AdValoremTaxes

The2021budgetincludesadvaloremtax revenueintheamount of $75,396,337 or 31% of all

revenue.The following factors are considered:(1) the tax base increased by an average of

5.86%or$1,117,165,265toanadjustedtaxablevaluationof$20,193,574,255.Thetaxratewas

$0.339978 per $100 valuation in 2020 and Commissioners’ Court has adopted $0.339978 per

$100 valuation in fiscal year 2021.(2) New property added to the tax roll provides

approximately $2,000,381 in additional revenues.(3)”Truth in Taxation” law establishes

guidelinesforgovernmententitiestofollowwhensettingtaxrates.Theeffectivetaxratewas

derivedfrom theprior year totaltax levy,andis adjusted for current yearchanges inexisting

propertyvaluationandlostpropertyfromthetaxroll.

PropertytaxesareleviedbyOctober1onthe assessedvaluelistedasofthepriorJanuary1for

allrealandbusinesspersonalpropertyinconformitywithTexasPropertyCode.Taxesaredue

onreceiptofthetaxbillandaredelinquentifnotpaidbyF ebruary1oftheyearfollowingthe

yearinwhichimposed.OnJanuary1ofeachyear,ataxlienisattachedtopropertytosecure

thepaymentofalltaxes,penalties,andinterestultimatelyimposed.

Lubbock County maintains a high collection of property tax.Historically, tax collections total

approximately 99% of the tax levy. The County encourages the Lubbock Central Appraisal

District(LCAD)tofollowanaggressivepolicyofcollectingpropertytaxrevenues.

