Michigan Department of Treasury (Rev. 03-23), Page 1 of 2

MI-1041D

2023 MICHIGAN Adjustments of Capital Gains and Losses

Issued under authority of Public Act 281 of 1967, as amended.

Include this form with the duciary income tax return MI-1041. Type or print in blue or black ink.

For 2023 or taxable year beginning

- 2023 , and ending .

MM-DD-2023 MM-DD-YYYY

Name of Estate or Trust Federal Employer Identication Number (FEIN)

PART 1:

SHORT-TERM CAPITAL GAINS AND LOSSES

(ASSETS HELD ONE YEAR OR LESS)

1.

Combine short-term totals from MI-8949, line 2 and U.S. Form 1041

Schedule D, line 1a, column h............................................................ 1.

2.

Short-term capital gain or (loss) from U.S. Forms 4684, 6252, 6781,

and 8824............................................................................................. 2.

3. Enter net short-term gain or (loss) from partnerships, S corporations

and other estates or trusts.................................................................. 3.

4. Short-term capital loss carryover from 2022....................................... 4.

5.

Net short-term gain or (loss). Combine lines 1 through 4. Enter here

and on line 13, column A .................................................................... 5.

PART 2:

LONG-TERM CAPITAL GAINS AND LOSSES

(ASSETS HELD MORE THAN ONE YEAR)

6.

Combine long-term totals from MI-8949, line 4 and U.S. Form 1041

Schedule D line 8a, column h............................................................. 6.

7.

Long-term capital gain or (loss) from U.S. Forms 2439, 4684, 6252,

6781, and 8824................................................................................... 7.

8. Enter net long-term gain or (loss) from partnerships, S corporations

and other estates or trusts.................................................................. 8.

9. Capital gain distributions .................................................................... 9.

10. Enter gain, if applicable, from U.S. Form 4797................................... 10.

11. Long-term capital loss carryover from 2022 ....................................... 11.

12.

Net long-term gain or (loss). Combine lines 6 through 11.

Enter here and on line 14, column A................................................... 12.

