was missing (i.e., an aircraft was identified in the Noise System

as having landed at the Airport and never departing and vice

versa).

c. There were 6 instances in which a single aircraft tail number was

associated with multiple aircraft types.

These data issues are immaterial and minimal in comparison to 35,000 data

records contained within the Noise System for calendar year 2018

only. However, for reconciliation purposes, it is important that

Airport Accounting conduct more thorough reviews of data completeness to

ensure that system data is as accurate as possible and that any issues with

the data are addressed promptly.

1.3 Revise the reconciliation process to include all counts of

landings, gate use, and overnight aircraft parking reported by

airlines. The reconciliation should also compare expected

revenues against actual revenues deposited into the City’s bank

account.

1.4 Ensure that reconciliation inputs are verified. This includes the

use of proper rates by the airlines and the verification of aircraft

The Noise System is

a valuable resource

but must be

periodically

reviewed for data

consistency and

accuracy.

Recommendations

17

weights based on an independent data source.

1.5 Include charter airlines in the airline revenue reconciliation.

1.6 Have Airport Accounting annually review Noise System data to

ensure that the data used in the reconciliations is accurate.

Finding #2: The Airport lacks strong contract management

practices, leading to unenforced contract terms.

Our audit reviewed all airline agreements and car rental agreements and

commercial use permits (CUPs). We assessed terms regarding fees that

companies are required to pay to the Airport. We found that there are

contract and CUP terms that are not reflective of current practices

surrounding airline fees and customer facility charge fees. We also found that

contract terms are not always consistent across similar airline agreements

and car rental agreements/CUPs.

One contract term that is not enforced is late fees for either airlines or car

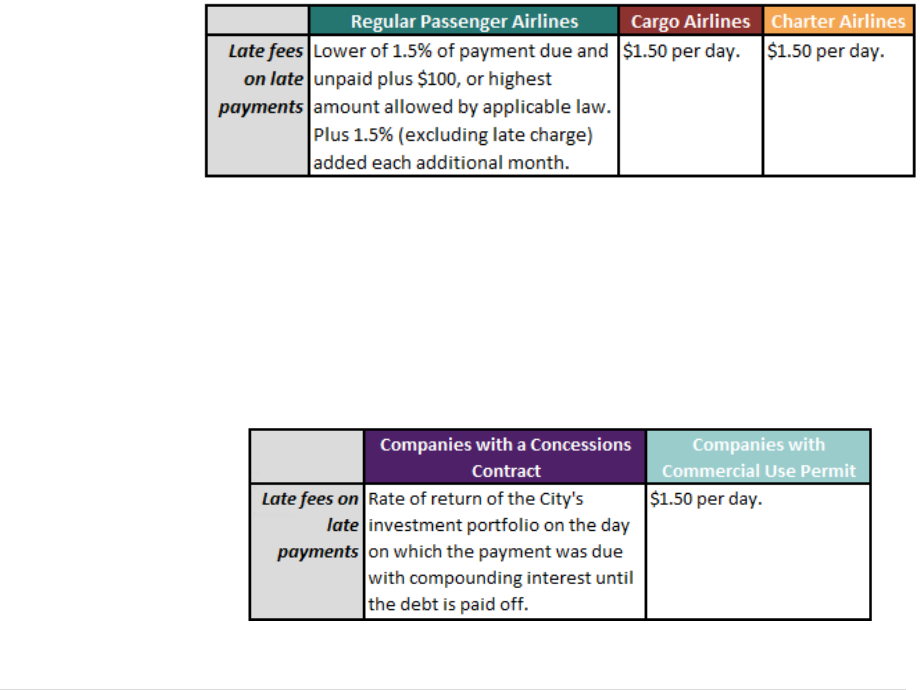

rental companies. Airline contracts are grouped into three different

categories: regular passenger airlines such as Southwest Airlines and

American Airlines, cargo airlines such as UPS and FedEx, and charter

airlines such as Miami Airlines. Late fees per airline category are listed below:

Figure 8.

Late fees vary across different airline types

Car rental companies fall into two different categories – larger companies

housed within the Airport (e.g. Hertz, Alamo) who have a concessions

contract with the Airport and smaller companies outside of the Airport (e.g.