LUBBOCK COUNTY, TEXAS

ADOPTED BUDGET 2020-2021

TAX DISTRIBUTION BY FUND

Total

Tax Gross Tax

Description of Fund Rate Taxes Distribution

General Fund 0.289342 64,166,909.66$ 85.11%

Permanent Improvement 0.010000 2,217,683.91$ 2.94%

Precinct 1 Park 0.000500 110,884.20$ 0.15%

Slaton/Roosevelt Parks 0.000500 110,884.20$ 0.15%

Idalou/New Deal Parks 0.000500 110,884.20$ 0.15%

Shallowater Parks 0.000500 110,884.20$ 0.15%

Debt Service 0.038636 8,568,243.54$ 11.36%

TOTAL TAX RATE/TAX LEVY 0.339978 75,396,373.88$ 100.00%

$48.1

$52.4

$53.8

$55.6

$60.7

$63.8

$67.3

$69.7

$72.0

$75.3

$‐

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

LubbockCounty,Texas

AdValoremTaxRevenue

0.31500

0.32000

0.32500

0.33000

0.33500

0.34000

0.34500

0.35000

0.35500

0.36000

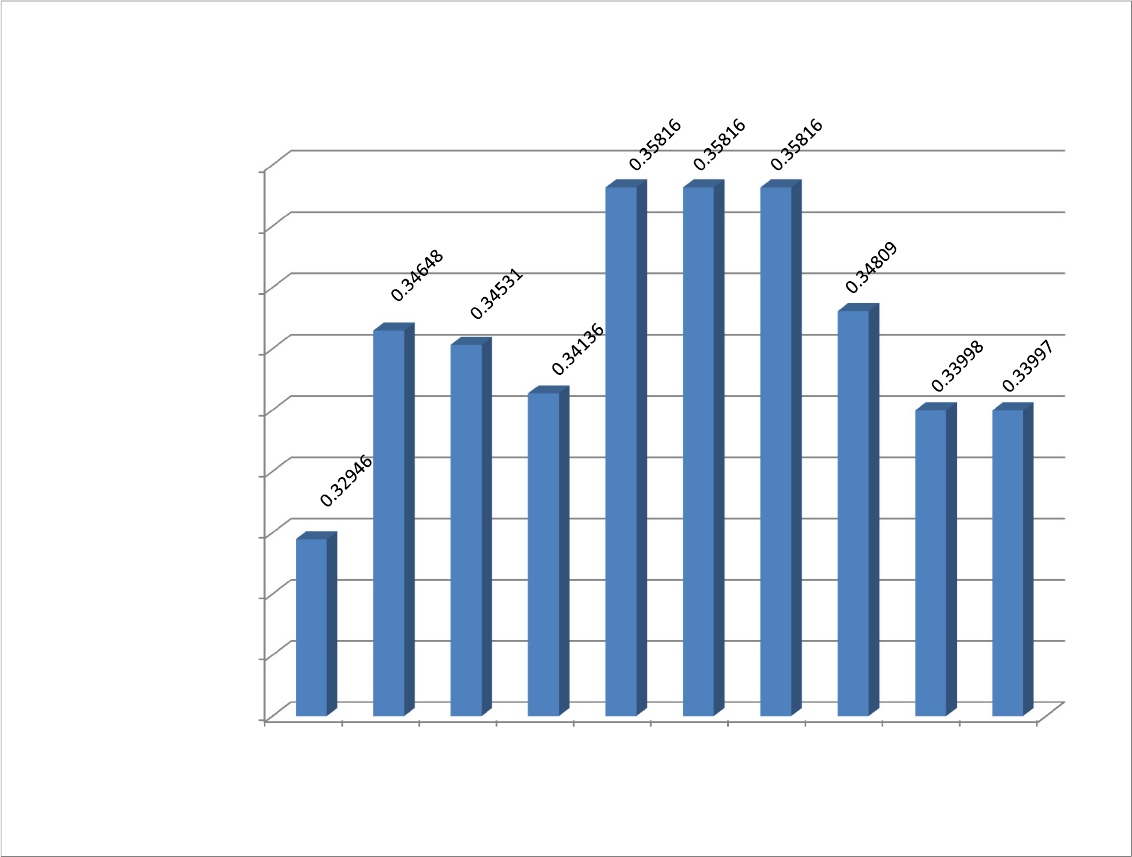

'12 '13 '14 '15 '16 '17 '18 '19 '20 '21

CentsPer$100Value

FiscalYear

LUBBOCKCOUNTY,TEXAS

TENYEARTAXRATEHISTORY

LUBBOCK COUNTY, TEXAS

ADOPTED BUDGET 2020-2021

TAX RATES BY FUND

Tax Tax Tax Tax Tax Tax Tax Tax Tax Tax

Rate Rate Rate Rate Rate Rate Rate Rate Rate Rate

Funds 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

GeneralFund 0.274946 0.289123 0.286094 0.283969 0.302542 0.303168 0.309104 0.296757 0.288650 0.289342

PermanentImprovemen

t

0.005000 0.010000 0.010000 0.010000 0.010000 0.010000 0.010000 0.010000 0.010000 0.010000

Precinct1Par

k

0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500

Slaton/RooseveltPark

s

0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500

Idalou/NewDealPark

s

0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500

ShallowaterPark

s

0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500 0.000500

DebtService 0.047512 0.045354 0.047216 0.045389 0.043616 0.042990 0.037054 0.039329 0.039329 0.038636

TOTA

L

0.329458 0.346477 0.345310 0.341358 0.358158 0.358158 0.358158 0.348086 0.339979 0.339978

FortheAverage$157,144Home

CountytaxesforFY2020‐2021onthesamehousewouldbe$534.26basedonthepropertytaxrateof.339978¢per$100valuation.

Allcalculationsarebasedonthecountyaveragetaxablevalueofasinglefamilyhomein2020asprovidedbyLCAD.

Changes in an individual taxpayer's county taxes are dependent on the specific change in property valuation. The above figures are presented for comparison purposes

only.

Thefollowingchartdisplaysasummaryoftaxespaidbytheaveragehomeownerincludingcity,school,andcountytaxesforFY2020‐2021.Thechart showsthatonly

16.72%oftaxespaidontheaveragehomeareforCountytaxes.

LUBBOCKCOUNTY,TEXAS

PROPERTYTAXANALYSISFORAVERAGEHOMEOWNER

County taxes for FY 2019‐2020 on a $150,852 home, which was the county average, were $512.86 based on the ad opted tax rate o

f

.339978¢ per $100 valuation.