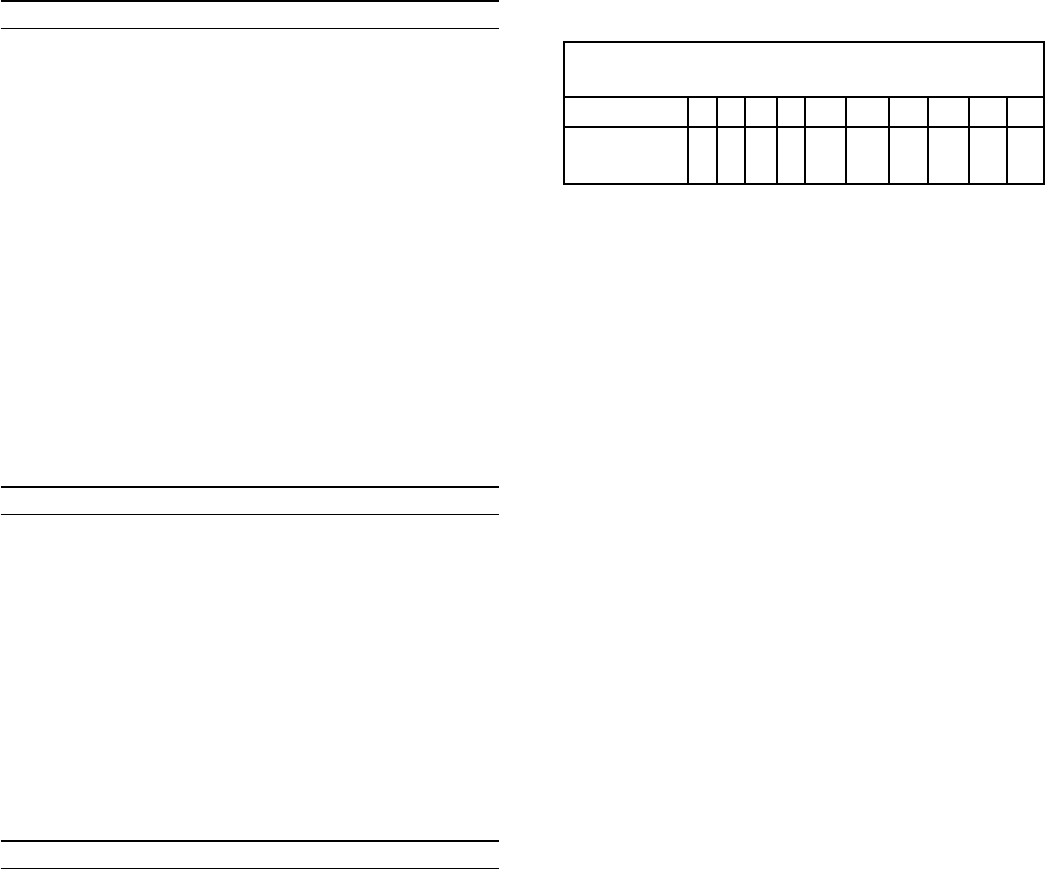

PART 3: SUMMARY OF PARTS 1 AND 2

D E

Federal Gain (Loss) Michigan Gain (Loss)

Federal Gain (Loss)

Gain (Loss)

from Column h of

from Column D Subject to

U.S. 1041 Schedule D

Michigan Income Tax

( ) ( )

D E

Federal Gain (Loss) Michigan Gain (Loss)

Federal Gain (Loss) Gain (Loss)

from Column h of from Column D Subject to

U.S. 1041 Schedule D Michigan Income Tax

( ) ( )

13.

Net short-term gain or (loss)

from line 5.................................

14.

Net long-term gain or (loss)

from line 12..............................

15.

Total net gain or (loss).

Combine lines 13 and 14..........

A

Total Gain or (Loss)

B

Fiduciary

C

Beneciary

Federal Michigan Federal Michigan Federal Michigan

For resident estates and trusts if line 15, column A is a net loss continue to Part 4. If line 15, column A is a net gain, continue to Part 5.

For nonresident estates and trusts carry line 15, column B, Michigan column to Form MI-1041, Schedule NR, line 24 and then continue

to Part 4.

Continued on Page 2.

Reset Form

2023 MI-1041D, Page 2 of 2

Federal Employer Identication Number (FEIN)

PART 4: COMPUTATION OF CAPITAL LOSS LIMITATION

16.

If line 15 column A, shows a net loss, enter the smaller of:

(a) the duciary’s share of net loss on line 15, column B; or

(b) $3,000 ......................................................................................................... 16.

D E

Federal Michigan

( ) ( )

Note: When determining whether 16a or 16b is smaller, treat both numbers as if they were positive.

Resident estates and trusts complete Part 5. Nonresident estates and trusts carry line 16, Michigan column E to Form MI-1041

Schedule NR, line 27.

If the net loss on line 15, column A, is more than $3,000, or if the taxable income on U.S. Form 1041, page 1, line 23, is zero or

less, complete Part 6 to determine the loss carryover.

PART 5: COMPUTATION OF CAPITAL ADJUSTMENT - FOR RESIDENT ESTATES OR TRUSTS

Gains

17.

Enter the duciary’s share of net gain from line 15, column B, federal column, as

a negative number; if a loss, enter “0”.................................................................... 17.

18.

Enter the duciary’s share of net gain from line 15, column B, Michigan column,

as a positive number; if a loss, enter “0”................................................................. 18.

Losses

19.

Enter loss from line 16, federal column, as a positive number.

If no loss shows, enter “0”. ..................................................................................... 19.

20.

Enter loss from line 16, Michigan column, as a negative number.

If no loss shows, enter “0” ...................................................................................... 20.