Airport Van Rentals, Allied Rent-A-Car) who have a commercial use permit

with the Airport. Late fees for the different types of car rental companies are

listed below:

Figure 9.

Late fees vary across car rental companies with different contract types

18

In a three-month sample period reviewed, 4 of 18 airline payments were late

3

;

however, no late charges were assessed or paid on these late payments. For

car rental companies, 3 of 19 payments were late

4

and were also not charged

late fees.

One car rental company payment in the amount of $33,720 was overdue by

approximately 10 months. The Airport noted that the payment was lost in the

mail, which was resolved by the car rental company reissuing the check.

While checks may occasionally be lost, it is important that payments do not

take this long to be submitted.

Airport staff indicated that the late fees are not enforced because missed late

fee revenue would not offset the administrative costs associated with

enforcement efforts. However, the Airport missed out on 10-months’ worth of

late fees aimed to recoup interest revenue that would have been earned from

investment of these funds. Enforcing late fees holds companies accountable

for timely submitting their payments, and it also ensures that the Airport earns

some of the revenue that it would have earned in interest revenue had the

payment been received on time.

As observed in the contract terms, late fees are not standardized across the

companies doing business with the Airport. Inconsistencies in contract

language make enforcement more difficult in all areas, including enforcement

of late fees. Other inconsistencies were also noted in areas such as dispute

resolution, record retention, and reports due to the Airport from the airlines

5

.

While some differences in contractual language are expected due to

differences in the type of operations in which each airline and car rental

company engages, contract best practices call for contract documents to be

as consistent as possible in substance and form. Inconsistencies may result

in disagreements or contradictory contractual obligations for individuals

conducting similar operations. Consistent terms that are easier to enforce,

moreover, may help reduce the time that staff spend on contract

enforcement.

2.1 Ensure that all contract stipulations are followed, including

enforcement of late fees.

2.2 Work with City Purchasing to ensure consistency among airline

contracts and car rental company contracts and CUPs to help

facilitate contract enforcement.

3

The 4 late payments include: 1 Southwest payment (22 days late), 2 American Airlines payments (23 and 3 days

late), and 1 SkyWest/Delta payment (1 day late).

4

The 3 late payments include: 1 Avis payment (71 days late), and 2 Hertz payments (297 and 5 days late).

5

See Appendix B for a breakdown of other contractual terms and differences observed.

Late fees were not

enforced on late

payments. The City

loses interest

revenue when

payments are late.

Recommendations

More consistent

contract terms

across similar

agreement types

helps facilitate

enforcement.

19

III. Objective, Scope & Methodology

The objective of this audit was to assess whether the Long Beach Airport is

effectively managing airline fees and customer facility charges to ensure fees

are properly assessed, collected, reconciled, and deposited in their entirety.

The audit scope covered the period of October 1, 2015 through March 31,

2019. To achieve this objective, we:

• Obtained an understanding of internal controls surrounding the collection,

recording, and management of airline fee and customer facility charge

revenues. Of the five internal control components and 17 underlying

principles, all are significant to this audit’s objective.

• Conducted interviews with Airport Administration, Accounting, and

Operations staff regarding processes surrounding airline fees and

customer facility charges.

• Reviewed Federal Aviation Administration and other legal guidelines

regarding airport fees. Assessed the Airport’s compliance with such

guidelines as it relates to setting, administering, and managing airline

fees.

• Reviewed California legal requirements regarding customer facility

charges and assessed the Airport’s compliance with such guidelines as it

relates to setting, administering, and managing customer facility charges.

• Reviewed Noise System data to assess accuracy of information.

• Assessed the effectiveness of the Airport’s airline fee reconciliation

process.

• Reconciled commercial and cargo airlines’ landing, gate use, and

overnight aircraft parking fees for the entire audit scope. Charter airline

fees were partially reconciled.

• Reconciled customer facility charges revenues from major car rental

companies at the Airport for a 3-month period.

• Benchmarked against 5 airports with similar enplanements and budgets

nationwide (Albany, Boise, Ontario, Reno, and Spokane).