Valuationsfortheaveragehomefor2020increasedbyanestimatedaverageof4.2%.Ahomevaluedat$150,852wouldhave,onanaverage,acurrentvalueof$157,144.

I

f

the valuation on your home was $150,852 in FY 2019‐2020 and remained the same in 2020‐2021, county taxes on your home would be $512.86, which is the same per

year. If your appraisal increased by an estimated 4.2%, taxes will increase by $21.39 per year or $1.78 per month in 2020‐2021.

SchoolDistrict

$1,809

or

56.64%

CityofLubbock

$851or26.64%

TotalTaxes

$3,194

LubbockCounty

$534or16.72%

LUBBOCKCOUNTY,TEXAS

ADOPTEDBUDGET2020‐2021

ANALYSISOFREVENUEDERIVEDBYTAXRATE

ADJUSTEDTAXABLEVALUE 20,193,574,255.00$

M&OTAXRATE/$100VALUATION 0.301342 60,851,720.53$

I&STAXRATE/$100VALUATION

CertificatesofObligation 20,193,574,255.00$

TOTALI&S 0.038636

7,801,989.35$

PROJECTEDLEVYW/OOVER65 68,653,709.88$

ESTIMATEDLEVYOFOVER65 6,742,664.00$

TOTALGROSSLEVY 0.339978

75,396,373.88$

DISTRIBUTION REVBYFUND ESTIMATED TOTAL

FUNDNAME TAXRATE

FOROVER65LEVY OVER65 REVENUE TAXREVENUE

GENERALFUND 0.289342 85.1061% 5,738,418.04$ 58,428,491.62$ 64,166,909.66$

PERMANENTIMPROVEMENTFUND 0.010000 2.9414% 198,326.48$ 2,019,357.43$ 2,217,683.91$

PRECINCT1PARK 0.000500 0.1471% 9,916.32$ 100,967.87$ 110,884.20$

SLATON/ROOSEVELTPARKS 0.000500 0.1471% 9,916.32$ 100,967.87$ 110,884.20$

IDALOU/NEWDEALPARKS 0.000500 0.1471% 9,916.32$ 100,967.87$ 110,884.20$

SHALLOWATERPARKS 0.000500 0.1471% 9,916.32$ 100,967.87$ 110,884.20$

SUBTOTALforM&O 0.301342 88.6357% 5,976,409.81$ 60,851,720.53$ 66,828,130.34

$

INTEREST&SINKINGFUND 0.038636

11.3643% 766,254.19$ 7,801,989.35$ 8,568,243.54$

ESTIMATEDLEVYOFOVER65 6,742,664.00$ 6,742,664.00$

TOTALTAXESBUDGETED 0.339978

100.0000% 75,396,373.88$ 75,396,373.88$

SalesandUseTax

A sales and use tax of one‐half of one percent, which is collected by the State of Texas, was

approved by voters of Lubbock County and went into effect on January 1, 1988.This tax is

imposedonthevalueoftaxableitemssoldandisenforcedandcollectedby theComptrollerof

Public Accounts ofthe State ofTexas. Proceeds are remittedmonthly lessa small service fee.

Theproceedsare creditedtotheGene ralFund.Thetaxisusedtofundoperations,whichhelps

defray county property tax.Actual county sales and use tax received in FY 2019 was

$26,378,687.Budgeted county sales tax for the 2021 budget increased by $712,386 from

$27,378,500inthe2020budgetto$28,090,886inthe2021budget.Salesandusetaxrevenue

accountsforapproximately11%ofallLubbockCountyrevenue.

Thefollowingchartdisplaysthesalestaxrevenueforthepasttenyears.

IntergovernmentalRevenues

Intergovernmentalrevenues are revenuesreceivedfrom otherunits of government, including

grantrevenues.AsofthebeginningofFY2021,LubbockCountyanticipatesthatthisrevenue

source will make up about 7.0% of total budgeted revenue.In special circumstances, the

County may receive one‐time funding from other governmental entities and this revenue

sourceisusedtoaccountforthosespecialfunds.Therearenoincreasesin2021inthistypeof

revenue.