Adjustment

21. Combine lines 17 through 20. Enter the total here and on MI-1041, line 11 ....... 21.

PART 6: COMPUTATION OF CAPITAL LOSS

CARRYOVERS FROM 2023 TO 2024

Carryover Limit

22.

Enter taxable income/loss from 2023 U.S. Form 1041, line 23, or U.S. Form 990-T,

Part I, line 11 in column D and MI-1041, line 12 in column E ...................................... 22.

23. Enter the loss from line 16 as a positive amount................................................... 23.

24. Enter the amount from U.S. Form 1041, line 21, or U.S. Form 990-T, Part I, line 8.. 24.

25.

Adjusted taxable income. Combine lines 22, 23 and 24. If less than zero,

enter “0”................................................................................................................. 25.

26. Enter the smaller of line 23 or 25........................................................................... 26.

( )

D E

Federal Michigan

NOTE: Complete this section only if there is a loss shown on line 5 and line 15, column A.

Short-Term Capital Loss Carryover

27. Enter the loss shown on Part 1, line 5 as a positive amount................................. 27.

28.

Enter the gain, if any, from line 12. If that line is blank or shows a loss,

enter “0”................................................................................................................. 28.

29. Enter the amount from line 26, above. .................................................................. 29.

30. Add lines 28 and 29............................................................................................... 30.

31.

Short-term capital loss carryover to 2024. Subtract line 30 from line 27. If less

than zero, enter “0”................................................................................................ 31.

NOTE: Complete this section only if there is a loss shown on line 12 and line 15, column A.

Long-Term Capital Loss Carryover

32. Enter the loss shown on Part 2, line 12 as a positive amount ..................................... 32.

33.

Enter the gain, if any, from line 5. If that line is blank or shows a loss,

enter “0”................................................................................................................. 33.

34. Enter the amount from line 26. .............................................................................. 34.

35. Enter the amount, if any, shown on line 27............................................................ 35.

36. Subtract line 35 from line 34. If less than zero, enter “0”....................................... 36.

37. Add lines 33 and 36............................................................................................... 37.

38.

Long-term capital loss carryover to 2024. Subtract line 37 from line 32. If less

than zero, enter “0”................................................................................................ 38.

2023 MI-1041D, Page 3

Instructions for Form MI-1041D

Adjustments of Capital Gains and Losses

When To File

Use this form to adjust Michigan taxable income if the estate

or trust has capital gains or losses that are attributable to:

1. Gains or losses from the sale of certain types of

properties located in other states and/or subject to

Michigan’s allocation provisions. Gains or losses subject

to Michigan’s apportionment provisions, refer to the

MI-1040H.

2. Periods before October 1, 1967 (Section 271 adjustment).

If U.S. Forms 1041 Schedule D or 4797 were led, and

an election to adjust under Section 271 of the Michigan

Income Tax Act was made, le the equivalent Michigan

forms (MI-1041D or MI-4797). All items of gain or loss

realized during the tax year must be included.

3. Gains or losses from the sale or exchange of U.S.

obligations that cannot be taxed by Michigan.

Form MI-1041D must be included with the Michigan

Fiduciary Income Tax Return (MI-1041).

General Information

Page 1 of Form MI-1041D follows the pattern of page 1

of the U.S. Form 1041 Schedule D and all the information

necessary for completing it should be taken from the U.S.

Form 1041 Schedule D.

Rounding Dollar Amounts

Round down amounts of 49 cents or less. Round up amounts

of 50 cents or more. If cents are entered on the form, they

will be treated as whole dollar amounts.

Identication

Enter the name of the estate or trust and the Federal Employer

Identication Number (FEIN) at the top of the MI-1041D.