• Assessed the Airport’s tracking of performance metrics and

communication related to airline fees and customer facility charges with

stakeholders regarding performance tracking.

We conducted this performance audit in accordance with Generally Accepted

Government Auditing Standards (GAGAS). Those standards require that we

plan and perform the audit to obtain sufficient, appropriate evidence to

provide a reasonable basis for our findings and conclusions based on the

audit objectives. We believe that the evidence obtained provides a

reasonable basis for our findings and conclusions based on the audit

objectives.

20

IV. Appendices

Appendix A: Reconciliation Results

The audit identified a total amount of $72,827 in fees owed. This amount is

based on a combination of a reconciliation performed by audit staff and the

Airport’s reconciliation for years in which reconciliations were fully completed

or partially completed. For 2018, the Airport completed their own

reconciliation and collected or credited any amounts owed. Our audit

identified an additional owed amount of $5,375. For 2017, the Airport was in

the process of reconciling and identified $23,592 in revenue owed by the

airlines. However, the Airport did not finish the process of collecting the

additional revenue identified.

Figure 10.

Reconciliations of airline fees from October 1, 2015 through March 31, 2019

found $72,827 owed to the Airport

Amounts identified as owed through this audit’s reconciliation of airline fee

revenues for the period of October 2015 – March 2019 were caused by

the following:

1. Airlines sometimes used fee rates that differed from those approved by City

Council. For example, American Airlines and JetBlue Airlines both paid the

incorrect fee rates between October 2015 and December 2015. Airport staff

who received the payment identified the discrepancy by checking the

mathematical accuracy of the airline’s self-reports, leading to outstanding

revenues to be collected later. The use of incorrect fee rates by the airlines

was not always detected during the Airport’s check for mathematical

accuracy, as was the case in 2017 when airlines used a nighttime landing

rate of $9.05 between May – September, but the correct rate was $10.06.

2. SkyWest/Delta Airlines did not separate its daytime and nighttime landings in

its airline fee reports. While daytime and nighttime landings incur different

fees, SkyWest/Delta paid daytime landing rates for all of its flights between

October 2015 – March 2019, even though Noise System data shows that the

airline had nighttime landings. The 2018 reconciliation conducted by the

Airport detected this discrepancy. The issue went undetected for other years,

because the annual reconciliations were not conducted.

21

3. There were some differences in the number of landing, gate use, and

overnight aircraft parking counts reported by the airlines versus the Airport’s

internal records. Specifically, the Noise System provides a count of landings,

all of which result in a landing fee and a corresponding gate use charge

which is based on passengers using airport gates. Airline-reported counts

and Noise System counts did not always align. Other differences were noted

between overnight aircraft parking counts reported by the airlines and Airport

Accounting’s monthly overnight aircraft parking logs.

Appendix B: Contract Language Differences

A review of airline contracts found that contracts are inconsistent in areas that

should be applicable across all companies. For example, language regarding

landing fees and the fee calculation method (based on plane weight) is

included in permits for regular passenger airlines. However, such language

is not outlined in the UPS contract. Regular passenger airline permits also

include more robust language than contracts for cargo and charter airlines,

specifically on topics such as late payment charges, dispute resolution,

record retention requirements, and reports due to the Airport. To

illustrate these differences, below is a brief contract comparison of some of

the terms where language differs for different airlines.

22

Figure 11.

Contract terms vary in requirements and level of detail across airlines

Similar inconsistencies were identified for car rental company contracts.

There are two types of car rental company contracts – full contracts for car

rental companies housed at the Airport and commercial use permits for

companies operating outside of Airport property. While most full contracts

with companies housed at the Airport contain the same terms, the Alamo

contract does not contain language surrounding fee due dates and record

retention. For commercial use permits, the Airport Van Rental permit does

not outline a requirement for monthly business reports due to the

Airport, while monthly business reports are required in other permits. Such

differences for companies conducting similar operations may lead to more

difficult enforcement of terms since enforcement varies for different

contracts.

23

V. Management Response

Date: August 23, 2021

To: Thomas B. Modica, City Manager

From: Cynthia Guidry, Director, Long Beach Airport

For: Laura Doud, City Auditor

Subject: Fees Administration Audit

Thank you for the opportunity to comment on the Performance Audit of the Airport’s processes

to manage fees collected from the airlines and rental car operations. Our Management

Response and Action Plan is attached.

We agree with the City Auditor’s recommendations that Airport can strengthen is processes

and believe the implementation of these recommendations will improve the timely collection

and reconciliation of these airport fees. The Airport has already begun implementing the

recommendations to document its procedures.

The Airport would also like to thank the City Auditor’s Office for continuing the reconciliation of

airlines fees from 2015 to 2019. Airport had begun the reconciliation process and was able to

recapture unreported fees. However, due to staffing difficulties and the COVID-19 pandemic,

Airport was not yet able to complete its reconciliation of past fees in a timely manner. The time

and effort the City Auditor’s Office dedicated to this reconciliation has been very helpful. The

Auditor was able to reconcile an additional $72,827 of uncollected revenue representing 0.17%

of the fees collected during the audit period. While the overall amount may seem immaterial

compared to the $42 million in total fees collected by the Airport, Airport recognizes that every

dollar counts and that there is room for improvement in its reconciliation process.

Additionally, the benchmarking of other airports against the Long Beach Airport is useful in

highlighting the Airport’s performance in comparison to other airports. Of the benchmarked

airports, only one had written policies and procedures regarding fee reconciliation, and none

of the airports had technology solutions that would detect errors in their fee process. The Airport

will be able to improve its performance over the benchmarked airports by implementing the

Auditor’s recommendations and by utilizing our unique noise technology.

Please note that some of the recommendations may not be implemented immediately. Namely,

the updating of permits and contracts would need to occur at the appropriate time.

If you have any questions, please contact me at (562) 570-2605.

ATTACHMENT

CC: CHARLES PARKIN, CITY ATTORNEY

D

OUGLAS P. HAUBERT, CITY PROSECUTOR

Memorandum

Airport Fees Performance Audit

August 23, 2021

Page 2 of 2

LAURA L. DOUD, CITY AUDITOR

L

INDA F. TATUM, ASSISTANT CITY MANAGER

K

EVIN JACKSON, DEPUTY CITY MANAGER

TERESA CHANDLER, DEPUTY CITY MANAGER

R

EBECCA G. GARNER, ADMINISTRATIVE DEPUTY CITY MANAGER

M

ONIQUE DE LA GARZA, CITY CLERK

D

EPARTMENT HEADS

MANAGEMENT RESPONSE AND ACTION PLAN

Airport Department

Airport Fees Performance Audit

No. Recommendation Priority Page #

Agree or

Disagree

Responsible

Party

Action Plan /

Explanation for Disagreement

Target Date for

Implementation

1.1

Create policies and procedures that assign tasks and

responsibilities to specific individuals in the area of airline

fee management. Policies and procedures should include

the following:

• Airline revenue reconciliations must be completed

annually.

• Airport Accounting must compile overnight aircraft

parking records on a monthly basis.

• Noise System data used in the reconciliations must be

obtained annually.

• Fee rates and other payment calculation inputs must be

verified when the monthly revenue reports are received

and during the reconciliation process.

• Require that airlines utilize standard reporting templates

that separate daytime and nighttime landings.

H 13 Agree

Airport

Department

The Airport will document the existing practices and develop

formal policies to ensure consistency and timeliness in

completing these tasks. Policies and procedures to be

documented include airline revenue reconciliation, managing

overnight aircraft parking records, obtaining noise system

data, verifying fee rates monthly and developing and

implementing standard reporting templates. These efforts will

begin immediately and will be fully completed within the next

12 months as the Airport documents, refines and finalizes the

policies and procedures.

August 31, 2022

1.2

Create policies and procedures assigning tasks and

responsibilities to specific individuals in the area of

customer facility charge revenue. Policies and procedures

should include at least one of the following:

• Customer facility charge transactions records should be

requested from car rental companies annually. The Airport

should complete an annual reconciliation of transaction

reports and revenues received.

• The Airport should request and confirm that an

independent audit of car rental companies was performed

which verifies that CFC revenues have been reported

accurately.