Parts 1 and 2

If U.S. Form 8949 Sales and Other Dispositions of Capital

Assets was led, complete Form MI-8949 in the same

manner. Transfer the information to MI-1041D, following

the instructions on Form MI-1041D. If the U.S. Form 8949

discloses capital assets reported under Internal Revenue Code

(IRC) Sections 1245 and 1250, these assets must be reported

on MI-8949. Also, if capital assets are allocated to another

state, they are excluded from the portion subject to Michigan

income tax. A capital loss carryover from preceding years is

entered as a short-term loss on line 4 or as a long-term loss

on line 11.

Federal Information

Line 1: Combine the amount from MI-8949, line 2, and the

amount from U.S. Form 1041 Schedule D, line 1a, column h.

For lines 2, 3, 4, 5, 7, 8, 9, 10, 11 and 12 column D, enter

the amounts from U.S. Form 1041 Schedule D, for the

corresponding line numbers listed on the top of the next

column.

Corresponding lines on MI-1041D and

U.S. 1041 Schedule D

MI-1041D 2 3 4 5 7 8 9 10 11 12

U.S. 1041

Schedule D

4 5 6 7 11 12 13 14 15 16

Line 6: Combine the amount from MI-8949, line 4, and the

amount from U.S. Form 1041 Schedule D, line 8a, column h.

Michigan Information

Enter the portion of federal gain and loss subject to Michigan

tax in column E on lines 2, 3, 4, 5, 7, 8, 9, 10, 11 and 12.

Section 271 of the Michigan Income Tax Act. To apportion

under Section 271 multiply the gain (loss) in column E by the

number of months the property was held after September 30,

1967. Divide the result by the total number of months held.

Enter the result in Michigan column E. For the purpose of this

computation, the rst month is excluded if acquisition took

place after the 15th, and the last month is excluded if disposal

took place on or before the 15th.

Gains from installment sales made before October 1, 1967,

must show the federal gain in federal column D and zero in

Michigan column E. Gains or losses from installment sales

made after October 1, 1967, are subject to Michigan tax but

may be apportioned under Section 271.

Distributions from employee’s pension, stock bonus or prot-

sharing trust plans that are considered to be long-term capital

gains (under IRC 402) and capital gains distributions are not

eligible for Section 271 treatment. Enter the total gain in both

the federal and state columns.

U.S. Obligations. Gains from the sale or exchange of some

U.S. obligations are not subject to tax and losses are not

deductible. Enter a zero in the Michigan column for gains

or losses realized from the sale of these non-taxable U.S.

obligations.

Note: Any interest expense and other expenses incurred in the

production of income from U.S. obligations should be entered

on MI-1041, line 32. (See MI-1041 instruction booklet for

line 32 on page 5.)

Capital gains or losses from the sale or exchange of municipal

bonds are taxable for Michigan residents.

Out-of-State Property. Gains from the sale of property located

in another state are not subject to Michigan tax, and losses

are not deductible. Enter in the Michigan column the gain or

loss from the sale or exchange of (1) real property located in

Michigan, or (2) tangible personal property located in Michigan

at the time of the sale or if the taxpayer was a Michigan resident

estate or trust, or (3) intangible personal property sold by a

Michigan resident estate or trust.

2023 MI-1041D, Page 4

Part 3: Lines 13, 14, and 15

Column A: Enter the corresponding net short-term or

long-term gain (loss) from column D (federal) and column E

(Michigan) in the appropriate boxes. Combine lines 13 and

14 and enter the result on line 15.

Column B: Enter the share of short-term and long-term gains

and losses retained by the duciary. Follow the instructions

on the form for resident and nonresident estates and

trusts.

Column C:

Enter the share of short-term and long-term gains

(losses) distributed to the beneciaries. Totals on line 15

should equal the totals on Form MI-1041, Schedule 4, line 44.

Part 6

If the net loss on line 15, column A, is more than $3,000,

or if the taxable income on U.S. Form 1041, line 23 or

U.S. Form 990-T, Unrelated Business Taxable Income is

zero or less, complete this section to determine the capital

loss carryover.