H 13 Agree

Airport

Department

The Airport will develop policies and procedures for these

tasks. Policies and procedures will include obtaining

transaction records from car rental companies and conducting

an annual reconciliation. This is a new process that will require

the Airport to work with car rental companies and train staff.

The Airport will request and confirm that an independent audit

of car rental companies was performed which verifies that CFC

revenues have been reported accurately.

August 31, 2022

1.3

Revise the reconciliation process to include all counts of

landings, gate use, and overnight aircraft parking reported

by airlines. The reconciliation should also compare

expected revenues against actual revenues deposited into

the City’s bank account.

H 17 Agree

Airport

Department

The Airport will review the existing templates and practices for

reconciling reports, activity and payments. The Airport will

develop a new worksheet and procedures that accurately

reconciles all pieces of the transactions including all counts of

landings, gate use, and overnight aircraft parking. This action

plan will be completed after the policies and procedures are

developed.

December 31, 2022

Page 1 of 2

MANAGEMENT RESPONSE AND ACTION PLAN

Airport Department

Airport Fees Performance Audit

No. Recommendation Priority Page #

Agree or

Disagree

Responsible

Party

Action Plan /

Explanation for Disagreement

Target Date for

Implementation

1.4

Ensure that reconciliation inputs are verified. This includes

the use of proper rates by the airlines and the verification

of aircraft weights based on an independent data source.

H 17 Agree

Airport

Department

The Airport will secure an independent data sources and begin

using the data to verify inputs when performing

reconciliations. This task will be completed during the next

reconciliation process for FY21 operations.

December 31, 2021

1.5 Include charter airlines in the airline revenue reconciliation. H 17 Agree

Airport

Department

The Airport will include charter airline revenue reconciliations

in its reconciliation process.

December 31, 2021

1.6

Have Airport Accounting annually review Noise System

data to ensure that the data used in the reconciliations is

accurate.

H 17 Agree

Airport

Department

The Airport will conduct a separate reconciliation of Noise

System data from the revenue reconciliation to add assurance

in the accuracy of the data. This process will require extensive

resources and focus to ensure a proper review of noise system

data is completed. A process does not currently exist and will

need to be developed and tested before full implementation.

December 31, 2022

2.1

Ensure that all contract stipulations are followed, including

enforcement of late fees.

M 19 Agree

Airport

Department

The Airport will conduct a review of all contracts and

implement new policies and procedures to ensure that all

contract stipulations are followed, including enforcement of

late fees. This action plan will follow the timeline of new

agreements already being developed for new facilities at the

Airport.

December 31, 2022

2.2

Work with City Purchasing to ensure consistency among

airline contracts and car rental company contracts and

CUPs to help facilitate contract enforcement.

L 19 Agree

Airport

Department

The Airport will update contracts with Rental Car Companies

when practical to ensure each group of similar users have

consistent contracts to help facilitate contract enforcement.

This action plan will follow the timeline of new agreements

that will be developed when new facilities are completed at

the Airport.

December 31, 2023

Priority

Shaded areas - to be completed by the department

H – High Priority - The recommendation pertains to a serious or materially significant audit finding or control weakness. Due to the seriousness or significance of the matter, immediate

management attention and appropriate corrective action is warranted.

L – Low Priority - The recommendation pertains to an audit finding or control weakness of relatively minor significance or concern. The timing of any corrective action is left to management's

discretion.

M – Medium Priority - The recommendation pertains to a moderately significant or potentially serious audit finding or control weakness. Reasonably prompt corrective action should be taken by

management to address the matter. Recommendation should be implemented no later than six months.

Page 2 of 2

Long Beach City Auditor’s Office

411 W. Ocean Blvd., 8

th

Floor

Long Beach, CA 90802

Telephone: 562-570-6751

Fax: 562-570-6167

Email: Auditor@longbeach.gov

Website: CityAuditorLauraDoud.com

MyAuditor App available at the App Store or Google Play

Follow Us:

Facebook: @LBCityAuditor

Instagram: @LBCityAuditor

Twitter: @LBCityAuditor

CITY AUDITOR’S FRAUD HOTLINE: 1-888-FRAUD-07